Analysis of Business Decision Making: Genesis & Dreams Ltd Report

VerifiedAdded on 2023/01/06

|8

|1431

|83

Report

AI Summary

This report provides a comprehensive analysis of business decision-making, focusing on a case study of Genesis & Dreams Ltd, a construction company in the UK. It begins with an introduction to the importance of effective decision-making in business, followed by a detailed examination of financial metrics such as payback period and Net Present Value (NPV) to evaluate investment projects. The report includes calculations for payback periods and NPV for two projects, with recommendations based on the financial outcomes. Furthermore, it explores both financial and non-financial factors that influence business decisions, including the size of the firm, liabilities, and the experience of the firm. Non-financial factors such as government laws, interest rates, and ease of doing business are also discussed. The report concludes with a summary of the key findings and the importance of considering all these factors for making informed business decisions. This analysis aims to aid in strategic planning and financial management for the company.

Business Decision-

Making

Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................1

MAIN BODY...................................................................................................................................1

Calculation of payback period and NPV.....................................................................................1

Analysis of financial and non-financial factors that aids decision making-................................3

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................5

INTRODUCTION ..........................................................................................................................1

MAIN BODY...................................................................................................................................1

Calculation of payback period and NPV.....................................................................................1

Analysis of financial and non-financial factors that aids decision making-................................3

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................5

INTRODUCTION

Decision making is a vital part of business as it has to take several decisions in its day to

day working as well as for specific problems. If it is correctly made it can help a business grow

and prosper as well as it has the power to demolish the firm if not rightly taken (Ballesteros and

Kunreuther, 2018). In this report there is a description about a firm that is Genesis & Dreams Ltd

which is a construction company in the UK. This report covers topics such as NPV, payback

period, and financial & non-financial factors.

