Business Statistics Assignment 1: Descriptive Analysis of Rental Costs

VerifiedAdded on 2023/01/16

|21

|2589

|26

Homework Assignment

AI Summary

This assignment solution analyzes rental cost data collected in a survey of one-bedroom accommodations near a university campus. The analysis includes frequency distributions, bar diagrams, and pie charts to visualize the data. Descriptive statistics such as mean, median, mode, standard deviation, and z-scores are calculated to understand the central tendencies, dispersion, and potential outliers in the rental prices. The assignment compares rental prices in different locations (near and other) and discusses the impact of outlier removal on the analysis. The student also provides interpretations of the results, including comparisons of central tendencies and variations in rental prices. The analysis provides insights into the affordability of student housing and helps in understanding the distribution of rental costs in the area.

BUGEN1502 Business Statistics

Semester 1, 2019

Assignment 1: Descriptive statistics

1

Semester 1, 2019

Assignment 1: Descriptive statistics

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Answer 1

Table 1: Frequency Distribution of rent prices ($)

LL UL Intervals

(dollars) Frequency Percentage

0 200 0 to 200 59 14.75%

200 250 Over 200 to 250 164 41.00%

250 300 Over 250 to 300 128 32.00%

300 350 Over 300 to 350 36 9.00%

350 --- Over 350 13 3.25%

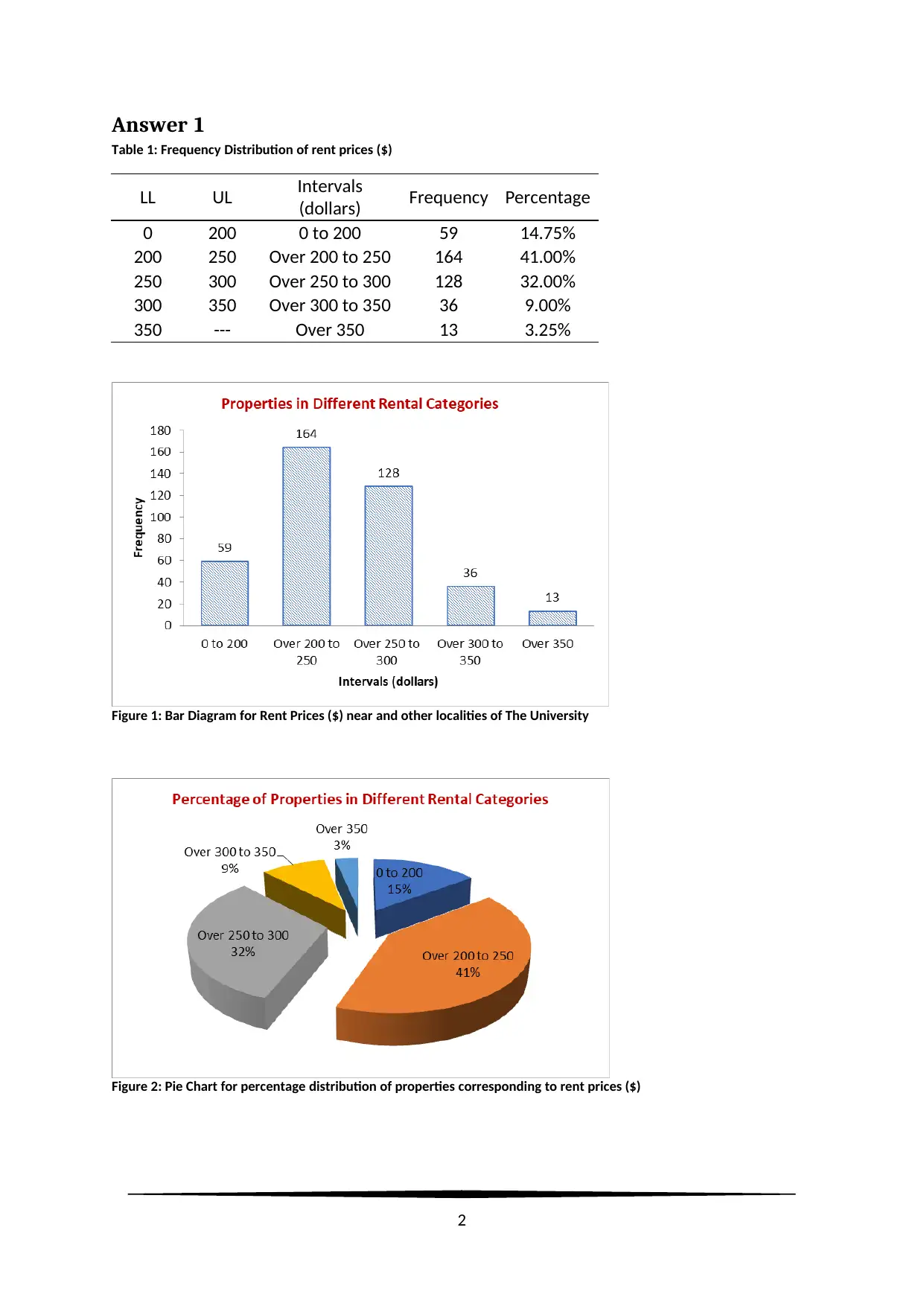

Figure 1: Bar Diagram for Rent Prices ($) near and other localities of The University

