Potential Economic Consequences of Brexit on the UK Dairy Sector

VerifiedAdded on 2023/05/29

|12

|2862

|194

Essay

AI Summary

This essay explores the potential economic consequences of Brexit on the British economy, with a specific focus on the dairy industry. It examines the impacts of a hard Brexit, including currency devaluation, inflation, and trade tariffs, on the overall economy. The analysis highlights the dairy sector's vulnerability due to its reliance on EU imports and the potential for supply shortages and price increases. The essay utilizes demand and supply theory to illustrate how Brexit-related disruptions can affect the dairy market, leading to higher prices and reduced consumption. It concludes that a hard Brexit poses significant challenges to the UK economy and the dairy industry, emphasizing the need for strategic adaptation to mitigate potential negative impacts. Desklib provides a platform for students to access this and other solved assignments for academic support.

Running head: ECONOMICS

Potential Economic Consequences of Brexit on British Economy, with a special focus on the

Dairy Industry

Name of the Student:

Name of the University:

Author note:

Potential Economic Consequences of Brexit on British Economy, with a special focus on the

Dairy Industry

Name of the Student:

Name of the University:

Author note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS

Introduction

Brexit is the abbreviation for Britain’s exit from the European Union (EU). On June 23,

2016, around 30 million British citizens voted in the referendum that whether Britain should

leave the EU or not. 51.9% voted for it while 48.1% voted against it (Hobolt 2016). Hence, it

was decided that Britain would end its 43 years relationship with the EU based on some terms

and conditions. David Cameron stepped down and Theresa May became the new Prime Minister,

who triggered Article 50 of the Lisbon Treaty on 29th March, 2017 to start the exit process

formally. Hence, complete Brexit will happen on 29th March, 2019. The forms of Brexit were

termed as hard and soft Brexit. Hard Brexit refers to the terms of not only leaving the EU, but

also the single market and the Customs Union of EU (Goodwin and Heath 2016). This would

give Britain a full control on its borders, making of new trade deals and applying the legislations

within the territories. On the other hand, soft Brexit will enable Britain to leave the union but

have an access to the single market. It is a matter of debate that whether the UK would adopt the

soft Brexit or hard. Hard Brexit will have more tough impact on all types of industries as it

would lose the access to the free market of the EU (Lawless and Morgenroth 2016). This essay

will focus on the consequences of hard Brexit on the British economy in general and emphasize

on the dairy industries, as it contains many international companies. Appropriate economic

theories and models will be used to illustrate the discussion.

Discussion

The referendum on Brexit and its outcome was a revolutionary event in the history of the

Great Britain and the European Union. Although the final impact on the UK economy is yet to be

affected, but in the past two years of ongoing Brexit process, there have been mixed impact on

Introduction

Brexit is the abbreviation for Britain’s exit from the European Union (EU). On June 23,

2016, around 30 million British citizens voted in the referendum that whether Britain should

leave the EU or not. 51.9% voted for it while 48.1% voted against it (Hobolt 2016). Hence, it

was decided that Britain would end its 43 years relationship with the EU based on some terms

and conditions. David Cameron stepped down and Theresa May became the new Prime Minister,

who triggered Article 50 of the Lisbon Treaty on 29th March, 2017 to start the exit process

formally. Hence, complete Brexit will happen on 29th March, 2019. The forms of Brexit were

termed as hard and soft Brexit. Hard Brexit refers to the terms of not only leaving the EU, but

also the single market and the Customs Union of EU (Goodwin and Heath 2016). This would

give Britain a full control on its borders, making of new trade deals and applying the legislations

within the territories. On the other hand, soft Brexit will enable Britain to leave the union but

have an access to the single market. It is a matter of debate that whether the UK would adopt the

soft Brexit or hard. Hard Brexit will have more tough impact on all types of industries as it

would lose the access to the free market of the EU (Lawless and Morgenroth 2016). This essay

will focus on the consequences of hard Brexit on the British economy in general and emphasize

on the dairy industries, as it contains many international companies. Appropriate economic

theories and models will be used to illustrate the discussion.

Discussion

The referendum on Brexit and its outcome was a revolutionary event in the history of the

Great Britain and the European Union. Although the final impact on the UK economy is yet to be

affected, but in the past two years of ongoing Brexit process, there have been mixed impact on

2ECONOMICS

the economy. However, Giles (2018) writes on the two year anniversary of the referendum that

the decision of Brexit has negative impacts on the economy as the pound became weaker and

that squeezed the household incomes. The level of investment fell significantly due to

uncertainty in the business world. It was found that in the first quarter of 2018, the economy was

1.2% smaller than what it would have been without the Brexit vote. This indicates a hit of £24

billion to the economy, which amounts to £450 million a week or £870 per household per year.

