University Business Decision Making BA4008QA Coursework 2 Project

VerifiedAdded on 2022/12/27

|13

|3233

|1

Project

AI Summary

This project, BA4008QA Coursework 2, delves into business decision-making and financial analysis. The first part focuses on capital budgeting techniques, including payback period, accounting rate of return, net present value (NPV), and internal rate of return (IRR), applied to an investment scenario involving two machines, Duke and Earl. Calculations and interpretations are provided, concluding with a recommendation to senior management. The second part analyzes the performance and position of Tesco plc, examining key performance indicators (KPIs) and financial ratios such as gross profit margin, return on total assets, return on capital employed, current ratio, and liquidity ratio to assess the company's financial health and strategic position in the retail industry.

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

Module Title Business Decision Making

Module Code BA4008QA

Assessment Project 2

1

Coursework)

Module Title Business Decision Making

Module Code BA4008QA

Assessment Project 2

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

TASK ONE

QUESTION 1(a) :

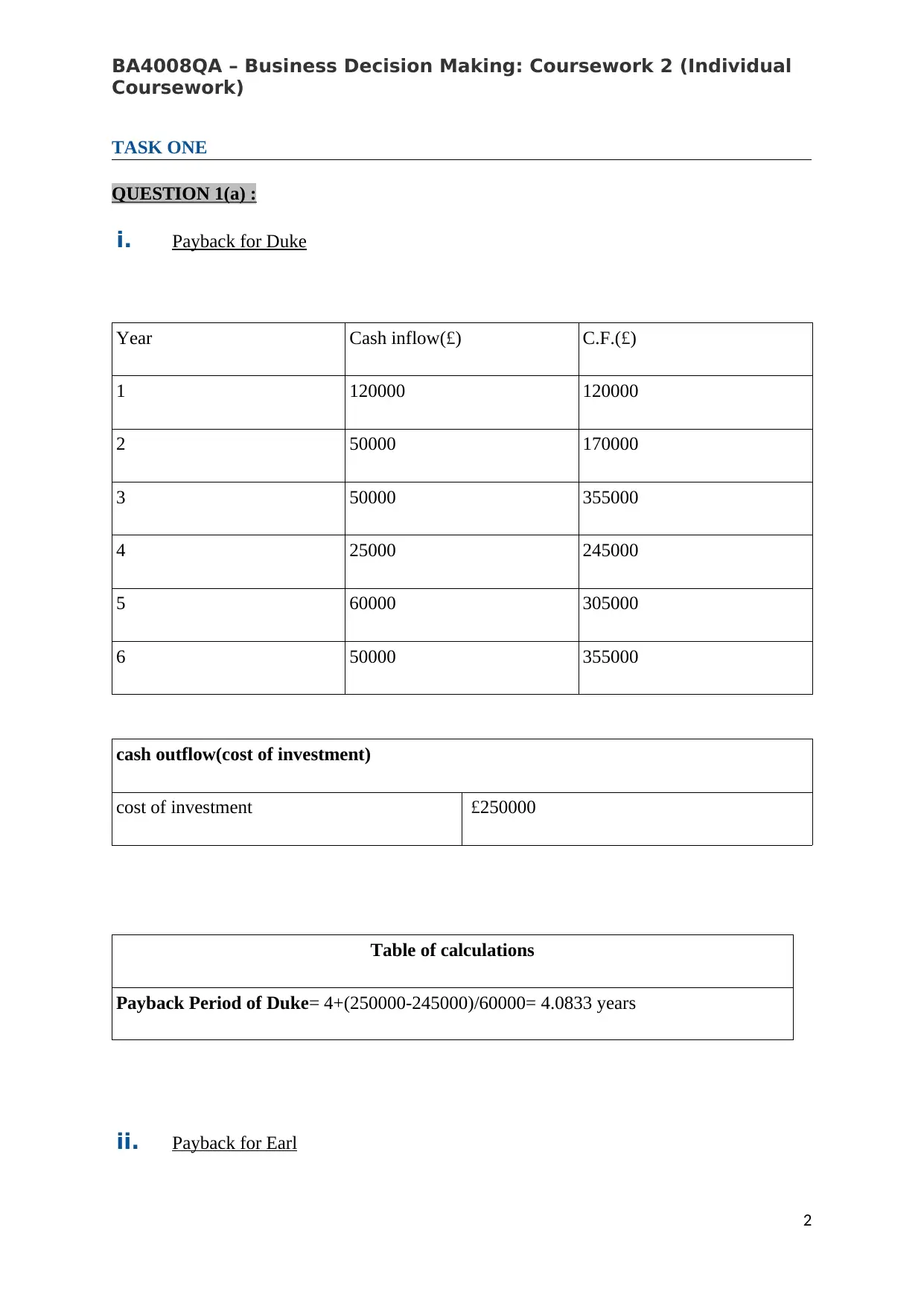

i. Payback for Duke

Year Cash inflow(£) C.F.(£)

1 120000 120000

2 50000 170000

3 50000 355000

4 25000 245000

5 60000 305000

6 50000 355000

cash outflow(cost of investment)

cost of investment £250000

Table of calculations

Payback Period of Duke= 4+(250000-245000)/60000= 4.0833 years

ii. Payback for Earl

2

Coursework)

TASK ONE

QUESTION 1(a) :

i. Payback for Duke

Year Cash inflow(£) C.F.(£)

1 120000 120000

2 50000 170000

3 50000 355000

4 25000 245000

5 60000 305000

6 50000 355000

cash outflow(cost of investment)

