Economic and Financial Management Report for British Red Cross

VerifiedAdded on 2023/01/05

|14

|3312

|68

Report

AI Summary

This report provides an in-depth analysis of economic and financial management, focusing on the British Red Cross. It explores the impact of economic factors, such as interest rates and inflation, on the organization's performance. The report delves into microeconomic and macroeconomic factors affecting the company, including shifts and movements in demand curves. A significant portion of the report is dedicated to financial analysis using accounting ratios like Return on Capital Employed, Net Profit Margin, Current Ratio, Debtors Collection Period, and Creditors Collection Period, calculated for the past three years. The importance of these ratios in assessing a firm's efficiency, profitability, and solvency is also discussed. The analysis includes an interpretation of the ratios' trends and their implications for the British Red Cross's financial health and strategic decision-making. Recommendations are provided, and the conclusion summarizes the findings and their significance.

Economic And Financial

Management

Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

This file is about economic and financial management that affects an organisation's

performance. Financial management is useful for managing firms short term liquidity and long

term debts. Economic factors affects business through internal and external factors. In financial

management it contains accounting ratios to know firm's position. Accounting ratio's help in to

know firms efficiency, transfer of information, profitability analysis, solvency position etc.

This file is about economic and financial management that affects an organisation's

performance. Financial management is useful for managing firms short term liquidity and long

term debts. Economic factors affects business through internal and external factors. In financial

management it contains accounting ratios to know firm's position. Accounting ratio's help in to

know firms efficiency, transfer of information, profitability analysis, solvency position etc.

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Analysis the economic factors and their impacts on the business:..............................................1

Calculation of ratios of the British red cross for the past three years:.........................................3

Accounting ratios and their importance in business:...................................................................3

RECOMMENDETION....................................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Analysis the economic factors and their impacts on the business:..............................................1

Calculation of ratios of the British red cross for the past three years:.........................................3

Accounting ratios and their importance in business:...................................................................3

RECOMMENDETION....................................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Economic and financial management are the elements which are important for an

organisation. Financial management is concerned with better utilisation of liquid cash available

to meet prioritized needs. While economic management is concerned about spendings that helps

in growth and development of micro and macro economy (Ward and Forker, 2017). Economic

factors can affects the business through consumer’s behaviour, inflation, interest rates, banking,

investment options etc. company which is selected for this report is “ British red cross”. It is a

society located in UK, the worldwide and impartial network the international red cross. The

society was founded in 1870, headquarter situated in London, UK and focuses on Humanitarian

aid. This file covers topic such as analysis of micro and macro economic factors along with the

shifts or movements curves. Apart from this, it includes analysis of financial position of the

company for past three years through ratio analysis and importance of accounting ratios.

MAIN BODY

Analysis the economic factors and their impacts on the business:

Economic factors are those, which helps company to determined competitiveness of the

environment in which firm runs its business activities. Economic factors includes consumers

demand, economic trends, inflation, interest rates and other economic indicators. These factors

affecting business by current trends, economy that can help a business or prevent it to achieve its

objectives. In British red cross, interest rates and inflation are badly effects its business.

Micro economic factors: It involves resources availability that impacts businesses and

individuals. British red cross as a company operator, understanding of macro economic factors

will help the firm to operate, planning and preparation. Micro economic factors that affects firm

are customers, employees, media, competitors, shareholders and suppliers.

