LUBM303 - Business Analytics: Costing, Revenue, and Data Correlation

VerifiedAdded on 2023/06/18

|16

|3752

|256

Report

AI Summary

This report provides a comprehensive analysis of various business analytics concepts. It includes a mathematical model for cost calculation, profit/loss analysis, and a 5-year projection using spreadsheets. The costing and revenue behavior of Marko farms limited (MK Ltd.) are analyzed, focusing on fixed and variable costs. Furthermore, the report calculates the correlation between advertising expenses and sales revenue for Jump-Well Limited (JWL), discussing the impact of advertising on organizational performance. Finally, it determines the break-even point and margin of safety for BAX Plc, providing insights into sales volume targets and profitability. Desklib offers a wide range of similar solved assignments and past papers for students.

Business Analytic

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

QUESTION 1...................................................................................................................................3

a) Developing a mathematical model by using cost information................................................3

b) Calculating the profit or loss...................................................................................................3

c) Drawing graph with spreadsheet for 5-year projection...........................................................4

d) Analysing costing and revenue behaviour..............................................................................5

QUESTION 2...................................................................................................................................6

a)..................................................................................................................................................6

calculating correlation.................................................................................................................6

b).................................................................................................................................................7

c)..................................................................................................................................................9

QUESTION 3.................................................................................................................................10

a) Determining breakeven point & margin of safety................................................................10

b) Discussing sales volume to achieve target and evaluating sales volume that will neither

cause profit nor loss..................................................................................................................12

c.................................................................................................................................................12

e)................................................................................................................................................12

REFERENCES..............................................................................................................................15

QUESTION 1...................................................................................................................................3

a) Developing a mathematical model by using cost information................................................3

b) Calculating the profit or loss...................................................................................................3

c) Drawing graph with spreadsheet for 5-year projection...........................................................4

d) Analysing costing and revenue behaviour..............................................................................5

QUESTION 2...................................................................................................................................6

a)..................................................................................................................................................6

calculating correlation.................................................................................................................6

b).................................................................................................................................................7

c)..................................................................................................................................................9

QUESTION 3.................................................................................................................................10

a) Determining breakeven point & margin of safety................................................................10

b) Discussing sales volume to achieve target and evaluating sales volume that will neither

cause profit nor loss..................................................................................................................12

c.................................................................................................................................................12

e)................................................................................................................................................12

REFERENCES..............................................................................................................................15

QUESTION 1

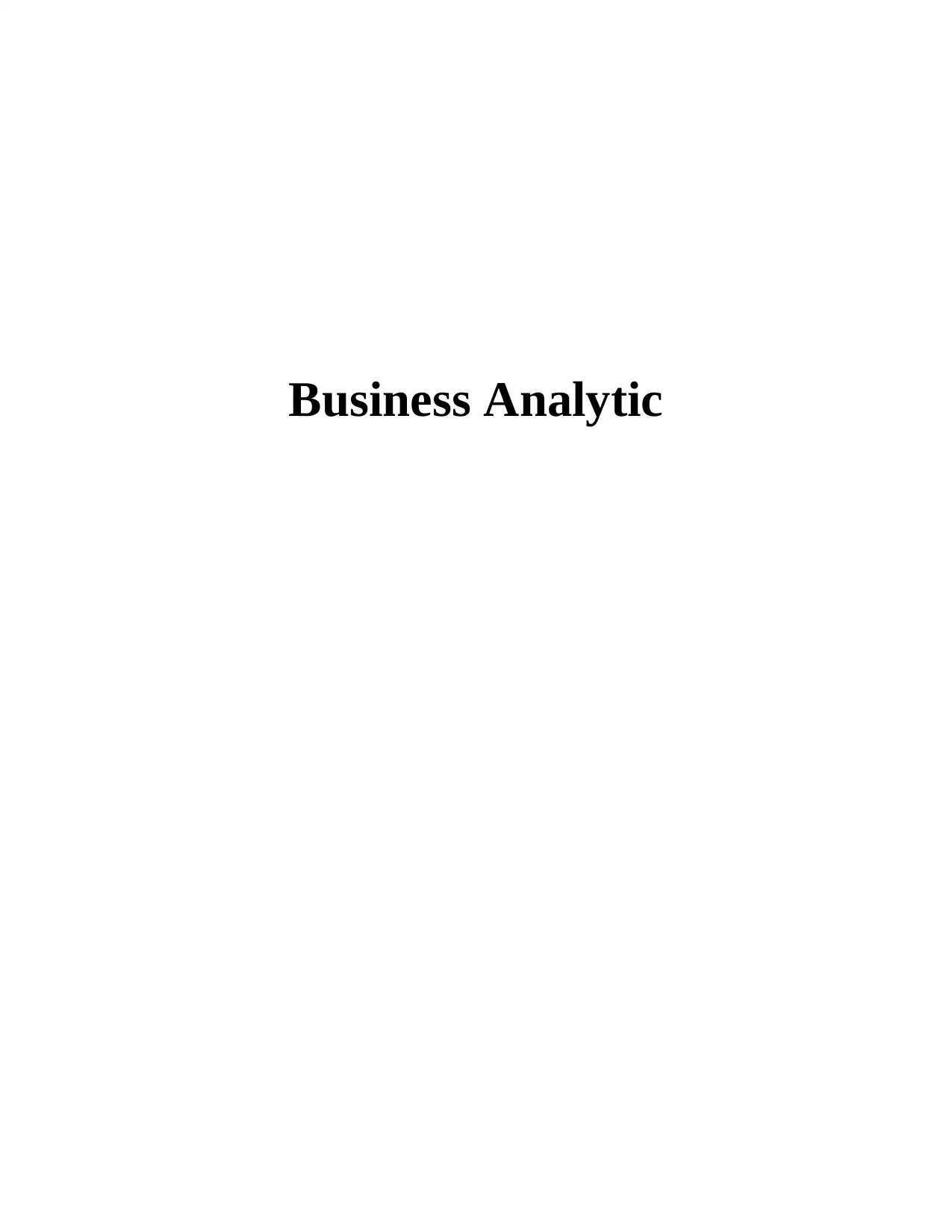

a) Developing a mathematical model by using cost information

The mathematical model helped in calculating the total cost of production as follows:

Quantity produced = 400000

Unit variable cost = £1.50

Total variable cost = £600000

Fixed cost = £100000

Therefore, Total cost = Fixed cost + variable cost

= £100,000 + £600000

= £700000

b) Calculating the profit or loss

Particulars Amount (£)

Total Cost

£700000

Unit variable

cost

£1.50

Fixed Cost

£100000

Quantity

produced

£400,000

Variable Cost

£600000

a) Developing a mathematical model by using cost information

The mathematical model helped in calculating the total cost of production as follows:

Quantity produced = 400000

Unit variable cost = £1.50

Total variable cost = £600000

Fixed cost = £100000

Therefore, Total cost = Fixed cost + variable cost

= £100,000 + £600000

= £700000

b) Calculating the profit or loss

Particulars Amount (£)