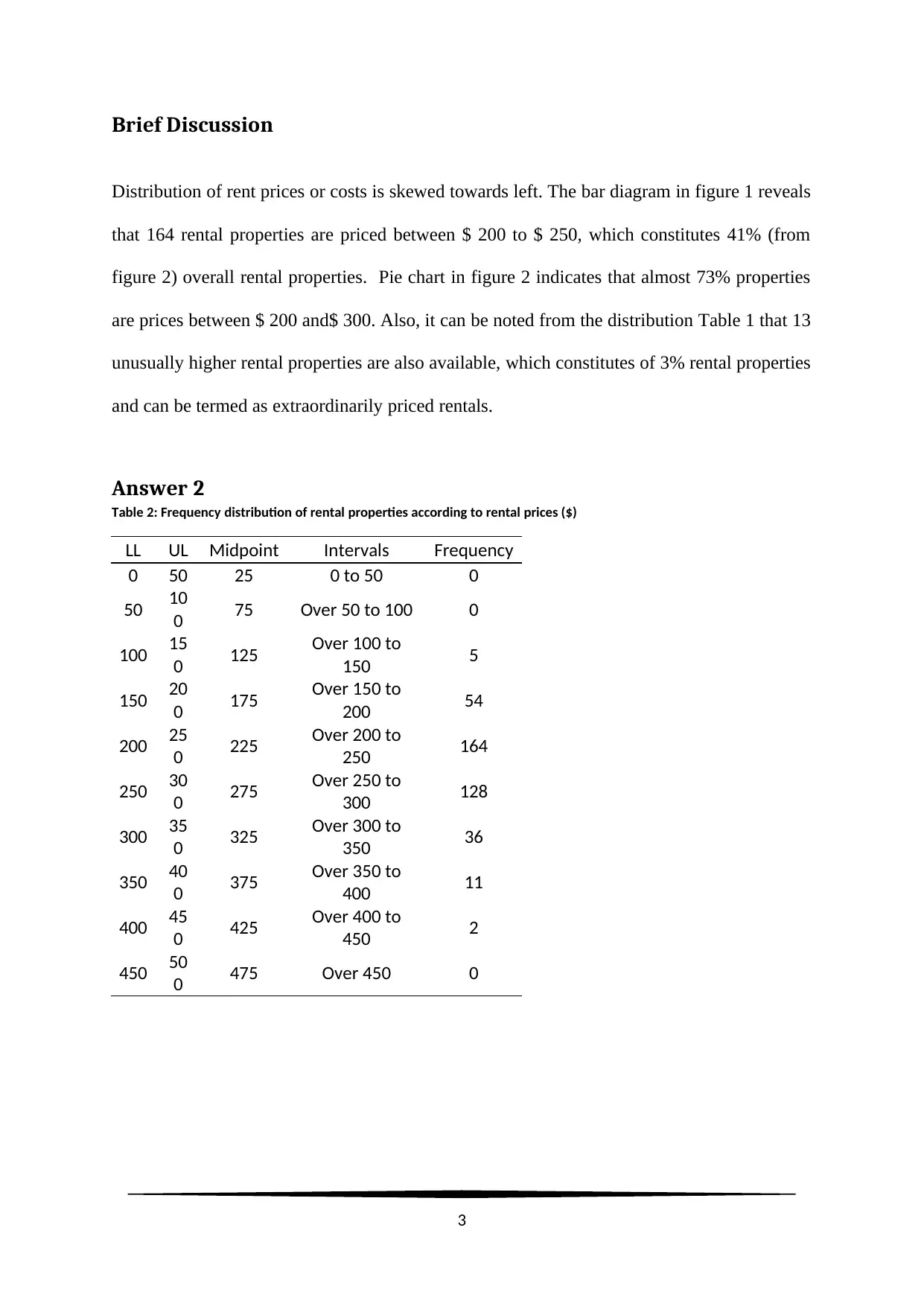

Figure 2: Pie Chart for percentage distribution of properties corresponding to rent prices ($)

2

Table 1: Frequency Distribution of rent prices ($)

LL UL Intervals

(dollars) Frequency Percentage

0 200 0 to 200 59 14.75%

200 250 Over 200 to 250 164 41.00%

250 300 Over 250 to 300 128 32.00%

300 350 Over 300 to 350 36 9.00%

350 --- Over 350 13 3.25%

Figure 1: Bar Diagram for Rent Prices ($) near and other localities of The University

Figure 2: Pie Chart for percentage distribution of properties corresponding to rent prices ($)

2

Brief Discussion

Distribution of rent prices or costs is skewed towards left. The bar diagram in figure 1 reveals

that 164 rental properties are priced between $ 200 to $ 250, which constitutes 41% (from

figure 2) overall rental properties. Pie chart in figure 2 indicates that almost 73% properties

are prices between $ 200 and$ 300. Also, it can be noted from the distribution Table 1 that 13

unusually higher rental properties are also available, which constitutes of 3% rental properties

and can be termed as extraordinarily priced rentals.

Answer 2

Table 2: Frequency distribution of rental properties according to rental prices ($)

LL UL Midpoint Intervals Frequency

0 50 25 0 to 50 0

50 10

0 75 Over 50 to 100 0

100 15

0 125 Over 100 to

150 5

150 20

0 175 Over 150 to

200 54

200 25

0 225 Over 200 to

250 164

250 30

0 275 Over 250 to

300 128

300 35

0 325 Over 300 to

350 36

350 40

0 375 Over 350 to

400 11

400 45

0 425 Over 400 to

450 2

450 50

0 475 Over 450 0

3

Distribution of rent prices or costs is skewed towards left. The bar diagram in figure 1 reveals

that 164 rental properties are priced between $ 200 to $ 250, which constitutes 41% (from

figure 2) overall rental properties. Pie chart in figure 2 indicates that almost 73% properties

are prices between $ 200 and$ 300. Also, it can be noted from the distribution Table 1 that 13

unusually higher rental properties are also available, which constitutes of 3% rental properties

and can be termed as extraordinarily priced rentals.

Answer 2

Table 2: Frequency distribution of rental properties according to rental prices ($)

