Investment Appraisal Report: Genesis & Dreams Ltd Project Analysis

VerifiedAdded on 2023/01/05

|7

|1383

|67

Report

AI Summary

This report evaluates an investment proposal for Genesis & Dreams Ltd, focusing on the application of investment appraisal techniques such as Net Present Value (NPV) and Payback Period (PBP). The report calculates and compares the NPV and PBP for two projects (A and B), concluding that Project B is the more financially viable option. It also discusses critical factors influencing investment decisions, including financial aspects like funding sources, profitability, and risk, as well as non-financial aspects such as employee skills, market prospects, and government regulations. The analysis emphasizes the importance of a comprehensive evaluation of all these elements for effective business decision-making and achieving long-term goals, ultimately recommending that Genesis & Dreams Ltd invest in Project B.

Business Decision

Making

Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION......................................................................................................................3

Application of investment appraisal techniques....................................................................3

Factors to be considered for undertaking decisions...............................................................5

CONCLUSION..........................................................................................................................6

REFERENCES...........................................................................................................................7

INTRODUCTION......................................................................................................................3

Application of investment appraisal techniques....................................................................3

Factors to be considered for undertaking decisions...............................................................5

CONCLUSION..........................................................................................................................6

REFERENCES...........................................................................................................................7

INTRODUCTION

Decision making is an important function of business management which states that

a business organization can only survive through the way of taking right decisions pertaining

to the business. At every step, an organization is required to take decisions which can be

monetary terms and in non-monetary. This essay provides an evaluation of the investment

proposal of the Genesis & Dreams Ltd and along with that the factors which are essential to

be taken into account for making decisions.

Application of investment appraisal techniques

For the purpose of determining the feasibility of the projects NPV and PBP method

is being applied in the given scenario.

