Business Accounting: Financial Statement Preparation & Ratio Analysis

VerifiedAdded on 2023/06/18

|20

|3440

|485

Report

AI Summary

This assignment solution covers various aspects of business accounting, including the calculation of missing figures using the accounting equation, journal entries, ledger postings, and the preparation of a trial balance. It also includes the preparation of an income statement and balance sheet, along with notes on inventory valuation, goods taken for personal use, electricity owing, depreciation, and debtors' allowances. Further, it discusses the difference between capital and revenue expenditure. The solution also covers the preparation of purchase and sales ledger control accounts and calculates various financial ratios to analyze business performance. Finally, it includes payback period and net present value calculations for investment appraisal and discusses the reasons for companies employing accountants, the need for external auditors for limited liability companies, and the benefits of non-accountants studying accounting. Desklib is a platform where students can find a wide array of assignments and study tools to help them excel in their academic pursuits.

BUSINESS

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1....................................................................................................................................3

Question 2 All the transaction are summarized into ledger.........................................................3

Question 3....................................................................................................................................6

Question 4....................................................................................................................................6

Question 5....................................................................................................................................8

Question 6....................................................................................................................................9

Question 7..................................................................................................................................10

Question 8..................................................................................................................................12

Question 9..................................................................................................................................13

Question: 10...............................................................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES................................................................................................................................1

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

Question 1....................................................................................................................................3

Question 2 All the transaction are summarized into ledger.........................................................3

Question 3....................................................................................................................................6

Question 4....................................................................................................................................6

Question 5....................................................................................................................................8

Question 6....................................................................................................................................9

Question 7..................................................................................................................................10

Question 8..................................................................................................................................12

Question 9..................................................................................................................................13

Question: 10...............................................................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES................................................................................................................................1

MAIN BODY

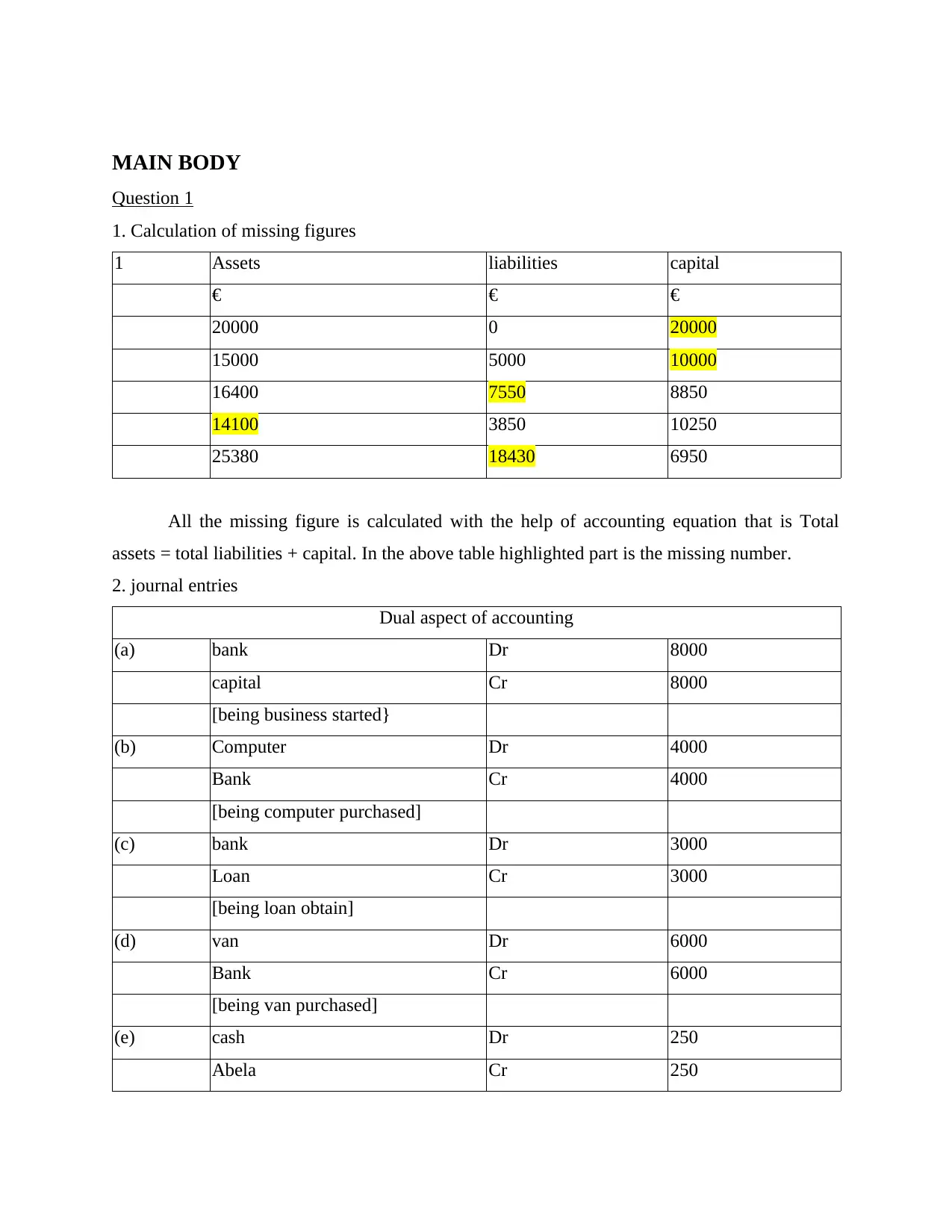

Question 1

1. Calculation of missing figures

1 Assets liabilities capital

€ € €

20000 0 20000

15000 5000 10000

16400 7550 8850

14100 3850 10250

25380 18430 6950

All the missing figure is calculated with the help of accounting equation that is Total

assets = total liabilities + capital. In the above table highlighted part is the missing number.

2. journal entries

Dual aspect of accounting

(a) bank Dr 8000

capital Cr 8000

[being business started}

(b) Computer Dr 4000

Bank Cr 4000

[being computer purchased]

(c) bank Dr 3000

Loan Cr 3000

[being loan obtain]

(d) van Dr 6000

Bank Cr 6000

[being van purchased]

(e) cash Dr 250

Abela Cr 250

Question 1

1. Calculation of missing figures

1 Assets liabilities capital

€ € €

20000 0 20000

15000 5000 10000

16400 7550 8850

14100 3850 10250

25380 18430 6950

All the missing figure is calculated with the help of accounting equation that is Total

assets = total liabilities + capital. In the above table highlighted part is the missing number.

