Financial Analysis of British Airways: Evaluating Performance and Risk Factors

VerifiedAdded on 2023/01/17

|15

|3652

|100

AI Summary

This report provides a comprehensive financial analysis of British Airways, including evaluating its performance through ratios and identifying risk factors that affect its brand reputation and market position.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Business Bus

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION

Financial analysis is the practice of evaluating the processes, projects, budgets and the

other financial related transactions for determining the suitability and the performance of the

business. Specifically, financial analysis is been used for assessing that an entity is solvent,

profitable, liquid and stable in warranting its monetary investment. Application of the statistical

tools such as median and mean helps in knowing the average value of the revenues over the

years and in interpreting the growing level of the revenues over the period. The present report is

based on British Airways, operating as the second leading Airline company in United Kingdom

on the basis of fleet size and in carrying the passengers. Furthermore. The study throws deeper

insights into the horizontal and the vertical analysis with showing an evaluation of the

performance by applying ratio analysis. Moreover the report states various risk factors that

affects market position and the revenue of the company.

ASSESSMENT 1

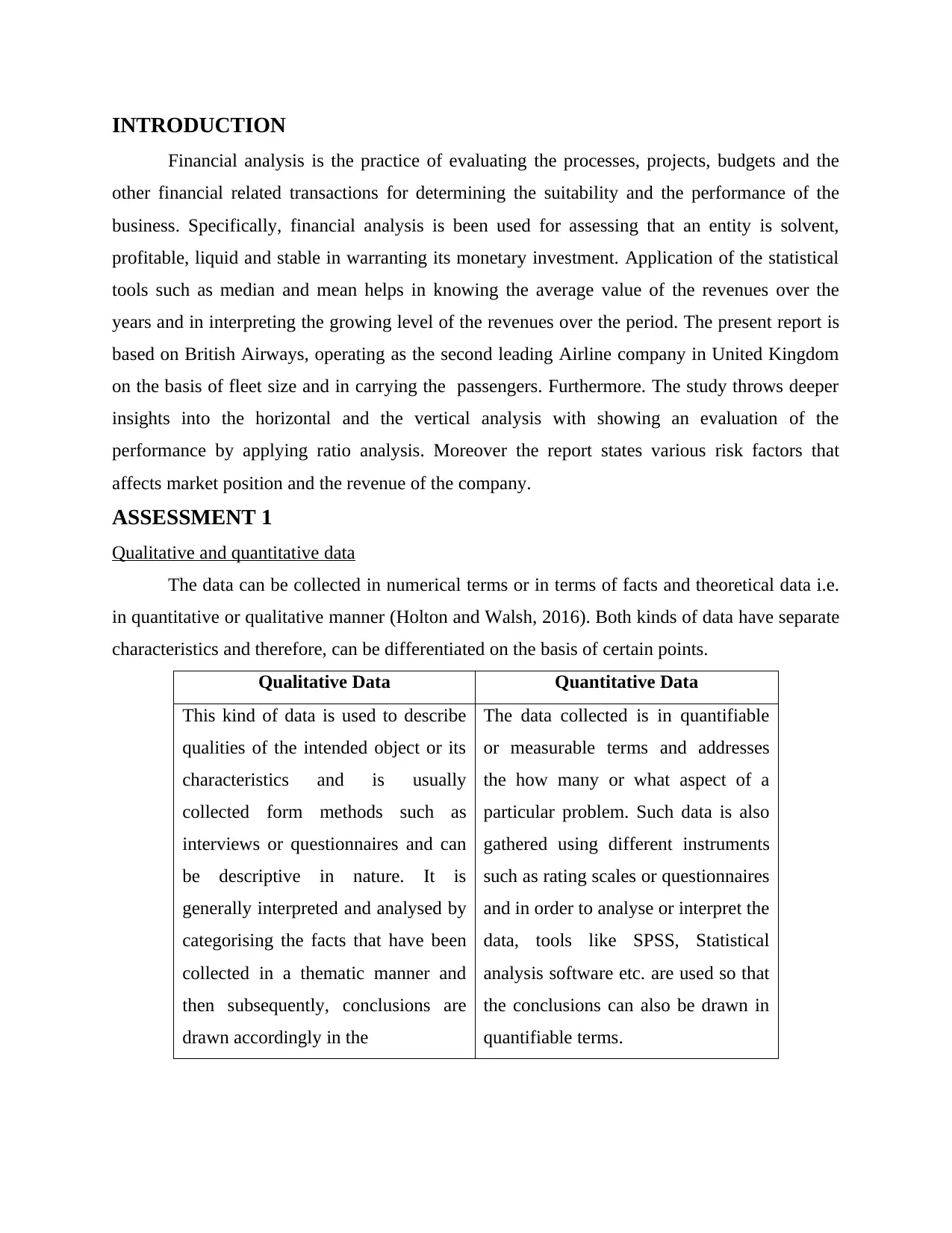

Qualitative and quantitative data

The data can be collected in numerical terms or in terms of facts and theoretical data i.e.

in quantitative or qualitative manner (Holton and Walsh, 2016). Both kinds of data have separate

characteristics and therefore, can be differentiated on the basis of certain points.

Qualitative Data Quantitative Data

This kind of data is used to describe

qualities of the intended object or its

characteristics and is usually

collected form methods such as

interviews or questionnaires and can

be descriptive in nature. It is

generally interpreted and analysed by

categorising the facts that have been

collected in a thematic manner and

then subsequently, conclusions are

drawn accordingly in the

The data collected is in quantifiable

or measurable terms and addresses

the how many or what aspect of a

particular problem. Such data is also

gathered using different instruments

such as rating scales or questionnaires

and in order to analyse or interpret the

data, tools like SPSS, Statistical

analysis software etc. are used so that

the conclusions can also be drawn in

quantifiable terms.

Financial analysis is the practice of evaluating the processes, projects, budgets and the

other financial related transactions for determining the suitability and the performance of the

business. Specifically, financial analysis is been used for assessing that an entity is solvent,

profitable, liquid and stable in warranting its monetary investment. Application of the statistical

tools such as median and mean helps in knowing the average value of the revenues over the

years and in interpreting the growing level of the revenues over the period. The present report is

based on British Airways, operating as the second leading Airline company in United Kingdom

on the basis of fleet size and in carrying the passengers. Furthermore. The study throws deeper

insights into the horizontal and the vertical analysis with showing an evaluation of the

performance by applying ratio analysis. Moreover the report states various risk factors that

affects market position and the revenue of the company.

ASSESSMENT 1

Qualitative and quantitative data

The data can be collected in numerical terms or in terms of facts and theoretical data i.e.

in quantitative or qualitative manner (Holton and Walsh, 2016). Both kinds of data have separate

characteristics and therefore, can be differentiated on the basis of certain points.

Qualitative Data Quantitative Data

This kind of data is used to describe

qualities of the intended object or its

characteristics and is usually

collected form methods such as

interviews or questionnaires and can

be descriptive in nature. It is

generally interpreted and analysed by

categorising the facts that have been

collected in a thematic manner and

then subsequently, conclusions are

drawn accordingly in the

The data collected is in quantifiable

or measurable terms and addresses

the how many or what aspect of a

particular problem. Such data is also

gathered using different instruments

such as rating scales or questionnaires

and in order to analyse or interpret the

data, tools like SPSS, Statistical

analysis software etc. are used so that

the conclusions can also be drawn in

quantifiable terms.

