Business Economics: Impact of Inflation, Deflation & Brexit on Europe

VerifiedAdded on 2023/04/21

|11

|1940

|407

Report

AI Summary

This report examines the effects of inflation, deflation, and Brexit on the European economy, focusing on the Eurozone. It begins by defining inflation and its calculation within the Euro area, highlighting the advantages and disadvantages of high inflation rates. It then explores the challenges posed by deflation, including decreased consumer spending and increased debt burdens, while also discussing the measures taken by the European Central Bank (ECB) to maintain the target inflation level. Finally, the report analyzes the economic consequences of Brexit, noting its impact on the UK's growth rate, inflation, and trade, contrasting it with the performance of the Euro area. The analysis draws upon various sources, including newspaper articles, journal publications, and websites like Euromonitor and Eurostat, to provide a comprehensive overview of these interconnected economic issues.

Running head: BUSINESS ECONOMICS

Business economics

Name of the student

Name of the University

Author note

Business economics

Name of the student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

BUSINESS ECONOMICS

Table of Contents

Answer 1....................................................................................................................................2

Answer 2....................................................................................................................................3

Answer 3....................................................................................................................................5

Reference list and bibliography.................................................................................................7

BUSINESS ECONOMICS

Table of Contents

Answer 1....................................................................................................................................2

Answer 2....................................................................................................................................3

Answer 3....................................................................................................................................5

Reference list and bibliography.................................................................................................7

