Business Decision Making: Techniques of Investment Appraisal

VerifiedAdded on 2023/06/13

|6

|1295

|311

AI Summary

This report discusses the techniques of investment appraisal such as payback period and net present value. It includes a case study of DD plc, a vegetarian manufacturing company operating in the UK. The report also encompasses financial and non-financial factors which impact the decision making of an organisation.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Business decision

making

making

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

1. Computation of payback period Of DD plc.......................................................................1

2. Calculation of Net present value of two different projects.................................................2

3. Explaining financial and non-financial factors which impact decision making.................3

CONCLUSION................................................................................................................................4

INTRODUCTION...........................................................................................................................1

1. Computation of payback period Of DD plc.......................................................................1

2. Calculation of Net present value of two different projects.................................................2

3. Explaining financial and non-financial factors which impact decision making.................3

CONCLUSION................................................................................................................................4

INTRODUCTION

Business decision making is a sequenced process in which managers take several

decisions related to operation and finance. The process of decision making is vital for every

organisation to achieve organisational goals and objectives. All the decisions are taken by top-

level managers to achieve economies of scale and enjoy a monopoly in the existing market

(Modak, Ghosh and Pathak, 2019). This report contains the techniques of investment appraisal

such as payback period and net present value. These tools aid in taking various decisions related

to investment. The company chosen for this report is DD plc, a vegetarian manufacturing

company operating in the UK. It deals in two different projects i.e., smoothies and non-dairy

milk products. It also encompasses financial and non-financial factors which impact the decision

making of an organisation.