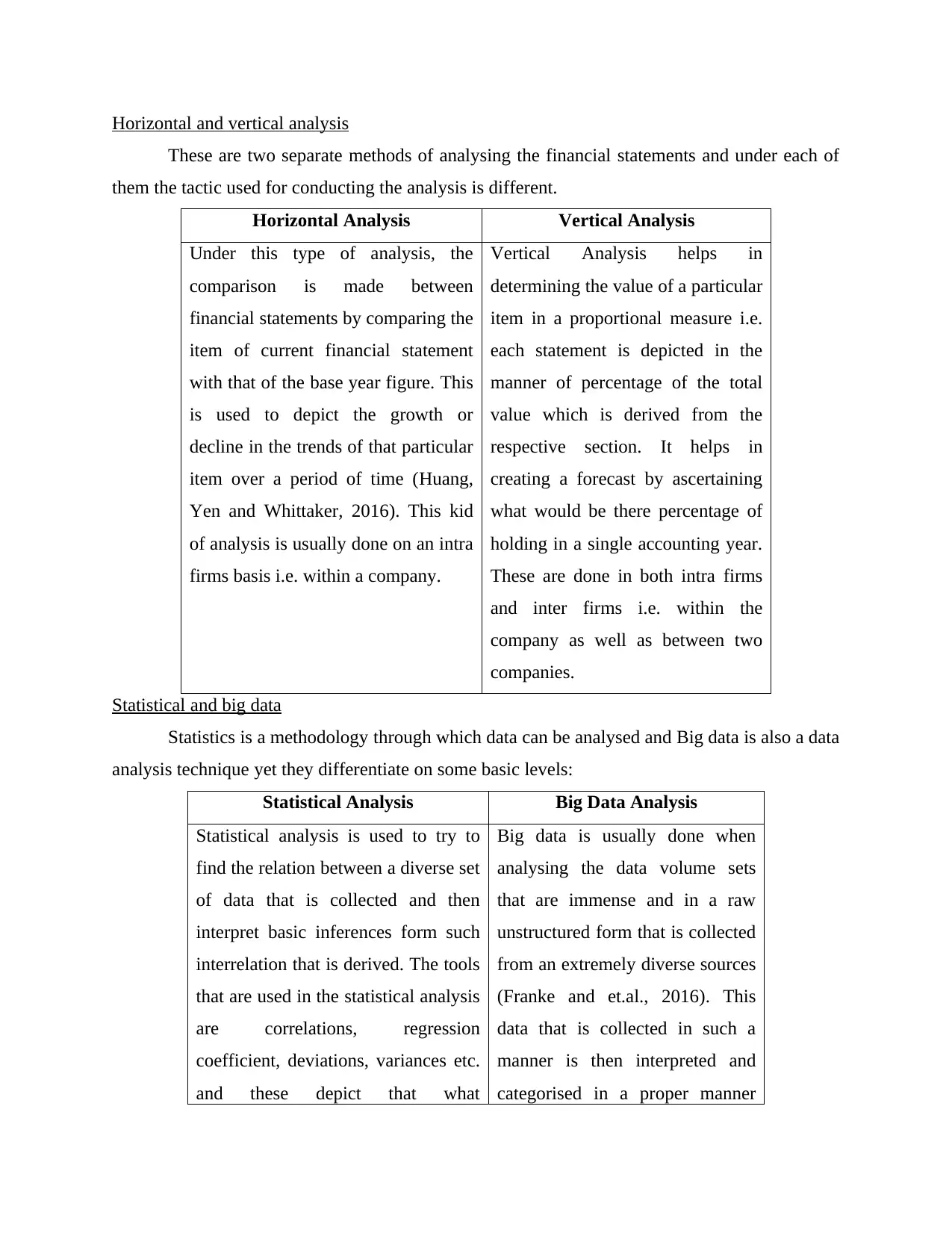

Horizontal and vertical analysis

These are two separate methods of analysing the financial statements and under each of

them the tactic used for conducting the analysis is different.

Horizontal Analysis Vertical Analysis

Under this type of analysis, the

comparison is made between

financial statements by comparing the

item of current financial statement

with that of the base year figure. This

is used to depict the growth or

decline in the trends of that particular

item over a period of time (Huang,

Yen and Whittaker, 2016). This kid

of analysis is usually done on an intra

firms basis i.e. within a company.

Vertical Analysis helps in

determining the value of a particular

item in a proportional measure i.e.

each statement is depicted in the

manner of percentage of the total

value which is derived from the

respective section. It helps in

creating a forecast by ascertaining

what would be there percentage of

holding in a single accounting year.

These are done in both intra firms

and inter firms i.e. within the

company as well as between two

companies.

Statistical and big data

Statistics is a methodology through which data can be analysed and Big data is also a data

analysis technique yet they differentiate on some basic levels:

Statistical Analysis Big Data Analysis

Statistical analysis is used to try to

find the relation between a diverse set

of data that is collected and then

interpret basic inferences form such

interrelation that is derived. The tools

that are used in the statistical analysis

are correlations, regression

coefficient, deviations, variances etc.

and these depict that what

Big data is usually done when

analysing the data volume sets

that are immense and in a raw

unstructured form that is collected

from an extremely diverse sources

(Franke and et.al., 2016). This

data that is collected in such a

manner is then interpreted and

categorised in a proper manner

These are two separate methods of analysing the financial statements and under each of

them the tactic used for conducting the analysis is different.

Horizontal Analysis Vertical Analysis

Under this type of analysis, the

comparison is made between

financial statements by comparing the

item of current financial statement

with that of the base year figure. This

is used to depict the growth or

decline in the trends of that particular

item over a period of time (Huang,

Yen and Whittaker, 2016). This kid

of analysis is usually done on an intra

firms basis i.e. within a company.

Vertical Analysis helps in

determining the value of a particular

item in a proportional measure i.e.

each statement is depicted in the

manner of percentage of the total

value which is derived from the

respective section. It helps in

creating a forecast by ascertaining

what would be there percentage of

holding in a single accounting year.

These are done in both intra firms

and inter firms i.e. within the

company as well as between two

companies.

Statistical and big data

Statistics is a methodology through which data can be analysed and Big data is also a data

analysis technique yet they differentiate on some basic levels:

Statistical Analysis Big Data Analysis

Statistical analysis is used to try to

find the relation between a diverse set

of data that is collected and then

interpret basic inferences form such

interrelation that is derived. The tools

that are used in the statistical analysis

are correlations, regression

coefficient, deviations, variances etc.

and these depict that what

Big data is usually done when

analysing the data volume sets

that are immense and in a raw

unstructured form that is collected

from an extremely diverse sources

(Franke and et.al., 2016). This

data that is collected in such a

manner is then interpreted and

categorised in a proper manner

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

relationship exists between two or

more data sets. It is not as vast in

nature as big data and is confined to a

limited number of statistical data.

using different primary keys and

other key fields so that when a

particular word or key field is

entered, amongst a sea of data, the

required data can be collected.

Data quality and its importance in financial statements

Data quality can be defined as the attribute of the data that is collected i.e. the collection

of theoretical or numerical facts and figures that will be used is assembled in a correct and

relevant manner (Cai and Zhu, 2015). When the purpose of intended use for which the data was

collected in the first place is achieved, then such data is termed as a data of higher quality.

Additionally, the consistency of the data that is collected is maintained and the results that are

generated are accurate and precise, then also the quality of data is achieved since it helps in

drawing appropriate conclusions and achieves the purpose for which it was collected. It has a

greater importance while preparing the financial statements as it fulfils several purposes that are

important in maintaining the quality of business:

Data Accuracy: When the organisations are operating at a vast level and there are many

activities that are being performed and many parties with which the company is dealing.

Therefore, it gets difficult and a complex process to collect the data in a relevant manner and this

inconsistency of data might lead to potential loss for the company (Cao, Chychyla and Stewart,

2015). Therefore, when the collection of data is done in a quality manner, i.e. the quality of data

is maintained then this problems gets resolved. This helps the firms in identifying how frequently

what mistakes are being made and what are the recurring faults so that those inaccuracies can be

adequately met and the data quality can be maintained.

Data Completeness: When the recurring faults are removed from the company, then the data

automatically becomes cleansed and improved which further assists in improving the data quality

(Christensen and et.al., 2016). Additionally, theb Use of KPI along with the KRI i.e. Key Risk

Indicators is the key assistance in increasing the data quality and when this will happen, the

accuracy level of the data will automatically rise thus inflicting in the financial statements as

well.

more data sets. It is not as vast in

nature as big data and is confined to a

limited number of statistical data.

using different primary keys and

other key fields so that when a

particular word or key field is

entered, amongst a sea of data, the

required data can be collected.