Total Cost

£700000

Unit variable

cost

£1.50

Fixed Cost

£100000

Quantity

produced

£400,000

Variable Cost

£600000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Annual Output 400000

Fixed cost 100000

Variable cost 600000

Total cost 700000

Selling price 3

Total sales 1200000

Profit 500000

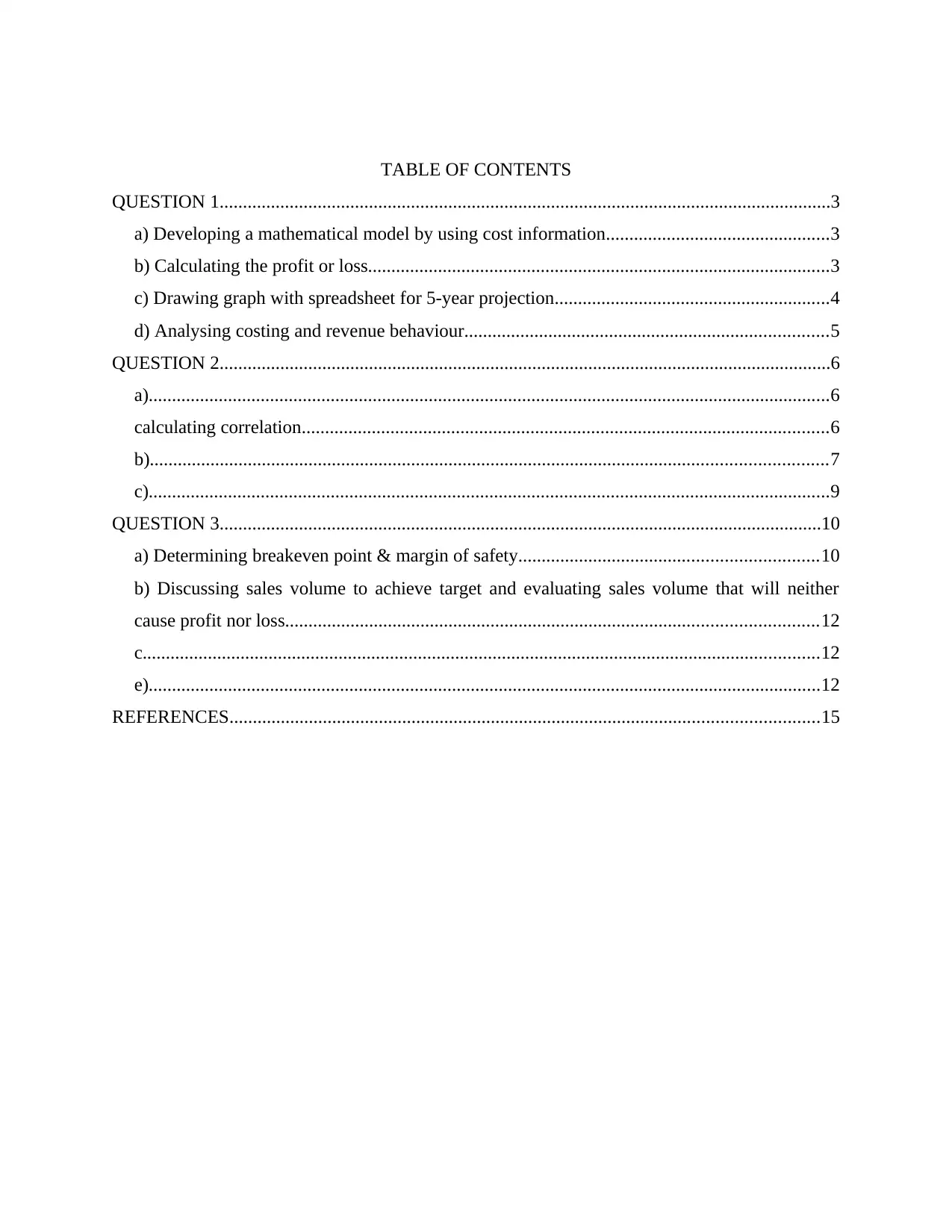

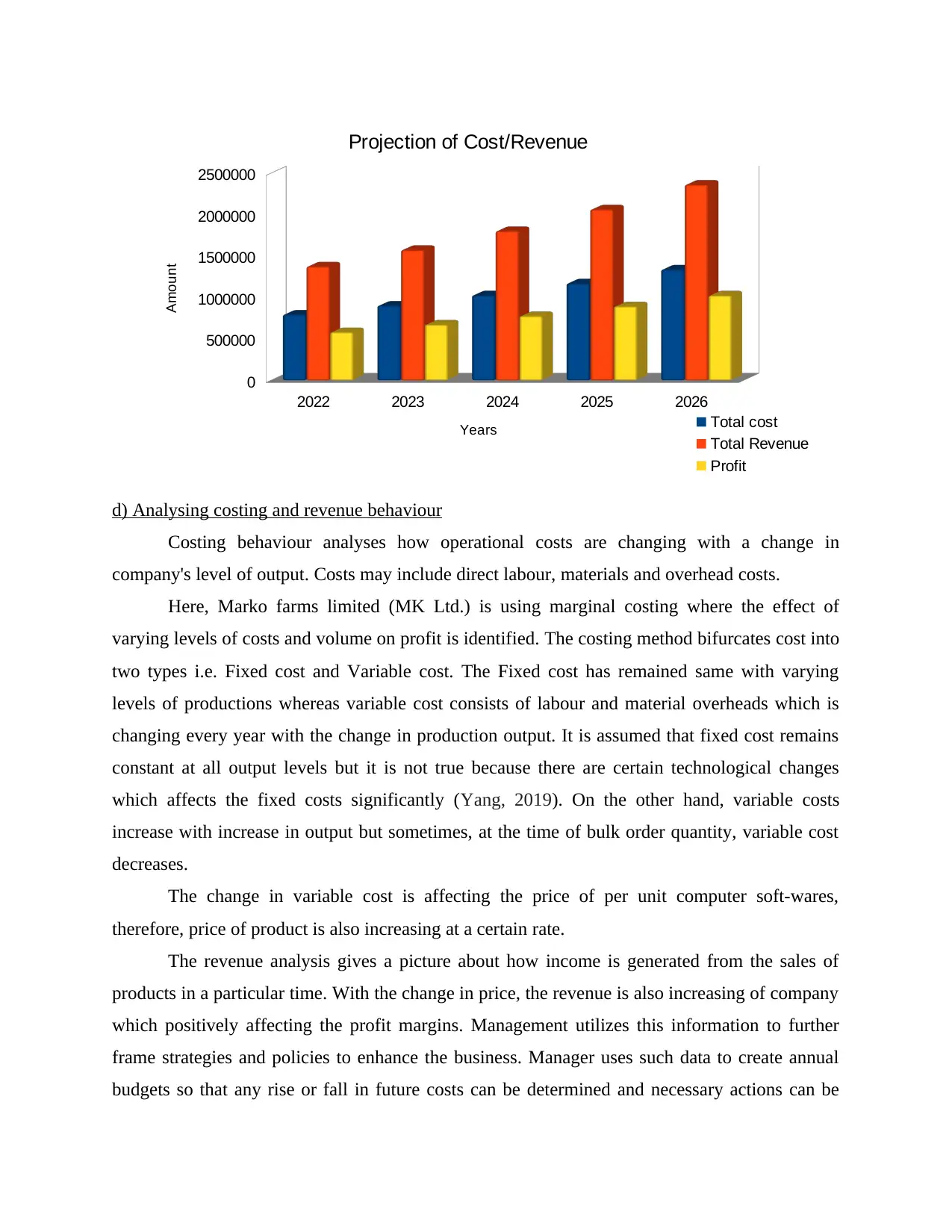

c) Drawing graph with spreadsheet for 5-year projection

Particulars Year 2022 2023 2024 2025 2026

Total output 428000 457960 490017.2 524318.40 561020.69

Fixed cost 100000 100000 100000 100000 100000

Variable cost (in

units) 1.62 1.75 1.89 2.04 2.20

Total variable

cost 693360 801246.82 925920.82 1069994.1 1236485.18

Total cost £793360 £901246.82 £1025920.82 £1169994.1 £1336485.18

Selling price 3.21 3.43 3.68 3.93 4.21

Total sales £1373880 £1572955.21 £1800876.42 £2061823.42 £2360581.63

Profit/Loss £580520 £671708.40 £774955.60 £891829.32 £1024096.45

Fixed cost 100000

Variable cost 600000

Total cost 700000

Selling price 3

Total sales 1200000

Profit 500000

c) Drawing graph with spreadsheet for 5-year projection

Particulars Year 2022 2023 2024 2025 2026

Total output 428000 457960 490017.2 524318.40 561020.69

Fixed cost 100000 100000 100000 100000 100000

Variable cost (in

units) 1.62 1.75 1.89 2.04 2.20

Total variable

cost 693360 801246.82 925920.82 1069994.1 1236485.18

Total cost £793360 £901246.82 £1025920.82 £1169994.1 £1336485.18

Selling price 3.21 3.43 3.68 3.93 4.21

Total sales £1373880 £1572955.21 £1800876.42 £2061823.42 £2360581.63

Profit/Loss £580520 £671708.40 £774955.60 £891829.32 £1024096.45

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2022 2023 2024 2025 2026

0

500000

1000000

1500000

2000000

2500000

Projection of Cost/Revenue

Total cost

Total Revenue

Profit

Years

Amount

d) Analysing costing and revenue behaviour

Costing behaviour analyses how operational costs are changing with a change in

company's level of output. Costs may include direct labour, materials and overhead costs.

