LB Finance: Comprehensive Business Environment Analysis Report

VerifiedAdded on 2021/09/01

|11

|2918

|213

Report

AI Summary

This report provides a comprehensive analysis of LB Finance, a leading finance company in Sri Lanka. It begins with a PESTLE analysis, examining the political, economic, social, technological, legal, and environmental factors affecting the company. The political factors include government instability, trade wars, and tax incentives. Economic factors cover recession, interest rate drops, and unemployment. Social factors highlight customer loyalty and diverse services. Technological factors focus on online transactions and data security. Legal factors address compliance with employment and labor laws. Environmental factors discuss the impact of COVID-19. The report then presents a SWOT analysis, identifying LB Finance's strengths (experienced workforce, brand recognition), weaknesses (employee engagement, internal competition), opportunities (skilled workforce, new market segments), and threats (brain drain, regulatory changes). Finally, a TOWS matrix is used to develop strategies based on the SWOT analysis, focusing on leveraging strengths to capitalize on opportunities and mitigate threats. The analysis provides a strategic overview of LB Finance's position in the market.

Business and Business Environment

Section B

Section B

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1.PESTLE ANALYSES ON LB FINANCE

1.1. POLITICAL FACTOR

LB finance is a leading finance company in Sri Lanka which owned by the famous MR.

Dammika Perera. Even though this is a finance company they practice some of the services

banks are providing so because of that there is a trade war between banks and LB finance since

they are doing something finance companies are not doing. Since 2019 the government of Sri

Lanka is not stable due to some reasons like Easter Attack and current situation Covid – 19,

despite those facts there is huge problem for most of the businesses of Sri Lanka the

Depreciation of Sri Lankan Rupee like others it affects to finance companies not directly but it

has an impact on them too. The recent interest dropping also effect to LB finance due central

bank and monetary fund of Sri Lanka decided to drop their interest rates on personal loan to

business people so that impact also affect on LB finance. And also, for their Myanmar branch

has an impact on depreciation of rupee since they deal with US dollars. And recent government

policies on protectionist have also have an impact on LB finance since they have a branch

overseas. And the tax incentive from the recent budget.

Having MR. Dammika Perera as the chairman is a plus point for our organization as politically

and in general. The trade war between banks and LB finance is a negative point all though

customers happen have trust on finance companies rather on some banks so it’s a positive point

in some areas, government stability of course a negative fact for the organization, depreciation of

Sri Lankan rupee and recent interest drop on personal loan is a negative fact for the organization

but on the other hand it also affected to fix deposits and savings so on the other hand it’s a

positive fact for company but not for the customers. And the recent international trade policies

are a negative factor for organization since LB finance have a branch in Myanmar. Tax incentive

from the government also a negative point for business.

1.2 ECONOMIC FACTOR

Since there is a recession going in Sri Lanka it affects many businesses it also effects on LB

finance too many employees are losing their jobs and no opening for new opportunities inside

1.1. POLITICAL FACTOR

LB finance is a leading finance company in Sri Lanka which owned by the famous MR.

Dammika Perera. Even though this is a finance company they practice some of the services

banks are providing so because of that there is a trade war between banks and LB finance since

they are doing something finance companies are not doing. Since 2019 the government of Sri

Lanka is not stable due to some reasons like Easter Attack and current situation Covid – 19,

despite those facts there is huge problem for most of the businesses of Sri Lanka the

Depreciation of Sri Lankan Rupee like others it affects to finance companies not directly but it

has an impact on them too. The recent interest dropping also effect to LB finance due central

bank and monetary fund of Sri Lanka decided to drop their interest rates on personal loan to

business people so that impact also affect on LB finance. And also, for their Myanmar branch

has an impact on depreciation of rupee since they deal with US dollars. And recent government

policies on protectionist have also have an impact on LB finance since they have a branch

overseas. And the tax incentive from the recent budget.

Having MR. Dammika Perera as the chairman is a plus point for our organization as politically

and in general. The trade war between banks and LB finance is a negative point all though

customers happen have trust on finance companies rather on some banks so it’s a positive point

in some areas, government stability of course a negative fact for the organization, depreciation of

Sri Lankan rupee and recent interest drop on personal loan is a negative fact for the organization

but on the other hand it also affected to fix deposits and savings so on the other hand it’s a

positive fact for company but not for the customers. And the recent international trade policies

are a negative factor for organization since LB finance have a branch in Myanmar. Tax incentive

from the government also a negative point for business.

1.2 ECONOMIC FACTOR

Since there is a recession going in Sri Lanka it affects many businesses it also effects on LB

finance too many employees are losing their jobs and no opening for new opportunities inside

the company while existing employees doesn’t get promoted or getting any pay raises due to this

situation. And the current economic growth decrease has also affected on LB finance since all

the interest rates dropped customers are afraid to deal with the organization even the existing

customers are retrieving their accounts and fix deposits. Current living situation has also had an

impact on LB finance since cost of living is really higher than what they earn.