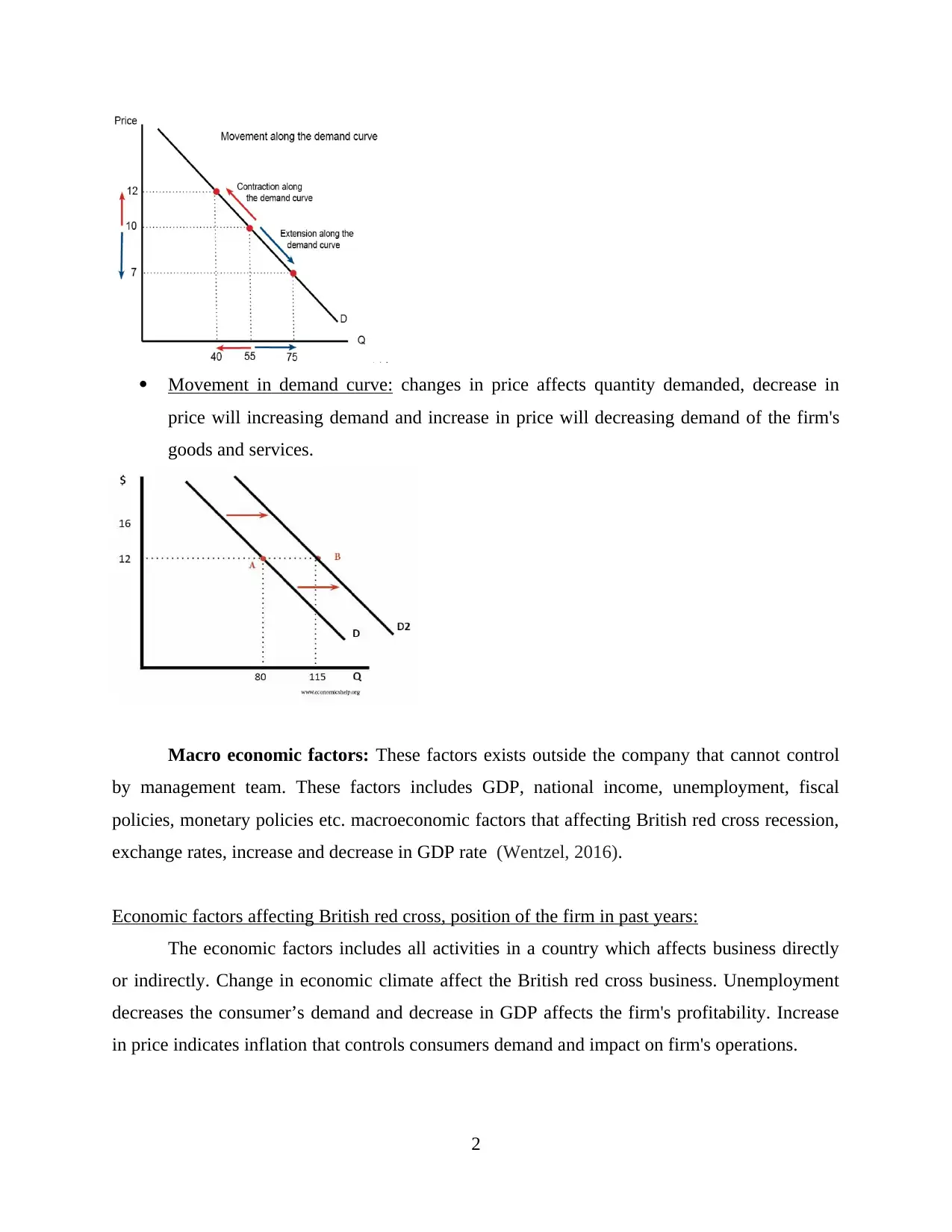

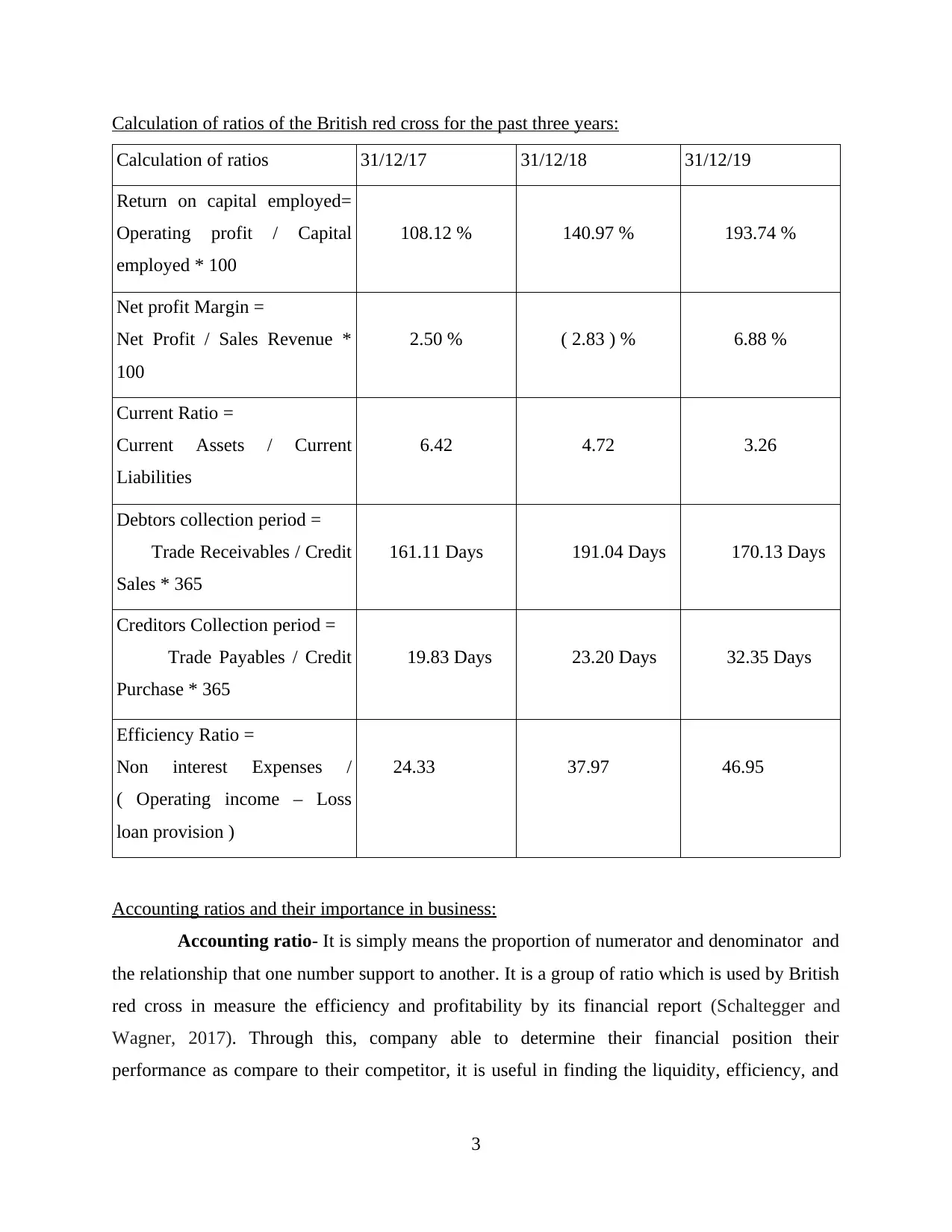

Shift in demand curve: Changing in the shift, towards right side will increase demand of

firm's goods or services but shift of demand curve towards left side will indicates less

demand of firm's services.

1

Economic and financial management are the elements which are important for an

organisation. Financial management is concerned with better utilisation of liquid cash available

to meet prioritized needs. While economic management is concerned about spendings that helps

in growth and development of micro and macro economy (Ward and Forker, 2017). Economic

factors can affects the business through consumer’s behaviour, inflation, interest rates, banking,

investment options etc. company which is selected for this report is “ British red cross”. It is a

society located in UK, the worldwide and impartial network the international red cross. The

society was founded in 1870, headquarter situated in London, UK and focuses on Humanitarian

aid. This file covers topic such as analysis of micro and macro economic factors along with the

shifts or movements curves. Apart from this, it includes analysis of financial position of the

company for past three years through ratio analysis and importance of accounting ratios.

MAIN BODY

Analysis the economic factors and their impacts on the business:

Economic factors are those, which helps company to determined competitiveness of the

environment in which firm runs its business activities. Economic factors includes consumers

demand, economic trends, inflation, interest rates and other economic indicators. These factors

affecting business by current trends, economy that can help a business or prevent it to achieve its

objectives. In British red cross, interest rates and inflation are badly effects its business.

Micro economic factors: It involves resources availability that impacts businesses and

individuals. British red cross as a company operator, understanding of macro economic factors

will help the firm to operate, planning and preparation. Micro economic factors that affects firm

are customers, employees, media, competitors, shareholders and suppliers.

Shift in demand curve: Changing in the shift, towards right side will increase demand of

firm's goods or services but shift of demand curve towards left side will indicates less

demand of firm's services.

1

Movement in demand curve: changes in price affects quantity demanded, decrease in

price will increasing demand and increase in price will decreasing demand of the firm's

goods and services.

