Consumer Behavior Analysis of Bunbury Boat Show Attendees: Report

VerifiedAdded on 2023/06/04

|18

|2995

|230

Report

AI Summary

This report analyzes consumer behavior and attitudes towards the Bunbury Boat Show, based on a survey of 244 attendees. The research investigates demographics, attitudes towards water-based activities, online behavior, and purchasing habits. Key findings reveal that the majority of attendees are male, and the primary barriers to participation in boating are lack of time and costs. The show is generally considered good value for money and informative, with a strong positive correlation between the two. Attendees enjoy the show for the opportunity to handle products, get advice, ask questions, talk to dealers, compare products, and find information about new products. The report concludes with recommendations to increase future attendance, emphasizing the value and informative nature of the show.

3/11/2018

Consumer Behavior with regards to the Bunbury Boat Show

Consumer Behavior with regards to the Bunbury Boat Show

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction.................................................................................................................................................1

Research methodology................................................................................................................................2

Data collection and analysis....................................................................................................................2

Demographic description........................................................................................................................2

Results.........................................................................................................................................................4

Conclusion.................................................................................................................................................15

Recommendations.....................................................................................................................................15

Introduction.................................................................................................................................................1

Research methodology................................................................................................................................2

Data collection and analysis....................................................................................................................2

Demographic description........................................................................................................................2

Results.........................................................................................................................................................4

Conclusion.................................................................................................................................................15

Recommendations.....................................................................................................................................15

Introduction

The recreational marine industry has widely been considered an alternative form of relaxation

and activity (Watson, 2008). A range of activities are being carried out in the marine industry

some of which are fishing and boating activities (Siân E. Rees, 2010).

However, significant changes have been experienced in the marine industry more so over the

past ten years resulting to a decline in the industry’s customer base (Beyers, 2008). Many factors

are thought to be attributed to this decline including an increased demand on leisure time, the

economic downturn and the rise of online entertainment especially among the youth (Prothe,

1993).

The research detailed in this report was therefore conducted to investigate the Bunbury Boat

Show attendees’ attitudes and consumer behavior with regards to the Bunbury Boat show in

order to find out how to increase the number of attendees to the Bunbury Boat Show in the

future.

The research statement for this study was to investigate the attitudes, consumer behavior and

online activity of current visitors to the Bunbury Boat Show.

The objectives for this research are as below;

i. Build a demographic profile of participants attending the Bunbury Boat Show.

ii. Investigate Bunbury Boat Show attendees attitudes and consumer behavior to water-

based

Activities.

iii. Investigate Bunbury Boat Show attendees’ attitudes and consumer behavior with regards

to the Bunbury Boat Show.

1

The recreational marine industry has widely been considered an alternative form of relaxation

and activity (Watson, 2008). A range of activities are being carried out in the marine industry

some of which are fishing and boating activities (Siân E. Rees, 2010).

However, significant changes have been experienced in the marine industry more so over the

past ten years resulting to a decline in the industry’s customer base (Beyers, 2008). Many factors

are thought to be attributed to this decline including an increased demand on leisure time, the

economic downturn and the rise of online entertainment especially among the youth (Prothe,

1993).

The research detailed in this report was therefore conducted to investigate the Bunbury Boat

Show attendees’ attitudes and consumer behavior with regards to the Bunbury Boat show in

order to find out how to increase the number of attendees to the Bunbury Boat Show in the

future.

The research statement for this study was to investigate the attitudes, consumer behavior and

online activity of current visitors to the Bunbury Boat Show.

The objectives for this research are as below;

i. Build a demographic profile of participants attending the Bunbury Boat Show.

ii. Investigate Bunbury Boat Show attendees attitudes and consumer behavior to water-

based

Activities.

iii. Investigate Bunbury Boat Show attendees’ attitudes and consumer behavior with regards

to the Bunbury Boat Show.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

iv. Investigate online participative behavior of attendees at the Bunbury Boat Show.

v. Investigate purchasing behavior of attendees at the Bunbury Boat Show.

The main objective of this research study was to investigate Bunbury Boat Show attitudes and

consumer behavior with regards to the Bunbury Boat show.

Research methodology

Data collection and analysis

Primary data for the study was collected through administration of questionnaires to the

participants during the survey. Data was entered into the Statistical Software for Social Statistics

(SPSS) for analysis.

Data was analyzed using statistical tools such as frequencies, descriptive statistics, cross

tabulation and correlation.

