Business Finance Report: Analysis of SBC Business Plan and Finances

VerifiedAdded on 2023/06/07

|9

|2198

|220

Report

AI Summary

This report presents a comprehensive financial analysis for 'The Street Bakers and Cafe' (SBC), a proposed bakery and cafe near a university. It begins with a business summary, outlining the business idea, aims, location, target consumers, and competitors. The report then delves into the specifics of fixed and variable costs, detailing the financing needs, including owner investments and bank loans. It includes a profit forecast statement, a budgeted cash flow forecast statement, and an analysis of the break-even point and margin of safety. Key performance indicators (KPIs) are identified, focusing on customer satisfaction, goods/services, and prime cost. The report concludes with recommendations based on the analysis and references relevant literature. The financial plan supports the enterprise for new expansion, enhancement, and advancement.

RESIT-Business

Finance for Managers

REPO1

Finance for Managers

REPO1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................3

TASK...............................................................................................................................................3

Summary of the business idea.....................................................................................................3

Outline and discussion of fixed and variable costs.....................................................................4

Financing need............................................................................................................................4

Profit forecast statement.............................................................................................................5

Budgeted Cash flow forecast statement......................................................................................6

Break even point and margin of safety.......................................................................................6

Key performance indicators........................................................................................................7

Recommendations on the basis of the analysis...........................................................................7

CONCLUSION ..............................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION ..........................................................................................................................3

TASK...............................................................................................................................................3

Summary of the business idea.....................................................................................................3

Outline and discussion of fixed and variable costs.....................................................................4

Financing need............................................................................................................................4

Profit forecast statement.............................................................................................................5

Budgeted Cash flow forecast statement......................................................................................6

Break even point and margin of safety.......................................................................................6

Key performance indicators........................................................................................................7

Recommendations on the basis of the analysis...........................................................................7

CONCLUSION ..............................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Business finance may be explained as the appropriate managing of funds and utilisation

of available resources so as to attain efficient and effective performance by the business. A

business plan will assist their appropriate use. A business plan refers to a structure comprising

of the business vision, mission and objectives and the forecasted statements (Arrondel, 2018).

This report is about the preparation of a new business plan named as “The Street Bakers and

Cafe” which will be popularly known as “SBC”. The business plan in the report briefly shows

the outline of the costs incurred, involves the preparation of profit and cash flow forecasting

projections, ascertaining the break-even point and the margin of safety and the key performance

indicators in relation to monetary and non monetary aspects.

Business summary: The business idea is The street bakers ad café which is provided snacks to

people as per the requirements.

Business aim: The company's goal is to develop a dominant position in the street food industry

by providing the most cost-effective solution to meet the needs and demands of the target

clients.

Finance: The overall expected cost to start the entire business is expected to be 160,000

TASK

Summary of the business idea

The business chosen for preparing the business plan is a bakery and coffee cafe named as

“The Street Bakers and Cafe”. The type of business is sole trader. The SBC offers prominent

coffee, wonderful pastries, comfortable chairs and tables, desk space and a location near the

University with a very welcoming atmosphere. Its aim is to attain a standard for industry 60%

profit margin and rational operating expenses and to attain rational profits in the second and

third year. The SBC offers a wide variety of coffee and Java products, all from top tier

imported coffee berry. The cafe is set on to become a every day requisite for local espresso

lovers, an environment to dream of as one try to escape from the daily stresses and a pleasant

place for a get together or to to do work, all in one (Asebedo, 2019).

Business finance may be explained as the appropriate managing of funds and utilisation

of available resources so as to attain efficient and effective performance by the business. A

business plan will assist their appropriate use. A business plan refers to a structure comprising

of the business vision, mission and objectives and the forecasted statements (Arrondel, 2018).

This report is about the preparation of a new business plan named as “The Street Bakers and

Cafe” which will be popularly known as “SBC”. The business plan in the report briefly shows

the outline of the costs incurred, involves the preparation of profit and cash flow forecasting

projections, ascertaining the break-even point and the margin of safety and the key performance

indicators in relation to monetary and non monetary aspects.