2. journal entries

Dual aspect of accounting

(a) bank Dr 8000

capital Cr 8000

[being business started}

(b) Computer Dr 4000

Bank Cr 4000

[being computer purchased]

(c) bank Dr 3000

Loan Cr 3000

[being loan obtain]

(d) van Dr 6000

Bank Cr 6000

[being van purchased]

(e) cash Dr 250

Abela Cr 250

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

[being cash received]

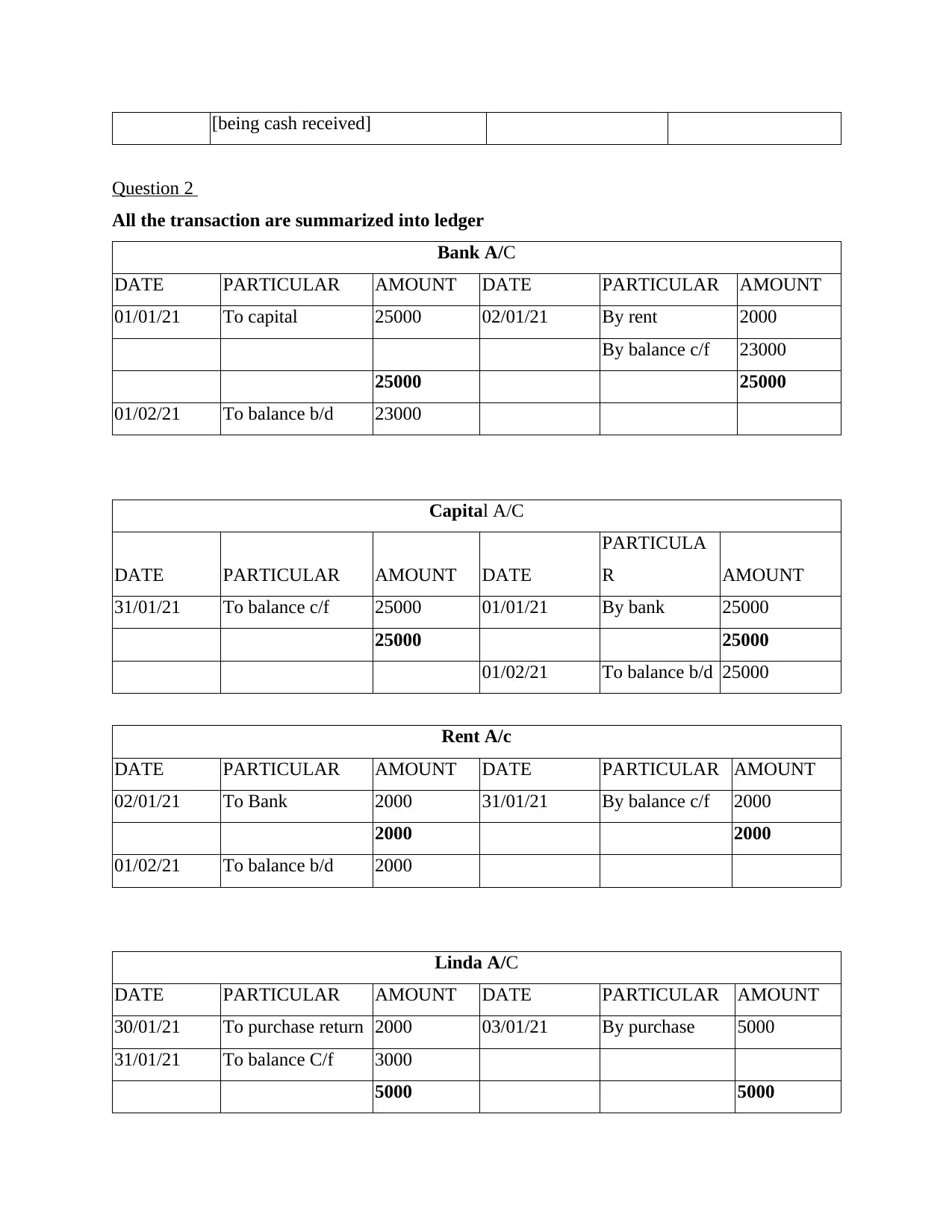

Question 2

All the transaction are summarized into ledger

Bank A/C

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

01/01/21 To capital 25000 02/01/21 By rent 2000

By balance c/f 23000

25000 25000

01/02/21 To balance b/d 23000

Capital A/C

DATE PARTICULAR AMOUNT DATE

PARTICULA

R AMOUNT

31/01/21 To balance c/f 25000 01/01/21 By bank 25000

25000 25000

01/02/21 To balance b/d 25000

Rent A/c

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

02/01/21 To Bank 2000 31/01/21 By balance c/f 2000

2000 2000

01/02/21 To balance b/d 2000

Linda A/C

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

30/01/21 To purchase return 2000 03/01/21 By purchase 5000

31/01/21 To balance C/f 3000

5000 5000

Question 2

All the transaction are summarized into ledger

Bank A/C

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

01/01/21 To capital 25000 02/01/21 By rent 2000

By balance c/f 23000

25000 25000

01/02/21 To balance b/d 23000

Capital A/C

DATE PARTICULAR AMOUNT DATE

PARTICULA

R AMOUNT

31/01/21 To balance c/f 25000 01/01/21 By bank 25000

25000 25000

01/02/21 To balance b/d 25000

Rent A/c

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

02/01/21 To Bank 2000 31/01/21 By balance c/f 2000

2000 2000

01/02/21 To balance b/d 2000

Linda A/C

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

30/01/21 To purchase return 2000 03/01/21 By purchase 5000

31/01/21 To balance C/f 3000

5000 5000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

01/02/21 By balance b/d 3000

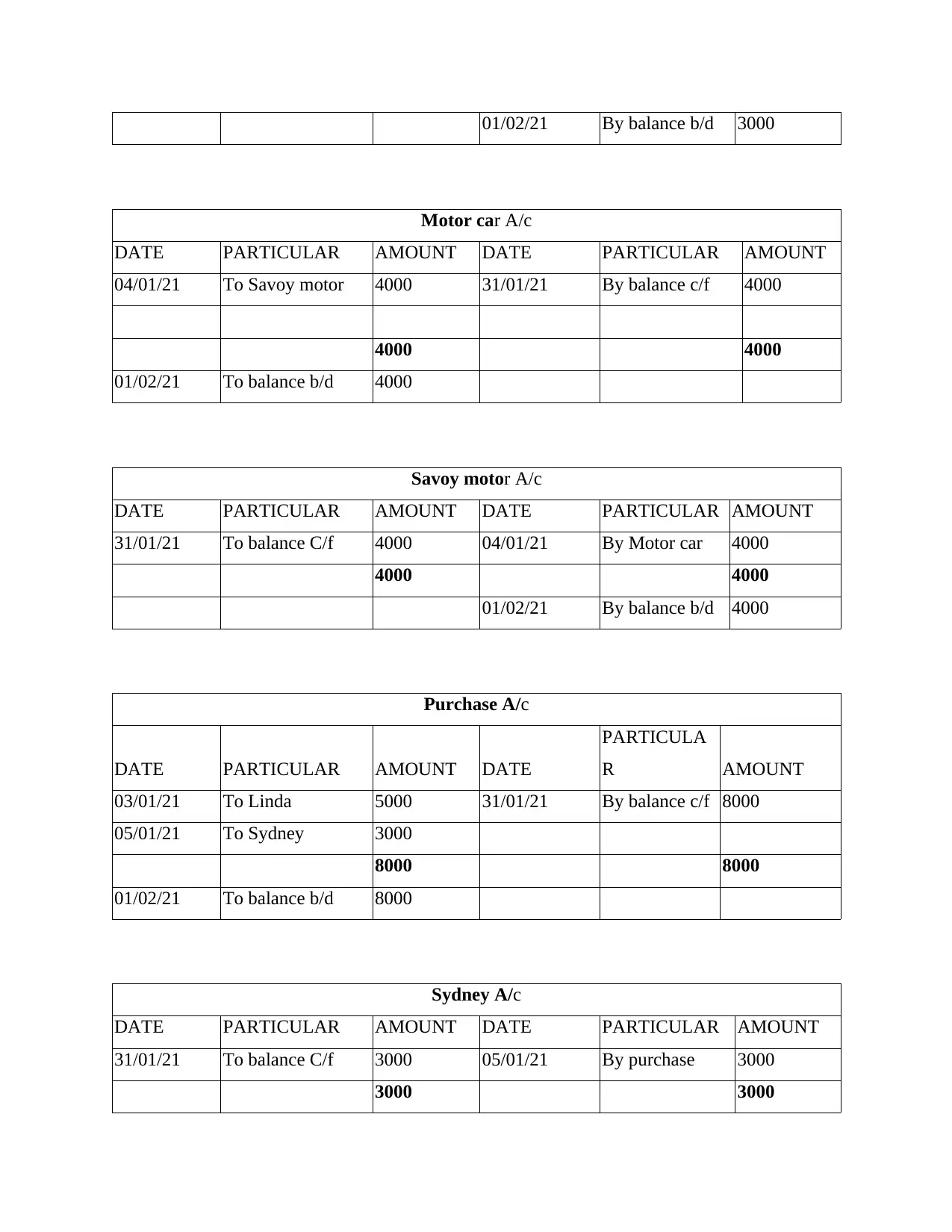

Motor car A/c

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

04/01/21 To Savoy motor 4000 31/01/21 By balance c/f 4000

4000 4000

01/02/21 To balance b/d 4000

Savoy motor A/c

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

31/01/21 To balance C/f 4000 04/01/21 By Motor car 4000

4000 4000

01/02/21 By balance b/d 4000

