BSBFIM501 Manage Budgets and Financial Plans Project Report Analysis

VerifiedAdded on 2023/06/09

|7

|1006

|314

Project

AI Summary

This project report, created for the BSBFIM501 unit, focuses on managing budgets and financial plans for Big Red Bicycle Pty Ltd. It includes a CAPEX budget for capital expenditure, sales, and expenses budget, a cash flow budget, and a master budget. The report analyzes financial data, including revenue, expenses, and net profit, across four quarters. Furthermore, the project includes a petty cash book for January, detailing transactions and balances. The report aims to assess the company's budgeting performance, identify discrepancies, and suggest improvements in financial strategies. The project covers various aspects of financial planning, from sales forecasting and expense control to cash management and profit maximization, providing a comprehensive overview of financial statement analysis and its practical application in a business context.

BSBFIM501 Manage budgets and financial plans

Project Report: Assessment No. 2

Project Report: Assessment No. 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BSBFIM501 Manage budgets and financial plans

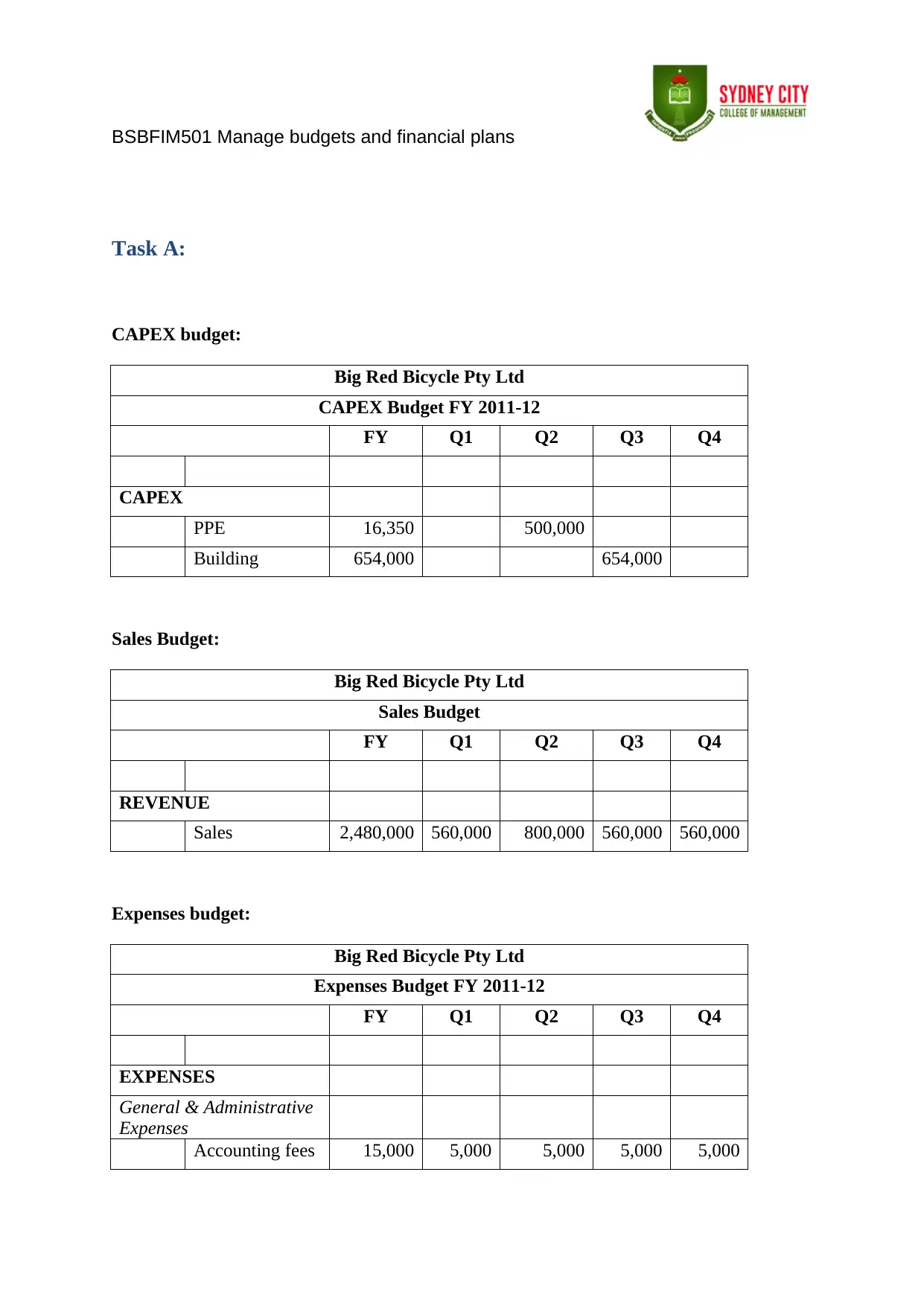

Task A:

CAPEX budget:

Big Red Bicycle Pty Ltd

CAPEX Budget FY 2011-12

FY Q1 Q2 Q3 Q4

CAPEX

PPE 16,350 500,000

Building 654,000 654,000

Sales Budget:

Big Red Bicycle Pty Ltd

Sales Budget

FY Q1 Q2 Q3 Q4

REVENUE

Sales 2,480,000 560,000 800,000 560,000 560,000

Expenses budget:

Big Red Bicycle Pty Ltd

Expenses Budget FY 2011-12

FY Q1 Q2 Q3 Q4

EXPENSES

General & Administrative

Expenses

Accounting fees 15,000 5,000 5,000 5,000 5,000

Task A:

CAPEX budget:

Big Red Bicycle Pty Ltd

CAPEX Budget FY 2011-12

FY Q1 Q2 Q3 Q4

CAPEX

PPE 16,350 500,000

Building 654,000 654,000

Sales Budget:

Big Red Bicycle Pty Ltd

Sales Budget

FY Q1 Q2 Q3 Q4

REVENUE

Sales 2,480,000 560,000 800,000 560,000 560,000

Expenses budget:

Big Red Bicycle Pty Ltd

Expenses Budget FY 2011-12

FY Q1 Q2 Q3 Q4

EXPENSES

General & Administrative

Expenses

Accounting fees 15,000 5,000 5,000 5,000 5,000

BSBFIM501 Manage budgets and financial plans

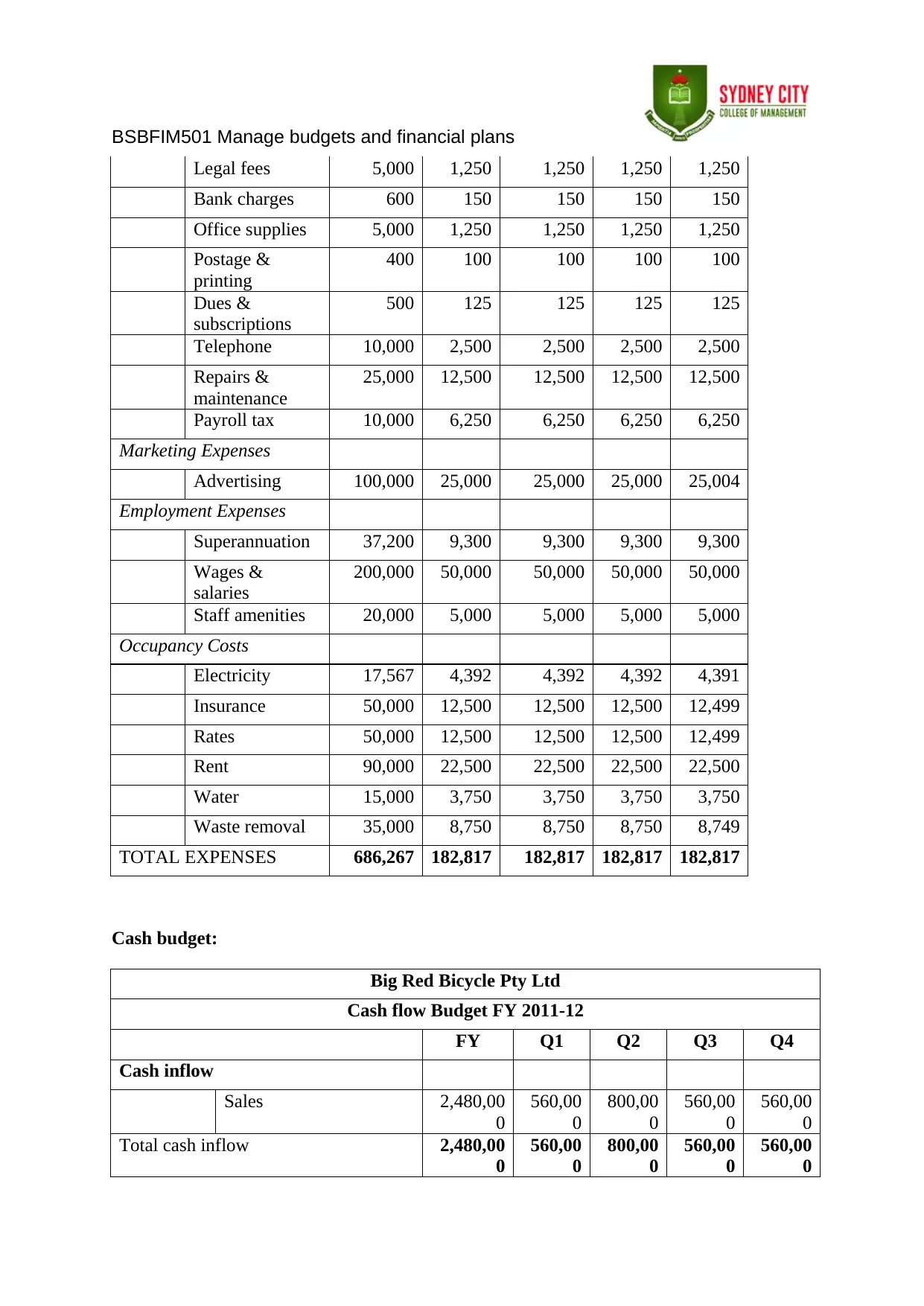

Legal fees 5,000 1,250 1,250 1,250 1,250

Bank charges 600 150 150 150 150

Office supplies 5,000 1,250 1,250 1,250 1,250

Postage &

printing

400 100 100 100 100

Dues &

subscriptions

500 125 125 125 125

Telephone 10,000 2,500 2,500 2,500 2,500

Repairs &

maintenance

25,000 12,500 12,500 12,500 12,500

Payroll tax 10,000 6,250 6,250 6,250 6,250

Marketing Expenses

Advertising 100,000 25,000 25,000 25,000 25,004

Employment Expenses

Superannuation 37,200 9,300 9,300 9,300 9,300

Wages &

salaries

200,000 50,000 50,000 50,000 50,000

Staff amenities 20,000 5,000 5,000 5,000 5,000

Occupancy Costs

Electricity 17,567 4,392 4,392 4,392 4,391

Insurance 50,000 12,500 12,500 12,500 12,499

Rates 50,000 12,500 12,500 12,500 12,499

Rent 90,000 22,500 22,500 22,500 22,500

