Financial Management of Small Businesses

VerifiedAdded on 2020/10/05

|11

|3217

|146

AI Summary

The assignment provides a comprehensive financial analysis of MGD Ltd and Glowsheets Ltd, highlighting the importance of effective working capital management for small businesses. It also discusses the implications of high gearing ratios on a company's solvency and recommends strategies for improving financial performance.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

BUSINESS FINANCE

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

1. Explaining what is meant by Profit and Cash flow and difference between them.................1

2. Explaining Working Capital and Receivables,

Inventory and Payables..............................................................................................................2

3. How change in Working Capital affects Cash flow................................................................3

4. Applying concepts for showing how company is managed and could affect financial results

.....................................................................................................................................................3

5. Analysing and recommending steps to be taken for improving cash flow of firm through

Working Capital management.....................................................................................................4

PART 2............................................................................................................................................4

1. Calculating ratios and applying the results.............................................................................4

2. Analysing and recommend how bank might assess the financial performance of company..7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

1. Explaining what is meant by Profit and Cash flow and difference between them.................1

2. Explaining Working Capital and Receivables,

Inventory and Payables..............................................................................................................2

3. How change in Working Capital affects Cash flow................................................................3

4. Applying concepts for showing how company is managed and could affect financial results

.....................................................................................................................................................3

5. Analysing and recommending steps to be taken for improving cash flow of firm through

Working Capital management.....................................................................................................4

PART 2............................................................................................................................................4

1. Calculating ratios and applying the results.............................................................................4

2. Analysing and recommend how bank might assess the financial performance of company..7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Business finance is crucial for meeting financing requirements of organisation. Present

report deals with two companies, of which MGD Ltd will be taken and how working capital can

be improve will be discussed in report. Moreover, steps for improving company's cash flow will

be explained through better working capital. Meaning of Working Capital, Receivables,

Inventory and Payables will be discussed along with difference between profit and cash flow.

Another scenario will be of Glowsheets Ltd whose financial ratios for past three years will be

computed in a better manner. Overall performance will be analysed and recommendation would

be provided to bank for assessing financial performance of organisation quite effectually.

PART 1

1. Explaining what is meant by Profit and Cash flow and difference between them

The profit is a residue left after deducting operating and non-operating expenses from

sales revenue for a particular year. It is clarified that business cannot function and survive unless

it earns profits and all expenses are then accounted for. On the other hand, cash flow is different

from profit as it is the money that flows in and out of the activities such as operating, investing

and financing activities in effective manner (Burns and Dewhurst, 2016). It is used for meeting

short-term obligations and needs of Modern Garden Designs Ltd in effectual way. Difference

between profit and cash flow are as follows-

Profit Cash flow

It is the difference between gross income and

its expenses.

On the other hand, cash flow is difference

obtained in cash receipts and payments from

activities.

Business may be profitable but still does not

have adequate cash flow.

It means that cash flow and profit are different

as despite of profitable business, its liquidity

may not be good.

The transactions are not of income nature but

remains either liability or equity transactions in

statement of financial position (Kraemer-Eis

and et.al., 2017).

Firm can have positive cash flow while having

no profit if the cash comes from other sources

such as loan taken.

1

Business finance is crucial for meeting financing requirements of organisation. Present

report deals with two companies, of which MGD Ltd will be taken and how working capital can

be improve will be discussed in report. Moreover, steps for improving company's cash flow will

be explained through better working capital. Meaning of Working Capital, Receivables,

Inventory and Payables will be discussed along with difference between profit and cash flow.

Another scenario will be of Glowsheets Ltd whose financial ratios for past three years will be

computed in a better manner. Overall performance will be analysed and recommendation would

be provided to bank for assessing financial performance of organisation quite effectually.

PART 1

1. Explaining what is meant by Profit and Cash flow and difference between them

The profit is a residue left after deducting operating and non-operating expenses from

sales revenue for a particular year. It is clarified that business cannot function and survive unless

it earns profits and all expenses are then accounted for. On the other hand, cash flow is different

from profit as it is the money that flows in and out of the activities such as operating, investing

and financing activities in effective manner (Burns and Dewhurst, 2016). It is used for meeting

short-term obligations and needs of Modern Garden Designs Ltd in effectual way. Difference

between profit and cash flow are as follows-

Profit Cash flow

It is the difference between gross income and

its expenses.

On the other hand, cash flow is difference

obtained in cash receipts and payments from

activities.

Business may be profitable but still does not

have adequate cash flow.

It means that cash flow and profit are different

as despite of profitable business, its liquidity

may not be good.

The transactions are not of income nature but

remains either liability or equity transactions in

statement of financial position (Kraemer-Eis

and et.al., 2017).

Firm can have positive cash flow while having

no profit if the cash comes from other sources

such as loan taken.

1

It can be analysed that business may attain

profits but due to poor liquidity, bankruptcy

situation prevails.

Insufficient balance of cash flow leads to

bankruptcy even if organisation is profitable.

