BA4008QA: Investment Appraisal Techniques and Financial Ratio Analysis

VerifiedAdded on 2023/06/18

|13

|2063

|251

Report

AI Summary

This report evaluates investment appraisal techniques, including Payback Period, Accounting Rate of Return (ARR), Net Present Value (NPV), and Internal Rate of Return (IRR), to advise Dolapo Plc on selecting a machine model (Dysn or Texla). It recommends Dysn model 1 based on its positive NPV, higher IRR and ARR, and shorter payback period. The report also assesses Tesco Plc's performance using accounting ratios over three years, highlighting improvements in gross profit margin and return on assets, while noting concerns about current and liquid ratios. Limitations of accounting ratios and factors affecting Tesco's performance, such as competitor innovation and underperforming stores, are also discussed. The analysis concludes that Dolapo Plc should adopt Dysn model 1 for profitability and that Tesco is showing signs of growth despite certain financial challenges.

Business Decision Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Task 1...............................................................................................................................................1

Question 1 A...........................................................................................................................1

Question 1 B...........................................................................................................................4

Question 1 C...........................................................................................................................6

Task 2...............................................................................................................................................6

Question 2 A...........................................................................................................................6

Question 2 B...........................................................................................................................7

Question 2 C...........................................................................................................................7

Conclusion.......................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Task 1...............................................................................................................................................1

Question 1 A...........................................................................................................................1

Question 1 B...........................................................................................................................4

Question 1 C...........................................................................................................................6

Task 2...............................................................................................................................................6

Question 2 A...........................................................................................................................6

Question 2 B...........................................................................................................................7

Question 2 C...........................................................................................................................7

Conclusion.......................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Effective decision making plays vital role in company's growth, decision making is

done by using investment appraisal tools. This report will discuss various investment

appraisal technique and also Dolapo Plc should select which model. Further will evaluate

Tesco's performance by reviewing ratios and also stating limitations of ratios.

MAIN BODY

Task 1

Question 1 A

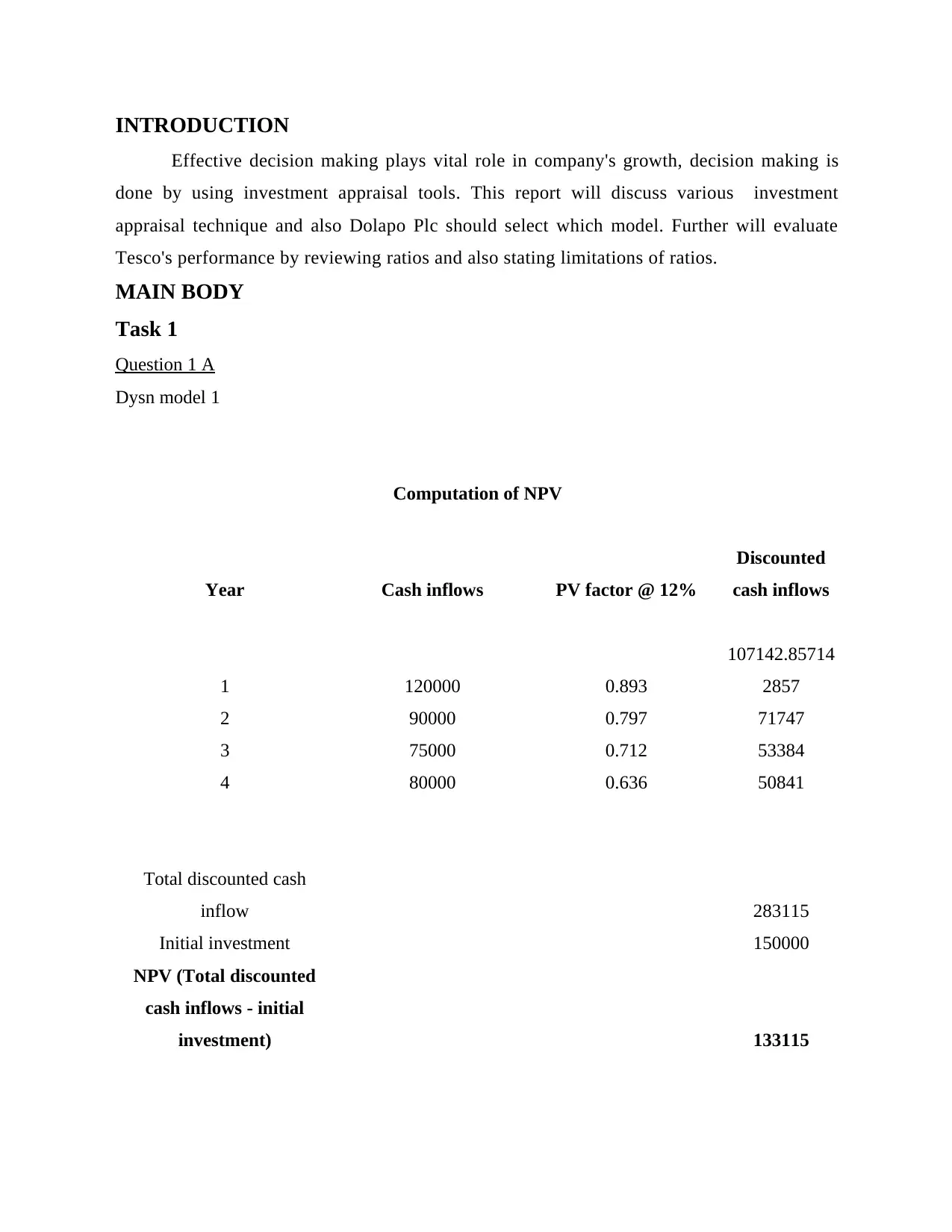

Dysn model 1

Computation of NPV

Year Cash inflows PV factor @ 12%

Discounted

cash inflows

1 120000 0.893

107142.85714

2857

2 90000 0.797 71747

3 75000 0.712 53384

4 80000 0.636 50841

Total discounted cash

inflow 283115

Initial investment 150000

NPV (Total discounted

cash inflows - initial

investment) 133115

Effective decision making plays vital role in company's growth, decision making is