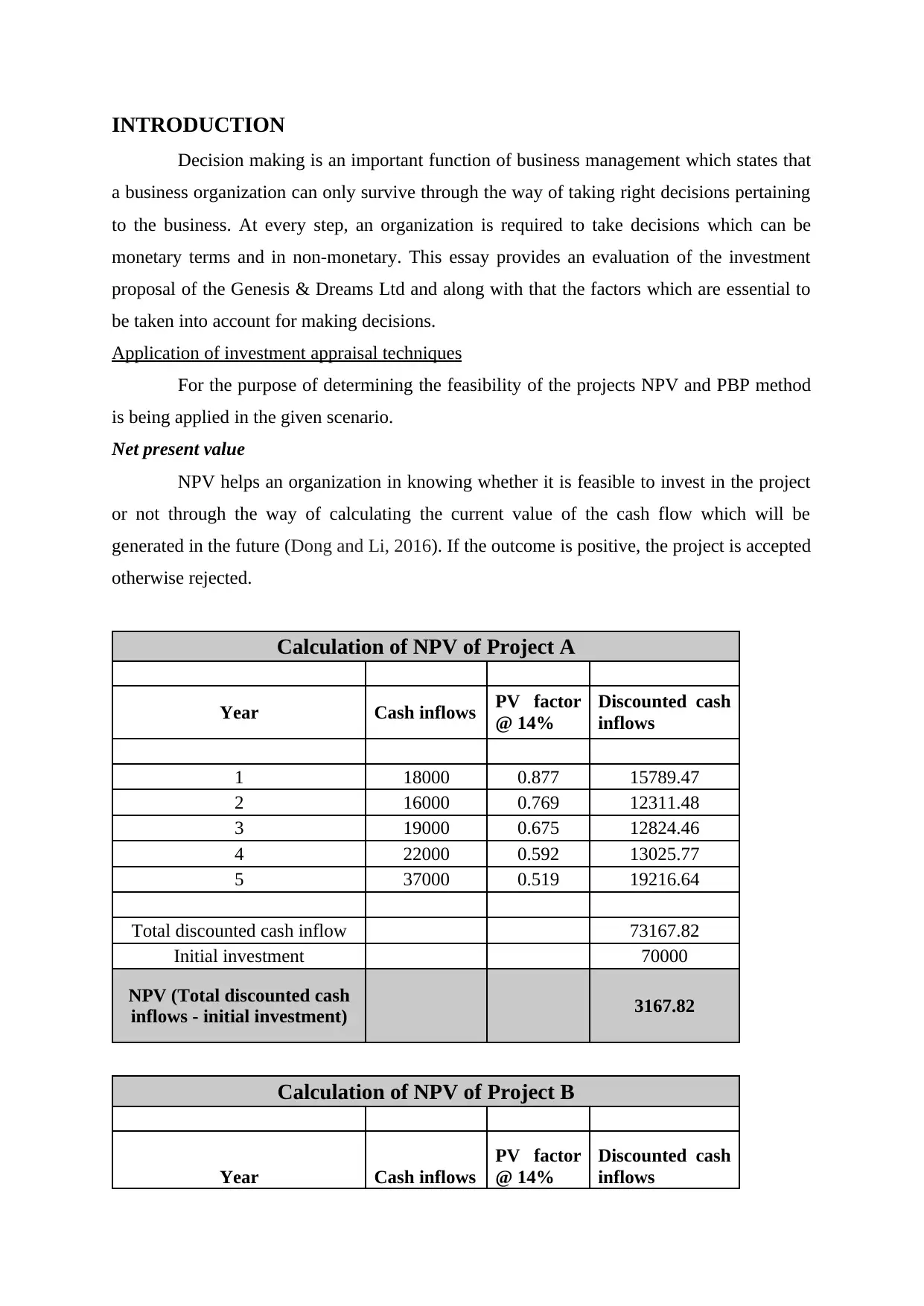

Net present value

NPV helps an organization in knowing whether it is feasible to invest in the project

or not through the way of calculating the current value of the cash flow which will be

generated in the future (Dong and Li, 2016). If the outcome is positive, the project is accepted

otherwise rejected.

Calculation of NPV of Project A

Year Cash inflows PV factor

@ 14%

Discounted cash

inflows

1 18000 0.877 15789.47

2 16000 0.769 12311.48

3 19000 0.675 12824.46

4 22000 0.592 13025.77

5 37000 0.519 19216.64

Total discounted cash inflow 73167.82

Initial investment 70000

NPV (Total discounted cash

inflows - initial investment) 3167.82

Calculation of NPV of Project B

Year Cash inflows

PV factor

@ 14%

Discounted cash

inflows

Decision making is an important function of business management which states that

a business organization can only survive through the way of taking right decisions pertaining

to the business. At every step, an organization is required to take decisions which can be

monetary terms and in non-monetary. This essay provides an evaluation of the investment

proposal of the Genesis & Dreams Ltd and along with that the factors which are essential to

be taken into account for making decisions.

Application of investment appraisal techniques

For the purpose of determining the feasibility of the projects NPV and PBP method

is being applied in the given scenario.

Net present value

NPV helps an organization in knowing whether it is feasible to invest in the project

or not through the way of calculating the current value of the cash flow which will be

generated in the future (Dong and Li, 2016). If the outcome is positive, the project is accepted

otherwise rejected.

Calculation of NPV of Project A

Year Cash inflows PV factor

@ 14%

Discounted cash

inflows

1 18000 0.877 15789.47

2 16000 0.769 12311.48

3 19000 0.675 12824.46

4 22000 0.592 13025.77

5 37000 0.519 19216.64

Total discounted cash inflow 73167.82

Initial investment 70000

NPV (Total discounted cash

inflows - initial investment) 3167.82

Calculation of NPV of Project B

Year Cash inflows

PV factor

@ 14%

Discounted cash

inflows

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 21000 0.877 18421.05

2 27000 0.769 20775.62

3 30000 0.675 20249.15

4 32000 0.592 18946.57

5 32000 0.519 16619.80

Total discounted cash inflow 95012.19

Initial investment 84000

NPV (Total discounted cash

inflows - initial investment) 11012.19

Interpretation: After comparing NPV of both the projects, it becomes very clear that the

company should go for Project B as it is having higher NPV as against Project A, even

though the outcome under the both the projects is positive and can be accepted (Hafenstein

and Bassen, 2016). But Genesis & Dreams Ltd an invest only in one project thus, Project B is

the right choice.