Data quality and its importance in financial statements

Data quality can be defined as the attribute of the data that is collected i.e. the collection

of theoretical or numerical facts and figures that will be used is assembled in a correct and

relevant manner (Cai and Zhu, 2015). When the purpose of intended use for which the data was

collected in the first place is achieved, then such data is termed as a data of higher quality.

Additionally, the consistency of the data that is collected is maintained and the results that are

generated are accurate and precise, then also the quality of data is achieved since it helps in

drawing appropriate conclusions and achieves the purpose for which it was collected. It has a

greater importance while preparing the financial statements as it fulfils several purposes that are

important in maintaining the quality of business:

Data Accuracy: When the organisations are operating at a vast level and there are many

activities that are being performed and many parties with which the company is dealing.

Therefore, it gets difficult and a complex process to collect the data in a relevant manner and this

inconsistency of data might lead to potential loss for the company (Cao, Chychyla and Stewart,

2015). Therefore, when the collection of data is done in a quality manner, i.e. the quality of data

is maintained then this problems gets resolved. This helps the firms in identifying how frequently

what mistakes are being made and what are the recurring faults so that those inaccuracies can be

adequately met and the data quality can be maintained.

Data Completeness: When the recurring faults are removed from the company, then the data

automatically becomes cleansed and improved which further assists in improving the data quality

(Christensen and et.al., 2016). Additionally, theb Use of KPI along with the KRI i.e. Key Risk

Indicators is the key assistance in increasing the data quality and when this will happen, the

accuracy level of the data will automatically rise thus inflicting in the financial statements as

well.

Data Intelligence: This is another attribute of increasing the data quality and when the business

adopts an intelligent approach towards collecting the data that is relevant and meaningful, then

automatically the data quality increases (Smith and et.al., 2016). It is an added benefit in

integrating the quality of data in the organisations and helps in assisting the key decision makers

since the financial statements are reported in an exact manner and no stipulation or stimulation of

figures take place where the data might be represented in an incorrect or faulty manner. This

increases the goodwill of the company and they are able to present a better image of their

financial statements.

ASSESSMENT 2

Question 1

On

balanc

e sheet

fixed

assets

Off

balance

sheet

operatin

g leases

Total

Decembe

r 2017

Total

Decembe

r 2016

Changes

Since

Decembe

r 2016

Future

deliverie

s

Option

s

Airbus A318 1 1 2 -1

Airbus A319 19 25 44 44

Airbus A320 40 27 67 67 25 33

Airbus A321 14 4 18 18 10

Airbus A350 0 18 36

Airbus A380 12 12 12 7

Boeing 747-400 36 36 37 -1

Boeing 757-200 1 2 3 3

Boeing 767-300 8 8 8

Boeing 777-200 41 5 46 46

Boeing 777-300 9 3 12 12

Boeing 787-8 9 9 8 1 3

Boeing 787-9 7 9 16 16 2 6

Boeing 787-10 0 12

Embraer E170 6 6 6

Embraer E190 9 6 15 14 1

Total operations 212 81 293 293 70 82

Max 67

adopts an intelligent approach towards collecting the data that is relevant and meaningful, then

automatically the data quality increases (Smith and et.al., 2016). It is an added benefit in

integrating the quality of data in the organisations and helps in assisting the key decision makers

since the financial statements are reported in an exact manner and no stipulation or stimulation of

figures take place where the data might be represented in an incorrect or faulty manner. This

increases the goodwill of the company and they are able to present a better image of their

financial statements.

ASSESSMENT 2

Question 1

On

balanc

e sheet

fixed

assets

Off

balance

sheet

operatin

g leases

Total

Decembe

r 2017

Total

Decembe

r 2016

Changes

Since

Decembe

r 2016

Future

deliverie

s

Option

s

Airbus A318 1 1 2 -1

Airbus A319 19 25 44 44

Airbus A320 40 27 67 67 25 33

Airbus A321 14 4 18 18 10

Airbus A350 0 18 36

Airbus A380 12 12 12 7

Boeing 747-400 36 36 37 -1

Boeing 757-200 1 2 3 3

Boeing 767-300 8 8 8

Boeing 777-200 41 5 46 46

Boeing 777-300 9 3 12 12

Boeing 787-8 9 9 8 1 3

Boeing 787-9 7 9 16 16 2 6

Boeing 787-10 0 12

Embraer E170 6 6 6

Embraer E190 9 6 15 14 1

Total operations 212 81 293 293 70 82

Max 67

Max in terms of

% 23%

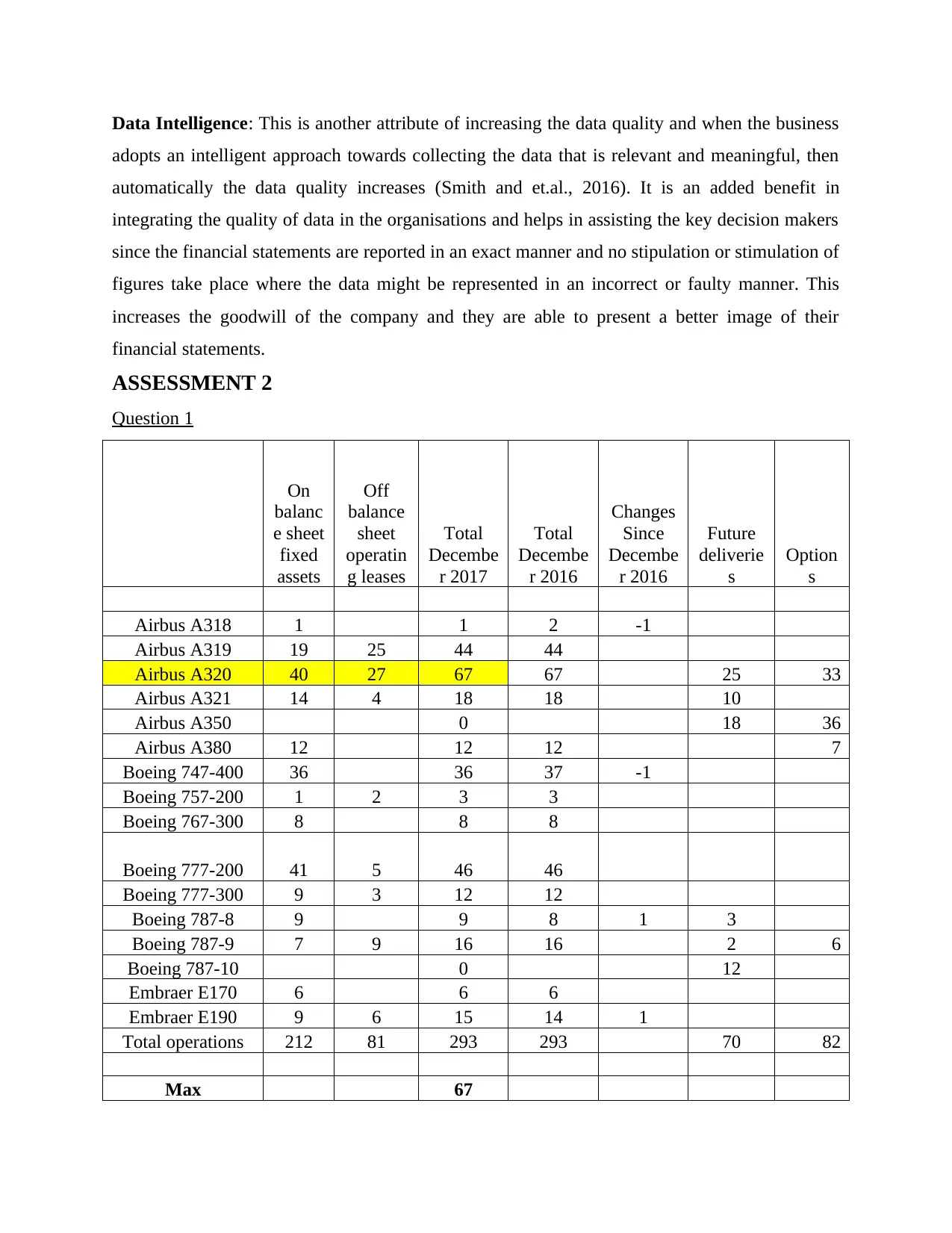

a. Recognising the Aircraft type that has the largest fleet

From the above table, it has been reflected that the aircraft that contained a largest fleet

seems to be Airbus320 as compared to other type and competitive aircraft company. It resulted

as 67 which includes on balance sheet fixed assets and the off balance sheet operating leases.