Business summary: The business idea is The street bakers ad café which is provided snacks to

people as per the requirements.

Business aim: The company's goal is to develop a dominant position in the street food industry

by providing the most cost-effective solution to meet the needs and demands of the target

clients.

Finance: The overall expected cost to start the entire business is expected to be 160,000

TASK

Summary of the business idea

The business chosen for preparing the business plan is a bakery and coffee cafe named as

“The Street Bakers and Cafe”. The type of business is sole trader. The SBC offers prominent

coffee, wonderful pastries, comfortable chairs and tables, desk space and a location near the

University with a very welcoming atmosphere. Its aim is to attain a standard for industry 60%

profit margin and rational operating expenses and to attain rational profits in the second and

third year. The SBC offers a wide variety of coffee and Java products, all from top tier

imported coffee berry. The cafe is set on to become a every day requisite for local espresso

lovers, an environment to dream of as one try to escape from the daily stresses and a pleasant

place for a get together or to to do work, all in one (Asebedo, 2019).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Location: SBC united based entity located near the Westcott House University, Cambridge. In

the city of Cambridge, there is a shortage of cafe spots where customers can get finest coffee

and freshly prepared pastries and coffee. People there just not need coffee or pastries, but they

also need a place to sit and meet comfortably, where they can have a group discussion, or if

they have to work and read, the cafe will provide the perfect atmosphere for all these things.

Consumers: The SBC cafe will focus on reaching the people of the University and offices

located close to the cafe and on the advanced youth. These people are included in the customer

squad which is most likely to buy coffee products according to the market research and

analysis.

Competitors: SBC's direct competitors will be other coffee shops and cafe located near the

Westcott House University. These include the Locker cafe, Cafe at Abantu, Indigo Coffee

House and other near bakery service establishments.

Outline and discussion of fixed and variable costs

For the purpose of starting a new business, it is crucial to evaluate the cost to be

expensed by the SBC. The type of costs can be divided into fixed and variable costs.

Fixed costs: Cost which remain same throughout the year are known as fixed costs. This

cost is to be bear by the SBC even when there is no production taking place. The fixed

costs of the company are salaries, rent, advertisement and accounting, and insurance

(Eichelberger and Gilpatrick, 2020).

Variable costs: Costs which vary with the change in the production are known as variable

costs. These cost depend upon the quantity of goods sold, inventory held and the internal

and external environment changes. These costs in relation to SBC are raw material,

transportation cost, and many more.

Financing need

The amount of $160,000 will be invested by the owners and they will take a bank loan

for $50,000 covering the starting expenses and assets required plus compensatory spending in

starting months.

The starting expenses of $45,000 include:

the city of Cambridge, there is a shortage of cafe spots where customers can get finest coffee

and freshly prepared pastries and coffee. People there just not need coffee or pastries, but they

also need a place to sit and meet comfortably, where they can have a group discussion, or if

they have to work and read, the cafe will provide the perfect atmosphere for all these things.

Consumers: The SBC cafe will focus on reaching the people of the University and offices

located close to the cafe and on the advanced youth. These people are included in the customer

squad which is most likely to buy coffee products according to the market research and

analysis.

Competitors: SBC's direct competitors will be other coffee shops and cafe located near the

Westcott House University. These include the Locker cafe, Cafe at Abantu, Indigo Coffee

House and other near bakery service establishments.

Outline and discussion of fixed and variable costs

For the purpose of starting a new business, it is crucial to evaluate the cost to be

expensed by the SBC. The type of costs can be divided into fixed and variable costs.

Fixed costs: Cost which remain same throughout the year are known as fixed costs. This

cost is to be bear by the SBC even when there is no production taking place. The fixed

costs of the company are salaries, rent, advertisement and accounting, and insurance

(Eichelberger and Gilpatrick, 2020).

Variable costs: Costs which vary with the change in the production are known as variable

costs. These cost depend upon the quantity of goods sold, inventory held and the internal

and external environment changes. These costs in relation to SBC are raw material,

transportation cost, and many more.

