UGB223 Business Finance: Investment Appraisal and Capital Structure

VerifiedAdded on 2023/06/10

|13

|3403

|316

Report

AI Summary

This report provides solutions to several business finance problems. It includes the calculation and analysis of Net Present Value (NPV) and Internal Rate of Return (IRR) for project evaluation, demonstrating how to determine the more profitable project based on these metrics. The report also covers the computation of theoretical ex-rights price per share, net cash raised, and the value of rights in the context of a rights issue, along with a discussion of the advantages and disadvantages of such issues. Furthermore, it calculates the Weighted Average Cost of Capital (WACC) using market weightings and discusses the impact of gearing on WACC. Finally, the report addresses dividend policy, including the determination of annual dividend size and the practical considerations involved, as well as an analysis of the effect of different dividend options on shareholder wealth. This document is designed to help students understand and apply key concepts in business finance, and Desklib provides access to similar solved assignments.

UGB223 BUSINESS

FINANCE

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

QUESTION 2..................................................................................................................................3

a) Compute NPV and suggest which project should be accepted...............................................3

b) Calculate IRR and on the basis of this which project should be accepted..............................4

c) If the cost of capital increase to 20 % in year 5, then does the changes would be advisable..5

QUESTION 3..................................................................................................................................5

a) The theoretical ex-rights price per share.................................................................................5

b) The net cash raised..................................................................................................................6

c) The value of the rights.............................................................................................................7

d) Critically discuss the advantages and disadvantages of rights issue.......................................8

QUESTION 4..................................................................................................................................8

a) Calculate the weighted average cost of capital (WACC) using the market weightings..........8

b) Critically discuss whether you consider that companies, by integrating a sensible level of

gearing into their capital structure, can minimise their weighted average cost of capital...........9

QUESTION 6..................................................................................................................................9

a) The size of the annual dividend to be paid to shareholders, as well as the practical concerns

to be considered while determining the dividend payment size..................................................9

b) Calculate the three options....................................................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................3

QUESTION 2..................................................................................................................................3

a) Compute NPV and suggest which project should be accepted...............................................3

b) Calculate IRR and on the basis of this which project should be accepted..............................4

c) If the cost of capital increase to 20 % in year 5, then does the changes would be advisable..5

QUESTION 3..................................................................................................................................5

a) The theoretical ex-rights price per share.................................................................................5

b) The net cash raised..................................................................................................................6

c) The value of the rights.............................................................................................................7

d) Critically discuss the advantages and disadvantages of rights issue.......................................8

QUESTION 4..................................................................................................................................8

a) Calculate the weighted average cost of capital (WACC) using the market weightings..........8

b) Critically discuss whether you consider that companies, by integrating a sensible level of

gearing into their capital structure, can minimise their weighted average cost of capital...........9

QUESTION 6..................................................................................................................................9

a) The size of the annual dividend to be paid to shareholders, as well as the practical concerns

to be considered while determining the dividend payment size..................................................9

b) Calculate the three options....................................................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

INTRODUCTION

In the below report, business finance is explained and analysed with the help of various

factors. Business finance is the term that stated the number of funds acquired by the owner of the

company for fulfilling their needs that including acquiring top-up funds to finance business

management, starting a business, or dealing with the cash crisis faced by the company

(Achleitner and Braun., 2018). The following report consists of four questions; 2, 3, 4, and 6

where every question represents the different ways to implement the business adequately. In

question number 2, Net present value and IRR are calculated; in 3 questions, Theoretical ex-

rights price per share, net cash raised, the value of the rights, and advantages and disadvantages

of rights issue are computed and explained; In question 4, WACC is determined and discussed

and in the last question, size of annual dividend and effect of the three elements on the wealth of

a shareholder are explained.

