BSBFIA401 Practical Assessment Part A

VerifiedAdded on 2023/06/18

|44

|6406

|55

AI Summary

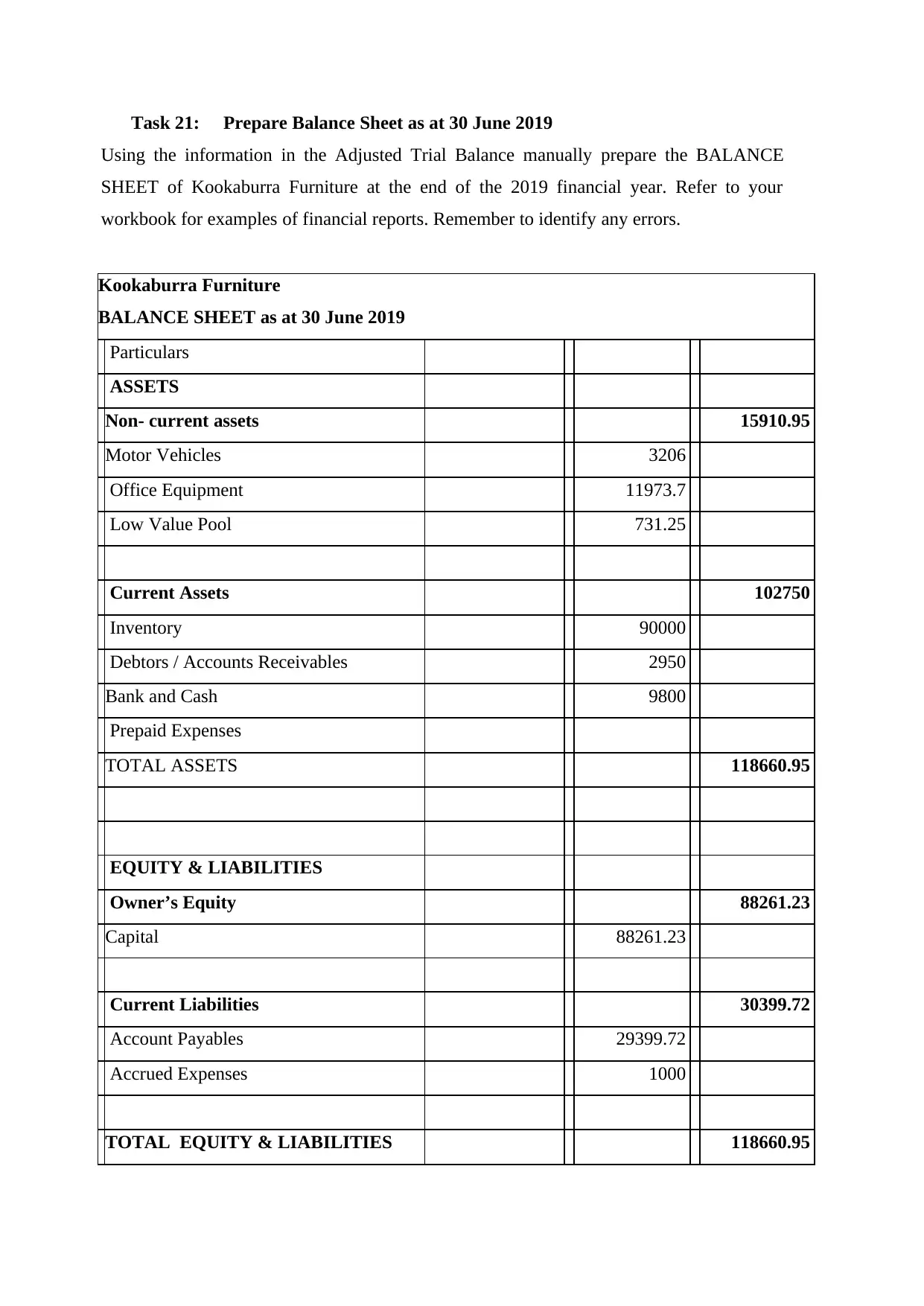

This assessment is in two parts and is to be completed using manual techniques in Part A and MYOB AccountRight in Part B. Part A must be marked Satisfactory to commence Part B. Preview the following General Ledger already prepared up to 29/06/19. In this assessment, you will maintain an asset register, process general journal entries on 30/06/19, post to the General Ledger, prepare an adjusted Trial Balance, Profit and Loss Statement and Balance Sheet.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

BSBFIA401

Part A

Practical Assessment

Manual Double Entry

V:\Business\Business Studies Team\02 Units\BSBFIA401\00 Assessments\Word Docs\BSBFIA401 Practical Assessment Part A.docx

Part A

Practical Assessment

Manual Double Entry

V:\Business\Business Studies Team\02 Units\BSBFIA401\00 Assessments\Word Docs\BSBFIA401 Practical Assessment Part A.docx

Student Name: .......................................................................................

Time Allowed: This assessment should take 2

to 3 hours to complete

Requirements:

• This Assessment

• Calculator

• Email access to supervisor to resolve any errors

• Access to Excel software

• Excel file “KookaburraDepreciation - 2019.xls” provided

on Moodle.

• Access to an electronic copy of Australian Accounting and

Auditing Standards AASB1018 - see the Resources section

in Moodle.

• Access to examples of financial data [found in “Preparing

Financial Reports [manual and MYOB AccountRight”]

• Access to the BAS Agent Code of Professional Conduct -

see the Resources section in Moodle.

Assessment Conditions:

Access to “Prepare Financial Reports [manual and MYOB AccountRight]” or any other

appropriate text, and participant’s notes are allowed.

Errors will be indicated.

All work must be accurate. It is recommended that on completion of this unit, participants

should be able to produce work with not more than two re-submissions.

Remember neatness and correction of error techniques are important.

Method of Assessment:

This assessment is in two parts and is to be completed using manual techniques in Part A and

MYOB AccountRight in Part B.

Part A must be marked Satisfactory to commence Part B.

Occupational Health and Safety:

Before beginning this assessment, check that your posture, lighting and working space meets

occupational health and safety recommendations.

3

Time Allowed: This assessment should take 2

to 3 hours to complete

Requirements:

• This Assessment

• Calculator

• Email access to supervisor to resolve any errors

• Access to Excel software

• Excel file “KookaburraDepreciation - 2019.xls” provided

on Moodle.

• Access to an electronic copy of Australian Accounting and

Auditing Standards AASB1018 - see the Resources section

in Moodle.

• Access to examples of financial data [found in “Preparing

Financial Reports [manual and MYOB AccountRight”]

• Access to the BAS Agent Code of Professional Conduct -

see the Resources section in Moodle.

Assessment Conditions:

Access to “Prepare Financial Reports [manual and MYOB AccountRight]” or any other

appropriate text, and participant’s notes are allowed.

Errors will be indicated.

All work must be accurate. It is recommended that on completion of this unit, participants

should be able to produce work with not more than two re-submissions.

Remember neatness and correction of error techniques are important.

Method of Assessment:

This assessment is in two parts and is to be completed using manual techniques in Part A and

MYOB AccountRight in Part B.

Part A must be marked Satisfactory to commence Part B.

Occupational Health and Safety:

Before beginning this assessment, check that your posture, lighting and working space meets

occupational health and safety recommendations.

3

Assessment Details

Jason Wilson set up his furniture business in Eskdale. Jason leases premises and

has taken out a Bank Loan to buy a motor vehicle.

Jason has registered “Kookaburra Furniture” as his business

name. He has obtained an ABN and registered for GST, reporting GST monthly

on an ACCRUAL BASIS. The business expenses any Capital Acquisitions less

than $100 excluding GST. Capital Acquisitions less than $1,000 excluding GST

are allocated to the Low-Value Pool.

An extract from the Policies and Procedures of Kookaburra Furniture is printed on the

following page. Printed below is the Chart of Accounts used by Kookaburra Furniture.

CHART OF ACCOUNTS – Kookaburra Furniture

110 Bank

120 Accounts Receivable [Debtors]

125 Provision for Doubtful Debts

130 Prepaid Expenses

135 Accrued Income

140 Stock on Hand [Furniture]

150 Office Equipment

155 Accumulated Depreciation – Office Equipment

160 Motor Vehicles

165 Accumulated Depreciation - Motor Vehicles

180 Low-Value Pool

210 Accounts Payable [Creditors]

220 GST Collected

230 GST Paid

240 Prepaid Income

250 Accrued Expenses

270 Bank Loan

310 Capital

320 Drawings

410 Sales [furniture]

430 Interest Received

510 Opening Stock

520 Purchases [furniture]

530 Closing Stock

610 Advertising

620 Accounting Fees

630 Bad and Doubtful Debts

640 Bank Charges

650 Depreciation

660 Lease of Premises

670 Motor Vehicle Expenses

V:\Business\Business Studies Team\02 Units\BSBFIA401\00 Assessments\Word Docs\BSBFIA401 Practical Assessment Part A.docx

Jason Wilson set up his furniture business in Eskdale. Jason leases premises and

has taken out a Bank Loan to buy a motor vehicle.

Jason has registered “Kookaburra Furniture” as his business

name. He has obtained an ABN and registered for GST, reporting GST monthly

on an ACCRUAL BASIS. The business expenses any Capital Acquisitions less

than $100 excluding GST. Capital Acquisitions less than $1,000 excluding GST

are allocated to the Low-Value Pool.

An extract from the Policies and Procedures of Kookaburra Furniture is printed on the

following page. Printed below is the Chart of Accounts used by Kookaburra Furniture.

CHART OF ACCOUNTS – Kookaburra Furniture

110 Bank

120 Accounts Receivable [Debtors]

125 Provision for Doubtful Debts

130 Prepaid Expenses

135 Accrued Income

140 Stock on Hand [Furniture]

150 Office Equipment

155 Accumulated Depreciation – Office Equipment

160 Motor Vehicles

165 Accumulated Depreciation - Motor Vehicles

180 Low-Value Pool

210 Accounts Payable [Creditors]

220 GST Collected

230 GST Paid

240 Prepaid Income

250 Accrued Expenses

270 Bank Loan

310 Capital

320 Drawings

410 Sales [furniture]

430 Interest Received

510 Opening Stock

520 Purchases [furniture]

530 Closing Stock

610 Advertising

620 Accounting Fees

630 Bad and Doubtful Debts

640 Bank Charges

650 Depreciation

660 Lease of Premises

670 Motor Vehicle Expenses

V:\Business\Business Studies Team\02 Units\BSBFIA401\00 Assessments\Word Docs\BSBFIA401 Practical Assessment Part A.docx

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

680 Superannuation

690 Wages

810 Gain on Sale of Asset

910 Loss on Sale of Asset

5

690 Wages

810 Gain on Sale of Asset

910 Loss on Sale of Asset

5

Kookaburra Furniture

[Extract from] Accounting Policies and Procedures

Accounting System

The business keeps an Accrual set of books, accounting for debtors and creditors. Credit purchases are

paid for by cheque or electronic transfer. Cash purchases are paid for by credit card or petty cash. Both

cash and credit sales are recorded. All discrepancies should be identified and resolved or referred to

Jason Wilson [your supervisor] for clarification.

General Ledger

A Chart of Accounts has been drawn up in consultation with the Accountant.

Accounts are not to be added unless there is no other account which can be used.

If accounts are added, care must be taken so that the new accounts are on the correct level so that

financial reports are accurate in MYOB AccountRight

3 General Journal Entries

General Journal Entries are to be avoided. Journals should only be used for the following transactions:

prepayments and accruals, end of year adjustments and stock adjustments if needed.

General Journal Procedures [manual set of books]:

1 A General Journal sheet is used to record journals.

2 Appropriate supporting documentation should be supplied with each journal entry to justify the

transaction. The supporting documents should clearly explain the reason for the journal entry and the

basis of the journal entries arising.

3 The journal entry should contain:

The correct account from the Chart of Accounts line

Amounts in dollars and cents

Amounts allocated to the correct debit or credit column clear

Distinction between numeric and alpha characters

The reason for the journal

Total debits and total credits

Errors must be neatly crossed out and initialled by the bookkeeper and the correct amount entered

above

A batch number is written on the top of the journal. This batch number will be used as the

posting reference in the General Ledger. The ledger account number is used as the posting

reference in the journal.

General Journal Procedures [using MYOB AccountRight]:

1 Appropriate supporting documentation should be supplied with each journal entry to justify the

transactions. The supporting documents should clearly explain the reason for the journal entry and the

basis of the journal entries arising.

2 The journal entry should contain:

The correct Chart of Accounts code

The reason for the journal

Amounts allocated to the correct debit or credit column

3 The Journal ID should be written on the source document.

4 At the end of each month, a hard copy of journal entries for the month is printed.

V:\Business\Business Studies Team\02 Units\BSBFIA401\00 Assessments\Word Docs\BSBFIA401 Practical Assessment Part A.docx

[Extract from] Accounting Policies and Procedures

Accounting System

The business keeps an Accrual set of books, accounting for debtors and creditors. Credit purchases are

paid for by cheque or electronic transfer. Cash purchases are paid for by credit card or petty cash. Both

cash and credit sales are recorded. All discrepancies should be identified and resolved or referred to

Jason Wilson [your supervisor] for clarification.

General Ledger

A Chart of Accounts has been drawn up in consultation with the Accountant.

Accounts are not to be added unless there is no other account which can be used.

If accounts are added, care must be taken so that the new accounts are on the correct level so that

financial reports are accurate in MYOB AccountRight

3 General Journal Entries

General Journal Entries are to be avoided. Journals should only be used for the following transactions:

prepayments and accruals, end of year adjustments and stock adjustments if needed.

General Journal Procedures [manual set of books]:

1 A General Journal sheet is used to record journals.

2 Appropriate supporting documentation should be supplied with each journal entry to justify the

transaction. The supporting documents should clearly explain the reason for the journal entry and the

basis of the journal entries arising.

3 The journal entry should contain:

The correct account from the Chart of Accounts line

Amounts in dollars and cents

Amounts allocated to the correct debit or credit column clear

Distinction between numeric and alpha characters

The reason for the journal

Total debits and total credits

Errors must be neatly crossed out and initialled by the bookkeeper and the correct amount entered

above

A batch number is written on the top of the journal. This batch number will be used as the

posting reference in the General Ledger. The ledger account number is used as the posting

reference in the journal.

General Journal Procedures [using MYOB AccountRight]:

1 Appropriate supporting documentation should be supplied with each journal entry to justify the

transactions. The supporting documents should clearly explain the reason for the journal entry and the

basis of the journal entries arising.

2 The journal entry should contain:

The correct Chart of Accounts code

The reason for the journal

Amounts allocated to the correct debit or credit column

3 The Journal ID should be written on the source document.

4 At the end of each month, a hard copy of journal entries for the month is printed.

V:\Business\Business Studies Team\02 Units\BSBFIA401\00 Assessments\Word Docs\BSBFIA401 Practical Assessment Part A.docx

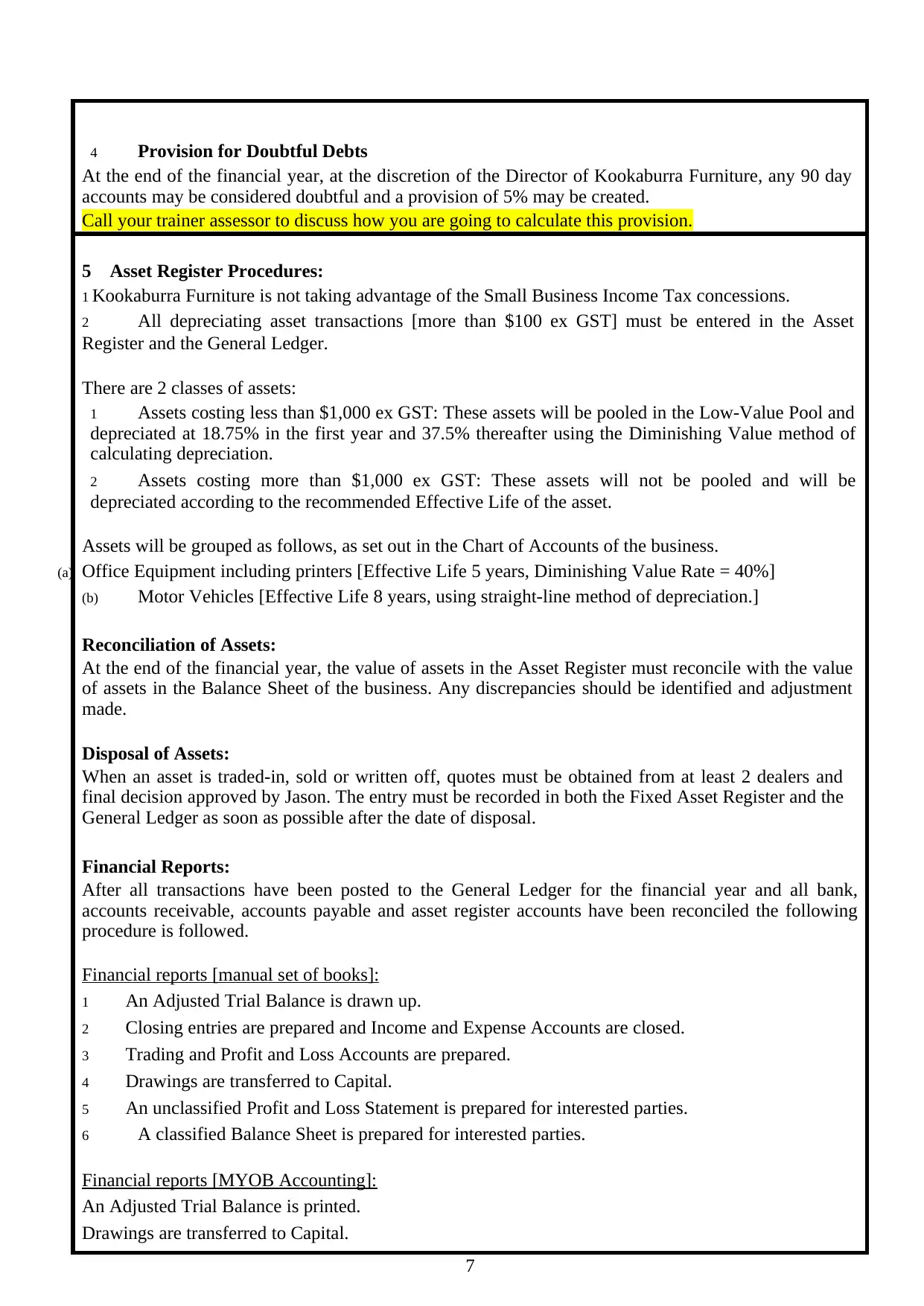

4 Provision for Doubtful Debts

At the end of the financial year, at the discretion of the Director of Kookaburra Furniture, any 90 day

accounts may be considered doubtful and a provision of 5% may be created.

Call your trainer assessor to discuss how you are going to calculate this provision.

5 Asset Register Procedures:

1 Kookaburra Furniture is not taking advantage of the Small Business Income Tax concessions.

2 All depreciating asset transactions [more than $100 ex GST] must be entered in the Asset

Register and the General Ledger.

There are 2 classes of assets:

1 Assets costing less than $1,000 ex GST: These assets will be pooled in the Low-Value Pool and

depreciated at 18.75% in the first year and 37.5% thereafter using the Diminishing Value method of

calculating depreciation.

2 Assets costing more than $1,000 ex GST: These assets will not be pooled and will be

depreciated according to the recommended Effective Life of the asset.

Assets will be grouped as follows, as set out in the Chart of Accounts of the business.

(a) Office Equipment including printers [Effective Life 5 years, Diminishing Value Rate = 40%]

(b) Motor Vehicles [Effective Life 8 years, using straight-line method of depreciation.]

Reconciliation of Assets:

At the end of the financial year, the value of assets in the Asset Register must reconcile with the value

of assets in the Balance Sheet of the business. Any discrepancies should be identified and adjustment

made.

Disposal of Assets:

When an asset is traded-in, sold or written off, quotes must be obtained from at least 2 dealers and

final decision approved by Jason. The entry must be recorded in both the Fixed Asset Register and the

General Ledger as soon as possible after the date of disposal.

Financial Reports:

After all transactions have been posted to the General Ledger for the financial year and all bank,

accounts receivable, accounts payable and asset register accounts have been reconciled the following

procedure is followed.

Financial reports [manual set of books]:

1 An Adjusted Trial Balance is drawn up.

2 Closing entries are prepared and Income and Expense Accounts are closed.

3 Trading and Profit and Loss Accounts are prepared.

4 Drawings are transferred to Capital.

5 An unclassified Profit and Loss Statement is prepared for interested parties.

6 A classified Balance Sheet is prepared for interested parties.

Financial reports [MYOB Accounting]:

An Adjusted Trial Balance is printed.

Drawings are transferred to Capital.

7

At the end of the financial year, at the discretion of the Director of Kookaburra Furniture, any 90 day

accounts may be considered doubtful and a provision of 5% may be created.

Call your trainer assessor to discuss how you are going to calculate this provision.

5 Asset Register Procedures:

1 Kookaburra Furniture is not taking advantage of the Small Business Income Tax concessions.

2 All depreciating asset transactions [more than $100 ex GST] must be entered in the Asset

Register and the General Ledger.

There are 2 classes of assets:

1 Assets costing less than $1,000 ex GST: These assets will be pooled in the Low-Value Pool and

depreciated at 18.75% in the first year and 37.5% thereafter using the Diminishing Value method of

calculating depreciation.

2 Assets costing more than $1,000 ex GST: These assets will not be pooled and will be

depreciated according to the recommended Effective Life of the asset.

Assets will be grouped as follows, as set out in the Chart of Accounts of the business.

(a) Office Equipment including printers [Effective Life 5 years, Diminishing Value Rate = 40%]

(b) Motor Vehicles [Effective Life 8 years, using straight-line method of depreciation.]

Reconciliation of Assets:

At the end of the financial year, the value of assets in the Asset Register must reconcile with the value

of assets in the Balance Sheet of the business. Any discrepancies should be identified and adjustment

made.

Disposal of Assets:

When an asset is traded-in, sold or written off, quotes must be obtained from at least 2 dealers and

final decision approved by Jason. The entry must be recorded in both the Fixed Asset Register and the

General Ledger as soon as possible after the date of disposal.

Financial Reports:

After all transactions have been posted to the General Ledger for the financial year and all bank,

accounts receivable, accounts payable and asset register accounts have been reconciled the following

procedure is followed.

Financial reports [manual set of books]:

1 An Adjusted Trial Balance is drawn up.

2 Closing entries are prepared and Income and Expense Accounts are closed.

3 Trading and Profit and Loss Accounts are prepared.

4 Drawings are transferred to Capital.

5 An unclassified Profit and Loss Statement is prepared for interested parties.

6 A classified Balance Sheet is prepared for interested parties.

Financial reports [MYOB Accounting]:

An Adjusted Trial Balance is printed.

Drawings are transferred to Capital.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Retained Earnings are transferred to Capital

4 A Profit and Loss Statement is printed for interested parties. 5 A Balance Sheet is printed

for interested parties.

9 Workplace Health and Safety

Kookaburra Furniture recognises its moral and legal responsibility, in particular to the Workplace

Health and Safety Act 2013 [Qld], to provide a safe and healthy work environment for employees and

customers.