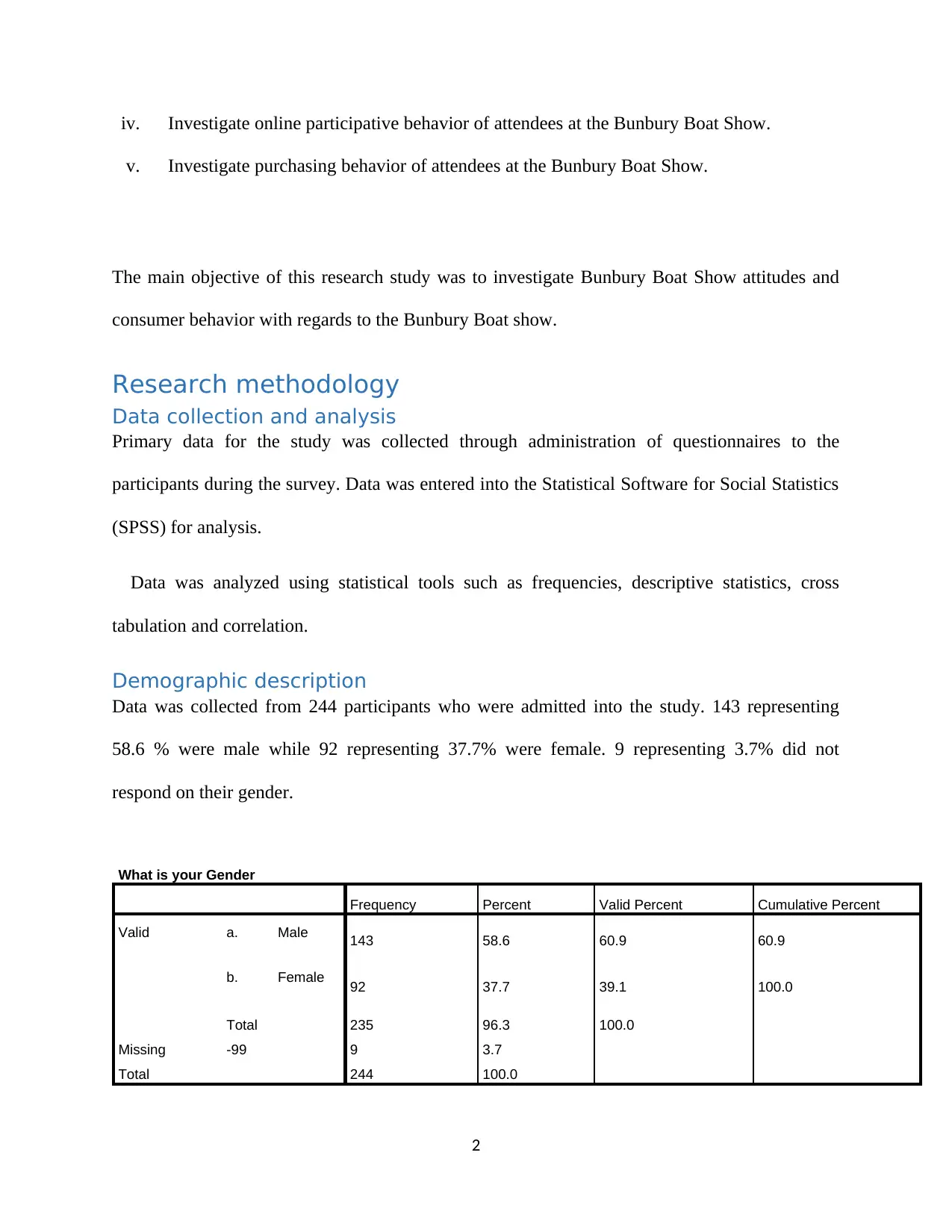

Demographic description

Data was collected from 244 participants who were admitted into the study. 143 representing

58.6 % were male while 92 representing 37.7% were female. 9 representing 3.7% did not

respond on their gender.

What is your Gender

Frequency Percent Valid Percent Cumulative Percent

Valid a. Male 143 58.6 60.9 60.9

b. Female 92 37.7 39.1 100.0

Total 235 96.3 100.0

Missing -99 9 3.7

Total 244 100.0

2

v. Investigate purchasing behavior of attendees at the Bunbury Boat Show.

The main objective of this research study was to investigate Bunbury Boat Show attitudes and

consumer behavior with regards to the Bunbury Boat show.

Research methodology

Data collection and analysis

Primary data for the study was collected through administration of questionnaires to the

participants during the survey. Data was entered into the Statistical Software for Social Statistics

(SPSS) for analysis.

Data was analyzed using statistical tools such as frequencies, descriptive statistics, cross

tabulation and correlation.

Demographic description

Data was collected from 244 participants who were admitted into the study. 143 representing

58.6 % were male while 92 representing 37.7% were female. 9 representing 3.7% did not

respond on their gender.

