Business Decision Making Report: Crossrail Project Analysis

VerifiedAdded on 2019/12/03

|22

|4109

|164

Report

AI Summary

This report delves into the core principles of business decision-making, evaluating various scenarios and providing recommendations for optimal outcomes. It incorporates a range of statistical tools and techniques to analyze data, including mean, mode, median, range, standard deviation, and percentiles, with graphical representations like line graphs, pie charts, bar graphs, and scatter plots to visualize data effectively. The report also examines project management methodologies, such as network diagrams, Gantt charts, and critical path analysis, along with investment appraisal techniques like Net Present Value (NPV) and Internal Rate of Return (IRR). The case study focuses on the UK government's Crossrail project, assessing its benefits to the local community, financial aspects, and project duration. The report provides detailed analysis and recommendations to aid in informed business decisions.

BUSINESS DECISION

MAKING

MAKING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION................................................................................................................................

TASK 1.................................................................................................................................................

Background..................................................................................................................................3

Rationale......................................................................................................................................3

Objectives of the research............................................................................................................3

Methodology................................................................................................................................4

Data Analysis...............................................................................................................................4

Time Frame..................................................................................................................................4

Budget section.............................................................................................................................5

Questionnaire...............................................................................................................................5

TASK 2.................................................................................................................................................

2.1 & 2.2 Mean, Mode and Median.............................................................................................7

2.3 Range and Standard Deviation..............................................................................................8

2.4 25th Percentile (Lower 25th Percentile (Lower Quartile) and 75th Percentile (Upper

Quartile) and use of Percentile....................................................................................................9

TASK 3...............................................................................................................................................

3.1 & 4.1 Produce line graph.....................................................................................................11

Scatter Plot on Advertising costs and sales...............................................................................13

3.2 & 4.1 Trend Lines................................................................................................................14

3.4 Formal Business Report.......................................................................................................14

TASK 4...............................................................................................................................................

4.2 Prepare a network diagram for activities using Microsoft Project......................................16

Calculate Project Duration.........................................................................................................16

Clearly mark the Critical Path...................................................................................................16

Prepare a Gantt chart and state the benefits of using it as a Project Management Tool............17

TASK 4 B...........................................................................................................................................

4.3 Calculation of Net present value and Internal rate of return...............................................17

Recommendations......................................................................................................................20

CONCLUSION..................................................................................................................................

REFERENCES...................................................................................................................................

INTRODUCTION................................................................................................................................

TASK 1.................................................................................................................................................

Background..................................................................................................................................3

Rationale......................................................................................................................................3

Objectives of the research............................................................................................................3

Methodology................................................................................................................................4

Data Analysis...............................................................................................................................4

Time Frame..................................................................................................................................4

Budget section.............................................................................................................................5

Questionnaire...............................................................................................................................5

TASK 2.................................................................................................................................................

2.1 & 2.2 Mean, Mode and Median.............................................................................................7

2.3 Range and Standard Deviation..............................................................................................8

2.4 25th Percentile (Lower 25th Percentile (Lower Quartile) and 75th Percentile (Upper

Quartile) and use of Percentile....................................................................................................9

TASK 3...............................................................................................................................................

3.1 & 4.1 Produce line graph.....................................................................................................11

Scatter Plot on Advertising costs and sales...............................................................................13

3.2 & 4.1 Trend Lines................................................................................................................14

3.4 Formal Business Report.......................................................................................................14

TASK 4...............................................................................................................................................

4.2 Prepare a network diagram for activities using Microsoft Project......................................16

Calculate Project Duration.........................................................................................................16

Clearly mark the Critical Path...................................................................................................16

Prepare a Gantt chart and state the benefits of using it as a Project Management Tool............17

TASK 4 B...........................................................................................................................................

4.3 Calculation of Net present value and Internal rate of return...............................................17

Recommendations......................................................................................................................20

CONCLUSION..................................................................................................................................

REFERENCES...................................................................................................................................

INTRODUCTION

In the current business environment, decision making play crucial role in establishing the

operations of business as well as ensuring long term sustainability. In general, business decision

making refers to the process of selecting best among the alternatives (Hedgebeth, 2007). In the

present report, researcher focuses on evaluating different scenarios and accordingly makes

decisions for the suitable results and outcomes. Further, it includes range of statistical tools and

techniques by the means of which different requirement will be satisfied. Along with this,

graphical presentation has been indulged to present the collected data in effective and efficient

manner. Lastly, with the help of investment appraisal techniques decision will be made regarding

selection of suitable and reliable investment proposals.

TASK 1

Background

According to the given case study, Government of UK is planning to start a Crossrail

Project with the aim of enhancing the local transport within London. The main purpose of this

project is provide travelling facilities to 1.5 million people so that it can generate key

employment, leisure and other business activities. Furthermore, it will enhance the journey times

across London to easing congestion and offering better and affordable connections (Badenhorst-

Weiss and et.al, 2008). Along with this, through the help of this project, Government of UK will

change the way of people travel around the capital.

Rationale

The main purpose of conducting this project is to enhance the level of travelling for the

local people and the visitors. Along with this, to minimize the road traffic so that level of

pollution can be managed and controlled. Furthermore, researcher focuses on evaluating the

benefits of Crossrail project for the local community. Therefore, researcher through the help of

this study will investigate different aspects about the project and provide detailed information to

the government officials.

Objectives of the research

The main objective of this study is to determine the benefits of Cross Rail project for the

local community of London. Along with this, to estimate budget and time frame for carrying out

the whole project. The three main objective of research are as follows.

To identify the benefits that this project will give to general public.

3

In the current business environment, decision making play crucial role in establishing the

operations of business as well as ensuring long term sustainability. In general, business decision

making refers to the process of selecting best among the alternatives (Hedgebeth, 2007). In the

present report, researcher focuses on evaluating different scenarios and accordingly makes

decisions for the suitable results and outcomes. Further, it includes range of statistical tools and

techniques by the means of which different requirement will be satisfied. Along with this,

graphical presentation has been indulged to present the collected data in effective and efficient

manner. Lastly, with the help of investment appraisal techniques decision will be made regarding

selection of suitable and reliable investment proposals.

TASK 1

Background

According to the given case study, Government of UK is planning to start a Crossrail

Project with the aim of enhancing the local transport within London. The main purpose of this

project is provide travelling facilities to 1.5 million people so that it can generate key

employment, leisure and other business activities. Furthermore, it will enhance the journey times

across London to easing congestion and offering better and affordable connections (Badenhorst-

Weiss and et.al, 2008). Along with this, through the help of this project, Government of UK will

change the way of people travel around the capital.

Rationale

The main purpose of conducting this project is to enhance the level of travelling for the

local people and the visitors. Along with this, to minimize the road traffic so that level of

pollution can be managed and controlled. Furthermore, researcher focuses on evaluating the

benefits of Crossrail project for the local community. Therefore, researcher through the help of

this study will investigate different aspects about the project and provide detailed information to

the government officials.

Objectives of the research

The main objective of this study is to determine the benefits of Cross Rail project for the

local community of London. Along with this, to estimate budget and time frame for carrying out

the whole project. The three main objective of research are as follows.

To identify the benefits that this project will give to general public.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

To identify whether this project will contribute to growth of economy of London.

To identify that this whether this project will help in controlling congestion on railway

station.

