Business Finance: Rio Tinto's Financial Analysis, Ratios & Capital

VerifiedAdded on 2023/04/03

|15

|2866

|92

Report

AI Summary

This report conducts a financial analysis of Rio Tinto Mining Company, evaluating its operations and financing activities. It examines key financial ratios, including profitability and operating efficiency, and determines the cost of capital by analyzing the company's finance sources. The cost of equity is calculated using the Gordon growth model. Additionally, the report compares the company's share price over two years with the All-Ordinary Index. The analysis indicates that Rio Tinto's financial performance is improving, with increasing profitability and better resource management.

Running head: BUSINESS FINANCE

Business Finance

Name of the Student:

Name of the University:

Author’s Note:

Business Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BUSINESS FINANCE

Executive Summary

The aim of the assignment is to conduct a financial analysis on the Rio Tinto Mining

Company whereby several aspects of the operations and financing activities undertaken

by the company were analysed. Key financial ratios including the profitability and the

operating profitability of the company were taken into consideration. The cost of capital

was also identified for the company after identifying the various finance sources used by

the company in the books and the after implications of the same. The cost of equity for the

company was calculated with the help of the Gordon growth model by backward induction

process. Further the share price of the company was analysed for a sum of two year and

the same was compared with the All-Ordinary Index which was taken as the benchmark

index for the company. After taking various factors and conditions the financial

performance of Rio-Tinto Company was found to be improving in terms of increasing

profitability and better management of the resources by the management of the company.

Executive Summary

The aim of the assignment is to conduct a financial analysis on the Rio Tinto Mining

Company whereby several aspects of the operations and financing activities undertaken

by the company were analysed. Key financial ratios including the profitability and the

operating profitability of the company were taken into consideration. The cost of capital

was also identified for the company after identifying the various finance sources used by

the company in the books and the after implications of the same. The cost of equity for the

company was calculated with the help of the Gordon growth model by backward induction

process. Further the share price of the company was analysed for a sum of two year and

the same was compared with the All-Ordinary Index which was taken as the benchmark

index for the company. After taking various factors and conditions the financial

performance of Rio-Tinto Company was found to be improving in terms of increasing

profitability and better management of the resources by the management of the company.

2BUSINESS FINANCE

Table of Contents

Introduction............................................................................................................................3

Discussion..............................................................................................................................3

Financial Ratio....................................................................................................................3

Profitability Ratios...........................................................................................................4

Operating Efficiency Ratios............................................................................................5

Share Price Comparison....................................................................................................7

Cost of Equity.....................................................................................................................8

Capital Structure of Company............................................................................................9

Conclusion...........................................................................................................................10

Recommendations...............................................................................................................11

References...........................................................................................................................12

Table of Contents

Introduction............................................................................................................................3

Discussion..............................................................................................................................3

Financial Ratio....................................................................................................................3

Profitability Ratios...........................................................................................................4

Operating Efficiency Ratios............................................................................................5

Share Price Comparison....................................................................................................7

Cost of Equity.....................................................................................................................8

Capital Structure of Company............................................................................................9

Conclusion...........................................................................................................................10

Recommendations...............................................................................................................11

References...........................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BUSINESS FINANCE

Introduction

Rio Tinto an Anglo Australian Mining company which stands out to be one of the

largest metal and mining producing corporation in the world. Mining and processing

mineral resources has been the primary activity for the business. The operations of the

company is spread on a global basis whereby the variety of mining activities undertaken

by the company has made the company the third largest company in terms of revenue

generation. The stock is traded on the London Stock Exchange and as well as on the

Australian Stock Exchange. The financial analysis for the company would be conducted

with the help of the various financial analysis tools like ratio analysis and Gordon growth

model where several financial results will be analysed for the purpose of analysis. Several

business and macro-economic factors are the key factors that influences the operations of

the company. The cost of capital for the company will be determined taking up the weights

and the cost associated with each of the financing source. On the other hand the cost of

equity for the company would be determined with key inputs like the dividend paid by the

company, applicable growth rate for the company and the current share price of the

company (Dividend.com 2019). Comparing share price of the company along with the

benchmark index help us know the volatility associated with the stock and the movement

of the stock and the corresponding risk and return feature of the stock.

Discussion

Financial Ratio

The financial ratio for the company will be analysed for the company for the sum of

two year where relevant financial data for the company for the year 2017 and 2018 would

be taken into consideration for the purpose of analysis. The financial ratios that will be

evaluated for the company would be the profitability ratios and the operating profitability

Introduction

Rio Tinto an Anglo Australian Mining company which stands out to be one of the

largest metal and mining producing corporation in the world. Mining and processing

mineral resources has been the primary activity for the business. The operations of the

company is spread on a global basis whereby the variety of mining activities undertaken

by the company has made the company the third largest company in terms of revenue

generation. The stock is traded on the London Stock Exchange and as well as on the

Australian Stock Exchange. The financial analysis for the company would be conducted

with the help of the various financial analysis tools like ratio analysis and Gordon growth

model where several financial results will be analysed for the purpose of analysis. Several

business and macro-economic factors are the key factors that influences the operations of

the company. The cost of capital for the company will be determined taking up the weights

and the cost associated with each of the financing source. On the other hand the cost of

equity for the company would be determined with key inputs like the dividend paid by the

company, applicable growth rate for the company and the current share price of the

company (Dividend.com 2019). Comparing share price of the company along with the

benchmark index help us know the volatility associated with the stock and the movement

of the stock and the corresponding risk and return feature of the stock.

Discussion

Financial Ratio

The financial ratio for the company will be analysed for the company for the sum of

two year where relevant financial data for the company for the year 2017 and 2018 would

be taken into consideration for the purpose of analysis. The financial ratios that will be

evaluated for the company would be the profitability ratios and the operating profitability

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BUSINESS FINANCE

ratios for the company whereby the financial performance of the company will be

evaluated (Analysisreport.morningstar.com 2019).