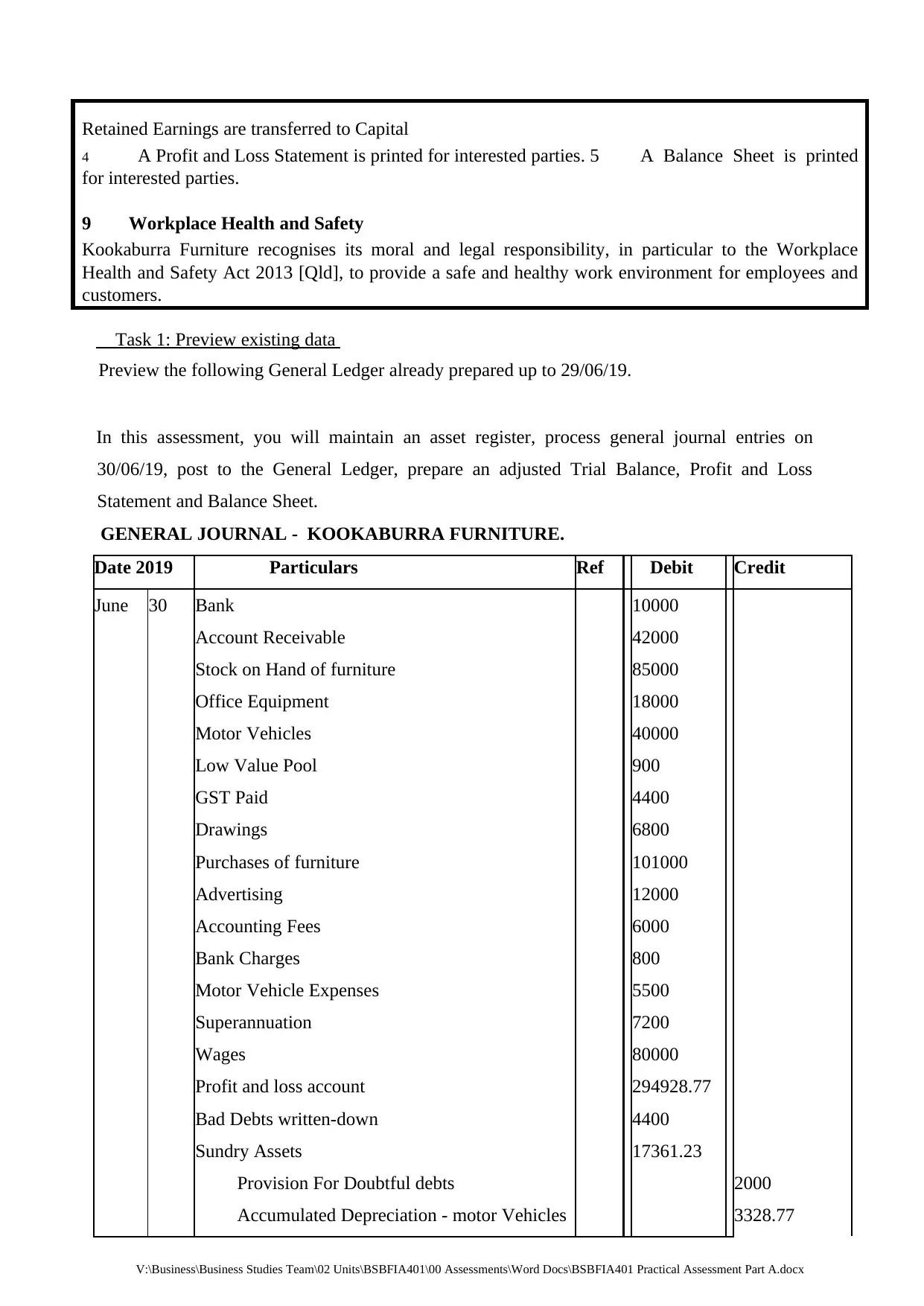

Task 1: Preview existing data

Preview the following General Ledger already prepared up to 29/06/19.

In this assessment, you will maintain an asset register, process general journal entries on

30/06/19, post to the General Ledger, prepare an adjusted Trial Balance, Profit and Loss

Statement and Balance Sheet.

GENERAL JOURNAL - KOOKABURRA FURNITURE.

Date 2019 Particulars Ref Debit Credit

June 30 Bank

Account Receivable

Stock on Hand of furniture

Office Equipment

Motor Vehicles

Low Value Pool

GST Paid

Drawings

Purchases of furniture

Advertising

Accounting Fees

Bank Charges

Motor Vehicle Expenses

Superannuation

Wages

Profit and loss account

Bad Debts written-down

Sundry Assets

Provision For Doubtful debts

Accumulated Depreciation - motor Vehicles

10000

42000

85000

18000

40000

900

4400

6800

101000

12000

6000

800

5500

7200

80000

294928.77

4400

17361.23

2000

3328.77

V:\Business\Business Studies Team\02 Units\BSBFIA401\00 Assessments\Word Docs\BSBFIA401 Practical Assessment Part A.docx

4 A Profit and Loss Statement is printed for interested parties. 5 A Balance Sheet is printed

for interested parties.

9 Workplace Health and Safety

Kookaburra Furniture recognises its moral and legal responsibility, in particular to the Workplace

Health and Safety Act 2013 [Qld], to provide a safe and healthy work environment for employees and

customers.

Task 1: Preview existing data

Preview the following General Ledger already prepared up to 29/06/19.

In this assessment, you will maintain an asset register, process general journal entries on

30/06/19, post to the General Ledger, prepare an adjusted Trial Balance, Profit and Loss

Statement and Balance Sheet.

GENERAL JOURNAL - KOOKABURRA FURNITURE.

Date 2019 Particulars Ref Debit Credit

June 30 Bank

Account Receivable

Stock on Hand of furniture

Office Equipment

Motor Vehicles

Low Value Pool

GST Paid

Drawings

Purchases of furniture

Advertising

Accounting Fees

Bank Charges

Motor Vehicle Expenses

Superannuation

Wages

Profit and loss account

Bad Debts written-down

Sundry Assets

Provision For Doubtful debts

Accumulated Depreciation - motor Vehicles

10000

42000

85000

18000

40000

900

4400

6800

101000

12000

6000

800

5500

7200

80000

294928.77

4400

17361.23

2000

3328.77

V:\Business\Business Studies Team\02 Units\BSBFIA401\00 Assessments\Word Docs\BSBFIA401 Practical Assessment Part A.docx

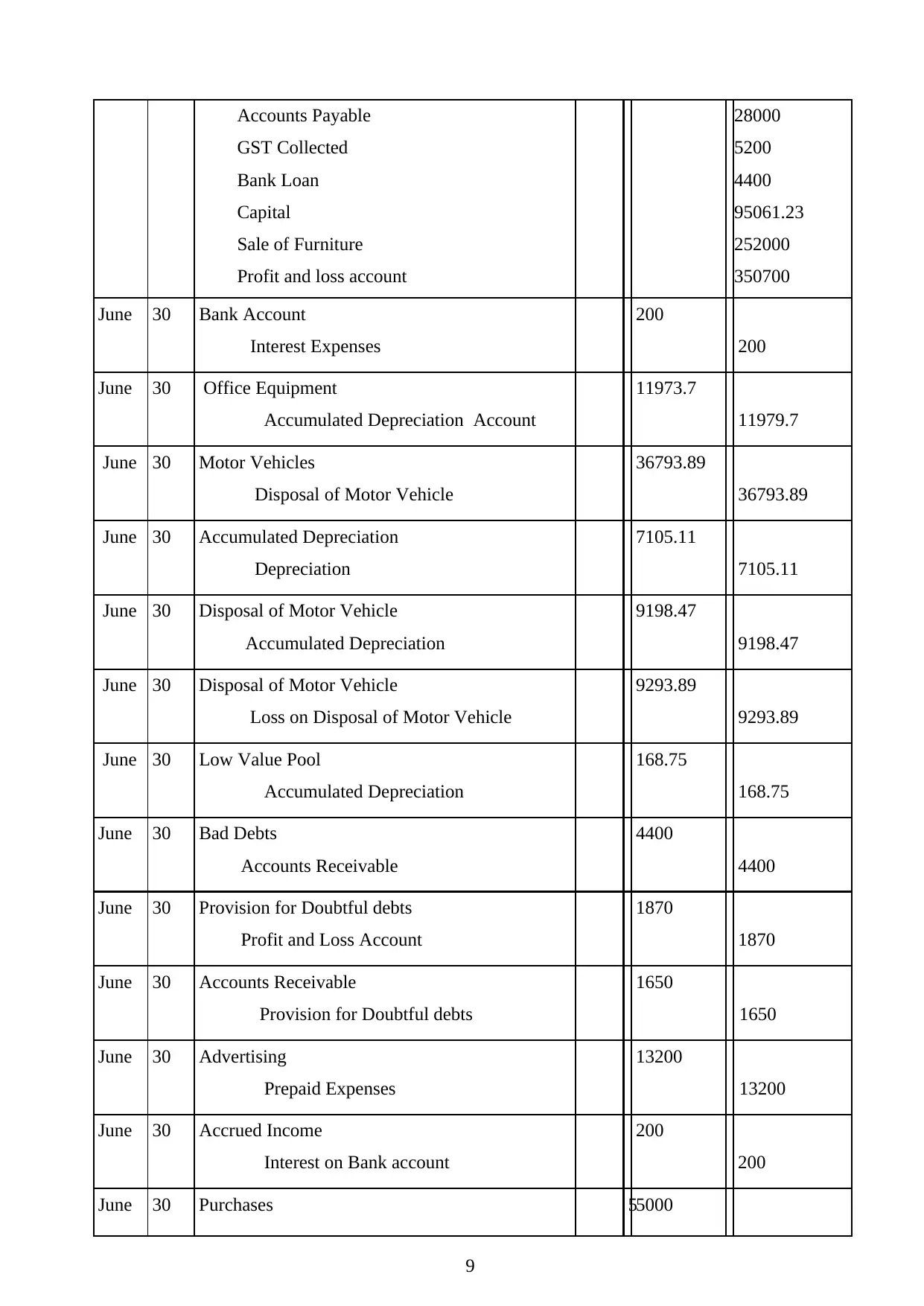

Accounts Payable

GST Collected

Bank Loan

Capital

Sale of Furniture

Profit and loss account

28000

5200

4400

95061.23

252000

350700

June 30 Bank Account

Interest Expenses

200

200

June 30 Office Equipment

Accumulated Depreciation Account

11973.7

11979.7

June 30 Motor Vehicles

Disposal of Motor Vehicle

36793.89

36793.89

June 30 Accumulated Depreciation

Depreciation

7105.11

7105.11

June 30 Disposal of Motor Vehicle

Accumulated Depreciation

9198.47

9198.47

June 30 Disposal of Motor Vehicle

Loss on Disposal of Motor Vehicle

9293.89

9293.89

June 30 Low Value Pool

Accumulated Depreciation

168.75

168.75

June 30 Bad Debts

Accounts Receivable

4400

4400

June 30 Provision for Doubtful debts

Profit and Loss Account

1870

1870

June 30 Accounts Receivable

Provision for Doubtful debts

1650

1650

June 30 Advertising

Prepaid Expenses

13200

13200

June 30 Accrued Income

Interest on Bank account

200

200

June 30 Purchases 55000

9

GST Collected

Bank Loan

Capital

Sale of Furniture

Profit and loss account

28000

5200

4400

95061.23

252000

350700

June 30 Bank Account

Interest Expenses

200

200

June 30 Office Equipment

Accumulated Depreciation Account

11973.7

11979.7

June 30 Motor Vehicles

Disposal of Motor Vehicle

36793.89

36793.89

June 30 Accumulated Depreciation

Depreciation

7105.11

7105.11

June 30 Disposal of Motor Vehicle

Accumulated Depreciation

9198.47

9198.47

June 30 Disposal of Motor Vehicle

Loss on Disposal of Motor Vehicle

9293.89

9293.89

June 30 Low Value Pool

Accumulated Depreciation

168.75

168.75

June 30 Bad Debts

Accounts Receivable

4400

4400

June 30 Provision for Doubtful debts

Profit and Loss Account

1870

1870

June 30 Accounts Receivable

Provision for Doubtful debts

1650

1650

June 30 Advertising

Prepaid Expenses

13200

13200

June 30 Accrued Income

Interest on Bank account

200

200

June 30 Purchases 55000

9

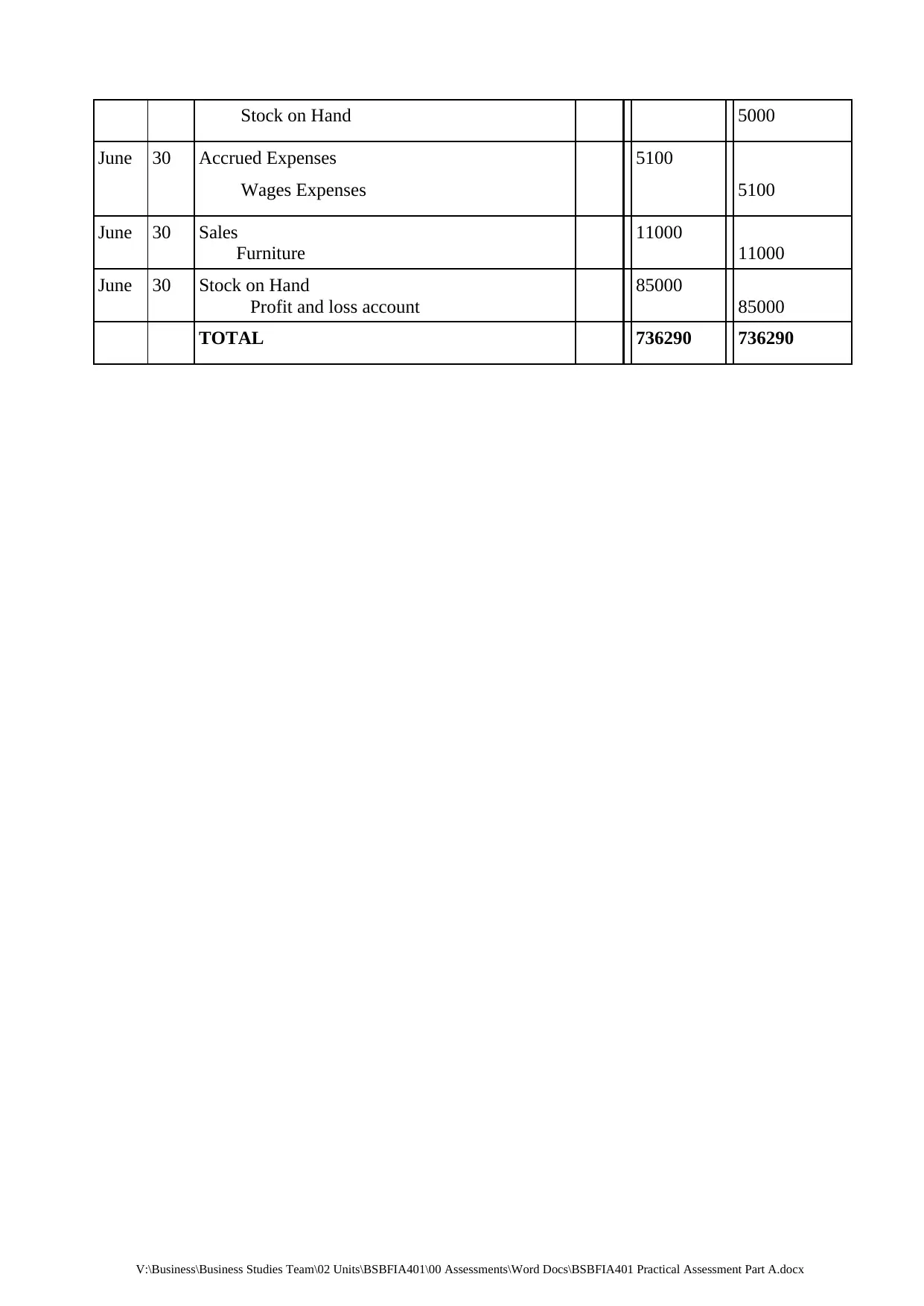

Stock on Hand 5000

June 30 Accrued Expenses

Wages Expenses

5100

5100

June 30 Sales

Furniture

11000

11000

June 30 Stock on Hand

Profit and loss account

85000

85000

TOTAL 736290 736290

V:\Business\Business Studies Team\02 Units\BSBFIA401\00 Assessments\Word Docs\BSBFIA401 Practical Assessment Part A.docx

June 30 Accrued Expenses

Wages Expenses

5100

5100

June 30 Sales

Furniture

11000

11000

June 30 Stock on Hand

Profit and loss account

85000

85000

TOTAL 736290 736290

V:\Business\Business Studies Team\02 Units\BSBFIA401\00 Assessments\Word Docs\BSBFIA401 Practical Assessment Part A.docx

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

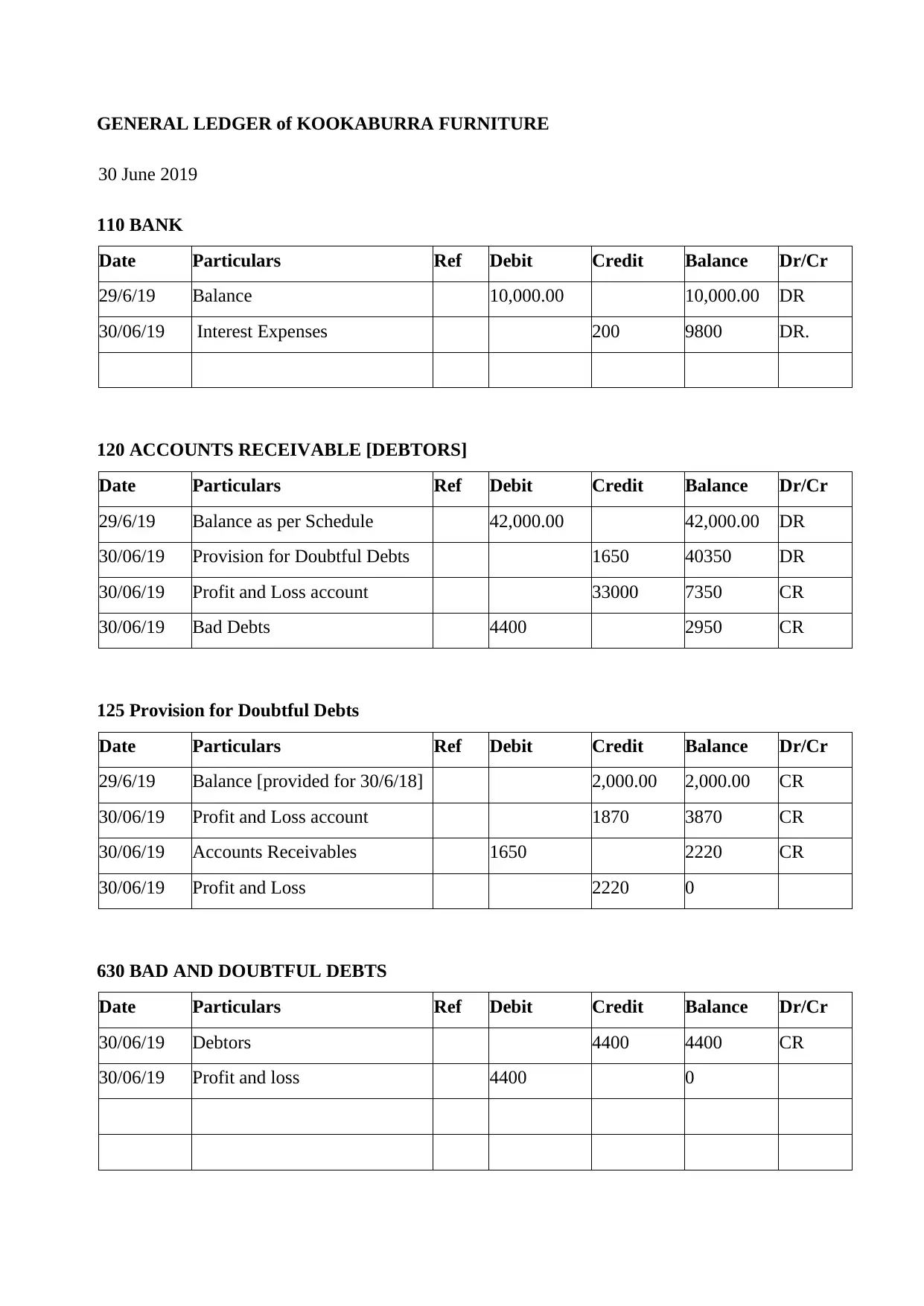

GENERAL LEDGER of KOOKABURRA FURNITURE

30 June 2019

110 BANK

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 10,000.00 10,000.00 DR

30/06/19 Interest Expenses 200 9800 DR.

120 ACCOUNTS RECEIVABLE [DEBTORS]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Schedule 42,000.00 42,000.00 DR

30/06/19 Provision for Doubtful Debts 1650 40350 DR

30/06/19 Profit and Loss account 33000 7350 CR

30/06/19 Bad Debts 4400 2950 CR

125 Provision for Doubtful Debts

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [provided for 30/6/18] 2,000.00 2,000.00 CR

30/06/19 Profit and Loss account 1870 3870 CR

30/06/19 Accounts Receivables 1650 2220 CR

30/06/19 Profit and Loss 2220 0

630 BAD AND DOUBTFUL DEBTS

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Debtors 4400 4400 CR

30/06/19 Profit and loss 4400 0

30 June 2019

110 BANK

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 10,000.00 10,000.00 DR

30/06/19 Interest Expenses 200 9800 DR.

120 ACCOUNTS RECEIVABLE [DEBTORS]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Schedule 42,000.00 42,000.00 DR

30/06/19 Provision for Doubtful Debts 1650 40350 DR

30/06/19 Profit and Loss account 33000 7350 CR

30/06/19 Bad Debts 4400 2950 CR

125 Provision for Doubtful Debts

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [provided for 30/6/18] 2,000.00 2,000.00 CR

30/06/19 Profit and Loss account 1870 3870 CR

30/06/19 Accounts Receivables 1650 2220 CR

30/06/19 Profit and Loss 2220 0

630 BAD AND DOUBTFUL DEBTS

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Debtors 4400 4400 CR

30/06/19 Profit and loss 4400 0

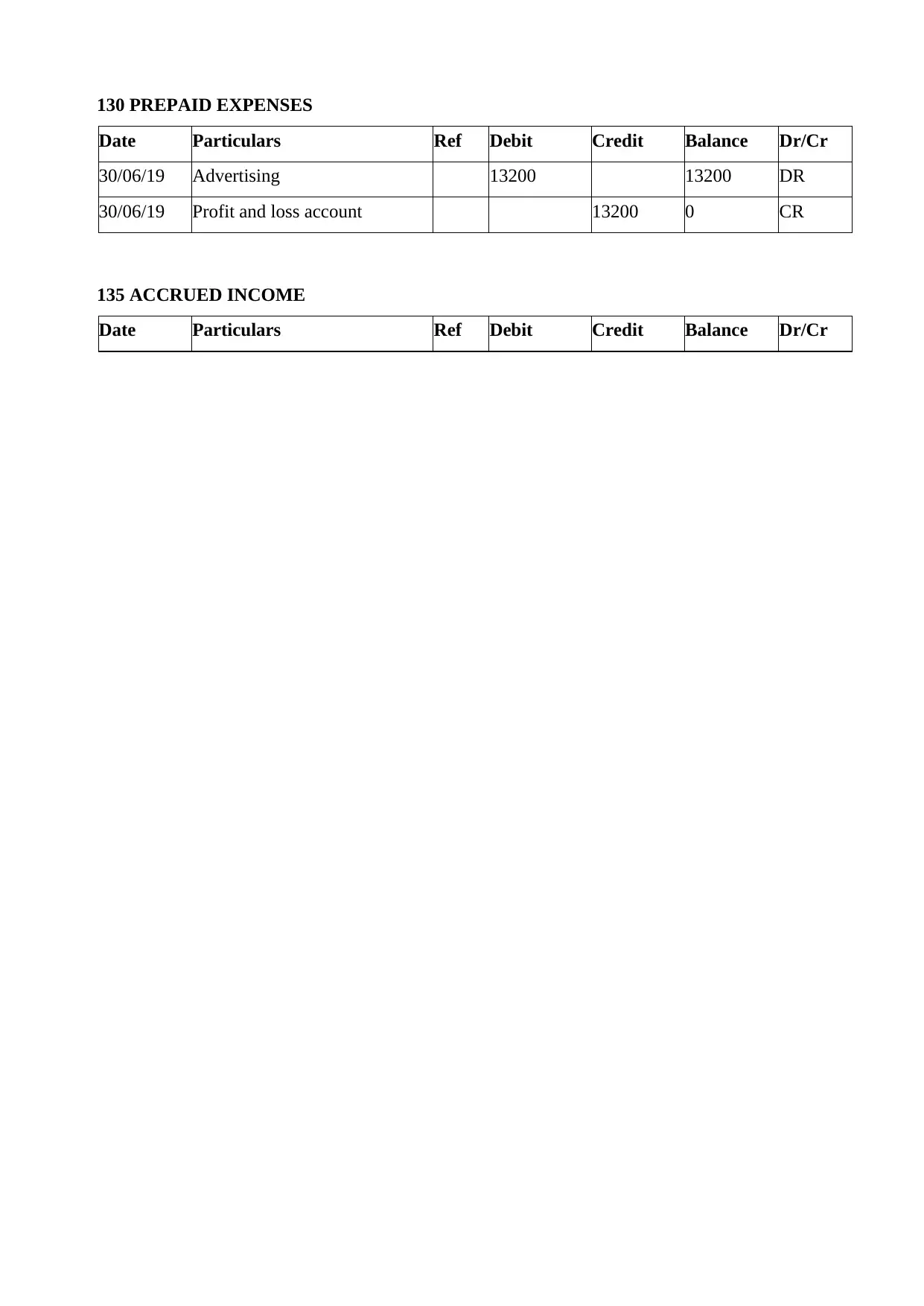

130 PREPAID EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Advertising 13200 13200 DR

30/06/19 Profit and loss account 13200 0 CR

135 ACCRUED INCOME

Date Particulars Ref Debit Credit Balance Dr/Cr

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Advertising 13200 13200 DR

30/06/19 Profit and loss account 13200 0 CR

135 ACCRUED INCOME

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Interest on Bank A/c 200 200 CR