And this value is increasing as the final exit date is approaching, as in December 2017, the

amount was £350 million a week (Giles 2018).

Figure 1: Growth of the UK and the EU before and after referendum

(Source: Giles 2018)

The specific impacts on the economy had hit the currency, inflation, business investment

and the stock market, employment and level of skilled workers and economic growth the most.

The first shock was on the currency. As soon as the result of the referendum was announced, the

the economy. However, Giles (2018) writes on the two year anniversary of the referendum that

the decision of Brexit has negative impacts on the economy as the pound became weaker and

that squeezed the household incomes. The level of investment fell significantly due to

uncertainty in the business world. It was found that in the first quarter of 2018, the economy was

1.2% smaller than what it would have been without the Brexit vote. This indicates a hit of £24

billion to the economy, which amounts to £450 million a week or £870 per household per year.

And this value is increasing as the final exit date is approaching, as in December 2017, the

amount was £350 million a week (Giles 2018).

Figure 1: Growth of the UK and the EU before and after referendum

(Source: Giles 2018)

The specific impacts on the economy had hit the currency, inflation, business investment

and the stock market, employment and level of skilled workers and economic growth the most.

The first shock was on the currency. As soon as the result of the referendum was announced, the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS

pound fell 10%, quite dramatically against dollar to a 31 year low, and hit $1.33 (Morrison

2018). The assumption of a hard Brexit did not get welcome from the economy and the currency

never improved. In January 2017, the currency was around $1.21 after the hard Brexit was

announced (Chu 2018). However, the currency improved slightly in the next few months due to

weakness of the dollar and not for the strength of the pound.

