Business Finance

VerifiedAdded on 2023/06/18

|11

|3254

|408

AI Summary

This report discusses cash budget formulation for three months, accounting equation and its balancing, benefits of shares listed on stock exchange, stakeholders in Marks and Spencer, and difference between profit and cash flow. It also highlights the importance of having appropriate business finance for better decision-making.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Business Finance

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Formulation of cash budget or the three months ending 31 March 2022...................................1

TASK 2............................................................................................................................................3

2.1 Explaining the accounting equation and reason for its balancing.........................................3

2.2 Explaining the benefits company obtains by having shares listed on stock exchange.........4

2.3 Describing stakeholders in large company In Marks and Spencer.......................................5

2.4 Different between profit and cash flow justification of whether profit is reliable indicator

of cash balances...........................................................................................................................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Formulation of cash budget or the three months ending 31 March 2022...................................1

TASK 2............................................................................................................................................3

2.1 Explaining the accounting equation and reason for its balancing.........................................3

2.2 Explaining the benefits company obtains by having shares listed on stock exchange.........4

2.3 Describing stakeholders in large company In Marks and Spencer.......................................5

2.4 Different between profit and cash flow justification of whether profit is reliable indicator

of cash balances...........................................................................................................................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

Business finance is related with obtaining the information regarding monetary resources

of organization through analyzing and monetary resources in turn proper decision can be taken.

In the recent era, there is need of having appropriate business finance in turn greater

effectiveness can be derived. The current report is based on formulation of cash budget so that

proper evaluation can be done. Present report will evaluate accounting equation and reason for

its balancing. The study will give emphasize benefits of shares listed on stock exchange for

providing depth insights. It will include different kinds of shareholders of a large company like

Marks & Spencer. The current study will highlight how reliable indicator of cash balance along

with showing difference between profit & cash.