cost of investment £250000

Table of calculations

Payback Period of Duke= 4+(250000-245000)/60000= 4.0833 years

ii. Payback for Earl

2

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

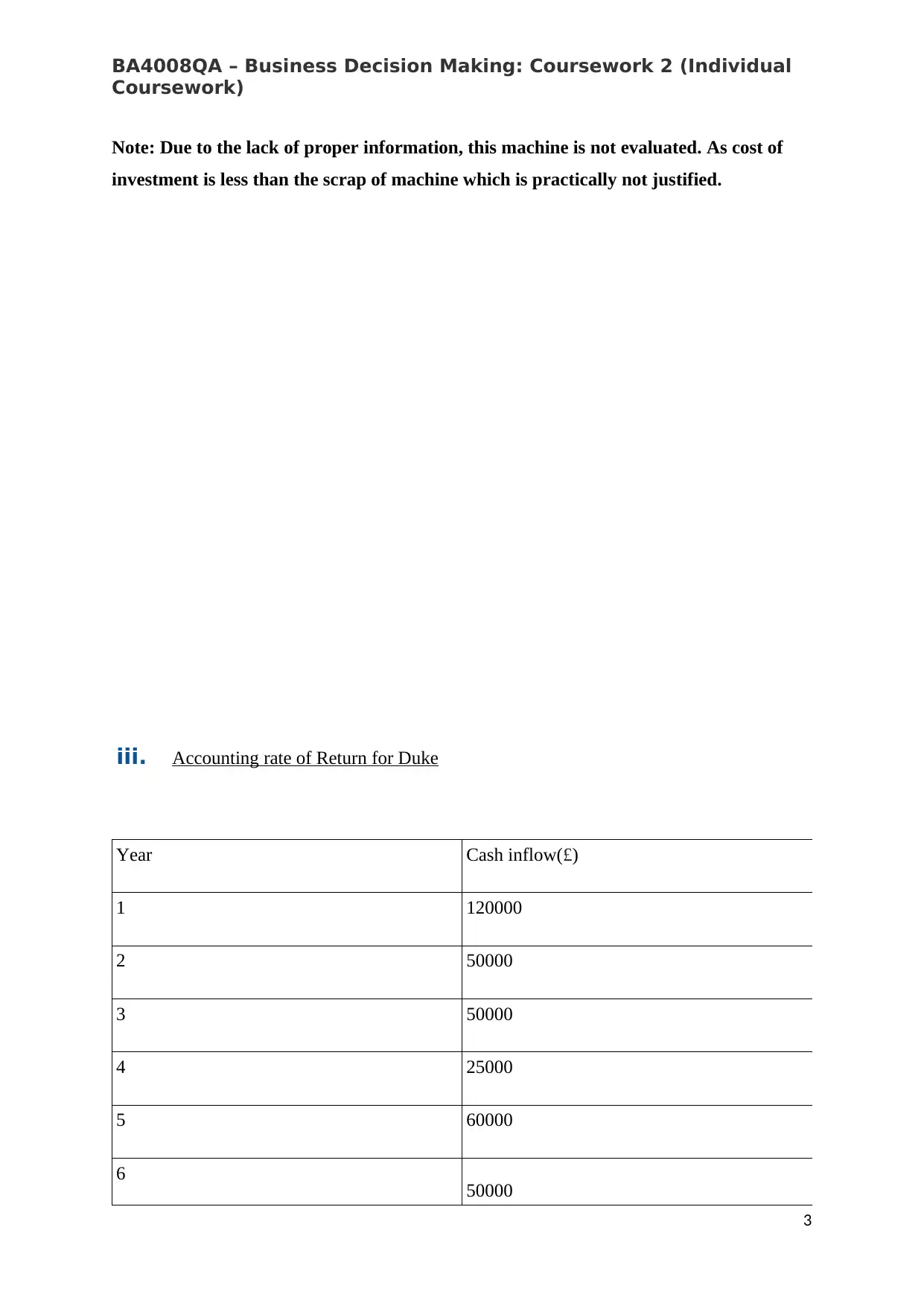

Note: Due to the lack of proper information, this machine is not evaluated. As cost of

investment is less than the scrap of machine which is practically not justified.

iii. Accounting rate of Return for Duke

Year Cash inflow(£)

1 120000

2 50000

3 50000

4 25000

5 60000

6 50000

3

Coursework)

Note: Due to the lack of proper information, this machine is not evaluated. As cost of

investment is less than the scrap of machine which is practically not justified.

iii. Accounting rate of Return for Duke

Year Cash inflow(£)

1 120000

2 50000

3 50000

4 25000

5 60000

6 50000

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

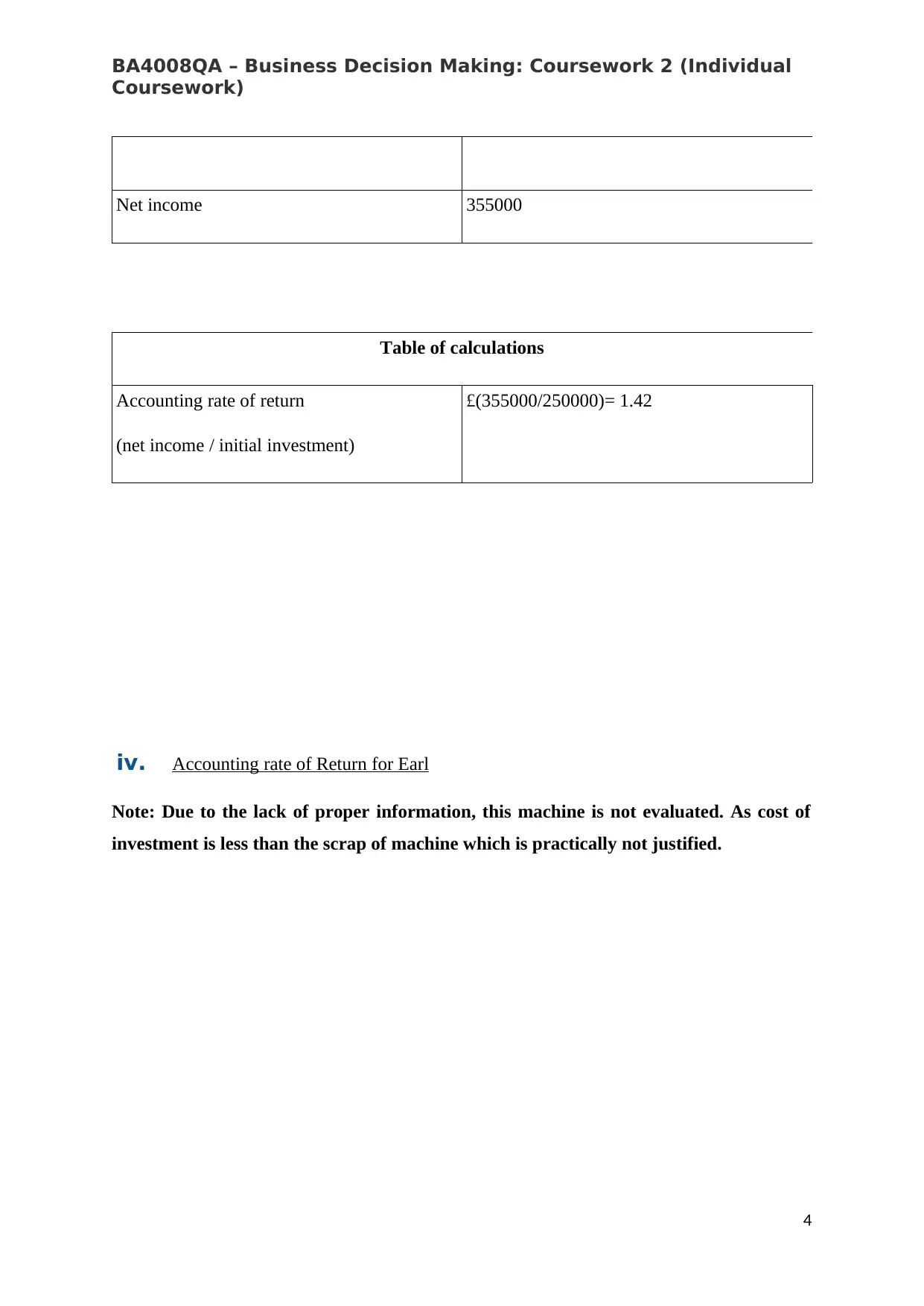

Net income 355000

Table of calculations

Accounting rate of return

(net income / initial investment)

