Business Accounting: Using Break-Even & Ratio Analysis for Business

VerifiedAdded on 2024/04/25

|19

|2820

|487

Report

AI Summary

This report provides a comprehensive analysis of key business accounting concepts. It begins with an exploration of break-even analysis, demonstrating its use in justifying business project decisions with a practical example of XYZ Ltd. and its housing complex project, including calculations for the breakeven point and margin of safety. The report then evaluates business decisions using management costing techniques such as activity-based costing, cost-volume-profit analysis, variance analysis, and make-or-buy decisions. Furthermore, it discusses the significance of final accounts to various stakeholders, including owners, managers, employees, government, customers, suppliers, shareholders, and investors, highlighting how these accounts inform their respective decisions. Finally, the report evaluates the financial state of a business through ratio analysis, using the example of Restaurant Group Plc to illustrate the application of efficiency and liquidity ratios in assessing financial performance. The document is contributed by a student and available on Desklib, a platform offering AI-based study tools and solved assignments.

BUSINESS ACCOUNTING

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

LO1. Knowing how to use break-even analysis as an assistance for business planning.................3

1.1 Using break-even analysis for the justification of a decision about a business project.............3

LO2. Understanding costing............................................................................................................5

2.1 Evaluation of a business decision using the techniques of management costing......................5

LO3. Understanding the significance of final accounts of a business.............................................7

3.1 Discussion of the reasons for the importance of final accounts to the stakeholders of a

business............................................................................................................................................7

LO4. Understanding ratio analysis..................................................................................................9

4.1 Evaluation of the financial state of a business through the application of the techniques of

ratio analysis....................................................................................................................................9

Reference list.................................................................................................................................14

Appendix........................................................................................................................................15

2

LO1. Knowing how to use break-even analysis as an assistance for business planning.................3

1.1 Using break-even analysis for the justification of a decision about a business project.............3

LO2. Understanding costing............................................................................................................5

2.1 Evaluation of a business decision using the techniques of management costing......................5

LO3. Understanding the significance of final accounts of a business.............................................7

3.1 Discussion of the reasons for the importance of final accounts to the stakeholders of a

business............................................................................................................................................7

LO4. Understanding ratio analysis..................................................................................................9

4.1 Evaluation of the financial state of a business through the application of the techniques of

ratio analysis....................................................................................................................................9

Reference list.................................................................................................................................14

Appendix........................................................................................................................................15

2

LO1. Knowing how to use break-even analysis as an assistance for business planning

1.1 Using break-even analysis for the justification of a decision about a business project

Breakeven analysis is a technique in economics that involves the examination and computation

of the “margin of safety” of a company based on the associated costs and revenues collected by

the company (Richards, 2013). Through the analysis of the various price levels of a company

related to its various levels of demand, the company uses the breakeven analysis for determining

the level of sales required for covering the sum of all the fixed costs of the company. The

breakeven analysis helps a company in deriving a point at which the sales made or the revenues

earned by a company are equal to the costs spent by the company for production of goods.

The breakeven analysis plays an important role in decision-making (Drury, 2013). It especially

helps in the determination of the minimum sales that must be exceeded in order to make profit

from the business project. The breakeven analysis is useful for decision-making in a business

project as it helps in setting selling prices, management of costs and planning for profits. For

example, XYZ Ltd. Company wants to invest in a project of building a housing complex. The

investment for building a hotel is huge and thus the company requires effective decision-making

in order to find out whether project should be undertaken or not. The decision-making of this