Macro economic factors: These factors exists outside the company that cannot control

by management team. These factors includes GDP, national income, unemployment, fiscal

policies, monetary policies etc. macroeconomic factors that affecting British red cross recession,

exchange rates, increase and decrease in GDP rate (Wentzel, 2016).

Economic factors affecting British red cross, position of the firm in past years:

The economic factors includes all activities in a country which affects business directly

or indirectly. Change in economic climate affect the British red cross business. Unemployment

decreases the consumer’s demand and decrease in GDP affects the firm's profitability. Increase

in price indicates inflation that controls consumers demand and impact on firm's operations.

2

price will increasing demand and increase in price will decreasing demand of the firm's

goods and services.

Macro economic factors: These factors exists outside the company that cannot control

by management team. These factors includes GDP, national income, unemployment, fiscal

policies, monetary policies etc. macroeconomic factors that affecting British red cross recession,

exchange rates, increase and decrease in GDP rate (Wentzel, 2016).

Economic factors affecting British red cross, position of the firm in past years:

The economic factors includes all activities in a country which affects business directly

or indirectly. Change in economic climate affect the British red cross business. Unemployment

decreases the consumer’s demand and decrease in GDP affects the firm's profitability. Increase

in price indicates inflation that controls consumers demand and impact on firm's operations.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

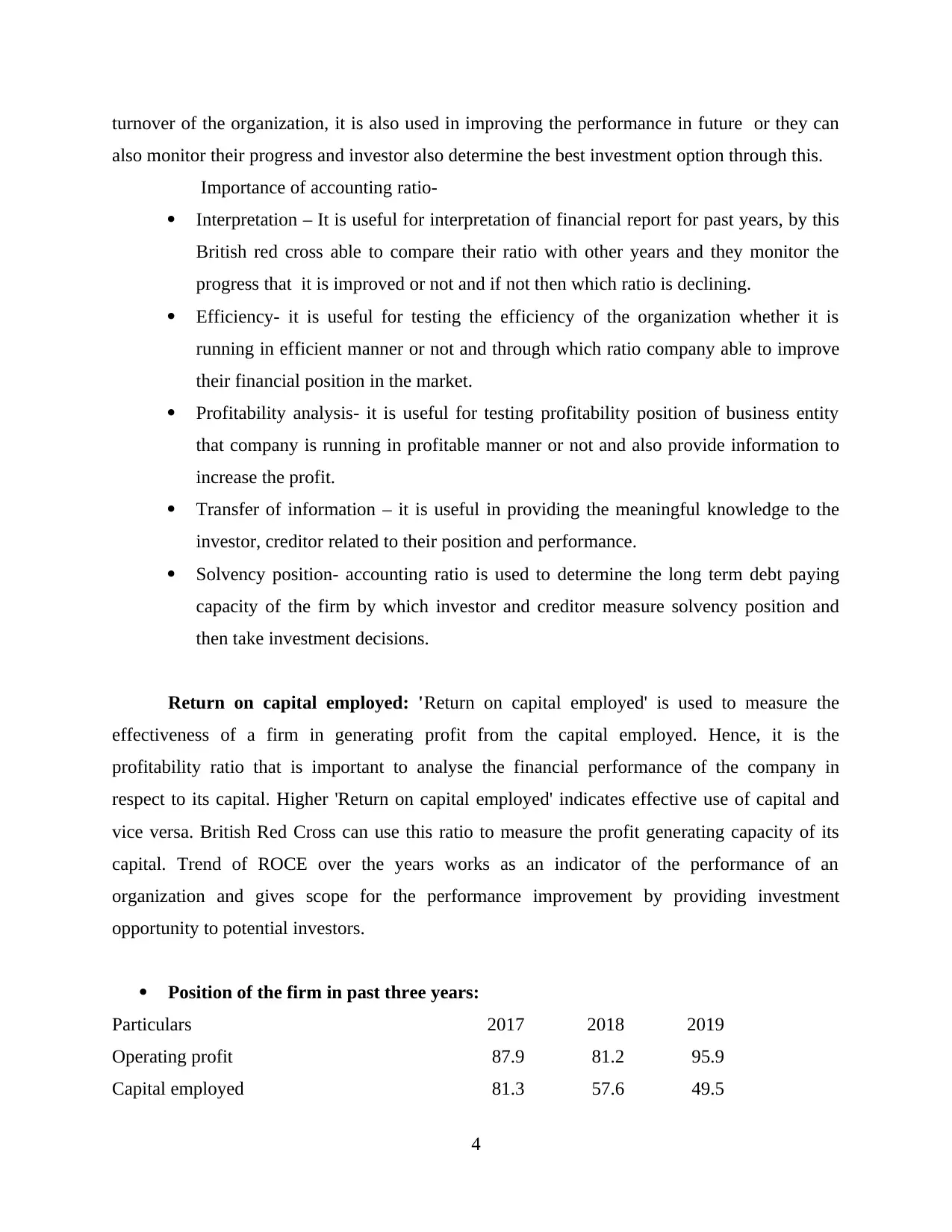

Calculation of ratios of the British red cross for the past three years:

Calculation of ratios 31/12/17 31/12/18 31/12/19

Return on capital employed=

Operating profit / Capital

employed * 100

108.12 % 140.97 % 193.74 %

Net profit Margin =

Net Profit / Sales Revenue *

100

2.50 % ( 2.83 ) % 6.88 %

Current Ratio =

Current Assets / Current

Liabilities

6.42 4.72 3.26

Debtors collection period =

Trade Receivables / Credit

Sales * 365

161.11 Days 191.04 Days 170.13 Days

Creditors Collection period =

Trade Payables / Credit

Purchase * 365

19.83 Days 23.20 Days 32.35 Days

Efficiency Ratio =

Non interest Expenses /

( Operating income – Loss

loan provision )

24.33 37.97 46.95

Accounting ratios and their importance in business:

Accounting ratio- It is simply means the proportion of numerator and denominator and

the relationship that one number support to another. It is a group of ratio which is used by British

red cross in measure the efficiency and profitability by its financial report (Schaltegger and

Wagner, 2017). Through this, company able to determine their financial position their

performance as compare to their competitor, it is useful in finding the liquidity, efficiency, and

