BAC221 Business Finance Assignment: WACC and NPV Analysis

VerifiedAdded on 2022/10/02

|8

|1375

|97

Homework Assignment

AI Summary

This report presents a detailed analysis of a business finance assignment, focusing on the calculation of the Weighted Average Cost of Capital (WACC) and Net Present Value (NPV). The assignment utilizes data related to Quick Investments Ltd., including bond information, preference shares, and ordinary shares, to determine the WACC. The report then calculates the NPV of a mining project over a five-year period, considering sales, costs, depreciation, and tax implications. Furthermore, the Internal Rate of Return (IRR) is calculated to evaluate the project's profitability. The analysis concludes that the project is financially viable, offering growth opportunities, as the NPV is positive and the IRR exceeds the cost of capital. The report highlights the application of capital budgeting techniques and provides a comprehensive understanding of financial decision-making.

Running head: BUSINESS FINANCE 1

BUSINESS FINANCE

BUSINESS FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running head: BUSINESS FINANCE

Table of Contents

Overview.....................................................................................................................................................3

Question 1: Calculation of WACC..............................................................................................................3

WACC.....................................................................................................................................................4

Question 2: Calculation of Net present value..............................................................................................4

Cash flow.................................................................................................................................................5

Net present value.....................................................................................................................................5

Conclusion...................................................................................................................................................7

References...................................................................................................................................................8

Table of Contents

Overview.....................................................................................................................................................3

Question 1: Calculation of WACC..............................................................................................................3

WACC.....................................................................................................................................................4

Question 2: Calculation of Net present value..............................................................................................4

Cash flow.................................................................................................................................................5

Net present value.....................................................................................................................................5

Conclusion...................................................................................................................................................7

References...................................................................................................................................................8

Running head: BUSINESS FINANCE

Overview

In this report two sections have been analyzed in detail, one is the section of the working capital,

whereas once is the section of net present value. The calculation of the cost of the capital and the

net present value will give an idea of how the capital budgeting techniques are implemented

(Lam, 2016).