2. Explaining Working Capital and Receivables,

Inventory and Payables

Working Capital-

The working capital is technically referred as subtracting current assets from current

liabilities. It is required that MGD Ltd should have proper working capital management in order

to attain efficiency in operational activities in the best manner possible. For accomplishing work

in a better manner, firm requires to meet current or short-term liabilities which can be easily

fulfilled by having effective working capital (Jordà, Schularick and Taylor, 2016).

Receivables-

Customers are given credit option for buying goods today and pay for them later. This is

called amount being owed to business in the best manner possible. MGD Ltd have trade

receivables and is legally enforceable for claim over the amount being held by debtors. They are

allowed to repay amount within given credit period. Lesser the time for repayment, more faster

money will be gained by business.

Inventory-

Inventory or stock which is held by business for the purpose of resale by making finished

products. MGD Ltd which is engaged in manufacturing luxury garden furniture requires raw

materials in the form of inventory so that desired production may be achieved. Without having

appropriate inventory, business cannot meet production.

Payables-

MGD Ltd manufacture luxury garden furniture and requires raw materials from suppliers.

The payment is made at a later date and as a result, credit period is allowed by suppliers. The

outstanding amount which is to be repaid is termed as payables. For achieving discounts on bulk

credit purchases, firm should pay quickly or before credit term stipulated by suppliers (Barnes,

2016).

2

profits but due to poor liquidity, bankruptcy

situation prevails.

Insufficient balance of cash flow leads to

bankruptcy even if organisation is profitable.

2. Explaining Working Capital and Receivables,

Inventory and Payables

Working Capital-

The working capital is technically referred as subtracting current assets from current

liabilities. It is required that MGD Ltd should have proper working capital management in order

to attain efficiency in operational activities in the best manner possible. For accomplishing work

in a better manner, firm requires to meet current or short-term liabilities which can be easily

fulfilled by having effective working capital (Jordà, Schularick and Taylor, 2016).

Receivables-

Customers are given credit option for buying goods today and pay for them later. This is

called amount being owed to business in the best manner possible. MGD Ltd have trade

receivables and is legally enforceable for claim over the amount being held by debtors. They are

allowed to repay amount within given credit period. Lesser the time for repayment, more faster

money will be gained by business.

Inventory-

Inventory or stock which is held by business for the purpose of resale by making finished

products. MGD Ltd which is engaged in manufacturing luxury garden furniture requires raw

materials in the form of inventory so that desired production may be achieved. Without having

appropriate inventory, business cannot meet production.

Payables-

MGD Ltd manufacture luxury garden furniture and requires raw materials from suppliers.

The payment is made at a later date and as a result, credit period is allowed by suppliers. The

outstanding amount which is to be repaid is termed as payables. For achieving discounts on bulk

credit purchases, firm should pay quickly or before credit term stipulated by suppliers (Barnes,

2016).

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

3. How change in Working Capital affects Cash flow

Cash flow means flow of cash in and out of operating, investing and financing activities.

It can be analysed that change observed in working capital leads to affect firm's cash flow as

both are interdependent on each other. It can be said that working capital is termed as the

difference between current assets and current liabilities. This implies that amount which has to

make available for paying-off short-term expenditures. If a particular transaction maximises

current assets and current liabilities by the same amount, no change in working capital will be

found. For example, if MGD Ltd receives cash from shorter period debt which needs to be repaid

in 30 days, cash flow statement would elevate. While, working capital will remain unchanged as

loan proceeds is current asset and note payable is current liability since, it is of shorter period.

Moreover, if firm purchases fixed asset, cash outflow will prevail. This will also have an

effect on company working capital as current asset portion would be reduced. While, current

liabilities would not be affected since it will be long-term debt (Haeger, 2017). However, in case

of selling of fixed asset, cash inflow will be attained and working capital will get enhanced as

well. On the other hand, if stock is bought by paying cash, no change in working capital will be

there as both stock and cash are part of current assets. While, cash outflow will prevail as cash

would go out.

4. Applying concepts for showing how company is managed and could affect financial results

MGD Ltd operates three factories in

Manchester, Leeds and Halifax and attained turnover of £220 million. Its been profitable for

recent years, however, firm's debt has gradually maximised up to a high extent. It can be

analysed that debt was £120 million in year before and reached to £157 million. This shows that

firm cash flows will be affected for longer term as repayments of debt has to be made with

interest and principal amount affecting solvency position. This means that burden for making

payments would be maximised (Ylhäinen, 2017). It is required that debt should be reduced and

issuance of equity must be made.

Furthermore, receivables of MGD Ltd are also increased up to a major extent. This is

evident from the fact that business owed £12 million for a series of large orders which were

placed by D&R and outstanding dispute amounting to £20 million. The payment is being

withheld in negotiations between lawyers and technical specialists. This means that outstanding

3

Cash flow means flow of cash in and out of operating, investing and financing activities.

It can be analysed that change observed in working capital leads to affect firm's cash flow as

both are interdependent on each other. It can be said that working capital is termed as the

difference between current assets and current liabilities. This implies that amount which has to

make available for paying-off short-term expenditures. If a particular transaction maximises

current assets and current liabilities by the same amount, no change in working capital will be

found. For example, if MGD Ltd receives cash from shorter period debt which needs to be repaid

in 30 days, cash flow statement would elevate. While, working capital will remain unchanged as

loan proceeds is current asset and note payable is current liability since, it is of shorter period.