What is your Gender

Frequency Percent Valid Percent Cumulative Percent

Valid a. Male 143 58.6 60.9 60.9

b. Female 92 37.7 39.1 100.0

Total 235 96.3 100.0

Missing -99 9 3.7

Total 244 100.0

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

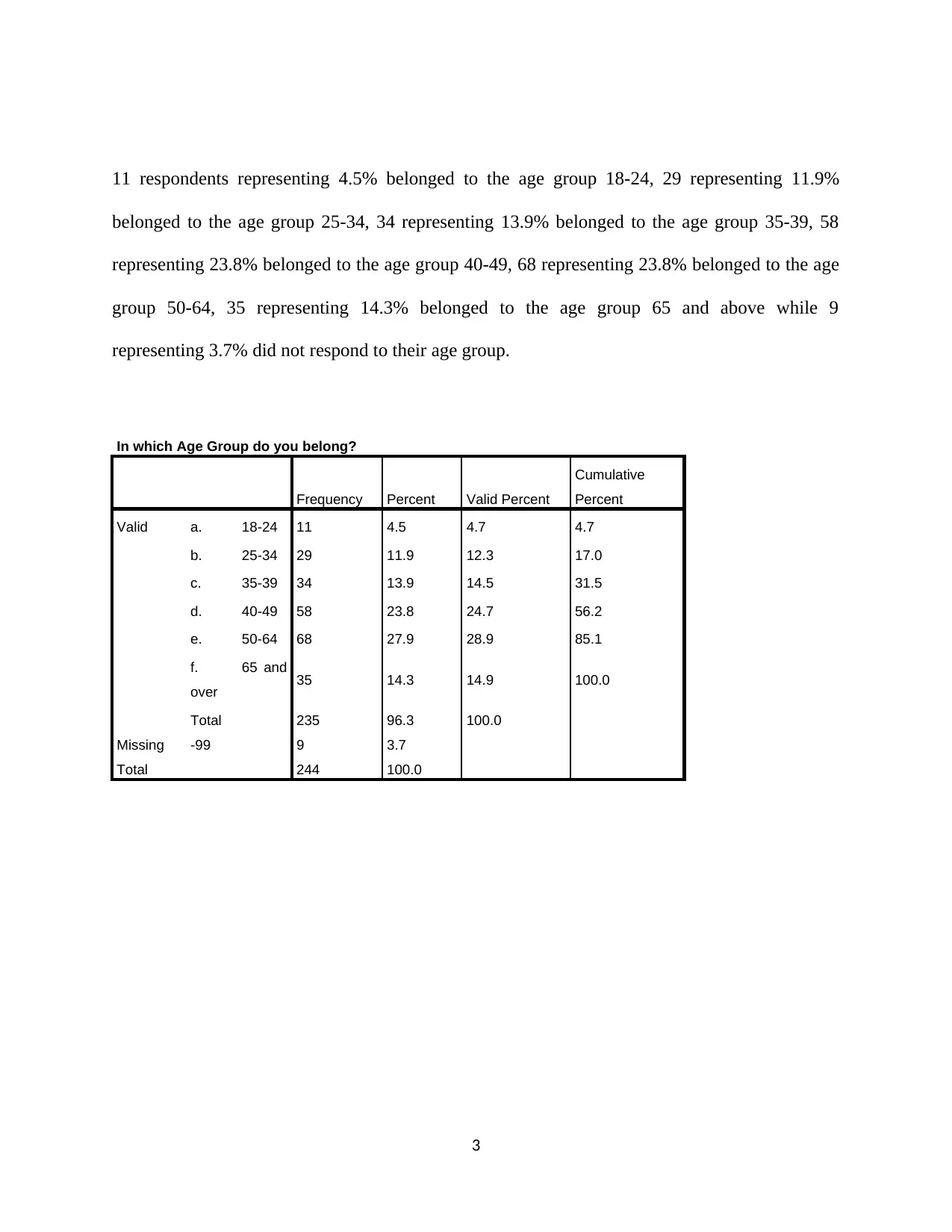

11 respondents representing 4.5% belonged to the age group 18-24, 29 representing 11.9%

belonged to the age group 25-34, 34 representing 13.9% belonged to the age group 35-39, 58

representing 23.8% belonged to the age group 40-49, 68 representing 23.8% belonged to the age

group 50-64, 35 representing 14.3% belonged to the age group 65 and above while 9

representing 3.7% did not respond to their age group.

In which Age Group do you belong?

Frequency Percent Valid Percent

Cumulative

Percent

Valid a. 18-24 11 4.5 4.7 4.7

b. 25-34 29 11.9 12.3 17.0

c. 35-39 34 13.9 14.5 31.5

d. 40-49 58 23.8 24.7 56.2

e. 50-64 68 27.9 28.9 85.1

f. 65 and

over 35 14.3 14.9 100.0

Total 235 96.3 100.0

Missing -99 9 3.7

Total 244 100.0

3

belonged to the age group 25-34, 34 representing 13.9% belonged to the age group 35-39, 58

representing 23.8% belonged to the age group 40-49, 68 representing 23.8% belonged to the age

group 50-64, 35 representing 14.3% belonged to the age group 65 and above while 9

representing 3.7% did not respond to their age group.

In which Age Group do you belong?