3

Calculation of ratios 31/12/17 31/12/18 31/12/19

Return on capital employed=

Operating profit / Capital

employed * 100

108.12 % 140.97 % 193.74 %

Net profit Margin =

Net Profit / Sales Revenue *

100

2.50 % ( 2.83 ) % 6.88 %

Current Ratio =

Current Assets / Current

Liabilities

6.42 4.72 3.26

Debtors collection period =

Trade Receivables / Credit

Sales * 365

161.11 Days 191.04 Days 170.13 Days

Creditors Collection period =

Trade Payables / Credit

Purchase * 365

19.83 Days 23.20 Days 32.35 Days

Efficiency Ratio =

Non interest Expenses /

( Operating income – Loss

loan provision )

24.33 37.97 46.95

Accounting ratios and their importance in business:

Accounting ratio- It is simply means the proportion of numerator and denominator and

the relationship that one number support to another. It is a group of ratio which is used by British

red cross in measure the efficiency and profitability by its financial report (Schaltegger and

Wagner, 2017). Through this, company able to determine their financial position their

performance as compare to their competitor, it is useful in finding the liquidity, efficiency, and

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

turnover of the organization, it is also used in improving the performance in future or they can

also monitor their progress and investor also determine the best investment option through this.

Importance of accounting ratio-

Interpretation – It is useful for interpretation of financial report for past years, by this

British red cross able to compare their ratio with other years and they monitor the

progress that it is improved or not and if not then which ratio is declining.

Efficiency- it is useful for testing the efficiency of the organization whether it is

running in efficient manner or not and through which ratio company able to improve

their financial position in the market.

Profitability analysis- it is useful for testing profitability position of business entity

that company is running in profitable manner or not and also provide information to

increase the profit.

Transfer of information – it is useful in providing the meaningful knowledge to the

investor, creditor related to their position and performance.

Solvency position- accounting ratio is used to determine the long term debt paying

capacity of the firm by which investor and creditor measure solvency position and

then take investment decisions.

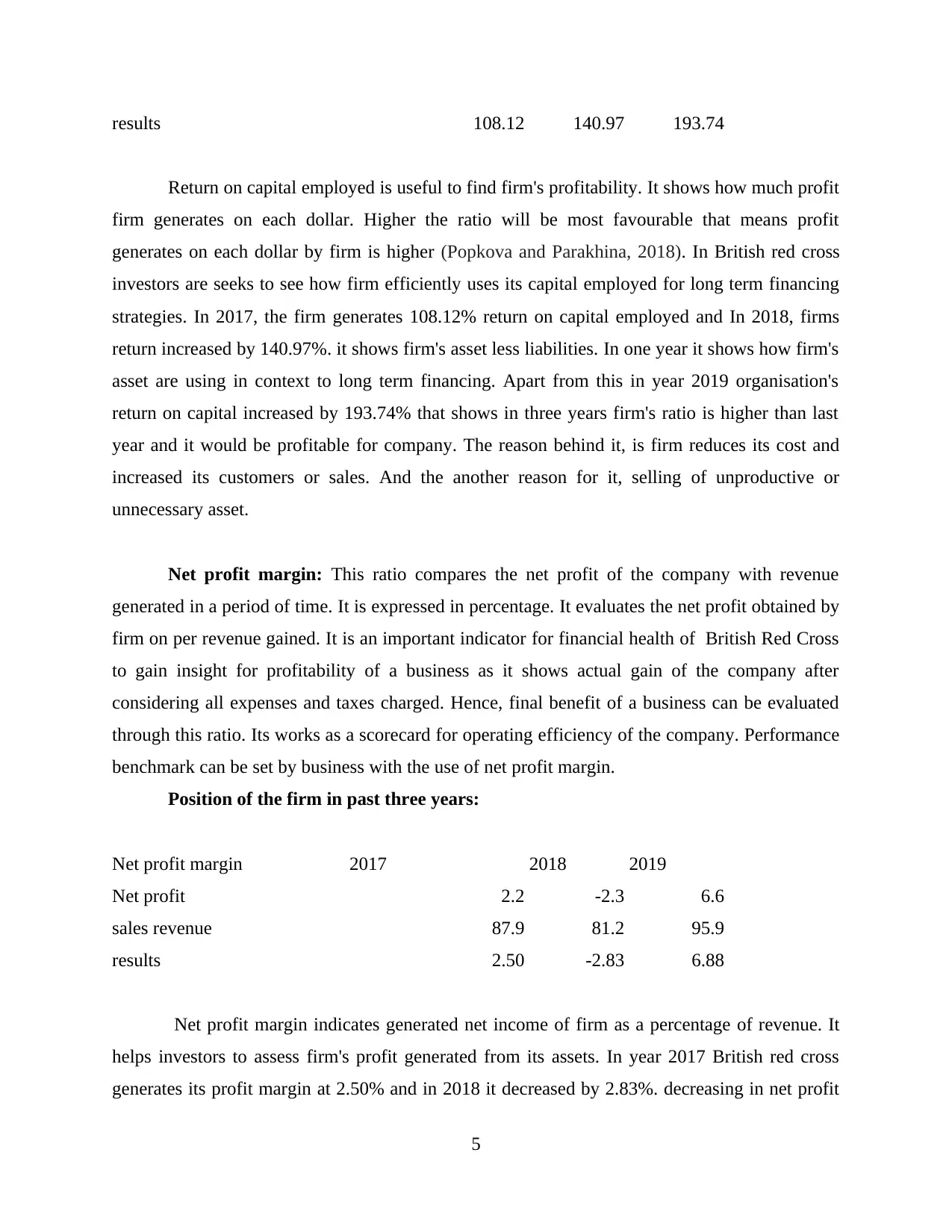

Return on capital employed: 'Return on capital employed' is used to measure the

effectiveness of a firm in generating profit from the capital employed. Hence, it is the

profitability ratio that is important to analyse the financial performance of the company in

respect to its capital. Higher 'Return on capital employed' indicates effective use of capital and

vice versa. British Red Cross can use this ratio to measure the profit generating capacity of its

capital. Trend of ROCE over the years works as an indicator of the performance of an

organization and gives scope for the performance improvement by providing investment

opportunity to potential investors.