Moreover, if firm purchases fixed asset, cash outflow will prevail. This will also have an

effect on company working capital as current asset portion would be reduced. While, current

liabilities would not be affected since it will be long-term debt (Haeger, 2017). However, in case

of selling of fixed asset, cash inflow will be attained and working capital will get enhanced as

well. On the other hand, if stock is bought by paying cash, no change in working capital will be

there as both stock and cash are part of current assets. While, cash outflow will prevail as cash

would go out.

4. Applying concepts for showing how company is managed and could affect financial results

MGD Ltd operates three factories in

Manchester, Leeds and Halifax and attained turnover of £220 million. Its been profitable for

recent years, however, firm's debt has gradually maximised up to a high extent. It can be

analysed that debt was £120 million in year before and reached to £157 million. This shows that

firm cash flows will be affected for longer term as repayments of debt has to be made with

interest and principal amount affecting solvency position. This means that burden for making

payments would be maximised (Ylhäinen, 2017). It is required that debt should be reduced and

issuance of equity must be made.

Furthermore, receivables of MGD Ltd are also increased up to a major extent. This is

evident from the fact that business owed £12 million for a series of large orders which were

placed by D&R and outstanding dispute amounting to £20 million. The payment is being

withheld in negotiations between lawyers and technical specialists. This means that outstanding

3

payment from debtors is of large quantum and furthermore, debt is increased of £37 million

which is of severe concern for firm. It is required that working capital must be enhanced and

quick payments to payables must be made. Else cash flow will be affected leading to have

adverse effect on working capital (Canales, 2016). Financial burden will increase of debt and

thus, needs to be reduced.

5. Analysing and recommending steps to be taken for improving cash flow of firm through

Working Capital management

There are various steps which can be taken by MGD Ltd for improving upon its cash

flow with the help of better working capital-

Meeting debt obligations-

It is required that for improving cash flow. MGD Ltd should use electronic payments'

system should be implemented so that timely payments must be made and no penalty could be

imposed for delayed payments.

Incentives to debtors-

It can be analysed that debtors should be provided with incentives so that they may

quickly pay-off liabilities in effective manner (Kumaran. 2015). This will reduce on payment

defaults of debtors. Hence, firm will be able to increase incentives in effective manner.

Opting vendors who offer discounts-

The vendors who offer discounts on bulk purchases should be opted so that firm may be

able to enhance cash inflow position. It can be assessed that if company is facing liquidity

crunch, discounts offered would certainly help for correcting position of organisation.

Managing stock-

It is required that order of inventory should be placed in accordance to the demands of

customers and production department. This will be fruitful for company as stock spoilage will

get alleviated and as a result, working capital would be improved leading to enhancement in cash

flow.

4

which is of severe concern for firm. It is required that working capital must be enhanced and

quick payments to payables must be made. Else cash flow will be affected leading to have

adverse effect on working capital (Canales, 2016). Financial burden will increase of debt and

thus, needs to be reduced.

5. Analysing and recommending steps to be taken for improving cash flow of firm through

Working Capital management

There are various steps which can be taken by MGD Ltd for improving upon its cash

flow with the help of better working capital-

Meeting debt obligations-

It is required that for improving cash flow. MGD Ltd should use electronic payments'

system should be implemented so that timely payments must be made and no penalty could be

imposed for delayed payments.

Incentives to debtors-

It can be analysed that debtors should be provided with incentives so that they may

quickly pay-off liabilities in effective manner (Kumaran. 2015). This will reduce on payment

defaults of debtors. Hence, firm will be able to increase incentives in effective manner.

Opting vendors who offer discounts-

The vendors who offer discounts on bulk purchases should be opted so that firm may be

able to enhance cash inflow position. It can be assessed that if company is facing liquidity

crunch, discounts offered would certainly help for correcting position of organisation.

Managing stock-

It is required that order of inventory should be placed in accordance to the demands of

customers and production department. This will be fruitful for company as stock spoilage will

get alleviated and as a result, working capital would be improved leading to enhancement in cash

flow.