b. Identifying an aircraft manufacturer from the data that is having a biggest representation in

British Airways

Airbus aircraft manufacturer contains the biggest representation in British Airways fleet

at the month of December 2017. This means that types of Airbus aircraft results higher

operations as compared to Boeing so it is called as the biggest representation manufacturer in

British Airways that acts as the Aircraft manufacturer.

c. Computing the percentage value of an entire total aircraft manufacturer

Airbus A320

67 / 293

= 23%

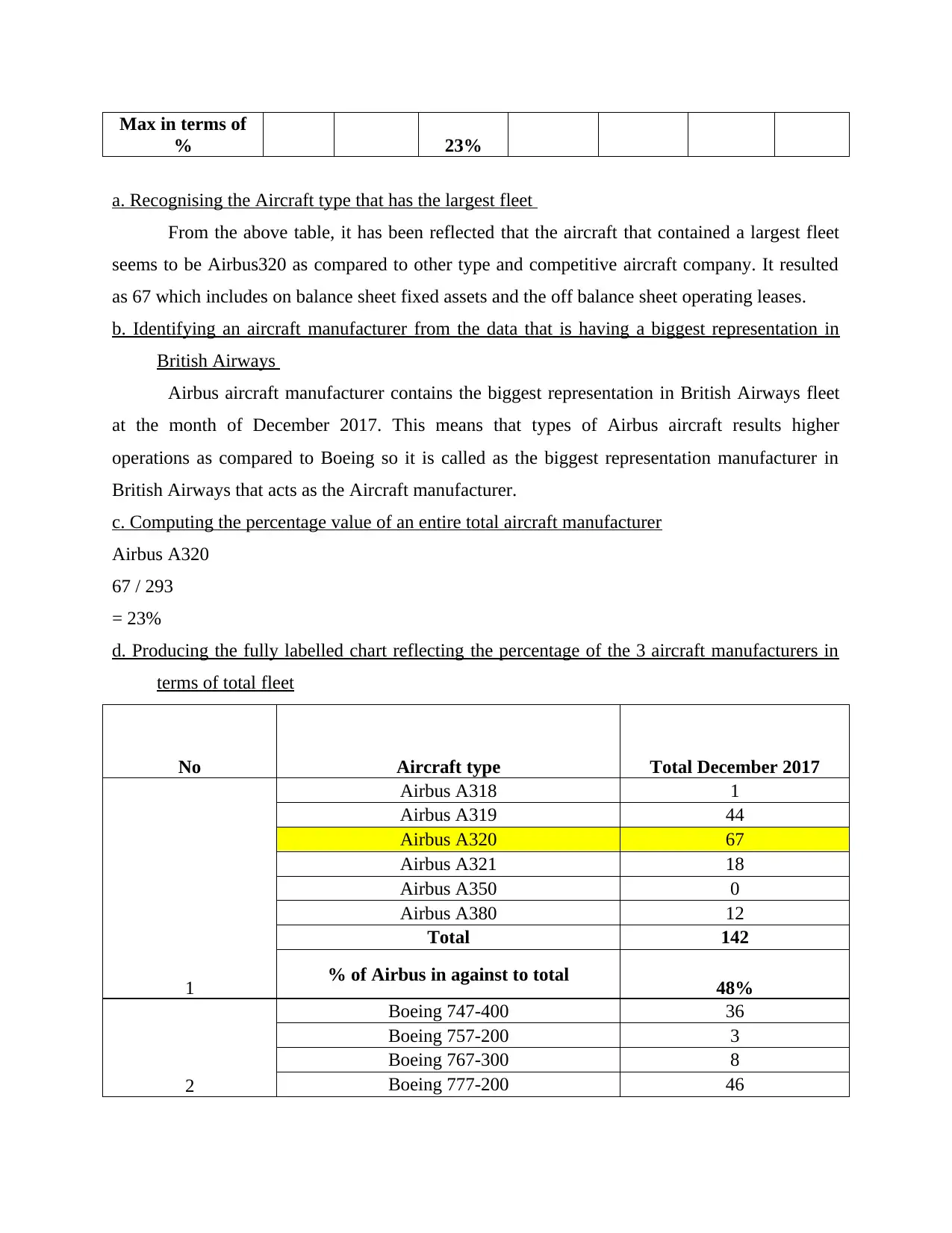

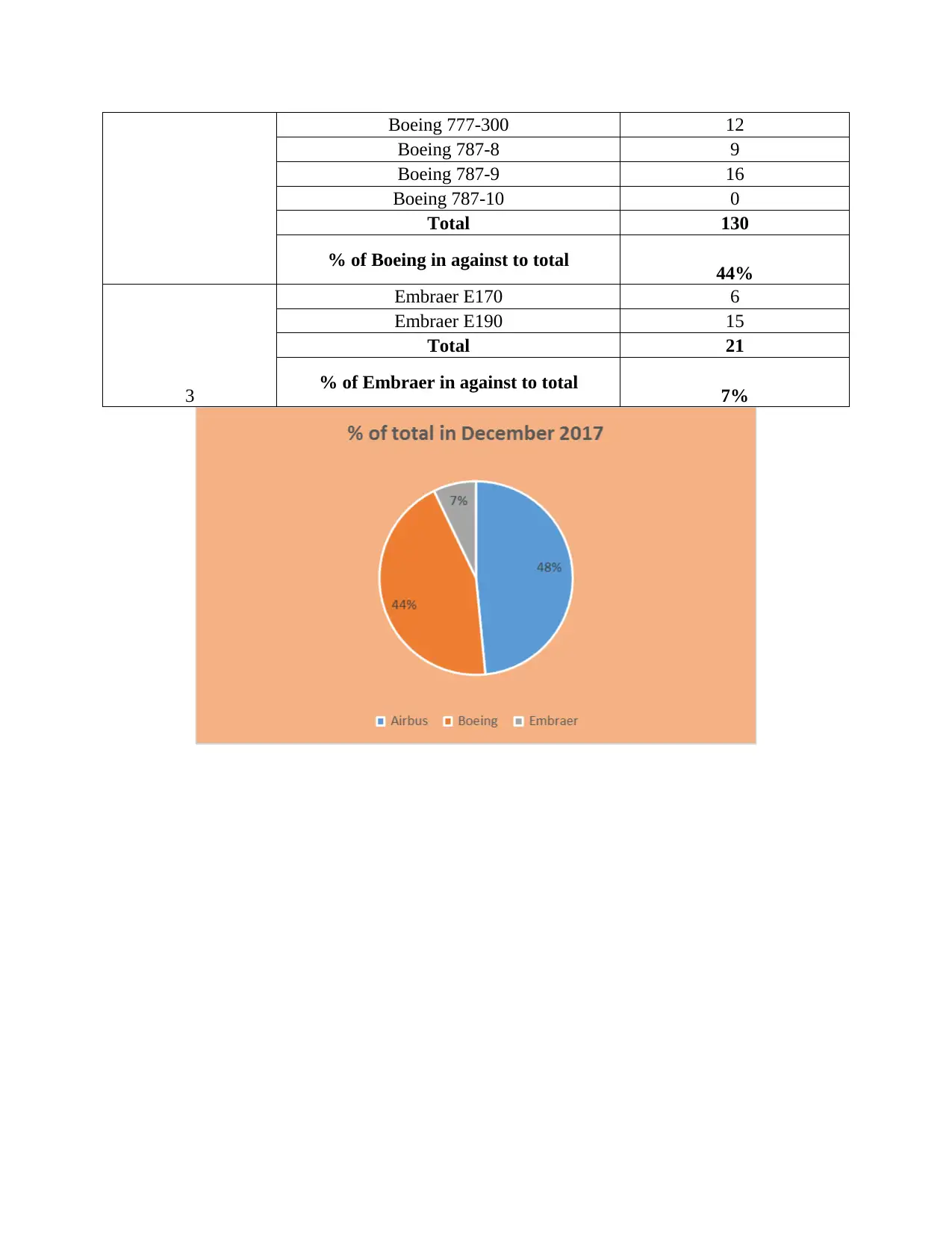

d. Producing the fully labelled chart reflecting the percentage of the 3 aircraft manufacturers in

