Business Decision Making: Financial Analysis for Genesis & Dreams Ltd

VerifiedAdded on 2023/01/05

|9

|1693

|49

Report

AI Summary

This report provides a financial analysis for Genesis & Dreams Ltd, a UK-based construction company, to aid in its business decision-making process regarding potential investment projects. The report calculates the payback period and Net Present Value (NPV) for two proposed projects: a Motor software project and a Hardware project. The payback period analysis determines the time required to recover the initial investment, recommending Project B with a shorter payback period. The NPV analysis evaluates the profitability of each project, recommending Project B due to its higher NPV. The report also analyzes the benefits and drawbacks of both methods and discusses the importance of considering financial factors such as interest rates and profit, as well as non-financial factors like legal and technological aspects, in the decision-making process. The conclusion emphasizes the importance of informed decision-making for business growth and recommends careful evaluation of all options by management. The report aims to provide recommendations for Genesis & Dreams Ltd based on the financial analysis conducted.

Business Decision

Making

Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction......................................................................................................................................3

Main body........................................................................................................................................3

1. Calculation of Pay Back Period ...............................................................................................3

2. Calculation of NPV..................................................................................................................4

3. Analysis....................................................................................................................................5

Conclusion.......................................................................................................................................7

REFERENCES................................................................................................................................8

Introduction......................................................................................................................................3

Main body........................................................................................................................................3

1. Calculation of Pay Back Period ...............................................................................................3

2. Calculation of NPV..................................................................................................................4

3. Analysis....................................................................................................................................5

Conclusion.......................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

The decision making process of business involves analysis of goals by gathering relevant

information by weighing the alternatives in order to make important decisions (Weygandt and

et.al., 2020). The importance of decision making for business is to reduce possibility of mistake

while accomplishing target goals of firm. This report is based on Genesis & Dreams Ltd which is

a construction company of UK. The management of firm wants to diversify their resources for

which they have been offered several business proposals. The objective of this report is to

provide recommendation to firm that which proposal is more beneficial to Genesis & Dreams

Ltd by evaluating pay back period and NPV.

MAIN BODY

1. Calculation of Pay Back Period

Payback period determines an amount of time that takes to recover the cost of

investment. It basically includes length of time an investment takes in order to reaches a break-

even point (Kimmel, Weygandt and Kieso, 2018). The analysis of two projects are:

Payback period:

Project A (Motor software

project)

Initial investment: £70,000

Year Cash flow Cumulative cash flow

1 18000 18000

2 16000 34000

3 19000 53000

4 22000 75000

5 37000 112000

Payback period: Year before recovery + amount to be recover/next years’ cash flow

The decision making process of business involves analysis of goals by gathering relevant

information by weighing the alternatives in order to make important decisions (Weygandt and

et.al., 2020). The importance of decision making for business is to reduce possibility of mistake

while accomplishing target goals of firm. This report is based on Genesis & Dreams Ltd which is

a construction company of UK. The management of firm wants to diversify their resources for

which they have been offered several business proposals. The objective of this report is to

provide recommendation to firm that which proposal is more beneficial to Genesis & Dreams

Ltd by evaluating pay back period and NPV.

MAIN BODY

1. Calculation of Pay Back Period

Payback period determines an amount of time that takes to recover the cost of

investment. It basically includes length of time an investment takes in order to reaches a break-

even point (Kimmel, Weygandt and Kieso, 2018). The analysis of two projects are:

Payback period:

Project A (Motor software

project)

Initial investment: £70,000

Year Cash flow Cumulative cash flow

1 18000 18000

2 16000 34000

3 19000 53000

4 22000 75000

5 37000 112000

Payback period: Year before recovery + amount to be recover/next years’ cash flow

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

= 3+ (70000-53000)/22000

= 3+17000/22000

= 3.77 or 3 years and 9 months.

