Business Decision Making: NPV and Payback Period for Investment

VerifiedAdded on 2023/06/17

|7

|1313

|470

Report

AI Summary

This report provides a comprehensive analysis of business decision-making using the payback period and net present value (NPV) methods. It evaluates two potential investment projects for AJ plc, a chocolate manufacturing company: a vegan chocolate project (Project A) and a vegan spread project (...

BUSINESS DECISION

MAKING

MAKING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................3

TASK...............................................................................................................................................3

Calculation of payback period....................................................................................................3

Calculation of NPV.....................................................................................................................4

ANALYSIS......................................................................................................................................5

a) Comparing and contrasting the payback period and the NPV................................................5

b) Using financial and non-financial factors and their implication on stakeholders and decision

making process............................................................................................................................6

CONCLUSION ...............................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION ..........................................................................................................................3

TASK...............................................................................................................................................3

Calculation of payback period....................................................................................................3

Calculation of NPV.....................................................................................................................4

ANALYSIS......................................................................................................................................5

a) Comparing and contrasting the payback period and the NPV................................................5

b) Using financial and non-financial factors and their implication on stakeholders and decision

making process............................................................................................................................6

CONCLUSION ...............................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION

Financial decision making is the consideration which is being made by the firms with the

effective analysis of monetary and non-monetary and also seeing the overall financial position of

the venture. These aspects helps the business to take the major consideration in enhancing the

overall financial position of the business venture(Denney and Merritt, 2020). AJ plc is the chosen

business and the stakeholder will predict the factors in order to invest in the venture. It is the

chocolate manufacturing company that is operating their business in UK. This respective essay

will cover the analysis of stakeholder as they will us two tools such s payback period and NPV.

Then they compare the two project in order to task appropriate decisions whether to invest or not

and also choosing the appropriate method of investing.