Financing need

The amount of $160,000 will be invested by the owners and they will take a bank loan

for $50,000 covering the starting expenses and assets required plus compensatory spending in

starting months.

The starting expenses of $45,000 include:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Statutory expenses and accounting services of $2,500.

Promotional and marketing expenses for the opening of the SBC totalling $7,000.

Consultant fees paid $4,000 for the set up.

Premium for the insurance coverage of $3500.

Rent prepaid expenses for 1 month at $1.75 per sq ft. Total amount of $6,000.

Remodelling of premises amounting to $15,000.

Other startup expenses including stationery of $2,000 and phone and utility deposits of

$5,000.

All these expenses has to be incurred before launch, so they will be showed as negative retained

earnings of $45,000 in the financial projections, at the end of the month before the launch. This

number will be shown in the balance sheet (Messer, 2020).

The startup assets required of $155,000 include:

Cash in the bank of amount equal to $70,000 which includes enough to cover the salaries

of employees and owner and the cash reserves for the first 2 months.

Inventory of $20,000, including: Coffee beans- $7,000, Coffee filters, baked goods and

beverages, etc.- $8000, Retail and office supplies- $5000

Amount for equipments total for $65,000: Coffee machine- $8000, Coffee maker and

grinder- $2000, Food service equipments- $20,000, Storage hardware- $5000, Counter

area and serving area equipment- $15,000, Store and office equipment- $14000, Other

miscellaneous expenses- $1000.

The two major sources of funding for the company includes owners invested funds and bank

loans. Two owners, namely, Arthur Roman and Austin Polk, have invested $60,000 and $40,000

respectively. $60000 are contributed by all other investors, totalling to $160,000. The balance

$50000 required to cover the startup expenses and assets, raised from the two bank loans, a 1

year loan for the amount $20,000 and a long term loan of $30,000. Both loans were secured

through the bank.

The balance sheet shows these amounts in the month before the opening. The investment of

$160000 will be showed as Paid in capital. The expenses of $45000 will be showed as negative

retained earnings. All assets and liabilities are showed according to the applicable financial

standards (Nair and Muda, 2021).

Promotional and marketing expenses for the opening of the SBC totalling $7,000.

Consultant fees paid $4,000 for the set up.

Premium for the insurance coverage of $3500.

Rent prepaid expenses for 1 month at $1.75 per sq ft. Total amount of $6,000.

Remodelling of premises amounting to $15,000.

Other startup expenses including stationery of $2,000 and phone and utility deposits of

$5,000.

All these expenses has to be incurred before launch, so they will be showed as negative retained

earnings of $45,000 in the financial projections, at the end of the month before the launch. This

number will be shown in the balance sheet (Messer, 2020).

The startup assets required of $155,000 include:

Cash in the bank of amount equal to $70,000 which includes enough to cover the salaries

of employees and owner and the cash reserves for the first 2 months.

Inventory of $20,000, including: Coffee beans- $7,000, Coffee filters, baked goods and

beverages, etc.- $8000, Retail and office supplies- $5000

Amount for equipments total for $65,000: Coffee machine- $8000, Coffee maker and

grinder- $2000, Food service equipments- $20,000, Storage hardware- $5000, Counter

area and serving area equipment- $15,000, Store and office equipment- $14000, Other

miscellaneous expenses- $1000.

The two major sources of funding for the company includes owners invested funds and bank

loans. Two owners, namely, Arthur Roman and Austin Polk, have invested $60,000 and $40,000

respectively. $60000 are contributed by all other investors, totalling to $160,000. The balance

$50000 required to cover the startup expenses and assets, raised from the two bank loans, a 1

year loan for the amount $20,000 and a long term loan of $30,000. Both loans were secured

through the bank.

The balance sheet shows these amounts in the month before the opening. The investment of

$160000 will be showed as Paid in capital. The expenses of $45000 will be showed as negative

retained earnings. All assets and liabilities are showed according to the applicable financial

standards (Nair and Muda, 2021).

