Business Finance Homework Assignment: Comprehensive Solutions

VerifiedAdded on 2020/05/16

|15

|2055

|97

Homework Assignment

AI Summary

This document presents a comprehensive solution to a business finance assignment, covering a range of topics including loan calculations, bond valuation, share price analysis, investment appraisal (NPV and IRR), and financial ratio analysis. The solution provides detailed calculations for loan amortization, bond pricing, and dividend discount models. It also includes an analysis of project viability using NPV and IRR, comparing different investment scenarios. Furthermore, the assignment explores financial ratios such as quick ratio, cash ratio, and profitability ratios, offering insights into a company's financial health and performance. The solution provides explanations and interpretations of the results, supported by relevant references, offering a thorough understanding of key finance concepts.

Running head: BUSINESS FINANCE

Business Finance

Name of the Student:

Name of the University:

Authors Note:

Business Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

1

Table of Contents

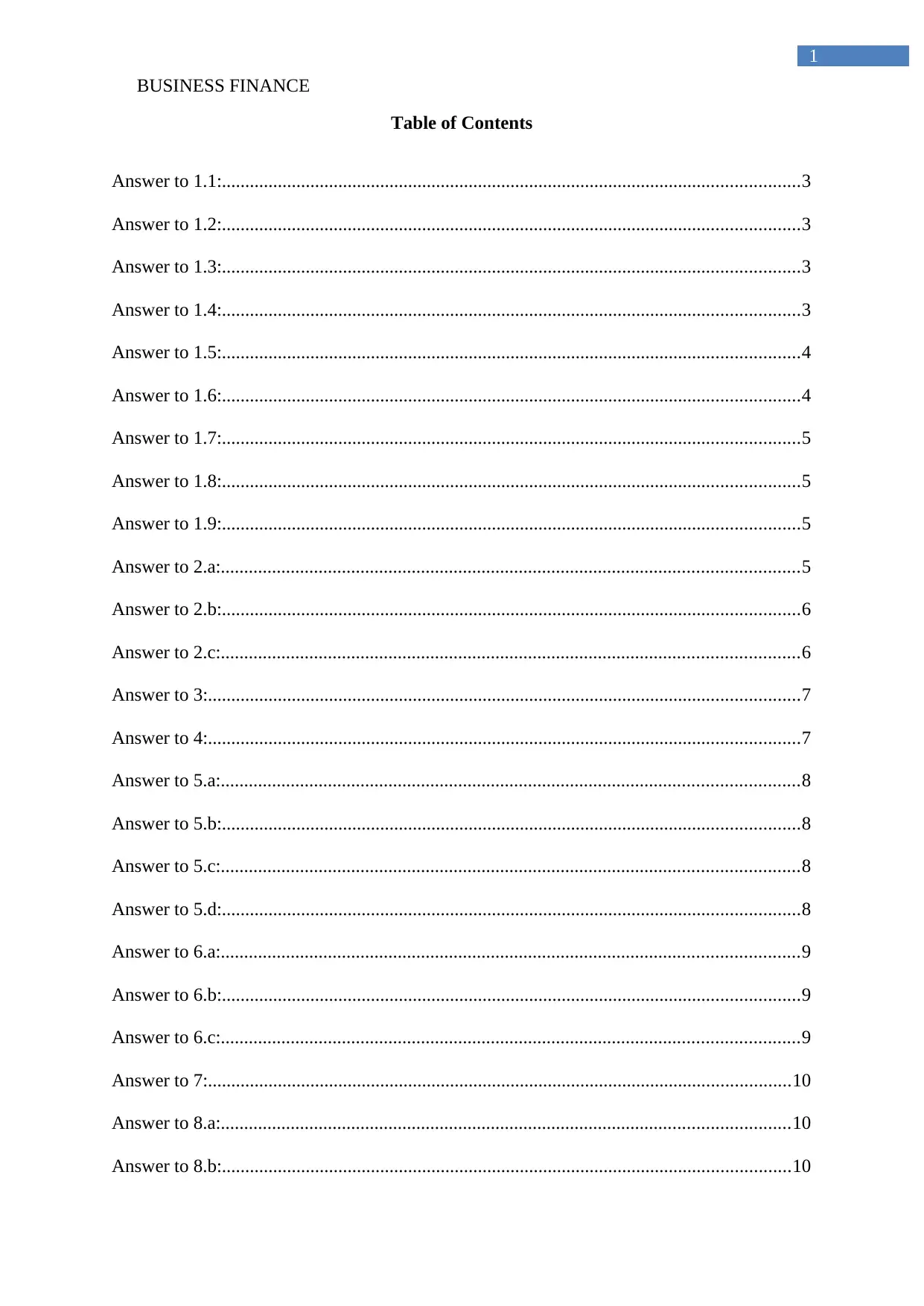

Answer to 1.1:............................................................................................................................3

Answer to 1.2:............................................................................................................................3

Answer to 1.3:............................................................................................................................3

Answer to 1.4:............................................................................................................................3

Answer to 1.5:............................................................................................................................4

Answer to 1.6:............................................................................................................................4

Answer to 1.7:............................................................................................................................5

Answer to 1.8:............................................................................................................................5

Answer to 1.9:............................................................................................................................5

Answer to 2.a:............................................................................................................................5

Answer to 2.b:............................................................................................................................6

Answer to 2.c:............................................................................................................................6

Answer to 3:...............................................................................................................................7

Answer to 4:...............................................................................................................................7

Answer to 5.a:............................................................................................................................8

Answer to 5.b:............................................................................................................................8

Answer to 5.c:............................................................................................................................8

Answer to 5.d:............................................................................................................................8

Answer to 6.a:............................................................................................................................9

Answer to 6.b:............................................................................................................................9

Answer to 6.c:............................................................................................................................9

Answer to 7:.............................................................................................................................10

Answer to 8.a:..........................................................................................................................10

Answer to 8.b:..........................................................................................................................10

1

Table of Contents

Answer to 1.1:............................................................................................................................3

Answer to 1.2:............................................................................................................................3

Answer to 1.3:............................................................................................................................3

Answer to 1.4:............................................................................................................................3

Answer to 1.5:............................................................................................................................4

Answer to 1.6:............................................................................................................................4

Answer to 1.7:............................................................................................................................5

Answer to 1.8:............................................................................................................................5

Answer to 1.9:............................................................................................................................5

Answer to 2.a:............................................................................................................................5

Answer to 2.b:............................................................................................................................6

Answer to 2.c:............................................................................................................................6

Answer to 3:...............................................................................................................................7

Answer to 4:...............................................................................................................................7

Answer to 5.a:............................................................................................................................8

Answer to 5.b:............................................................................................................................8

Answer to 5.c:............................................................................................................................8

Answer to 5.d:............................................................................................................................8

Answer to 6.a:............................................................................................................................9

Answer to 6.b:............................................................................................................................9

Answer to 6.c:............................................................................................................................9

Answer to 7:.............................................................................................................................10

Answer to 8.a:..........................................................................................................................10

Answer to 8.b:..........................................................................................................................10