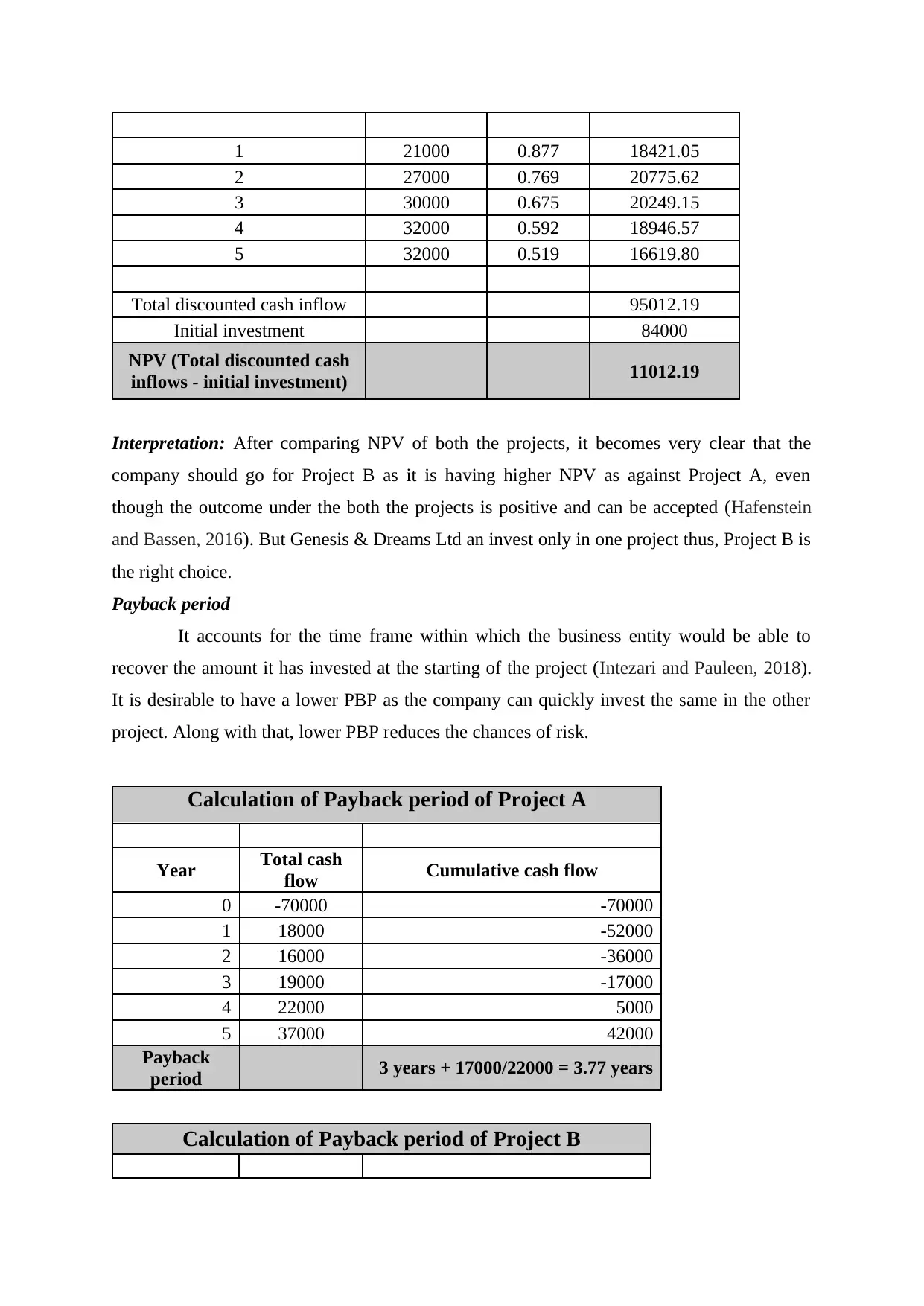

Payback period

It accounts for the time frame within which the business entity would be able to

recover the amount it has invested at the starting of the project (Intezari and Pauleen, 2018).

It is desirable to have a lower PBP as the company can quickly invest the same in the other

project. Along with that, lower PBP reduces the chances of risk.