TASK 1

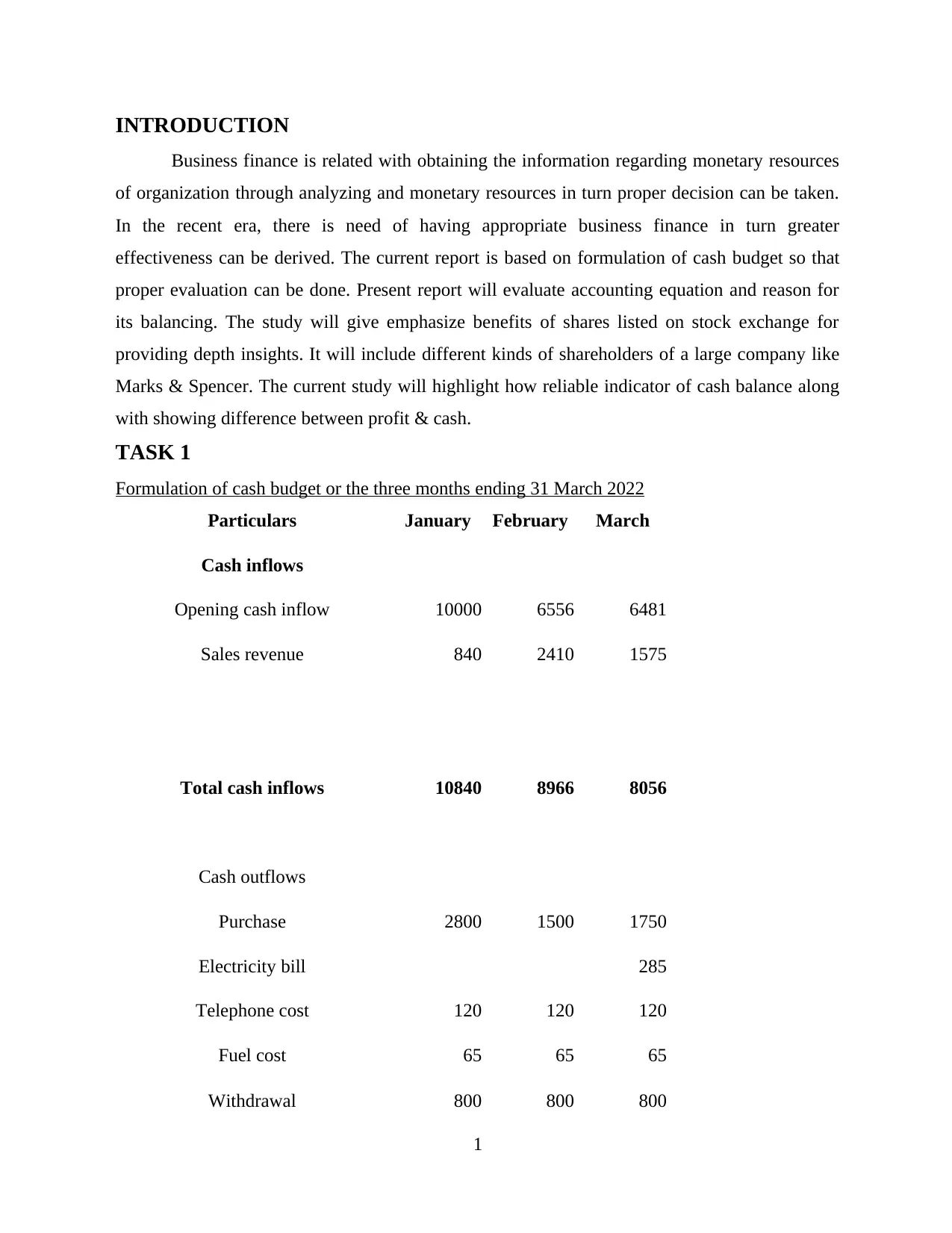

Formulation of cash budget or the three months ending 31 March 2022

Particulars January February March

Cash inflows

Opening cash inflow 10000 6556 6481

Sales revenue 840 2410 1575

Total cash inflows 10840 8966 8056

Cash outflows

Purchase 2800 1500 1750

Electricity bill 285

Telephone cost 120 120 120

Fuel cost 65 65 65

Withdrawal 800 800 800

1

Business finance is related with obtaining the information regarding monetary resources

of organization through analyzing and monetary resources in turn proper decision can be taken.

In the recent era, there is need of having appropriate business finance in turn greater

effectiveness can be derived. The current report is based on formulation of cash budget so that

proper evaluation can be done. Present report will evaluate accounting equation and reason for

its balancing. The study will give emphasize benefits of shares listed on stock exchange for

providing depth insights. It will include different kinds of shareholders of a large company like

Marks & Spencer. The current study will highlight how reliable indicator of cash balance along

with showing difference between profit & cash.