4

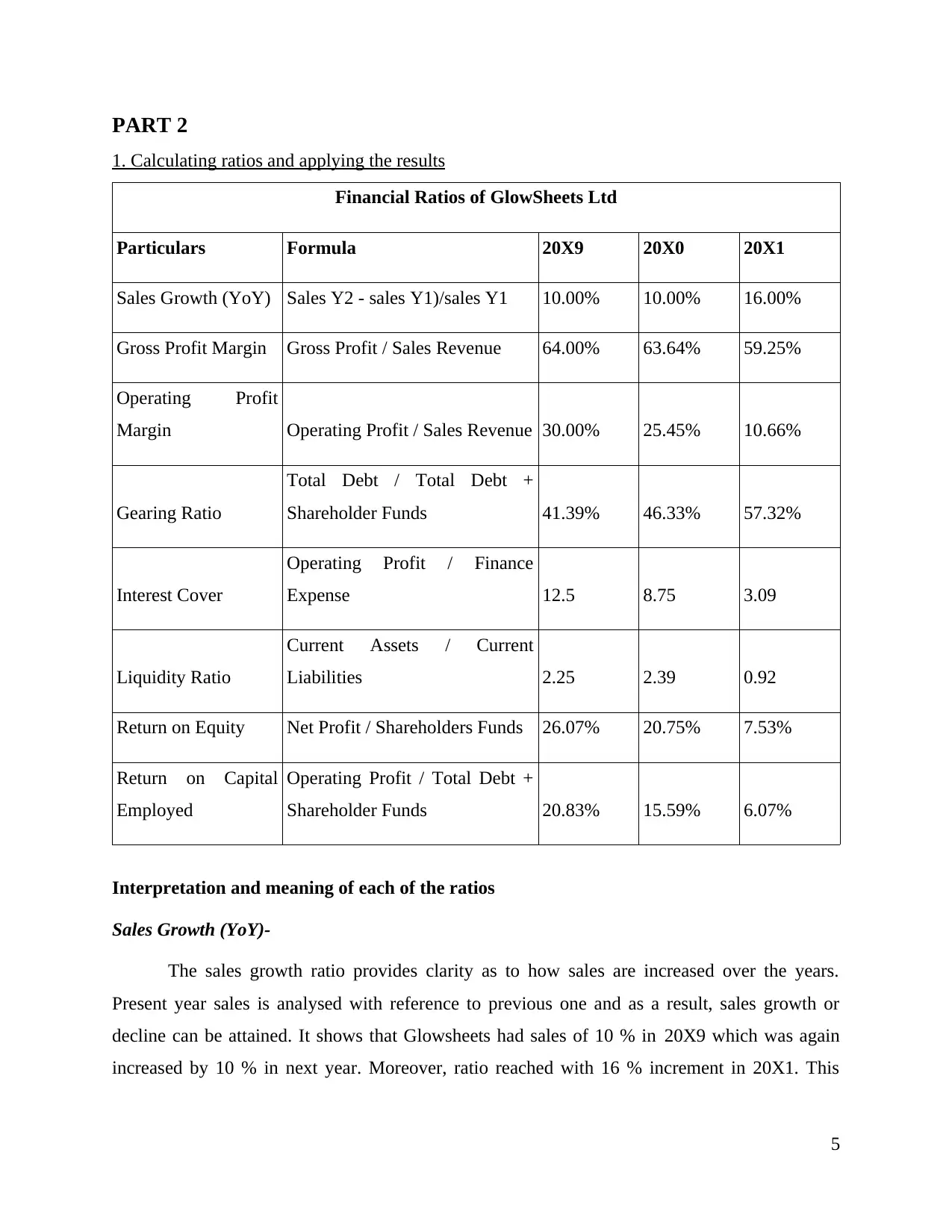

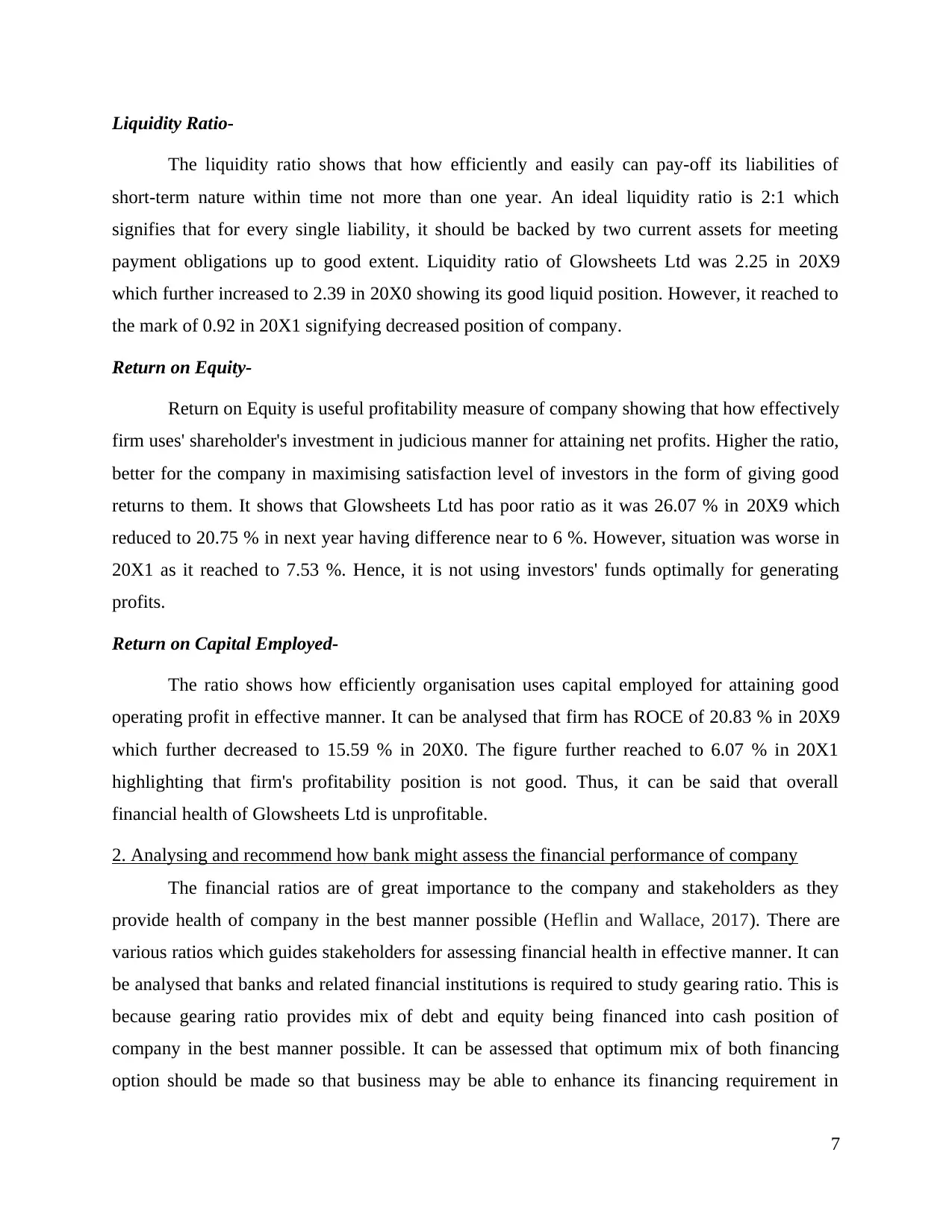

PART 2

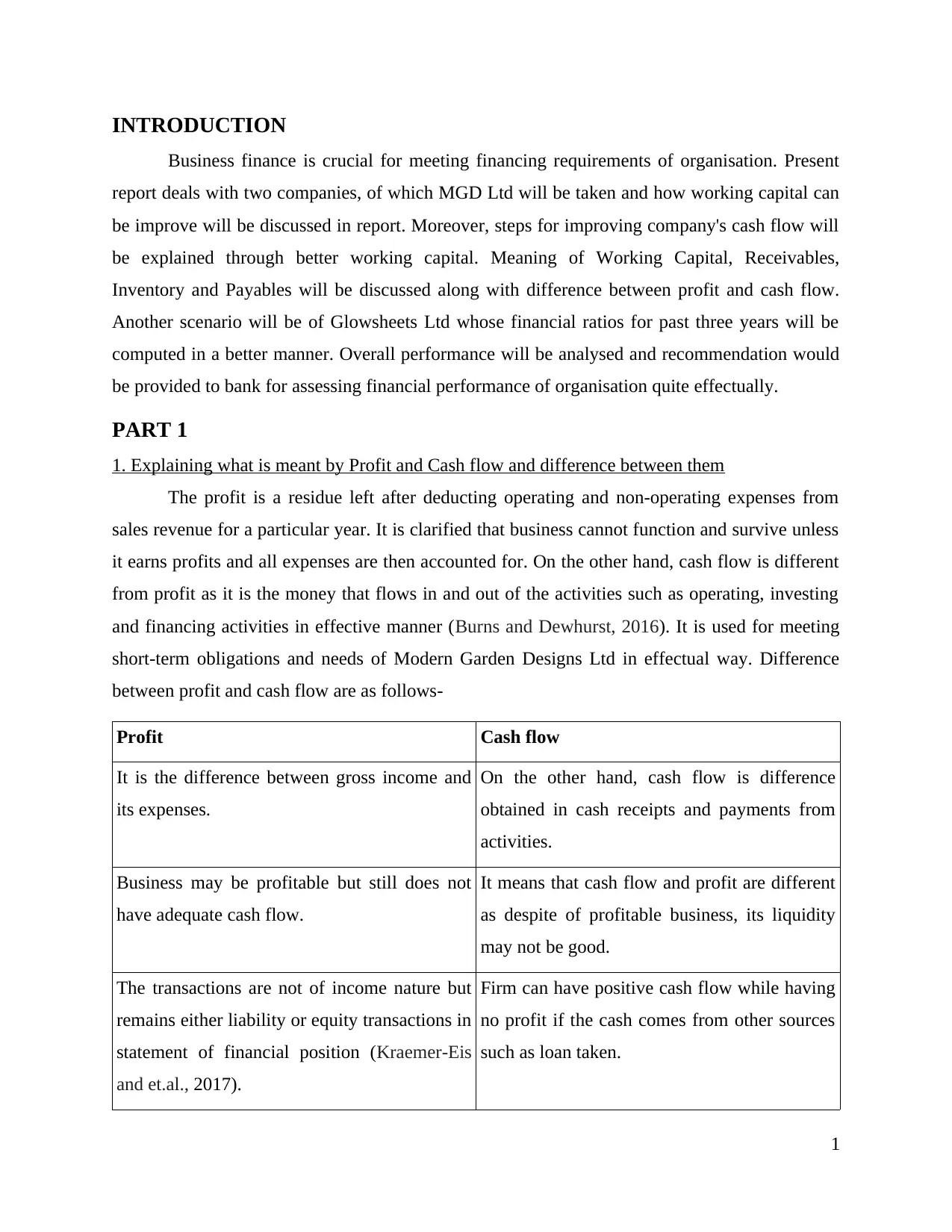

1. Calculating ratios and applying the results

Financial Ratios of GlowSheets Ltd

Particulars Formula 20X9 20X0 20X1

Sales Growth (YoY) Sales Y2 - sales Y1)/sales Y1 10.00% 10.00% 16.00%

Gross Profit Margin Gross Profit / Sales Revenue 64.00% 63.64% 59.25%

Operating Profit

Margin Operating Profit / Sales Revenue 30.00% 25.45% 10.66%

Gearing Ratio

Total Debt / Total Debt +

Shareholder Funds 41.39% 46.33% 57.32%

Interest Cover

Operating Profit / Finance

Expense 12.5 8.75 3.09

Liquidity Ratio

Current Assets / Current

Liabilities 2.25 2.39 0.92

Return on Equity Net Profit / Shareholders Funds 26.07% 20.75% 7.53%

Return on Capital

Employed

Operating Profit / Total Debt +

Shareholder Funds 20.83% 15.59% 6.07%

Interpretation and meaning of each of the ratios

Sales Growth (YoY)-

The sales growth ratio provides clarity as to how sales are increased over the years.

Present year sales is analysed with reference to previous one and as a result, sales growth or

decline can be attained. It shows that Glowsheets had sales of 10 % in 20X9 which was again

increased by 10 % in next year. Moreover, ratio reached with 16 % increment in 20X1. This

5

1. Calculating ratios and applying the results

Financial Ratios of GlowSheets Ltd

Particulars Formula 20X9 20X0 20X1

Sales Growth (YoY) Sales Y2 - sales Y1)/sales Y1 10.00% 10.00% 16.00%

Gross Profit Margin Gross Profit / Sales Revenue 64.00% 63.64% 59.25%

Operating Profit

Margin Operating Profit / Sales Revenue 30.00% 25.45% 10.66%

Gearing Ratio

Total Debt / Total Debt +

Shareholder Funds 41.39% 46.33% 57.32%

Interest Cover

Operating Profit / Finance

Expense 12.5 8.75 3.09

