Tesco Plc Business Analysis Project: Strategic and Financial Review

VerifiedAdded on 2020/12/10

|32

|6625

|300

Project

AI Summary

This project presents a comprehensive business analysis of Tesco Plc, a major UK-based multinational retail organization. The analysis begins with an introduction outlining the project's purpose, which is to evaluate Tesco's business strategy and compare its performance with competitors, Morrisons Plc and Sainsbury Plc. A strategic analysis is conducted using PESTLE and Porter's Five Forces models to assess the external and competitive environments. The project then delves into a financial analysis, examining key ratios like current ratio, net profit margin, gross profit margin, and return on capital employed. The financial performance of Tesco is compared with its competitors. The analysis identifies limitations and concludes with recommendations for Tesco's strategic direction, including strategy evaluation and financial data modeling. The project highlights key issues such as grocery inflation and customer satisfaction levels. Finally, the project underscores the importance of adapting to changing consumer behavior and technological advancements to maintain a competitive edge in the retail industry.

Business Analysis Project

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

1. INTRODUCTION.......................................................................................................................1

2. STRATEGIC ANALYSIS...........................................................................................................3

2.1 PESTLE Analysis.............................................................................................................3

2.2 Industry Analysis by conducting Porter’s five forces model (modified).........................5

3. FINANCIAL ANALYSIS...........................................................................................................8

3.1 Financial performance......................................................................................................8

3.2 Industry Specific Performance.......................................................................................12

4. Limitations of Analysis..............................................................................................................14

4.1 Limitations of Strategic Analysis...................................................................................14

4.2 Limitations of Financial Analysis..................................................................................15

5. Conclusion.................................................................................................................................15

6. Recommendation.......................................................................................................................16

7. Strategy Evaluation....................................................................................................................18

8. Financial Data Modelling..........................................................................................................20

9. References..................................................................................................................................27

Figure 1: Industry Specific Performance.......................................................................................13

Figure 2: Market share of three companies Source: statista.com..................................................14

Figure 3: Trend analysis of Tesco Plc related to current ratio ......................................................23

Figure 4: Trend analysis of Tesco Plc related to NP margin ........................................................24

Figure 5: Trend analysis of Tesco Plc related to GP margin ........................................................25

Figure 6: Trend analysis of Tesco Plc related to ROCE................................................................26

Table 1: Rationale............................................................................................................................2

Table 2: Ratio analysis of Tesco Plc................................................................................................9

Table 3: Ratio analysis of Morrison’s Plc........................................................................................9

Table 4: Ratio analysis of Sainsbury Plc.......................................................................................10

Table 5: Tesco Plc Trend analysis.................................................................................................18

1. INTRODUCTION.......................................................................................................................1

2. STRATEGIC ANALYSIS...........................................................................................................3

2.1 PESTLE Analysis.............................................................................................................3

2.2 Industry Analysis by conducting Porter’s five forces model (modified).........................5

3. FINANCIAL ANALYSIS...........................................................................................................8

3.1 Financial performance......................................................................................................8

3.2 Industry Specific Performance.......................................................................................12

4. Limitations of Analysis..............................................................................................................14

4.1 Limitations of Strategic Analysis...................................................................................14

4.2 Limitations of Financial Analysis..................................................................................15

5. Conclusion.................................................................................................................................15

6. Recommendation.......................................................................................................................16

7. Strategy Evaluation....................................................................................................................18

8. Financial Data Modelling..........................................................................................................20

9. References..................................................................................................................................27

Figure 1: Industry Specific Performance.......................................................................................13

Figure 2: Market share of three companies Source: statista.com..................................................14

Figure 3: Trend analysis of Tesco Plc related to current ratio ......................................................23

Figure 4: Trend analysis of Tesco Plc related to NP margin ........................................................24

Figure 5: Trend analysis of Tesco Plc related to GP margin ........................................................25

Figure 6: Trend analysis of Tesco Plc related to ROCE................................................................26

Table 1: Rationale............................................................................................................................2

Table 2: Ratio analysis of Tesco Plc................................................................................................9

Table 3: Ratio analysis of Morrison’s Plc........................................................................................9

Table 4: Ratio analysis of Sainsbury Plc.......................................................................................10

Table 5: Tesco Plc Trend analysis.................................................................................................18

1. INTRODUCTION

Purpose of project

The main purpose of conducting project is to analyse the business strategy of Tesco Plc.

Furthermore, comparison will be made with other two companies such as Morrisons Plc and

Sainsbury Plc which are listed on LSE (London Stock Exchange). By analysing strategic model

of company so that stakeholders may be able to invest in it.

Background of organisation

Tesco Plc is one of the biggest retail multinational organisations headquartered in UK. It

was founded in 1919 by Jack Cohen. Company has effectively diversified its business and

satisfies customers by providing quality products and enhanced services.

