Comprehensive Report: British Airways Business Environment Impact

VerifiedAdded on 2019/12/03

|16

|5852

|319

Report

AI Summary

This report provides a comprehensive analysis of the business environment impacting British Airways. It begins with an introduction to the airline and an overview of the report's structure, then dives into Task 1, which examines the different types of organizations, including sole traders, partnerships, public, private, and non-profit entities, and the objectives of each. The report then assesses the extent to which organizations meet stakeholder objectives, including employees, shareholders, and creditors. Task 1 concludes by outlining the responsibilities of an organization and strategies to meet stakeholder needs. Task 2 delves into economic systems, resource allocation, and the impact of monetary and fiscal policies on organizations, specifically British Airways, along with the effects of competition policy. Task 3 analyzes the role of market structure in pricing and output decisions, the impact of market forces, and the influence of the business and cultural environment on British Airways. Finally, Task 4 explores the significance of international trade, global business factors, and the policies of the European Union on UK business organizations, with a focus on British Airways. The report concludes with a summary of the key findings and a list of references.

BUSINESS ENVIRONMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Purpose of different type of organizations.......................................................................1

1.2 Extent to which organization meet objectives of stakeholders........................................2

1.3 Responsibilities of an organization and strategies employed to meet needs of stakeholders

................................................................................................................................................2

TASK 2............................................................................................................................................3

2.1 Economic system and allocation of resources..................................................................3

2.2 Impact of monetary and fiscal policy on organizations....................................................4

2.3 Impact of competition policy on British Airways............................................................4

TASK 3............................................................................................................................................5

3.1 Role of market structure in pricing and output decisions.................................................5

3.2 Impact of market forces to shape organization response..................................................5

3.3 Impact of business and culture environment on the British Airways...............................6

TASK 4............................................................................................................................................7

4.1 Significance of international trade to UK business organizations....................................7

4.2 Impact of global business factors on business organizations...........................................7

4.3 Impact of policies of European Union on UK business organizations.............................8

CONCLUSION................................................................................................................................9

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Purpose of different type of organizations.......................................................................1

1.2 Extent to which organization meet objectives of stakeholders........................................2

1.3 Responsibilities of an organization and strategies employed to meet needs of stakeholders

................................................................................................................................................2

TASK 2............................................................................................................................................3

2.1 Economic system and allocation of resources..................................................................3

2.2 Impact of monetary and fiscal policy on organizations....................................................4

2.3 Impact of competition policy on British Airways............................................................4

TASK 3............................................................................................................................................5

3.1 Role of market structure in pricing and output decisions.................................................5

3.2 Impact of market forces to shape organization response..................................................5

3.3 Impact of business and culture environment on the British Airways...............................6

TASK 4............................................................................................................................................7

4.1 Significance of international trade to UK business organizations....................................7

4.2 Impact of global business factors on business organizations...........................................7

4.3 Impact of policies of European Union on UK business organizations.............................8

CONCLUSION................................................................................................................................9

REFERENCES................................................................................................................................9

INTRODUCTION

British Airways in terms of fleet size is the second largest airline in the UK. This report is

prepared on business environment in order to help readers in understanding the impact of change

in business environment. In this report, stakeholders and their importance from company point of

view is discussed in detail. Along with this, strategies are also mentioned in the report that can be

adopted in order to maintain good relations with the stakeholders. Further, fiscal and monetary

policy and their impact on organization are also discussed in detail. At the end of report,

significance of international trade on the UK aviation industry in respect to British Airways is

also discussed in detail.

TASK 1

1.1 Purpose of different type of organizations

There are three kinds of organizations like public, private and nonprofit organizations.

Purpose of these organizations is given below. Sole trader- These are mainly small sized business that have limited resources. Their

main aim to increase their profitability. Due to this reason their main purpose is to control

cost as much as possible. Partnership- In this mode of business multiple people as an owner of business operate a

firm. Their main purpose is to increase profitability of the firm by taking mutual

agreeable decision. Public organizations- The main purpose of such kind of organizations is to create

employment opportunities. Welfare of existing labor force is another important objective

of these public sector organizations. Due to this reason these firms mostly run in loss or

they are not able to generate sufficient amount of profits. Private organization- British Airways is a private firm and profit maximization is its

primary objective which is divided into various sub objectives (Diedrich, 2014). The

organization is able to achieve its long-term objectives through achievement of short-

term targets or benchmarks. These firms strictly follow the business policy. However in

order to earn more amount of profit, the employees’ welfare is ignored sometimes.

1

British Airways in terms of fleet size is the second largest airline in the UK. This report is

prepared on business environment in order to help readers in understanding the impact of change

in business environment. In this report, stakeholders and their importance from company point of

view is discussed in detail. Along with this, strategies are also mentioned in the report that can be

adopted in order to maintain good relations with the stakeholders. Further, fiscal and monetary

policy and their impact on organization are also discussed in detail. At the end of report,

significance of international trade on the UK aviation industry in respect to British Airways is

also discussed in detail.

TASK 1

1.1 Purpose of different type of organizations

There are three kinds of organizations like public, private and nonprofit organizations.

