University Finance Assignment: Ratio Analysis and Time Value of Money

VerifiedAdded on 2022/08/14

|4

|581

|14

Homework Assignment

AI Summary

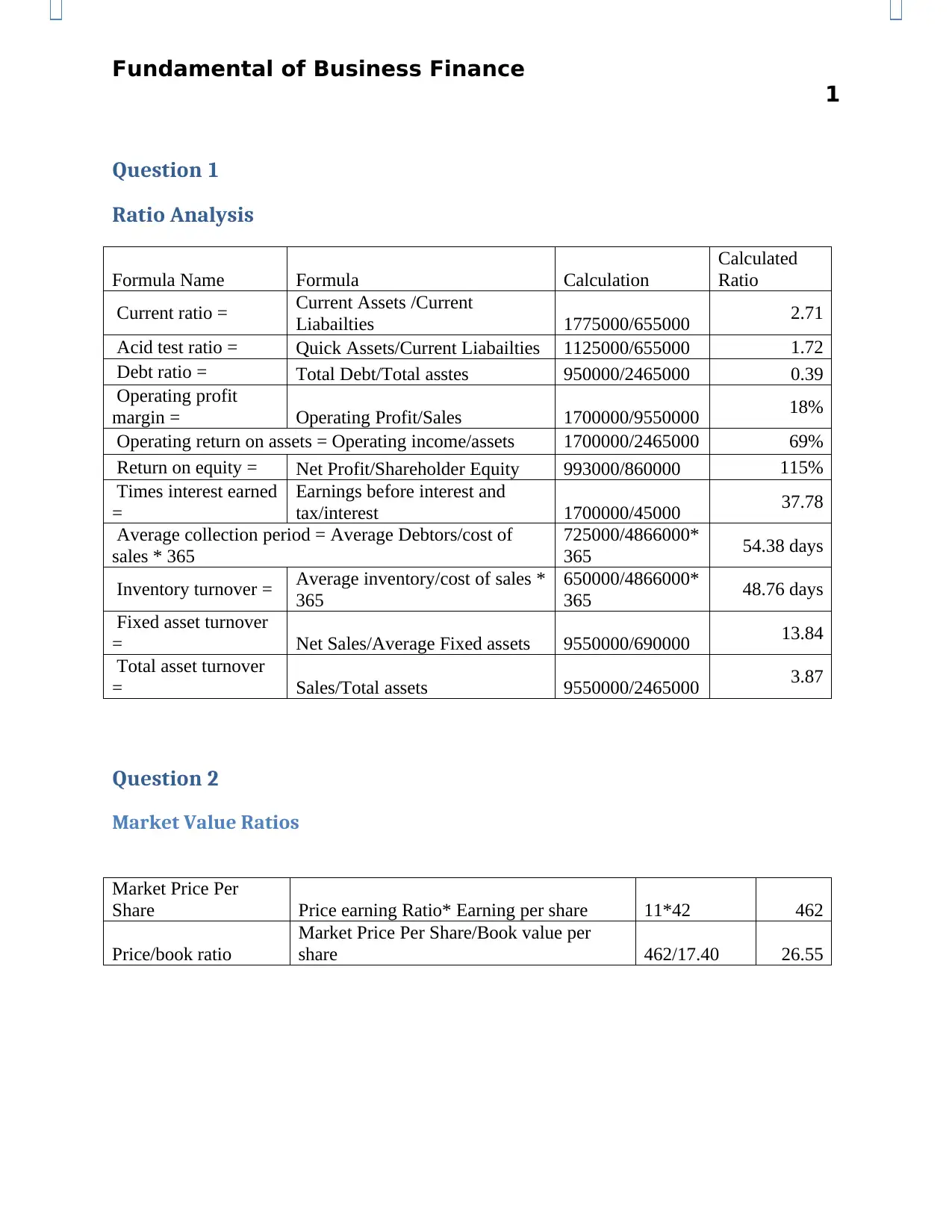

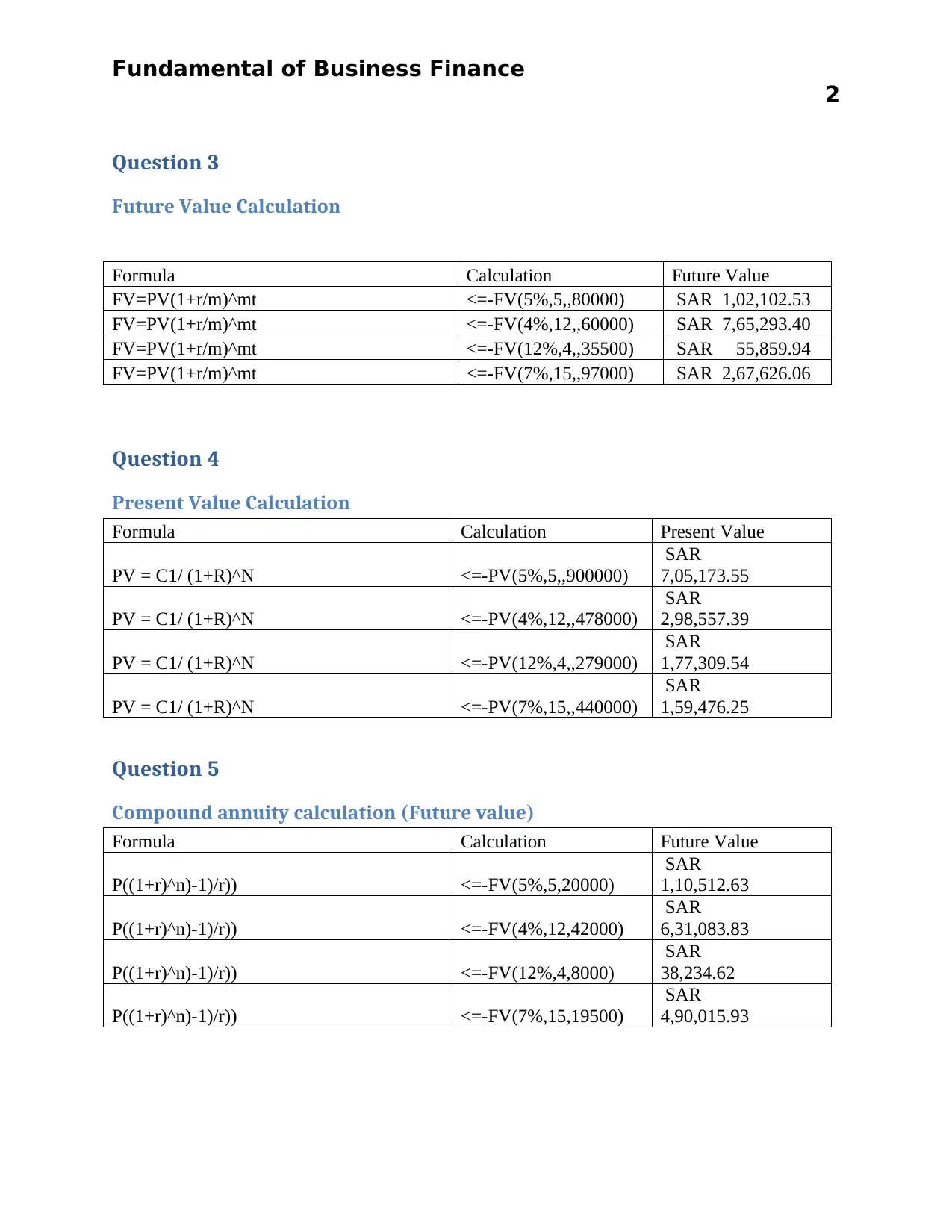

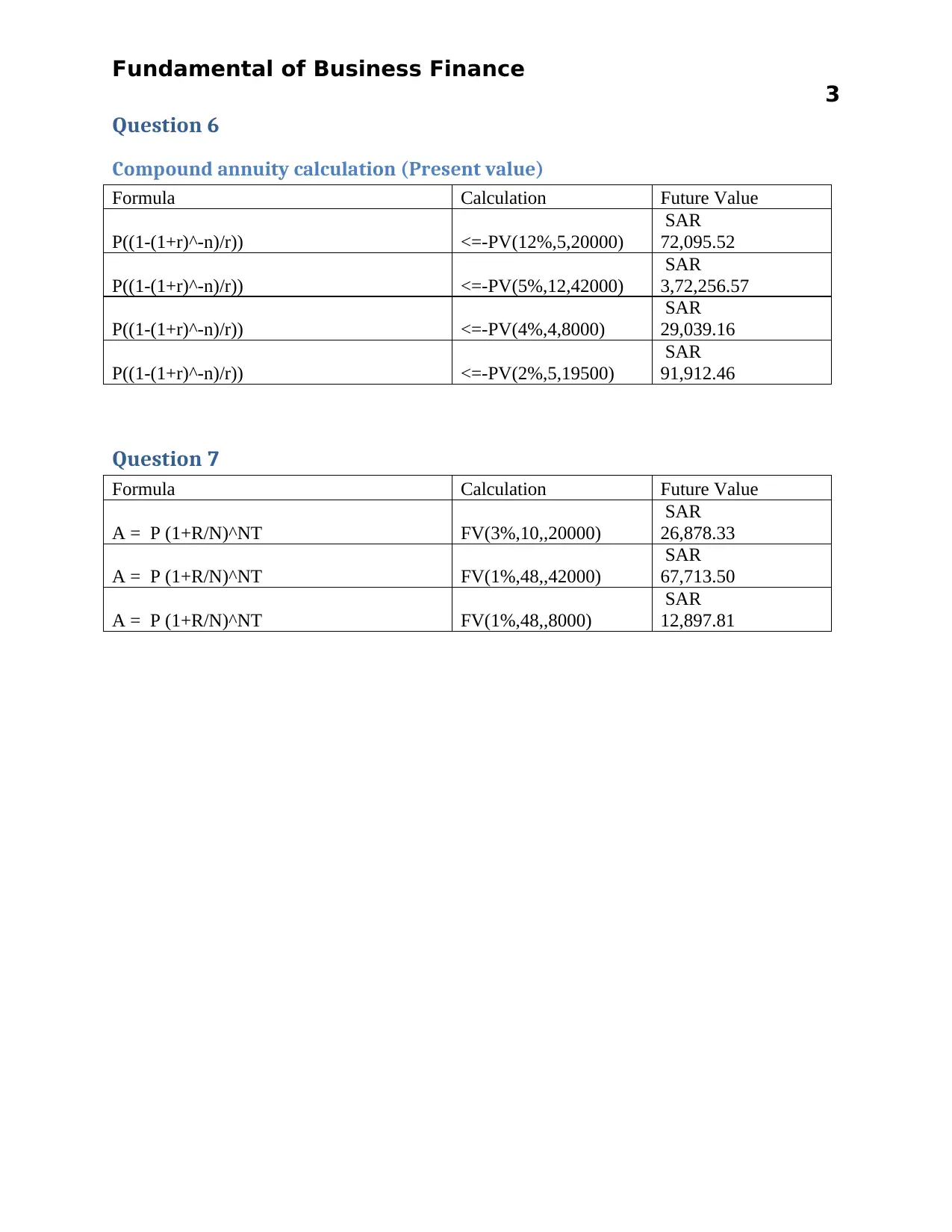

This finance assignment solution addresses key concepts in business finance, including ratio analysis and time value of money calculations. The solution begins with a detailed calculation of various financial ratios, such as current ratio, acid test ratio, debt ratio, and profitability ratios, using provided balance sheet and income statement data. It then proceeds to solve market value ratio problems, calculating the price per share and price-to-book ratio. The assignment also covers future value, present value, and compound annuity calculations, providing formulas and solutions for various scenarios. These calculations involve different interest rates, compounding periods, and investment terms. The assignment is designed to provide students with a comprehensive understanding of fundamental finance concepts, including how to apply the time value of money and perform ratio analysis to assess a company's financial health.

1 out of 4

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)