BUSINESS FINANCE TABLE OF CONTENTS INTRODUCTION 1 PART 11

VerifiedAdded on 2020/12/23

|11

|3153

|176

AI Summary

PART 1 1 1.a Profit and cash flow Profit is the revenue which is being generated b y the business by performing various business operations. It is receivable and the amount of money which is being paid by the customers is the amount which will be received by the firm in the future (Kraemer-Eis et. It is receivable and the amount of money which is being paid by the customers is the amount which will be received by the firm in the future (Kraemer-Eis et

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

BUSINESS FINANCE

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

1.a Profit and cash flow ..............................................................................................................1

b. Working Capital and meaning of receivables, Inventory and payables ................................2

c. Changes in working capital affect Cash flow .........................................................................2

2. Application of concept to UberTools Ltd..............................................................................3

3. Analysis and recommendation to improve cash flow through better working capital

management ...............................................................................................................................3

PART 2............................................................................................................................................4

1. a Elements of financial performance .....................................................................................4

b. Calculation of ratios ...............................................................................................................5

c. Application of the result .........................................................................................................5

2. Analysis and recommendation ...............................................................................................6

CONCLUSION ..............................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

1.a Profit and cash flow ..............................................................................................................1

b. Working Capital and meaning of receivables, Inventory and payables ................................2

c. Changes in working capital affect Cash flow .........................................................................2

2. Application of concept to UberTools Ltd..............................................................................3

3. Analysis and recommendation to improve cash flow through better working capital

management ...............................................................................................................................3

PART 2............................................................................................................................................4

1. a Elements of financial performance .....................................................................................4

b. Calculation of ratios ...............................................................................................................5

c. Application of the result .........................................................................................................5

2. Analysis and recommendation ...............................................................................................6

CONCLUSION ..............................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

Business finance is related to the funds which are required by the organisation of fund

their operations. With the help of finance the firm is able to source and utilize the funds

effectively and efficiently. In this study UberTools Ltd will be consider that own the factory in

the new market of producing power tools. In this assignment the difference between profit cash

flow will be provided. It will also include the meaning of working capital. Also, It will provide

understanding about the effect on cash flow due to changes in working capital.

PART 1

1.a Profit and cash flow

Profit is the revenue which is being generated b y the business by performing various

business operations. It is identified by preparing the income statement which consist of the

income and experiences for the period. It is necessary for the firm to acquire profit for the future

growth and success of organisation. The profit is earned by company by providing its products

and services in the market (Burns and Dewhurst, 2016). It is identified by meeting the expenses

incurred less revenue generates which provided with the profit earned during the period.

Business success and failure is measured by the profit generate by the firm if the firm has

increase the profitability over the years that means it if growing and if the profits are fluctuating

of decreasing over the years the firm is leading towards failure of business. Whereas Cash flow

include the cash inflow and outflow for the period. It is used to identify the cash requirement of

the business (Kraemer-Eis, Lang and Gvetadze, 2015). The cash flow during the period is

determined on the basis of the cash flow statement which include the cash inflow and outflow

for the period on the basis of operating, investing and financing activities.

Difference between cash flow and profit

Profit Cash flow

It is a revenue generated by business by

performing its operations

It is the cash inflow and outflow for the period

It is based on accrual concept It is based on cash accounting concept.

The profit is identified by preparing the income It is identified through the cash flow statement

1

Business finance is related to the funds which are required by the organisation of fund

their operations. With the help of finance the firm is able to source and utilize the funds

effectively and efficiently. In this study UberTools Ltd will be consider that own the factory in

the new market of producing power tools. In this assignment the difference between profit cash

flow will be provided. It will also include the meaning of working capital. Also, It will provide

understanding about the effect on cash flow due to changes in working capital.

PART 1

1.a Profit and cash flow

Profit is the revenue which is being generated b y the business by performing various

business operations. It is identified by preparing the income statement which consist of the

income and experiences for the period. It is necessary for the firm to acquire profit for the future

growth and success of organisation. The profit is earned by company by providing its products

and services in the market (Burns and Dewhurst, 2016). It is identified by meeting the expenses

incurred less revenue generates which provided with the profit earned during the period.

Business success and failure is measured by the profit generate by the firm if the firm has

increase the profitability over the years that means it if growing and if the profits are fluctuating

of decreasing over the years the firm is leading towards failure of business. Whereas Cash flow

include the cash inflow and outflow for the period. It is used to identify the cash requirement of

the business (Kraemer-Eis, Lang and Gvetadze, 2015). The cash flow during the period is

determined on the basis of the cash flow statement which include the cash inflow and outflow

for the period on the basis of operating, investing and financing activities.

Difference between cash flow and profit

Profit Cash flow

It is a revenue generated by business by

performing its operations

It is the cash inflow and outflow for the period

It is based on accrual concept It is based on cash accounting concept.