£(355000/250000)= 1.42

iv. Accounting rate of Return for Earl

Note: Due to the lack of proper information, this machine is not evaluated. As cost of

investment is less than the scrap of machine which is practically not justified.

4

Coursework)

Net income 355000

Table of calculations

Accounting rate of return

(net income / initial investment)

£(355000/250000)= 1.42

iv. Accounting rate of Return for Earl

Note: Due to the lack of proper information, this machine is not evaluated. As cost of

investment is less than the scrap of machine which is practically not justified.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

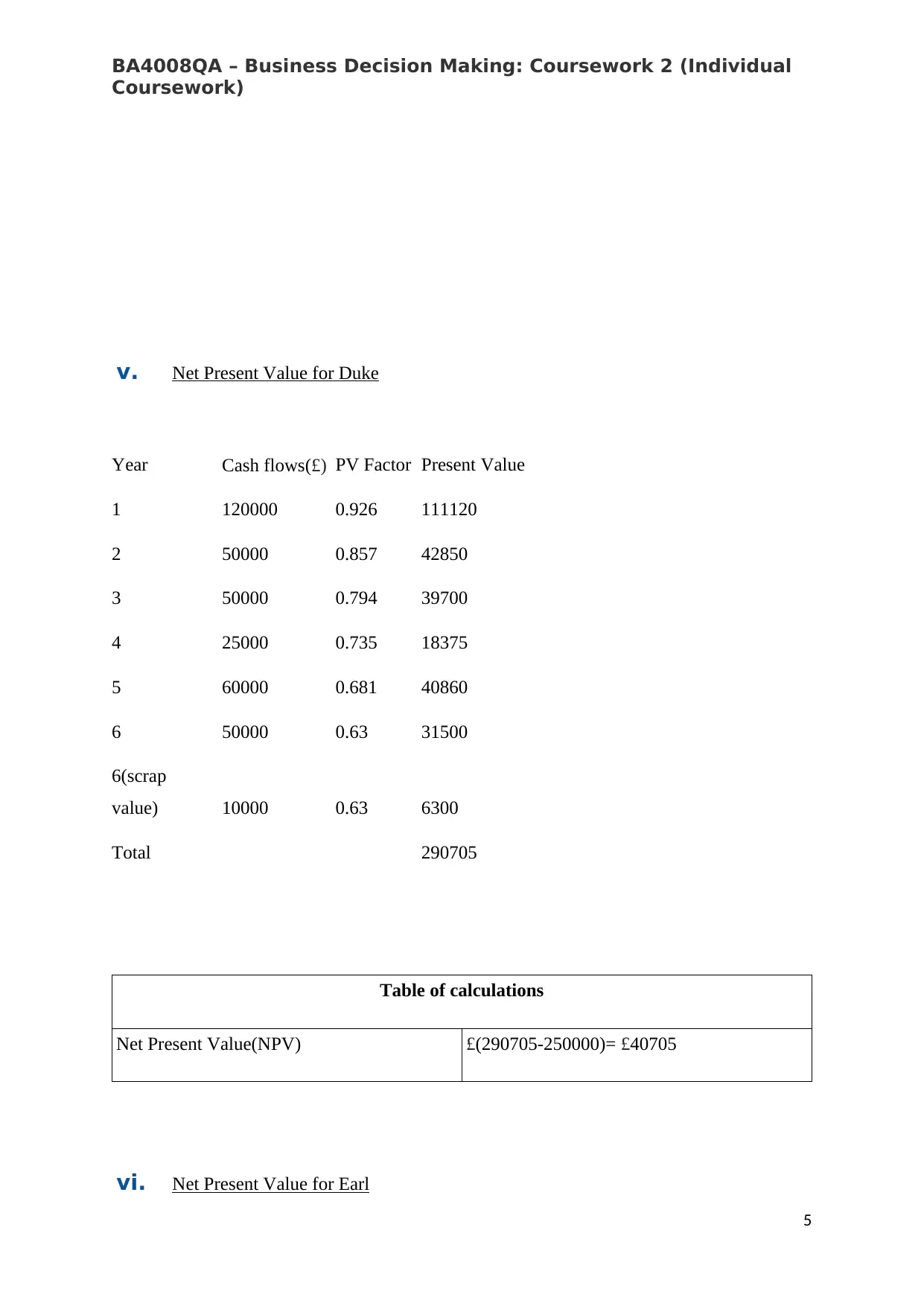

v. Net Present Value for Duke

Year Cash flows(£) PV Factor Present Value

1 120000 0.926 111120

2 50000 0.857 42850

3 50000 0.794 39700

4 25000 0.735 18375

5 60000 0.681 40860

6 50000 0.63 31500

6(scrap

value) 10000 0.63 6300

Total 290705

Table of calculations

Net Present Value(NPV) £(290705-250000)= £40705

vi. Net Present Value for Earl

5

Coursework)