Calculation of Payback period of Project A

Year Total cash

flow Cumulative cash flow

0 -70000 -70000

1 18000 -52000

2 16000 -36000

3 19000 -17000

4 22000 5000

5 37000 42000

Payback

period 3 years + 17000/22000 = 3.77 years

Calculation of Payback period of Project B

2 27000 0.769 20775.62

3 30000 0.675 20249.15

4 32000 0.592 18946.57

5 32000 0.519 16619.80

Total discounted cash inflow 95012.19

Initial investment 84000

NPV (Total discounted cash

inflows - initial investment) 11012.19

Interpretation: After comparing NPV of both the projects, it becomes very clear that the

company should go for Project B as it is having higher NPV as against Project A, even

though the outcome under the both the projects is positive and can be accepted (Hafenstein

and Bassen, 2016). But Genesis & Dreams Ltd an invest only in one project thus, Project B is

the right choice.

Payback period

It accounts for the time frame within which the business entity would be able to

recover the amount it has invested at the starting of the project (Intezari and Pauleen, 2018).

It is desirable to have a lower PBP as the company can quickly invest the same in the other

project. Along with that, lower PBP reduces the chances of risk.

Calculation of Payback period of Project A

Year Total cash

flow Cumulative cash flow

0 -70000 -70000

1 18000 -52000

2 16000 -36000

3 19000 -17000

4 22000 5000

5 37000 42000

Payback

period 3 years + 17000/22000 = 3.77 years

Calculation of Payback period of Project B

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

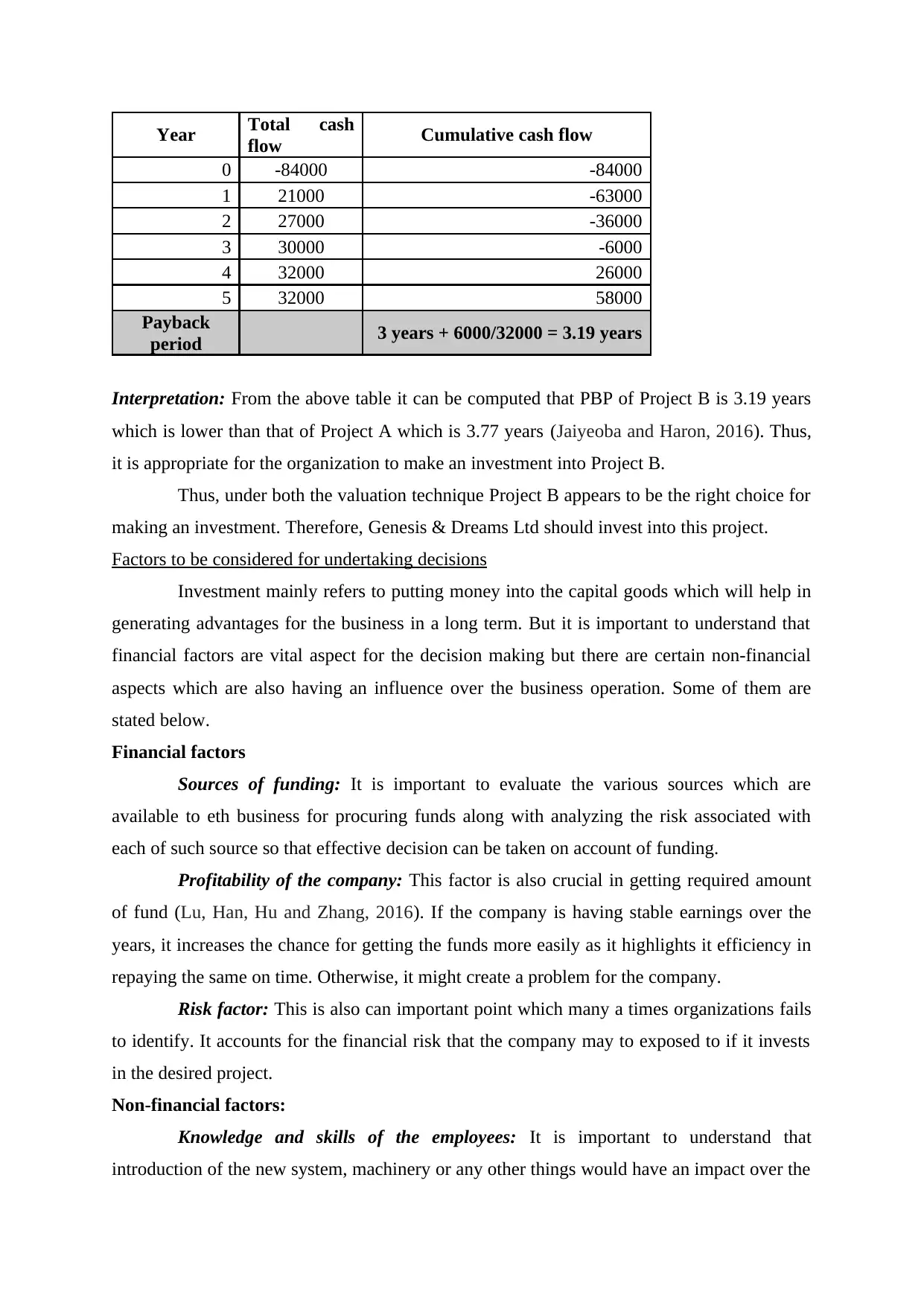

Year Total cash

flow Cumulative cash flow

0 -84000 -84000

1 21000 -63000

2 27000 -36000

3 30000 -6000

4 32000 26000

5 32000 58000

Payback

period 3 years + 6000/32000 = 3.19 years

Interpretation: From the above table it can be computed that PBP of Project B is 3.19 years

which is lower than that of Project A which is 3.77 years (Jaiyeoba and Haron, 2016). Thus,

it is appropriate for the organization to make an investment into Project B.

Thus, under both the valuation technique Project B appears to be the right choice for

making an investment. Therefore, Genesis & Dreams Ltd should invest into this project.

Factors to be considered for undertaking decisions

Investment mainly refers to putting money into the capital goods which will help in

generating advantages for the business in a long term. But it is important to understand that

financial factors are vital aspect for the decision making but there are certain non-financial

aspects which are also having an influence over the business operation. Some of them are

stated below.

Financial factors

Sources of funding: It is important to evaluate the various sources which are

available to eth business for procuring funds along with analyzing the risk associated with

each of such source so that effective decision can be taken on account of funding.

Profitability of the company: This factor is also crucial in getting required amount

of fund (Lu, Han, Hu and Zhang, 2016). If the company is having stable earnings over the

years, it increases the chance for getting the funds more easily as it highlights it efficiency in