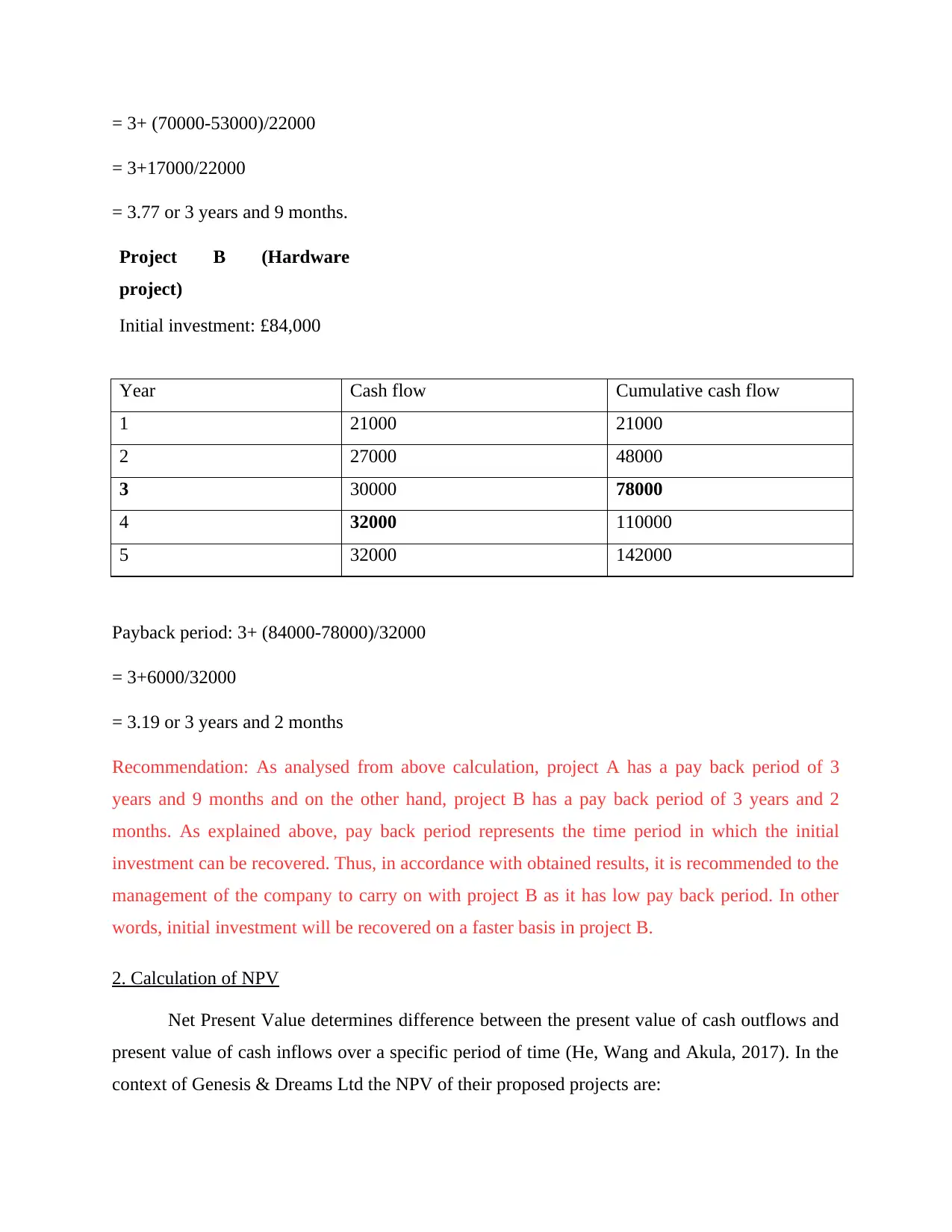

Project B (Hardware

project)

Initial investment: £84,000

Year Cash flow Cumulative cash flow

1 21000 21000

2 27000 48000

3 30000 78000

4 32000 110000

5 32000 142000

Payback period: 3+ (84000-78000)/32000

= 3+6000/32000

= 3.19 or 3 years and 2 months

Recommendation: As analysed from above calculation, project A has a pay back period of 3

years and 9 months and on the other hand, project B has a pay back period of 3 years and 2

months. As explained above, pay back period represents the time period in which the initial

investment can be recovered. Thus, in accordance with obtained results, it is recommended to the

management of the company to carry on with project B as it has low pay back period. In other

words, initial investment will be recovered on a faster basis in project B.