Here, Marko farms limited (MK Ltd.) is using marginal costing where the effect of

varying levels of costs and volume on profit is identified. The costing method bifurcates cost into

two types i.e. Fixed cost and Variable cost. The Fixed cost has remained same with varying

levels of productions whereas variable cost consists of labour and material overheads which is

changing every year with the change in production output. It is assumed that fixed cost remains

constant at all output levels but it is not true because there are certain technological changes

which affects the fixed costs significantly (Yang, 2019). On the other hand, variable costs

increase with increase in output but sometimes, at the time of bulk order quantity, variable cost

decreases.

The change in variable cost is affecting the price of per unit computer soft-wares,

therefore, price of product is also increasing at a certain rate.

The revenue analysis gives a picture about how income is generated from the sales of

products in a particular time. With the change in price, the revenue is also increasing of company

which positively affecting the profit margins. Management utilizes this information to further

frame strategies and policies to enhance the business. Manager uses such data to create annual

budgets so that any rise or fall in future costs can be determined and necessary actions can be

0

500000

1000000

1500000

2000000

2500000

Projection of Cost/Revenue

Total cost

Total Revenue

Profit

Years

Amount

d) Analysing costing and revenue behaviour

Costing behaviour analyses how operational costs are changing with a change in

company's level of output. Costs may include direct labour, materials and overhead costs.

Here, Marko farms limited (MK Ltd.) is using marginal costing where the effect of

varying levels of costs and volume on profit is identified. The costing method bifurcates cost into

two types i.e. Fixed cost and Variable cost. The Fixed cost has remained same with varying

levels of productions whereas variable cost consists of labour and material overheads which is

changing every year with the change in production output. It is assumed that fixed cost remains

constant at all output levels but it is not true because there are certain technological changes

which affects the fixed costs significantly (Yang, 2019). On the other hand, variable costs

increase with increase in output but sometimes, at the time of bulk order quantity, variable cost

decreases.

The change in variable cost is affecting the price of per unit computer soft-wares,

therefore, price of product is also increasing at a certain rate.

The revenue analysis gives a picture about how income is generated from the sales of

products in a particular time. With the change in price, the revenue is also increasing of company

which positively affecting the profit margins. Management utilizes this information to further

frame strategies and policies to enhance the business. Manager uses such data to create annual

budgets so that any rise or fall in future costs can be determined and necessary actions can be

taken to solve issues. It is an important planning, forecasting and controlling tool which helps

business to avoid instability in operations.

QUESTION 2

a)

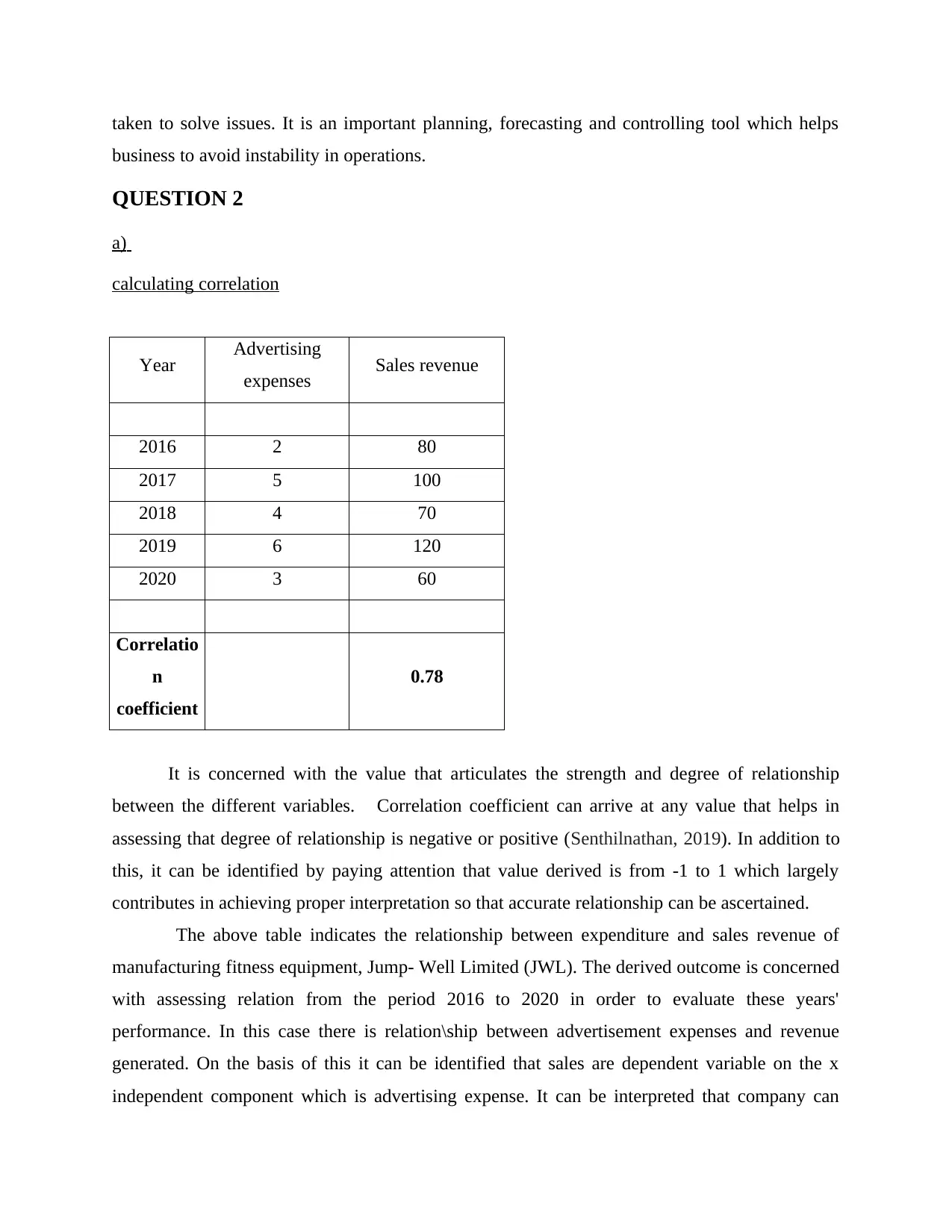

calculating correlation

Year Advertising

expenses Sales revenue

2016 2 80

2017 5 100

2018 4 70

2019 6 120

2020 3 60

Correlatio

n

coefficient

0.78

It is concerned with the value that articulates the strength and degree of relationship

between the different variables. Correlation coefficient can arrive at any value that helps in

assessing that degree of relationship is negative or positive (Senthilnathan, 2019). In addition to

this, it can be identified by paying attention that value derived is from -1 to 1 which largely

contributes in achieving proper interpretation so that accurate relationship can be ascertained.