MAIN BODY

Calculation of payback period and NPV

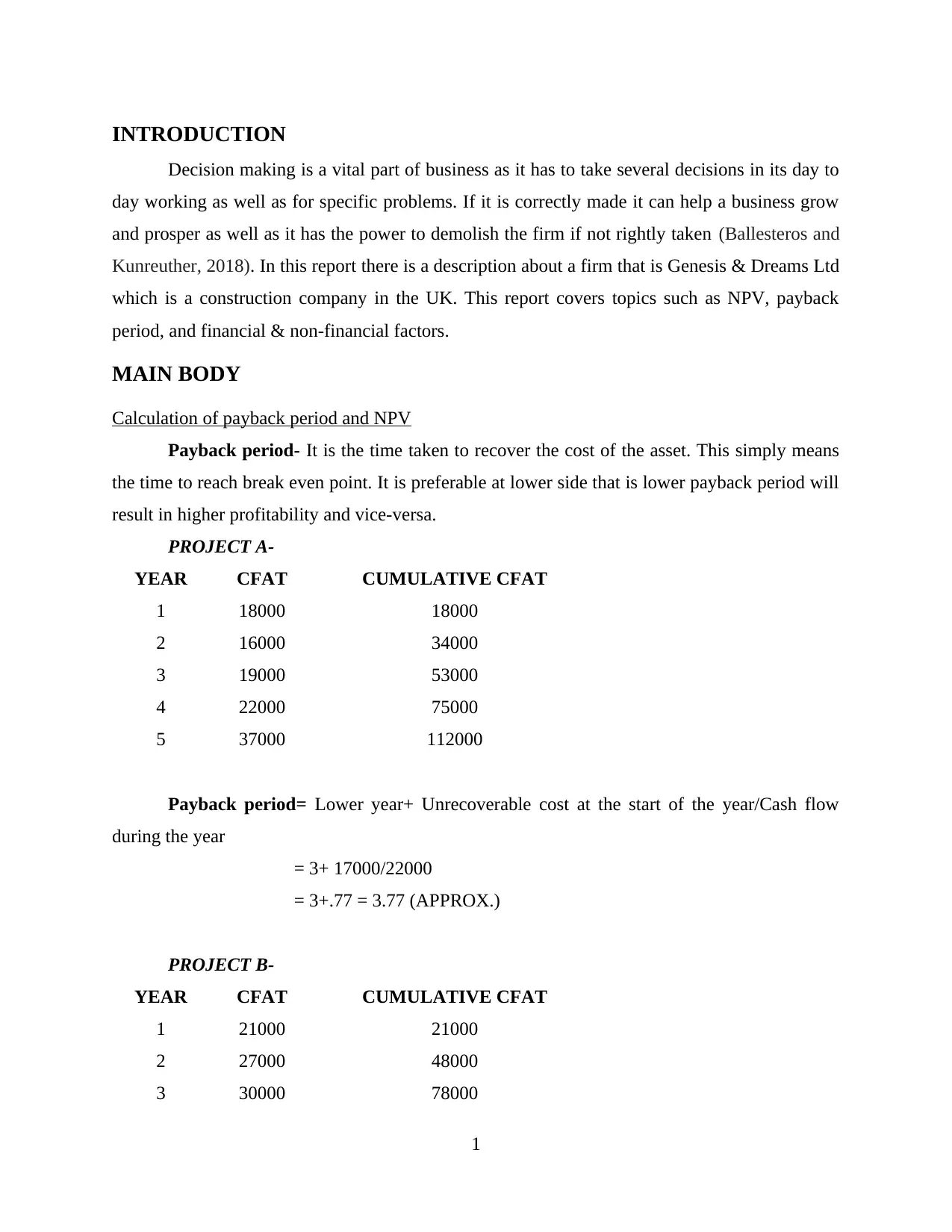

Payback period- It is the time taken to recover the cost of the asset. This simply means

the time to reach break even point. It is preferable at lower side that is lower payback period will

result in higher profitability and vice-versa.

PROJECT A-

YEAR CFAT CUMULATIVE CFAT

1 18000 18000

2 16000 34000

3 19000 53000

4 22000 75000

5 37000 112000

Payback period= Lower year+ Unrecoverable cost at the start of the year/Cash flow

during the year

= 3+ 17000/22000

= 3+.77 = 3.77 (APPROX.)

PROJECT B-

YEAR CFAT CUMULATIVE CFAT

1 21000 21000

2 27000 48000

3 30000 78000

1

Decision making is a vital part of business as it has to take several decisions in its day to

day working as well as for specific problems. If it is correctly made it can help a business grow

and prosper as well as it has the power to demolish the firm if not rightly taken (Ballesteros and

Kunreuther, 2018). In this report there is a description about a firm that is Genesis & Dreams Ltd

which is a construction company in the UK. This report covers topics such as NPV, payback

period, and financial & non-financial factors.

MAIN BODY

Calculation of payback period and NPV

Payback period- It is the time taken to recover the cost of the asset. This simply means

the time to reach break even point. It is preferable at lower side that is lower payback period will

result in higher profitability and vice-versa.

PROJECT A-

YEAR CFAT CUMULATIVE CFAT

1 18000 18000

2 16000 34000

3 19000 53000

4 22000 75000

5 37000 112000

Payback period= Lower year+ Unrecoverable cost at the start of the year/Cash flow

during the year

= 3+ 17000/22000

= 3+.77 = 3.77 (APPROX.)