project can be evaluated from the breakeven analysis in the following way –

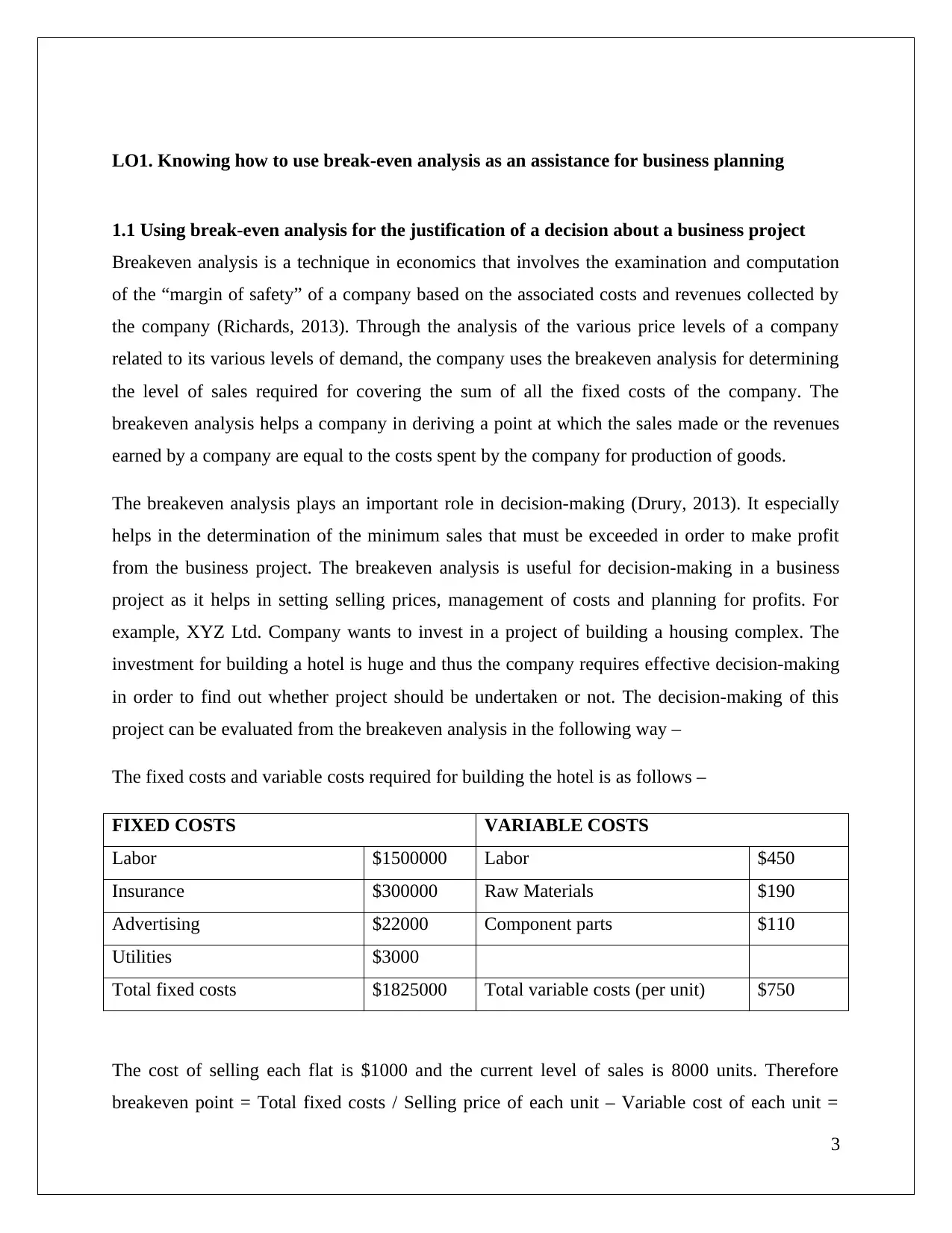

The fixed costs and variable costs required for building the hotel is as follows –

FIXED COSTS VARIABLE COSTS

Labor $1500000 Labor $450

Insurance $300000 Raw Materials $190

Advertising $22000 Component parts $110

Utilities $3000

Total fixed costs $1825000 Total variable costs (per unit) $750

The cost of selling each flat is $1000 and the current level of sales is 8000 units. Therefore

breakeven point = Total fixed costs / Selling price of each unit – Variable cost of each unit =

3

1.1 Using break-even analysis for the justification of a decision about a business project

Breakeven analysis is a technique in economics that involves the examination and computation

of the “margin of safety” of a company based on the associated costs and revenues collected by

the company (Richards, 2013). Through the analysis of the various price levels of a company

related to its various levels of demand, the company uses the breakeven analysis for determining

the level of sales required for covering the sum of all the fixed costs of the company. The

breakeven analysis helps a company in deriving a point at which the sales made or the revenues

earned by a company are equal to the costs spent by the company for production of goods.

The breakeven analysis plays an important role in decision-making (Drury, 2013). It especially

helps in the determination of the minimum sales that must be exceeded in order to make profit

from the business project. The breakeven analysis is useful for decision-making in a business

project as it helps in setting selling prices, management of costs and planning for profits. For

example, XYZ Ltd. Company wants to invest in a project of building a housing complex. The

investment for building a hotel is huge and thus the company requires effective decision-making

in order to find out whether project should be undertaken or not. The decision-making of this

project can be evaluated from the breakeven analysis in the following way –

The fixed costs and variable costs required for building the hotel is as follows –

FIXED COSTS VARIABLE COSTS

Labor $1500000 Labor $450

Insurance $300000 Raw Materials $190

Advertising $22000 Component parts $110

Utilities $3000

Total fixed costs $1825000 Total variable costs (per unit) $750

The cost of selling each flat is $1000 and the current level of sales is 8000 units. Therefore

breakeven point = Total fixed costs / Selling price of each unit – Variable cost of each unit =

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

$1825000 / $1000 – $750 = 7300 units. Therefore, XYZ Ltd. requires selling 7300 units of flats

in the housing complex in order to reach a point where the costs spent for the project will be

equal to the revenues of the project. According to this analysis, the company can take decisions

regarding setting selling prices, management of costs and planning for profits. According to

Bodie et al. (2014), the risks of the company for undertaking the project can also be derived from

the breakeven analysis through the derivation of the MOS or the margin of safety of the project

with the following formula – MOS = (Current level of sales – Breakeven point / Current level of

sales) * 100

Thus, MOS of XYZ Ltd. = (8000 – 7300 / 8000) * 100 = 8.75%

This shows that the present level of sales of XYZ Ltd. can fall up to a percentage of 8.75 from

the present sales level. However, if the sales of the business project fall by more than 8.75%, it

can of great risks for the company. In this way, breakeven analysis helps a company in effective

decision-making related to a business project.

