Fig and Olive Capital: Financial Analysis

VerifiedAdded on 2020/05/16

|18

|2761

|205

AI Summary

This assignment presents a set of financial records for 'Fig and Olive Capital'. Students are tasked with analyzing these records to understand the company's financial performance. The analysis involves examining various accounts such as revenue, expenses, profit, and capital contributions. The provided data includes income statements, balance sheets, and a summary of drawings by the owner. Students will gain insights into key financial ratios and the overall financial health of Fig and Olive Capital.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ACCOUNTING CONCEPTS AND PRACTICES

Accounting Concepts and Practices

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Accounting Concepts and Practices

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ACCOUNTING CONCEPTS AND PRACTICES

Table of Contents

Question 1:.......................................................................................................................................2

Question 2:.......................................................................................................................................8

Question 3:.....................................................................................................................................10

Part A:........................................................................................................................................10

Part C:........................................................................................................................................13

Part D:........................................................................................................................................15

References:....................................................................................................................................17

Table of Contents

Question 1:.......................................................................................................................................2

Question 2:.......................................................................................................................................8

Question 3:.....................................................................................................................................10

Part A:........................................................................................................................................10

Part C:........................................................................................................................................13

Part D:........................................................................................................................................15

References:....................................................................................................................................17

2ACCOUNTING CONCEPTS AND PRACTICES

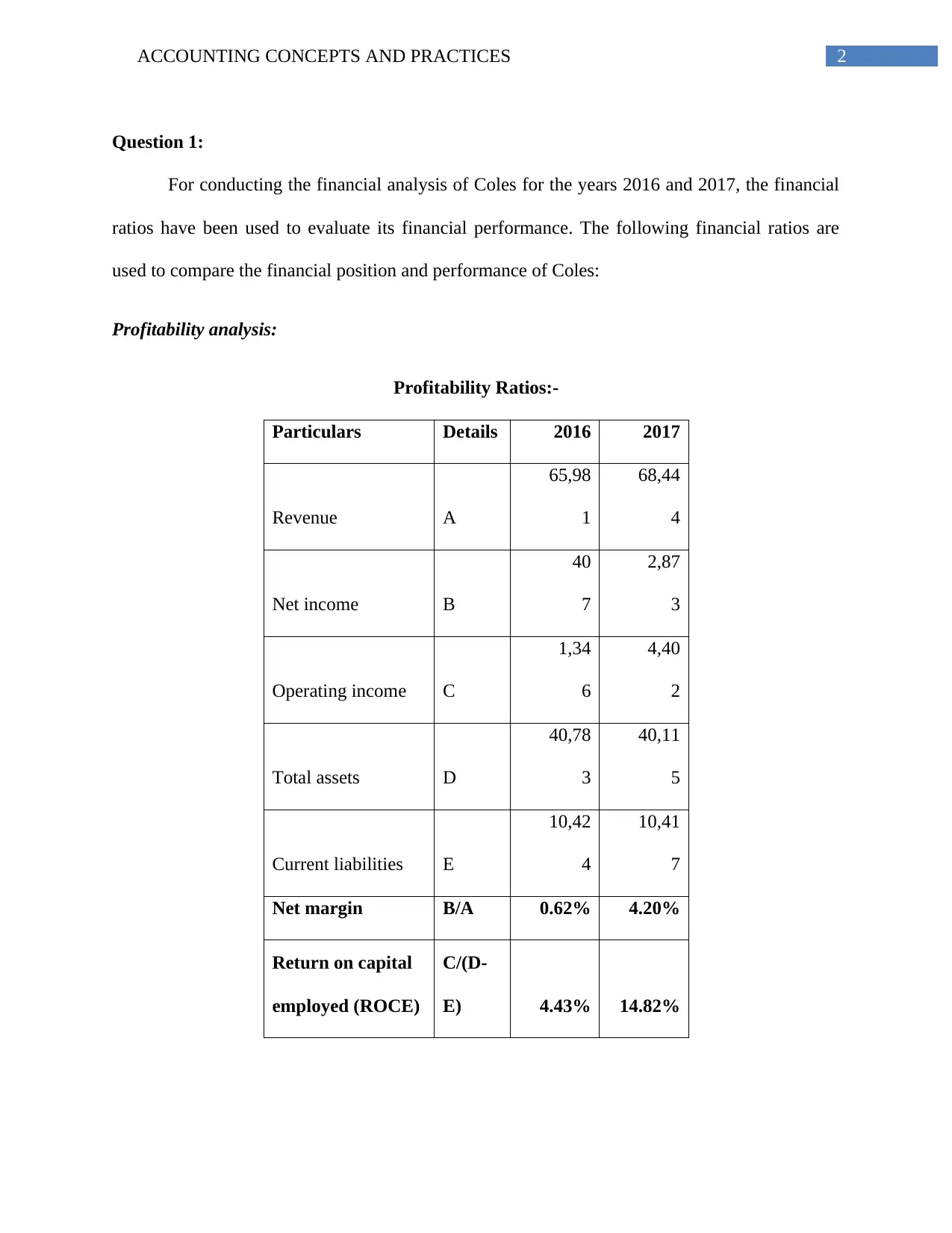

Question 1:

For conducting the financial analysis of Coles for the years 2016 and 2017, the financial

ratios have been used to evaluate its financial performance. The following financial ratios are

used to compare the financial position and performance of Coles:

Profitability analysis:

Profitability Ratios:-

Particulars Details 2016 2017

Revenue A

65,98

1

68,44

4

Net income B

40

7

2,87

3

Operating income C

1,34

6

4,40

2

Total assets D

40,78

3

40,11

5

Current liabilities E

10,42

4

10,41

7

Net margin B/A 0.62% 4.20%

Return on capital

employed (ROCE)

C/(D-

E) 4.43% 14.82%

Question 1:

For conducting the financial analysis of Coles for the years 2016 and 2017, the financial

ratios have been used to evaluate its financial performance. The following financial ratios are

used to compare the financial position and performance of Coles:

Profitability analysis:

Profitability Ratios:-

Particulars Details 2016 2017

Revenue A

65,98

1

68,44

4

Net income B

40

7

2,87

3

Operating income C

1,34

6

4,40

2

Total assets D

40,78

3

40,11

5

Current liabilities E

10,42

4

10,41

7

Net margin B/A 0.62% 4.20%

Return on capital

employed (ROCE)

C/(D-

E) 4.43% 14.82%

3ACCOUNTING CONCEPTS AND PRACTICES

According to the above table, it could be stated that the net margin of the organisation has

increased from 0.62% in 2016 to 4.20% in 2017. As commented by Cooper, Ezzamel & Qu

(2017), the net margin denotes the percentage of profit that an organisation earns after it has

incurred all its expenses and taxes from the revenue made. The higher the percentage, the better

is the position of the organisation in the operating market. In case of Coles, the trend is

increasing, which denotes that the organisation has improved its performance in 2017 mainly due

to reduced amount in impairment expenses.

The similar trend is observed in case of ROCE, as it has increased to 14.82% in 2017

from 4.43% in 2016 (Wesfarmers.com.au, 2018). A higher ratio is always favourable, since it

denotes the efficiency of the firm in generating higher returns from the invested amount. In this

case, the ratio has increased for Coles mainly due to increase in operating income and fall in

current liabilities. Hence, from the profitability point of view, Coles has shown improved

performance in 2017.

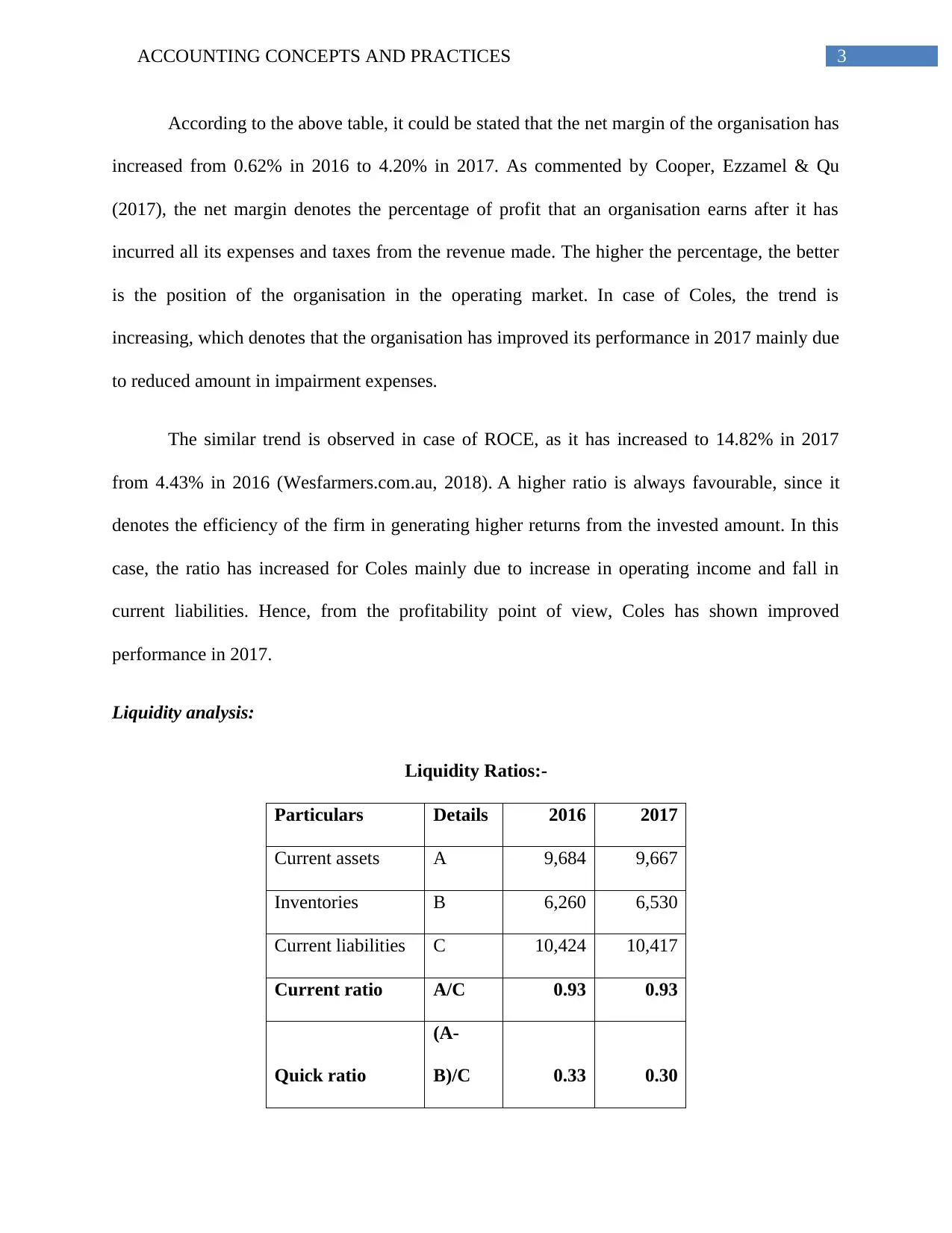

Liquidity analysis:

Liquidity Ratios:-

Particulars Details 2016 2017

Current assets A 9,684 9,667

Inventories B 6,260 6,530

Current liabilities C 10,424 10,417

Current ratio A/C 0.93 0.93

Quick ratio

(A-

B)/C 0.33 0.30

According to the above table, it could be stated that the net margin of the organisation has

increased from 0.62% in 2016 to 4.20% in 2017. As commented by Cooper, Ezzamel & Qu

(2017), the net margin denotes the percentage of profit that an organisation earns after it has

incurred all its expenses and taxes from the revenue made. The higher the percentage, the better

is the position of the organisation in the operating market. In case of Coles, the trend is

increasing, which denotes that the organisation has improved its performance in 2017 mainly due

to reduced amount in impairment expenses.

The similar trend is observed in case of ROCE, as it has increased to 14.82% in 2017

from 4.43% in 2016 (Wesfarmers.com.au, 2018). A higher ratio is always favourable, since it

denotes the efficiency of the firm in generating higher returns from the invested amount. In this

case, the ratio has increased for Coles mainly due to increase in operating income and fall in

current liabilities. Hence, from the profitability point of view, Coles has shown improved

performance in 2017.

Liquidity analysis:

Liquidity Ratios:-

Particulars Details 2016 2017

Current assets A 9,684 9,667

Inventories B 6,260 6,530

Current liabilities C 10,424 10,417

Current ratio A/C 0.93 0.93

Quick ratio

(A-

B)/C 0.33 0.30

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ACCOUNTING CONCEPTS AND PRACTICES

Based on the above table, it could be found that the current ratio of Coles has remained

the same at 0.93 in 2016 and 2017. An ideal current ratio in the Australian retail industry is

considered as 2 (Crawford, 2016). In this case, the ratio is well below the stated ideal standard,

which denotes that the organisation is struggling to meet its current obligations with the available

short-term asset base. Quick ratio is considered as the advanced liquidity ratio, since it does not

consider the value of inventory in assessing the liquidity position of a firm (Edmonds et al.,

2016). In case of Coles, the quick ratio has fallen from 0.33 in 2016 to 0.30 in 2017. An ideal

quick ratio in the above-stated industry is considered as 1 (Engel, 2016). In this case, the ratio is

below the industrial standard; thus, denoting that the organisation is going through a poor

liquidity position in the Australian retail sector.

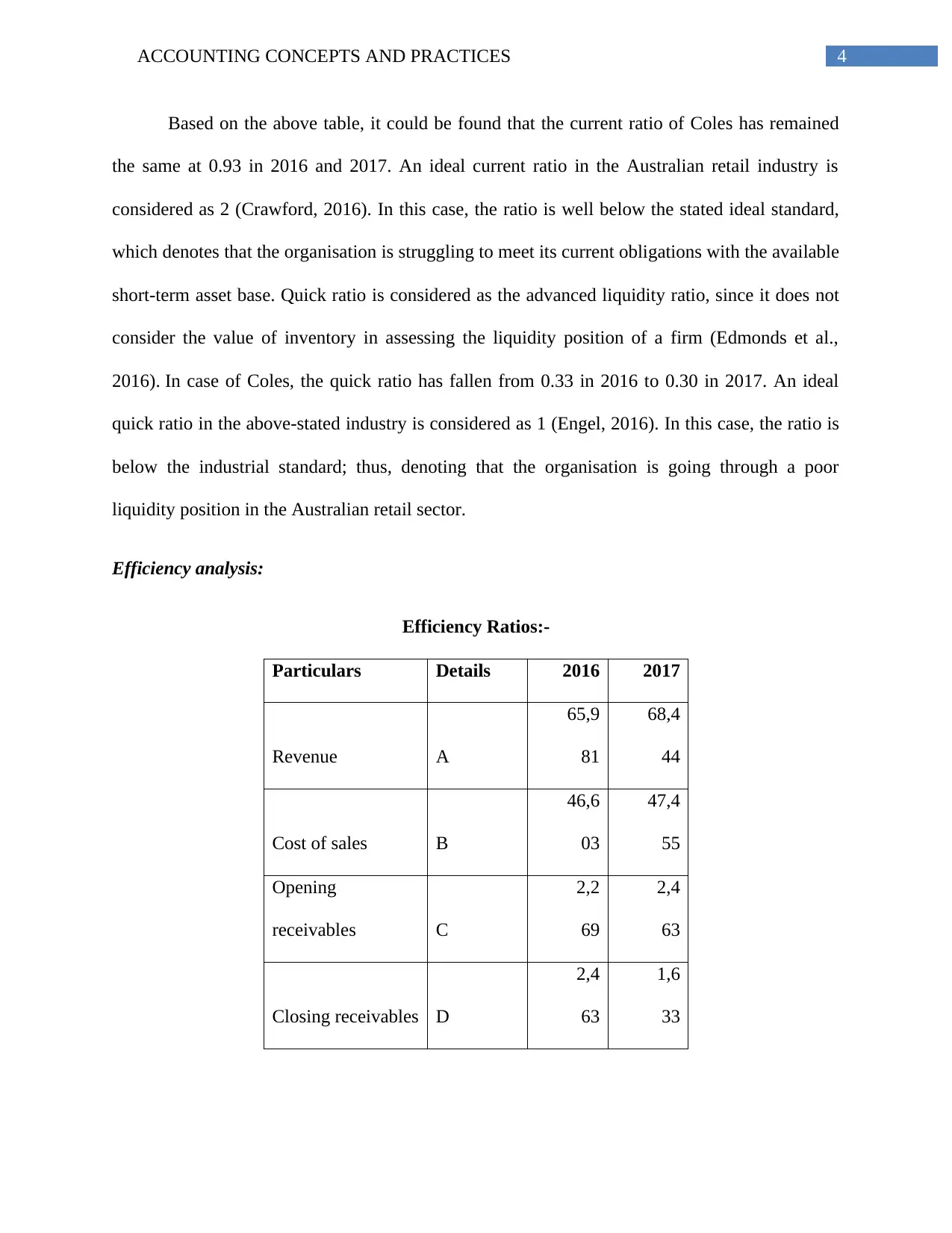

Efficiency analysis:

Efficiency Ratios:-

Particulars Details 2016 2017

Revenue A

65,9

81

68,4

44

Cost of sales B

46,6

03

47,4

55

Opening

receivables C

2,2

69

2,4

63

Closing receivables D

2,4

63

1,6

33

Based on the above table, it could be found that the current ratio of Coles has remained

the same at 0.93 in 2016 and 2017. An ideal current ratio in the Australian retail industry is

considered as 2 (Crawford, 2016). In this case, the ratio is well below the stated ideal standard,

which denotes that the organisation is struggling to meet its current obligations with the available

short-term asset base. Quick ratio is considered as the advanced liquidity ratio, since it does not

consider the value of inventory in assessing the liquidity position of a firm (Edmonds et al.,

2016). In case of Coles, the quick ratio has fallen from 0.33 in 2016 to 0.30 in 2017. An ideal

quick ratio in the above-stated industry is considered as 1 (Engel, 2016). In this case, the ratio is

below the industrial standard; thus, denoting that the organisation is going through a poor

liquidity position in the Australian retail sector.

Efficiency analysis:

Efficiency Ratios:-

Particulars Details 2016 2017

Revenue A

65,9

81

68,4

44

Cost of sales B

46,6

03

47,4

55

Opening

receivables C

2,2

69

2,4

63

Closing receivables D

2,4

63

1,6

33

5ACCOUNTING CONCEPTS AND PRACTICES

Average

receivables

E=(C+D)/

2

2,3

66

2,0

48

Opening inventory F

5,4

97

6,2

60

Closing inventory G

6,2

60

6,5

30

Average inventory

H=(F+G)/

2

5,878.