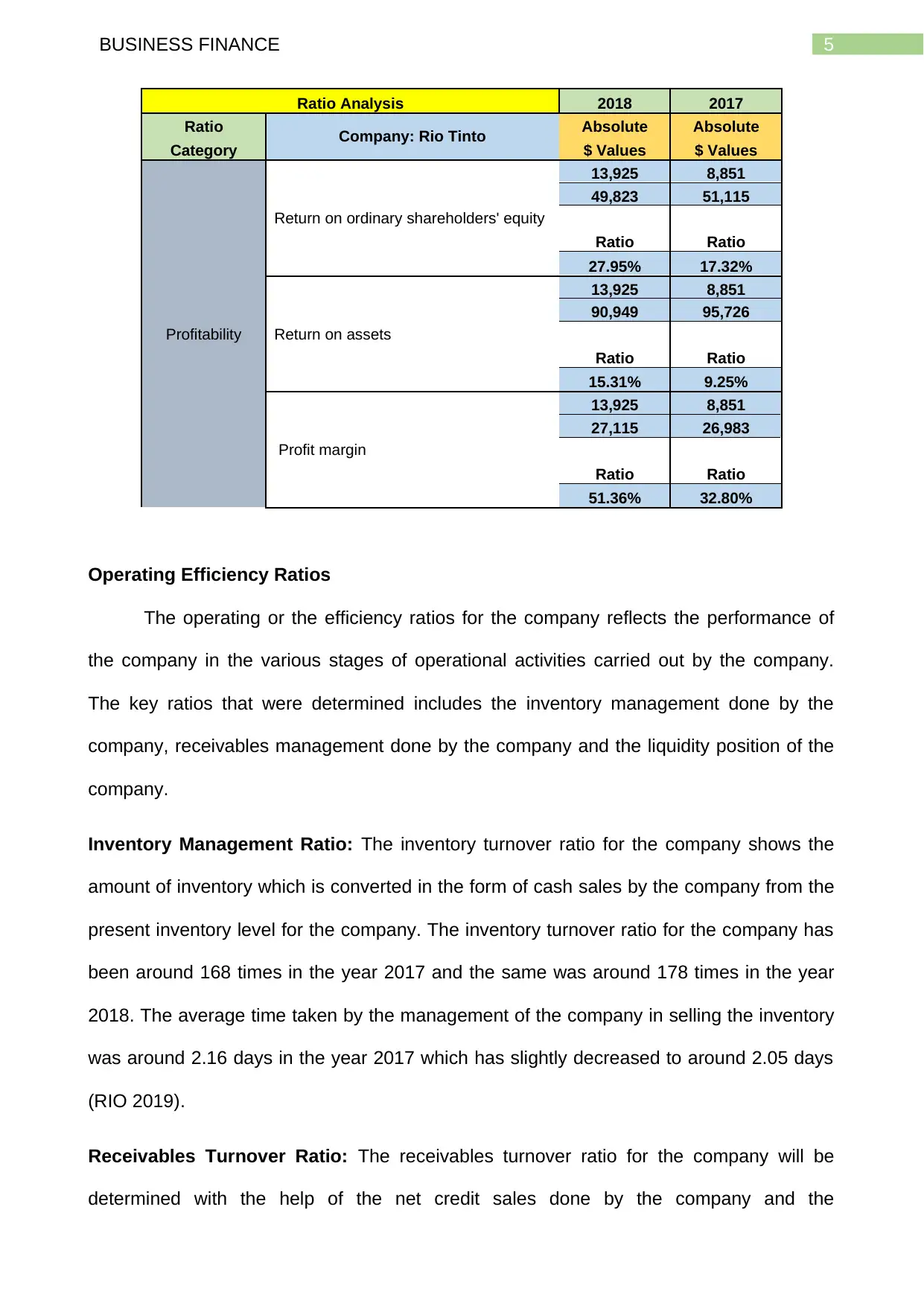

Profitability Ratios

The profitability ratio for the Rio-Tinto Company would be evaluated for the purpose

of assessing the financial performance of the company. The key profitability ratio that

were evaluated for the company is the return on shareholders’ equity, net profit margin and

the return generated by the company on the total assets (Riotinto.com 2018).

Return on Shareholder’s Equity: The return generated by the company on the equity

shareholders can be well evaluated with the help of the net profit of the company divided

by the equity shareholders value for the current year. The return generated by the

company in the year 2017 was around 17.32% which increased marginally to around

27.95% in the year 2018. Higher net profitability of the company has been the key reason

for the growth of the return (Intelligence 2010).

Return on Assets: The return generated by the assets of the company can be well

evaluated with the help of the profitability generated by the company with the active

utilisation of the total assets of the company. The return on assets for the company in the

year 2017 was around 9.25% and the same has increased consistently to around 15.31%

in the year 2018. The growing return on assets for the company shows the effectiveness

showed by the company in better utilisation and management of the resources of

company.

Net Profit Margin: The net profitability margin for a company shows the amount of

profitability left after paying off all the expenses and adjusting all the sources of income for

the company. The net profitability margin for the company in the year 2017 was around

32.80% and was around 51.36% in the year 2018 (Editorial 2019).

ratios for the company whereby the financial performance of the company will be

evaluated (Analysisreport.morningstar.com 2019).

Profitability Ratios

The profitability ratio for the Rio-Tinto Company would be evaluated for the purpose

of assessing the financial performance of the company. The key profitability ratio that

were evaluated for the company is the return on shareholders’ equity, net profit margin and

the return generated by the company on the total assets (Riotinto.com 2018).

Return on Shareholder’s Equity: The return generated by the company on the equity

shareholders can be well evaluated with the help of the net profit of the company divided

by the equity shareholders value for the current year. The return generated by the

company in the year 2017 was around 17.32% which increased marginally to around

27.95% in the year 2018. Higher net profitability of the company has been the key reason

for the growth of the return (Intelligence 2010).

Return on Assets: The return generated by the assets of the company can be well

evaluated with the help of the profitability generated by the company with the active

utilisation of the total assets of the company. The return on assets for the company in the

year 2017 was around 9.25% and the same has increased consistently to around 15.31%

in the year 2018. The growing return on assets for the company shows the effectiveness

showed by the company in better utilisation and management of the resources of

company.