2

BUSINESS ECONOMICS

Answer 1

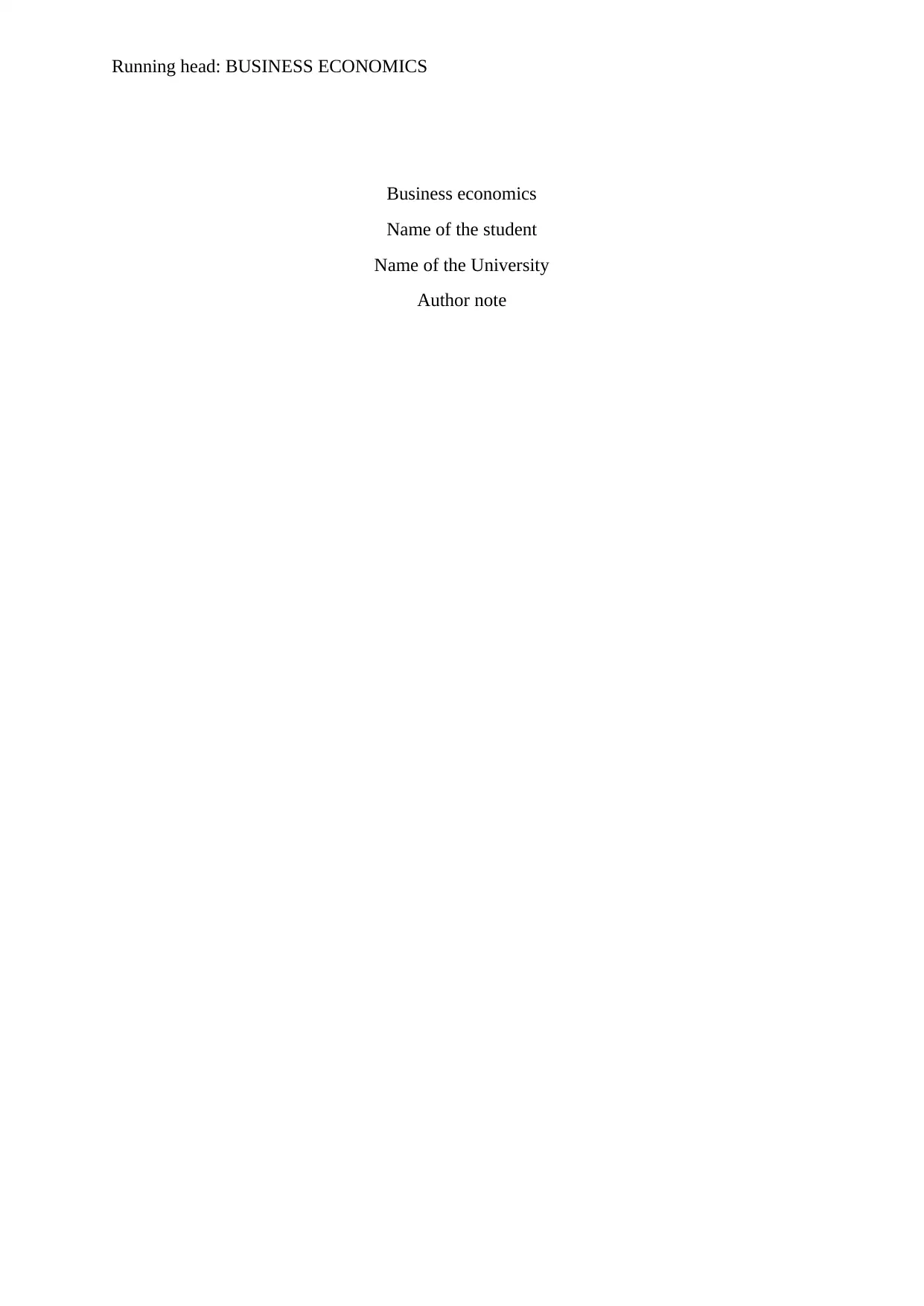

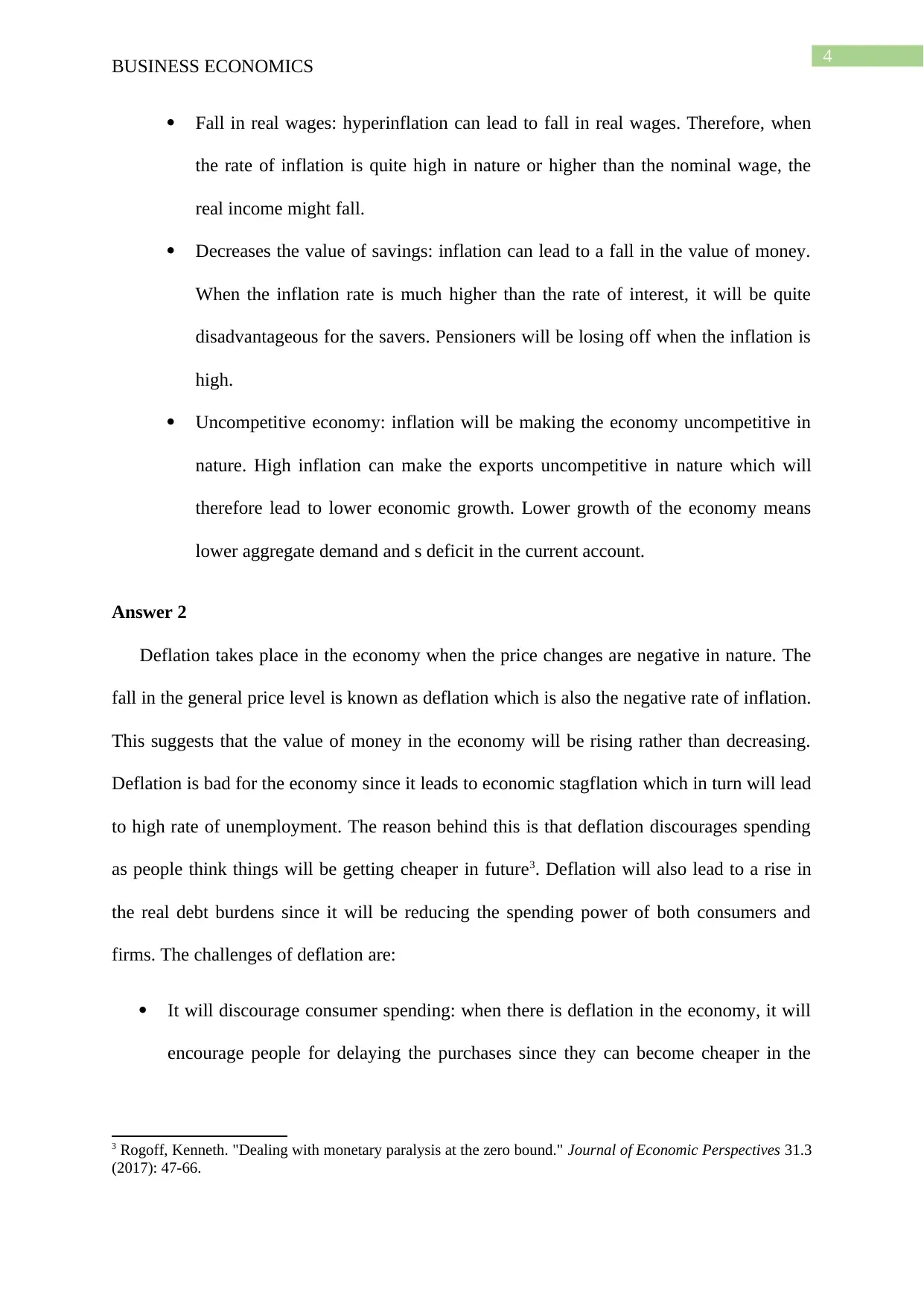

Inflation is known as the quantitative measure of the rate where the price level of a

basket of commodities along with the services of an economy goes up over a period of time.

In the Euro area, the inflation is measured by the Harmonised Index of the Consumer Prices.

The main work of the European Central Bank is to see that the price is stable in nature which

means the rate of inflation should be below 2% over the medium term. The European Central

Bank Consumer Price Index in the year of 2018 is known to be 10.94%. inflation is the terms

used when there is rise in the prices of both goods as well as services1.

Figure 1 Inflation in Europe

There are several advantages as well as disadvantages of inflation in the economy. The

advantages of inflation are as follows:

1 Braun, Benjamin. "Speaking to the people? Money, trust, and central bank legitimacy in the age of quantitative

easing." Review of International Political Economy 23.6 (2016): 1064-1092.

BUSINESS ECONOMICS

Answer 1

Inflation is known as the quantitative measure of the rate where the price level of a

basket of commodities along with the services of an economy goes up over a period of time.

In the Euro area, the inflation is measured by the Harmonised Index of the Consumer Prices.

The main work of the European Central Bank is to see that the price is stable in nature which

means the rate of inflation should be below 2% over the medium term. The European Central

Bank Consumer Price Index in the year of 2018 is known to be 10.94%. inflation is the terms

used when there is rise in the prices of both goods as well as services1.