50

6,3

95

Opening payables I

5,7

61

6,4

91

Closing payables J

6,4

91

6,6

15

Average payables K=(I+J)/2

6,1

26

6,5

53

Receivables

turnover (in days) 365/(A/E) 13 11

Inventory

turnover (in days) 365/(B/H) 46 49

Payables turnover

(in days) 365/(B/K) 48 50

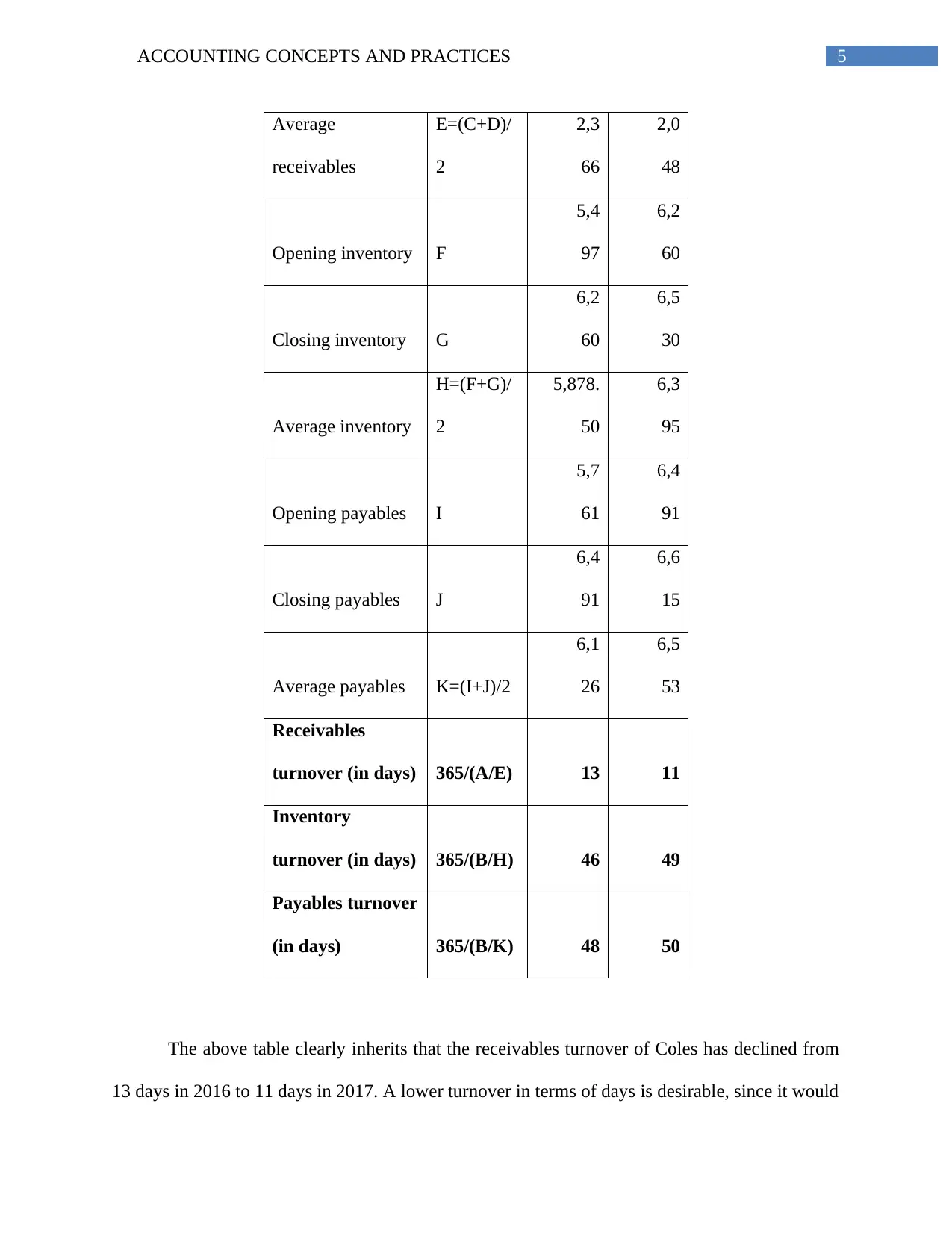

The above table clearly inherits that the receivables turnover of Coles has declined from

13 days in 2016 to 11 days in 2017. A lower turnover in terms of days is desirable, since it would

Average

receivables

E=(C+D)/

2

2,3

66

2,0

48

Opening inventory F

5,4

97

6,2

60

Closing inventory G

6,2

60

6,5

30

Average inventory

H=(F+G)/

2

5,878.

50

6,3

95

Opening payables I

5,7

61

6,4

91

Closing payables J

6,4

91

6,6

15

Average payables K=(I+J)/2

6,1

26

6,5

53

Receivables

turnover (in days) 365/(A/E) 13 11

Inventory

turnover (in days) 365/(B/H) 46 49

Payables turnover

(in days) 365/(B/K) 48 50

The above table clearly inherits that the receivables turnover of Coles has declined from

13 days in 2016 to 11 days in 2017. A lower turnover in terms of days is desirable, since it would

6ACCOUNTING CONCEPTS AND PRACTICES

help an organisation in accumulating cash from the debtors, which would increase its working

capital (Fullerton, Kennedy & Widener, 2014). In the above case, the ratio has declined for

Coles, which denotes that the organisation has tightened its credit policy for increasing its

working capital base in order to invest in business operations or for expansion programme. The

inventory turnover in terms of days has risen from 46 days in 2016 to 49 days in 2017; however,

a lower turnover is desirable, since a firm is able to discharge its inventory at a faster rate (Jones,

2015). In this case, the ratio has fallen for Coles, which signifies falling demand in the market in

contrast to the supply situation in the same.

On the other hand, the payables turnover of Coles has increased to 50 days in 2017 from

48 days in 2016. The higher payables turnover in terms of days is effective from the

organisational perspective, as it helps the organisation to retain greater cash in hand for greater

amount of time (Lai & Samkin, 2017). The ratio is on the increasing scale for Coles, as it has

used its brand image in the market to extend the payment terms from the creditors. Hence, from

the efficiency point of view, Coles is in an average position in the Australian retail market.

Solvency analysis:

Solvency Ratios:-

Particulars Details 2016 2017

Non-current

liabilities A

7,4

10

5,7

57

Equity B

22,9

49

23,9

41

Operating income C 1,3 4,4

help an organisation in accumulating cash from the debtors, which would increase its working

capital (Fullerton, Kennedy & Widener, 2014). In the above case, the ratio has declined for

Coles, which denotes that the organisation has tightened its credit policy for increasing its

working capital base in order to invest in business operations or for expansion programme. The

inventory turnover in terms of days has risen from 46 days in 2016 to 49 days in 2017; however,

a lower turnover is desirable, since a firm is able to discharge its inventory at a faster rate (Jones,

2015). In this case, the ratio has fallen for Coles, which signifies falling demand in the market in

contrast to the supply situation in the same.

On the other hand, the payables turnover of Coles has increased to 50 days in 2017 from

48 days in 2016. The higher payables turnover in terms of days is effective from the

organisational perspective, as it helps the organisation to retain greater cash in hand for greater

amount of time (Lai & Samkin, 2017). The ratio is on the increasing scale for Coles, as it has

used its brand image in the market to extend the payment terms from the creditors. Hence, from

the efficiency point of view, Coles is in an average position in the Australian retail market.

Solvency analysis:

Solvency Ratios:-

Particulars Details 2016 2017

Non-current

liabilities A

7,4

10

5,7

57

Equity B

22,9

49

23,9

41

Operating income C 1,3 4,4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING CONCEPTS AND PRACTICES