QUESTION 2

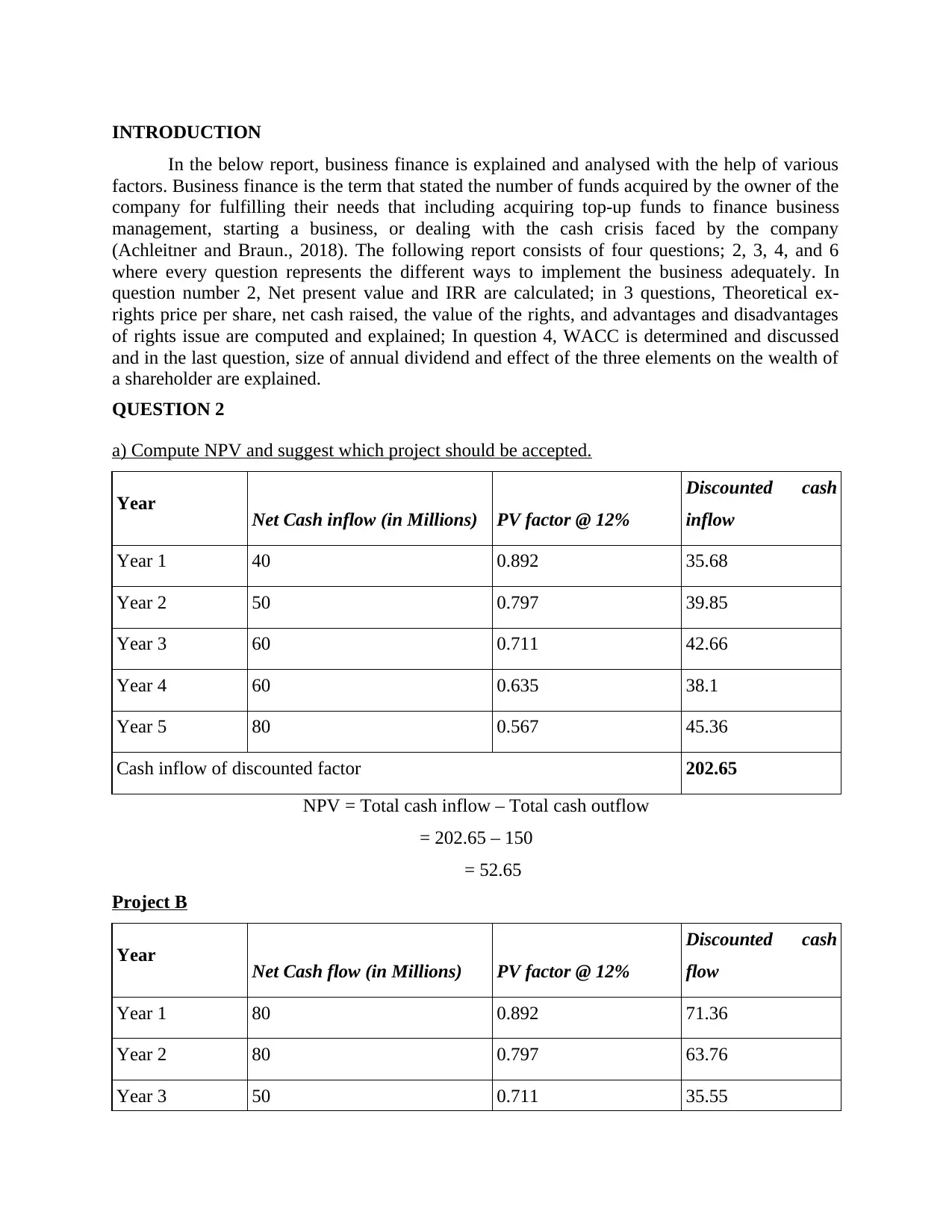

a) Compute NPV and suggest which project should be accepted.

Year Net Cash inflow (in Millions) PV factor @ 12%

Discounted cash

inflow

Year 1 40 0.892 35.68

Year 2 50 0.797 39.85

Year 3 60 0.711 42.66

Year 4 60 0.635 38.1

Year 5 80 0.567 45.36

Cash inflow of discounted factor 202.65

NPV = Total cash inflow – Total cash outflow

= 202.65 – 150

= 52.65

Project B

Year Net Cash flow (in Millions) PV factor @ 12%

Discounted cash

flow

Year 1 80 0.892 71.36

Year 2 80 0.797 63.76

Year 3 50 0.711 35.55

In the below report, business finance is explained and analysed with the help of various

factors. Business finance is the term that stated the number of funds acquired by the owner of the

company for fulfilling their needs that including acquiring top-up funds to finance business

management, starting a business, or dealing with the cash crisis faced by the company

(Achleitner and Braun., 2018). The following report consists of four questions; 2, 3, 4, and 6

where every question represents the different ways to implement the business adequately. In

question number 2, Net present value and IRR are calculated; in 3 questions, Theoretical ex-

rights price per share, net cash raised, the value of the rights, and advantages and disadvantages

of rights issue are computed and explained; In question 4, WACC is determined and discussed

and in the last question, size of annual dividend and effect of the three elements on the wealth of

a shareholder are explained.

QUESTION 2

a) Compute NPV and suggest which project should be accepted.