4

in the housing complex in order to reach a point where the costs spent for the project will be

equal to the revenues of the project. According to this analysis, the company can take decisions

regarding setting selling prices, management of costs and planning for profits. According to

Bodie et al. (2014), the risks of the company for undertaking the project can also be derived from

the breakeven analysis through the derivation of the MOS or the margin of safety of the project

with the following formula – MOS = (Current level of sales – Breakeven point / Current level of

sales) * 100

Thus, MOS of XYZ Ltd. = (8000 – 7300 / 8000) * 100 = 8.75%

This shows that the present level of sales of XYZ Ltd. can fall up to a percentage of 8.75 from

the present sales level. However, if the sales of the business project fall by more than 8.75%, it

can of great risks for the company. In this way, breakeven analysis helps a company in effective

decision-making related to a business project.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LO2. Understanding costing

2.1 Evaluation of a business decision using the techniques of management costing

It is important for every organization to choose and adopt the correct techniques for decision-

making in the organization. The techniques used for decision-making directly impact the

financial performance and stability of a company. Any wrong decision taken by a company can

have an adverse effect on the company. The adoption of different management costing

techniques assists an organization in decision-making. The various techniques of management

costing useful for business decision-making are as follows –

Activity based costing – Activity based costing is a management costing technique,

which identifies different activities going on within an enterprise and assigns costs

required by the enterprise for completing those activities (Stefano and Casarotto Filho,

2013). This technique helps in effective decision-making in a company for the

assignment of indirect costs to goods as well as services, and help in deciding the way in

which resources are going to be allocated for different activities in a company. It also

assists a company in making decisions on production, what to produce, in what quantity

to be produced, costs to be spent for production, etc.

Cost volume profit (CVP) analysis – The CVP analysis refers to the analysis used for the

derivation of the effect on an enterprise’s operating and net earnings due to changes in

the costs incurred and volumes produced by the enterprise (Santos Almada et al., 2016).

This management costing technique helps an enterprise in making cost effective as well

as smart decisions related to the enterprise. It is most useful for making short-term

decisions of a company through the analysis of costs, volumes and profits.

Variance analysis – Variance analysis is another technique that is adopted by companies

for quantitative evaluation of the difference between the actual behavior or actual

outcome of a company to the budgeted, planned or estimated behavior and outcome of

the company (Levy, 2015). Variance analysis helps a company in deriving variances in

different factors such as material variance, overhead variance, labor variance, etc., which

in turn helps in increasing the effectiveness of decision-making. Through this analysis,

5

2.1 Evaluation of a business decision using the techniques of management costing

It is important for every organization to choose and adopt the correct techniques for decision-

making in the organization. The techniques used for decision-making directly impact the

financial performance and stability of a company. Any wrong decision taken by a company can

have an adverse effect on the company. The adoption of different management costing

techniques assists an organization in decision-making. The various techniques of management

costing useful for business decision-making are as follows –

Activity based costing – Activity based costing is a management costing technique,

which identifies different activities going on within an enterprise and assigns costs

required by the enterprise for completing those activities (Stefano and Casarotto Filho,

2013). This technique helps in effective decision-making in a company for the

assignment of indirect costs to goods as well as services, and help in deciding the way in

which resources are going to be allocated for different activities in a company. It also

assists a company in making decisions on production, what to produce, in what quantity

to be produced, costs to be spent for production, etc.

Cost volume profit (CVP) analysis – The CVP analysis refers to the analysis used for the

derivation of the effect on an enterprise’s operating and net earnings due to changes in

the costs incurred and volumes produced by the enterprise (Santos Almada et al., 2016).

This management costing technique helps an enterprise in making cost effective as well

as smart decisions related to the enterprise. It is most useful for making short-term

decisions of a company through the analysis of costs, volumes and profits.

Variance analysis – Variance analysis is another technique that is adopted by companies

for quantitative evaluation of the difference between the actual behavior or actual

outcome of a company to the budgeted, planned or estimated behavior and outcome of

the company (Levy, 2015). Variance analysis helps a company in deriving variances in

different factors such as material variance, overhead variance, labor variance, etc., which

in turn helps in increasing the effectiveness of decision-making. Through this analysis,

5

an enterprise can make effective decisions for overcoming the variance in the

enterprise’s performance.

Make or Buy decision – The make or buy decision is a simple management costing

technique that involves the selection of one option between two, which are in-house

manufacture of products and purchase of finished goods from external suppliers

(Narasimhan, 2017). This technique helps an organization in deciding whether the

organization is going to manufacture the products and services it is going to sell or is

going to depend on external suppliers for buying finished goods for sale.

Except for the above techniques, there are many other management costing techniques such as

just in time (JIT), budgeting, enterprise cost management, inventory management, etc., which

also help in effective decision-making of a company (Potts and Ankrah, 2014).

6

enterprise’s performance.