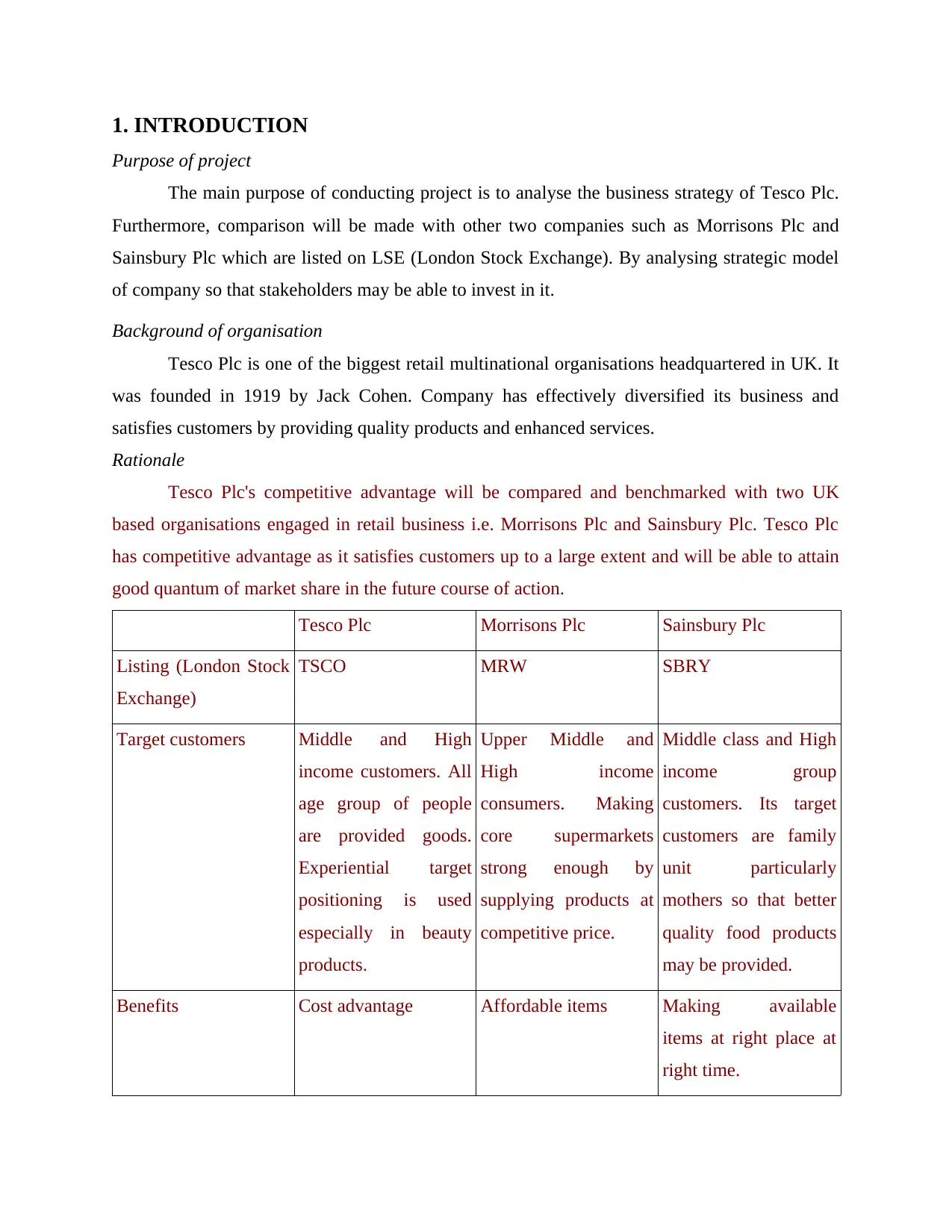

Rationale

Tesco Plc's competitive advantage will be compared and benchmarked with two UK

based organisations engaged in retail business i.e. Morrisons Plc and Sainsbury Plc. Tesco Plc

has competitive advantage as it satisfies customers up to a large extent and will be able to attain

good quantum of market share in the future course of action.

Tesco Plc Morrisons Plc Sainsbury Plc

Listing (London Stock

Exchange)

TSCO MRW SBRY

Target customers Middle and High

income customers. All

age group of people

are provided goods.

Experiential target

positioning is used

especially in beauty

products.

Upper Middle and

High income

consumers. Making

core supermarkets

strong enough by

supplying products at

competitive price.

Middle class and High

income group

customers. Its target

customers are family

unit particularly

mothers so that better

quality food products

may be provided.

Benefits Cost advantage Affordable items Making available

items at right place at

right time.

Purpose of project

The main purpose of conducting project is to analyse the business strategy of Tesco Plc.

Furthermore, comparison will be made with other two companies such as Morrisons Plc and

Sainsbury Plc which are listed on LSE (London Stock Exchange). By analysing strategic model

of company so that stakeholders may be able to invest in it.

Background of organisation

Tesco Plc is one of the biggest retail multinational organisations headquartered in UK. It

was founded in 1919 by Jack Cohen. Company has effectively diversified its business and

satisfies customers by providing quality products and enhanced services.

Rationale

Tesco Plc's competitive advantage will be compared and benchmarked with two UK

based organisations engaged in retail business i.e. Morrisons Plc and Sainsbury Plc. Tesco Plc

has competitive advantage as it satisfies customers up to a large extent and will be able to attain

good quantum of market share in the future course of action.

Tesco Plc Morrisons Plc Sainsbury Plc

Listing (London Stock

Exchange)

TSCO MRW SBRY

Target customers Middle and High

income customers. All

age group of people

are provided goods.

Experiential target

positioning is used

especially in beauty

products.

Upper Middle and

High income

consumers. Making

core supermarkets

strong enough by

supplying products at

competitive price.

Middle class and High

income group

customers. Its target

customers are family

unit particularly

mothers so that better

quality food products

may be provided.