Water 15,000 3,750 3,750 3,750 3,750

Waste removal 35,000 8,750 8,750 8,750 8,749

TOTAL EXPENSES 686,267 182,817 182,817 182,817 182,817

Cash budget:

Big Red Bicycle Pty Ltd

Cash flow Budget FY 2011-12

FY Q1 Q2 Q3 Q4

Cash inflow

Sales 2,480,00

0

560,00

0

800,00

0

560,00

0

560,00

0

Total cash inflow 2,480,00

0

560,00

0

800,00

0

560,00

0

560,00

0

Legal fees 5,000 1,250 1,250 1,250 1,250

Bank charges 600 150 150 150 150

Office supplies 5,000 1,250 1,250 1,250 1,250

Postage &

printing

400 100 100 100 100

Dues &

subscriptions

500 125 125 125 125

Telephone 10,000 2,500 2,500 2,500 2,500

Repairs &

maintenance

25,000 12,500 12,500 12,500 12,500

Payroll tax 10,000 6,250 6,250 6,250 6,250

Marketing Expenses

Advertising 100,000 25,000 25,000 25,000 25,004

Employment Expenses

Superannuation 37,200 9,300 9,300 9,300 9,300

Wages &

salaries

200,000 50,000 50,000 50,000 50,000

Staff amenities 20,000 5,000 5,000 5,000 5,000

Occupancy Costs

Electricity 17,567 4,392 4,392 4,392 4,391

Insurance 50,000 12,500 12,500 12,500 12,499

Rates 50,000 12,500 12,500 12,500 12,499

Rent 90,000 22,500 22,500 22,500 22,500

Water 15,000 3,750 3,750 3,750 3,750

Waste removal 35,000 8,750 8,750 8,750 8,749

TOTAL EXPENSES 686,267 182,817 182,817 182,817 182,817

Cash budget:

Big Red Bicycle Pty Ltd

Cash flow Budget FY 2011-12

FY Q1 Q2 Q3 Q4

Cash inflow

Sales 2,480,00

0

560,00

0

800,00

0

560,00

0

560,00

0

Total cash inflow 2,480,00

0

560,00

0

800,00

0

560,00

0

560,00

0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSBFIM501 Manage budgets and financial plans