Methodology

According to the present given scenario, researcher is focusing on using both primary and

secondary information to collect data regarding Crossrail project and accordingly build

understanding regarding benefits of the project to local community. Furthermore purposive

sampling technique has been selected because managers associated with the Crossrail project are

required to generate wide range of information. Sample size of will be 30 senior managers.

Firstly, through the means of qualitative techniques researcher will be able to enhance the

understanding regarding the perception of local people towards the project (Day, 2005). Along

with this, using quantitative techniques will assist in collecting numerical data for the benefits to

the people. In primary section, people of London will be provided questionnaire and accordingly

reliable and valuable information will be collected.

Data Analysis

In the present study, investigator will use thematic as well as statistical approaches to

analyse the collected information. However, thematic analysis will assist in evaluating the

subjective or qualitative information generated through the means of different sources (4

Decision Making Methods, 2011). On the other hand, statistical approach will assist in

interpreting the numerical information so that benefits of Crossrail projects for local community

of London can be identified effectively.

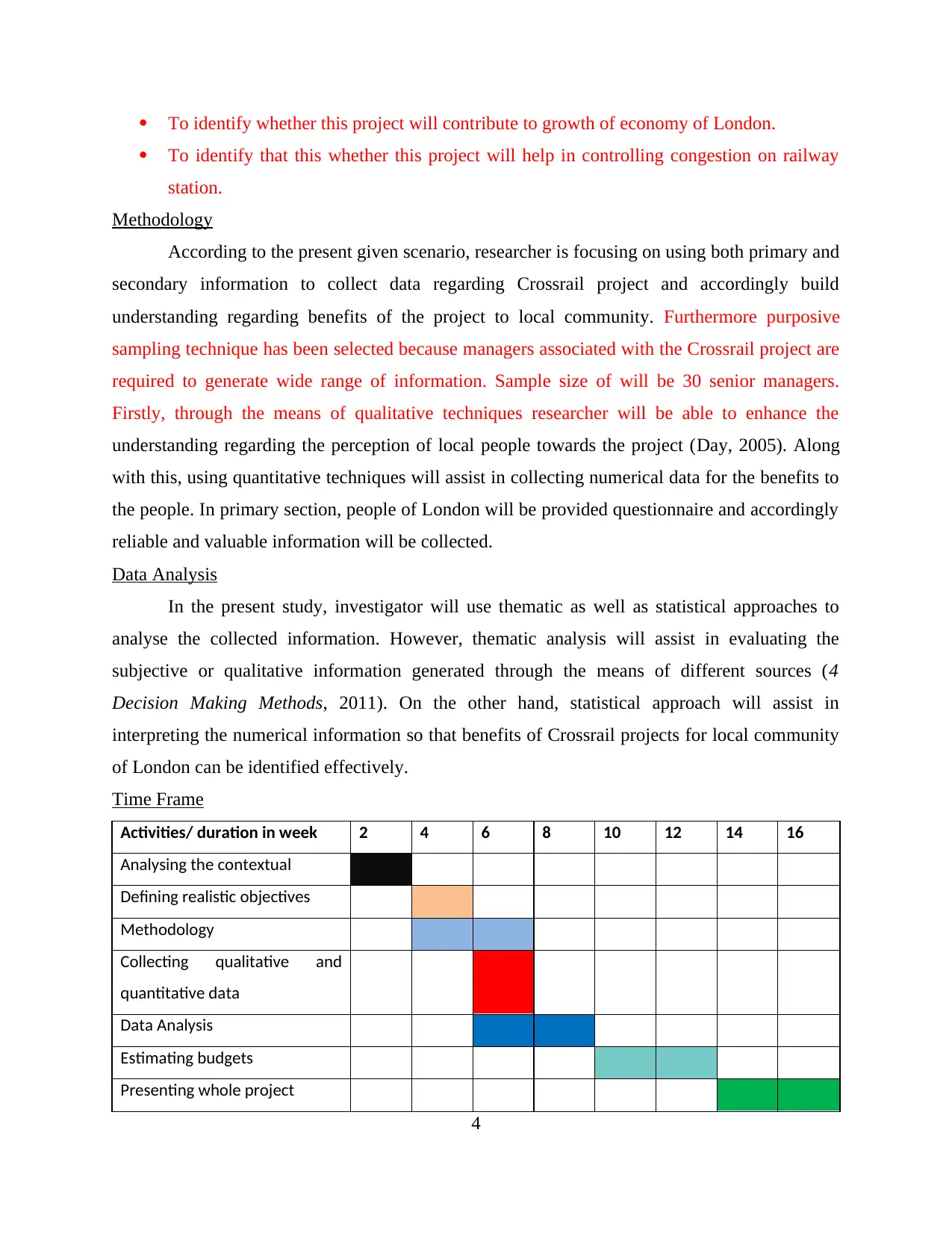

Time Frame

Activities/ duration in week 2 4 6 8 10 12 14 16

Analysing the contextual

Defining realistic objectives

Methodology

Collecting qualitative and

quantitative data

Data Analysis

Estimating budgets

Presenting whole project

4

To identify that this whether this project will help in controlling congestion on railway

station.

Methodology

According to the present given scenario, researcher is focusing on using both primary and

secondary information to collect data regarding Crossrail project and accordingly build

understanding regarding benefits of the project to local community. Furthermore purposive

sampling technique has been selected because managers associated with the Crossrail project are

required to generate wide range of information. Sample size of will be 30 senior managers.

Firstly, through the means of qualitative techniques researcher will be able to enhance the

understanding regarding the perception of local people towards the project (Day, 2005). Along

with this, using quantitative techniques will assist in collecting numerical data for the benefits to

the people. In primary section, people of London will be provided questionnaire and accordingly

reliable and valuable information will be collected.

Data Analysis

In the present study, investigator will use thematic as well as statistical approaches to

analyse the collected information. However, thematic analysis will assist in evaluating the

subjective or qualitative information generated through the means of different sources (4

Decision Making Methods, 2011). On the other hand, statistical approach will assist in

interpreting the numerical information so that benefits of Crossrail projects for local community

of London can be identified effectively.