done by using investment appraisal tools. This report will discuss various investment

appraisal technique and also Dolapo Plc should select which model. Further will evaluate

Tesco's performance by reviewing ratios and also stating limitations of ratios.

MAIN BODY

Task 1

Question 1 A

Dysn model 1

Computation of NPV

Year Cash inflows PV factor @ 12%

Discounted

cash inflows

1 120000 0.893

107142.85714

2857

2 90000 0.797 71747

3 75000 0.712 53384

4 80000 0.636 50841

Total discounted cash

inflow 283115

Initial investment 150000

NPV (Total discounted

cash inflows - initial

investment) 133115

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

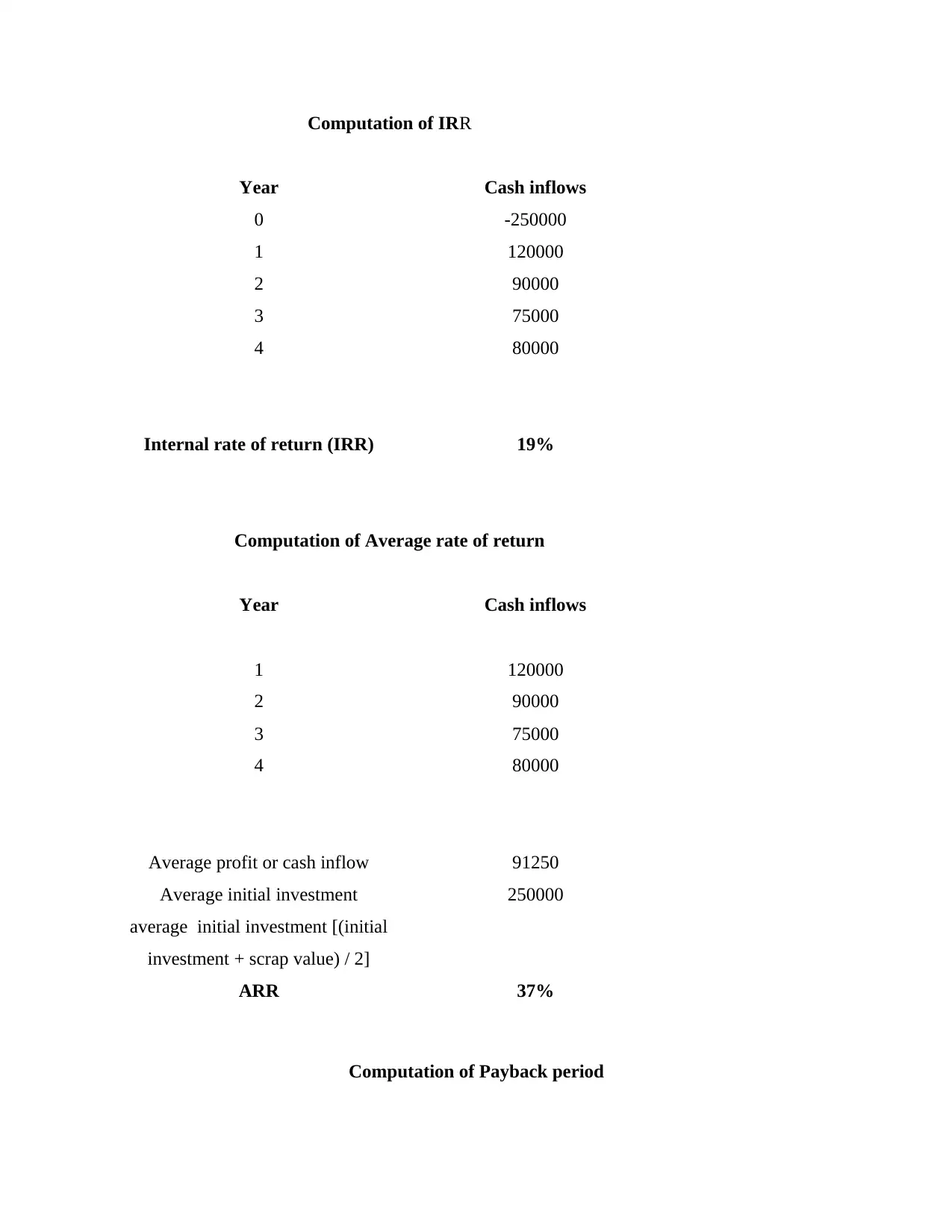

Computation of IRR

Year Cash inflows

0 -250000

1 120000

2 90000

3 75000

4 80000

Internal rate of return (IRR) 19%

Computation of Average rate of return

Year Cash inflows

1 120000

2 90000

3 75000

4 80000

Average profit or cash inflow 91250

Average initial investment 250000

average initial investment [(initial

investment + scrap value) / 2]