30/06/19 Profit and loss account 200 0 DR

140 STOCK ON HAND [Furniture]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [1/7/18] 85,000.00 85,000.00 DR

30/06/19 Purchases 5000 90000 DR

30/06/19 Profit and loss account 90000 0

13

30/06/19 Profit and loss account 200 0 DR

140 STOCK ON HAND [Furniture]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [1/7/18] 85,000.00 85,000.00 DR

30/06/19 Purchases 5000 90000 DR

30/06/19 Profit and loss account 90000 0

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

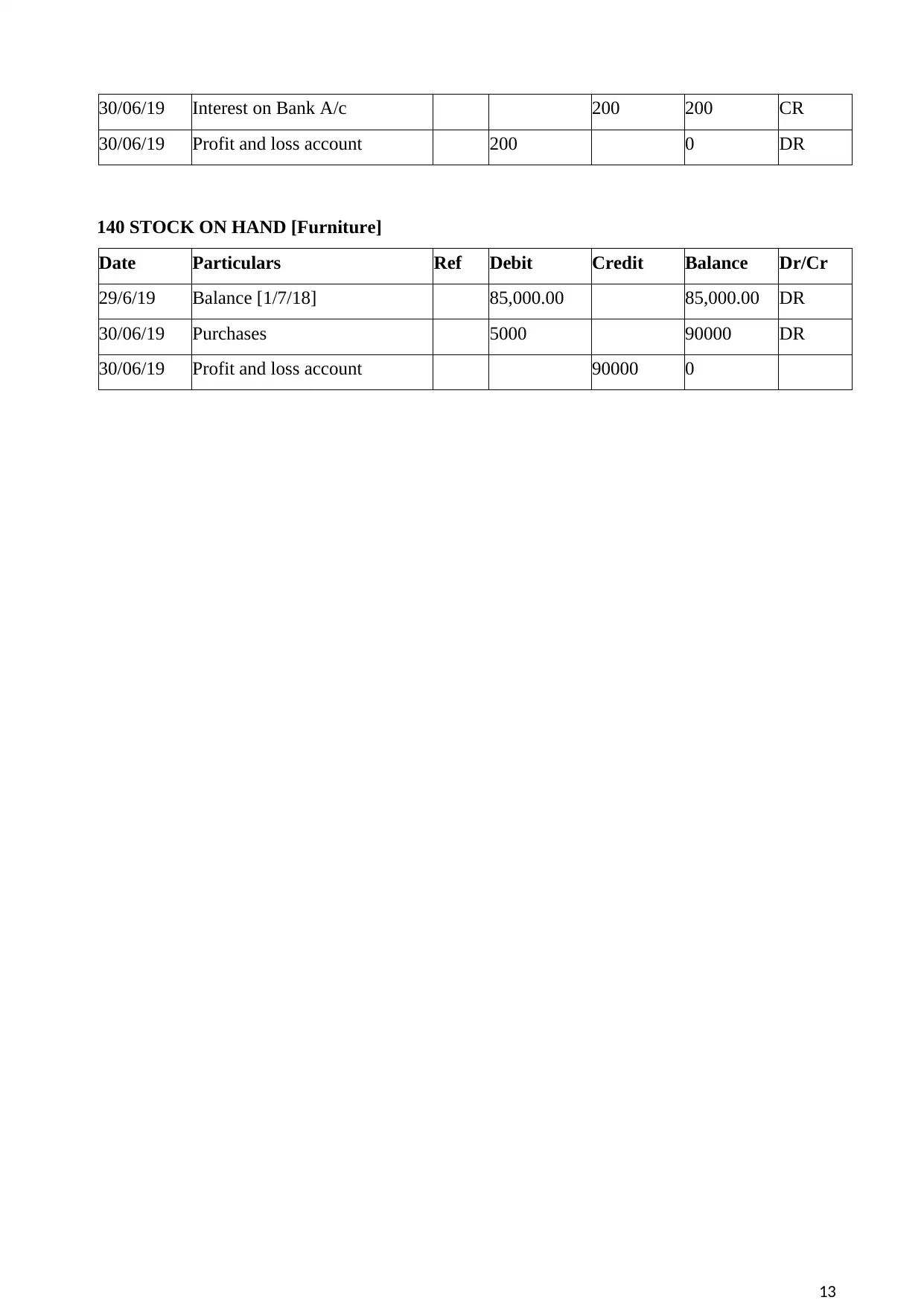

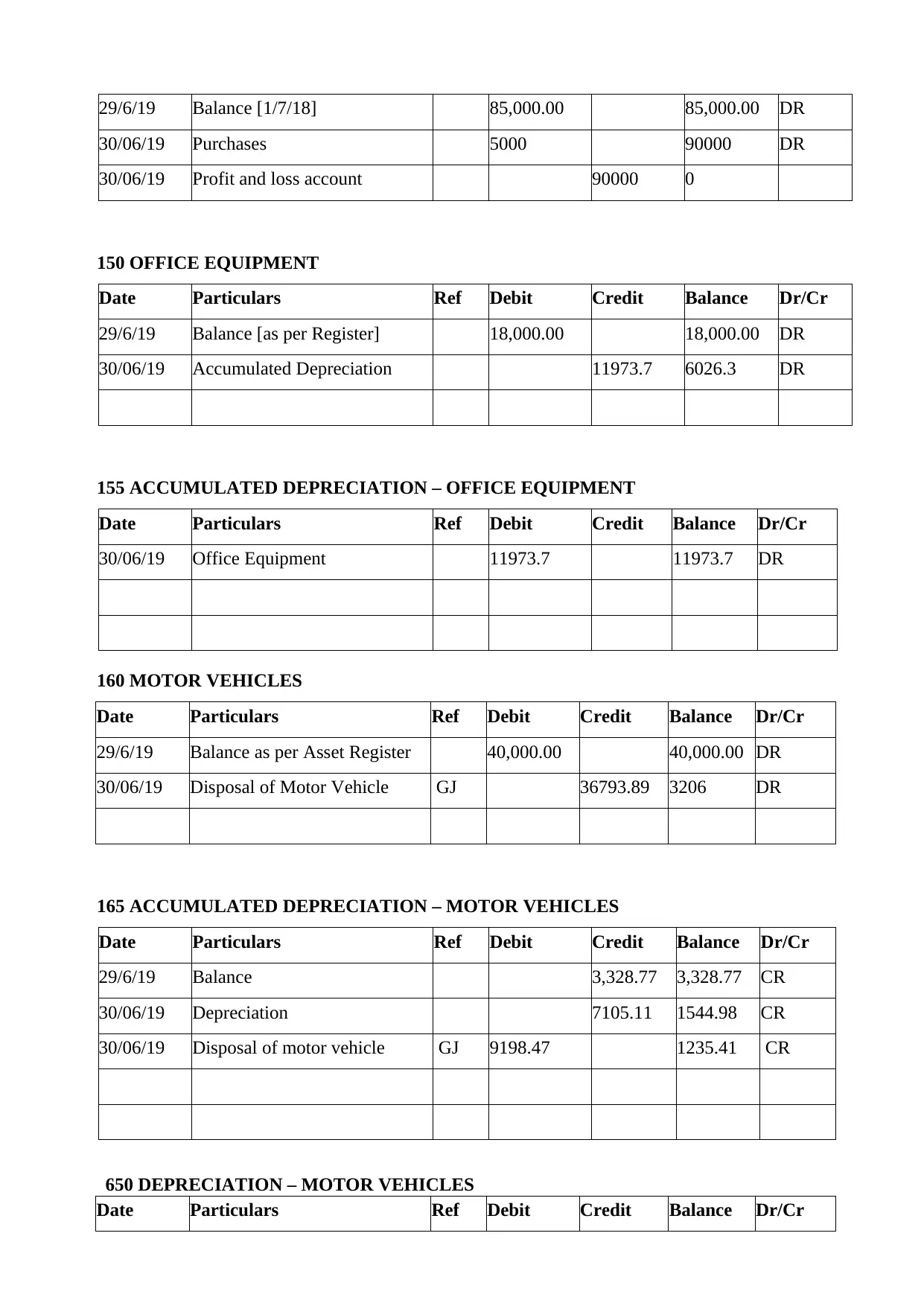

150 OFFICE EQUIPMENT

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [as per Register] 18,000.00 18,000.00 DR

30/06/19 Accumulated Depreciation 11973.7 6026.3 DR

155 ACCUMULATED DEPRECIATION – OFFICE EQUIPMENT

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Office Equipment 11973.7 11973.7 DR

160 MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Asset Register 40,000.00 40,000.00 DR

30/06/19 Disposal of Motor Vehicle GJ 36793.89 3206 DR

165 ACCUMULATED DEPRECIATION – MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 3,328.77 3,328.77 CR

30/06/19 Depreciation 7105.11 1544.98 CR

30/06/19 Disposal of motor vehicle GJ 9198.47 1235.41 CR

650 DEPRECIATION – MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Accumulated Depreciation GJ 7105.11 7105.11 DR

14

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [as per Register] 18,000.00 18,000.00 DR

30/06/19 Accumulated Depreciation 11973.7 6026.3 DR

155 ACCUMULATED DEPRECIATION – OFFICE EQUIPMENT

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Office Equipment 11973.7 11973.7 DR

160 MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Asset Register 40,000.00 40,000.00 DR

30/06/19 Disposal of Motor Vehicle GJ 36793.89 3206 DR

165 ACCUMULATED DEPRECIATION – MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 3,328.77 3,328.77 CR

30/06/19 Depreciation 7105.11 1544.98 CR

30/06/19 Disposal of motor vehicle GJ 9198.47 1235.41 CR

650 DEPRECIATION – MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Accumulated Depreciation GJ 7105.11 7105.11 DR

14

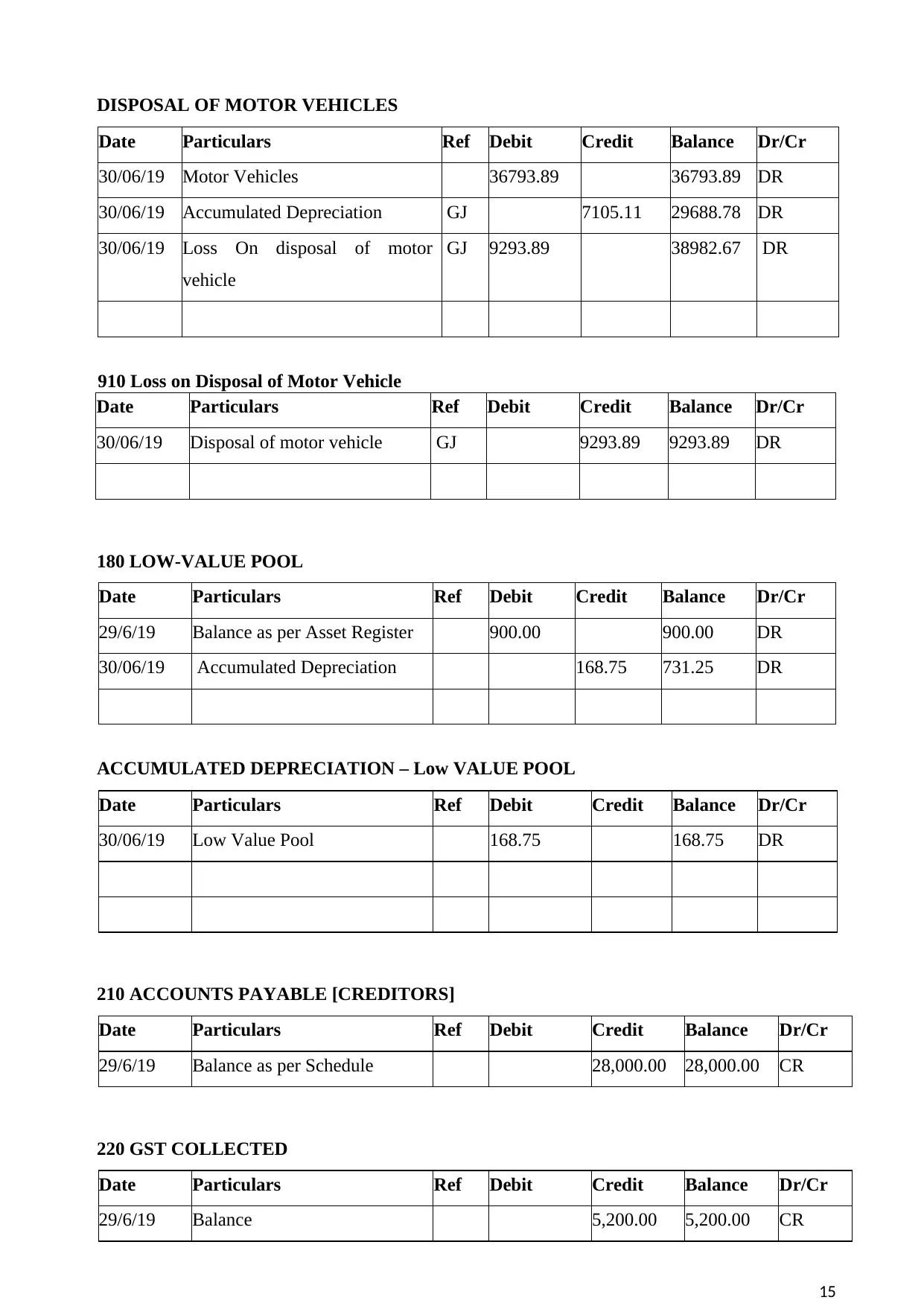

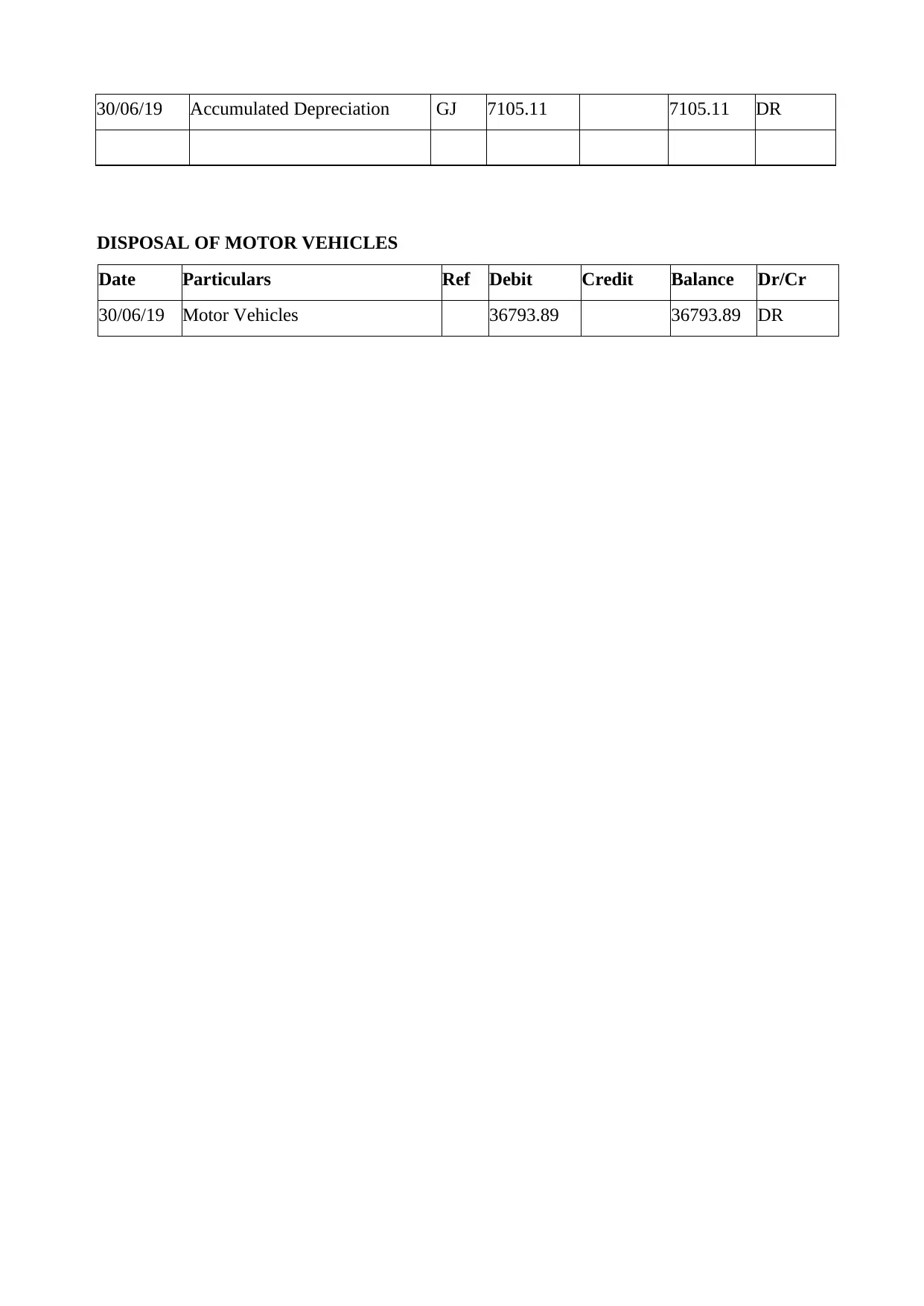

DISPOSAL OF MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Motor Vehicles 36793.89 36793.89 DR

30/06/19 Accumulated Depreciation GJ 7105.11 29688.78 DR

30/06/19 Loss On disposal of motor

vehicle

GJ 9293.89 38982.67 DR

910 Loss on Disposal of Motor Vehicle

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Disposal of motor vehicle GJ 9293.89 9293.89 DR

180 LOW-VALUE POOL

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Asset Register 900.00 900.00 DR

30/06/19 Accumulated Depreciation 168.75 731.25 DR

ACCUMULATED DEPRECIATION – Low VALUE POOL

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Low Value Pool 168.75 168.75 DR

210 ACCOUNTS PAYABLE [CREDITORS]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Schedule 28,000.00 28,000.00 CR

220 GST COLLECTED

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 5,200.00 5,200.00 CR

15

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Motor Vehicles 36793.89 36793.89 DR

30/06/19 Accumulated Depreciation GJ 7105.11 29688.78 DR

30/06/19 Loss On disposal of motor

vehicle

GJ 9293.89 38982.67 DR

910 Loss on Disposal of Motor Vehicle

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Disposal of motor vehicle GJ 9293.89 9293.89 DR

180 LOW-VALUE POOL

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Asset Register 900.00 900.00 DR

30/06/19 Accumulated Depreciation 168.75 731.25 DR

ACCUMULATED DEPRECIATION – Low VALUE POOL

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Low Value Pool 168.75 168.75 DR