2. Calculation of NPV

Net Present Value determines difference between the present value of cash outflows and

present value of cash inflows over a specific period of time (He, Wang and Akula, 2017). In the

context of Genesis & Dreams Ltd the NPV of their proposed projects are:

= 3+17000/22000

= 3.77 or 3 years and 9 months.

Project B (Hardware

project)

Initial investment: £84,000

Year Cash flow Cumulative cash flow

1 21000 21000

2 27000 48000

3 30000 78000

4 32000 110000

5 32000 142000

Payback period: 3+ (84000-78000)/32000

= 3+6000/32000

= 3.19 or 3 years and 2 months

Recommendation: As analysed from above calculation, project A has a pay back period of 3

years and 9 months and on the other hand, project B has a pay back period of 3 years and 2

months. As explained above, pay back period represents the time period in which the initial

investment can be recovered. Thus, in accordance with obtained results, it is recommended to the

management of the company to carry on with project B as it has low pay back period. In other

words, initial investment will be recovered on a faster basis in project B.

2. Calculation of NPV

Net Present Value determines difference between the present value of cash outflows and

present value of cash inflows over a specific period of time (He, Wang and Akula, 2017). In the

context of Genesis & Dreams Ltd the NPV of their proposed projects are:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

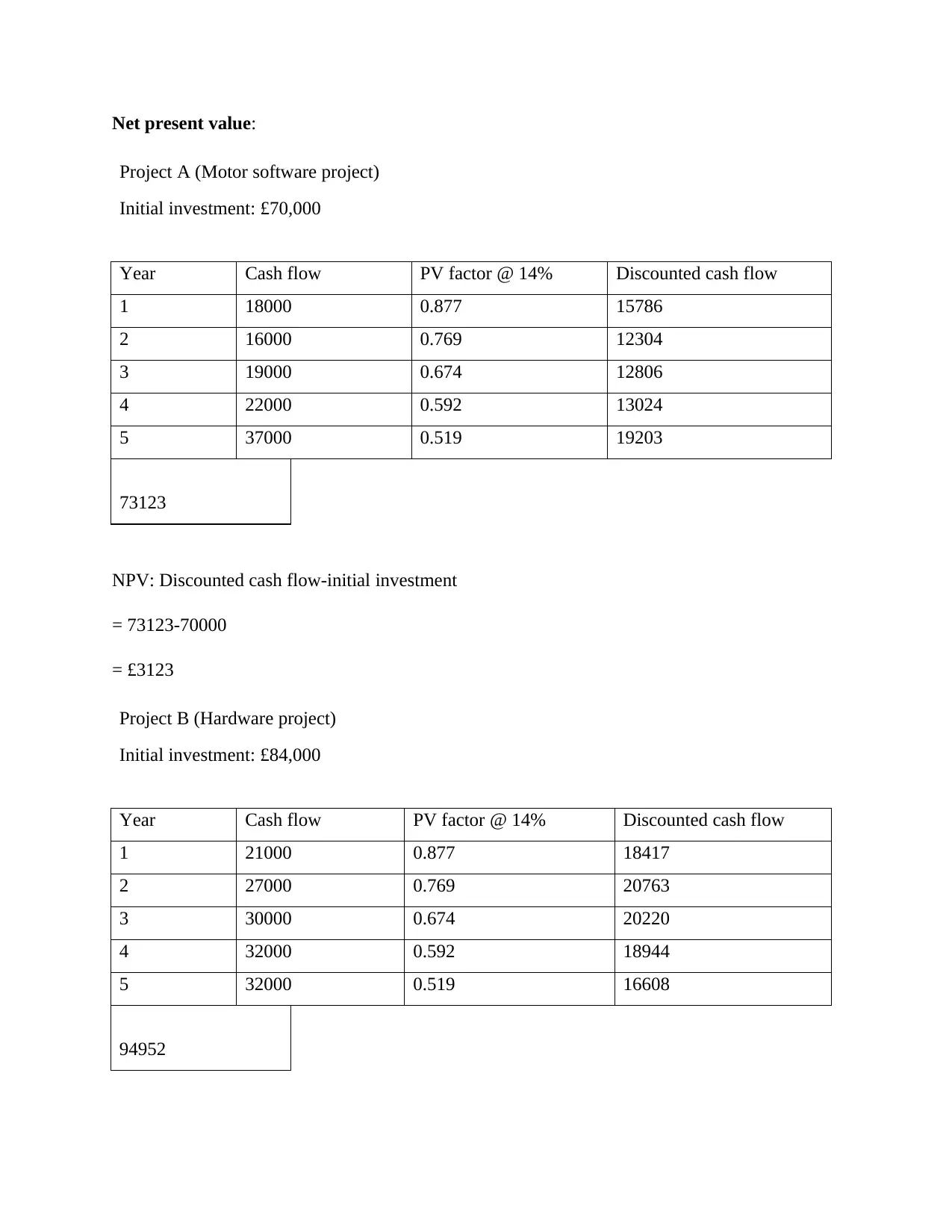

Net present value:

Project A (Motor software project)

Initial investment: £70,000

Year Cash flow PV factor @ 14% Discounted cash flow

1 18000 0.877 15786

2 16000 0.769 12304

3 19000 0.674 12806

4 22000 0.592 13024

5 37000 0.519 19203

73123

NPV: Discounted cash flow-initial investment

= 73123-70000

= £3123

Project B (Hardware project)

Initial investment: £84,000

Year Cash flow PV factor @ 14% Discounted cash flow

1 21000 0.877 18417

2 27000 0.769 20763

3 30000 0.674 20220

4 32000 0.592 18944

5 32000 0.519 16608