terms of total fleet

No Aircraft type Total December 2017

1

Airbus A318 1

Airbus A319 44

Airbus A320 67

Airbus A321 18

Airbus A350 0

Airbus A380 12

Total 142

% of Airbus in against to total 48%

2

Boeing 747-400 36

Boeing 757-200 3

Boeing 767-300 8

Boeing 777-200 46

% 23%

a. Recognising the Aircraft type that has the largest fleet

From the above table, it has been reflected that the aircraft that contained a largest fleet

seems to be Airbus320 as compared to other type and competitive aircraft company. It resulted

as 67 which includes on balance sheet fixed assets and the off balance sheet operating leases.

b. Identifying an aircraft manufacturer from the data that is having a biggest representation in

British Airways

Airbus aircraft manufacturer contains the biggest representation in British Airways fleet

at the month of December 2017. This means that types of Airbus aircraft results higher

operations as compared to Boeing so it is called as the biggest representation manufacturer in

British Airways that acts as the Aircraft manufacturer.

c. Computing the percentage value of an entire total aircraft manufacturer

Airbus A320

67 / 293

= 23%

d. Producing the fully labelled chart reflecting the percentage of the 3 aircraft manufacturers in

terms of total fleet

No Aircraft type Total December 2017

1

Airbus A318 1

Airbus A319 44

Airbus A320 67

Airbus A321 18

Airbus A350 0

Airbus A380 12

Total 142

% of Airbus in against to total 48%

2

Boeing 747-400 36

Boeing 757-200 3

Boeing 767-300 8

Boeing 777-200 46

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Boeing 777-300 12

Boeing 787-8 9

Boeing 787-9 16

Boeing 787-10 0

Total 130

% of Boeing in against to total 44%

3

Embraer E170 6

Embraer E190 15

Total 21

% of Embraer in against to total 7%

Boeing 787-8 9

Boeing 787-9 16

Boeing 787-10 0

Total 130

% of Boeing in against to total 44%

3

Embraer E170 6

Embraer E190 15

Total 21

% of Embraer in against to total 7%

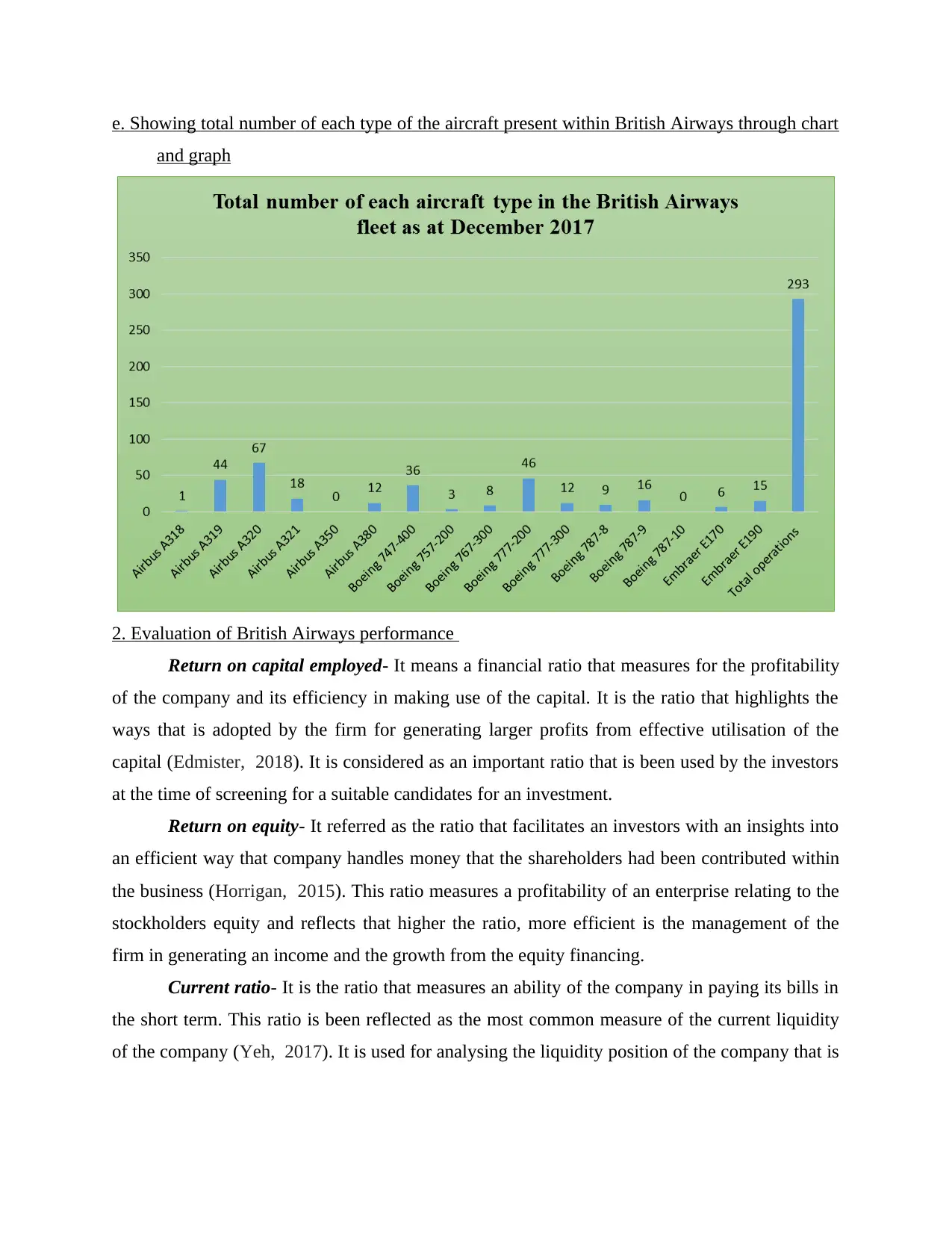

e. Showing total number of each type of the aircraft present within British Airways through chart