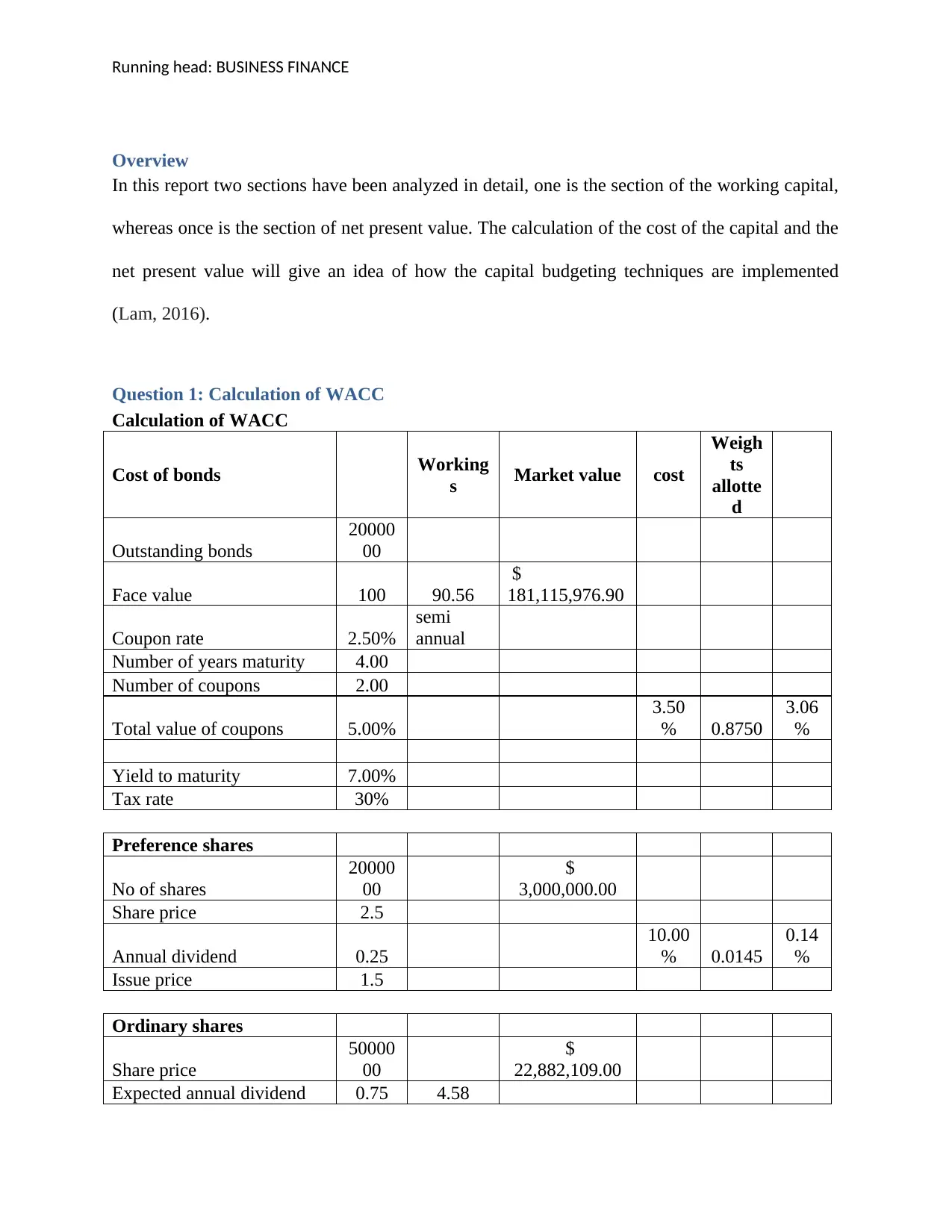

Question 1: Calculation of WACC

Calculation of WACC

Cost of bonds Working

s Market value cost

Weigh

ts

allotte

d

Outstanding bonds

20000

00

Face value 100 90.56

$

181,115,976.90

Coupon rate 2.50%

semi

annual

Number of years maturity 4.00

Number of coupons 2.00

Total value of coupons 5.00%

3.50

% 0.8750

3.06

%

Yield to maturity 7.00%

Tax rate 30%

Preference shares

No of shares

20000

00

$

3,000,000.00

Share price 2.5

Annual dividend 0.25

10.00

% 0.0145

0.14

%

Issue price 1.5

Ordinary shares

Share price

50000

00

$

22,882,109.00

Expected annual dividend 0.75 4.58

Overview

In this report two sections have been analyzed in detail, one is the section of the working capital,

whereas once is the section of net present value. The calculation of the cost of the capital and the

net present value will give an idea of how the capital budgeting techniques are implemented

(Lam, 2016).

Question 1: Calculation of WACC

Calculation of WACC

Cost of bonds Working

s Market value cost

Weigh

ts

allotte

d

Outstanding bonds

20000

00

Face value 100 90.56

$

181,115,976.90

Coupon rate 2.50%

semi

annual

Number of years maturity 4.00

Number of coupons 2.00

Total value of coupons 5.00%

3.50

% 0.8750

3.06

%

Yield to maturity 7.00%

Tax rate 30%

Preference shares

No of shares

20000

00

$

3,000,000.00

Share price 2.5

Annual dividend 0.25

10.00

% 0.0145

0.14

%

Issue price 1.5

Ordinary shares

Share price

50000

00

$

22,882,109.00

Expected annual dividend 0.75 4.58

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running head: BUSINESS FINANCE

Growth rate 3%

Risk free rate of return 2.60% 0.77

beta value 1.2 16.88%

Market risk premium 17%

19.88

% 0.1105

2.20

%

Total value of debt and

equity

$

206,998,085.90

Weighted average cost of

capital

5.40

%

WACC

The weighted average cost of capital is the metric that is used to evaluate the comparison of the

debt and the equity structure of the business. In the other words, it measures the weight of debt

and true cost of borrowing money, the funds through the equity to finance the new capital

purchases. The weighted average cost of capital is the rate at which the company expects to pay

to all its investors and the shareholders. The most fact is the rate is affected by the external

factors of the market and not driven by the management (Baker, Jabbouri and Dyaz, 2017). The

WACC in the present case is 5.4% whereas the same depicts that the ability of the company to

take the risk is suitable.