Benefits Cost advantage Affordable items Making available

items at right place at

right time.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

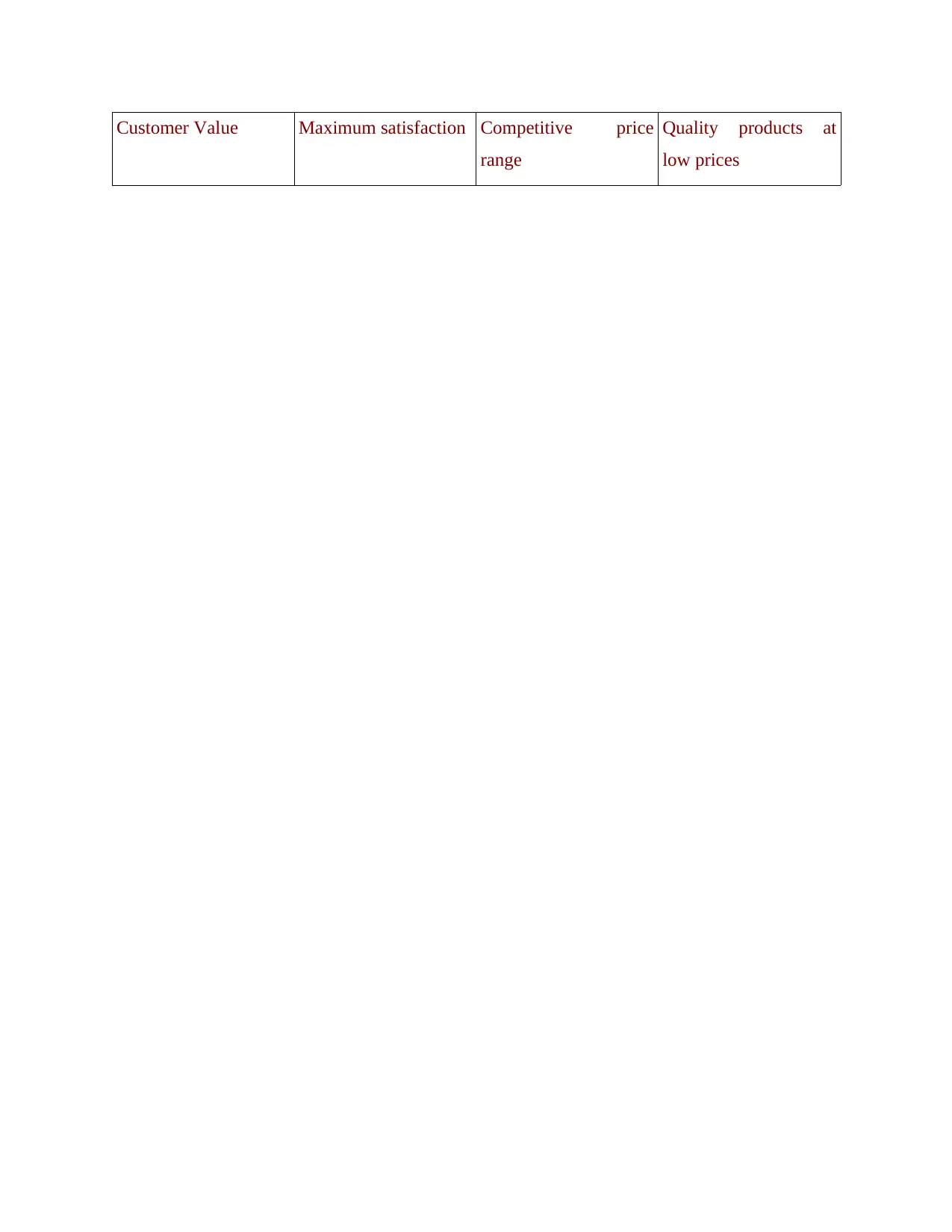

Customer Value Maximum satisfaction Competitive price

range

Quality products at

low prices

range

Quality products at

low prices

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table 1: Rationale

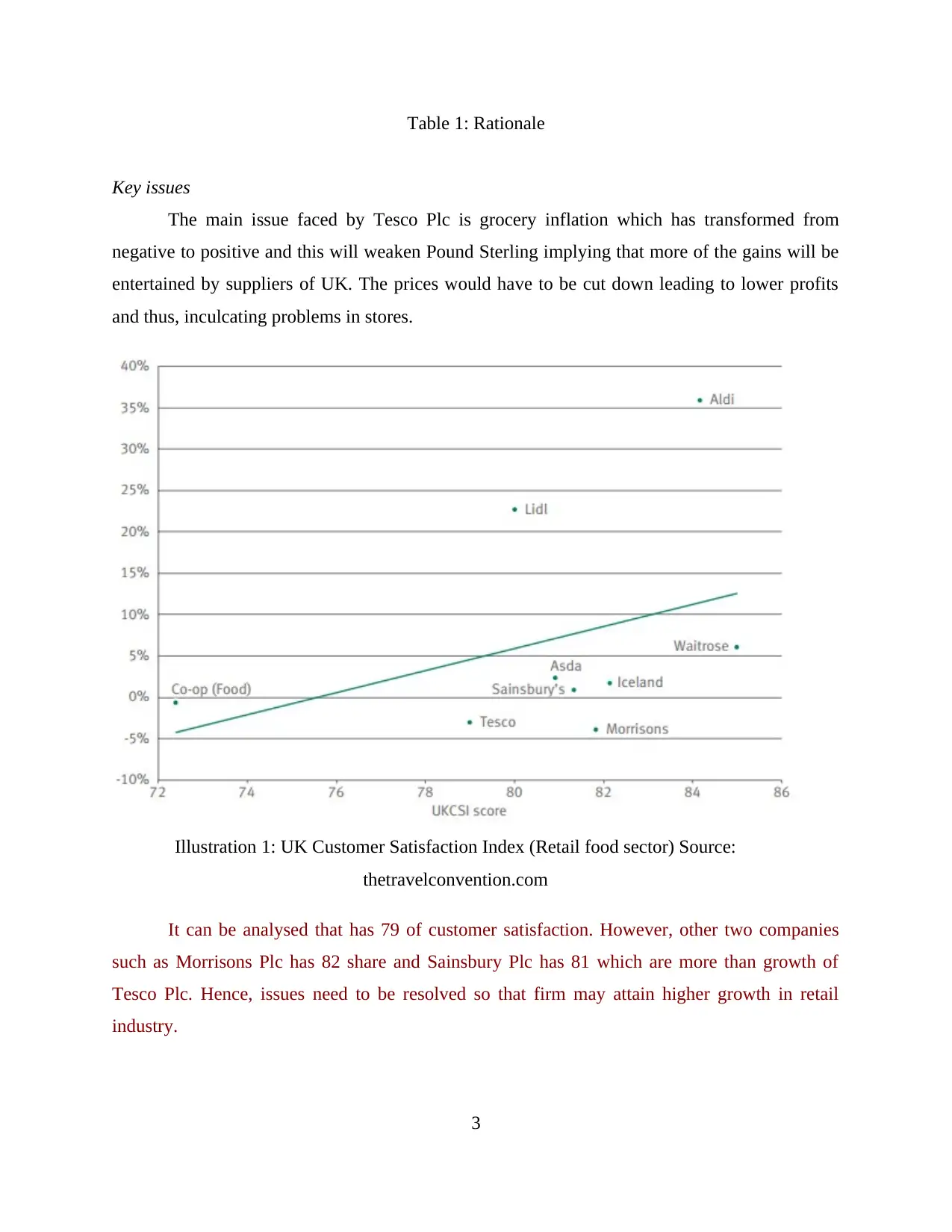

Key issues

The main issue faced by Tesco Plc is grocery inflation which has transformed from

negative to positive and this will weaken Pound Sterling implying that more of the gains will be

entertained by suppliers of UK. The prices would have to be cut down leading to lower profits

and thus, inculcating problems in stores.

Illustration 1: UK Customer Satisfaction Index (Retail food sector) Source:

thetravelconvention.com

It can be analysed that has 79 of customer satisfaction. However, other two companies

such as Morrisons Plc has 82 share and Sainsbury Plc has 81 which are more than growth of

Tesco Plc. Hence, issues need to be resolved so that firm may attain higher growth in retail

industry.

3

Key issues

The main issue faced by Tesco Plc is grocery inflation which has transformed from

negative to positive and this will weaken Pound Sterling implying that more of the gains will be

entertained by suppliers of UK. The prices would have to be cut down leading to lower profits

and thus, inculcating problems in stores.

Illustration 1: UK Customer Satisfaction Index (Retail food sector) Source:

thetravelconvention.com

It can be analysed that has 79 of customer satisfaction. However, other two companies

such as Morrisons Plc has 82 share and Sainsbury Plc has 81 which are more than growth of

Tesco Plc. Hence, issues need to be resolved so that firm may attain higher growth in retail

industry.

3

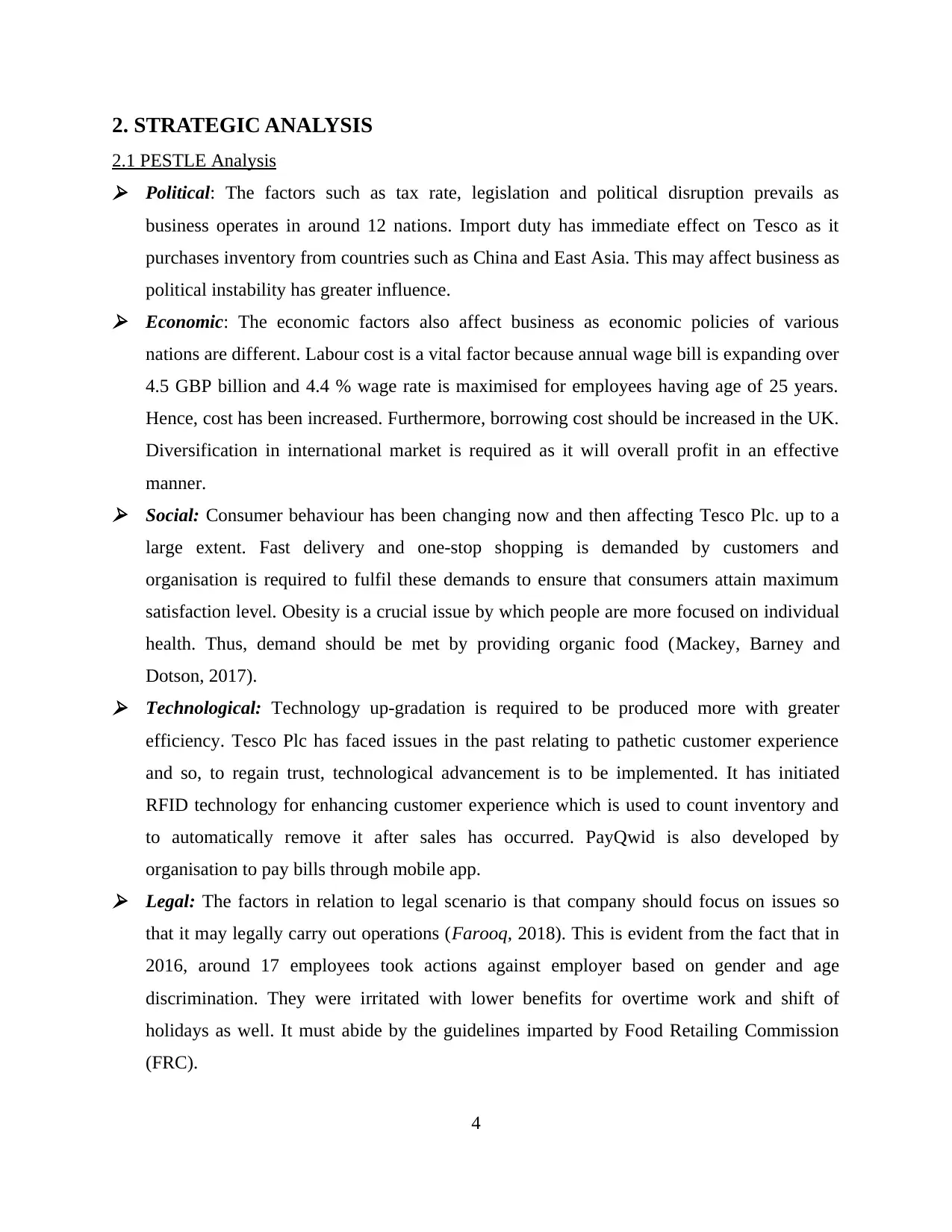

2. STRATEGIC ANALYSIS

2.1 PESTLE Analysis Political: The factors such as tax rate, legislation and political disruption prevails as

business operates in around 12 nations. Import duty has immediate effect on Tesco as it