Position of the firm in past three years:

Particulars 2017 2018 2019

Operating profit 87.9 81.2 95.9

Capital employed 81.3 57.6 49.5

4

also monitor their progress and investor also determine the best investment option through this.

Importance of accounting ratio-

Interpretation – It is useful for interpretation of financial report for past years, by this

British red cross able to compare their ratio with other years and they monitor the

progress that it is improved or not and if not then which ratio is declining.

Efficiency- it is useful for testing the efficiency of the organization whether it is

running in efficient manner or not and through which ratio company able to improve

their financial position in the market.

Profitability analysis- it is useful for testing profitability position of business entity

that company is running in profitable manner or not and also provide information to

increase the profit.

Transfer of information – it is useful in providing the meaningful knowledge to the

investor, creditor related to their position and performance.

Solvency position- accounting ratio is used to determine the long term debt paying

capacity of the firm by which investor and creditor measure solvency position and

then take investment decisions.

Return on capital employed: 'Return on capital employed' is used to measure the

effectiveness of a firm in generating profit from the capital employed. Hence, it is the

profitability ratio that is important to analyse the financial performance of the company in

respect to its capital. Higher 'Return on capital employed' indicates effective use of capital and

vice versa. British Red Cross can use this ratio to measure the profit generating capacity of its

capital. Trend of ROCE over the years works as an indicator of the performance of an

organization and gives scope for the performance improvement by providing investment

opportunity to potential investors.

Position of the firm in past three years:

Particulars 2017 2018 2019

Operating profit 87.9 81.2 95.9

Capital employed 81.3 57.6 49.5

4

results 108.12 140.97 193.74

Return on capital employed is useful to find firm's profitability. It shows how much profit

firm generates on each dollar. Higher the ratio will be most favourable that means profit

generates on each dollar by firm is higher (Popkova and Parakhina, 2018). In British red cross

investors are seeks to see how firm efficiently uses its capital employed for long term financing

strategies. In 2017, the firm generates 108.12% return on capital employed and In 2018, firms

return increased by 140.97%. it shows firm's asset less liabilities. In one year it shows how firm's

asset are using in context to long term financing. Apart from this in year 2019 organisation's

return on capital increased by 193.74% that shows in three years firm's ratio is higher than last

year and it would be profitable for company. The reason behind it, is firm reduces its cost and

increased its customers or sales. And the another reason for it, selling of unproductive or

unnecessary asset.

Net profit margin: This ratio compares the net profit of the company with revenue

generated in a period of time. It is expressed in percentage. It evaluates the net profit obtained by

firm on per revenue gained. It is an important indicator for financial health of British Red Cross

to gain insight for profitability of a business as it shows actual gain of the company after

considering all expenses and taxes charged. Hence, final benefit of a business can be evaluated

through this ratio. Its works as a scorecard for operating efficiency of the company. Performance

benchmark can be set by business with the use of net profit margin.

Position of the firm in past three years:

Net profit margin 2017 2018 2019

Net profit 2.2 -2.3 6.6

sales revenue 87.9 81.2 95.9

results 2.50 -2.83 6.88

Net profit margin indicates generated net income of firm as a percentage of revenue. It

helps investors to assess firm's profit generated from its assets. In year 2017 British red cross

generates its profit margin at 2.50% and in 2018 it decreased by 2.83%. decreasing in net profit

5

Return on capital employed is useful to find firm's profitability. It shows how much profit

firm generates on each dollar. Higher the ratio will be most favourable that means profit

generates on each dollar by firm is higher (Popkova and Parakhina, 2018). In British red cross

investors are seeks to see how firm efficiently uses its capital employed for long term financing

strategies. In 2017, the firm generates 108.12% return on capital employed and In 2018, firms

return increased by 140.97%. it shows firm's asset less liabilities. In one year it shows how firm's

asset are using in context to long term financing. Apart from this in year 2019 organisation's

return on capital increased by 193.74% that shows in three years firm's ratio is higher than last

year and it would be profitable for company. The reason behind it, is firm reduces its cost and

increased its customers or sales. And the another reason for it, selling of unproductive or

unnecessary asset.

Net profit margin: This ratio compares the net profit of the company with revenue

generated in a period of time. It is expressed in percentage. It evaluates the net profit obtained by

firm on per revenue gained. It is an important indicator for financial health of British Red Cross

to gain insight for profitability of a business as it shows actual gain of the company after

considering all expenses and taxes charged. Hence, final benefit of a business can be evaluated

through this ratio. Its works as a scorecard for operating efficiency of the company. Performance

benchmark can be set by business with the use of net profit margin.

Position of the firm in past three years:

Net profit margin 2017 2018 2019

Net profit 2.2 -2.3 6.6

sales revenue 87.9 81.2 95.9

results 2.50 -2.83 6.88

Net profit margin indicates generated net income of firm as a percentage of revenue. It

helps investors to assess firm's profit generated from its assets. In year 2017 British red cross

generates its profit margin at 2.50% and in 2018 it decreased by 2.83%. decreasing in net profit

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

margin means company is not able to control its costs effectively or supply its services on lower

price than its costs (Murphy and et.al., 2018). Decrease in net profit will affect the firm's

profitability against its sale. In 2019, firm's net profit margin increased, it becomes 6.88% that

shows higher margin than last year and shows firm's ability to control its costs and generate more

profit. This is because firm sale its product on higher price than its costs. This indicates

company's efficiency and effectiveness to control its overhead cost and tax.