The profit is identified by preparing the income It is identified through the cash flow statement

1

statement

b. Working Capital and meaning of receivables, Inventory and payables

Working capital is the amount of capital which is required in the firm to perform its day

to day operations. It is defined as current assets less current liabilities. It is the money available

with the firm for performing its business activities with the help of working capital the business

is able to measure its liquidity position , efficiency and the performance of the firm. Working

capital include the cash, inventory, account receivables etc (Jordà, Schularick, and Taylor,

2016). The working capital assist in growth and success of the business which help the firm in

increasing the performance and its profitability by utilizing the working capital in the effective

way to generate revenue. It include the followings :

Receivables : It is the amount which will be received by the company from its customers

that has purchases good on credit. The receivable shows the amount which is being

unpaid by the customers and will be received at the future pint of time. The unpaid

balance amount is show ion the current assets of the balance sheet. It represent the line of

credit which is extended by the company.

Inventory : It is the accounting term that refers to the goods which are in the different

stages for being ready to sale. It is the goods which are being used by organisation for

providing to the customers in the future. It is the largest current assets of the firm

(Kraemer-Eis and et.al., 2018). The inventory include raw materials, work in progress

and the finished goods.

Payables : It is the amount which is not paid by the company to its creditors for

purchasing goods from the suppliers on credit. It is shown on the current liability of the

balance because it is the best for the company which is required to be paid in the future

pint of time. It is the obligation for the company to pay the current liabilities such as

payables. It assist in understanding the liquidity position of the firm.

c. Changes in working capital affect Cash flow

Working capital is the amount which is required by the business for performing its day to

day operation which help in the growth and success of the business. The changes in working

capital is caused due to increase or decrease in the current assets and liability of the firm. The

changes in working capital may leads to positive or negative working capital which is reflected

2

b. Working Capital and meaning of receivables, Inventory and payables

Working capital is the amount of capital which is required in the firm to perform its day

to day operations. It is defined as current assets less current liabilities. It is the money available

with the firm for performing its business activities with the help of working capital the business

is able to measure its liquidity position , efficiency and the performance of the firm. Working

capital include the cash, inventory, account receivables etc (Jordà, Schularick, and Taylor,

2016). The working capital assist in growth and success of the business which help the firm in

increasing the performance and its profitability by utilizing the working capital in the effective

way to generate revenue. It include the followings :

Receivables : It is the amount which will be received by the company from its customers

that has purchases good on credit. The receivable shows the amount which is being

unpaid by the customers and will be received at the future pint of time. The unpaid

balance amount is show ion the current assets of the balance sheet. It represent the line of

credit which is extended by the company.

Inventory : It is the accounting term that refers to the goods which are in the different

stages for being ready to sale. It is the goods which are being used by organisation for

providing to the customers in the future. It is the largest current assets of the firm

(Kraemer-Eis and et.al., 2018). The inventory include raw materials, work in progress

and the finished goods.

Payables : It is the amount which is not paid by the company to its creditors for

purchasing goods from the suppliers on credit. It is shown on the current liability of the

balance because it is the best for the company which is required to be paid in the future

pint of time. It is the obligation for the company to pay the current liabilities such as

payables. It assist in understanding the liquidity position of the firm.

c. Changes in working capital affect Cash flow

Working capital is the amount which is required by the business for performing its day to

day operation which help in the growth and success of the business. The changes in working

capital is caused due to increase or decrease in the current assets and liability of the firm. The

changes in working capital may leads to positive or negative working capital which is reflected

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

in the cash flow statement (Maxwell, 2017). Positive working capital is when the firm has more

current assets than the current liabilities. whereas negative working capital is when the firm have

less current assets and more current liability. The changes in the working capital may affect the

cash flow by the following ways :

Increase in current assets : It will increase the cash flow from operating activities

because cash will be increased which will lead to positive working capital.

Decrease in current assets : It will leads to less use of the cash which will reduce the

amount of the cash flow.

Increase in current liability : It means the payables have been increase which will

reduce the cash balance and thus the cash balance will be reduced.

Decrease in current liabilities : It will increase the cash flow as there is reduction in the

payables.

From the above its can be said that there are positive working capital when there is

increase in current assets and decrease in current liabilities and vice versa.

2. Application of concept to UberTools Ltd

The profit earned by the UberTools Ltd was reasonably beneficial as it earn operating

profit of £36 million but on the contrary the company debts have been increased to £350 million

from £250 million. It is identified that UberTools Ltd is having the two main customers which

include D&R DIY Ltd and BricoFrance SA. The outstanding amount from the D&R DIY Ltd is

equal to £12 million as it has placed the large order last year. It is working capital for the

UberTools Ltd is changes due to changing in the current assets and current liabilities.

