BUS105 Computing Assignment: Data Analysis and Financial Concepts

VerifiedAdded on 2020/03/23

|19

|1427

|56

Homework Assignment

AI Summary

This computing assignment, submitted by Azaz Mahmood for BUS105, demonstrates data analysis and statistical techniques across several sections. Section 1 focuses on scatter plots and regression analysis, exploring the relationship between income and annual contribution. Section 2 uses pivot tables to summarize data on investment risk and loss probability, calculating z-scores and p-values to test hypotheses. Section 3 extends this analysis to investment returns. Section 4 investigates confidence intervals for proportions related to changes. Section 5 uses pivot tables to summarize the relationship between gender and average monthly spending. Finally, Section 6 discusses the application of mean and standard deviation in financial contexts, particularly in portfolio formation, emphasizing the importance of risk and return analysis for investment decisions. The assignment utilizes various statistical tools and concepts to analyze different datasets and draw meaningful conclusions.

Bus105 Computing Assignment

Name: Azaz Mahmood

Student Number: 11600096

Allocated Sample: 9

25-Sep-17

Name: Azaz Mahmood

Student Number: 11600096

Allocated Sample: 9

25-Sep-17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 1

Relevant data

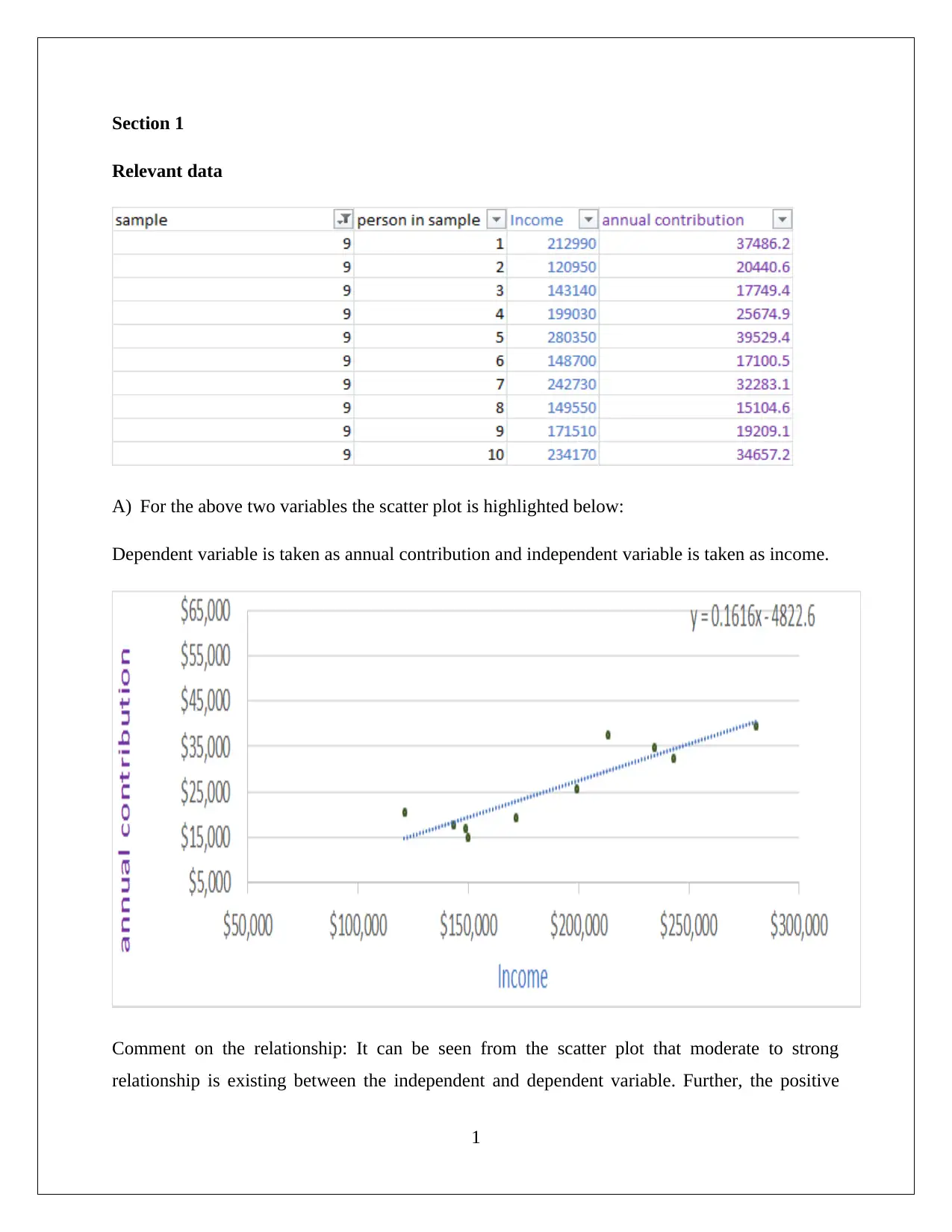

A) For the above two variables the scatter plot is highlighted below:

Dependent variable is taken as annual contribution and independent variable is taken as income.

Comment on the relationship: It can be seen from the scatter plot that moderate to strong

relationship is existing between the independent and dependent variable. Further, the positive

1

Relevant data

A) For the above two variables the scatter plot is highlighted below:

Dependent variable is taken as annual contribution and independent variable is taken as income.

Comment on the relationship: It can be seen from the scatter plot that moderate to strong

relationship is existing between the independent and dependent variable. Further, the positive

1

slope indicates that income and annual contribution is having positive linear relationship, which

means as the income increases the annual contribution would also be increased.