ARR 37%

Computation of Payback period

Year Cash inflows

0 -250000

1 120000

2 90000

3 75000

4 80000

Internal rate of return (IRR) 19%

Computation of Average rate of return

Year Cash inflows

1 120000

2 90000

3 75000

4 80000

Average profit or cash inflow 91250

Average initial investment 250000

average initial investment [(initial

investment + scrap value) / 2]

ARR 37%

Computation of Payback period

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

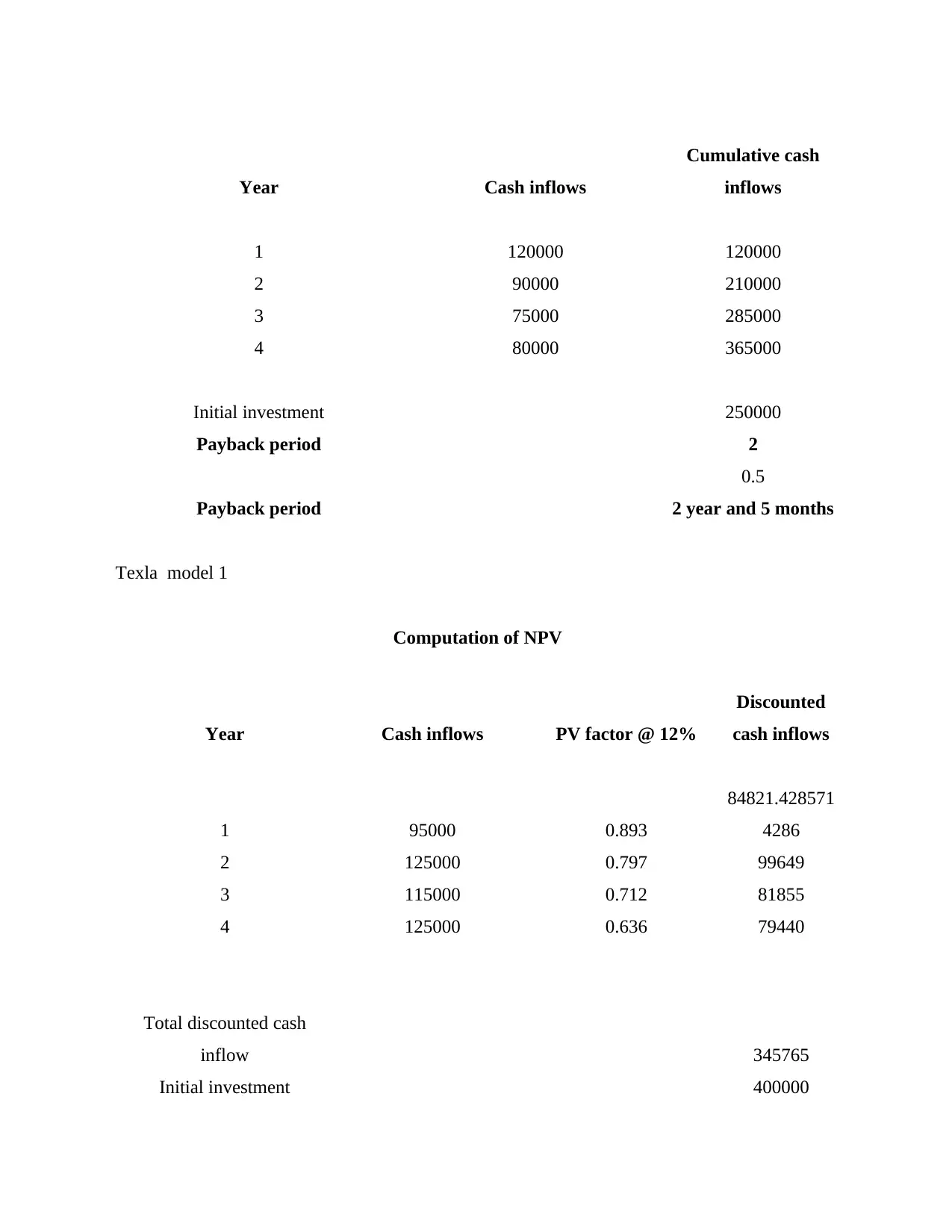

Year Cash inflows

Cumulative cash

inflows

1 120000 120000

2 90000 210000

3 75000 285000

4 80000 365000

Initial investment 250000

Payback period 2

0.5

Payback period 2 year and 5 months

Texla model 1

Computation of NPV

Year Cash inflows PV factor @ 12%

Discounted

cash inflows

1 95000 0.893

84821.428571

4286

2 125000 0.797 99649

3 115000 0.712 81855

4 125000 0.636 79440

Total discounted cash

inflow 345765

Initial investment 400000

Cumulative cash

inflows

1 120000 120000

2 90000 210000

3 75000 285000

4 80000 365000

Initial investment 250000

Payback period 2

0.5

Payback period 2 year and 5 months