Recession has a positive and negative factor on business. The organization has to work with a

limited resources whilst it’s a positive point in profit areas its also a negative point when we

don’t have enough resources to work and existing employees getting discourage since no

opportunities and not having a reward for their hard work. And loosing its customers since

interest rates drop and not getting any new customers. But having loyal customers is a plus point

for the business. And the recent situation of cost of living and living style of the general public

also has a negative impact on the business.

1.3. SOCIAL FACTOR

Even though above factors have an impact on the organization still it has a large crowd of loyal

customers who are still willing to deal. LB finance respect each and all cultural beliefs and

religions so they have special services for each and everyone. Even with this current situation

they manage to help their employees with the maximum that they can to make them satisfied and

loyal to the company. they have 127 branches around the country for easy use of the customers.

Having a good brand name and lasting for more than decade in the business and having best

awards for our services the organization manage to keep its loyal customers in track with them

it’s a plus point for them, and having different investment program for everyone cultures age

groups is a positive factor for the organization. And even though this tough time they are doing

their best to keep their existing employees satisfied for the organization good it’s a positive point

for them. Having branches around the country is a positive point for the organization more

branches mean more customers.

situation. And the current economic growth decrease has also affected on LB finance since all

the interest rates dropped customers are afraid to deal with the organization even the existing

customers are retrieving their accounts and fix deposits. Current living situation has also had an

impact on LB finance since cost of living is really higher than what they earn.

Recession has a positive and negative factor on business. The organization has to work with a

limited resources whilst it’s a positive point in profit areas its also a negative point when we

don’t have enough resources to work and existing employees getting discourage since no

opportunities and not having a reward for their hard work. And loosing its customers since

interest rates drop and not getting any new customers. But having loyal customers is a plus point

for the business. And the recent situation of cost of living and living style of the general public

also has a negative impact on the business.

1.3. SOCIAL FACTOR

Even though above factors have an impact on the organization still it has a large crowd of loyal

customers who are still willing to deal. LB finance respect each and all cultural beliefs and

religions so they have special services for each and everyone. Even with this current situation

they manage to help their employees with the maximum that they can to make them satisfied and

loyal to the company. they have 127 branches around the country for easy use of the customers.

Having a good brand name and lasting for more than decade in the business and having best

awards for our services the organization manage to keep its loyal customers in track with them

it’s a plus point for them, and having different investment program for everyone cultures age

groups is a positive factor for the organization. And even though this tough time they are doing

their best to keep their existing employees satisfied for the organization good it’s a positive point

for them. Having branches around the country is a positive point for the organization more

branches mean more customers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1.4. TECHNOLOGICAL FACTOR

Since we live in a fast-growing technological era, the organization also updated in every area of

technology it is easy for its customers to deal with them, new innovation like LB application to

do their online transactions, debit/credit card services are really helpful to the customers they

don’t have to present to withdraw money all the time they can use online trans actions or ATM

services for that. And most importantly privacy and security for their customers they highly

consider above two factors.

Its always a positive factor to stay in touch with the revolution of the technology since this is a

past growing era every business has to move forward with technology. LB finance also use the

new innovations to move closer to their customers with new and reachable tech since people tend

to use them its definitely a plus point to the company since we can earn profit form that fact to all

the service charges and other charges to maintain them but also the company has to spend some

money to keep up with technology its not a big negative point but some impact on that. Having

most secured systems and data base they manage to keep their customers privacy and security

it’s a plus fact for the company.

1.5. LEGAL FACTOR

LB finance is registered company and obliged to all the employment law, labor laws and

common laws. All the employees of the company get the minimum wage rates which given by

the government and yearly wage raise, since this pandemic the company is doing the best, they

can to make that happen. And above all they protect their customers. And also, they adhere to all

health and safety regulations.

To have protected by laws are obviously a positive fact for the organization since it protects

company from every harm coming from internal and external environment of the business. But

also, it’s a negative point when it comes to deal with disruptive employees which covered by

those laws since they can’t deal with them in a proper way. Adhering to all those safety

regulations also a positive fact since the company is safe guarded by them and also its customers.

Since we live in a fast-growing technological era, the organization also updated in every area of

technology it is easy for its customers to deal with them, new innovation like LB application to

do their online transactions, debit/credit card services are really helpful to the customers they

don’t have to present to withdraw money all the time they can use online trans actions or ATM

services for that. And most importantly privacy and security for their customers they highly

consider above two factors.

Its always a positive factor to stay in touch with the revolution of the technology since this is a

past growing era every business has to move forward with technology. LB finance also use the

new innovations to move closer to their customers with new and reachable tech since people tend

to use them its definitely a plus point to the company since we can earn profit form that fact to all

the service charges and other charges to maintain them but also the company has to spend some

money to keep up with technology its not a big negative point but some impact on that. Having

most secured systems and data base they manage to keep their customers privacy and security

it’s a plus fact for the company.