Make or Buy decision – The make or buy decision is a simple management costing

technique that involves the selection of one option between two, which are in-house

manufacture of products and purchase of finished goods from external suppliers

(Narasimhan, 2017). This technique helps an organization in deciding whether the

organization is going to manufacture the products and services it is going to sell or is

going to depend on external suppliers for buying finished goods for sale.

Except for the above techniques, there are many other management costing techniques such as

just in time (JIT), budgeting, enterprise cost management, inventory management, etc., which

also help in effective decision-making of a company (Potts and Ankrah, 2014).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

LO3. Understanding the significance of final accounts of a business

3.1 Discussion of the reasons for the importance of final accounts to the stakeholders of a

business

The final accounts refer to the financial reports and statements prepared by an entity that gives

the idea of the present financial performance and position of the entity (Burrows, 2016). Final

accounts are important for a business, as it gives the idea about the profitability and financial

position of the business to its stakeholders such as investors, shareholders, customers, owners,

supplier, government, managers, employees, etc. (Lawrence and Weber, 2014). The decision-

making of stakeholders are dependent on the final accounts prepared by a company. It is also

used for many other purposes. According to Mitchell et al. (2015), the importance of a

company’s final accounts to the stakeholders of the company is the following –

A company’s owner uses the final accounts of the company for determining the way in

which the owner’s personal drawings affects the business. The owner also refers to the

final accounts for decision-making related to the projects of the company, the sources of

funding for the company, etc.

The managers and directors in a company also make different decisions in the company

by referring to the final accounts of the company. They also evaluate the investment

opportunities, long-term financial health and annual bonuses of the company.

The employees decide to continue working in a company in future depending on the

condition of operations and financial position of the company. Final accounts help

employees in analyzing whether the company in which they are working is secure or

insecure for working.

The government and the tax authorities use the final accounts of a company for analyzing

whether the company is paying proper taxes or not. This is common mostly in case of

public limited companies and large multinational corporations.

The consumers or customers of an organization examine the dependability of a company

through the analysis of the final accounts of the company. Customers use the final

7

3.1 Discussion of the reasons for the importance of final accounts to the stakeholders of a

business

The final accounts refer to the financial reports and statements prepared by an entity that gives

the idea of the present financial performance and position of the entity (Burrows, 2016). Final

accounts are important for a business, as it gives the idea about the profitability and financial

position of the business to its stakeholders such as investors, shareholders, customers, owners,

supplier, government, managers, employees, etc. (Lawrence and Weber, 2014). The decision-

making of stakeholders are dependent on the final accounts prepared by a company. It is also

used for many other purposes. According to Mitchell et al. (2015), the importance of a

company’s final accounts to the stakeholders of the company is the following –

A company’s owner uses the final accounts of the company for determining the way in

which the owner’s personal drawings affects the business. The owner also refers to the

final accounts for decision-making related to the projects of the company, the sources of

funding for the company, etc.

The managers and directors in a company also make different decisions in the company

by referring to the final accounts of the company. They also evaluate the investment

opportunities, long-term financial health and annual bonuses of the company.

The employees decide to continue working in a company in future depending on the

condition of operations and financial position of the company. Final accounts help

employees in analyzing whether the company in which they are working is secure or

insecure for working.

The government and the tax authorities use the final accounts of a company for analyzing

whether the company is paying proper taxes or not. This is common mostly in case of

public limited companies and large multinational corporations.

The consumers or customers of an organization examine the dependability of a company

through the analysis of the final accounts of the company. Customers use the final

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

accounts of a company for promoting the company and maintaining their loyalty to the

company.

The rival companies use final accounts of a company for comparing the financial

performance of their own companies with the rival company. They also use final

accounts of an enterprise to find the chances of partnership or joint ventures with the

enterprise.

Suppliers analyze final accounts of a company to which they supply materials for

analyzing whether the company can prove to be a bad debtor for the supplier or not.

Shareholders use final accounts of a company to measure whether the investment

decisions made by them to invest in the shares of the company are correct or not.

Investors use final accounts of a company to analyze whether investing in the company

will be beneficial for them or not.

Lastly, the special interest groups in the business environment of a company use final

accounts of the company to examine whether the company is undertaking any unethical

act or not.

Thus, from the above points, it is clear that different stakeholders use final accounts for different

purposes and the importance of final accounts to stakeholders is huge.

8

company.

The rival companies use final accounts of a company for comparing the financial

performance of their own companies with the rival company. They also use final

accounts of an enterprise to find the chances of partnership or joint ventures with the

enterprise.

Suppliers analyze final accounts of a company to which they supply materials for

analyzing whether the company can prove to be a bad debtor for the supplier or not.

Shareholders use final accounts of a company to measure whether the investment

decisions made by them to invest in the shares of the company are correct or not.

Investors use final accounts of a company to analyze whether investing in the company

will be beneficial for them or not.

Lastly, the special interest groups in the business environment of a company use final

accounts of the company to examine whether the company is undertaking any unethical

act or not.

Thus, from the above points, it is clear that different stakeholders use final accounts for different

purposes and the importance of final accounts to stakeholders is huge.