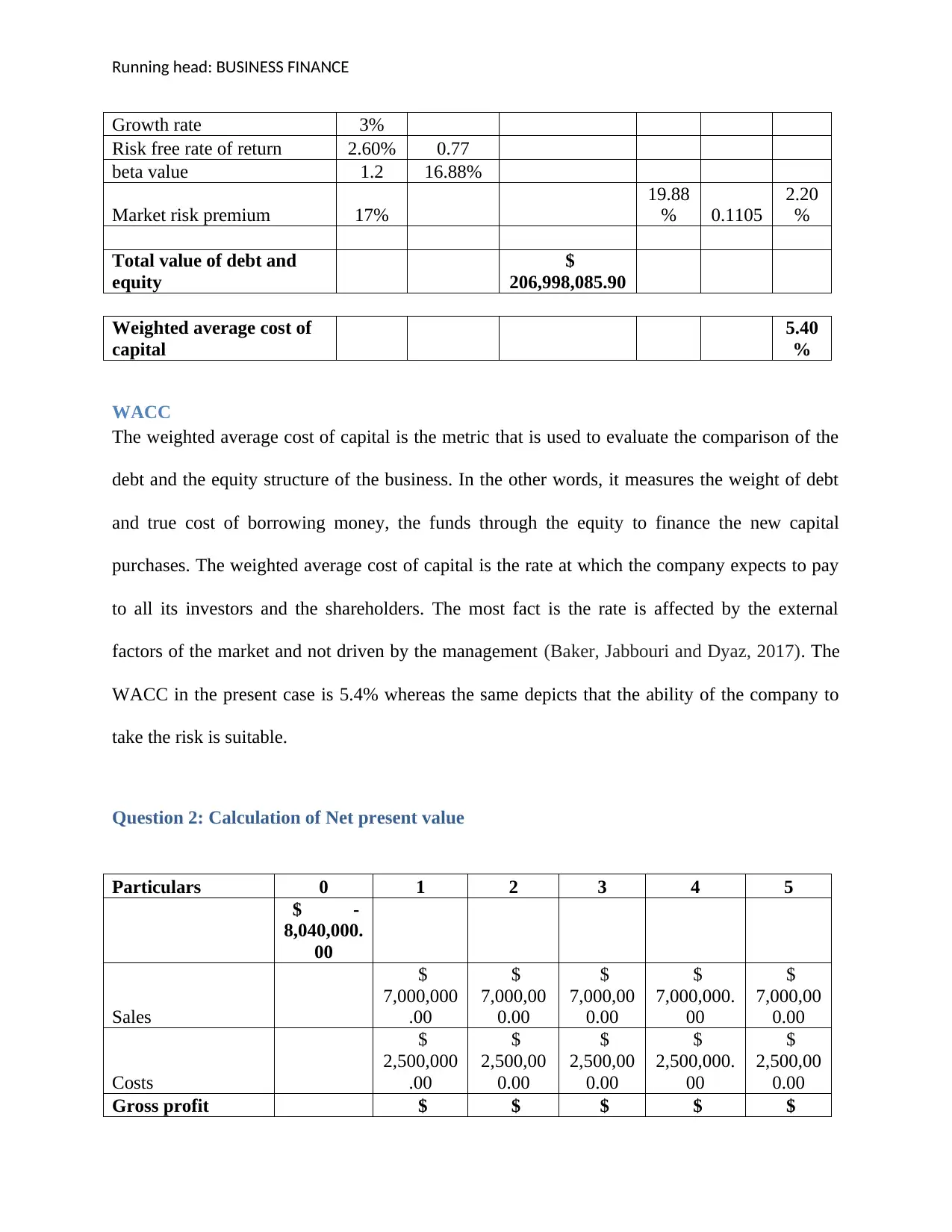

Question 2: Calculation of Net present value

Particulars 0 1 2 3 4 5

$ -

8,040,000.

00

Sales

$

7,000,000

.00

$

7,000,00

0.00

$

7,000,00

0.00

$

7,000,000.

00

$

7,000,00

0.00

Costs

$

2,500,000

.00

$

2,500,00

0.00

$

2,500,00

0.00

$

2,500,000.

00

$

2,500,00

0.00

Gross profit $ $ $ $ $

Growth rate 3%

Risk free rate of return 2.60% 0.77

beta value 1.2 16.88%

Market risk premium 17%

19.88

% 0.1105

2.20

%

Total value of debt and

equity

$

206,998,085.90

Weighted average cost of

capital

5.40

%

WACC

The weighted average cost of capital is the metric that is used to evaluate the comparison of the

debt and the equity structure of the business. In the other words, it measures the weight of debt

and true cost of borrowing money, the funds through the equity to finance the new capital

purchases. The weighted average cost of capital is the rate at which the company expects to pay

to all its investors and the shareholders. The most fact is the rate is affected by the external

factors of the market and not driven by the management (Baker, Jabbouri and Dyaz, 2017). The

WACC in the present case is 5.4% whereas the same depicts that the ability of the company to

take the risk is suitable.

Question 2: Calculation of Net present value

Particulars 0 1 2 3 4 5

$ -

8,040,000.