Time Frame

Activities/ duration in week 2 4 6 8 10 12 14 16

Analysing the contextual

Defining realistic objectives

Methodology

Collecting qualitative and

quantitative data

Data Analysis

Estimating budgets

Presenting whole project

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

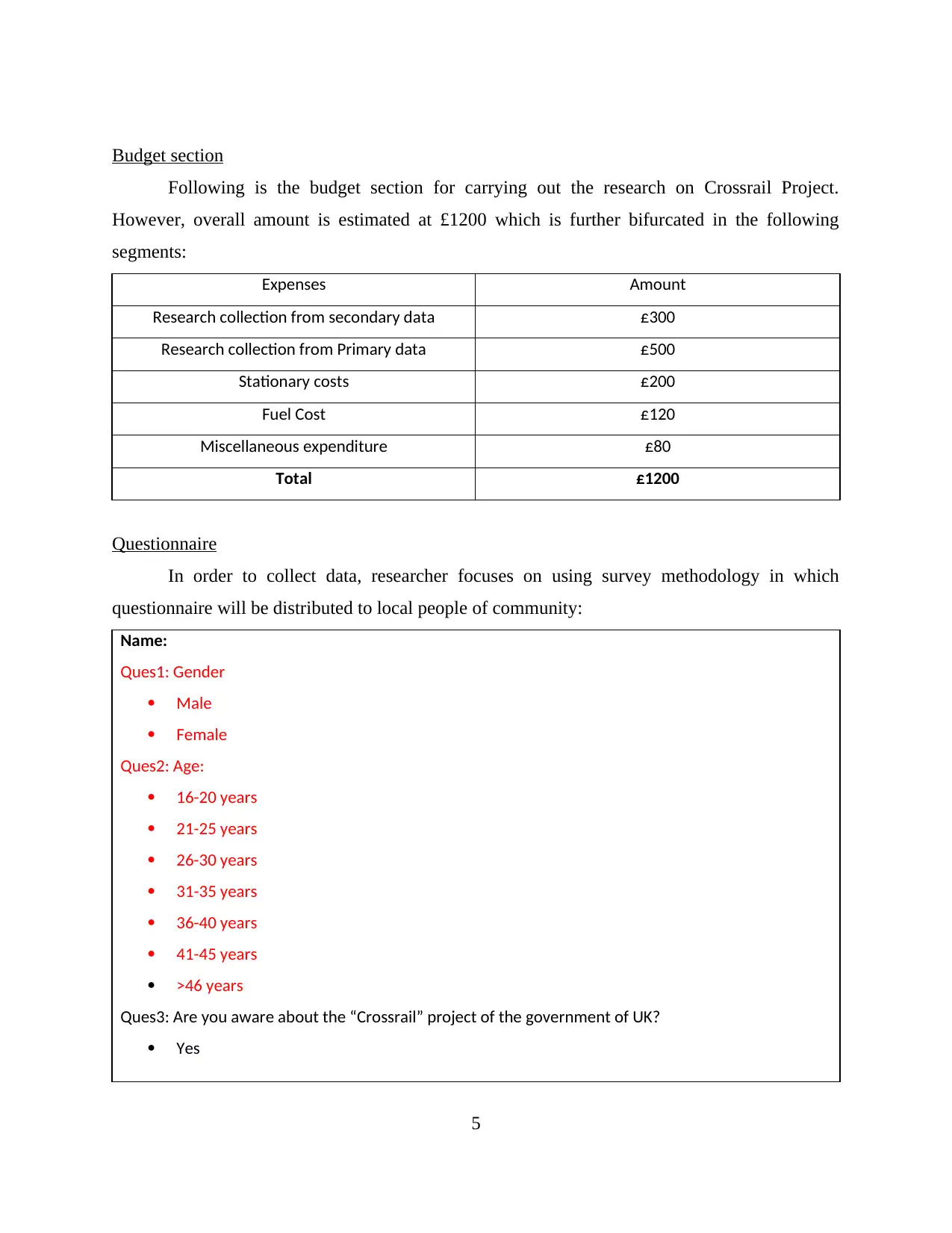

Budget section

Following is the budget section for carrying out the research on Crossrail Project.

However, overall amount is estimated at £1200 which is further bifurcated in the following

segments:

Expenses Amount

Research collection from secondary data £300

Research collection from Primary data £500

Stationary costs £200

Fuel Cost £120

Miscellaneous expenditure £80

Total £1200

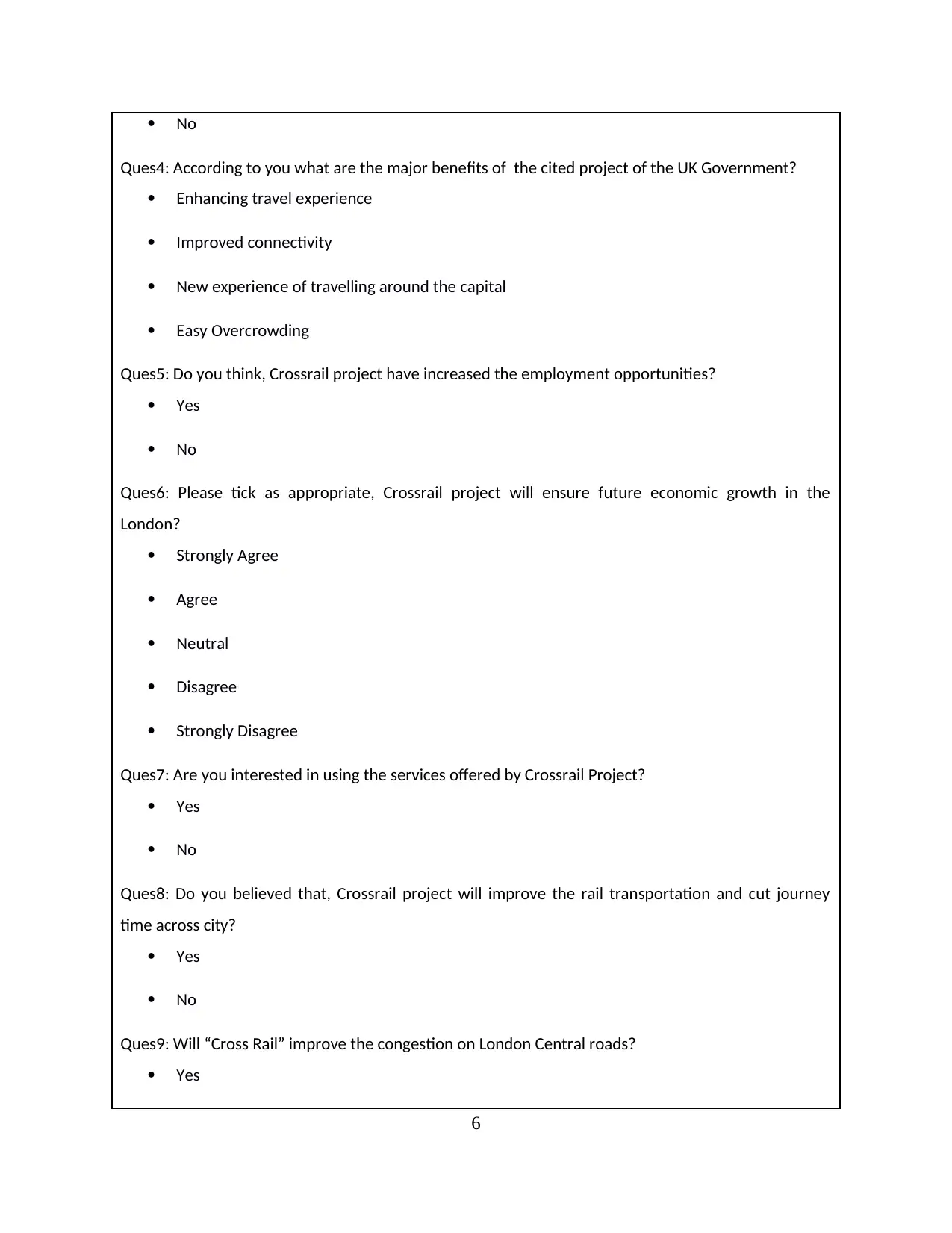

Questionnaire

In order to collect data, researcher focuses on using survey methodology in which

questionnaire will be distributed to local people of community:

Name:

Ques1: Gender

Male

Female

Ques2: Age:

16-20 years

21-25 years

26-30 years

31-35 years

36-40 years

41-45 years

>46 years

Ques3: Are you aware about the “Crossrail” project of the government of UK?