Purchase A/c

DATE PARTICULAR AMOUNT DATE

PARTICULA

R AMOUNT

03/01/21 To Linda 5000 31/01/21 By balance c/f 8000

05/01/21 To Sydney 3000

8000 8000

01/02/21 To balance b/d 8000

Sydney A/c

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

31/01/21 To balance C/f 3000 05/01/21 By purchase 3000

3000 3000

Motor car A/c

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

04/01/21 To Savoy motor 4000 31/01/21 By balance c/f 4000

4000 4000

01/02/21 To balance b/d 4000

Savoy motor A/c

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

31/01/21 To balance C/f 4000 04/01/21 By Motor car 4000

4000 4000

01/02/21 By balance b/d 4000

Purchase A/c

DATE PARTICULAR AMOUNT DATE

PARTICULA

R AMOUNT

03/01/21 To Linda 5000 31/01/21 By balance c/f 8000

05/01/21 To Sydney 3000

8000 8000

01/02/21 To balance b/d 8000

Sydney A/c

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

31/01/21 To balance C/f 3000 05/01/21 By purchase 3000

3000 3000

01/02/21 By balance b/d 3000

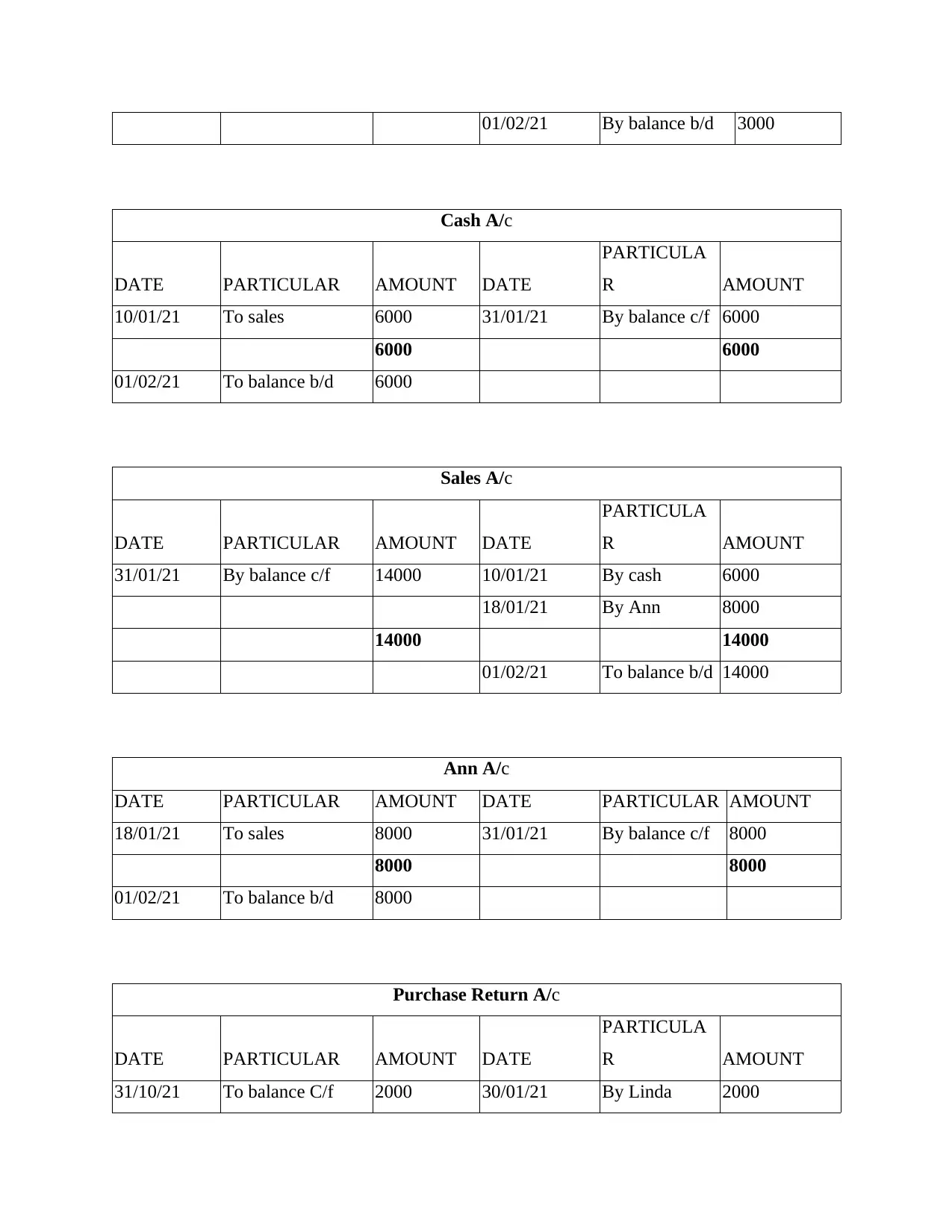

Cash A/c

DATE PARTICULAR AMOUNT DATE

PARTICULA

R AMOUNT

10/01/21 To sales 6000 31/01/21 By balance c/f 6000

6000 6000

01/02/21 To balance b/d 6000

Sales A/c

DATE PARTICULAR AMOUNT DATE

PARTICULA

R AMOUNT

31/01/21 By balance c/f 14000 10/01/21 By cash 6000

18/01/21 By Ann 8000

14000 14000

01/02/21 To balance b/d 14000

Ann A/c

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

18/01/21 To sales 8000 31/01/21 By balance c/f 8000

8000 8000

01/02/21 To balance b/d 8000

Purchase Return A/c

DATE PARTICULAR AMOUNT DATE

PARTICULA

R AMOUNT

31/10/21 To balance C/f 2000 30/01/21 By Linda 2000

Cash A/c

DATE PARTICULAR AMOUNT DATE

PARTICULA

R AMOUNT

10/01/21 To sales 6000 31/01/21 By balance c/f 6000

6000 6000

01/02/21 To balance b/d 6000

Sales A/c

DATE PARTICULAR AMOUNT DATE

PARTICULA

R AMOUNT

31/01/21 By balance c/f 14000 10/01/21 By cash 6000

18/01/21 By Ann 8000

14000 14000

01/02/21 To balance b/d 14000

Ann A/c

DATE PARTICULAR AMOUNT DATE PARTICULAR AMOUNT

18/01/21 To sales 8000 31/01/21 By balance c/f 8000

8000 8000

01/02/21 To balance b/d 8000

Purchase Return A/c

DATE PARTICULAR AMOUNT DATE

PARTICULA

R AMOUNT

31/10/21 To balance C/f 2000 30/01/21 By Linda 2000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2000 2000