1.5. LEGAL FACTOR

LB finance is registered company and obliged to all the employment law, labor laws and

common laws. All the employees of the company get the minimum wage rates which given by

the government and yearly wage raise, since this pandemic the company is doing the best, they

can to make that happen. And above all they protect their customers. And also, they adhere to all

health and safety regulations.

To have protected by laws are obviously a positive fact for the organization since it protects

company from every harm coming from internal and external environment of the business. But

also, it’s a negative point when it comes to deal with disruptive employees which covered by

those laws since they can’t deal with them in a proper way. Adhering to all those safety

regulations also a positive fact since the company is safe guarded by them and also its customers.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

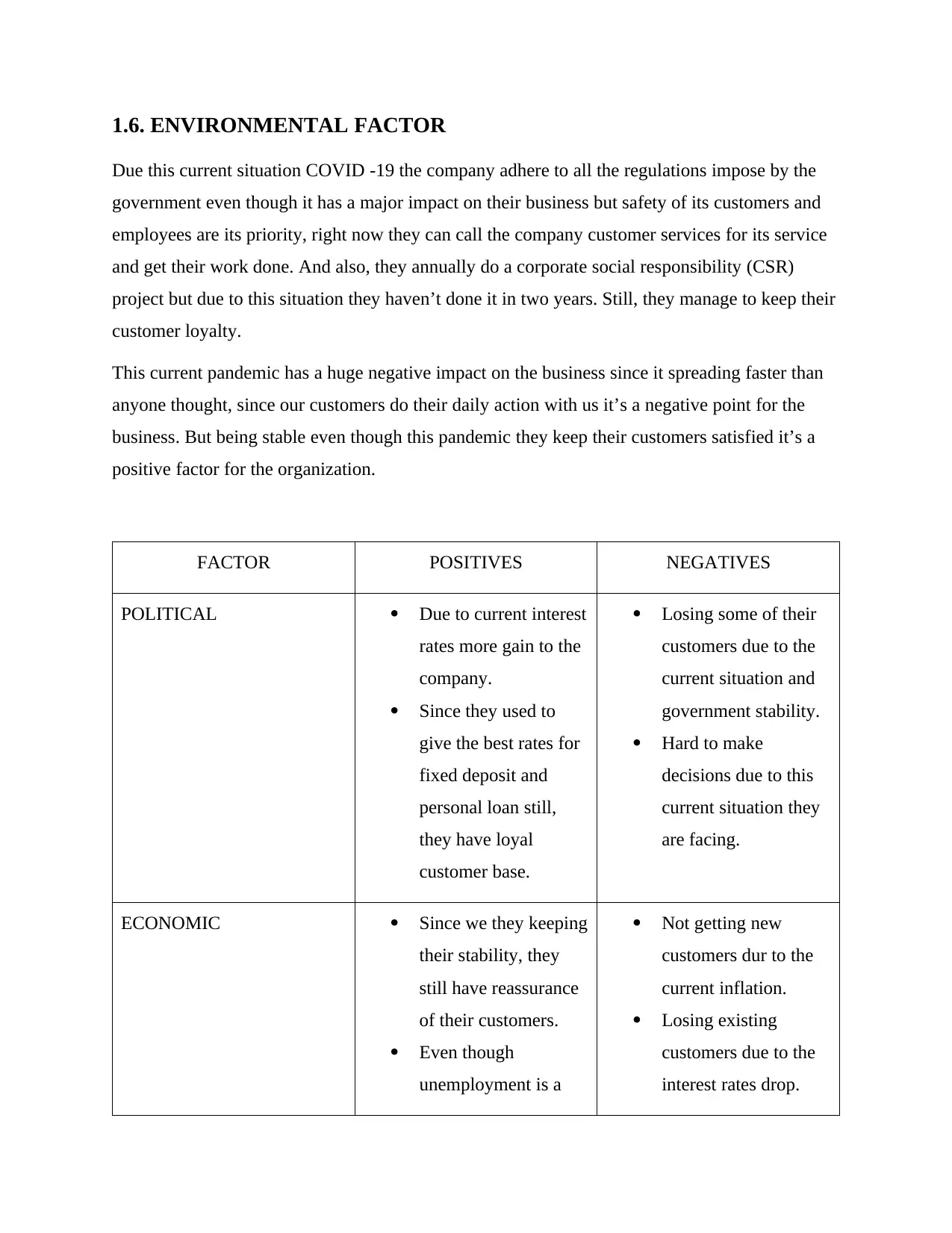

1.6. ENVIRONMENTAL FACTOR

Due this current situation COVID -19 the company adhere to all the regulations impose by the

government even though it has a major impact on their business but safety of its customers and

employees are its priority, right now they can call the company customer services for its service

and get their work done. And also, they annually do a corporate social responsibility (CSR)

project but due to this situation they haven’t done it in two years. Still, they manage to keep their

customer loyalty.

