Investment Decisions, Performance Indicators and Pricing Strategies

VerifiedAdded on 2023/06/18

|16

|2511

|203

Report

AI Summary

This report provides a comprehensive analysis of business finance, focusing on capital investment decisions and performance indicators. It begins by evaluating investment opportunities using methods such as the payback period, net present value (NPV), and internal rate of return (IRR) to determine the most profitable project for Beta Limited, recommending Project A based on its superior NPV and IRR. The report then delves into analyzing and comparing internal and external performance indicators through financial ratios like current ratio, quick ratio, debt-to-equity ratio, and interest coverage ratio, assessing Beta Limited's financial health and operational efficiency. External factors influencing Beta Limited's performance, such as credit facility and target audience, are also discussed alongside internal factors like resources and capabilities. Finally, the report explores different pricing strategies, including cost-plus pricing, value pricing, and penetration pricing, providing a holistic view of financial decision-making in a business context.

BUSINESS FINANCE

(Assessment – 2)

(Assessment – 2)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................................3

MAIN BODY.................................................................................................................................................3

Capital investment decision.....................................................................................................................3

Analysing and comparing the internal and external performance indicators..........................................9

CONCLUSION.............................................................................................................................................13

REFERENCES..............................................................................................................................................15

INTRODUCTION...........................................................................................................................................3

MAIN BODY.................................................................................................................................................3

Capital investment decision.....................................................................................................................3

Analysing and comparing the internal and external performance indicators..........................................9

CONCLUSION.............................................................................................................................................13

REFERENCES..............................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Business finance refers to the funds necessary to implement retail operations. Mostly every

company activity necessitates some form of funding. Business finance is a broad phrase that

refers to a variety of operations and specialties centered on the utilization of resources and other

tangible resources. It's a broad phrase that refers to a variety of operations and specializations

centered on the liquidity management and some other tangible assets. To start a firm, run it,

modernize it, increase it, or broaden it (Althnian, 2021). It is necessary for the purchase of a wide

range of assets, both visible and immaterial, such as technology, companies, structures, and

workplaces. In this report consist of investment techniques like Payback period, IRR and NPV to

analysis in which project invest for good return. Along with compare internal as well as external

performance indicators and discuss various types of pricing strategies.

MAIN BODY

Capital investment decision

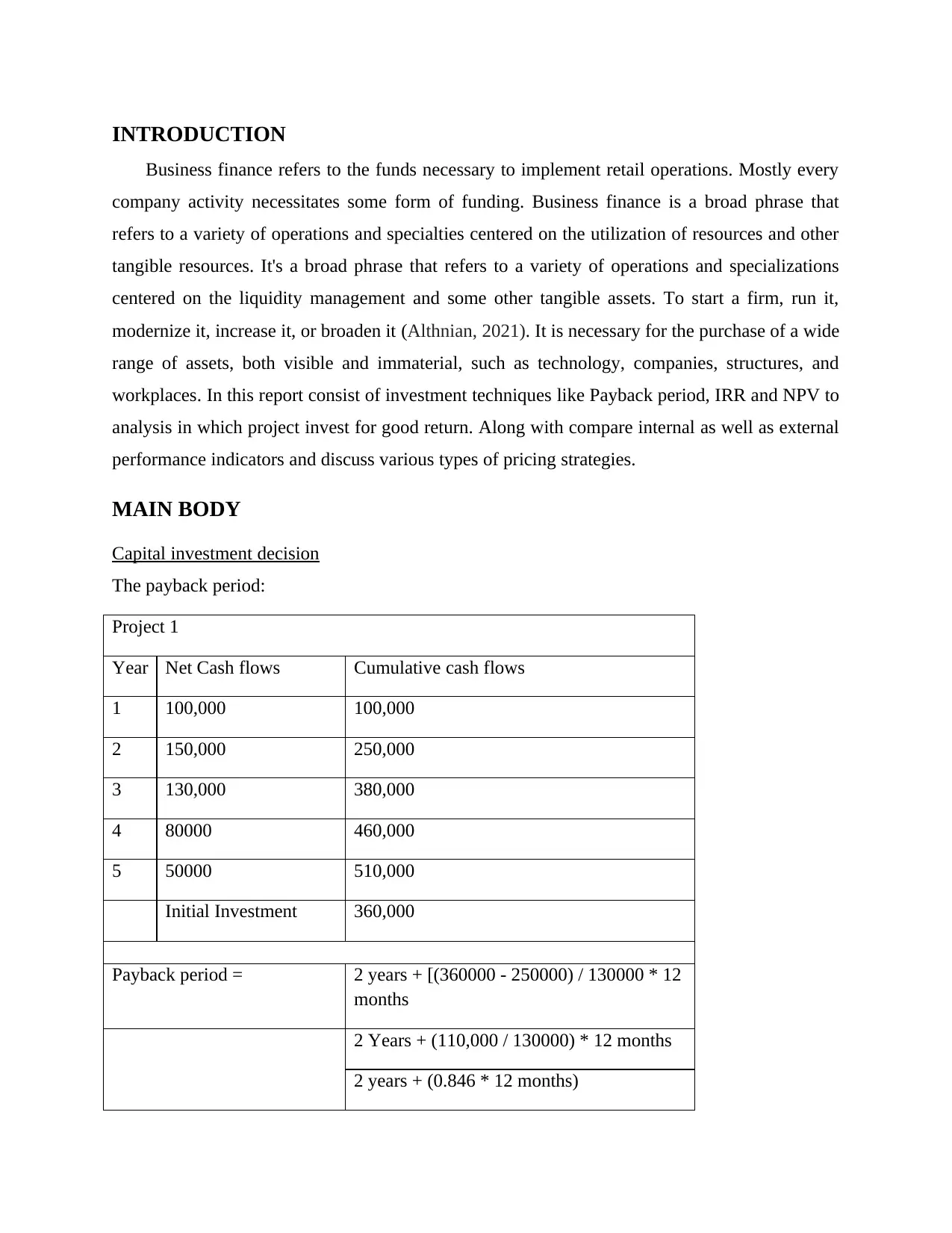

The payback period:

Project 1

Year Net Cash flows Cumulative cash flows

1 100,000 100,000

2 150,000 250,000

3 130,000 380,000

4 80000 460,000

5 50000 510,000

Initial Investment 360,000

Payback period = 2 years + [(360000 - 250000) / 130000 * 12

months

2 Years + (110,000 / 130000) * 12 months

2 years + (0.846 * 12 months)

Business finance refers to the funds necessary to implement retail operations. Mostly every

company activity necessitates some form of funding. Business finance is a broad phrase that

refers to a variety of operations and specialties centered on the utilization of resources and other

tangible resources. It's a broad phrase that refers to a variety of operations and specializations

centered on the liquidity management and some other tangible assets. To start a firm, run it,

modernize it, increase it, or broaden it (Althnian, 2021). It is necessary for the purchase of a wide

range of assets, both visible and immaterial, such as technology, companies, structures, and

workplaces. In this report consist of investment techniques like Payback period, IRR and NPV to

analysis in which project invest for good return. Along with compare internal as well as external

performance indicators and discuss various types of pricing strategies.

MAIN BODY

Capital investment decision

The payback period:

Project 1

Year Net Cash flows Cumulative cash flows

1 100,000 100,000

2 150,000 250,000

3 130,000 380,000

4 80000 460,000

5 50000 510,000

Initial Investment 360,000

Payback period = 2 years + [(360000 - 250000) / 130000 * 12

months

2 Years + (110,000 / 130000) * 12 months

2 years + (0.846 * 12 months)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2 years + 10.15 months

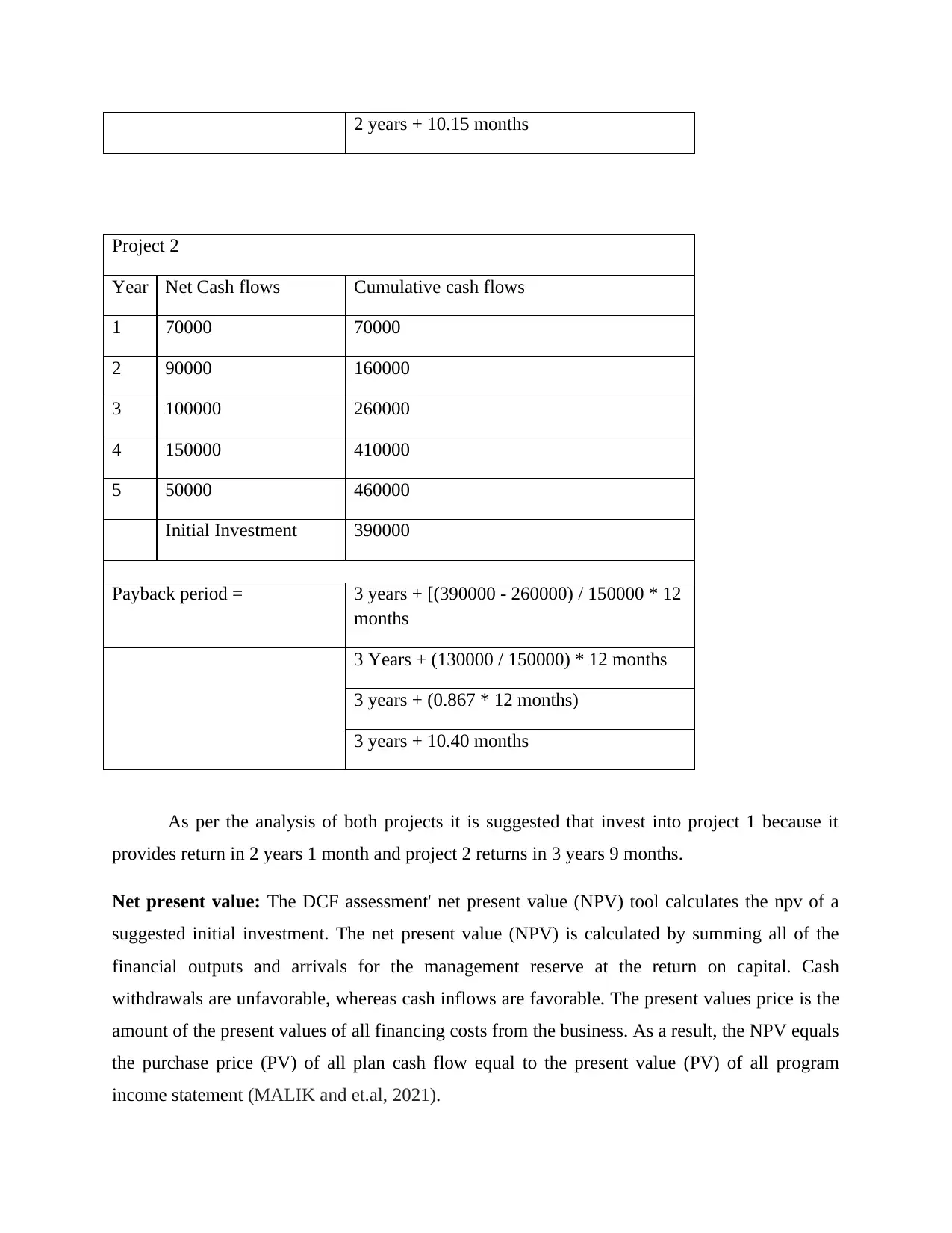

Project 2

Year Net Cash flows Cumulative cash flows

1 70000 70000

2 90000 160000

3 100000 260000

4 150000 410000

5 50000 460000

Initial Investment 390000

Payback period = 3 years + [(390000 - 260000) / 150000 * 12

months

3 Years + (130000 / 150000) * 12 months

3 years + (0.867 * 12 months)

3 years + 10.40 months

As per the analysis of both projects it is suggested that invest into project 1 because it

provides return in 2 years 1 month and project 2 returns in 3 years 9 months.