Purpose of these organizations is given below. Sole trader- These are mainly small sized business that have limited resources. Their

main aim to increase their profitability. Due to this reason their main purpose is to control

cost as much as possible. Partnership- In this mode of business multiple people as an owner of business operate a

firm. Their main purpose is to increase profitability of the firm by taking mutual

agreeable decision. Public organizations- The main purpose of such kind of organizations is to create

employment opportunities. Welfare of existing labor force is another important objective

of these public sector organizations. Due to this reason these firms mostly run in loss or

they are not able to generate sufficient amount of profits. Private organization- British Airways is a private firm and profit maximization is its

primary objective which is divided into various sub objectives (Diedrich, 2014). The

organization is able to achieve its long-term objectives through achievement of short-

term targets or benchmarks. These firms strictly follow the business policy. However in

order to earn more amount of profit, the employees’ welfare is ignored sometimes.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

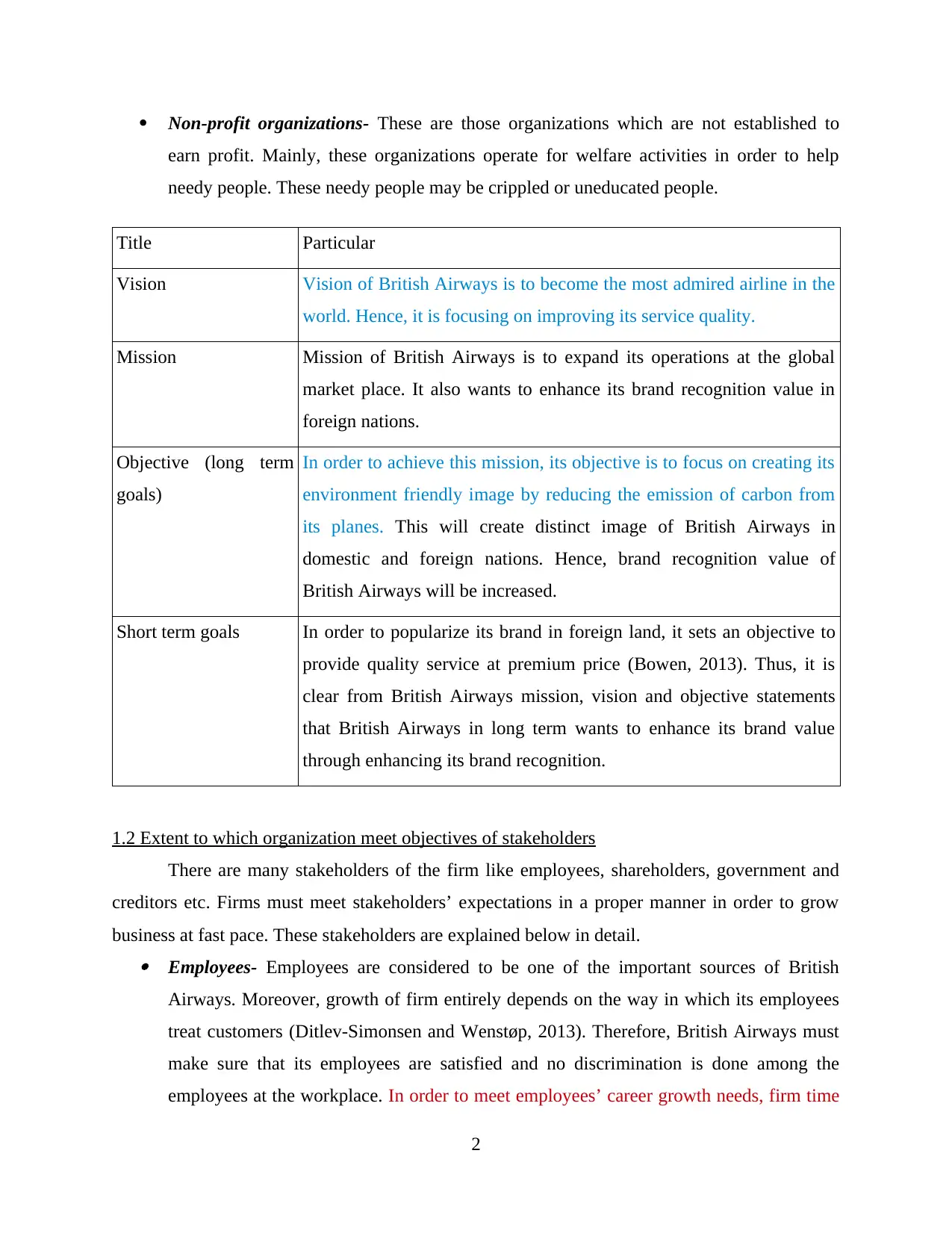

Non-profit organizations- These are those organizations which are not established to

earn profit. Mainly, these organizations operate for welfare activities in order to help

needy people. These needy people may be crippled or uneducated people.

Title Particular

Vision Vision of British Airways is to become the most admired airline in the

world. Hence, it is focusing on improving its service quality.

Mission Mission of British Airways is to expand its operations at the global

market place. It also wants to enhance its brand recognition value in

foreign nations.