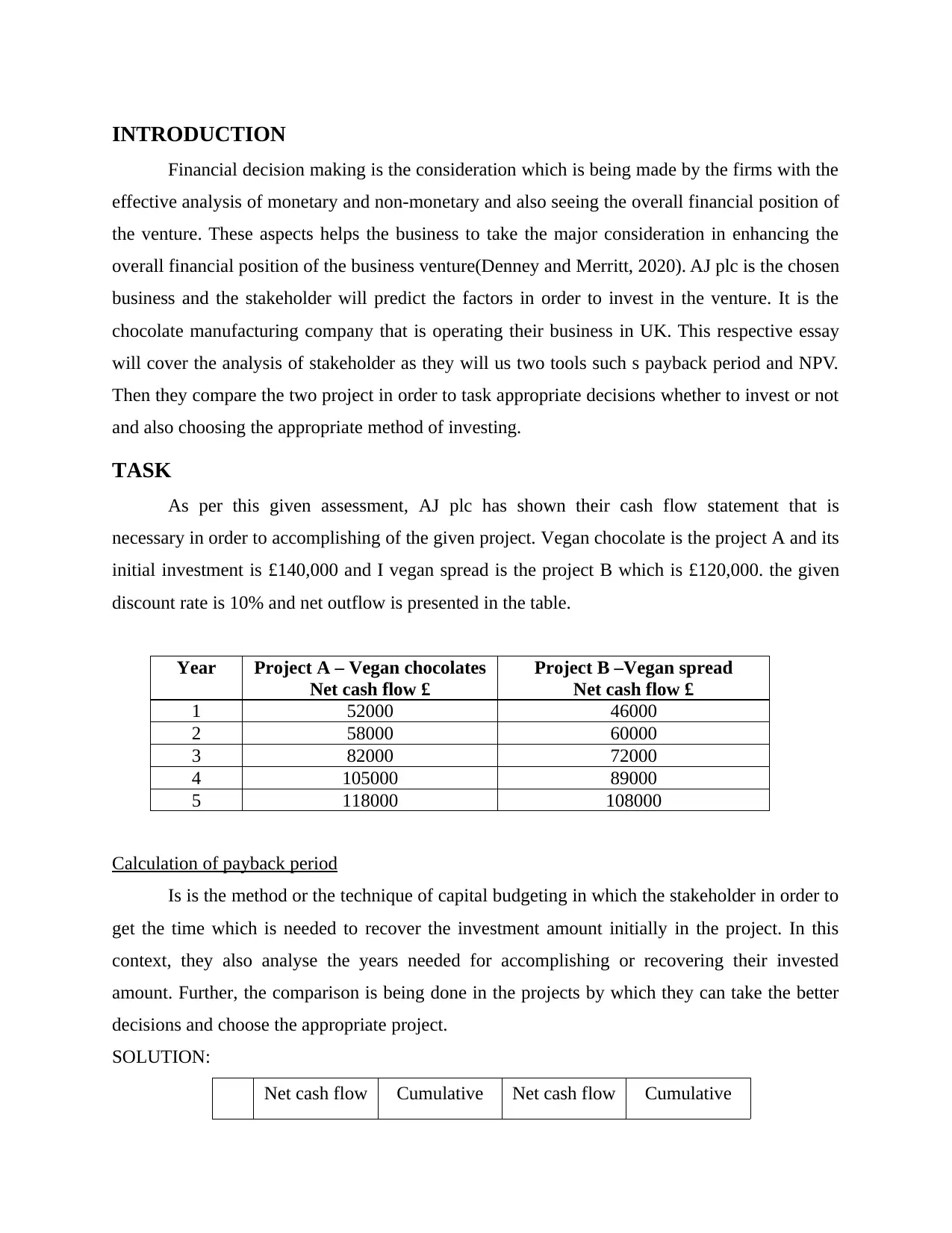

TASK

As per this given assessment, AJ plc has shown their cash flow statement that is

necessary in order to accomplishing of the given project. Vegan chocolate is the project A and its

initial investment is £140,000 and I vegan spread is the project B which is £120,000. the given

discount rate is 10% and net outflow is presented in the table.

Year Project A – Vegan chocolates

Net cash flow £

Project B –Vegan spread

Net cash flow £

1 52000 46000

2 58000 60000

3 82000 72000

4 105000 89000

5 118000 108000

Calculation of payback period

Is is the method or the technique of capital budgeting in which the stakeholder in order to

get the time which is needed to recover the investment amount initially in the project. In this

context, they also analyse the years needed for accomplishing or recovering their invested

amount. Further, the comparison is being done in the projects by which they can take the better

decisions and choose the appropriate project.

SOLUTION:

Net cash flow Cumulative Net cash flow Cumulative

Financial decision making is the consideration which is being made by the firms with the

effective analysis of monetary and non-monetary and also seeing the overall financial position of

the venture. These aspects helps the business to take the major consideration in enhancing the

overall financial position of the business venture(Denney and Merritt, 2020). AJ plc is the chosen

business and the stakeholder will predict the factors in order to invest in the venture. It is the

chocolate manufacturing company that is operating their business in UK. This respective essay

will cover the analysis of stakeholder as they will us two tools such s payback period and NPV.

Then they compare the two project in order to task appropriate decisions whether to invest or not

and also choosing the appropriate method of investing.

TASK

As per this given assessment, AJ plc has shown their cash flow statement that is

necessary in order to accomplishing of the given project. Vegan chocolate is the project A and its

initial investment is £140,000 and I vegan spread is the project B which is £120,000. the given

discount rate is 10% and net outflow is presented in the table.

Year Project A – Vegan chocolates

Net cash flow £

Project B –Vegan spread

Net cash flow £

1 52000 46000

2 58000 60000

3 82000 72000

4 105000 89000

5 118000 108000

Calculation of payback period

Is is the method or the technique of capital budgeting in which the stakeholder in order to

get the time which is needed to recover the investment amount initially in the project. In this

context, they also analyse the years needed for accomplishing or recovering their invested

amount. Further, the comparison is being done in the projects by which they can take the better

decisions and choose the appropriate project.

