Business Finance 1: Project Evaluation, Stock Valuation, Portfolio

VerifiedAdded on 2023/06/03

|7

|989

|382

Homework Assignment

AI Summary

This assignment delves into various aspects of business finance, starting with a comparative analysis of project investment decisions using methods such as payback period, net present value (NPV), internal rate of return (IRR), and profitability index, ultimately favoring NPV for its comprehensive consideration of time value of money. It further explores stock valuation, demonstrating the inverse relationship between required return and share price, and discusses investor motivations for purchasing non-dividend paying stocks. The assignment also covers portfolio theory, emphasizing risk reduction through diversification, and calculates expected portfolio return and standard deviation. Finally, it addresses bond valuation, weighted average cost of capital (WACC), and the advantages and disadvantages of debt versus equity financing, highlighting the tax benefits of debt and the control implications of equity.

Business Finance 1

By Name

Course

Instructor

Institution

Location

Date

Question 1

By Name

Course

Instructor

Institution

Location

Date

Question 1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance 2

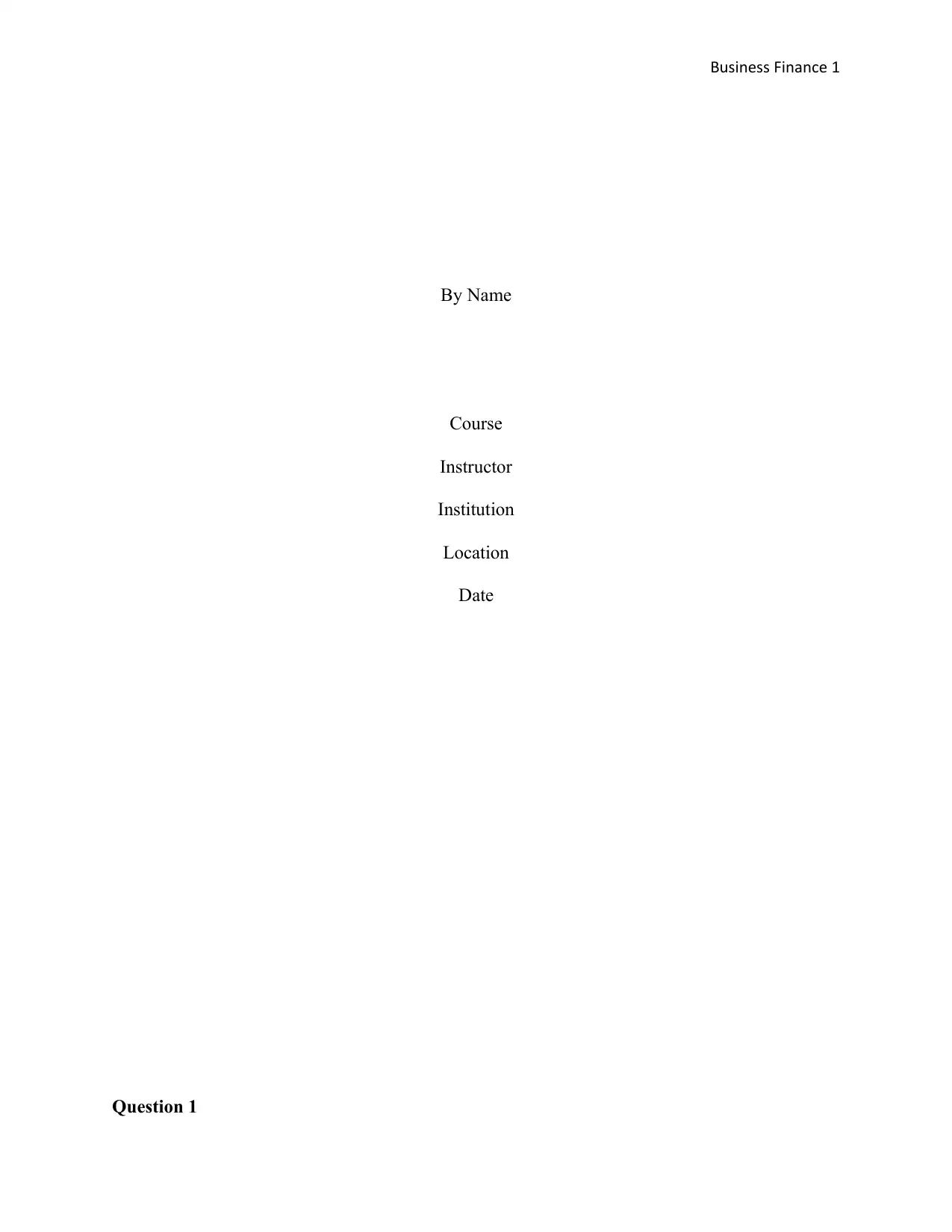

(a) The payback period defines the time required for a project to generate cash flow that covers

the initial capital outlay (Sharpe & Litterman, 2014). The payback period for project A is 3.31

years while that of project B is 1.76 years. Under this criterion, the project B is preferred since it

has a lower payback period.