Objective (long term

goals)

In order to achieve this mission, its objective is to focus on creating its

environment friendly image by reducing the emission of carbon from

its planes. This will create distinct image of British Airways in

domestic and foreign nations. Hence, brand recognition value of

British Airways will be increased.

Short term goals In order to popularize its brand in foreign land, it sets an objective to

provide quality service at premium price (Bowen, 2013). Thus, it is

clear from British Airways mission, vision and objective statements

that British Airways in long term wants to enhance its brand value

through enhancing its brand recognition.

1.2 Extent to which organization meet objectives of stakeholders

There are many stakeholders of the firm like employees, shareholders, government and

creditors etc. Firms must meet stakeholders’ expectations in a proper manner in order to grow

business at fast pace. These stakeholders are explained below in detail. Employees- Employees are considered to be one of the important sources of British

Airways. Moreover, growth of firm entirely depends on the way in which its employees

treat customers (Ditlev-Simonsen and Wenstøp, 2013). Therefore, British Airways must

make sure that its employees are satisfied and no discrimination is done among the

employees at the workplace. In order to meet employees’ career growth needs, firm time

2

earn profit. Mainly, these organizations operate for welfare activities in order to help

needy people. These needy people may be crippled or uneducated people.

Title Particular

Vision Vision of British Airways is to become the most admired airline in the

world. Hence, it is focusing on improving its service quality.

Mission Mission of British Airways is to expand its operations at the global

market place. It also wants to enhance its brand recognition value in

foreign nations.

Objective (long term

goals)

In order to achieve this mission, its objective is to focus on creating its

environment friendly image by reducing the emission of carbon from

its planes. This will create distinct image of British Airways in

domestic and foreign nations. Hence, brand recognition value of

British Airways will be increased.

Short term goals In order to popularize its brand in foreign land, it sets an objective to

provide quality service at premium price (Bowen, 2013). Thus, it is

clear from British Airways mission, vision and objective statements

that British Airways in long term wants to enhance its brand value

through enhancing its brand recognition.

1.2 Extent to which organization meet objectives of stakeholders

There are many stakeholders of the firm like employees, shareholders, government and

creditors etc. Firms must meet stakeholders’ expectations in a proper manner in order to grow

business at fast pace. These stakeholders are explained below in detail. Employees- Employees are considered to be one of the important sources of British

Airways. Moreover, growth of firm entirely depends on the way in which its employees

treat customers (Ditlev-Simonsen and Wenstøp, 2013). Therefore, British Airways must

make sure that its employees are satisfied and no discrimination is done among the

employees at the workplace. In order to meet employees’ career growth needs, firm time

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to time conducts the training programs. Through these programs, employees develop

their skills. Hence, chances of career growth increased for employees. In this way, British

Airways satisfy the needs of employees. Shareholders- These are important stakeholders of the firm because they provide capital

to the firm by using which company can expand its business. British Airways must try to

give good performance in order to maintain confidence among investors regarding safety

of their investment value. Firm brings transparency in its operations and it discloses each

and everything in its annual report. Hence, British Airways is satisfying the needs of

shareholders.

Creditors- These are those who give credit to the British Airways. In business, it is seen

that firms require working capital in order to perform their day-to-day business activity.

Due to lack of cash, organizations approach their friends or banks for meeting their

working capital requirements (Green Jr, 2005). This is a part of routine business and due

to this reason it is important for the British Airways to make payments to its creditors on

time. British Airways make payment of amount to creditors on time by strictly following

cash management strategy. In this way, British Airways is meeting the needs of its

stakeholders.

1.3 Responsibilities of an organization and strategies employed to meet needs of stakeholders

Stakeholders are the entities that act as the growth drivers for an organization and they

play supportive in helping an organization to sustain its business. Shareholders- It is the responsibility of an organization to give maximum possible return

to its shareholders (Spitzeck and Hansen, 2010). British Airways are operating in highly

competitive business environment. It is through adoption of cost control and curtailment

measures that the firm is able to maintain adequate profitability. It is also a major

responsibility of an organization to make sure that correct information is made available

to the shareholders. In this way, company can create a positive image among

shareholders. Creditors- It is responsibility of the firm to pay its creditors on time. In order to ensure

timely payment, the organization should avail short-term credit facility (Schwartz, 2012).

On the other hand, British Airways must abstain from taking too much credit from

3

their skills. Hence, chances of career growth increased for employees. In this way, British

Airways satisfy the needs of employees. Shareholders- These are important stakeholders of the firm because they provide capital

to the firm by using which company can expand its business. British Airways must try to

give good performance in order to maintain confidence among investors regarding safety

of their investment value. Firm brings transparency in its operations and it discloses each

and everything in its annual report. Hence, British Airways is satisfying the needs of

shareholders.

Creditors- These are those who give credit to the British Airways. In business, it is seen

that firms require working capital in order to perform their day-to-day business activity.

Due to lack of cash, organizations approach their friends or banks for meeting their

working capital requirements (Green Jr, 2005). This is a part of routine business and due

to this reason it is important for the British Airways to make payments to its creditors on

time. British Airways make payment of amount to creditors on time by strictly following

cash management strategy. In this way, British Airways is meeting the needs of its

stakeholders.