Net Profit Margin: The net profitability margin for a company shows the amount of

profitability left after paying off all the expenses and adjusting all the sources of income for

the company. The net profitability margin for the company in the year 2017 was around

32.80% and was around 51.36% in the year 2018 (Editorial 2019).

5BUSINESS FINANCE

Ratio Analysis 2018 2017

Ratio Company: Rio Tinto Absolute Absolute

Category $ Values $ Values

Profitability

Return on ordinary shareholders' equity

13,925 8,851

49,823 51,115

Ratio Ratio

27.95% 17.32%

Return on assets

13,925 8,851

90,949 95,726

Ratio Ratio

15.31% 9.25%

Profit margin

13,925 8,851

27,115 26,983

Ratio Ratio

51.36% 32.80%

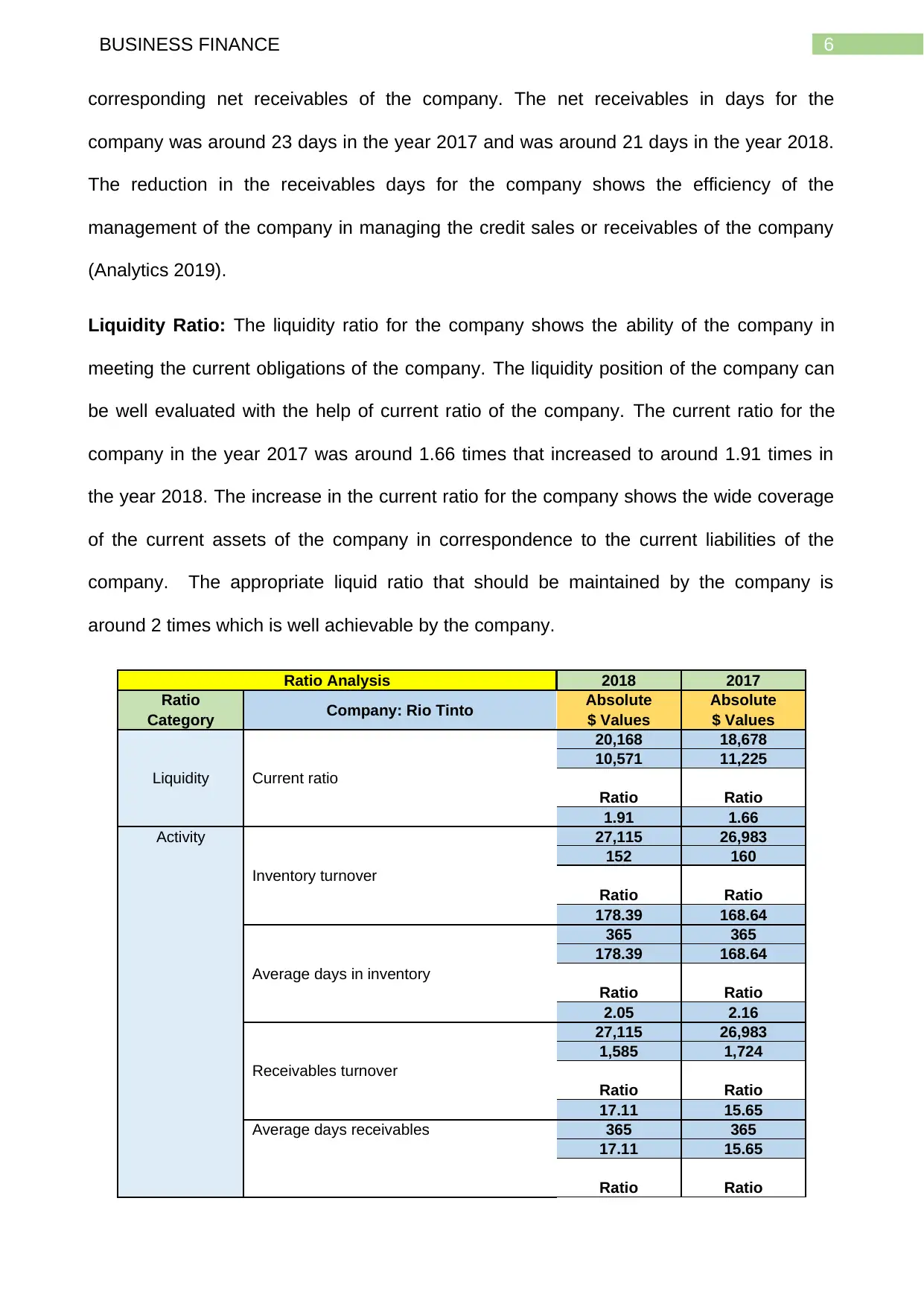

Operating Efficiency Ratios

The operating or the efficiency ratios for the company reflects the performance of

the company in the various stages of operational activities carried out by the company.

The key ratios that were determined includes the inventory management done by the

company, receivables management done by the company and the liquidity position of the

company.

Inventory Management Ratio: The inventory turnover ratio for the company shows the

amount of inventory which is converted in the form of cash sales by the company from the

present inventory level for the company. The inventory turnover ratio for the company has

been around 168 times in the year 2017 and the same was around 178 times in the year

2018. The average time taken by the management of the company in selling the inventory

was around 2.16 days in the year 2017 which has slightly decreased to around 2.05 days

(RIO 2019).

Receivables Turnover Ratio: The receivables turnover ratio for the company will be

determined with the help of the net credit sales done by the company and the

Ratio Analysis 2018 2017

Ratio Company: Rio Tinto Absolute Absolute

Category $ Values $ Values

Profitability

Return on ordinary shareholders' equity

13,925 8,851

49,823 51,115

Ratio Ratio

27.95% 17.32%

Return on assets

13,925 8,851

90,949 95,726

Ratio Ratio

15.31% 9.25%

Profit margin

13,925 8,851

27,115 26,983

Ratio Ratio

51.36% 32.80%

Operating Efficiency Ratios

The operating or the efficiency ratios for the company reflects the performance of

the company in the various stages of operational activities carried out by the company.