Liquidity Ratio

Current Assets / Current

Liabilities 2.25 2.39 0.92

Return on Equity Net Profit / Shareholders Funds 26.07% 20.75% 7.53%

Return on Capital

Employed

Operating Profit / Total Debt +

Shareholder Funds 20.83% 15.59% 6.07%

Interpretation and meaning of each of the ratios

Sales Growth (YoY)-

The sales growth ratio provides clarity as to how sales are increased over the years.

Present year sales is analysed with reference to previous one and as a result, sales growth or

decline can be attained. It shows that Glowsheets had sales of 10 % in 20X9 which was again

increased by 10 % in next year. Moreover, ratio reached with 16 % increment in 20X1. This

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

clearly shows that sales are being increased up to a major extent year after year leading to have

good position of company in terms of sales.

Gross Profit Margin-

This ratio is calculated by dividing gross profit with sales revenue so that gross profit

ratio could be accomplished in a better manner. It can be analysed that firm should have higher

gross profit which could be gained by initiating control over the operating expenses in effective

manner. Glowsheets Ltd had gross profit margin of 64 % in 20X9 which decreased a bit and

reached 63.64 % in 20X0. However, it further decreased to 59.25 % in 20X1. Thus, it is required

that performance of company should be increased by minimising expenditures quite effectually.

Operating Profit Margin-

Operating profit is another useful measure of profitability of company. It reflects residue

left after accounting for all cost of goods manufactured and operating expenses of firm. This

means that operating profit remains after deducting these elements. It can be analysed that