SOLUTION:

Net cash flow Cumulative Net cash flow Cumulative

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

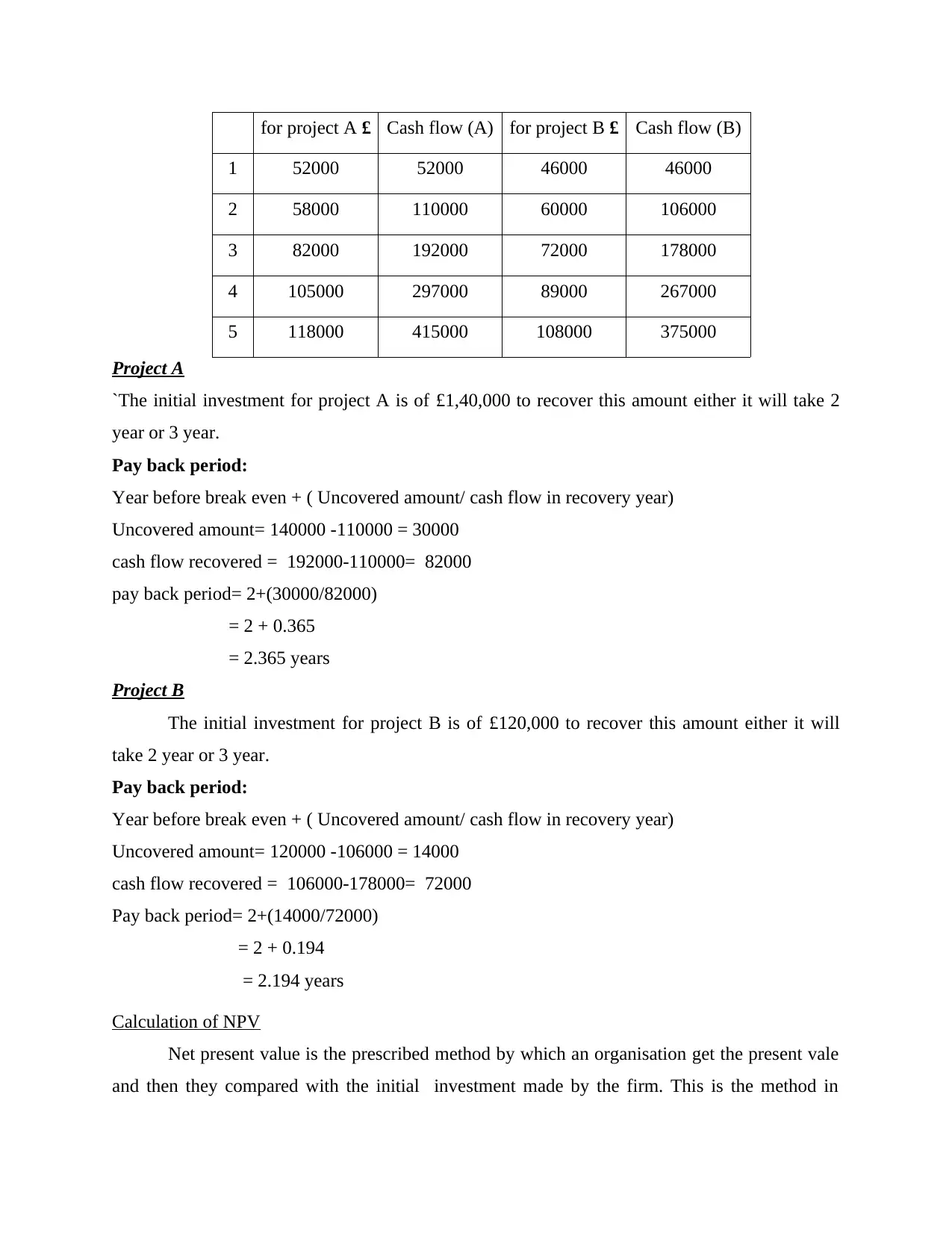

for project A £ Cash flow (A) for project B £ Cash flow (B)

1 52000 52000 46000 46000

2 58000 110000 60000 106000

3 82000 192000 72000 178000

4 105000 297000 89000 267000

5 118000 415000 108000 375000

Project A

`The initial investment for project A is of £1,40,000 to recover this amount either it will take 2

year or 3 year.