PROJECT B-

YEAR CFAT CUMULATIVE CFAT

1 21000 21000

2 27000 48000

3 30000 78000

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

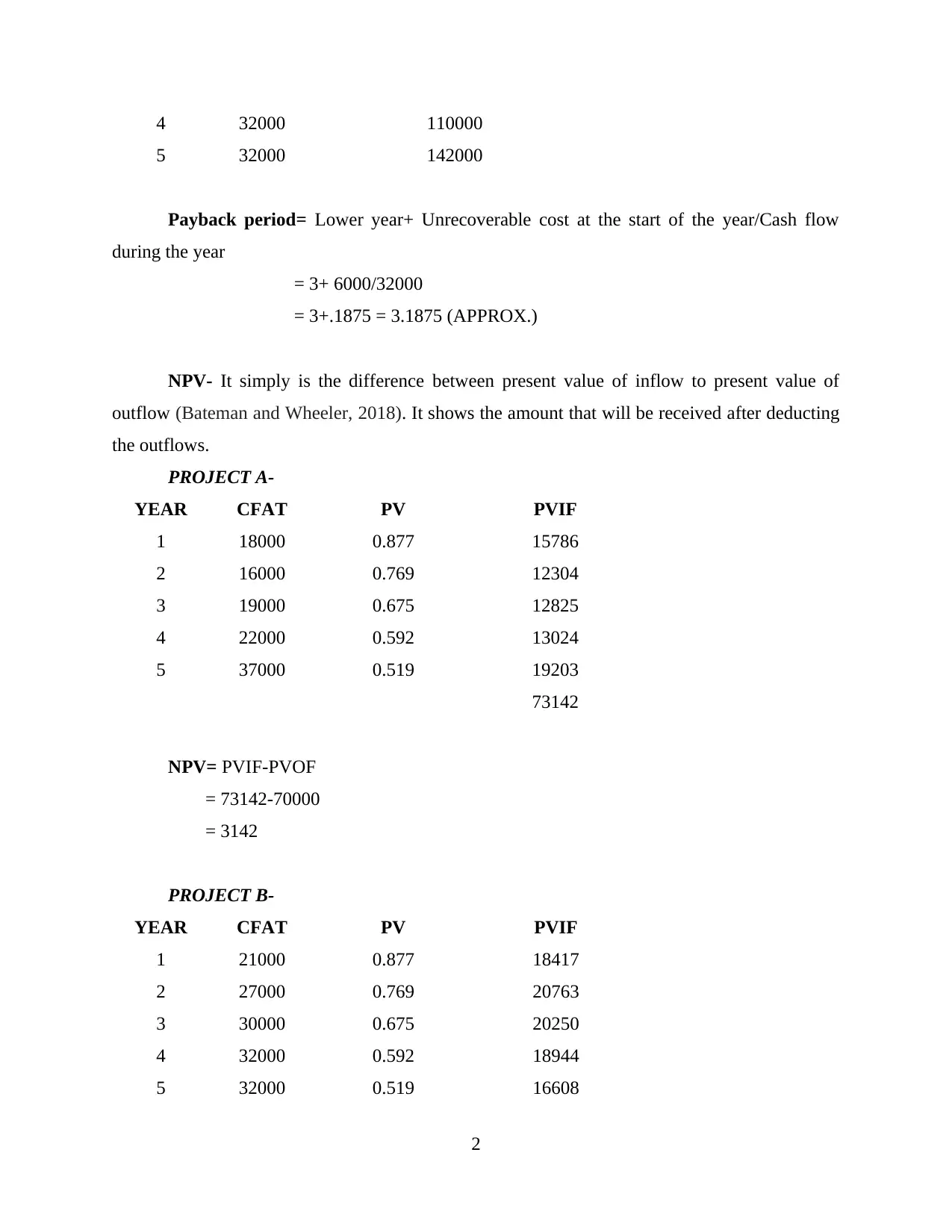

4 32000 110000

5 32000 142000

Payback period= Lower year+ Unrecoverable cost at the start of the year/Cash flow

during the year

= 3+ 6000/32000

= 3+.1875 = 3.1875 (APPROX.)

NPV- It simply is the difference between present value of inflow to present value of

outflow (Bateman and Wheeler, 2018). It shows the amount that will be received after deducting

the outflows.

PROJECT A-

YEAR CFAT PV PVIF

1 18000 0.877 15786

2 16000 0.769 12304

3 19000 0.675 12825

4 22000 0.592 13024

5 37000 0.519 19203

73142

NPV= PVIF-PVOF

= 73142-70000

= 3142

PROJECT B-

YEAR CFAT PV PVIF

1 21000 0.877 18417

2 27000 0.769 20763

3 30000 0.675 20250

4 32000 0.592 18944

5 32000 0.519 16608

2

5 32000 142000

Payback period= Lower year+ Unrecoverable cost at the start of the year/Cash flow

during the year

= 3+ 6000/32000

= 3+.1875 = 3.1875 (APPROX.)

NPV- It simply is the difference between present value of inflow to present value of

outflow (Bateman and Wheeler, 2018). It shows the amount that will be received after deducting

the outflows.

PROJECT A-

YEAR CFAT PV PVIF

1 18000 0.877 15786

2 16000 0.769 12304

3 19000 0.675 12825

4 22000 0.592 13024

5 37000 0.519 19203

73142

NPV= PVIF-PVOF

= 73142-70000

= 3142

PROJECT B-

YEAR CFAT PV PVIF

1 21000 0.877 18417

2 27000 0.769 20763

3 30000 0.675 20250

4 32000 0.592 18944

5 32000 0.519 16608

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

94982

NPV= PVIF-PVOF

= 94982-84000

= 10982

Where, CFAT= Cash flow after tax

PV= Present value that is 14%

PVIF= Present value of inflow

PVOF= Present value of outflow

RECOMMENDATION- It is recommended from the above that in the payback period

of both the projects the variation is not much but there is high difference of return that can be

seen in NPV so it can be seen from that PROJECT B is profitable for the company.