LL UL Midpoint Intervals Frequency

0 50 25 0 to 50 0

50 10

0 75 Over 50 to 100 0

100 15

0 125 Over 100 to

150 5

150 20

0 175 Over 150 to

200 54

200 25

0 225 Over 200 to

250 164

250 30

0 275 Over 250 to

300 128

300 35

0 325 Over 300 to

350 36

350 40

0 375 Over 350 to

400 11

400 45

0 425 Over 400 to

450 2

450 50

0 475 Over 450 0

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

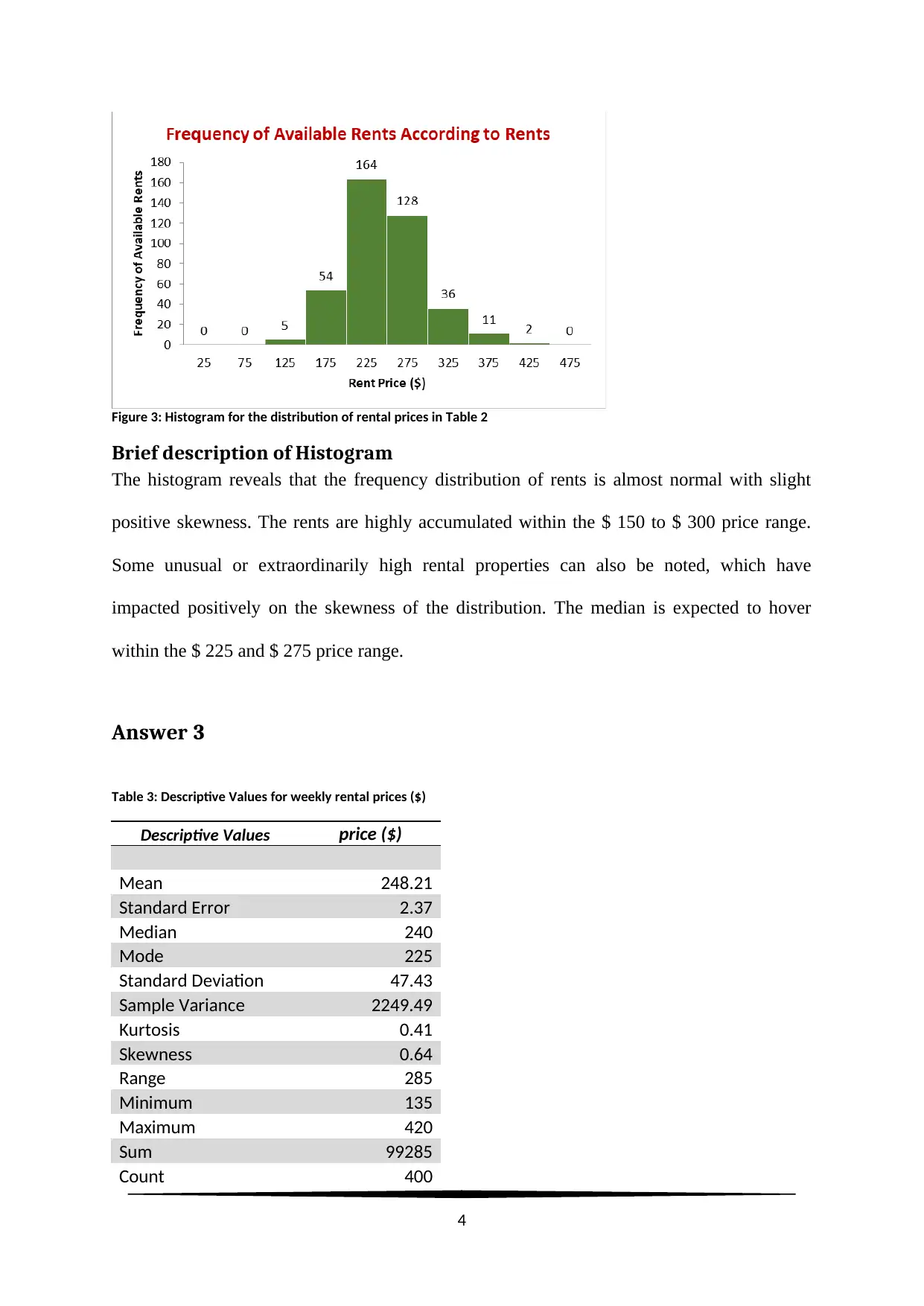

Figure 3: Histogram for the distribution of rental prices in Table 2

Brief description of Histogram

The histogram reveals that the frequency distribution of rents is almost normal with slight

positive skewness. The rents are highly accumulated within the $ 150 to $ 300 price range.

Some unusual or extraordinarily high rental properties can also be noted, which have

impacted positively on the skewness of the distribution. The median is expected to hover

within the $ 225 and $ 275 price range.

Answer 3

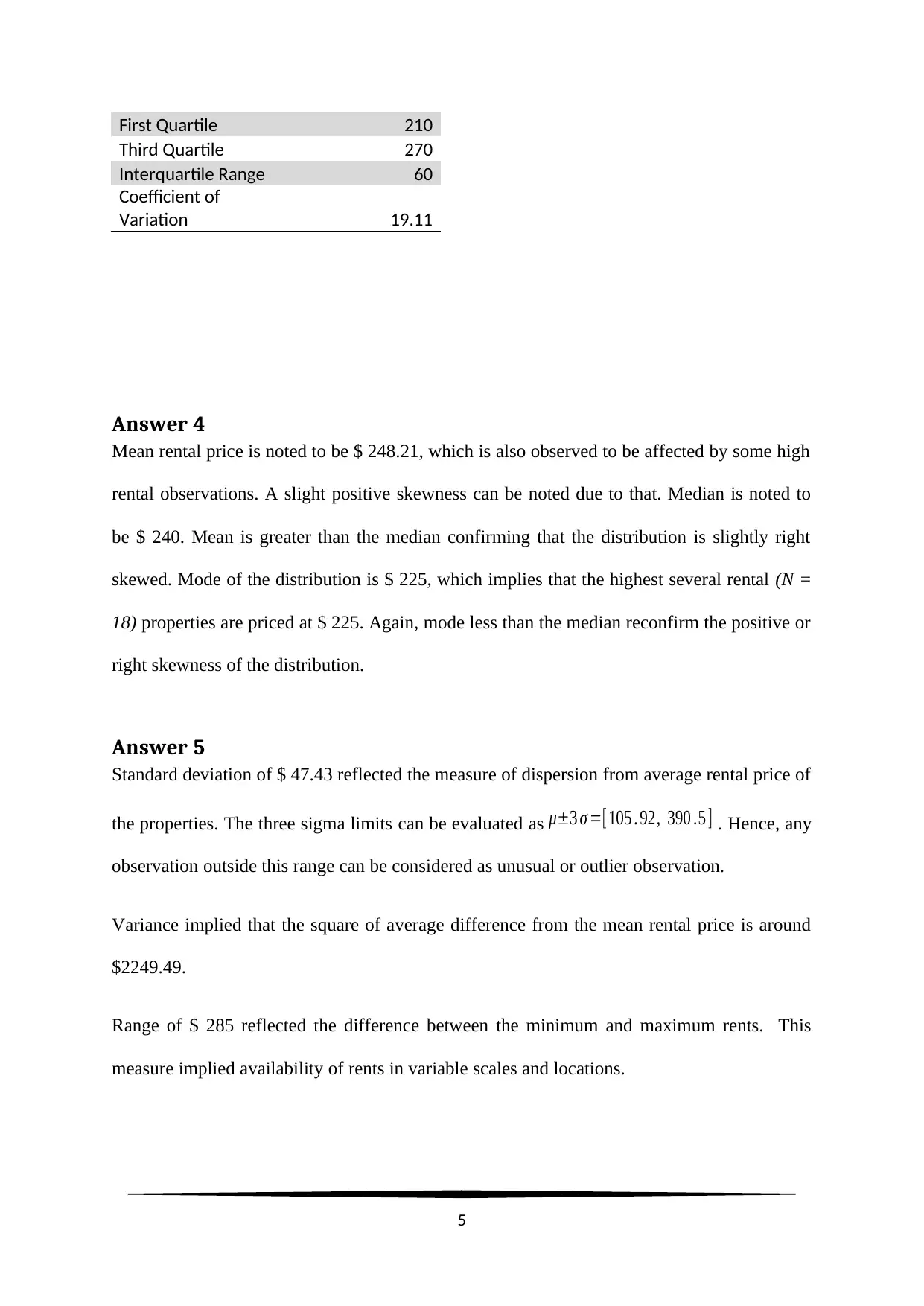

Table 3: Descriptive Values for weekly rental prices ($)

Descriptive Values price ($)

Mean 248.21

Standard Error 2.37

Median 240

Mode 225

Standard Deviation 47.43

Sample Variance 2249.49

Kurtosis 0.41

Skewness 0.64

Range 285

Minimum 135

Maximum 420

Sum 99285

Count 400

4

Brief description of Histogram

The histogram reveals that the frequency distribution of rents is almost normal with slight

positive skewness. The rents are highly accumulated within the $ 150 to $ 300 price range.