8

LO4. Understanding ratio analysis

4.1 Evaluation of the financial state of a business through the application of the techniques

of ratio analysis

Ratio analysis refers to a quantitative measure and analysis of the information present in the

financial statements of an enterprise (Uechi et al., 2015). This analysis is used for evaluating the

different aspects of an enterprise such as profitability, efficiency, solvency and liquidity, which

help in reviewing the financial performance of the enterprise. The techniques used in ratio

analysis refer to the different financial ratios that can be computed through the techniques.

The way in which the financial state of a business or organization can be evaluated through the

application of ratio analysis techniques can be understood through the evaluation of a few

profitability, efficiency, solvency and liquidity of a company. For example, if the financial

statement of Restaurant Group Plc is evaluated, the financial state of the company can be

analyzed through the application of ratio analysis techniques in the following way –

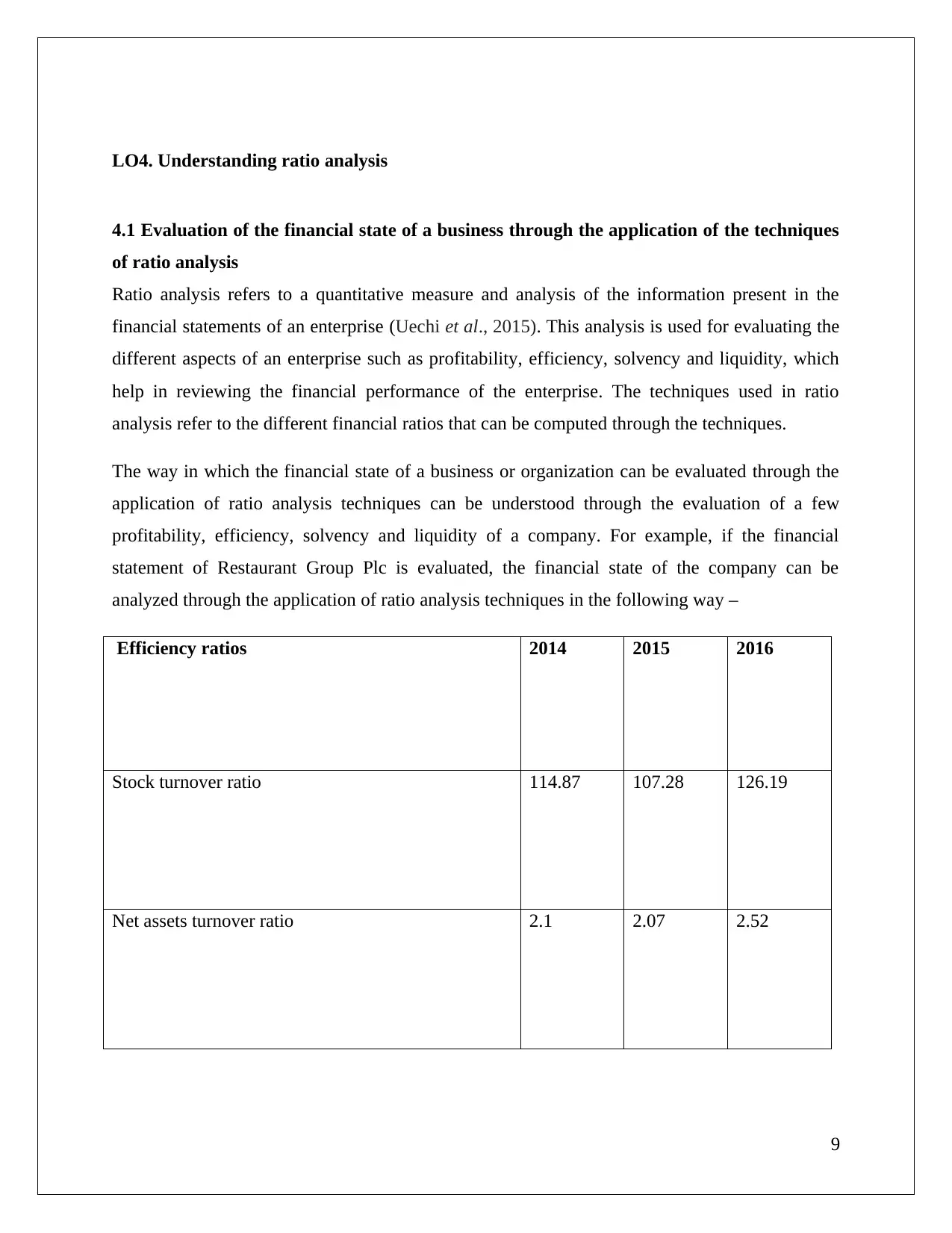

Efficiency ratios 2014 2015 2016

Stock turnover ratio 114.87 107.28 126.19

Net assets turnover ratio 2.1 2.07 2.52

9

4.1 Evaluation of the financial state of a business through the application of the techniques

of ratio analysis

Ratio analysis refers to a quantitative measure and analysis of the information present in the

financial statements of an enterprise (Uechi et al., 2015). This analysis is used for evaluating the

different aspects of an enterprise such as profitability, efficiency, solvency and liquidity, which

help in reviewing the financial performance of the enterprise. The techniques used in ratio

analysis refer to the different financial ratios that can be computed through the techniques.