210 ACCOUNTS PAYABLE [CREDITORS]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Schedule 28,000.00 28,000.00 CR

220 GST COLLECTED

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 5,200.00 5,200.00 CR

15

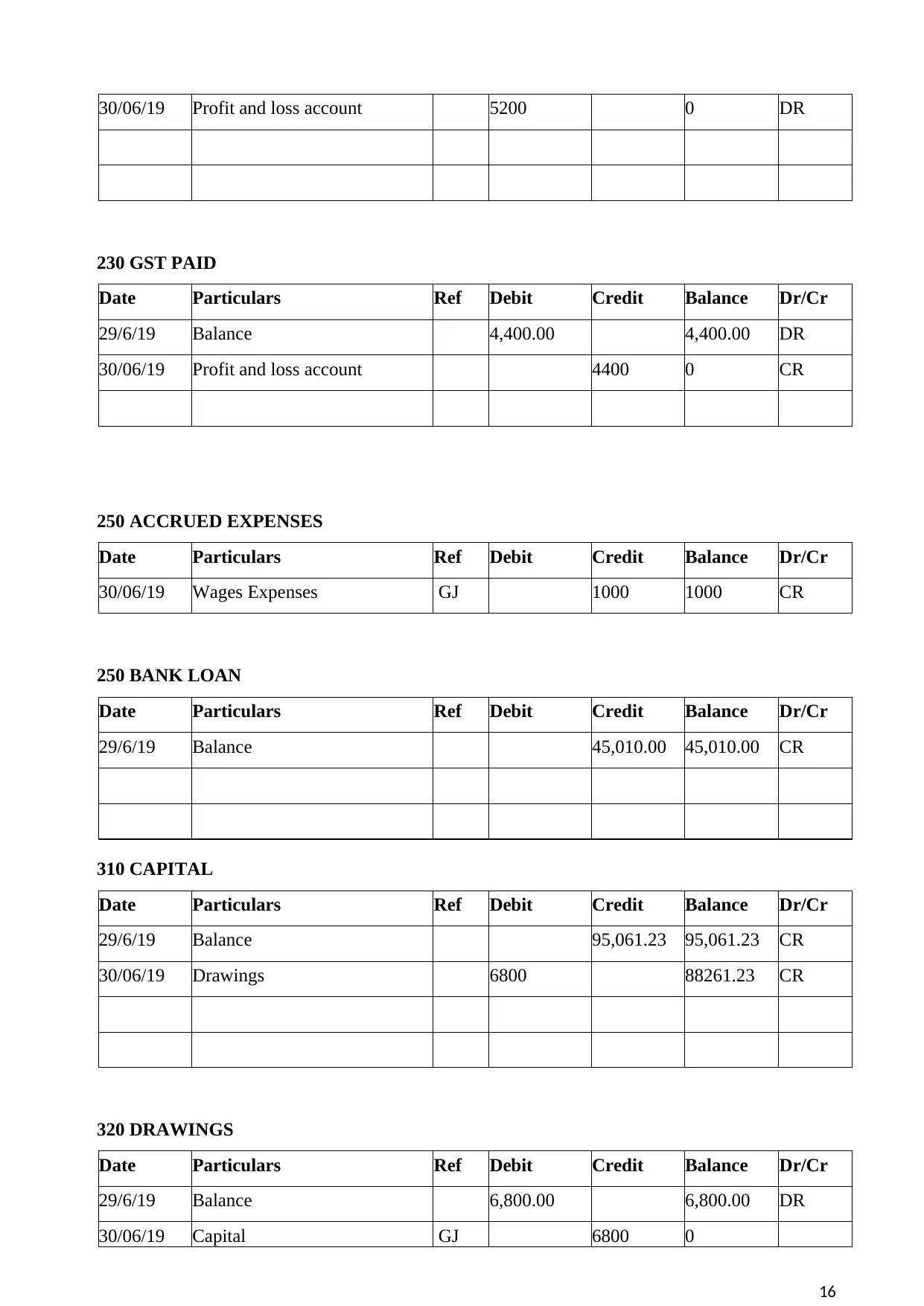

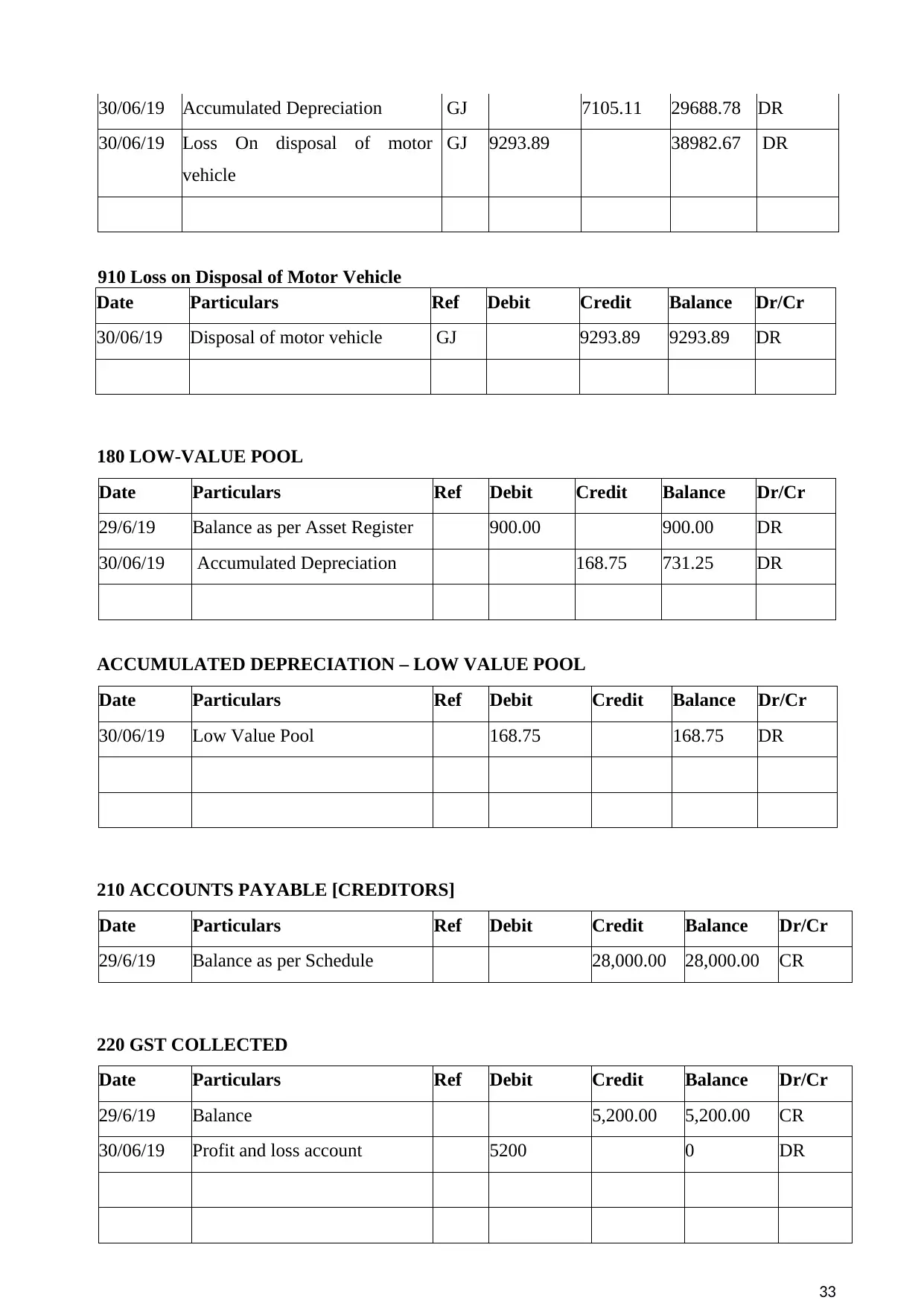

30/06/19 Profit and loss account 5200 0 DR

230 GST PAID

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 4,400.00 4,400.00 DR

30/06/19 Profit and loss account 4400 0 CR

250 ACCRUED EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Wages Expenses GJ 1000 1000 CR

250 BANK LOAN

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 45,010.00 45,010.00 CR

310 CAPITAL

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 95,061.23 95,061.23 CR

30/06/19 Drawings 6800 88261.23 CR

320 DRAWINGS

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 6,800.00 6,800.00 DR

30/06/19 Capital GJ 6800 0

16

230 GST PAID

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 4,400.00 4,400.00 DR

30/06/19 Profit and loss account 4400 0 CR

250 ACCRUED EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Wages Expenses GJ 1000 1000 CR

250 BANK LOAN

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 45,010.00 45,010.00 CR

310 CAPITAL

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 95,061.23 95,061.23 CR

30/06/19 Drawings 6800 88261.23 CR

320 DRAWINGS

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 6,800.00 6,800.00 DR

30/06/19 Capital GJ 6800 0

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

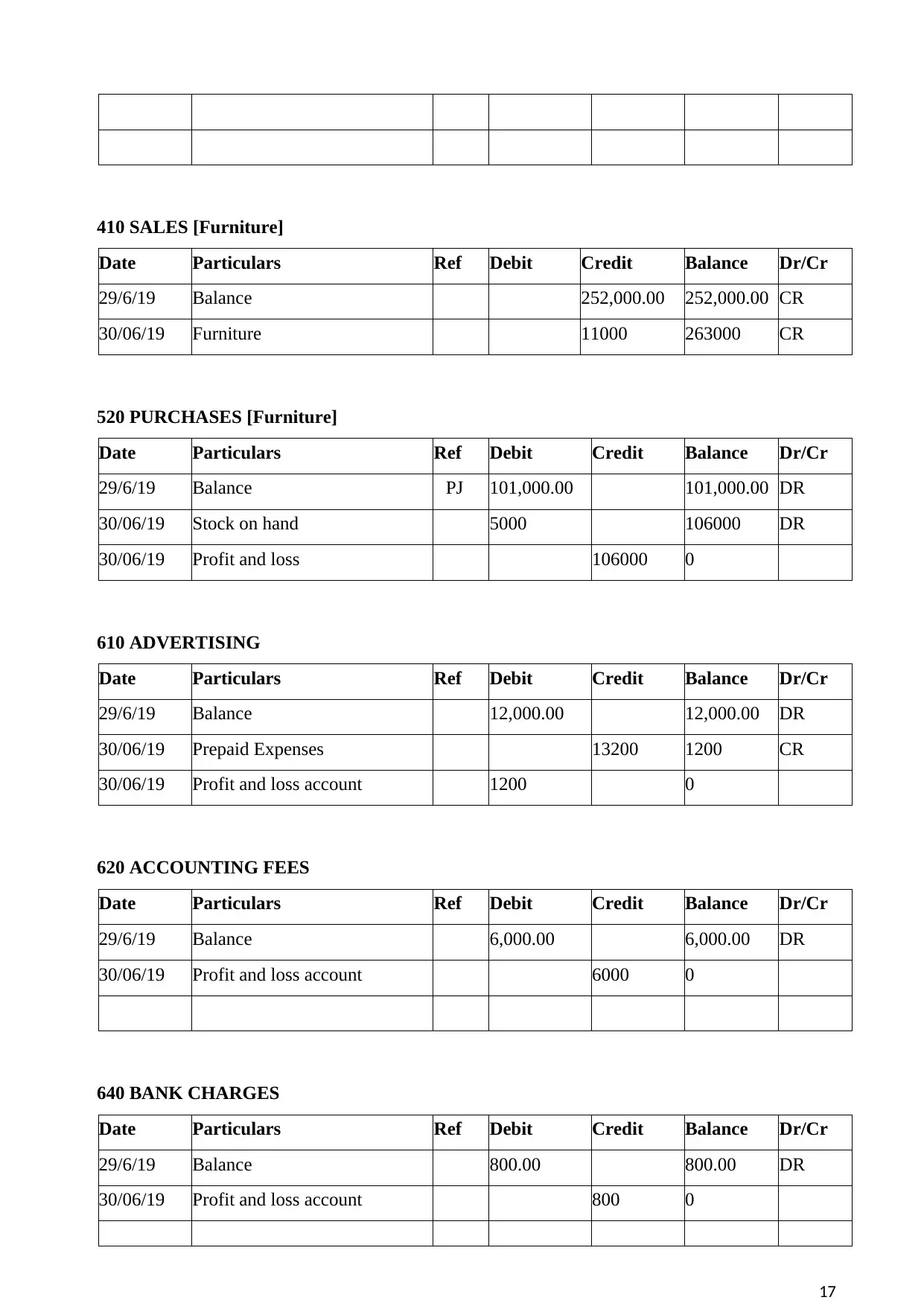

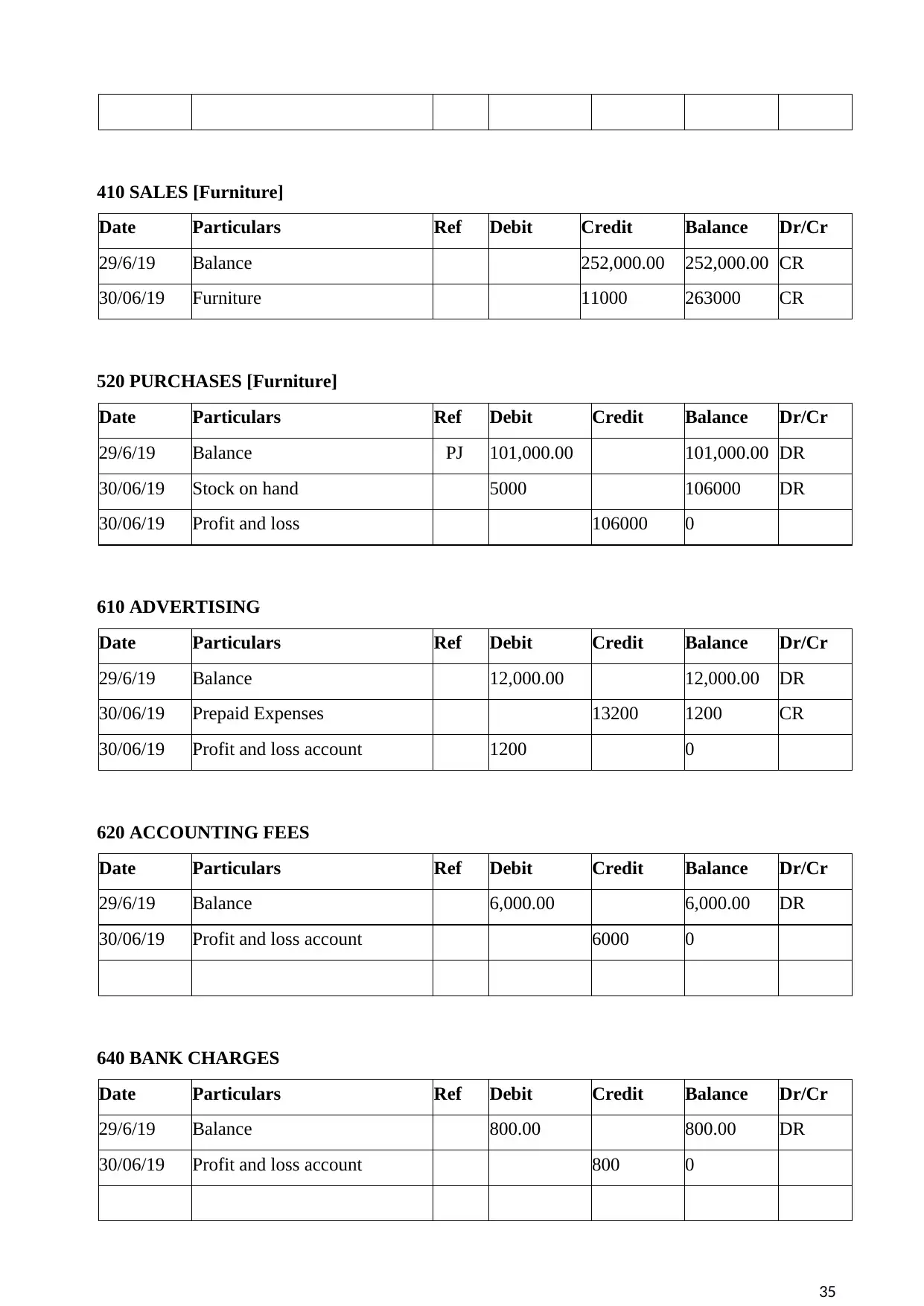

410 SALES [Furniture]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 252,000.00 252,000.00 CR

30/06/19 Furniture 11000 263000 CR

520 PURCHASES [Furniture]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance PJ 101,000.00 101,000.00 DR

30/06/19 Stock on hand 5000 106000 DR

30/06/19 Profit and loss 106000 0

610 ADVERTISING

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 12,000.00 12,000.00 DR

30/06/19 Prepaid Expenses 13200 1200 CR

30/06/19 Profit and loss account 1200 0

620 ACCOUNTING FEES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 6,000.00 6,000.00 DR

30/06/19 Profit and loss account 6000 0

640 BANK CHARGES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 800.00 800.00 DR

30/06/19 Profit and loss account 800 0

17

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 252,000.00 252,000.00 CR

30/06/19 Furniture 11000 263000 CR

520 PURCHASES [Furniture]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance PJ 101,000.00 101,000.00 DR

30/06/19 Stock on hand 5000 106000 DR

30/06/19 Profit and loss 106000 0

610 ADVERTISING

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 12,000.00 12,000.00 DR

30/06/19 Prepaid Expenses 13200 1200 CR

30/06/19 Profit and loss account 1200 0

620 ACCOUNTING FEES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 6,000.00 6,000.00 DR

30/06/19 Profit and loss account 6000 0

640 BANK CHARGES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 800.00 800.00 DR

30/06/19 Profit and loss account 800 0

17

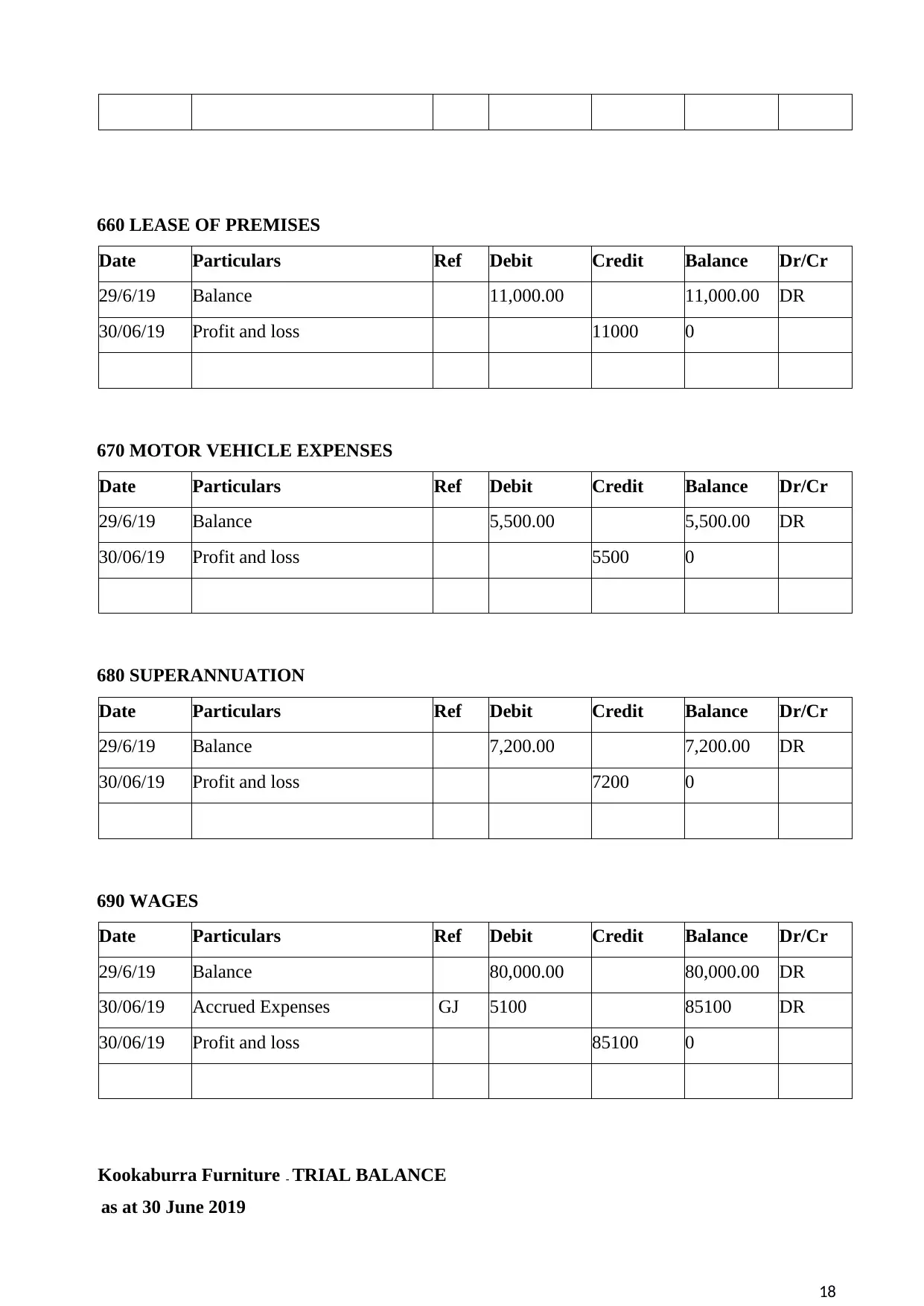

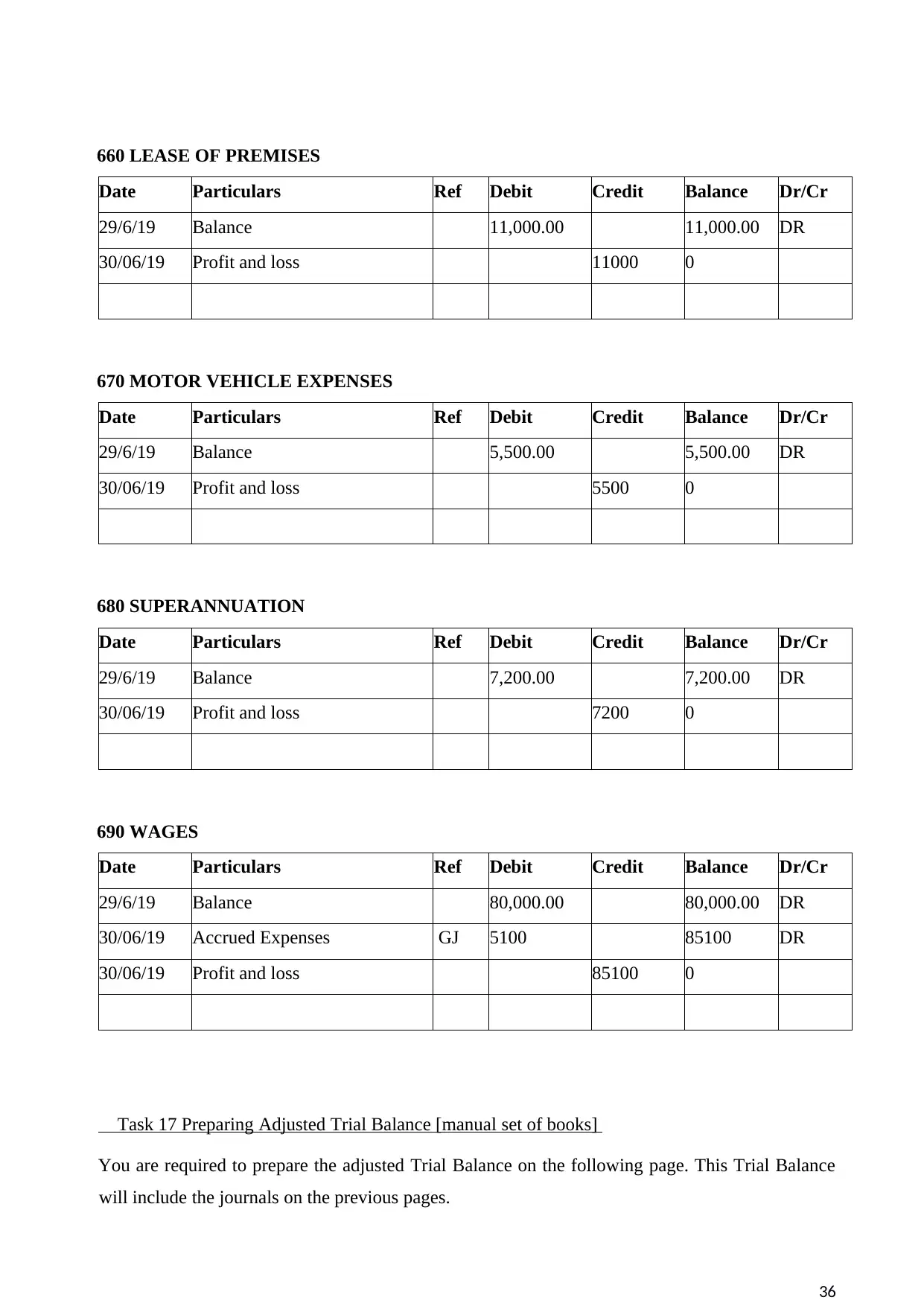

660 LEASE OF PREMISES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 11,000.00 11,000.00 DR

30/06/19 Profit and loss 11000 0

670 MOTOR VEHICLE EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 5,500.00 5,500.00 DR

30/06/19 Profit and loss 5500 0

680 SUPERANNUATION

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 7,200.00 7,200.00 DR

30/06/19 Profit and loss 7200 0

690 WAGES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 80,000.00 80,000.00 DR

30/06/19 Accrued Expenses GJ 5100 85100 DR

30/06/19 Profit and loss 85100 0

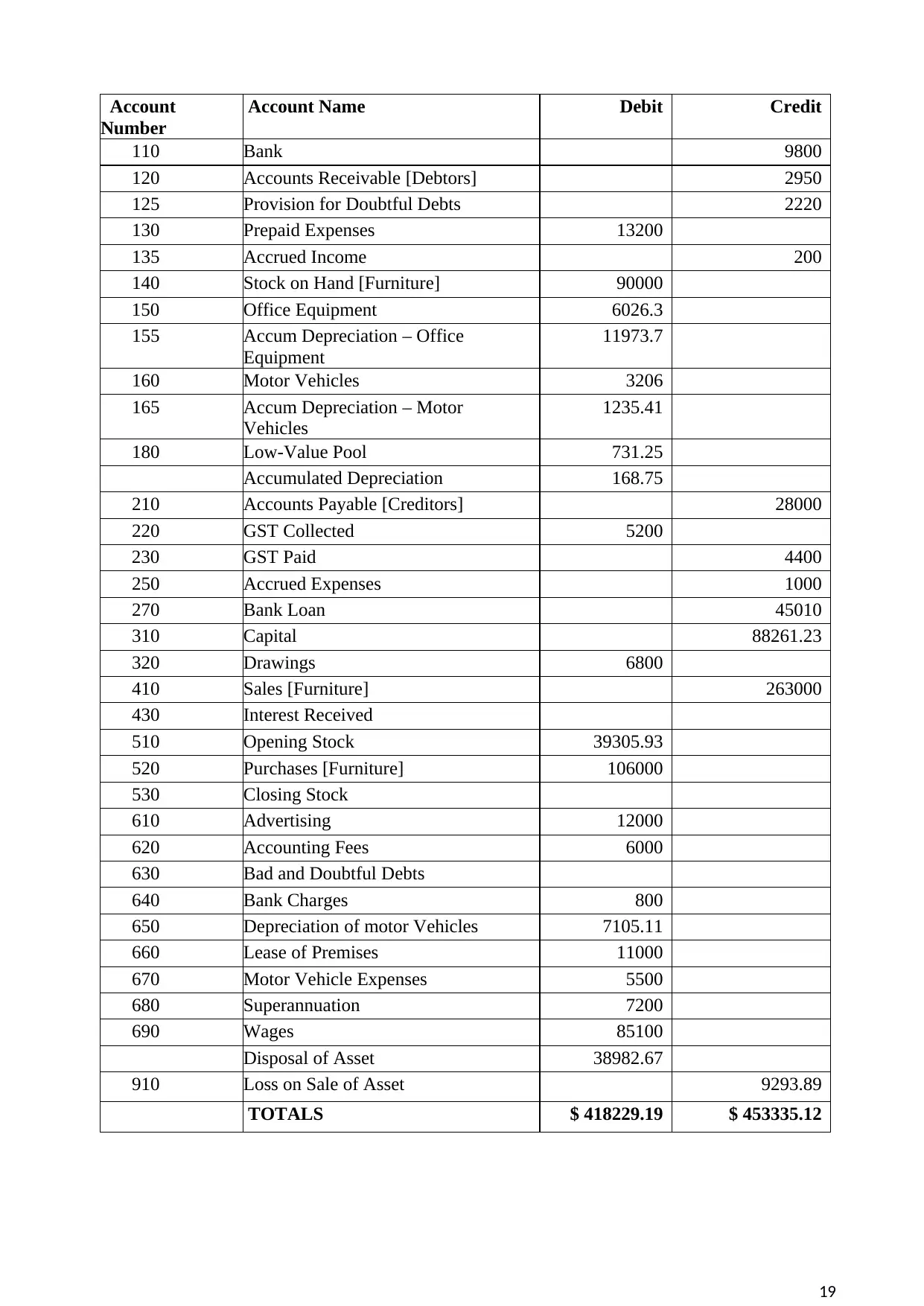

Kookaburra Furniture - TRIAL BALANCE

as at 30 June 2019

18

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 11,000.00 11,000.00 DR

30/06/19 Profit and loss 11000 0

670 MOTOR VEHICLE EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 5,500.00 5,500.00 DR

30/06/19 Profit and loss 5500 0

680 SUPERANNUATION

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 7,200.00 7,200.00 DR

30/06/19 Profit and loss 7200 0

690 WAGES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 80,000.00 80,000.00 DR

30/06/19 Accrued Expenses GJ 5100 85100 DR

30/06/19 Profit and loss 85100 0

Kookaburra Furniture - TRIAL BALANCE

as at 30 June 2019

18

Account

Number

Account Name Debit Credit

110 Bank 9800

120 Accounts Receivable [Debtors] 2950

125 Provision for Doubtful Debts 2220

130 Prepaid Expenses 13200

135 Accrued Income 200

140 Stock on Hand [Furniture] 90000

150 Office Equipment 6026.3

155 Accum Depreciation – Office

Equipment

11973.7

160 Motor Vehicles 3206

165 Accum Depreciation – Motor

Vehicles

1235.41

180 Low-Value Pool 731.25

Accumulated Depreciation 168.75

210 Accounts Payable [Creditors] 28000

220 GST Collected 5200

230 GST Paid 4400

250 Accrued Expenses 1000

270 Bank Loan 45010

310 Capital 88261.23

320 Drawings 6800

410 Sales [Furniture] 263000

430 Interest Received

510 Opening Stock 39305.93

520 Purchases [Furniture] 106000

530 Closing Stock

610 Advertising 12000

620 Accounting Fees 6000

630 Bad and Doubtful Debts

640 Bank Charges 800

650 Depreciation of motor Vehicles 7105.11

660 Lease of Premises 11000

670 Motor Vehicle Expenses 5500

680 Superannuation 7200

690 Wages 85100

Disposal of Asset 38982.67

910 Loss on Sale of Asset 9293.89

TOTALS $ 418229.19 $ 453335.12

19

Number

Account Name Debit Credit

110 Bank 9800

120 Accounts Receivable [Debtors] 2950

125 Provision for Doubtful Debts 2220

130 Prepaid Expenses 13200

135 Accrued Income 200

140 Stock on Hand [Furniture] 90000

150 Office Equipment 6026.3

155 Accum Depreciation – Office

Equipment

11973.7

160 Motor Vehicles 3206

165 Accum Depreciation – Motor

Vehicles

1235.41

180 Low-Value Pool 731.25

Accumulated Depreciation 168.75

210 Accounts Payable [Creditors] 28000

220 GST Collected 5200

230 GST Paid 4400

250 Accrued Expenses 1000

270 Bank Loan 45010

310 Capital 88261.23

320 Drawings 6800

410 Sales [Furniture] 263000

430 Interest Received

510 Opening Stock 39305.93

520 Purchases [Furniture] 106000

530 Closing Stock

610 Advertising 12000

620 Accounting Fees 6000

630 Bad and Doubtful Debts

640 Bank Charges 800

650 Depreciation of motor Vehicles 7105.11

660 Lease of Premises 11000

670 Motor Vehicle Expenses 5500

680 Superannuation 7200

690 Wages 85100

Disposal of Asset 38982.67

910 Loss on Sale of Asset 9293.89

TOTALS $ 418229.19 $ 453335.12

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

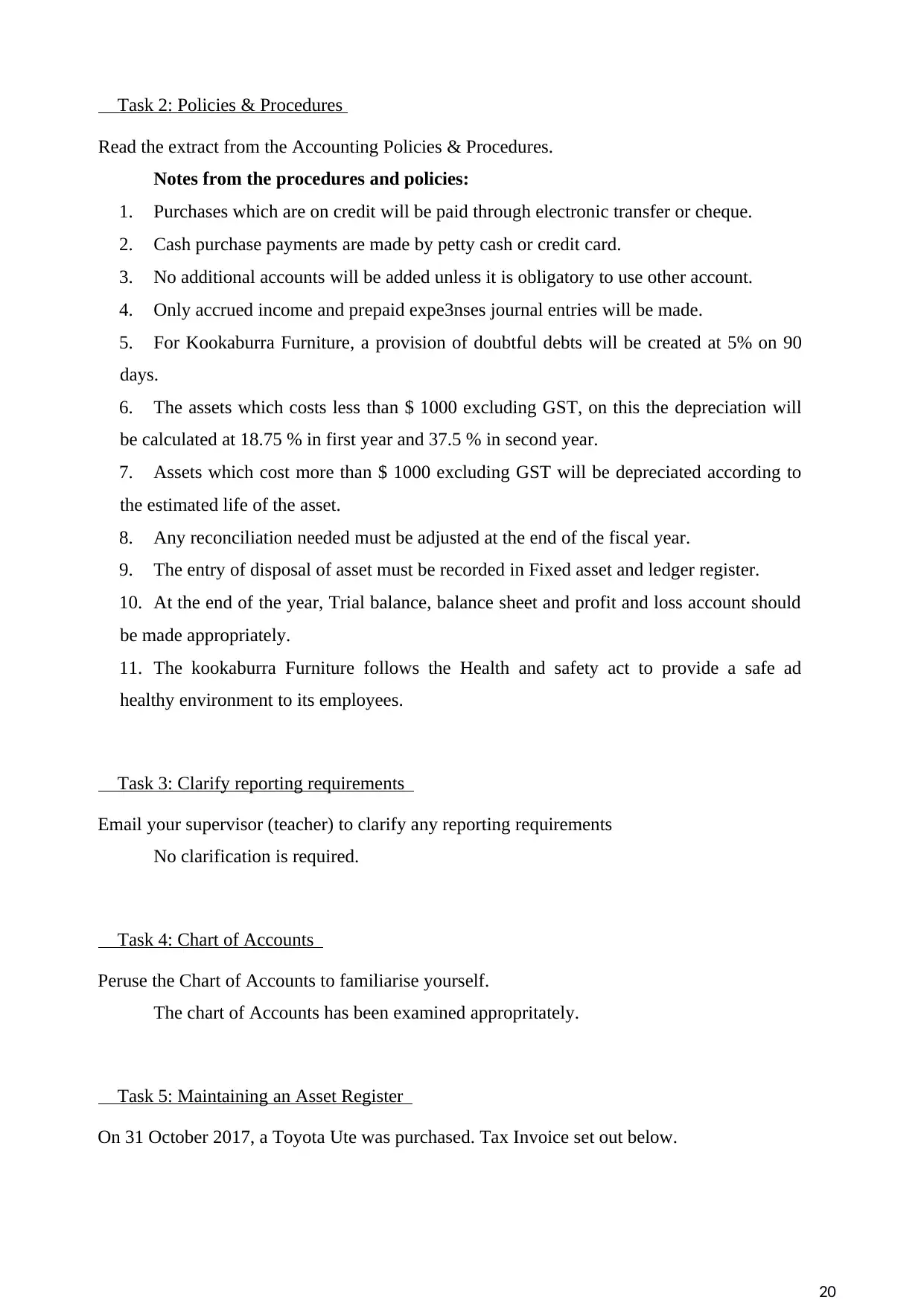

Task 2: Policies & Procedures

Read the extract from the Accounting Policies & Procedures.

Notes from the procedures and policies:

1. Purchases which are on credit will be paid through electronic transfer or cheque.

2. Cash purchase payments are made by petty cash or credit card.

3. No additional accounts will be added unless it is obligatory to use other account.

4. Only accrued income and prepaid expe3nses journal entries will be made.

5. For Kookaburra Furniture, a provision of doubtful debts will be created at 5% on 90

days.

6. The assets which costs less than $ 1000 excluding GST, on this the depreciation will

be calculated at 18.75 % in first year and 37.5 % in second year.

7. Assets which cost more than $ 1000 excluding GST will be depreciated according to

the estimated life of the asset.

8. Any reconciliation needed must be adjusted at the end of the fiscal year.

9. The entry of disposal of asset must be recorded in Fixed asset and ledger register.

10. At the end of the year, Trial balance, balance sheet and profit and loss account should

be made appropriately.

11. The kookaburra Furniture follows the Health and safety act to provide a safe ad

healthy environment to its employees.

Task 3: Clarify reporting requirements

Email your supervisor (teacher) to clarify any reporting requirements

No clarification is required.

Task 4: Chart of Accounts

Peruse the Chart of Accounts to familiarise yourself.