purchases inventory from countries such as China and East Asia. This may affect business as

political instability has greater influence. Economic: The economic factors also affect business as economic policies of various

nations are different. Labour cost is a vital factor because annual wage bill is expanding over

4.5 GBP billion and 4.4 % wage rate is maximised for employees having age of 25 years.

Hence, cost has been increased. Furthermore, borrowing cost should be increased in the UK.

Diversification in international market is required as it will overall profit in an effective

manner. Social: Consumer behaviour has been changing now and then affecting Tesco Plc. up to a

large extent. Fast delivery and one-stop shopping is demanded by customers and

organisation is required to fulfil these demands to ensure that consumers attain maximum

satisfaction level. Obesity is a crucial issue by which people are more focused on individual

health. Thus, demand should be met by providing organic food (Mackey, Barney and

Dotson, 2017). Technological: Technology up-gradation is required to be produced more with greater

efficiency. Tesco Plc has faced issues in the past relating to pathetic customer experience

and so, to regain trust, technological advancement is to be implemented. It has initiated

RFID technology for enhancing customer experience which is used to count inventory and

to automatically remove it after sales has occurred. PayQwid is also developed by

organisation to pay bills through mobile app. Legal: The factors in relation to legal scenario is that company should focus on issues so

that it may legally carry out operations (Farooq, 2018). This is evident from the fact that in

2016, around 17 employees took actions against employer based on gender and age

discrimination. They were irritated with lower benefits for overtime work and shift of

holidays as well. It must abide by the guidelines imparted by Food Retailing Commission

(FRC).

4

2.1 PESTLE Analysis Political: The factors such as tax rate, legislation and political disruption prevails as

business operates in around 12 nations. Import duty has immediate effect on Tesco as it

purchases inventory from countries such as China and East Asia. This may affect business as

political instability has greater influence. Economic: The economic factors also affect business as economic policies of various

nations are different. Labour cost is a vital factor because annual wage bill is expanding over

4.5 GBP billion and 4.4 % wage rate is maximised for employees having age of 25 years.

Hence, cost has been increased. Furthermore, borrowing cost should be increased in the UK.

Diversification in international market is required as it will overall profit in an effective

manner. Social: Consumer behaviour has been changing now and then affecting Tesco Plc. up to a

large extent. Fast delivery and one-stop shopping is demanded by customers and

organisation is required to fulfil these demands to ensure that consumers attain maximum

satisfaction level. Obesity is a crucial issue by which people are more focused on individual

health. Thus, demand should be met by providing organic food (Mackey, Barney and

Dotson, 2017). Technological: Technology up-gradation is required to be produced more with greater

efficiency. Tesco Plc has faced issues in the past relating to pathetic customer experience

and so, to regain trust, technological advancement is to be implemented. It has initiated

RFID technology for enhancing customer experience which is used to count inventory and

to automatically remove it after sales has occurred. PayQwid is also developed by

organisation to pay bills through mobile app. Legal: The factors in relation to legal scenario is that company should focus on issues so

that it may legally carry out operations (Farooq, 2018). This is evident from the fact that in

2016, around 17 employees took actions against employer based on gender and age

discrimination. They were irritated with lower benefits for overtime work and shift of

holidays as well. It must abide by the guidelines imparted by Food Retailing Commission

(FRC).

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

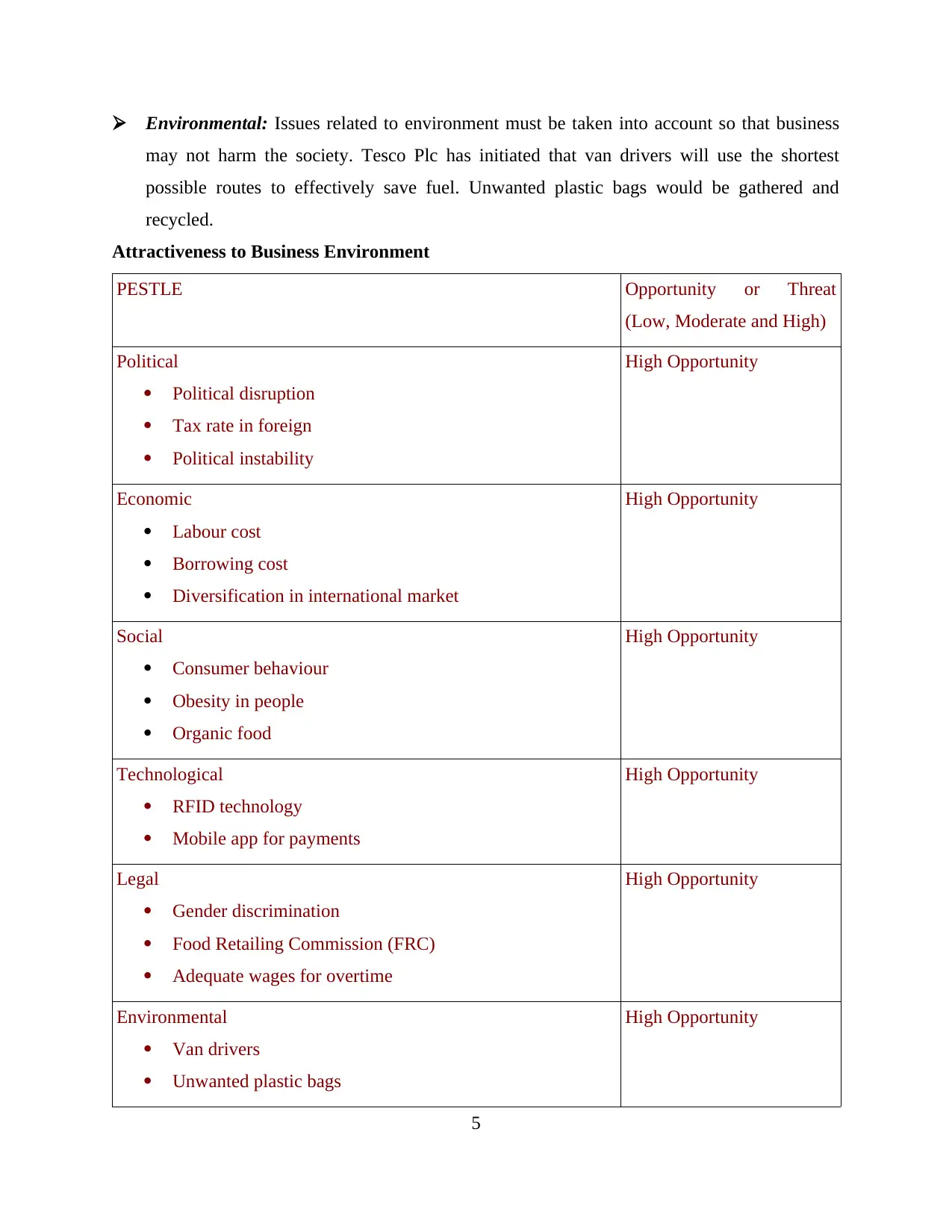

Environmental: Issues related to environment must be taken into account so that business

may not harm the society. Tesco Plc has initiated that van drivers will use the shortest

possible routes to effectively save fuel. Unwanted plastic bags would be gathered and

recycled.