Yes

5

Following is the budget section for carrying out the research on Crossrail Project.

However, overall amount is estimated at £1200 which is further bifurcated in the following

segments:

Expenses Amount

Research collection from secondary data £300

Research collection from Primary data £500

Stationary costs £200

Fuel Cost £120

Miscellaneous expenditure £80

Total £1200

Questionnaire

In order to collect data, researcher focuses on using survey methodology in which

questionnaire will be distributed to local people of community:

Name:

Ques1: Gender

Male

Female

Ques2: Age:

16-20 years

21-25 years

26-30 years

31-35 years

36-40 years

41-45 years

>46 years

Ques3: Are you aware about the “Crossrail” project of the government of UK?

Yes

5

No

Ques4: According to you what are the major benefits of the cited project of the UK Government?

Enhancing travel experience

Improved connectivity

New experience of travelling around the capital

Easy Overcrowding

Ques5: Do you think, Crossrail project have increased the employment opportunities?

Yes

No

Ques6: Please tick as appropriate, Crossrail project will ensure future economic growth in the

London?

Strongly Agree

Agree

Neutral

Disagree

Strongly Disagree

Ques7: Are you interested in using the services offered by Crossrail Project?

Yes

No

Ques8: Do you believed that, Crossrail project will improve the rail transportation and cut journey

time across city?

Yes

No

Ques9: Will “Cross Rail” improve the congestion on London Central roads?

Yes

6

Ques4: According to you what are the major benefits of the cited project of the UK Government?

Enhancing travel experience

Improved connectivity

New experience of travelling around the capital

Easy Overcrowding

Ques5: Do you think, Crossrail project have increased the employment opportunities?

Yes

No

Ques6: Please tick as appropriate, Crossrail project will ensure future economic growth in the

London?

Strongly Agree

Agree

Neutral

Disagree

Strongly Disagree

Ques7: Are you interested in using the services offered by Crossrail Project?

Yes

No

Ques8: Do you believed that, Crossrail project will improve the rail transportation and cut journey

time across city?

Yes

No

Ques9: Will “Cross Rail” improve the congestion on London Central roads?

Yes

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

No

Maybe

TASK 2

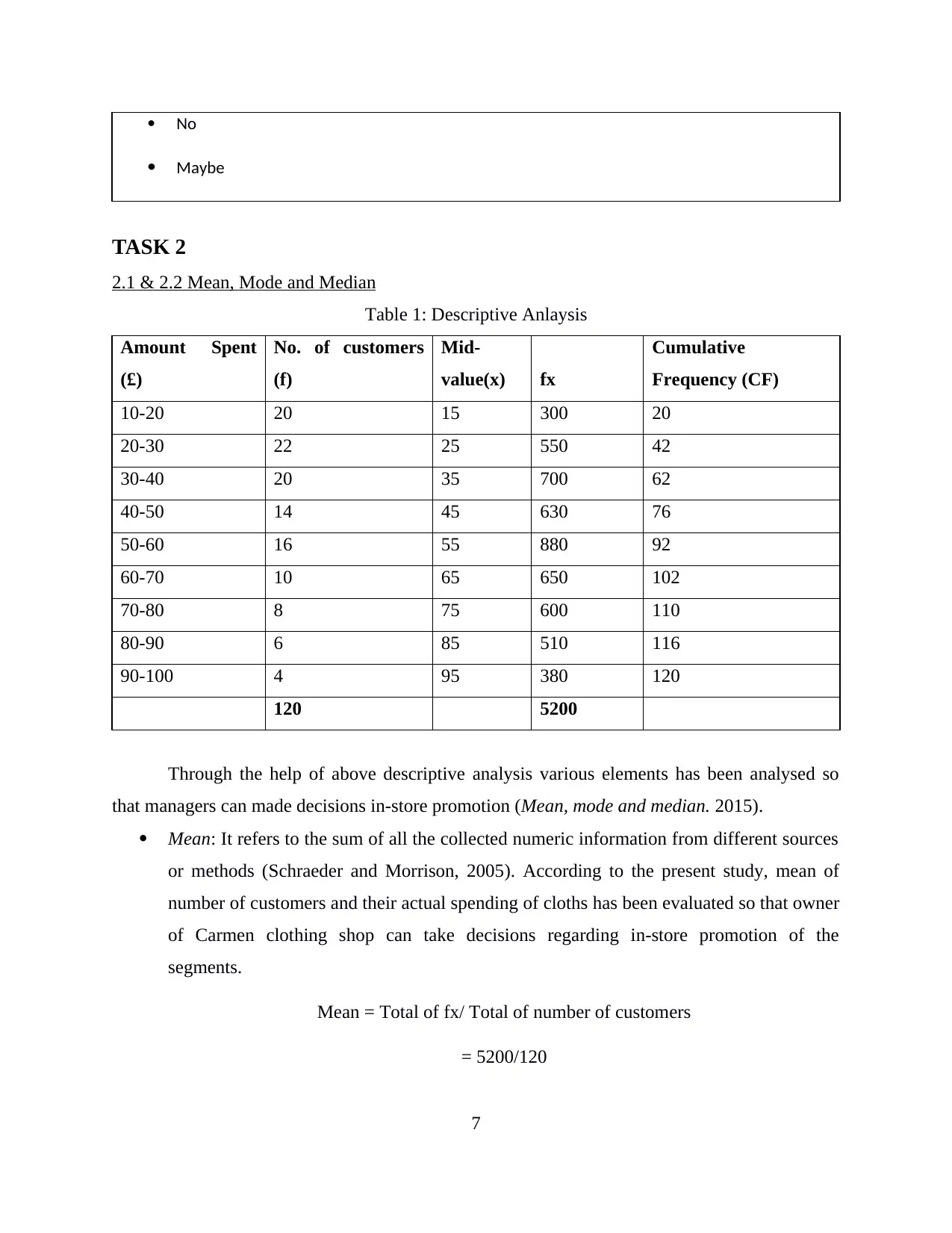

2.1 & 2.2 Mean, Mode and Median

Table 1: Descriptive Anlaysis

Amount Spent

(£)

No. of customers

(f)

Mid-

value(x) fx

Cumulative

Frequency (CF)

10-20 20 15 300 20

20-30 22 25 550 42

30-40 20 35 700 62

40-50 14 45 630 76

50-60 16 55 880 92

60-70 10 65 650 102

70-80 8 75 600 110

80-90 6 85 510 116

90-100 4 95 380 120

120 5200

Through the help of above descriptive analysis various elements has been analysed so

that managers can made decisions in-store promotion (Mean, mode and median. 2015).

Mean: It refers to the sum of all the collected numeric information from different sources

or methods (Schraeder and Morrison, 2005). According to the present study, mean of

number of customers and their actual spending of cloths has been evaluated so that owner

of Carmen clothing shop can take decisions regarding in-store promotion of the

segments.