This current pandemic has a huge negative impact on the business since it spreading faster than

anyone thought, since our customers do their daily action with us it’s a negative point for the

business. But being stable even though this pandemic they keep their customers satisfied it’s a

positive factor for the organization.

FACTOR POSITIVES NEGATIVES

POLITICAL Due to current interest

rates more gain to the

company.

Since they used to

give the best rates for

fixed deposit and

personal loan still,

they have loyal

customer base.

Losing some of their

customers due to the

current situation and

government stability.

Hard to make

decisions due to this

current situation they

are facing.

ECONOMIC Since we they keeping

their stability, they

still have reassurance

of their customers.

Even though

unemployment is a

Not getting new

customers dur to the

current inflation.

Losing existing

customers due to the

interest rates drop.

Due this current situation COVID -19 the company adhere to all the regulations impose by the

government even though it has a major impact on their business but safety of its customers and

employees are its priority, right now they can call the company customer services for its service

and get their work done. And also, they annually do a corporate social responsibility (CSR)

project but due to this situation they haven’t done it in two years. Still, they manage to keep their

customer loyalty.

This current pandemic has a huge negative impact on the business since it spreading faster than

anyone thought, since our customers do their daily action with us it’s a negative point for the

business. But being stable even though this pandemic they keep their customers satisfied it’s a

positive factor for the organization.

FACTOR POSITIVES NEGATIVES

POLITICAL Due to current interest

rates more gain to the

company.

Since they used to

give the best rates for

fixed deposit and

personal loan still,

they have loyal

customer base.

Losing some of their

customers due to the

current situation and

government stability.

Hard to make

decisions due to this

current situation they

are facing.

ECONOMIC Since we they keeping

their stability, they

still have reassurance

of their customers.

Even though

unemployment is a

Not getting new

customers dur to the

current inflation.

Losing existing

customers due to the

interest rates drop.

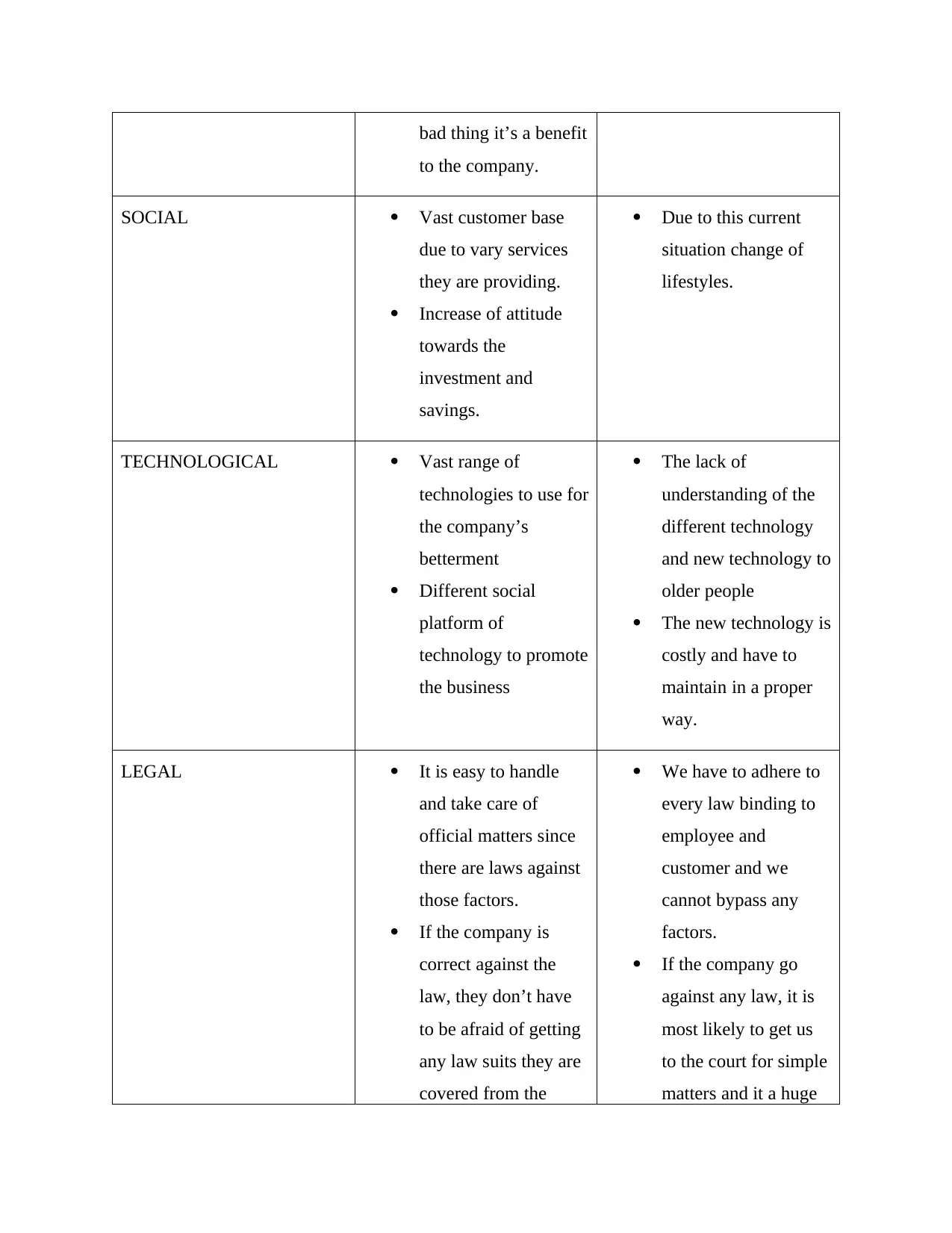

bad thing it’s a benefit

to the company.