The chart of Accounts has been examined appropritately.

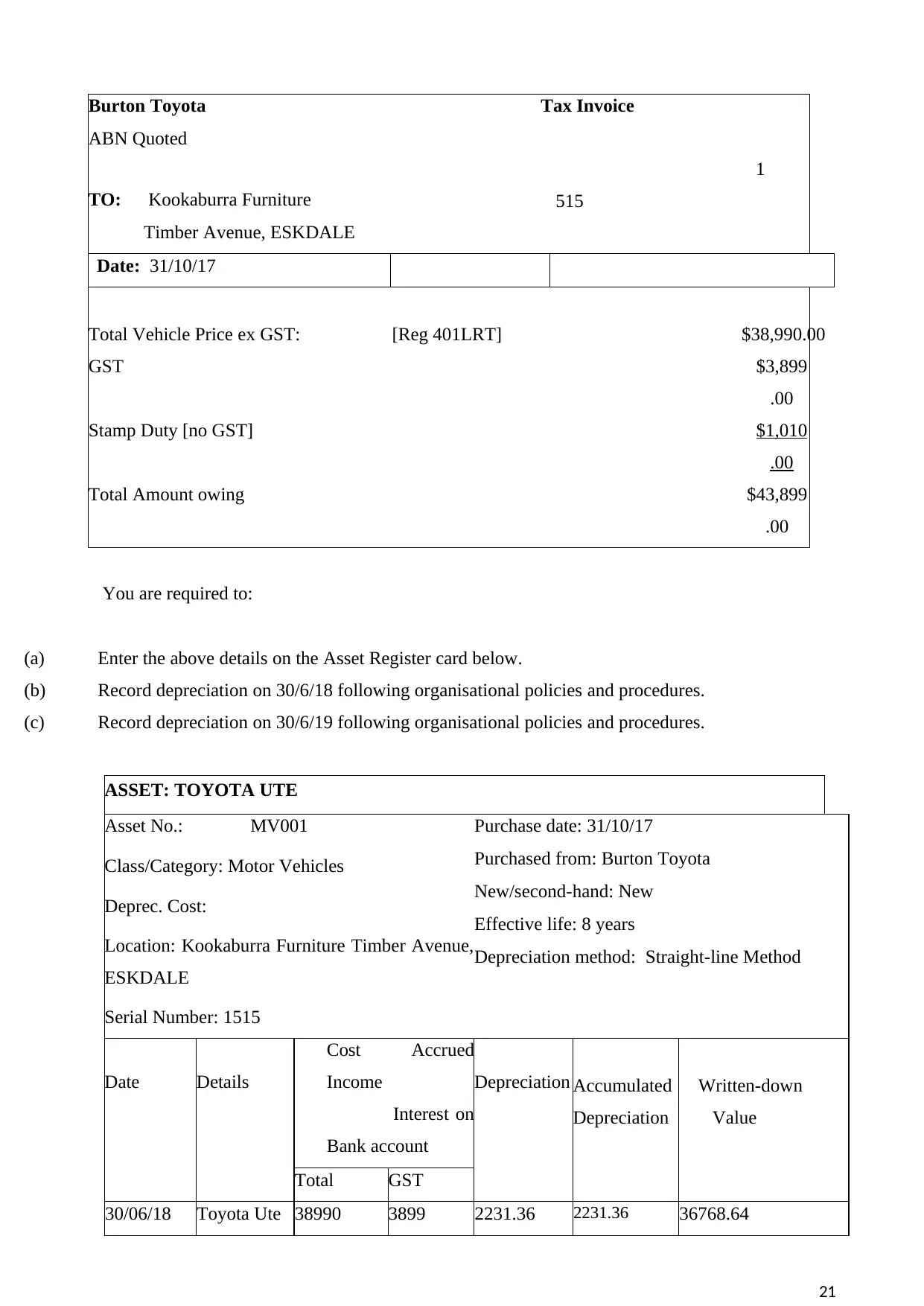

Task 5: Maintaining an Asset Register

On 31 October 2017, a Toyota Ute was purchased. Tax Invoice set out below.

20

Read the extract from the Accounting Policies & Procedures.

Notes from the procedures and policies:

1. Purchases which are on credit will be paid through electronic transfer or cheque.

2. Cash purchase payments are made by petty cash or credit card.

3. No additional accounts will be added unless it is obligatory to use other account.

4. Only accrued income and prepaid expe3nses journal entries will be made.

5. For Kookaburra Furniture, a provision of doubtful debts will be created at 5% on 90

days.

6. The assets which costs less than $ 1000 excluding GST, on this the depreciation will

be calculated at 18.75 % in first year and 37.5 % in second year.

7. Assets which cost more than $ 1000 excluding GST will be depreciated according to

the estimated life of the asset.

8. Any reconciliation needed must be adjusted at the end of the fiscal year.

9. The entry of disposal of asset must be recorded in Fixed asset and ledger register.

10. At the end of the year, Trial balance, balance sheet and profit and loss account should

be made appropriately.

11. The kookaburra Furniture follows the Health and safety act to provide a safe ad

healthy environment to its employees.

Task 3: Clarify reporting requirements

Email your supervisor (teacher) to clarify any reporting requirements

No clarification is required.

Task 4: Chart of Accounts

Peruse the Chart of Accounts to familiarise yourself.

The chart of Accounts has been examined appropritately.

Task 5: Maintaining an Asset Register

On 31 October 2017, a Toyota Ute was purchased. Tax Invoice set out below.

20

Burton Toyota Tax Invoice

ABN Quoted

TO: Kookaburra Furniture

Timber Avenue, ESKDALE

1

515

Date: 31/10/17

Total Vehicle Price ex GST: [Reg 401LRT] $38,990.00

GST $3,899

.00

Stamp Duty [no GST] $1,010

.00

Total Amount owing $43,899

.00

You are required to:

(a) Enter the above details on the Asset Register card below.

(b) Record depreciation on 30/6/18 following organisational policies and procedures.

(c) Record depreciation on 30/6/19 following organisational policies and procedures.

ASSET: TOYOTA UTE

Asset No.: MV001

Class/Category: Motor Vehicles

Deprec. Cost:

Location: Kookaburra Furniture Timber Avenue,

ESKDALE

Serial Number: 1515

Purchase date: 31/10/17

Purchased from: Burton Toyota

New/second-hand: New

Effective life: 8 years

Depreciation method: Straight-line Method

Date Details

Cost Accrued

Income

Interest on

Bank account

Depreciation Accumulated

Depreciation

Written-down

Value

Total GST

30/06/18 Toyota Ute 38990 3899 2231.36 2231.36 36768.64

21

ABN Quoted

TO: Kookaburra Furniture

Timber Avenue, ESKDALE

1

515

Date: 31/10/17

Total Vehicle Price ex GST: [Reg 401LRT] $38,990.00

GST $3,899

.00

Stamp Duty [no GST] $1,010

.00

Total Amount owing $43,899

.00

You are required to:

(a) Enter the above details on the Asset Register card below.

(b) Record depreciation on 30/6/18 following organisational policies and procedures.

(c) Record depreciation on 30/6/19 following organisational policies and procedures.

ASSET: TOYOTA UTE

Asset No.: MV001

Class/Category: Motor Vehicles

Deprec. Cost:

Location: Kookaburra Furniture Timber Avenue,

ESKDALE

Serial Number: 1515

Purchase date: 31/10/17

Purchased from: Burton Toyota

New/second-hand: New

Effective life: 8 years

Depreciation method: Straight-line Method

Date Details

Cost Accrued

Income

Interest on

Bank account

Depreciation Accumulated

Depreciation

Written-down

Value

Total GST

30/06/18 Toyota Ute 38990 3899 2231.36 2231.36 36768.64

21

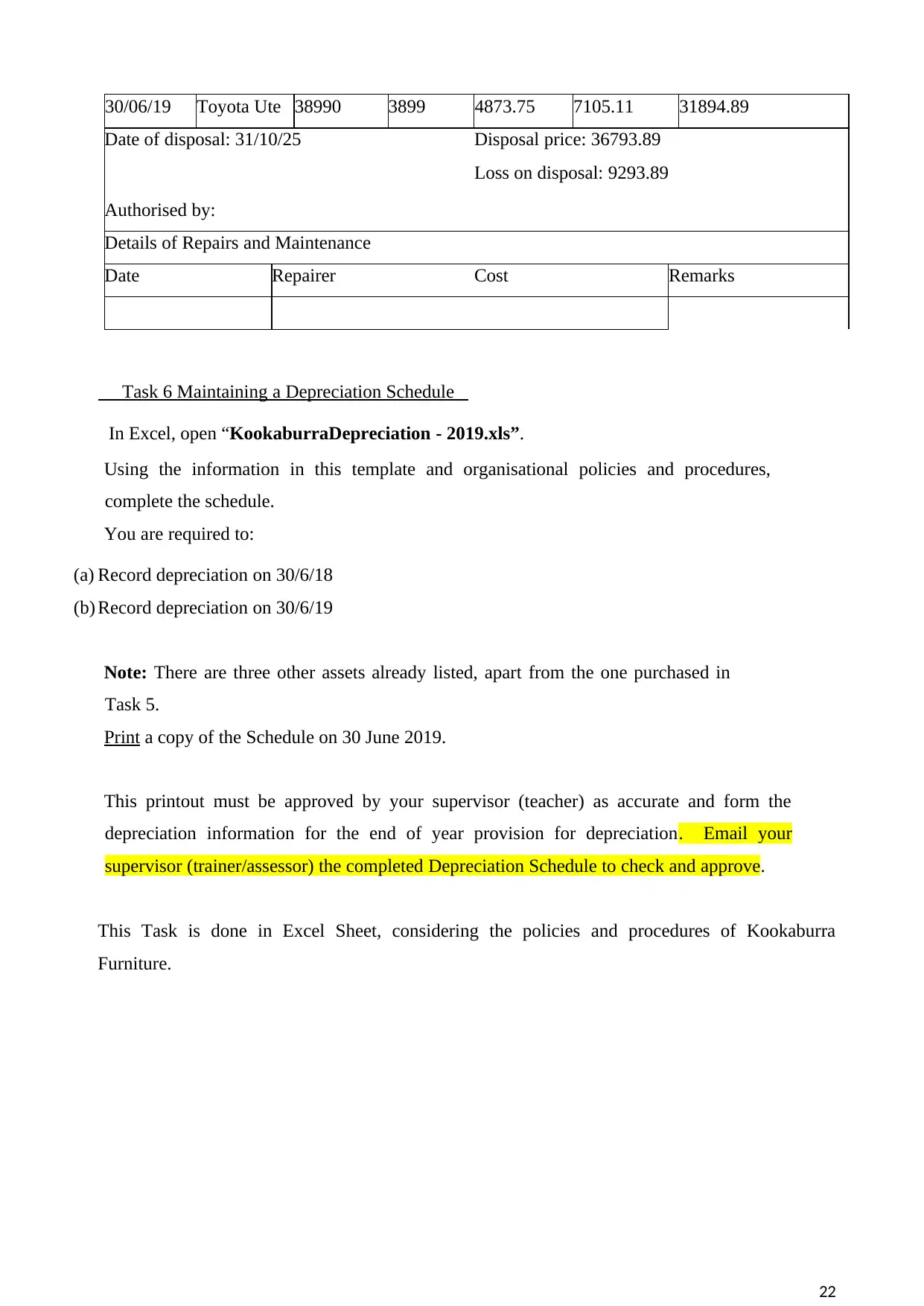

30/06/19 Toyota Ute 38990 3899 4873.75 7105.11 31894.89

Date of disposal: 31/10/25

Authorised by:

Disposal price: 36793.89

Loss on disposal: 9293.89

Details of Repairs and Maintenance

Date Repairer Cost Remarks

Task 6 Maintaining a Depreciation Schedule

In Excel, open “KookaburraDepreciation - 2019.xls”.

Using the information in this template and organisational policies and procedures,

complete the schedule.

You are required to:

(a) Record depreciation on 30/6/18

(b) Record depreciation on 30/6/19

Note: There are three other assets already listed, apart from the one purchased in

Task 5.

Print a copy of the Schedule on 30 June 2019.

This printout must be approved by your supervisor (teacher) as accurate and form the

depreciation information for the end of year provision for depreciation. Email your

supervisor (trainer/assessor) the completed Depreciation Schedule to check and approve.

This Task is done in Excel Sheet, considering the policies and procedures of Kookaburra

Furniture.

22

Date of disposal: 31/10/25

Authorised by:

Disposal price: 36793.89

Loss on disposal: 9293.89

Details of Repairs and Maintenance

Date Repairer Cost Remarks

Task 6 Maintaining a Depreciation Schedule

In Excel, open “KookaburraDepreciation - 2019.xls”.

Using the information in this template and organisational policies and procedures,

complete the schedule.

You are required to:

(a) Record depreciation on 30/6/18

(b) Record depreciation on 30/6/19

Note: There are three other assets already listed, apart from the one purchased in

Task 5.

Print a copy of the Schedule on 30 June 2019.

This printout must be approved by your supervisor (teacher) as accurate and form the

depreciation information for the end of year provision for depreciation. Email your

supervisor (trainer/assessor) the completed Depreciation Schedule to check and approve.

This Task is done in Excel Sheet, considering the policies and procedures of Kookaburra

Furniture.

22

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

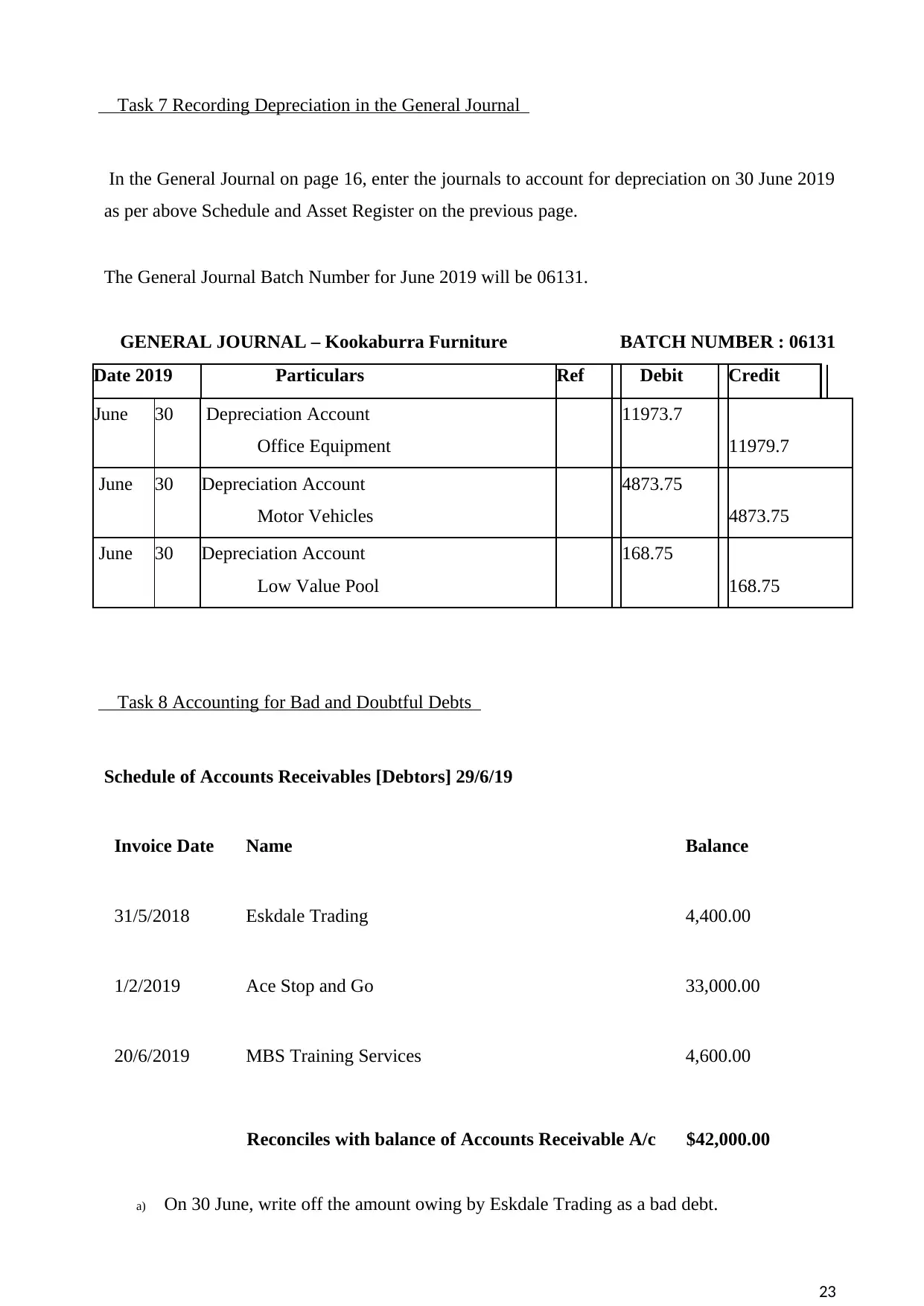

Task 7 Recording Depreciation in the General Journal

In the General Journal on page 16, enter the journals to account for depreciation on 30 June 2019

as per above Schedule and Asset Register on the previous page.

The General Journal Batch Number for June 2019 will be 06131.

GENERAL JOURNAL – Kookaburra Furniture BATCH NUMBER : 06131

Date 2019 Particulars Ref Debit Credit

June 30 Depreciation Account

Office Equipment

11973.7

11979.7

June 30 Depreciation Account

Motor Vehicles

4873.75

4873.75

June 30 Depreciation Account

Low Value Pool

168.75

168.75

Task 8 Accounting for Bad and Doubtful Debts

Schedule of Accounts Receivables [Debtors] 29/6/19

Invoice Date Name Balance

31/5/2018 Eskdale Trading 4,400.00

1/2/2019 Ace Stop and Go 33,000.00

20/6/2019 MBS Training Services 4,600.00

Reconciles with balance of Accounts Receivable A/c $42,000.00

a) On 30 June, write off the amount owing by Eskdale Trading as a bad debt.

23

In the General Journal on page 16, enter the journals to account for depreciation on 30 June 2019

as per above Schedule and Asset Register on the previous page.

The General Journal Batch Number for June 2019 will be 06131.

GENERAL JOURNAL – Kookaburra Furniture BATCH NUMBER : 06131

Date 2019 Particulars Ref Debit Credit

June 30 Depreciation Account

Office Equipment

11973.7

11979.7

June 30 Depreciation Account

Motor Vehicles

4873.75

4873.75

June 30 Depreciation Account

Low Value Pool

168.75

168.75

Task 8 Accounting for Bad and Doubtful Debts

Schedule of Accounts Receivables [Debtors] 29/6/19

Invoice Date Name Balance

31/5/2018 Eskdale Trading 4,400.00

1/2/2019 Ace Stop and Go 33,000.00

20/6/2019 MBS Training Services 4,600.00

Reconciles with balance of Accounts Receivable A/c $42,000.00

a) On 30 June, write off the amount owing by Eskdale Trading as a bad debt.

23

b) You are required to follow the company policies and procedures and calculate and enter

appropriate journals to provide for doubtful debts.

Date 2019 Particulars Ref Debit Credit

June 30 Bad Debts

Accounts Receivable

4400

4400

June 30 Provision for Doubtful debts

Profit and Loss Account

1870

1870

Task 9 Accounting for Prepaid Expenses

The following entry was processed on the Bank Statement for June.