Figure 1 Inflation in Europe

There are several advantages as well as disadvantages of inflation in the economy. The

advantages of inflation are as follows:

1 Braun, Benjamin. "Speaking to the people? Money, trust, and central bank legitimacy in the age of quantitative

easing." Review of International Political Economy 23.6 (2016): 1064-1092.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

BUSINESS ECONOMICS

It boosts growth: when the rate of inflation is very low in nature, the economy will be

in a recession. When the rate of inflation will be high, it will lead to an increase in the

economic growth.

Adjustment of the wages: inflation can also make the adjustment of wages possible.

Moderate rate of inflation makes it much easier for adjusting the rate of inflation to

the relative wages and therefore help in increasing the wages of the productive

workers. when the rate od inflation will be zero, there can be real wage

unemployment where firms will not be able to attract workers.

Rise in employment: according to the most of the economist’s inflation can lead to

rise in employment2. The increasing unemployment therefore can be fought with the

increased inflation. The inverse relation between inflation and unemployment can be

defined with the help of Philips Curve. It can be therefore said that rise in inflation

will lead to rise in employment as the economy will be no longer experiencing

recession.

Preventing paradox of Thrift: inflation is very necessary for preventing the paradox

the thrift. Paradox of thrift will result in reduction of aggregate demand, less

production, increasing layoffs along with faltering economy. Therefore, inflation can

help in preventing paradox of thrift.

Inflation can become quite problematic in nature when the rate will be increasing

above two percent. High rate of inflation can be a serious issue where hyperinflation can

also wipe away people’s savings. The disadvantages of inflation are as follows:

2 Rogoff, Kenneth. "Dealing with monetary paralysis at the zero bound." Journal of Economic Perspectives 31.3

(2017): 47-66.

BUSINESS ECONOMICS

It boosts growth: when the rate of inflation is very low in nature, the economy will be

in a recession. When the rate of inflation will be high, it will lead to an increase in the

economic growth.

Adjustment of the wages: inflation can also make the adjustment of wages possible.

Moderate rate of inflation makes it much easier for adjusting the rate of inflation to

the relative wages and therefore help in increasing the wages of the productive

workers. when the rate od inflation will be zero, there can be real wage

unemployment where firms will not be able to attract workers.

Rise in employment: according to the most of the economist’s inflation can lead to

rise in employment2. The increasing unemployment therefore can be fought with the

increased inflation. The inverse relation between inflation and unemployment can be

defined with the help of Philips Curve. It can be therefore said that rise in inflation

will lead to rise in employment as the economy will be no longer experiencing

recession.

Preventing paradox of Thrift: inflation is very necessary for preventing the paradox

the thrift. Paradox of thrift will result in reduction of aggregate demand, less

production, increasing layoffs along with faltering economy. Therefore, inflation can

help in preventing paradox of thrift.

Inflation can become quite problematic in nature when the rate will be increasing

above two percent. High rate of inflation can be a serious issue where hyperinflation can

also wipe away people’s savings. The disadvantages of inflation are as follows:

2 Rogoff, Kenneth. "Dealing with monetary paralysis at the zero bound." Journal of Economic Perspectives 31.3

(2017): 47-66.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

BUSINESS ECONOMICS

Fall in real wages: hyperinflation can lead to fall in real wages. Therefore, when

the rate of inflation is quite high in nature or higher than the nominal wage, the

real income might fall.

Decreases the value of savings: inflation can lead to a fall in the value of money.

When the inflation rate is much higher than the rate of interest, it will be quite

disadvantageous for the savers. Pensioners will be losing off when the inflation is

high.

Uncompetitive economy: inflation will be making the economy uncompetitive in

nature. High inflation can make the exports uncompetitive in nature which will

therefore lead to lower economic growth. Lower growth of the economy means

lower aggregate demand and s deficit in the current account.