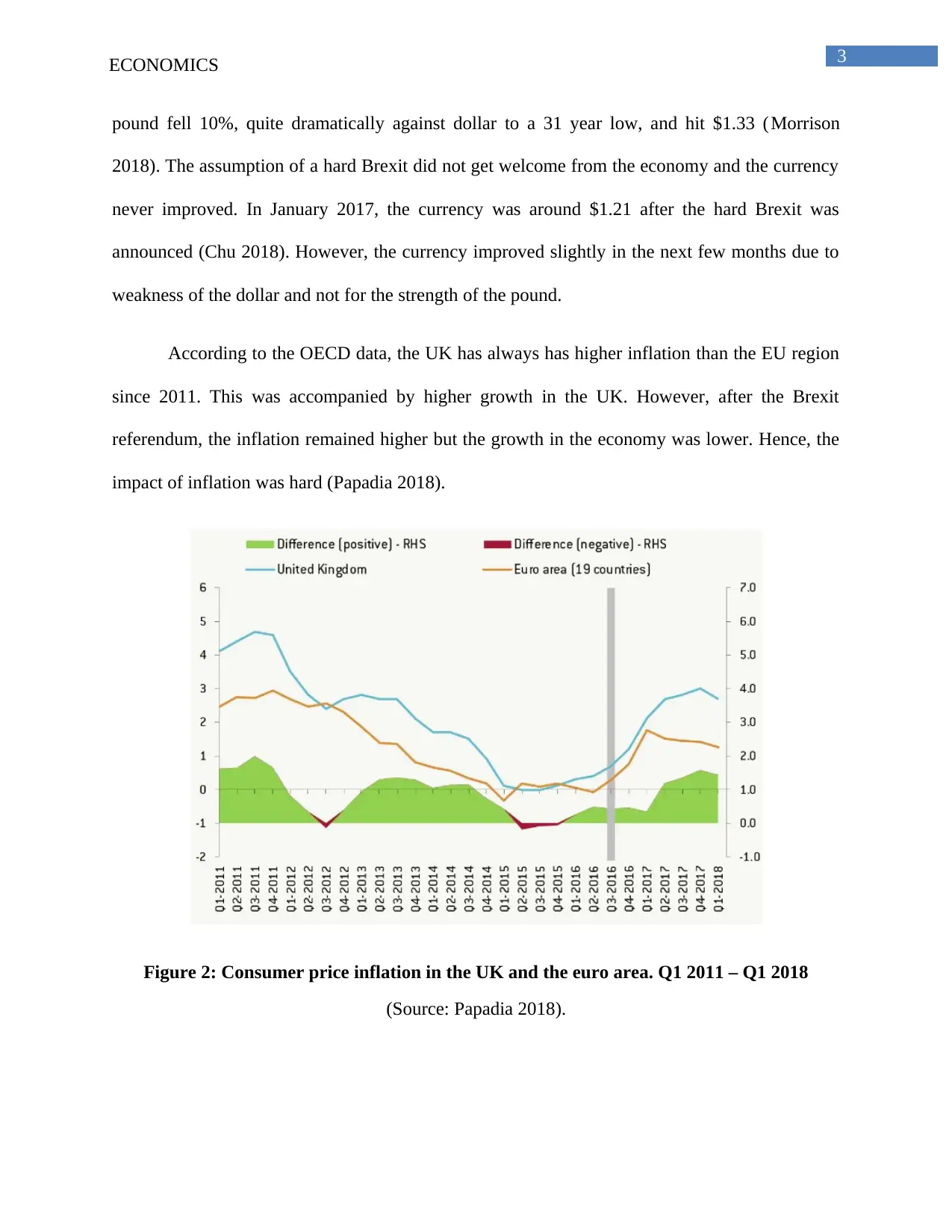

According to the OECD data, the UK has always has higher inflation than the EU region

since 2011. This was accompanied by higher growth in the UK. However, after the Brexit

referendum, the inflation remained higher but the growth in the economy was lower. Hence, the

impact of inflation was hard (Papadia 2018).

Figure 2: Consumer price inflation in the UK and the euro area. Q1 2011 – Q1 2018

(Source: Papadia 2018).

pound fell 10%, quite dramatically against dollar to a 31 year low, and hit $1.33 (Morrison

2018). The assumption of a hard Brexit did not get welcome from the economy and the currency

never improved. In January 2017, the currency was around $1.21 after the hard Brexit was

announced (Chu 2018). However, the currency improved slightly in the next few months due to

weakness of the dollar and not for the strength of the pound.

According to the OECD data, the UK has always has higher inflation than the EU region

since 2011. This was accompanied by higher growth in the UK. However, after the Brexit

referendum, the inflation remained higher but the growth in the economy was lower. Hence, the

impact of inflation was hard (Papadia 2018).

Figure 2: Consumer price inflation in the UK and the euro area. Q1 2011 – Q1 2018

(Source: Papadia 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS

Hard Brexit and consequent weak currency are pushing the cost of foreign holidays and

other investments in the global market higher and in turn the cost of living in the UK has been

increasing too. The production cost has increased due to higher cost of imports and the burden is

being shifted to the customers. Hence, the prices of goods and services have gone up to 3% from

0.5% resulting in higher cost of living (Chu 2018). The average wage was not increased in

comparison to the inflation. However, the unemployment rate was lowest since 1975 and wages

are increasing, which is again putting pressure on the inflation. It was also found that, there was a

significant shortage in the supply of skilled workers in the economy, especially in the

construction sector. As the free movement of labor will cease after Brexit, the supply shortage

will become more intense in the future and affect the productivity and quality of production.

The UK economy is benefitted from the investments from foreign firms. Due to fall in

pound, the level of investment has lowered as the return from the pound has lowered too. The

anticipation of hard Brexit also affected the business investment and consequent economic

growth. The companies that have invested in the foreign business, have gained more due to fall

in the pound, exports have increased and imports have reduced due to higher price. The

anticipation of hard Brexit also created uncertainty in the economy, leading to a fall in the

vestment and thereby affecting the overall economic growth (Dhingra et al. 2016).

Dairy sector is a significant contributor in the UK economy. It is one of the largest

producers of the country. According to the Dairy Industry of the UK, there are around 13000

dairy farmers, supplying almost 14 billion litres of milk per year, worth of £8.8 billion

(dairyuk.org 2018). It is the single largest agricultural sector in the UK. However, it is seen that

the value of the exported milk products is much lower than the imported milk products. In 2012,

the trade deficit in the dairy industry was £1.5 million (viva.org.uk 2018). According to a report

Hard Brexit and consequent weak currency are pushing the cost of foreign holidays and

other investments in the global market higher and in turn the cost of living in the UK has been

increasing too. The production cost has increased due to higher cost of imports and the burden is

being shifted to the customers. Hence, the prices of goods and services have gone up to 3% from

0.5% resulting in higher cost of living (Chu 2018). The average wage was not increased in

comparison to the inflation. However, the unemployment rate was lowest since 1975 and wages

are increasing, which is again putting pressure on the inflation. It was also found that, there was a

significant shortage in the supply of skilled workers in the economy, especially in the

construction sector. As the free movement of labor will cease after Brexit, the supply shortage

will become more intense in the future and affect the productivity and quality of production.