The way in which the financial state of a business or organization can be evaluated through the

application of ratio analysis techniques can be understood through the evaluation of a few

profitability, efficiency, solvency and liquidity of a company. For example, if the financial

statement of Restaurant Group Plc is evaluated, the financial state of the company can be

analyzed through the application of ratio analysis techniques in the following way –

Efficiency ratios 2014 2015 2016

Stock turnover ratio 114.87 107.28 126.19

Net assets turnover ratio 2.1 2.07 2.52

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2016 2015 2014

0

20

40

60

80

100

120

140

Stock turnover ratio

Net assets turnover ratio

The evaluation of the efficiency ratios of Restaurant Group Plc shows that the stock turnover

ratio of the company has been fluctuating during the last three years but the ratio has been high

in all the three years, indicating good efficiency of the company’s inventories. Similarly, if the

net asset ratio of the company is evaluated, it can be seen that the ratio has gradually increased in

the last three years. However, it is not enough for the company to have a good financial

performance.

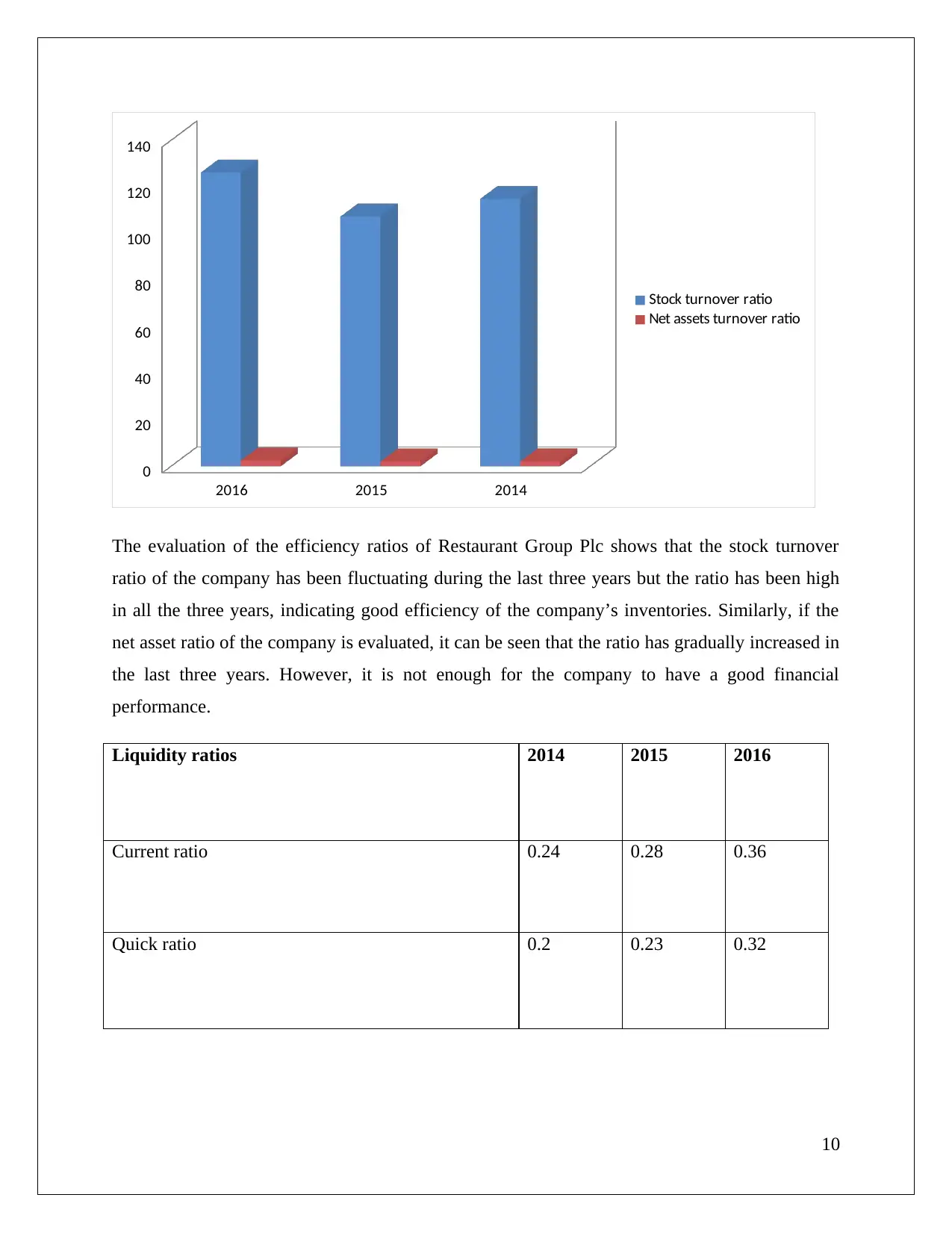

Liquidity ratios 2014 2015 2016

Current ratio 0.24 0.28 0.36

Quick ratio 0.2 0.23 0.32

10

0

20

40

60

80

100

120

140

Stock turnover ratio

Net assets turnover ratio

The evaluation of the efficiency ratios of Restaurant Group Plc shows that the stock turnover

ratio of the company has been fluctuating during the last three years but the ratio has been high

in all the three years, indicating good efficiency of the company’s inventories. Similarly, if the

net asset ratio of the company is evaluated, it can be seen that the ratio has gradually increased in

the last three years. However, it is not enough for the company to have a good financial

performance.