Some unusual or extraordinarily high rental properties can also be noted, which have

impacted positively on the skewness of the distribution. The median is expected to hover

within the $ 225 and $ 275 price range.

Answer 3

Table 3: Descriptive Values for weekly rental prices ($)

Descriptive Values price ($)

Mean 248.21

Standard Error 2.37

Median 240

Mode 225

Standard Deviation 47.43

Sample Variance 2249.49

Kurtosis 0.41

Skewness 0.64

Range 285

Minimum 135

Maximum 420

Sum 99285

Count 400

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

First Quartile 210

Third Quartile 270

Interquartile Range 60

Coefficient of

Variation 19.11

Answer 4

Mean rental price is noted to be $ 248.21, which is also observed to be affected by some high

rental observations. A slight positive skewness can be noted due to that. Median is noted to

be $ 240. Mean is greater than the median confirming that the distribution is slightly right

skewed. Mode of the distribution is $ 225, which implies that the highest several rental (N =

18) properties are priced at $ 225. Again, mode less than the median reconfirm the positive or

right skewness of the distribution.

Answer 5

Standard deviation of $ 47.43 reflected the measure of dispersion from average rental price of

the properties. The three sigma limits can be evaluated as μ±3 σ =[ 105 . 92, 390 .5 ] . Hence, any

observation outside this range can be considered as unusual or outlier observation.

Variance implied that the square of average difference from the mean rental price is around

$2249.49.

Range of $ 285 reflected the difference between the minimum and maximum rents. This

measure implied availability of rents in variable scales and locations.

5

Third Quartile 270

Interquartile Range 60

Coefficient of

Variation 19.11

Answer 4

Mean rental price is noted to be $ 248.21, which is also observed to be affected by some high

rental observations. A slight positive skewness can be noted due to that. Median is noted to

be $ 240. Mean is greater than the median confirming that the distribution is slightly right

skewed. Mode of the distribution is $ 225, which implies that the highest several rental (N =

18) properties are priced at $ 225. Again, mode less than the median reconfirm the positive or

right skewness of the distribution.

Answer 5

Standard deviation of $ 47.43 reflected the measure of dispersion from average rental price of

the properties. The three sigma limits can be evaluated as μ±3 σ =[ 105 . 92, 390 .5 ] . Hence, any

observation outside this range can be considered as unusual or outlier observation.

Variance implied that the square of average difference from the mean rental price is around

$2249.49.

Range of $ 285 reflected the difference between the minimum and maximum rents. This

measure implied availability of rents in variable scales and locations.

5

The first quartile reflected the cheapest 25% rental properties are price below $ 210, and third

quartile indicated that the costly top 25% properties are placed above $ 270. The middle 50%

properties are placed between $ 210 and $ 270 (the interquartile range).

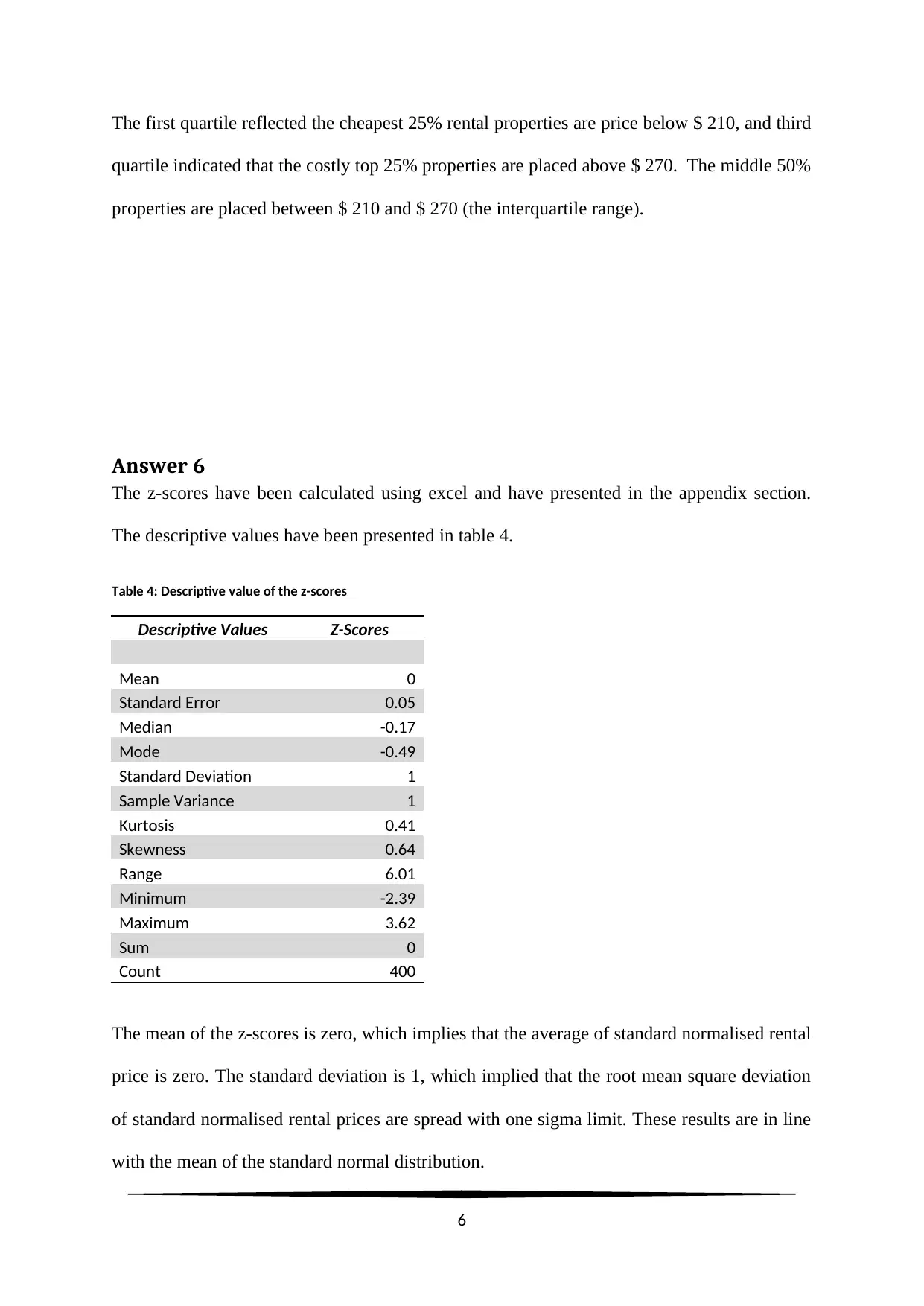

Answer 6

The z-scores have been calculated using excel and have presented in the appendix section.