Texla model 1

Computation of NPV

Year Cash inflows PV factor @ 12%

Discounted

cash inflows

1 95000 0.893

84821.428571

4286

2 125000 0.797 99649

3 115000 0.712 81855

4 125000 0.636 79440

Total discounted cash

inflow 345765

Initial investment 400000

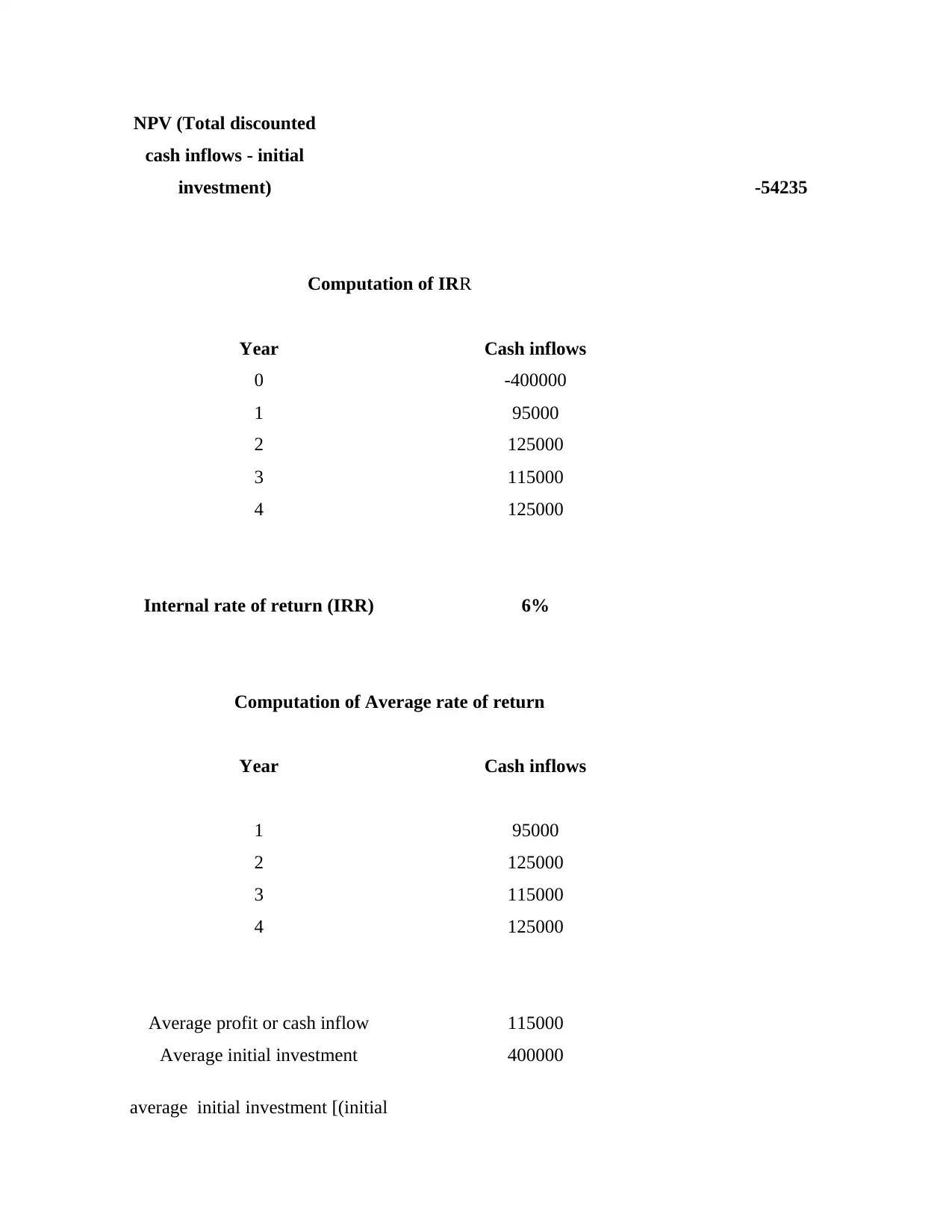

NPV (Total discounted

cash inflows - initial

investment) -54235

Computation of IRR

Year Cash inflows

0 -400000

1 95000

2 125000

3 115000

4 125000

Internal rate of return (IRR) 6%

Computation of Average rate of return

Year Cash inflows

1 95000

2 125000

3 115000

4 125000

Average profit or cash inflow 115000

Average initial investment 400000

average initial investment [(initial

cash inflows - initial

investment) -54235

Computation of IRR

Year Cash inflows

0 -400000

1 95000

2 125000

3 115000

4 125000

Internal rate of return (IRR) 6%

Computation of Average rate of return

Year Cash inflows

1 95000

2 125000

3 115000

4 125000

Average profit or cash inflow 115000

Average initial investment 400000

average initial investment [(initial

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

investment + scrap value) / 2]