B) From the scatter plot the regression line can be obtained and is shown below:

Y =0.1616 x −4822.6

Representation:

X= dependent variable = Income ($)

Y = independent variable = Annual contribution ($)

The next task is to determine the annual contribution for the income amount (x) of $200,000.

Now,

Y =(0.1616 ×200,000)−4822.6

Y =32320−4822.6

Y =$ 27497.4

Hence, the computed value of annual contribution for income amount $200,000 is $ 27 , 497.4 .

C) Estimation of z score

Given values

Average of estimates μ is $27,000

Standard deviation σ is $2,100

x ( Obtained∈Part B ) =$ 27497.4

Formula for z score

z= ( x −μ

σ )

2

means as the income increases the annual contribution would also be increased.

B) From the scatter plot the regression line can be obtained and is shown below:

Y =0.1616 x −4822.6

Representation:

X= dependent variable = Income ($)

Y = independent variable = Annual contribution ($)

The next task is to determine the annual contribution for the income amount (x) of $200,000.

Now,

Y =(0.1616 ×200,000)−4822.6

Y =32320−4822.6

Y =$ 27497.4

Hence, the computed value of annual contribution for income amount $200,000 is $ 27 , 497.4 .

C) Estimation of z score

Given values

Average of estimates μ is $27,000

Standard deviation σ is $2,100

x ( Obtained∈Part B ) =$ 27497.4

Formula for z score

z= ( x −μ

σ )

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

z= (27497.4−27000

2100 )

z score=0.2368

Hence, the value of z score is computed as 0.2368.

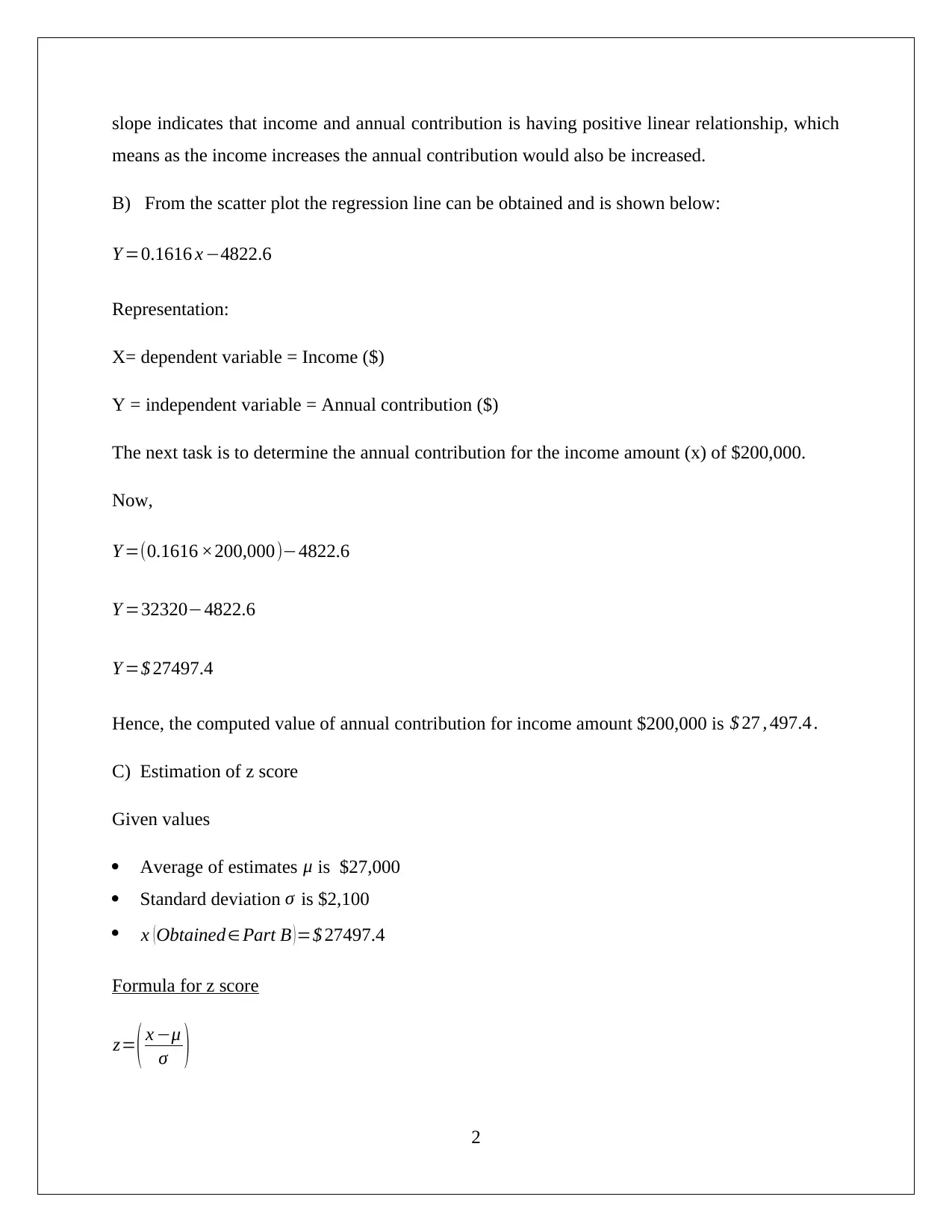

D) By using the given link, the value of P(Z<Z score) i.e. P ( Z <0.2368 ) has been computed and

is shown below:

E) List of estimates = 10,000

Hence,

3

2100 )

z score=0.2368

Hence, the value of z score is computed as 0.2368.