BUSINESS FINANCE

2

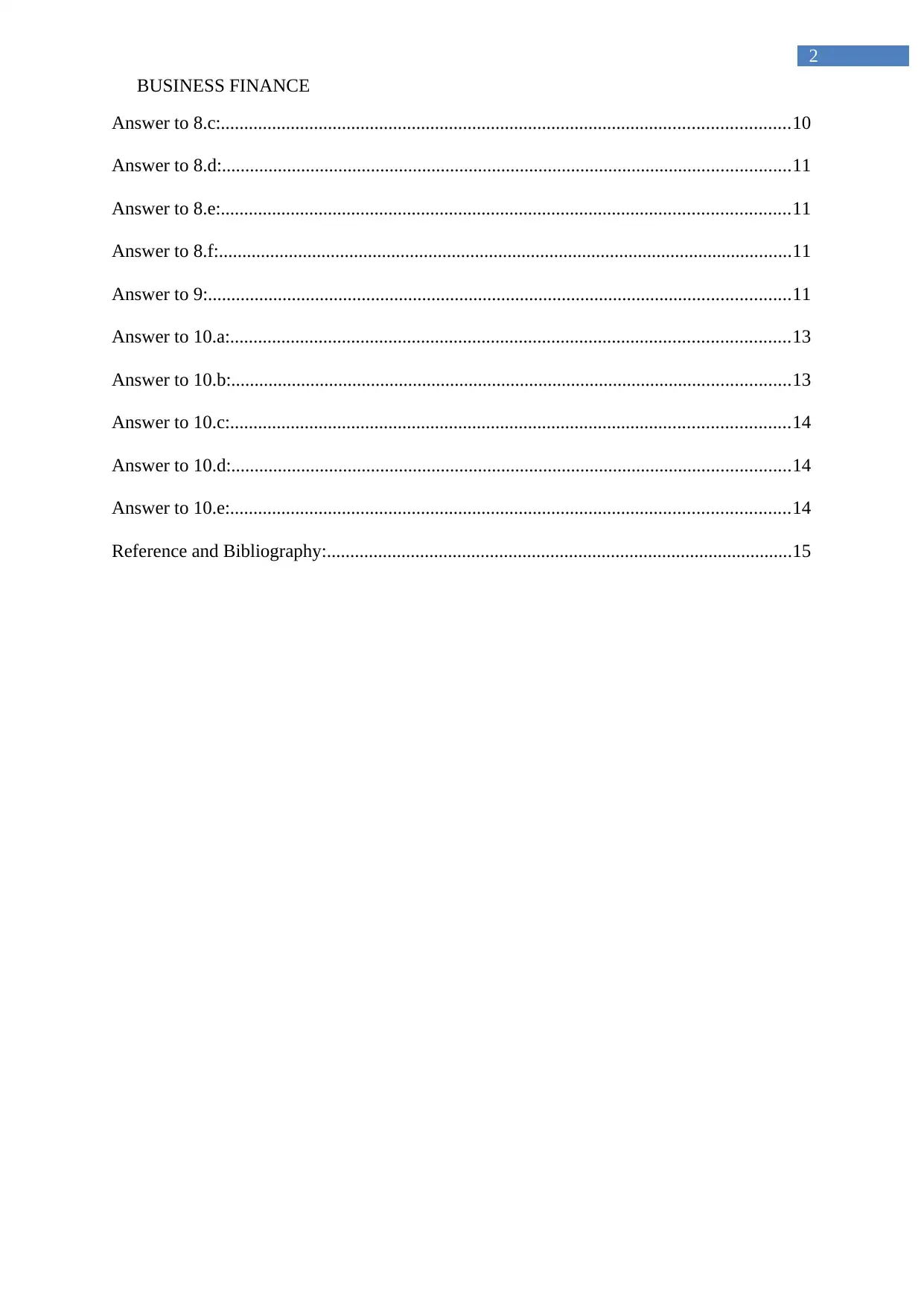

Answer to 8.c:..........................................................................................................................10

Answer to 8.d:..........................................................................................................................11

Answer to 8.e:..........................................................................................................................11

Answer to 8.f:...........................................................................................................................11

Answer to 9:.............................................................................................................................11

Answer to 10.a:........................................................................................................................13

Answer to 10.b:........................................................................................................................13

Answer to 10.c:........................................................................................................................14

Answer to 10.d:........................................................................................................................14

Answer to 10.e:........................................................................................................................14

Reference and Bibliography:....................................................................................................15

2

Answer to 8.c:..........................................................................................................................10

Answer to 8.d:..........................................................................................................................11

Answer to 8.e:..........................................................................................................................11

Answer to 8.f:...........................................................................................................................11

Answer to 9:.............................................................................................................................11

Answer to 10.a:........................................................................................................................13

Answer to 10.b:........................................................................................................................13

Answer to 10.c:........................................................................................................................14

Answer to 10.d:........................................................................................................................14

Answer to 10.e:........................................................................................................................14

Reference and Bibliography:....................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUSINESS FINANCE