Glowsheets Ltd had ratio of 30 % in 20X9 which decreased to 25.45 % in 20X0 and further

reached to 10.66 %. This clearly shows that firm's operating profit has declined year after year

and reduction in expenses is needed.

Gearing Ratio-

The gearing ratio provides clarity that total amount of debt and equity in capital structure

of company. An ideal ratio should be below 40 % highlighting that debt should be 40 % and

equity should be 60 % used in capital structure in order to have balance in capital structure. It

can be analysed that gearing ratio in 20X9 was 41.39 % which further elevated to 46.33 % in

next year. Moreover, it increased to 57.32 % in 20X1 in effective manner.

Interest Cover-

It is another useful measure of analysing efficiency position of business in effective

manner. It shows how easily firm can pay their interest accrued on outstanding debt in a better

way. The interest cover ratio should be high which shows efficiency of company in paying

interest amount over debt. Glowsheets Ltd had ratio of 12.5 in 20X9, decreased in next year to

8.75 times, further in 20X1, it reached to 3.09 showing that firm would face difficulty in making

interest payments of debt.

6

good position of company in terms of sales.

Gross Profit Margin-

This ratio is calculated by dividing gross profit with sales revenue so that gross profit

ratio could be accomplished in a better manner. It can be analysed that firm should have higher

gross profit which could be gained by initiating control over the operating expenses in effective

manner. Glowsheets Ltd had gross profit margin of 64 % in 20X9 which decreased a bit and

reached 63.64 % in 20X0. However, it further decreased to 59.25 % in 20X1. Thus, it is required

that performance of company should be increased by minimising expenditures quite effectually.