MAIN BODY

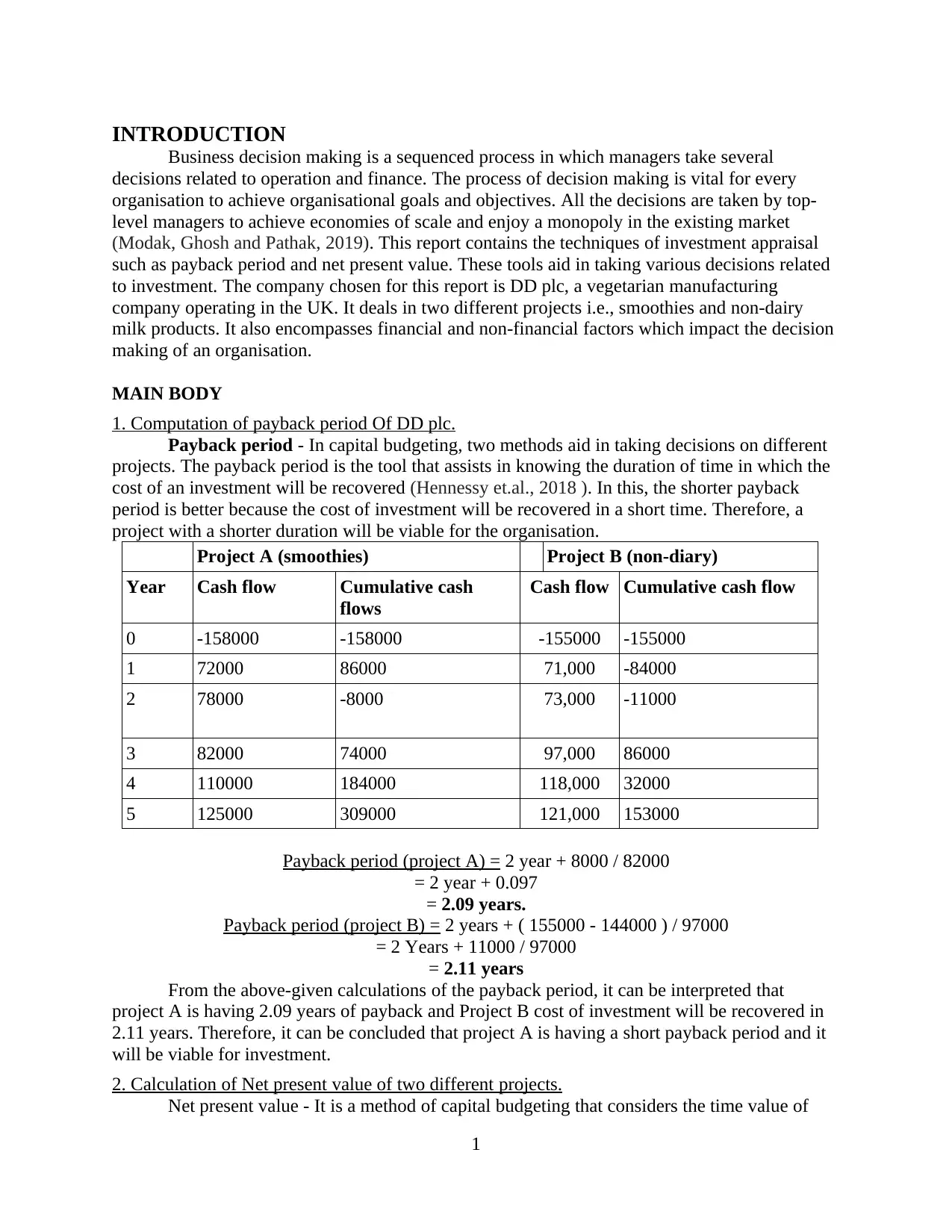

1. Computation of payback period Of DD plc.

Payback period - In capital budgeting, two methods aid in taking decisions on different

projects. The payback period is the tool that assists in knowing the duration of time in which the

cost of an investment will be recovered (Hennessy et.al., 2018 ). In this, the shorter payback

period is better because the cost of investment will be recovered in a short time. Therefore, a

project with a shorter duration will be viable for the organisation.

Project A (smoothies) Project B (non-diary)

Year Cash flow Cumulative cash

flows

Cash flow Cumulative cash flow

0 -158000 -158000 -155000 -155000

1 72000 86000 71,000 -84000

2 78000 -8000 73,000 -11000

3 82000 74000 97,000 86000

4 110000 184000 118,000 32000

5 125000 309000 121,000 153000

Payback period (project A) = 2 year + 8000 / 82000

= 2 year + 0.097

= 2.09 years.

Payback period (project B) = 2 years + ( 155000 - 144000 ) / 97000

= 2 Years + 11000 / 97000

= 2.11 years

From the above-given calculations of the payback period, it can be interpreted that

project A is having 2.09 years of payback and Project B cost of investment will be recovered in

2.11 years. Therefore, it can be concluded that project A is having a short payback period and it

will be viable for investment.

2. Calculation of Net present value of two different projects.

Net present value - It is a method of capital budgeting that considers the time value of

1

Business decision making is a sequenced process in which managers take several

decisions related to operation and finance. The process of decision making is vital for every

organisation to achieve organisational goals and objectives. All the decisions are taken by top-

level managers to achieve economies of scale and enjoy a monopoly in the existing market

(Modak, Ghosh and Pathak, 2019). This report contains the techniques of investment appraisal

such as payback period and net present value. These tools aid in taking various decisions related

to investment. The company chosen for this report is DD plc, a vegetarian manufacturing

company operating in the UK. It deals in two different projects i.e., smoothies and non-dairy

milk products. It also encompasses financial and non-financial factors which impact the decision

making of an organisation.

MAIN BODY

1. Computation of payback period Of DD plc.

Payback period - In capital budgeting, two methods aid in taking decisions on different

projects. The payback period is the tool that assists in knowing the duration of time in which the

cost of an investment will be recovered (Hennessy et.al., 2018 ). In this, the shorter payback

period is better because the cost of investment will be recovered in a short time. Therefore, a

project with a shorter duration will be viable for the organisation.

Project A (smoothies) Project B (non-diary)

Year Cash flow Cumulative cash

flows

Cash flow Cumulative cash flow

0 -158000 -158000 -155000 -155000

1 72000 86000 71,000 -84000

2 78000 -8000 73,000 -11000

3 82000 74000 97,000 86000

4 110000 184000 118,000 32000

5 125000 309000 121,000 153000

Payback period (project A) = 2 year + 8000 / 82000

= 2 year + 0.097

= 2.09 years.