D) By using the given link, the value of P(Z<Z score) i.e. P ( Z <0.2368 ) has been computed and

is shown below:

E) List of estimates = 10,000

Hence,

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Expected rank =P(Z <Z score) ×10000

¿ P(Z< 0.2368)×10000

¿ 0.5935 ×10000

¿ 5936.16

Thus, the expected rank is computed as 5936.16.

Section 2

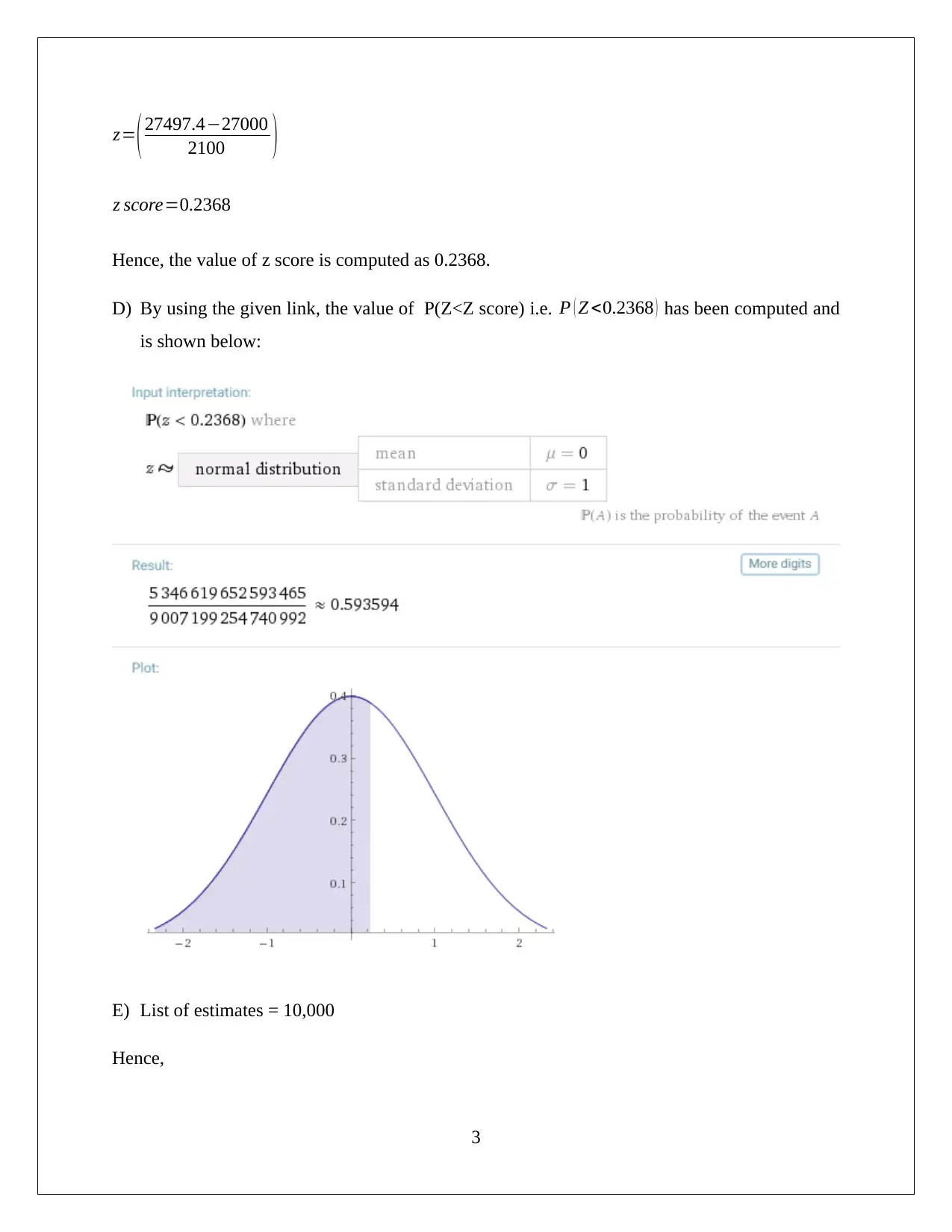

A) Pivot table

For the given data, the numerical summary has been made by using pivot table function of excel.

The pivot table output is highlighted below:

Risk level – R (Represents that the investment is a type of high risk investment (riskier))

- S (Represents that the investment is a type of low risk investment (safer))

Computation

Sample size of high risk investment n1=78

Proportion of high risk investment that would result loss P1=14 /78=0.1794

Sample size of low risk investment ¿ 22

4

¿ P(Z< 0.2368)×10000

¿ 0.5935 ×10000

¿ 5936.16

Thus, the expected rank is computed as 5936.16.

Section 2

A) Pivot table

For the given data, the numerical summary has been made by using pivot table function of excel.

The pivot table output is highlighted below:

Risk level – R (Represents that the investment is a type of high risk investment (riskier))

- S (Represents that the investment is a type of low risk investment (safer))