The descriptive values have been presented in table 4.

Table 4: Descriptive value of the z-scores

Descriptive Values Z-Scores

Mean 0

Standard Error 0.05

Median -0.17

Mode -0.49

Standard Deviation 1

Sample Variance 1

Kurtosis 0.41

Skewness 0.64

Range 6.01

Minimum -2.39

Maximum 3.62

Sum 0

Count 400

The mean of the z-scores is zero, which implies that the average of standard normalised rental

price is zero. The standard deviation is 1, which implied that the root mean square deviation

of standard normalised rental prices are spread with one sigma limit. These results are in line

with the mean of the standard normal distribution.

6

quartile indicated that the costly top 25% properties are placed above $ 270. The middle 50%

properties are placed between $ 210 and $ 270 (the interquartile range).

Answer 6

The z-scores have been calculated using excel and have presented in the appendix section.

The descriptive values have been presented in table 4.

Table 4: Descriptive value of the z-scores

Descriptive Values Z-Scores

Mean 0

Standard Error 0.05

Median -0.17

Mode -0.49

Standard Deviation 1

Sample Variance 1

Kurtosis 0.41

Skewness 0.64

Range 6.01

Minimum -2.39

Maximum 3.62

Sum 0

Count 400

The mean of the z-scores is zero, which implies that the average of standard normalised rental

price is zero. The standard deviation is 1, which implied that the root mean square deviation

of standard normalised rental prices are spread with one sigma limit. These results are in line

with the mean of the standard normal distribution.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

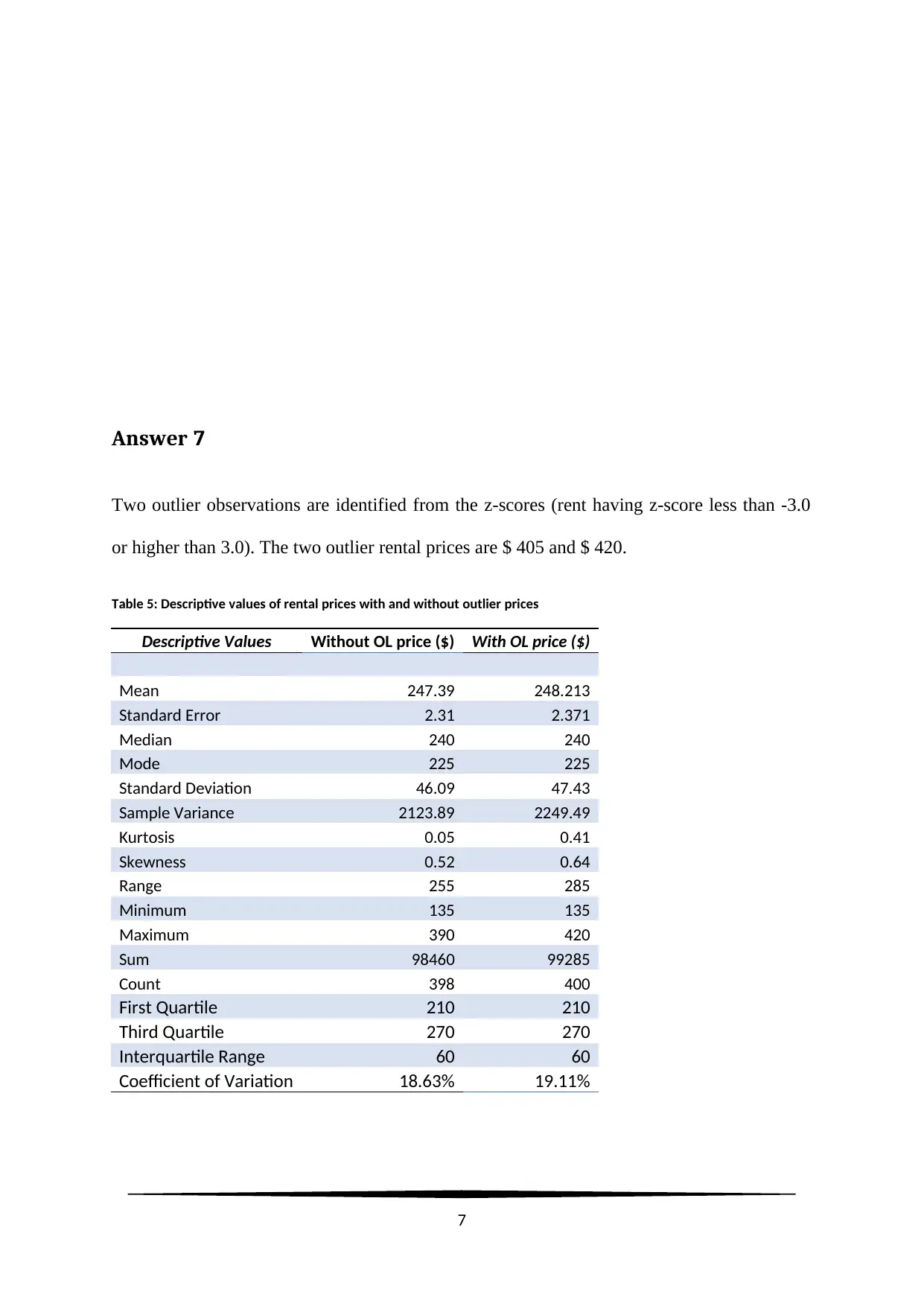

Answer 7

Two outlier observations are identified from the z-scores (rent having z-score less than -3.0

or higher than 3.0). The two outlier rental prices are $ 405 and $ 420.

Table 5: Descriptive values of rental prices with and without outlier prices

Descriptive Values Without OL price ($) With OL price ($)

Mean 247.39 248.213

Standard Error 2.31 2.371

Median 240 240

Mode 225 225

Standard Deviation 46.09 47.43

Sample Variance 2123.89 2249.49

Kurtosis 0.05 0.41

Skewness 0.52 0.64

Range 255 285

Minimum 135 135

Maximum 390 420

Sum 98460 99285

Count 398 400

First Quartile 210 210

Third Quartile 270 270

Interquartile Range 60 60

Coefficient of Variation 18.63% 19.11%

7

Two outlier observations are identified from the z-scores (rent having z-score less than -3.0

or higher than 3.0). The two outlier rental prices are $ 405 and $ 420.