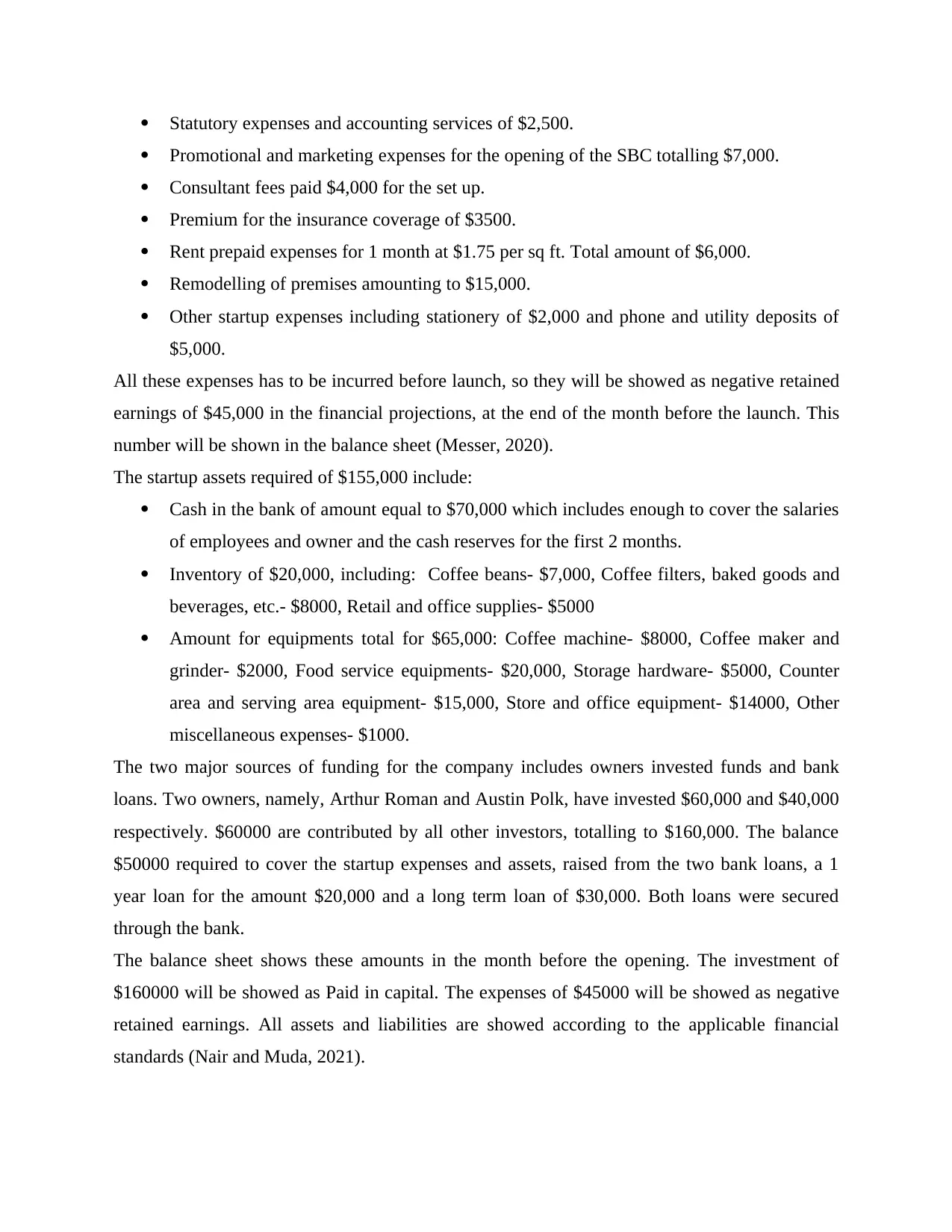

Profit forecast statement

Profit forecast statement

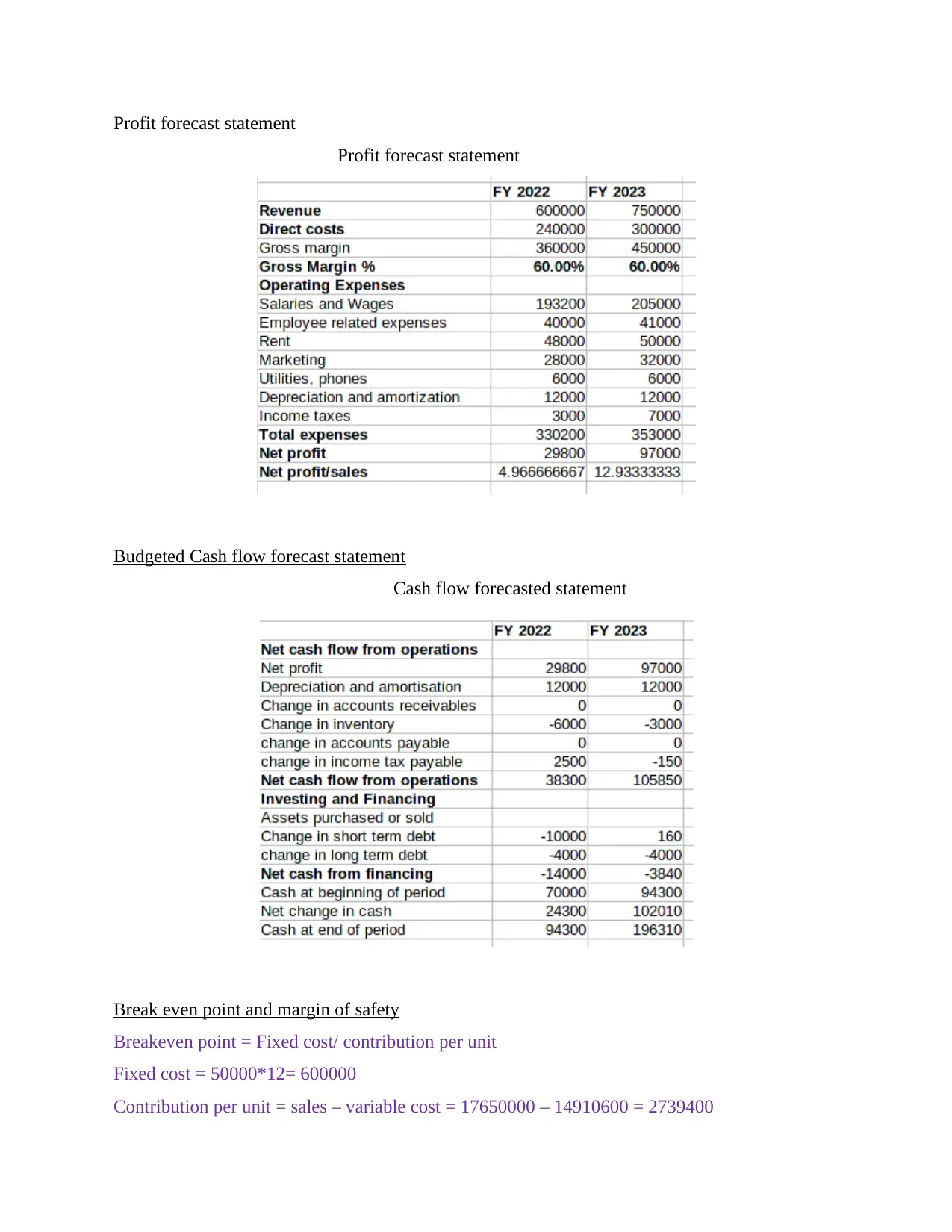

Budgeted Cash flow forecast statement

Cash flow forecasted statement

Break even point and margin of safety

Breakeven point = Fixed cost/ contribution per unit

Fixed cost = 50000*12= 600000

Contribution per unit = sales – variable cost = 17650000 – 14910600 = 2739400

Profit forecast statement

Budgeted Cash flow forecast statement

Cash flow forecasted statement

Break even point and margin of safety

Breakeven point = Fixed cost/ contribution per unit

Fixed cost = 50000*12= 600000

Contribution per unit = sales – variable cost = 17650000 – 14910600 = 2739400

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Breakeven point = 600000/2739400 = 0.2190260641016281