3

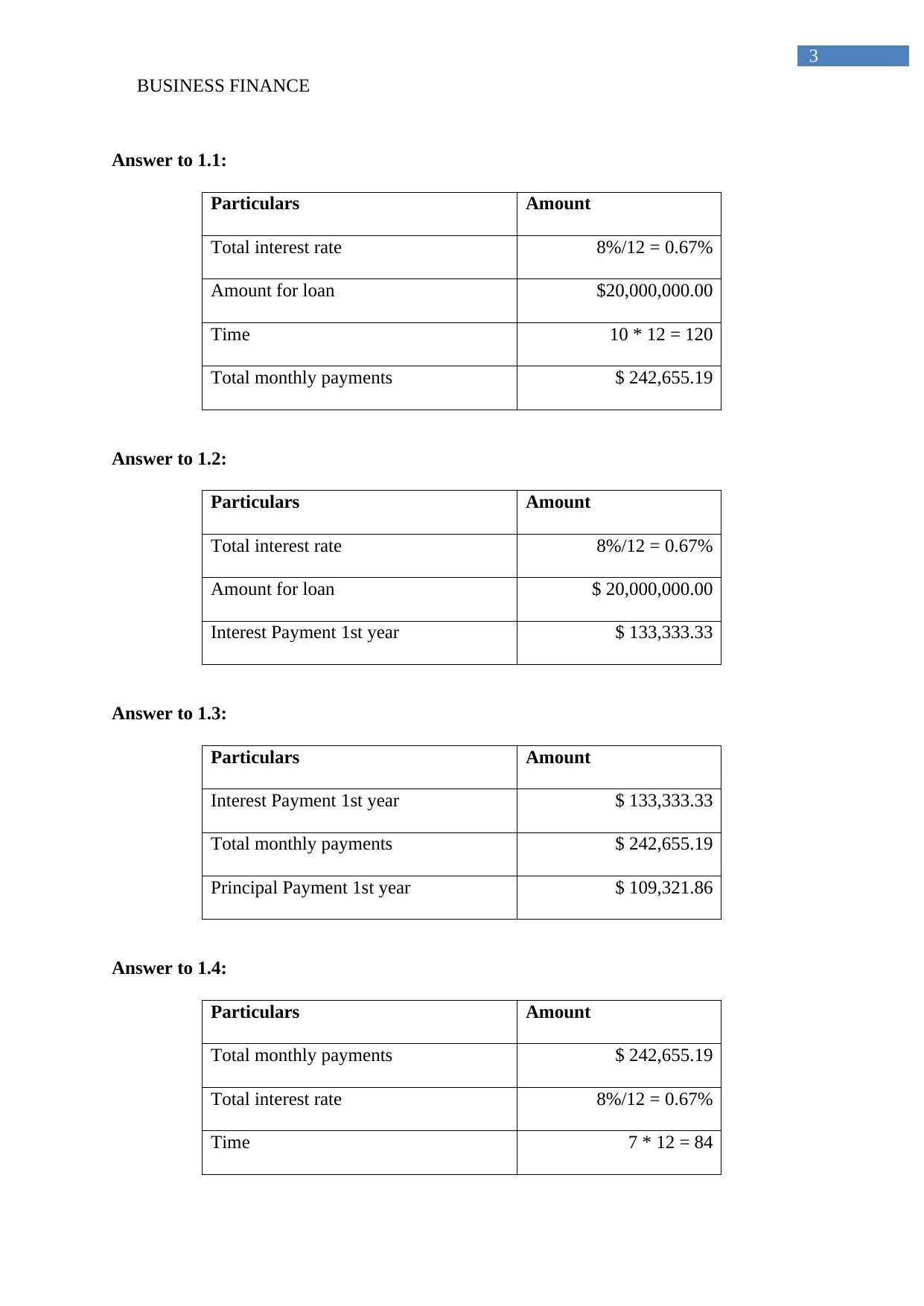

Answer to 1.1:

Particulars Amount

Total interest rate 8%/12 = 0.67%

Amount for loan $20,000,000.00

Time 10 * 12 = 120

Total monthly payments $ 242,655.19

Answer to 1.2:

Particulars Amount

Total interest rate 8%/12 = 0.67%

Amount for loan $ 20,000,000.00

Interest Payment 1st year $ 133,333.33

Answer to 1.3:

Particulars Amount

Interest Payment 1st year $ 133,333.33

Total monthly payments $ 242,655.19

Principal Payment 1st year $ 109,321.86

Answer to 1.4:

Particulars Amount

Total monthly payments $ 242,655.19

Total interest rate 8%/12 = 0.67%

Time 7 * 12 = 84

3

Answer to 1.1:

Particulars Amount

Total interest rate 8%/12 = 0.67%

Amount for loan $20,000,000.00

Time 10 * 12 = 120

Total monthly payments $ 242,655.19

Answer to 1.2:

Particulars Amount

Total interest rate 8%/12 = 0.67%

Amount for loan $ 20,000,000.00

Interest Payment 1st year $ 133,333.33

Answer to 1.3:

Particulars Amount

Interest Payment 1st year $ 133,333.33

Total monthly payments $ 242,655.19

Principal Payment 1st year $ 109,321.86

Answer to 1.4:

Particulars Amount

Total monthly payments $ 242,655.19

Total interest rate 8%/12 = 0.67%

Time 7 * 12 = 84

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

4

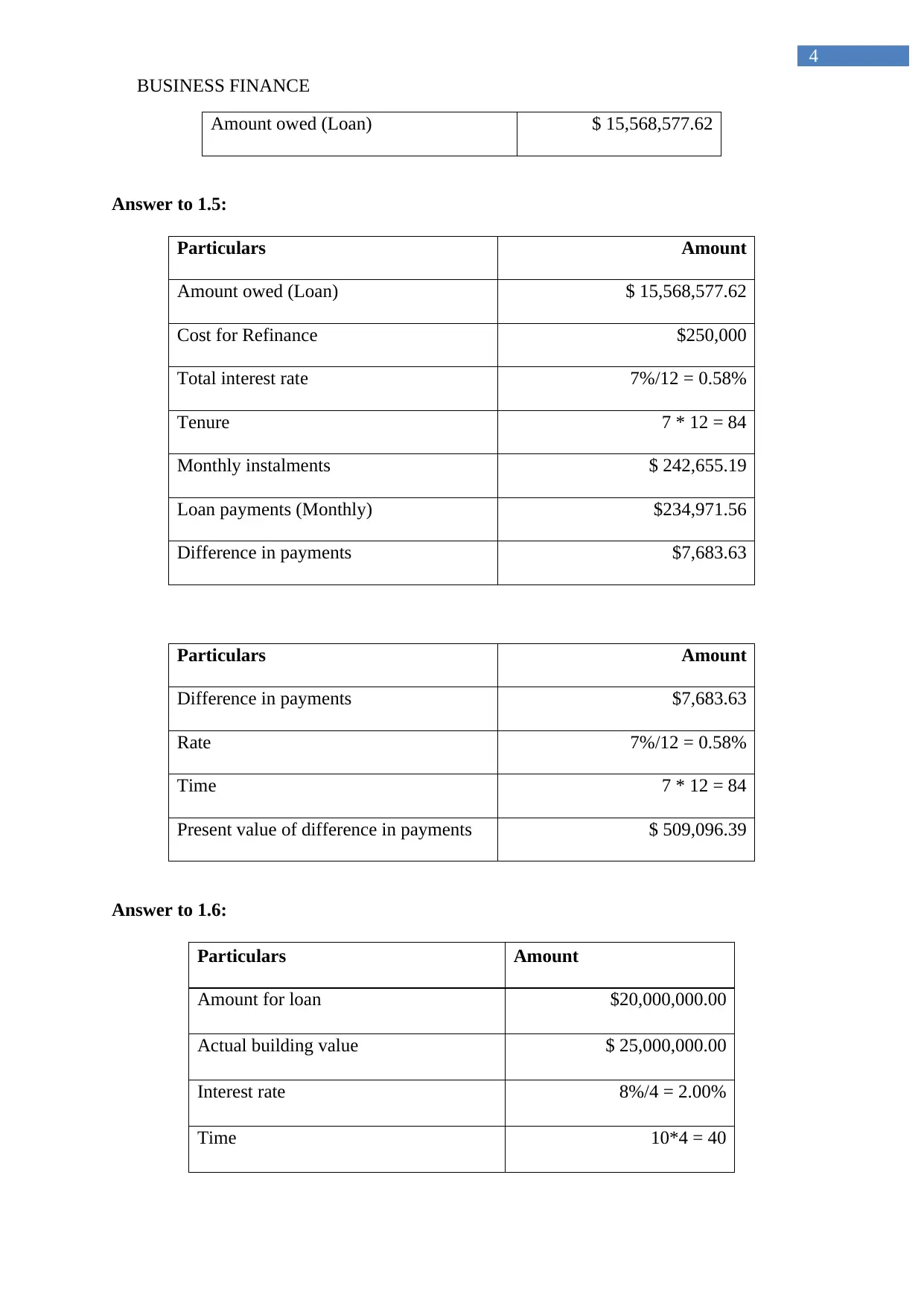

Amount owed (Loan) $ 15,568,577.62

Answer to 1.5:

Particulars Amount

Amount owed (Loan) $ 15,568,577.62

Cost for Refinance $250,000

Total interest rate 7%/12 = 0.58%

Tenure 7 * 12 = 84

Monthly instalments $ 242,655.19

Loan payments (Monthly) $234,971.56

Difference in payments $7,683.63

Particulars Amount

Difference in payments $7,683.63

Rate 7%/12 = 0.58%

Time 7 * 12 = 84

Present value of difference in payments $ 509,096.39

Answer to 1.6:

Particulars Amount

Amount for loan $20,000,000.00

Actual building value $ 25,000,000.00

Interest rate 8%/4 = 2.00%

Time 10*4 = 40

4

Amount owed (Loan) $ 15,568,577.62

Answer to 1.5:

Particulars Amount

Amount owed (Loan) $ 15,568,577.62

Cost for Refinance $250,000

Total interest rate 7%/12 = 0.58%

Tenure 7 * 12 = 84

Monthly instalments $ 242,655.19

Loan payments (Monthly) $234,971.56

Difference in payments $7,683.63

Particulars Amount

Difference in payments $7,683.63

Rate 7%/12 = 0.58%

Time 7 * 12 = 84

Present value of difference in payments $ 509,096.39

Answer to 1.6:

Particulars Amount

Amount for loan $20,000,000.00

Actual building value $ 25,000,000.00

Interest rate 8%/4 = 2.00%

Time 10*4 = 40

BUSINESS FINANCE

5

Payments in quarterly $731,115.96

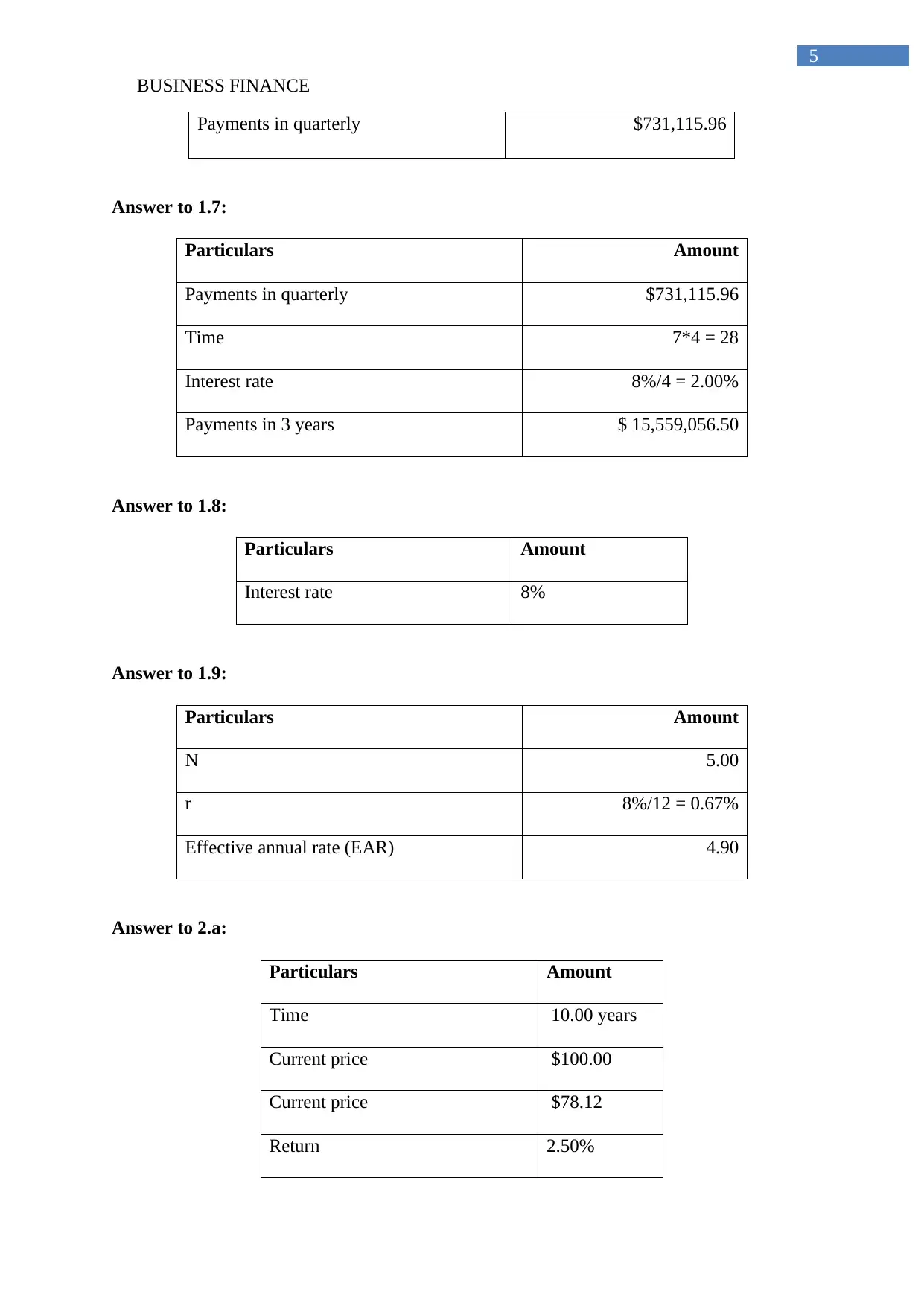

Answer to 1.7:

Particulars Amount

Payments in quarterly $731,115.96

Time 7*4 = 28

Interest rate 8%/4 = 2.00%

Payments in 3 years $ 15,559,056.50

Answer to 1.8:

Particulars Amount

Interest rate 8%

Answer to 1.9:

Particulars Amount

N 5.00

r 8%/12 = 0.67%

Effective annual rate (EAR) 4.90

Answer to 2.a:

Particulars Amount

Time 10.00 years

Current price $100.00

Current price $78.12

Return 2.50%

5

Payments in quarterly $731,115.96

Answer to 1.7:

Particulars Amount

Payments in quarterly $731,115.96

Time 7*4 = 28

Interest rate 8%/4 = 2.00%

Payments in 3 years $ 15,559,056.50

Answer to 1.8:

Particulars Amount

Interest rate 8%

Answer to 1.9:

Particulars Amount

N 5.00

r 8%/12 = 0.67%

Effective annual rate (EAR) 4.90

Answer to 2.a:

Particulars Amount

Time 10.00 years

Current price $100.00

Current price $78.12

Return 2.50%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUSINESS FINANCE

6

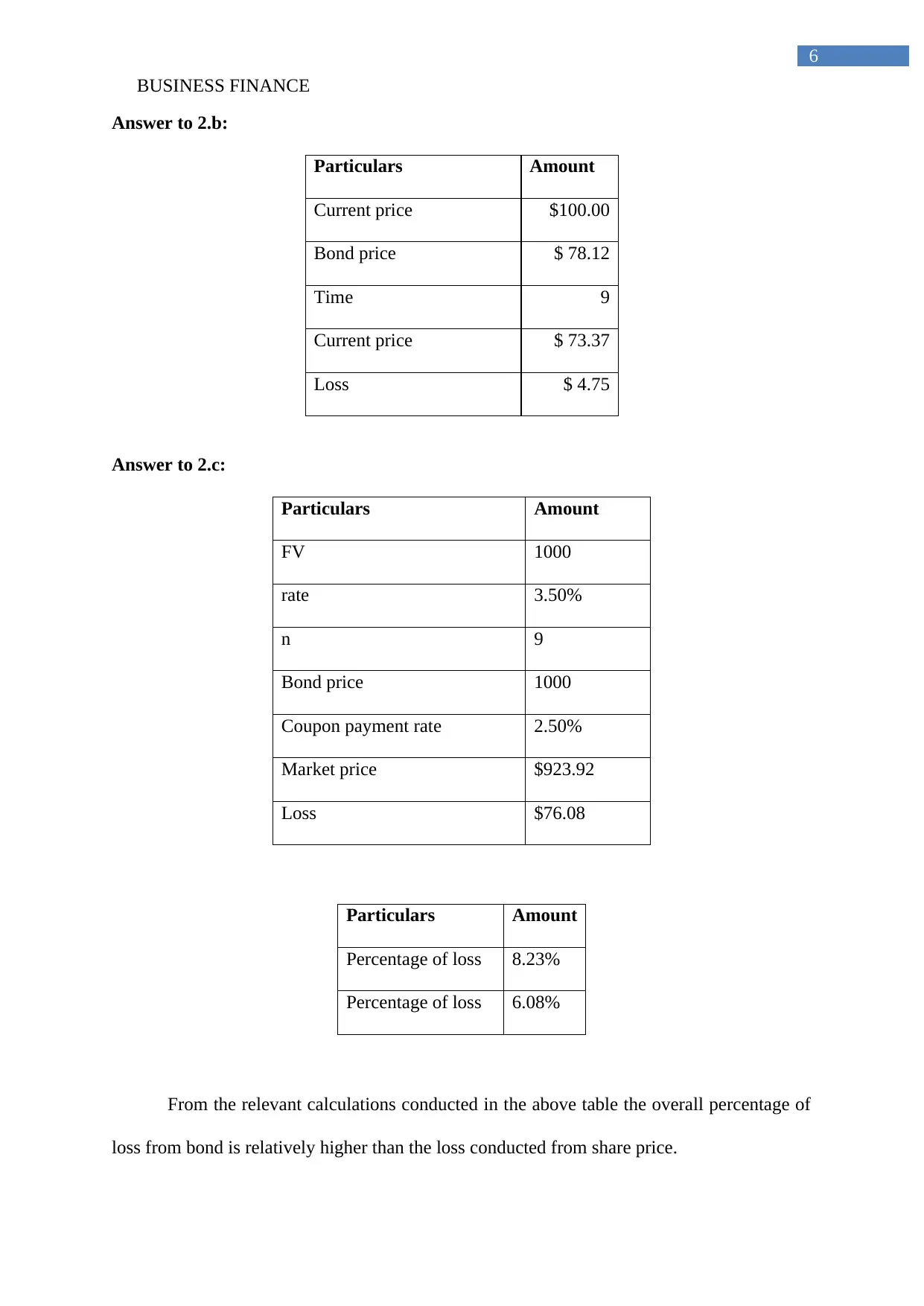

Answer to 2.b:

Particulars Amount

Current price $100.00

Bond price $ 78.12

Time 9

Current price $ 73.37

Loss $ 4.75

Answer to 2.c:

Particulars Amount

FV 1000

rate 3.50%

n 9

Bond price 1000

Coupon payment rate 2.50%

Market price $923.92

Loss $76.08

Particulars Amount

Percentage of loss 8.23%

Percentage of loss 6.08%

From the relevant calculations conducted in the above table the overall percentage of

loss from bond is relatively higher than the loss conducted from share price.

6

Answer to 2.b:

Particulars Amount

Current price $100.00

Bond price $ 78.12

Time 9

Current price $ 73.37

Loss $ 4.75

Answer to 2.c:

Particulars Amount

FV 1000

rate 3.50%

n 9

Bond price 1000

Coupon payment rate 2.50%

Market price $923.92

Loss $76.08

Particulars Amount

Percentage of loss 8.23%

Percentage of loss 6.08%

From the relevant calculations conducted in the above table the overall percentage of

loss from bond is relatively higher than the loss conducted from share price.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