Table 5: Descriptive values of rental prices with and without outlier prices

Descriptive Values Without OL price ($) With OL price ($)

Mean 247.39 248.213

Standard Error 2.31 2.371

Median 240 240

Mode 225 225

Standard Deviation 46.09 47.43

Sample Variance 2123.89 2249.49

Kurtosis 0.05 0.41

Skewness 0.52 0.64

Range 255 285

Minimum 135 135

Maximum 390 420

Sum 98460 99285

Count 398 400

First Quartile 210 210

Third Quartile 270 270

Interquartile Range 60 60

Coefficient of Variation 18.63% 19.11%

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Comparison of data analysis results

After removal of the outliers, the average rental price reduced to $ 247.39 and came near to

median rental price of $ 240. Median is not affected by outlier values, and here also a similar

reflexion is noted.

The standard deviation reduced to $ 46.09 due to outlier removal. Hence, the variability of

the prices reduced approximately by $ 1.34.

The distribution of rental prices after outlier removal is still positively skewed, but the

dissemination became more close to normal distribution. The coefficient of variance also

reduced to 18.63%. It is also to be noted that the quartiles remain unchanged.

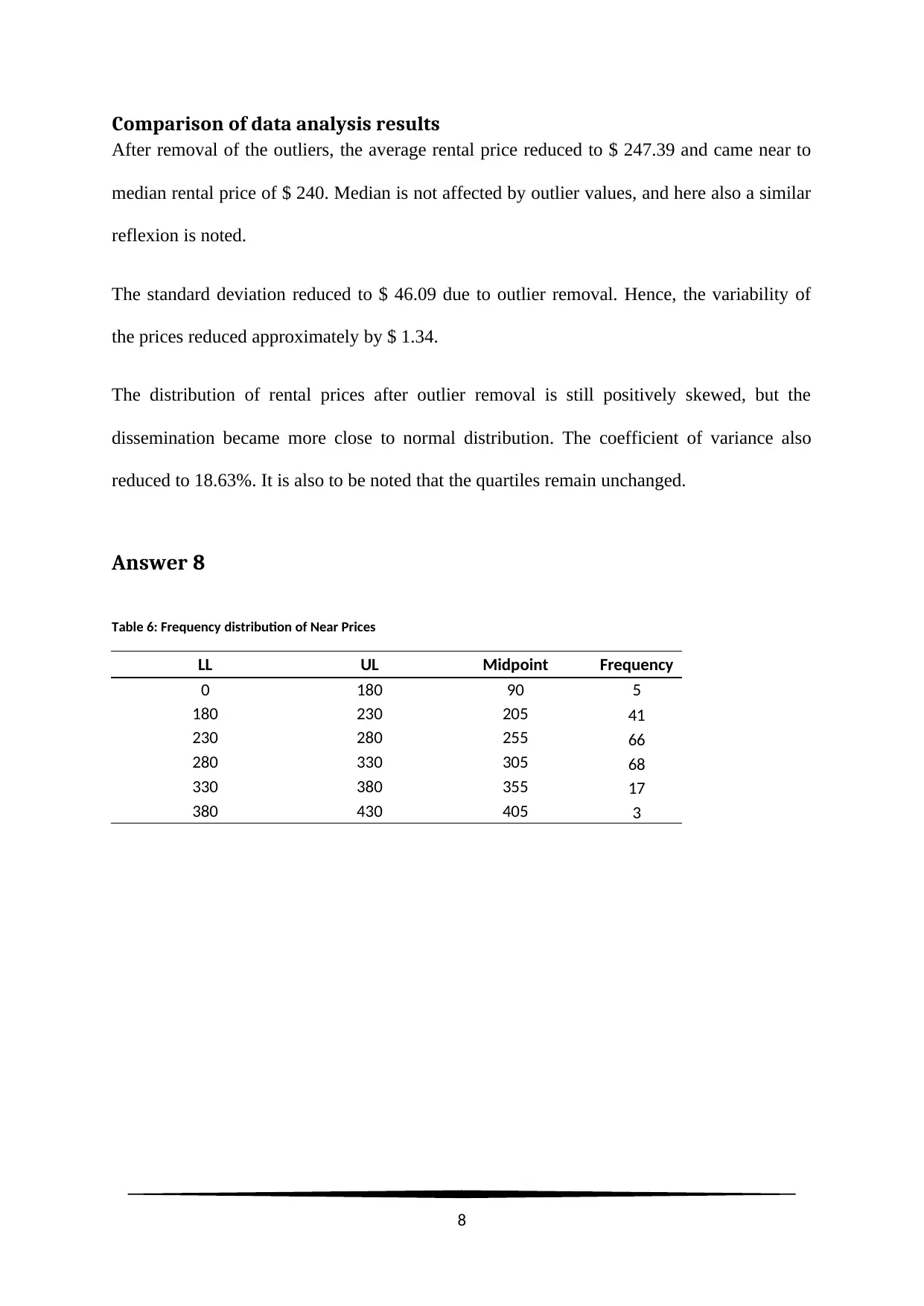

Answer 8

Table 6: Frequency distribution of Near Prices

LL UL Midpoint Frequency

0 180 90 5

180 230 205 41

230 280 255 66

280 330 305 68

330 380 355 17

380 430 405 3

8

After removal of the outliers, the average rental price reduced to $ 247.39 and came near to

median rental price of $ 240. Median is not affected by outlier values, and here also a similar

reflexion is noted.

The standard deviation reduced to $ 46.09 due to outlier removal. Hence, the variability of

the prices reduced approximately by $ 1.34.

The distribution of rental prices after outlier removal is still positively skewed, but the

dissemination became more close to normal distribution. The coefficient of variance also

reduced to 18.63%. It is also to be noted that the quartiles remain unchanged.

Answer 8

Table 6: Frequency distribution of Near Prices

LL UL Midpoint Frequency

0 180 90 5

180 230 205 41

230 280 255 66

280 330 305 68

330 380 355 17

380 430 405 3

8

Figure 4: Histogram of Rents for Near Properties

Shape of the distribution

The histogram of rental prices for the near the university properties is almost normal with

slight positive skewness due to presence of few outlier values. Rents above $ 390 are the two

outlier values present in the distribution. The majority of the rental properties are

concentrated within price range of $ 230 to $ 330.

Table 7: Frequency distribution of other rental properties

LL UL Midpoint Frequency

0 140 70 2

140 180 160 18

180 220 200 61

220 260 240 102

260 300 280 16

300 340 320 1

9

Shape of the distribution

The histogram of rental prices for the near the university properties is almost normal with

slight positive skewness due to presence of few outlier values. Rents above $ 390 are the two

outlier values present in the distribution. The majority of the rental properties are

concentrated within price range of $ 230 to $ 330.