Mean = Total of fx/ Total of number of customers

= 5200/120

7

Maybe

TASK 2

2.1 & 2.2 Mean, Mode and Median

Table 1: Descriptive Anlaysis

Amount Spent

(£)

No. of customers

(f)

Mid-

value(x) fx

Cumulative

Frequency (CF)

10-20 20 15 300 20

20-30 22 25 550 42

30-40 20 35 700 62

40-50 14 45 630 76

50-60 16 55 880 92

60-70 10 65 650 102

70-80 8 75 600 110

80-90 6 85 510 116

90-100 4 95 380 120

120 5200

Through the help of above descriptive analysis various elements has been analysed so

that managers can made decisions in-store promotion (Mean, mode and median. 2015).

Mean: It refers to the sum of all the collected numeric information from different sources

or methods (Schraeder and Morrison, 2005). According to the present study, mean of

number of customers and their actual spending of cloths has been evaluated so that owner

of Carmen clothing shop can take decisions regarding in-store promotion of the

segments.

Mean = Total of fx/ Total of number of customers

= 5200/120

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Mode: It is the number which frequently appears within the collected information for the

present study (Aripin, Tower and Taylor, 2011). The amount spend by customers of £20-

£30 has the highest frequency of 22 customers. Hence, mode for the present study is as

follows:

Mode = Lmo + (Δ1/ Δ1 + Δ2) * i

= 20 + (22-20) / (22-20) + (22-20)* 10

= 25

Median: In statistical term, it is the middle value of the collected information. Thus,

median for present study is:

Median = lower limit + (60- CF of previous class interval)/Frequency * class interval

= 30 + (60-42)/20*10

= 30+18/20 *10

= 30+9

= 39

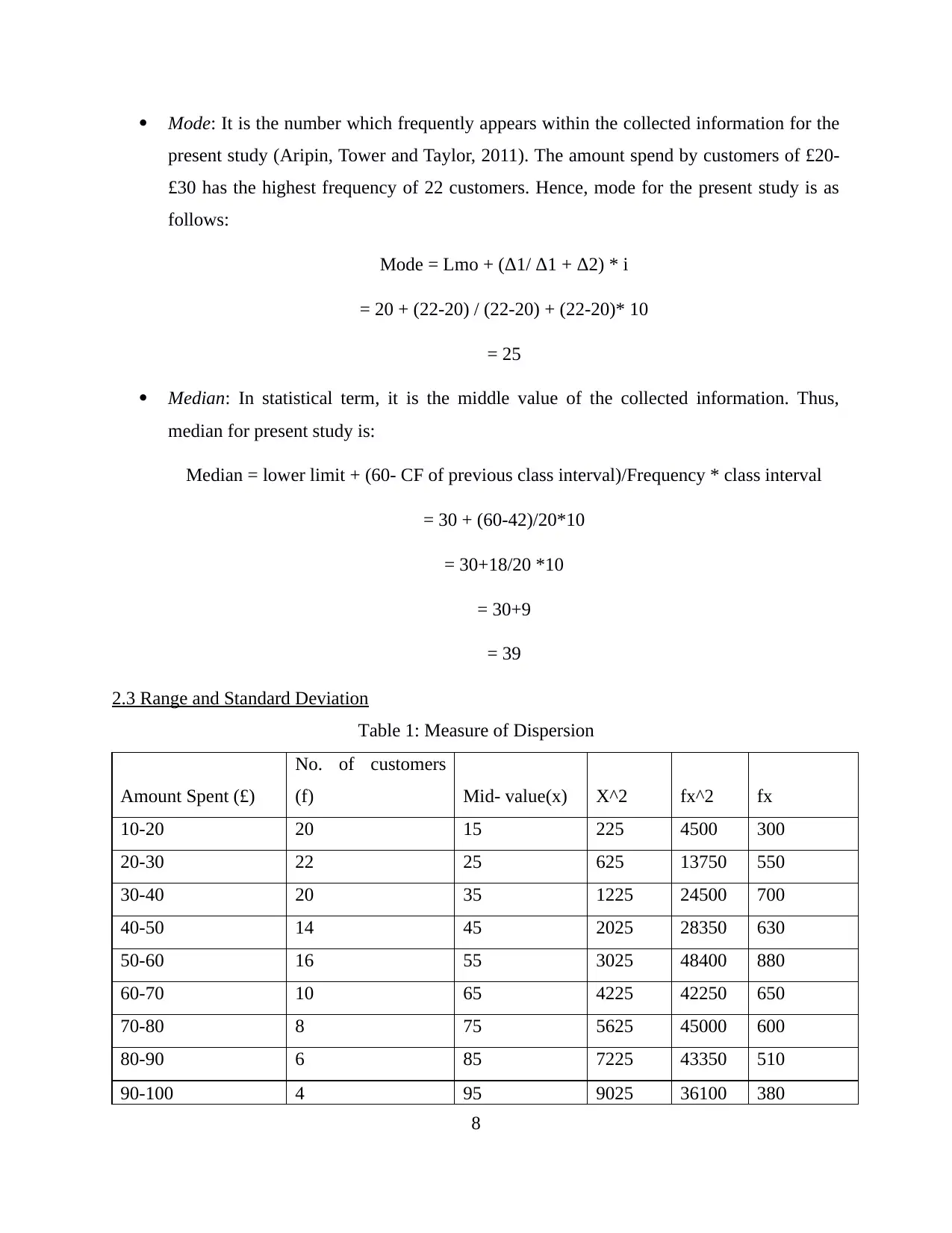

2.3 Range and Standard Deviation

Table 1: Measure of Dispersion

Amount Spent (£)

No. of customers

(f) Mid- value(x) X^2 fx^2 fx

10-20 20 15 225 4500 300

20-30 22 25 625 13750 550

30-40 20 35 1225 24500 700

40-50 14 45 2025 28350 630

50-60 16 55 3025 48400 880

60-70 10 65 4225 42250 650

70-80 8 75 5625 45000 600

80-90 6 85 7225 43350 510

90-100 4 95 9025 36100 380

8

present study (Aripin, Tower and Taylor, 2011). The amount spend by customers of £20-

£30 has the highest frequency of 22 customers. Hence, mode for the present study is as

follows:

Mode = Lmo + (Δ1/ Δ1 + Δ2) * i

= 20 + (22-20) / (22-20) + (22-20)* 10

= 25

Median: In statistical term, it is the middle value of the collected information. Thus,

median for present study is:

Median = lower limit + (60- CF of previous class interval)/Frequency * class interval

= 30 + (60-42)/20*10

= 30+18/20 *10

= 30+9

= 39

2.3 Range and Standard Deviation

Table 1: Measure of Dispersion

Amount Spent (£)

No. of customers

(f) Mid- value(x) X^2 fx^2 fx

10-20 20 15 225 4500 300

20-30 22 25 625 13750 550

30-40 20 35 1225 24500 700

40-50 14 45 2025 28350 630

50-60 16 55 3025 48400 880

60-70 10 65 4225 42250 650

70-80 8 75 5625 45000 600

80-90 6 85 7225 43350 510

90-100 4 95 9025 36100 380

8

120 495 33225 286200 5200

Measure of dispersion refers to the process by the means of which investigator evaluate

how wide spread the set of given data is in the defined variables. There are three major elements

of measure of dispersion such as: Standard deviation, Range and variance. Following are the

computation of these elements:

Standard Deviation: With help of standard deviation, researcher can easily identify the

variation between given set of information (Byrne, McAllister and Wyatt, 2011). In the

present study, standard deviation assist owner of Carmen clothing shop to whether stick

below 40 price range or increase it above 40.