00

Sales

$

7,000,000

.00

$

7,000,00

0.00

$

7,000,00

0.00

$

7,000,000.

00

$

7,000,00

0.00

Costs

$

2,500,000

.00

$

2,500,00

0.00

$

2,500,00

0.00

$

2,500,000.

00

$

2,500,00

0.00

Gross profit $ $ $ $ $

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running head: BUSINESS FINANCE

4,500,000

.00

4,500,00

0.00

4,500,00

0.00

4,500,000.

00

4,500,00

0.00

Cost of restoring

$

1,200,00

0.00

Feasibility expenses

$

2,000,000

.00

Depreciation

$

1,594,000

.00

$

1,594,00

0.00

$

1,594,00

0.00

$

1,594,000.

00

$

1,594,00

0.00

Rent as an

opportunity cost

$

750,000.0

0

$

750,000.

00

$

750,000.

00

$

750,000.0

0

$

750,000.

00

Profit before tax

$

156,000.0

0

$

2,156,00

0.00

$

2,156,00

0.00

$

2,156,000.

00

$

956,000.

00

tax @ 30%

$

46,800.00

$

646,800.

00

$

646,800.

00

$

646,800.0

0

$

286,800.

00

Incremental

annual cash flows

$

109,200.0

0

$

1,509,20

0.00

$

1,509,20

0.00

$

1,509,200.

00

$

669,200.

00

Incremental cash

flows added

depreciation

$ -

8,040,000.

00

$

1,703,200

.00

$

3,103,20

0.00

$

3,103,20

0.00

$

3,103,200.