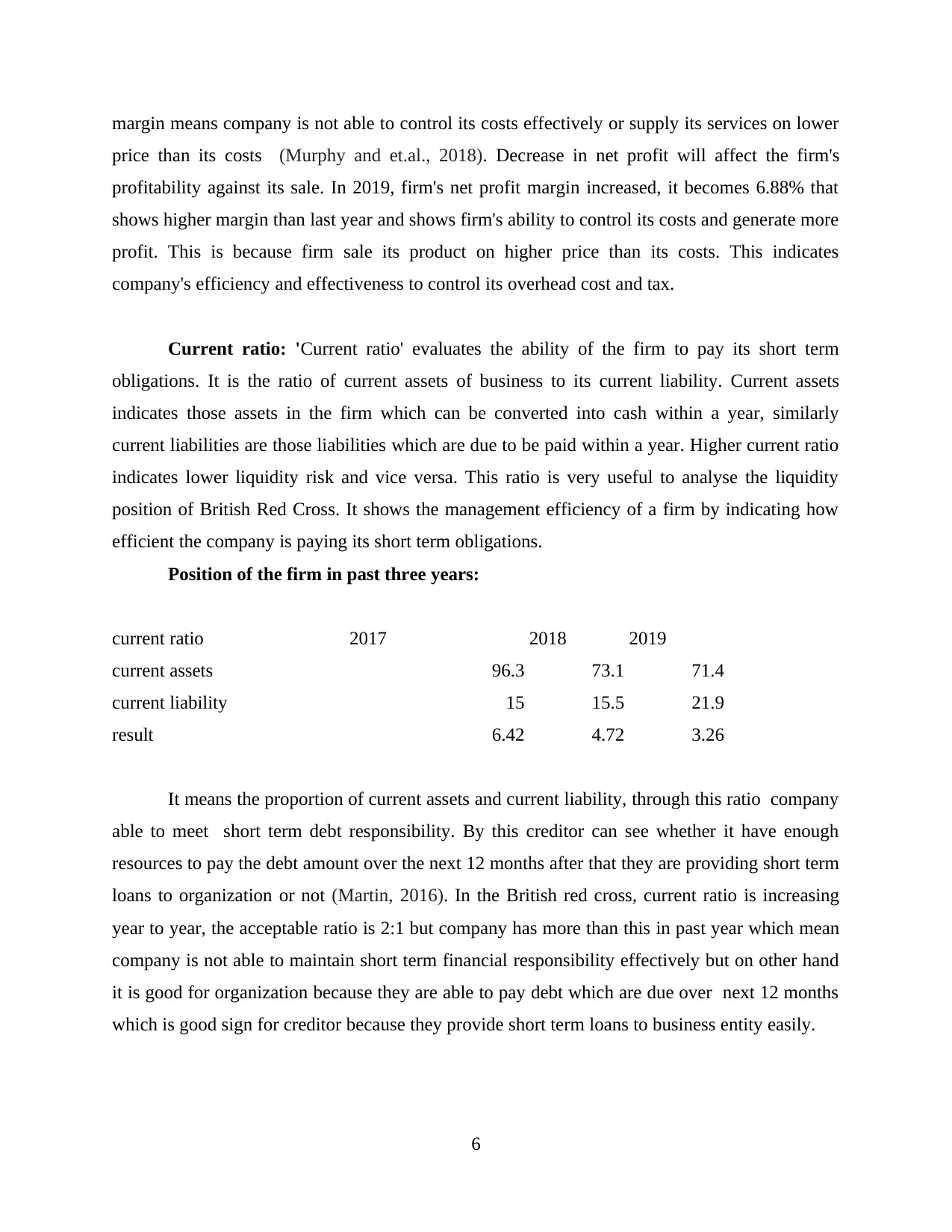

Current ratio: 'Current ratio' evaluates the ability of the firm to pay its short term

obligations. It is the ratio of current assets of business to its current liability. Current assets

indicates those assets in the firm which can be converted into cash within a year, similarly

current liabilities are those liabilities which are due to be paid within a year. Higher current ratio

indicates lower liquidity risk and vice versa. This ratio is very useful to analyse the liquidity

position of British Red Cross. It shows the management efficiency of a firm by indicating how

efficient the company is paying its short term obligations.

Position of the firm in past three years:

current ratio 2017 2018 2019

current assets 96.3 73.1 71.4

current liability 15 15.5 21.9

result 6.42 4.72 3.26

It means the proportion of current assets and current liability, through this ratio company

able to meet short term debt responsibility. By this creditor can see whether it have enough

resources to pay the debt amount over the next 12 months after that they are providing short term

loans to organization or not (Martin, 2016). In the British red cross, current ratio is increasing

year to year, the acceptable ratio is 2:1 but company has more than this in past year which mean

company is not able to maintain short term financial responsibility effectively but on other hand

it is good for organization because they are able to pay debt which are due over next 12 months

which is good sign for creditor because they provide short term loans to business entity easily.

6

price than its costs (Murphy and et.al., 2018). Decrease in net profit will affect the firm's

profitability against its sale. In 2019, firm's net profit margin increased, it becomes 6.88% that

shows higher margin than last year and shows firm's ability to control its costs and generate more

profit. This is because firm sale its product on higher price than its costs. This indicates

company's efficiency and effectiveness to control its overhead cost and tax.

Current ratio: 'Current ratio' evaluates the ability of the firm to pay its short term

obligations. It is the ratio of current assets of business to its current liability. Current assets

indicates those assets in the firm which can be converted into cash within a year, similarly

current liabilities are those liabilities which are due to be paid within a year. Higher current ratio

indicates lower liquidity risk and vice versa. This ratio is very useful to analyse the liquidity

position of British Red Cross. It shows the management efficiency of a firm by indicating how

efficient the company is paying its short term obligations.

Position of the firm in past three years:

current ratio 2017 2018 2019

current assets 96.3 73.1 71.4

current liability 15 15.5 21.9

result 6.42 4.72 3.26

It means the proportion of current assets and current liability, through this ratio company

able to meet short term debt responsibility. By this creditor can see whether it have enough

resources to pay the debt amount over the next 12 months after that they are providing short term

loans to organization or not (Martin, 2016). In the British red cross, current ratio is increasing

year to year, the acceptable ratio is 2:1 but company has more than this in past year which mean

company is not able to maintain short term financial responsibility effectively but on other hand

it is good for organization because they are able to pay debt which are due over next 12 months

which is good sign for creditor because they provide short term loans to business entity easily.