v. Net Present Value for Duke

Year Cash flows(£) PV Factor Present Value

1 120000 0.926 111120

2 50000 0.857 42850

3 50000 0.794 39700

4 25000 0.735 18375

5 60000 0.681 40860

6 50000 0.63 31500

6(scrap

value) 10000 0.63 6300

Total 290705

Table of calculations

Net Present Value(NPV) £(290705-250000)= £40705

vi. Net Present Value for Earl

5

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

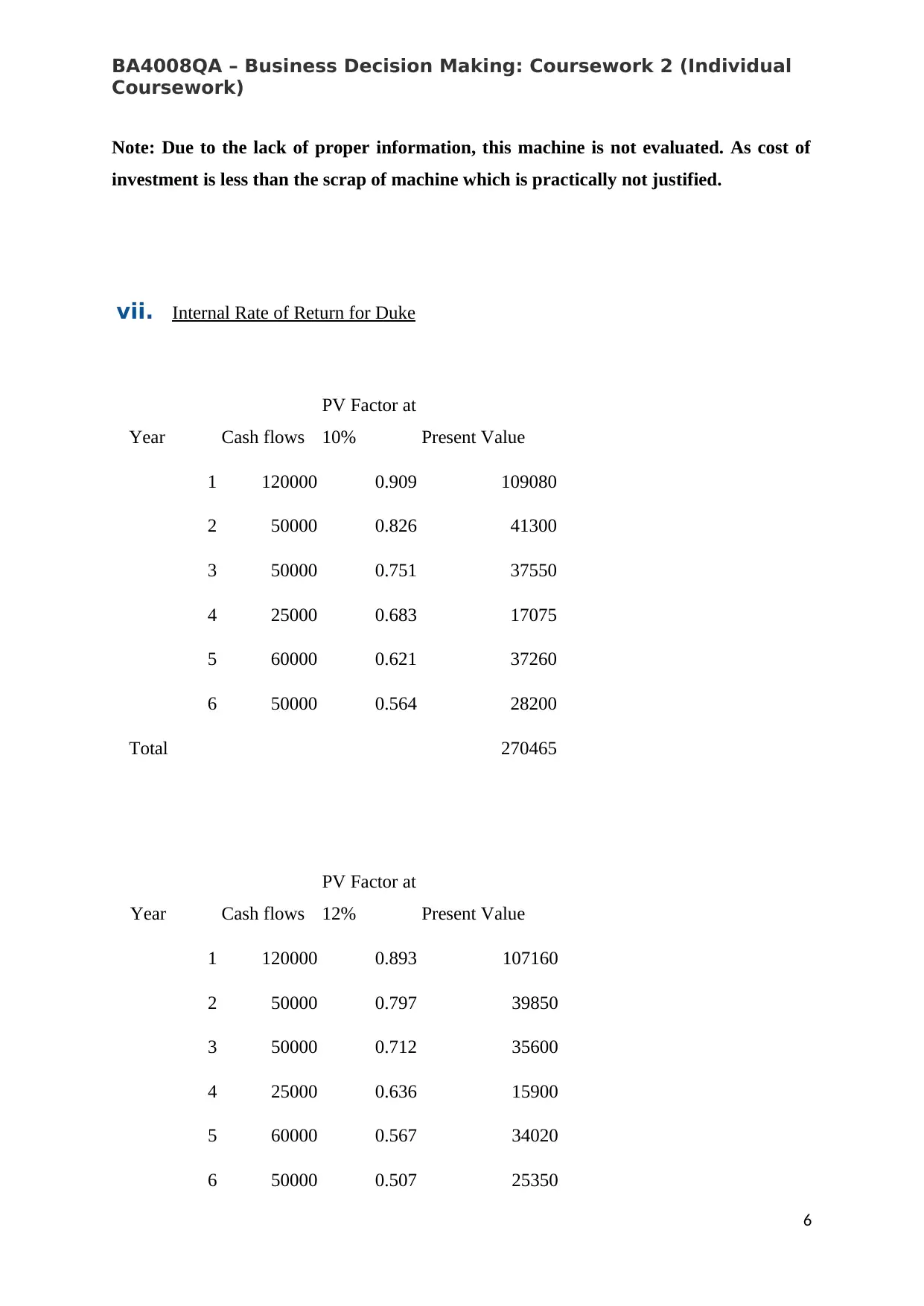

Note: Due to the lack of proper information, this machine is not evaluated. As cost of

investment is less than the scrap of machine which is practically not justified.

vii. Internal Rate of Return for Duke

Year Cash flows

PV Factor at

10% Present Value

1 120000 0.909 109080

2 50000 0.826 41300

3 50000 0.751 37550

4 25000 0.683 17075

5 60000 0.621 37260

6 50000 0.564 28200

Total 270465

Year Cash flows

PV Factor at

12% Present Value

1 120000 0.893 107160

2 50000 0.797 39850

3 50000 0.712 35600

4 25000 0.636 15900

5 60000 0.567 34020

6 50000 0.507 25350

6

Coursework)

Note: Due to the lack of proper information, this machine is not evaluated. As cost of

investment is less than the scrap of machine which is practically not justified.