01/02/21 By balance b/d 2000

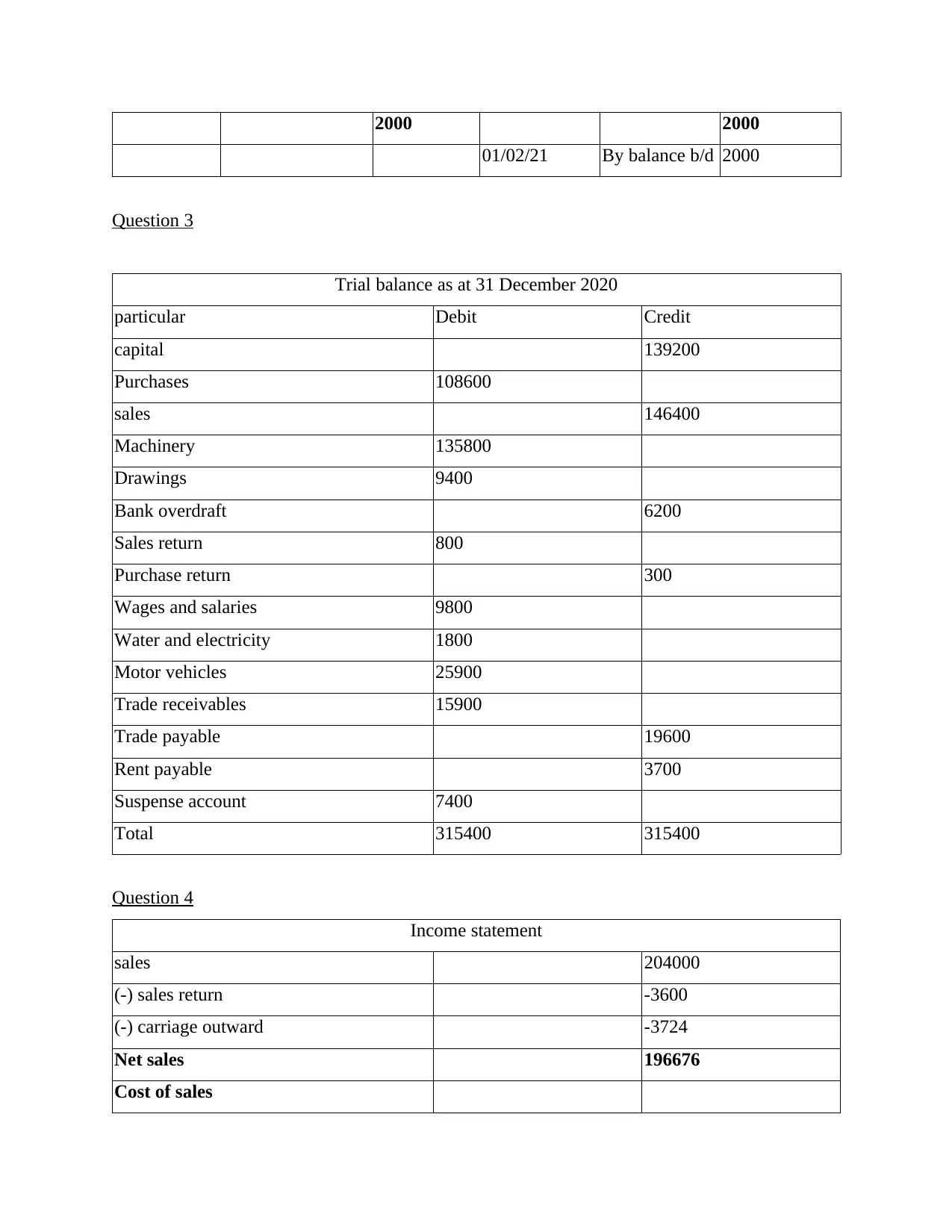

Question 3

Trial balance as at 31 December 2020

particular Debit Credit

capital 139200

Purchases 108600

sales 146400

Machinery 135800

Drawings 9400

Bank overdraft 6200

Sales return 800

Purchase return 300

Wages and salaries 9800

Water and electricity 1800

Motor vehicles 25900

Trade receivables 15900

Trade payable 19600

Rent payable 3700

Suspense account 7400

Total 315400 315400

Question 4

Income statement

sales 204000

(-) sales return -3600

(-) carriage outward -3724

Net sales 196676

Cost of sales

01/02/21 By balance b/d 2000

Question 3

Trial balance as at 31 December 2020

particular Debit Credit

capital 139200

Purchases 108600

sales 146400

Machinery 135800

Drawings 9400

Bank overdraft 6200

Sales return 800

Purchase return 300

Wages and salaries 9800

Water and electricity 1800

Motor vehicles 25900

Trade receivables 15900

Trade payable 19600

Rent payable 3700

Suspense account 7400

Total 315400 315400

Question 4

Income statement

sales 204000

(-) sales return -3600

(-) carriage outward -3724

Net sales 196676

Cost of sales

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

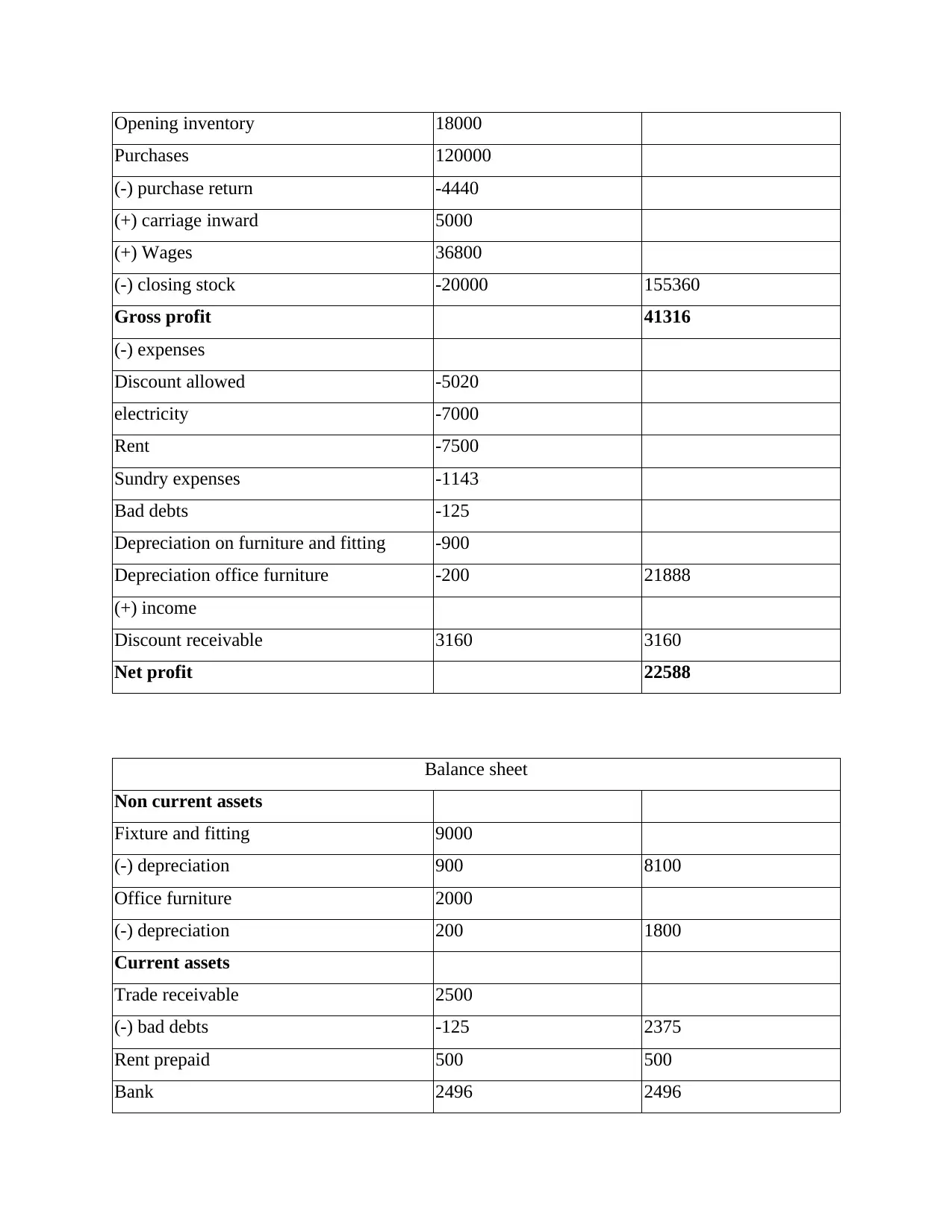

Opening inventory 18000

Purchases 120000

(-) purchase return -4440