Pay back period:

Year before break even + ( Uncovered amount/ cash flow in recovery year)

Uncovered amount= 140000 -110000 = 30000

cash flow recovered = 192000-110000= 82000

pay back period= 2+(30000/82000)

= 2 + 0.365

= 2.365 years

Project B

The initial investment for project B is of £120,000 to recover this amount either it will

take 2 year or 3 year.

Pay back period:

Year before break even + ( Uncovered amount/ cash flow in recovery year)

Uncovered amount= 120000 -106000 = 14000

cash flow recovered = 106000-178000= 72000

Pay back period= 2+(14000/72000)

= 2 + 0.194

= 2.194 years

Calculation of NPV

Net present value is the prescribed method by which an organisation get the present vale

and then they compared with the initial investment made by the firm. This is the method in

1 52000 52000 46000 46000

2 58000 110000 60000 106000

3 82000 192000 72000 178000

4 105000 297000 89000 267000

5 118000 415000 108000 375000

Project A

`The initial investment for project A is of £1,40,000 to recover this amount either it will take 2

year or 3 year.

Pay back period:

Year before break even + ( Uncovered amount/ cash flow in recovery year)

Uncovered amount= 140000 -110000 = 30000

cash flow recovered = 192000-110000= 82000

pay back period= 2+(30000/82000)

= 2 + 0.365

= 2.365 years

Project B

The initial investment for project B is of £120,000 to recover this amount either it will

take 2 year or 3 year.

Pay back period:

Year before break even + ( Uncovered amount/ cash flow in recovery year)

Uncovered amount= 120000 -106000 = 14000

cash flow recovered = 106000-178000= 72000

Pay back period= 2+(14000/72000)

= 2 + 0.194

= 2.194 years

Calculation of NPV

Net present value is the prescribed method by which an organisation get the present vale

and then they compared with the initial investment made by the firm. This is the method in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