Liquidity ratios 2014 2015 2016

Current ratio 0.24 0.28 0.36

Quick ratio 0.2 0.23 0.32

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2016 2015 2014

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

Current ratio

Quick ratio

The analysis of both the quick and current ratio of the company shows the two ratios have

gradually increased from 2014 to 2016. However, both the ratios are quite low, thus indicating

poor liquidity of the company.

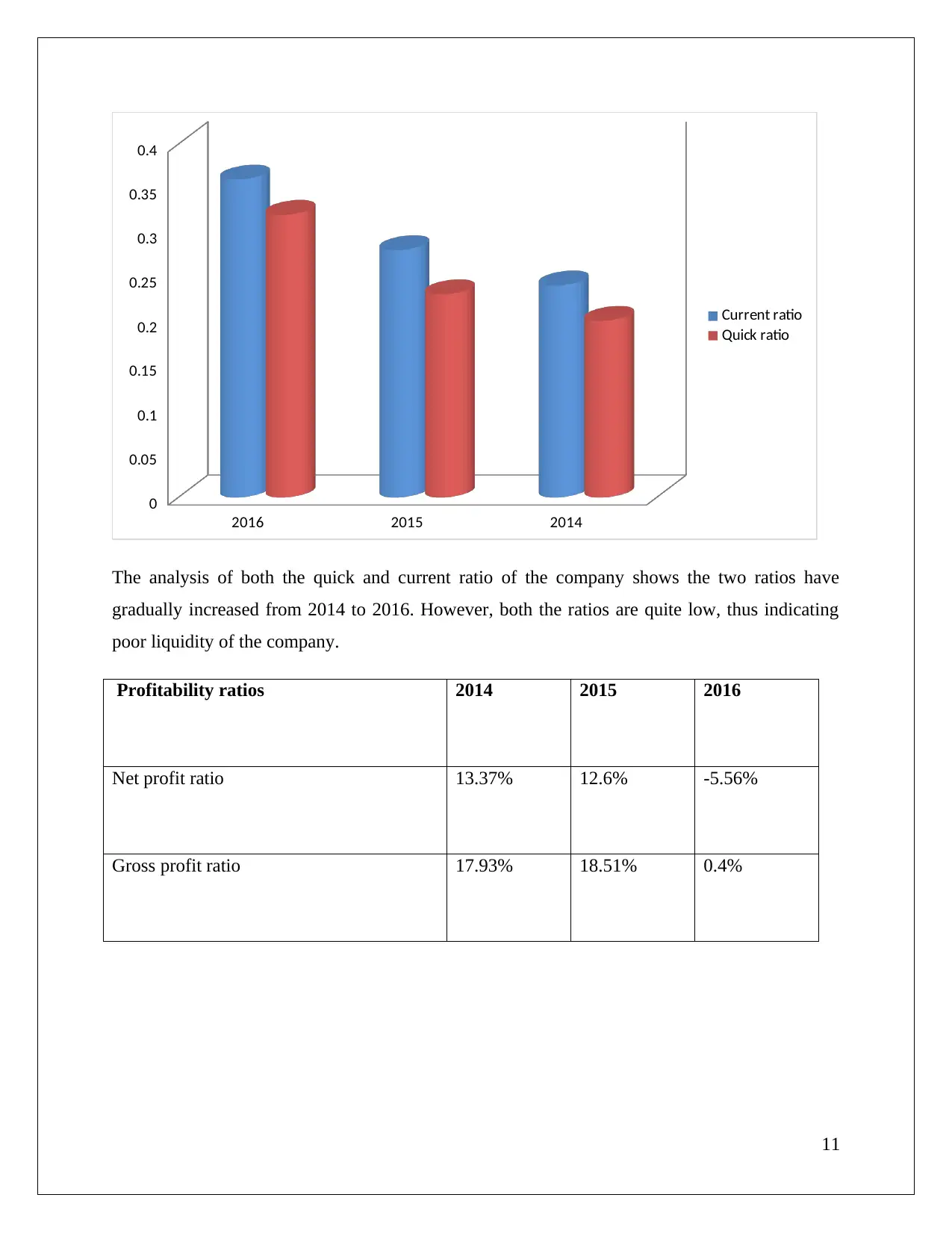

Profitability ratios 2014 2015 2016

Net profit ratio 13.37% 12.6% -5.56%

Gross profit ratio 17.93% 18.51% 0.4%

11

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

Current ratio

Quick ratio

The analysis of both the quick and current ratio of the company shows the two ratios have

gradually increased from 2014 to 2016. However, both the ratios are quite low, thus indicating

poor liquidity of the company.