(+) carriage inward 5000

(+) Wages 36800

(-) closing stock -20000 155360

Gross profit 41316

(-) expenses

Discount allowed -5020

electricity -7000

Rent -7500

Sundry expenses -1143

Bad debts -125

Depreciation on furniture and fitting -900

Depreciation office furniture -200 21888

(+) income

Discount receivable 3160 3160

Net profit 22588

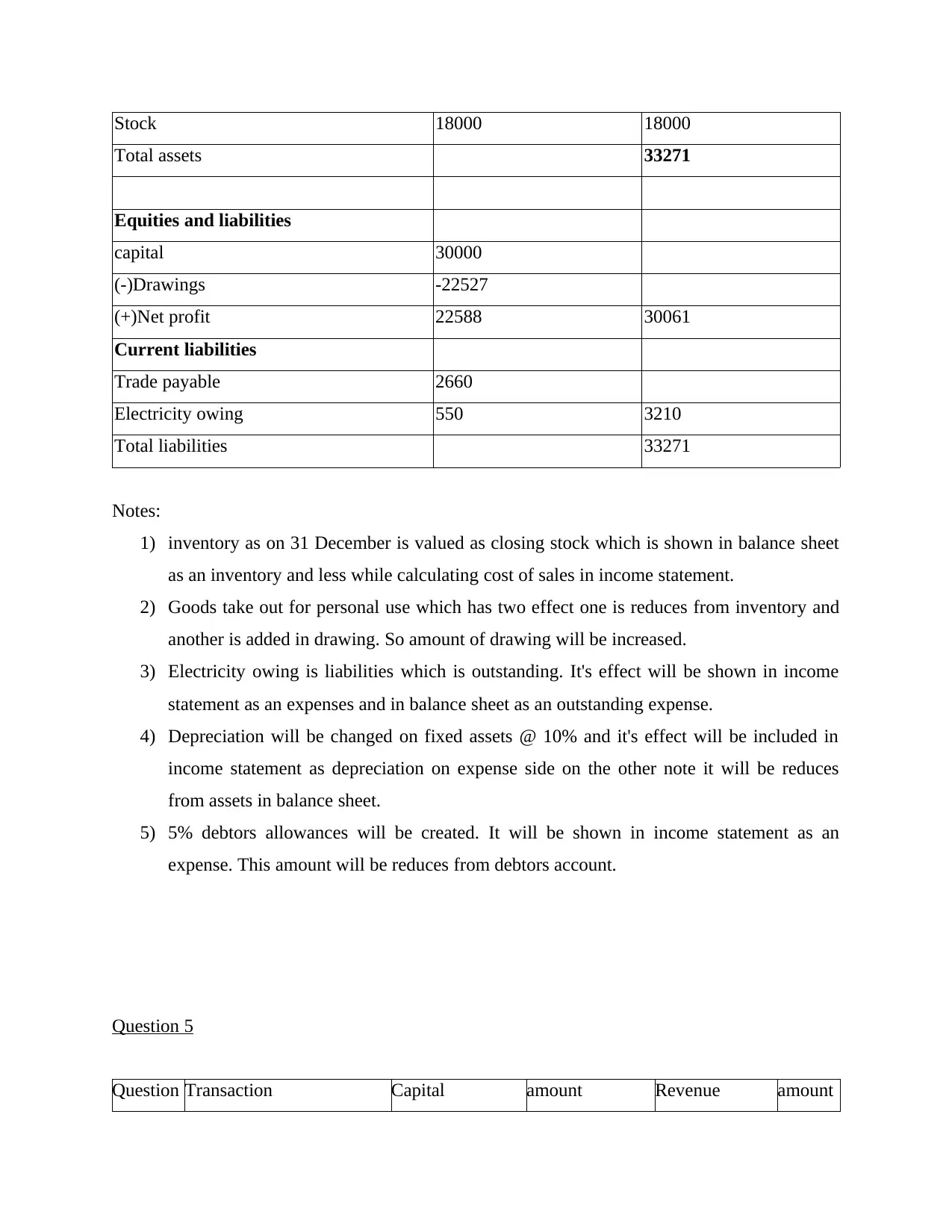

Balance sheet

Non current assets

Fixture and fitting 9000

(-) depreciation 900 8100

Office furniture 2000

(-) depreciation 200 1800

Current assets

Trade receivable 2500

(-) bad debts -125 2375

Rent prepaid 500 500

Bank 2496 2496

Purchases 120000

(-) purchase return -4440

(+) carriage inward 5000

(+) Wages 36800

(-) closing stock -20000 155360

Gross profit 41316

(-) expenses

Discount allowed -5020

electricity -7000

Rent -7500

Sundry expenses -1143

Bad debts -125

Depreciation on furniture and fitting -900

Depreciation office furniture -200 21888

(+) income

Discount receivable 3160 3160

Net profit 22588

Balance sheet

Non current assets

Fixture and fitting 9000

(-) depreciation 900 8100

Office furniture 2000

(-) depreciation 200 1800

Current assets

Trade receivable 2500

(-) bad debts -125 2375

Rent prepaid 500 500

Bank 2496 2496

Stock 18000 18000

Total assets 33271

Equities and liabilities