BANK STATEMENT - June

Date Particulars

Withdrawals

DR

Deposits

CR Balance

June 15 Yellow Pages 13,200.00

The payment was made to pay the following Tax Invoice.

Yellow Pages Tax Invoice

ABN 14573853200

Ink Street, BRISBANE QLD 4000

Phone (07) 3235 8765 Fax (07) 3235 8766

TO: Kookaburra Furniture

Timber Avenue,

ESKDALE QLD 4350

101

Date: 25/6/19 Purchase Order Number: Terms: net 30 days

Details Amount Tax

Code

Advertising for 12 months [June 2019 to May 2020] 12,000.00 GST

24

appropriate journals to provide for doubtful debts.

Date 2019 Particulars Ref Debit Credit

June 30 Bad Debts

Accounts Receivable

4400

4400

June 30 Provision for Doubtful debts

Profit and Loss Account

1870

1870

Task 9 Accounting for Prepaid Expenses

The following entry was processed on the Bank Statement for June.

BANK STATEMENT - June

Date Particulars

Withdrawals

DR

Deposits

CR Balance

June 15 Yellow Pages 13,200.00

The payment was made to pay the following Tax Invoice.

Yellow Pages Tax Invoice

ABN 14573853200

Ink Street, BRISBANE QLD 4000

Phone (07) 3235 8765 Fax (07) 3235 8766

TO: Kookaburra Furniture

Timber Avenue,

ESKDALE QLD 4350

101

Date: 25/6/19 Purchase Order Number: Terms: net 30 days

Details Amount Tax

Code

Advertising for 12 months [June 2019 to May 2020] 12,000.00 GST

24

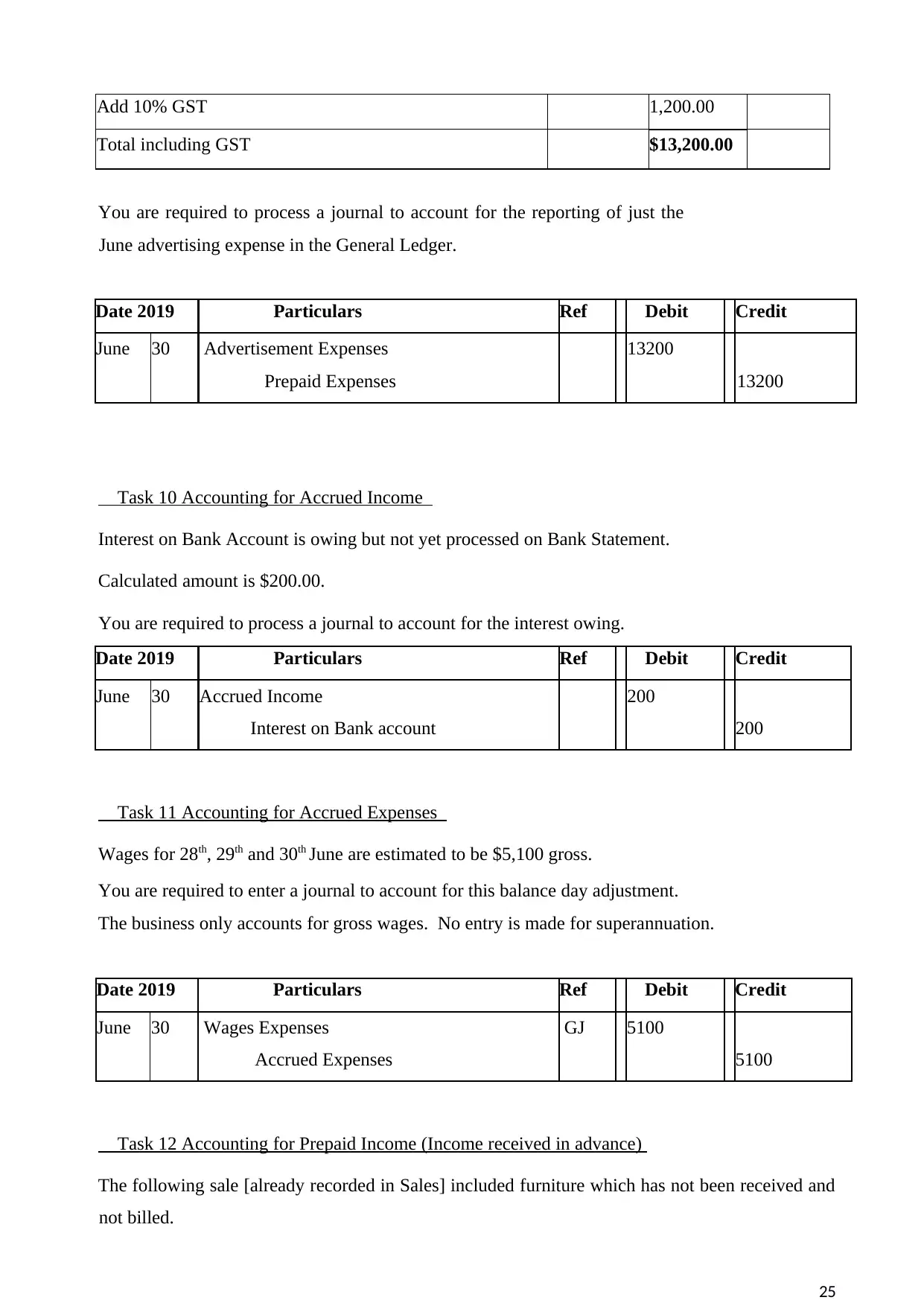

Add 10% GST 1,200.00

Total including GST $13,200.00

You are required to process a journal to account for the reporting of just the

June advertising expense in the General Ledger.

Date 2019 Particulars Ref Debit Credit

June 30 Advertisement Expenses

Prepaid Expenses

13200

13200

Task 10 Accounting for Accrued Income

Interest on Bank Account is owing but not yet processed on Bank Statement.

Calculated amount is $200.00.

You are required to process a journal to account for the interest owing.

Date 2019 Particulars Ref Debit Credit

June 30 Accrued Income

Interest on Bank account

200

200

Task 11 Accounting for Accrued Expenses

Wages for 28th, 29th and 30th June are estimated to be $5,100 gross.

You are required to enter a journal to account for this balance day adjustment.

The business only accounts for gross wages. No entry is made for superannuation.

Date 2019 Particulars Ref Debit Credit

June 30 Wages Expenses

Accrued Expenses

GJ 5100

5100

Task 12 Accounting for Prepaid Income (Income received in advance)

The following sale [already recorded in Sales] included furniture which has not been received and

not billed.

25

Total including GST $13,200.00

You are required to process a journal to account for the reporting of just the

June advertising expense in the General Ledger.

Date 2019 Particulars Ref Debit Credit

June 30 Advertisement Expenses

Prepaid Expenses

13200

13200

Task 10 Accounting for Accrued Income

Interest on Bank Account is owing but not yet processed on Bank Statement.

Calculated amount is $200.00.

You are required to process a journal to account for the interest owing.

Date 2019 Particulars Ref Debit Credit

June 30 Accrued Income

Interest on Bank account

200

200

Task 11 Accounting for Accrued Expenses

Wages for 28th, 29th and 30th June are estimated to be $5,100 gross.

You are required to enter a journal to account for this balance day adjustment.

The business only accounts for gross wages. No entry is made for superannuation.

Date 2019 Particulars Ref Debit Credit

June 30 Wages Expenses

Accrued Expenses

GJ 5100

5100

Task 12 Accounting for Prepaid Income (Income received in advance)

The following sale [already recorded in Sales] included furniture which has not been received and

not billed.

25

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

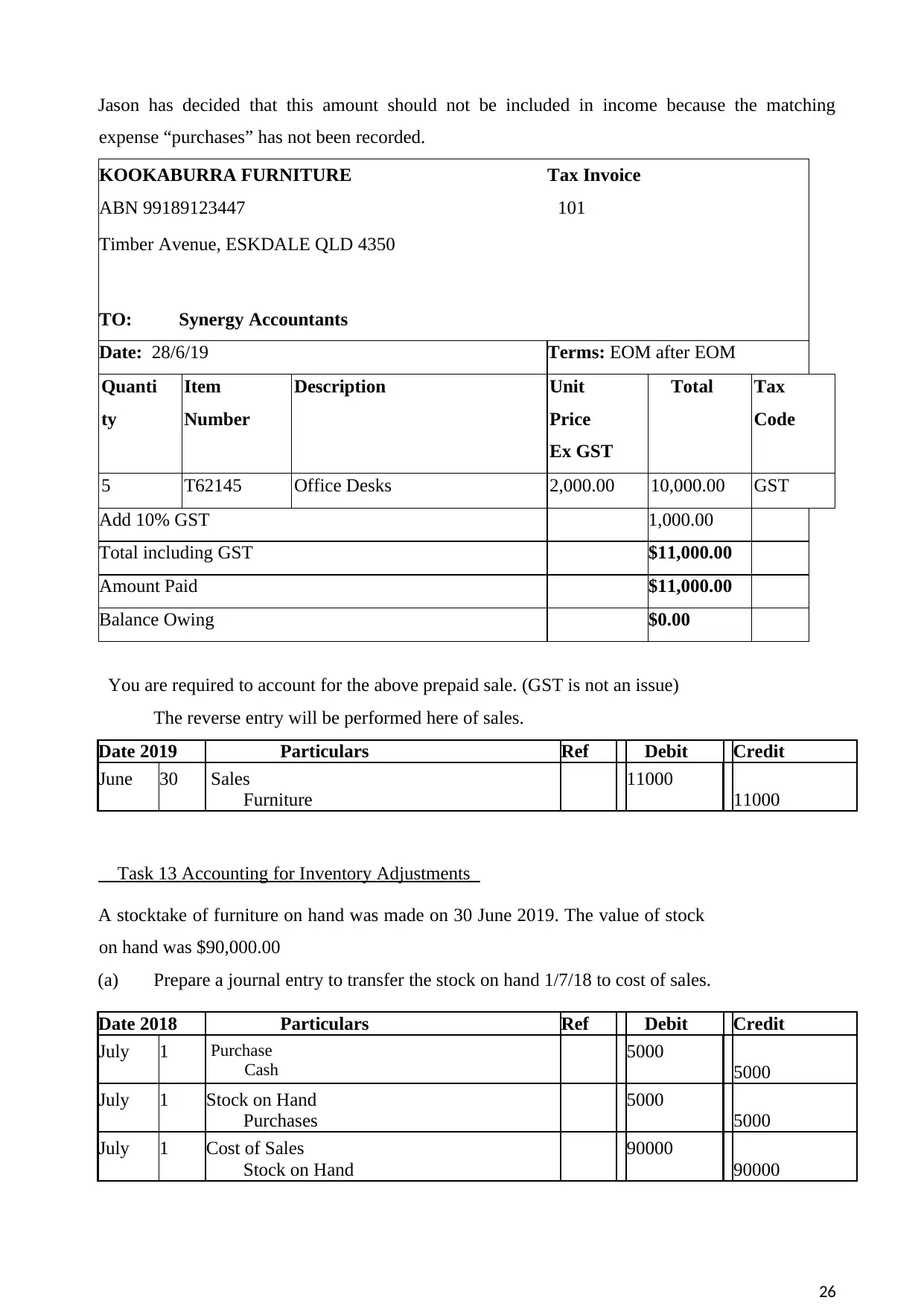

Jason has decided that this amount should not be included in income because the matching

expense “purchases” has not been recorded.

KOOKABURRA FURNITURE Tax Invoice

ABN 99189123447

Timber Avenue, ESKDALE QLD 4350

TO: Synergy Accountants

101

Date: 28/6/19 Terms: EOM after EOM

Quanti

ty

Item

Number

Description Unit

Price

Ex GST

Total Tax

Code

5 T62145 Office Desks 2,000.00 10,000.00 GST

Add 10% GST 1,000.00

Total including GST $11,000.00

Amount Paid $11,000.00

Balance Owing $0.00

You are required to account for the above prepaid sale. (GST is not an issue)

The reverse entry will be performed here of sales.

Date 2019 Particulars Ref Debit Credit

June 30 Sales

Furniture

11000

11000

Task 13 Accounting for Inventory Adjustments

A stocktake of furniture on hand was made on 30 June 2019. The value of stock

on hand was $90,000.00

(a) Prepare a journal entry to transfer the stock on hand 1/7/18 to cost of sales.

Date 2018 Particulars Ref Debit Credit

July 1 Purchase

Cash

5000

5000

July 1 Stock on Hand

Purchases

5000

5000

July 1 Cost of Sales

Stock on Hand

90000

90000

26

expense “purchases” has not been recorded.

KOOKABURRA FURNITURE Tax Invoice

ABN 99189123447

Timber Avenue, ESKDALE QLD 4350

TO: Synergy Accountants

101

Date: 28/6/19 Terms: EOM after EOM

Quanti

ty

Item

Number

Description Unit

Price

Ex GST

Total Tax

Code

5 T62145 Office Desks 2,000.00 10,000.00 GST

Add 10% GST 1,000.00

Total including GST $11,000.00

Amount Paid $11,000.00

Balance Owing $0.00

You are required to account for the above prepaid sale. (GST is not an issue)

The reverse entry will be performed here of sales.

Date 2019 Particulars Ref Debit Credit

June 30 Sales

Furniture

11000

11000

Task 13 Accounting for Inventory Adjustments

A stocktake of furniture on hand was made on 30 June 2019. The value of stock

on hand was $90,000.00

(a) Prepare a journal entry to transfer the stock on hand 1/7/18 to cost of sales.

Date 2018 Particulars Ref Debit Credit

July 1 Purchase

Cash

5000

5000

July 1 Stock on Hand

Purchases

5000

5000

July 1 Cost of Sales

Stock on Hand

90000

90000

26

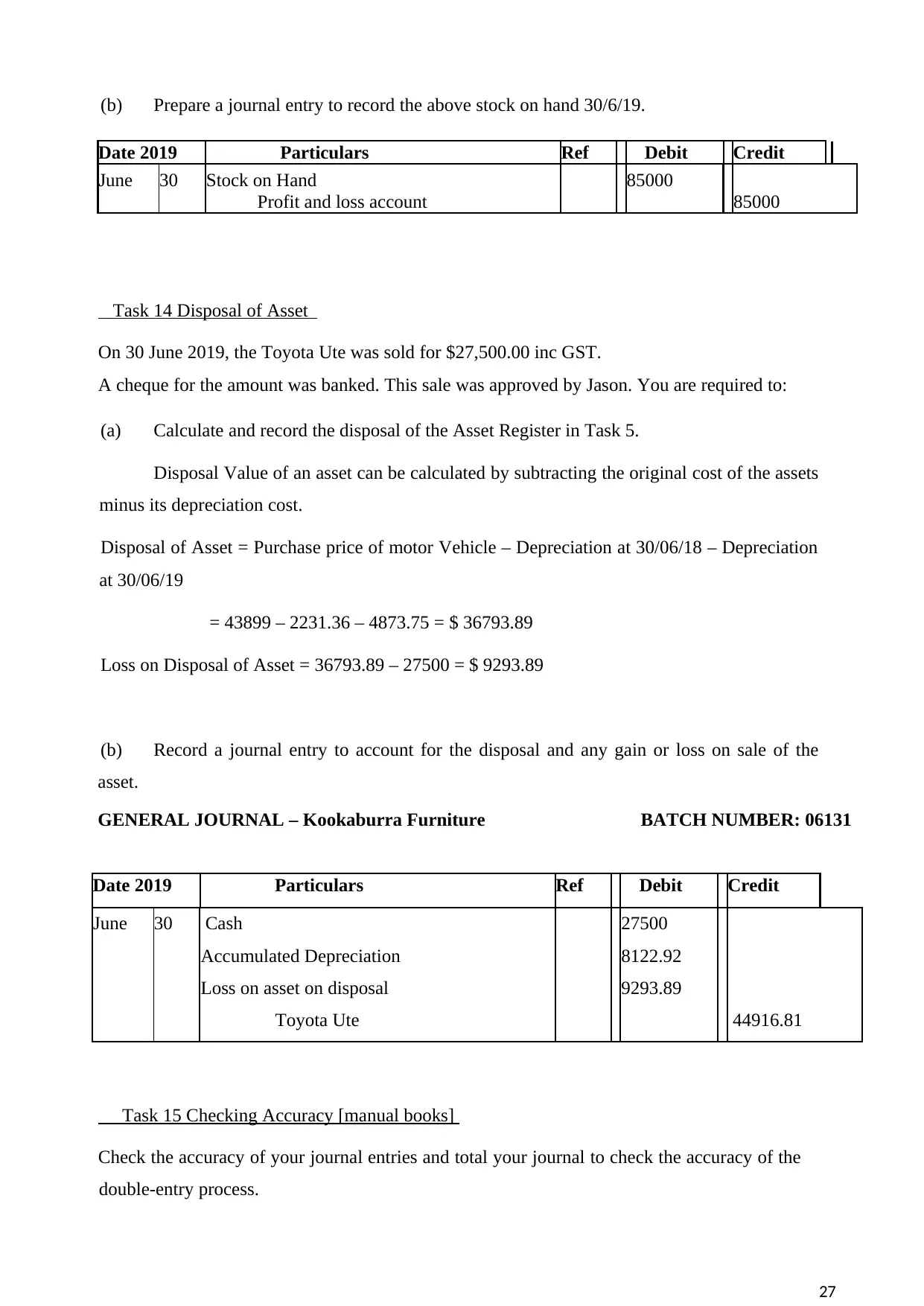

(b) Prepare a journal entry to record the above stock on hand 30/6/19.

Date 2019 Particulars Ref Debit Credit

June 30 Stock on Hand

Profit and loss account

85000

85000

Task 14 Disposal of Asset

On 30 June 2019, the Toyota Ute was sold for $27,500.00 inc GST.

A cheque for the amount was banked. This sale was approved by Jason. You are required to:

(a) Calculate and record the disposal of the Asset Register in Task 5.

Disposal Value of an asset can be calculated by subtracting the original cost of the assets

minus its depreciation cost.

Disposal of Asset = Purchase price of motor Vehicle – Depreciation at 30/06/18 – Depreciation

at 30/06/19

= 43899 – 2231.36 – 4873.75 = $ 36793.89

Loss on Disposal of Asset = 36793.89 – 27500 = $ 9293.89

(b) Record a journal entry to account for the disposal and any gain or loss on sale of the

asset.

GENERAL JOURNAL – Kookaburra Furniture BATCH NUMBER: 06131

Date 2019 Particulars Ref Debit Credit

June 30 Cash

Accumulated Depreciation

Loss on asset on disposal

Toyota Ute

27500

8122.92

9293.89

44916.81

Task 15 Checking Accuracy [manual books]

Check the accuracy of your journal entries and total your journal to check the accuracy of the

double-entry process.

27

Date 2019 Particulars Ref Debit Credit

June 30 Stock on Hand

Profit and loss account

85000

85000

Task 14 Disposal of Asset

On 30 June 2019, the Toyota Ute was sold for $27,500.00 inc GST.

A cheque for the amount was banked. This sale was approved by Jason. You are required to:

(a) Calculate and record the disposal of the Asset Register in Task 5.

Disposal Value of an asset can be calculated by subtracting the original cost of the assets

minus its depreciation cost.

Disposal of Asset = Purchase price of motor Vehicle – Depreciation at 30/06/18 – Depreciation

at 30/06/19

= 43899 – 2231.36 – 4873.75 = $ 36793.89

Loss on Disposal of Asset = 36793.89 – 27500 = $ 9293.89

(b) Record a journal entry to account for the disposal and any gain or loss on sale of the

asset.

GENERAL JOURNAL – Kookaburra Furniture BATCH NUMBER: 06131

Date 2019 Particulars Ref Debit Credit

June 30 Cash

Accumulated Depreciation

Loss on asset on disposal

Toyota Ute

27500

8122.92

9293.89

44916.81

Task 15 Checking Accuracy [manual books]

Check the accuracy of your journal entries and total your journal to check the accuracy of the

double-entry process.

27

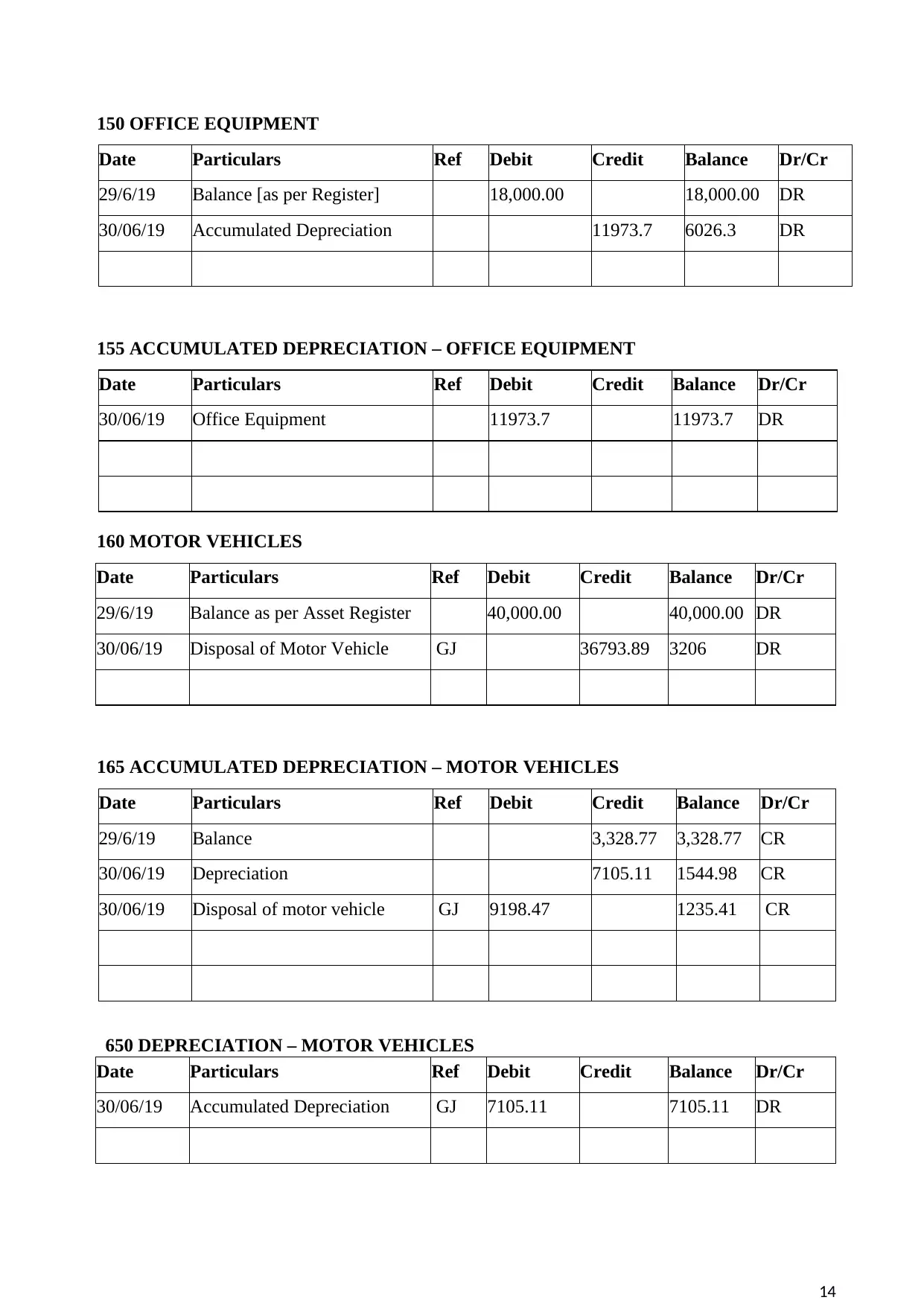

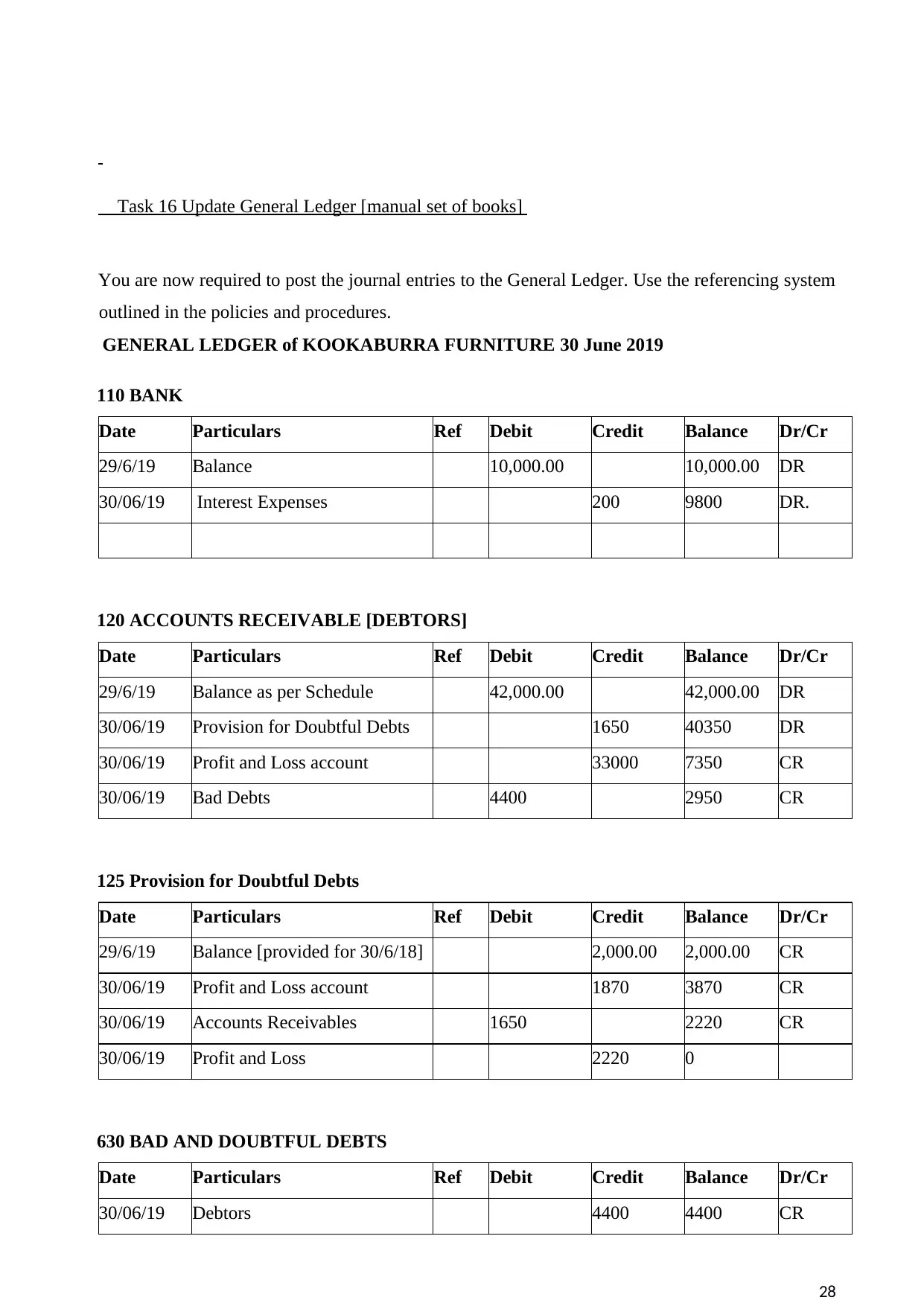

Task 16 Update General Ledger [manual set of books]

You are now required to post the journal entries to the General Ledger. Use the referencing system

outlined in the policies and procedures.