Attractiveness to Business Environment

PESTLE Opportunity or Threat

(Low, Moderate and High)

Political

Political disruption

Tax rate in foreign

Political instability

High Opportunity

Economic

Labour cost

Borrowing cost

Diversification in international market

High Opportunity

Social

Consumer behaviour

Obesity in people

Organic food

High Opportunity

Technological

RFID technology

Mobile app for payments

High Opportunity

Legal

Gender discrimination

Food Retailing Commission (FRC)

Adequate wages for overtime

High Opportunity

Environmental

Van drivers

Unwanted plastic bags

High Opportunity

5

may not harm the society. Tesco Plc has initiated that van drivers will use the shortest

possible routes to effectively save fuel. Unwanted plastic bags would be gathered and

recycled.

Attractiveness to Business Environment

PESTLE Opportunity or Threat

(Low, Moderate and High)

Political

Political disruption

Tax rate in foreign

Political instability

High Opportunity

Economic

Labour cost

Borrowing cost

Diversification in international market

High Opportunity

Social

Consumer behaviour

Obesity in people

Organic food

High Opportunity

Technological

RFID technology

Mobile app for payments

High Opportunity

Legal

Gender discrimination

Food Retailing Commission (FRC)

Adequate wages for overtime

High Opportunity

Environmental

Van drivers

Unwanted plastic bags

High Opportunity

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Recycling

Table 2: Summary of PESTLE Analysis

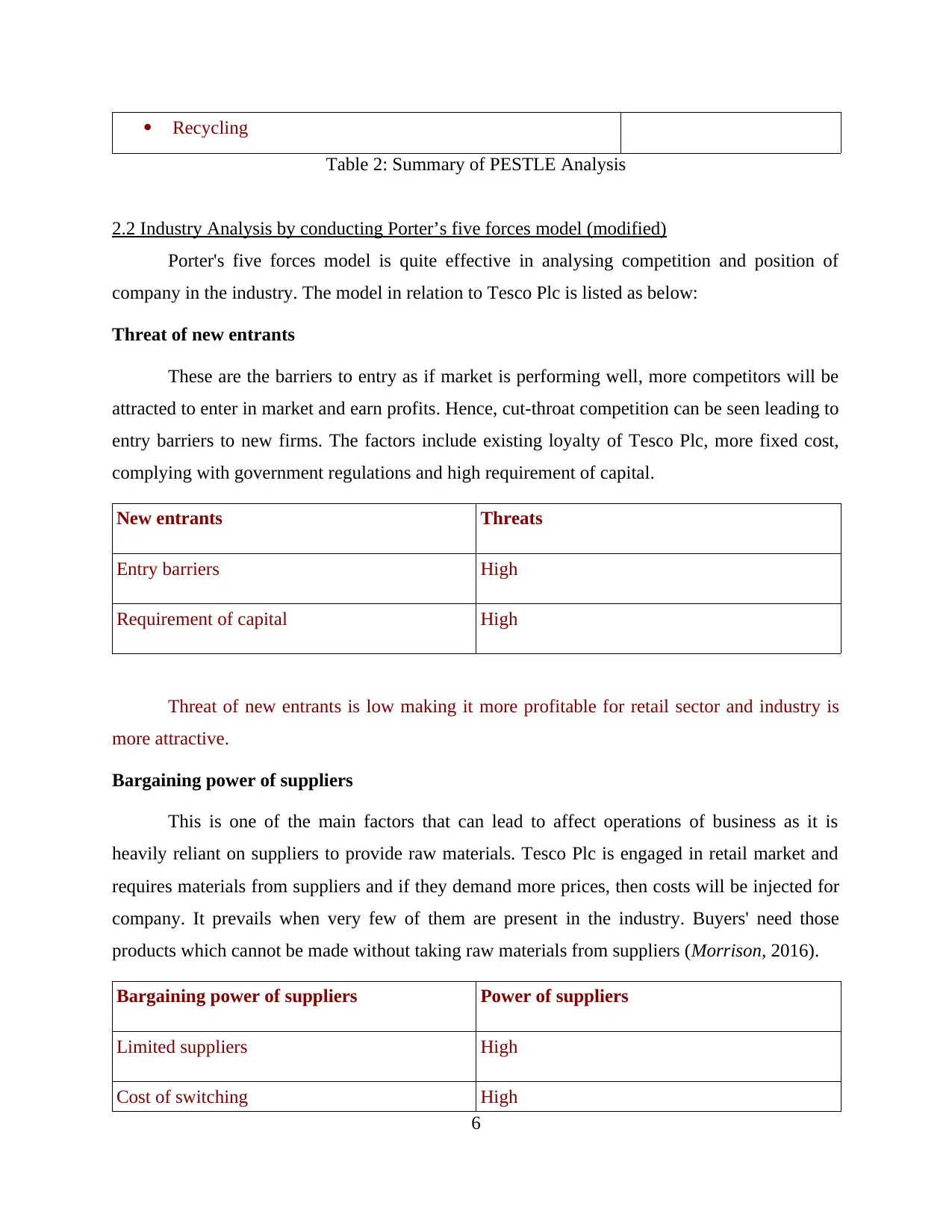

2.2 Industry Analysis by conducting Porter’s five forces model (modified)

Porter's five forces model is quite effective in analysing competition and position of

company in the industry. The model in relation to Tesco Plc is listed as below:

Threat of new entrants

These are the barriers to entry as if market is performing well, more competitors will be

attracted to enter in market and earn profits. Hence, cut-throat competition can be seen leading to

entry barriers to new firms. The factors include existing loyalty of Tesco Plc, more fixed cost,

complying with government regulations and high requirement of capital.

New entrants Threats

Entry barriers High

Requirement of capital High

Threat of new entrants is low making it more profitable for retail sector and industry is

more attractive.

Bargaining power of suppliers

This is one of the main factors that can lead to affect operations of business as it is

heavily reliant on suppliers to provide raw materials. Tesco Plc is engaged in retail market and

requires materials from suppliers and if they demand more prices, then costs will be injected for

company. It prevails when very few of them are present in the industry. Buyers' need those

products which cannot be made without taking raw materials from suppliers (Morrison, 2016).

Bargaining power of suppliers Power of suppliers

Limited suppliers High

Cost of switching High

6

Table 2: Summary of PESTLE Analysis

2.2 Industry Analysis by conducting Porter’s five forces model (modified)

Porter's five forces model is quite effective in analysing competition and position of

company in the industry. The model in relation to Tesco Plc is listed as below:

Threat of new entrants

These are the barriers to entry as if market is performing well, more competitors will be

attracted to enter in market and earn profits. Hence, cut-throat competition can be seen leading to

entry barriers to new firms. The factors include existing loyalty of Tesco Plc, more fixed cost,

complying with government regulations and high requirement of capital.

New entrants Threats

Entry barriers High

Requirement of capital High

Threat of new entrants is low making it more profitable for retail sector and industry is

more attractive.