Analysis of financial and non-financial factors that aids decision making-

Financial factors- Financial factors or it can be termed as internal factors which aid in

decision making are those which affects the decision of the firm that is related to it financially. It

can be the asset structure of the company, its size and nature, its liabilities, cost and the return

that it would give and the risk involved with it, experience of the firm in the related market, etc.

A business has to take these decisions accordingly so that it would add to its growth, prosperity,

and profitability rather than being a reason of its downfall (Hvastová, 2016). The main factors

are explained briefly below- Size of the firm- It affects the decision making of a company because decisions are taken

on the basis on its size if a company is large it will take its decisions accordingly and if a

firm is of small size it will decide its factors in accordance with it. Genesis and Dreams

Ltd is a construction company and has a vast area to be covered in its working so it is

very important for it to take decisions in accordance with it so that it could be helpful in

the working of it. Liabilities- They are very important aspect of any company as it is the driving force and

interprets the doing of a business. If they are large in number it can result in a firm being

too risky and vice versa (Jeble, Kumari and Patil, 2017). As Genesis and Dreams Ltd is a

construction company and has to take liability to meet its credit requirements but it

3

NPV= PVIF-PVOF

= 94982-84000

= 10982

Where, CFAT= Cash flow after tax

PV= Present value that is 14%

PVIF= Present value of inflow

PVOF= Present value of outflow

RECOMMENDATION- It is recommended from the above that in the payback period

of both the projects the variation is not much but there is high difference of return that can be

seen in NPV so it can be seen from that PROJECT B is profitable for the company.

Analysis of financial and non-financial factors that aids decision making-

Financial factors- Financial factors or it can be termed as internal factors which aid in

decision making are those which affects the decision of the firm that is related to it financially. It

can be the asset structure of the company, its size and nature, its liabilities, cost and the return

that it would give and the risk involved with it, experience of the firm in the related market, etc.

A business has to take these decisions accordingly so that it would add to its growth, prosperity,

and profitability rather than being a reason of its downfall (Hvastová, 2016). The main factors

are explained briefly below- Size of the firm- It affects the decision making of a company because decisions are taken

on the basis on its size if a company is large it will take its decisions accordingly and if a

firm is of small size it will decide its factors in accordance with it. Genesis and Dreams

Ltd is a construction company and has a vast area to be covered in its working so it is

very important for it to take decisions in accordance with it so that it could be helpful in

the working of it. Liabilities- They are very important aspect of any company as it is the driving force and

interprets the doing of a business. If they are large in number it can result in a firm being

too risky and vice versa (Jeble, Kumari and Patil, 2017). As Genesis and Dreams Ltd is a

construction company and has to take liability to meet its credit requirements but it

3

should take decisions very carefully and must involve lot of research and analysis so that

liability should not become a burden which can have adverse consequences on the firm.

Experience of the firm- It plays a vital role as many decisions can easily be taken if a

company is established for a long time. Due to this a firm knows cause and effect of

many things which can help it in the present as well as the future. Genesis and Dreams

Ltd is a construction company which is established since long with a good market share

in hand can use its experience as a plus point in its decision making as it can help to take

a lot of decisions on that behalf (Kashyap, 2018).

Non-financial factors- These are those factors which are not directly related to the

business but they does possess a important part in determined the well being of the firm. It can

be government rules and regulations, policies and procedures, interest rates, ease of doing

business, stability of the government, laws, etc. A firm must study all these factors so that they

would be beneficial for the company and increase in its return and profitability. Some important

non financial factors are explained below- Government laws- They are very important as it can be a deciding factor in operation and

non-operation of a business. Genesis and Dreams Ltd must follow all the laws and must

abide by that so it would be benefited by it. Interest rate- It is an integral part of as it can govern the profitability of the product and

services. Genesis and Dreams Ltd can do research and analysis about the rate of interest

and then decide accordingly about the things that has to be changed so that it could be

helpful for the firm (Nykänen, Järvenpää and Teittinen, 2016).