Year Net Cash inflow (in Millions) PV factor @ 12%

Discounted cash

inflow

Year 1 40 0.892 35.68

Year 2 50 0.797 39.85

Year 3 60 0.711 42.66

Year 4 60 0.635 38.1

Year 5 80 0.567 45.36

Cash inflow of discounted factor 202.65

NPV = Total cash inflow – Total cash outflow

= 202.65 – 150

= 52.65

Project B

Year Net Cash flow (in Millions) PV factor @ 12%

Discounted cash

flow

Year 1 80 0.892 71.36

Year 2 80 0.797 63.76

Year 3 50 0.711 35.55

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Year 4 40 0.635 25.4

Year 5 30 0.567 17.01

Cash Flow 213.08

Net Present Value = Total cash inflow – Total cash outflow

= 213.08 – 152

= 61.08

Analysis: By analysing both the net present value, it can be recommended that project B is better

than project A because the higher value of the NPV is referred well for the company. In Project

A and B, the result of NPV is 52.65 and 61.08 respectively which indicates project B is 8.43

more than Project A.

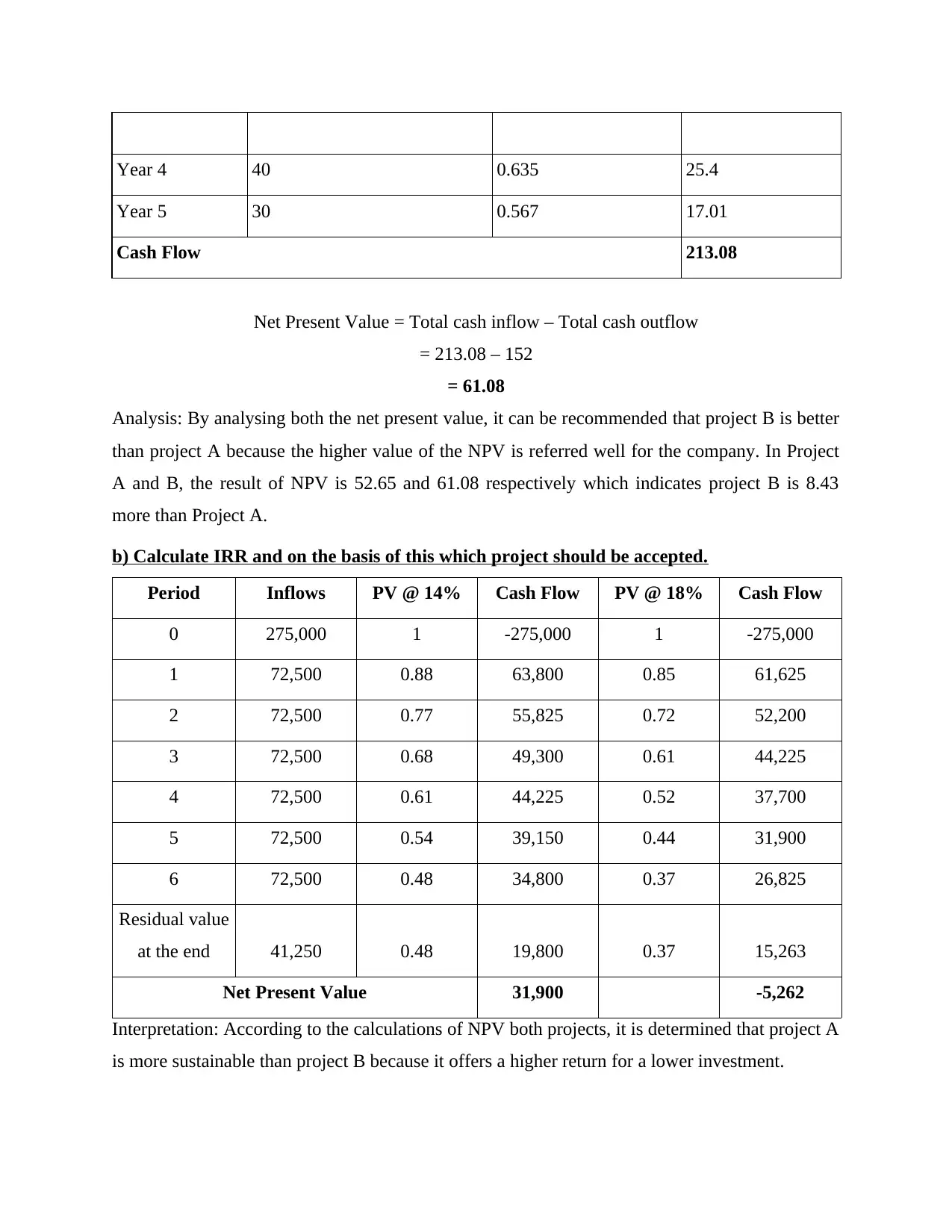

b) Calculate IRR and on the basis of this which project should be accepted.