94952

Project A (Motor software project)

Initial investment: £70,000

Year Cash flow PV factor @ 14% Discounted cash flow

1 18000 0.877 15786

2 16000 0.769 12304

3 19000 0.674 12806

4 22000 0.592 13024

5 37000 0.519 19203

73123

NPV: Discounted cash flow-initial investment

= 73123-70000

= £3123

Project B (Hardware project)

Initial investment: £84,000

Year Cash flow PV factor @ 14% Discounted cash flow

1 21000 0.877 18417

2 27000 0.769 20763

3 30000 0.674 20220

4 32000 0.592 18944

5 32000 0.519 16608

94952

NPV: 94952-84000

= £10952

Recommendation: Net present value is an index of possible profitability of proposed projects and

it is a known fact, that higher the NPV, higher will the profitability index of proposed project. In

given case, project A and project B has net present vale of £3123 and £10952, respectively.

Therefore, it is recommended to the management that they should opt for project B due to the

reason that it has higher net present value.

3. Analysis

The benefits and drawbacks of the payback period and NPV

On the basis of above analysis, it has been summarised that Pay back period and NPV are

two most effective methods that may help an organisation to make effective decisions based on

their future targets. These methods can be appropriate for firm based on its requirements and

targets as:

Pay Back Period is a most effective method that may help Genesis & Dreams Ltd in

revealing the payback period of an investment (Kimmel, Weygandt and Kieso, 2018). Major

benefit of this approach is that it is simple to use and easy to understand. On the other hand,

major drawback of this approach for firm could be ignorance of value for time and money.

Furthermore, NPV is used to evaluate the time value of money that helps the

management to make better decisions. Major advantage of this method for firm that it provides

unambiguous measures to firm. On the other hand, major disadvantages of implementing this is

to initially select a discount rate and make decision according to this.