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

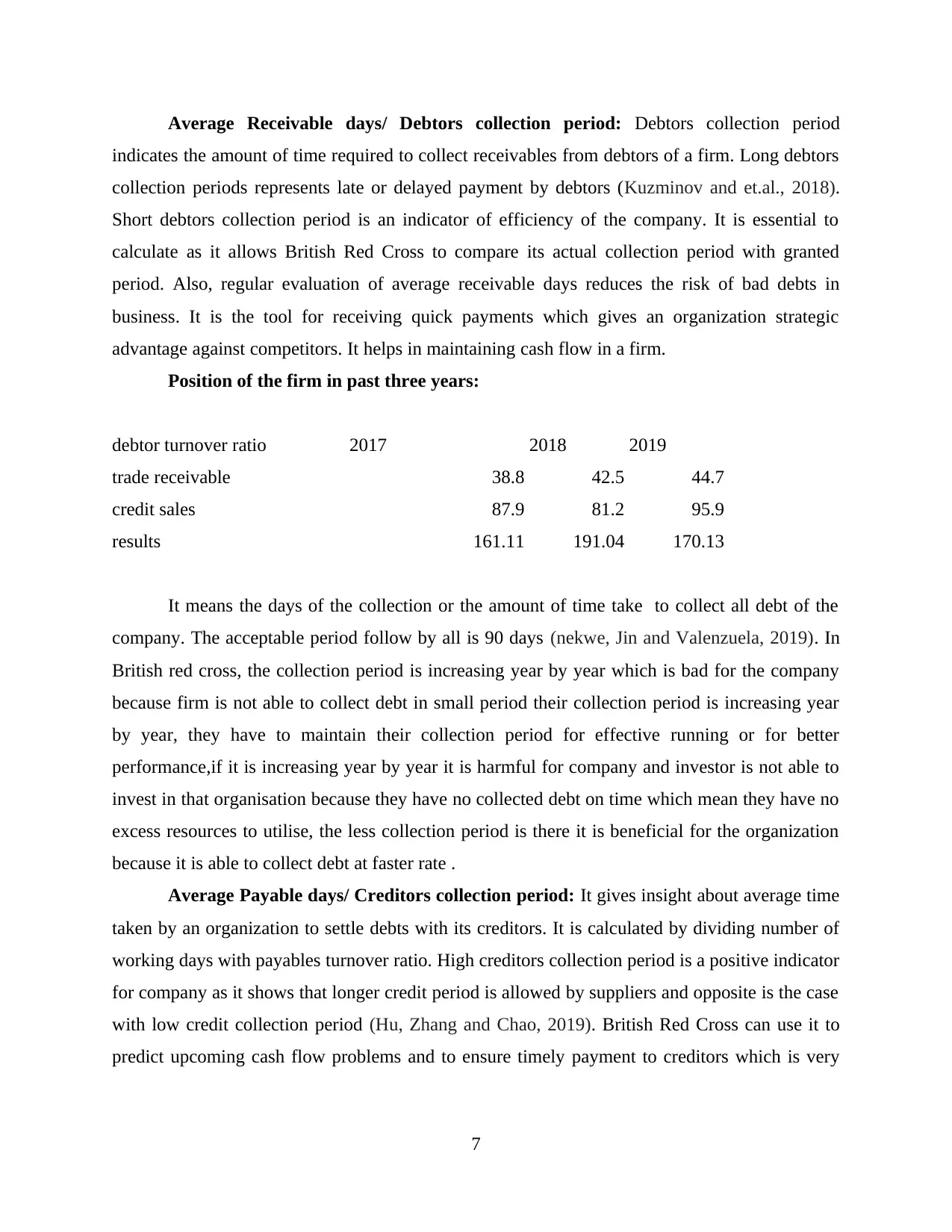

Average Receivable days/ Debtors collection period: Debtors collection period

indicates the amount of time required to collect receivables from debtors of a firm. Long debtors

collection periods represents late or delayed payment by debtors (Kuzminov and et.al., 2018).

Short debtors collection period is an indicator of efficiency of the company. It is essential to

calculate as it allows British Red Cross to compare its actual collection period with granted

period. Also, regular evaluation of average receivable days reduces the risk of bad debts in

business. It is the tool for receiving quick payments which gives an organization strategic

advantage against competitors. It helps in maintaining cash flow in a firm.

Position of the firm in past three years:

debtor turnover ratio 2017 2018 2019

trade receivable 38.8 42.5 44.7

credit sales 87.9 81.2 95.9

results 161.11 191.04 170.13

It means the days of the collection or the amount of time take to collect all debt of the

company. The acceptable period follow by all is 90 days (nekwe, Jin and Valenzuela, 2019). In

British red cross, the collection period is increasing year by year which is bad for the company

because firm is not able to collect debt in small period their collection period is increasing year

by year, they have to maintain their collection period for effective running or for better

performance,if it is increasing year by year it is harmful for company and investor is not able to

invest in that organisation because they have no collected debt on time which mean they have no

excess resources to utilise, the less collection period is there it is beneficial for the organization

because it is able to collect debt at faster rate .

Average Payable days/ Creditors collection period: It gives insight about average time

taken by an organization to settle debts with its creditors. It is calculated by dividing number of

working days with payables turnover ratio. High creditors collection period is a positive indicator

for company as it shows that longer credit period is allowed by suppliers and opposite is the case

with low credit collection period (Hu, Zhang and Chao, 2019). British Red Cross can use it to

predict upcoming cash flow problems and to ensure timely payment to creditors which is very

7

indicates the amount of time required to collect receivables from debtors of a firm. Long debtors

collection periods represents late or delayed payment by debtors (Kuzminov and et.al., 2018).

Short debtors collection period is an indicator of efficiency of the company. It is essential to

calculate as it allows British Red Cross to compare its actual collection period with granted

period. Also, regular evaluation of average receivable days reduces the risk of bad debts in

business. It is the tool for receiving quick payments which gives an organization strategic

advantage against competitors. It helps in maintaining cash flow in a firm.

Position of the firm in past three years:

debtor turnover ratio 2017 2018 2019

trade receivable 38.8 42.5 44.7

credit sales 87.9 81.2 95.9

results 161.11 191.04 170.13

It means the days of the collection or the amount of time take to collect all debt of the

company. The acceptable period follow by all is 90 days (nekwe, Jin and Valenzuela, 2019). In

British red cross, the collection period is increasing year by year which is bad for the company

because firm is not able to collect debt in small period their collection period is increasing year

by year, they have to maintain their collection period for effective running or for better

performance,if it is increasing year by year it is harmful for company and investor is not able to

invest in that organisation because they have no collected debt on time which mean they have no

excess resources to utilise, the less collection period is there it is beneficial for the organization

because it is able to collect debt at faster rate .