ARR 29%

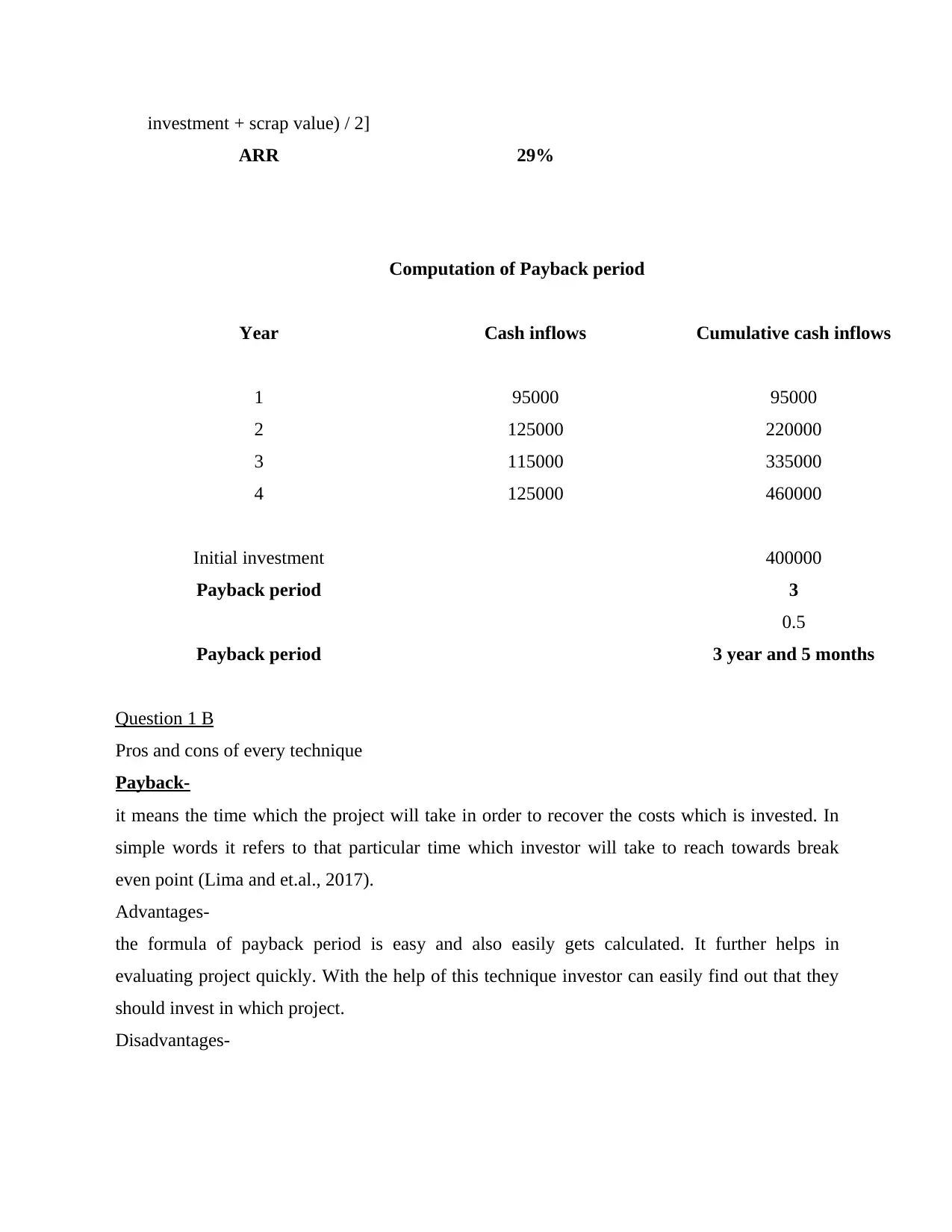

Computation of Payback period

Year Cash inflows Cumulative cash inflows

1 95000 95000

2 125000 220000

3 115000 335000

4 125000 460000

Initial investment 400000

Payback period 3

0.5

Payback period 3 year and 5 months

Question 1 B

Pros and cons of every technique

Payback-

it means the time which the project will take in order to recover the costs which is invested. In

simple words it refers to that particular time which investor will take to reach towards break

even point (Lima and et.al., 2017).

Advantages-

the formula of payback period is easy and also easily gets calculated. It further helps in

evaluating project quickly. With the help of this technique investor can easily find out that they

should invest in which project.

Disadvantages-

ARR 29%

Computation of Payback period

Year Cash inflows Cumulative cash inflows

1 95000 95000

2 125000 220000

3 115000 335000

4 125000 460000

Initial investment 400000

Payback period 3

0.5

Payback period 3 year and 5 months

Question 1 B

Pros and cons of every technique

Payback-

it means the time which the project will take in order to recover the costs which is invested. In

simple words it refers to that particular time which investor will take to reach towards break

even point (Lima and et.al., 2017).

Advantages-

the formula of payback period is easy and also easily gets calculated. It further helps in

evaluating project quickly. With the help of this technique investor can easily find out that they

should invest in which project.