Answer 2

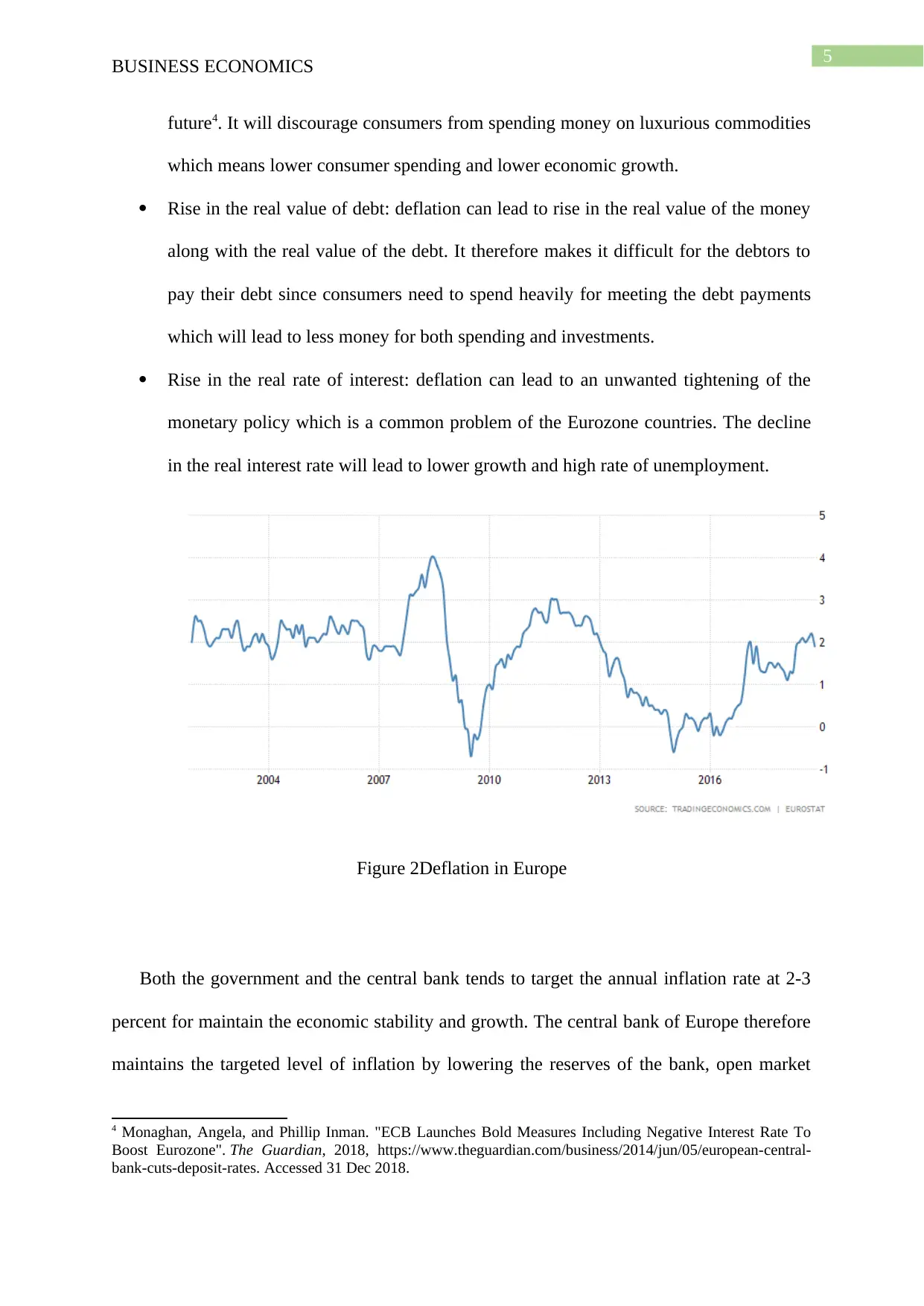

Deflation takes place in the economy when the price changes are negative in nature. The

fall in the general price level is known as deflation which is also the negative rate of inflation.

This suggests that the value of money in the economy will be rising rather than decreasing.

Deflation is bad for the economy since it leads to economic stagflation which in turn will lead

to high rate of unemployment. The reason behind this is that deflation discourages spending

as people think things will be getting cheaper in future3. Deflation will also lead to a rise in

the real debt burdens since it will be reducing the spending power of both consumers and

firms. The challenges of deflation are:

It will discourage consumer spending: when there is deflation in the economy, it will

encourage people for delaying the purchases since they can become cheaper in the

3 Rogoff, Kenneth. "Dealing with monetary paralysis at the zero bound." Journal of Economic Perspectives 31.3

(2017): 47-66.

BUSINESS ECONOMICS

Fall in real wages: hyperinflation can lead to fall in real wages. Therefore, when

the rate of inflation is quite high in nature or higher than the nominal wage, the

real income might fall.

Decreases the value of savings: inflation can lead to a fall in the value of money.

When the inflation rate is much higher than the rate of interest, it will be quite

disadvantageous for the savers. Pensioners will be losing off when the inflation is

high.

Uncompetitive economy: inflation will be making the economy uncompetitive in

nature. High inflation can make the exports uncompetitive in nature which will

therefore lead to lower economic growth. Lower growth of the economy means

lower aggregate demand and s deficit in the current account.

Answer 2

Deflation takes place in the economy when the price changes are negative in nature. The

fall in the general price level is known as deflation which is also the negative rate of inflation.

This suggests that the value of money in the economy will be rising rather than decreasing.

Deflation is bad for the economy since it leads to economic stagflation which in turn will lead

to high rate of unemployment. The reason behind this is that deflation discourages spending

as people think things will be getting cheaper in future3. Deflation will also lead to a rise in

the real debt burdens since it will be reducing the spending power of both consumers and

firms. The challenges of deflation are:

It will discourage consumer spending: when there is deflation in the economy, it will

encourage people for delaying the purchases since they can become cheaper in the

3 Rogoff, Kenneth. "Dealing with monetary paralysis at the zero bound." Journal of Economic Perspectives 31.3

(2017): 47-66.

5

BUSINESS ECONOMICS

future4. It will discourage consumers from spending money on luxurious commodities

which means lower consumer spending and lower economic growth.

Rise in the real value of debt: deflation can lead to rise in the real value of the money

along with the real value of the debt. It therefore makes it difficult for the debtors to

pay their debt since consumers need to spend heavily for meeting the debt payments

which will lead to less money for both spending and investments.

Rise in the real rate of interest: deflation can lead to an unwanted tightening of the

monetary policy which is a common problem of the Eurozone countries. The decline

in the real interest rate will lead to lower growth and high rate of unemployment.

Figure 2Deflation in Europe

Both the government and the central bank tends to target the annual inflation rate at 2-3

percent for maintain the economic stability and growth. The central bank of Europe therefore

maintains the targeted level of inflation by lowering the reserves of the bank, open market

4 Monaghan, Angela, and Phillip Inman. "ECB Launches Bold Measures Including Negative Interest Rate To

Boost Eurozone". The Guardian, 2018, https://www.theguardian.com/business/2014/jun/05/european-central-

bank-cuts-deposit-rates. Accessed 31 Dec 2018.