The key ratios that were determined includes the inventory management done by the

company, receivables management done by the company and the liquidity position of the

company.

Inventory Management Ratio: The inventory turnover ratio for the company shows the

amount of inventory which is converted in the form of cash sales by the company from the

present inventory level for the company. The inventory turnover ratio for the company has

been around 168 times in the year 2017 and the same was around 178 times in the year

2018. The average time taken by the management of the company in selling the inventory

was around 2.16 days in the year 2017 which has slightly decreased to around 2.05 days

(RIO 2019).

Receivables Turnover Ratio: The receivables turnover ratio for the company will be

determined with the help of the net credit sales done by the company and the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BUSINESS FINANCE

corresponding net receivables of the company. The net receivables in days for the

company was around 23 days in the year 2017 and was around 21 days in the year 2018.

The reduction in the receivables days for the company shows the efficiency of the

management of the company in managing the credit sales or receivables of the company

(Analytics 2019).

Liquidity Ratio: The liquidity ratio for the company shows the ability of the company in

meeting the current obligations of the company. The liquidity position of the company can

be well evaluated with the help of current ratio of the company. The current ratio for the

company in the year 2017 was around 1.66 times that increased to around 1.91 times in

the year 2018. The increase in the current ratio for the company shows the wide coverage

of the current assets of the company in correspondence to the current liabilities of the

company. The appropriate liquid ratio that should be maintained by the company is

around 2 times which is well achievable by the company.

Ratio Analysis 2018 2017

Ratio Company: Rio Tinto Absolute Absolute

Category $ Values $ Values

Liquidity Current ratio

20,168 18,678

10,571 11,225

Ratio Ratio

1.91 1.66

Activity

Inventory turnover

27,115 26,983

152 160

Ratio Ratio

178.39 168.64

Average days in inventory

365 365

178.39 168.64

Ratio Ratio

2.05 2.16

27,115 26,983

1,585 1,724

Receivables turnover

Ratio Ratio

17.11 15.65

Average days receivables 365 365

17.11 15.65

Ratio Ratio

corresponding net receivables of the company. The net receivables in days for the

company was around 23 days in the year 2017 and was around 21 days in the year 2018.

The reduction in the receivables days for the company shows the efficiency of the

management of the company in managing the credit sales or receivables of the company

(Analytics 2019).

Liquidity Ratio: The liquidity ratio for the company shows the ability of the company in

meeting the current obligations of the company. The liquidity position of the company can

be well evaluated with the help of current ratio of the company. The current ratio for the

company in the year 2017 was around 1.66 times that increased to around 1.91 times in

the year 2018. The increase in the current ratio for the company shows the wide coverage

of the current assets of the company in correspondence to the current liabilities of the

company. The appropriate liquid ratio that should be maintained by the company is

around 2 times which is well achievable by the company.