Variance = s2 = ∑Fx2 – ((∑Fx)2 /n)/ n – 1

Variance = 511.48

Standard Deviation = S= √s2

Standard Deviation = 22.61

Range: Range helps in computing the different between highest value and lowest value in

the collected information or data (Sucky, Aksoy and Ozturk, 2012).

Range = (100-(10/ (20+1))-(10/ (4+1)))

Range = 97.52

2.4 25th Percentile (Lower 25th Percentile (Lower Quartile) and 75th Percentile (Upper Quartile)

and use of Percentile

Quartile:

In general, quartile refers to the statistical approach of dividing set of numbers into four

different quarters. All the quarters are denoted with: Q1, Q2, Q3, and Q4. In this, first quartile

(Q1) illustrates the middle number between smallest number and the median of the defined set of

data (Morato, 2013). While second quartile (Q2) denotes median of the data and Third quartile

(Q3) refers to the middle number between highest number and the median of the defined set of

data.

9

Measure of dispersion refers to the process by the means of which investigator evaluate

how wide spread the set of given data is in the defined variables. There are three major elements

of measure of dispersion such as: Standard deviation, Range and variance. Following are the

computation of these elements:

Standard Deviation: With help of standard deviation, researcher can easily identify the

variation between given set of information (Byrne, McAllister and Wyatt, 2011). In the

present study, standard deviation assist owner of Carmen clothing shop to whether stick

below 40 price range or increase it above 40.

Variance = s2 = ∑Fx2 – ((∑Fx)2 /n)/ n – 1

Variance = 511.48

Standard Deviation = S= √s2

Standard Deviation = 22.61

Range: Range helps in computing the different between highest value and lowest value in

the collected information or data (Sucky, Aksoy and Ozturk, 2012).

Range = (100-(10/ (20+1))-(10/ (4+1)))

Range = 97.52

2.4 25th Percentile (Lower 25th Percentile (Lower Quartile) and 75th Percentile (Upper Quartile)

and use of Percentile

Quartile:

In general, quartile refers to the statistical approach of dividing set of numbers into four

different quarters. All the quarters are denoted with: Q1, Q2, Q3, and Q4. In this, first quartile

(Q1) illustrates the middle number between smallest number and the median of the defined set of

data (Morato, 2013). While second quartile (Q2) denotes median of the data and Third quartile

(Q3) refers to the middle number between highest number and the median of the defined set of

data.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Percentile:

This statistical measure helps in defining the value that falls under a below given set of

percentage. For instance: 25th percentile falls under the observation of 25 percentage of total

value.

Lower quartile/25th percentile 24.5

Upper quartile/75th percentile 58.8

Interquartile range:

In general, inter-quartile range can be defined as the measure of variability which

depends upon dividing given set of data into four different quarters. In other words, it is the

difference between upper quartile and lower quartile.

Interquartile range 34.2

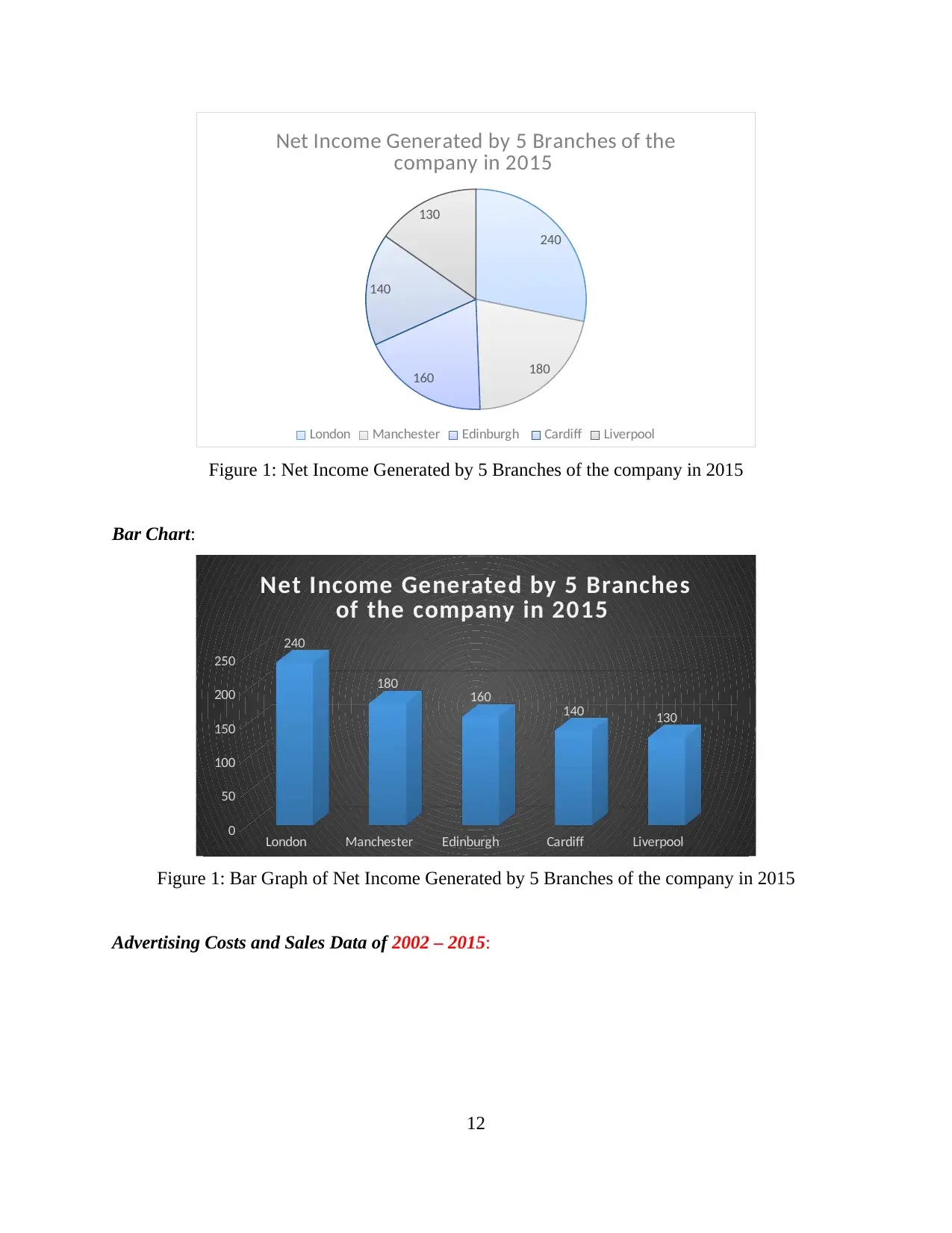

2.4 Calculate correlation coefficient using the additional information provided and discuss it

advantages to a business

Sales (Units) Discounts (%)

20 1

40 4

50 6

55 6

60 10

70 12

80 13

90 14

100 15

The correlation coefficient of sales and discount are given below:

Table 1: Correlation and Coefficient

Particular Sales (Units) Discounts (%)

Sales (Units) 1 0.97

Discounts (%) 0.97 1

10

This statistical measure helps in defining the value that falls under a below given set of

percentage. For instance: 25th percentile falls under the observation of 25 percentage of total

value.