repaying the same on time. Otherwise, it might create a problem for the company.

Risk factor: This is also can important point which many a times organizations fails

to identify. It accounts for the financial risk that the company may to exposed to if it invests

in the desired project.

Non-financial factors:

Knowledge and skills of the employees: It is important to understand that

introduction of the new system, machinery or any other things would have an impact over the

flow Cumulative cash flow

0 -84000 -84000

1 21000 -63000

2 27000 -36000

3 30000 -6000

4 32000 26000

5 32000 58000

Payback

period 3 years + 6000/32000 = 3.19 years

Interpretation: From the above table it can be computed that PBP of Project B is 3.19 years

which is lower than that of Project A which is 3.77 years (Jaiyeoba and Haron, 2016). Thus,

it is appropriate for the organization to make an investment into Project B.

Thus, under both the valuation technique Project B appears to be the right choice for

making an investment. Therefore, Genesis & Dreams Ltd should invest into this project.

Factors to be considered for undertaking decisions

Investment mainly refers to putting money into the capital goods which will help in

generating advantages for the business in a long term. But it is important to understand that

financial factors are vital aspect for the decision making but there are certain non-financial

aspects which are also having an influence over the business operation. Some of them are

stated below.

Financial factors

Sources of funding: It is important to evaluate the various sources which are

available to eth business for procuring funds along with analyzing the risk associated with

each of such source so that effective decision can be taken on account of funding.

Profitability of the company: This factor is also crucial in getting required amount

of fund (Lu, Han, Hu and Zhang, 2016). If the company is having stable earnings over the

years, it increases the chance for getting the funds more easily as it highlights it efficiency in

repaying the same on time. Otherwise, it might create a problem for the company.

Risk factor: This is also can important point which many a times organizations fails

to identify. It accounts for the financial risk that the company may to exposed to if it invests

in the desired project.

Non-financial factors:

Knowledge and skills of the employees: It is important to understand that

introduction of the new system, machinery or any other things would have an impact over the

employees (Maxwell, 2016). The company needs to understand whether the current employee

group is having the relevant skill set for dealing with the same. Along with that whether it

will affect the morale and motivational level of the employees.

Market prospects: Another non-financial factor is the future market position. It is

crucial to analyze whether there is any possibility that in future there will be not growth in the

respected market in which the company is willing to invest (Verma, 2016). Thus,

organization is needed to conduct extensive market research in order to ensure whether the

market is growth oriented or not.