Frequency Percent Valid Percent

Cumulative

Percent

Valid a. 18-24 11 4.5 4.7 4.7

b. 25-34 29 11.9 12.3 17.0

c. 35-39 34 13.9 14.5 31.5

d. 40-49 58 23.8 24.7 56.2

e. 50-64 68 27.9 28.9 85.1

f. 65 and

over 35 14.3 14.9 100.0

Total 235 96.3 100.0

Missing -99 9 3.7

Total 244 100.0

3

Results

Descriptive statistics on how customers first heard of the show

How did you first hear about the Boat Show? (please tick only one)

Frequency Percent Valid Percent

Cumulative

Percent

Valid a. Online 8 3.3 3.4 3.4

b. Email 1 .4 .4 3.8

c. Facebook 4 1.6 1.7 5.5

d. Mail out 1 .4 .4 5.9

e. Newspaper 42 17.2 17.7 23.6

f. Magazine 8 3.3 3.4 27.0

g. TV 45 18.4 19.0 46.0

h. Outdoor advertising 20 8.2 8.4 54.4

i. From a friend 29 11.9 12.2 66.7

j. Radio 19 7.8 8.0 74.7

k. Work or industry

colleagues 11 4.5 4.6 79.3

I. Other 49 20.1 20.7 100.0

Total 237 97.1 100.0

Missing -99 7 2.9

Total 244 100.0

4

Descriptive statistics on how customers first heard of the show

How did you first hear about the Boat Show? (please tick only one)

Frequency Percent Valid Percent

Cumulative

Percent

Valid a. Online 8 3.3 3.4 3.4

b. Email 1 .4 .4 3.8

c. Facebook 4 1.6 1.7 5.5

d. Mail out 1 .4 .4 5.9

e. Newspaper 42 17.2 17.7 23.6

f. Magazine 8 3.3 3.4 27.0

g. TV 45 18.4 19.0 46.0

h. Outdoor advertising 20 8.2 8.4 54.4

i. From a friend 29 11.9 12.2 66.7

j. Radio 19 7.8 8.0 74.7

k. Work or industry

colleagues 11 4.5 4.6 79.3

I. Other 49 20.1 20.7 100.0

Total 237 97.1 100.0

Missing -99 7 2.9

Total 244 100.0

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The largest outlet through which the respondents heard of the show is other source of

information representing 20.1% followed by TV which had 18.4% of the respondents. The least

number of respondents who were about 0.4 % heard it through mail out.

What is the primary barrier to your participation in boating or water based activities? (please tick

one)

Frequency Percent Valid Percent

Cumulative

Percent

Valid a. Upfront costs 53 21.7 22.6 22.6

b. Costs associated

with participation (e.g. fuel,

storage and maintenance)

43 17.6 18.4 41.0

c. Lack of time 87 35.7 37.2 78.2

d. Lack of access to

facilities 6 2.5 2.6 80.8

e. Lack of storage

facilities 2 .8 .9 81.6

f. Other 43 17.6 18.4 100.0

Total 234 95.9 100.0

Missing -99 10 4.1

5

information representing 20.1% followed by TV which had 18.4% of the respondents. The least

number of respondents who were about 0.4 % heard it through mail out.

What is the primary barrier to your participation in boating or water based activities? (please tick

one)

Frequency Percent Valid Percent

Cumulative

Percent

Valid a. Upfront costs 53 21.7 22.6 22.6

b. Costs associated

with participation (e.g. fuel,

storage and maintenance)

43 17.6 18.4 41.0

c. Lack of time 87 35.7 37.2 78.2

d. Lack of access to

facilities 6 2.5 2.6 80.8

e. Lack of storage

facilities 2 .8 .9 81.6

f. Other 43 17.6 18.4 100.0

Total 234 95.9 100.0

Missing -99 10 4.1

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total 244 100.0

The primary barriers to customers participation in boating or water based activities are lack of

time, upfront costs, costs associated with participation, lack of access to facilities and lack of

storage facilities in order of frequencies from highest to lowest respectively.

I consider the Boat Show good value for money?

Frequency Percent Valid Percent

Cumulative

Percent

Valid 1. Strongly Disagree 5 2.0 2.1 2.1

2. Moderately Disagree 4 1.6 1.7 3.8

3. Slightly Disagree 12 4.9 5.1 8.9

4. Slightly Agree 29 11.9 12.3 21.3

5. Moderately Agree 79 32.4 33.6 54.9

6. Strongly Agree 106 43.4 45.1 100.0

Total 235 96.3 100.0

Missing -99 9 3.7

Total 244 100.0

6

The primary barriers to customers participation in boating or water based activities are lack of

time, upfront costs, costs associated with participation, lack of access to facilities and lack of

storage facilities in order of frequencies from highest to lowest respectively.

I consider the Boat Show good value for money?

Frequency Percent Valid Percent

Cumulative

Percent

Valid 1. Strongly Disagree 5 2.0 2.1 2.1

2. Moderately Disagree 4 1.6 1.7 3.8

3. Slightly Disagree 12 4.9 5.1 8.9

4. Slightly Agree 29 11.9 12.3 21.3

5. Moderately Agree 79 32.4 33.6 54.9

6. Strongly Agree 106 43.4 45.1 100.0

Total 235 96.3 100.0

Missing -99 9 3.7

Total 244 100.0

6

The highest frequency of respondents argued that Boat Shows are a good value for money

representing 43.4%. The least number of respondents representing 1.6% argued that they

moderately disagreed on the point that Boat Shows are a good value for money.