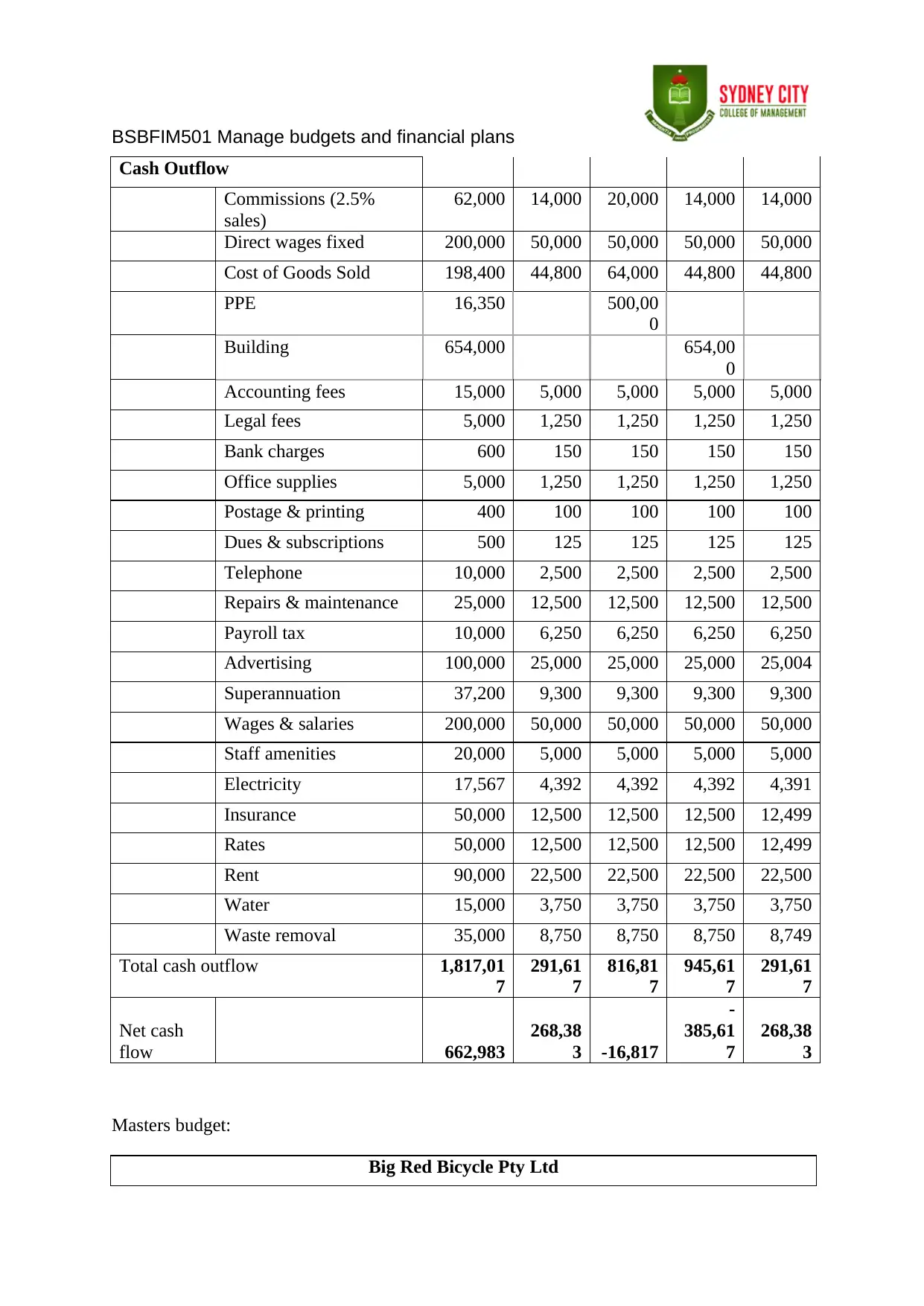

Cash Outflow

Commissions (2.5%

sales)

62,000 14,000 20,000 14,000 14,000

Direct wages fixed 200,000 50,000 50,000 50,000 50,000

Cost of Goods Sold 198,400 44,800 64,000 44,800 44,800

PPE 16,350 500,00

0

Building 654,000 654,00

0

Accounting fees 15,000 5,000 5,000 5,000 5,000

Legal fees 5,000 1,250 1,250 1,250 1,250

Bank charges 600 150 150 150 150

Office supplies 5,000 1,250 1,250 1,250 1,250

Postage & printing 400 100 100 100 100

Dues & subscriptions 500 125 125 125 125

Telephone 10,000 2,500 2,500 2,500 2,500

Repairs & maintenance 25,000 12,500 12,500 12,500 12,500

Payroll tax 10,000 6,250 6,250 6,250 6,250

Advertising 100,000 25,000 25,000 25,000 25,004

Superannuation 37,200 9,300 9,300 9,300 9,300

Wages & salaries 200,000 50,000 50,000 50,000 50,000

Staff amenities 20,000 5,000 5,000 5,000 5,000

Electricity 17,567 4,392 4,392 4,392 4,391

Insurance 50,000 12,500 12,500 12,500 12,499

Rates 50,000 12,500 12,500 12,500 12,499

Rent 90,000 22,500 22,500 22,500 22,500

Water 15,000 3,750 3,750 3,750 3,750

Waste removal 35,000 8,750 8,750 8,750 8,749

Total cash outflow 1,817,01

7

291,61

7

816,81

7

945,61

7

291,61

7

Net cash

flow 662,983

268,38

3 -16,817

-

385,61

7

268,38

3

Masters budget:

Big Red Bicycle Pty Ltd

Cash Outflow

Commissions (2.5%

sales)

62,000 14,000 20,000 14,000 14,000

Direct wages fixed 200,000 50,000 50,000 50,000 50,000

Cost of Goods Sold 198,400 44,800 64,000 44,800 44,800

PPE 16,350 500,00

0

Building 654,000 654,00

0

Accounting fees 15,000 5,000 5,000 5,000 5,000

Legal fees 5,000 1,250 1,250 1,250 1,250

Bank charges 600 150 150 150 150

Office supplies 5,000 1,250 1,250 1,250 1,250

Postage & printing 400 100 100 100 100

Dues & subscriptions 500 125 125 125 125

Telephone 10,000 2,500 2,500 2,500 2,500

Repairs & maintenance 25,000 12,500 12,500 12,500 12,500

Payroll tax 10,000 6,250 6,250 6,250 6,250

Advertising 100,000 25,000 25,000 25,000 25,004

Superannuation 37,200 9,300 9,300 9,300 9,300

Wages & salaries 200,000 50,000 50,000 50,000 50,000

Staff amenities 20,000 5,000 5,000 5,000 5,000

Electricity 17,567 4,392 4,392 4,392 4,391

Insurance 50,000 12,500 12,500 12,500 12,499

Rates 50,000 12,500 12,500 12,500 12,499

Rent 90,000 22,500 22,500 22,500 22,500

Water 15,000 3,750 3,750 3,750 3,750

Waste removal 35,000 8,750 8,750 8,750 8,749

Total cash outflow 1,817,01

7

291,61

7

816,81

7

945,61

7

291,61

7

Net cash

flow 662,983

268,38

3 -16,817

-

385,61

7

268,38

3

Masters budget:

Big Red Bicycle Pty Ltd

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BSBFIM501 Manage budgets and financial plans

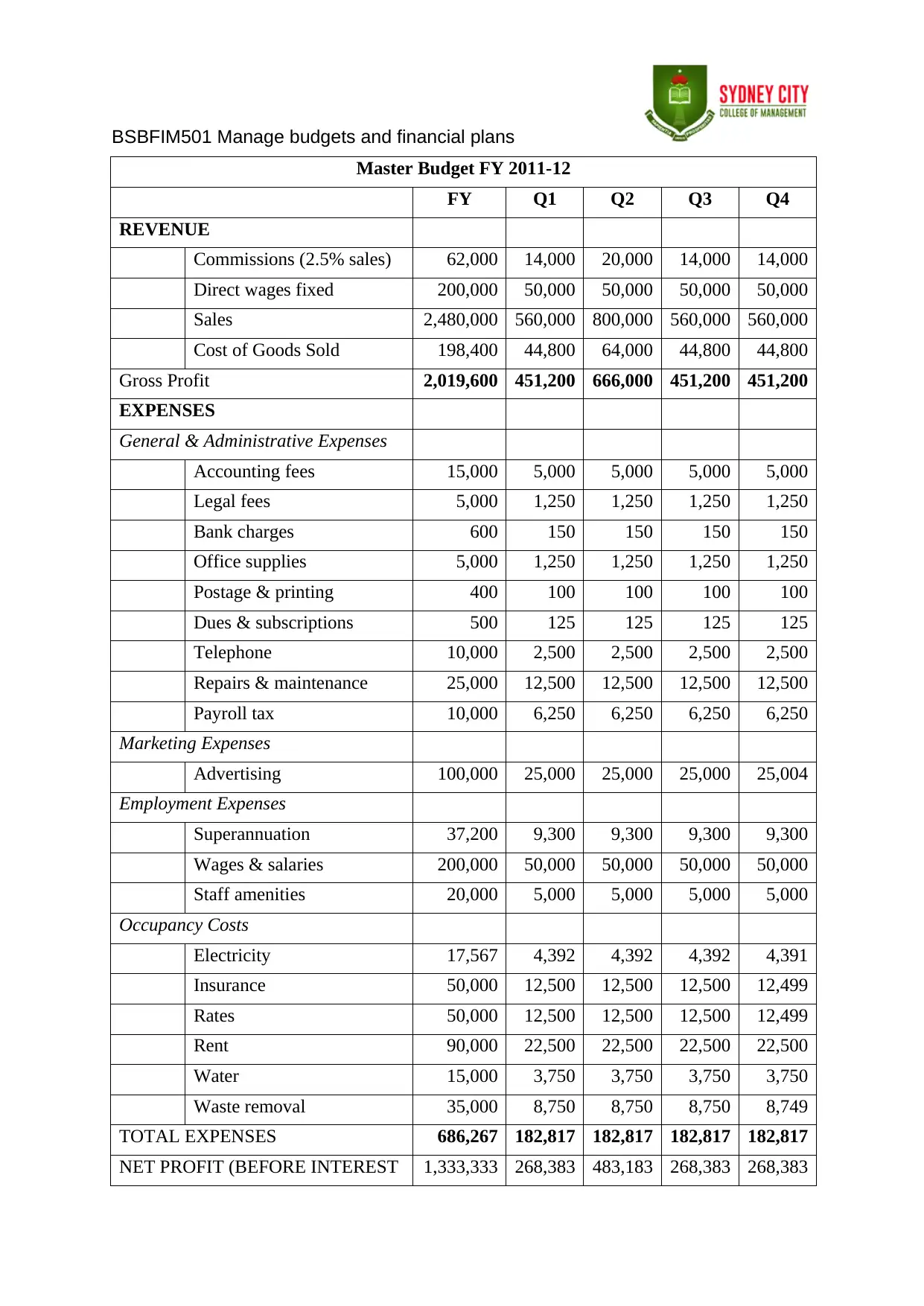

Master Budget FY 2011-12

FY Q1 Q2 Q3 Q4

REVENUE

Commissions (2.5% sales) 62,000 14,000 20,000 14,000 14,000

Direct wages fixed 200,000 50,000 50,000 50,000 50,000

Sales 2,480,000 560,000 800,000 560,000 560,000

Cost of Goods Sold 198,400 44,800 64,000 44,800 44,800

Gross Profit 2,019,600 451,200 666,000 451,200 451,200

EXPENSES

General & Administrative Expenses

Accounting fees 15,000 5,000 5,000 5,000 5,000

Legal fees 5,000 1,250 1,250 1,250 1,250

Bank charges 600 150 150 150 150

Office supplies 5,000 1,250 1,250 1,250 1,250

Postage & printing 400 100 100 100 100

Dues & subscriptions 500 125 125 125 125

Telephone 10,000 2,500 2,500 2,500 2,500

Repairs & maintenance 25,000 12,500 12,500 12,500 12,500

Payroll tax 10,000 6,250 6,250 6,250 6,250

Marketing Expenses

Advertising 100,000 25,000 25,000 25,000 25,004

Employment Expenses

Superannuation 37,200 9,300 9,300 9,300 9,300

Wages & salaries 200,000 50,000 50,000 50,000 50,000

Staff amenities 20,000 5,000 5,000 5,000 5,000

Occupancy Costs

Electricity 17,567 4,392 4,392 4,392 4,391

Insurance 50,000 12,500 12,500 12,500 12,499

Rates 50,000 12,500 12,500 12,500 12,499