Period Inflows PV @ 14% Cash Flow PV @ 18% Cash Flow

0 275,000 1 -275,000 1 -275,000

1 72,500 0.88 63,800 0.85 61,625

2 72,500 0.77 55,825 0.72 52,200

3 72,500 0.68 49,300 0.61 44,225

4 72,500 0.61 44,225 0.52 37,700

5 72,500 0.54 39,150 0.44 31,900

6 72,500 0.48 34,800 0.37 26,825

Residual value

at the end 41,250 0.48 19,800 0.37 15,263

Net Present Value 31,900 -5,262

Interpretation: According to the calculations of NPV both projects, it is determined that project A

is more sustainable than project B because it offers a higher return for a lower investment.

Year 5 30 0.567 17.01

Cash Flow 213.08

Net Present Value = Total cash inflow – Total cash outflow

= 213.08 – 152

= 61.08

Analysis: By analysing both the net present value, it can be recommended that project B is better

than project A because the higher value of the NPV is referred well for the company. In Project

A and B, the result of NPV is 52.65 and 61.08 respectively which indicates project B is 8.43

more than Project A.

b) Calculate IRR and on the basis of this which project should be accepted.

Period Inflows PV @ 14% Cash Flow PV @ 18% Cash Flow

0 275,000 1 -275,000 1 -275,000

1 72,500 0.88 63,800 0.85 61,625

2 72,500 0.77 55,825 0.72 52,200

3 72,500 0.68 49,300 0.61 44,225

4 72,500 0.61 44,225 0.52 37,700

5 72,500 0.54 39,150 0.44 31,900

6 72,500 0.48 34,800 0.37 26,825

Residual value

at the end 41,250 0.48 19,800 0.37 15,263

Net Present Value 31,900 -5,262

Interpretation: According to the calculations of NPV both projects, it is determined that project A

is more sustainable than project B because it offers a higher return for a lower investment.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