Net present value: The DCF assessment' net present value (NPV) tool calculates the npv of a

suggested initial investment. The net present value (NPV) is calculated by summing all of the

financial outputs and arrivals for the management reserve at the return on capital. Cash

withdrawals are unfavorable, whereas cash inflows are favorable. The present values price is the

amount of the present values of all financing costs from the business. As a result, the NPV equals

the purchase price (PV) of all plan cash flow equal to the present value (PV) of all program

income statement (MALIK and et.al, 2021).

Project 2

Year Net Cash flows Cumulative cash flows

1 70000 70000

2 90000 160000

3 100000 260000

4 150000 410000

5 50000 460000

Initial Investment 390000

Payback period = 3 years + [(390000 - 260000) / 150000 * 12

months

3 Years + (130000 / 150000) * 12 months

3 years + (0.867 * 12 months)

3 years + 10.40 months

As per the analysis of both projects it is suggested that invest into project 1 because it

provides return in 2 years 1 month and project 2 returns in 3 years 9 months.

Net present value: The DCF assessment' net present value (NPV) tool calculates the npv of a

suggested initial investment. The net present value (NPV) is calculated by summing all of the

financial outputs and arrivals for the management reserve at the return on capital. Cash

withdrawals are unfavorable, whereas cash inflows are favorable. The present values price is the

amount of the present values of all financing costs from the business. As a result, the NPV equals

the purchase price (PV) of all plan cash flow equal to the present value (PV) of all program

income statement (MALIK and et.al, 2021).

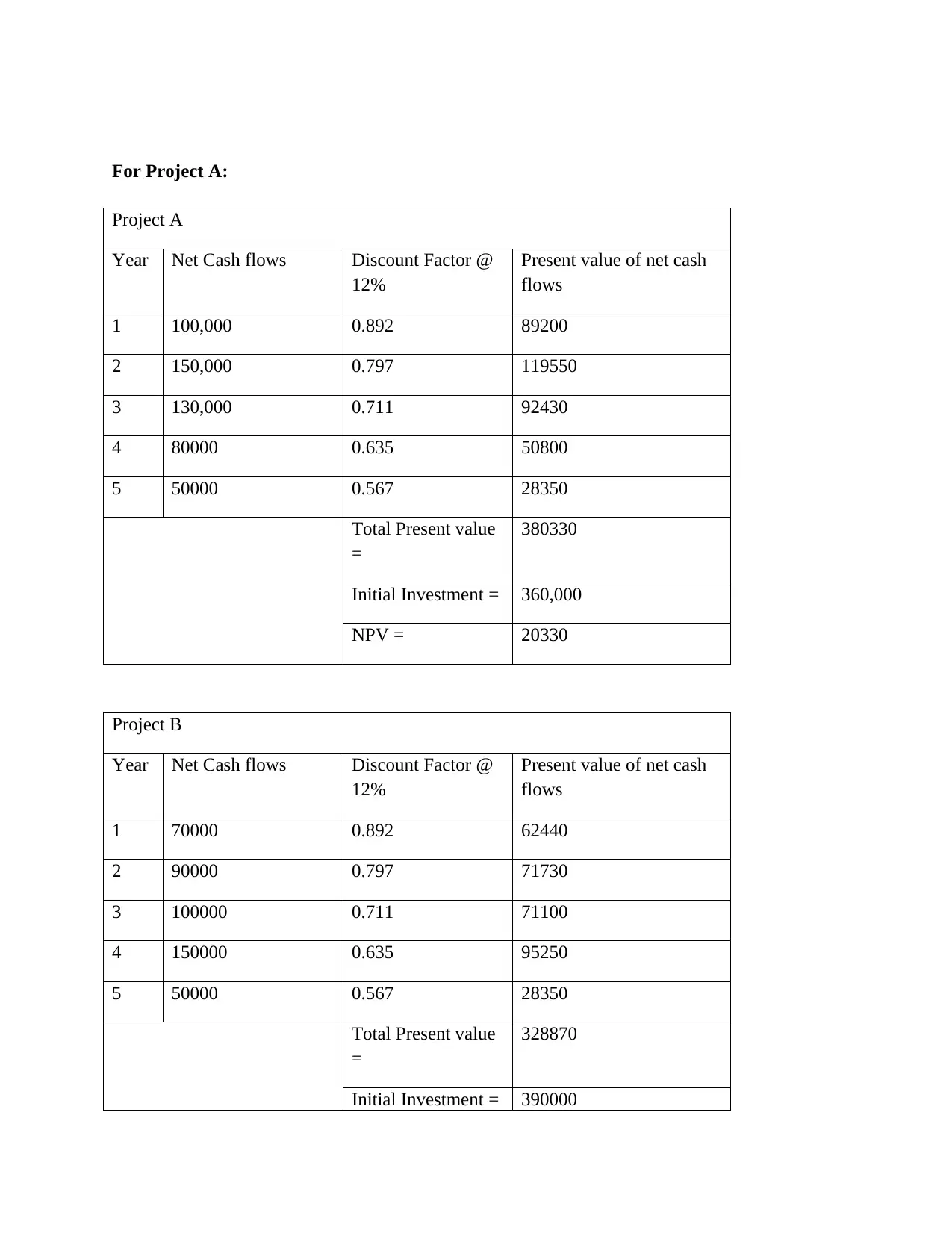

For Project A:

Project A

Year Net Cash flows Discount Factor @

12%

Present value of net cash

flows

1 100,000 0.892 89200

2 150,000 0.797 119550

3 130,000 0.711 92430

4 80000 0.635 50800

5 50000 0.567 28350

Total Present value

=

380330

Initial Investment = 360,000

NPV = 20330

Project B

Year Net Cash flows Discount Factor @

12%

Present value of net cash

flows

1 70000 0.892 62440

2 90000 0.797 71730

3 100000 0.711 71100

4 150000 0.635 95250

5 50000 0.567 28350

Total Present value

=

328870

Initial Investment = 390000

Project A

Year Net Cash flows Discount Factor @

12%

Present value of net cash

flows

1 100,000 0.892 89200

2 150,000 0.797 119550

3 130,000 0.711 92430

4 80000 0.635 50800

5 50000 0.567 28350

Total Present value

=

380330

Initial Investment = 360,000

NPV = 20330

Project B

Year Net Cash flows Discount Factor @

12%

Present value of net cash

flows

1 70000 0.892 62440

2 90000 0.797 71730

3 100000 0.711 71100

4 150000 0.635 95250

5 50000 0.567 28350

Total Present value

=

328870

Initial Investment = 390000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

NPV = - 61130

As a result of the business's analysis of the two proposals, it can be stated that initiative

A's Net Present Value is significantly higher and should be adopted by Beta Limited. The Net

Present Value of Project B has sunk to a negative level. The corporation should not approve

Project B.

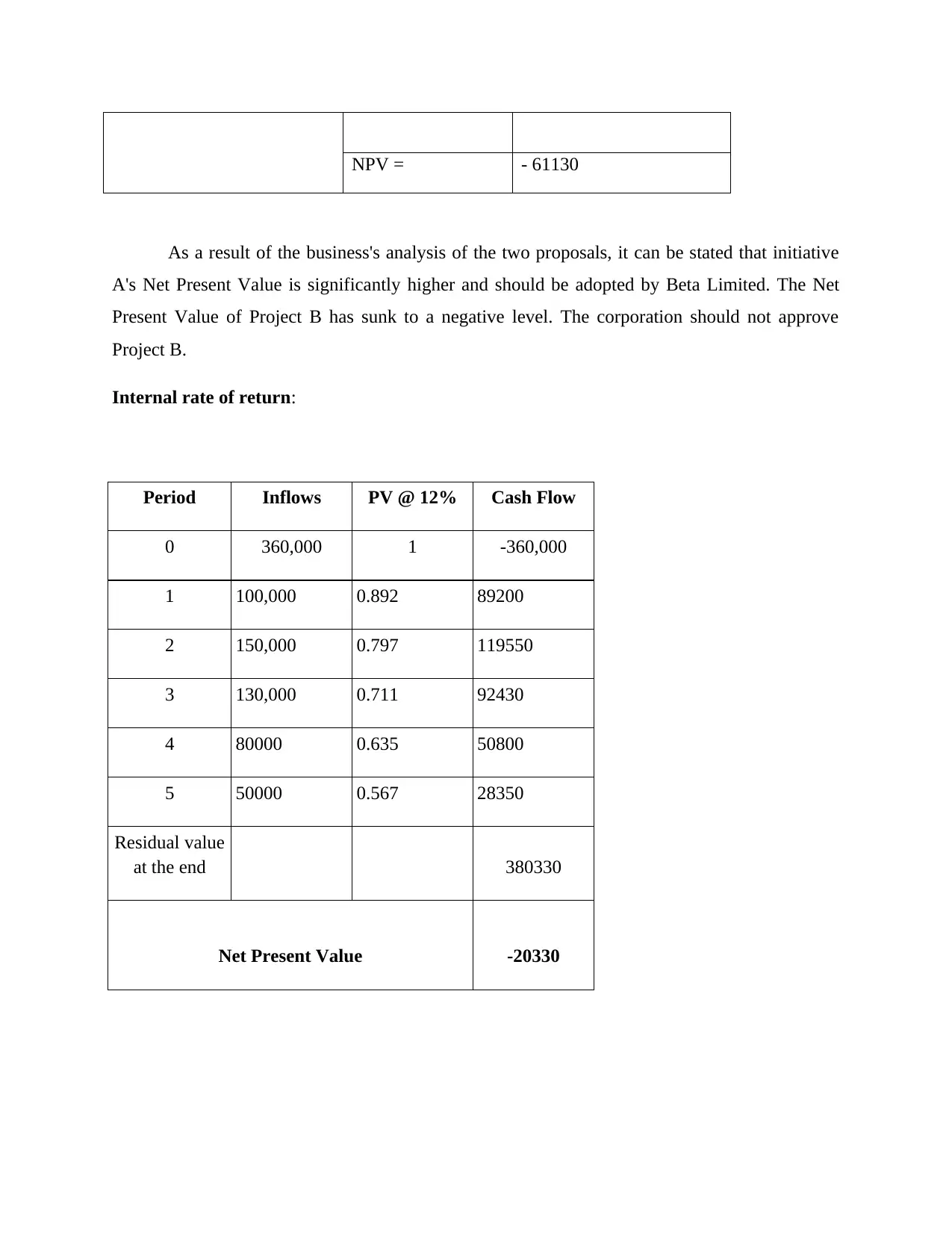

Internal rate of return:

Period Inflows PV @ 12% Cash Flow

0 360,000 1 -360,000

1 100,000 0.892 89200

2 150,000 0.797 119550

3 130,000 0.711 92430

4 80000 0.635 50800

5 50000 0.567 28350

Residual value

at the end 380330

Net Present Value -20330

As a result of the business's analysis of the two proposals, it can be stated that initiative

A's Net Present Value is significantly higher and should be adopted by Beta Limited. The Net

Present Value of Project B has sunk to a negative level. The corporation should not approve

Project B.