Figure 1

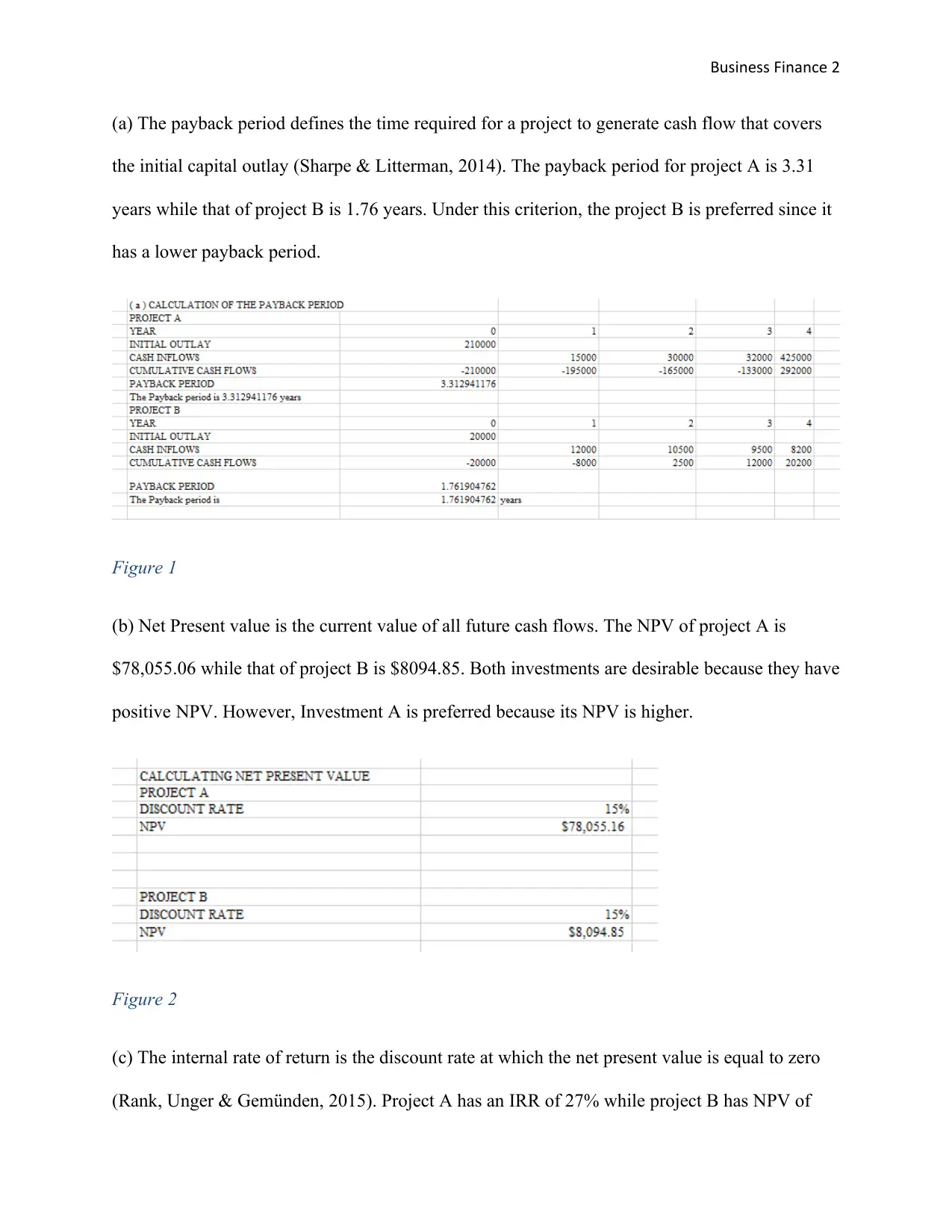

(b) Net Present value is the current value of all future cash flows. The NPV of project A is

$78,055.06 while that of project B is $8094.85. Both investments are desirable because they have

positive NPV. However, Investment A is preferred because its NPV is higher.

Figure 2

(c) The internal rate of return is the discount rate at which the net present value is equal to zero

(Rank, Unger & Gemünden, 2015). Project A has an IRR of 27% while project B has NPV of

(a) The payback period defines the time required for a project to generate cash flow that covers

the initial capital outlay (Sharpe & Litterman, 2014). The payback period for project A is 3.31

years while that of project B is 1.76 years. Under this criterion, the project B is preferred since it

has a lower payback period.

Figure 1

(b) Net Present value is the current value of all future cash flows. The NPV of project A is

$78,055.06 while that of project B is $8094.85. Both investments are desirable because they have

positive NPV. However, Investment A is preferred because its NPV is higher.

Figure 2

(c) The internal rate of return is the discount rate at which the net present value is equal to zero

(Rank, Unger & Gemünden, 2015). Project A has an IRR of 27% while project B has NPV of

Business Finance 3

38%. Since the firms cost of capital is 15%, both investments are worthwhile. However, B is

more preferable than A.

Figure 3

(d) Profitability index measures value generated per unit of investment. Project A has a

profitability index of 1.37 while project B has Profitability index of 1.40. Investment B is

preferred under this criteria because it generates greater value per unit of inflow.

(e) The four methods yield different conclusions. Payback period, internal rate of return and

profitability index support the selection of project B while internal rate of return result prefers

selection of project A. However, the net present value is most preferred by investors because it

considers time value of money and takes in to account all cash flows generated by the

investment.

Question 2

(a) I will be willing to pay $40 for each Wombat share if the required return is 15%.

(b) I will be willing to pay $80 for each Wombat share if the required return is 10%.

38%. Since the firms cost of capital is 15%, both investments are worthwhile. However, B is

more preferable than A.

Figure 3

(d) Profitability index measures value generated per unit of investment. Project A has a

profitability index of 1.37 while project B has Profitability index of 1.40. Investment B is

preferred under this criteria because it generates greater value per unit of inflow.

(e) The four methods yield different conclusions. Payback period, internal rate of return and

profitability index support the selection of project B while internal rate of return result prefers

selection of project A. However, the net present value is most preferred by investors because it

considers time value of money and takes in to account all cash flows generated by the

investment.