00

$

2,263,20

0.00

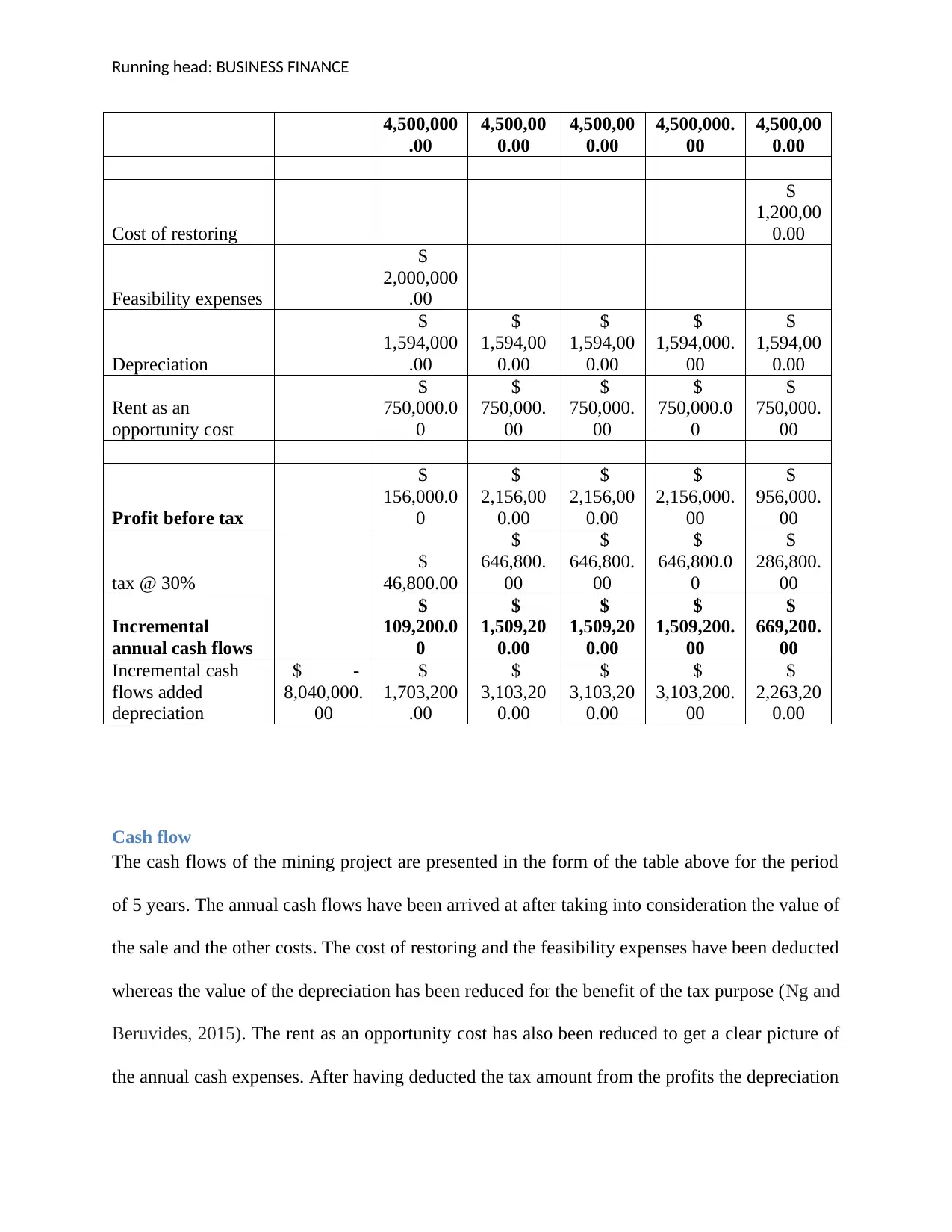

Cash flow

The cash flows of the mining project are presented in the form of the table above for the period

of 5 years. The annual cash flows have been arrived at after taking into consideration the value of

the sale and the other costs. The cost of restoring and the feasibility expenses have been deducted

whereas the value of the depreciation has been reduced for the benefit of the tax purpose (Ng and

Beruvides, 2015). The rent as an opportunity cost has also been reduced to get a clear picture of

the annual cash expenses. After having deducted the tax amount from the profits the depreciation

4,500,000

.00

4,500,00

0.00

4,500,00

0.00

4,500,000.

00

4,500,00

0.00

Cost of restoring

$

1,200,00

0.00

Feasibility expenses

$

2,000,000

.00

Depreciation

$

1,594,000

.00

$

1,594,00

0.00

$

1,594,00

0.00

$

1,594,000.

00

$

1,594,00

0.00

Rent as an

opportunity cost

$

750,000.0

0

$

750,000.

00

$

750,000.

00

$

750,000.0

0

$

750,000.

00

Profit before tax

$

156,000.0

0

$

2,156,00

0.00

$

2,156,00

0.00

$

2,156,000.

00

$

956,000.

00

tax @ 30%

$

46,800.00

$

646,800.

00

$

646,800.

00

$

646,800.0

0

$

286,800.

00

Incremental

annual cash flows

$

109,200.0

0

$

1,509,20

0.00

$

1,509,20

0.00

$

1,509,200.

00

$

669,200.

00

Incremental cash

flows added

depreciation

$ -

8,040,000.

00

$

1,703,200

.00

$

3,103,20

0.00

$

3,103,20

0.00

$

3,103,200.

00

$

2,263,20

0.00

Cash flow

The cash flows of the mining project are presented in the form of the table above for the period

of 5 years. The annual cash flows have been arrived at after taking into consideration the value of

the sale and the other costs. The cost of restoring and the feasibility expenses have been deducted

whereas the value of the depreciation has been reduced for the benefit of the tax purpose (Ng and

Beruvides, 2015). The rent as an opportunity cost has also been reduced to get a clear picture of

the annual cash expenses. After having deducted the tax amount from the profits the depreciation

Running head: BUSINESS FINANCE

has been added back as it is a non-cash expense. Henceforth, in this manner the value of the

annual cash flows has been arrived at (Bentley and Teeguarden, 2018).