Disadvantages-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

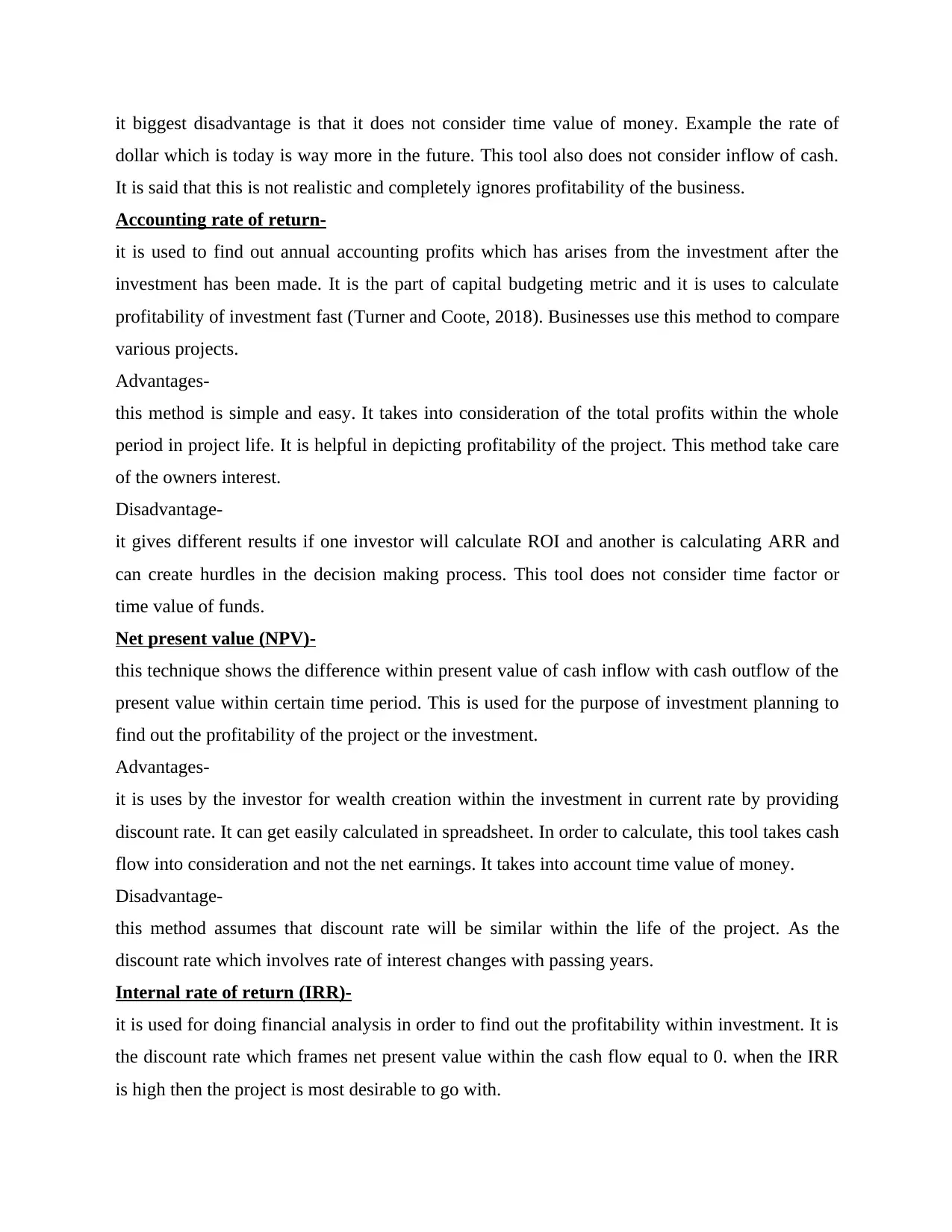

it biggest disadvantage is that it does not consider time value of money. Example the rate of

dollar which is today is way more in the future. This tool also does not consider inflow of cash.

It is said that this is not realistic and completely ignores profitability of the business.

Accounting rate of return-

it is used to find out annual accounting profits which has arises from the investment after the

investment has been made. It is the part of capital budgeting metric and it is uses to calculate

profitability of investment fast (Turner and Coote, 2018). Businesses use this method to compare

various projects.

Advantages-

this method is simple and easy. It takes into consideration of the total profits within the whole

period in project life. It is helpful in depicting profitability of the project. This method take care

of the owners interest.

Disadvantage-

it gives different results if one investor will calculate ROI and another is calculating ARR and

can create hurdles in the decision making process. This tool does not consider time factor or

time value of funds.

Net present value (NPV)-

this technique shows the difference within present value of cash inflow with cash outflow of the

present value within certain time period. This is used for the purpose of investment planning to

find out the profitability of the project or the investment.

Advantages-

it is uses by the investor for wealth creation within the investment in current rate by providing

discount rate. It can get easily calculated in spreadsheet. In order to calculate, this tool takes cash

flow into consideration and not the net earnings. It takes into account time value of money.

Disadvantage-

this method assumes that discount rate will be similar within the life of the project. As the

discount rate which involves rate of interest changes with passing years.

Internal rate of return (IRR)-

it is used for doing financial analysis in order to find out the profitability within investment. It is

the discount rate which frames net present value within the cash flow equal to 0. when the IRR

is high then the project is most desirable to go with.

dollar which is today is way more in the future. This tool also does not consider inflow of cash.

It is said that this is not realistic and completely ignores profitability of the business.

Accounting rate of return-

it is used to find out annual accounting profits which has arises from the investment after the

investment has been made. It is the part of capital budgeting metric and it is uses to calculate

profitability of investment fast (Turner and Coote, 2018). Businesses use this method to compare

various projects.

Advantages-

this method is simple and easy. It takes into consideration of the total profits within the whole

period in project life. It is helpful in depicting profitability of the project. This method take care

of the owners interest.

Disadvantage-

it gives different results if one investor will calculate ROI and another is calculating ARR and

can create hurdles in the decision making process. This tool does not consider time factor or

time value of funds.

Net present value (NPV)-

this technique shows the difference within present value of cash inflow with cash outflow of the

present value within certain time period. This is used for the purpose of investment planning to

find out the profitability of the project or the investment.

Advantages-

it is uses by the investor for wealth creation within the investment in current rate by providing

discount rate. It can get easily calculated in spreadsheet. In order to calculate, this tool takes cash

flow into consideration and not the net earnings. It takes into account time value of money.

Disadvantage-

this method assumes that discount rate will be similar within the life of the project. As the

discount rate which involves rate of interest changes with passing years.