7

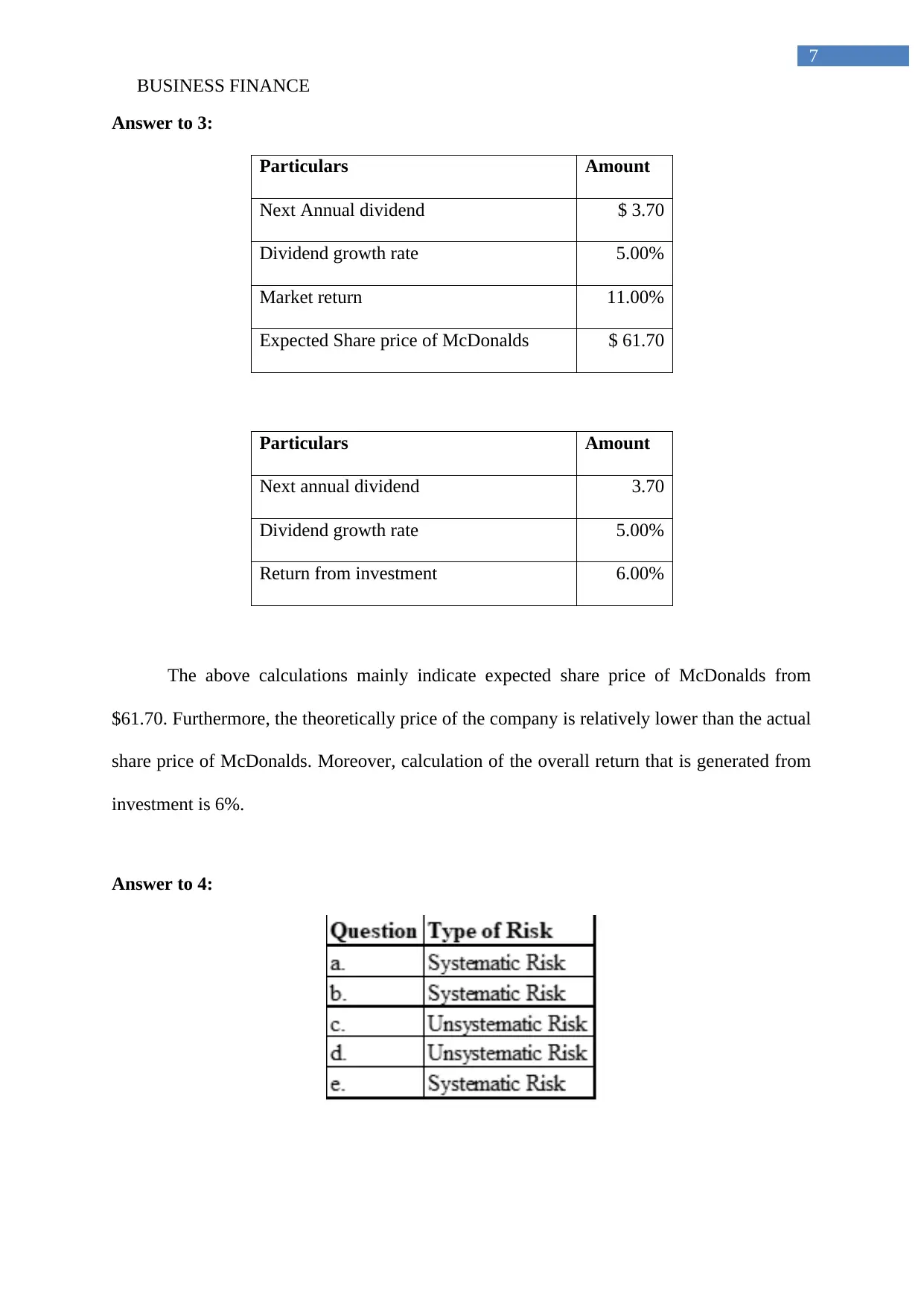

Answer to 3:

Particulars Amount

Next Annual dividend $ 3.70

Dividend growth rate 5.00%

Market return 11.00%

Expected Share price of McDonalds $ 61.70

Particulars Amount

Next annual dividend 3.70

Dividend growth rate 5.00%

Return from investment 6.00%

The above calculations mainly indicate expected share price of McDonalds from

$61.70. Furthermore, the theoretically price of the company is relatively lower than the actual

share price of McDonalds. Moreover, calculation of the overall return that is generated from

investment is 6%.

Answer to 4:

7

Answer to 3:

Particulars Amount

Next Annual dividend $ 3.70

Dividend growth rate 5.00%

Market return 11.00%

Expected Share price of McDonalds $ 61.70

Particulars Amount

Next annual dividend 3.70

Dividend growth rate 5.00%

Return from investment 6.00%

The above calculations mainly indicate expected share price of McDonalds from

$61.70. Furthermore, the theoretically price of the company is relatively lower than the actual

share price of McDonalds. Moreover, calculation of the overall return that is generated from

investment is 6%.

Answer to 4:

BUSINESS FINANCE

8

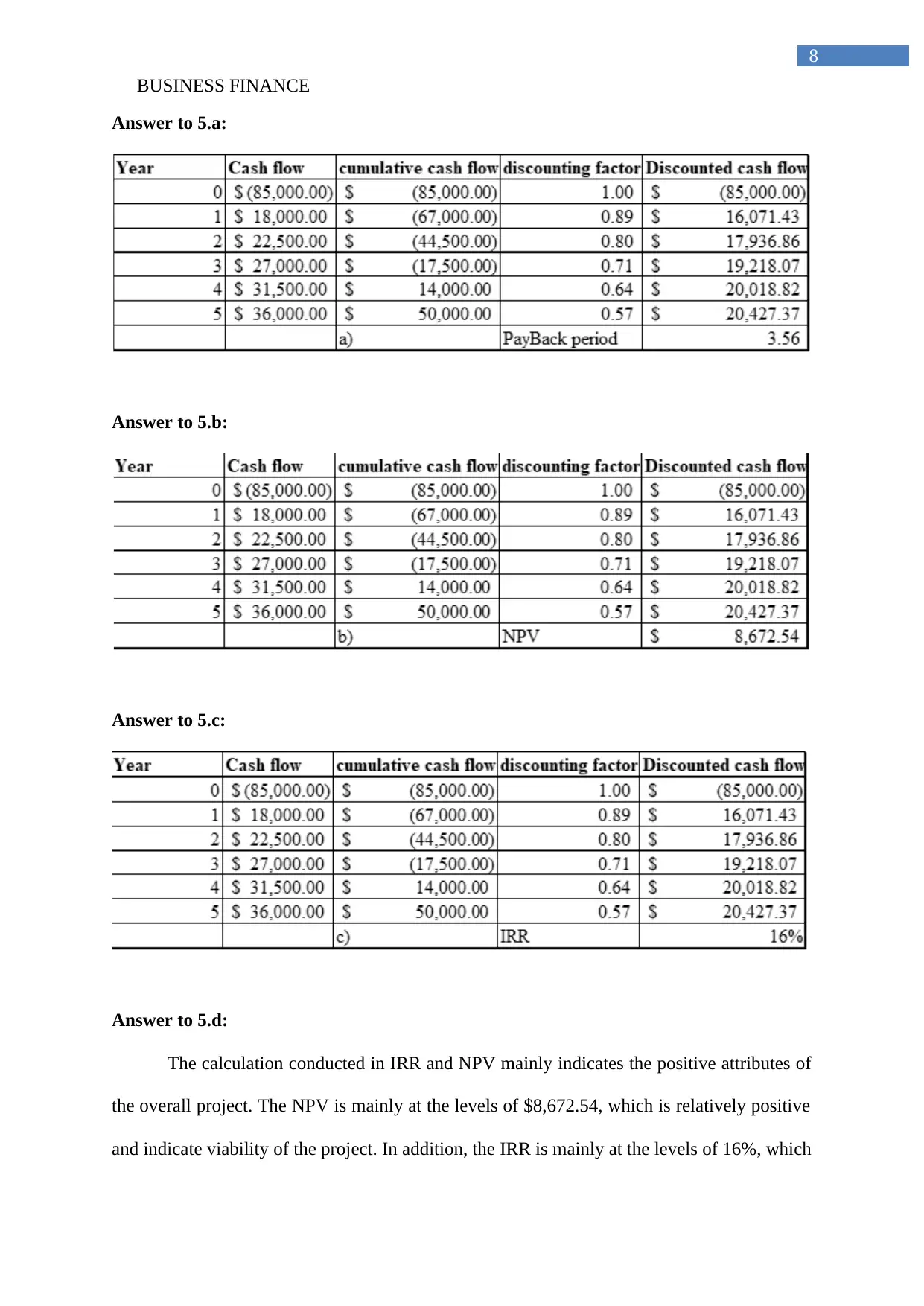

Answer to 5.a:

Answer to 5.b:

Answer to 5.c:

Answer to 5.d:

The calculation conducted in IRR and NPV mainly indicates the positive attributes of

the overall project. The NPV is mainly at the levels of $8,672.54, which is relatively positive

and indicate viability of the project. In addition, the IRR is mainly at the levels of 16%, which

8

Answer to 5.a:

Answer to 5.b:

Answer to 5.c:

Answer to 5.d:

The calculation conducted in IRR and NPV mainly indicates the positive attributes of

the overall project. The NPV is mainly at the levels of $8,672.54, which is relatively positive

and indicate viability of the project. In addition, the IRR is mainly at the levels of 16%, which

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUSINESS FINANCE

9

is higher than cost of capital of 12%, which portrays financial performance of the project

(Balakrishnan, Watts & Zuo, 2016).