Internal rate of return:

Period Inflows PV @ 12% Cash Flow

0 360,000 1 -360,000

1 100,000 0.892 89200

2 150,000 0.797 119550

3 130,000 0.711 92430

4 80000 0.635 50800

5 50000 0.567 28350

Residual value

at the end 380330

Net Present Value -20330

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Period Inflows PV @ 14% Cash Flow

0 360,000 1 -360000

1 100,000 0.877 87700

2 150,000 0.769 115350

3 130,000 0.674 87620

4 80000 0.592 47360

5 50000 0.519 25950

Residual value

at the end 363980

Net Present Value -3980

IRR = 12 + { -20330 / (20330) - (-3980) } * ( 14 - 12 )

= 12 + { -20330 / 3980 } * 2

= 8.8 %.

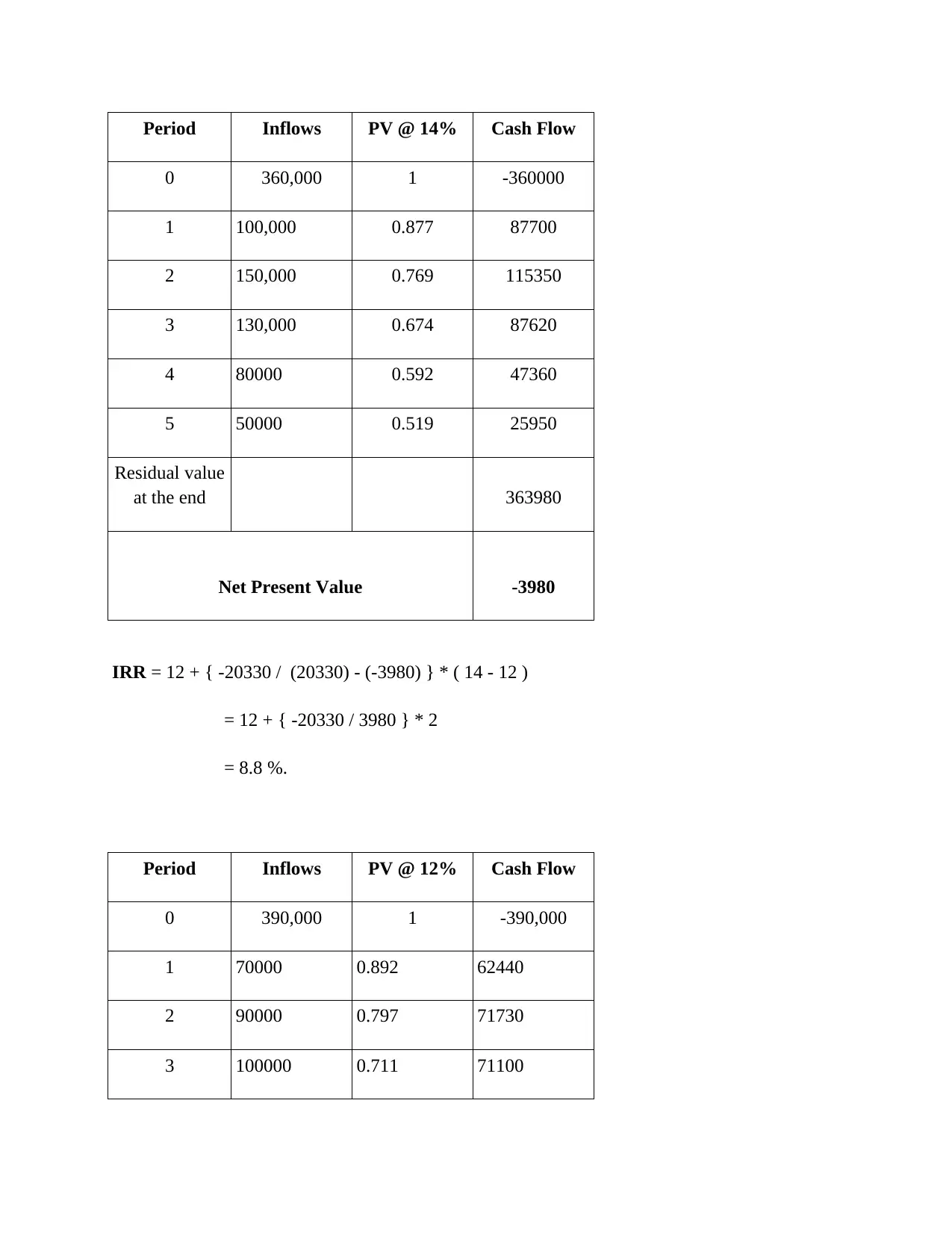

Period Inflows PV @ 12% Cash Flow

0 390,000 1 -390,000

1 70000 0.892 62440

2 90000 0.797 71730

3 100000 0.711 71100

0 360,000 1 -360000

1 100,000 0.877 87700

2 150,000 0.769 115350

3 130,000 0.674 87620

4 80000 0.592 47360

5 50000 0.519 25950

Residual value

at the end 363980

Net Present Value -3980

IRR = 12 + { -20330 / (20330) - (-3980) } * ( 14 - 12 )

= 12 + { -20330 / 3980 } * 2

= 8.8 %.

Period Inflows PV @ 12% Cash Flow

0 390,000 1 -390,000

1 70000 0.892 62440

2 90000 0.797 71730

3 100000 0.711 71100

4 150000 0.635 95250

5 50000 0.567 28350

Residual value

at the end 328870

Net Present Value 61130

Period Inflows PV @ 14% Cash Flow

0 390,000 1 -390000

1 70000 0.877 61390

2 90000 0.769 69210

3 100000 0.674 67400

4 150000 0.592 88800

5 50000 0.519 25950

Residual value

at the end 312750

Net Present Value 77250

IRR = 12 + {61130 / 61130 - 77250) } * ( 14 - 12 )

= 12 + {61130 / (16120) } * 2

= 12 %.