1.3 Responsibilities of an organization and strategies employed to meet needs of stakeholders

Stakeholders are the entities that act as the growth drivers for an organization and they

play supportive in helping an organization to sustain its business. Shareholders- It is the responsibility of an organization to give maximum possible return

to its shareholders (Spitzeck and Hansen, 2010). British Airways are operating in highly

competitive business environment. It is through adoption of cost control and curtailment

measures that the firm is able to maintain adequate profitability. It is also a major

responsibility of an organization to make sure that correct information is made available

to the shareholders. In this way, company can create a positive image among

shareholders. Creditors- It is responsibility of the firm to pay its creditors on time. In order to ensure

timely payment, the organization should avail short-term credit facility (Schwartz, 2012).

On the other hand, British Airways must abstain from taking too much credit from

3

creditors. By strictly following this strategy British Airways can reduce its debt burden

and make payment to creditors on time. Employees/social- It is the responsibility of firm that discrimination is not done among

employees on the basis of caste, creed, religion and gender. In order to ensure these,

British Airways can develop a corporate culture under which strict actions must be taken

against those officers that are involved in discrimination practices at the workplace. It is

an ethical responsibility of an organization to provide good working environment to the

employees. It is the legal responsibility of organization to pay fair salary and wages to the

employees at the workplace. Hence, company must fulfill its entire responsibility towards

employees. Government- Government is an important stakeholder of British Airways and it needs to

comply with all rules and regulations that are formed by the government regarding

aviation industry and taxation. Breach of rules may invite penalty from regulatory

authorities. It is an ethical responsibility of government to work for the welfare of

society. It is also its social responsibility to follow all rules and regulations in a proper

manner. By performing these duties in a proper manner, government can perform its

responsibilities.

Public- Public is an important stakeholder of company because revenue comes from

general public. Hence, it is the responsibility of firm to control emission of pollutants

from its planes.

All these mentioned responsibilities come under corporate responsibilities of British

Airways and it is accountable to perform all these responsibilities on time to respective

stakeholders.

TASK 2

2.1 Economic system and allocation of resources Free market economy- It is an economy in which government does not control market by

imposing rules and regulations. In this kind of market economy, allocation of resources

depends on businesses. In other words, it can be said that the organizations make

purchase of resources according of their requirements and purchasing-power.

4

and make payment to creditors on time. Employees/social- It is the responsibility of firm that discrimination is not done among

employees on the basis of caste, creed, religion and gender. In order to ensure these,

British Airways can develop a corporate culture under which strict actions must be taken

against those officers that are involved in discrimination practices at the workplace. It is

an ethical responsibility of an organization to provide good working environment to the

employees. It is the legal responsibility of organization to pay fair salary and wages to the

employees at the workplace. Hence, company must fulfill its entire responsibility towards

employees. Government- Government is an important stakeholder of British Airways and it needs to

comply with all rules and regulations that are formed by the government regarding

aviation industry and taxation. Breach of rules may invite penalty from regulatory

authorities. It is an ethical responsibility of government to work for the welfare of

society. It is also its social responsibility to follow all rules and regulations in a proper

manner. By performing these duties in a proper manner, government can perform its

responsibilities.

Public- Public is an important stakeholder of company because revenue comes from

general public. Hence, it is the responsibility of firm to control emission of pollutants

from its planes.

All these mentioned responsibilities come under corporate responsibilities of British

Airways and it is accountable to perform all these responsibilities on time to respective

stakeholders.

TASK 2

2.1 Economic system and allocation of resources Free market economy- It is an economy in which government does not control market by

imposing rules and regulations. In this kind of market economy, allocation of resources

depends on businesses. In other words, it can be said that the organizations make

purchase of resources according of their requirements and purchasing-power.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Socialist economy- It is an economic system in which government make rules and

regulations regarding every industry (Altintas, 2011). Organizations have to follow these

rules in order to operate efficiently in respective industry. In such kind of economies

allocation of resources is done by government by following pre-determined rules and

regulations. Hence, it can be said that the organizations get equal access to the natural

resources of the domestic nation to some extent.

Mixed economy- In UK there is a mixed economy system in which government

maintains control on the firms by forming and implementing rules and regulations.

British Airways are operating in a mixed economy. In mixed economy there are both

public and private companies. However, numbers of private firms are relatively more

than public ones. In mixed economy, government keeps tight control on some of

strategically important sectors like atomic energy, etc. In UK, operations of British

Airways are looked after by UK civil aviation authority and it issues guidelines time to

time that mentioned firm needs to follow (Avlonitis and Indounas, 2004). Due to mixed

economic nature, everything is not in the hands of British Airways. For example, it

cannot purchase majority of slots on primary airport. Here, resources are controlled by

the government. This is the best example of government control on resource allocation. It

can be said that although governments give more liberality to firms but they keep control

on allocation of resources.