Key performance indicators

The KPI to monitor progress towards business goals are SMART. SMART refers to

Specific measurable, Achievable, Realistic and Time sensitive. The key performance indicators

for a business should be SMART. These are measurable factors used to examine personnel and

company performance. Quantitative measures for evaluating the business's performance against

the set budget goals can be said as key performance indicators. This assist organisation to grow

in the long run. This helps in setting the monetary or non monetary targets the company could

attain looking at the other competitors (Spanos and Liapis, 2019). Following are the Key

performance indicators that could be set by the SBC.

The first one is customers. Customers are the users in the end of the products produced by the

SBC. Customer satisfaction is the only key to decide whether the business is able to attain the

targets or not. This assists the business to create a strong bond with the customers that would be

there for long term. This will also help business to increase its visibility by creating awareness in

the market (Terrones, 2020).

The second one is goods and services. Ascertaining the quality and the quantity demanded by the

customers will assist business operations. This affects the inventory holding and the position in

the market. This refers to the practical method for assessing the accomplishment of the business

authorising the use of time and money more effectively and efficiently.

The third one is the prime cost. It is the direct costs related to production like raw material and

labour. It generally runs 60% to 65% of hard and fast arrangements in a whole organisation of

the outlet shops and 55% to 60% of the income for the rapid administrations demonstrated by the

firm.

Prime cost = Labour cost + Cost of goods sold

Recommendations on the basis of the analysis

The financial plan prepared by the organisation is incredible. This financial plan shows

powerful support for the enterprise for its new expansion, enhancement and advancement. The

SBC can also further add new products like cookies and must have a book for analysis, which

each customer will fill ensuring to use their items and work. This would be important for

managing the resources and handling with the administration of the SBC. This will help for the

increment of overall benefit (Van der Zwan, 2019).

Key performance indicators

The KPI to monitor progress towards business goals are SMART. SMART refers to

Specific measurable, Achievable, Realistic and Time sensitive. The key performance indicators

for a business should be SMART. These are measurable factors used to examine personnel and

company performance. Quantitative measures for evaluating the business's performance against

the set budget goals can be said as key performance indicators. This assist organisation to grow

in the long run. This helps in setting the monetary or non monetary targets the company could

attain looking at the other competitors (Spanos and Liapis, 2019). Following are the Key

performance indicators that could be set by the SBC.

The first one is customers. Customers are the users in the end of the products produced by the

SBC. Customer satisfaction is the only key to decide whether the business is able to attain the

targets or not. This assists the business to create a strong bond with the customers that would be

there for long term. This will also help business to increase its visibility by creating awareness in

the market (Terrones, 2020).

The second one is goods and services. Ascertaining the quality and the quantity demanded by the

customers will assist business operations. This affects the inventory holding and the position in

the market. This refers to the practical method for assessing the accomplishment of the business

authorising the use of time and money more effectively and efficiently.

The third one is the prime cost. It is the direct costs related to production like raw material and

labour. It generally runs 60% to 65% of hard and fast arrangements in a whole organisation of

the outlet shops and 55% to 60% of the income for the rapid administrations demonstrated by the

firm.

Prime cost = Labour cost + Cost of goods sold

Recommendations on the basis of the analysis

The financial plan prepared by the organisation is incredible. This financial plan shows

powerful support for the enterprise for its new expansion, enhancement and advancement. The

SBC can also further add new products like cookies and must have a book for analysis, which

each customer will fill ensuring to use their items and work. This would be important for

managing the resources and handling with the administration of the SBC. This will help for the

increment of overall benefit (Van der Zwan, 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

A person needs to be careful while making a investment in a new enterprise. The parties

that are investing puts their holdings at risk in the new firm by making large investments with

the high competition existing in the market. Good returns are demanded by them in exchange of

these funds. Thus the owners before starting a business must have a practical feasible plan and

have conducted a proper survey on the products and the market. Then the initiation of plan

should begin. The report shows the financial plan for the SBC. All the required analysis is done

in the plan. The break even point assists in assessing minimum number of units necessary to

sale for achieving a high level of profit. KPI's will assist the firm in attaining the level which it

wants to achieve through its level of accomplishment.