5 50000 0.567 28350

Residual value

at the end 328870

Net Present Value 61130

Period Inflows PV @ 14% Cash Flow

0 390,000 1 -390000

1 70000 0.877 61390

2 90000 0.769 69210

3 100000 0.674 67400

4 150000 0.592 88800

5 50000 0.519 25950

Residual value

at the end 312750

Net Present Value 77250

IRR = 12 + {61130 / 61130 - 77250) } * ( 14 - 12 )

= 12 + {61130 / (16120) } * 2

= 12 %.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

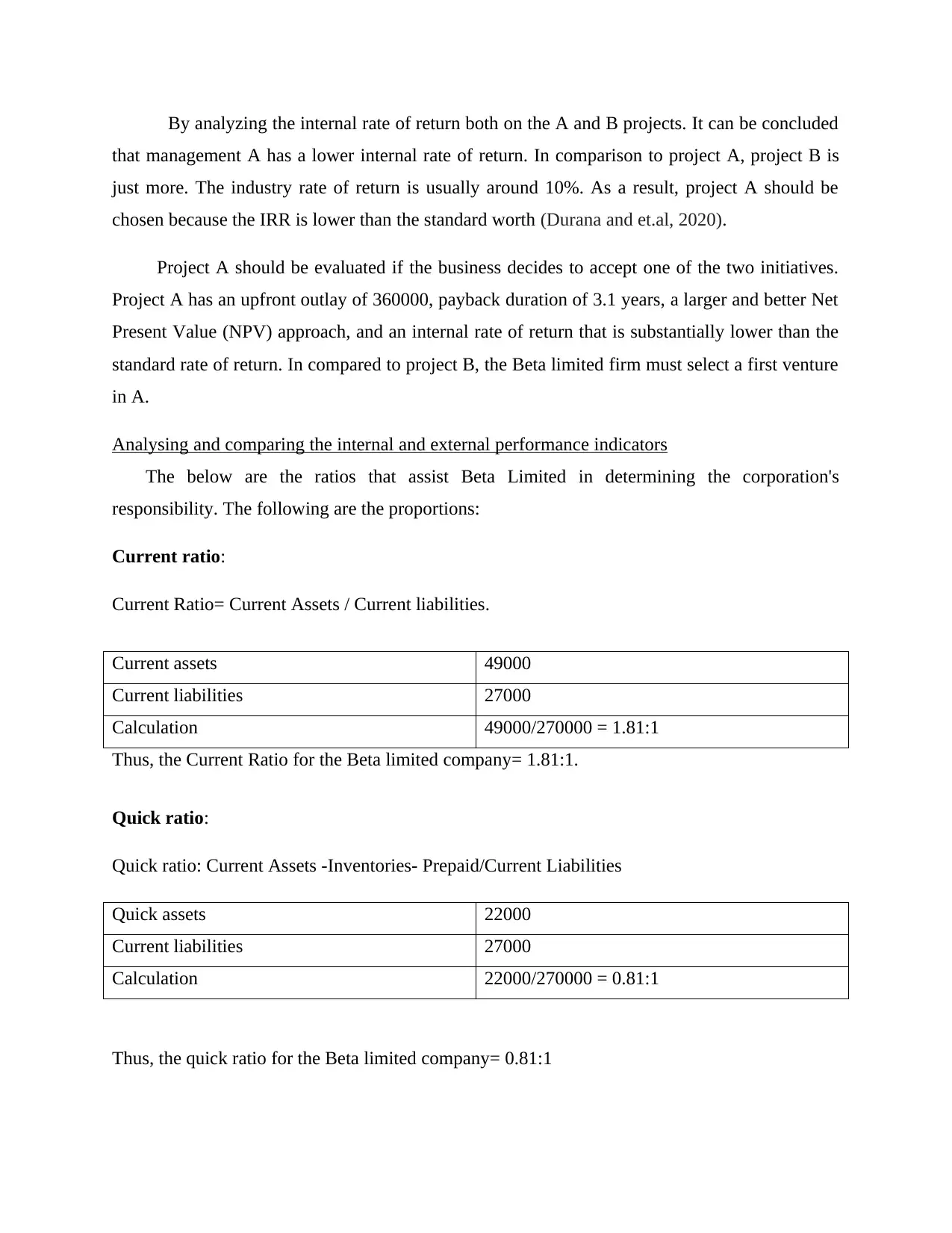

By analyzing the internal rate of return both on the A and B projects. It can be concluded

that management A has a lower internal rate of return. In comparison to project A, project B is

just more. The industry rate of return is usually around 10%. As a result, project A should be

chosen because the IRR is lower than the standard worth (Durana and et.al, 2020).

Project A should be evaluated if the business decides to accept one of the two initiatives.

Project A has an upfront outlay of 360000, payback duration of 3.1 years, a larger and better Net

Present Value (NPV) approach, and an internal rate of return that is substantially lower than the

standard rate of return. In compared to project B, the Beta limited firm must select a first venture

in A.

Analysing and comparing the internal and external performance indicators

The below are the ratios that assist Beta Limited in determining the corporation's

responsibility. The following are the proportions:

Current ratio:

Current Ratio= Current Assets / Current liabilities.

Current assets 49000

Current liabilities 27000

Calculation 49000/270000 = 1.81:1

Thus, the Current Ratio for the Beta limited company= 1.81:1.

Quick ratio:

Quick ratio: Current Assets -Inventories- Prepaid/Current Liabilities

Quick assets 22000

Current liabilities 27000

Calculation 22000/270000 = 0.81:1

Thus, the quick ratio for the Beta limited company= 0.81:1

that management A has a lower internal rate of return. In comparison to project A, project B is

just more. The industry rate of return is usually around 10%. As a result, project A should be

chosen because the IRR is lower than the standard worth (Durana and et.al, 2020).