The UK economy is benefitted from the investments from foreign firms. Due to fall in

pound, the level of investment has lowered as the return from the pound has lowered too. The

anticipation of hard Brexit also affected the business investment and consequent economic

growth. The companies that have invested in the foreign business, have gained more due to fall

in the pound, exports have increased and imports have reduced due to higher price. The

anticipation of hard Brexit also created uncertainty in the economy, leading to a fall in the

vestment and thereby affecting the overall economic growth (Dhingra et al. 2016).

Dairy sector is a significant contributor in the UK economy. It is one of the largest

producers of the country. According to the Dairy Industry of the UK, there are around 13000

dairy farmers, supplying almost 14 billion litres of milk per year, worth of £8.8 billion

(dairyuk.org 2018). It is the single largest agricultural sector in the UK. However, it is seen that

the value of the exported milk products is much lower than the imported milk products. In 2012,

the trade deficit in the dairy industry was £1.5 million (viva.org.uk 2018). According to a report

5ECONOMICS

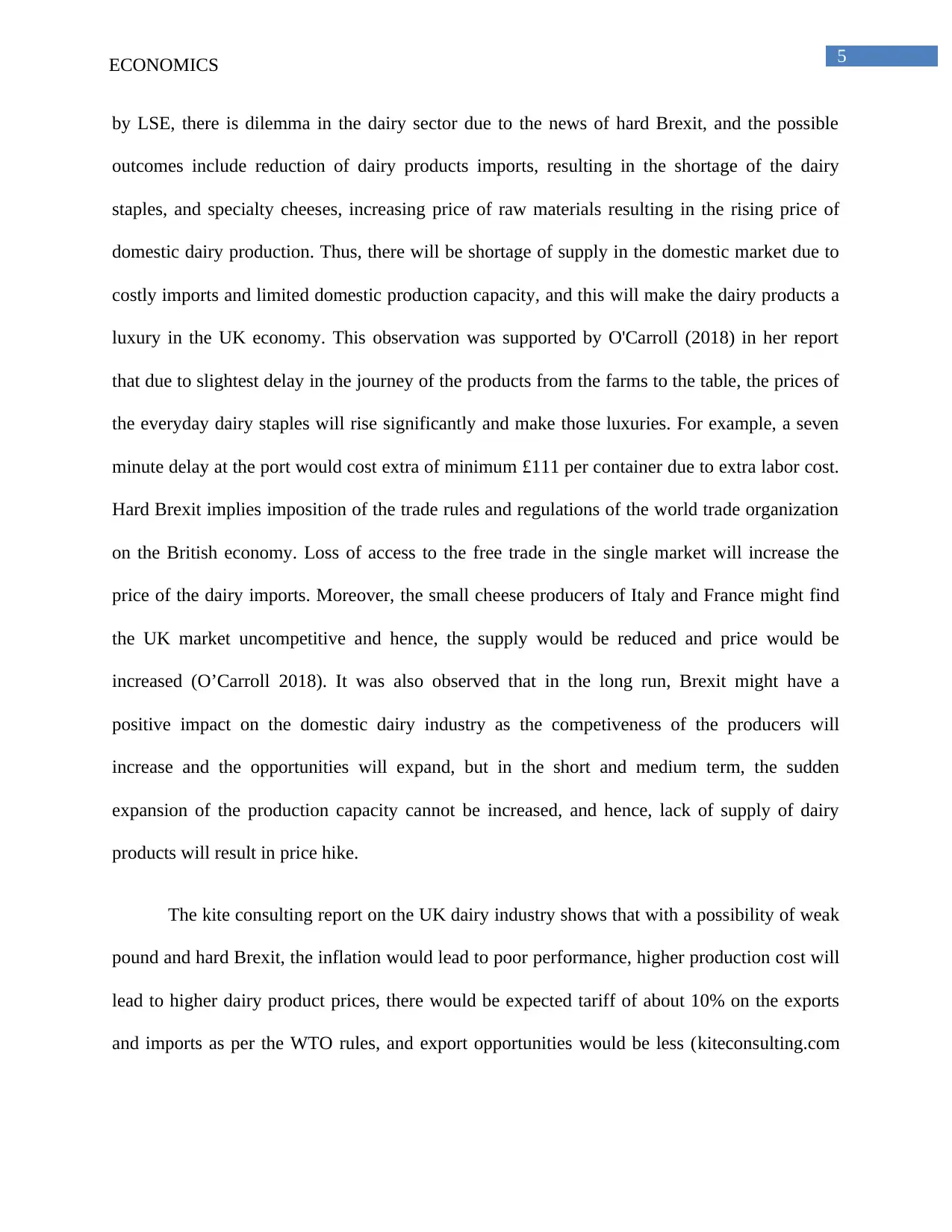

by LSE, there is dilemma in the dairy sector due to the news of hard Brexit, and the possible

outcomes include reduction of dairy products imports, resulting in the shortage of the dairy

staples, and specialty cheeses, increasing price of raw materials resulting in the rising price of

domestic dairy production. Thus, there will be shortage of supply in the domestic market due to

costly imports and limited domestic production capacity, and this will make the dairy products a

luxury in the UK economy. This observation was supported by O'Carroll (2018) in her report

that due to slightest delay in the journey of the products from the farms to the table, the prices of

the everyday dairy staples will rise significantly and make those luxuries. For example, a seven

minute delay at the port would cost extra of minimum £111 per container due to extra labor cost.

Hard Brexit implies imposition of the trade rules and regulations of the world trade organization

on the British economy. Loss of access to the free trade in the single market will increase the

price of the dairy imports. Moreover, the small cheese producers of Italy and France might find

the UK market uncompetitive and hence, the supply would be reduced and price would be

increased (O’Carroll 2018). It was also observed that in the long run, Brexit might have a

positive impact on the domestic dairy industry as the competiveness of the producers will

increase and the opportunities will expand, but in the short and medium term, the sudden

expansion of the production capacity cannot be increased, and hence, lack of supply of dairy