Profitability ratios 2014 2015 2016

Net profit ratio 13.37% 12.6% -5.56%

Gross profit ratio 17.93% 18.51% 0.4%

11

2016 2015 2014

-10

-5

0

5

10

15

20

Net profit ratio

Gross profit ratio

The analysis of the gross and net profit ratio of the company shows that the company’s profits

have terribly decreased from 2014 to 2016, which indicates a major fall in the company’s profits.

The company is presently running at losses.

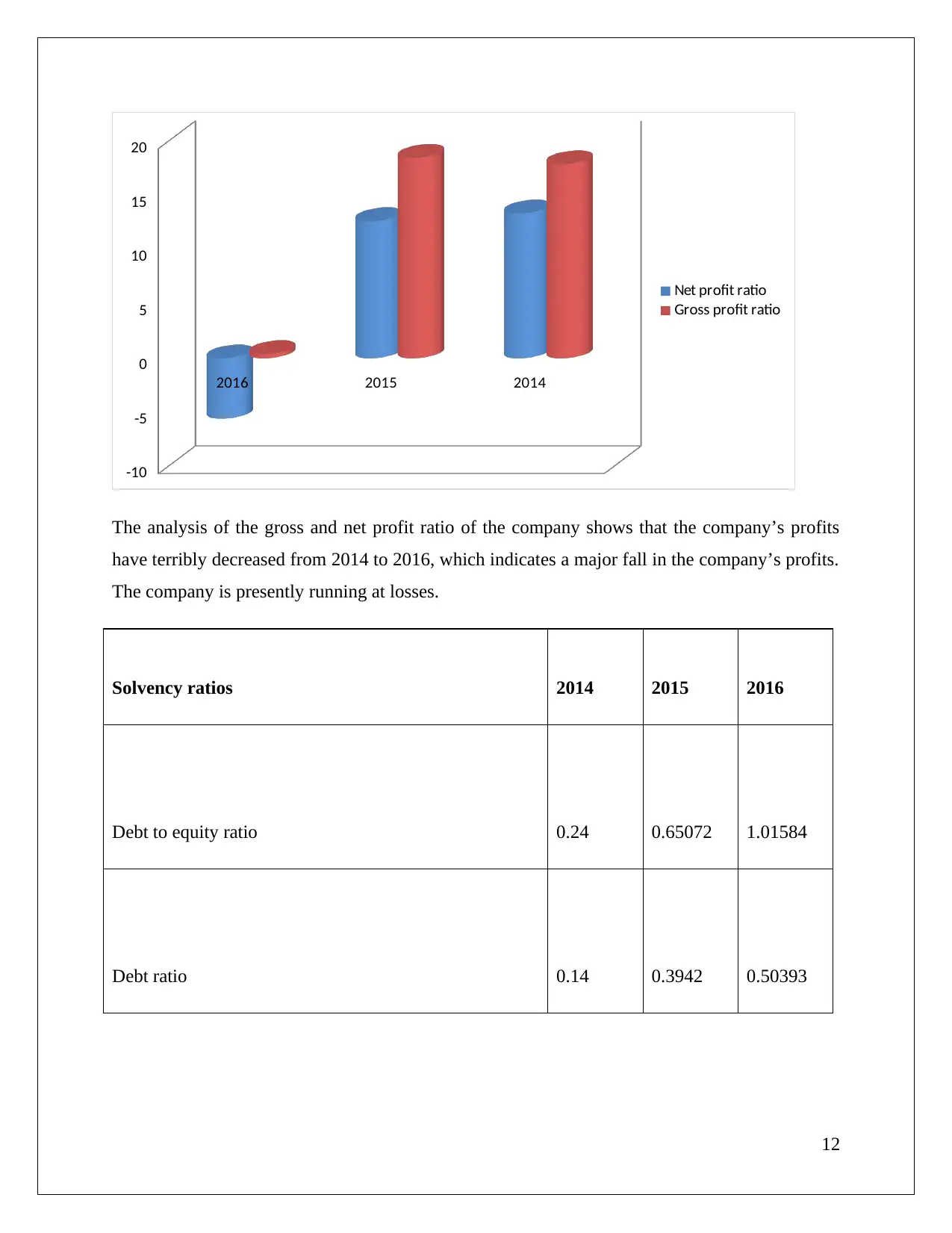

Solvency ratios 2014 2015 2016

Debt to equity ratio 0.24 0.65072 1.01584

Debt ratio 0.14 0.3942 0.50393

12

-10

-5

0

5

10

15

20

Net profit ratio

Gross profit ratio

The analysis of the gross and net profit ratio of the company shows that the company’s profits

have terribly decreased from 2014 to 2016, which indicates a major fall in the company’s profits.

The company is presently running at losses.

Solvency ratios 2014 2015 2016

Debt to equity ratio 0.24 0.65072 1.01584

Debt ratio 0.14 0.3942 0.50393

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.