46 02

Interest expense D

3

08

2

64

Gearing ratio

A/

(A+B) 24.41% 19.39%

Interest cover ratio C/D 4.37 16.67

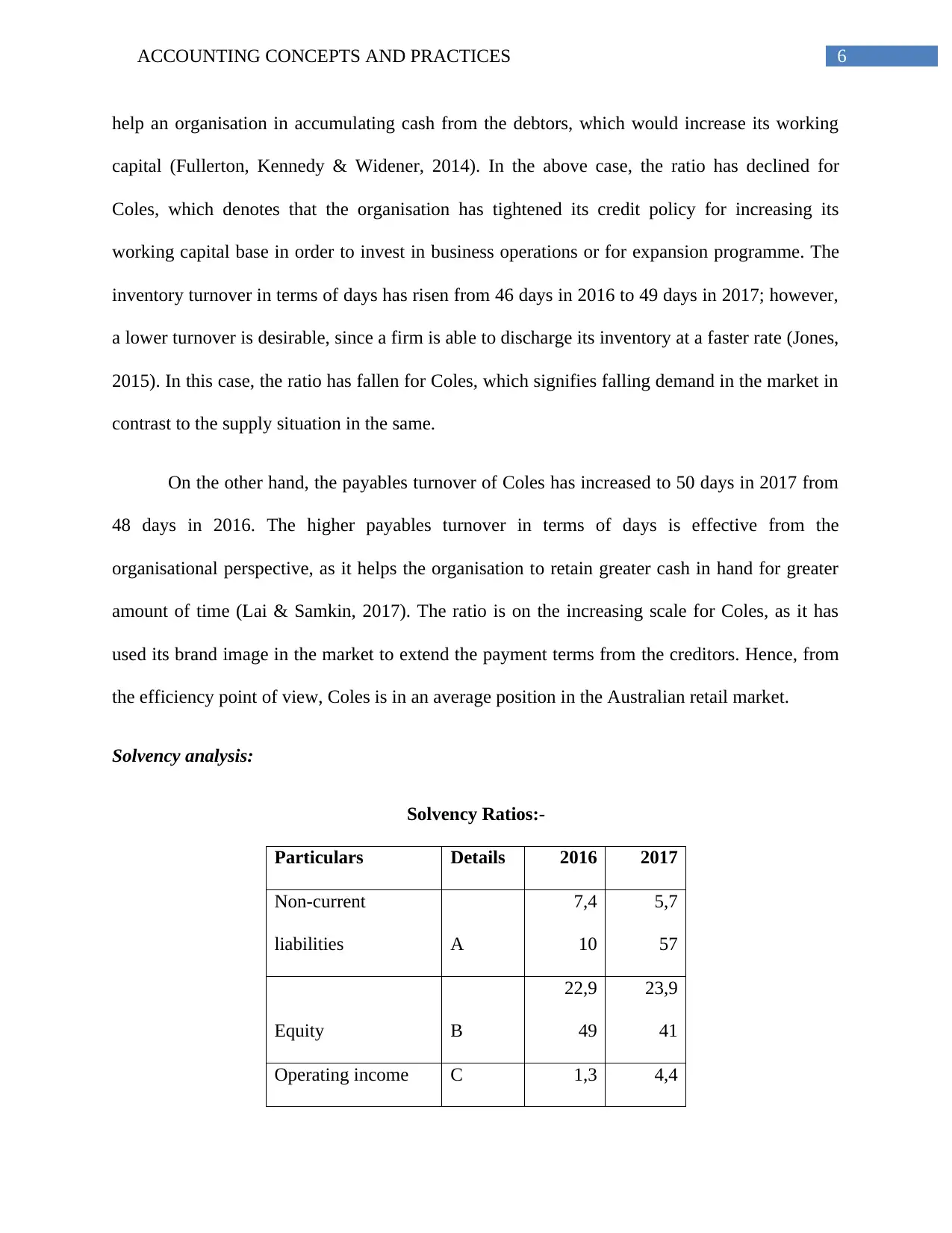

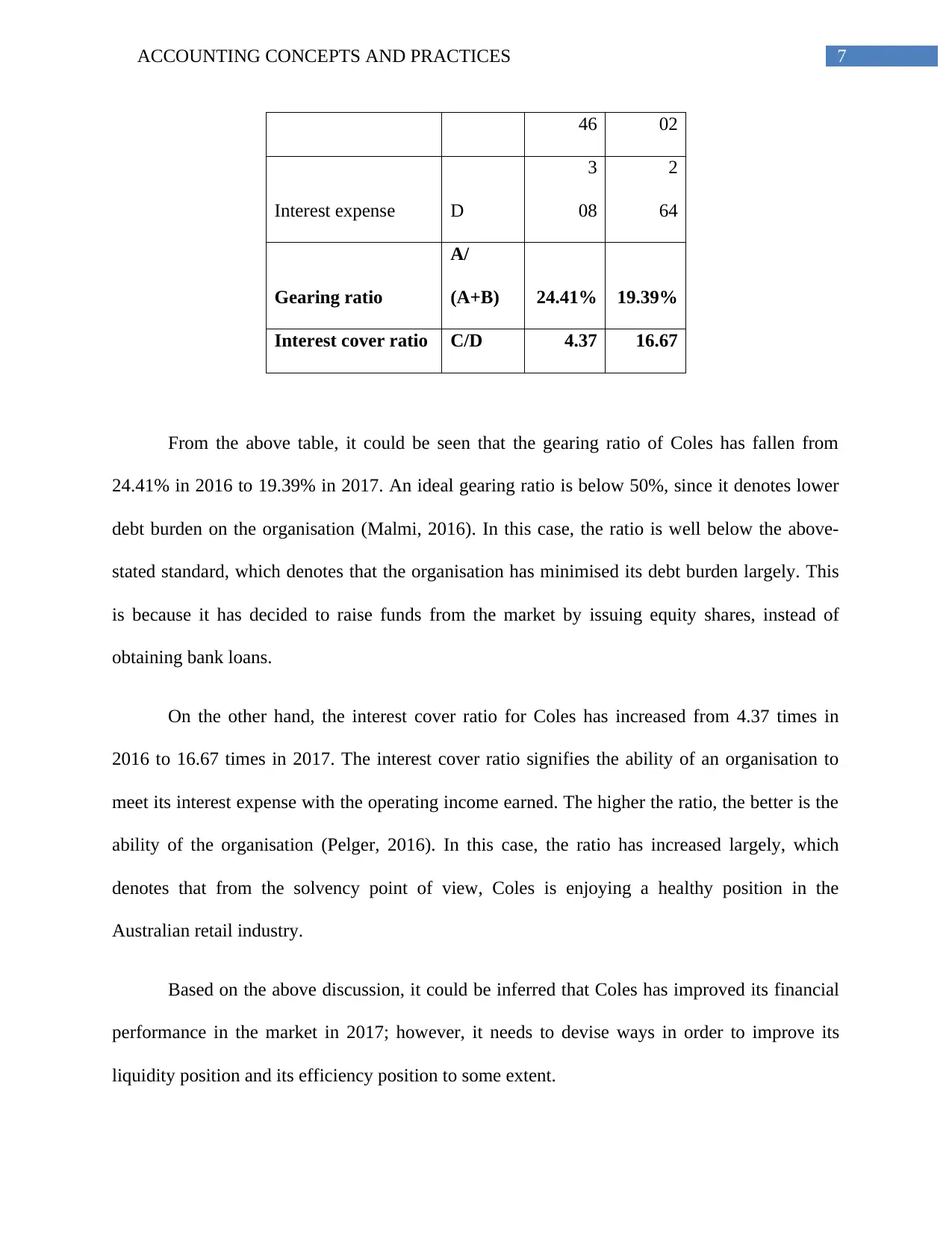

From the above table, it could be seen that the gearing ratio of Coles has fallen from

24.41% in 2016 to 19.39% in 2017. An ideal gearing ratio is below 50%, since it denotes lower

debt burden on the organisation (Malmi, 2016). In this case, the ratio is well below the above-

stated standard, which denotes that the organisation has minimised its debt burden largely. This

is because it has decided to raise funds from the market by issuing equity shares, instead of

obtaining bank loans.

On the other hand, the interest cover ratio for Coles has increased from 4.37 times in

2016 to 16.67 times in 2017. The interest cover ratio signifies the ability of an organisation to

meet its interest expense with the operating income earned. The higher the ratio, the better is the

ability of the organisation (Pelger, 2016). In this case, the ratio has increased largely, which

denotes that from the solvency point of view, Coles is enjoying a healthy position in the

Australian retail industry.

Based on the above discussion, it could be inferred that Coles has improved its financial

performance in the market in 2017; however, it needs to devise ways in order to improve its

liquidity position and its efficiency position to some extent.

46 02

Interest expense D

3

08

2

64

Gearing ratio

A/

(A+B) 24.41% 19.39%

Interest cover ratio C/D 4.37 16.67

From the above table, it could be seen that the gearing ratio of Coles has fallen from

24.41% in 2016 to 19.39% in 2017. An ideal gearing ratio is below 50%, since it denotes lower

debt burden on the organisation (Malmi, 2016). In this case, the ratio is well below the above-

stated standard, which denotes that the organisation has minimised its debt burden largely. This

is because it has decided to raise funds from the market by issuing equity shares, instead of

obtaining bank loans.

On the other hand, the interest cover ratio for Coles has increased from 4.37 times in

2016 to 16.67 times in 2017. The interest cover ratio signifies the ability of an organisation to

meet its interest expense with the operating income earned. The higher the ratio, the better is the

ability of the organisation (Pelger, 2016). In this case, the ratio has increased largely, which

denotes that from the solvency point of view, Coles is enjoying a healthy position in the

Australian retail industry.

Based on the above discussion, it could be inferred that Coles has improved its financial

performance in the market in 2017; however, it needs to devise ways in order to improve its

liquidity position and its efficiency position to some extent.

8ACCOUNTING CONCEPTS AND PRACTICES

Question 2:

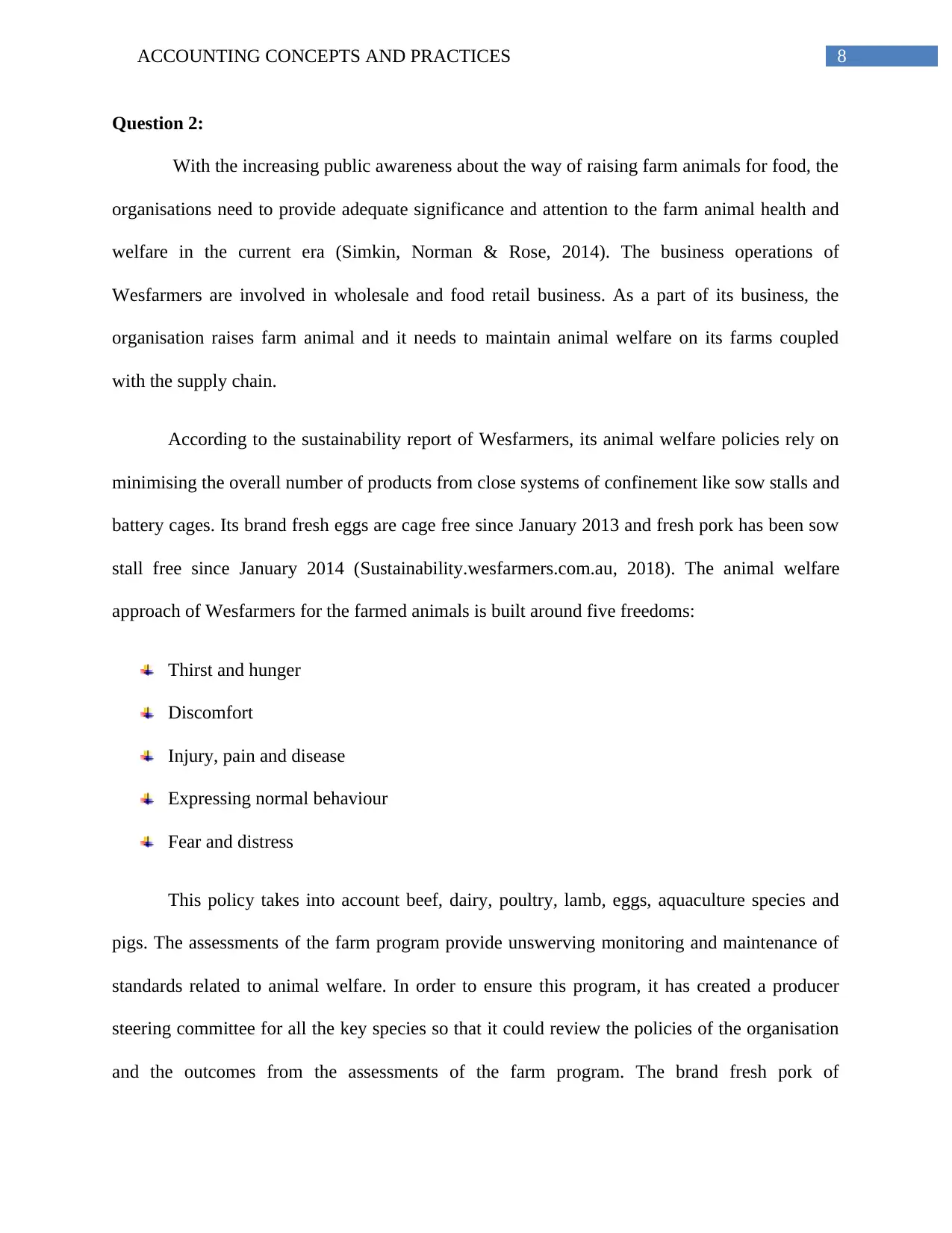

With the increasing public awareness about the way of raising farm animals for food, the

organisations need to provide adequate significance and attention to the farm animal health and

welfare in the current era (Simkin, Norman & Rose, 2014). The business operations of

Wesfarmers are involved in wholesale and food retail business. As a part of its business, the

organisation raises farm animal and it needs to maintain animal welfare on its farms coupled

with the supply chain.