Ratio Analysis 2018 2017

Ratio Company: Rio Tinto Absolute Absolute

Category $ Values $ Values

Liquidity Current ratio

20,168 18,678

10,571 11,225

Ratio Ratio

1.91 1.66

Activity

Inventory turnover

27,115 26,983

152 160

Ratio Ratio

178.39 168.64

Average days in inventory

365 365

178.39 168.64

Ratio Ratio

2.05 2.16

27,115 26,983

1,585 1,724

Receivables turnover

Ratio Ratio

17.11 15.65

Average days receivables 365 365

17.11 15.65

Ratio Ratio

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7BUSINESS FINANCE

21 23

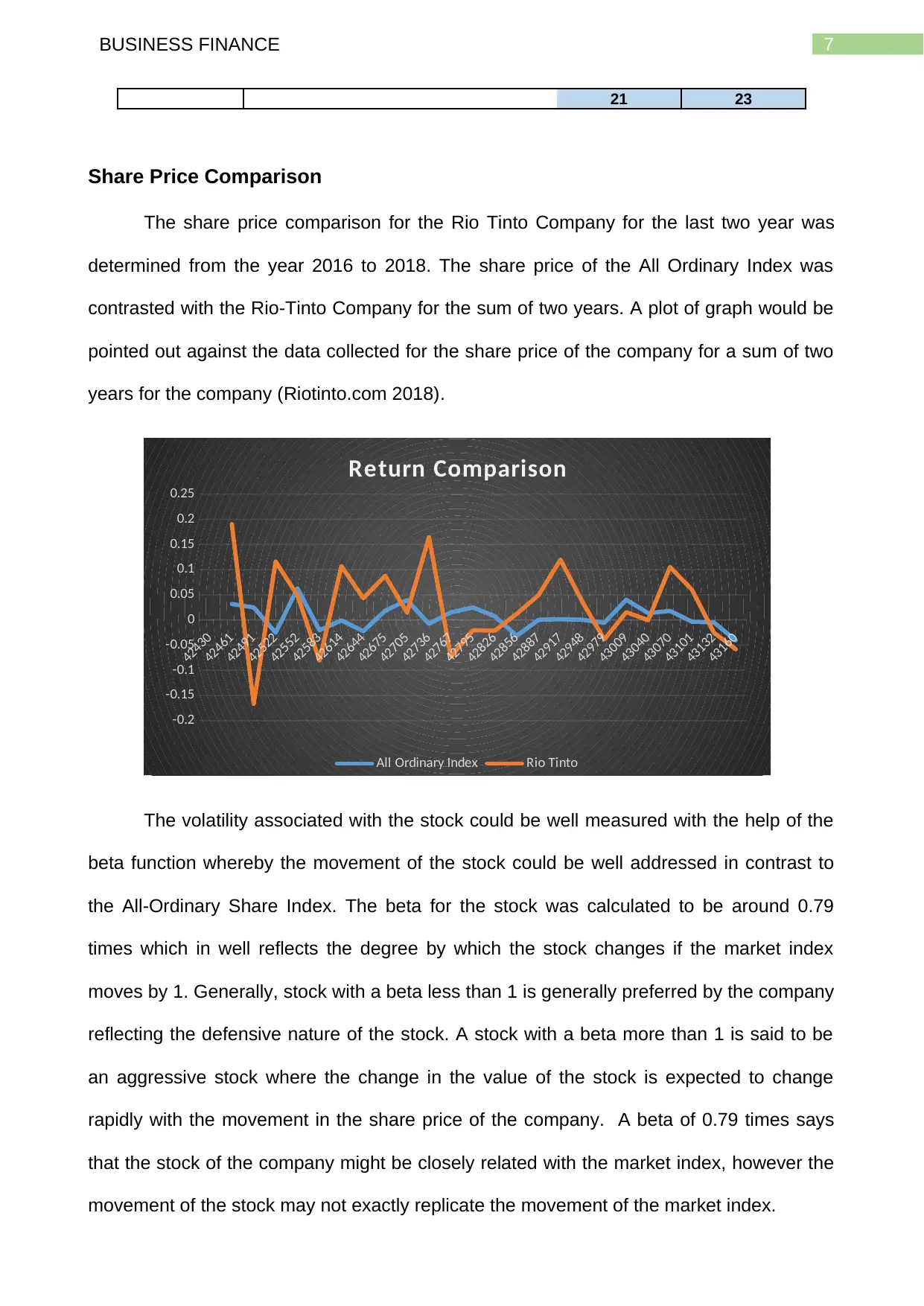

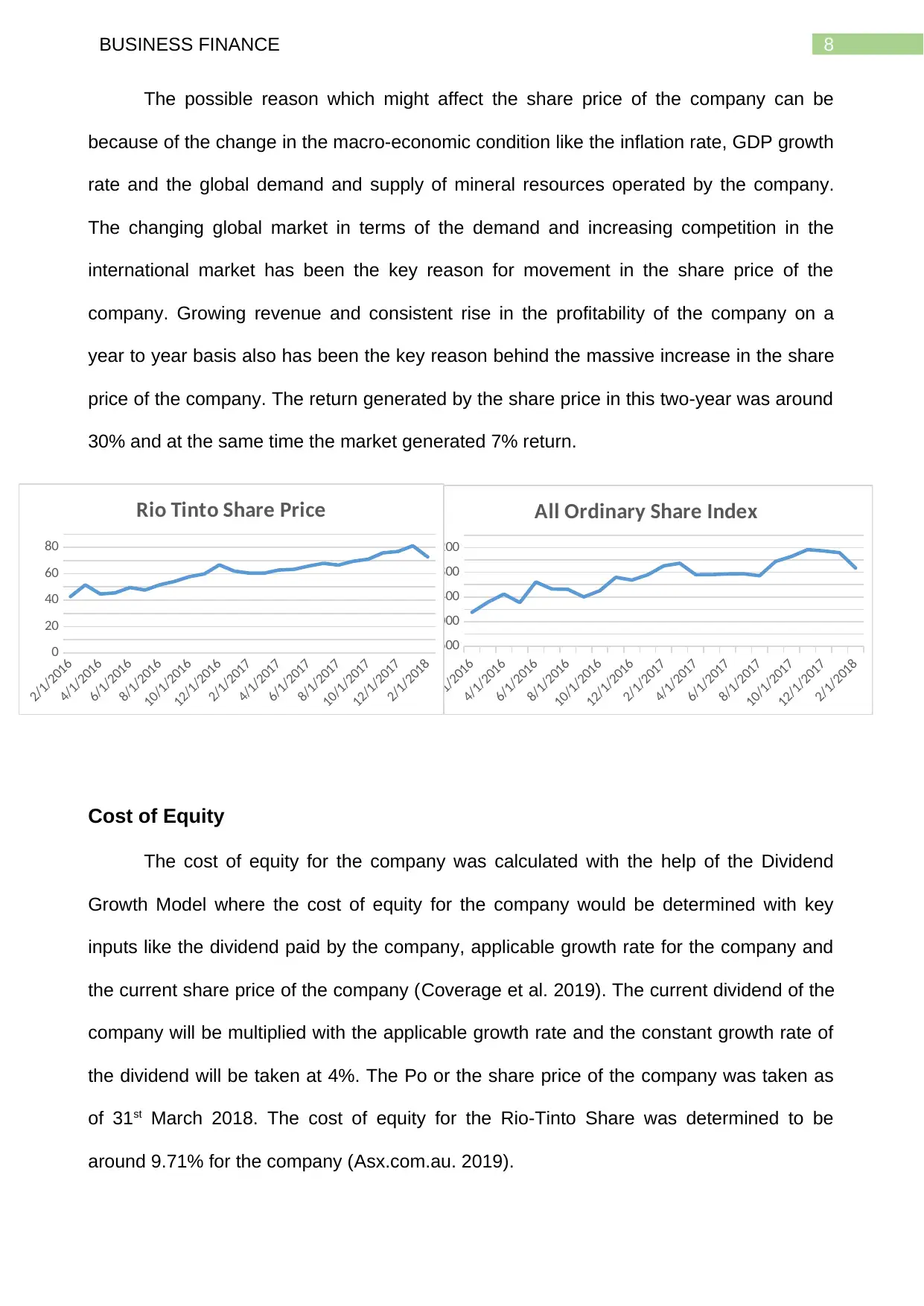

Share Price Comparison

The share price comparison for the Rio Tinto Company for the last two year was

determined from the year 2016 to 2018. The share price of the All Ordinary Index was

contrasted with the Rio-Tinto Company for the sum of two years. A plot of graph would be

pointed out against the data collected for the share price of the company for a sum of two

years for the company (Riotinto.com 2018).