Table 7: Frequency distribution of other rental properties

LL UL Midpoint Frequency

0 140 70 2

140 180 160 18

180 220 200 61

220 260 240 102

260 300 280 16

300 340 320 1

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

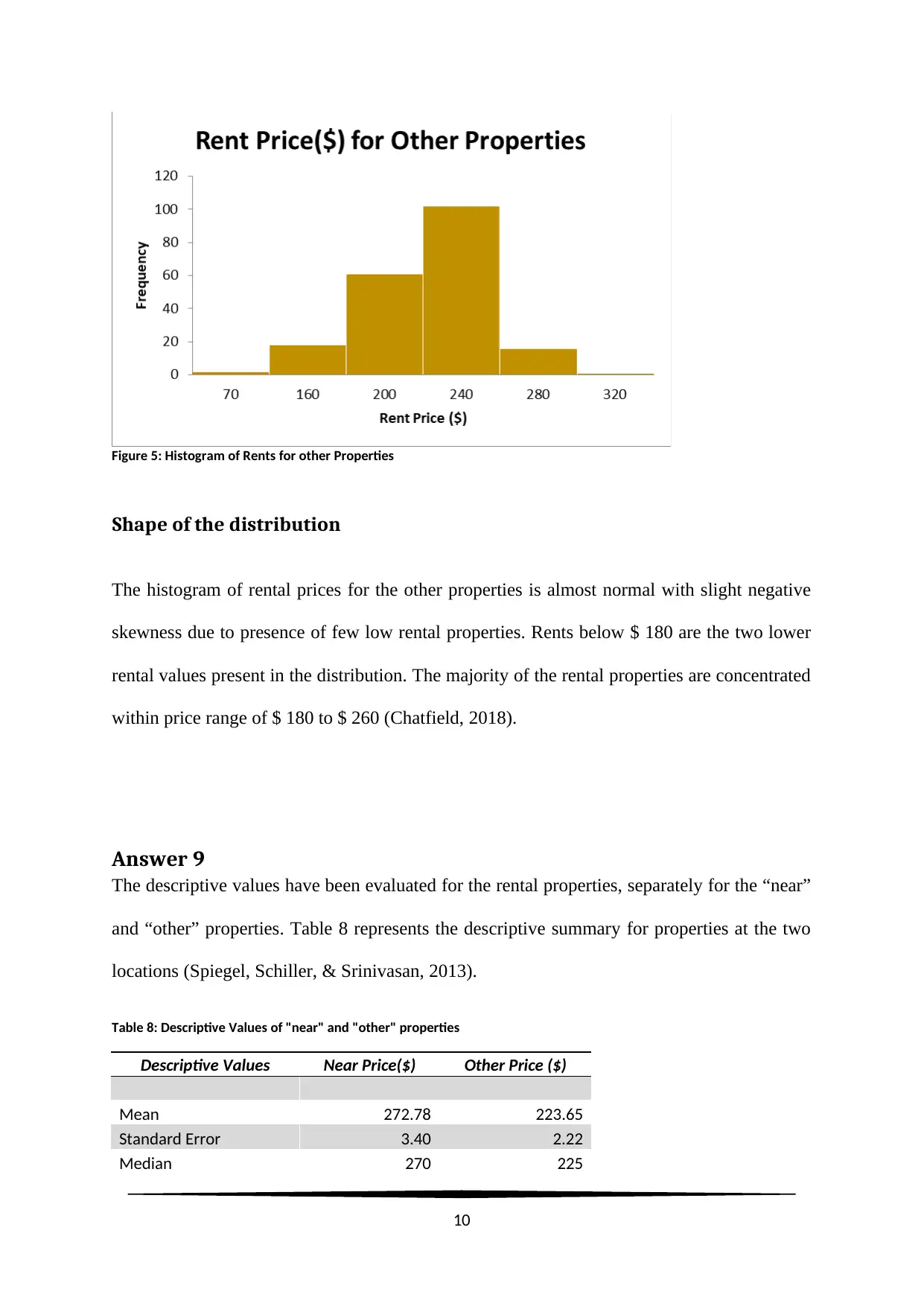

Figure 5: Histogram of Rents for other Properties

Shape of the distribution

The histogram of rental prices for the other properties is almost normal with slight negative

skewness due to presence of few low rental properties. Rents below $ 180 are the two lower

rental values present in the distribution. The majority of the rental properties are concentrated

within price range of $ 180 to $ 260 (Chatfield, 2018).