and graph

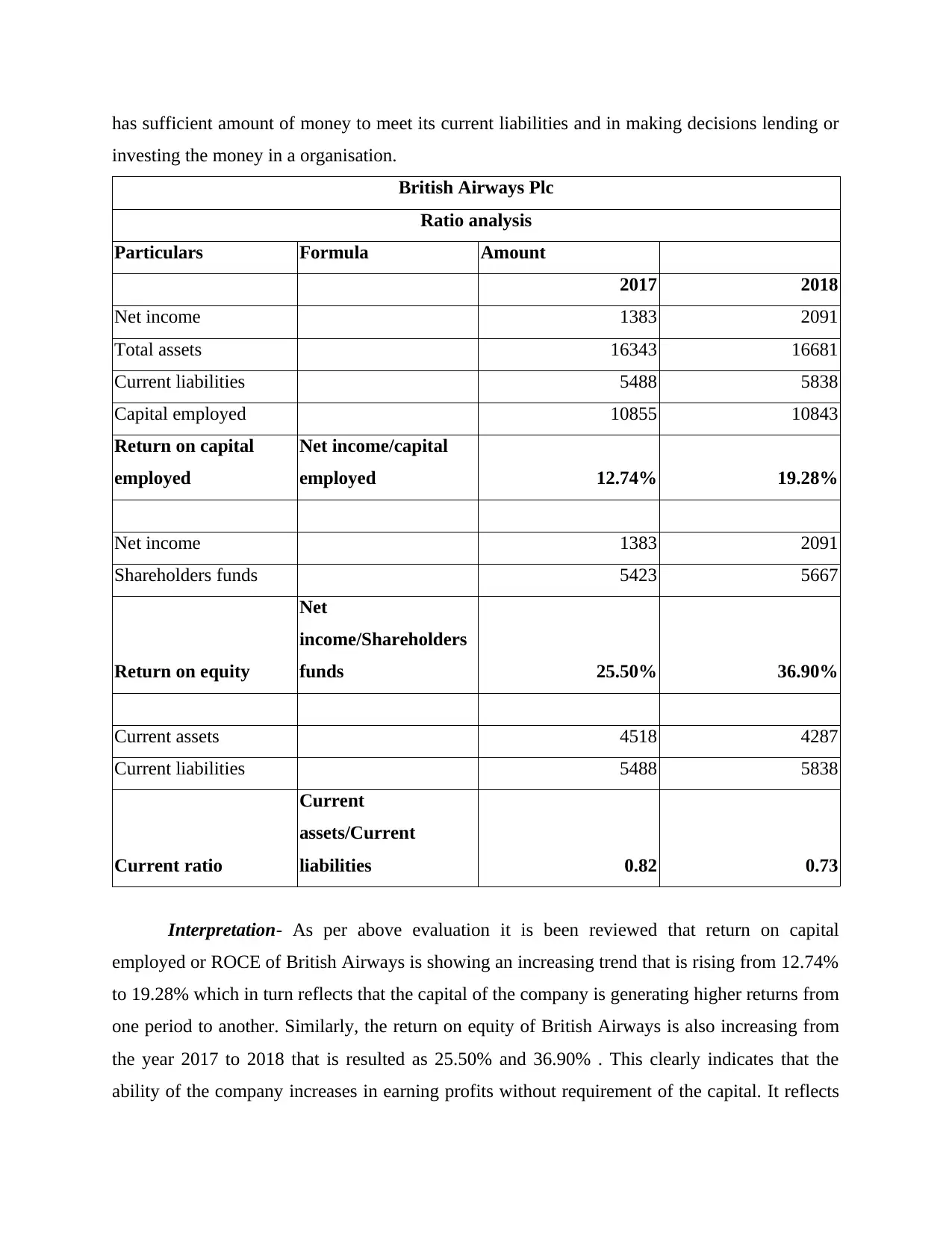

2. Evaluation of British Airways performance

Return on capital employed- It means a financial ratio that measures for the profitability

of the company and its efficiency in making use of the capital. It is the ratio that highlights the

ways that is adopted by the firm for generating larger profits from effective utilisation of the

capital (Edmister, 2018). It is considered as an important ratio that is been used by the investors

at the time of screening for a suitable candidates for an investment.

Return on equity- It referred as the ratio that facilitates an investors with an insights into

an efficient way that company handles money that the shareholders had been contributed within

the business (Horrigan, 2015). This ratio measures a profitability of an enterprise relating to the

stockholders equity and reflects that higher the ratio, more efficient is the management of the

firm in generating an income and the growth from the equity financing.

Current ratio- It is the ratio that measures an ability of the company in paying its bills in

the short term. This ratio is been reflected as the most common measure of the current liquidity

of the company (Yeh, 2017). It is used for analysing the liquidity position of the company that is

and graph

2. Evaluation of British Airways performance

Return on capital employed- It means a financial ratio that measures for the profitability

of the company and its efficiency in making use of the capital. It is the ratio that highlights the

ways that is adopted by the firm for generating larger profits from effective utilisation of the

capital (Edmister, 2018). It is considered as an important ratio that is been used by the investors

at the time of screening for a suitable candidates for an investment.

Return on equity- It referred as the ratio that facilitates an investors with an insights into

an efficient way that company handles money that the shareholders had been contributed within

the business (Horrigan, 2015). This ratio measures a profitability of an enterprise relating to the

stockholders equity and reflects that higher the ratio, more efficient is the management of the

firm in generating an income and the growth from the equity financing.

Current ratio- It is the ratio that measures an ability of the company in paying its bills in

the short term. This ratio is been reflected as the most common measure of the current liquidity

of the company (Yeh, 2017). It is used for analysing the liquidity position of the company that is

has sufficient amount of money to meet its current liabilities and in making decisions lending or

investing the money in a organisation.

British Airways Plc

Ratio analysis

Particulars Formula Amount

2017 2018

Net income 1383 2091

Total assets 16343 16681

Current liabilities 5488 5838

Capital employed 10855 10843

Return on capital

employed

Net income/capital

employed 12.74% 19.28%

Net income 1383 2091

Shareholders funds 5423 5667

Return on equity

Net

income/Shareholders

funds 25.50% 36.90%

Current assets 4518 4287

Current liabilities 5488 5838

Current ratio

Current

assets/Current

liabilities 0.82 0.73

Interpretation- As per above evaluation it is been reviewed that return on capital

employed or ROCE of British Airways is showing an increasing trend that is rising from 12.74%

to 19.28% which in turn reflects that the capital of the company is generating higher returns from

one period to another. Similarly, the return on equity of British Airways is also increasing from

the year 2017 to 2018 that is resulted as 25.50% and 36.90% . This clearly indicates that the

ability of the company increases in earning profits without requirement of the capital. It reflects

investing the money in a organisation.

British Airways Plc

Ratio analysis

Particulars Formula Amount

2017 2018

Net income 1383 2091

Total assets 16343 16681

Current liabilities 5488 5838

Capital employed 10855 10843

Return on capital

employed

Net income/capital

employed 12.74% 19.28%

Net income 1383 2091

Shareholders funds 5423 5667

Return on equity

Net

income/Shareholders

funds 25.50% 36.90%

Current assets 4518 4287

Current liabilities 5488 5838

Current ratio

Current

assets/Current

liabilities 0.82 0.73

Interpretation- As per above evaluation it is been reviewed that return on capital

employed or ROCE of British Airways is showing an increasing trend that is rising from 12.74%

to 19.28% which in turn reflects that the capital of the company is generating higher returns from

one period to another. Similarly, the return on equity of British Airways is also increasing from

the year 2017 to 2018 that is resulted as 25.50% and 36.90% . This clearly indicates that the

ability of the company increases in earning profits without requirement of the capital. It reflects

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

that profitability performance of British Airways is becoming more ad more better over the year

with respect to the use of the capital and the equities. Moreover, current ratio of an organization

seen as 0.82 in the year 2017 and 0.73 in the year 2018 which means that it had not reached to an

ideal ratio but has attain a good ratio that is close to 1 that in turn clearly means it is managing its

assets effectively and efficiently and has the capability in meeting their current obligations

without lack of funds and in meeting any kind of uncertainty that appears in the future periods.

3. Discussion relating to the risk factors that affects the brand reputation and the market position

of the company

British Airways operates under highly regulated and the commercially competitive

environment along with the operational complexities, that exposes the group several risk factors.

The company had emphasized on measures for mitigating the risks that are associated within

business, although majority of them remains outside the control of the group like government

regulations, economic and the political environment, foreign exchange or currency exchange

rates. Some of these risk factors that impacts the position of the firm to great extent are as

follows-

Reputation of Brand- BA contains a significant commercial brand value and erosion of

such brand either through the single event and the series of an event might adversely affects

leadership position of the group with their customers and ultimately impacts the profitability and

the future revenue (Hwang, Zhao and Yu,2016). In case if the company doesn't meets the

expectation of its customers and does not maintain for an emotional attachment towards the

brand then it might face a brand erosion and loss of the market share. In order to overcome or

mitigate this risk, the group had undertook the significant review of British Airways brand in

understanding the preferences of the customers and the better position of its offerings.