TASK 1

Formulation of cash budget or the three months ending 31 March 2022

Particulars January February March

Cash inflows

Opening cash inflow 10000 6556 6481

Sales revenue 840 2410 1575

Total cash inflows 10840 8966 8056

Cash outflows

Purchase 2800 1500 1750

Electricity bill 285

Telephone cost 120 120 120

Fuel cost 65 65 65

Withdrawal 800 800 800

1

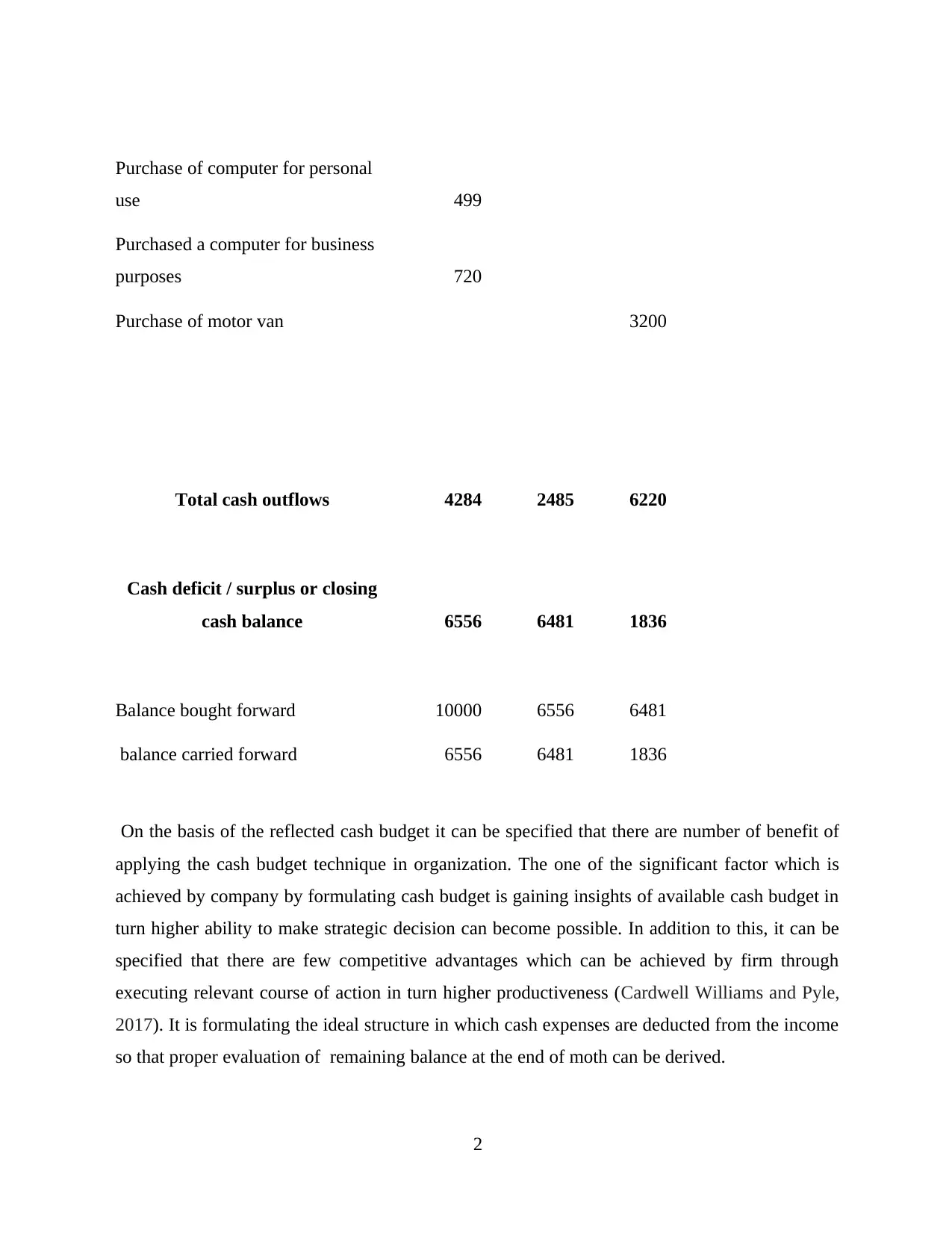

Purchase of computer for personal

use 499

Purchased a computer for business

purposes 720

Purchase of motor van 3200

Total cash outflows 4284 2485 6220

Cash deficit / surplus or closing

cash balance 6556 6481 1836

Balance bought forward 10000 6556 6481

balance carried forward 6556 6481 1836

On the basis of the reflected cash budget it can be specified that there are number of benefit of

applying the cash budget technique in organization. The one of the significant factor which is

achieved by company by formulating cash budget is gaining insights of available cash budget in

turn higher ability to make strategic decision can become possible. In addition to this, it can be

specified that there are few competitive advantages which can be achieved by firm through

executing relevant course of action in turn higher productiveness (Cardwell Williams and Pyle,

2017). It is formulating the ideal structure in which cash expenses are deducted from the income

so that proper evaluation of remaining balance at the end of moth can be derived.

2

use 499

Purchased a computer for business

purposes 720

Purchase of motor van 3200

Total cash outflows 4284 2485 6220

Cash deficit / surplus or closing

cash balance 6556 6481 1836

Balance bought forward 10000 6556 6481

balance carried forward 6556 6481 1836

On the basis of the reflected cash budget it can be specified that there are number of benefit of

applying the cash budget technique in organization. The one of the significant factor which is

achieved by company by formulating cash budget is gaining insights of available cash budget in

turn higher ability to make strategic decision can become possible. In addition to this, it can be

specified that there are few competitive advantages which can be achieved by firm through

executing relevant course of action in turn higher productiveness (Cardwell Williams and Pyle,

2017). It is formulating the ideal structure in which cash expenses are deducted from the income

so that proper evaluation of remaining balance at the end of moth can be derived.

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

From the evaluation of the cash budget it can be articulated that there are significant

expenses incurred by the company for carrying forward its operational activities. The present

prepared budget for the shown months it can be specified that the h prevailing trend is

downward falling (Donelan and Liu, Y., 202). It is basically reflecting poor performance for the

particular quarter. The main reason behind this outcome can be identified that incurred cost for

each period is increasing and the source of income shown in providing less cash. It is presenting

that company does not have effective performance in order to gain competitiveness which might

not allow the particular enterprise to have stability.

There are number of reasons for which company formulated the budget cash budget in

turn higher profitability and sustainability can be derived. The one of the significant reason for

highlighted kind of budgetary is formulated in turn higher productiveness can be achieved by

focusing on having ability to identification crucial aspects. This provides capabilities to avoid

the debt by identifying unforeseen circumstance in significant pattern. There are larger number

of advantages but optimum utilization of resources with having this can lead incline accuracy

and fairness. Taking strategic decision highly becomes possible by availing accurate & reliable

information regarding the financial health of the company.

On the basis of this it can be interpreted that derived outcome is helpful in having

appropriate information to raise funds in respect to coordinate with changing situations. The

particular organization should focus on having higher competitiveness to deal with prevailing

challenges by declining the cost and increasing income sources (Marques and et.al., 2019). In

addition to this, it can be stated that obtaining relevant strategy for establishing coordination can

be effectually exerted by enterprise through implementing it. It should focus on declining

expenses to certain extent to incline the cash balance at the end of month for enhancing its

financial ability to meet obligations.