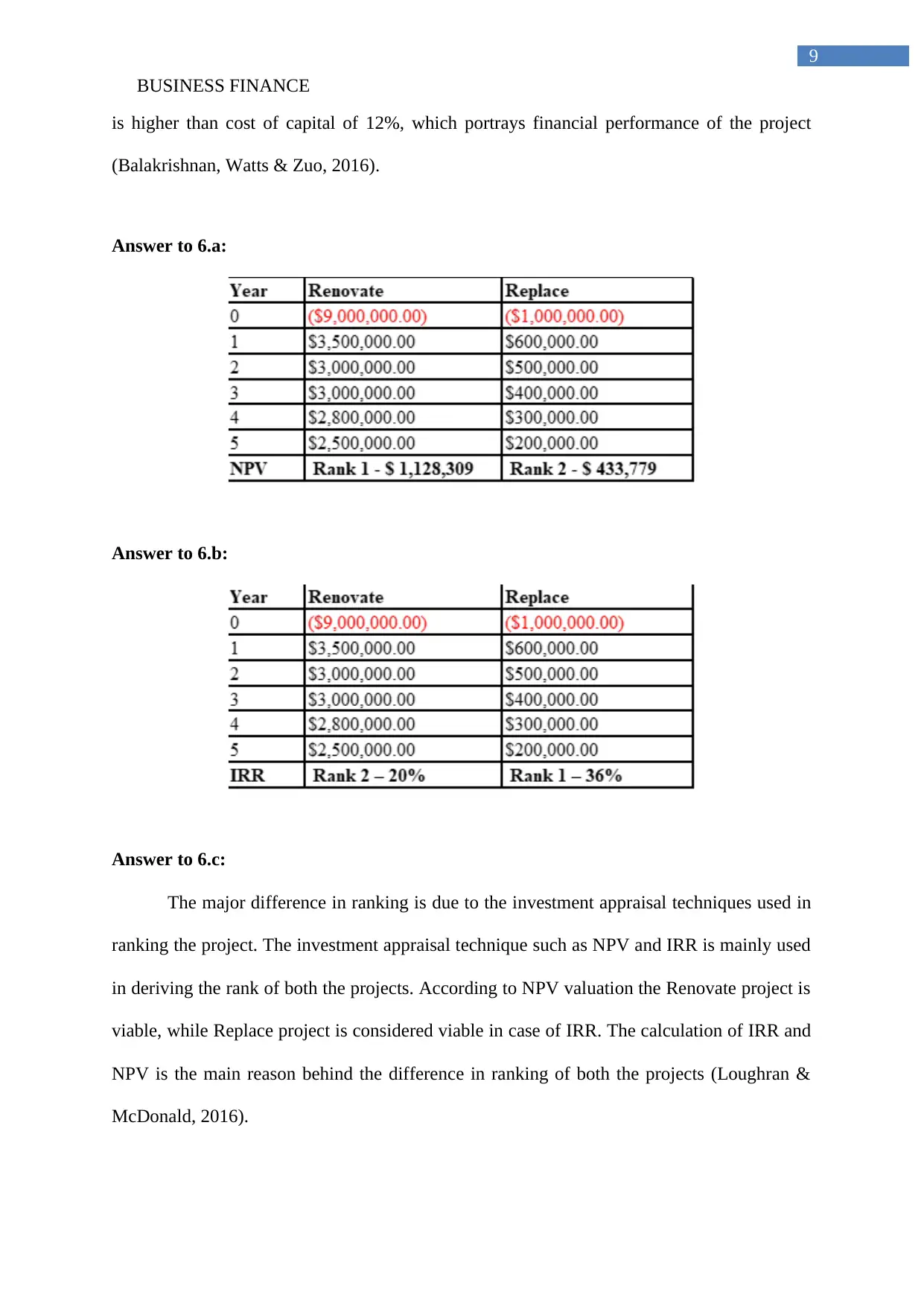

Answer to 6.a:

Answer to 6.b:

Answer to 6.c:

The major difference in ranking is due to the investment appraisal techniques used in

ranking the project. The investment appraisal technique such as NPV and IRR is mainly used

in deriving the rank of both the projects. According to NPV valuation the Renovate project is

viable, while Replace project is considered viable in case of IRR. The calculation of IRR and

NPV is the main reason behind the difference in ranking of both the projects (Loughran &

McDonald, 2016).

9

is higher than cost of capital of 12%, which portrays financial performance of the project

(Balakrishnan, Watts & Zuo, 2016).

Answer to 6.a:

Answer to 6.b:

Answer to 6.c:

The major difference in ranking is due to the investment appraisal techniques used in

ranking the project. The investment appraisal technique such as NPV and IRR is mainly used

in deriving the rank of both the projects. According to NPV valuation the Renovate project is

viable, while Replace project is considered viable in case of IRR. The calculation of IRR and

NPV is the main reason behind the difference in ranking of both the projects (Loughran &