Computation

Sample size of high risk investment n1=78

Proportion of high risk investment that would result loss P1=14 /78=0.1794

Sample size of low risk investment ¿ 22

4

Proportion of low risk investment that would result loss P2=4 /22=0.1818

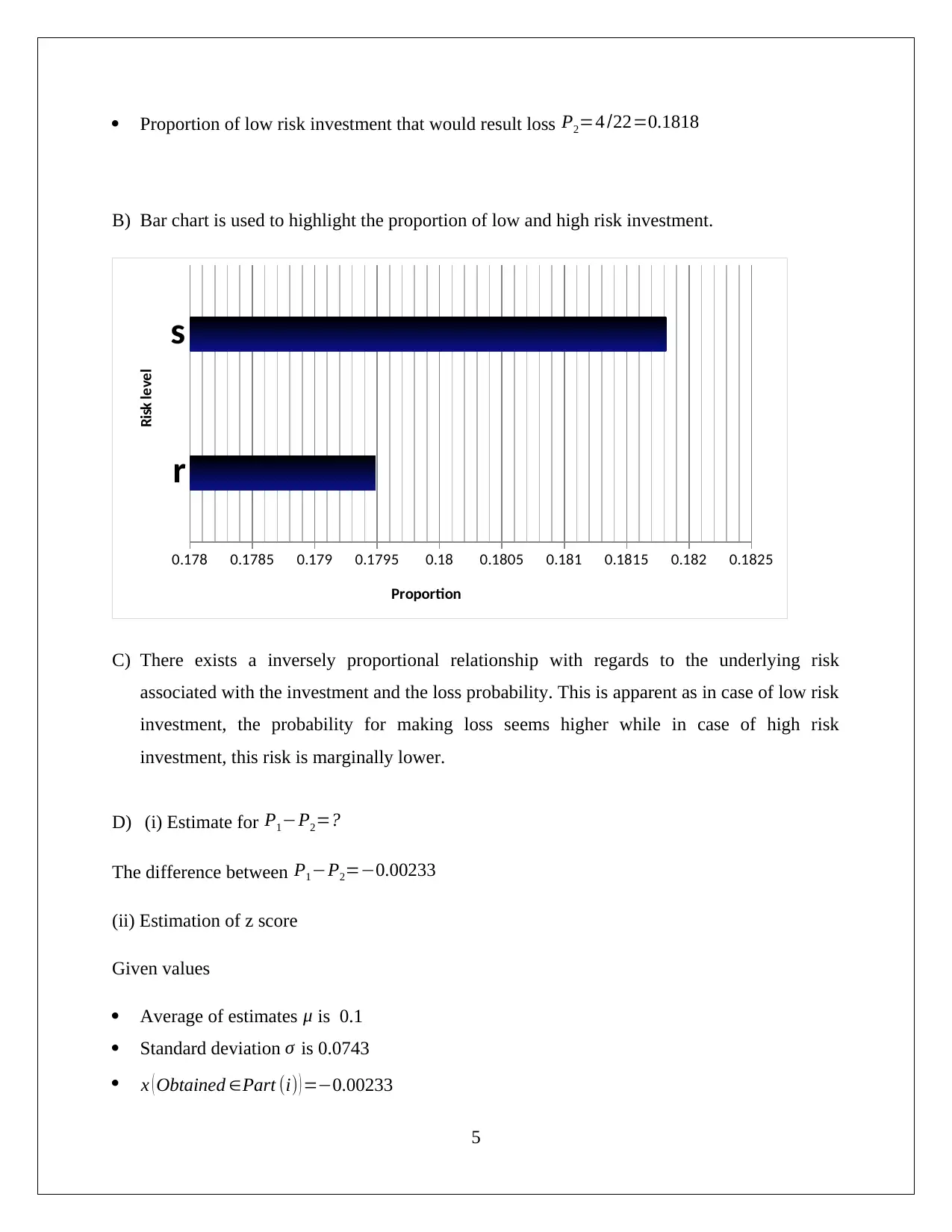

B) Bar chart is used to highlight the proportion of low and high risk investment.

r

s

0.178 0.1785 0.179 0.1795 0.18 0.1805 0.181 0.1815 0.182 0.1825

Proportion

Risk level

C) There exists a inversely proportional relationship with regards to the underlying risk

associated with the investment and the loss probability. This is apparent as in case of low risk

investment, the probability for making loss seems higher while in case of high risk

investment, this risk is marginally lower.

D) (i) Estimate for P1−P2=?

The difference between P1−P2=−0.00233

(ii) Estimation of z score

Given values

Average of estimates μ is 0.1

Standard deviation σ is 0.0743

x ( Obtained ∈Part (i) ) =−0.00233

5

B) Bar chart is used to highlight the proportion of low and high risk investment.

r

s

0.178 0.1785 0.179 0.1795 0.18 0.1805 0.181 0.1815 0.182 0.1825

Proportion

Risk level

C) There exists a inversely proportional relationship with regards to the underlying risk

associated with the investment and the loss probability. This is apparent as in case of low risk

investment, the probability for making loss seems higher while in case of high risk

investment, this risk is marginally lower.

D) (i) Estimate for P1−P2=?

The difference between P1−P2=−0.00233

(ii) Estimation of z score

Given values

Average of estimates μ is 0.1

Standard deviation σ is 0.0743

x ( Obtained ∈Part (i) ) =−0.00233

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Formula for z score

z= ( x −μ

σ )

z= ( −0.00233−0.1

0.0743 )

z score=−1.377

Hence, the value of z score is computed as -1.377.