Internal rate of return (IRR)-

it is used for doing financial analysis in order to find out the profitability within investment. It is

the discount rate which frames net present value within the cash flow equal to 0. when the IRR

is high then the project is most desirable to go with.

Advantages-

this tool considers time value of money at the time of analysing the project or investment. After

IRR has been calculated then interpretation becomes easy to do (Zativita and Chumaidiyah,

2019). Managers commonly use this method for the purpose of interpretation.

Disadvantage-

it completely ignores economies of scale which is the major limitation. This technique also

ignore manually exclusive project. It involves mixture of positive and negative cash flows.

Increase in wealth cannot get calculated with the help of this method.

Question 1 C

Recommendation for selection of machine

The project which is suggested to Dolapo plc is Dysn model 1 because in this model the value of

NPV is 133115 which is positive when compared with the value of NPV in second model which

is -54235 and in case of NPV those project gets selected whose value will comes positive. In

case of IRR that model will get selected whose percentage is more. In model 1 IRR is 19% and

in model 2 IRR is 6%. if talking about ARR than also higher percentage value will gets selected.

Value of model 1 is 37% and value of model 2 is 29%. hence it can be said that model 1 will get

selected. Payback period is used to calculate the time which is required to cover the investment

amount. Model 1 will require the time of 2 years and 5 months and model 2 will be requiring

time of 3 years and 5 months. In case of payback period shorter time will get selected so that is

why again model 1 will be chosen (Kessler, 2017). Every technique is favouring model 1 Dysn

only. So it is recommended that if Dolapo will go with model 1 then company will incur

profitability and attain success.

Task 2

Question 2 A

Performance of the company on the basis of accounting ratios of three years.

If talking about performance of Tesco Plc then it can be said that gross profit margin of

company is increasing i.e in year 2017 it was 5.19, 2018 it was 5.83 and 2019 it was 6.48 which

means that company's sales are increasing and COGS is decreasing. Return of total assets are

also increasing from 0.32 to 3.41 which means that Tesco is using its resources effectively and

its current liabilities are also decreasing. Return on capital employed is also increasing which

this tool considers time value of money at the time of analysing the project or investment. After

IRR has been calculated then interpretation becomes easy to do (Zativita and Chumaidiyah,

2019). Managers commonly use this method for the purpose of interpretation.

Disadvantage-

it completely ignores economies of scale which is the major limitation. This technique also

ignore manually exclusive project. It involves mixture of positive and negative cash flows.

Increase in wealth cannot get calculated with the help of this method.

Question 1 C

Recommendation for selection of machine

The project which is suggested to Dolapo plc is Dysn model 1 because in this model the value of

NPV is 133115 which is positive when compared with the value of NPV in second model which

is -54235 and in case of NPV those project gets selected whose value will comes positive. In

case of IRR that model will get selected whose percentage is more. In model 1 IRR is 19% and

in model 2 IRR is 6%. if talking about ARR than also higher percentage value will gets selected.

Value of model 1 is 37% and value of model 2 is 29%. hence it can be said that model 1 will get

selected. Payback period is used to calculate the time which is required to cover the investment

amount. Model 1 will require the time of 2 years and 5 months and model 2 will be requiring

time of 3 years and 5 months. In case of payback period shorter time will get selected so that is

why again model 1 will be chosen (Kessler, 2017). Every technique is favouring model 1 Dysn

only. So it is recommended that if Dolapo will go with model 1 then company will incur

profitability and attain success.

Task 2

Question 2 A

Performance of the company on the basis of accounting ratios of three years.

If talking about performance of Tesco Plc then it can be said that gross profit margin of

company is increasing i.e in year 2017 it was 5.19, 2018 it was 5.83 and 2019 it was 6.48 which

means that company's sales are increasing and COGS is decreasing. Return of total assets are

also increasing from 0.32 to 3.41 which means that Tesco is using its resources effectively and

its current liabilities are also decreasing. Return on capital employed is also increasing which

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

means that operating profits are increasing and company is putting efforts in reducing the costs.

They are efficiently using their capital. Hence company have the potential to attract their

investors (Cagle, 2020). Current ratio of company is decreasing as in 2017 it was 0.79 and in

2019 it was 0.61 which shows that company is not using their current assets properly in order

pay its current liabilities. Company's liquid ratio is also at declining rate which means that

current asset is not effectively utilised by the company.

Inventory days of company in 2017 was 15.02 and in 2018 it was 14.37 and in 2019 it was 14.95

which means that their sales are increasing. there is fluctuation in trade receivables as it is

increasing then decreasing then again increasing. It shows that company does not have stable

credit policy and not using proper planning process. Trade payable is decreasing it is good with

company's perspective because they will get more time to pay their creditors and company can

use that money in expanding their business. Gearing ratio should be less then 25% because it is

the situation of less risk for company and for investors. Although this ratio is more then 25% but

it is declining as in 2017 it was 454.44 and in 2019 it was 161.26 so it can said that company is

making efforts for improvement.

Question 2 B

Limitations of using accounting ratios

Company can make changes in financial reports to improvise their ratio then the

calculation of ratio becomes waste (Gabric, 2018).

Ratio does not consider price level changes.

No such standard guidelines for ratio.

It does not helps in solving company's financial problems.

It consider monetary aspect and ignores qualitative aspect.