TASK 2

2.1 Explaining the accounting equation and reason for its balancing

The financial statement is formulated by following the accounting equation in which

there are two side assets and liabilities. The balance sheet prepared by companies has main

objective of presenting significant insights of summary data which can lead to increase ability to

take strategy accordingly (Alarussi and Alhaderi, 2018). The assets involve cash, inventory, van,

machinery, property, goodwill, etc. These help in presenting the capacity of enterprise to

3

expenses incurred by the company for carrying forward its operational activities. The present

prepared budget for the shown months it can be specified that the h prevailing trend is

downward falling (Donelan and Liu, Y., 202). It is basically reflecting poor performance for the

particular quarter. The main reason behind this outcome can be identified that incurred cost for

each period is increasing and the source of income shown in providing less cash. It is presenting

that company does not have effective performance in order to gain competitiveness which might

not allow the particular enterprise to have stability.

There are number of reasons for which company formulated the budget cash budget in

turn higher profitability and sustainability can be derived. The one of the significant reason for

highlighted kind of budgetary is formulated in turn higher productiveness can be achieved by

focusing on having ability to identification crucial aspects. This provides capabilities to avoid

the debt by identifying unforeseen circumstance in significant pattern. There are larger number

of advantages but optimum utilization of resources with having this can lead incline accuracy

and fairness. Taking strategic decision highly becomes possible by availing accurate & reliable

information regarding the financial health of the company.

On the basis of this it can be interpreted that derived outcome is helpful in having

appropriate information to raise funds in respect to coordinate with changing situations. The

particular organization should focus on having higher competitiveness to deal with prevailing

challenges by declining the cost and increasing income sources (Marques and et.al., 2019). In

addition to this, it can be stated that obtaining relevant strategy for establishing coordination can

be effectually exerted by enterprise through implementing it. It should focus on declining

expenses to certain extent to incline the cash balance at the end of month for enhancing its

financial ability to meet obligations.

TASK 2

2.1 Explaining the accounting equation and reason for its balancing

The financial statement is formulated by following the accounting equation in which

there are two side assets and liabilities. The balance sheet prepared by companies has main

objective of presenting significant insights of summary data which can lead to increase ability to

take strategy accordingly (Alarussi and Alhaderi, 2018). The assets involve cash, inventory, van,

machinery, property, goodwill, etc. These help in presenting the capacity of enterprise to

3

optimize the resources and obligation overcoming situation. Accounting equation is concerned

with liabilities plus equities equal to assets. Balance sheet is related with having balance at both

the side such as assets ans liabilities in turn material information can be provided.

Balance sheet is based on the double entry system which is related with recording the

commercial transaction in two accounts. In addition to this, it can be specified that financial

sheet is based on double entry system which allows to equalize the balance. For instance- assets

purchased worth of 324 by paying cash. On the basis of this, it can be specified that company

has recorded in both the mentioned accounts. The balance amount can be understood that firm

has liabilities of $259 and $65 equities. From the evaluation it can articulate that both the side of

assets and liabilities plus equity are equal.

2.2 Explaining the benefits company obtains by having shares listed on stock exchange

There are number of benefits which can be achieved by the enterprise through being

listed on the stock exchange. The main reason for which enterprise lists itself on the stock

market is to being able to achieve distinct competitiveness. It can be specified that there are

crucial merits which comprise higher profitability, sustainability, raising fund from diverse

sources, etc.

Boosted profile

The one of the crucial benefit which can be attained by company being listed on the stock

exchange is availing capabilities to boost its profile (Agustia, Sawarjuwono and Dianawati,

2019). The main reason behind this is to have more visible and recognizable when compared to

other privately held counterparts.

Access to capital

It is an essential requirement of any business sis to raise capital in turn ability to meet

predetermined objective can become possible. Raising capital from the divers range of technique

to gain suitable cost of capital in turn better objective accomplishing can become possible.

Transparency & efficiency

These are considered to be crucial for the company's growth and development as allows

conducting operational practices in efficient pattern. Listed company is required to present the

financial information to stakeholders in accurate and transparent manner. It increases

trustworthiness so that dealing becomes easy.

Enhanced visibility

4

with liabilities plus equities equal to assets. Balance sheet is related with having balance at both

the side such as assets ans liabilities in turn material information can be provided.

Balance sheet is based on the double entry system which is related with recording the

commercial transaction in two accounts. In addition to this, it can be specified that financial

sheet is based on double entry system which allows to equalize the balance. For instance- assets

purchased worth of 324 by paying cash. On the basis of this, it can be specified that company

has recorded in both the mentioned accounts. The balance amount can be understood that firm

has liabilities of $259 and $65 equities. From the evaluation it can articulate that both the side of

assets and liabilities plus equity are equal.