vii. Internal Rate of Return for Duke

Year Cash flows

PV Factor at

10% Present Value

1 120000 0.909 109080

2 50000 0.826 41300

3 50000 0.751 37550

4 25000 0.683 17075

5 60000 0.621 37260

6 50000 0.564 28200

Total 270465

Year Cash flows

PV Factor at

12% Present Value

1 120000 0.893 107160

2 50000 0.797 39850

3 50000 0.712 35600

4 25000 0.636 15900

5 60000 0.567 34020

6 50000 0.507 25350

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

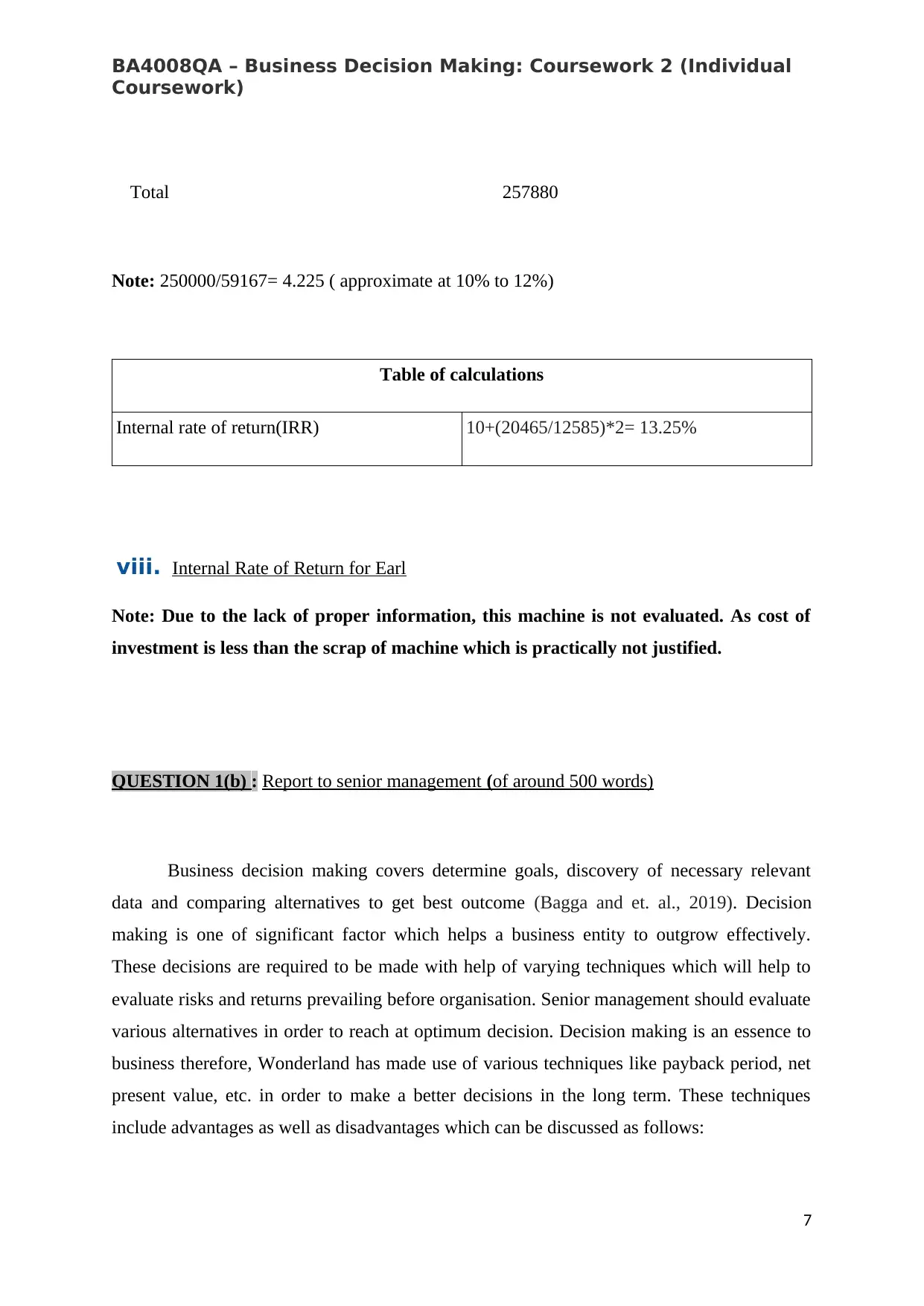

Total 257880

Note: 250000/59167= 4.225 ( approximate at 10% to 12%)

Table of calculations

Internal rate of return(IRR) 10+(20465/12585)*2= 13.25%

viii. Internal Rate of Return for Earl

Note: Due to the lack of proper information, this machine is not evaluated. As cost of

investment is less than the scrap of machine which is practically not justified.

QUESTION 1(b) : Report to senior management (of around 500 words)

Business decision making covers determine goals, discovery of necessary relevant

data and comparing alternatives to get best outcome (Bagga and et. al., 2019). Decision

making is one of significant factor which helps a business entity to outgrow effectively.

These decisions are required to be made with help of varying techniques which will help to

evaluate risks and returns prevailing before organisation. Senior management should evaluate

various alternatives in order to reach at optimum decision. Decision making is an essence to

business therefore, Wonderland has made use of various techniques like payback period, net

present value, etc. in order to make a better decisions in the long term. These techniques

include advantages as well as disadvantages which can be discussed as follows:

7

Coursework)

Total 257880

Note: 250000/59167= 4.225 ( approximate at 10% to 12%)

Table of calculations

Internal rate of return(IRR) 10+(20465/12585)*2= 13.25%

viii. Internal Rate of Return for Earl

Note: Due to the lack of proper information, this machine is not evaluated. As cost of

investment is less than the scrap of machine which is practically not justified.

QUESTION 1(b) : Report to senior management (of around 500 words)

Business decision making covers determine goals, discovery of necessary relevant

data and comparing alternatives to get best outcome (Bagga and et. al., 2019). Decision

making is one of significant factor which helps a business entity to outgrow effectively.

These decisions are required to be made with help of varying techniques which will help to

evaluate risks and returns prevailing before organisation. Senior management should evaluate

various alternatives in order to reach at optimum decision. Decision making is an essence to

business therefore, Wonderland has made use of various techniques like payback period, net

present value, etc. in order to make a better decisions in the long term. These techniques

include advantages as well as disadvantages which can be discussed as follows:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