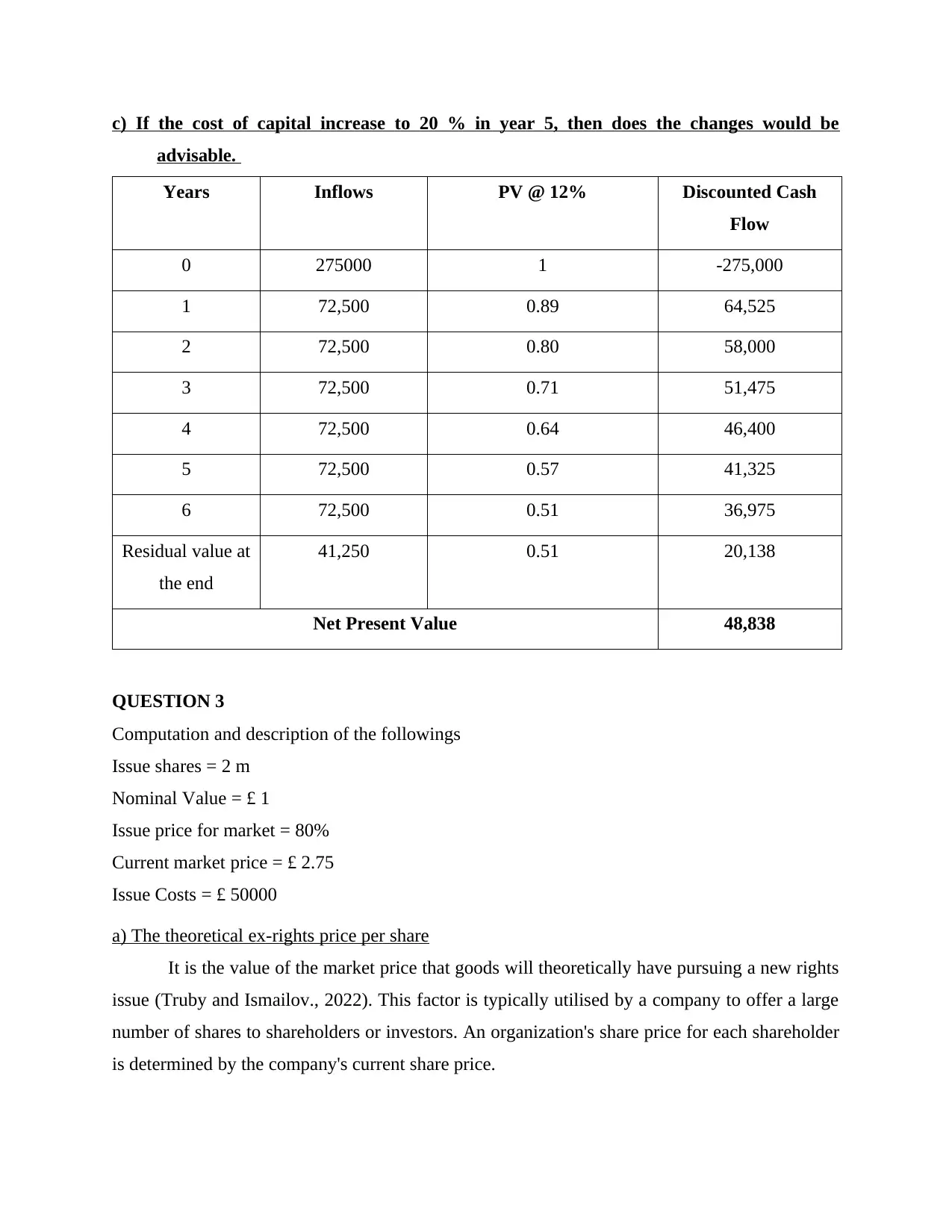

c) If the cost of capital increase to 20 % in year 5, then does the changes would be

advisable.