Financial/non-financial factors

For Genesis & Dreams Ltd, it is required to analyse financial and non-financial factors

that may have a direct impact over the operational and functional activities of firm. Thus, it is

needed for firm to segregate all the factors by analysing its effective need for firm as:

Interest rate is a financial factor which associate an amount that charged by lender for the

uses of their assets. Interest rates are basically determined in the form of percentage of the

= £10952

Recommendation: Net present value is an index of possible profitability of proposed projects and

it is a known fact, that higher the NPV, higher will the profitability index of proposed project. In

given case, project A and project B has net present vale of £3123 and £10952, respectively.

Therefore, it is recommended to the management that they should opt for project B due to the

reason that it has higher net present value.

3. Analysis

The benefits and drawbacks of the payback period and NPV

On the basis of above analysis, it has been summarised that Pay back period and NPV are

two most effective methods that may help an organisation to make effective decisions based on

their future targets. These methods can be appropriate for firm based on its requirements and

targets as:

Pay Back Period is a most effective method that may help Genesis & Dreams Ltd in

revealing the payback period of an investment (Kimmel, Weygandt and Kieso, 2018). Major

benefit of this approach is that it is simple to use and easy to understand. On the other hand,

major drawback of this approach for firm could be ignorance of value for time and money.

Furthermore, NPV is used to evaluate the time value of money that helps the

management to make better decisions. Major advantage of this method for firm that it provides

unambiguous measures to firm. On the other hand, major disadvantages of implementing this is

to initially select a discount rate and make decision according to this.

Financial/non-financial factors

For Genesis & Dreams Ltd, it is required to analyse financial and non-financial factors

that may have a direct impact over the operational and functional activities of firm. Thus, it is

needed for firm to segregate all the factors by analysing its effective need for firm as:

Interest rate is a financial factor which associate an amount that charged by lender for the

uses of their assets. Interest rates are basically determined in the form of percentage of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

principal. The nature of such practices are based on a specific time period as while it noted on

annual basis, it determines as Annual Percentage Rate of a specific amount. If in given projects,

there is certain kind of interest involved than it will have to be taken in consideration in process

of calculating pay back period and also net present value. Interest amount is a cost that is

associated with the asset or project itself. Therefore, it becomes essential to take this amount in

consideration in process of evaluating feasibility of various alternatives of investment available.

Profit is also known as financial factor that recognize in the form of benefit or revenue

which earned by an organisation after conducting its business activities. Profit of a firm is

basically evaluated as the exceed amount over the cost, expenses and taxes. This is one essential

factor which help to pay all the returns and rewards to the employees. Sometimes profit is taken

as only yardstick of measuring the feasibility of a proposed project, this can lead to ignoring of

some other vital factors, such as, time period of profitability, cash flows, etc., therefore, it is

important to consider every element.

Non-Financial factors are those that has a direct impact over the business decision

making.

Legal factors determine rules and regulation which are determined by government of a

country. For an organisation it is required to implement all the regulation appropriately in order

to comply the legal practices in the firm. Main factors that contains tax liabilities, intellectual

property rights, import and export duty and so on. To consider this factor at the time of

evaluating the project feasibility is important as there may be a project which is successful in

every financial aspect but it is very difficult to comply with all legal formalities those are

applicable on the project. Thus, it is important to consider even non financial measures at the

time of evaluating alternatives of project.

Technological factors are most crucial aspects that impact directly upon business decision

making (Bennun and et.al., 2018). As nowadays, each and every organisation implements digital

practices in their business workings. Main reason behind this is to resolve issues of time and cost

because advancement of technology assist in providing appropriate solution to firm within a very

small duration. These kind of factors enhance quality of work as well as improves business

productivity. A business should consider this factor as well during the process of decision

making as if some out dated technology is used in the project, that surely it will lead to low cost

annual basis, it determines as Annual Percentage Rate of a specific amount. If in given projects,

there is certain kind of interest involved than it will have to be taken in consideration in process

of calculating pay back period and also net present value. Interest amount is a cost that is

associated with the asset or project itself. Therefore, it becomes essential to take this amount in

consideration in process of evaluating feasibility of various alternatives of investment available.