Payback period (project B) = 2 years + ( 155000 - 144000 ) / 97000

= 2 Years + 11000 / 97000

= 2.11 years

From the above-given calculations of the payback period, it can be interpreted that

project A is having 2.09 years of payback and Project B cost of investment will be recovered in

2.11 years. Therefore, it can be concluded that project A is having a short payback period and it

will be viable for investment.

2. Calculation of Net present value of two different projects.

Net present value - It is a method of capital budgeting that considers the time value of

1

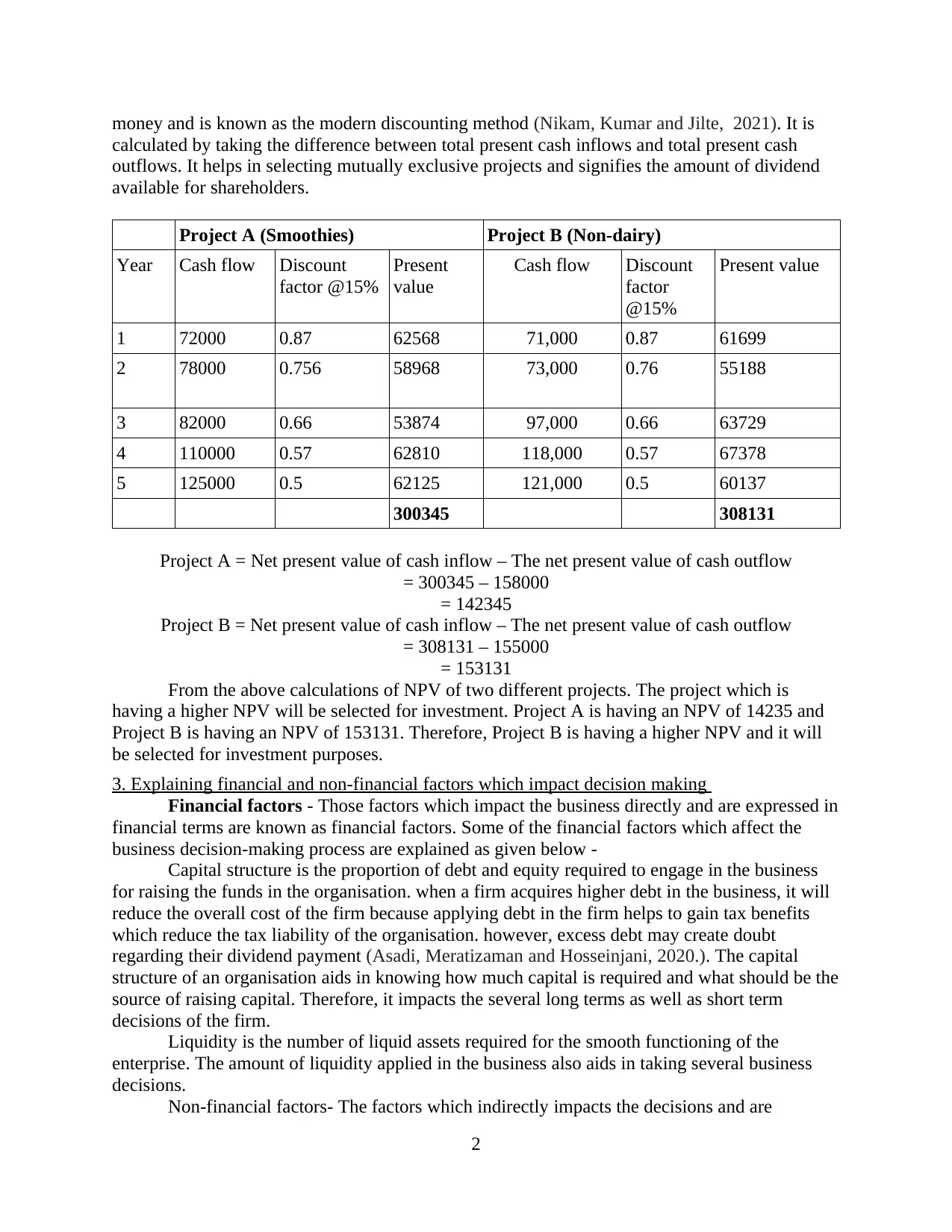

money and is known as the modern discounting method (Nikam, Kumar and Jilte, 2021). It is

calculated by taking the difference between total present cash inflows and total present cash

outflows. It helps in selecting mutually exclusive projects and signifies the amount of dividend

available for shareholders.