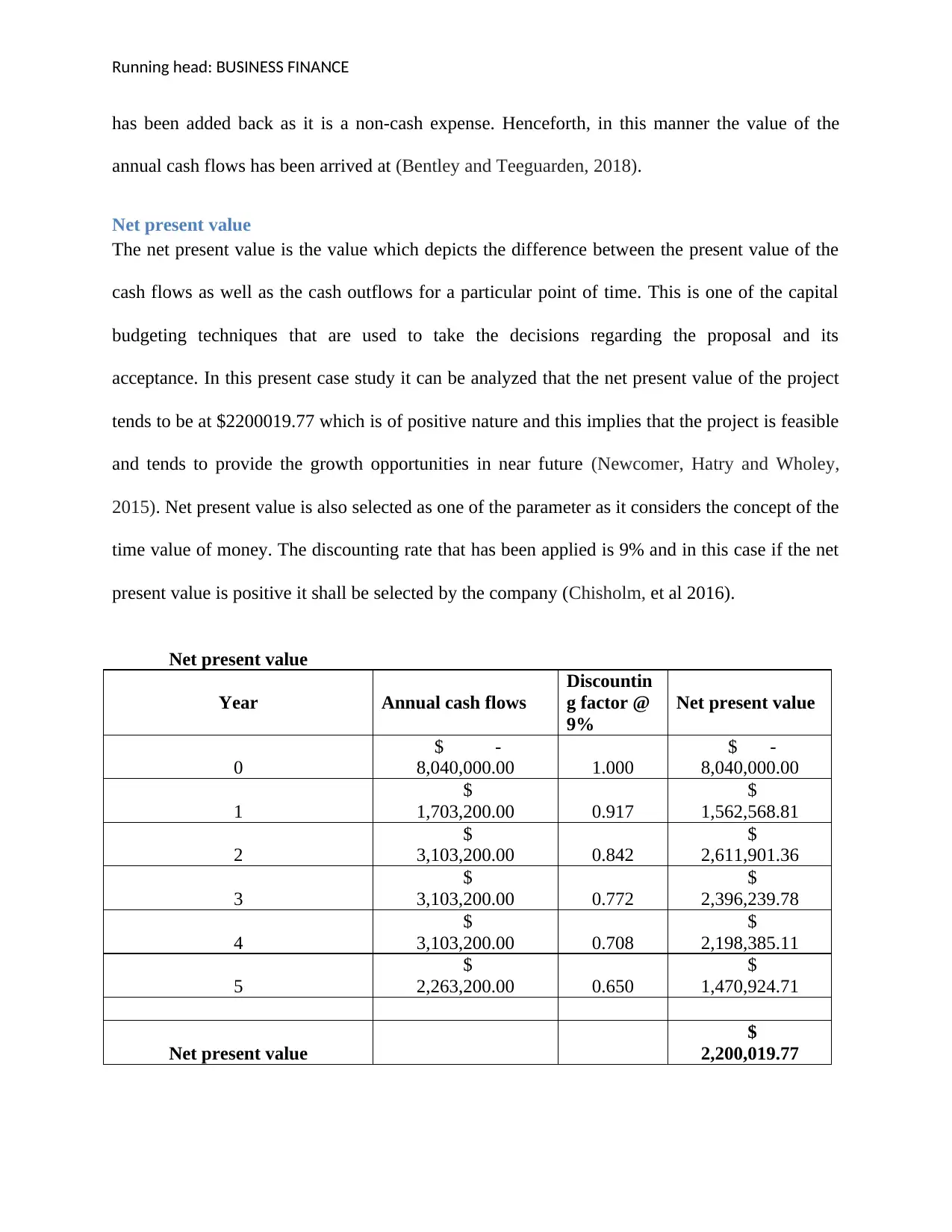

Net present value

The net present value is the value which depicts the difference between the present value of the

cash flows as well as the cash outflows for a particular point of time. This is one of the capital

budgeting techniques that are used to take the decisions regarding the proposal and its

acceptance. In this present case study it can be analyzed that the net present value of the project

tends to be at $2200019.77 which is of positive nature and this implies that the project is feasible

and tends to provide the growth opportunities in near future (Newcomer, Hatry and Wholey,

2015). Net present value is also selected as one of the parameter as it considers the concept of the

time value of money. The discounting rate that has been applied is 9% and in this case if the net

present value is positive it shall be selected by the company (Chisholm, et al 2016).

Net present value

Year Annual cash flows

Discountin

g factor @

9%

Net present value

0

$ -

8,040,000.00 1.000

$ -

8,040,000.00

1

$

1,703,200.00 0.917

$

1,562,568.81

2

$

3,103,200.00 0.842

$

2,611,901.36

3

$

3,103,200.00 0.772

$

2,396,239.78

4

$

3,103,200.00 0.708

$

2,198,385.11

5

$

2,263,200.00 0.650

$

1,470,924.71

Net present value

$

2,200,019.77

has been added back as it is a non-cash expense. Henceforth, in this manner the value of the

annual cash flows has been arrived at (Bentley and Teeguarden, 2018).

Net present value

The net present value is the value which depicts the difference between the present value of the

cash flows as well as the cash outflows for a particular point of time. This is one of the capital

budgeting techniques that are used to take the decisions regarding the proposal and its

acceptance. In this present case study it can be analyzed that the net present value of the project

tends to be at $2200019.77 which is of positive nature and this implies that the project is feasible

and tends to provide the growth opportunities in near future (Newcomer, Hatry and Wholey,

2015). Net present value is also selected as one of the parameter as it considers the concept of the

time value of money. The discounting rate that has been applied is 9% and in this case if the net

present value is positive it shall be selected by the company (Chisholm, et al 2016).