Profit is also known as financial factor that recognize in the form of benefit or revenue

which earned by an organisation after conducting its business activities. Profit of a firm is

basically evaluated as the exceed amount over the cost, expenses and taxes. This is one essential

factor which help to pay all the returns and rewards to the employees. Sometimes profit is taken

as only yardstick of measuring the feasibility of a proposed project, this can lead to ignoring of

some other vital factors, such as, time period of profitability, cash flows, etc., therefore, it is

important to consider every element.

Non-Financial factors are those that has a direct impact over the business decision

making.

Legal factors determine rules and regulation which are determined by government of a

country. For an organisation it is required to implement all the regulation appropriately in order

to comply the legal practices in the firm. Main factors that contains tax liabilities, intellectual

property rights, import and export duty and so on. To consider this factor at the time of

evaluating the project feasibility is important as there may be a project which is successful in

every financial aspect but it is very difficult to comply with all legal formalities those are

applicable on the project. Thus, it is important to consider even non financial measures at the

time of evaluating alternatives of project.

Technological factors are most crucial aspects that impact directly upon business decision

making (Bennun and et.al., 2018). As nowadays, each and every organisation implements digital

practices in their business workings. Main reason behind this is to resolve issues of time and cost

because advancement of technology assist in providing appropriate solution to firm within a very

small duration. These kind of factors enhance quality of work as well as improves business

productivity. A business should consider this factor as well during the process of decision

making as if some out dated technology is used in the project, that surely it will lead to low cost

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

but also to failure in a very updated technological environment. Thus, its I required for an

organisation to effectively implement technological practices that can assist them in attaining

target objectives within desired time period.

CONCLUSION

Form the above report it has been summarised that for an organisation it is required to

make appropriate decision after analysing situation and targets based on future growth. Thus, in

context of a business, effective decisions play an essential role that may help in reducing

possibility uncertain errors. In this regard, managers and leaders of a firm are responsible to

review all the possible options by evaluating their potential outcomes.

organisation to effectively implement technological practices that can assist them in attaining

target objectives within desired time period.

CONCLUSION

Form the above report it has been summarised that for an organisation it is required to

make appropriate decision after analysing situation and targets based on future growth. Thus, in

context of a business, effective decisions play an essential role that may help in reducing

possibility uncertain errors. In this regard, managers and leaders of a firm are responsible to

review all the possible options by evaluating their potential outcomes.

REFERENCES

Books & Journals

Weygandt, J.J. and et.al., 2020. Managerial Accounting: Tools for Business Decision-Making.

John Wiley & Sons.

Kimmel, P.D., Weygandt, J.J. and Kieso, D.E., 2018. Financial accounting: Tools for business

decision making. John Wiley & Sons.

He, W., Wang, F.K. and Akula, V., 2017. Managing extracted knowledge from big social media

data for business decision making. Journal of Knowledge Management.

Kimmel, P.D., Weygandt, J.J. and Kieso, D.E., 2018. Accounting: Tools for business decision

making. John Wiley & Sons.

Bennun, L. and et.al., 2018. The value of the IUCN Red List for business decision‐

making. Conservation Letters. 11(1). p.e12353.

Books & Journals

Weygandt, J.J. and et.al., 2020. Managerial Accounting: Tools for Business Decision-Making.

John Wiley & Sons.

Kimmel, P.D., Weygandt, J.J. and Kieso, D.E., 2018. Financial accounting: Tools for business

decision making. John Wiley & Sons.

He, W., Wang, F.K. and Akula, V., 2017. Managing extracted knowledge from big social media

data for business decision making. Journal of Knowledge Management.

Kimmel, P.D., Weygandt, J.J. and Kieso, D.E., 2018. Accounting: Tools for business decision

making. John Wiley & Sons.

Bennun, L. and et.al., 2018. The value of the IUCN Red List for business decision‐

making. Conservation Letters. 11(1). p.e12353.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.