Question 2

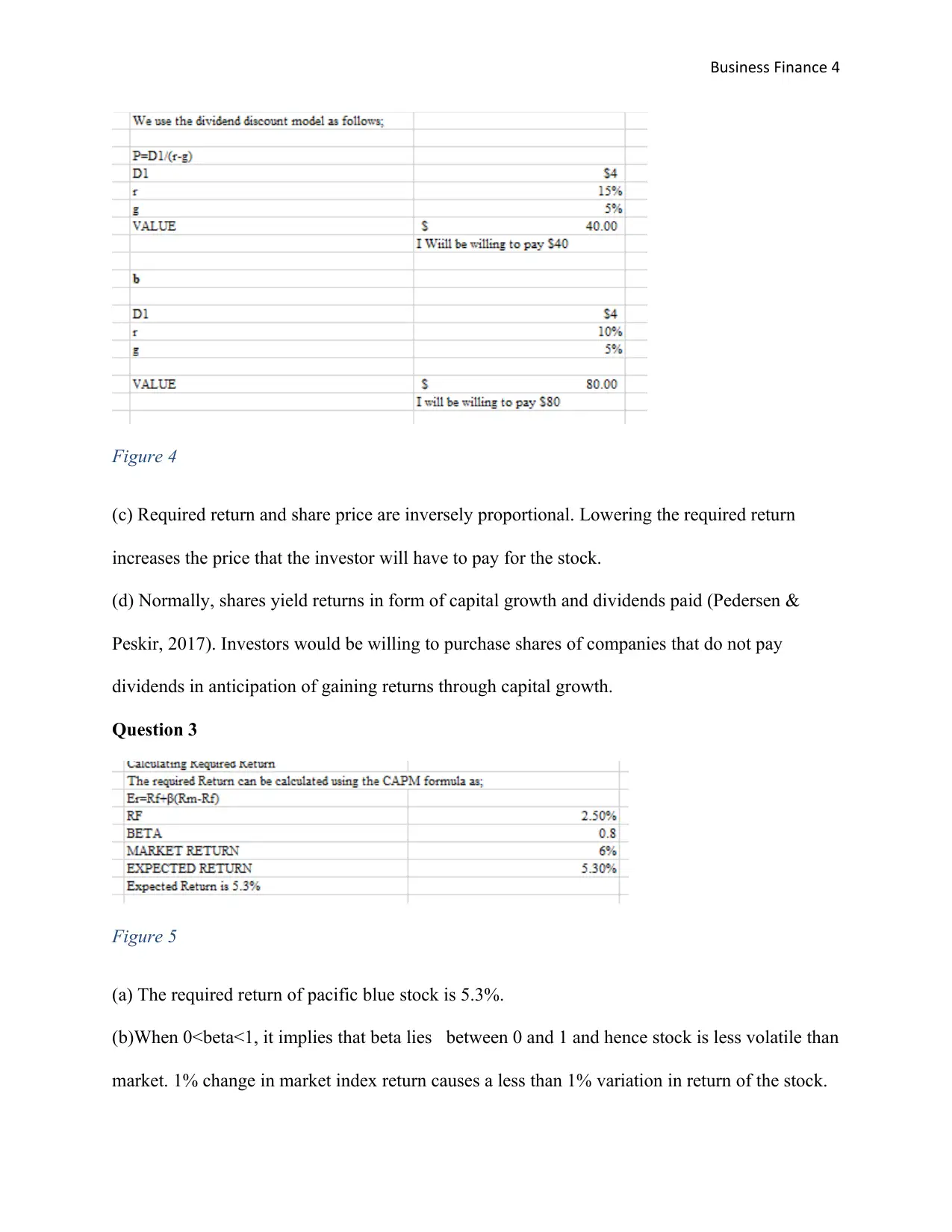

(a) I will be willing to pay $40 for each Wombat share if the required return is 15%.

(b) I will be willing to pay $80 for each Wombat share if the required return is 10%.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business Finance 4

Figure 4

(c) Required return and share price are inversely proportional. Lowering the required return

increases the price that the investor will have to pay for the stock.

(d) Normally, shares yield returns in form of capital growth and dividends paid (Pedersen &

Peskir, 2017). Investors would be willing to purchase shares of companies that do not pay

dividends in anticipation of gaining returns through capital growth.