The above table indicates the relationship between expenditure and sales revenue of

manufacturing fitness equipment, Jump- Well Limited (JWL). The derived outcome is concerned

with assessing relation from the period 2016 to 2020 in order to evaluate these years'

performance. In this case there is relation\ship between advertisement expenses and revenue

generated. On the basis of this it can be identified that sales are dependent variable on the x

independent component which is advertising expense. It can be interpreted that company can

business to avoid instability in operations.

QUESTION 2

a)

calculating correlation

Year Advertising

expenses Sales revenue

2016 2 80

2017 5 100

2018 4 70

2019 6 120

2020 3 60

Correlatio

n

coefficient

0.78

It is concerned with the value that articulates the strength and degree of relationship

between the different variables. Correlation coefficient can arrive at any value that helps in

assessing that degree of relationship is negative or positive (Senthilnathan, 2019). In addition to

this, it can be identified by paying attention that value derived is from -1 to 1 which largely

contributes in achieving proper interpretation so that accurate relationship can be ascertained.

The above table indicates the relationship between expenditure and sales revenue of

manufacturing fitness equipment, Jump- Well Limited (JWL). The derived outcome is concerned

with assessing relation from the period 2016 to 2020 in order to evaluate these years'

performance. In this case there is relation\ship between advertisement expenses and revenue

generated. On the basis of this it can be identified that sales are dependent variable on the x

independent component which is advertising expense. It can be interpreted that company can

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

assess how effectively its advertising expenditure is assisting in obtaining positive level of

performance in terms of revenue. JWL can pay attention can quantify the linear dependency of

two variables.

On the basis of above computation of model, it can be interpreted that there is positive

relationship among the stated X and Y variable. This can be articulated on the basis of derived

outcome that these both mentioned components have positive directional growth. If the

advertisement expenses will go in upper direction, there is possibility of increasing sales (Tellis,

2019). Once Jump- Well Limited will decline its expenditure relation with independent variable

like advertisement cost, reduced revenue generating capacity will be obtained. The attained

result is more than zero which is positive indicator of relationship between these variable.

This can be articulated that specified organization as per the performance of 2016 to 2020,

when expenses are increasing, outcome in form of revenue will incline. It can be validated that

from 2016 to 2019 it has increased which forced the sales category to uplift the performance. On

the other side, in 2020 as compared to 2019, revenue generating capacity has decreased due to

reduce in stated expenditure. It is highly beneficial for the specified organization to pay attention

measuring the correlation in order to get higher productivity & sustainability in sector. The

obtained outcome will be largely useful in terms of taking decision regarding analysing,

allocating and controlling expenses for the advertising department in order to incline

organizational performance. This will aid firm to concentrate on applying proper actions to attain

greater outcome.

b)

performance in terms of revenue. JWL can pay attention can quantify the linear dependency of

two variables.

On the basis of above computation of model, it can be interpreted that there is positive

relationship among the stated X and Y variable. This can be articulated on the basis of derived

outcome that these both mentioned components have positive directional growth. If the

advertisement expenses will go in upper direction, there is possibility of increasing sales (Tellis,

2019). Once Jump- Well Limited will decline its expenditure relation with independent variable

like advertisement cost, reduced revenue generating capacity will be obtained. The attained

result is more than zero which is positive indicator of relationship between these variable.

This can be articulated that specified organization as per the performance of 2016 to 2020,

when expenses are increasing, outcome in form of revenue will incline. It can be validated that

from 2016 to 2019 it has increased which forced the sales category to uplift the performance. On

the other side, in 2020 as compared to 2019, revenue generating capacity has decreased due to

reduce in stated expenditure. It is highly beneficial for the specified organization to pay attention

measuring the correlation in order to get higher productivity & sustainability in sector. The

obtained outcome will be largely useful in terms of taking decision regarding analysing,

allocating and controlling expenses for the advertising department in order to incline

organizational performance. This will aid firm to concentrate on applying proper actions to attain

greater outcome.