According to the sustainability report of Wesfarmers, its animal welfare policies rely on

minimising the overall number of products from close systems of confinement like sow stalls and

battery cages. Its brand fresh eggs are cage free since January 2013 and fresh pork has been sow

stall free since January 2014 (Sustainability.wesfarmers.com.au, 2018). The animal welfare

approach of Wesfarmers for the farmed animals is built around five freedoms:

Thirst and hunger

Discomfort

Injury, pain and disease

Expressing normal behaviour

Fear and distress

This policy takes into account beef, dairy, poultry, lamb, eggs, aquaculture species and

pigs. The assessments of the farm program provide unswerving monitoring and maintenance of

standards related to animal welfare. In order to ensure this program, it has created a producer

steering committee for all the key species so that it could review the policies of the organisation

and the outcomes from the assessments of the farm program. The brand fresh pork of

Question 2:

With the increasing public awareness about the way of raising farm animals for food, the

organisations need to provide adequate significance and attention to the farm animal health and

welfare in the current era (Simkin, Norman & Rose, 2014). The business operations of

Wesfarmers are involved in wholesale and food retail business. As a part of its business, the

organisation raises farm animal and it needs to maintain animal welfare on its farms coupled

with the supply chain.

According to the sustainability report of Wesfarmers, its animal welfare policies rely on

minimising the overall number of products from close systems of confinement like sow stalls and

battery cages. Its brand fresh eggs are cage free since January 2013 and fresh pork has been sow

stall free since January 2014 (Sustainability.wesfarmers.com.au, 2018). The animal welfare

approach of Wesfarmers for the farmed animals is built around five freedoms:

Thirst and hunger

Discomfort

Injury, pain and disease

Expressing normal behaviour

Fear and distress

This policy takes into account beef, dairy, poultry, lamb, eggs, aquaculture species and

pigs. The assessments of the farm program provide unswerving monitoring and maintenance of

standards related to animal welfare. In order to ensure this program, it has created a producer

steering committee for all the key species so that it could review the policies of the organisation

and the outcomes from the assessments of the farm program. The brand fresh pork of

9ACCOUNTING CONCEPTS AND PRACTICES

Wesfarmers is obtained from farms using only gestation stalls for a maximum of one day in

contrast to the industrial standard of 10 days.

Its free range pork is the only “RSPCA Approved” fresh pork, which is stocked

nationally on the part of an Australian supermarket. As it has entered into long-term contract, it

has helped in increasing the number of “RSPCA Approved” pigs, which are grown exclusively

for the organisation in Western Australia. As a result, it has lead to rise in farm employment.

All the brand poultry of the organisation is sourced completely from “RSPCA Approved”

farms since January 2014. It has been observed that at the time Coles made its path towards

greater welfare chicken, below 5% of the chicken production in Australia was approved on the

part of RSPCA. In the current day, above 70% of national production satisfies this greater

welfare standard, since the other organisations operating in the market and industry have

followed the lead of the organisation (Taleb, Gibson & Hovey, 2015).

However, there are certain risks involved with the Farm Animal Welfare Program of

Coles. These risks are depicted briefly as follows:

Expenditures would be incurred because of the animal right training to be provided to the

staffs

It might not be effective, since the program is still under the control of the management

The organisation needs to spend additional time and incur additional costs, since it needs

to explore and resolve the issues related to human rights (Walters, 2015).

It has been found out in the “The Business Benchmark on Farm Animal Welfare

(BBFAW)” report that Wesfarmers was provided with the “Tier 5” rank in 2016. After that

period, the ranking of Wesfarmers did not move upwards, which denotes that the organisation is

Wesfarmers is obtained from farms using only gestation stalls for a maximum of one day in

contrast to the industrial standard of 10 days.

Its free range pork is the only “RSPCA Approved” fresh pork, which is stocked

nationally on the part of an Australian supermarket. As it has entered into long-term contract, it

has helped in increasing the number of “RSPCA Approved” pigs, which are grown exclusively

for the organisation in Western Australia. As a result, it has lead to rise in farm employment.

All the brand poultry of the organisation is sourced completely from “RSPCA Approved”

farms since January 2014. It has been observed that at the time Coles made its path towards

greater welfare chicken, below 5% of the chicken production in Australia was approved on the

part of RSPCA. In the current day, above 70% of national production satisfies this greater

welfare standard, since the other organisations operating in the market and industry have

followed the lead of the organisation (Taleb, Gibson & Hovey, 2015).

However, there are certain risks involved with the Farm Animal Welfare Program of

Coles. These risks are depicted briefly as follows:

Expenditures would be incurred because of the animal right training to be provided to the

staffs

It might not be effective, since the program is still under the control of the management

The organisation needs to spend additional time and incur additional costs, since it needs

to explore and resolve the issues related to human rights (Walters, 2015).

It has been found out in the “The Business Benchmark on Farm Animal Welfare

(BBFAW)” report that Wesfarmers was provided with the “Tier 5” rank in 2016. After that

period, the ranking of Wesfarmers did not move upwards, which denotes that the organisation is

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ACCOUNTING CONCEPTS AND PRACTICES

on the process of business agenda; however, the evidence of implementation is limited. This is

because of the following reasons:

Use of antibiotics for preventing infections in stressed animals, which has increased

animal growth.

Use of antibiotics in food-producing animals, which is not ideal for animal welfare and

human health.

Hence, it could be inferred that the organisation has lost marks under the category of

animals’ right and it could be rated under Tier 5.

Question 3:

Part A:

Fig and Olive Inc

Adjusting Journal

30 June 2017

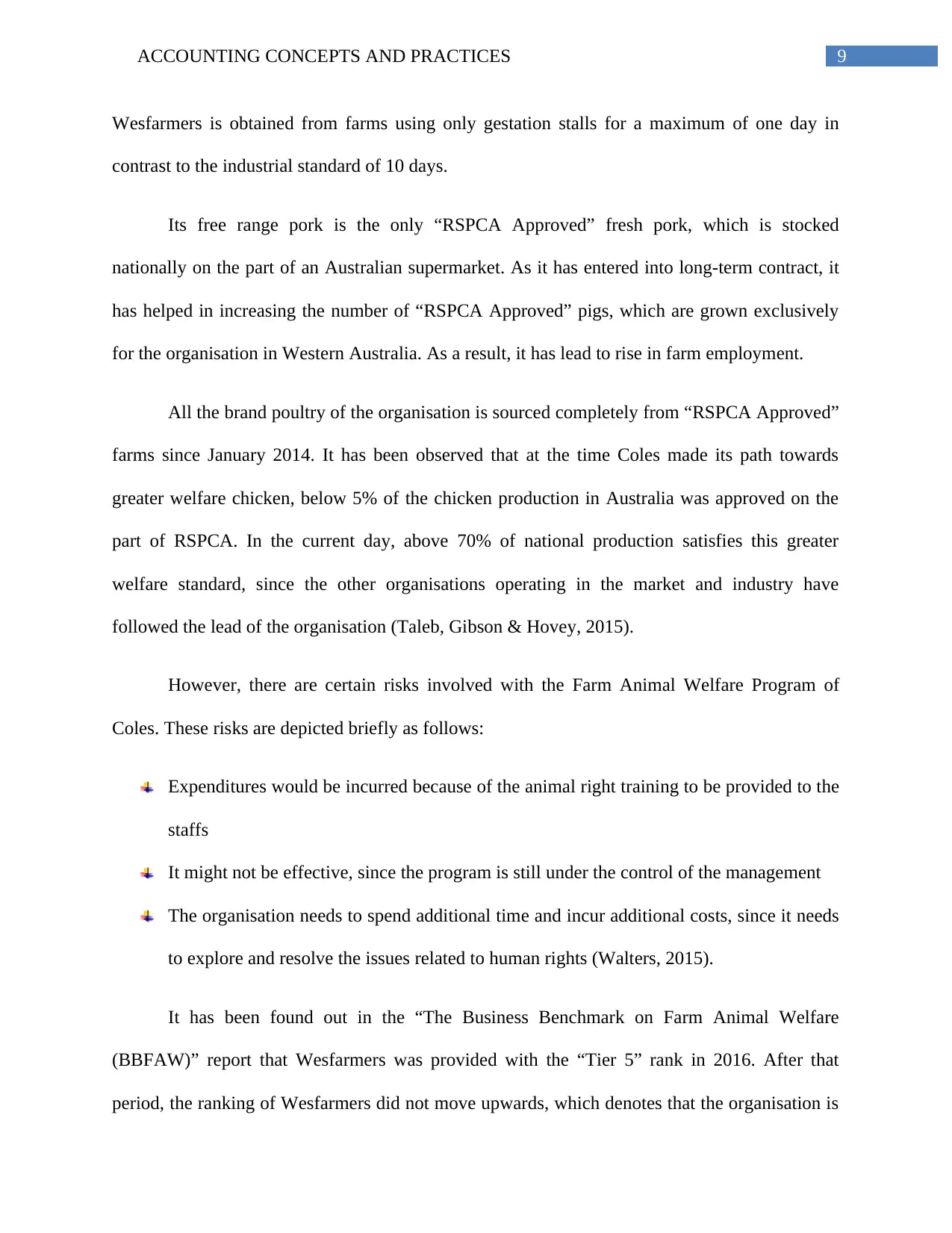

Date Particular L Ref Debit Credit

01 Depreciation Expense – Plant &

Equipment(120000-

20000*25/100+20000*25/100*3/12)

26250

Accumulated Depreciation- Plant &

Equipment

26250

on the process of business agenda; however, the evidence of implementation is limited. This is

because of the following reasons:

Use of antibiotics for preventing infections in stressed animals, which has increased

animal growth.

Use of antibiotics in food-producing animals, which is not ideal for animal welfare and

human health.

Hence, it could be inferred that the organisation has lost marks under the category of

animals’ right and it could be rated under Tier 5.