Rent 90,000 22,500 22,500 22,500 22,500

Water 15,000 3,750 3,750 3,750 3,750

Waste removal 35,000 8,750 8,750 8,750 8,749

TOTAL EXPENSES 686,267 182,817 182,817 182,817 182,817

NET PROFIT (BEFORE INTEREST 1,333,333 268,383 483,183 268,383 268,383

Master Budget FY 2011-12

FY Q1 Q2 Q3 Q4

REVENUE

Commissions (2.5% sales) 62,000 14,000 20,000 14,000 14,000

Direct wages fixed 200,000 50,000 50,000 50,000 50,000

Sales 2,480,000 560,000 800,000 560,000 560,000

Cost of Goods Sold 198,400 44,800 64,000 44,800 44,800

Gross Profit 2,019,600 451,200 666,000 451,200 451,200

EXPENSES

General & Administrative Expenses

Accounting fees 15,000 5,000 5,000 5,000 5,000

Legal fees 5,000 1,250 1,250 1,250 1,250

Bank charges 600 150 150 150 150

Office supplies 5,000 1,250 1,250 1,250 1,250

Postage & printing 400 100 100 100 100

Dues & subscriptions 500 125 125 125 125

Telephone 10,000 2,500 2,500 2,500 2,500

Repairs & maintenance 25,000 12,500 12,500 12,500 12,500

Payroll tax 10,000 6,250 6,250 6,250 6,250

Marketing Expenses

Advertising 100,000 25,000 25,000 25,000 25,004

Employment Expenses

Superannuation 37,200 9,300 9,300 9,300 9,300

Wages & salaries 200,000 50,000 50,000 50,000 50,000

Staff amenities 20,000 5,000 5,000 5,000 5,000

Occupancy Costs

Electricity 17,567 4,392 4,392 4,392 4,391