42430

42461

42491

42522

42552

42583

42614

42644

42675

42705

42736

42767

42795

42826

42856

42887

42917

42948

42979

43009

43040

43070

43101

43132

43160

-0.2

-0.15

-0.1

-0.05

0

0.05

0.1

0.15

0.2

0.25

Return Comparison

All Ordinary Index Rio Tinto

The volatility associated with the stock could be well measured with the help of the

beta function whereby the movement of the stock could be well addressed in contrast to

the All-Ordinary Share Index. The beta for the stock was calculated to be around 0.79

times which in well reflects the degree by which the stock changes if the market index

moves by 1. Generally, stock with a beta less than 1 is generally preferred by the company

reflecting the defensive nature of the stock. A stock with a beta more than 1 is said to be

an aggressive stock where the change in the value of the stock is expected to change

rapidly with the movement in the share price of the company. A beta of 0.79 times says

that the stock of the company might be closely related with the market index, however the

movement of the stock may not exactly replicate the movement of the market index.

21 23

Share Price Comparison

The share price comparison for the Rio Tinto Company for the last two year was

determined from the year 2016 to 2018. The share price of the All Ordinary Index was

contrasted with the Rio-Tinto Company for the sum of two years. A plot of graph would be

pointed out against the data collected for the share price of the company for a sum of two

years for the company (Riotinto.com 2018).

42430

42461

42491

42522

42552

42583

42614

42644

42675

42705

42736

42767

42795

42826

42856

42887

42917

42948

42979

43009

43040

43070

43101

43132

43160

-0.2

-0.15

-0.1

-0.05

0

0.05

0.1

0.15

0.2

0.25

Return Comparison

All Ordinary Index Rio Tinto

The volatility associated with the stock could be well measured with the help of the

beta function whereby the movement of the stock could be well addressed in contrast to

the All-Ordinary Share Index. The beta for the stock was calculated to be around 0.79

times which in well reflects the degree by which the stock changes if the market index

moves by 1. Generally, stock with a beta less than 1 is generally preferred by the company

reflecting the defensive nature of the stock. A stock with a beta more than 1 is said to be

an aggressive stock where the change in the value of the stock is expected to change

rapidly with the movement in the share price of the company. A beta of 0.79 times says

that the stock of the company might be closely related with the market index, however the

movement of the stock may not exactly replicate the movement of the market index.

8BUSINESS FINANCE

The possible reason which might affect the share price of the company can be

because of the change in the macro-economic condition like the inflation rate, GDP growth

rate and the global demand and supply of mineral resources operated by the company.

The changing global market in terms of the demand and increasing competition in the

international market has been the key reason for movement in the share price of the

company. Growing revenue and consistent rise in the profitability of the company on a

year to year basis also has been the key reason behind the massive increase in the share

price of the company. The return generated by the share price in this two-year was around

30% and at the same time the market generated 7% return.

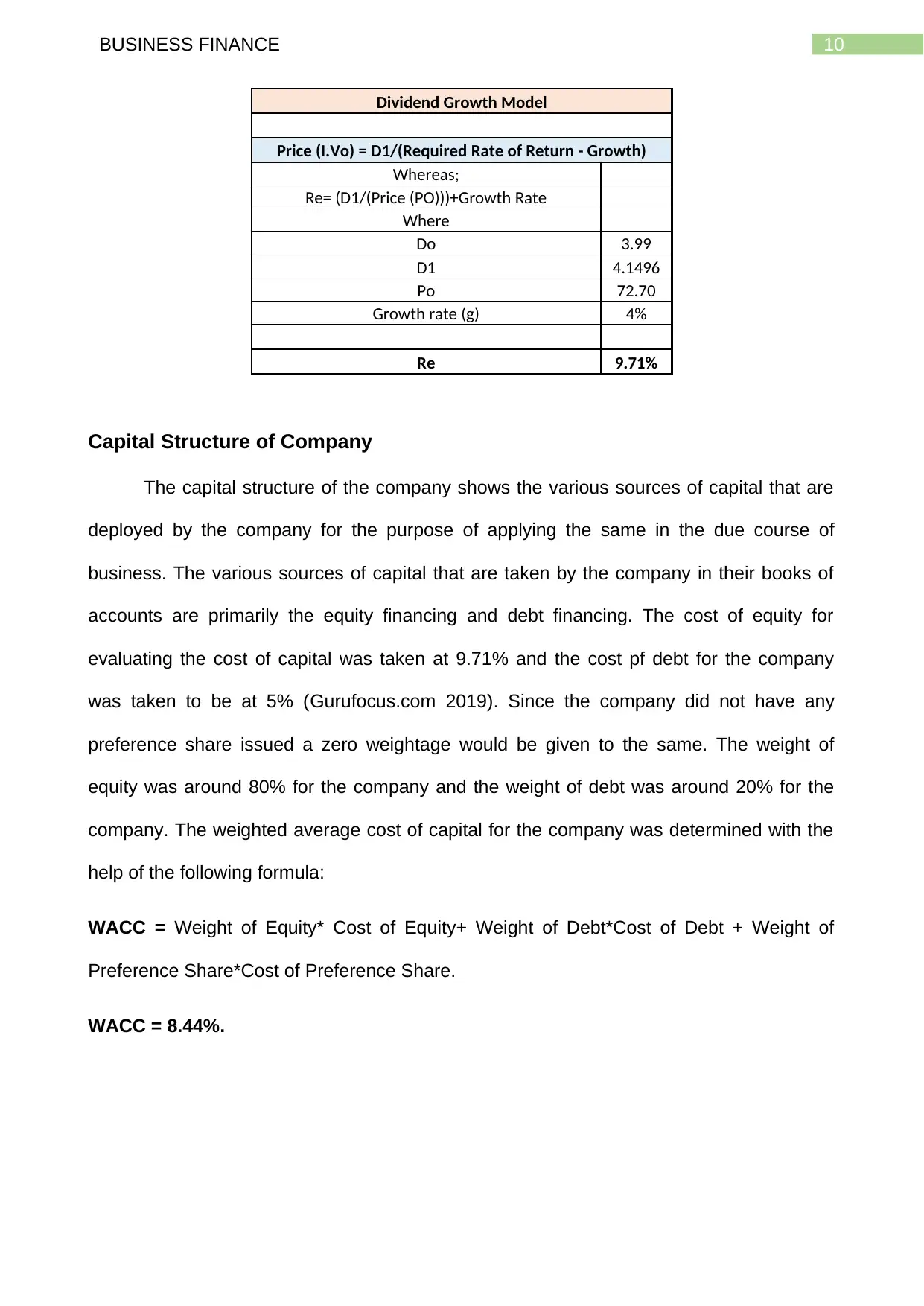

Cost of Equity

The cost of equity for the company was calculated with the help of the Dividend

Growth Model where the cost of equity for the company would be determined with key

inputs like the dividend paid by the company, applicable growth rate for the company and

the current share price of the company (Coverage et al. 2019). The current dividend of the

company will be multiplied with the applicable growth rate and the constant growth rate of

the dividend will be taken at 4%. The Po or the share price of the company was taken as

of 31st March 2018. The cost of equity for the Rio-Tinto Share was determined to be

around 9.71% for the company (Asx.com.au. 2019).