Question 3:

Part A:

Fig and Olive Inc

Adjusting Journal

30 June 2017

Date Particular L Ref Debit Credit

01 Depreciation Expense – Plant &

Equipment(120000-

20000*25/100+20000*25/100*3/12)

26250

Accumulated Depreciation- Plant &

Equipment

26250

11ACCOUNTING CONCEPTS AND PRACTICES

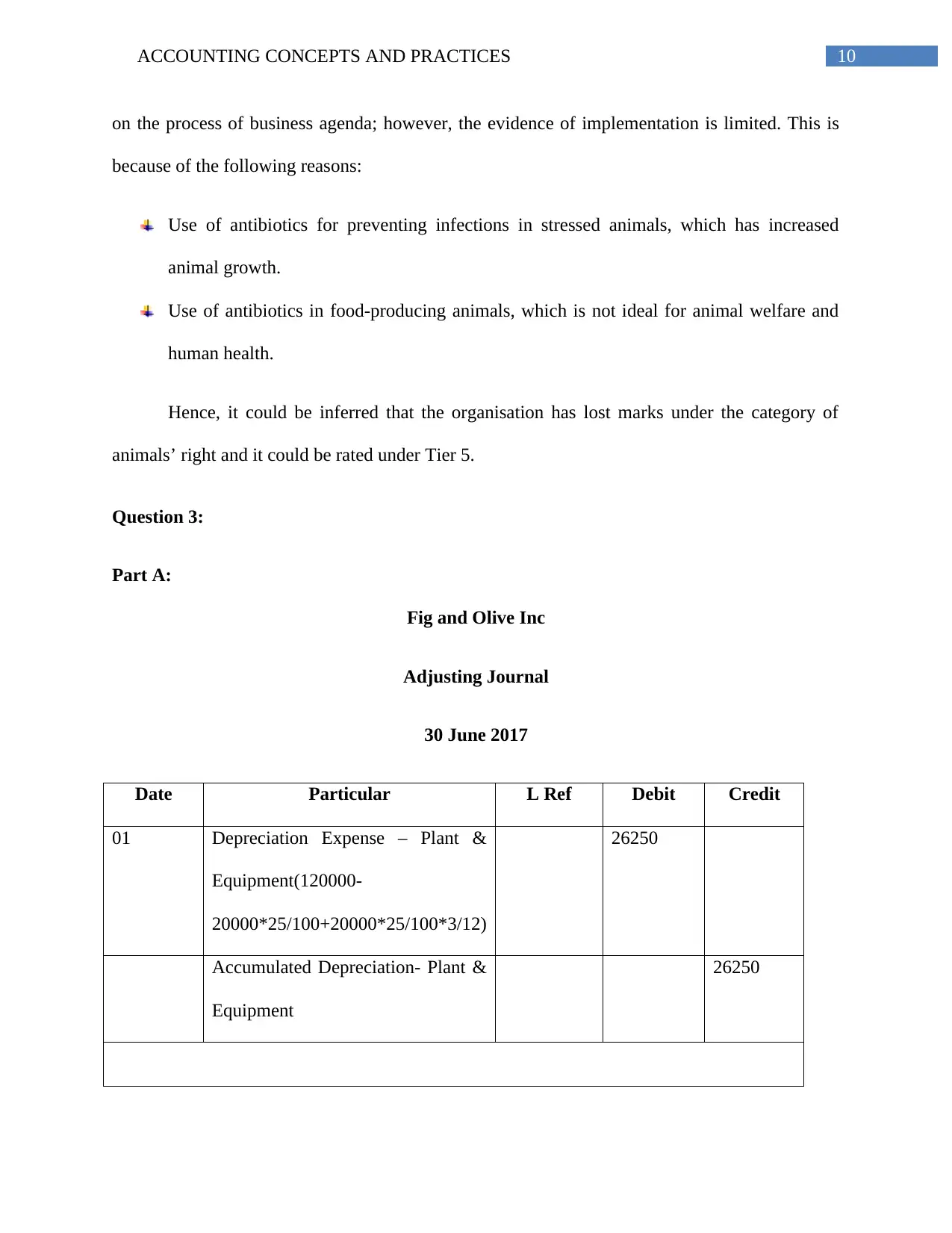

02 Drawings (500*52) 26000

Cash/Bank 26000

03 Insurance Expense(3500-2000) 1500

Prepaid Insurance 1500

04 Rent Expense 11000

Rent payable 11000

05 Salary Expense 13200

Salary payable 13200

06 Sales Return & Allowance 42000

Account Receivable 42000

Inventory loss 20000

Cost of Sales 20000

Part B:

Fig and Olive Inc

Income Statement

For the Year Ended 30 June 2017

02 Drawings (500*52) 26000

Cash/Bank 26000

03 Insurance Expense(3500-2000) 1500

Prepaid Insurance 1500

04 Rent Expense 11000

Rent payable 11000

05 Salary Expense 13200

Salary payable 13200

06 Sales Return & Allowance 42000

Account Receivable 42000

Inventory loss 20000

Cost of Sales 20000

Part B:

Fig and Olive Inc

Income Statement

For the Year Ended 30 June 2017

12ACCOUNTING CONCEPTS AND PRACTICES

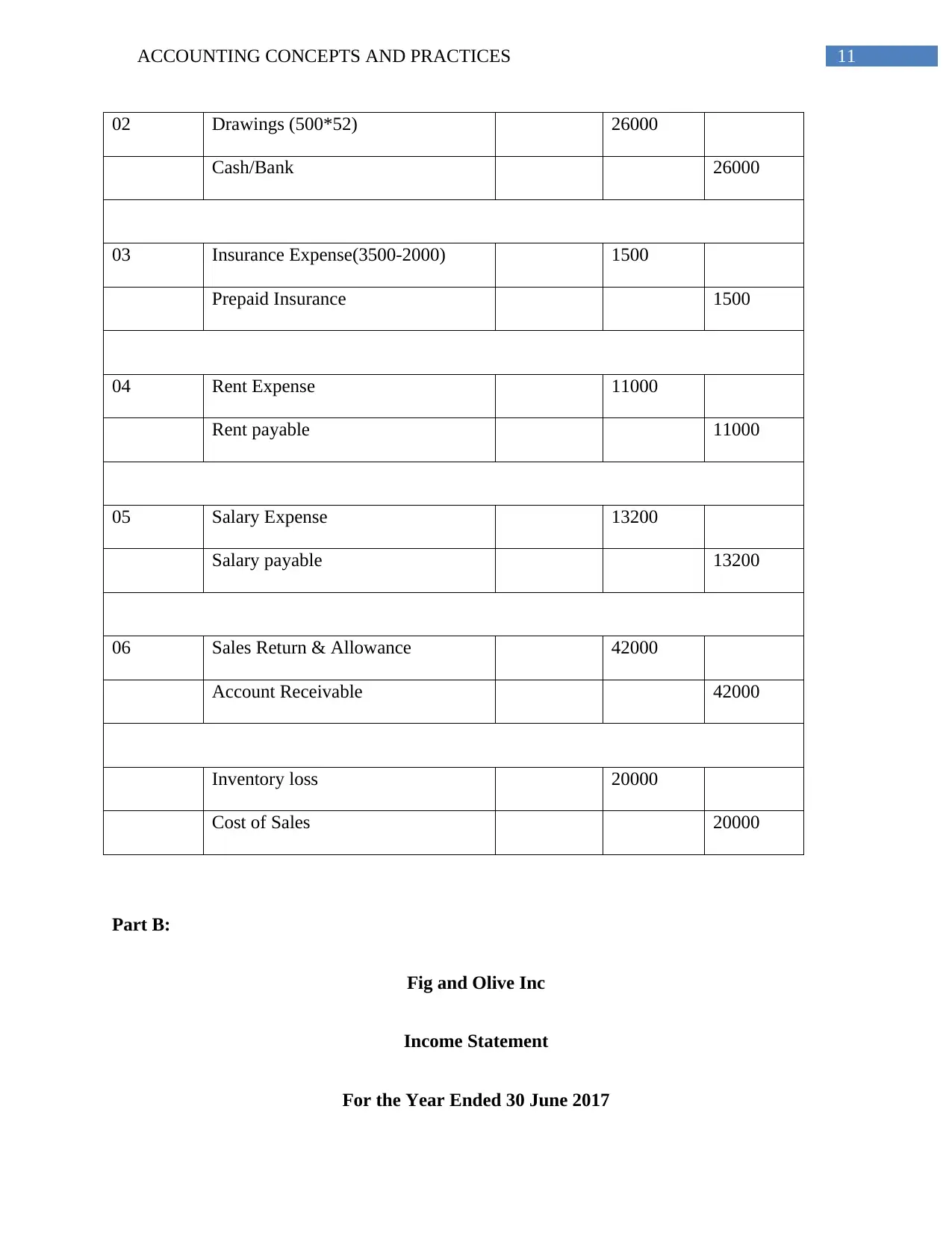

Income $ $

Sales 675,000

(-) Cost of Sales 392,000

Net Sales 283,000

(-) Sales Return 42,000

Gross Profit 241,000

Expenses

Depreciation 26,250

Salaries & wages 90,200

Rent 44,000

Utilities 5,200

Insurance Expense 1,500

General Expense 2,800

Inventory Loss 20,000

Total Expense 189,950

Profit/ loss 51,050

Income $ $

Sales 675,000

(-) Cost of Sales 392,000

Net Sales 283,000

(-) Sales Return 42,000

Gross Profit 241,000

Expenses

Depreciation 26,250

Salaries & wages 90,200

Rent 44,000

Utilities 5,200

Insurance Expense 1,500

General Expense 2,800

Inventory Loss 20,000

Total Expense 189,950

Profit/ loss 51,050

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13ACCOUNTING CONCEPTS AND PRACTICES