capital 30000

(-)Drawings -22527

(+)Net profit 22588 30061

Current liabilities

Trade payable 2660

Electricity owing 550 3210

Total liabilities 33271

Notes:

1) inventory as on 31 December is valued as closing stock which is shown in balance sheet

as an inventory and less while calculating cost of sales in income statement.

2) Goods take out for personal use which has two effect one is reduces from inventory and

another is added in drawing. So amount of drawing will be increased.

3) Electricity owing is liabilities which is outstanding. It's effect will be shown in income

statement as an expenses and in balance sheet as an outstanding expense.

4) Depreciation will be changed on fixed assets @ 10% and it's effect will be included in

income statement as depreciation on expense side on the other note it will be reduces

from assets in balance sheet.

5) 5% debtors allowances will be created. It will be shown in income statement as an

expense. This amount will be reduces from debtors account.

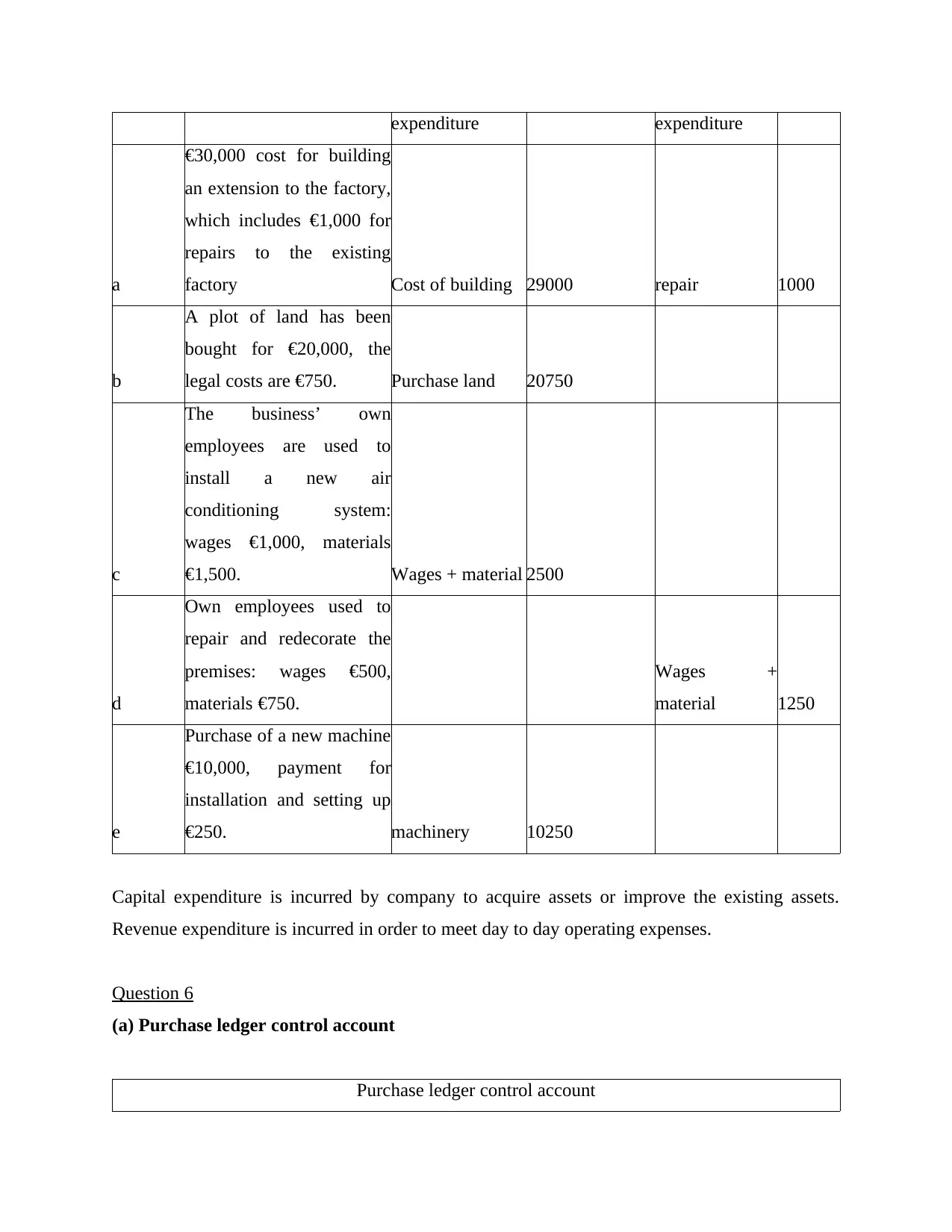

Question 5

Question Transaction Capital amount Revenue amount

Total assets 33271

Equities and liabilities

capital 30000

(-)Drawings -22527

(+)Net profit 22588 30061

Current liabilities

Trade payable 2660

Electricity owing 550 3210

Total liabilities 33271

Notes:

1) inventory as on 31 December is valued as closing stock which is shown in balance sheet

as an inventory and less while calculating cost of sales in income statement.

2) Goods take out for personal use which has two effect one is reduces from inventory and

another is added in drawing. So amount of drawing will be increased.

3) Electricity owing is liabilities which is outstanding. It's effect will be shown in income

statement as an expenses and in balance sheet as an outstanding expense.

4) Depreciation will be changed on fixed assets @ 10% and it's effect will be included in

income statement as depreciation on expense side on the other note it will be reduces

from assets in balance sheet.

5) 5% debtors allowances will be created. It will be shown in income statement as an

expense. This amount will be reduces from debtors account.

Question 5

Question Transaction Capital amount Revenue amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

expenditure expenditure

a

€30,000 cost for building

an extension to the factory,

which includes €1,000 for

repairs to the existing

factory Cost of building 29000 repair 1000

b

A plot of land has been

bought for €20,000, the

legal costs are €750. Purchase land 20750

c

The business’ own

employees are used to

install a new air

conditioning system:

wages €1,000, materials

€1,500. Wages + material 2500

d

Own employees used to

repair and redecorate the

premises: wages €500,

materials €750.

Wages +

material 1250

e

Purchase of a new machine

€10,000, payment for

installation and setting up

€250. machinery 10250

Capital expenditure is incurred by company to acquire assets or improve the existing assets.

Revenue expenditure is incurred in order to meet day to day operating expenses.

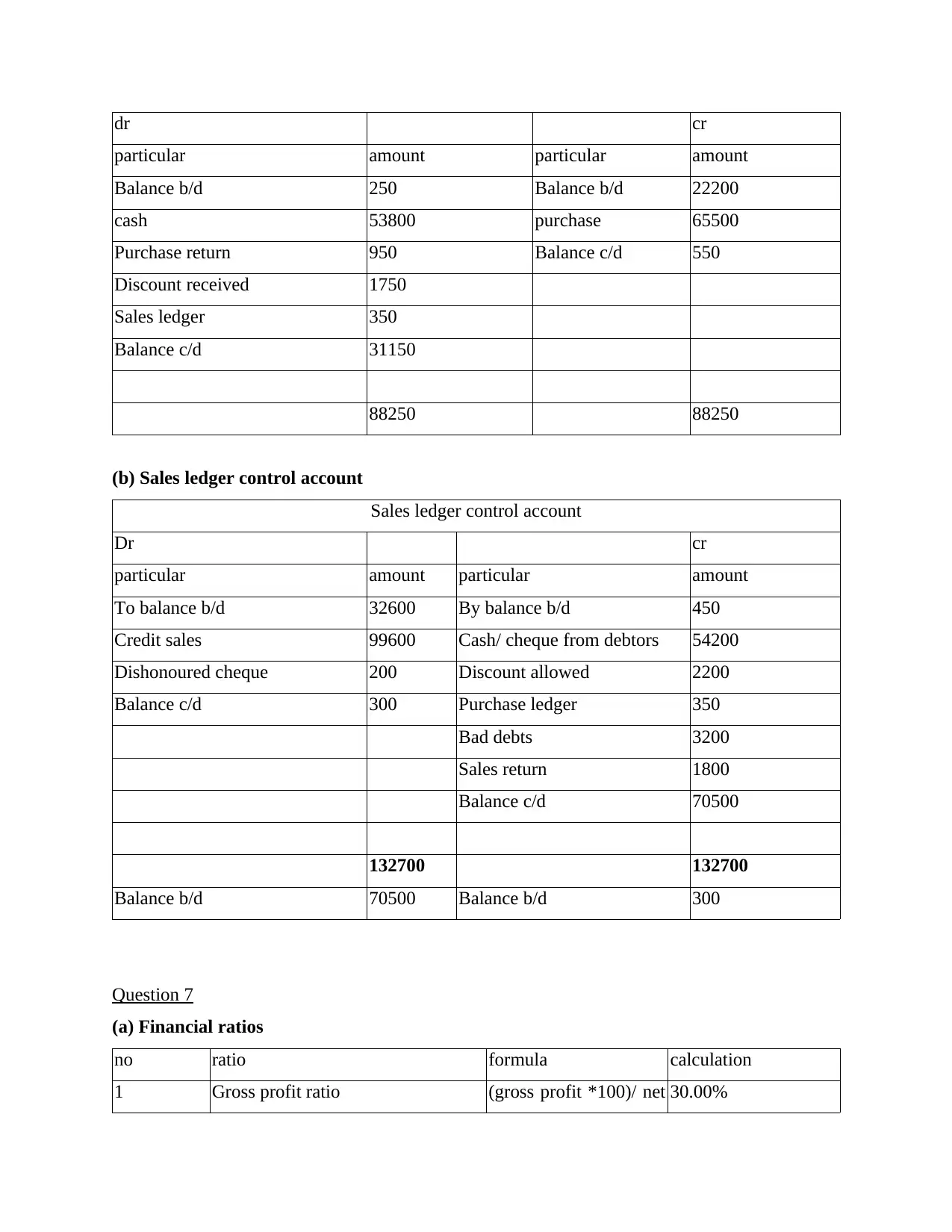

Question 6

(a) Purchase ledger control account

Purchase ledger control account

a

€30,000 cost for building

an extension to the factory,

which includes €1,000 for

repairs to the existing

factory Cost of building 29000 repair 1000

b

A plot of land has been

bought for €20,000, the

legal costs are €750. Purchase land 20750

c

The business’ own

employees are used to

install a new air

conditioning system:

wages €1,000, materials

€1,500. Wages + material 2500

d

Own employees used to

repair and redecorate the

premises: wages €500,

materials €750.

Wages +

material 1250

e

Purchase of a new machine

€10,000, payment for

installation and setting up

€250. machinery 10250

Capital expenditure is incurred by company to acquire assets or improve the existing assets.