Government legislations: Along with that, it requires to comply with various

government regulatory standards and the legislation in order to run the business operations

smoothly. Otherwise, it may negatively impact the reputation of the organization. Thus, these

factors are very important for taking business decisions and attaining long term goals.

CONCLUSION

It can be concluded that it is very crucial for every business organization to

effectively evaluate each and every aspect before undertaking a decision pertaining to making

an investment. The organization requires to consider various elements such as cost, risk,

profitability, competency of the workforce and so forth in order to gain much benefit from the

investment undertaken. Based on the given situation, it is economically feasible for Genesis

& Dreams Ltd to invest its funds in Project B instead of Project A.

group is having the relevant skill set for dealing with the same. Along with that whether it

will affect the morale and motivational level of the employees.

Market prospects: Another non-financial factor is the future market position. It is

crucial to analyze whether there is any possibility that in future there will be not growth in the

respected market in which the company is willing to invest (Verma, 2016). Thus,

organization is needed to conduct extensive market research in order to ensure whether the

market is growth oriented or not.

Government legislations: Along with that, it requires to comply with various

government regulatory standards and the legislation in order to run the business operations

smoothly. Otherwise, it may negatively impact the reputation of the organization. Thus, these

factors are very important for taking business decisions and attaining long term goals.

CONCLUSION

It can be concluded that it is very crucial for every business organization to

effectively evaluate each and every aspect before undertaking a decision pertaining to making

an investment. The organization requires to consider various elements such as cost, risk,

profitability, competency of the workforce and so forth in order to gain much benefit from the

investment undertaken. Based on the given situation, it is economically feasible for Genesis

& Dreams Ltd to invest its funds in Project B instead of Project A.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Dong, M. G. and Li, S. Y., 2016. Project investment decision making with fuzzy information:

A literature review of methodologies based on taxonomy. Journal of Intelligent &

Fuzzy Systems. 30(6). pp.3239-3252.

Hafenstein, A. and Bassen, A., 2016. Influences for using sustainability information in the

investment decision-making of non-professional investors. Journal of Sustainable

Finance & Investment. 6(3). pp.186-210.

Intezari, A. and Pauleen, D. J., 2018. Conceptualizing Wise Management Decision‐Making:

A Grounded Theory Approach. Decision Sciences. 49(2). pp.335-400.

Jaiyeoba, H. B. and Haron, R., 2016. A qualitative inquiry into the investment decision

behaviour of the Malaysian stock market investors. Qualitative Research in

Financial Markets.

Lu, J., Han, J., Hu, Y. and Zhang, G., 2016. Multilevel decision-making: A

survey. Information Sciences. 346. pp.463-487.

Maxwell, A., 2016. Investment decision-making by business angels. In Handbook of

Research on Business Angels. Edward Elgar Publishing.

Verma, N., 2016. Impact of Behavioral Biases in Investment Decision and

Strategies. Journal of Management Research and Analysis. 3(1). pp.28-30.

Books and Journals

Dong, M. G. and Li, S. Y., 2016. Project investment decision making with fuzzy information:

A literature review of methodologies based on taxonomy. Journal of Intelligent &

Fuzzy Systems. 30(6). pp.3239-3252.

Hafenstein, A. and Bassen, A., 2016. Influences for using sustainability information in the

investment decision-making of non-professional investors. Journal of Sustainable

Finance & Investment. 6(3). pp.186-210.

Intezari, A. and Pauleen, D. J., 2018. Conceptualizing Wise Management Decision‐Making:

A Grounded Theory Approach. Decision Sciences. 49(2). pp.335-400.

Jaiyeoba, H. B. and Haron, R., 2016. A qualitative inquiry into the investment decision

behaviour of the Malaysian stock market investors. Qualitative Research in

Financial Markets.

Lu, J., Han, J., Hu, Y. and Zhang, G., 2016. Multilevel decision-making: A

survey. Information Sciences. 346. pp.463-487.

Maxwell, A., 2016. Investment decision-making by business angels. In Handbook of

Research on Business Angels. Edward Elgar Publishing.

Verma, N., 2016. Impact of Behavioral Biases in Investment Decision and

Strategies. Journal of Management Research and Analysis. 3(1). pp.28-30.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.