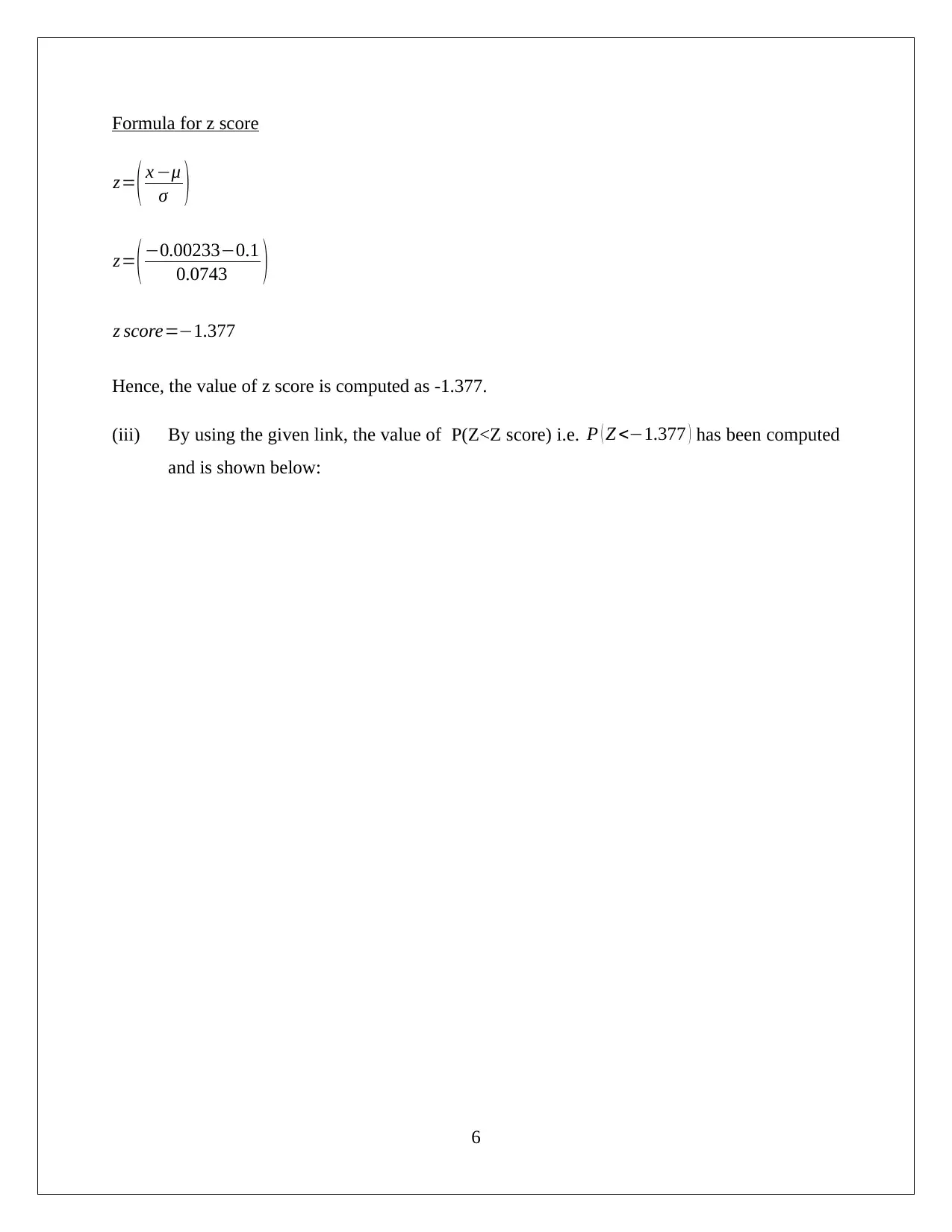

(iii) By using the given link, the value of P(Z<Z score) i.e. P ( Z <−1.377 ) has been computed

and is shown below:

6

z= ( x −μ

σ )

z= ( −0.00233−0.1

0.0743 )

z score=−1.377

Hence, the value of z score is computed as -1.377.

(iii) By using the given link, the value of P(Z<Z score) i.e. P ( Z <−1.377 ) has been computed

and is shown below:

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

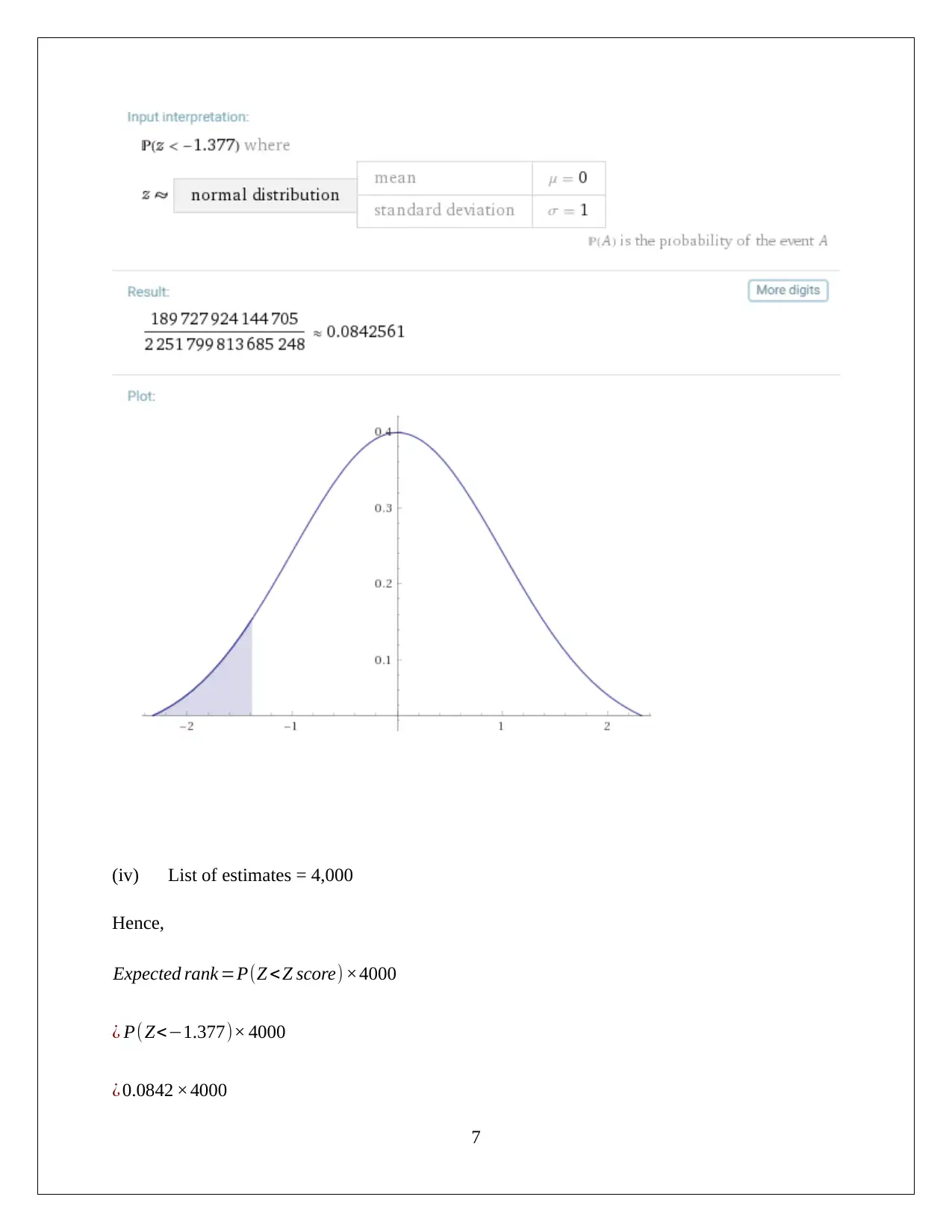

(iv) List of estimates = 4,000

Hence,

Expected rank =P(Z <Z score) ×4000

¿ P(Z<−1.377)× 4000

¿ 0.0842 ×4000

7

Hence,

Expected rank =P(Z <Z score) ×4000

¿ P(Z<−1.377)× 4000

¿ 0.0842 ×4000

7

¿ 336.85

Thus, the expected rank is computed as 336.85.

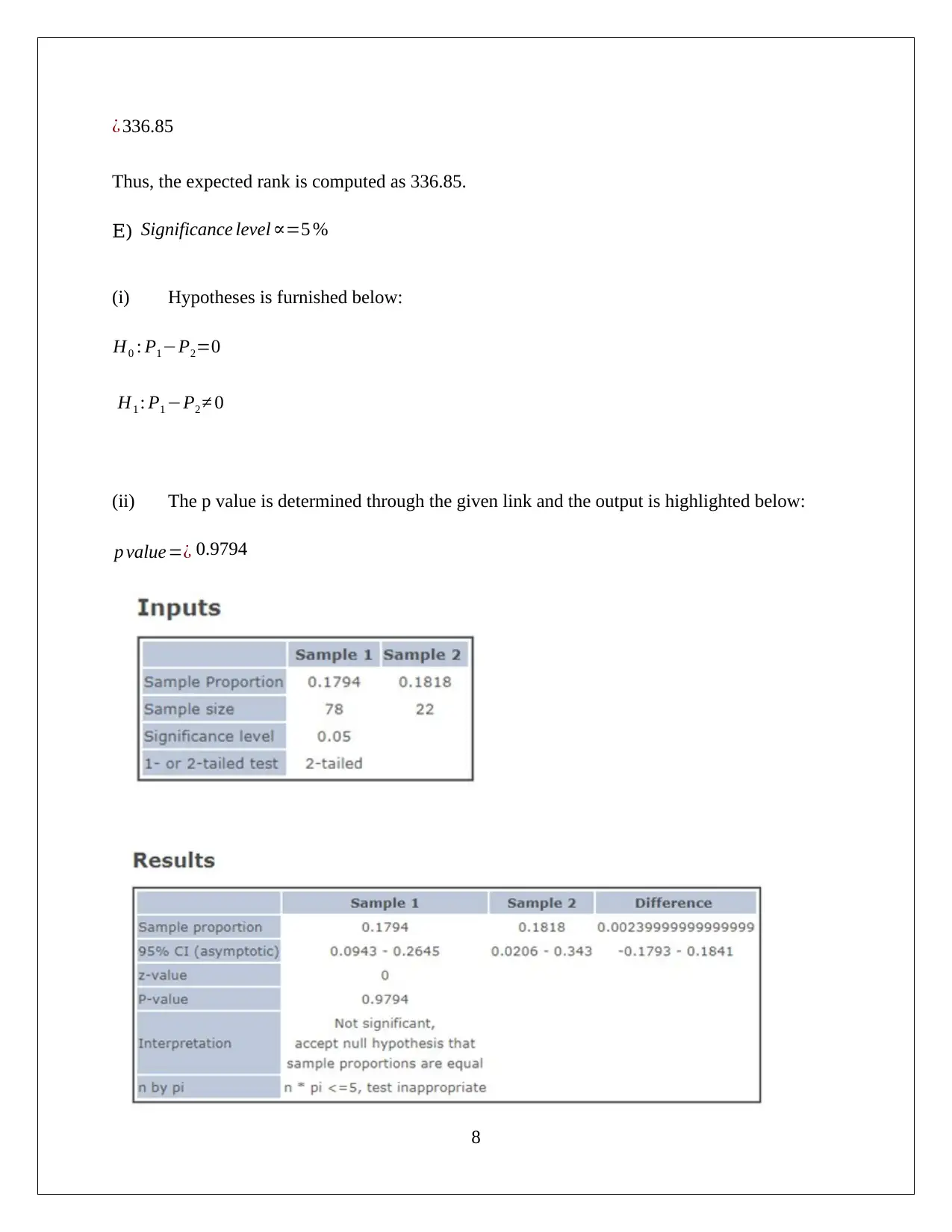

E) Significance level ∝=5 %

(i) Hypotheses is furnished below:

H0 : P1−P2=0

H1 : P1 −P2 ≠ 0

(ii) The p value is determined through the given link and the output is highlighted below:

p value=¿ 0.9794

8

Thus, the expected rank is computed as 336.85.