There have been increase in the current liabilities in the last year which means the cash

flow statement is changed negatively because of negative working capital (Ylhäinen, 2017).

Also, there is an outstanding dispute of £35 million for BricoFrance which means there have

been reduction in the current assets due to non payment of the outstanding amount from the

receivables. The company have invested 18 Million in the design company which have lead to

outflow of the cash.

3. Analysis and recommendation to improve cash flow through better working capital

management

From the above application it is analysed that the UberTools Ltd is having more debts

that the assets which means the profitability and liquidity position of the firm is affected. It is

3

current assets than the current liabilities. whereas negative working capital is when the firm have

less current assets and more current liability. The changes in the working capital may affect the

cash flow by the following ways :

Increase in current assets : It will increase the cash flow from operating activities

because cash will be increased which will lead to positive working capital.

Decrease in current assets : It will leads to less use of the cash which will reduce the

amount of the cash flow.

Increase in current liability : It means the payables have been increase which will

reduce the cash balance and thus the cash balance will be reduced.

Decrease in current liabilities : It will increase the cash flow as there is reduction in the

payables.

From the above its can be said that there are positive working capital when there is

increase in current assets and decrease in current liabilities and vice versa.

2. Application of concept to UberTools Ltd

The profit earned by the UberTools Ltd was reasonably beneficial as it earn operating

profit of £36 million but on the contrary the company debts have been increased to £350 million

from £250 million. It is identified that UberTools Ltd is having the two main customers which

include D&R DIY Ltd and BricoFrance SA. The outstanding amount from the D&R DIY Ltd is

equal to £12 million as it has placed the large order last year. It is working capital for the

UberTools Ltd is changes due to changing in the current assets and current liabilities.

There have been increase in the current liabilities in the last year which means the cash

flow statement is changed negatively because of negative working capital (Ylhäinen, 2017).

Also, there is an outstanding dispute of £35 million for BricoFrance which means there have

been reduction in the current assets due to non payment of the outstanding amount from the

receivables. The company have invested 18 Million in the design company which have lead to

outflow of the cash.

3. Analysis and recommendation to improve cash flow through better working capital

management

From the above application it is analysed that the UberTools Ltd is having more debts

that the assets which means the profitability and liquidity position of the firm is affected. It is

3

also analysed that the there is outstanding amount which is not being paid by receivables of this

company which leads to reduction in the working capital (Block and et.al., 2018). So, it is

recommended to the company to manage the working capital for improving the cash flow of the

business. Working capital management is used to increase the company's profitability and and

to ensure that the firm have sufficient liquidity to pay out its short term obligations (Working

Capital Management (WCM), 2018). It assist in monitoring the current assets and current

liabilities of the company to improve the cash flow of the business (Storey, 2016). It is

recommended to the firm to increase their current assets or maintained that level of current assets

which is sufficient to meet the short term obligation of the firm.

Working capital management involved monitoring the cash flow, inventory, receivables

payables etc. With the help of working capital ratio the firm is able to understand it working

capital requirement on the basis of which it can improve the cash flow (Brooks, 2019).

Moreover, the firm by lowering the collection period of the receivables that can increase the

cash inflow which will help in increasing the cash balance. The management of inventory can

also help in improving the cash flow.

PART 2

1. a Elements of financial performance

The financial performance of the firm is measured on the basis of the statement which are

prepared by organisation that include the financial information of the period. It consist of

income statement , balance sheet and cash flow statement. The income statement is prepared

which assist in identifying the profitability of the business on the basis of elements which

include income and experience for the period. Income refers to the revenue generated by the firm

by performing its various business activities (Foroohar, 2016). Whereas expenses are those

which are incurred by the business during the period for performing their business activities.

Balance sheet is the statement which shows the financial position of the firm on the basis

of the elements which consist of assets and liabilities. Assets are the the owner property of the

business which can be used by the firm to generate profit and pay their firm's obligation. It

consist of current assets, fixed assets. On the other hand liabilities are the obligation of the

business which are required to paid in the future point of time (Roberts, 2015). Cash flow

statement record the information about the cash inflow and outflow for the period from the

4

company which leads to reduction in the working capital (Block and et.al., 2018). So, it is

recommended to the company to manage the working capital for improving the cash flow of the

business. Working capital management is used to increase the company's profitability and and

to ensure that the firm have sufficient liquidity to pay out its short term obligations (Working

Capital Management (WCM), 2018). It assist in monitoring the current assets and current

liabilities of the company to improve the cash flow of the business (Storey, 2016). It is

recommended to the firm to increase their current assets or maintained that level of current assets

which is sufficient to meet the short term obligation of the firm.

Working capital management involved monitoring the cash flow, inventory, receivables

payables etc. With the help of working capital ratio the firm is able to understand it working

capital requirement on the basis of which it can improve the cash flow (Brooks, 2019).