BUSINESS ECONOMICS

future4. It will discourage consumers from spending money on luxurious commodities

which means lower consumer spending and lower economic growth.

Rise in the real value of debt: deflation can lead to rise in the real value of the money

along with the real value of the debt. It therefore makes it difficult for the debtors to

pay their debt since consumers need to spend heavily for meeting the debt payments

which will lead to less money for both spending and investments.

Rise in the real rate of interest: deflation can lead to an unwanted tightening of the

monetary policy which is a common problem of the Eurozone countries. The decline

in the real interest rate will lead to lower growth and high rate of unemployment.

Figure 2Deflation in Europe

Both the government and the central bank tends to target the annual inflation rate at 2-3

percent for maintain the economic stability and growth. The central bank of Europe therefore

maintains the targeted level of inflation by lowering the reserves of the bank, open market

4 Monaghan, Angela, and Phillip Inman. "ECB Launches Bold Measures Including Negative Interest Rate To

Boost Eurozone". The Guardian, 2018, https://www.theguardian.com/business/2014/jun/05/european-central-

bank-cuts-deposit-rates. Accessed 31 Dec 2018.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

BUSINESS ECONOMICS

operations, lowering the interest rates and increasing the government spending5. When the

rate of interest went down, the President of The European Central Bank announced €400bn

worth of loans for the eurozone banks in order to boost lending for the small business 6. The

bank also cut its financing rate to 0.15 percent from 0.25 percent to maintain the targeted

level of inflation. The bank had also stopped funding directly to the financial system via

quantitative easing.

Answer 3

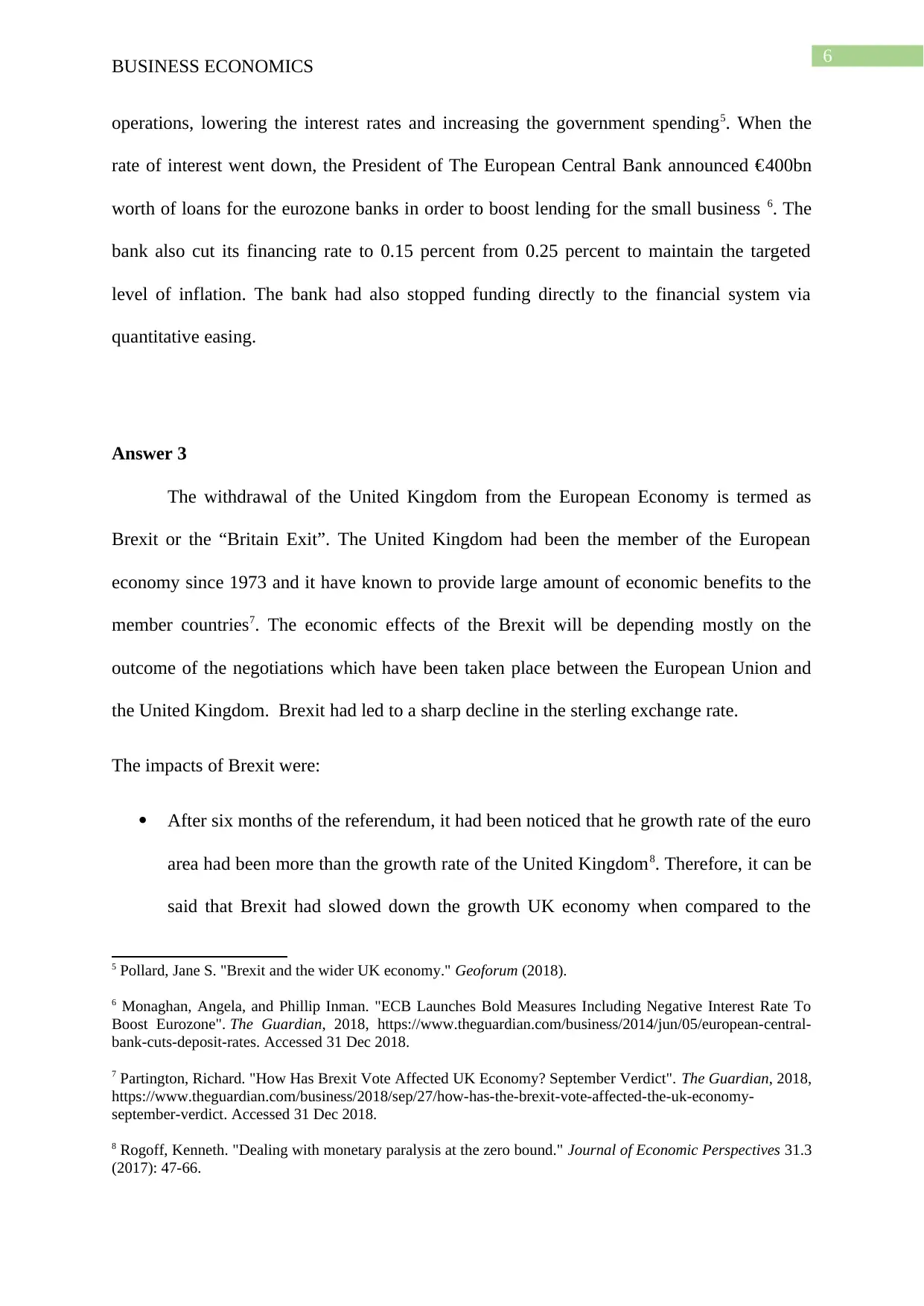

The withdrawal of the United Kingdom from the European Economy is termed as

Brexit or the “Britain Exit”. The United Kingdom had been the member of the European

economy since 1973 and it have known to provide large amount of economic benefits to the

member countries7. The economic effects of the Brexit will be depending mostly on the

outcome of the negotiations which have been taken place between the European Union and

the United Kingdom. Brexit had led to a sharp decline in the sterling exchange rate.