Bargaining power of suppliers

This is one of the main factors that can lead to affect operations of business as it is

heavily reliant on suppliers to provide raw materials. Tesco Plc is engaged in retail market and

requires materials from suppliers and if they demand more prices, then costs will be injected for

company. It prevails when very few of them are present in the industry. Buyers' need those

products which cannot be made without taking raw materials from suppliers (Morrison, 2016).

Bargaining power of suppliers Power of suppliers

Limited suppliers High

Cost of switching High

6

High bargaining power of suppliers prevails making less profitable for retail sector.

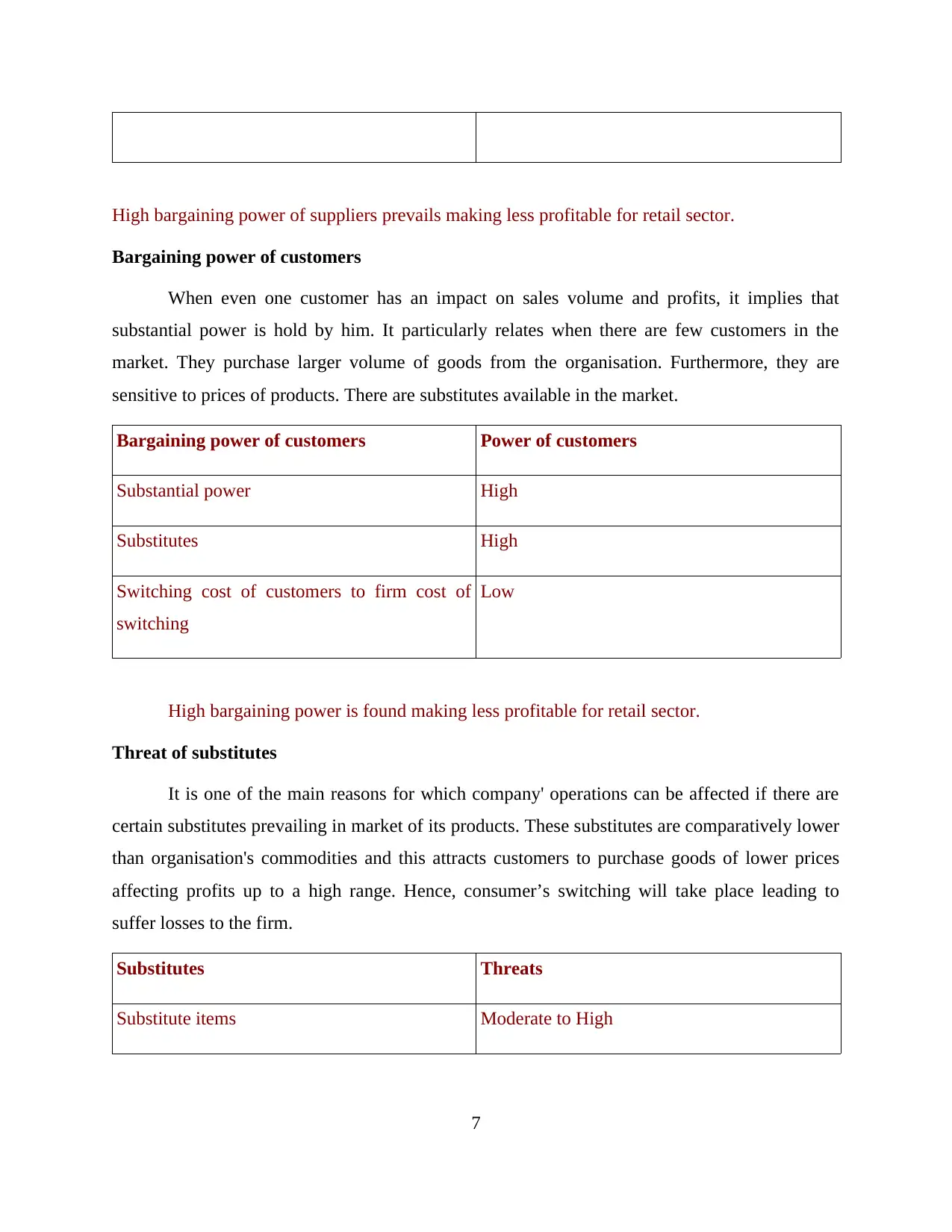

Bargaining power of customers

When even one customer has an impact on sales volume and profits, it implies that

substantial power is hold by him. It particularly relates when there are few customers in the

market. They purchase larger volume of goods from the organisation. Furthermore, they are

sensitive to prices of products. There are substitutes available in the market.

Bargaining power of customers Power of customers

Substantial power High

Substitutes High

Switching cost of customers to firm cost of

switching

Low

High bargaining power is found making less profitable for retail sector.

Threat of substitutes

It is one of the main reasons for which company' operations can be affected if there are

certain substitutes prevailing in market of its products. These substitutes are comparatively lower

than organisation's commodities and this attracts customers to purchase goods of lower prices

affecting profits up to a high range. Hence, consumer’s switching will take place leading to

suffer losses to the firm.

Substitutes Threats

Substitute items Moderate to High

7

Bargaining power of customers

When even one customer has an impact on sales volume and profits, it implies that

substantial power is hold by him. It particularly relates when there are few customers in the

market. They purchase larger volume of goods from the organisation. Furthermore, they are

sensitive to prices of products. There are substitutes available in the market.

Bargaining power of customers Power of customers

Substantial power High

Substitutes High

Switching cost of customers to firm cost of

switching

Low

High bargaining power is found making less profitable for retail sector.

Threat of substitutes

It is one of the main reasons for which company' operations can be affected if there are

certain substitutes prevailing in market of its products. These substitutes are comparatively lower

than organisation's commodities and this attracts customers to purchase goods of lower prices

affecting profits up to a high range. Hence, consumer’s switching will take place leading to

suffer losses to the firm.

Substitutes Threats

Substitute items Moderate to High

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Substitutes are moderate to high which means that industry is less to moderate attractive

and profits are affected.