E) Significance level ∝=5 %

(i) Hypotheses is furnished below:

H0 : P1−P2=0

H1 : P1 −P2 ≠ 0

(ii) The p value is determined through the given link and the output is highlighted below:

p value=¿ 0.9794

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(iii) The p value being more in magnitude as compared to significance level is indicative of

the absence of requisite statistical evidence for causing null hypothesis rejection. As a

result, there would not be acceptance of alternative hypothesis.

(iv) A logical conclusion that can be drawn from the above output is that there is absence of

any significant difference in the loss probability associated with the investment risk.

Hence, investment risk and loss making probability appear to be independent of each

other.

Section 3

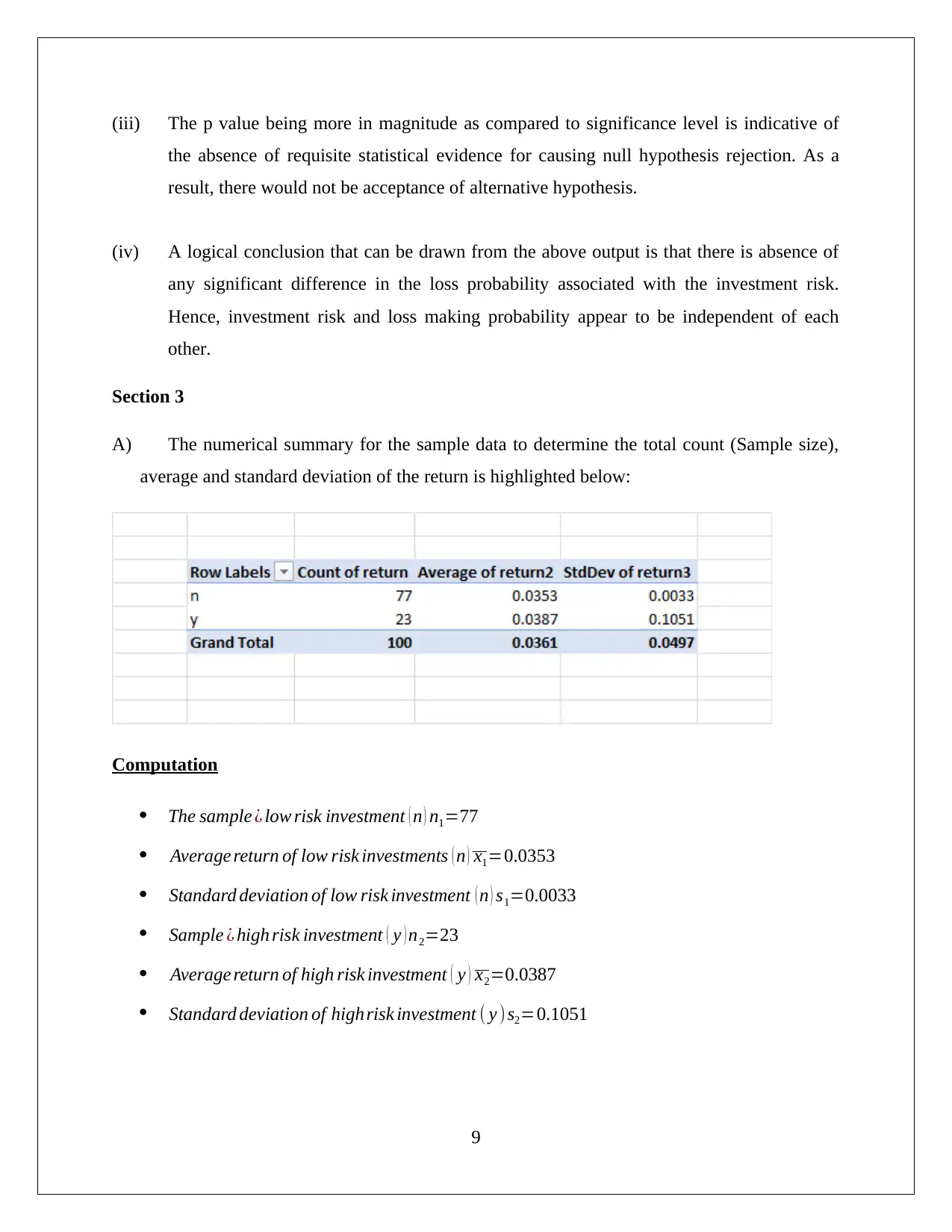

A) The numerical summary for the sample data to determine the total count (Sample size),

average and standard deviation of the return is highlighted below:

Computation

The sample ¿ low risk investment ( n ) n1=77

Average return of low risk investments ( n ) x1=0.0353

Standard deviation of low risk investment ( n ) s1=0.0033

Sample ¿ high risk investment ( y ) n2=23

Average return of high risk investment ( y ) x2=0.0387

Standard deviation of highrisk investment ( y )s2=0.1051

9

the absence of requisite statistical evidence for causing null hypothesis rejection. As a

result, there would not be acceptance of alternative hypothesis.

(iv) A logical conclusion that can be drawn from the above output is that there is absence of

any significant difference in the loss probability associated with the investment risk.

Hence, investment risk and loss making probability appear to be independent of each

other.