I found the Boat Show to be very informative?

Frequency Percent Valid Percent

Cumulative

Percent

Valid 1. Strongly Disagree 2 .8 .9 .9

2. Moderately Disagree 4 1.6 1.7 2.6

3. Slightly Disagree 6 2.5 2.6 5.1

4. Slightly Agree 38 15.6 16.2 21.3

5. Moderately Agree 77 31.6 32.8 54.0

6. Strongly Agree 108 44.3 46.0 100.0

Total 235 96.3 100.0

Missing -99 9 3.7

Total 244 100.0

7

representing 43.4%. The least number of respondents representing 1.6% argued that they

moderately disagreed on the point that Boat Shows are a good value for money.

I found the Boat Show to be very informative?

Frequency Percent Valid Percent

Cumulative

Percent

Valid 1. Strongly Disagree 2 .8 .9 .9

2. Moderately Disagree 4 1.6 1.7 2.6

3. Slightly Disagree 6 2.5 2.6 5.1

4. Slightly Agree 38 15.6 16.2 21.3

5. Moderately Agree 77 31.6 32.8 54.0

6. Strongly Agree 108 44.3 46.0 100.0

Total 235 96.3 100.0

Missing -99 9 3.7

Total 244 100.0

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

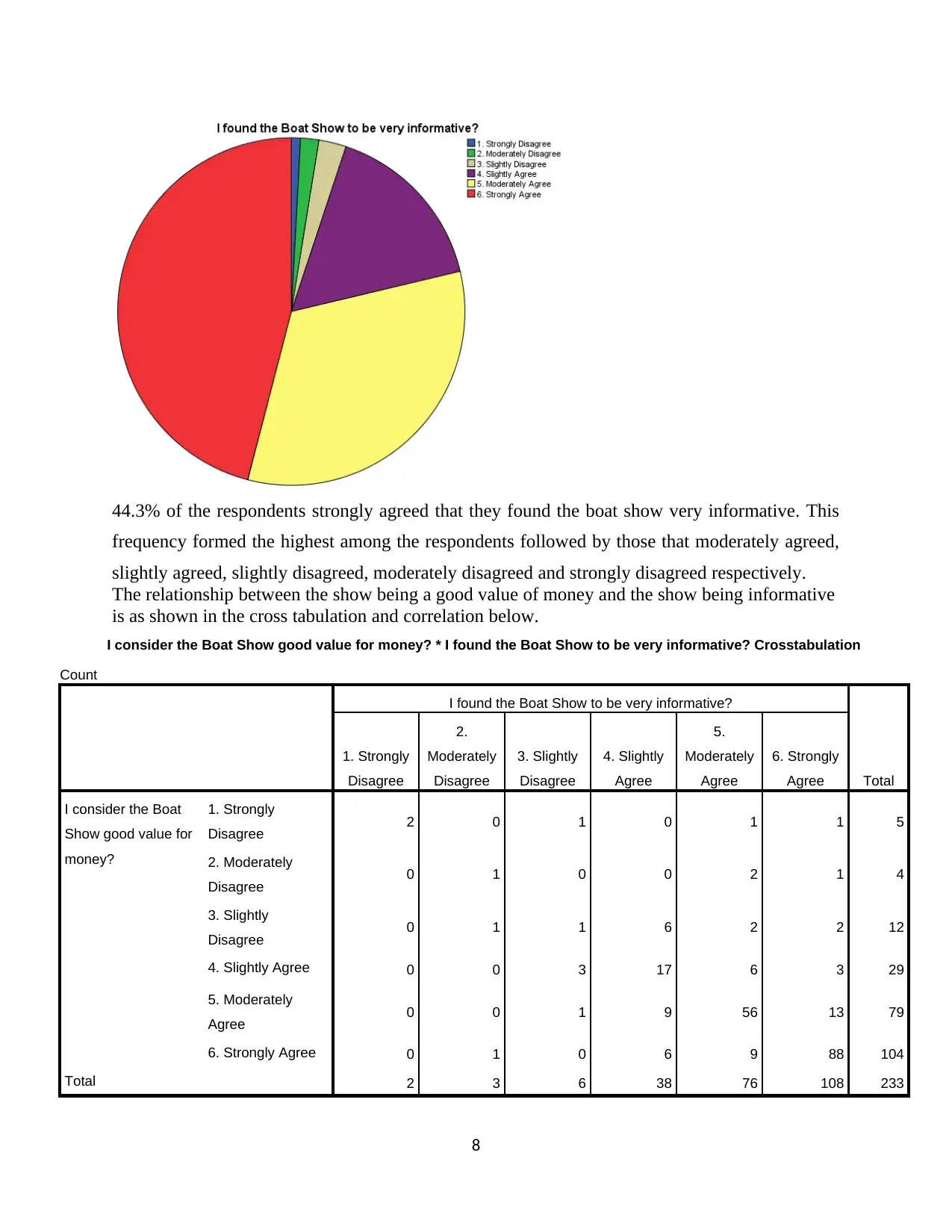

44.3% of the respondents strongly agreed that they found the boat show very informative. This

frequency formed the highest among the respondents followed by those that moderately agreed,

slightly agreed, slightly disagreed, moderately disagreed and strongly disagreed respectively.