b)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

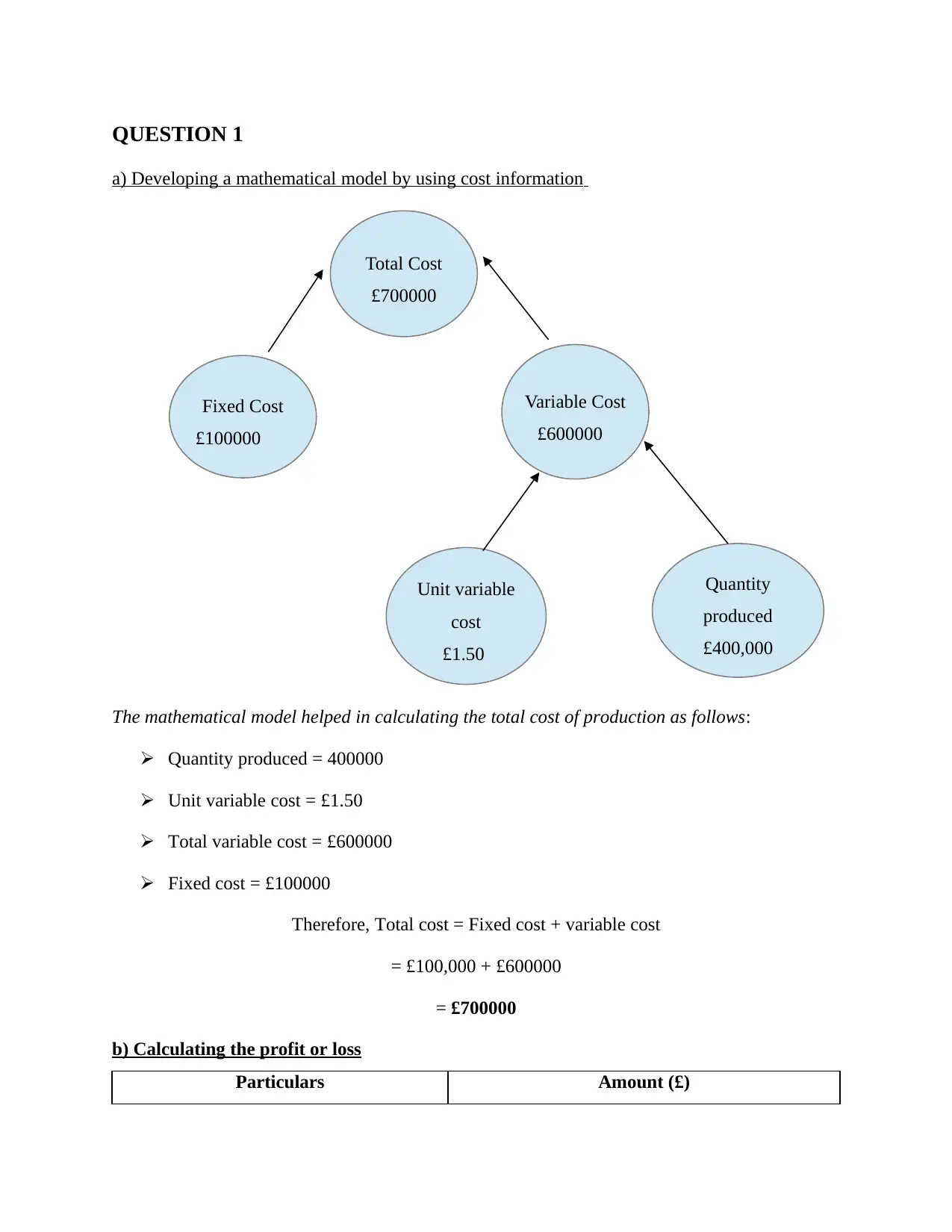

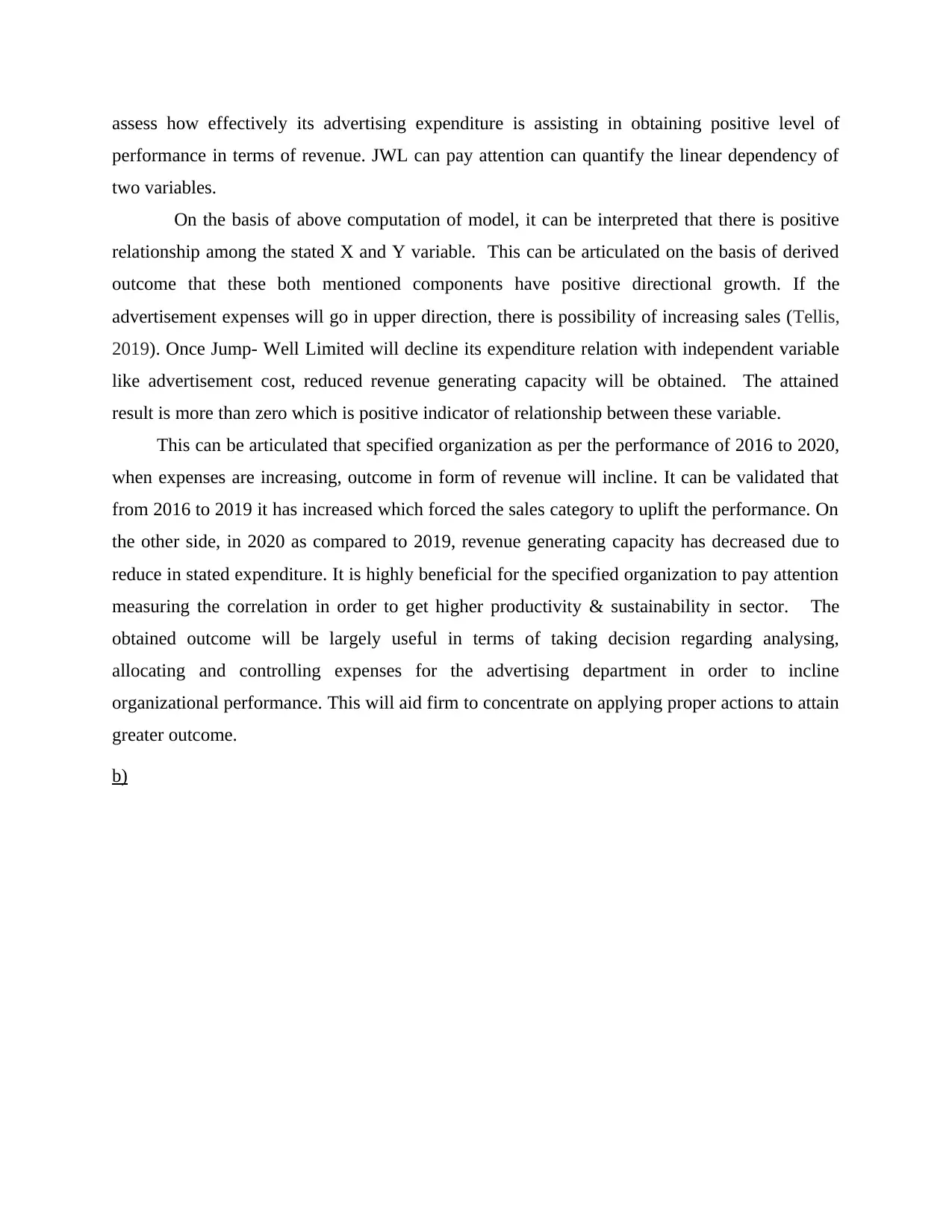

Above diagram can be taken into consideration for assessing relationship between

advertising & sales revenue. In addition to this, it can be identified that blue plotted dots are

presenting advertising expenses whereas red is showing sales revenue. The degree of relationship

on the basis of specified factors can be understood by looking the scatter form of plotted chart. It

is indicating that organization is incurring cost on advertising department which is having direct

relationship with sales created.

This is reflecting the direct form of increasing & decreasing is shown in chart as both

components are moving in same direction. The pattern of relationship is presenting that firm is

getting accurate form of results as per the efforts contributed in terms of expenses incurred. It

can be clearly seen in that there is favourable performance achieved by specified company via

conducting accurate manner of expenses to have desired level of revenue. It is highly useful in

comparing organizational performance among the years so that gaining accurate knowledge

regarding relationship occurring can be derived. On the basis of obtained evaluation it can be

identified that Jump Well Limited is having proper application of level of expenditure for

achieving desired level of sales.

2015 2016 2017 2018 2019 2020 2021

0

20

40

60

80

100

120

140

Advertising expenses

Sales revenue

advertising & sales revenue. In addition to this, it can be identified that blue plotted dots are

presenting advertising expenses whereas red is showing sales revenue. The degree of relationship

on the basis of specified factors can be understood by looking the scatter form of plotted chart. It

is indicating that organization is incurring cost on advertising department which is having direct

relationship with sales created.

This is reflecting the direct form of increasing & decreasing is shown in chart as both

components are moving in same direction. The pattern of relationship is presenting that firm is

getting accurate form of results as per the efforts contributed in terms of expenses incurred. It

can be clearly seen in that there is favourable performance achieved by specified company via

conducting accurate manner of expenses to have desired level of revenue. It is highly useful in

comparing organizational performance among the years so that gaining accurate knowledge

regarding relationship occurring can be derived. On the basis of obtained evaluation it can be

identified that Jump Well Limited is having proper application of level of expenditure for

achieving desired level of sales.

2015 2016 2017 2018 2019 2020 2021

0

20

40

60

80

100

120

140

Advertising expenses

Sales revenue

c)