Project A should be evaluated if the business decides to accept one of the two initiatives.

Project A has an upfront outlay of 360000, payback duration of 3.1 years, a larger and better Net

Present Value (NPV) approach, and an internal rate of return that is substantially lower than the

standard rate of return. In compared to project B, the Beta limited firm must select a first venture

in A.

Analysing and comparing the internal and external performance indicators

The below are the ratios that assist Beta Limited in determining the corporation's

responsibility. The following are the proportions:

Current ratio:

Current Ratio= Current Assets / Current liabilities.

Current assets 49000

Current liabilities 27000

Calculation 49000/270000 = 1.81:1

Thus, the Current Ratio for the Beta limited company= 1.81:1.

Quick ratio:

Quick ratio: Current Assets -Inventories- Prepaid/Current Liabilities

Quick assets 22000

Current liabilities 27000

Calculation 22000/270000 = 0.81:1

Thus, the quick ratio for the Beta limited company= 0.81:1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

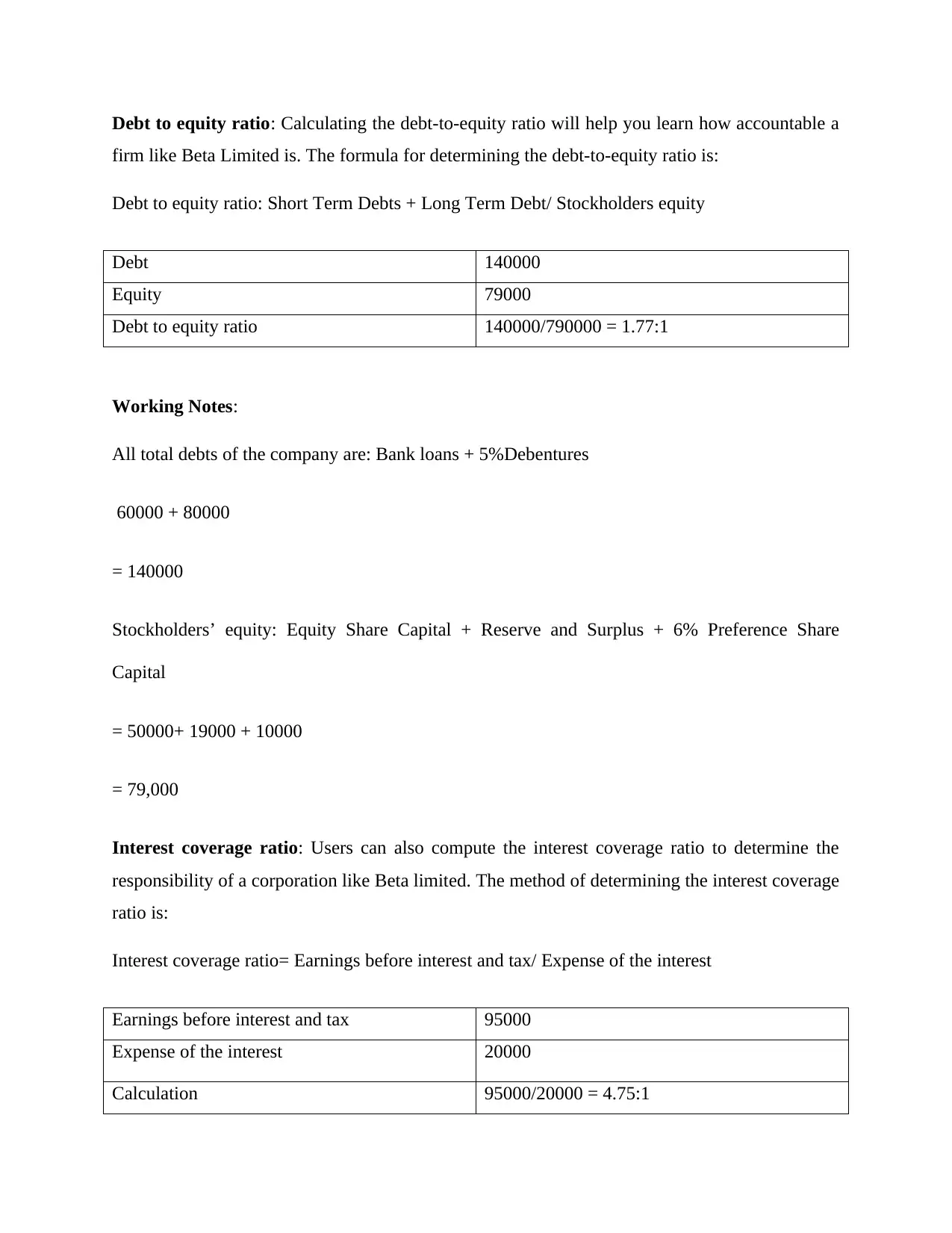

Debt to equity ratio: Calculating the debt-to-equity ratio will help you learn how accountable a

firm like Beta Limited is. The formula for determining the debt-to-equity ratio is:

Debt to equity ratio: Short Term Debts + Long Term Debt/ Stockholders equity

Debt 140000

Equity 79000

Debt to equity ratio 140000/790000 = 1.77:1

Working Notes:

All total debts of the company are: Bank loans + 5%Debentures

60000 + 80000

= 140000

Stockholders’ equity: Equity Share Capital + Reserve and Surplus + 6% Preference Share

Capital

= 50000+ 19000 + 10000

= 79,000

Interest coverage ratio: Users can also compute the interest coverage ratio to determine the

responsibility of a corporation like Beta limited. The method of determining the interest coverage

ratio is:

Interest coverage ratio= Earnings before interest and tax/ Expense of the interest

Earnings before interest and tax 95000

Expense of the interest 20000

Calculation 95000/20000 = 4.75:1

firm like Beta Limited is. The formula for determining the debt-to-equity ratio is:

Debt to equity ratio: Short Term Debts + Long Term Debt/ Stockholders equity

Debt 140000

Equity 79000

Debt to equity ratio 140000/790000 = 1.77:1

Working Notes:

All total debts of the company are: Bank loans + 5%Debentures

60000 + 80000

= 140000

Stockholders’ equity: Equity Share Capital + Reserve and Surplus + 6% Preference Share

Capital

= 50000+ 19000 + 10000

= 79,000

Interest coverage ratio: Users can also compute the interest coverage ratio to determine the

responsibility of a corporation like Beta limited. The method of determining the interest coverage

ratio is:

Interest coverage ratio= Earnings before interest and tax/ Expense of the interest

Earnings before interest and tax 95000

Expense of the interest 20000

Calculation 95000/20000 = 4.75:1

Thus, the interest coverage ratio for the Beta limited company= 4.75:1.