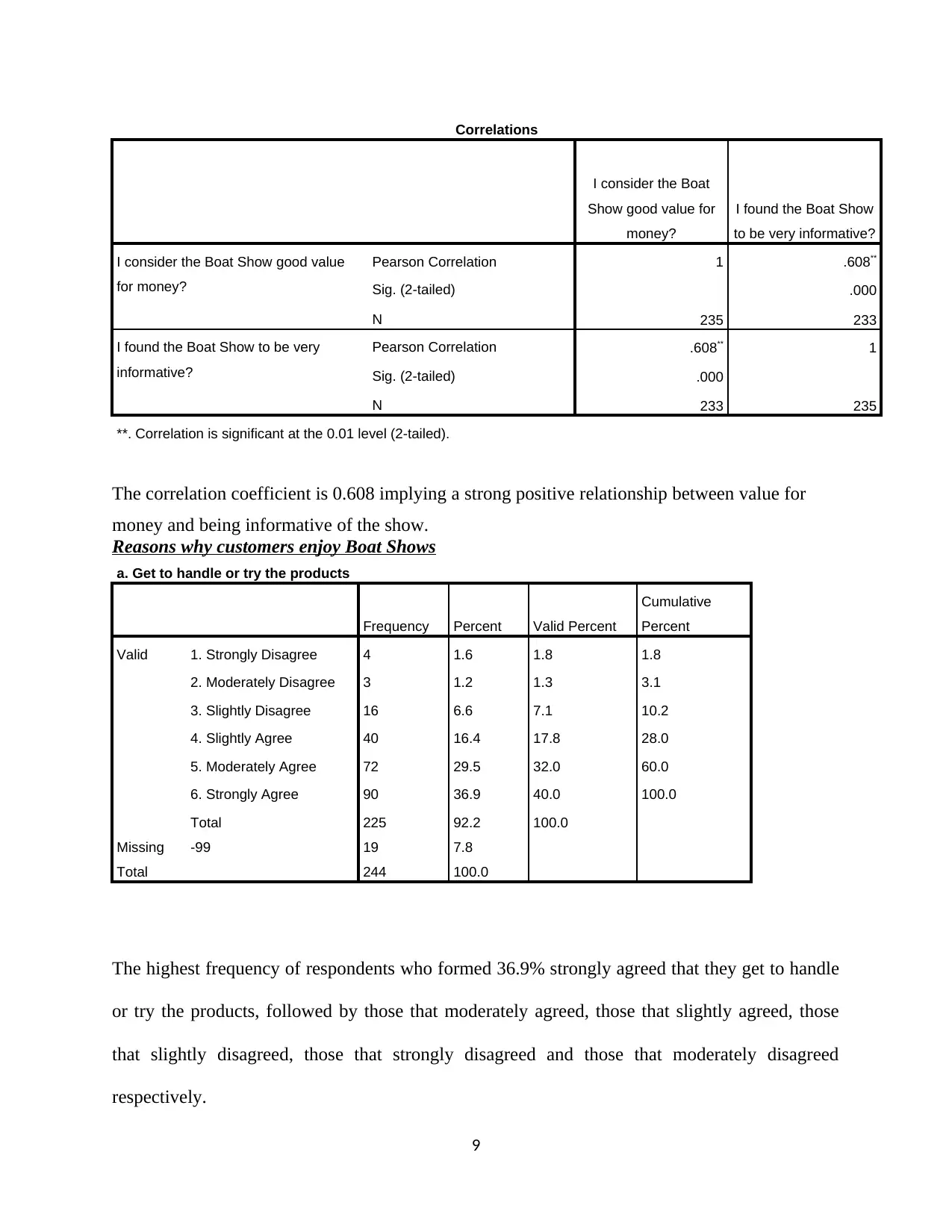

The relationship between the show being a good value of money and the show being informative

is as shown in the cross tabulation and correlation below.

I consider the Boat Show good value for money? * I found the Boat Show to be very informative? Crosstabulation

Count

I found the Boat Show to be very informative?

Total

1. Strongly

Disagree

2.

Moderately

Disagree

3. Slightly

Disagree

4. Slightly

Agree

5.

Moderately

Agree

6. Strongly

Agree

I consider the Boat

Show good value for

money?

1. Strongly

Disagree 2 0 1 0 1 1 5

2. Moderately

Disagree 0 1 0 0 2 1 4

3. Slightly

Disagree 0 1 1 6 2 2 12

4. Slightly Agree 0 0 3 17 6 3 29

5. Moderately

Agree 0 0 1 9 56 13 79

6. Strongly Agree 0 1 0 6 9 88 104

Total 2 3 6 38 76 108 233

8

frequency formed the highest among the respondents followed by those that moderately agreed,

slightly agreed, slightly disagreed, moderately disagreed and strongly disagreed respectively.