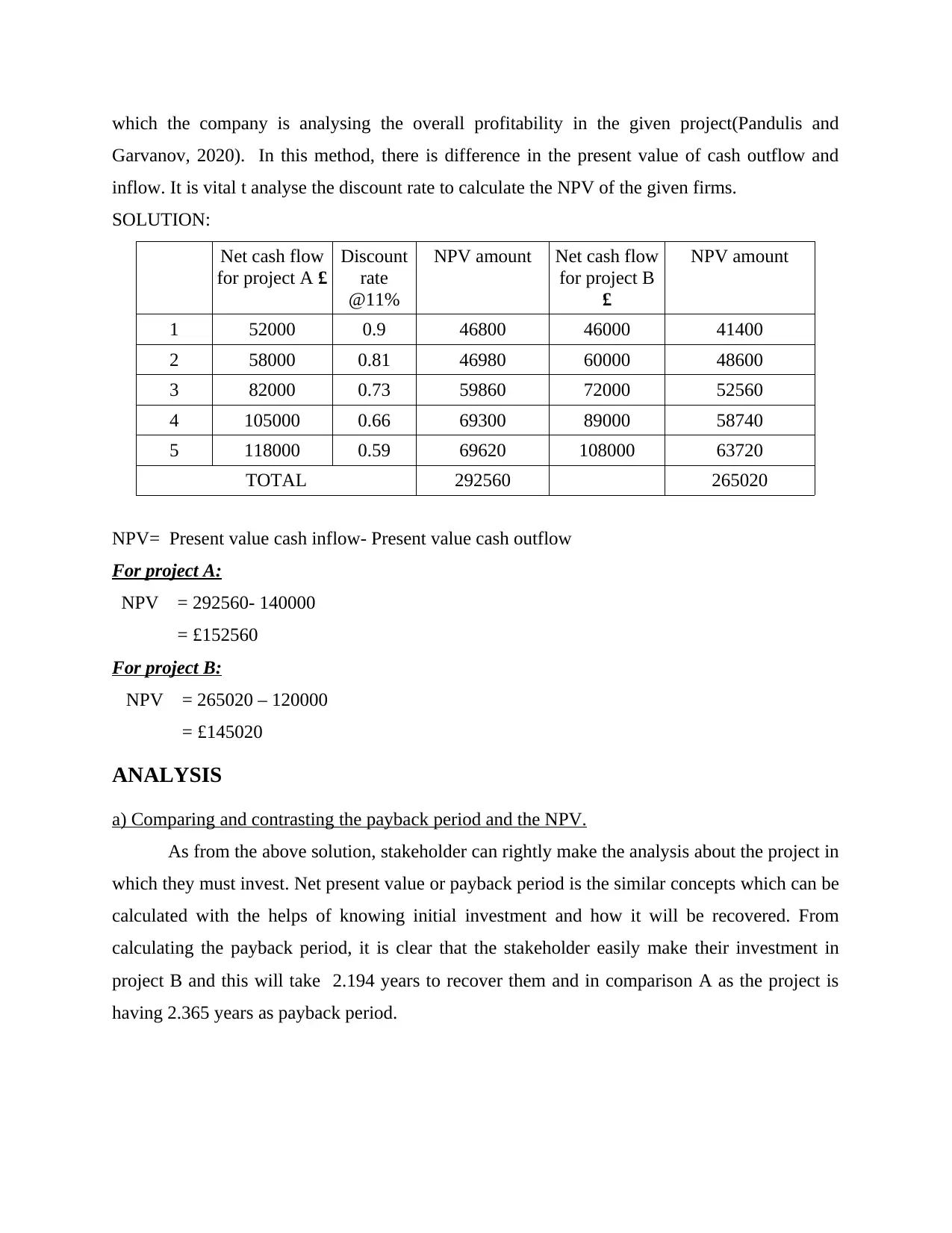

which the company is analysing the overall profitability in the given project(Pandulis and

Garvanov, 2020). In this method, there is difference in the present value of cash outflow and

inflow. It is vital t analyse the discount rate to calculate the NPV of the given firms.

SOLUTION:

Net cash flow

for project A £

Discount

rate

@11%

NPV amount Net cash flow

for project B

£

NPV amount

1 52000 0.9 46800 46000 41400

2 58000 0.81 46980 60000 48600

3 82000 0.73 59860 72000 52560

4 105000 0.66 69300 89000 58740

5 118000 0.59 69620 108000 63720

TOTAL 292560 265020

NPV= Present value cash inflow- Present value cash outflow

For project A:

NPV = 292560- 140000

= £152560

For project B:

NPV = 265020 – 120000

= £145020

ANALYSIS

a) Comparing and contrasting the payback period and the NPV.

As from the above solution, stakeholder can rightly make the analysis about the project in

which they must invest. Net present value or payback period is the similar concepts which can be

calculated with the helps of knowing initial investment and how it will be recovered. From

calculating the payback period, it is clear that the stakeholder easily make their investment in

project B and this will take 2.194 years to recover them and in comparison A as the project is

having 2.365 years as payback period.

Garvanov, 2020). In this method, there is difference in the present value of cash outflow and

inflow. It is vital t analyse the discount rate to calculate the NPV of the given firms.

SOLUTION:

Net cash flow

for project A £

Discount

rate

@11%

NPV amount Net cash flow

for project B

£

NPV amount

1 52000 0.9 46800 46000 41400

2 58000 0.81 46980 60000 48600

3 82000 0.73 59860 72000 52560

4 105000 0.66 69300 89000 58740

5 118000 0.59 69620 108000 63720

TOTAL 292560 265020

NPV= Present value cash inflow- Present value cash outflow

For project A:

NPV = 292560- 140000

= £152560

For project B:

NPV = 265020 – 120000

= £145020

ANALYSIS

a) Comparing and contrasting the payback period and the NPV.

As from the above solution, stakeholder can rightly make the analysis about the project in

which they must invest. Net present value or payback period is the similar concepts which can be

calculated with the helps of knowing initial investment and how it will be recovered. From

calculating the payback period, it is clear that the stakeholder easily make their investment in

project B and this will take 2.194 years to recover them and in comparison A as the project is

having 2.365 years as payback period.

b) Using financial and non-financial factors and their implication on stakeholders and decision

making process.

There are certain aspects that are financial or non-financial factors and having major

significant affects in the decisions making of the investors and its implication.

Financial factor are the aspects which analyse the major consideration to which the

company is having full control and direct relation with the cash flow and the outflow of the

venture. While making the investing decisions, they must look to the financial factors and

includes the certain amount of wealth. They also look to the debts paying abilities in order to

analyse the market reputations in terms of paying interest.