2.2 Impact of monetary and fiscal policy on organizations

Monetary policy is a policy whose main components are CRR, SLR and open market

operations. The central bank is able to control liquidity in the country through adoption of

effective monetary policy. On the other hand, fiscal policy is a policy whose main objective is to

revise taxation and public expenditure in the country.

Monetary policy

It is a fact that excessive and lack of liquidity in an economy creates problems. Moreover,

it is through changes in CRR and open market operations that the central bank attempts to

control money supply in domestic economy. If CRR get increased and through open market

operations central bank purchase securities or instruments in the financial market then money

supply in economy get reduced (Ghannadian, 2006). Due to increase in CRR banks have to keep

more money with central bank which is a part of reserves they actually have with them. Reserves

5

regulations regarding every industry (Altintas, 2011). Organizations have to follow these

rules in order to operate efficiently in respective industry. In such kind of economies

allocation of resources is done by government by following pre-determined rules and

regulations. Hence, it can be said that the organizations get equal access to the natural

resources of the domestic nation to some extent.

Mixed economy- In UK there is a mixed economy system in which government

maintains control on the firms by forming and implementing rules and regulations.

British Airways are operating in a mixed economy. In mixed economy there are both

public and private companies. However, numbers of private firms are relatively more

than public ones. In mixed economy, government keeps tight control on some of

strategically important sectors like atomic energy, etc. In UK, operations of British

Airways are looked after by UK civil aviation authority and it issues guidelines time to

time that mentioned firm needs to follow (Avlonitis and Indounas, 2004). Due to mixed

economic nature, everything is not in the hands of British Airways. For example, it

cannot purchase majority of slots on primary airport. Here, resources are controlled by

the government. This is the best example of government control on resource allocation. It

can be said that although governments give more liberality to firms but they keep control

on allocation of resources.

2.2 Impact of monetary and fiscal policy on organizations

Monetary policy is a policy whose main components are CRR, SLR and open market

operations. The central bank is able to control liquidity in the country through adoption of

effective monetary policy. On the other hand, fiscal policy is a policy whose main objective is to

revise taxation and public expenditure in the country.

Monetary policy

It is a fact that excessive and lack of liquidity in an economy creates problems. Moreover,

it is through changes in CRR and open market operations that the central bank attempts to

control money supply in domestic economy. If CRR get increased and through open market

operations central bank purchase securities or instruments in the financial market then money

supply in economy get reduced (Ghannadian, 2006). Due to increase in CRR banks have to keep

more money with central bank which is a part of reserves they actually have with them. Reserves

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

refer to deposits and loan amount payable by customers to the bank. Hence, bank’s ability to give

loan gets reduced and due to this reason, British Airways face problems in getting required

amount of loan from a single bank. Inverse impact is seen in loan-allocation ability of banks if

CRR gets reduced and central bank sells securities through open market operations. Changes in

monetary policy affect interest rates. Suppose central bank hikes the interest rate, then British

Airways will get loan at a higher rate. If company takes a loan before hike in interest rates then it

would get loan at cheaper rates. Hence, monetary policy affects the finance cost of British

Airways.

Fiscal policy

Fiscal policy brings changes in taxation policy and with revision of this policy firms get

many new relaxations from the government in terms of tax rates (Gibbons, 2005). This saves

million of amounts for British Airways. Hence, fiscal policy is also considered to affect business

of British Airways to a large extent. British Airways also provide consignment service under

which it transports the goods. If government of UK boosts economic development activities then

there will be heavy need of raw material. Some of the raw material can be purchased from other

countries. In such a case, government can contact British Airways for service. If this would

happen, then revenue of British Airways will be increased. Hence, fiscal policy affects British

Airways.

2.3 Impact of competition policy on British Airways

In UK several laws are formulated in order to prevent firms from adopting unethical

practices in order to compete with rival firms. British Airways have to follow these rules and

regulations very strictly. . Failure to comply with these rules and regulations may invite penalty

from regulatory authorities like EASA or CSA (Gurtoo and Antony, 2007). Civil aviation

authority is a body that controls and implements rule and regulations related to aviation industry

of the UK. Some of the aspects of UK aviation industry are managed by CSA and some of the

aspects are looked after by EASA. In the UK, EASA perform its operations through CAA office

(Civil aviation authority, 2015). As per rule, British Airways can also participate in EASA

meetings and can give useful recommendations that may help it in growing its business. There

are many other rules that prohibit British Airways from forming a cartel in order to order to serve

its own interests. Thus, competition policies of UK are very tight and British Airways has to

6

loan gets reduced and due to this reason, British Airways face problems in getting required

amount of loan from a single bank. Inverse impact is seen in loan-allocation ability of banks if

CRR gets reduced and central bank sells securities through open market operations. Changes in

monetary policy affect interest rates. Suppose central bank hikes the interest rate, then British

Airways will get loan at a higher rate. If company takes a loan before hike in interest rates then it

would get loan at cheaper rates. Hence, monetary policy affects the finance cost of British

Airways.