2/1/2016

4/1/2016

6/1/2016

8/1/2016

10/1/2016

12/1/2016

2/1/2017

4/1/2017

6/1/2017

8/1/2017

10/1/2017

12/1/2017

2/1/2018

4600

5000

5400

5800

6200

All Ordinary Share Index

2/1/2016

4/1/2016

6/1/2016

8/1/2016

10/1/2016

12/1/2016

2/1/2017

4/1/2017

6/1/2017

8/1/2017

10/1/2017

12/1/2017

2/1/2018

0

20

40

60

80

Rio Tinto Share Price

The possible reason which might affect the share price of the company can be

because of the change in the macro-economic condition like the inflation rate, GDP growth

rate and the global demand and supply of mineral resources operated by the company.

The changing global market in terms of the demand and increasing competition in the

international market has been the key reason for movement in the share price of the

company. Growing revenue and consistent rise in the profitability of the company on a

year to year basis also has been the key reason behind the massive increase in the share

price of the company. The return generated by the share price in this two-year was around

30% and at the same time the market generated 7% return.

Cost of Equity

The cost of equity for the company was calculated with the help of the Dividend

Growth Model where the cost of equity for the company would be determined with key

inputs like the dividend paid by the company, applicable growth rate for the company and

the current share price of the company (Coverage et al. 2019). The current dividend of the

company will be multiplied with the applicable growth rate and the constant growth rate of

the dividend will be taken at 4%. The Po or the share price of the company was taken as

of 31st March 2018. The cost of equity for the Rio-Tinto Share was determined to be

around 9.71% for the company (Asx.com.au. 2019).

2/1/2016

4/1/2016

6/1/2016

8/1/2016

10/1/2016

12/1/2016

2/1/2017

4/1/2017

6/1/2017

8/1/2017

10/1/2017

12/1/2017

2/1/2018

4600

5000

5400

5800

6200

All Ordinary Share Index

2/1/2016

4/1/2016

6/1/2016

8/1/2016

10/1/2016

12/1/2016

2/1/2017

4/1/2017

6/1/2017

8/1/2017

10/1/2017

12/1/2017

2/1/2018

0

20

40

60

80

Rio Tinto Share Price

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9BUSINESS FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10BUSINESS FINANCE

Dividend Growth Model

Price (I.Vo) = D1/(Required Rate of Return - Growth)

Whereas;