Revenue expenditure is incurred in order to meet day to day operating expenses.

Question 6

(a) Purchase ledger control account

Purchase ledger control account

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

dr cr

particular amount particular amount

Balance b/d 250 Balance b/d 22200

cash 53800 purchase 65500

Purchase return 950 Balance c/d 550

Discount received 1750

Sales ledger 350

Balance c/d 31150

88250 88250

(b) Sales ledger control account

Sales ledger control account

Dr cr

particular amount particular amount

To balance b/d 32600 By balance b/d 450

Credit sales 99600 Cash/ cheque from debtors 54200

Dishonoured cheque 200 Discount allowed 2200

Balance c/d 300 Purchase ledger 350

Bad debts 3200

Sales return 1800

Balance c/d 70500

132700 132700

Balance b/d 70500 Balance b/d 300

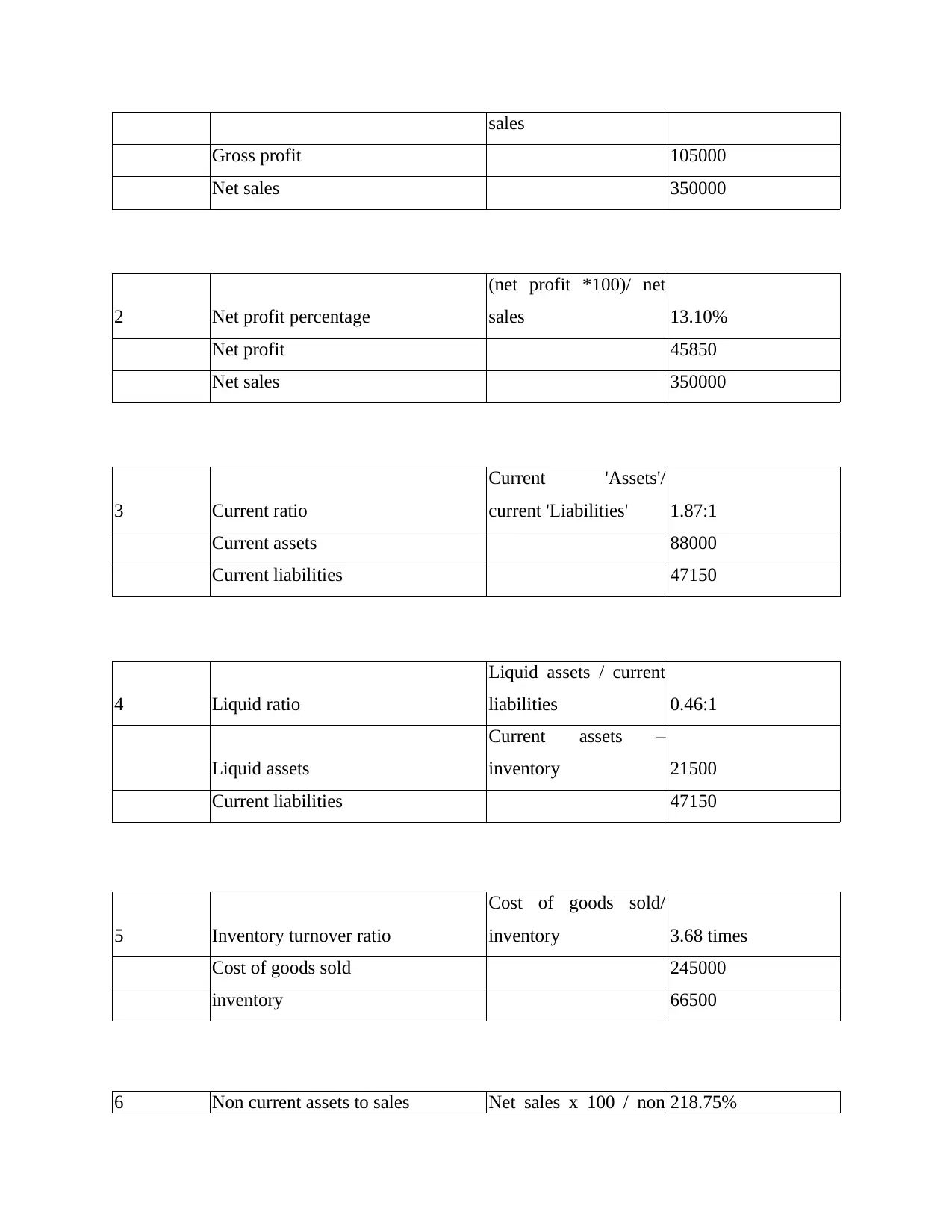

Question 7

(a) Financial ratios

no ratio formula calculation

1 Gross profit ratio (gross profit *100)/ net 30.00%

particular amount particular amount

Balance b/d 250 Balance b/d 22200

cash 53800 purchase 65500

Purchase return 950 Balance c/d 550

Discount received 1750

Sales ledger 350

Balance c/d 31150

88250 88250

(b) Sales ledger control account

Sales ledger control account

Dr cr

particular amount particular amount

To balance b/d 32600 By balance b/d 450

Credit sales 99600 Cash/ cheque from debtors 54200

Dishonoured cheque 200 Discount allowed 2200

Balance c/d 300 Purchase ledger 350

Bad debts 3200

Sales return 1800

Balance c/d 70500

132700 132700

Balance b/d 70500 Balance b/d 300

Question 7

(a) Financial ratios

no ratio formula calculation

1 Gross profit ratio (gross profit *100)/ net 30.00%

sales

Gross profit 105000

Net sales 350000

2 Net profit percentage

(net profit *100)/ net

sales 13.10%

Net profit 45850

Net sales 350000

3 Current ratio

Current 'Assets'/

current 'Liabilities' 1.87:1

Current assets 88000

Current liabilities 47150

4 Liquid ratio

Liquid assets / current

liabilities 0.46:1

Liquid assets

Current assets –

inventory 21500

Current liabilities 47150

5 Inventory turnover ratio

Cost of goods sold/

inventory 3.68 times

Cost of goods sold 245000

inventory 66500

6 Non current assets to sales Net sales x 100 / non 218.75%

Gross profit 105000

Net sales 350000

2 Net profit percentage

(net profit *100)/ net

sales 13.10%

Net profit 45850

Net sales 350000

3 Current ratio

Current 'Assets'/

current 'Liabilities' 1.87:1

Current assets 88000

Current liabilities 47150

4 Liquid ratio

Liquid assets / current

liabilities 0.46:1

Liquid assets

Current assets –

inventory 21500

Current liabilities 47150

5 Inventory turnover ratio

Cost of goods sold/

inventory 3.68 times

Cost of goods sold 245000

inventory 66500

6 Non current assets to sales Net sales x 100 / non 218.75%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.