products will result in price hike.

The kite consulting report on the UK dairy industry shows that with a possibility of weak

pound and hard Brexit, the inflation would lead to poor performance, higher production cost will

lead to higher dairy product prices, there would be expected tariff of about 10% on the exports

and imports as per the WTO rules, and export opportunities would be less (kiteconsulting.com

by LSE, there is dilemma in the dairy sector due to the news of hard Brexit, and the possible

outcomes include reduction of dairy products imports, resulting in the shortage of the dairy

staples, and specialty cheeses, increasing price of raw materials resulting in the rising price of

domestic dairy production. Thus, there will be shortage of supply in the domestic market due to

costly imports and limited domestic production capacity, and this will make the dairy products a

luxury in the UK economy. This observation was supported by O'Carroll (2018) in her report

that due to slightest delay in the journey of the products from the farms to the table, the prices of

the everyday dairy staples will rise significantly and make those luxuries. For example, a seven

minute delay at the port would cost extra of minimum £111 per container due to extra labor cost.

Hard Brexit implies imposition of the trade rules and regulations of the world trade organization

on the British economy. Loss of access to the free trade in the single market will increase the

price of the dairy imports. Moreover, the small cheese producers of Italy and France might find

the UK market uncompetitive and hence, the supply would be reduced and price would be

increased (O’Carroll 2018). It was also observed that in the long run, Brexit might have a

positive impact on the domestic dairy industry as the competiveness of the producers will

increase and the opportunities will expand, but in the short and medium term, the sudden

expansion of the production capacity cannot be increased, and hence, lack of supply of dairy

products will result in price hike.

The kite consulting report on the UK dairy industry shows that with a possibility of weak

pound and hard Brexit, the inflation would lead to poor performance, higher production cost will

lead to higher dairy product prices, there would be expected tariff of about 10% on the exports

and imports as per the WTO rules, and export opportunities would be less (kiteconsulting.com

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS

S1

DExcess demand

P*

Q*

P1

P2

Q1Q2

E

E1

E2

E3

Price

hike due

to

supply

shortage

Quantity of dairy

Price of dairy S2

Fall in supply

2018). As per the LSE report, UK has the second biggest trade deficit in dairy, which is up to

16% as 98% of the dairy imports come from the EU (arlafoods.co.uk. 2018).