Moreover, the firm by lowering the collection period of the receivables that can increase the

cash inflow which will help in increasing the cash balance. The management of inventory can

also help in improving the cash flow.

PART 2

1. a Elements of financial performance

The financial performance of the firm is measured on the basis of the statement which are

prepared by organisation that include the financial information of the period. It consist of

income statement , balance sheet and cash flow statement. The income statement is prepared

which assist in identifying the profitability of the business on the basis of elements which

include income and experience for the period. Income refers to the revenue generated by the firm

by performing its various business activities (Foroohar, 2016). Whereas expenses are those

which are incurred by the business during the period for performing their business activities.

Balance sheet is the statement which shows the financial position of the firm on the basis

of the elements which consist of assets and liabilities. Assets are the the owner property of the

business which can be used by the firm to generate profit and pay their firm's obligation. It

consist of current assets, fixed assets. On the other hand liabilities are the obligation of the

business which are required to paid in the future point of time (Roberts, 2015). Cash flow

statement record the information about the cash inflow and outflow for the period from the

4

operating activities, financing activities and investing activities which help in identifying the net

cans inflow and outflow of the period.

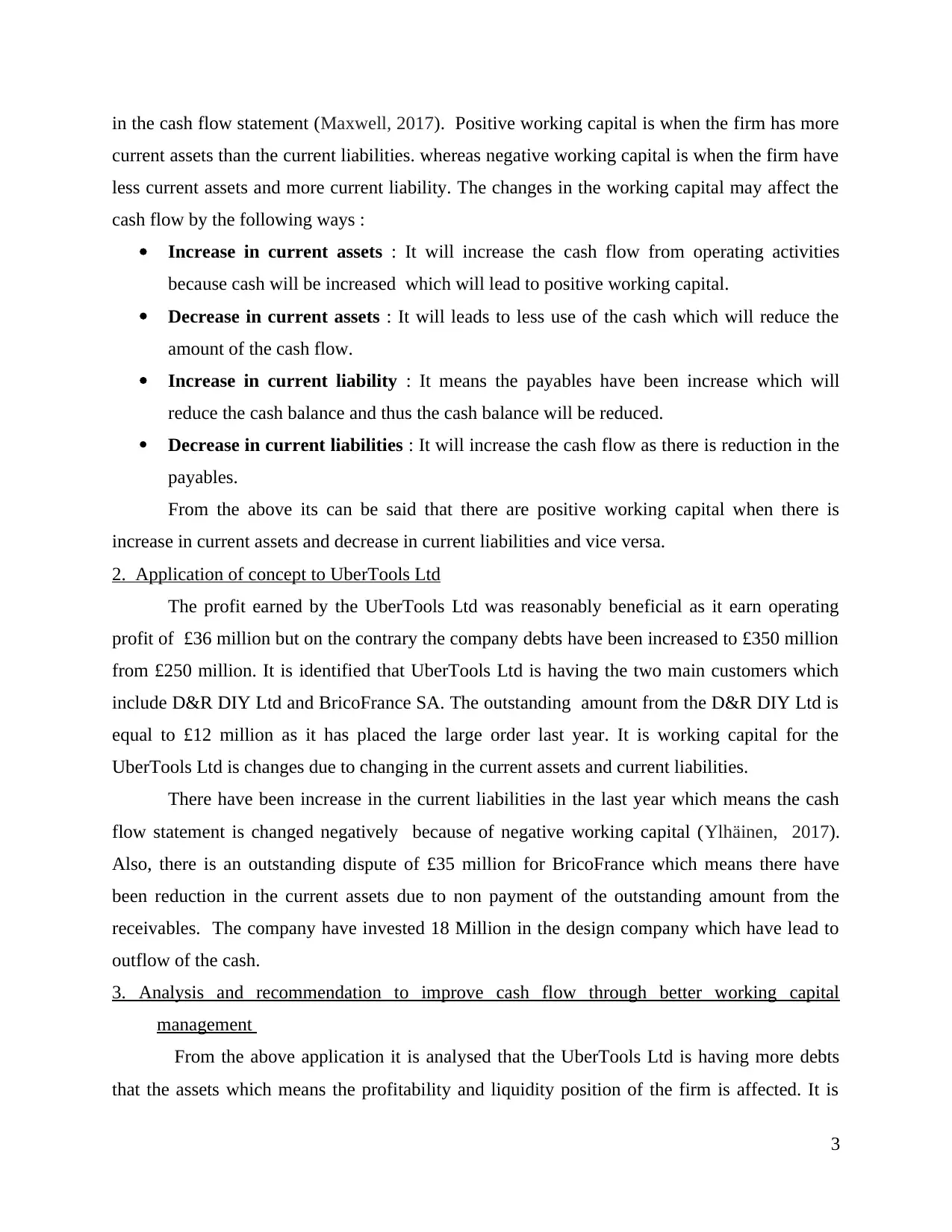

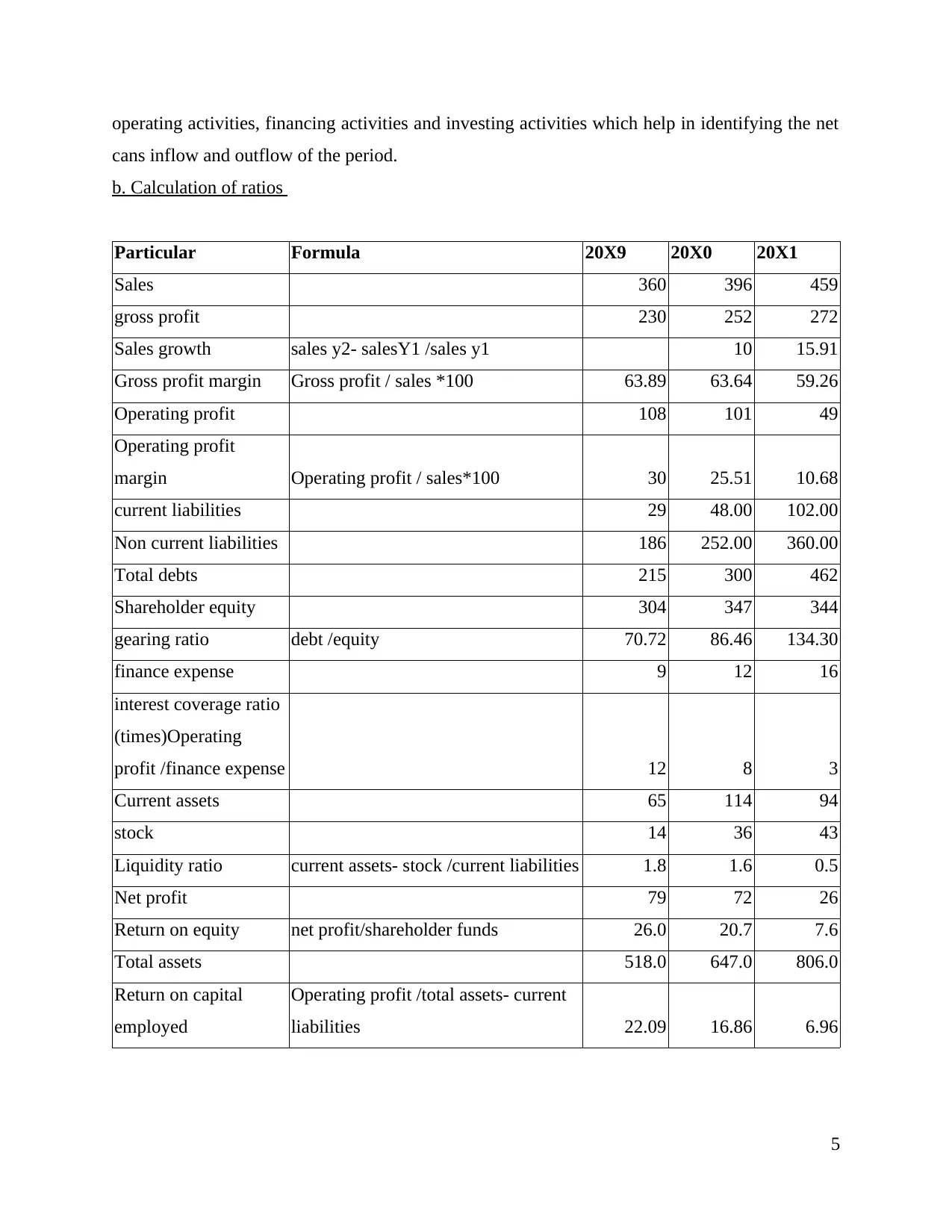

b. Calculation of ratios

Particular Formula 20X9 20X0 20X1

Sales 360 396 459

gross profit 230 252 272

Sales growth sales y2- salesY1 /sales y1 10 15.91

Gross profit margin Gross profit / sales *100 63.89 63.64 59.26

Operating profit 108 101 49

Operating profit

margin Operating profit / sales*100 30 25.51 10.68

current liabilities 29 48.00 102.00

Non current liabilities 186 252.00 360.00

Total debts 215 300 462

Shareholder equity 304 347 344

gearing ratio debt /equity 70.72 86.46 134.30

finance expense 9 12 16

interest coverage ratio

(times)Operating

profit /finance expense 12 8 3

Current assets 65 114 94

stock 14 36 43

Liquidity ratio current assets- stock /current liabilities 1.8 1.6 0.5

Net profit 79 72 26

Return on equity net profit/shareholder funds 26.0 20.7 7.6

Total assets 518.0 647.0 806.0

Return on capital

employed

Operating profit /total assets- current

liabilities 22.09 16.86 6.96

5

cans inflow and outflow of the period.