Question 2 C

Factors affecting Tesco

Tesco's operating profits (OP) has decreased and so its share price because of decrease in

OP.

It is observed that competitors of Tesco is launching innovative products in the market

and that is affecting their performance adversely (Akbulut, 2017).

There are few stores of Tesco in various countries which are not performing as expected.

They are efficiently using their capital. Hence company have the potential to attract their

investors (Cagle, 2020). Current ratio of company is decreasing as in 2017 it was 0.79 and in

2019 it was 0.61 which shows that company is not using their current assets properly in order

pay its current liabilities. Company's liquid ratio is also at declining rate which means that

current asset is not effectively utilised by the company.

Inventory days of company in 2017 was 15.02 and in 2018 it was 14.37 and in 2019 it was 14.95

which means that their sales are increasing. there is fluctuation in trade receivables as it is

increasing then decreasing then again increasing. It shows that company does not have stable

credit policy and not using proper planning process. Trade payable is decreasing it is good with

company's perspective because they will get more time to pay their creditors and company can

use that money in expanding their business. Gearing ratio should be less then 25% because it is

the situation of less risk for company and for investors. Although this ratio is more then 25% but

it is declining as in 2017 it was 454.44 and in 2019 it was 161.26 so it can said that company is

making efforts for improvement.

Question 2 B

Limitations of using accounting ratios

Company can make changes in financial reports to improvise their ratio then the

calculation of ratio becomes waste (Gabric, 2018).

Ratio does not consider price level changes.

No such standard guidelines for ratio.

It does not helps in solving company's financial problems.

It consider monetary aspect and ignores qualitative aspect.

Question 2 C

Factors affecting Tesco

Tesco's operating profits (OP) has decreased and so its share price because of decrease in

OP.

It is observed that competitors of Tesco is launching innovative products in the market

and that is affecting their performance adversely (Akbulut, 2017).

There are few stores of Tesco in various countries which are not performing as expected.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conclusion

Through this report it can be concluded that company should go with Dysn model 1

because that will provide profits to the company. Report has also evaluated Tesco's performance

on the basis of ratios. Company is using its resources properly and achieving growth. Report has

also discussed limitation of ratios and factors affecting Tesco.

Through this report it can be concluded that company should go with Dysn model 1

because that will provide profits to the company. Report has also evaluated Tesco's performance

on the basis of ratios. Company is using its resources properly and achieving growth. Report has

also discussed limitation of ratios and factors affecting Tesco.

REFERENCES

Books and Journals

Akbulut, D.H., 2017. The Effects of Operating Leases Capitalization on Financial Statements

and Accounting Ratios: A Literature Survey. Regional Studies on Economic Growth,

Financial Economics and Management, pp.3-10.

Cagle, M.N., 2020. Reflections of Digitalization on Accounting: The Effects of Industry 4.0 on

Financial Statements and Financial Ratios. In Digital Business Strategies in Blockchain

Ecosystems (pp. 473-501). Springer, Cham.

Gabric, D., 2018. Determination of accounting manipulations in the financial statements using

accrual based investment ratios. Economic Review: Journal of Economics and

Business. 16(1). pp.71-81.

Kessler, W., 2017. Comparing energy payback and simple payback period for solar photovoltaic

systems. In E3S web of conferences (Vol. 22, p. 00080). EDP Sciences.

Lima, A.C. and et.al., 2017. A qualitative analysis of capital budgeting in cotton ginning

plants. Qualitative Research in Accounting & Management.

Turner, M.J. and Coote, L.V., 2018. Incentives and monitoring: impact on the financial and non-

financial orientation of capital budgeting. Meditari Accountancy Research.

Zativita, F.I. and Chumaidiyah, E., 2019, May. Feasibility analysis of Rumah Tempe Zanada

establishment in Bandung using net present value, internal rate of return, and payback

period. In IOP Conference Series: Materials Science and Engineering (Vol. 505, No. 1,

p. 012007). IOP Publishing.

Books and Journals

Akbulut, D.H., 2017. The Effects of Operating Leases Capitalization on Financial Statements

and Accounting Ratios: A Literature Survey. Regional Studies on Economic Growth,

Financial Economics and Management, pp.3-10.

Cagle, M.N., 2020. Reflections of Digitalization on Accounting: The Effects of Industry 4.0 on

Financial Statements and Financial Ratios. In Digital Business Strategies in Blockchain

Ecosystems (pp. 473-501). Springer, Cham.

Gabric, D., 2018. Determination of accounting manipulations in the financial statements using

accrual based investment ratios. Economic Review: Journal of Economics and

Business. 16(1). pp.71-81.

Kessler, W., 2017. Comparing energy payback and simple payback period for solar photovoltaic

systems. In E3S web of conferences (Vol. 22, p. 00080). EDP Sciences.

Lima, A.C. and et.al., 2017. A qualitative analysis of capital budgeting in cotton ginning

plants. Qualitative Research in Accounting & Management.

Turner, M.J. and Coote, L.V., 2018. Incentives and monitoring: impact on the financial and non-

financial orientation of capital budgeting. Meditari Accountancy Research.

Zativita, F.I. and Chumaidiyah, E., 2019, May. Feasibility analysis of Rumah Tempe Zanada

establishment in Bandung using net present value, internal rate of return, and payback

period. In IOP Conference Series: Materials Science and Engineering (Vol. 505, No. 1,

p. 012007). IOP Publishing.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.