The impact of hard Brexit on the dairy sector can be illustrated by the theory of demand

and supply and impact of tariff and price rise on the demand and supply. As per the law of

demand and supply, price rise of a product or service leads to fall in demand and rise in supply.

On the other hand, shortage of supply increases the price of a product, which results in the

decline of the demand (Cowell 2018). Thus, a shortage in the supply of the dairy products due to

Brexit leads to rise in the price of dairy products in the UK market.

Figure 3: Demand and supply in the dairy industry and impact of hard Brexit

(Source: Author)

S1

DExcess demand

P*

Q*

P1

P2

Q1Q2

E

E1

E2

E3

Price

hike due

to

supply

shortage

Quantity of dairy

Price of dairy S2

Fall in supply

2018). As per the LSE report, UK has the second biggest trade deficit in dairy, which is up to

16% as 98% of the dairy imports come from the EU (arlafoods.co.uk. 2018).

The impact of hard Brexit on the dairy sector can be illustrated by the theory of demand

and supply and impact of tariff and price rise on the demand and supply. As per the law of

demand and supply, price rise of a product or service leads to fall in demand and rise in supply.

On the other hand, shortage of supply increases the price of a product, which results in the

decline of the demand (Cowell 2018). Thus, a shortage in the supply of the dairy products due to

Brexit leads to rise in the price of dairy products in the UK market.

Figure 3: Demand and supply in the dairy industry and impact of hard Brexit

(Source: Author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS

It can be seen from the above diagram that, the initial demand and supply curves for dairy

sector in the UK is D and S1 respectively. The equilibrium was at E, with price P* and quantity

Q*. due to hard Brexit, UK loses the supply of the EU as many foreign suppliers will be out of

the market. Hence, the supply of dairy products falls. Since, the fall in supply is attributed to

other factors than the price; there is a shift in the supply curve. The supply curve shifts to the left

to S2. Due to this movement of the supply curve, the equilibrium price rises to P2 from P*. The

equilibrium quantity is also reduced to Q2. However, demand remains same. Thus, there is

excess demand in the market. As per the diagram, when the quantity supplied is Q2, the

demanded quantity isQ3. The potential market price would be P1 with the initial supply curve,

but as the supply curve of dairy products has shifted upwards due to the reasons like hard Brexit,

foreign farms going out of the market, imports of dairy becoming costlier, the price of the limited

quantity of dairy product supply in the domestic market of the UK goes very high, that is, at P2.

Moreover, imposition of tariff and fall in the exchange rate also increases the price of

imports and reduces the price of exports, thereby reducing the profits of the dairy sector. Fall in

the currency and exchange rate automatically raises the overall price level in the economy,

resulting in the inflation occurring in the nation. Moreover, due to hard Brexit, there is

imposition of tariff on the imports and exports, resulting in fall in the imports from the EU and

that contribute in the supply shortage in the economy and price hike of the dairy products.

Conclusion

It can be concluded from the above discussion that hard Brexit has negative influence on

the economy of the UK including on the dairy sector. The dairy sector is one of the largest

agricultural sectors in the UK, but it requires imports from the EU region to meet the demand for

It can be seen from the above diagram that, the initial demand and supply curves for dairy

sector in the UK is D and S1 respectively. The equilibrium was at E, with price P* and quantity

Q*. due to hard Brexit, UK loses the supply of the EU as many foreign suppliers will be out of

the market. Hence, the supply of dairy products falls. Since, the fall in supply is attributed to

other factors than the price; there is a shift in the supply curve. The supply curve shifts to the left

to S2. Due to this movement of the supply curve, the equilibrium price rises to P2 from P*. The

equilibrium quantity is also reduced to Q2. However, demand remains same. Thus, there is

excess demand in the market. As per the diagram, when the quantity supplied is Q2, the

demanded quantity isQ3. The potential market price would be P1 with the initial supply curve,

but as the supply curve of dairy products has shifted upwards due to the reasons like hard Brexit,

foreign farms going out of the market, imports of dairy becoming costlier, the price of the limited

quantity of dairy product supply in the domestic market of the UK goes very high, that is, at P2.

Moreover, imposition of tariff and fall in the exchange rate also increases the price of

imports and reduces the price of exports, thereby reducing the profits of the dairy sector. Fall in

the currency and exchange rate automatically raises the overall price level in the economy,

resulting in the inflation occurring in the nation. Moreover, due to hard Brexit, there is

imposition of tariff on the imports and exports, resulting in fall in the imports from the EU and

that contribute in the supply shortage in the economy and price hike of the dairy products.