SOCIAL Vast customer base

due to vary services

they are providing.

Increase of attitude

towards the

investment and

savings.

Due to this current

situation change of

lifestyles.

TECHNOLOGICAL Vast range of

technologies to use for

the company’s

betterment

Different social

platform of

technology to promote

the business

The lack of

understanding of the

different technology

and new technology to

older people

The new technology is

costly and have to

maintain in a proper

way.

LEGAL It is easy to handle

and take care of

official matters since

there are laws against

those factors.

If the company is

correct against the

law, they don’t have

to be afraid of getting

any law suits they are

covered from the

We have to adhere to

every law binding to

employee and

customer and we

cannot bypass any

factors.

If the company go

against any law, it is

most likely to get us

to the court for simple

matters and it a huge

to the company.

SOCIAL Vast customer base

due to vary services

they are providing.

Increase of attitude

towards the

investment and

savings.

Due to this current

situation change of

lifestyles.

TECHNOLOGICAL Vast range of

technologies to use for

the company’s

betterment

Different social

platform of

technology to promote

the business

The lack of

understanding of the

different technology

and new technology to

older people

The new technology is

costly and have to

maintain in a proper

way.

LEGAL It is easy to handle

and take care of

official matters since

there are laws against

those factors.

If the company is

correct against the

law, they don’t have

to be afraid of getting

any law suits they are

covered from the

We have to adhere to

every law binding to

employee and

customer and we

cannot bypass any

factors.