Fiscal policy

Fiscal policy brings changes in taxation policy and with revision of this policy firms get

many new relaxations from the government in terms of tax rates (Gibbons, 2005). This saves

million of amounts for British Airways. Hence, fiscal policy is also considered to affect business

of British Airways to a large extent. British Airways also provide consignment service under

which it transports the goods. If government of UK boosts economic development activities then

there will be heavy need of raw material. Some of the raw material can be purchased from other

countries. In such a case, government can contact British Airways for service. If this would

happen, then revenue of British Airways will be increased. Hence, fiscal policy affects British

Airways.

2.3 Impact of competition policy on British Airways

In UK several laws are formulated in order to prevent firms from adopting unethical

practices in order to compete with rival firms. British Airways have to follow these rules and

regulations very strictly. . Failure to comply with these rules and regulations may invite penalty

from regulatory authorities like EASA or CSA (Gurtoo and Antony, 2007). Civil aviation

authority is a body that controls and implements rule and regulations related to aviation industry

of the UK. Some of the aspects of UK aviation industry are managed by CSA and some of the

aspects are looked after by EASA. In the UK, EASA perform its operations through CAA office

(Civil aviation authority, 2015). As per rule, British Airways can also participate in EASA

meetings and can give useful recommendations that may help it in growing its business. There

are many other rules that prohibit British Airways from forming a cartel in order to order to serve

its own interests. Thus, competition policies of UK are very tight and British Airways has to

6

strictly comply with these policies. Breach of this policy may lead to strict action from regulatory

authorities and this action will tarnish image of British Airways among the local people.

In UK, an attempt is made to liberalize aviation industry. As a result, many new changes

have come in competition policy. Now companies operating in UK aviation industry can decide

fares at their own discretion. They can start flights on new routes and they can increase their

passenger carrying capacity. Hence, it can be said that firms are getting a free hand to compete

with competitors. Liberalized policy of Euro zone is positively affecting British Airways because

now firm can easily start its flights on new routes without waiting for the approval from any

authority. It can also enhance its passenger carrying capacity with taking approval from any

authority. Hence, due to this policy, firm is in position to take fast decisions without any

hindrance. Thus, it can be said that this policy is positively affecting British Airways.

TASK 3

3.1 Role of market structure in pricing and output decisions

Market structure to large extent affects pricing and output decisions of the firm. Market

structure simply reflects number of buyers and sellers and nature of their product similarities and

differences. On the basis of these two factors every firm in the business world take its product

pricing and output decisions. Perfect market competition- This is a market structure in which there are numerous

buyers and sellers and there are lot of similarities in products produced by group of

organizations (Budd, Griggs, and Howarth, 2013). Another main characteristic of this

market structure is that consumers have good product knowledge. Thus, British Airways

do not fall in this market structure. Pricing and output decisions are taken on the basis of

competition in industry under this market structure. By looking at competitors,

companies determine price for their product. Output decisions are taken on the basis of

demand for product in the market. Company’s sales trend is also considered while taking

output decisions. Hence, in this way, price and output decisions are taken in the perfect

competition market. Monopoly- It is a market structure in which there is a single company and it sells unique

product to the customers. There is a single firm in the industry and due to this reason firm

freely takes price and output decisions in respect to product. Hence, British Airways do

7

authorities and this action will tarnish image of British Airways among the local people.

In UK, an attempt is made to liberalize aviation industry. As a result, many new changes

have come in competition policy. Now companies operating in UK aviation industry can decide

fares at their own discretion. They can start flights on new routes and they can increase their

passenger carrying capacity. Hence, it can be said that firms are getting a free hand to compete

with competitors. Liberalized policy of Euro zone is positively affecting British Airways because

now firm can easily start its flights on new routes without waiting for the approval from any

authority. It can also enhance its passenger carrying capacity with taking approval from any

authority. Hence, due to this policy, firm is in position to take fast decisions without any

hindrance. Thus, it can be said that this policy is positively affecting British Airways.

TASK 3

3.1 Role of market structure in pricing and output decisions

Market structure to large extent affects pricing and output decisions of the firm. Market

structure simply reflects number of buyers and sellers and nature of their product similarities and

differences. On the basis of these two factors every firm in the business world take its product

pricing and output decisions. Perfect market competition- This is a market structure in which there are numerous

buyers and sellers and there are lot of similarities in products produced by group of

organizations (Budd, Griggs, and Howarth, 2013). Another main characteristic of this

market structure is that consumers have good product knowledge. Thus, British Airways

do not fall in this market structure. Pricing and output decisions are taken on the basis of

competition in industry under this market structure. By looking at competitors,

companies determine price for their product. Output decisions are taken on the basis of

demand for product in the market. Company’s sales trend is also considered while taking

output decisions. Hence, in this way, price and output decisions are taken in the perfect

competition market. Monopoly- It is a market structure in which there is a single company and it sells unique

product to the customers. There is a single firm in the industry and due to this reason firm

freely takes price and output decisions in respect to product. Hence, British Airways do

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

not come in this category of market structure. In this market structure, price and output

decisions are taken by company at its own level. There is no other company in the

industry and due to this reason, competitor factor do not need to be considered while

taking decisions. Output decisions are taken on the basis of demand for the product in

market and price is decided by the firm at its own discretion. Monopolistic- In monopolistic market structure, there are number of buyers and sellers.