2.2 Explaining the benefits company obtains by having shares listed on stock exchange

There are number of benefits which can be achieved by the enterprise through being

listed on the stock exchange. The main reason for which enterprise lists itself on the stock

market is to being able to achieve distinct competitiveness. It can be specified that there are

crucial merits which comprise higher profitability, sustainability, raising fund from diverse

sources, etc.

Boosted profile

The one of the crucial benefit which can be attained by company being listed on the stock

exchange is availing capabilities to boost its profile (Agustia, Sawarjuwono and Dianawati,

2019). The main reason behind this is to have more visible and recognizable when compared to

other privately held counterparts.

Access to capital

It is an essential requirement of any business sis to raise capital in turn ability to meet

predetermined objective can become possible. Raising capital from the divers range of technique

to gain suitable cost of capital in turn better objective accomplishing can become possible.

Transparency & efficiency

These are considered to be crucial for the company's growth and development as allows

conducting operational practices in efficient pattern. Listed company is required to present the

financial information to stakeholders in accurate and transparent manner. It increases

trustworthiness so that dealing becomes easy.

Enhanced visibility

4

listing on the stock exchange aids company to increase h credibility and viability among

institution and investing public (Lindsten, Auvinen and Juuti, 2019). It provides assistance in

avoiding non crucial legal complications by increasing visibility and transparency in its

operational activities.

Increased exposure and accountability

Being listed on stock exchange is helpful for the enterprise to conduct its business

activities and advertising crucial investment journal, financial, magazines and news stories. The

company is held itself responsible for any non ethical practices as there are many rules and

regulations are imposed by company.

There are several other advantages as well that can be achieved by companies through listing its

hares on stock exchange. The one of the significant ability which is derived by the company is to

have trustworthiness and credibility in the sector which inclines its eligibility to raise funds from

the distinct sources (Radzi and et.al., 2018). To accomplish the obtained objectives firm need

efficient ability to accomplish the requirements in turn strategic management can be done. There

are collateral values of practice which has better compliance with corporate rules and

regulations. Timely disclosure of corporate information and fair prices for the securities of

supervision & controlling of trading in securities. Ready of marketability of securities in turn he

fair prices of securities can be achieved. On the basis of this, it can be articulated that these are

the benefits which can lead to increase profitability and stability in industry.

2.3 Describing stakeholders in large company In Marks and Spencer

Larger company like Marks and Spencer (M&S) operates in international market which

has both internal and external stakeholders. Each type of stakeholders in sector play significant

role in affecting the growth and development of enterprise.

Internal stakeholders

The stakeholders who have are connected and responsible for managing and controlling

operational activities. The internal stakeholders are employees, management and owners. There

are several kinds of activities which are executed by internal stakeholders in turn higher

profitability & stability can be derived. Management of the enterprise is responsible for

assigning and delegating job and authority for meeting the overall accomplishing objectives can

become possible (Internal, External, vs Shareholders. 2021). The employees of M&S a re

recruited from the department parts which formulated divers workforce and enable the enterprise

5

institution and investing public (Lindsten, Auvinen and Juuti, 2019). It provides assistance in

avoiding non crucial legal complications by increasing visibility and transparency in its

operational activities.

Increased exposure and accountability

Being listed on stock exchange is helpful for the enterprise to conduct its business

activities and advertising crucial investment journal, financial, magazines and news stories. The

company is held itself responsible for any non ethical practices as there are many rules and

regulations are imposed by company.

There are several other advantages as well that can be achieved by companies through listing its

hares on stock exchange. The one of the significant ability which is derived by the company is to

have trustworthiness and credibility in the sector which inclines its eligibility to raise funds from

the distinct sources (Radzi and et.al., 2018). To accomplish the obtained objectives firm need

efficient ability to accomplish the requirements in turn strategic management can be done. There

are collateral values of practice which has better compliance with corporate rules and

regulations. Timely disclosure of corporate information and fair prices for the securities of

supervision & controlling of trading in securities. Ready of marketability of securities in turn he

fair prices of securities can be achieved. On the basis of this, it can be articulated that these are

the benefits which can lead to increase profitability and stability in industry.

2.3 Describing stakeholders in large company In Marks and Spencer

Larger company like Marks and Spencer (M&S) operates in international market which

has both internal and external stakeholders. Each type of stakeholders in sector play significant

role in affecting the growth and development of enterprise.