Ease of doing business- Ease of entry and exit in the market and the subsidies provided

can be major aspect in it. Genesis and Dreams Ltd is well established and have a lot of

expertise knowledge so it can take decisions for it accordingly so that it can be benefited

by it.

CONCLUSION

From the above discussion it can be concluded that business decision making is a process

of taking decision about a normal day to day activity or a specific thing. Decision making

include two types of factors that are financial and non-financial. Financial factors includes major

part like size, nature, rate, etc. of a company. Non- financial includes government laws, rules and

4

liability should not become a burden which can have adverse consequences on the firm.

Experience of the firm- It plays a vital role as many decisions can easily be taken if a

company is established for a long time. Due to this a firm knows cause and effect of

many things which can help it in the present as well as the future. Genesis and Dreams

Ltd is a construction company which is established since long with a good market share

in hand can use its experience as a plus point in its decision making as it can help to take

a lot of decisions on that behalf (Kashyap, 2018).

Non-financial factors- These are those factors which are not directly related to the

business but they does possess a important part in determined the well being of the firm. It can

be government rules and regulations, policies and procedures, interest rates, ease of doing

business, stability of the government, laws, etc. A firm must study all these factors so that they

would be beneficial for the company and increase in its return and profitability. Some important

non financial factors are explained below- Government laws- They are very important as it can be a deciding factor in operation and

non-operation of a business. Genesis and Dreams Ltd must follow all the laws and must

abide by that so it would be benefited by it. Interest rate- It is an integral part of as it can govern the profitability of the product and

services. Genesis and Dreams Ltd can do research and analysis about the rate of interest

and then decide accordingly about the things that has to be changed so that it could be

helpful for the firm (Nykänen, Järvenpää and Teittinen, 2016).

Ease of doing business- Ease of entry and exit in the market and the subsidies provided

can be major aspect in it. Genesis and Dreams Ltd is well established and have a lot of

expertise knowledge so it can take decisions for it accordingly so that it can be benefited

by it.

CONCLUSION

From the above discussion it can be concluded that business decision making is a process

of taking decision about a normal day to day activity or a specific thing. Decision making

include two types of factors that are financial and non-financial. Financial factors includes major

part like size, nature, rate, etc. of a company. Non- financial includes government laws, rules and

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

regulations, policy and procedures, stability aspect, etc. There are many techniques that can be

used in the above calculation and the used techniques are payback period and NPV.

5

used in the above calculation and the used techniques are payback period and NPV.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and journals

Ballesteros, L. and Kunreuther, H., 2018. Organizational decision making under uncertainty

shocks (No. w24924). National Bureau of Economic Research.

Bateman, I. and Wheeler, B. W., 2018. Bringing Health and the Environment into Decision-

Making: The Natural Capital Approach.

Hvastová, J., 2016. Exploring Ethical Decision Making in Business Management. Quality-

Access to Success. 17(155).

Jeble, S., Kumari, S. and Patil, Y., 2017. Role of big data in decision making. Operations and

Supply Chain Management: An International Journal. 11(1). pp.36-44.

Kashyap, P., 2018. Machine Learning for Decision Makers: Cognitive Computing Fundamentals

for Better Decision Making. Apress.

Nykänen, E., Järvenpää, M. and Teittinen, H., 2016. Business intelligence in decision making in

Finnish enterprises. Nordic journal of business. 65.

6

Books and journals

Ballesteros, L. and Kunreuther, H., 2018. Organizational decision making under uncertainty

shocks (No. w24924). National Bureau of Economic Research.

Bateman, I. and Wheeler, B. W., 2018. Bringing Health and the Environment into Decision-

Making: The Natural Capital Approach.

Hvastová, J., 2016. Exploring Ethical Decision Making in Business Management. Quality-

Access to Success. 17(155).

Jeble, S., Kumari, S. and Patil, Y., 2017. Role of big data in decision making. Operations and

Supply Chain Management: An International Journal. 11(1). pp.36-44.

Kashyap, P., 2018. Machine Learning for Decision Makers: Cognitive Computing Fundamentals

for Better Decision Making. Apress.

Nykänen, E., Järvenpää, M. and Teittinen, H., 2016. Business intelligence in decision making in

Finnish enterprises. Nordic journal of business. 65.

6

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.