Conclusion

It can be concluded from the above discussion that hard Brexit has negative influence on

the economy of the UK including on the dairy sector. The dairy sector is one of the largest

agricultural sectors in the UK, but it requires imports from the EU region to meet the demand for

8ECONOMICS

dairy products, especially that for the specialized cheeses. Potential hard Brexit has negative

impacts on the economy in terms of fall in the currency value, inflation, fall in exchange rate,

imposition of tariffs on the exports and imports. In case of dairy sector, the hard Brexit affects

the supply of dairy products in the economy as UK will not have access to the single market of

the EU and there will be tariffs as per the rules of the WTO. Thus, these new rules will reduce

the number of foreign dairy farms operating in the UK market and also the amount of imports.

Hence, this will raise the price of the limited dairy products available in the market. In the long

run, the domestic dairy sector may be competitive, but in the near future, hard Brexit will affect

the dairy sector of the UK negatively.

dairy products, especially that for the specialized cheeses. Potential hard Brexit has negative

impacts on the economy in terms of fall in the currency value, inflation, fall in exchange rate,

imposition of tariffs on the exports and imports. In case of dairy sector, the hard Brexit affects

the supply of dairy products in the economy as UK will not have access to the single market of

the EU and there will be tariffs as per the rules of the WTO. Thus, these new rules will reduce

the number of foreign dairy farms operating in the UK market and also the amount of imports.

Hence, this will raise the price of the limited dairy products available in the market. In the long

run, the domestic dairy sector may be competitive, but in the near future, hard Brexit will affect

the dairy sector of the UK negatively.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS

References

arlafoods.co.uk., 2018. Britain’s biggest dairy company warns of “dairy dilemma” of impossible

choices post-Brexit. [online] Available at:

https://www.arlafoods.co.uk/overview/news-press/2018/pressrelease/britains-biggest-dairy-

company-warns-of-dairy-dilemma-of-impossible-choices-post-brexit-2586695/ [Accessed 11

Nov. 2018].

Bakker, J. and Datta, N., 2018. The impact of Brexit on the UK dairy sector. [online] Lse.ac.uk.

Available at: http://www.lse.ac.uk/business-and-consultancy/consulting/assets/documents/the-

impact-of-brexit-on-the-uk-dairy-sector.pdf [Accessed 11 Nov. 2018].

Chu, B., 2018. With one year to Brexit, how well is the UK economy performing?. [online] The

Independent. Available at: https://www.independent.co.uk/news/business/analysis-and-features/

brexit-uk-economy-one-year-gdp-inflation-investment-growth-a8270861.html [Accessed 11

Nov. 2018].

Cowell, F., 2018. Microeconomics: principles and analysis. Oxford University Press.

dairyuk.org., 2018. The UK Dairy Industry. [online] Available at: https://www.dairyuk.org/the-

uk-dairy-industry/ [Accessed 11 Nov. 2018].

Dhingra, S., Ottaviano, G., Sampson, T. and Van Reenen, J., 2016. The impact of Brexit on

foreign investment in the UK. BREXIT 2016, 24.

References

arlafoods.co.uk., 2018. Britain’s biggest dairy company warns of “dairy dilemma” of impossible

choices post-Brexit. [online] Available at:

https://www.arlafoods.co.uk/overview/news-press/2018/pressrelease/britains-biggest-dairy-

company-warns-of-dairy-dilemma-of-impossible-choices-post-brexit-2586695/ [Accessed 11

Nov. 2018].

Bakker, J. and Datta, N., 2018. The impact of Brexit on the UK dairy sector. [online] Lse.ac.uk.

Available at: http://www.lse.ac.uk/business-and-consultancy/consulting/assets/documents/the-

impact-of-brexit-on-the-uk-dairy-sector.pdf [Accessed 11 Nov. 2018].

Chu, B., 2018. With one year to Brexit, how well is the UK economy performing?. [online] The

Independent. Available at: https://www.independent.co.uk/news/business/analysis-and-features/

brexit-uk-economy-one-year-gdp-inflation-investment-growth-a8270861.html [Accessed 11

Nov. 2018].

Cowell, F., 2018. Microeconomics: principles and analysis. Oxford University Press.

dairyuk.org., 2018. The UK Dairy Industry. [online] Available at: https://www.dairyuk.org/the-

uk-dairy-industry/ [Accessed 11 Nov. 2018].