Internal stakeholders

The stakeholders who have are connected and responsible for managing and controlling

operational activities. The internal stakeholders are employees, management and owners. There

are several kinds of activities which are executed by internal stakeholders in turn higher

profitability & stability can be derived. Management of the enterprise is responsible for

assigning and delegating job and authority for meeting the overall accomplishing objectives can

become possible (Internal, External, vs Shareholders. 2021). The employees of M&S a re

recruited from the department parts which formulated divers workforce and enable the enterprise

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to have maximum capabilities to meet organizational objectives. In addition to this, it can be

said that having mentioned that internal stakeholders of M&S are highly responsible for

optimizing resources, stratifying customers, etc in turn leading position in sector ca be derived.

External stakeholders

There are various external stakeholders of the M&S which are required to be taken into

consideration as has impact on the proceeding of company. The external stakeholders involve

investors, competitors, financial institutions, lenders, suppliers, creditors, local community,

government, etc. Each stakeholder has different role and has significant power which impact the

proceeding of enterprise. Investors of Marks and Spencer highly get affected from the

operational efficiency and profitability of firm. M&S's investors provide fund to the company

for carrying forward its operational activities in turn better return can be given to them.

Competitors of the organization as well play crucial role in affecting the processing of enterprise

as pay attention on gaining leading position in respect to have stability and profitability. M&S

as being international organization as larger number of competitors which are required to be

emphasized by focused for obtaining leading position in sector. Suppliers and lenders are those

external stakeholders that has impact on meeting market capabilities of enterprise. In addition to

this, meeting forces of company can be done by company effectively through having suppliers.

(Hart and Zingales, 2017) The main reason behind having suppliers as these permits to get the

ability to accomplish objective of providing relevant products to customers. Buyers are as well

crucial stakeholder which need to be emphasized as ultimate objective of meeting market forces,

higher share, increased revenue. Higher profit margin, etc. In addition to this, meeting Gehrig

level of customers satisfaction becomes important as allows to have efficient processing.

To gain success it is important for the firm to look into the prevailing issues of company

which are arising due to non-compliance with government rules and regulations. It is highly

required to focus on having appropriate adherence with imposed legislation, laws and rule sin

turn higher chances of attaining stability inclines. In addition to this, it can be specified that

these are external stakeholder which are needed to be focused by Marks & Spencer in turn

higher profitability can be derived.

6

said that having mentioned that internal stakeholders of M&S are highly responsible for

optimizing resources, stratifying customers, etc in turn leading position in sector ca be derived.

External stakeholders

There are various external stakeholders of the M&S which are required to be taken into

consideration as has impact on the proceeding of company. The external stakeholders involve

investors, competitors, financial institutions, lenders, suppliers, creditors, local community,

government, etc. Each stakeholder has different role and has significant power which impact the

proceeding of enterprise. Investors of Marks and Spencer highly get affected from the

operational efficiency and profitability of firm. M&S's investors provide fund to the company

for carrying forward its operational activities in turn better return can be given to them.

Competitors of the organization as well play crucial role in affecting the processing of enterprise

as pay attention on gaining leading position in respect to have stability and profitability. M&S

as being international organization as larger number of competitors which are required to be

emphasized by focused for obtaining leading position in sector. Suppliers and lenders are those

external stakeholders that has impact on meeting market capabilities of enterprise. In addition to

this, meeting forces of company can be done by company effectively through having suppliers.

(Hart and Zingales, 2017) The main reason behind having suppliers as these permits to get the

ability to accomplish objective of providing relevant products to customers. Buyers are as well

crucial stakeholder which need to be emphasized as ultimate objective of meeting market forces,

higher share, increased revenue. Higher profit margin, etc. In addition to this, meeting Gehrig

level of customers satisfaction becomes important as allows to have efficient processing.

To gain success it is important for the firm to look into the prevailing issues of company

which are arising due to non-compliance with government rules and regulations. It is highly

required to focus on having appropriate adherence with imposed legislation, laws and rule sin

turn higher chances of attaining stability inclines. In addition to this, it can be specified that

these are external stakeholder which are needed to be focused by Marks & Spencer in turn

higher profitability can be derived.

6

2.4 Different between profit and cash flow justification of whether profit is reliable indicator of

cash balances

There are some major differences between the cash flow and profit is that profit indicates

the amount of money that is left over after all the expenses are deducted (Budiputra, 2021).

However, the cash flow in the indication of the net flow of cash which is collected by the

business. The investors and business owners are often in search of a single metric which helps

the organization in understanding the health of the company. The cash flow can be said to be the

flow of money which takes place either in or out of the business for a given period but the profit

is the remains which are left from the revenue after all the costs are deducted.

The profit is considered to show the immediate success of the business the cash flow in

know to be sharper means for the determination of the company's long term financial outlook.