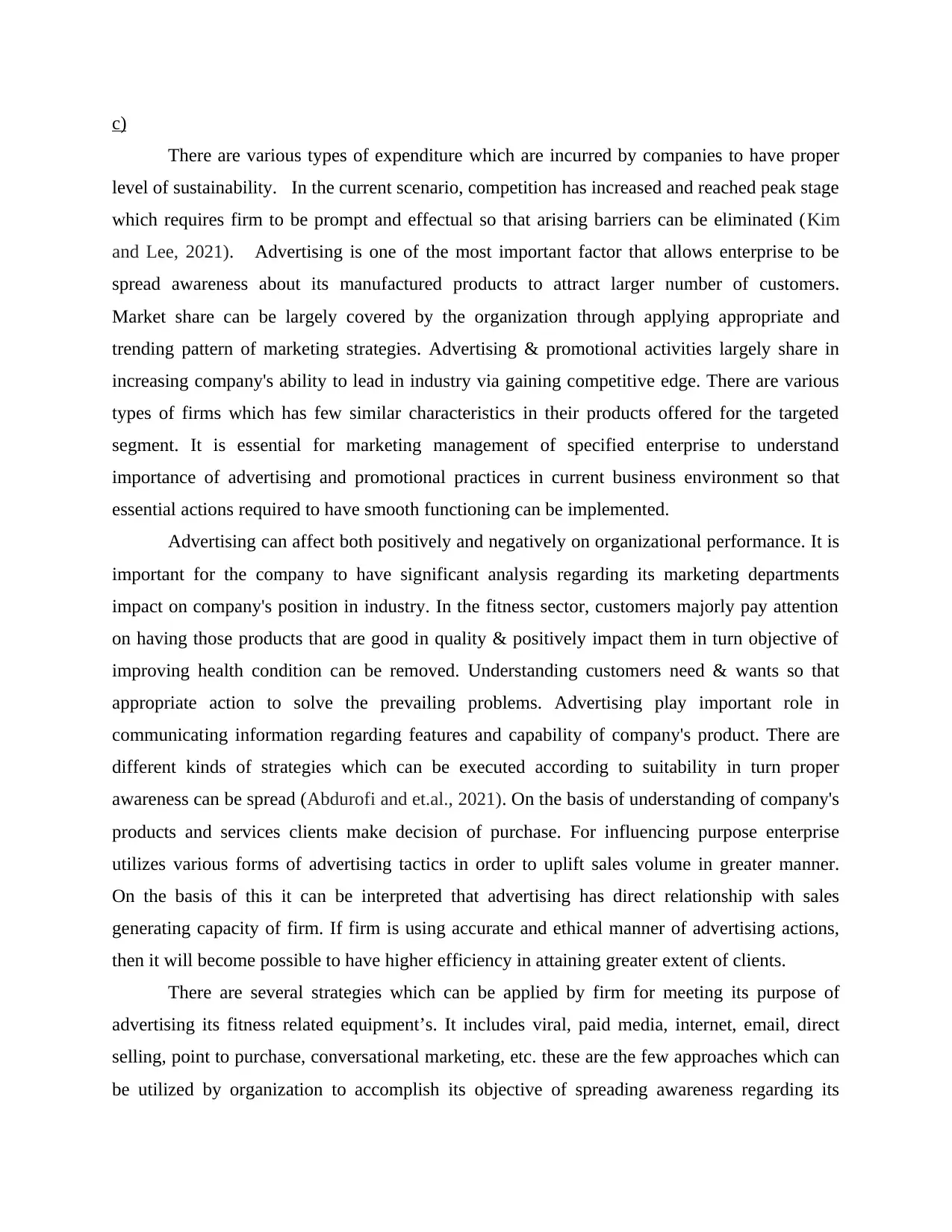

There are various types of expenditure which are incurred by companies to have proper

level of sustainability. In the current scenario, competition has increased and reached peak stage

which requires firm to be prompt and effectual so that arising barriers can be eliminated (Kim

and Lee, 2021). Advertising is one of the most important factor that allows enterprise to be

spread awareness about its manufactured products to attract larger number of customers.

Market share can be largely covered by the organization through applying appropriate and

trending pattern of marketing strategies. Advertising & promotional activities largely share in

increasing company's ability to lead in industry via gaining competitive edge. There are various

types of firms which has few similar characteristics in their products offered for the targeted

segment. It is essential for marketing management of specified enterprise to understand

importance of advertising and promotional practices in current business environment so that

essential actions required to have smooth functioning can be implemented.

Advertising can affect both positively and negatively on organizational performance. It is

important for the company to have significant analysis regarding its marketing departments

impact on company's position in industry. In the fitness sector, customers majorly pay attention

on having those products that are good in quality & positively impact them in turn objective of

improving health condition can be removed. Understanding customers need & wants so that

appropriate action to solve the prevailing problems. Advertising play important role in

communicating information regarding features and capability of company's product. There are

different kinds of strategies which can be executed according to suitability in turn proper

awareness can be spread (Abdurofi and et.al., 2021). On the basis of understanding of company's

products and services clients make decision of purchase. For influencing purpose enterprise

utilizes various forms of advertising tactics in order to uplift sales volume in greater manner.

On the basis of this it can be interpreted that advertising has direct relationship with sales

generating capacity of firm. If firm is using accurate and ethical manner of advertising actions,

then it will become possible to have higher efficiency in attaining greater extent of clients.

There are several strategies which can be applied by firm for meeting its purpose of

advertising its fitness related equipment’s. It includes viral, paid media, internet, email, direct

selling, point to purchase, conversational marketing, etc. these are the few approaches which can

be utilized by organization to accomplish its objective of spreading awareness regarding its

There are various types of expenditure which are incurred by companies to have proper

level of sustainability. In the current scenario, competition has increased and reached peak stage

which requires firm to be prompt and effectual so that arising barriers can be eliminated (Kim

and Lee, 2021). Advertising is one of the most important factor that allows enterprise to be

spread awareness about its manufactured products to attract larger number of customers.

Market share can be largely covered by the organization through applying appropriate and

trending pattern of marketing strategies. Advertising & promotional activities largely share in

increasing company's ability to lead in industry via gaining competitive edge. There are various

types of firms which has few similar characteristics in their products offered for the targeted

segment. It is essential for marketing management of specified enterprise to understand

importance of advertising and promotional practices in current business environment so that

essential actions required to have smooth functioning can be implemented.

Advertising can affect both positively and negatively on organizational performance. It is

important for the company to have significant analysis regarding its marketing departments

impact on company's position in industry. In the fitness sector, customers majorly pay attention

on having those products that are good in quality & positively impact them in turn objective of

improving health condition can be removed. Understanding customers need & wants so that

appropriate action to solve the prevailing problems. Advertising play important role in

communicating information regarding features and capability of company's product. There are

different kinds of strategies which can be executed according to suitability in turn proper

awareness can be spread (Abdurofi and et.al., 2021). On the basis of understanding of company's

products and services clients make decision of purchase. For influencing purpose enterprise

utilizes various forms of advertising tactics in order to uplift sales volume in greater manner.

On the basis of this it can be interpreted that advertising has direct relationship with sales

generating capacity of firm. If firm is using accurate and ethical manner of advertising actions,

then it will become possible to have higher efficiency in attaining greater extent of clients.

There are several strategies which can be applied by firm for meeting its purpose of

advertising its fitness related equipment’s. It includes viral, paid media, internet, email, direct

selling, point to purchase, conversational marketing, etc. these are the few approaches which can

be utilized by organization to accomplish its objective of spreading awareness regarding its

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

offered products benefits to make buyer positively influenced and take decision in favour of

organization (Ndidi and Etebo, 2021). The targeted audience of the fitness industry is usually

persons who are health conscious & have objective of good physical appearance. This comprises

youngsters, middle age group people, etc. with respect to this, it can be recognized that for

having higher attention of clients, fitness based enterprise can use digital marketing practices,

conducting campaigns, etc. Social media, email, display, etc. are those approaches which can be

largely useful in having distinct competitive advantages in terms of higher transparency, proper

clarity of features, etc. that can permit to building trustworthiness relationship among customers.

It will as well provide assistance in having two-way communication which is useful in solving

queries and issues to positively impact clients and create positive working atmosphere. The

mentioned organization will become positively affected by adopting these marketing practices

through identifying suitable market segment to obtain growth in sector. Marketing strategies is

important to choose wisely so that favourable impact can be implemented by eliminating

irrelevant aspects in order to reach desirable position in industry.