Moreover, their products are different from each other in terms of quality and price

(Sakbani, 2005). British Airways and its rival companies provide similar services at

various price levels. Therefore, British Airways fall in this category. In this structure,

limited firms are operating and due to this reason, pricing decisions are taken by looking

at the competitor pricing strategy. Whereas, output decisions are taken by identifying

demand for company’s product and expectation about percentage change in sales in the

upcoming months. In this way, price and output decisions are taken in this market

structure.

Oligopoly- It is the market structure in which there are few firms and one firm dominates

a market. In such a structure, companies try to sell their product at low price in order to

increase their market share in the industry. Hence, pricing decisions are taken by

reviewing competitor’s pricing strategy. On the other hand, output decisions are taken by

estimating the future demand for company’s product.

3.2 Impact of market forces to shape organization response

Market forces refer to factors that largely influence firm’s decisions. These factors

change industry to industry. However, some of the factors remain same like consumer behavior

of the people. Some of the market forces that shape British Airways response are given below. Demand and supply- British Airways revenue comes from travelers that may travel from

one location to other for business, education and tourism purpose (Chen, Liu and Cheung,

2014). Hence, business and economic conditions of people affect their demand for travel

from airlines. Hence, demand to a large extent affects British Airways response to change

in business environment. In past few years UK tourism industry grows and due to this

reason UK aviation industry also grows in size. This is evidence from the fact that private

airlines are commencing their airplanes on many new routes in UK on continue basis.

8

decisions are taken by company at its own level. There is no other company in the

industry and due to this reason, competitor factor do not need to be considered while

taking decisions. Output decisions are taken on the basis of demand for the product in

market and price is decided by the firm at its own discretion. Monopolistic- In monopolistic market structure, there are number of buyers and sellers.

Moreover, their products are different from each other in terms of quality and price

(Sakbani, 2005). British Airways and its rival companies provide similar services at

various price levels. Therefore, British Airways fall in this category. In this structure,

limited firms are operating and due to this reason, pricing decisions are taken by looking

at the competitor pricing strategy. Whereas, output decisions are taken by identifying

demand for company’s product and expectation about percentage change in sales in the

upcoming months. In this way, price and output decisions are taken in this market

structure.

Oligopoly- It is the market structure in which there are few firms and one firm dominates

a market. In such a structure, companies try to sell their product at low price in order to

increase their market share in the industry. Hence, pricing decisions are taken by

reviewing competitor’s pricing strategy. On the other hand, output decisions are taken by

estimating the future demand for company’s product.

3.2 Impact of market forces to shape organization response

Market forces refer to factors that largely influence firm’s decisions. These factors

change industry to industry. However, some of the factors remain same like consumer behavior

of the people. Some of the market forces that shape British Airways response are given below. Demand and supply- British Airways revenue comes from travelers that may travel from

one location to other for business, education and tourism purpose (Chen, Liu and Cheung,

2014). Hence, business and economic conditions of people affect their demand for travel

from airlines. Hence, demand to a large extent affects British Airways response to change

in business environment. In past few years UK tourism industry grows and due to this

reason UK aviation industry also grows in size. This is evidence from the fact that private

airlines are commencing their airplanes on many new routes in UK on continue basis.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Customer perception- People perceptions also affect their demand for a choice of

airlines. In UK many airlines are operating like Easy jet, Ryan air etc. These airlines

provide services at very cheaper price in UK and in other European nations. Hence,

people positive perceptions about these cheaper airlines may create problems for British

Airways. As per the fact of geographic breakdown, EasyJet and Ryanair are nearby to

British Airways. It means that both low fare airlines grow at a rapid pace. British

Airways come in existence before so many years and even though these two firms are

giving nearby performance to British Airways. This happens because both the firms are

providing their service at a cheaper price. Hence, people have very positive performance

towards both airlines. Due to these reasons, British Airways is receiving stiff competition

from EasyJet and Ryanair. Hence, positive customer perception towards EasyJet and

Ryanair affects British Airways in terms of intensity of competition.

Technology- Technology also acts as a market factor that affects organization’s response

to business environment. As mentioned above, British airway is operating in an industry

in which there is a fierce competition. Due to this reason British Airways consistently

needs to involve into R&D activities in order to upgrade its technology (Whetten, 2009).

If British Airways legged behind its rival firms in up gradation of technology then it may

lose its grip on market. Over the past few years, British Airways upgrade its technology

and due to this reason, it enjoys commendable position in the industry.

3.3 Impact of business and culture environment on the British Airways

Culture environment is one of the components of business environment. Business

environment affects decision making of British Airways because it is a set of conditions in which

the firm is operating its business. Hence, British Airways need to formulate strategy in order to

counter problems that come in existence due to negative changes in business environment. Economic environment- It refers to economic conditions of UK in terms of GDP and

inflation rate. If economic conditions of the UK deteriorate then it will affect people

income level, unemployment opportunity and their saving rate. Negative change in these

factors will affect British Airways profitability (Yu and Ramanathan, 2012). In such kind

of environment British Airways need to make changes in its business strategy in order to

keep its business stable.