Section 3

A) The numerical summary for the sample data to determine the total count (Sample size),

average and standard deviation of the return is highlighted below:

Computation

The sample ¿ low risk investment ( n ) n1=77

Average return of low risk investments ( n ) x1=0.0353

Standard deviation of low risk investment ( n ) s1=0.0033

Sample ¿ high risk investment ( y ) n2=23

Average return of high risk investment ( y ) x2=0.0387

Standard deviation of highrisk investment ( y )s2=0.1051

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

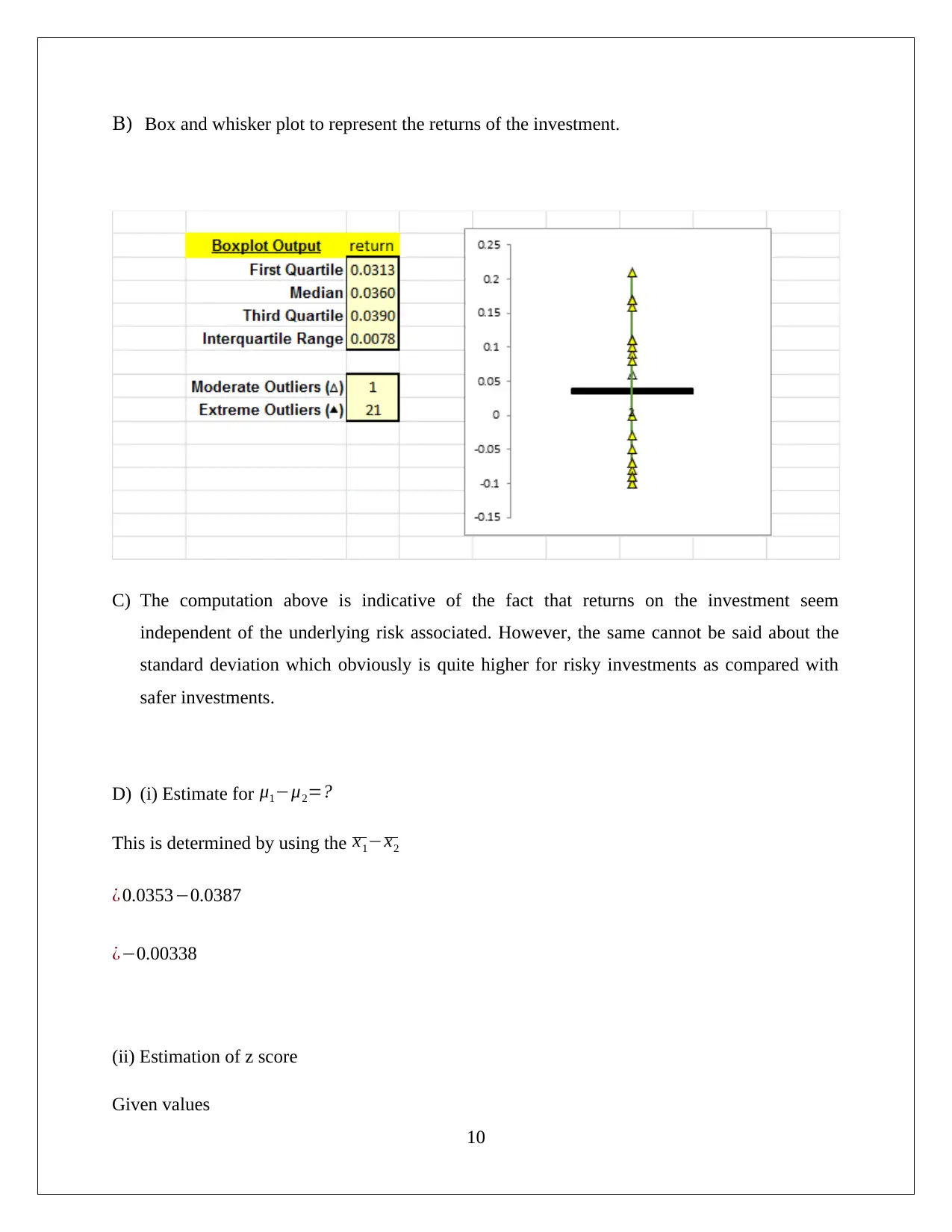

B) Box and whisker plot to represent the returns of the investment.

C) The computation above is indicative of the fact that returns on the investment seem

independent of the underlying risk associated. However, the same cannot be said about the

standard deviation which obviously is quite higher for risky investments as compared with

safer investments.

D) (i) Estimate for μ1−μ2=?

This is determined by using the x1−x2

¿ 0.0353−0.0387

¿−0.00338

(ii) Estimation of z score

Given values

10

C) The computation above is indicative of the fact that returns on the investment seem

independent of the underlying risk associated. However, the same cannot be said about the

standard deviation which obviously is quite higher for risky investments as compared with

safer investments.

D) (i) Estimate for μ1−μ2=?

This is determined by using the x1−x2

¿ 0.0353−0.0387

¿−0.00338

(ii) Estimation of z score

Given values

10

Average of estimates μ is -0.0256

Standard deviation σ is 0.0173

x ( Obtained ∈Part (i) ) =−0.00338

Formula for z score

z= ( x −μ

σ )

z= ( −0.00338−−0.0256

0.0173 )

z score=−1.6753

Hence, the value of z score is computed as −1.6753

(iii) By using the given link, the value of P(Z<Z score) i.e. P ( Z <−1.6753 ) has been

computed and is shown below:

11

Standard deviation σ is 0.0173

x ( Obtained ∈Part (i) ) =−0.00338

Formula for z score

z= ( x −μ

σ )

z= ( −0.00338−−0.0256

0.0173 )

z score=−1.6753

Hence, the value of z score is computed as −1.6753

(iii) By using the given link, the value of P(Z<Z score) i.e. P ( Z <−1.6753 ) has been

computed and is shown below:

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.