QUESTION 3

a) Determining breakeven point & margin of safety

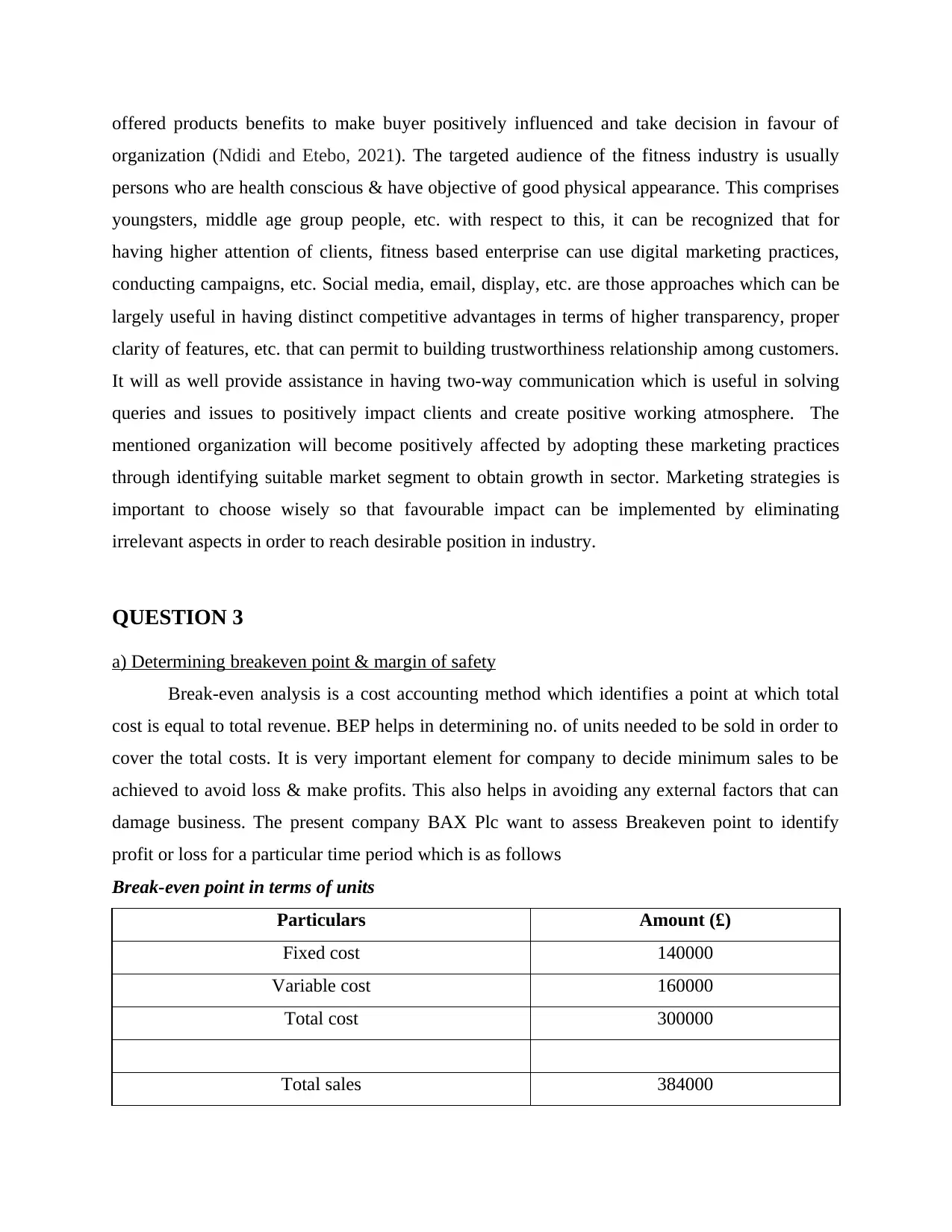

Break-even analysis is a cost accounting method which identifies a point at which total

cost is equal to total revenue. BEP helps in determining no. of units needed to be sold in order to

cover the total costs. It is very important element for company to decide minimum sales to be

achieved to avoid loss & make profits. This also helps in avoiding any external factors that can

damage business. The present company BAX Plc want to assess Breakeven point to identify

profit or loss for a particular time period which is as follows

Break-even point in terms of units

Particulars Amount (£)

Fixed cost 140000

Variable cost 160000

Total cost 300000

Total sales 384000

organization (Ndidi and Etebo, 2021). The targeted audience of the fitness industry is usually

persons who are health conscious & have objective of good physical appearance. This comprises

youngsters, middle age group people, etc. with respect to this, it can be recognized that for

having higher attention of clients, fitness based enterprise can use digital marketing practices,

conducting campaigns, etc. Social media, email, display, etc. are those approaches which can be

largely useful in having distinct competitive advantages in terms of higher transparency, proper

clarity of features, etc. that can permit to building trustworthiness relationship among customers.

It will as well provide assistance in having two-way communication which is useful in solving

queries and issues to positively impact clients and create positive working atmosphere. The

mentioned organization will become positively affected by adopting these marketing practices

through identifying suitable market segment to obtain growth in sector. Marketing strategies is

important to choose wisely so that favourable impact can be implemented by eliminating

irrelevant aspects in order to reach desirable position in industry.

QUESTION 3

a) Determining breakeven point & margin of safety

Break-even analysis is a cost accounting method which identifies a point at which total

cost is equal to total revenue. BEP helps in determining no. of units needed to be sold in order to

cover the total costs. It is very important element for company to decide minimum sales to be

achieved to avoid loss & make profits. This also helps in avoiding any external factors that can

damage business. The present company BAX Plc want to assess Breakeven point to identify

profit or loss for a particular time period which is as follows

Break-even point in terms of units

Particulars Amount (£)

Fixed cost 140000

Variable cost 160000

Total cost 300000

Total sales 384000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Profit 84000

Computation of BEP

Particulars Formula Amount (£)

Selling price per unit (SPU) 640

Variable cost per unit (VCPU) 250

Contribution per unit (CPU) SPU - VCPU 390

Fixed cost (FC) 140000

Breakeven point FC / CPU 359

Break even sales BEP units * SPU 229743.59

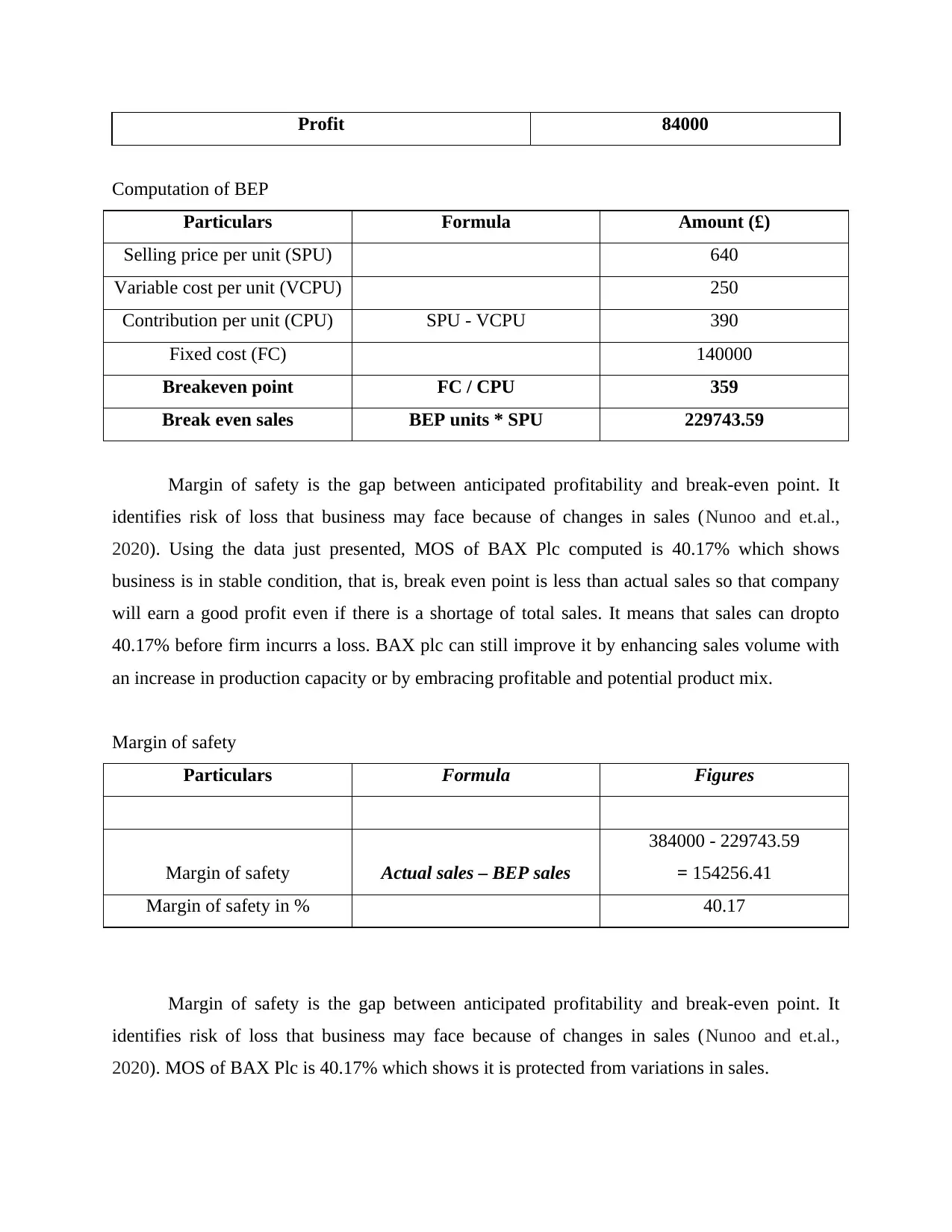

Margin of safety is the gap between anticipated profitability and break-even point. It

identifies risk of loss that business may face because of changes in sales (Nunoo and et.al.,

2020). Using the data just presented, MOS of BAX Plc computed is 40.17% which shows

business is in stable condition, that is, break even point is less than actual sales so that company

will earn a good profit even if there is a shortage of total sales. It means that sales can dropto

40.17% before firm incurrs a loss. BAX plc can still improve it by enhancing sales volume with

an increase in production capacity or by embracing profitable and potential product mix.