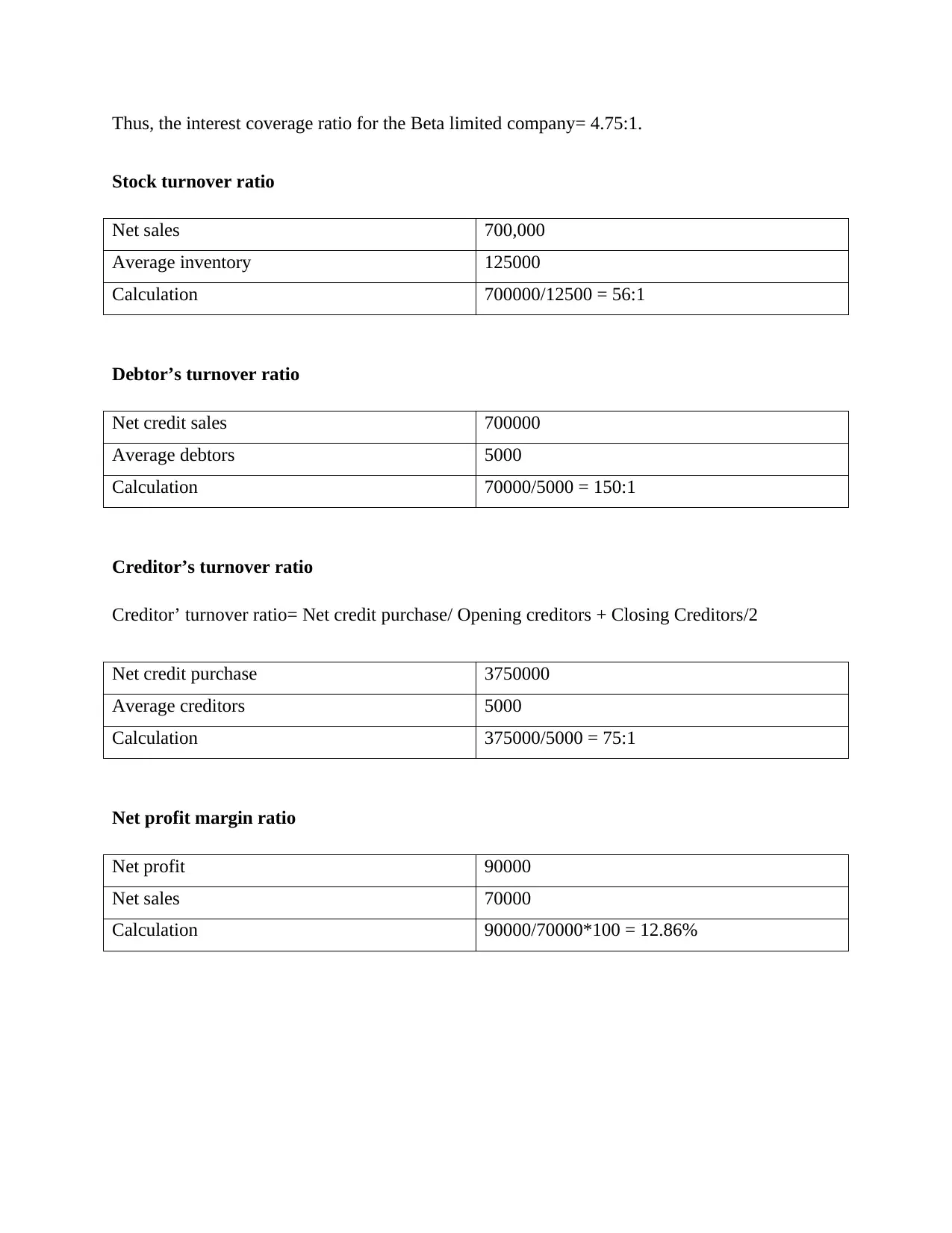

Stock turnover ratio

Net sales 700,000

Average inventory 125000

Calculation 700000/12500 = 56:1

Debtor’s turnover ratio

Net credit sales 700000

Average debtors 5000

Calculation 70000/5000 = 150:1

Creditor’s turnover ratio

Creditor’ turnover ratio= Net credit purchase/ Opening creditors + Closing Creditors/2

Net credit purchase 3750000

Average creditors 5000

Calculation 375000/5000 = 75:1

Net profit margin ratio

Net profit 90000

Net sales 70000

Calculation 90000/70000*100 = 12.86%

Stock turnover ratio

Net sales 700,000

Average inventory 125000

Calculation 700000/12500 = 56:1

Debtor’s turnover ratio

Net credit sales 700000

Average debtors 5000

Calculation 70000/5000 = 150:1

Creditor’s turnover ratio

Creditor’ turnover ratio= Net credit purchase/ Opening creditors + Closing Creditors/2

Net credit purchase 3750000

Average creditors 5000

Calculation 375000/5000 = 75:1

Net profit margin ratio

Net profit 90000

Net sales 70000

Calculation 90000/70000*100 = 12.86%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.