Insurance 50,000 12,500 12,500 12,500 12,499

Rates 50,000 12,500 12,500 12,500 12,499

Rent 90,000 22,500 22,500 22,500 22,500

Water 15,000 3,750 3,750 3,750 3,750

Waste removal 35,000 8,750 8,750 8,750 8,749

TOTAL EXPENSES 686,267 182,817 182,817 182,817 182,817

NET PROFIT (BEFORE INTEREST 1,333,333 268,383 483,183 268,383 268,383

BSBFIM501 Manage budgets and financial plans

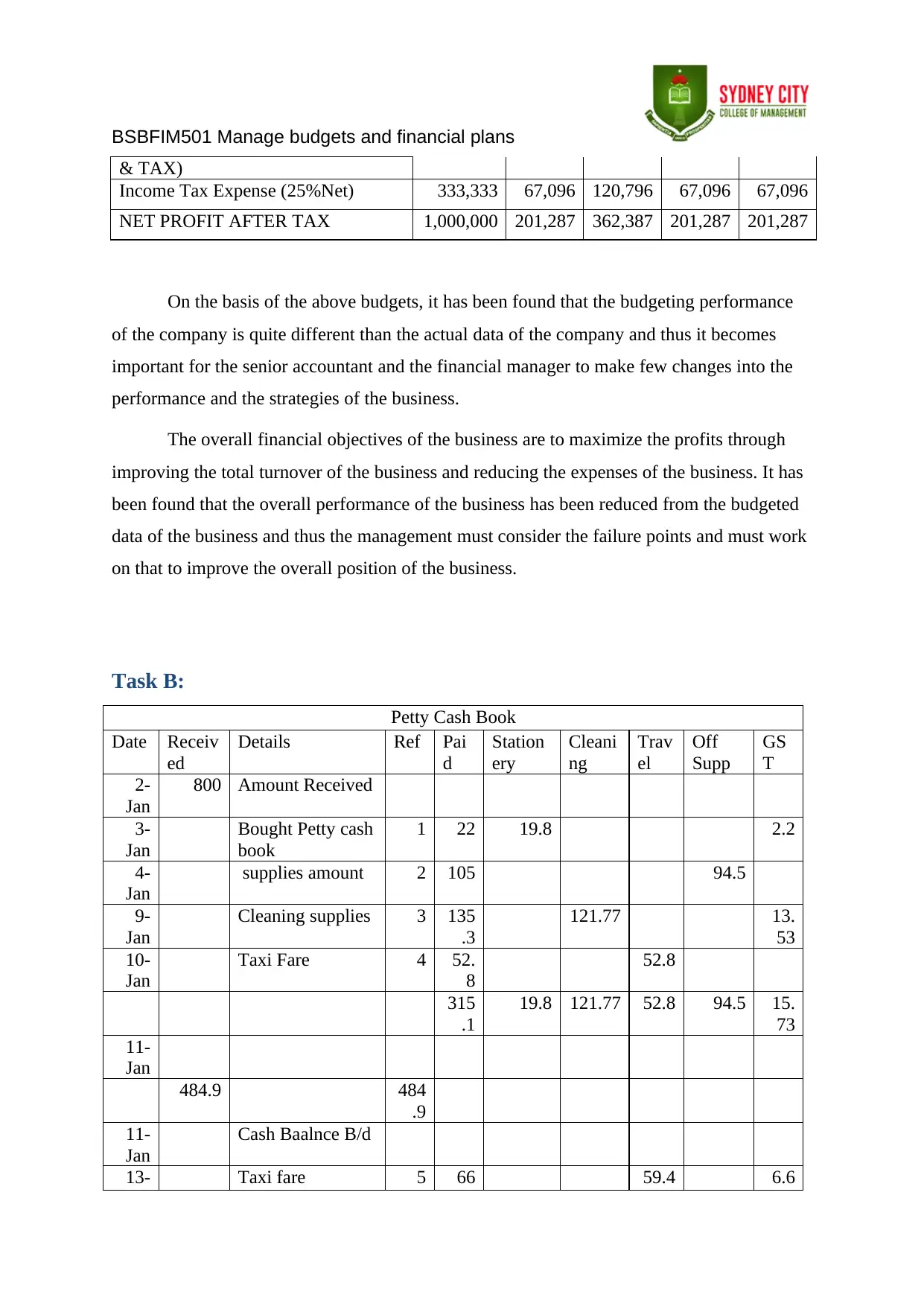

& TAX)

Income Tax Expense (25%Net) 333,333 67,096 120,796 67,096 67,096

NET PROFIT AFTER TAX 1,000,000 201,287 362,387 201,287 201,287

On the basis of the above budgets, it has been found that the budgeting performance

of the company is quite different than the actual data of the company and thus it becomes

important for the senior accountant and the financial manager to make few changes into the

performance and the strategies of the business.

The overall financial objectives of the business are to maximize the profits through

improving the total turnover of the business and reducing the expenses of the business. It has

been found that the overall performance of the business has been reduced from the budgeted

data of the business and thus the management must consider the failure points and must work

on that to improve the overall position of the business.