b. Calculation of ratios

Particular Formula 20X9 20X0 20X1

Sales 360 396 459

gross profit 230 252 272

Sales growth sales y2- salesY1 /sales y1 10 15.91

Gross profit margin Gross profit / sales *100 63.89 63.64 59.26

Operating profit 108 101 49

Operating profit

margin Operating profit / sales*100 30 25.51 10.68

current liabilities 29 48.00 102.00

Non current liabilities 186 252.00 360.00

Total debts 215 300 462

Shareholder equity 304 347 344

gearing ratio debt /equity 70.72 86.46 134.30

finance expense 9 12 16

interest coverage ratio

(times)Operating

profit /finance expense 12 8 3

Current assets 65 114 94

stock 14 36 43

Liquidity ratio current assets- stock /current liabilities 1.8 1.6 0.5

Net profit 79 72 26

Return on equity net profit/shareholder funds 26.0 20.7 7.6

Total assets 518.0 647.0 806.0

Return on capital

employed

Operating profit /total assets- current

liabilities 22.09 16.86 6.96

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

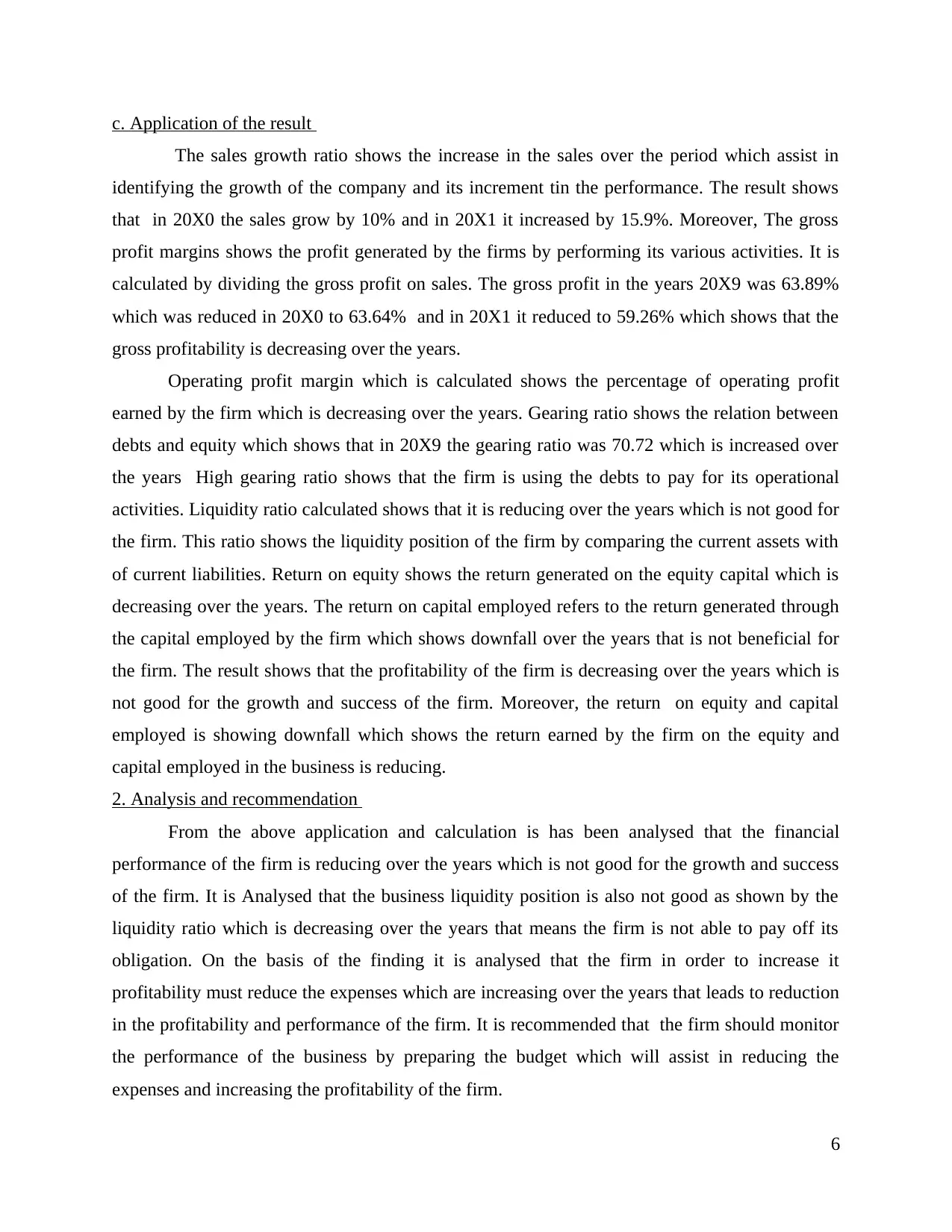

c. Application of the result

The sales growth ratio shows the increase in the sales over the period which assist in