Years Inflows PV @ 12% Discounted Cash

Flow

0 275000 1 -275,000

1 72,500 0.89 64,525

2 72,500 0.80 58,000

3 72,500 0.71 51,475

4 72,500 0.64 46,400

5 72,500 0.57 41,325

6 72,500 0.51 36,975

Residual value at

the end

41,250 0.51 20,138

Net Present Value 48,838

QUESTION 3

Computation and description of the followings

Issue shares = 2 m

Nominal Value = £ 1

Issue price for market = 80%

Current market price = £ 2.75

Issue Costs = £ 50000

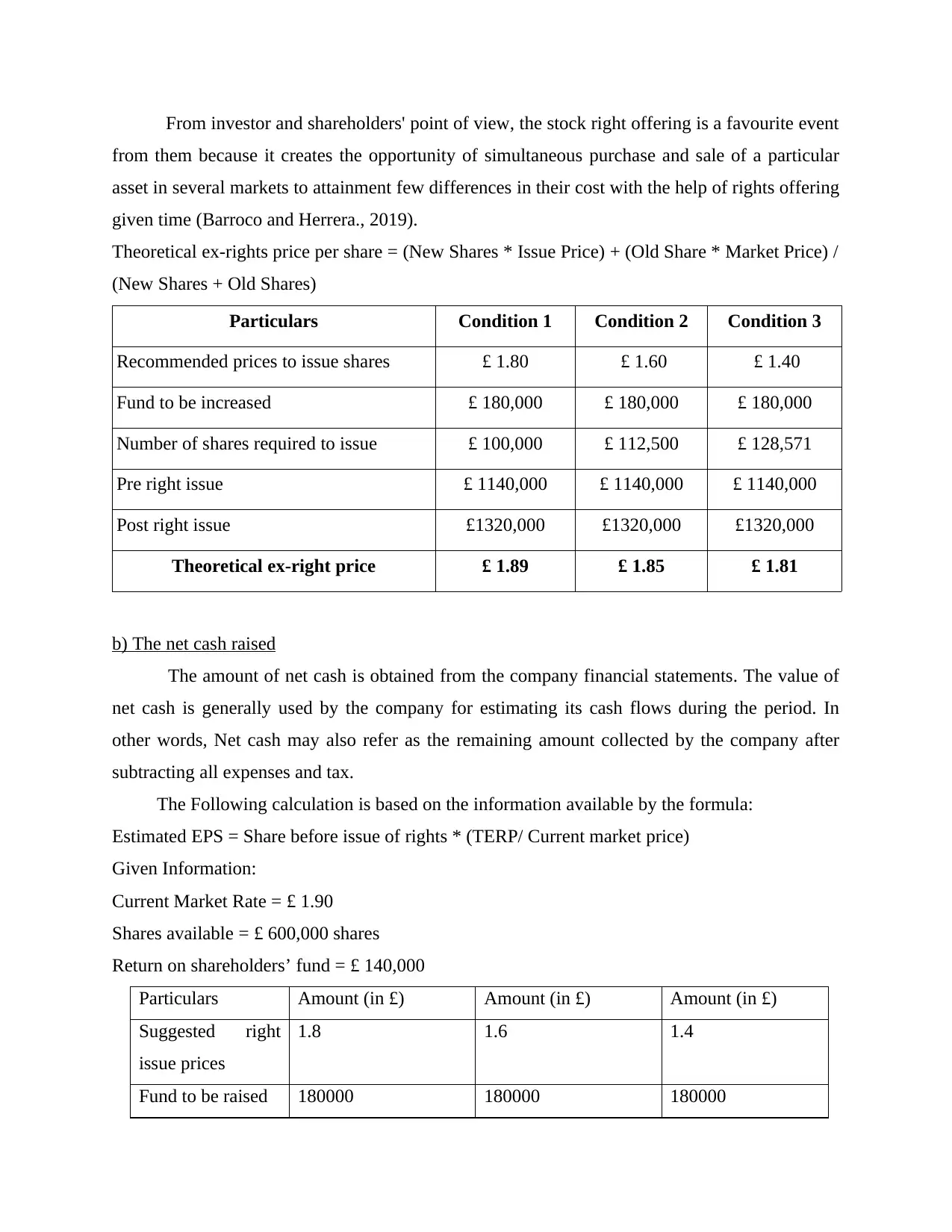

a) The theoretical ex-rights price per share

It is the value of the market price that goods will theoretically have pursuing a new rights

issue (Truby and Ismailov., 2022). This factor is typically utilised by a company to offer a large

number of shares to shareholders or investors. An organization's share price for each shareholder

is determined by the company's current share price.

advisable.

Years Inflows PV @ 12% Discounted Cash

Flow

0 275000 1 -275,000

1 72,500 0.89 64,525

2 72,500 0.80 58,000

3 72,500 0.71 51,475

4 72,500 0.64 46,400

5 72,500 0.57 41,325

6 72,500 0.51 36,975

Residual value at

the end

41,250 0.51 20,138

Net Present Value 48,838

QUESTION 3

Computation and description of the followings

Issue shares = 2 m

Nominal Value = £ 1

Issue price for market = 80%

Current market price = £ 2.75

Issue Costs = £ 50000

a) The theoretical ex-rights price per share

It is the value of the market price that goods will theoretically have pursuing a new rights

issue (Truby and Ismailov., 2022). This factor is typically utilised by a company to offer a large

number of shares to shareholders or investors. An organization's share price for each shareholder

is determined by the company's current share price.

From investor and shareholders' point of view, the stock right offering is a favourite event

from them because it creates the opportunity of simultaneous purchase and sale of a particular

asset in several markets to attainment few differences in their cost with the help of rights offering

given time (Barroco and Herrera., 2019).

Theoretical ex-rights price per share = (New Shares * Issue Price) + (Old Share * Market Price) /

(New Shares + Old Shares)

Particulars Condition 1 Condition 2 Condition 3

Recommended prices to issue shares £ 1.80 £ 1.60 £ 1.40

Fund to be increased £ 180,000 £ 180,000 £ 180,000

Number of shares required to issue £ 100,000 £ 112,500 £ 128,571

Pre right issue £ 1140,000 £ 1140,000 £ 1140,000

Post right issue £1320,000 £1320,000 £1320,000

Theoretical ex-right price £ 1.89 £ 1.85 £ 1.81

b) The net cash raised

The amount of net cash is obtained from the company financial statements. The value of

net cash is generally used by the company for estimating its cash flows during the period. In

other words, Net cash may also refer as the remaining amount collected by the company after

subtracting all expenses and tax.

The Following calculation is based on the information available by the formula:

Estimated EPS = Share before issue of rights * (TERP/ Current market price)

Given Information:

Current Market Rate = £ 1.90

Shares available = £ 600,000 shares

Return on shareholders’ fund = £ 140,000

Particulars Amount (in £) Amount (in £) Amount (in £)

Suggested right

issue prices

1.8 1.6 1.4

Fund to be raised 180000 180000 180000

from them because it creates the opportunity of simultaneous purchase and sale of a particular

asset in several markets to attainment few differences in their cost with the help of rights offering

given time (Barroco and Herrera., 2019).