Net present value

Year Annual cash flows

Discountin

g factor @

9%

Net present value

0

$ -

8,040,000.00 1.000

$ -

8,040,000.00

1

$

1,703,200.00 0.917

$

1,562,568.81

2

$

3,103,200.00 0.842

$

2,611,901.36

3

$

3,103,200.00 0.772

$

2,396,239.78

4

$

3,103,200.00 0.708

$

2,198,385.11

5

$

2,263,200.00 0.650

$

1,470,924.71

Net present value

$

2,200,019.77

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running head: BUSINESS FINANCE

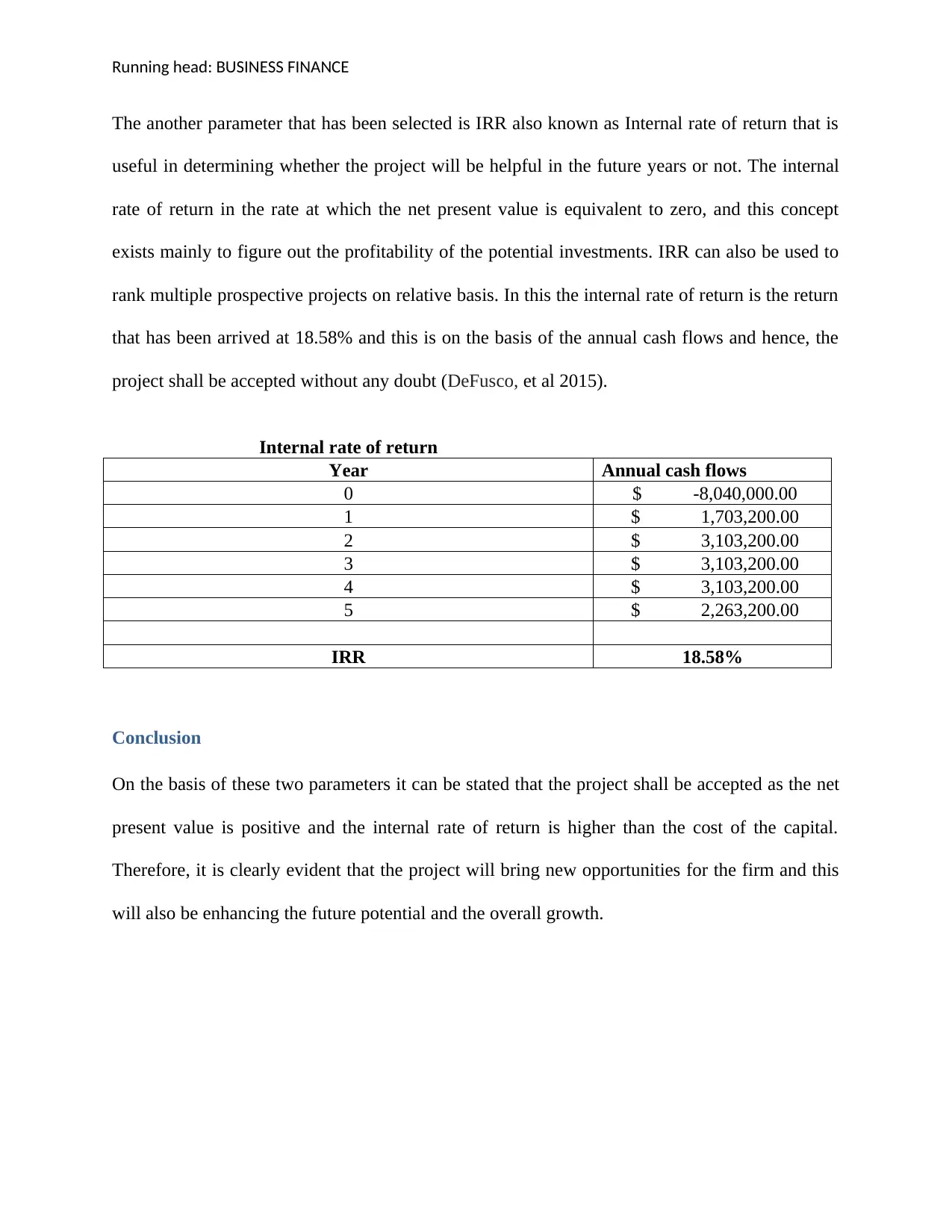

The another parameter that has been selected is IRR also known as Internal rate of return that is

useful in determining whether the project will be helpful in the future years or not. The internal

rate of return in the rate at which the net present value is equivalent to zero, and this concept

exists mainly to figure out the profitability of the potential investments. IRR can also be used to

rank multiple prospective projects on relative basis. In this the internal rate of return is the return

that has been arrived at 18.58% and this is on the basis of the annual cash flows and hence, the

project shall be accepted without any doubt (DeFusco, et al 2015).