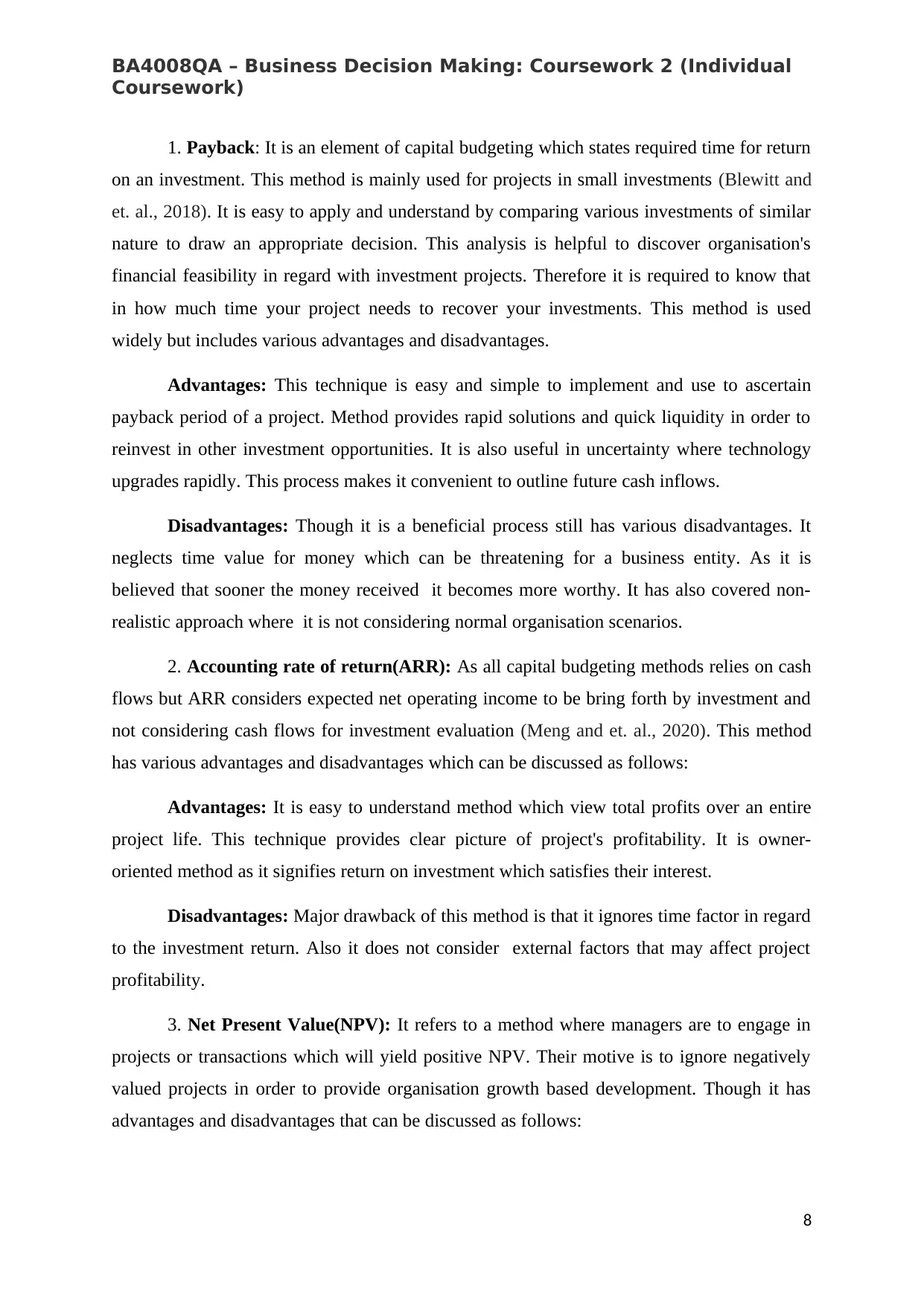

1. Payback: It is an element of capital budgeting which states required time for return

on an investment. This method is mainly used for projects in small investments (Blewitt and

et. al., 2018). It is easy to apply and understand by comparing various investments of similar

nature to draw an appropriate decision. This analysis is helpful to discover organisation's

financial feasibility in regard with investment projects. Therefore it is required to know that

in how much time your project needs to recover your investments. This method is used

widely but includes various advantages and disadvantages.

Advantages: This technique is easy and simple to implement and use to ascertain

payback period of a project. Method provides rapid solutions and quick liquidity in order to

reinvest in other investment opportunities. It is also useful in uncertainty where technology

upgrades rapidly. This process makes it convenient to outline future cash inflows.

Disadvantages: Though it is a beneficial process still has various disadvantages. It

neglects time value for money which can be threatening for a business entity. As it is

believed that sooner the money received it becomes more worthy. It has also covered non-

realistic approach where it is not considering normal organisation scenarios.

2. Accounting rate of return(ARR): As all capital budgeting methods relies on cash

flows but ARR considers expected net operating income to be bring forth by investment and

not considering cash flows for investment evaluation (Meng and et. al., 2020). This method

has various advantages and disadvantages which can be discussed as follows:

Advantages: It is easy to understand method which view total profits over an entire

project life. This technique provides clear picture of project's profitability. It is owner-

oriented method as it signifies return on investment which satisfies their interest.

Disadvantages: Major drawback of this method is that it ignores time factor in regard

to the investment return. Also it does not consider external factors that may affect project

profitability.

3. Net Present Value(NPV): It refers to a method where managers are to engage in

projects or transactions which will yield positive NPV. Their motive is to ignore negatively

valued projects in order to provide organisation growth based development. Though it has

advantages and disadvantages that can be discussed as follows:

8

Coursework)

1. Payback: It is an element of capital budgeting which states required time for return

on an investment. This method is mainly used for projects in small investments (Blewitt and

et. al., 2018). It is easy to apply and understand by comparing various investments of similar

nature to draw an appropriate decision. This analysis is helpful to discover organisation's

financial feasibility in regard with investment projects. Therefore it is required to know that

in how much time your project needs to recover your investments. This method is used

widely but includes various advantages and disadvantages.

Advantages: This technique is easy and simple to implement and use to ascertain

payback period of a project. Method provides rapid solutions and quick liquidity in order to

reinvest in other investment opportunities. It is also useful in uncertainty where technology

upgrades rapidly. This process makes it convenient to outline future cash inflows.

Disadvantages: Though it is a beneficial process still has various disadvantages. It

neglects time value for money which can be threatening for a business entity. As it is

believed that sooner the money received it becomes more worthy. It has also covered non-

realistic approach where it is not considering normal organisation scenarios.

2. Accounting rate of return(ARR): As all capital budgeting methods relies on cash

flows but ARR considers expected net operating income to be bring forth by investment and

not considering cash flows for investment evaluation (Meng and et. al., 2020). This method

has various advantages and disadvantages which can be discussed as follows:

Advantages: It is easy to understand method which view total profits over an entire

project life. This technique provides clear picture of project's profitability. It is owner-

oriented method as it signifies return on investment which satisfies their interest.

Disadvantages: Major drawback of this method is that it ignores time factor in regard

to the investment return. Also it does not consider external factors that may affect project

profitability.

3. Net Present Value(NPV): It refers to a method where managers are to engage in

projects or transactions which will yield positive NPV. Their motive is to ignore negatively

valued projects in order to provide organisation growth based development. Though it has

advantages and disadvantages that can be discussed as follows:

8

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

Advantages: This method is helpful in measuring risks involved in a project that

gives overall picture of it. Here, cash flows are not expected to be reinvested as it is in

method of internal rate of return.

Disadvantages: It is dependent on discount rates so even a little change can change

entire outcome. It is not useful for comparing differing size of projects therefore varying

projects are not compared here. It is based on estimations so it may result forecasting errors.

4. Internal rate of return(IRR): It is term of financial analysis which figure out

profitability of potential investment. It is discounting rate of return where Net present value is

equivalent to zero. This tool is useful in identifying most worthy project amongst various

alternatives.

Advantages: It is advantageous in measuring time value for money. This technique

gives each cash flow equal weight-age by considering all future years of cash flows. It has

easy as well as simple usage by comparing various projects. This method also diminishes use

of hurdle rate so the risk of determining wrong rate is eliminated.

Disadvantages: This method disregard the size of project while comparing projects

which may be unrealistic approach of equivalence. It also ignores recognition of reinvestment

rates. IRR furnish incomplete picture of future and struggles to keep up various cash flows.

QUESTION 1(c) : Decision and explanations (in around 200 words)

Various techniques of cost budgeting were executed in order to conclude most efficient

investment. These techniques is used to identify various factors in relevance with investment

in a project. In this manner most beneficial option can be adopted which will help an

organisation to increase its productivity in the long run.