Project A (Smoothies) Project B (Non-dairy)

Year Cash flow Discount

factor @15%

Present

value

Cash flow Discount

factor

@15%

Present value

1 72000 0.87 62568 71,000 0.87 61699

2 78000 0.756 58968 73,000 0.76 55188

3 82000 0.66 53874 97,000 0.66 63729

4 110000 0.57 62810 118,000 0.57 67378

5 125000 0.5 62125 121,000 0.5 60137

300345 308131

Project A = Net present value of cash inflow – The net present value of cash outflow

= 300345 – 158000

= 142345

Project B = Net present value of cash inflow – The net present value of cash outflow

= 308131 – 155000

= 153131

From the above calculations of NPV of two different projects. The project which is

having a higher NPV will be selected for investment. Project A is having an NPV of 14235 and

Project B is having an NPV of 153131. Therefore, Project B is having a higher NPV and it will

be selected for investment purposes.

3. Explaining financial and non-financial factors which impact decision making

Financial factors - Those factors which impact the business directly and are expressed in

financial terms are known as financial factors. Some of the financial factors which affect the

business decision-making process are explained as given below -

Capital structure is the proportion of debt and equity required to engage in the business

for raising the funds in the organisation. when a firm acquires higher debt in the business, it will

reduce the overall cost of the firm because applying debt in the firm helps to gain tax benefits

which reduce the tax liability of the organisation. however, excess debt may create doubt

regarding their dividend payment (Asadi, Meratizaman and Hosseinjani, 2020.). The capital

structure of an organisation aids in knowing how much capital is required and what should be the

source of raising capital. Therefore, it impacts the several long terms as well as short term

decisions of the firm.

Liquidity is the number of liquid assets required for the smooth functioning of the

enterprise. The amount of liquidity applied in the business also aids in taking several business

decisions.

Non-financial factors- The factors which indirectly impacts the decisions and are

2

calculated by taking the difference between total present cash inflows and total present cash

outflows. It helps in selecting mutually exclusive projects and signifies the amount of dividend

available for shareholders.

Project A (Smoothies) Project B (Non-dairy)

Year Cash flow Discount

factor @15%

Present

value

Cash flow Discount

factor

@15%

Present value

1 72000 0.87 62568 71,000 0.87 61699

2 78000 0.756 58968 73,000 0.76 55188

3 82000 0.66 53874 97,000 0.66 63729

4 110000 0.57 62810 118,000 0.57 67378

5 125000 0.5 62125 121,000 0.5 60137

300345 308131

Project A = Net present value of cash inflow – The net present value of cash outflow

= 300345 – 158000

= 142345

Project B = Net present value of cash inflow – The net present value of cash outflow

= 308131 – 155000

= 153131

From the above calculations of NPV of two different projects. The project which is

having a higher NPV will be selected for investment. Project A is having an NPV of 14235 and

Project B is having an NPV of 153131. Therefore, Project B is having a higher NPV and it will

be selected for investment purposes.

3. Explaining financial and non-financial factors which impact decision making

Financial factors - Those factors which impact the business directly and are expressed in

financial terms are known as financial factors. Some of the financial factors which affect the

business decision-making process are explained as given below -

Capital structure is the proportion of debt and equity required to engage in the business

for raising the funds in the organisation. when a firm acquires higher debt in the business, it will

reduce the overall cost of the firm because applying debt in the firm helps to gain tax benefits

which reduce the tax liability of the organisation. however, excess debt may create doubt

regarding their dividend payment (Asadi, Meratizaman and Hosseinjani, 2020.). The capital

structure of an organisation aids in knowing how much capital is required and what should be the

source of raising capital. Therefore, it impacts the several long terms as well as short term

decisions of the firm.