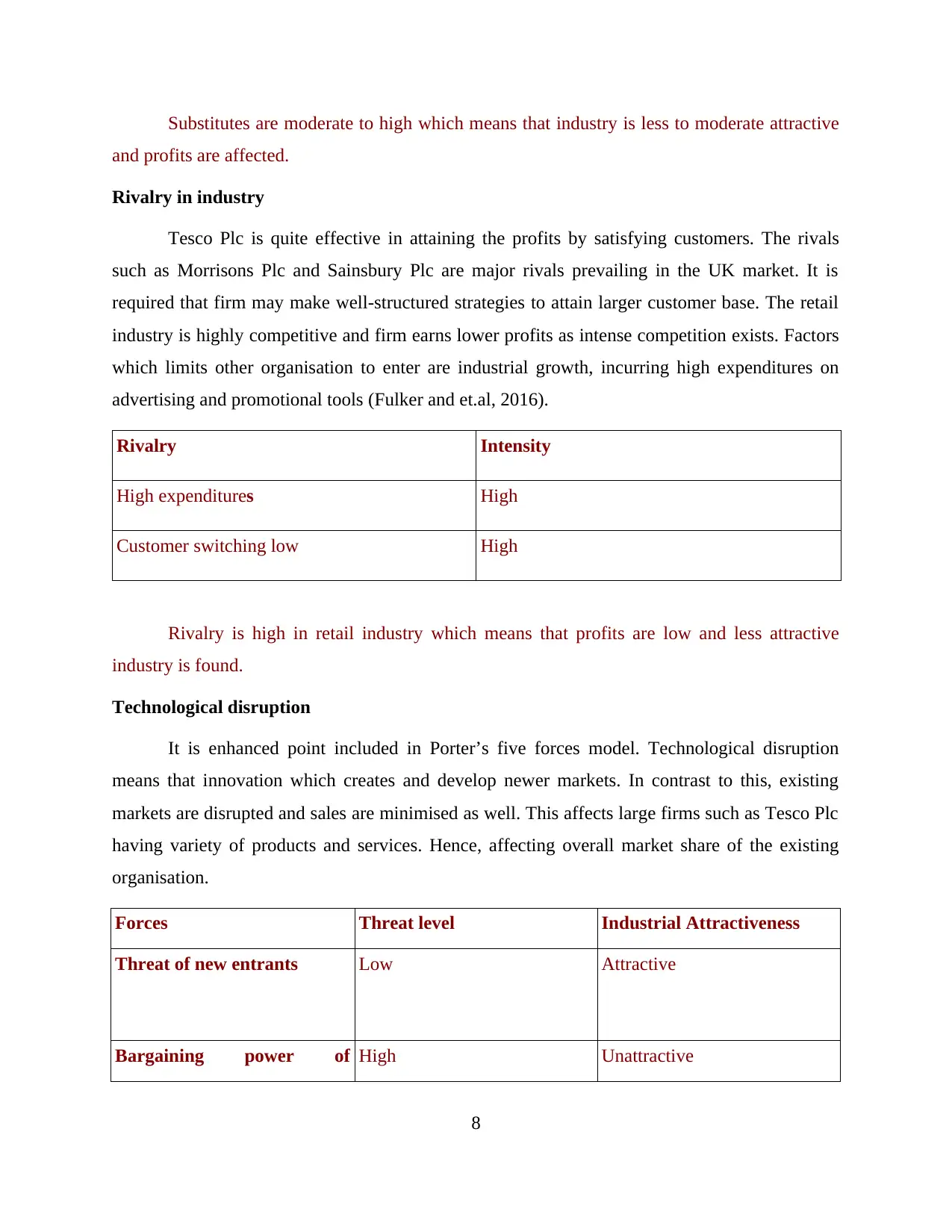

Rivalry in industry

Tesco Plc is quite effective in attaining the profits by satisfying customers. The rivals

such as Morrisons Plc and Sainsbury Plc are major rivals prevailing in the UK market. It is

required that firm may make well-structured strategies to attain larger customer base. The retail

industry is highly competitive and firm earns lower profits as intense competition exists. Factors

which limits other organisation to enter are industrial growth, incurring high expenditures on

advertising and promotional tools (Fulker and et.al, 2016).

Rivalry Intensity

High expenditures High

Customer switching low High

Rivalry is high in retail industry which means that profits are low and less attractive

industry is found.

Technological disruption

It is enhanced point included in Porter’s five forces model. Technological disruption

means that innovation which creates and develop newer markets. In contrast to this, existing

markets are disrupted and sales are minimised as well. This affects large firms such as Tesco Plc

having variety of products and services. Hence, affecting overall market share of the existing

organisation.

Forces Threat level Industrial Attractiveness

Threat of new entrants Low Attractive

Bargaining power of High Unattractive

8

and profits are affected.

Rivalry in industry

Tesco Plc is quite effective in attaining the profits by satisfying customers. The rivals

such as Morrisons Plc and Sainsbury Plc are major rivals prevailing in the UK market. It is

required that firm may make well-structured strategies to attain larger customer base. The retail

industry is highly competitive and firm earns lower profits as intense competition exists. Factors

which limits other organisation to enter are industrial growth, incurring high expenditures on

advertising and promotional tools (Fulker and et.al, 2016).

Rivalry Intensity

High expenditures High

Customer switching low High

Rivalry is high in retail industry which means that profits are low and less attractive

industry is found.

Technological disruption

It is enhanced point included in Porter’s five forces model. Technological disruption

means that innovation which creates and develop newer markets. In contrast to this, existing

markets are disrupted and sales are minimised as well. This affects large firms such as Tesco Plc

having variety of products and services. Hence, affecting overall market share of the existing

organisation.

Forces Threat level Industrial Attractiveness

Threat of new entrants Low Attractive

Bargaining power of High Unattractive

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

suppliers

Bargaining power of

customers

High Unattractive

Threat of substitutes Moderate to High Neutral to Unattractive

Rivalry in industry High Unattractive

Table 3: Favourability of Retail sector

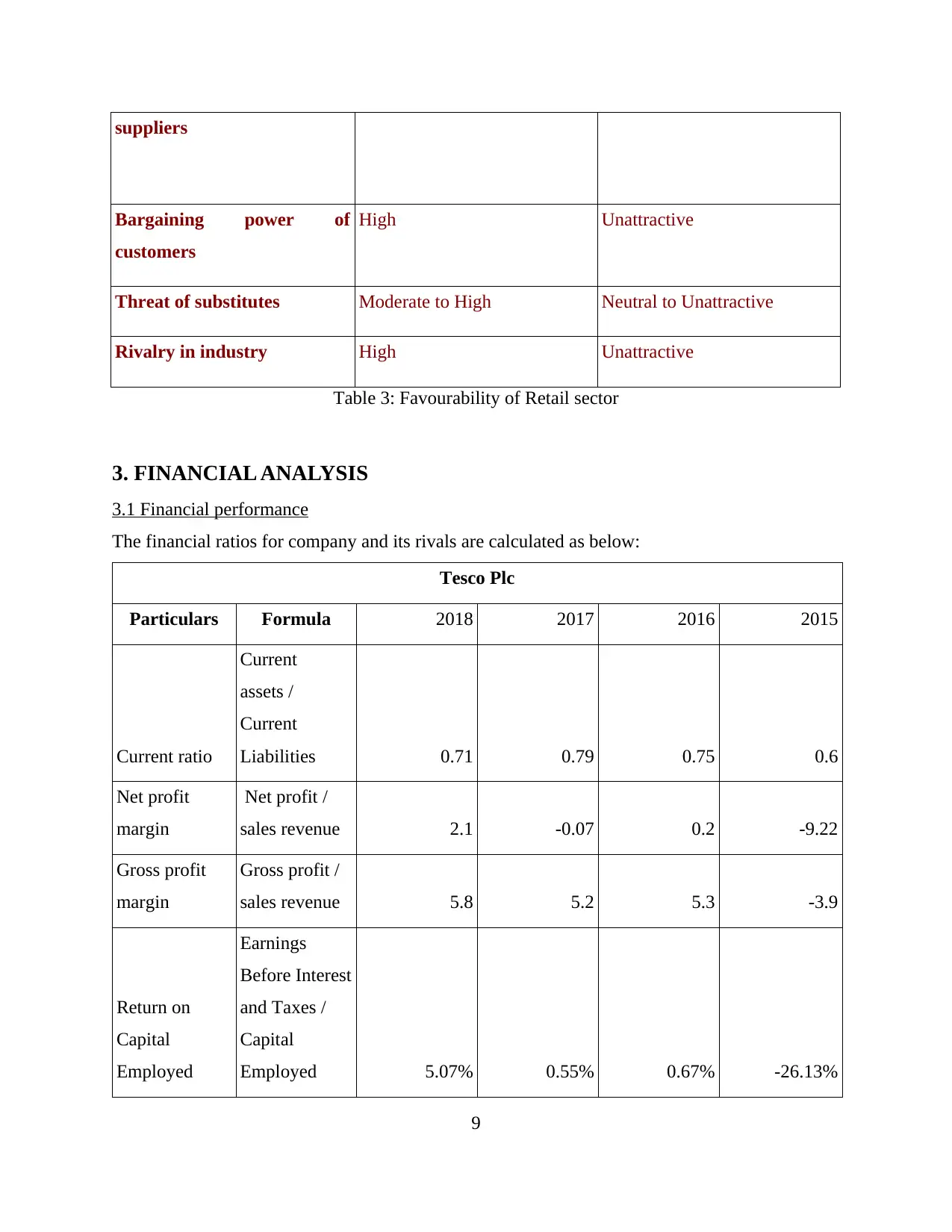

3. FINANCIAL ANALYSIS

3.1 Financial performance

The financial ratios for company and its rivals are calculated as below:

Tesco Plc

Particulars Formula 2018 2017 2016 2015

Current ratio

Current

assets /

Current

Liabilities 0.71 0.79 0.75 0.6

Net profit

margin

Net profit /

sales revenue 2.1 -0.07 0.2 -9.22

Gross profit

margin

Gross profit /

sales revenue 5.8 5.2 5.3 -3.9

Return on

Capital

Employed

Earnings

Before Interest

and Taxes /

Capital

Employed 5.07% 0.55% 0.67% -26.13%

9

Bargaining power of

customers

High Unattractive

Threat of substitutes Moderate to High Neutral to Unattractive

Rivalry in industry High Unattractive

Table 3: Favourability of Retail sector

3. FINANCIAL ANALYSIS

3.1 Financial performance

The financial ratios for company and its rivals are calculated as below:

Tesco Plc

Particulars Formula 2018 2017 2016 2015

Current ratio

Current

assets /

Current

Liabilities 0.71 0.79 0.75 0.6

Net profit

margin

Net profit /

sales revenue 2.1 -0.07 0.2 -9.22

Gross profit

margin

Gross profit /

sales revenue 5.8 5.2 5.3 -3.9

Return on

Capital

Employed

Earnings

Before Interest

and Taxes /

Capital

Employed 5.07% 0.55% 0.67% -26.13%

9

Table 4: Ratio analysis of Tesco Plc

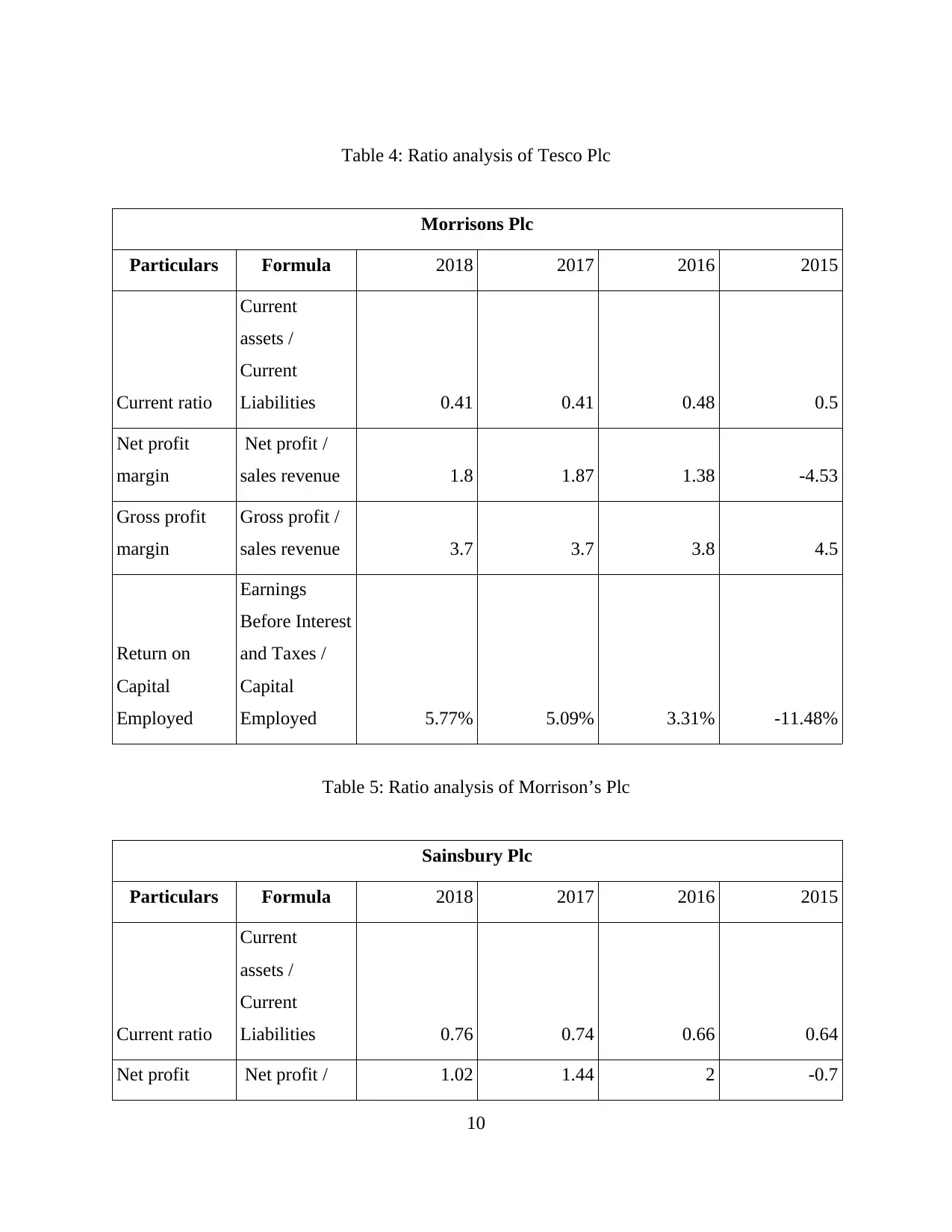

Morrisons Plc

Particulars Formula 2018 2017 2016 2015

Current ratio

Current

assets /

Current

Liabilities 0.41 0.41 0.48 0.5

Net profit

margin

Net profit /

sales revenue 1.8 1.87 1.38 -4.53

Gross profit

margin

Gross profit /

sales revenue 3.7 3.7 3.8 4.5

Return on

Capital

Employed

Earnings

Before Interest

and Taxes /

Capital

Employed 5.77% 5.09% 3.31% -11.48%

Table 5: Ratio analysis of Morrison’s Plc

Sainsbury Plc

Particulars Formula 2018 2017 2016 2015

Current ratio

Current

assets /

Current

Liabilities 0.76 0.74 0.66 0.64

Net profit Net profit / 1.02 1.44 2 -0.7

10

Morrisons Plc

Particulars Formula 2018 2017 2016 2015

Current ratio

Current

assets /

Current

Liabilities 0.41 0.41 0.48 0.5

Net profit

margin

Net profit /

sales revenue 1.8 1.87 1.38 -4.53

Gross profit

margin

Gross profit /

sales revenue 3.7 3.7 3.8 4.5

Return on

Capital

Employed

Earnings

Before Interest

and Taxes /

Capital

Employed 5.77% 5.09% 3.31% -11.48%

Table 5: Ratio analysis of Morrison’s Plc

Sainsbury Plc

Particulars Formula 2018 2017 2016 2015

Current ratio

Current

assets /

Current

Liabilities 0.76 0.74 0.66 0.64

Net profit Net profit / 1.02 1.44 2 -0.7

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 32

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.