Senior Management at Wonderland Plc has known that a strategy is needed in order to

replace old machine for its production department. Therefore, two machines namely, Duke

and Earl were evaluated in order to reach at an appropriate outcome. With the use of various

capital budgeting techniques, the company is advised to adopt machine Duke as the other

machine namely Earl does not contain appropriate content. As Earl has less cost of

investment and more scrap value of machine. Being practically it is not possible to have more

scrap value than cost of a machine. Therefore, by calculating payback, accounting rate of

9

Coursework)

Advantages: This method is helpful in measuring risks involved in a project that

gives overall picture of it. Here, cash flows are not expected to be reinvested as it is in

method of internal rate of return.

Disadvantages: It is dependent on discount rates so even a little change can change

entire outcome. It is not useful for comparing differing size of projects therefore varying

projects are not compared here. It is based on estimations so it may result forecasting errors.

4. Internal rate of return(IRR): It is term of financial analysis which figure out

profitability of potential investment. It is discounting rate of return where Net present value is

equivalent to zero. This tool is useful in identifying most worthy project amongst various

alternatives.

Advantages: It is advantageous in measuring time value for money. This technique

gives each cash flow equal weight-age by considering all future years of cash flows. It has

easy as well as simple usage by comparing various projects. This method also diminishes use

of hurdle rate so the risk of determining wrong rate is eliminated.

Disadvantages: This method disregard the size of project while comparing projects

which may be unrealistic approach of equivalence. It also ignores recognition of reinvestment

rates. IRR furnish incomplete picture of future and struggles to keep up various cash flows.

QUESTION 1(c) : Decision and explanations (in around 200 words)

Various techniques of cost budgeting were executed in order to conclude most efficient

investment. These techniques is used to identify various factors in relevance with investment

in a project. In this manner most beneficial option can be adopted which will help an

organisation to increase its productivity in the long run.

Senior Management at Wonderland Plc has known that a strategy is needed in order to

replace old machine for its production department. Therefore, two machines namely, Duke

and Earl were evaluated in order to reach at an appropriate outcome. With the use of various

capital budgeting techniques, the company is advised to adopt machine Duke as the other

machine namely Earl does not contain appropriate content. As Earl has less cost of

investment and more scrap value of machine. Being practically it is not possible to have more

scrap value than cost of a machine. Therefore, by calculating payback, accounting rate of

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

return, net present value and internal rate of return a conclusion can be drawn that the

company should replace its old machine with the Duke machine as it can be used in an

effective manner which will produce maximum as well as optimum outcome in favour of the

company.

TASK TWO

QUESTION 2(a): (Tesco plc performance and position)

Performance and position analysis is a discipline which includes organized observations

which enhance organisation's overall performance and amend its decision-making power.

Tesco being large supermarket chain headquartered in UK has made huge impact in retail

industry. It is one of fastest growing organisation in UK and also in various parts of world. It

has adopted effective strategic policies which helped to provide efficient and effective

performance outcome. It is holding unshakable position in the industry which means Tesco

grew from core to become one of market leader in current times. The organisation is

following some Key Performance Indicators(KPI) which will help to to outgrow even more.

These KPIs are profitability, increase sales, modify operating cash flows, customer

satisfaction, employees satisfaction and to develop trusted partners. Therefore its overall

performance analysis can be conducted on the basis of various accounting ratios as follows:

Gross profit margin: It is financial tool which is used to assess efficiency of

company's productivity. This ratio indicated company's productivity at managing its various

operations. It is based on cost of goods sold by company (Kotze and et. al., 2020). Being a

profitability ratio it is used to compare company's gross margin with its revenue. Tesco has

showed positive results in regard to its gross margin. It has increased margin to 6.5% in 2019

which is regarded as immense development in its strategic policy formulation.

Return on total assets: It is used to compare organisation's total assets with amount

of return is provided to its shareholders. It is referred as profitability ratio as it aims at

generating higher level of return by increasing its productivity. It is believed at higher the

return on total assets, the better it is. Tesla has been achieving target goals in order to sustain

10

Coursework)

return, net present value and internal rate of return a conclusion can be drawn that the

company should replace its old machine with the Duke machine as it can be used in an

effective manner which will produce maximum as well as optimum outcome in favour of the

company.

TASK TWO

QUESTION 2(a): (Tesco plc performance and position)

Performance and position analysis is a discipline which includes organized observations

which enhance organisation's overall performance and amend its decision-making power.

Tesco being large supermarket chain headquartered in UK has made huge impact in retail

industry. It is one of fastest growing organisation in UK and also in various parts of world. It

has adopted effective strategic policies which helped to provide efficient and effective

performance outcome. It is holding unshakable position in the industry which means Tesco

grew from core to become one of market leader in current times. The organisation is

following some Key Performance Indicators(KPI) which will help to to outgrow even more.

These KPIs are profitability, increase sales, modify operating cash flows, customer

satisfaction, employees satisfaction and to develop trusted partners. Therefore its overall

performance analysis can be conducted on the basis of various accounting ratios as follows:

Gross profit margin: It is financial tool which is used to assess efficiency of

company's productivity. This ratio indicated company's productivity at managing its various

operations. It is based on cost of goods sold by company (Kotze and et. al., 2020). Being a

profitability ratio it is used to compare company's gross margin with its revenue. Tesco has

showed positive results in regard to its gross margin. It has increased margin to 6.5% in 2019

which is regarded as immense development in its strategic policy formulation.

Return on total assets: It is used to compare organisation's total assets with amount

of return is provided to its shareholders. It is referred as profitability ratio as it aims at

generating higher level of return by increasing its productivity. It is believed at higher the

return on total assets, the better it is. Tesla has been achieving target goals in order to sustain

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

longer in market. It has provided optimum returns in the frequent years by reaching at

favourable place.

Return on capital employed: This ratio is determined to interpret company's

profitability as well as capital efficiency. It is generally used ratio by various financial

analysts, stakeholders as well as investors for making an investment in an organisation.

Tesco's return on capital employed is not much fluctuating in the given years. As it has

increasing trend in regard to rate of return. It performed well in financial terms by achieving

5.90% return in 2019.

Current ratio: It is used to analyse company's liquidity to pay back short term

liabilities or current liabilities in the given period of about a year. Tesco has decreasing trend

of current ratio which reflects that the company has low level of liquidity. It had 0.61:1 ratio

which is less as compared to ratio of 2018. Therefore it should develop optimum strategies

which will enable it to achieve appropriate liquidity level. The ratio suggested that

organisation has more debts than its assets.

Liquidity ratio: This ratio is considered as liquidity ratio because it evaluates

organisation's capacity to pay off its short term obligations (Ghenimi and et. al., 2020). It

includes both current ratio as well as quick ratio as they measures company's ability to repay

short term debt. Tesco being a largest retailer, has decrement in its liquidity ratio throughout

three years. This made company's liquidity position unstable in the industry. In order to

compete with heavy competition in industry it is required to overcome the shortage of

liquidity by applying effective policies and managing levels of assets and liabilities within the

organisation.