If the company go

against any law, it is

most likely to get us

to the court for simple

matters and it a huge

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

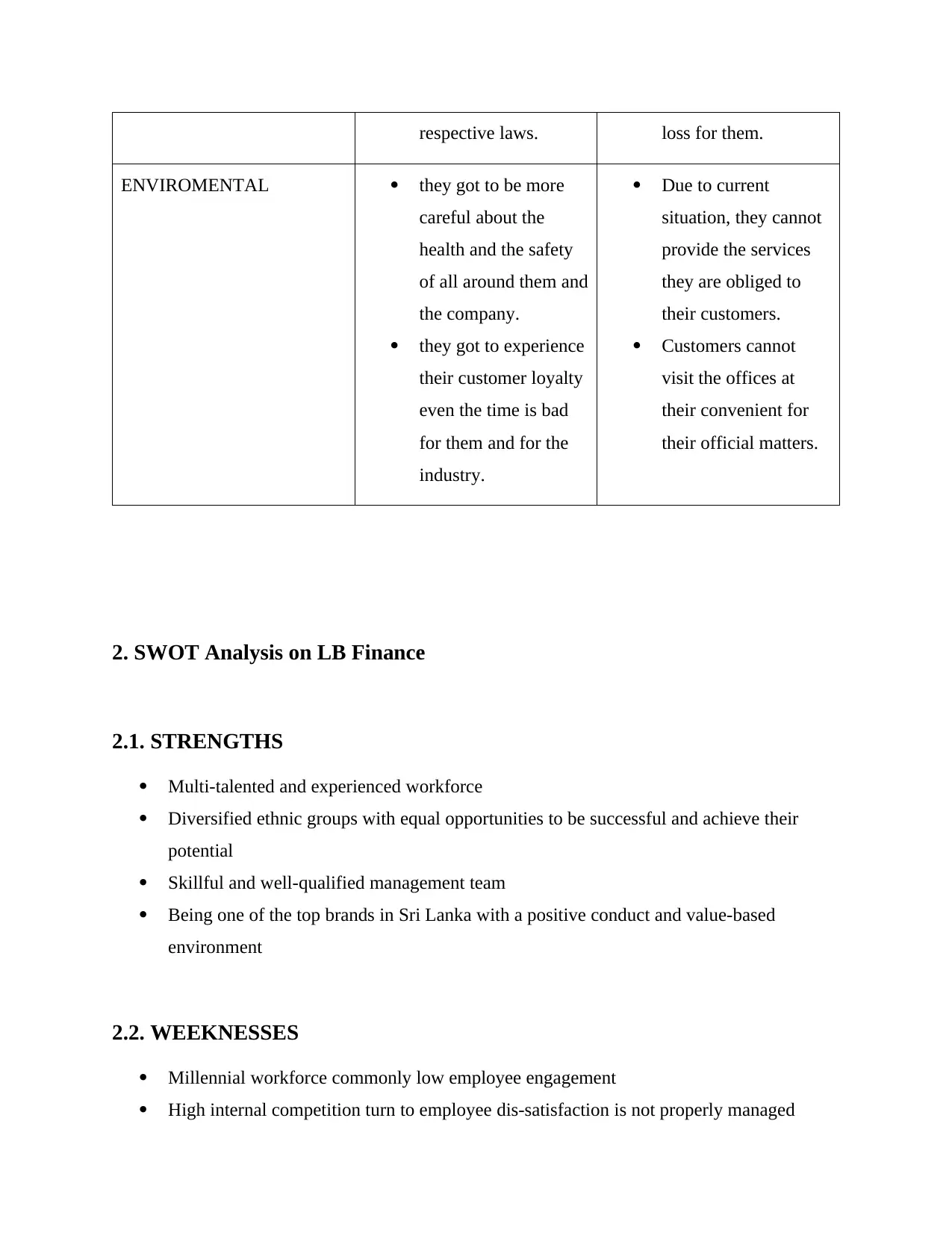

respective laws. loss for them.

ENVIROMENTAL they got to be more

careful about the

health and the safety

of all around them and

the company.

they got to experience

their customer loyalty

even the time is bad

for them and for the

industry.

Due to current

situation, they cannot

provide the services

they are obliged to

their customers.

Customers cannot

visit the offices at

their convenient for

their official matters.

2. SWOT Analysis on LB Finance

2.1. STRENGTHS

Multi-talented and experienced workforce

Diversified ethnic groups with equal opportunities to be successful and achieve their

potential

Skillful and well-qualified management team

Being one of the top brands in Sri Lanka with a positive conduct and value-based

environment

2.2. WEEKNESSES

Millennial workforce commonly low employee engagement

High internal competition turn to employee dis-satisfaction is not properly managed

ENVIROMENTAL they got to be more

careful about the

health and the safety

of all around them and

the company.

they got to experience

their customer loyalty

even the time is bad

for them and for the

industry.

Due to current

situation, they cannot

provide the services

they are obliged to

their customers.

Customers cannot

visit the offices at

their convenient for

their official matters.

2. SWOT Analysis on LB Finance

2.1. STRENGTHS

Multi-talented and experienced workforce

Diversified ethnic groups with equal opportunities to be successful and achieve their

potential

Skillful and well-qualified management team

Being one of the top brands in Sri Lanka with a positive conduct and value-based

environment

2.2. WEEKNESSES

Millennial workforce commonly low employee engagement

High internal competition turn to employee dis-satisfaction is not properly managed