Theoretical ex-rights price per share = (New Shares * Issue Price) + (Old Share * Market Price) /

(New Shares + Old Shares)

Particulars Condition 1 Condition 2 Condition 3

Recommended prices to issue shares £ 1.80 £ 1.60 £ 1.40

Fund to be increased £ 180,000 £ 180,000 £ 180,000

Number of shares required to issue £ 100,000 £ 112,500 £ 128,571

Pre right issue £ 1140,000 £ 1140,000 £ 1140,000

Post right issue £1320,000 £1320,000 £1320,000

Theoretical ex-right price £ 1.89 £ 1.85 £ 1.81

b) The net cash raised

The amount of net cash is obtained from the company financial statements. The value of

net cash is generally used by the company for estimating its cash flows during the period. In

other words, Net cash may also refer as the remaining amount collected by the company after

subtracting all expenses and tax.

The Following calculation is based on the information available by the formula:

Estimated EPS = Share before issue of rights * (TERP/ Current market price)

Given Information:

Current Market Rate = £ 1.90

Shares available = £ 600,000 shares

Return on shareholders’ fund = £ 140,000

Particulars Amount (in £) Amount (in £) Amount (in £)

Suggested right

issue prices

1.8 1.6 1.4

Fund to be raised 180000 180000 180000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