Question 3

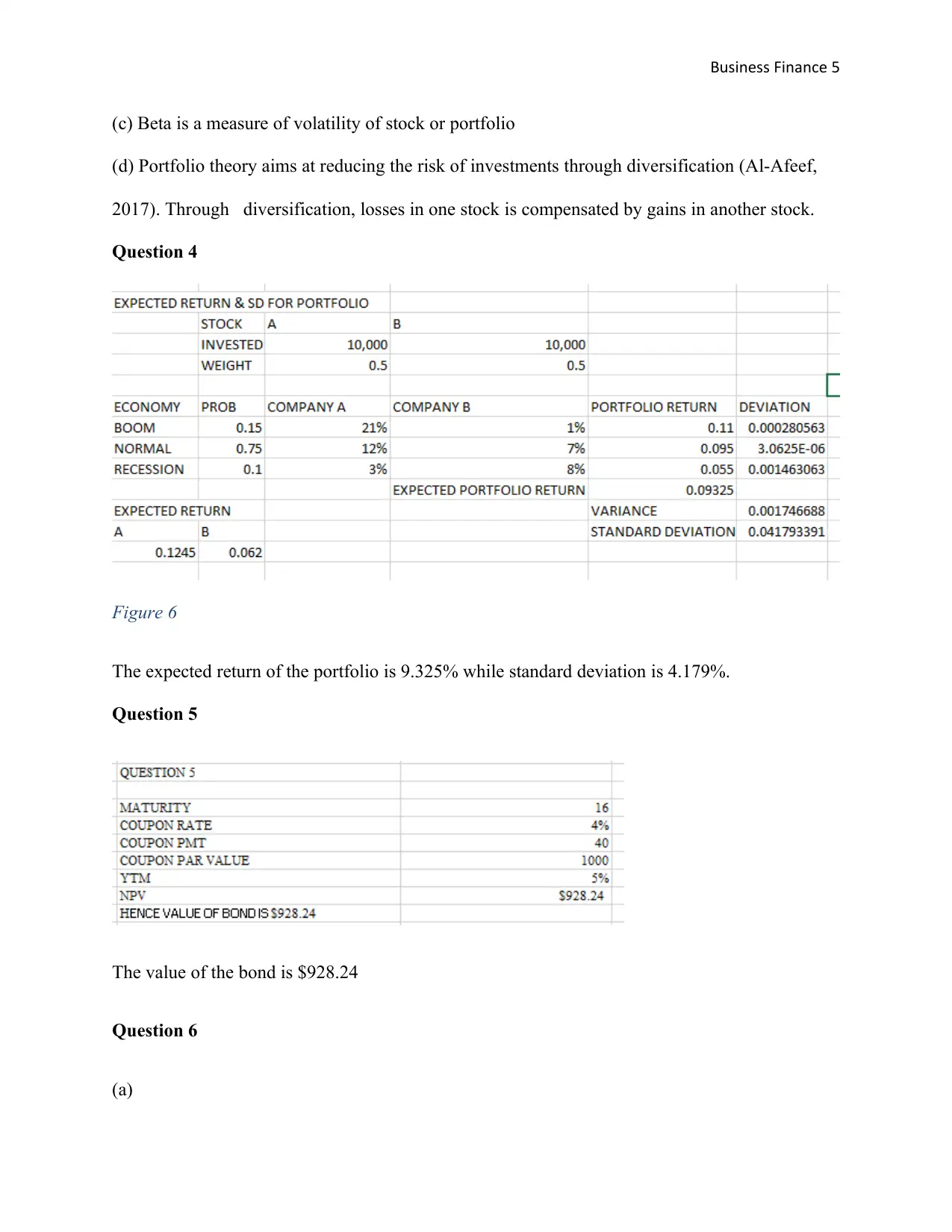

Figure 5

(a) The required return of pacific blue stock is 5.3%.

(b)When 0<beta<1, it implies that beta lies between 0 and 1 and hence stock is less volatile than

market. 1% change in market index return causes a less than 1% variation in return of the stock.

Figure 4

(c) Required return and share price are inversely proportional. Lowering the required return

increases the price that the investor will have to pay for the stock.

(d) Normally, shares yield returns in form of capital growth and dividends paid (Pedersen &

Peskir, 2017). Investors would be willing to purchase shares of companies that do not pay

dividends in anticipation of gaining returns through capital growth.

Question 3

Figure 5

(a) The required return of pacific blue stock is 5.3%.

(b)When 0<beta<1, it implies that beta lies between 0 and 1 and hence stock is less volatile than

market. 1% change in market index return causes a less than 1% variation in return of the stock.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance 5

(c) Beta is a measure of volatility of stock or portfolio

(d) Portfolio theory aims at reducing the risk of investments through diversification (Al-Afeef,

2017). Through diversification, losses in one stock is compensated by gains in another stock.