The impacts of Brexit were:

After six months of the referendum, it had been noticed that he growth rate of the euro

area had been more than the growth rate of the United Kingdom8. Therefore, it can be

said that Brexit had slowed down the growth UK economy when compared to the

5 Pollard, Jane S. "Brexit and the wider UK economy." Geoforum (2018).

6 Monaghan, Angela, and Phillip Inman. "ECB Launches Bold Measures Including Negative Interest Rate To

Boost Eurozone". The Guardian, 2018, https://www.theguardian.com/business/2014/jun/05/european-central-

bank-cuts-deposit-rates. Accessed 31 Dec 2018.

7 Partington, Richard. "How Has Brexit Vote Affected UK Economy? September Verdict". The Guardian, 2018,

https://www.theguardian.com/business/2018/sep/27/how-has-the-brexit-vote-affected-the-uk-economy-

september-verdict. Accessed 31 Dec 2018.

8 Rogoff, Kenneth. "Dealing with monetary paralysis at the zero bound." Journal of Economic Perspectives 31.3

(2017): 47-66.

BUSINESS ECONOMICS

operations, lowering the interest rates and increasing the government spending5. When the

rate of interest went down, the President of The European Central Bank announced €400bn

worth of loans for the eurozone banks in order to boost lending for the small business 6. The

bank also cut its financing rate to 0.15 percent from 0.25 percent to maintain the targeted

level of inflation. The bank had also stopped funding directly to the financial system via

quantitative easing.

Answer 3

The withdrawal of the United Kingdom from the European Economy is termed as

Brexit or the “Britain Exit”. The United Kingdom had been the member of the European

economy since 1973 and it have known to provide large amount of economic benefits to the

member countries7. The economic effects of the Brexit will be depending mostly on the

outcome of the negotiations which have been taken place between the European Union and

the United Kingdom. Brexit had led to a sharp decline in the sterling exchange rate.

The impacts of Brexit were:

After six months of the referendum, it had been noticed that he growth rate of the euro

area had been more than the growth rate of the United Kingdom8. Therefore, it can be

said that Brexit had slowed down the growth UK economy when compared to the

5 Pollard, Jane S. "Brexit and the wider UK economy." Geoforum (2018).

6 Monaghan, Angela, and Phillip Inman. "ECB Launches Bold Measures Including Negative Interest Rate To

Boost Eurozone". The Guardian, 2018, https://www.theguardian.com/business/2014/jun/05/european-central-

bank-cuts-deposit-rates. Accessed 31 Dec 2018.

7 Partington, Richard. "How Has Brexit Vote Affected UK Economy? September Verdict". The Guardian, 2018,

https://www.theguardian.com/business/2018/sep/27/how-has-the-brexit-vote-affected-the-uk-economy-

september-verdict. Accessed 31 Dec 2018.

8 Rogoff, Kenneth. "Dealing with monetary paralysis at the zero bound." Journal of Economic Perspectives 31.3

(2017): 47-66.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

BUSINESS ECONOMICS

euro area. There had been also a loss in the terms of trade in both the cases impacting

the exchange rate of the pounds.