The differences of the cash flow and profit shows that a business can be profitable even while

having poor cash flow (Hastuti, Arfan and Diantimala, 2018). This happens because the cash

flow does not record the transactions which are made on credit. Certain organization with poor

cash flow end up facing issues which despite the reaching profitability in the business are unable

to meet the financial obligation. The profit and cash flow are considered to be very important in

their own ways which effects decision-making of the business owner, employees, investor and

entrepreneur. They are known to be very helpful for the business as understanding both the

metrics is said to be very helpful for the business to evaluate the financial health of the business.

For understanding which is more important for the business when it comes to the debate

between profit and cash flow. Once the debt is said to be paid or the cash is considered to be the

paid or the business sees the influx in the revenue it keeps the business running while still being

in profit. In this organization a business can increase the revenue and cash flow which is

considered to be the substantial amount of debt that allows the business to make profit. It is said

that the absence of the profit eventual results in the decline of effects of the cash flow (What is

Profit vs Cash?, 2021). Thus, it can be said that profit is much more important for a business

than cash flow. It is also said that it depends on the size of the business which determines which

is more important profit or cash-flow. For a business in which the owner has invested its

personal assets as capital into the business. Then for such business the cash flow is more

essential as it helps the owner in recovering the invested amount.

7

cash balances

There are some major differences between the cash flow and profit is that profit indicates

the amount of money that is left over after all the expenses are deducted (Budiputra, 2021).

However, the cash flow in the indication of the net flow of cash which is collected by the

business. The investors and business owners are often in search of a single metric which helps

the organization in understanding the health of the company. The cash flow can be said to be the

flow of money which takes place either in or out of the business for a given period but the profit

is the remains which are left from the revenue after all the costs are deducted.

The profit is considered to show the immediate success of the business the cash flow in

know to be sharper means for the determination of the company's long term financial outlook.

The differences of the cash flow and profit shows that a business can be profitable even while

having poor cash flow (Hastuti, Arfan and Diantimala, 2018). This happens because the cash

flow does not record the transactions which are made on credit. Certain organization with poor

cash flow end up facing issues which despite the reaching profitability in the business are unable

to meet the financial obligation. The profit and cash flow are considered to be very important in

their own ways which effects decision-making of the business owner, employees, investor and

entrepreneur. They are known to be very helpful for the business as understanding both the

metrics is said to be very helpful for the business to evaluate the financial health of the business.

For understanding which is more important for the business when it comes to the debate

between profit and cash flow. Once the debt is said to be paid or the cash is considered to be the

paid or the business sees the influx in the revenue it keeps the business running while still being

in profit. In this organization a business can increase the revenue and cash flow which is

considered to be the substantial amount of debt that allows the business to make profit. It is said

that the absence of the profit eventual results in the decline of effects of the cash flow (What is

Profit vs Cash?, 2021). Thus, it can be said that profit is much more important for a business

than cash flow. It is also said that it depends on the size of the business which determines which

is more important profit or cash-flow. For a business in which the owner has invested its

personal assets as capital into the business. Then for such business the cash flow is more

essential as it helps the owner in recovering the invested amount.

7

CONCLUSION

From the above report it can be concluded that business finance is crucial for giving

insights needed for making strategic decision. The present working environment has become

complex which needs to be dealt with having effective planning & controlling of business

finance. The current report has comprised cash budget which is reflecting declining trend. The

current report has given emphasis on providing reason for balancing financial position which is

double entry book keeping system and accounting equation. There are number of benefits which

can be attained by listed by organization which involves raising fund, higher transparency &

visibility, etc. In addition to this, current report has comprised stakeholders of M&S which

involves internal & external such as employees, government, etc. the present study has involved

difference between profit and cash flows so that significant indicator of growth can be derived.

REFERENCES

Books and Journals

Agustia, D., Sawarjuwono, T. and Dianawati, W., 2019. The mediating effect of environmental

management accounting on green innovation-Firm value relationship. International

Journal of Energy Economics and Policy, 9(2), pp.299-306.

Alarussi, A.S. and Alhaderi, S.M., 2018. Factors affecting profitability in Malaysia. Journal of

Economic Studies.

Budiputra, F.R., 2021. The effect of using profitability, liquidity and cash flow in predicting

financial distress on transportation companies listed in Indonesia Stock Exchange

(Doctoral dissertation, Universitas Pelita Harapan).

Cardwell, L.A., Williams, S. and Pyle, A., 2017. Corporate public relations dynamics: Internal

vs. external stakeholders and the role of the practitioner. Public Relations Review. 43(1).

pp.152-162.

Donelan, J.G. and Liu, Y., 2021. Using the Accounting Equation for Preparing the Statement of

Cash Flows. In Advances in Accounting Education: Teaching and Curriculum

Innovations. Emerald Publishing Limited.