identifying the growth of the company and its increment tin the performance. The result shows

that in 20X0 the sales grow by 10% and in 20X1 it increased by 15.9%. Moreover, The gross

profit margins shows the profit generated by the firms by performing its various activities. It is

calculated by dividing the gross profit on sales. The gross profit in the years 20X9 was 63.89%

which was reduced in 20X0 to 63.64% and in 20X1 it reduced to 59.26% which shows that the

gross profitability is decreasing over the years.

Operating profit margin which is calculated shows the percentage of operating profit

earned by the firm which is decreasing over the years. Gearing ratio shows the relation between

debts and equity which shows that in 20X9 the gearing ratio was 70.72 which is increased over

the years High gearing ratio shows that the firm is using the debts to pay for its operational

activities. Liquidity ratio calculated shows that it is reducing over the years which is not good for

the firm. This ratio shows the liquidity position of the firm by comparing the current assets with

of current liabilities. Return on equity shows the return generated on the equity capital which is

decreasing over the years. The return on capital employed refers to the return generated through

the capital employed by the firm which shows downfall over the years that is not beneficial for

the firm. The result shows that the profitability of the firm is decreasing over the years which is

not good for the growth and success of the firm. Moreover, the return on equity and capital

employed is showing downfall which shows the return earned by the firm on the equity and

capital employed in the business is reducing.

2. Analysis and recommendation

From the above application and calculation is has been analysed that the financial

performance of the firm is reducing over the years which is not good for the growth and success

of the firm. It is Analysed that the business liquidity position is also not good as shown by the

liquidity ratio which is decreasing over the years that means the firm is not able to pay off its

obligation. On the basis of the finding it is analysed that the firm in order to increase it

profitability must reduce the expenses which are increasing over the years that leads to reduction

in the profitability and performance of the firm. It is recommended that the firm should monitor

the performance of the business by preparing the budget which will assist in reducing the

expenses and increasing the profitability of the firm.

6

The sales growth ratio shows the increase in the sales over the period which assist in

identifying the growth of the company and its increment tin the performance. The result shows

that in 20X0 the sales grow by 10% and in 20X1 it increased by 15.9%. Moreover, The gross

profit margins shows the profit generated by the firms by performing its various activities. It is

calculated by dividing the gross profit on sales. The gross profit in the years 20X9 was 63.89%

which was reduced in 20X0 to 63.64% and in 20X1 it reduced to 59.26% which shows that the

gross profitability is decreasing over the years.

Operating profit margin which is calculated shows the percentage of operating profit

earned by the firm which is decreasing over the years. Gearing ratio shows the relation between

debts and equity which shows that in 20X9 the gearing ratio was 70.72 which is increased over

the years High gearing ratio shows that the firm is using the debts to pay for its operational

activities. Liquidity ratio calculated shows that it is reducing over the years which is not good for

the firm. This ratio shows the liquidity position of the firm by comparing the current assets with

of current liabilities. Return on equity shows the return generated on the equity capital which is

decreasing over the years. The return on capital employed refers to the return generated through

the capital employed by the firm which shows downfall over the years that is not beneficial for

the firm. The result shows that the profitability of the firm is decreasing over the years which is

not good for the growth and success of the firm. Moreover, the return on equity and capital

employed is showing downfall which shows the return earned by the firm on the equity and

capital employed in the business is reducing.

2. Analysis and recommendation

From the above application and calculation is has been analysed that the financial

performance of the firm is reducing over the years which is not good for the growth and success

of the firm. It is Analysed that the business liquidity position is also not good as shown by the

liquidity ratio which is decreasing over the years that means the firm is not able to pay off its

obligation. On the basis of the finding it is analysed that the firm in order to increase it

profitability must reduce the expenses which are increasing over the years that leads to reduction

in the profitability and performance of the firm. It is recommended that the firm should monitor

the performance of the business by preparing the budget which will assist in reducing the

expenses and increasing the profitability of the firm.

6

It is analysed that the firm is using more debts that the equity to fund its operation which

is increasing the obligation for the firm which will affect the liquidity position of the

organisation. It is recommended to the organisation that it can monitor its financial performance

by forecasting about the income , expenses etc. through help of preparing budgets. It is

recommended to the board that its should use equity funds rather than using debts funds because

it is reduce the obligation of the firm and will help in increasing the financial performance and

position of the firm. With the help of monitoring the cash flow and reducing the expenses the

firm is able to enhance its profitability and performance which will assist in enhancing the

financial performance of the firm. The firm by monitoring its performance through help of KPI

can enhance its performance and profitability which will assist in the growth and success of the

business.