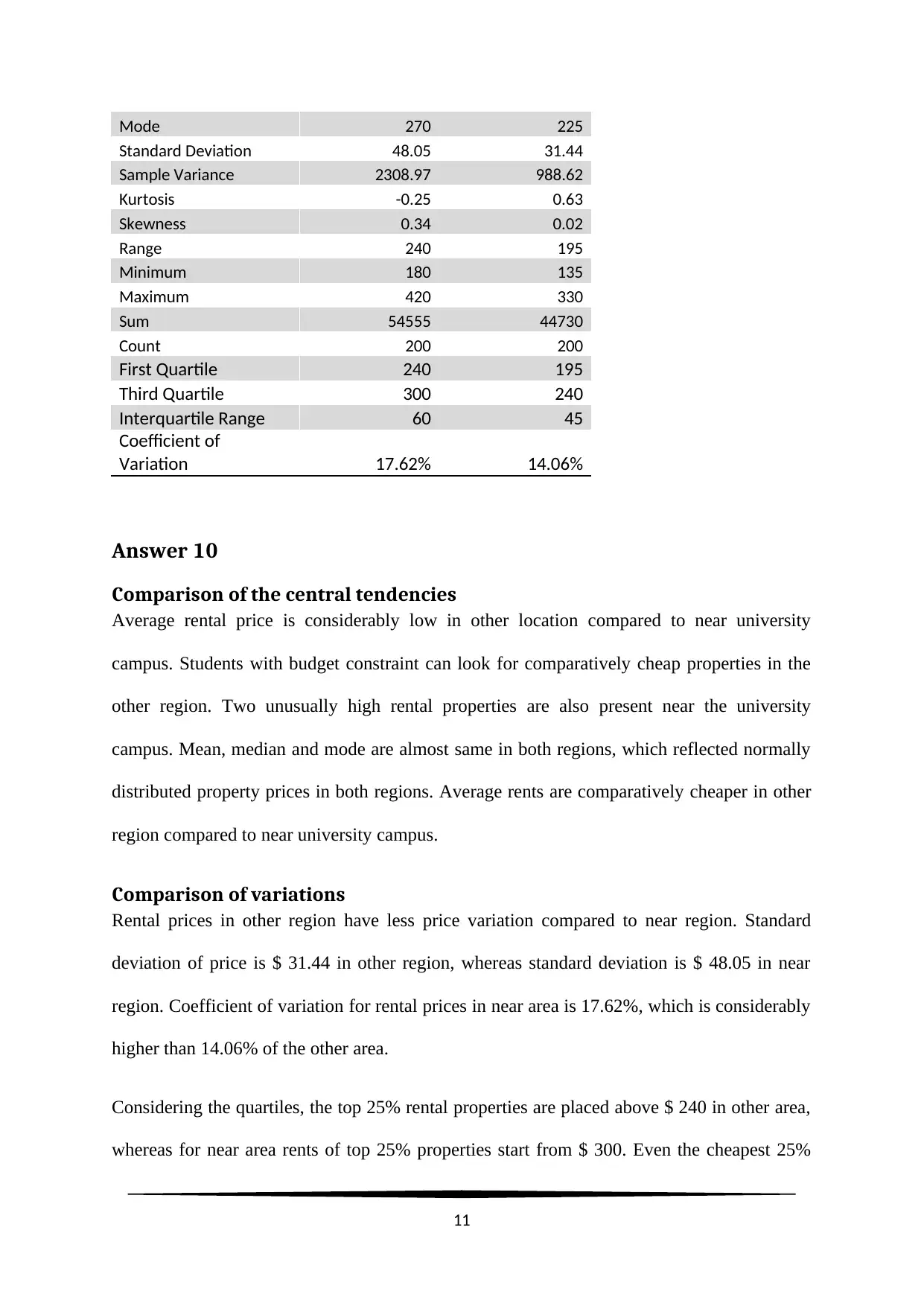

Answer 9

The descriptive values have been evaluated for the rental properties, separately for the “near”

and “other” properties. Table 8 represents the descriptive summary for properties at the two

locations (Spiegel, Schiller, & Srinivasan, 2013).

Table 8: Descriptive Values of "near" and "other" properties

Descriptive Values Near Price($) Other Price ($)

Mean 272.78 223.65

Standard Error 3.40 2.22

Median 270 225

10

Shape of the distribution

The histogram of rental prices for the other properties is almost normal with slight negative

skewness due to presence of few low rental properties. Rents below $ 180 are the two lower

rental values present in the distribution. The majority of the rental properties are concentrated

within price range of $ 180 to $ 260 (Chatfield, 2018).

Answer 9

The descriptive values have been evaluated for the rental properties, separately for the “near”

and “other” properties. Table 8 represents the descriptive summary for properties at the two

locations (Spiegel, Schiller, & Srinivasan, 2013).

Table 8: Descriptive Values of "near" and "other" properties

Descriptive Values Near Price($) Other Price ($)

Mean 272.78 223.65

Standard Error 3.40 2.22

Median 270 225

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Mode 270 225

Standard Deviation 48.05 31.44

Sample Variance 2308.97 988.62

Kurtosis -0.25 0.63

Skewness 0.34 0.02

Range 240 195

Minimum 180 135

Maximum 420 330

Sum 54555 44730

Count 200 200

First Quartile 240 195

Third Quartile 300 240

Interquartile Range 60 45

Coefficient of

Variation 17.62% 14.06%

Answer 10

Comparison of the central tendencies

Average rental price is considerably low in other location compared to near university

campus. Students with budget constraint can look for comparatively cheap properties in the

other region. Two unusually high rental properties are also present near the university

campus. Mean, median and mode are almost same in both regions, which reflected normally

distributed property prices in both regions. Average rents are comparatively cheaper in other

region compared to near university campus.

Comparison of variations

Rental prices in other region have less price variation compared to near region. Standard

deviation of price is $ 31.44 in other region, whereas standard deviation is $ 48.05 in near

region. Coefficient of variation for rental prices in near area is 17.62%, which is considerably

higher than 14.06% of the other area.

Considering the quartiles, the top 25% rental properties are placed above $ 240 in other area,

whereas for near area rents of top 25% properties start from $ 300. Even the cheapest 25%

11

Standard Deviation 48.05 31.44

Sample Variance 2308.97 988.62

Kurtosis -0.25 0.63

Skewness 0.34 0.02

Range 240 195

Minimum 180 135

Maximum 420 330

Sum 54555 44730

Count 200 200

First Quartile 240 195

Third Quartile 300 240

Interquartile Range 60 45

Coefficient of

Variation 17.62% 14.06%

Answer 10

Comparison of the central tendencies

Average rental price is considerably low in other location compared to near university

campus. Students with budget constraint can look for comparatively cheap properties in the

other region. Two unusually high rental properties are also present near the university

campus. Mean, median and mode are almost same in both regions, which reflected normally

distributed property prices in both regions. Average rents are comparatively cheaper in other

region compared to near university campus.

Comparison of variations

Rental prices in other region have less price variation compared to near region. Standard

deviation of price is $ 31.44 in other region, whereas standard deviation is $ 48.05 in near

region. Coefficient of variation for rental prices in near area is 17.62%, which is considerably

higher than 14.06% of the other area.

Considering the quartiles, the top 25% rental properties are placed above $ 240 in other area,

whereas for near area rents of top 25% properties start from $ 300. Even the cheapest 25%

11

rentals are priced below $ 195 in other area, whereas the same is price below $ 240 in near

area. Clearly, prices in near university campus are higher than other area.

References

Spiegel, M. R., Schiller, J. J., & Srinivasan, R. A. (2013). Probability and statistics (Fourth

edition). In Schaum’s Outlines (Fourth edition). New York: McGraw-Hill.

Chatfield, C. (2018). Statistics for Technology, A Course in Applied Statistics. Third edition.

New York, USA: Routledge. https://doi.org/10.1201/9780203738467

Appendix

Table 9: Z-scores of prices (related to Answer 6 and 7)

price

($) Z-Score

135 -2.386999038

135 -2.386999038

150 -2.070735502

150 -2.070735502

150 -2.070735502

165 -1.754471966

165 -1.754471966

12

area. Clearly, prices in near university campus are higher than other area.

References

Spiegel, M. R., Schiller, J. J., & Srinivasan, R. A. (2013). Probability and statistics (Fourth

edition). In Schaum’s Outlines (Fourth edition). New York: McGraw-Hill.

Chatfield, C. (2018). Statistics for Technology, A Course in Applied Statistics. Third edition.

New York, USA: Routledge. https://doi.org/10.1201/9780203738467

Appendix

Table 9: Z-scores of prices (related to Answer 6 and 7)

price

($) Z-Score

135 -2.386999038

135 -2.386999038

150 -2.070735502

150 -2.070735502

150 -2.070735502

165 -1.754471966

165 -1.754471966

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.