Competition- As the firm is operating its business in the highly competitive environment

with the direct competition on all their routes and from the indirect flights, transport mode and

the charter services. If the company could not operate in the cost effective manner or in facing

the competitor growth capacity in the excess of the growth demand, then this would materially

impacts their margins (Al‐Hadi, Hasan and Habib, 2016). However, strong global position,

leaders in the strategic market and alliances with diverse customer segment helps the firm in

mitigating the risk. For the purpose of improving the customer experience, group continues to

review its product constantly and respond through taking initiatives.

with respect to the use of the capital and the equities. Moreover, current ratio of an organization

seen as 0.82 in the year 2017 and 0.73 in the year 2018 which means that it had not reached to an

ideal ratio but has attain a good ratio that is close to 1 that in turn clearly means it is managing its

assets effectively and efficiently and has the capability in meeting their current obligations

without lack of funds and in meeting any kind of uncertainty that appears in the future periods.

3. Discussion relating to the risk factors that affects the brand reputation and the market position

of the company

British Airways operates under highly regulated and the commercially competitive

environment along with the operational complexities, that exposes the group several risk factors.

The company had emphasized on measures for mitigating the risks that are associated within

business, although majority of them remains outside the control of the group like government

regulations, economic and the political environment, foreign exchange or currency exchange

rates. Some of these risk factors that impacts the position of the firm to great extent are as

follows-

Reputation of Brand- BA contains a significant commercial brand value and erosion of

such brand either through the single event and the series of an event might adversely affects

leadership position of the group with their customers and ultimately impacts the profitability and

the future revenue (Hwang, Zhao and Yu,2016). In case if the company doesn't meets the

expectation of its customers and does not maintain for an emotional attachment towards the

brand then it might face a brand erosion and loss of the market share. In order to overcome or

mitigate this risk, the group had undertook the significant review of British Airways brand in

understanding the preferences of the customers and the better position of its offerings.

Competition- As the firm is operating its business in the highly competitive environment

with the direct competition on all their routes and from the indirect flights, transport mode and

the charter services. If the company could not operate in the cost effective manner or in facing

the competitor growth capacity in the excess of the growth demand, then this would materially

impacts their margins (Al‐Hadi, Hasan and Habib, 2016). However, strong global position,

leaders in the strategic market and alliances with diverse customer segment helps the firm in

mitigating the risk. For the purpose of improving the customer experience, group continues to

review its product constantly and respond through taking initiatives.

De-regulation- M&A among the competitors has potential in adversely affects revenue

& position of the market. The firm is having a flexibility in reacting to the market opportunities

that arises from its competitors in leading to the opportunities for capturing the market share and

expanding group. It reliant on the other members of one-world alliance for safeguarding the

alliance of the proposition. The group had also maintained well known and leading presence

across the world fro ensuring that alliance attracts and retains the members rights that is been

counted as key to an ongoing development of network.

Digital interruption- Competitors or the new entrants to travel the market might use the

digital technology in more effective manner that disrupts their business model or the technology

disruptors might use the tools for positioning themselves between their customers and the brands.

British Airways focuses on customer experience in addition with their exploitation of the

technology, reducing an impact of the digital disruptors.

Government interference- Regulation of an airline industry comprises of many of their

activities involving routine flying rights, security, departure taxes, landing rights and an

environmental controls (Annual report of British Airways, 2018). High tax liability and an

increase in the regulation might affect financial and operational performance of the company.

The group had continued for monitoring and assessing negative effects of the government policy

like imposition of the Air passenger duty.

Infrastructure constraints- British Airways is highly dependent on the infrastructure

changes or the decisions in the policy by the governments, other entities and the regulators that

impacts operations but are present outside the control of the group. Moreover, Airport transit,

landing and the security charges had represented significant level of the operating cost to the

company. On the other hand, such security charges are been passed in a way of surcharges to the

passengers.

Joint businesses- It was having a agreements with the other airlines in partnering in

respect to the provision of the flights and the share revenues over the specified routes. Such

business arrangements involves delivery risks like realising the planned synergies and in

agreeing with deployment of an additional capacity and the performance of the one partner to

other in the joint venture. Strong governance and the financial controls are present within each of

the joint business.

& position of the market. The firm is having a flexibility in reacting to the market opportunities

that arises from its competitors in leading to the opportunities for capturing the market share and

expanding group. It reliant on the other members of one-world alliance for safeguarding the

alliance of the proposition. The group had also maintained well known and leading presence

across the world fro ensuring that alliance attracts and retains the members rights that is been

counted as key to an ongoing development of network.

Digital interruption- Competitors or the new entrants to travel the market might use the

digital technology in more effective manner that disrupts their business model or the technology

disruptors might use the tools for positioning themselves between their customers and the brands.

British Airways focuses on customer experience in addition with their exploitation of the

technology, reducing an impact of the digital disruptors.

Government interference- Regulation of an airline industry comprises of many of their

activities involving routine flying rights, security, departure taxes, landing rights and an

environmental controls (Annual report of British Airways, 2018). High tax liability and an

increase in the regulation might affect financial and operational performance of the company.

The group had continued for monitoring and assessing negative effects of the government policy

like imposition of the Air passenger duty.

Infrastructure constraints- British Airways is highly dependent on the infrastructure

changes or the decisions in the policy by the governments, other entities and the regulators that

impacts operations but are present outside the control of the group. Moreover, Airport transit,

landing and the security charges had represented significant level of the operating cost to the

company. On the other hand, such security charges are been passed in a way of surcharges to the

passengers.

Joint businesses- It was having a agreements with the other airlines in partnering in

respect to the provision of the flights and the share revenues over the specified routes. Such

business arrangements involves delivery risks like realising the planned synergies and in

agreeing with deployment of an additional capacity and the performance of the one partner to

other in the joint venture. Strong governance and the financial controls are present within each of

the joint business.