9

airlines. In UK many airlines are operating like Easy jet, Ryan air etc. These airlines

provide services at very cheaper price in UK and in other European nations. Hence,

people positive perceptions about these cheaper airlines may create problems for British

Airways. As per the fact of geographic breakdown, EasyJet and Ryanair are nearby to

British Airways. It means that both low fare airlines grow at a rapid pace. British

Airways come in existence before so many years and even though these two firms are

giving nearby performance to British Airways. This happens because both the firms are

providing their service at a cheaper price. Hence, people have very positive performance

towards both airlines. Due to these reasons, British Airways is receiving stiff competition

from EasyJet and Ryanair. Hence, positive customer perception towards EasyJet and

Ryanair affects British Airways in terms of intensity of competition.

Technology- Technology also acts as a market factor that affects organization’s response

to business environment. As mentioned above, British airway is operating in an industry

in which there is a fierce competition. Due to this reason British Airways consistently

needs to involve into R&D activities in order to upgrade its technology (Whetten, 2009).

If British Airways legged behind its rival firms in up gradation of technology then it may

lose its grip on market. Over the past few years, British Airways upgrade its technology

and due to this reason, it enjoys commendable position in the industry.

3.3 Impact of business and culture environment on the British Airways

Culture environment is one of the components of business environment. Business

environment affects decision making of British Airways because it is a set of conditions in which

the firm is operating its business. Hence, British Airways need to formulate strategy in order to

counter problems that come in existence due to negative changes in business environment. Economic environment- It refers to economic conditions of UK in terms of GDP and

inflation rate. If economic conditions of the UK deteriorate then it will affect people

income level, unemployment opportunity and their saving rate. Negative change in these

factors will affect British Airways profitability (Yu and Ramanathan, 2012). In such kind

of environment British Airways need to make changes in its business strategy in order to

keep its business stable.

9

Social environment – It refers to people attitude and belief on certain issue. Currently,

people in UK are facing lot of economic problems in terms of income level and

unemployment of large number of people. In such a scenario people will have a positive

attitude towards low fare airlines like Easyjet, Ryanair etc. In such a scenario offering

services at premium price may create problems for British Airways. Political environment- It refers to political parties’ attitude and their business policies.

UK government is fully committed towards providing support to the UK aviation

industry and tourism sector. Hence, from these angle British Airways is not facing any

problem. Legal environment- It refers to rules and regulations that govern UK aviation industry.

Violation of these laws may tarnish image of British Airways and may invite penalty of

huge amount from regulatory authorities.

Technological environment- It is mentioned above that British Airways need to update

its technology in order remain in the top position of UK aviation industry (Zhang and

Huang, 2012). Ignorance of this factor may reduce the grip of British Airways on

domestic aviation industry.

TASK 4

4.1 Significance of international trade to UK business organizations

The international trade between nations leads to traveling of people of different countries

to foreign land. As a result, every year, thousand of business tourists inbound and outbound take

place in UK. With increase in global economic condition, this segment of tourism will certainly

get increased. Hence, enhancement in international trade creates an opportunity for British

Airways (Chen, Liu and Cheung, 2014). Today, many of the UK firms are operating in

developed and developing nations like India. From India, every year, numerous IT professionals

visit UK for providing support to the mentioned nation in respect to implementation and

completion of business projects. Same happens in case of other nations with whom UK have

good business tie ups. Hence, this segment of inbound tourism creates ample of opportunities for

British Airways (Weymes, 2005). In this way, international trade has a lot of significance to the

UK aviation industry.

10

people in UK are facing lot of economic problems in terms of income level and

unemployment of large number of people. In such a scenario people will have a positive

attitude towards low fare airlines like Easyjet, Ryanair etc. In such a scenario offering

services at premium price may create problems for British Airways. Political environment- It refers to political parties’ attitude and their business policies.

UK government is fully committed towards providing support to the UK aviation

industry and tourism sector. Hence, from these angle British Airways is not facing any

problem. Legal environment- It refers to rules and regulations that govern UK aviation industry.

Violation of these laws may tarnish image of British Airways and may invite penalty of

huge amount from regulatory authorities.

Technological environment- It is mentioned above that British Airways need to update

its technology in order remain in the top position of UK aviation industry (Zhang and

Huang, 2012). Ignorance of this factor may reduce the grip of British Airways on

domestic aviation industry.

TASK 4

4.1 Significance of international trade to UK business organizations

The international trade between nations leads to traveling of people of different countries

to foreign land. As a result, every year, thousand of business tourists inbound and outbound take

place in UK. With increase in global economic condition, this segment of tourism will certainly

get increased. Hence, enhancement in international trade creates an opportunity for British

Airways (Chen, Liu and Cheung, 2014). Today, many of the UK firms are operating in

developed and developing nations like India. From India, every year, numerous IT professionals

visit UK for providing support to the mentioned nation in respect to implementation and

completion of business projects. Same happens in case of other nations with whom UK have

good business tie ups. Hence, this segment of inbound tourism creates ample of opportunities for

British Airways (Weymes, 2005). In this way, international trade has a lot of significance to the

UK aviation industry.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.