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

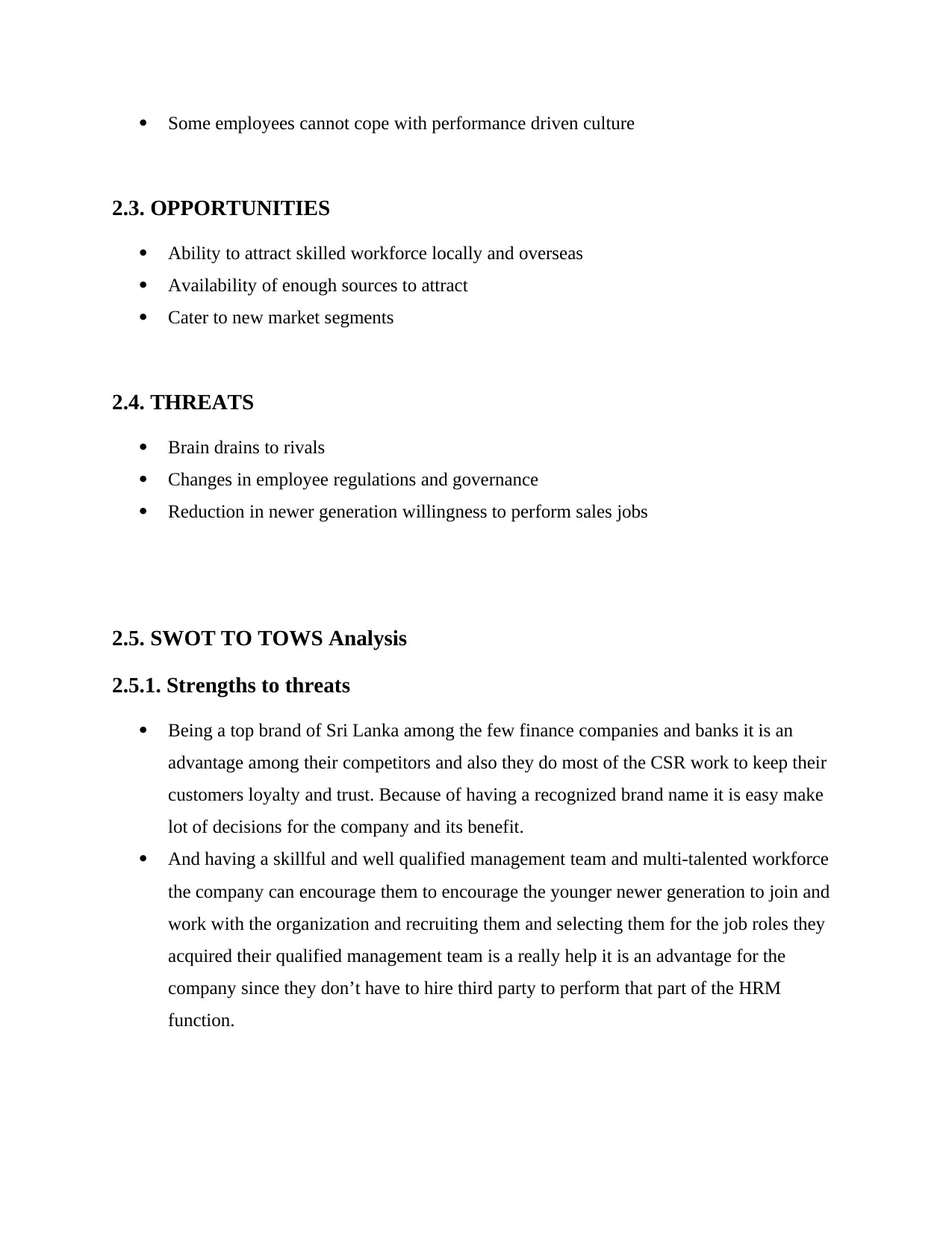

Some employees cannot cope with performance driven culture

2.3. OPPORTUNITIES

Ability to attract skilled workforce locally and overseas

Availability of enough sources to attract

Cater to new market segments

2.4. THREATS

Brain drains to rivals

Changes in employee regulations and governance

Reduction in newer generation willingness to perform sales jobs

2.5. SWOT TO TOWS Analysis

2.5.1. Strengths to threats

Being a top brand of Sri Lanka among the few finance companies and banks it is an

advantage among their competitors and also they do most of the CSR work to keep their

customers loyalty and trust. Because of having a recognized brand name it is easy make

lot of decisions for the company and its benefit.

And having a skillful and well qualified management team and multi-talented workforce

the company can encourage them to encourage the younger newer generation to join and

work with the organization and recruiting them and selecting them for the job roles they

acquired their qualified management team is a really help it is an advantage for the

company since they don’t have to hire third party to perform that part of the HRM

function.

2.3. OPPORTUNITIES

Ability to attract skilled workforce locally and overseas

Availability of enough sources to attract

Cater to new market segments

2.4. THREATS

Brain drains to rivals

Changes in employee regulations and governance

Reduction in newer generation willingness to perform sales jobs

2.5. SWOT TO TOWS Analysis

2.5.1. Strengths to threats

Being a top brand of Sri Lanka among the few finance companies and banks it is an

advantage among their competitors and also they do most of the CSR work to keep their

customers loyalty and trust. Because of having a recognized brand name it is easy make

lot of decisions for the company and its benefit.

And having a skillful and well qualified management team and multi-talented workforce

the company can encourage them to encourage the younger newer generation to join and

work with the organization and recruiting them and selecting them for the job roles they

acquired their qualified management team is a really help it is an advantage for the

company since they don’t have to hire third party to perform that part of the HRM

function.

Having different cultures and religious employees working for the company use that in a

positive way to show outside a good image of the company for attract more employees

and customers.

2.5.2. Strengths to Opportunities

Same as above mentioned being a top brand in Sri Lanka use that as an advantage to

reach new segments of markets and widen the business area to gain more profit and

bigger customer base.

Since they have a skillful and multi-talented workforce use that to attract new and fresh

youngsters to the company and use their new ideas and innovation for the betterment of

company future.

Use their brand name to gain the new sources of investment for the company.

2.5.3. Weaknesses to Opportunities

Encourage the millennials to join and work with the company using their company brand

name and CSR done by them and the achievements they have reached to be where they

are now and give them new opportunities to handle and make them interest on what they

do.

Use the new sources to cater internal workforce satisfaction to work hard and give them

goals to so that they will be satisfied and reaching their goals the company also

automatically become profitable.

Use teamwork programs and social events for employees to experience other cultures

and different attitudes of the people they work among so they get used to them and work

as a family.

positive way to show outside a good image of the company for attract more employees

and customers.

2.5.2. Strengths to Opportunities

Same as above mentioned being a top brand in Sri Lanka use that as an advantage to

reach new segments of markets and widen the business area to gain more profit and

bigger customer base.

Since they have a skillful and multi-talented workforce use that to attract new and fresh

youngsters to the company and use their new ideas and innovation for the betterment of

company future.

Use their brand name to gain the new sources of investment for the company.