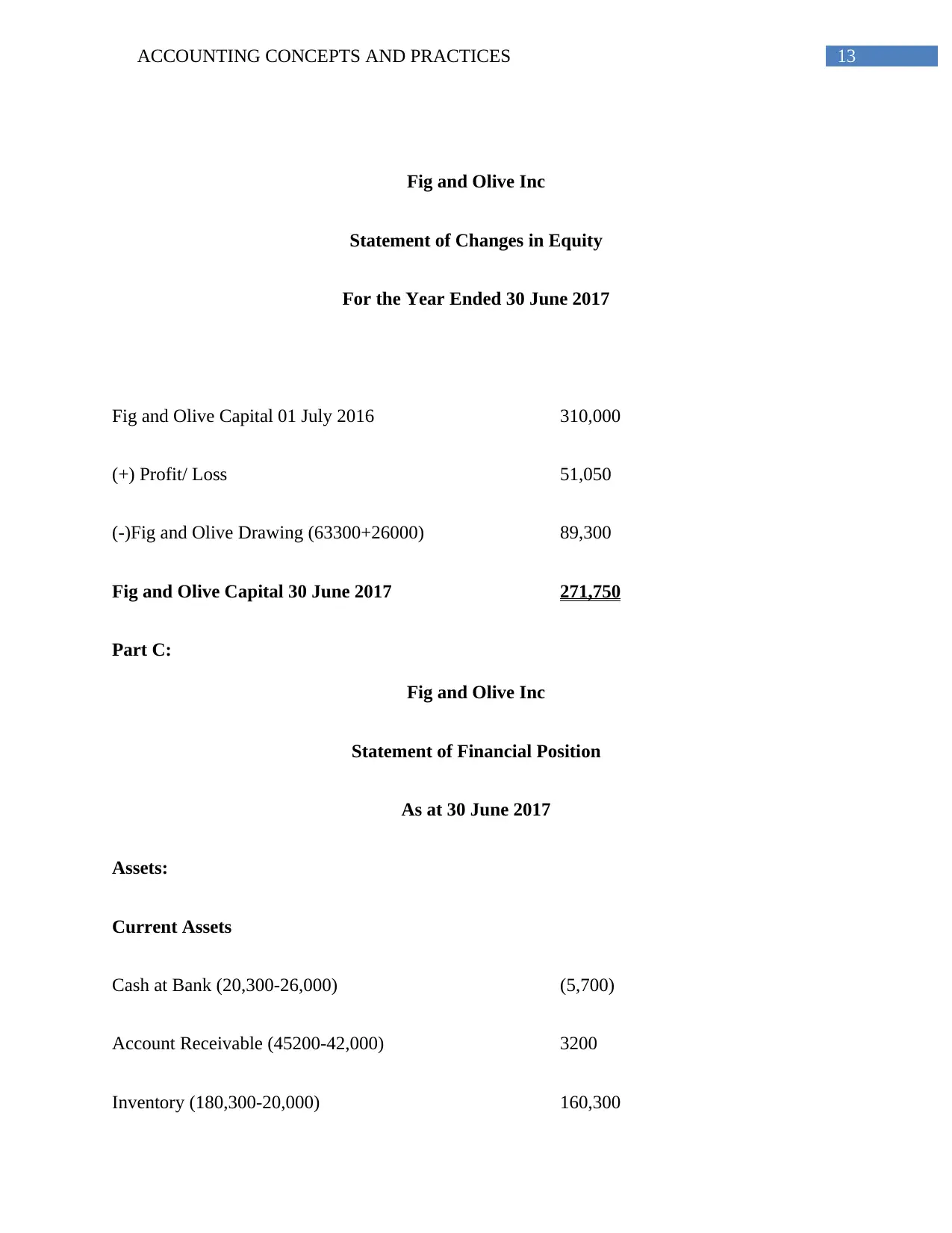

Fig and Olive Inc

Statement of Changes in Equity

For the Year Ended 30 June 2017

Fig and Olive Capital 01 July 2016 310,000

(+) Profit/ Loss 51,050

(-)Fig and Olive Drawing (63300+26000) 89,300

Fig and Olive Capital 30 June 2017 271,750

Part C:

Fig and Olive Inc

Statement of Financial Position

As at 30 June 2017

Assets:

Current Assets

Cash at Bank (20,300-26,000) (5,700)

Account Receivable (45200-42,000) 3200

Inventory (180,300-20,000) 160,300

Fig and Olive Inc

Statement of Changes in Equity

For the Year Ended 30 June 2017

Fig and Olive Capital 01 July 2016 310,000

(+) Profit/ Loss 51,050

(-)Fig and Olive Drawing (63300+26000) 89,300

Fig and Olive Capital 30 June 2017 271,750

Part C:

Fig and Olive Inc

Statement of Financial Position

As at 30 June 2017

Assets:

Current Assets

Cash at Bank (20,300-26,000) (5,700)

Account Receivable (45200-42,000) 3200

Inventory (180,300-20,000) 160,300

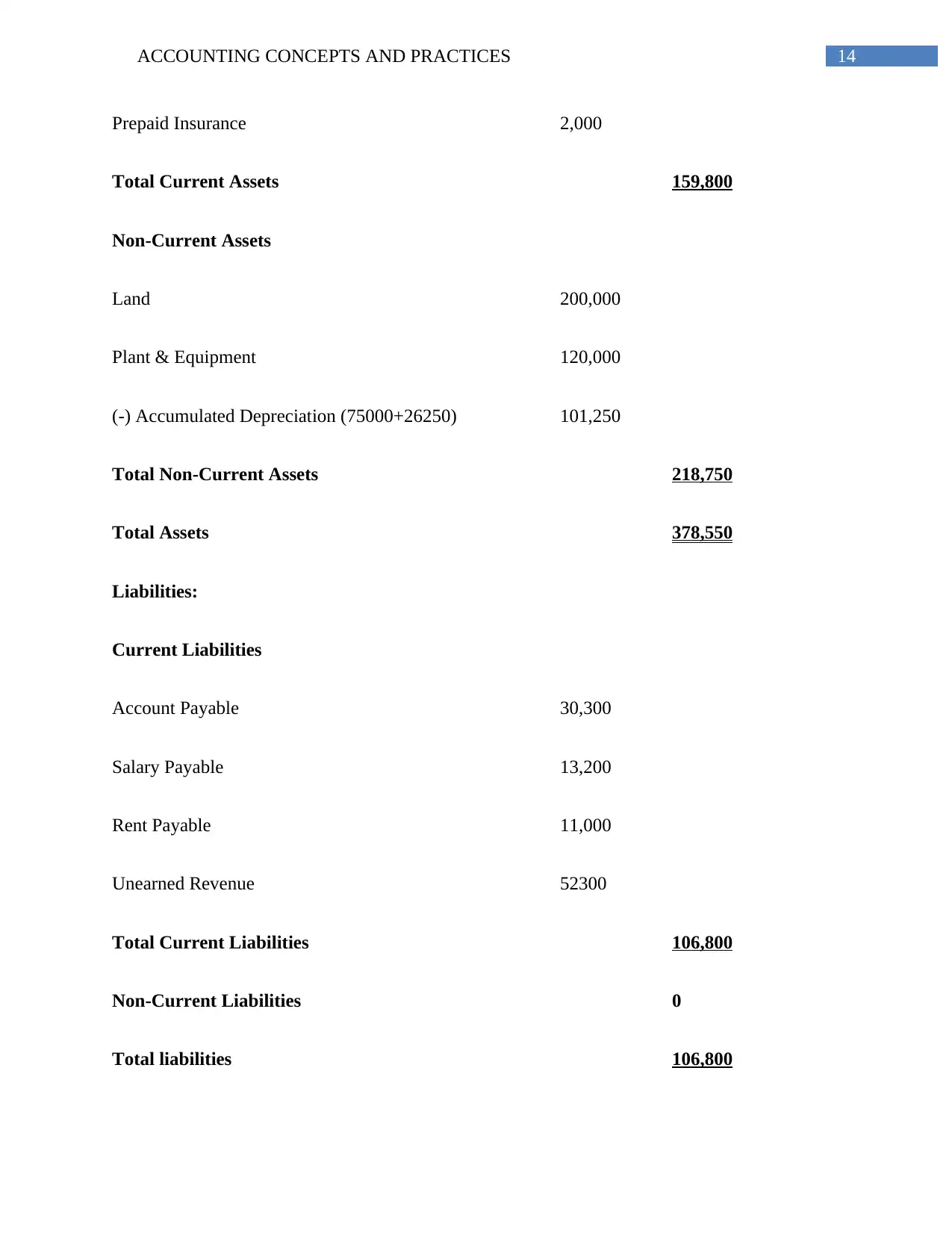

14ACCOUNTING CONCEPTS AND PRACTICES

Prepaid Insurance 2,000

Total Current Assets 159,800

Non-Current Assets

Land 200,000

Plant & Equipment 120,000

(-) Accumulated Depreciation (75000+26250) 101,250

Total Non-Current Assets 218,750

Total Assets 378,550

Liabilities:

Current Liabilities

Account Payable 30,300

Salary Payable 13,200

Rent Payable 11,000

Unearned Revenue 52300

Total Current Liabilities 106,800

Non-Current Liabilities 0

Total liabilities 106,800

Prepaid Insurance 2,000

Total Current Assets 159,800

Non-Current Assets

Land 200,000

Plant & Equipment 120,000

(-) Accumulated Depreciation (75000+26250) 101,250

Total Non-Current Assets 218,750

Total Assets 378,550

Liabilities:

Current Liabilities

Account Payable 30,300

Salary Payable 13,200

Rent Payable 11,000

Unearned Revenue 52300

Total Current Liabilities 106,800

Non-Current Liabilities 0

Total liabilities 106,800

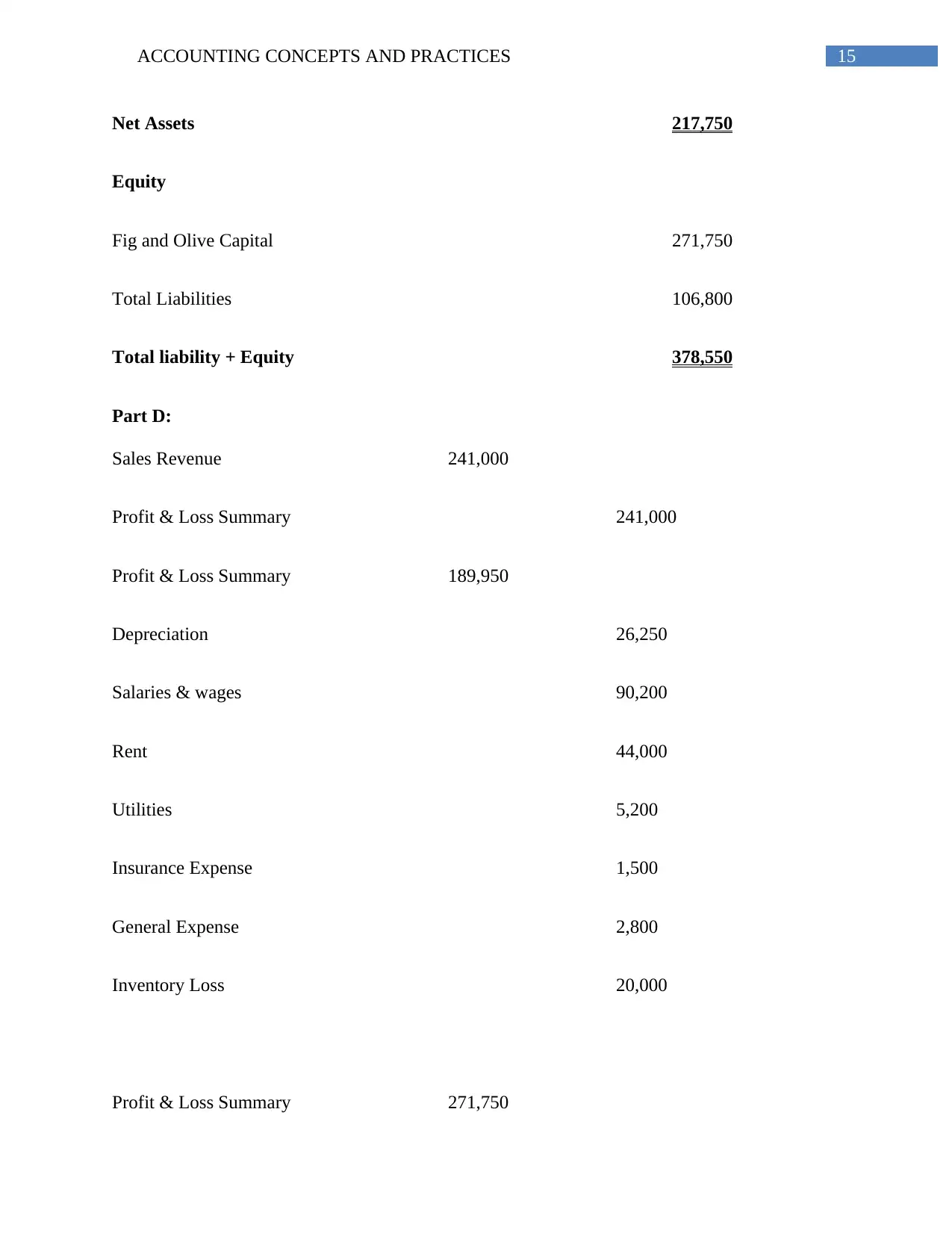

15ACCOUNTING CONCEPTS AND PRACTICES

Net Assets 217,750

Equity

Fig and Olive Capital 271,750

Total Liabilities 106,800

Total liability + Equity 378,550

Part D:

Sales Revenue 241,000

Profit & Loss Summary 241,000

Profit & Loss Summary 189,950

Depreciation 26,250

Salaries & wages 90,200

Rent 44,000

Utilities 5,200

Insurance Expense 1,500

General Expense 2,800

Inventory Loss 20,000

Profit & Loss Summary 271,750

Net Assets 217,750

Equity

Fig and Olive Capital 271,750

Total Liabilities 106,800

Total liability + Equity 378,550

Part D:

Sales Revenue 241,000

Profit & Loss Summary 241,000

Profit & Loss Summary 189,950

Depreciation 26,250

Salaries & wages 90,200

Rent 44,000

Utilities 5,200

Insurance Expense 1,500

General Expense 2,800

Inventory Loss 20,000

Profit & Loss Summary 271,750

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

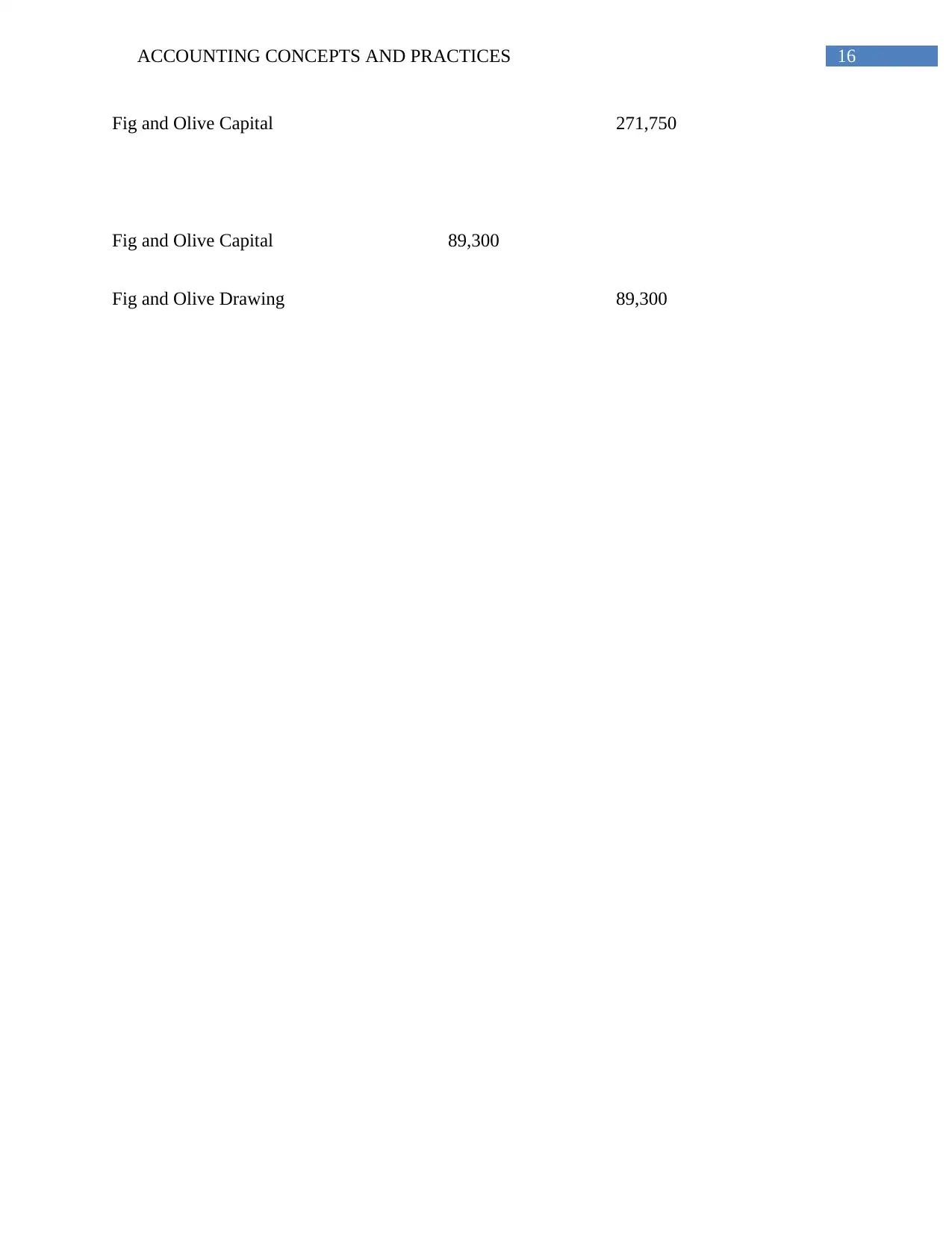

16ACCOUNTING CONCEPTS AND PRACTICES

Fig and Olive Capital 271,750

Fig and Olive Capital 89,300

Fig and Olive Drawing 89,300

Fig and Olive Capital 271,750

Fig and Olive Capital 89,300

Fig and Olive Drawing 89,300

17ACCOUNTING CONCEPTS AND PRACTICES

References:

Cooper, D. J., Ezzamel, M., & Qu, S. Q. (2017). Popularizing a management accounting idea:

The case of the balanced scorecard. Contemporary Accounting Research, 34(2), 991-

1025.

Crawford, C. W. (2016). ACTG 201.05: Principles of Financial Accounting.

Edmonds, T. P., Edmonds, C. D., Tsay, B. Y., & Olds, P. R. (2016). Fundamental managerial

accounting concepts. McGraw-Hill Education.

Engel, C. J. (2016). A Primer on the Accounting and Reporting Requirements for Not-for-Profit

Organizations. Journal of Public Management Research, 2(1), 14.

Fullerton, R. R., Kennedy, F. A., & Widener, S. K. (2014). Lean manufacturing and firm

performance: The incremental contribution of lean management accounting

practices. Journal of Operations Management, 32(7-8), 414-428.

Jones, S. (2015). Development of financial accounting theory. The Routledge Companion to

Financial Accounting Theory, 1.

Lai, A., & Samkin, G. (2017). Accounting history in diverse settings-an introduction.

Malmi, T. (2016). Managerialist studies in management accounting: 1990–2014. Management

Accounting Research, 31, 31-44.

Pelger, C. (2016). Practices of standard-setting–An analysis of the IASB's and FASB's process of

identifying the objective of financial reporting. Accounting, Organizations and

Society, 50, 51-73.

References:

Cooper, D. J., Ezzamel, M., & Qu, S. Q. (2017). Popularizing a management accounting idea:

The case of the balanced scorecard. Contemporary Accounting Research, 34(2), 991-

1025.

Crawford, C. W. (2016). ACTG 201.05: Principles of Financial Accounting.

Edmonds, T. P., Edmonds, C. D., Tsay, B. Y., & Olds, P. R. (2016). Fundamental managerial

accounting concepts. McGraw-Hill Education.

Engel, C. J. (2016). A Primer on the Accounting and Reporting Requirements for Not-for-Profit

Organizations. Journal of Public Management Research, 2(1), 14.

Fullerton, R. R., Kennedy, F. A., & Widener, S. K. (2014). Lean manufacturing and firm

performance: The incremental contribution of lean management accounting

practices. Journal of Operations Management, 32(7-8), 414-428.

Jones, S. (2015). Development of financial accounting theory. The Routledge Companion to

Financial Accounting Theory, 1.

Lai, A., & Samkin, G. (2017). Accounting history in diverse settings-an introduction.

Malmi, T. (2016). Managerialist studies in management accounting: 1990–2014. Management

Accounting Research, 31, 31-44.

Pelger, C. (2016). Practices of standard-setting–An analysis of the IASB's and FASB's process of

identifying the objective of financial reporting. Accounting, Organizations and

Society, 50, 51-73.

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.