Average Payable days/ Creditors collection period: It gives insight about average time

taken by an organization to settle debts with its creditors. It is calculated by dividing number of

working days with payables turnover ratio. High creditors collection period is a positive indicator

for company as it shows that longer credit period is allowed by suppliers and opposite is the case

with low credit collection period (Hu, Zhang and Chao, 2019). British Red Cross can use it to

predict upcoming cash flow problems and to ensure timely payment to creditors which is very

7

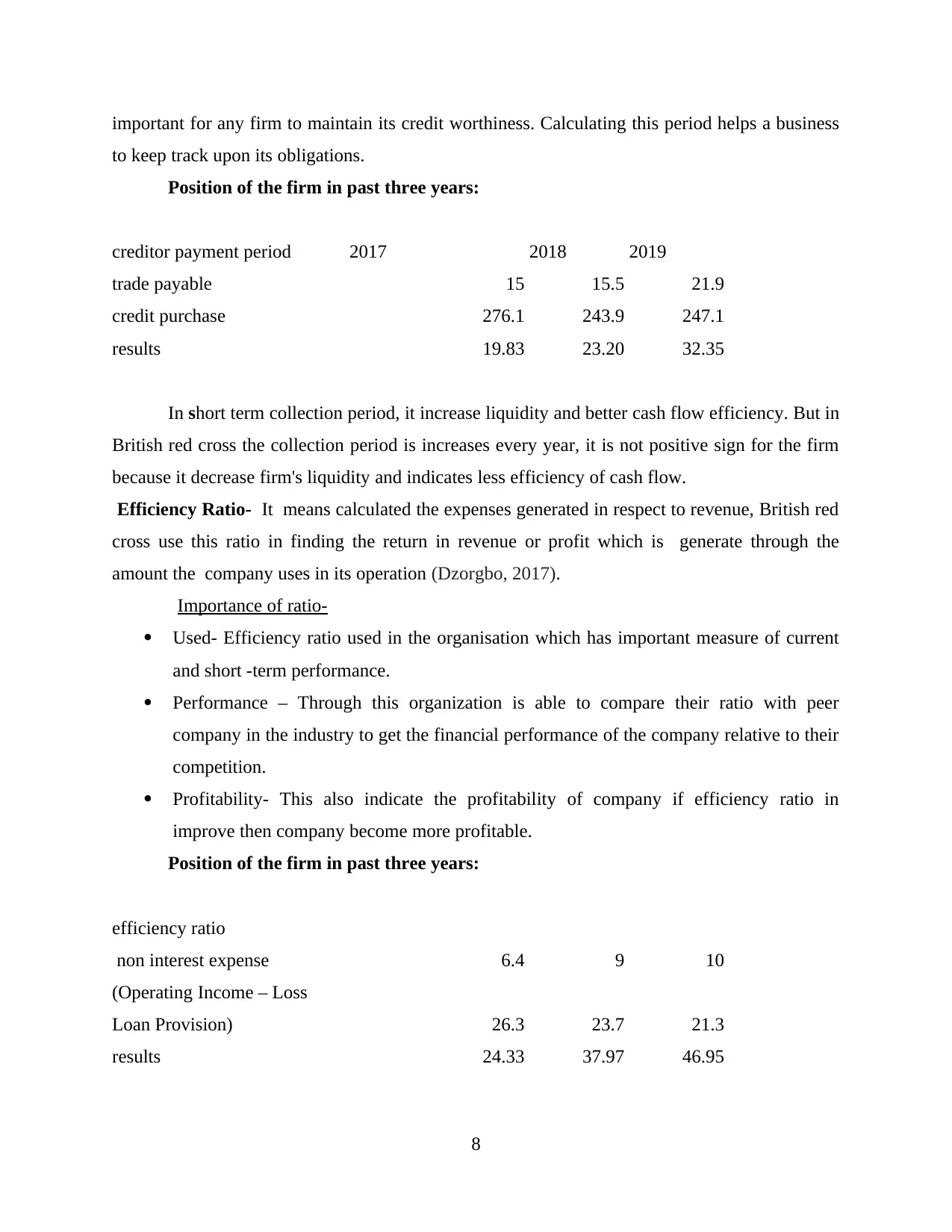

important for any firm to maintain its credit worthiness. Calculating this period helps a business

to keep track upon its obligations.

Position of the firm in past three years:

creditor payment period 2017 2018 2019

trade payable 15 15.5 21.9

credit purchase 276.1 243.9 247.1

results 19.83 23.20 32.35

In short term collection period, it increase liquidity and better cash flow efficiency. But in

British red cross the collection period is increases every year, it is not positive sign for the firm

because it decrease firm's liquidity and indicates less efficiency of cash flow.

Efficiency Ratio- It means calculated the expenses generated in respect to revenue, British red

cross use this ratio in finding the return in revenue or profit which is generate through the

amount the company uses in its operation (Dzorgbo, 2017).

Importance of ratio-

Used- Efficiency ratio used in the organisation which has important measure of current

and short -term performance.

Performance – Through this organization is able to compare their ratio with peer

company in the industry to get the financial performance of the company relative to their

competition.

Profitability- This also indicate the profitability of company if efficiency ratio in

improve then company become more profitable.

Position of the firm in past three years:

efficiency ratio

non interest expense 6.4 9 10

(Operating Income – Loss

Loan Provision) 26.3 23.7 21.3

results 24.33 37.97 46.95

8

to keep track upon its obligations.

Position of the firm in past three years:

creditor payment period 2017 2018 2019

trade payable 15 15.5 21.9

credit purchase 276.1 243.9 247.1

results 19.83 23.20 32.35

In short term collection period, it increase liquidity and better cash flow efficiency. But in

British red cross the collection period is increases every year, it is not positive sign for the firm

because it decrease firm's liquidity and indicates less efficiency of cash flow.

Efficiency Ratio- It means calculated the expenses generated in respect to revenue, British red

cross use this ratio in finding the return in revenue or profit which is generate through the

amount the company uses in its operation (Dzorgbo, 2017).

Importance of ratio-

Used- Efficiency ratio used in the organisation which has important measure of current

and short -term performance.

Performance – Through this organization is able to compare their ratio with peer

company in the industry to get the financial performance of the company relative to their

competition.

Profitability- This also indicate the profitability of company if efficiency ratio in

improve then company become more profitable.

Position of the firm in past three years:

efficiency ratio

non interest expense 6.4 9 10

(Operating Income – Loss

Loan Provision) 26.3 23.7 21.3

results 24.33 37.97 46.95

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.