Question 4

Figure 6

The expected return of the portfolio is 9.325% while standard deviation is 4.179%.

Question 5

The value of the bond is $928.24

Question 6

(a)

(c) Beta is a measure of volatility of stock or portfolio

(d) Portfolio theory aims at reducing the risk of investments through diversification (Al-Afeef,

2017). Through diversification, losses in one stock is compensated by gains in another stock.

Question 4

Figure 6

The expected return of the portfolio is 9.325% while standard deviation is 4.179%.

Question 5

The value of the bond is $928.24

Question 6

(a)

Business Finance 6

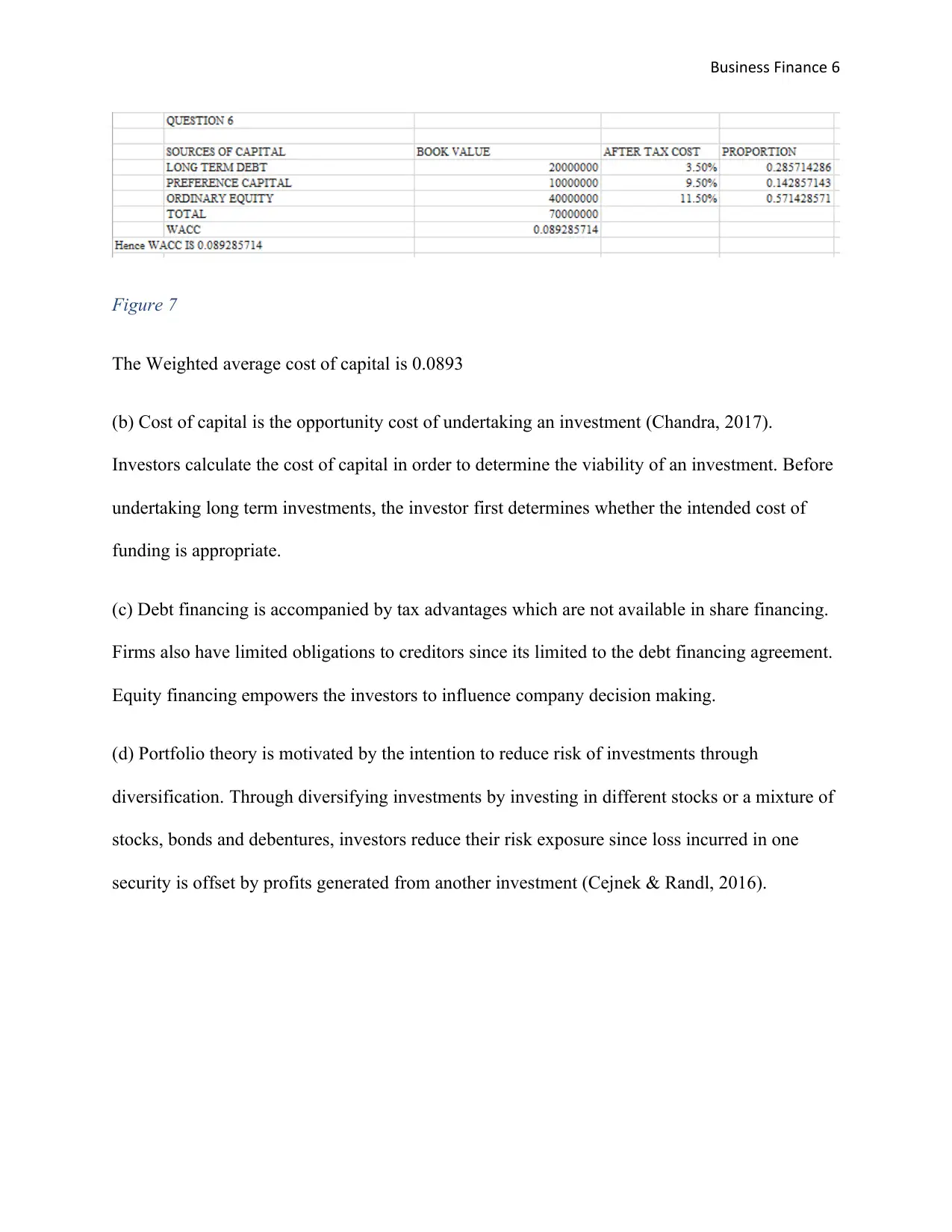

Figure 7

The Weighted average cost of capital is 0.0893

(b) Cost of capital is the opportunity cost of undertaking an investment (Chandra, 2017).