Operating Profit Margin-

Operating profit is another useful measure of profitability of company. It reflects residue

left after accounting for all cost of goods manufactured and operating expenses of firm. This

means that operating profit remains after deducting these elements. It can be analysed that

Glowsheets Ltd had ratio of 30 % in 20X9 which decreased to 25.45 % in 20X0 and further

reached to 10.66 %. This clearly shows that firm's operating profit has declined year after year

and reduction in expenses is needed.

Gearing Ratio-

The gearing ratio provides clarity that total amount of debt and equity in capital structure

of company. An ideal ratio should be below 40 % highlighting that debt should be 40 % and

equity should be 60 % used in capital structure in order to have balance in capital structure. It

can be analysed that gearing ratio in 20X9 was 41.39 % which further elevated to 46.33 % in

next year. Moreover, it increased to 57.32 % in 20X1 in effective manner.

Interest Cover-

It is another useful measure of analysing efficiency position of business in effective

manner. It shows how easily firm can pay their interest accrued on outstanding debt in a better

way. The interest cover ratio should be high which shows efficiency of company in paying

interest amount over debt. Glowsheets Ltd had ratio of 12.5 in 20X9, decreased in next year to

8.75 times, further in 20X1, it reached to 3.09 showing that firm would face difficulty in making

interest payments of debt.

6

Liquidity Ratio-

The liquidity ratio shows that how efficiently and easily can pay-off its liabilities of

short-term nature within time not more than one year. An ideal liquidity ratio is 2:1 which

signifies that for every single liability, it should be backed by two current assets for meeting

payment obligations up to good extent. Liquidity ratio of Glowsheets Ltd was 2.25 in 20X9

which further increased to 2.39 in 20X0 showing its good liquid position. However, it reached to

the mark of 0.92 in 20X1 signifying decreased position of company.

Return on Equity-

Return on Equity is useful profitability measure of company showing that how effectively

firm uses' shareholder's investment in judicious manner for attaining net profits. Higher the ratio,

better for the company in maximising satisfaction level of investors in the form of giving good

returns to them. It shows that Glowsheets Ltd has poor ratio as it was 26.07 % in 20X9 which

reduced to 20.75 % in next year having difference near to 6 %. However, situation was worse in

20X1 as it reached to 7.53 %. Hence, it is not using investors' funds optimally for generating

profits.

Return on Capital Employed-

The ratio shows how efficiently organisation uses capital employed for attaining good

operating profit in effective manner. It can be analysed that firm has ROCE of 20.83 % in 20X9

which further decreased to 15.59 % in 20X0. The figure further reached to 6.07 % in 20X1

highlighting that firm's profitability position is not good. Thus, it can be said that overall

financial health of Glowsheets Ltd is unprofitable.

2. Analysing and recommend how bank might assess the financial performance of company

The financial ratios are of great importance to the company and stakeholders as they

provide health of company in the best manner possible (Heflin and Wallace, 2017). There are

various ratios which guides stakeholders for assessing financial health in effective manner. It can

be analysed that banks and related financial institutions is required to study gearing ratio. This is

because gearing ratio provides mix of debt and equity being financed into cash position of

company in the best manner possible. It can be assessed that optimum mix of both financing

option should be made so that business may be able to enhance its financing requirement in

7

The liquidity ratio shows that how efficiently and easily can pay-off its liabilities of

short-term nature within time not more than one year. An ideal liquidity ratio is 2:1 which

signifies that for every single liability, it should be backed by two current assets for meeting

payment obligations up to good extent. Liquidity ratio of Glowsheets Ltd was 2.25 in 20X9

which further increased to 2.39 in 20X0 showing its good liquid position. However, it reached to

the mark of 0.92 in 20X1 signifying decreased position of company.

Return on Equity-

Return on Equity is useful profitability measure of company showing that how effectively

firm uses' shareholder's investment in judicious manner for attaining net profits. Higher the ratio,

better for the company in maximising satisfaction level of investors in the form of giving good

returns to them. It shows that Glowsheets Ltd has poor ratio as it was 26.07 % in 20X9 which

reduced to 20.75 % in next year having difference near to 6 %. However, situation was worse in

20X1 as it reached to 7.53 %. Hence, it is not using investors' funds optimally for generating

profits.

Return on Capital Employed-

The ratio shows how efficiently organisation uses capital employed for attaining good

operating profit in effective manner. It can be analysed that firm has ROCE of 20.83 % in 20X9

which further decreased to 15.59 % in 20X0. The figure further reached to 6.07 % in 20X1

highlighting that firm's profitability position is not good. Thus, it can be said that overall

financial health of Glowsheets Ltd is unprofitable.

2. Analysing and recommend how bank might assess the financial performance of company

The financial ratios are of great importance to the company and stakeholders as they

provide health of company in the best manner possible (Heflin and Wallace, 2017). There are

various ratios which guides stakeholders for assessing financial health in effective manner. It can

be analysed that banks and related financial institutions is required to study gearing ratio. This is

because gearing ratio provides mix of debt and equity being financed into cash position of

company in the best manner possible. It can be assessed that optimum mix of both financing

option should be made so that business may be able to enhance its financing requirement in

7

effective manner (Loughran and McDonald, 2016). It is also called leverage ratios as to indicate

long-term solvency of company in the best manner possible.