Re= (D1/(Price (PO)))+Growth Rate

Where

Do 3.99

D1 4.1496

Po 72.70

Growth rate (g) 4%

Re 9.71%

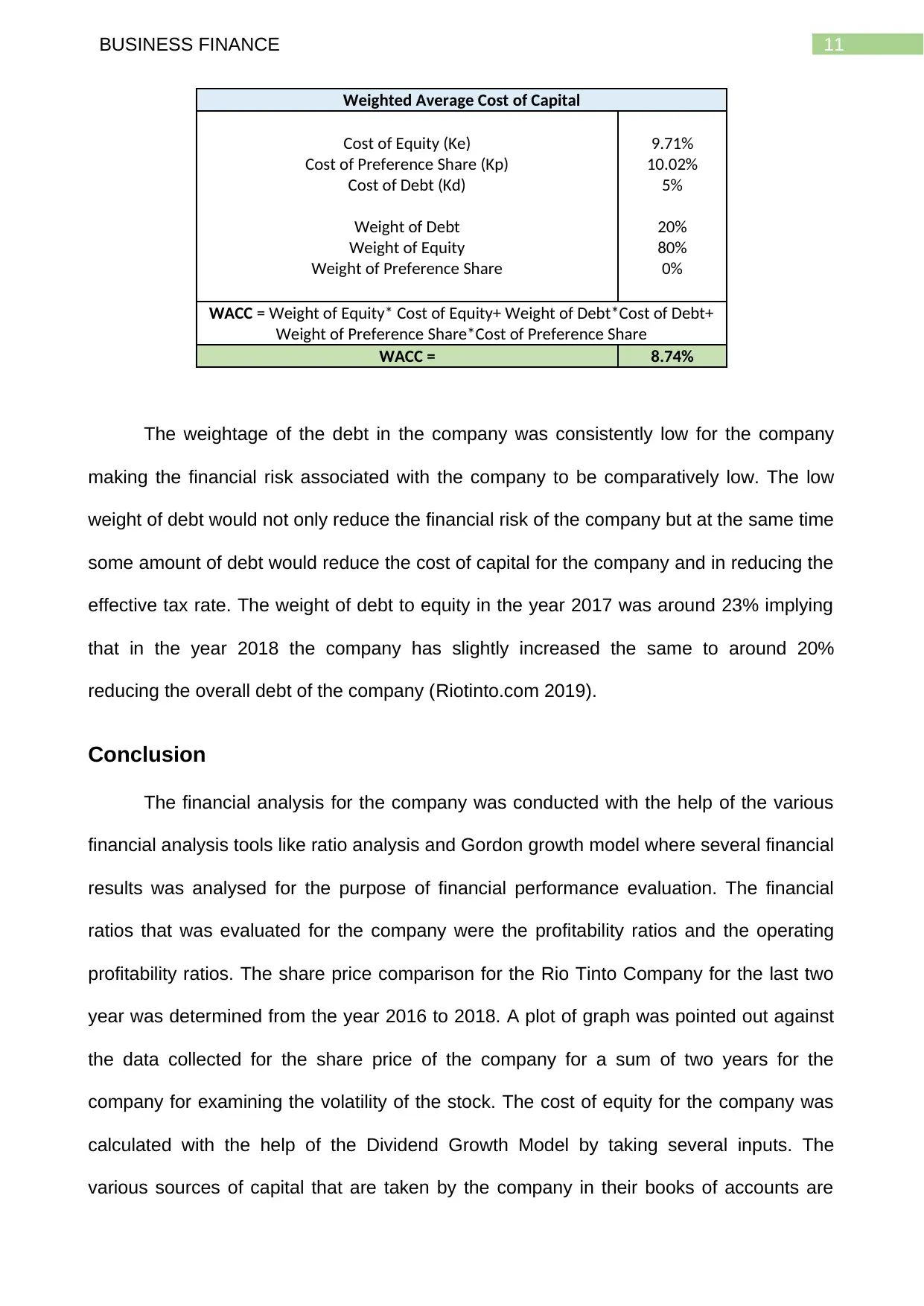

Capital Structure of Company

The capital structure of the company shows the various sources of capital that are

deployed by the company for the purpose of applying the same in the due course of

business. The various sources of capital that are taken by the company in their books of

accounts are primarily the equity financing and debt financing. The cost of equity for

evaluating the cost of capital was taken at 9.71% and the cost pf debt for the company

was taken to be at 5% (Gurufocus.com 2019). Since the company did not have any

preference share issued a zero weightage would be given to the same. The weight of

equity was around 80% for the company and the weight of debt was around 20% for the

company. The weighted average cost of capital for the company was determined with the

help of the following formula:

WACC = Weight of Equity* Cost of Equity+ Weight of Debt*Cost of Debt + Weight of

Preference Share*Cost of Preference Share.

WACC = 8.44%.

Dividend Growth Model

Price (I.Vo) = D1/(Required Rate of Return - Growth)

Whereas;

Re= (D1/(Price (PO)))+Growth Rate

Where

Do 3.99

D1 4.1496

Po 72.70

Growth rate (g) 4%

Re 9.71%

Capital Structure of Company

The capital structure of the company shows the various sources of capital that are

deployed by the company for the purpose of applying the same in the due course of

business. The various sources of capital that are taken by the company in their books of

accounts are primarily the equity financing and debt financing. The cost of equity for

evaluating the cost of capital was taken at 9.71% and the cost pf debt for the company

was taken to be at 5% (Gurufocus.com 2019). Since the company did not have any

preference share issued a zero weightage would be given to the same. The weight of

equity was around 80% for the company and the weight of debt was around 20% for the

company. The weighted average cost of capital for the company was determined with the

help of the following formula:

WACC = Weight of Equity* Cost of Equity+ Weight of Debt*Cost of Debt + Weight of

Preference Share*Cost of Preference Share.

WACC = 8.44%.

11BUSINESS FINANCE

Weighted Average Cost of Capital

Cost of Equity (Ke) 9.71%

Cost of Preference Share (Kp) 10.02%

Cost of Debt (Kd) 5%

Weight of Debt 20%

Weight of Equity 80%

Weight of Preference Share 0%

WACC = Weight of Equity* Cost of Equity+ Weight of Debt*Cost of Debt+

Weight of Preference Share*Cost of Preference Share

WACC = 8.74%

The weightage of the debt in the company was consistently low for the company

making the financial risk associated with the company to be comparatively low. The low

weight of debt would not only reduce the financial risk of the company but at the same time

some amount of debt would reduce the cost of capital for the company and in reducing the

effective tax rate. The weight of debt to equity in the year 2017 was around 23% implying

that in the year 2018 the company has slightly increased the same to around 20%

reducing the overall debt of the company (Riotinto.com 2019).

Conclusion

The financial analysis for the company was conducted with the help of the various

financial analysis tools like ratio analysis and Gordon growth model where several financial

results was analysed for the purpose of financial performance evaluation. The financial

ratios that was evaluated for the company were the profitability ratios and the operating

profitability ratios. The share price comparison for the Rio Tinto Company for the last two

year was determined from the year 2016 to 2018. A plot of graph was pointed out against

the data collected for the share price of the company for a sum of two years for the

company for examining the volatility of the stock. The cost of equity for the company was

calculated with the help of the Dividend Growth Model by taking several inputs. The

various sources of capital that are taken by the company in their books of accounts are

Weighted Average Cost of Capital

Cost of Equity (Ke) 9.71%

Cost of Preference Share (Kp) 10.02%

Cost of Debt (Kd) 5%

Weight of Debt 20%

Weight of Equity 80%

Weight of Preference Share 0%

WACC = Weight of Equity* Cost of Equity+ Weight of Debt*Cost of Debt+

Weight of Preference Share*Cost of Preference Share

WACC = 8.74%

The weightage of the debt in the company was consistently low for the company

making the financial risk associated with the company to be comparatively low. The low

weight of debt would not only reduce the financial risk of the company but at the same time

some amount of debt would reduce the cost of capital for the company and in reducing the

effective tax rate. The weight of debt to equity in the year 2017 was around 23% implying

that in the year 2018 the company has slightly increased the same to around 20%

reducing the overall debt of the company (Riotinto.com 2019).

Conclusion

The financial analysis for the company was conducted with the help of the various

financial analysis tools like ratio analysis and Gordon growth model where several financial

results was analysed for the purpose of financial performance evaluation. The financial

ratios that was evaluated for the company were the profitability ratios and the operating

profitability ratios. The share price comparison for the Rio Tinto Company for the last two

year was determined from the year 2016 to 2018. A plot of graph was pointed out against

the data collected for the share price of the company for a sum of two years for the

company for examining the volatility of the stock. The cost of equity for the company was

calculated with the help of the Dividend Growth Model by taking several inputs. The

various sources of capital that are taken by the company in their books of accounts are

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.