GENERAL LEDGER of KOOKABURRA FURNITURE 30 June 2019

110 BANK

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 10,000.00 10,000.00 DR

30/06/19 Interest Expenses 200 9800 DR.

120 ACCOUNTS RECEIVABLE [DEBTORS]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Schedule 42,000.00 42,000.00 DR

30/06/19 Provision for Doubtful Debts 1650 40350 DR

30/06/19 Profit and Loss account 33000 7350 CR

30/06/19 Bad Debts 4400 2950 CR

125 Provision for Doubtful Debts

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [provided for 30/6/18] 2,000.00 2,000.00 CR

30/06/19 Profit and Loss account 1870 3870 CR

30/06/19 Accounts Receivables 1650 2220 CR

30/06/19 Profit and Loss 2220 0

630 BAD AND DOUBTFUL DEBTS

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Debtors 4400 4400 CR

28

You are now required to post the journal entries to the General Ledger. Use the referencing system

outlined in the policies and procedures.

GENERAL LEDGER of KOOKABURRA FURNITURE 30 June 2019

110 BANK

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 10,000.00 10,000.00 DR

30/06/19 Interest Expenses 200 9800 DR.

120 ACCOUNTS RECEIVABLE [DEBTORS]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Schedule 42,000.00 42,000.00 DR

30/06/19 Provision for Doubtful Debts 1650 40350 DR

30/06/19 Profit and Loss account 33000 7350 CR

30/06/19 Bad Debts 4400 2950 CR

125 Provision for Doubtful Debts

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [provided for 30/6/18] 2,000.00 2,000.00 CR

30/06/19 Profit and Loss account 1870 3870 CR

30/06/19 Accounts Receivables 1650 2220 CR

30/06/19 Profit and Loss 2220 0

630 BAD AND DOUBTFUL DEBTS

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Debtors 4400 4400 CR

28

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

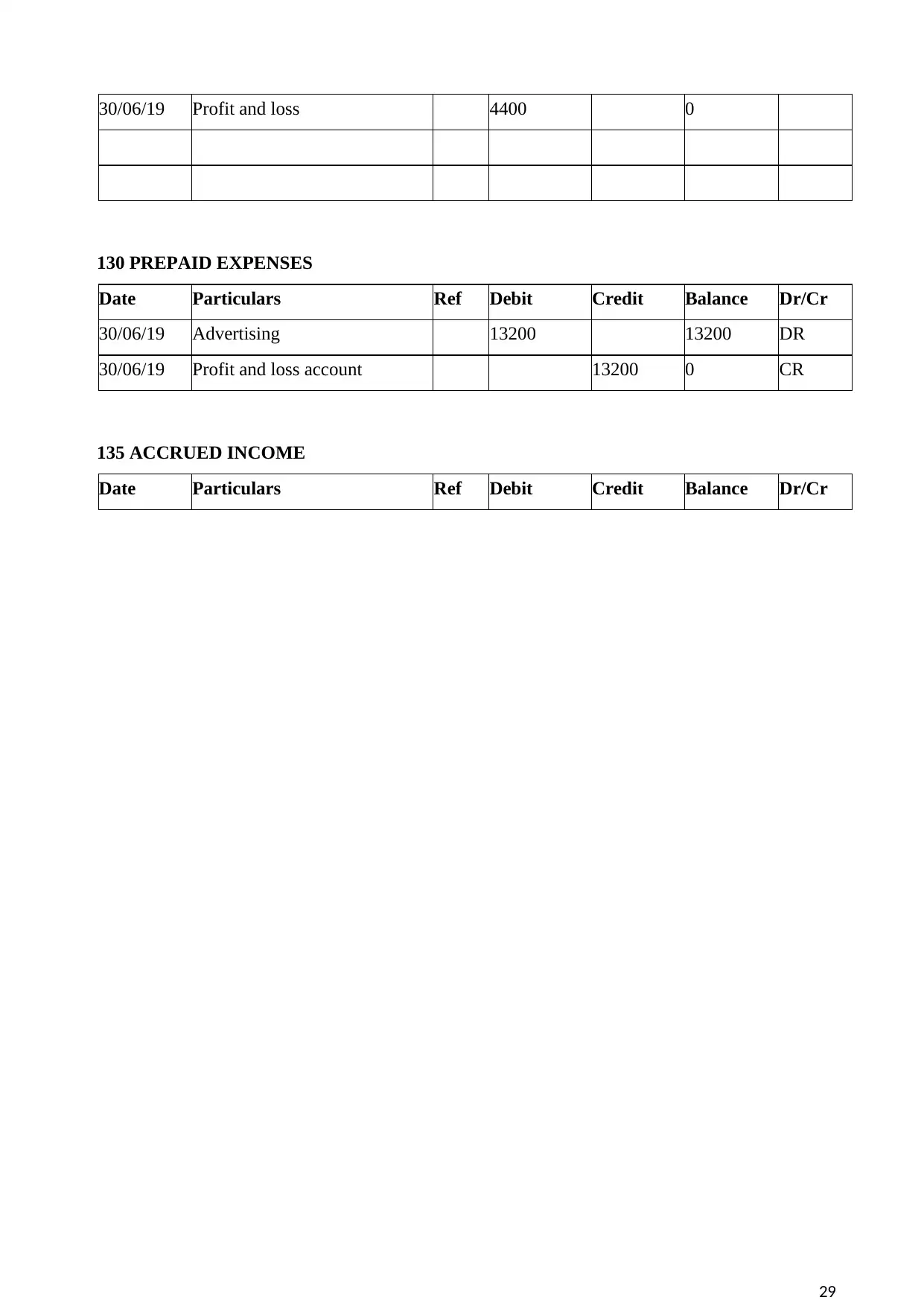

30/06/19 Profit and loss 4400 0

130 PREPAID EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Advertising 13200 13200 DR

30/06/19 Profit and loss account 13200 0 CR

135 ACCRUED INCOME

Date Particulars Ref Debit Credit Balance Dr/Cr

29

130 PREPAID EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Advertising 13200 13200 DR

30/06/19 Profit and loss account 13200 0 CR

135 ACCRUED INCOME

Date Particulars Ref Debit Credit Balance Dr/Cr

29

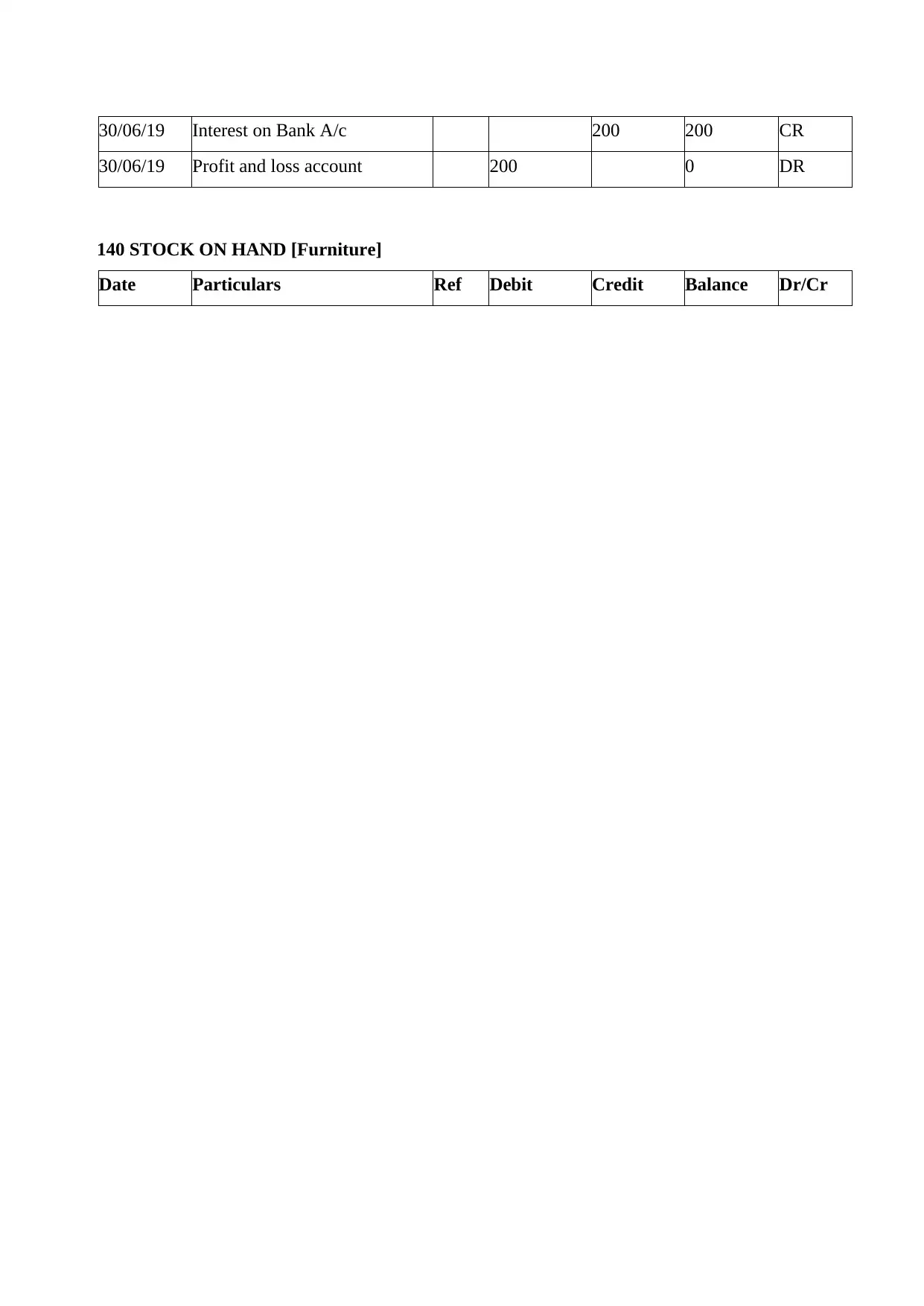

30/06/19 Interest on Bank A/c 200 200 CR

30/06/19 Profit and loss account 200 0 DR

140 STOCK ON HAND [Furniture]

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Profit and loss account 200 0 DR

140 STOCK ON HAND [Furniture]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [1/7/18] 85,000.00 85,000.00 DR

30/06/19 Purchases 5000 90000 DR

30/06/19 Profit and loss account 90000 0

150 OFFICE EQUIPMENT

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [as per Register] 18,000.00 18,000.00 DR

30/06/19 Accumulated Depreciation 11973.7 6026.3 DR

155 ACCUMULATED DEPRECIATION – OFFICE EQUIPMENT

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Office Equipment 11973.7 11973.7 DR

160 MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Asset Register 40,000.00 40,000.00 DR

30/06/19 Disposal of Motor Vehicle GJ 36793.89 3206 DR

165 ACCUMULATED DEPRECIATION – MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 3,328.77 3,328.77 CR

30/06/19 Depreciation 7105.11 1544.98 CR

30/06/19 Disposal of motor vehicle GJ 9198.47 1235.41 CR

650 DEPRECIATION – MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Purchases 5000 90000 DR

30/06/19 Profit and loss account 90000 0

150 OFFICE EQUIPMENT

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance [as per Register] 18,000.00 18,000.00 DR

30/06/19 Accumulated Depreciation 11973.7 6026.3 DR

155 ACCUMULATED DEPRECIATION – OFFICE EQUIPMENT

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Office Equipment 11973.7 11973.7 DR

160 MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Asset Register 40,000.00 40,000.00 DR

30/06/19 Disposal of Motor Vehicle GJ 36793.89 3206 DR

165 ACCUMULATED DEPRECIATION – MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 3,328.77 3,328.77 CR

30/06/19 Depreciation 7105.11 1544.98 CR

30/06/19 Disposal of motor vehicle GJ 9198.47 1235.41 CR

650 DEPRECIATION – MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

30/06/19 Accumulated Depreciation GJ 7105.11 7105.11 DR

DISPOSAL OF MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Motor Vehicles 36793.89 36793.89 DR

DISPOSAL OF MOTOR VEHICLES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Motor Vehicles 36793.89 36793.89 DR

30/06/19 Accumulated Depreciation GJ 7105.11 29688.78 DR

30/06/19 Loss On disposal of motor

vehicle

GJ 9293.89 38982.67 DR

910 Loss on Disposal of Motor Vehicle

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Disposal of motor vehicle GJ 9293.89 9293.89 DR

180 LOW-VALUE POOL

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Asset Register 900.00 900.00 DR

30/06/19 Accumulated Depreciation 168.75 731.25 DR

ACCUMULATED DEPRECIATION – LOW VALUE POOL

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Low Value Pool 168.75 168.75 DR

210 ACCOUNTS PAYABLE [CREDITORS]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Schedule 28,000.00 28,000.00 CR

220 GST COLLECTED

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 5,200.00 5,200.00 CR

30/06/19 Profit and loss account 5200 0 DR

33

30/06/19 Loss On disposal of motor

vehicle

GJ 9293.89 38982.67 DR

910 Loss on Disposal of Motor Vehicle

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Disposal of motor vehicle GJ 9293.89 9293.89 DR

180 LOW-VALUE POOL

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Asset Register 900.00 900.00 DR

30/06/19 Accumulated Depreciation 168.75 731.25 DR

ACCUMULATED DEPRECIATION – LOW VALUE POOL

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Low Value Pool 168.75 168.75 DR

210 ACCOUNTS PAYABLE [CREDITORS]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance as per Schedule 28,000.00 28,000.00 CR

220 GST COLLECTED

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 5,200.00 5,200.00 CR

30/06/19 Profit and loss account 5200 0 DR

33

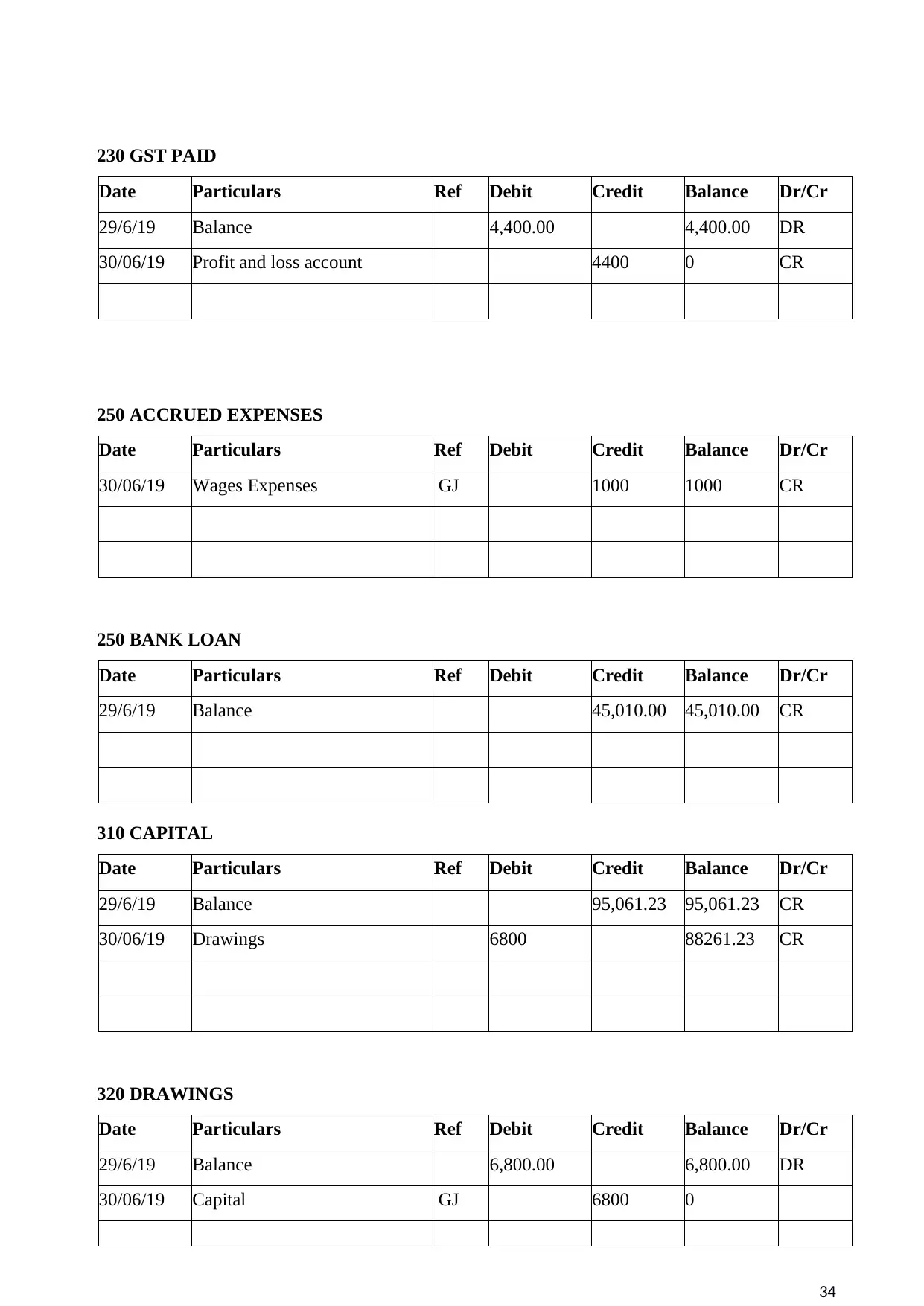

230 GST PAID

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 4,400.00 4,400.00 DR

30/06/19 Profit and loss account 4400 0 CR

250 ACCRUED EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Wages Expenses GJ 1000 1000 CR

250 BANK LOAN

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 45,010.00 45,010.00 CR

310 CAPITAL

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 95,061.23 95,061.23 CR

30/06/19 Drawings 6800 88261.23 CR

320 DRAWINGS

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 6,800.00 6,800.00 DR

30/06/19 Capital GJ 6800 0

34

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 4,400.00 4,400.00 DR

30/06/19 Profit and loss account 4400 0 CR

250 ACCRUED EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

30/06/19 Wages Expenses GJ 1000 1000 CR

250 BANK LOAN

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 45,010.00 45,010.00 CR

310 CAPITAL

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 95,061.23 95,061.23 CR

30/06/19 Drawings 6800 88261.23 CR

320 DRAWINGS

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 6,800.00 6,800.00 DR

30/06/19 Capital GJ 6800 0

34

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

410 SALES [Furniture]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 252,000.00 252,000.00 CR

30/06/19 Furniture 11000 263000 CR

520 PURCHASES [Furniture]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance PJ 101,000.00 101,000.00 DR

30/06/19 Stock on hand 5000 106000 DR

30/06/19 Profit and loss 106000 0

610 ADVERTISING

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 12,000.00 12,000.00 DR

30/06/19 Prepaid Expenses 13200 1200 CR

30/06/19 Profit and loss account 1200 0

620 ACCOUNTING FEES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 6,000.00 6,000.00 DR

30/06/19 Profit and loss account 6000 0

640 BANK CHARGES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 800.00 800.00 DR

30/06/19 Profit and loss account 800 0

35

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 252,000.00 252,000.00 CR

30/06/19 Furniture 11000 263000 CR

520 PURCHASES [Furniture]

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance PJ 101,000.00 101,000.00 DR

30/06/19 Stock on hand 5000 106000 DR

30/06/19 Profit and loss 106000 0

610 ADVERTISING

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 12,000.00 12,000.00 DR

30/06/19 Prepaid Expenses 13200 1200 CR

30/06/19 Profit and loss account 1200 0

620 ACCOUNTING FEES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 6,000.00 6,000.00 DR

30/06/19 Profit and loss account 6000 0

640 BANK CHARGES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 800.00 800.00 DR

30/06/19 Profit and loss account 800 0

35

660 LEASE OF PREMISES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 11,000.00 11,000.00 DR

30/06/19 Profit and loss 11000 0

670 MOTOR VEHICLE EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 5,500.00 5,500.00 DR

30/06/19 Profit and loss 5500 0

680 SUPERANNUATION

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 7,200.00 7,200.00 DR

30/06/19 Profit and loss 7200 0

690 WAGES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 80,000.00 80,000.00 DR

30/06/19 Accrued Expenses GJ 5100 85100 DR

30/06/19 Profit and loss 85100 0

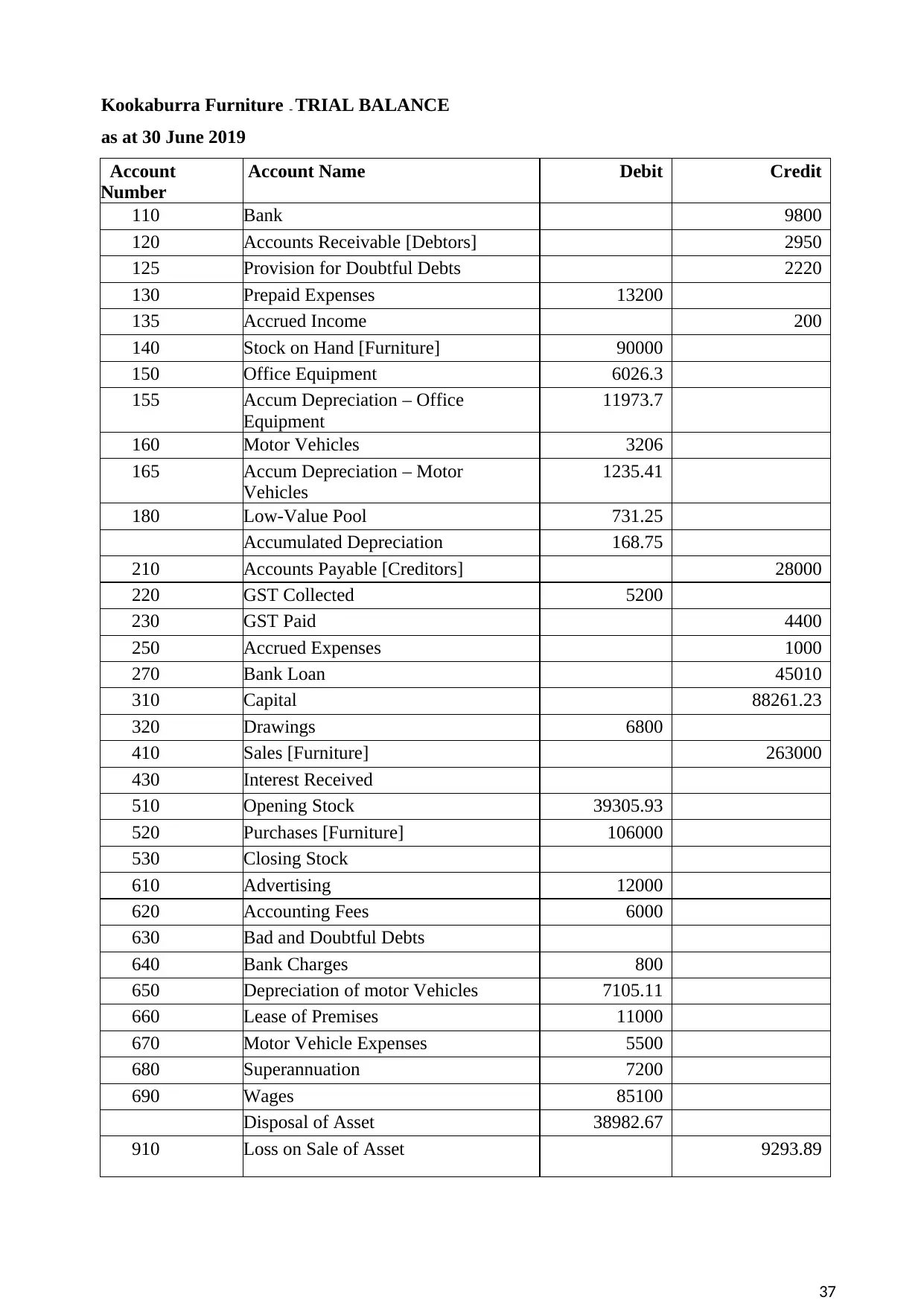

Task 17 Preparing Adjusted Trial Balance [manual set of books]

You are required to prepare the adjusted Trial Balance on the following page. This Trial Balance

will include the journals on the previous pages.