Efficiency ratios: These ratios are helpful in analysing company's effective use of

assets and liabilities in order to increase its efficiency (Lan and et. al., 2019). It is used to

measure company's performance in short term or at current. This would help organisation to

meet productivity levels and achieving profitability. Tesco has performed outstanding as per

its efficiency ratios as it reflected that the company is paying off its creditors in a while and

recovering from its debtors much quickly. This way company stands with more liquid funds

which will enable it to provide more effective and efficient results.

Gearing ratio: It is a financial tool which suggests comparison between owner's

equity to funds borrowed by the company (Siebert and et. al., 2018). It measures company's

11

Coursework)

longer in market. It has provided optimum returns in the frequent years by reaching at

favourable place.

Return on capital employed: This ratio is determined to interpret company's

profitability as well as capital efficiency. It is generally used ratio by various financial

analysts, stakeholders as well as investors for making an investment in an organisation.

Tesco's return on capital employed is not much fluctuating in the given years. As it has

increasing trend in regard to rate of return. It performed well in financial terms by achieving

5.90% return in 2019.

Current ratio: It is used to analyse company's liquidity to pay back short term

liabilities or current liabilities in the given period of about a year. Tesco has decreasing trend

of current ratio which reflects that the company has low level of liquidity. It had 0.61:1 ratio

which is less as compared to ratio of 2018. Therefore it should develop optimum strategies

which will enable it to achieve appropriate liquidity level. The ratio suggested that

organisation has more debts than its assets.

Liquidity ratio: This ratio is considered as liquidity ratio because it evaluates

organisation's capacity to pay off its short term obligations (Ghenimi and et. al., 2020). It

includes both current ratio as well as quick ratio as they measures company's ability to repay

short term debt. Tesco being a largest retailer, has decrement in its liquidity ratio throughout

three years. This made company's liquidity position unstable in the industry. In order to

compete with heavy competition in industry it is required to overcome the shortage of

liquidity by applying effective policies and managing levels of assets and liabilities within the

organisation.

Efficiency ratios: These ratios are helpful in analysing company's effective use of

assets and liabilities in order to increase its efficiency (Lan and et. al., 2019). It is used to

measure company's performance in short term or at current. This would help organisation to

meet productivity levels and achieving profitability. Tesco has performed outstanding as per

its efficiency ratios as it reflected that the company is paying off its creditors in a while and

recovering from its debtors much quickly. This way company stands with more liquid funds

which will enable it to provide more effective and efficient results.

Gearing ratio: It is a financial tool which suggests comparison between owner's

equity to funds borrowed by the company (Siebert and et. al., 2018). It measures company's

11

BA4008QA – Business Decision Making: Coursework 2 (Individual

Coursework)

financial leverage which tells how much it is being funded by shareholders and creditors.

This means the lower is ratio, company has more financial stability. Because higher ratio

means company has more borrowed funds as compared to owners funds. Tesco has proven its

efficiency by owning low borrowed funds as compared to owners funds. It has been

continuously improving its gearing ratios which reflects its high sustainability.

QUESTION 2(b): limitations in the use of accounting ratios

In regard to various accounting ratios, they reflected with various advantages but also

has limitations in reference to inflation in prices, operational changes, accounting policies and

various business conditions. Tesco has faced various ups and downs in regard to such ratios

which made it difficult for organisation to outgrow in market. Though the organisation has

performed well in regard to FTSE(Financial Times Stock Exchange) 100 in 2019. Its prices

were opened at approximate at £1.91 in December 2018 which a year later traded at £2.53.

therefore company hiked at increase of about more than 31% to those who did their trading

on time. Organisation had huge change in its trading price which reflected that it has

implemented adequate changes in its operations. As company was lacking at liquidity which

made it short in sources to pay back short term loans. This created negative impact on

company's performance, but it managed to modify its policies which give boost to company's

shares trading over FTSE platform. The organisation has used various accounting ratios

which provides historic results i.e. they are not based on practical base. Therefore Tesco

needs to improvise their use of traditional ratios which are not realistic as it is based on

assumptions over which organisation is operating. The base to be taken by organisation

should be more realistic than just being in the books. It should improvise its strategic

planning and evaluation of using techniques of accounting which will provide more accurate

results so that it would become easier to provide efficient and effective results to the

organisation in the long run.

QUESTION 2(c): (other factors affecting Tesco in 2019)

It is important for an organisation to improvise its performance on the basis of various factors

like gross profits, net profits, sales, etc. This way a company can compete with its

competitors in more effective manner. Tesco is operating on a large platform across the globe

12

Coursework)

financial leverage which tells how much it is being funded by shareholders and creditors.

This means the lower is ratio, company has more financial stability. Because higher ratio

means company has more borrowed funds as compared to owners funds. Tesco has proven its

efficiency by owning low borrowed funds as compared to owners funds. It has been

continuously improving its gearing ratios which reflects its high sustainability.

QUESTION 2(b): limitations in the use of accounting ratios

In regard to various accounting ratios, they reflected with various advantages but also

has limitations in reference to inflation in prices, operational changes, accounting policies and

various business conditions. Tesco has faced various ups and downs in regard to such ratios

which made it difficult for organisation to outgrow in market. Though the organisation has

performed well in regard to FTSE(Financial Times Stock Exchange) 100 in 2019. Its prices

were opened at approximate at £1.91 in December 2018 which a year later traded at £2.53.

therefore company hiked at increase of about more than 31% to those who did their trading

on time. Organisation had huge change in its trading price which reflected that it has

implemented adequate changes in its operations. As company was lacking at liquidity which

made it short in sources to pay back short term loans. This created negative impact on

company's performance, but it managed to modify its policies which give boost to company's

shares trading over FTSE platform. The organisation has used various accounting ratios

which provides historic results i.e. they are not based on practical base. Therefore Tesco

needs to improvise their use of traditional ratios which are not realistic as it is based on

assumptions over which organisation is operating. The base to be taken by organisation

should be more realistic than just being in the books. It should improvise its strategic

planning and evaluation of using techniques of accounting which will provide more accurate

results so that it would become easier to provide efficient and effective results to the

organisation in the long run.

QUESTION 2(c): (other factors affecting Tesco in 2019)

It is important for an organisation to improvise its performance on the basis of various factors

like gross profits, net profits, sales, etc. This way a company can compete with its

competitors in more effective manner. Tesco is operating on a large platform across the globe

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.