Figure 3 Growth rate of UK and Euro area

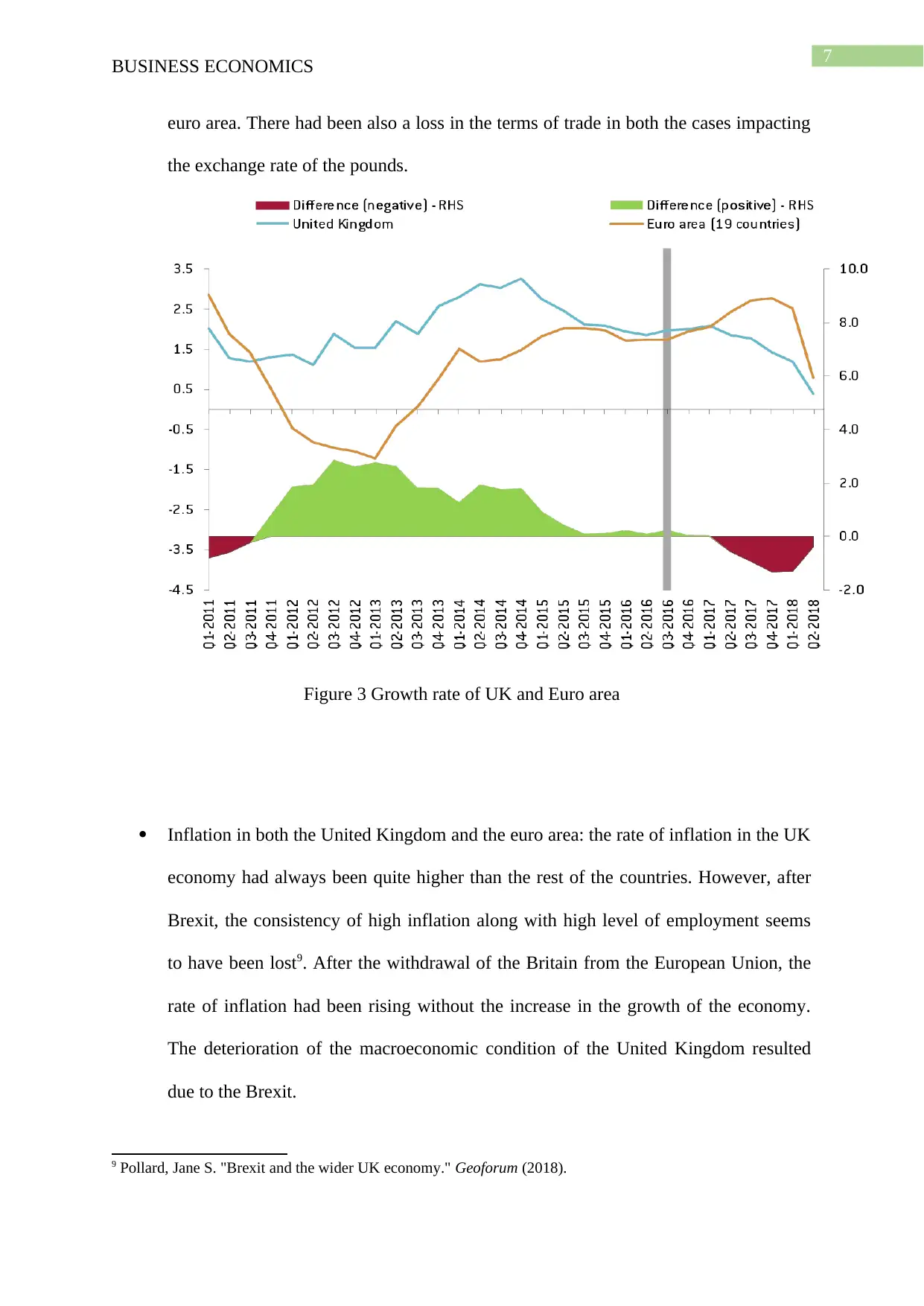

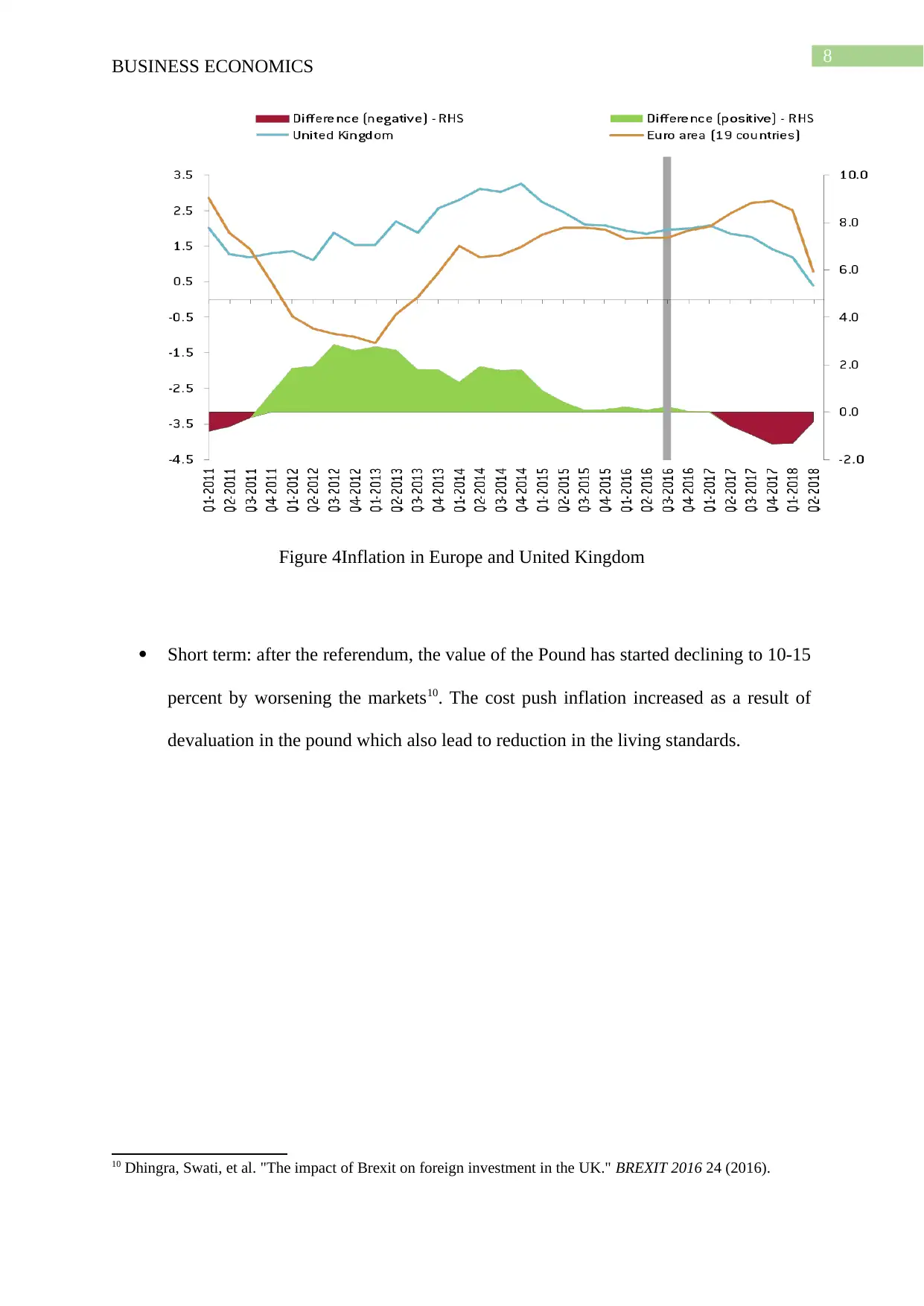

Inflation in both the United Kingdom and the euro area: the rate of inflation in the UK

economy had always been quite higher than the rest of the countries. However, after