CONCLUSION

From the above study it has concluded about the business finance that is related to

sources which are used by the business to fund their operations. In this assignment it has shown

understanding about profit and cash flow whereas profit is the revenue generate by performing

firm's operation whereas cash flow is the inflow and outflow of the cash. It has given

information about the effect on the cash flow due to changes in the working capital due to

increase of decrease in the current assets and current liabilities. Moreover, it has included

information about the ratios which assist in identifying the financial performance o0f the firm.

7

is increasing the obligation for the firm which will affect the liquidity position of the

organisation. It is recommended to the organisation that it can monitor its financial performance

by forecasting about the income , expenses etc. through help of preparing budgets. It is

recommended to the board that its should use equity funds rather than using debts funds because

it is reduce the obligation of the firm and will help in increasing the financial performance and

position of the firm. With the help of monitoring the cash flow and reducing the expenses the

firm is able to enhance its profitability and performance which will assist in enhancing the

financial performance of the firm. The firm by monitoring its performance through help of KPI

can enhance its performance and profitability which will assist in the growth and success of the

business.

CONCLUSION

From the above study it has concluded about the business finance that is related to

sources which are used by the business to fund their operations. In this assignment it has shown

understanding about profit and cash flow whereas profit is the revenue generate by performing

firm's operation whereas cash flow is the inflow and outflow of the cash. It has given

information about the effect on the cash flow due to changes in the working capital due to

increase of decrease in the current assets and current liabilities. Moreover, it has included

information about the ratios which assist in identifying the financial performance o0f the firm.

7

REFERENCES

Books and journals

Block, J.H. and et.al.,2018. New players in entrepreneurial finance and why they are there. Small

Business Economics. 50(2). pp.239-250.

Brooks, C., 2019. Introductory econometrics for finance. Cambridge university press.

Burns, P. and Dewhurst, J. eds., 2016. Small business and entrepreneurship. Macmillan

International Higher Education.

Foroohar, R., 2016. Makers and takers: The rise of finance and the fall of American business.

Crown Books.

Jordà, Ò., Schularick, M. and Taylor, A.M., 2016. The great mortgaging: housing finance, crises

and business cycles. Economic Policy. 31(85). pp.107-152.

Kraemer-Eis, H. and et.al., 2018. European Small Business Finance Outlook: December

2018 (No. 2018/53). EIF Working Paper.

Kraemer-Eis, H., Lang, F. and Gvetadze, S., 2015. European small business finance

outlook. EIF Research & Market Analysis.

Maxwell, D., 2017. Valuing Natural Capital: Future Proofing Business and Finance. Routledge.

Roberts, R., 2015. Finance for small and entrepreneurial business. Routledge.

Scholes, M.S., 2015. Taxes and business strategy. Prentice Hall.

Storey, D.J., 2016. Understanding the small business sector. Routledge.

Ylhäinen, I., 2017. Life-cycle effects in small business finance. Journal of Banking &

Finance. 77. pp.176-196.

Online

Working Capital Management (WCM). 2018.[Online]. Available through

:<https://www.investopedia.com/terms/w/workingcapitalmanagement.asp>

8

Books and journals

Block, J.H. and et.al.,2018. New players in entrepreneurial finance and why they are there. Small

Business Economics. 50(2). pp.239-250.

Brooks, C., 2019. Introductory econometrics for finance. Cambridge university press.

Burns, P. and Dewhurst, J. eds., 2016. Small business and entrepreneurship. Macmillan

International Higher Education.

Foroohar, R., 2016. Makers and takers: The rise of finance and the fall of American business.

Crown Books.

Jordà, Ò., Schularick, M. and Taylor, A.M., 2016. The great mortgaging: housing finance, crises

and business cycles. Economic Policy. 31(85). pp.107-152.

Kraemer-Eis, H. and et.al., 2018. European Small Business Finance Outlook: December

2018 (No. 2018/53). EIF Working Paper.

Kraemer-Eis, H., Lang, F. and Gvetadze, S., 2015. European small business finance

outlook. EIF Research & Market Analysis.

Maxwell, D., 2017. Valuing Natural Capital: Future Proofing Business and Finance. Routledge.

Roberts, R., 2015. Finance for small and entrepreneurial business. Routledge.

Scholes, M.S., 2015. Taxes and business strategy. Prentice Hall.

Storey, D.J., 2016. Understanding the small business sector. Routledge.

Ylhäinen, I., 2017. Life-cycle effects in small business finance. Journal of Banking &

Finance. 77. pp.176-196.

Online

Working Capital Management (WCM). 2018.[Online]. Available through

:<https://www.investopedia.com/terms/w/workingcapitalmanagement.asp>

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.