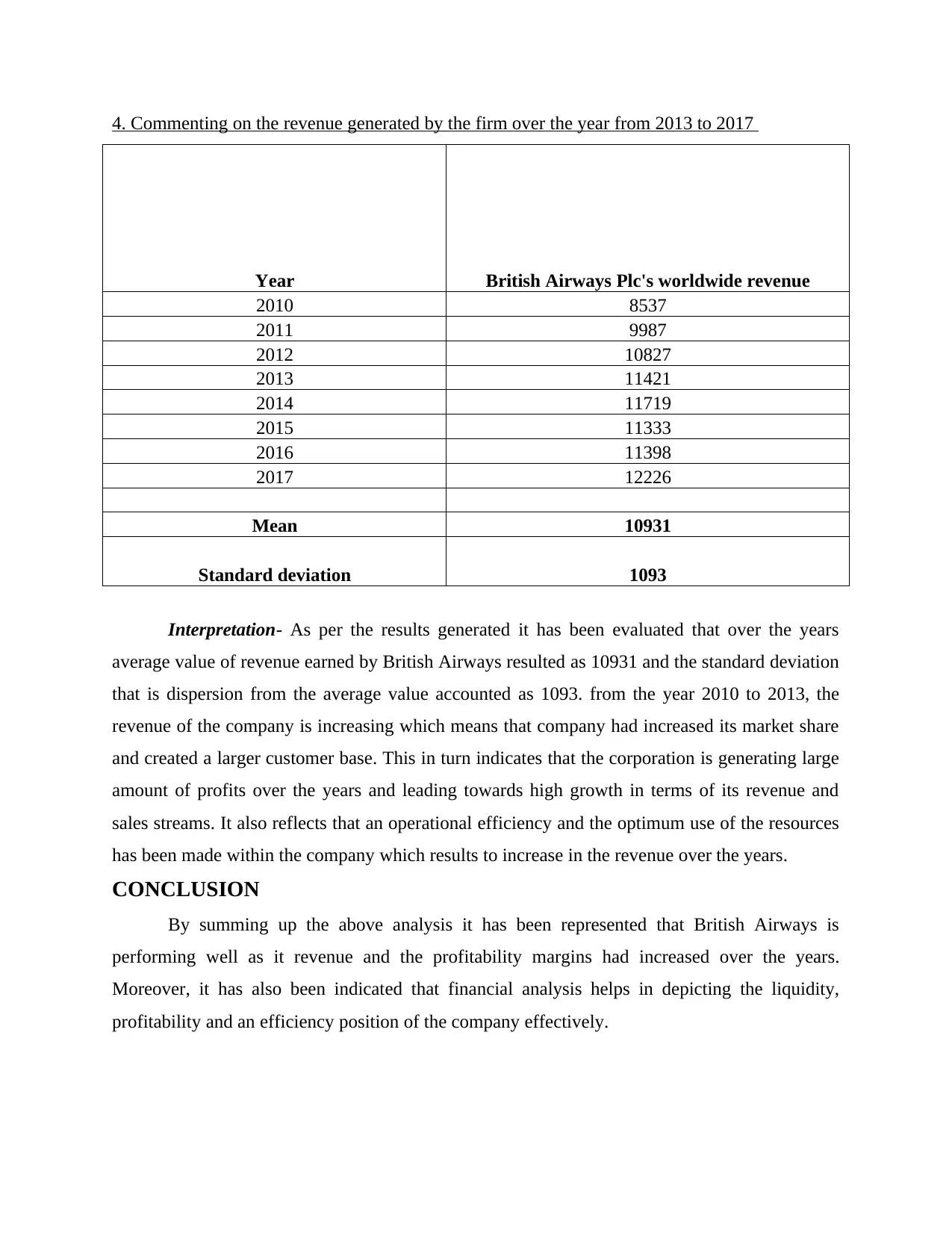

4. Commenting on the revenue generated by the firm over the year from 2013 to 2017

Year British Airways Plc's worldwide revenue

2010 8537

2011 9987

2012 10827

2013 11421

2014 11719

2015 11333

2016 11398

2017 12226

Mean 10931

Standard deviation 1093

Interpretation- As per the results generated it has been evaluated that over the years

average value of revenue earned by British Airways resulted as 10931 and the standard deviation

that is dispersion from the average value accounted as 1093. from the year 2010 to 2013, the

revenue of the company is increasing which means that company had increased its market share

and created a larger customer base. This in turn indicates that the corporation is generating large

amount of profits over the years and leading towards high growth in terms of its revenue and

sales streams. It also reflects that an operational efficiency and the optimum use of the resources

has been made within the company which results to increase in the revenue over the years.

CONCLUSION

By summing up the above analysis it has been represented that British Airways is

performing well as it revenue and the profitability margins had increased over the years.

Moreover, it has also been indicated that financial analysis helps in depicting the liquidity,

profitability and an efficiency position of the company effectively.

Year British Airways Plc's worldwide revenue

2010 8537

2011 9987

2012 10827

2013 11421

2014 11719

2015 11333

2016 11398

2017 12226

Mean 10931

Standard deviation 1093

Interpretation- As per the results generated it has been evaluated that over the years

average value of revenue earned by British Airways resulted as 10931 and the standard deviation

that is dispersion from the average value accounted as 1093. from the year 2010 to 2013, the

revenue of the company is increasing which means that company had increased its market share

and created a larger customer base. This in turn indicates that the corporation is generating large

amount of profits over the years and leading towards high growth in terms of its revenue and

sales streams. It also reflects that an operational efficiency and the optimum use of the resources

has been made within the company which results to increase in the revenue over the years.

CONCLUSION

By summing up the above analysis it has been represented that British Airways is

performing well as it revenue and the profitability margins had increased over the years.

Moreover, it has also been indicated that financial analysis helps in depicting the liquidity,

profitability and an efficiency position of the company effectively.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and journals

Al‐Hadi, A., Hasan, M. M. and Habib, A., 2016. Risk committee, firm life cycle, and market

risk disclosures. Corporate Governance: An International Review. 24(2). pp.145-170.

Cai, L. and Zhu, Y., 2015. The challenges of data quality and data quality assessment in the big

data era. Data science journal, 14.

Cao, M., Chychyla, R. and Stewart, T., 2015. Big Data analytics in financial statement

audits. Accounting Horizons, 29(2). pp.423-429.

Christensen, B.E., and et.al., 2016. Understanding audit quality: Insights from audit

professionals and investors. Contemporary Accounting Research, 33(4). pp.1648-1684.

Edmister, R. O., 2018. An empirical test of financial ratio analysis for small business failure

prediction. Journal of Financial and Quantitative analysis. 7(2). pp.1477-1493.

Franke, B., and et.al., 2016. Statistical inference, learning and models in big data. International

Statistical Review, 84(3). pp.371-389.

Holton, J.A. and Walsh, I., 2016. Classic grounded theory: Applications with qualitative and

quantitative data. Sage Publications.

Horrigan, J. O., 2015. A short history of financial ratio analysis. The Accounting Review. 43(2).

pp.284-294.

Huang, Y.N., Yen, W.Y. and Whittaker, A.S., 2016. Correlation of horizontal and vertical

components of strong ground motion for response-history analysis of safety-related nuclear

facilities. Nuclear Engineering and Design, 310. pp.273-279.

Hwang, B. G., Zhao, X. and Yu, G. S., 2016. Risk identification and allocation in underground

rail construction joint ventures: contractors’ perspective. Journal of Civil Engineering and

Management. 22(6). pp.758-767.

Smith, S.M., and et.al., 2016. A multi-group analysis of online survey respondent data quality:

Comparing a regular USA consumer panel to MTurk samples. Journal of Business

Research, 69(8). pp.3139-3148.

Yeh, Q. J., 2017. The application of data envelopment analysis in conjunction with financial

ratios for bank performance evaluation. Journal of the Operational Research Society. 47(8).

pp.980-988.

Online

1

Books and journals

Al‐Hadi, A., Hasan, M. M. and Habib, A., 2016. Risk committee, firm life cycle, and market

risk disclosures. Corporate Governance: An International Review. 24(2). pp.145-170.

Cai, L. and Zhu, Y., 2015. The challenges of data quality and data quality assessment in the big

data era. Data science journal, 14.

Cao, M., Chychyla, R. and Stewart, T., 2015. Big Data analytics in financial statement

audits. Accounting Horizons, 29(2). pp.423-429.

Christensen, B.E., and et.al., 2016. Understanding audit quality: Insights from audit

professionals and investors. Contemporary Accounting Research, 33(4). pp.1648-1684.

Edmister, R. O., 2018. An empirical test of financial ratio analysis for small business failure

prediction. Journal of Financial and Quantitative analysis. 7(2). pp.1477-1493.

Franke, B., and et.al., 2016. Statistical inference, learning and models in big data. International

Statistical Review, 84(3). pp.371-389.

Holton, J.A. and Walsh, I., 2016. Classic grounded theory: Applications with qualitative and

quantitative data. Sage Publications.

Horrigan, J. O., 2015. A short history of financial ratio analysis. The Accounting Review. 43(2).

pp.284-294.

Huang, Y.N., Yen, W.Y. and Whittaker, A.S., 2016. Correlation of horizontal and vertical

components of strong ground motion for response-history analysis of safety-related nuclear

facilities. Nuclear Engineering and Design, 310. pp.273-279.

Hwang, B. G., Zhao, X. and Yu, G. S., 2016. Risk identification and allocation in underground

rail construction joint ventures: contractors’ perspective. Journal of Civil Engineering and

Management. 22(6). pp.758-767.

Smith, S.M., and et.al., 2016. A multi-group analysis of online survey respondent data quality:

Comparing a regular USA consumer panel to MTurk samples. Journal of Business

Research, 69(8). pp.3139-3148.

Yeh, Q. J., 2017. The application of data envelopment analysis in conjunction with financial

ratios for bank performance evaluation. Journal of the Operational Research Society. 47(8).

pp.980-988.

Online

1

Annual report of British Airways. 2018. [Online]. Available through:

<https://www.iairgroup.com/~/media/Files/I/IAG/annual-reports/ba/en/british-airways-plc-

annual-report-and-accounts-2018.pdf>

2

<https://www.iairgroup.com/~/media/Files/I/IAG/annual-reports/ba/en/british-airways-plc-

annual-report-and-accounts-2018.pdf>

2

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.