36

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 11,000.00 11,000.00 DR

30/06/19 Profit and loss 11000 0

670 MOTOR VEHICLE EXPENSES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 5,500.00 5,500.00 DR

30/06/19 Profit and loss 5500 0

680 SUPERANNUATION

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 7,200.00 7,200.00 DR

30/06/19 Profit and loss 7200 0

690 WAGES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 80,000.00 80,000.00 DR

30/06/19 Accrued Expenses GJ 5100 85100 DR

30/06/19 Profit and loss 85100 0

Task 17 Preparing Adjusted Trial Balance [manual set of books]

You are required to prepare the adjusted Trial Balance on the following page. This Trial Balance

will include the journals on the previous pages.

36

Kookaburra Furniture - TRIAL BALANCE

as at 30 June 2019

Account

Number

Account Name Debit Credit

110 Bank 9800

120 Accounts Receivable [Debtors] 2950

125 Provision for Doubtful Debts 2220

130 Prepaid Expenses 13200

135 Accrued Income 200

140 Stock on Hand [Furniture] 90000

150 Office Equipment 6026.3

155 Accum Depreciation – Office

Equipment

11973.7

160 Motor Vehicles 3206

165 Accum Depreciation – Motor

Vehicles

1235.41

180 Low-Value Pool 731.25

Accumulated Depreciation 168.75

210 Accounts Payable [Creditors] 28000

220 GST Collected 5200

230 GST Paid 4400

250 Accrued Expenses 1000

270 Bank Loan 45010

310 Capital 88261.23

320 Drawings 6800

410 Sales [Furniture] 263000

430 Interest Received

510 Opening Stock 39305.93

520 Purchases [Furniture] 106000

530 Closing Stock

610 Advertising 12000

620 Accounting Fees 6000

630 Bad and Doubtful Debts

640 Bank Charges 800

650 Depreciation of motor Vehicles 7105.11

660 Lease of Premises 11000

670 Motor Vehicle Expenses 5500

680 Superannuation 7200

690 Wages 85100

Disposal of Asset 38982.67

910 Loss on Sale of Asset 9293.89

37

as at 30 June 2019

Account

Number

Account Name Debit Credit

110 Bank 9800

120 Accounts Receivable [Debtors] 2950

125 Provision for Doubtful Debts 2220

130 Prepaid Expenses 13200

135 Accrued Income 200

140 Stock on Hand [Furniture] 90000

150 Office Equipment 6026.3

155 Accum Depreciation – Office

Equipment

11973.7

160 Motor Vehicles 3206

165 Accum Depreciation – Motor

Vehicles

1235.41

180 Low-Value Pool 731.25

Accumulated Depreciation 168.75

210 Accounts Payable [Creditors] 28000

220 GST Collected 5200

230 GST Paid 4400

250 Accrued Expenses 1000

270 Bank Loan 45010

310 Capital 88261.23

320 Drawings 6800

410 Sales [Furniture] 263000

430 Interest Received

510 Opening Stock 39305.93

520 Purchases [Furniture] 106000

530 Closing Stock

610 Advertising 12000

620 Accounting Fees 6000

630 Bad and Doubtful Debts

640 Bank Charges 800

650 Depreciation of motor Vehicles 7105.11

660 Lease of Premises 11000

670 Motor Vehicle Expenses 5500

680 Superannuation 7200

690 Wages 85100

Disposal of Asset 38982.67

910 Loss on Sale of Asset 9293.89

37

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

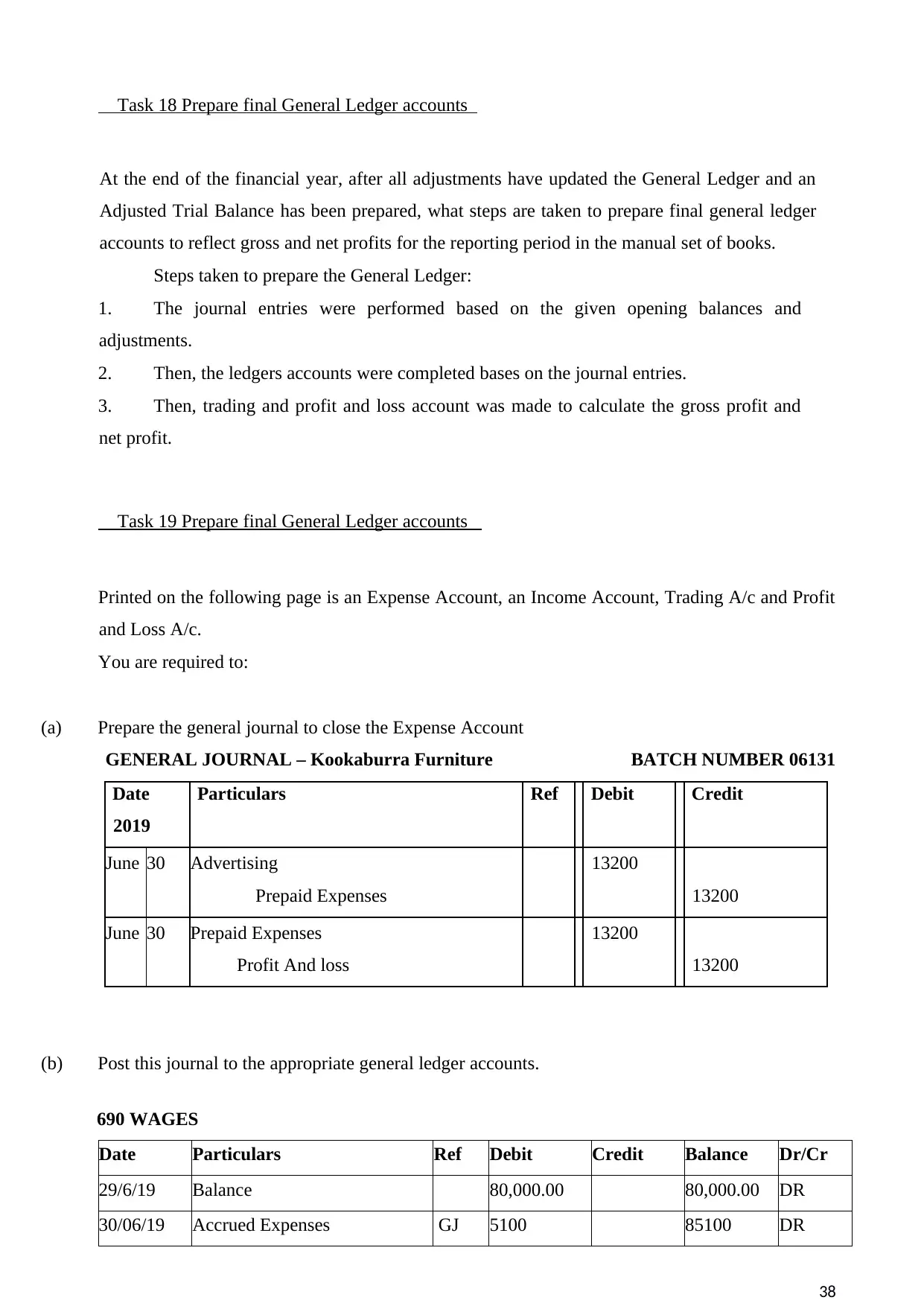

Task 18 Prepare final General Ledger accounts

At the end of the financial year, after all adjustments have updated the General Ledger and an

Adjusted Trial Balance has been prepared, what steps are taken to prepare final general ledger

accounts to reflect gross and net profits for the reporting period in the manual set of books.

Steps taken to prepare the General Ledger:

1. The journal entries were performed based on the given opening balances and

adjustments.

2. Then, the ledgers accounts were completed bases on the journal entries.

3. Then, trading and profit and loss account was made to calculate the gross profit and

net profit.

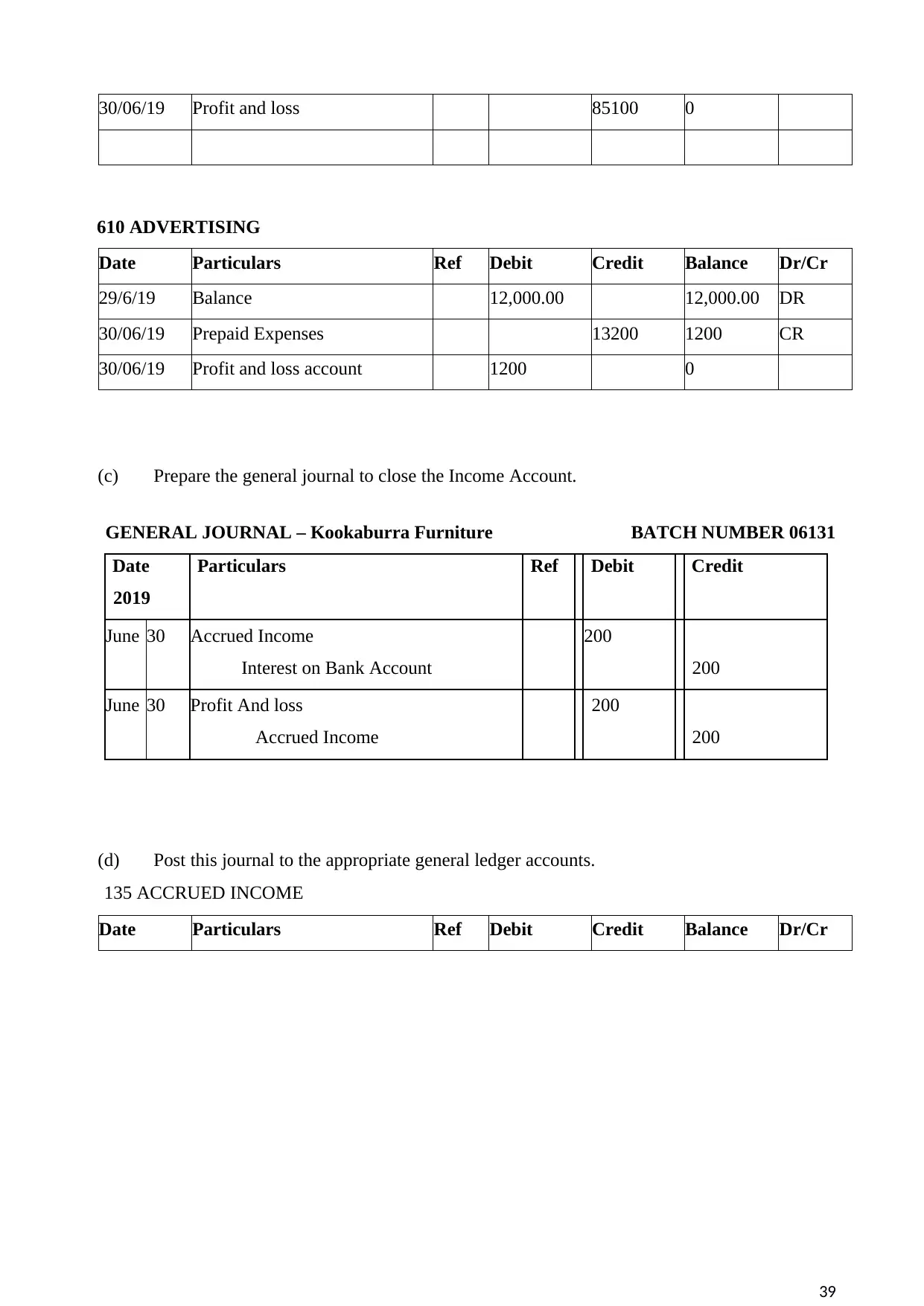

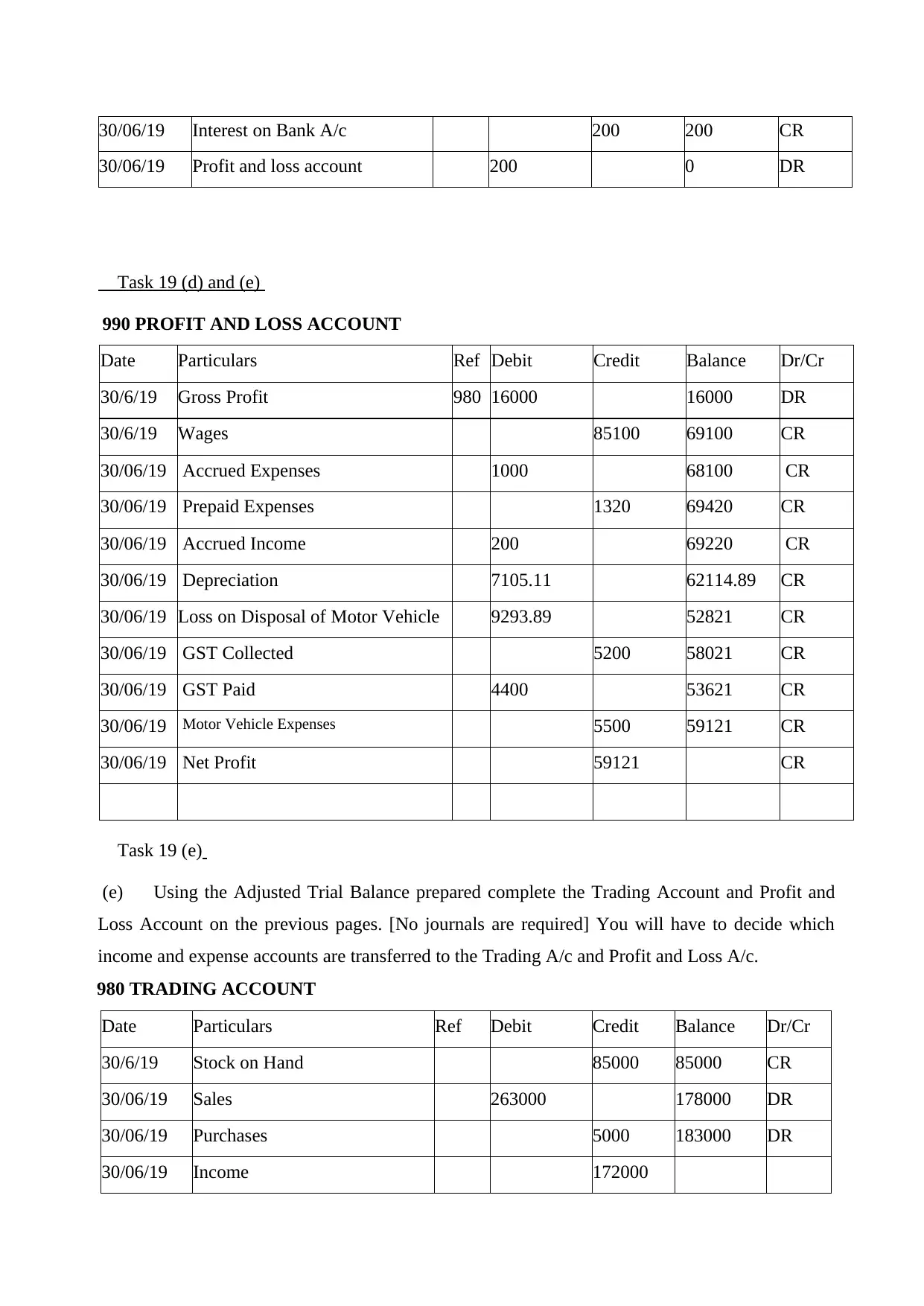

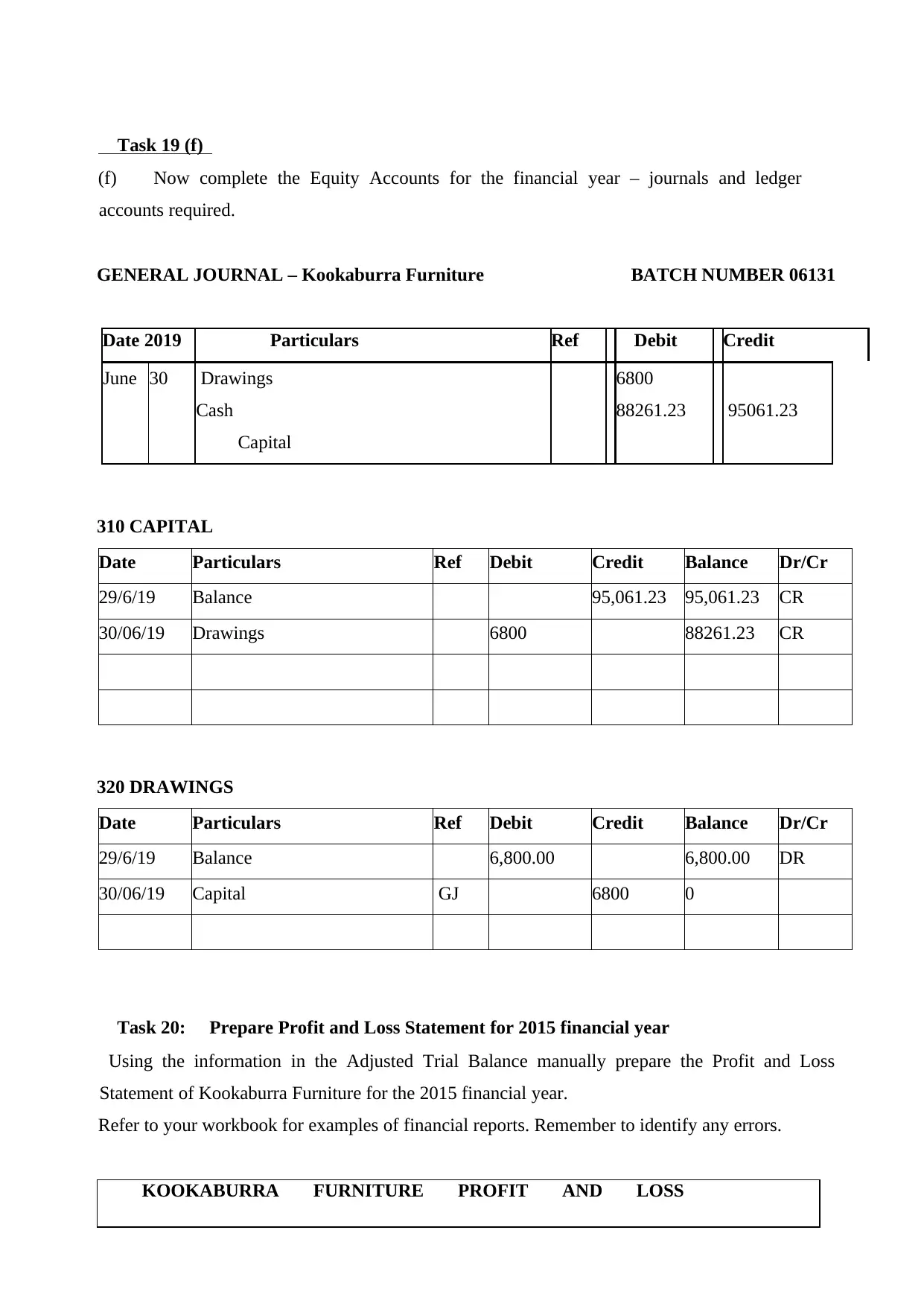

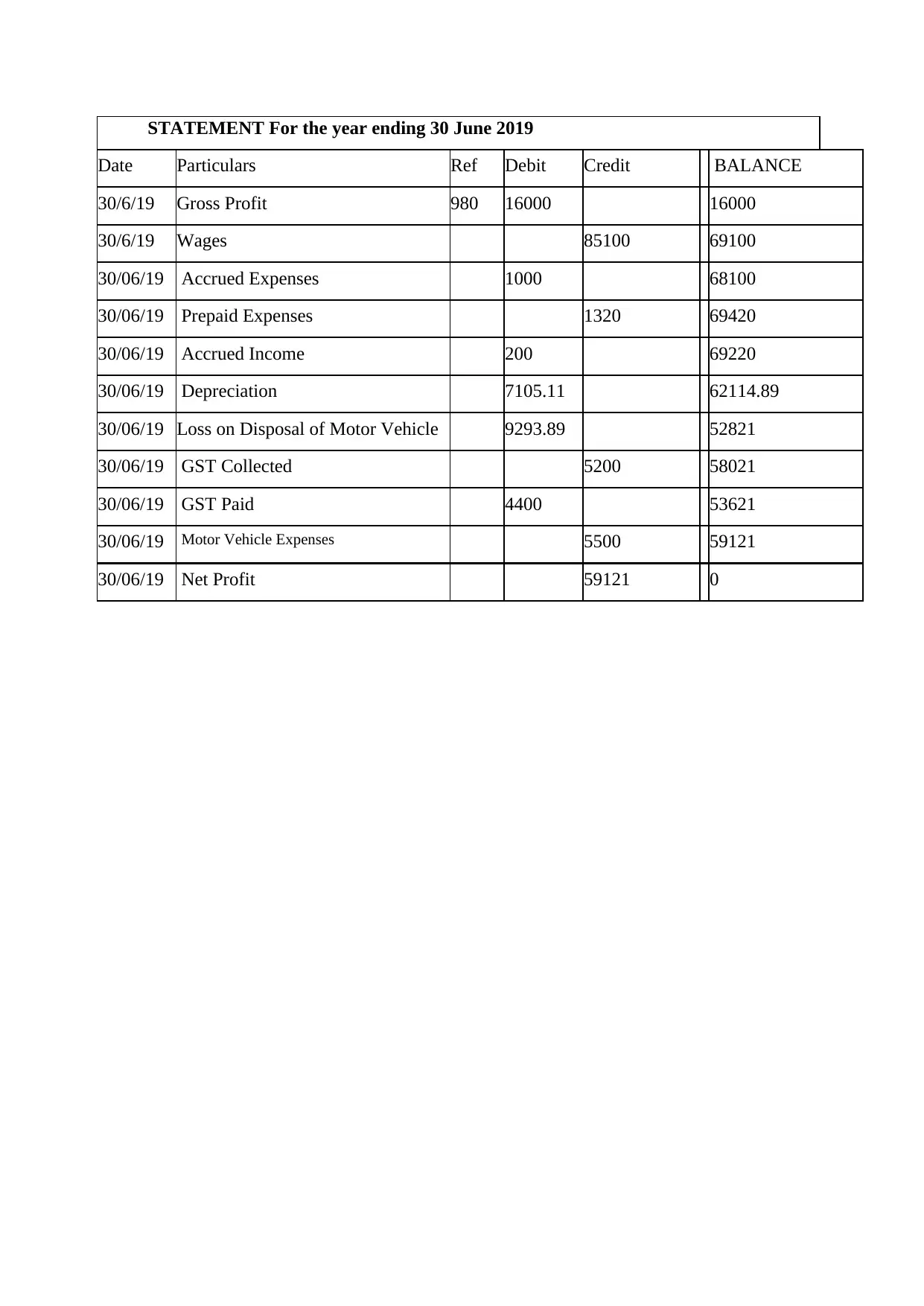

Task 19 Prepare final General Ledger accounts

Printed on the following page is an Expense Account, an Income Account, Trading A/c and Profit

and Loss A/c.

You are required to:

(a) Prepare the general journal to close the Expense Account

GENERAL JOURNAL – Kookaburra Furniture BATCH NUMBER 06131

Date

2019

Particulars Ref Debit Credit

June 30 Advertising

Prepaid Expenses

13200

13200

June 30 Prepaid Expenses

Profit And loss

13200

13200

(b) Post this journal to the appropriate general ledger accounts.

690 WAGES

Date Particulars Ref Debit Credit Balance Dr/Cr

29/6/19 Balance 80,000.00 80,000.00 DR

30/06/19 Accrued Expenses GJ 5100 85100 DR

38