The relationship between the show being a good value of money and the show being informative

is as shown in the cross tabulation and correlation below.

I consider the Boat Show good value for money? * I found the Boat Show to be very informative? Crosstabulation

Count

I found the Boat Show to be very informative?

Total

1. Strongly

Disagree

2.

Moderately

Disagree

3. Slightly

Disagree

4. Slightly

Agree

5.

Moderately

Agree

6. Strongly

Agree

I consider the Boat

Show good value for

money?

1. Strongly

Disagree 2 0 1 0 1 1 5

2. Moderately

Disagree 0 1 0 0 2 1 4

3. Slightly

Disagree 0 1 1 6 2 2 12

4. Slightly Agree 0 0 3 17 6 3 29

5. Moderately

Agree 0 0 1 9 56 13 79

6. Strongly Agree 0 1 0 6 9 88 104

Total 2 3 6 38 76 108 233

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Correlations

I consider the Boat

Show good value for

money?

I found the Boat Show

to be very informative?

I consider the Boat Show good value

for money?

Pearson Correlation 1 .608**

Sig. (2-tailed) .000

N 235 233

I found the Boat Show to be very

informative?

Pearson Correlation .608** 1

Sig. (2-tailed) .000

N 233 235

**. Correlation is significant at the 0.01 level (2-tailed).

The correlation coefficient is 0.608 implying a strong positive relationship between value for

money and being informative of the show.