Investors calculate the cost of capital in order to determine the viability of an investment. Before

undertaking long term investments, the investor first determines whether the intended cost of

funding is appropriate.

(c) Debt financing is accompanied by tax advantages which are not available in share financing.

Firms also have limited obligations to creditors since its limited to the debt financing agreement.

Equity financing empowers the investors to influence company decision making.

(d) Portfolio theory is motivated by the intention to reduce risk of investments through

diversification. Through diversifying investments by investing in different stocks or a mixture of

stocks, bonds and debentures, investors reduce their risk exposure since loss incurred in one

security is offset by profits generated from another investment (Cejnek & Randl, 2016).

Figure 7

The Weighted average cost of capital is 0.0893

(b) Cost of capital is the opportunity cost of undertaking an investment (Chandra, 2017).

Investors calculate the cost of capital in order to determine the viability of an investment. Before

undertaking long term investments, the investor first determines whether the intended cost of

funding is appropriate.

(c) Debt financing is accompanied by tax advantages which are not available in share financing.

Firms also have limited obligations to creditors since its limited to the debt financing agreement.

Equity financing empowers the investors to influence company decision making.

(d) Portfolio theory is motivated by the intention to reduce risk of investments through

diversification. Through diversifying investments by investing in different stocks or a mixture of

stocks, bonds and debentures, investors reduce their risk exposure since loss incurred in one

security is offset by profits generated from another investment (Cejnek & Randl, 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business Finance 7

References

BIBLIOGRAPHY Al-Afeef, M. A., 2017. Capital Asset Pricing Model, Theory and Practice: Evidence from

USA (2009-2016). International Journal of Business and Management, 12(8), p. 182.

Cejnek, G. & Randl, O., 2016. Risk and return of short-duration equity investments. Journal of

Empirical Finance, pp. 181-198.

Chandra, P., 2017. Investment analysis and portfolio management. New York: McGraw-Hill

Education.

Pedersen, J. L. & Peskir, G., 2017. Optimal mean-variance portfolio selection. Mathematics and

Financial Economics, 11(2), pp. 137-160.

Rank, J., Unger, B. N. & Gemünden, H. G., 2015. Preparedness for the future in project portfolio

management: The roles of proactiveness, riskiness and willingness to cannibalize. International

Journal of Project Management, pp. 1730-1743.

Sharpe, W. F. & Litterman, R., 2014. Past, present, and future financial thinking. Financial

Analysts Journal, 70(6), pp. 16-22.

References

BIBLIOGRAPHY Al-Afeef, M. A., 2017. Capital Asset Pricing Model, Theory and Practice: Evidence from

USA (2009-2016). International Journal of Business and Management, 12(8), p. 182.

Cejnek, G. & Randl, O., 2016. Risk and return of short-duration equity investments. Journal of

Empirical Finance, pp. 181-198.

Chandra, P., 2017. Investment analysis and portfolio management. New York: McGraw-Hill

Education.

Pedersen, J. L. & Peskir, G., 2017. Optimal mean-variance portfolio selection. Mathematics and

Financial Economics, 11(2), pp. 137-160.

Rank, J., Unger, B. N. & Gemünden, H. G., 2015. Preparedness for the future in project portfolio

management: The roles of proactiveness, riskiness and willingness to cannibalize. International

Journal of Project Management, pp. 1730-1743.

Sharpe, W. F. & Litterman, R., 2014. Past, present, and future financial thinking. Financial

Analysts Journal, 70(6), pp. 16-22.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.