A person needs to be careful while making a investment in a new enterprise. The parties

that are investing puts their holdings at risk in the new firm by making large investments with

the high competition existing in the market. Good returns are demanded by them in exchange of

these funds. Thus the owners before starting a business must have a practical feasible plan and

have conducted a proper survey on the products and the market. Then the initiation of plan

should begin. The report shows the financial plan for the SBC. All the required analysis is done

in the plan. The break even point assists in assessing minimum number of units necessary to

sale for achieving a high level of profit. KPI's will assist the firm in attaining the level which it

wants to achieve through its level of accomplishment.

REFERENCES

Books and Journals

Arrondel, L., 2018. Financial Literacy and Asset Behaviour: Poor Education and Zero for

Conduct?. Comparative Economic Studies, 60(1). pp.144-160.

Asebedo, S.D., 2019. Financial Planning Client Interaction Theory (FPCIT). Journal of Personal

Finance, 18(1).

Eichelberger, B. and Gilpatrick, T., 2020. Financial education, college retention, and graduation

rates. College Student Journal, 53(4). pp.479-489.

Messer, R., 2020. Budget Management Decisions. In Financial Modeling for Decision Making:

Using MS-Excel in Accounting and Finance. Emerald Publishing Limited.

Nair, R. and Muda, R., 2021. A critical reading of impression management in times of financial

crisis and implications for business writing. Journal of Education for Business, 96(4).

pp.230-236.

Spanos, P.M. and Liapis, K.J., 2019. Corporate financial modeling using quantitative methods.

In Economic and Financial Challenges for Eastern Europe (pp. 161-183).

Terrones, P., 2020. Powering Innovation with TBM. The Journal of Government Financial

Management, 68(4). pp.38-43.

Van der Zwan, N., 2019. 11 The financial politics of occupational pensions. Business Interests

and the Development of the Modern Welfare State. p.110.

Walker, L., 2018. The Profession of Financial Planning: Past, Present, and the Next 45

Years. Journal of Financial Planning, Mar, 31(3). pp.20-26.

Books and Journals

Arrondel, L., 2018. Financial Literacy and Asset Behaviour: Poor Education and Zero for

Conduct?. Comparative Economic Studies, 60(1). pp.144-160.

Asebedo, S.D., 2019. Financial Planning Client Interaction Theory (FPCIT). Journal of Personal

Finance, 18(1).

Eichelberger, B. and Gilpatrick, T., 2020. Financial education, college retention, and graduation

rates. College Student Journal, 53(4). pp.479-489.

Messer, R., 2020. Budget Management Decisions. In Financial Modeling for Decision Making:

Using MS-Excel in Accounting and Finance. Emerald Publishing Limited.

Nair, R. and Muda, R., 2021. A critical reading of impression management in times of financial

crisis and implications for business writing. Journal of Education for Business, 96(4).

pp.230-236.

Spanos, P.M. and Liapis, K.J., 2019. Corporate financial modeling using quantitative methods.

In Economic and Financial Challenges for Eastern Europe (pp. 161-183).

Terrones, P., 2020. Powering Innovation with TBM. The Journal of Government Financial

Management, 68(4). pp.38-43.

Van der Zwan, N., 2019. 11 The financial politics of occupational pensions. Business Interests

and the Development of the Modern Welfare State. p.110.

Walker, L., 2018. The Profession of Financial Planning: Past, Present, and the Next 45

Years. Journal of Financial Planning, Mar, 31(3). pp.20-26.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.