McDonald, 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

10

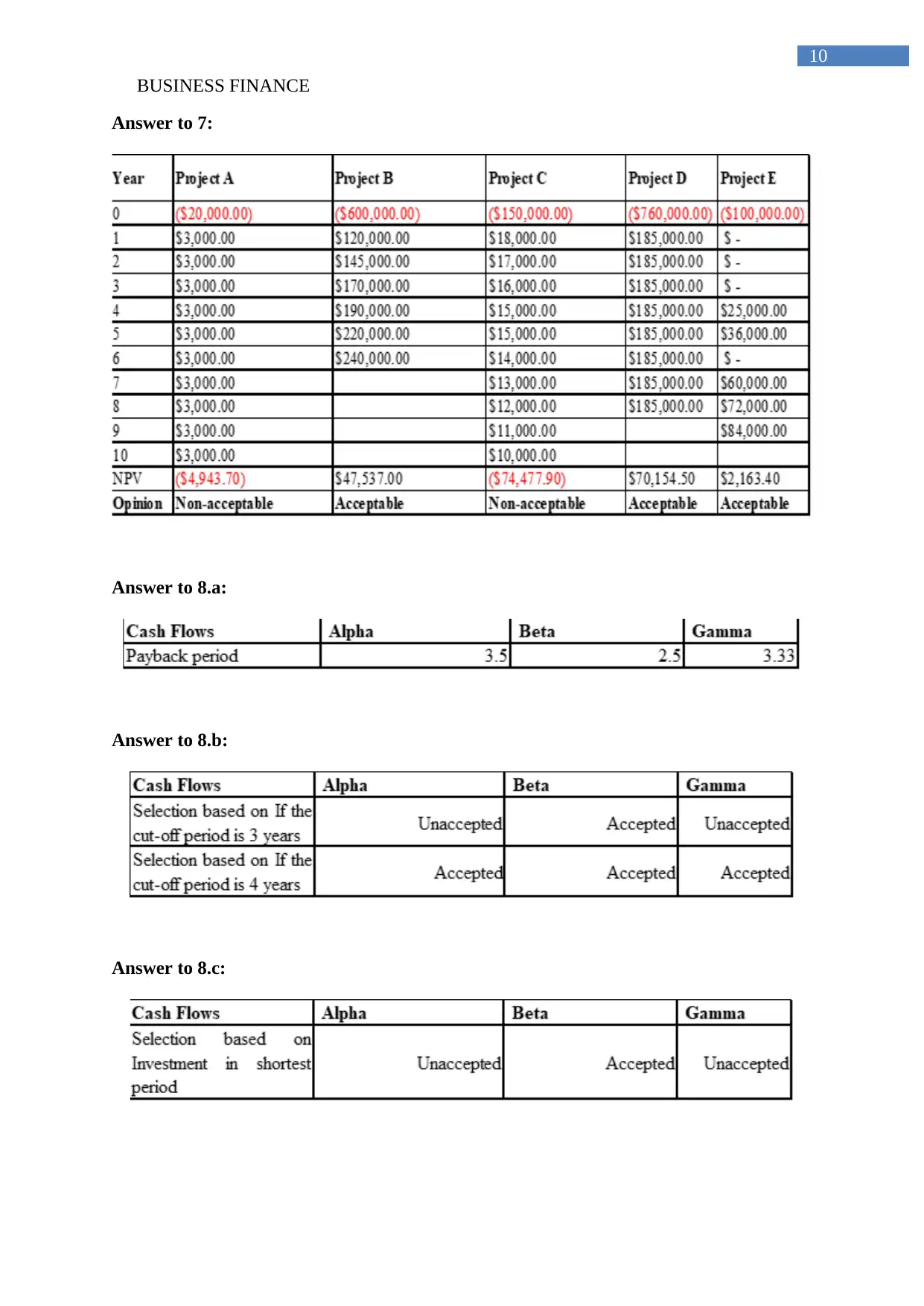

Answer to 7:

Answer to 8.a:

Answer to 8.b:

Answer to 8.c:

10

Answer to 7:

Answer to 8.a:

Answer to 8.b:

Answer to 8.c:

BUSINESS FINANCE

11

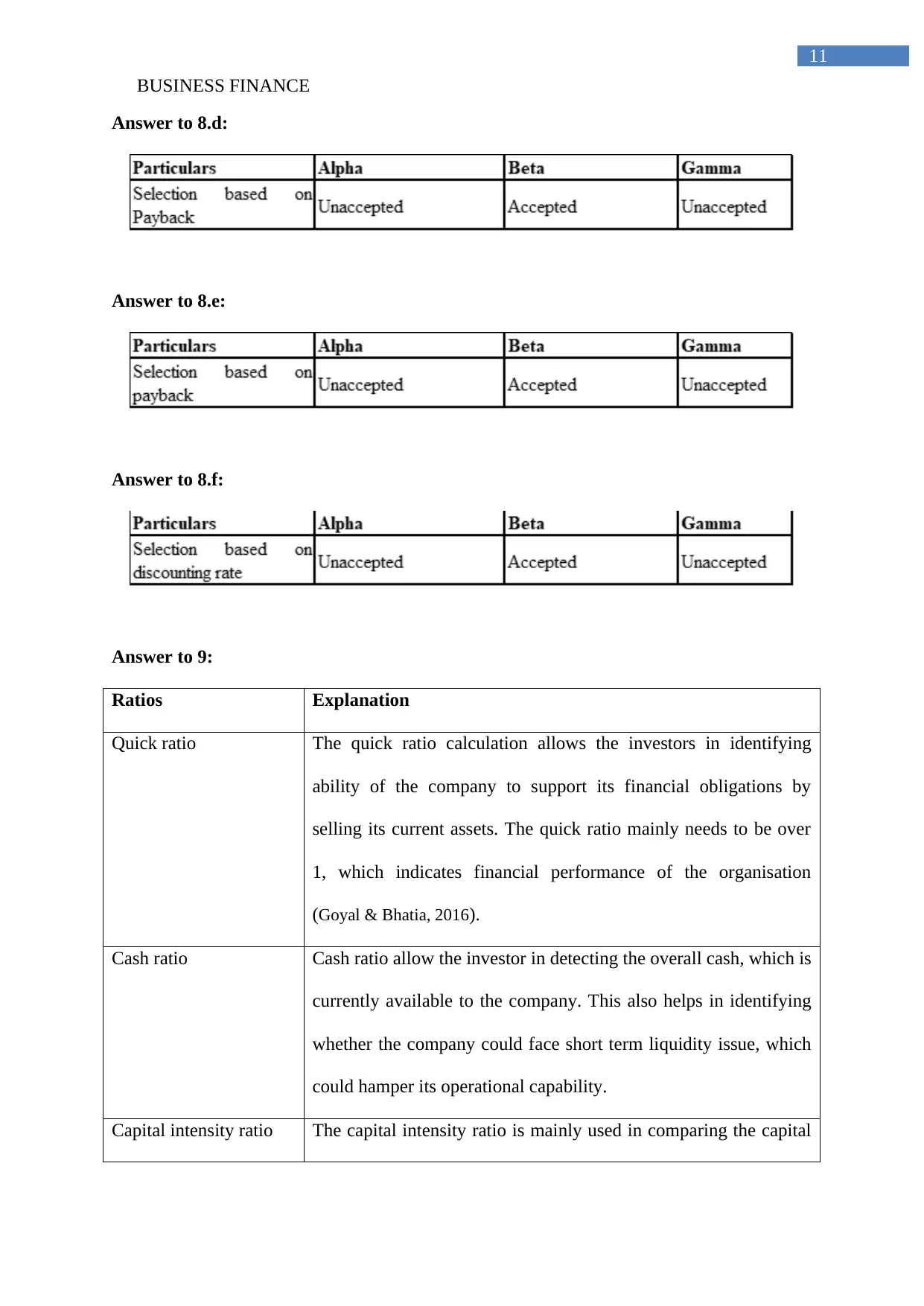

Answer to 8.d:

Answer to 8.e:

Answer to 8.f:

Answer to 9:

Ratios Explanation

Quick ratio The quick ratio calculation allows the investors in identifying

ability of the company to support its financial obligations by

selling its current assets. The quick ratio mainly needs to be over

1, which indicates financial performance of the organisation

(Goyal & Bhatia, 2016).

Cash ratio Cash ratio allow the investor in detecting the overall cash, which is

currently available to the company. This also helps in identifying

whether the company could face short term liquidity issue, which

could hamper its operational capability.

Capital intensity ratio The capital intensity ratio is mainly used in comparing the capital

11

Answer to 8.d:

Answer to 8.e:

Answer to 8.f:

Answer to 9:

Ratios Explanation

Quick ratio The quick ratio calculation allows the investors in identifying

ability of the company to support its financial obligations by

selling its current assets. The quick ratio mainly needs to be over

1, which indicates financial performance of the organisation

(Goyal & Bhatia, 2016).

Cash ratio Cash ratio allow the investor in detecting the overall cash, which is

currently available to the company. This also helps in identifying

whether the company could face short term liquidity issue, which

could hamper its operational capability.

Capital intensity ratio The capital intensity ratio is mainly used in comparing the capital

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.

![Financial Problems Analysis: Finance Assignment for [University Name]](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fsr%2F60e406c63e90418b8e9357fd9a9a4d51.jpg&w=256&q=75)