Brexit, the consistency of high inflation along with high level of employment seems

to have been lost9. After the withdrawal of the Britain from the European Union, the

rate of inflation had been rising without the increase in the growth of the economy.

The deterioration of the macroeconomic condition of the United Kingdom resulted

due to the Brexit.

9 Pollard, Jane S. "Brexit and the wider UK economy." Geoforum (2018).

BUSINESS ECONOMICS

euro area. There had been also a loss in the terms of trade in both the cases impacting

the exchange rate of the pounds.

Figure 3 Growth rate of UK and Euro area

Inflation in both the United Kingdom and the euro area: the rate of inflation in the UK

economy had always been quite higher than the rest of the countries. However, after

Brexit, the consistency of high inflation along with high level of employment seems

to have been lost9. After the withdrawal of the Britain from the European Union, the

rate of inflation had been rising without the increase in the growth of the economy.

The deterioration of the macroeconomic condition of the United Kingdom resulted

due to the Brexit.

9 Pollard, Jane S. "Brexit and the wider UK economy." Geoforum (2018).

8

BUSINESS ECONOMICS

Figure 4Inflation in Europe and United Kingdom

Short term: after the referendum, the value of the Pound has started declining to 10-15

percent by worsening the markets10. The cost push inflation increased as a result of

devaluation in the pound which also lead to reduction in the living standards.

10 Dhingra, Swati, et al. "The impact of Brexit on foreign investment in the UK." BREXIT 2016 24 (2016).

BUSINESS ECONOMICS

Figure 4Inflation in Europe and United Kingdom

Short term: after the referendum, the value of the Pound has started declining to 10-15

percent by worsening the markets10. The cost push inflation increased as a result of

devaluation in the pound which also lead to reduction in the living standards.

10 Dhingra, Swati, et al. "The impact of Brexit on foreign investment in the UK." BREXIT 2016 24 (2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

BUSINESS ECONOMICS

Reference list and bibliography

Braun, Benjamin. "Speaking to the people? Money, trust, and central bank legitimacy in the

age of quantitative easing." Review of International Political Economy 23.6 (2016): 1064-

1092.

Dhingra, Swati, et al. "The consequences of Brexit for UK trade and living standards."

(2016).

Dhingra, Swati, et al. "The impact of Brexit on foreign investment in the UK." BREXIT

2016 24 (2016).

Kang, Dae, Nick Ligthart, and Ashoka Mody. "The European Central Bank: Building a

shelter in a storm." (2015).

Monaghan, Angela, and Phillip Inman. "ECB Launches Bold Measures Including Negative

Interest Rate To Boost Eurozone". The Guardian, 2018,

https://www.theguardian.com/business/2014/jun/05/european-central-bank-cuts-deposit-rates.

Accessed 31 Dec 2018.

Partington, Richard. "How Has Brexit Vote Affected UK Economy? September

Verdict". The Guardian, 2018, https://www.theguardian.com/business/2018/sep/27/how-has-

the-brexit-vote-affected-the-uk-economy-september-verdict. Accessed 31 Dec 2018.

Pollard, Jane S. "Brexit and the wider UK economy." Geoforum (2018).

Rogoff, Kenneth. "Dealing with monetary paralysis at the zero bound." Journal of Economic

Perspectives 31.3 (2017): 47-66.

BUSINESS ECONOMICS

Reference list and bibliography

Braun, Benjamin. "Speaking to the people? Money, trust, and central bank legitimacy in the

age of quantitative easing." Review of International Political Economy 23.6 (2016): 1064-

1092.

Dhingra, Swati, et al. "The consequences of Brexit for UK trade and living standards."

(2016).

Dhingra, Swati, et al. "The impact of Brexit on foreign investment in the UK." BREXIT

2016 24 (2016).

Kang, Dae, Nick Ligthart, and Ashoka Mody. "The European Central Bank: Building a

shelter in a storm." (2015).

Monaghan, Angela, and Phillip Inman. "ECB Launches Bold Measures Including Negative

Interest Rate To Boost Eurozone". The Guardian, 2018,

https://www.theguardian.com/business/2014/jun/05/european-central-bank-cuts-deposit-rates.

Accessed 31 Dec 2018.

Partington, Richard. "How Has Brexit Vote Affected UK Economy? September

Verdict". The Guardian, 2018, https://www.theguardian.com/business/2018/sep/27/how-has-

the-brexit-vote-affected-the-uk-economy-september-verdict. Accessed 31 Dec 2018.

Pollard, Jane S. "Brexit and the wider UK economy." Geoforum (2018).

Rogoff, Kenneth. "Dealing with monetary paralysis at the zero bound." Journal of Economic

Perspectives 31.3 (2017): 47-66.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

BUSINESS ECONOMICS

BUSINESS ECONOMICS

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.