Internal rate of return

Year Annual cash flows

0 $ -8,040,000.00

1 $ 1,703,200.00

2 $ 3,103,200.00

3 $ 3,103,200.00

4 $ 3,103,200.00

5 $ 2,263,200.00

IRR 18.58%

Conclusion

On the basis of these two parameters it can be stated that the project shall be accepted as the net

present value is positive and the internal rate of return is higher than the cost of the capital.

Therefore, it is clearly evident that the project will bring new opportunities for the firm and this

will also be enhancing the future potential and the overall growth.

The another parameter that has been selected is IRR also known as Internal rate of return that is

useful in determining whether the project will be helpful in the future years or not. The internal

rate of return in the rate at which the net present value is equivalent to zero, and this concept

exists mainly to figure out the profitability of the potential investments. IRR can also be used to

rank multiple prospective projects on relative basis. In this the internal rate of return is the return

that has been arrived at 18.58% and this is on the basis of the annual cash flows and hence, the

project shall be accepted without any doubt (DeFusco, et al 2015).

Internal rate of return

Year Annual cash flows

0 $ -8,040,000.00

1 $ 1,703,200.00

2 $ 3,103,200.00

3 $ 3,103,200.00

4 $ 3,103,200.00

5 $ 2,263,200.00

IRR 18.58%

Conclusion

On the basis of these two parameters it can be stated that the project shall be accepted as the net

present value is positive and the internal rate of return is higher than the cost of the capital.

Therefore, it is clearly evident that the project will bring new opportunities for the firm and this

will also be enhancing the future potential and the overall growth.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running head: BUSINESS FINANCE

References

Baker, H.K., Jabbouri, I. and Dyaz, C., 2017. Corporate finance practices in

Morocco. Managerial Finance, 43(8), pp.865-880.

Bentley, W.R. and Teeguarden, D.E., 2018. Financial maturity: a theoretical review.

In Economics of Forestry (pp. 67-78). Routledge.

Chisholm, D., Sweeny, K., Sheehan, P., Rasmussen, B., Smit, F., Cuijpers, P. and Saxena, S.,

2016. Scaling-up treatment of depression and anxiety: a global return on investment

analysis. The Lancet Psychiatry, 3(5), pp.415-424.

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Runkle, D.E. and Anson, M.J., 2015. Quantitative

investment analysis. John Wiley & Sons.

Lam, A.P., 2016. Finance-Economic Analysis and Evaluation of Oil and Gas Industry: A Case

Study of X Oil Field in Nam Con Son Basin (Doctoral dissertation).

Newcomer, K.E., Hatry, H.P. and Wholey, J.S., 2015. Cost-effectiveness and cost-benefit

analysis. Handbook of practical program evaluation, p.636.

Ng, E.H. and Beruvides, M.G., 2015. Multiple internal rate of return revisited: frequency of

occurrences. The Engineering Economist, 60(1), pp.75-87.

References

Baker, H.K., Jabbouri, I. and Dyaz, C., 2017. Corporate finance practices in

Morocco. Managerial Finance, 43(8), pp.865-880.

Bentley, W.R. and Teeguarden, D.E., 2018. Financial maturity: a theoretical review.

In Economics of Forestry (pp. 67-78). Routledge.

Chisholm, D., Sweeny, K., Sheehan, P., Rasmussen, B., Smit, F., Cuijpers, P. and Saxena, S.,

2016. Scaling-up treatment of depression and anxiety: a global return on investment

analysis. The Lancet Psychiatry, 3(5), pp.415-424.

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Runkle, D.E. and Anson, M.J., 2015. Quantitative

investment analysis. John Wiley & Sons.

Lam, A.P., 2016. Finance-Economic Analysis and Evaluation of Oil and Gas Industry: A Case

Study of X Oil Field in Nam Con Son Basin (Doctoral dissertation).

Newcomer, K.E., Hatry, H.P. and Wholey, J.S., 2015. Cost-effectiveness and cost-benefit

analysis. Handbook of practical program evaluation, p.636.

Ng, E.H. and Beruvides, M.G., 2015. Multiple internal rate of return revisited: frequency of

occurrences. The Engineering Economist, 60(1), pp.75-87.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.