2.5.3. Weaknesses to Opportunities

Encourage the millennials to join and work with the company using their company brand

name and CSR done by them and the achievements they have reached to be where they

are now and give them new opportunities to handle and make them interest on what they

do.

Use the new sources to cater internal workforce satisfaction to work hard and give them

goals to so that they will be satisfied and reaching their goals the company also

automatically become profitable.

Use teamwork programs and social events for employees to experience other cultures

and different attitudes of the people they work among so they get used to them and work

as a family.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.5.4. Weakness to Threats

Keep their brand a straight and quality service all the time to make sure they are giving

the best services to their loyal customers to keep their brand name at the top of the

industry and give a good competition to their rivals.

Make their existing employees encouraged at all time to show the newer members

attracted to the trade and make a competition among them to get into working in the

finance field.

Conclusion,

From all the fact above mention most of the company decision are based on above factors to

reach the company objectives. Their management decision all base on and towards to become a

major player in the financial industry. They have to work hard to become the best in the industry

so from above factors we take seriously and all the employees are given a major role in all

function and goals they have to reach.

3. HOW STRENGTHS AND WEAKNESSES OF THE ORGANIZATION

INTERRELATE WITH EXTERNAL MACRO FACTOR AND INFLUENCE

COMPANY OPERATIONS.

The macro-environment is more general - it is the environment in the economy itself. It has an

effect on how all business groups operate, perform, make decisions, and form strategies

Keep their brand a straight and quality service all the time to make sure they are giving

the best services to their loyal customers to keep their brand name at the top of the

industry and give a good competition to their rivals.

Make their existing employees encouraged at all time to show the newer members

attracted to the trade and make a competition among them to get into working in the

finance field.

Conclusion,

From all the fact above mention most of the company decision are based on above factors to

reach the company objectives. Their management decision all base on and towards to become a

major player in the financial industry. They have to work hard to become the best in the industry

so from above factors we take seriously and all the employees are given a major role in all

function and goals they have to reach.

3. HOW STRENGTHS AND WEAKNESSES OF THE ORGANIZATION

INTERRELATE WITH EXTERNAL MACRO FACTOR AND INFLUENCE

COMPANY OPERATIONS.

The macro-environment is more general - it is the environment in the economy itself. It has an

effect on how all business groups operate, perform, make decisions, and form strategies

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

simultaneously. It is quite dynamic, which means that a business has to constantly track its

changes.

All the strengths and weaknesses of the organization depend on the external macro factor also

known as PESTLE factor. These factors have uncontrollable influence on how organization

decisions and strategies are being taken. And it can change from time to time depending the

PESTLE changes. These factors can be either good or bad but it’s the management responsibility

to take good decisions depending on the changes happen on above factors. As an example, the

current situation covid-19 is an external macro factor so all the organization operation are

changing according the situation like those organizational strengths and weaknesses are

interrelate with those factors and they influence all the operational requirements to change

according to that.

4. CRITICALLY IVALUATE THE IMPACT THAT BOTH MACRO AND

MICRO FACTORS HAVE UPON THE BUSINESS OBJECTIVES AND

DECISION MAKING.

What is the micro-environment?

The micro-environment is basically the environment that has a direct impact on your business. It

is related to the particular area where your company operates and can directly affect all of your

business processes. it consists of all the factors that affect particularly your business. They have

the ability to influence your daily proceedings and general performance of the company. Still,

the effect that they have is not a long-lasting one.

The micro-environment includes customers, suppliers, resellers, competitors, and the general

public.

What is the macro-environment?

The macro-environment is more general - it is the environment in the economy itself. It has an

effect on how all business groups operate, perform, make decisions, and form

strategies simultaneously. It is quite dynamic, which means that a business has to constantly

changes.

All the strengths and weaknesses of the organization depend on the external macro factor also

known as PESTLE factor. These factors have uncontrollable influence on how organization

decisions and strategies are being taken. And it can change from time to time depending the

PESTLE changes. These factors can be either good or bad but it’s the management responsibility

to take good decisions depending on the changes happen on above factors. As an example, the

current situation covid-19 is an external macro factor so all the organization operation are

changing according the situation like those organizational strengths and weaknesses are

interrelate with those factors and they influence all the operational requirements to change

according to that.

4. CRITICALLY IVALUATE THE IMPACT THAT BOTH MACRO AND

MICRO FACTORS HAVE UPON THE BUSINESS OBJECTIVES AND

DECISION MAKING.

What is the micro-environment?

The micro-environment is basically the environment that has a direct impact on your business. It

is related to the particular area where your company operates and can directly affect all of your

business processes. it consists of all the factors that affect particularly your business. They have

the ability to influence your daily proceedings and general performance of the company. Still,

the effect that they have is not a long-lasting one.

The micro-environment includes customers, suppliers, resellers, competitors, and the general

public.

What is the macro-environment?

The macro-environment is more general - it is the environment in the economy itself. It has an

effect on how all business groups operate, perform, make decisions, and form

strategies simultaneously. It is quite dynamic, which means that a business has to constantly

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.