Hart, O. and Zingales, L., 2017. Companies should maximize shareholder welfare not market

value. ECGI-Finance Working Paper, (521).

Hastuti, C.S.F., Arfan, M. and Diantimala, Y., 2018. The Influence of Free Cash Flow and

Operating Cash Flow on Earnings Management at Manufacturing Firms Listed in the

Indonesian Stock Exchange. International Journal of Academic Research in Business &

Social Sciences. 8(9). pp.1133-1146.

Lindsten, H.H., Auvinen, P.J. and Juuti, T.S., 2019. INTERNAL AND EXTERNAL

STAKEHOLDERS’IMPACT ON PRODUCT DEVELOPMENT CURRICULUM

DESIGN. In DS 95: Proceedings of the 21st International Conference on Engineering and

Product Design Education (E&PDE 2019), University of Strathclyde, Glasgow. 12th-13th

September 2019.

8

From the above report it can be concluded that business finance is crucial for giving

insights needed for making strategic decision. The present working environment has become

complex which needs to be dealt with having effective planning & controlling of business

finance. The current report has comprised cash budget which is reflecting declining trend. The

current report has given emphasis on providing reason for balancing financial position which is

double entry book keeping system and accounting equation. There are number of benefits which

can be attained by listed by organization which involves raising fund, higher transparency &

visibility, etc. In addition to this, current report has comprised stakeholders of M&S which

involves internal & external such as employees, government, etc. the present study has involved

difference between profit and cash flows so that significant indicator of growth can be derived.

REFERENCES

Books and Journals

Agustia, D., Sawarjuwono, T. and Dianawati, W., 2019. The mediating effect of environmental

management accounting on green innovation-Firm value relationship. International

Journal of Energy Economics and Policy, 9(2), pp.299-306.

Alarussi, A.S. and Alhaderi, S.M., 2018. Factors affecting profitability in Malaysia. Journal of

Economic Studies.

Budiputra, F.R., 2021. The effect of using profitability, liquidity and cash flow in predicting

financial distress on transportation companies listed in Indonesia Stock Exchange

(Doctoral dissertation, Universitas Pelita Harapan).

Cardwell, L.A., Williams, S. and Pyle, A., 2017. Corporate public relations dynamics: Internal

vs. external stakeholders and the role of the practitioner. Public Relations Review. 43(1).

pp.152-162.

Donelan, J.G. and Liu, Y., 2021. Using the Accounting Equation for Preparing the Statement of

Cash Flows. In Advances in Accounting Education: Teaching and Curriculum

Innovations. Emerald Publishing Limited.

Hart, O. and Zingales, L., 2017. Companies should maximize shareholder welfare not market

value. ECGI-Finance Working Paper, (521).

Hastuti, C.S.F., Arfan, M. and Diantimala, Y., 2018. The Influence of Free Cash Flow and

Operating Cash Flow on Earnings Management at Manufacturing Firms Listed in the

Indonesian Stock Exchange. International Journal of Academic Research in Business &

Social Sciences. 8(9). pp.1133-1146.

Lindsten, H.H., Auvinen, P.J. and Juuti, T.S., 2019. INTERNAL AND EXTERNAL

STAKEHOLDERS’IMPACT ON PRODUCT DEVELOPMENT CURRICULUM

DESIGN. In DS 95: Proceedings of the 21st International Conference on Engineering and

Product Design Education (E&PDE 2019), University of Strathclyde, Glasgow. 12th-13th

September 2019.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Marques, P. and et.al., 2019. Corporate social responsibility in a local subsidiary: internal and

external stakeholders’ power. EuroMed Journal of Business.

Radzi, N.A.M. and et.al., 2018. What drives them to do CSR? Another empirical study of CSR

motives from the perspective of the internal and external stakeholders. International

Information Institute (Tokyo). Information, 21(3), pp.909-928.

Online

Internal, External, vs Shareholders. 2021. [Online]. Available through:

<https://boycewire.com/stakeholder-definition//>.

What is Profit vs Cash?, 2021.[Online]. Available through:

<https://corporatefinanceinstitute.com/resources/knowledge/finance/profit-vs-cash/>

9

external stakeholders’ power. EuroMed Journal of Business.

Radzi, N.A.M. and et.al., 2018. What drives them to do CSR? Another empirical study of CSR

motives from the perspective of the internal and external stakeholders. International

Information Institute (Tokyo). Information, 21(3), pp.909-928.

Online

Internal, External, vs Shareholders. 2021. [Online]. Available through:

<https://boycewire.com/stakeholder-definition//>.

What is Profit vs Cash?, 2021.[Online]. Available through:

<https://corporatefinanceinstitute.com/resources/knowledge/finance/profit-vs-cash/>

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.