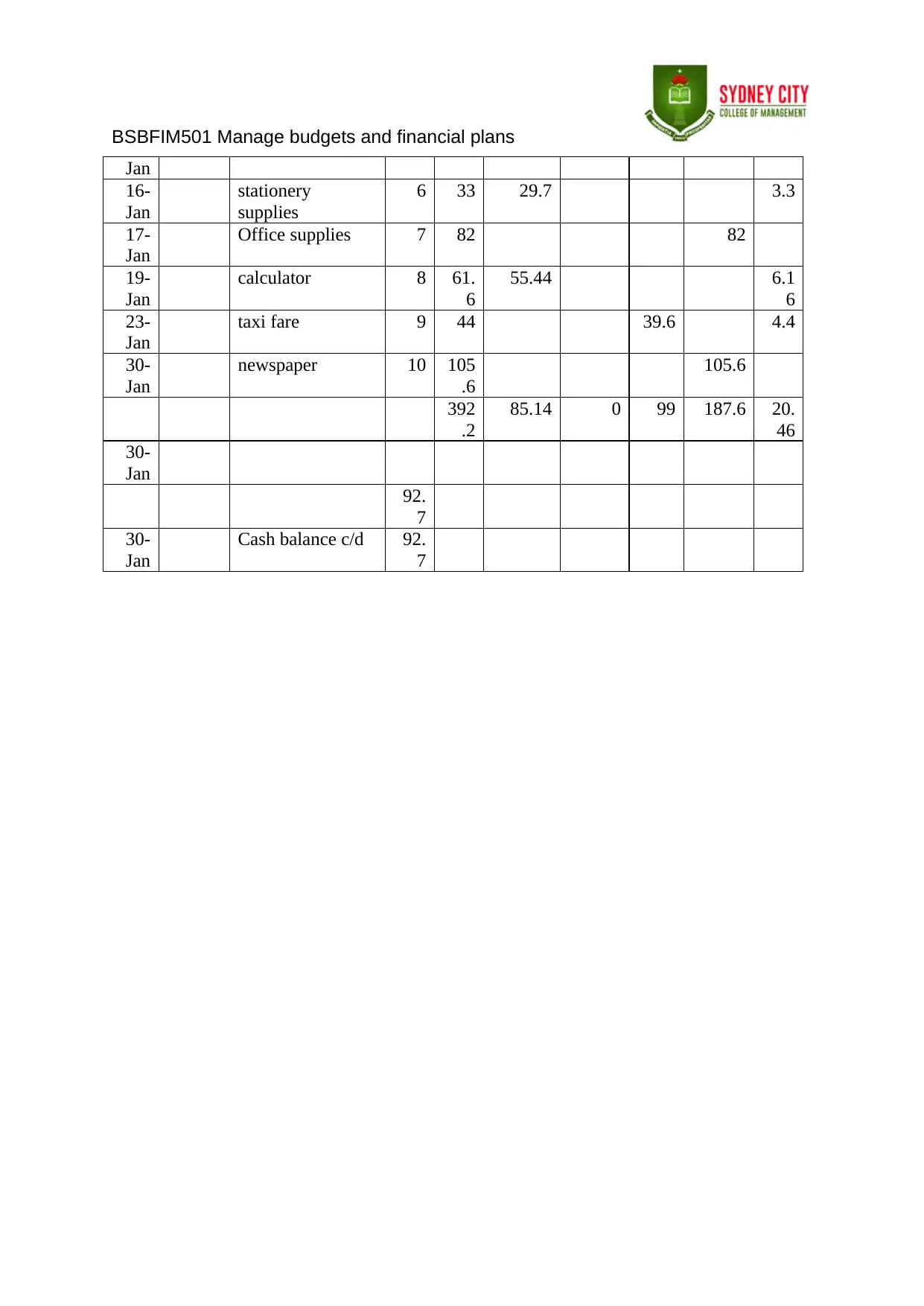

Task B:

Petty Cash Book

Date Receiv

ed

Details Ref Pai

d

Station

ery

Cleani

ng

Trav

el

Off

Supp

GS

T

2-

Jan

800 Amount Received

3-

Jan

Bought Petty cash

book

1 22 19.8 2.2

4-

Jan

supplies amount 2 105 94.5

9-

Jan

Cleaning supplies 3 135

.3

121.77 13.

53

10-

Jan

Taxi Fare 4 52.

8

52.8

315

.1

19.8 121.77 52.8 94.5 15.

73

11-

Jan

484.9 484

.9

11-

Jan

Cash Baalnce B/d

13- Taxi fare 5 66 59.4 6.6

& TAX)

Income Tax Expense (25%Net) 333,333 67,096 120,796 67,096 67,096

NET PROFIT AFTER TAX 1,000,000 201,287 362,387 201,287 201,287

On the basis of the above budgets, it has been found that the budgeting performance

of the company is quite different than the actual data of the company and thus it becomes

important for the senior accountant and the financial manager to make few changes into the

performance and the strategies of the business.

The overall financial objectives of the business are to maximize the profits through

improving the total turnover of the business and reducing the expenses of the business. It has

been found that the overall performance of the business has been reduced from the budgeted

data of the business and thus the management must consider the failure points and must work

on that to improve the overall position of the business.

Task B:

Petty Cash Book

Date Receiv

ed

Details Ref Pai

d

Station

ery

Cleani

ng

Trav

el

Off

Supp

GS

T

2-

Jan

800 Amount Received

3-

Jan

Bought Petty cash

book

1 22 19.8 2.2

4-

Jan

supplies amount 2 105 94.5

9-

Jan

Cleaning supplies 3 135

.3

121.77 13.

53

10-

Jan

Taxi Fare 4 52.

8

52.8

315

.1

19.8 121.77 52.8 94.5 15.

73

11-

Jan

484.9 484

.9

11-

Jan

Cash Baalnce B/d

13- Taxi fare 5 66 59.4 6.6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSBFIM501 Manage budgets and financial plans

Jan

16-

Jan

stationery

supplies

6 33 29.7 3.3

17-

Jan

Office supplies 7 82 82

19-

Jan

calculator 8 61.

6

55.44 6.1

6

23-

Jan

taxi fare 9 44 39.6 4.4

30-

Jan

newspaper 10 105

.6

105.6

392

.2

85.14 0 99 187.6 20.

46

30-

Jan

92.

7

30-

Jan

Cash balance c/d 92.

7

Jan

16-

Jan

stationery

supplies

6 33 29.7 3.3

17-

Jan

Office supplies 7 82 82

19-

Jan

calculator 8 61.

6

55.44 6.1

6

23-

Jan

taxi fare 9 44 39.6 4.4

30-

Jan

newspaper 10 105

.6

105.6

392

.2

85.14 0 99 187.6 20.

46

30-

Jan

92.

7

30-

Jan

Cash balance c/d 92.

7

1 out of 7

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.