Reasons why customers enjoy Boat Shows

a. Get to handle or try the products

Frequency Percent Valid Percent

Cumulative

Percent

Valid 1. Strongly Disagree 4 1.6 1.8 1.8

2. Moderately Disagree 3 1.2 1.3 3.1

3. Slightly Disagree 16 6.6 7.1 10.2

4. Slightly Agree 40 16.4 17.8 28.0

5. Moderately Agree 72 29.5 32.0 60.0

6. Strongly Agree 90 36.9 40.0 100.0

Total 225 92.2 100.0

Missing -99 19 7.8

Total 244 100.0

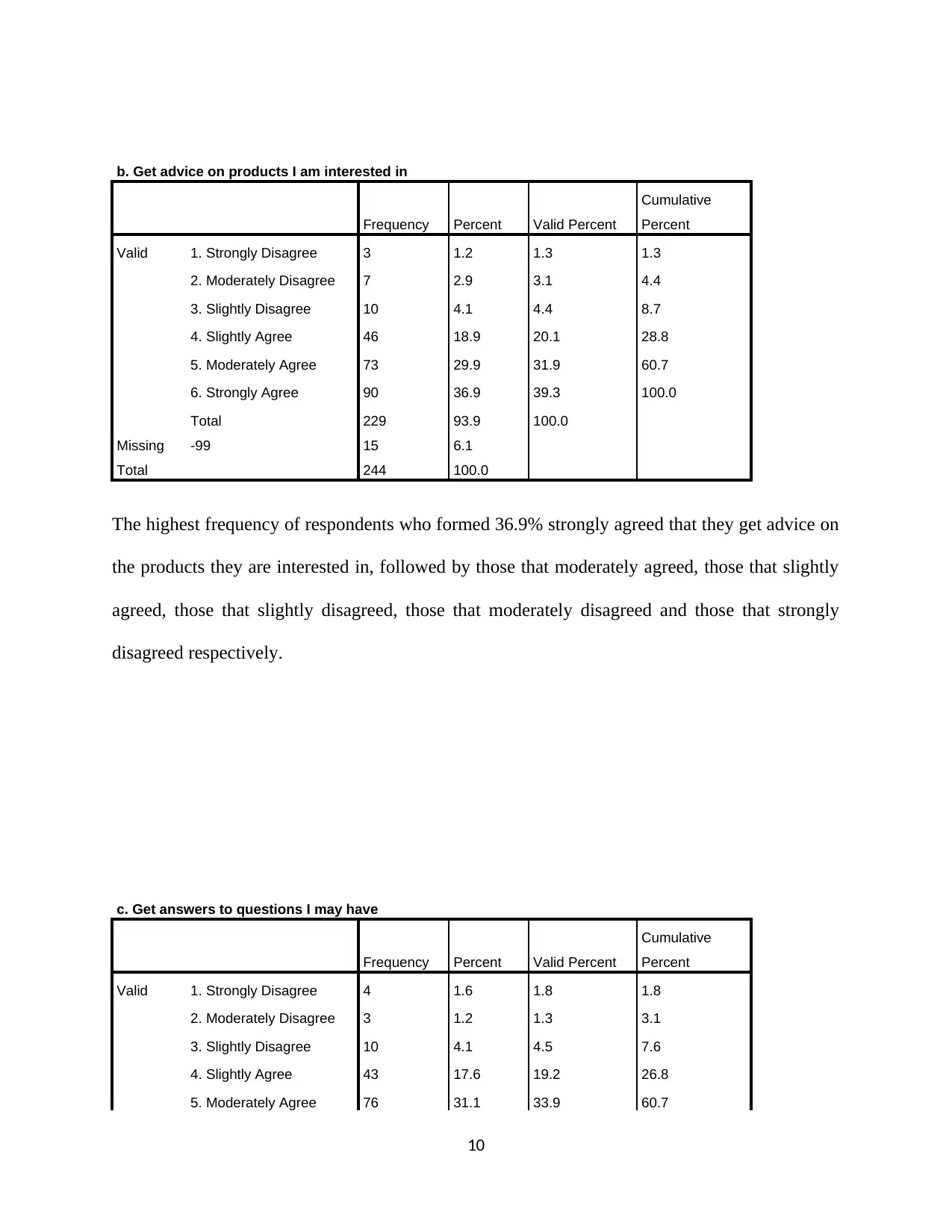

The highest frequency of respondents who formed 36.9% strongly agreed that they get to handle

or try the products, followed by those that moderately agreed, those that slightly agreed, those

that slightly disagreed, those that strongly disagreed and those that moderately disagreed

respectively.

9

I consider the Boat

Show good value for

money?

I found the Boat Show

to be very informative?

I consider the Boat Show good value

for money?

Pearson Correlation 1 .608**

Sig. (2-tailed) .000

N 235 233

I found the Boat Show to be very

informative?

Pearson Correlation .608** 1

Sig. (2-tailed) .000

N 233 235

**. Correlation is significant at the 0.01 level (2-tailed).

The correlation coefficient is 0.608 implying a strong positive relationship between value for

money and being informative of the show.

Reasons why customers enjoy Boat Shows

a. Get to handle or try the products

Frequency Percent Valid Percent

Cumulative

Percent

Valid 1. Strongly Disagree 4 1.6 1.8 1.8

2. Moderately Disagree 3 1.2 1.3 3.1

3. Slightly Disagree 16 6.6 7.1 10.2

4. Slightly Agree 40 16.4 17.8 28.0

5. Moderately Agree 72 29.5 32.0 60.0

6. Strongly Agree 90 36.9 40.0 100.0

Total 225 92.2 100.0

Missing -99 19 7.8

Total 244 100.0

The highest frequency of respondents who formed 36.9% strongly agreed that they get to handle

or try the products, followed by those that moderately agreed, those that slightly agreed, those

that slightly disagreed, those that strongly disagreed and those that moderately disagreed

respectively.

9

b. Get advice on products I am interested in

Frequency Percent Valid Percent

Cumulative

Percent

Valid 1. Strongly Disagree 3 1.2 1.3 1.3

2. Moderately Disagree 7 2.9 3.1 4.4

3. Slightly Disagree 10 4.1 4.4 8.7

4. Slightly Agree 46 18.9 20.1 28.8

5. Moderately Agree 73 29.9 31.9 60.7

6. Strongly Agree 90 36.9 39.3 100.0

Total 229 93.9 100.0

Missing -99 15 6.1

Total 244 100.0

The highest frequency of respondents who formed 36.9% strongly agreed that they get advice on

the products they are interested in, followed by those that moderately agreed, those that slightly

agreed, those that slightly disagreed, those that moderately disagreed and those that strongly

disagreed respectively.

c. Get answers to questions I may have

Frequency Percent Valid Percent

Cumulative

Percent

Valid 1. Strongly Disagree 4 1.6 1.8 1.8

2. Moderately Disagree 3 1.2 1.3 3.1

3. Slightly Disagree 10 4.1 4.5 7.6

4. Slightly Agree 43 17.6 19.2 26.8

5. Moderately Agree 76 31.1 33.9 60.7

10

Frequency Percent Valid Percent

Cumulative

Percent

Valid 1. Strongly Disagree 3 1.2 1.3 1.3

2. Moderately Disagree 7 2.9 3.1 4.4

3. Slightly Disagree 10 4.1 4.4 8.7

4. Slightly Agree 46 18.9 20.1 28.8

5. Moderately Agree 73 29.9 31.9 60.7

6. Strongly Agree 90 36.9 39.3 100.0

Total 229 93.9 100.0

Missing -99 15 6.1

Total 244 100.0

The highest frequency of respondents who formed 36.9% strongly agreed that they get advice on

the products they are interested in, followed by those that moderately agreed, those that slightly

agreed, those that slightly disagreed, those that moderately disagreed and those that strongly

disagreed respectively.

c. Get answers to questions I may have

Frequency Percent Valid Percent

Cumulative

Percent

Valid 1. Strongly Disagree 4 1.6 1.8 1.8

2. Moderately Disagree 3 1.2 1.3 3.1

3. Slightly Disagree 10 4.1 4.5 7.6

4. Slightly Agree 43 17.6 19.2 26.8

5. Moderately Agree 76 31.1 33.9 60.7

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.