Non financial factors

CONCLUSION

From the above scenario, it is concluded that business decisions is having the main

consideration by which they can understand the management in order to generate higher profits.

There are certain aspects which is used by the firms in decide the certain investment areas or the

particular projects. By selecting such aspects, business can rightly make appropriate decisions in

order to have higher success.

making process.

There are certain aspects that are financial or non-financial factors and having major

significant affects in the decisions making of the investors and its implication.

Financial factor are the aspects which analyse the major consideration to which the

company is having full control and direct relation with the cash flow and the outflow of the

venture. While making the investing decisions, they must look to the financial factors and

includes the certain amount of wealth. They also look to the debts paying abilities in order to

analyse the market reputations in terms of paying interest.

Non financial factors

CONCLUSION

From the above scenario, it is concluded that business decisions is having the main

consideration by which they can understand the management in order to generate higher profits.

There are certain aspects which is used by the firms in decide the certain investment areas or the

particular projects. By selecting such aspects, business can rightly make appropriate decisions in

order to have higher success.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Denney, V.P. and Merritt, D.M., 2020. Improving Ethical Decision Making through the Lens of

Graduate Project Management Students. The Journal of Modern Project Management,

8(2).

Drapeau, M.J. and Tremblay, M., 2020. Revisiting the Entrepreneurial Exit Decision Process: A

Decision-Making Model. In Business Transfers, Family Firms and Entrepreneurship

(pp. 22-36). Routledge.

Hauser, A., Eggers, F. and Güldenberg, S., 2020. Strategic decision-making in SMEs:

effectuation, causation, and the absence of strategy. Small Business Economics, 54(3),

pp.775-790.

Iram, T., Bilal, A.R. and Latif, S., 2021. Is Awareness That Powerful? Women’s Financial

Literacy Support to Prospects Behaviour in Prudent Decision-making. Global Business

Review, p.0972150921996185.

Pandulis, A. and Garvanov, I., 2020. Decision Support Framework for Composing of Different

Questionnaires Based on Business Model with Optimization. In Integrated Uncertainty

in Knowledge Modelling and Decision Making: 8th International Symposium, IUKM

2020, Phuket, Thailand, November 11-13, 2020, Proceedings (Vol. 12482, p. 50).

Springer Nature.

Tingey-Holyoak, J.L., Pisaniello, J., Buss, P. and Wiersma, B., 2020. Water productivity

accounting in Australian agriculture: The need for cost-informed decision-making.

Outlook on Agriculture, 49(2), pp.172-184.

Books and Journals

Denney, V.P. and Merritt, D.M., 2020. Improving Ethical Decision Making through the Lens of

Graduate Project Management Students. The Journal of Modern Project Management,

8(2).

Drapeau, M.J. and Tremblay, M., 2020. Revisiting the Entrepreneurial Exit Decision Process: A

Decision-Making Model. In Business Transfers, Family Firms and Entrepreneurship

(pp. 22-36). Routledge.

Hauser, A., Eggers, F. and Güldenberg, S., 2020. Strategic decision-making in SMEs:

effectuation, causation, and the absence of strategy. Small Business Economics, 54(3),

pp.775-790.

Iram, T., Bilal, A.R. and Latif, S., 2021. Is Awareness That Powerful? Women’s Financial

Literacy Support to Prospects Behaviour in Prudent Decision-making. Global Business

Review, p.0972150921996185.

Pandulis, A. and Garvanov, I., 2020. Decision Support Framework for Composing of Different

Questionnaires Based on Business Model with Optimization. In Integrated Uncertainty

in Knowledge Modelling and Decision Making: 8th International Symposium, IUKM

2020, Phuket, Thailand, November 11-13, 2020, Proceedings (Vol. 12482, p. 50).

Springer Nature.

Tingey-Holyoak, J.L., Pisaniello, J., Buss, P. and Wiersma, B., 2020. Water productivity

accounting in Australian agriculture: The need for cost-informed decision-making.

Outlook on Agriculture, 49(2), pp.172-184.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.