Margin of safety

Particulars Formula Figures

Margin of safety Actual sales – BEP sales

384000 - 229743.59

= 154256.41

Margin of safety in % 40.17

Margin of safety is the gap between anticipated profitability and break-even point. It

identifies risk of loss that business may face because of changes in sales (Nunoo and et.al.,

2020). MOS of BAX Plc is 40.17% which shows it is protected from variations in sales.

Computation of BEP

Particulars Formula Amount (£)

Selling price per unit (SPU) 640

Variable cost per unit (VCPU) 250

Contribution per unit (CPU) SPU - VCPU 390

Fixed cost (FC) 140000

Breakeven point FC / CPU 359

Break even sales BEP units * SPU 229743.59

Margin of safety is the gap between anticipated profitability and break-even point. It

identifies risk of loss that business may face because of changes in sales (Nunoo and et.al.,

2020). Using the data just presented, MOS of BAX Plc computed is 40.17% which shows

business is in stable condition, that is, break even point is less than actual sales so that company

will earn a good profit even if there is a shortage of total sales. It means that sales can dropto

40.17% before firm incurrs a loss. BAX plc can still improve it by enhancing sales volume with

an increase in production capacity or by embracing profitable and potential product mix.

Margin of safety

Particulars Formula Figures

Margin of safety Actual sales – BEP sales

384000 - 229743.59

= 154256.41

Margin of safety in % 40.17

Margin of safety is the gap between anticipated profitability and break-even point. It

identifies risk of loss that business may face because of changes in sales (Nunoo and et.al.,

2020). MOS of BAX Plc is 40.17% which shows it is protected from variations in sales.

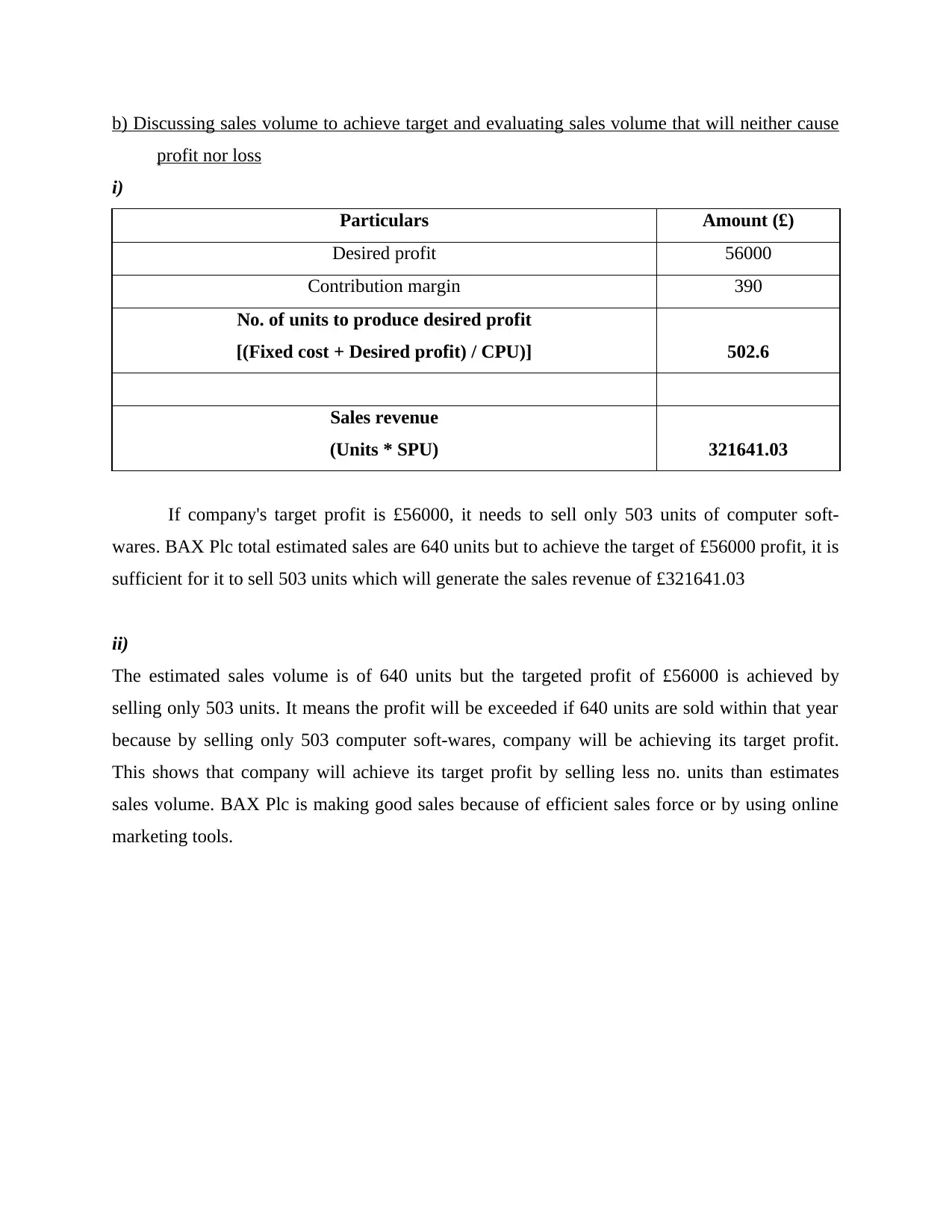

b) Discussing sales volume to achieve target and evaluating sales volume that will neither cause

profit nor loss

i)

Particulars Amount (£)

Desired profit 56000

Contribution margin 390

No. of units to produce desired profit

[(Fixed cost + Desired profit) / CPU)] 502.6

Sales revenue

(Units * SPU) 321641.03

If company's target profit is £56000, it needs to sell only 503 units of computer soft-

wares. BAX Plc total estimated sales are 640 units but to achieve the target of £56000 profit, it is

sufficient for it to sell 503 units which will generate the sales revenue of £321641.03

ii)

The estimated sales volume is of 640 units but the targeted profit of £56000 is achieved by

selling only 503 units. It means the profit will be exceeded if 640 units are sold within that year

because by selling only 503 computer soft-wares, company will be achieving its target profit.

This shows that company will achieve its target profit by selling less no. units than estimates

sales volume. BAX Plc is making good sales because of efficient sales force or by using online

marketing tools.

profit nor loss

i)

Particulars Amount (£)

Desired profit 56000

Contribution margin 390

No. of units to produce desired profit

[(Fixed cost + Desired profit) / CPU)] 502.6

Sales revenue

(Units * SPU) 321641.03

If company's target profit is £56000, it needs to sell only 503 units of computer soft-

wares. BAX Plc total estimated sales are 640 units but to achieve the target of £56000 profit, it is

sufficient for it to sell 503 units which will generate the sales revenue of £321641.03

ii)

The estimated sales volume is of 640 units but the targeted profit of £56000 is achieved by

selling only 503 units. It means the profit will be exceeded if 640 units are sold within that year

because by selling only 503 computer soft-wares, company will be achieving its target profit.

This shows that company will achieve its target profit by selling less no. units than estimates

sales volume. BAX Plc is making good sales because of efficient sales force or by using online

marketing tools.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.