Lower quartile/25th percentile 24.5

Upper quartile/75th percentile 58.8

Interquartile range:

In general, inter-quartile range can be defined as the measure of variability which

depends upon dividing given set of data into four different quarters. In other words, it is the

difference between upper quartile and lower quartile.

Interquartile range 34.2

2.4 Calculate correlation coefficient using the additional information provided and discuss it

advantages to a business

Sales (Units) Discounts (%)

20 1

40 4

50 6

55 6

60 10

70 12

80 13

90 14

100 15

The correlation coefficient of sales and discount are given below:

Table 1: Correlation and Coefficient

Particular Sales (Units) Discounts (%)

Sales (Units) 1 0.97

Discounts (%) 0.97 1

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

As per the formula R2 =0.97

On the basis of above computation of correlation coefficient it has been evaluated that,

sales and discounts are highly correlated to the each other. Hence, if the units of sales increases,

discount rates also increase and vice-verse.

TASK 3

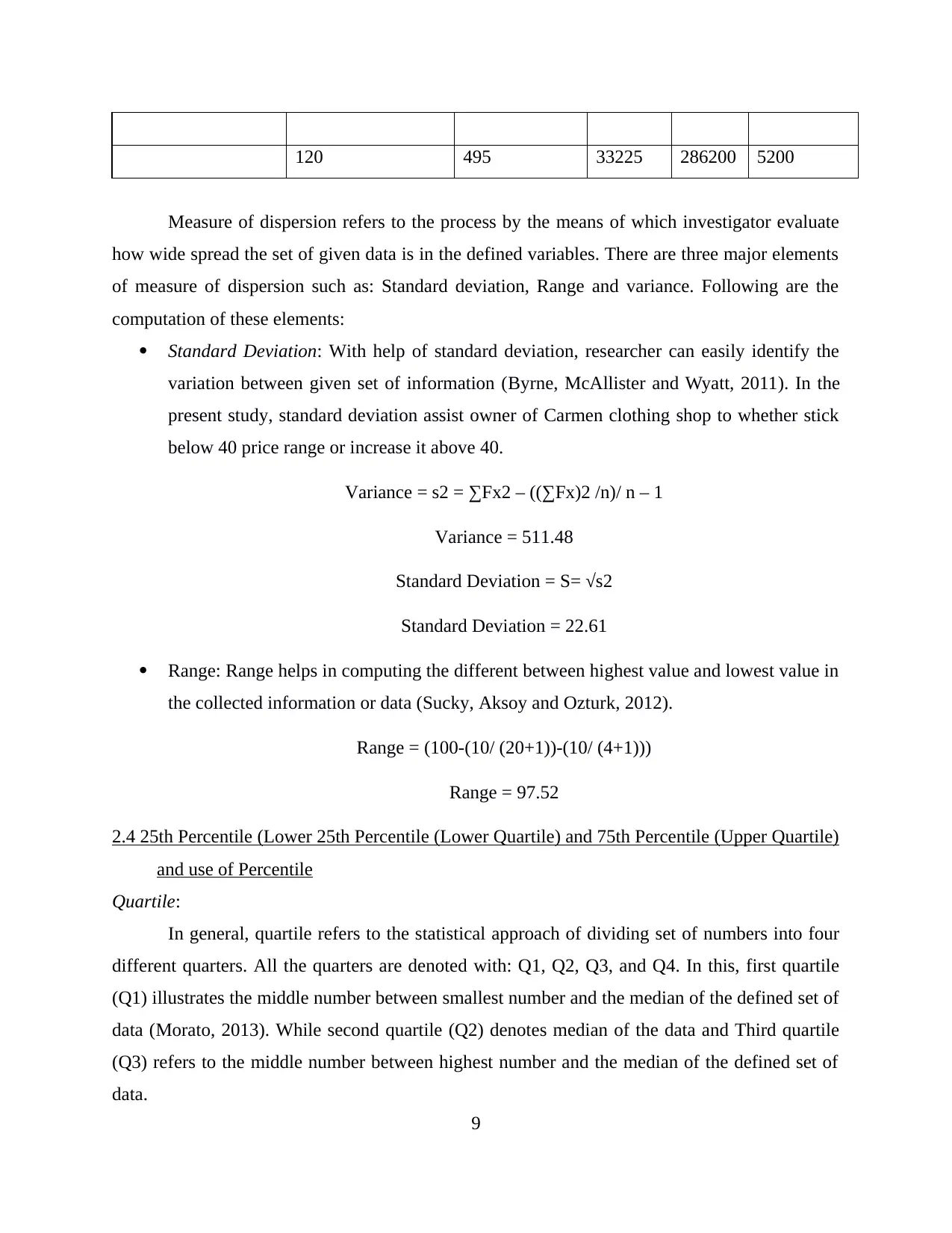

3.1 & 4.1 Produce line graph

According to the given case study, Managing Director of Clothing Company that import

cloths from different parts of the world so that diverse needs and wants of customers can be

satisfied. In regard to this, data of last 10 years has been extracted regarding sales and advertising

costs.

Line graph:

2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5

0

1000

2000

3000

4000

5000

6000

7000

Line Graph

Advertising Cost £'000s Sales £'000s

Figure 1: Line graph

Pie Chart:

11

On the basis of above computation of correlation coefficient it has been evaluated that,

sales and discounts are highly correlated to the each other. Hence, if the units of sales increases,

discount rates also increase and vice-verse.

TASK 3

3.1 & 4.1 Produce line graph

According to the given case study, Managing Director of Clothing Company that import

cloths from different parts of the world so that diverse needs and wants of customers can be

satisfied. In regard to this, data of last 10 years has been extracted regarding sales and advertising

costs.

Line graph:

2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5

0

1000

2000

3000

4000

5000

6000

7000

Line Graph

Advertising Cost £'000s Sales £'000s

Figure 1: Line graph

Pie Chart:

11

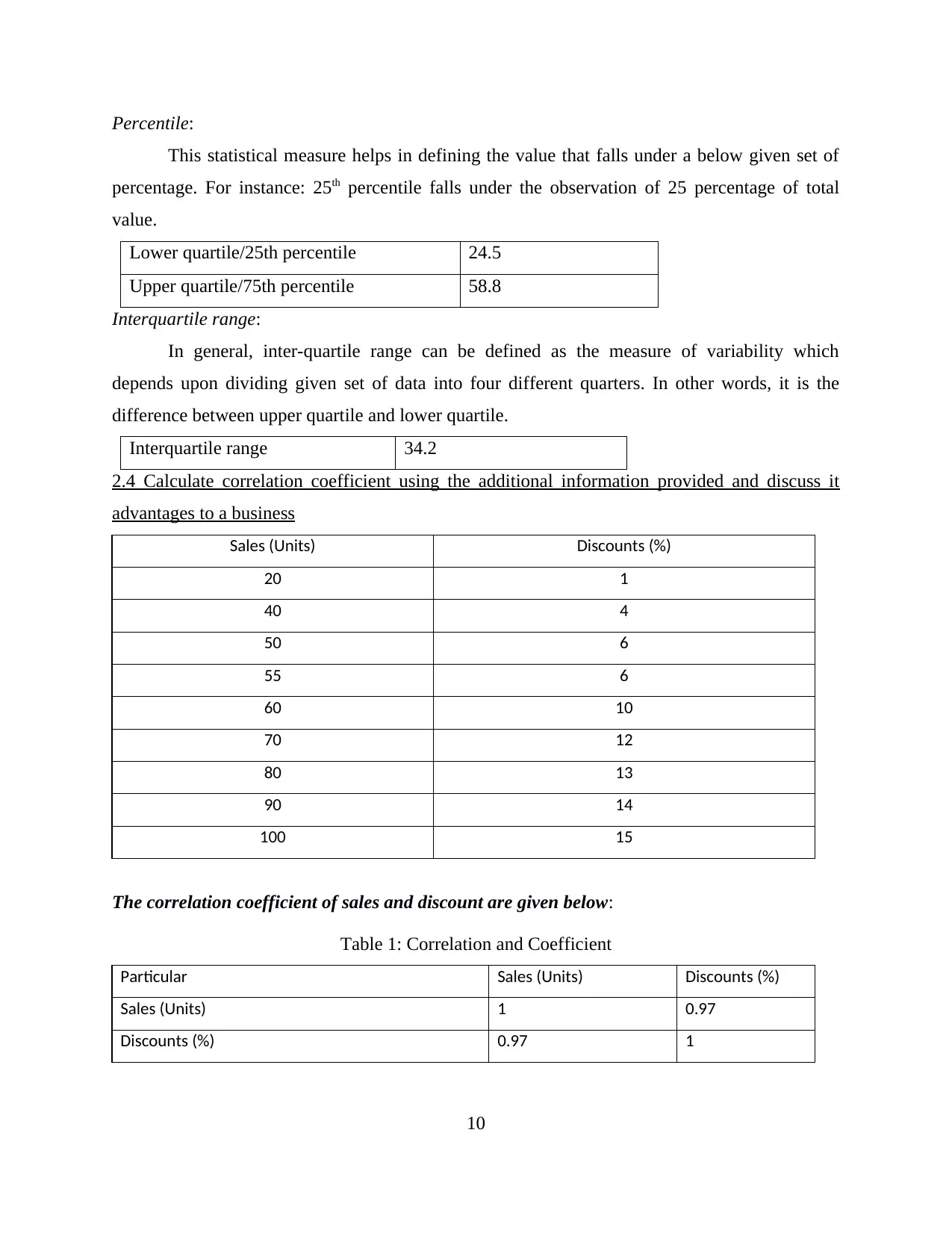

240

180

160

140

130

Net Income Generated by 5 Branches of the

company in 2015

London Manchester Edinburgh Cardiff Liverpool

Figure 1: Net Income Generated by 5 Branches of the company in 2015

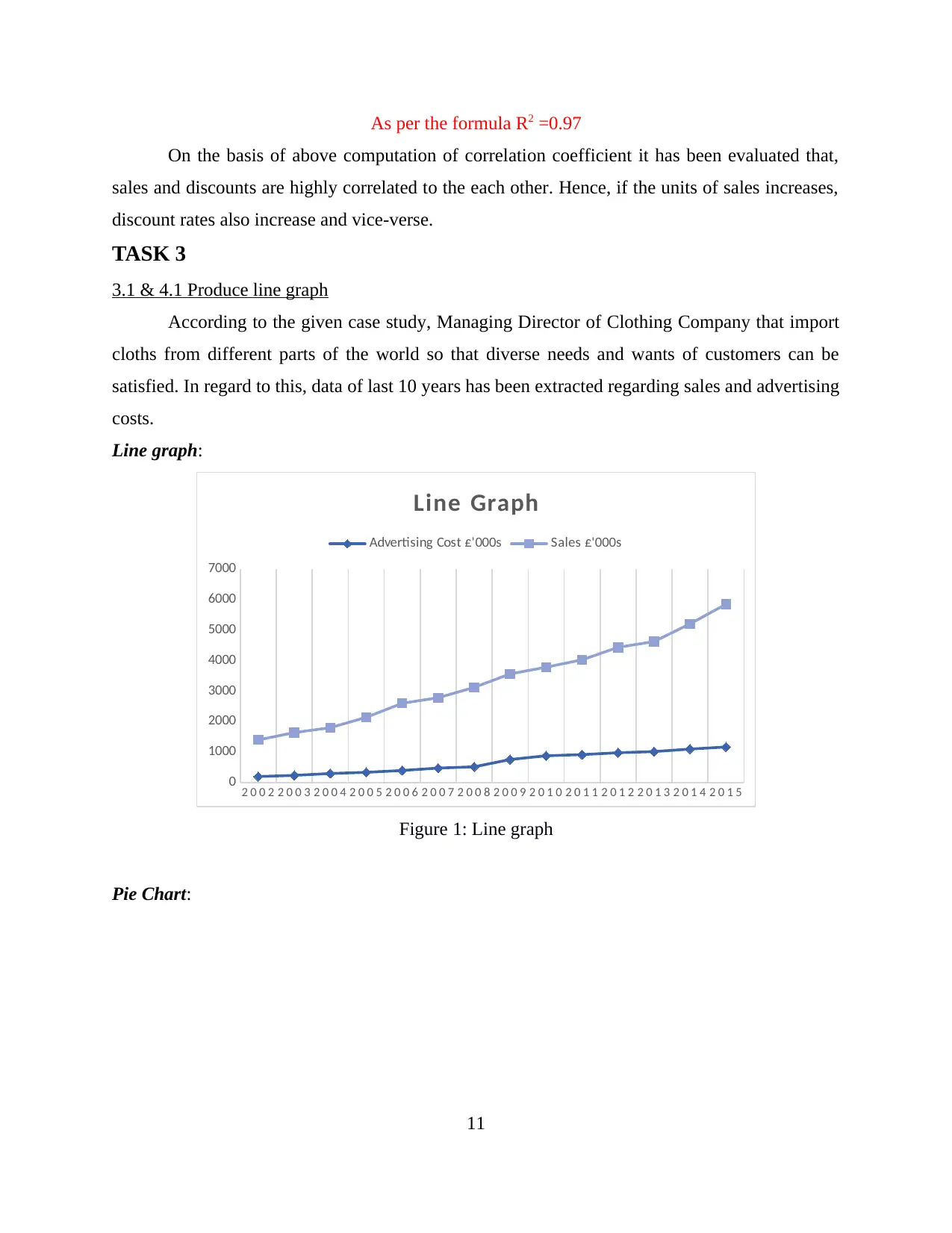

Bar Chart:

London Manchester Edinburgh Cardiff Liverpool

0

50

100

150

200

250

240

180 160 140 130

Net Income Generated by 5 Branches

of the company in 2015

Figure 1: Bar Graph of Net Income Generated by 5 Branches of the company in 2015

Advertising Costs and Sales Data of 2002 – 2015:

12

180

160

140

130

Net Income Generated by 5 Branches of the

company in 2015

London Manchester Edinburgh Cardiff Liverpool

Figure 1: Net Income Generated by 5 Branches of the company in 2015

Bar Chart:

London Manchester Edinburgh Cardiff Liverpool

0

50

100

150

200

250

240

180 160 140 130

Net Income Generated by 5 Branches

of the company in 2015

Figure 1: Bar Graph of Net Income Generated by 5 Branches of the company in 2015

Advertising Costs and Sales Data of 2002 – 2015:

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.