Dhingra, S., Ottaviano, G., Sampson, T. and Van Reenen, J., 2016. The impact of Brexit on

foreign investment in the UK. BREXIT 2016, 24.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS

Giles, C., 2018. What are the economic effects of Brexit so far?. [online] Financial Times.

Available at: https://www.ft.com/content/dfafc806-762d-11e8-a8c4-408cfba4327c [Accessed 11

Nov. 2018].

Goodwin, M.J. and Heath, O., 2016. The 2016 referendum, Brexit and the left behind: An

aggregate‐level analysis of the result. The Political Quarterly, 87(3), pp.323-332.

Hobolt, S.B., 2016. The Brexit vote: a divided nation, a divided continent. Journal of European

Public Policy, 23(9), pp.1259-1277.

kiteconsulting.com, 2018. What will Brexit mean for the UK Dairy Sector? [online] Available at:

https://www.kiteconsulting.com/wp-content/uploads/2018/01/Kite-Brexit-Report-2018-web.pdf

[Accessed 11 Nov. 2018].

Lawless, M. and Morgenroth, E.L., 2016. The Product and Sector Level impact of a hard Brexit

across the EU (No. 550). ESRI Working paper.

Morrison, C., 2018. The Brexit effect: How the last two years have impacted the economy.

[online] The Independent. Available at: https://www.independent.co.uk/news/business/analysis-

and -features/brexit-vote-two-years-eu-referendum-uk-economy-pound-sterling-gbp-usd-ftse-

skills-shortage-a8410596.html [Accessed 11 Nov. 2018].

O’Carroll, L., 2018. Dairy products 'may become luxuries' after UK leaves EU. [online] The

Guardian. Available at: https://www.theguardian.com/politics/2018/jul/18/dairy-products-may-

become-luxuries-after-uk-leaves-eu [Accessed 11 Nov. 2018].

Giles, C., 2018. What are the economic effects of Brexit so far?. [online] Financial Times.

Available at: https://www.ft.com/content/dfafc806-762d-11e8-a8c4-408cfba4327c [Accessed 11

Nov. 2018].

Goodwin, M.J. and Heath, O., 2016. The 2016 referendum, Brexit and the left behind: An

aggregate‐level analysis of the result. The Political Quarterly, 87(3), pp.323-332.

Hobolt, S.B., 2016. The Brexit vote: a divided nation, a divided continent. Journal of European

Public Policy, 23(9), pp.1259-1277.

kiteconsulting.com, 2018. What will Brexit mean for the UK Dairy Sector? [online] Available at:

https://www.kiteconsulting.com/wp-content/uploads/2018/01/Kite-Brexit-Report-2018-web.pdf

[Accessed 11 Nov. 2018].

Lawless, M. and Morgenroth, E.L., 2016. The Product and Sector Level impact of a hard Brexit

across the EU (No. 550). ESRI Working paper.

Morrison, C., 2018. The Brexit effect: How the last two years have impacted the economy.

[online] The Independent. Available at: https://www.independent.co.uk/news/business/analysis-

and -features/brexit-vote-two-years-eu-referendum-uk-economy-pound-sterling-gbp-usd-ftse-

skills-shortage-a8410596.html [Accessed 11 Nov. 2018].

O’Carroll, L., 2018. Dairy products 'may become luxuries' after UK leaves EU. [online] The

Guardian. Available at: https://www.theguardian.com/politics/2018/jul/18/dairy-products-may-

become-luxuries-after-uk-leaves-eu [Accessed 11 Nov. 2018].

11ECONOMICS

Papadia, F., 2018. The effects of Brexit on UK growth and inflation. [online] Bruegel. Available

at: http://bruegel.org/2018/05/the-effects-of-brexit-on-uk-growth-and-inflation/ [Accessed 11

Nov. 2018].

viva.org.uk., 2018. The Dairy Industry in Britain. [online] Available at:

https://www.viva.org.uk/dark-side-dairy/dairy-industry-britain [Accessed 11 Nov. 2018].

Papadia, F., 2018. The effects of Brexit on UK growth and inflation. [online] Bruegel. Available

at: http://bruegel.org/2018/05/the-effects-of-brexit-on-uk-growth-and-inflation/ [Accessed 11

Nov. 2018].

viva.org.uk., 2018. The Dairy Industry in Britain. [online] Available at:

https://www.viva.org.uk/dark-side-dairy/dairy-industry-britain [Accessed 11 Nov. 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.