Liquidity is the number of liquid assets required for the smooth functioning of the

enterprise. The amount of liquidity applied in the business also aids in taking several business

decisions.

Non-financial factors- The factors which indirectly impacts the decisions and are

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

expressed in qualitative terms are known as non-finnacial factors (Kane, 2020).

The legal structure of the country and its legislation impact the decision making power of

the organisation. For instance, change in laws and policies which are not framed in favour of the

organisation adversely affect the working of the enterprise.

Good Public relationships and governance policies assist in maintaining the goodwill of

the enterprise and increase the overall image of its competitors. Therefore, healthy relationships

also affect business decisions making (Adam, Mishra and Usman, 2021).

CONCLUSION

From the above report, it can be concluded that the application of investment appraisal

techniques helps to know the amount of profitability and return, investment is going to produce.

Using the techniques such as payback period and NPV helps to gain sights into investing

decisions. Several financial and non-financial factors impact the process of making decisions in

the business.

3

The legal structure of the country and its legislation impact the decision making power of

the organisation. For instance, change in laws and policies which are not framed in favour of the

organisation adversely affect the working of the enterprise.

Good Public relationships and governance policies assist in maintaining the goodwill of

the enterprise and increase the overall image of its competitors. Therefore, healthy relationships

also affect business decisions making (Adam, Mishra and Usman, 2021).

CONCLUSION

From the above report, it can be concluded that the application of investment appraisal

techniques helps to know the amount of profitability and return, investment is going to produce.

Using the techniques such as payback period and NPV helps to gain sights into investing

decisions. Several financial and non-financial factors impact the process of making decisions in

the business.

3

REFERENCES

Books and Journals

Adam, A.M., Mishra, A. and Usman, A., 2021. Economic Implication and Impact of Climate

Change on Net Zero Energy Building (NZEB). Advances in Interdisciplinary

Engineering. pp.195-204.

Asadi, A., Meratizaman, M. and Hosseinjani, A.A., 2020. Feasibility study of small-scale gas

engine integrated with innovative net-zero water desiccant cooling system and single-

effect thermal desalination unit. International Journal of Refrigeration. 119. pp.276-

293.

Hennessy, J. and et.al., 2018. Towards smart thermal grids: Techno-economic feasibility of

commercial heat-to-power technologies for district heating. Applied Energy.228.pp.766-

776.

Kane, E., 2020. Implicit and explicit norms and tools of safety net management. China Finance

Review International.

Modak, M., Ghosh, K.K. and Pathak, K., 2019. A BSC-ANP approach to organizational

outsourcing decision support-A case study. Journal of Business Research. 103. pp.432-

447.

Nikam, K.C., Kumar, R. and Jilte, R., 2021. Economic and exergoeconomic investigation of 660

MW coal-fired power plant. Journal of Thermal Analysis and Calorimetry. 145(3).

pp.1121-1135.

4

Books and Journals

Adam, A.M., Mishra, A. and Usman, A., 2021. Economic Implication and Impact of Climate

Change on Net Zero Energy Building (NZEB). Advances in Interdisciplinary

Engineering. pp.195-204.

Asadi, A., Meratizaman, M. and Hosseinjani, A.A., 2020. Feasibility study of small-scale gas

engine integrated with innovative net-zero water desiccant cooling system and single-

effect thermal desalination unit. International Journal of Refrigeration. 119. pp.276-

293.

Hennessy, J. and et.al., 2018. Towards smart thermal grids: Techno-economic feasibility of

commercial heat-to-power technologies for district heating. Applied Energy.228.pp.766-

776.

Kane, E., 2020. Implicit and explicit norms and tools of safety net management. China Finance

Review International.

Modak, M., Ghosh, K.K. and Pathak, K., 2019. A BSC-ANP approach to organizational

outsourcing decision support-A case study. Journal of Business Research. 103. pp.432-

447.

Nikam, K.C., Kumar, R. and Jilte, R., 2021. Economic and exergoeconomic investigation of 660

MW coal-fired power plant. Journal of Thermal Analysis and Calorimetry. 145(3).

pp.1121-1135.

4

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.