Glowsheets Ltd had increased its non-current liabilities as it was 129 in 20X9 which

increased to 175 in 20X0 and further reached to 250 in 20X1. This means that company needs to

reduce its debt for enhancing its overall position in the best manner possible. It is recommended

to NIB (National

Interest Bank) which has sanctioned loan facility of £250,000 3 years

ago which expires in 8 months’ time that gearing ratio should be judged. If it is likely that

Glowsheets Ltd would default, then it is recommended to take possession of non-current assets

as collateral security so that loan amount could be recovered by selling it.

CONCLUSION

Hereby it can be concluded that finance is need of business for meeting day-to-day

operational activities with ease. Finance requirements of company can be attained properly by

managing working capital in a better manner. It can be analysed that firm should have good

working capital as MGD Ltd could enhance its position by reducing amount of debt and improve

its cash flow. On the other hand, financial performance of Glowsheets Ltd is not good as overall

profitability position is not good as computed with the help of ratios.

8

long-term solvency of company in the best manner possible.

Glowsheets Ltd had increased its non-current liabilities as it was 129 in 20X9 which

increased to 175 in 20X0 and further reached to 250 in 20X1. This means that company needs to

reduce its debt for enhancing its overall position in the best manner possible. It is recommended

to NIB (National

Interest Bank) which has sanctioned loan facility of £250,000 3 years

ago which expires in 8 months’ time that gearing ratio should be judged. If it is likely that

Glowsheets Ltd would default, then it is recommended to take possession of non-current assets

as collateral security so that loan amount could be recovered by selling it.

CONCLUSION

Hereby it can be concluded that finance is need of business for meeting day-to-day

operational activities with ease. Finance requirements of company can be attained properly by

managing working capital in a better manner. It can be analysed that firm should have good

working capital as MGD Ltd could enhance its position by reducing amount of debt and improve

its cash flow. On the other hand, financial performance of Glowsheets Ltd is not good as overall

profitability position is not good as computed with the help of ratios.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journals

Barnes, P., 2016. Stock market efficiency, insider dealing and market abuse. Gower.

Burns, P. and Dewhurst, J. eds., 2016. Small business and entrepreneurship. Macmillan

International Higher Education.

Canales, R., 2016. From ideals to institutions: Institutional entrepreneurship and the growth of

Mexican small business finance. Organization Science. 27(6).pp.1548-1573.

Haeger, J. D., 2017. John Jacob Astor: Business and Finance in the Early Republic. Wayne State

University Press.

Heflin, F. and Wallace, D., 2017. The BP oil spill: shareholder wealth effects and environmental

disclosures. Journal of Business Finance & Accounting. 44(3-4). pp.337-374.

Jordà, Ò., Schularick, M. and Taylor, A.M., 2016. The great mortgaging: housing finance, crises

and business cycles.Economic Policy. 31(85). pp.107-152.

Kraemer-Eis, H. and et.al., 2017. European Small Business Finance Outlook: December

2017 (No. 2017/46). EIF Working Paper.

Loughran, T. and McDonald, B., 2016. Textual analysis in accounting and finance: A

survey. Journal of Accounting Research. 54(4). pp.1187-1230.

Ylhäinen, I., 2017. Life-cycle effects in small business finance.Journal of Banking &

Finance. 77. pp.176-196.

ONLINE

Kumaran. 2015 11 Best Ways to Improve Working Capital [Online] Available Through:

<https://www.invensis.net/blog/finance-and-accounting/11-best-ways-improve-working-

capital/>

9

Books and Journals

Barnes, P., 2016. Stock market efficiency, insider dealing and market abuse. Gower.

Burns, P. and Dewhurst, J. eds., 2016. Small business and entrepreneurship. Macmillan

International Higher Education.

Canales, R., 2016. From ideals to institutions: Institutional entrepreneurship and the growth of

Mexican small business finance. Organization Science. 27(6).pp.1548-1573.

Haeger, J. D., 2017. John Jacob Astor: Business and Finance in the Early Republic. Wayne State

University Press.

Heflin, F. and Wallace, D., 2017. The BP oil spill: shareholder wealth effects and environmental

disclosures. Journal of Business Finance & Accounting. 44(3-4). pp.337-374.

Jordà, Ò., Schularick, M. and Taylor, A.M., 2016. The great mortgaging: housing finance, crises

and business cycles.Economic Policy. 31(85). pp.107-152.

Kraemer-Eis, H. and et.al., 2017. European Small Business Finance Outlook: December

2017 (No. 2017/46). EIF Working Paper.

Loughran, T. and McDonald, B., 2016. Textual analysis in accounting and finance: A

survey. Journal of Accounting Research. 54(4). pp.1187-1230.

Ylhäinen, I., 2017. Life-cycle effects in small business finance.Journal of Banking &

Finance. 77. pp.176-196.

ONLINE

Kumaran. 2015 11 Best Ways to Improve Working Capital [Online] Available Through:

<https://www.invensis.net/blog/finance-and-accounting/11-best-ways-improve-working-

capital/>

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.