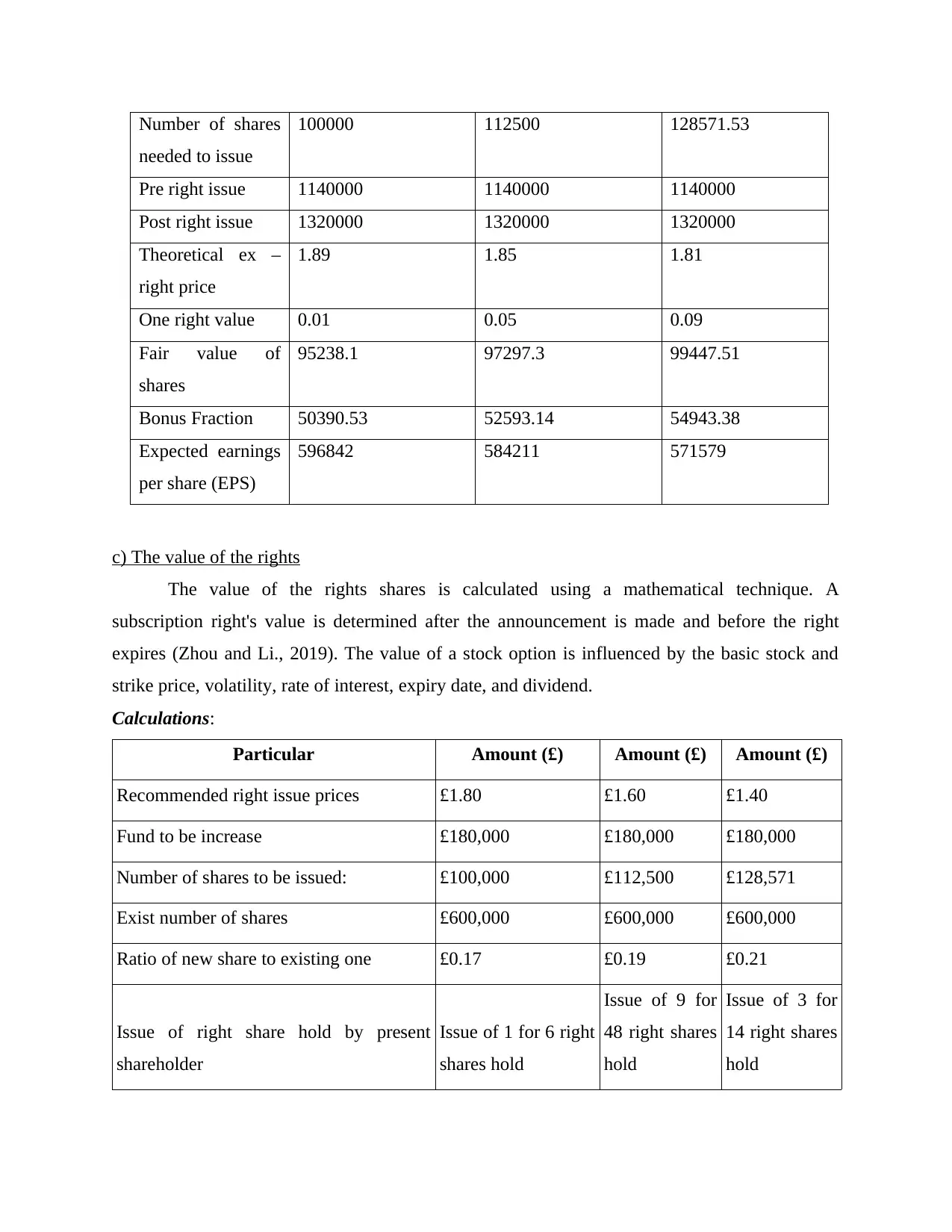

Number of shares

needed to issue

100000 112500 128571.53

Pre right issue 1140000 1140000 1140000

Post right issue 1320000 1320000 1320000

Theoretical ex –

right price

1.89 1.85 1.81

One right value 0.01 0.05 0.09

Fair value of

shares

95238.1 97297.3 99447.51

Bonus Fraction 50390.53 52593.14 54943.38

Expected earnings

per share (EPS)

596842 584211 571579

c) The value of the rights

The value of the rights shares is calculated using a mathematical technique. A

subscription right's value is determined after the announcement is made and before the right

expires (Zhou and Li., 2019). The value of a stock option is influenced by the basic stock and

strike price, volatility, rate of interest, expiry date, and dividend.

Calculations:

Particular Amount (£) Amount (£) Amount (£)

Recommended right issue prices £1.80 £1.60 £1.40

Fund to be increase £180,000 £180,000 £180,000

Number of shares to be issued: £100,000 £112,500 £128,571

Exist number of shares £600,000 £600,000 £600,000

Ratio of new share to existing one £0.17 £0.19 £0.21

Issue of right share hold by present

shareholder

Issue of 1 for 6 right

shares hold

Issue of 9 for

48 right shares

hold

Issue of 3 for

14 right shares

hold

needed to issue

100000 112500 128571.53

Pre right issue 1140000 1140000 1140000

Post right issue 1320000 1320000 1320000

Theoretical ex –

right price

1.89 1.85 1.81

One right value 0.01 0.05 0.09

Fair value of

shares

95238.1 97297.3 99447.51

Bonus Fraction 50390.53 52593.14 54943.38

Expected earnings

per share (EPS)

596842 584211 571579

c) The value of the rights

The value of the rights shares is calculated using a mathematical technique. A

subscription right's value is determined after the announcement is made and before the right

expires (Zhou and Li., 2019). The value of a stock option is influenced by the basic stock and

strike price, volatility, rate of interest, expiry date, and dividend.

Calculations:

Particular Amount (£) Amount (£) Amount (£)

Recommended right issue prices £1.80 £1.60 £1.40

Fund to be increase £180,000 £180,000 £180,000

Number of shares to be issued: £100,000 £112,500 £128,571

Exist number of shares £600,000 £600,000 £600,000

Ratio of new share to existing one £0.17 £0.19 £0.21

Issue of right share hold by present

shareholder

Issue of 1 for 6 right

shares hold

Issue of 9 for

48 right shares

hold

Issue of 3 for

14 right shares

hold

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

d) Critically discuss the advantages and disadvantages of rights issue

A right issue is an excessive capital-raising mechanism utilised by the top-ranked

corporation. It is carried out when a company is experiencing a liquidity problem. The

corporation asks its current owners or investors for additional funds in exchange for the issuance

of discounted shares (Chang and Jo., 2019). As a result, this stock issue is known as the right

issue.

Advantages of Right Issue:

Useful in raising capital: Unlike public offerings, the right problem is more of an internal

affair with fewer rules and regulations. The only protocol that remains in the right issue is

that before issuing new shares, listed businesses must file a letter of offer with SEBI and

stock exchanges for public discussion and approval..

Organizer shareholder Inflation: The fact that the right issuance assists promoters in

increasing their shareholding turns out to be a huge benefit (Vaslavskaya., 2020).

Disadvantages of Right Issue:

Limits are set for rising up capital: Typically, stock exchanges limit the amount of

money a firm can raise through a right issue. Furthermore, the restriction is usually

proportional to the company's current equity worth. As a result, if a firm's stock is

undervalued, obtaining capital through the appropriate issuance may put pressure on the

company..

Decreasing goodwill of the company: The fundamental cause for the stock increase is

that the company's liquidity assets are insufficient in comparison to its present liabilities.

Typically, a reputable company will issue the appropriate shares in the market, negatively

impacting the company's goodwill and lowering its market position (Barnett and Sergi.,

2018). As a result, investors believe that organising is a problem in running a corporation.

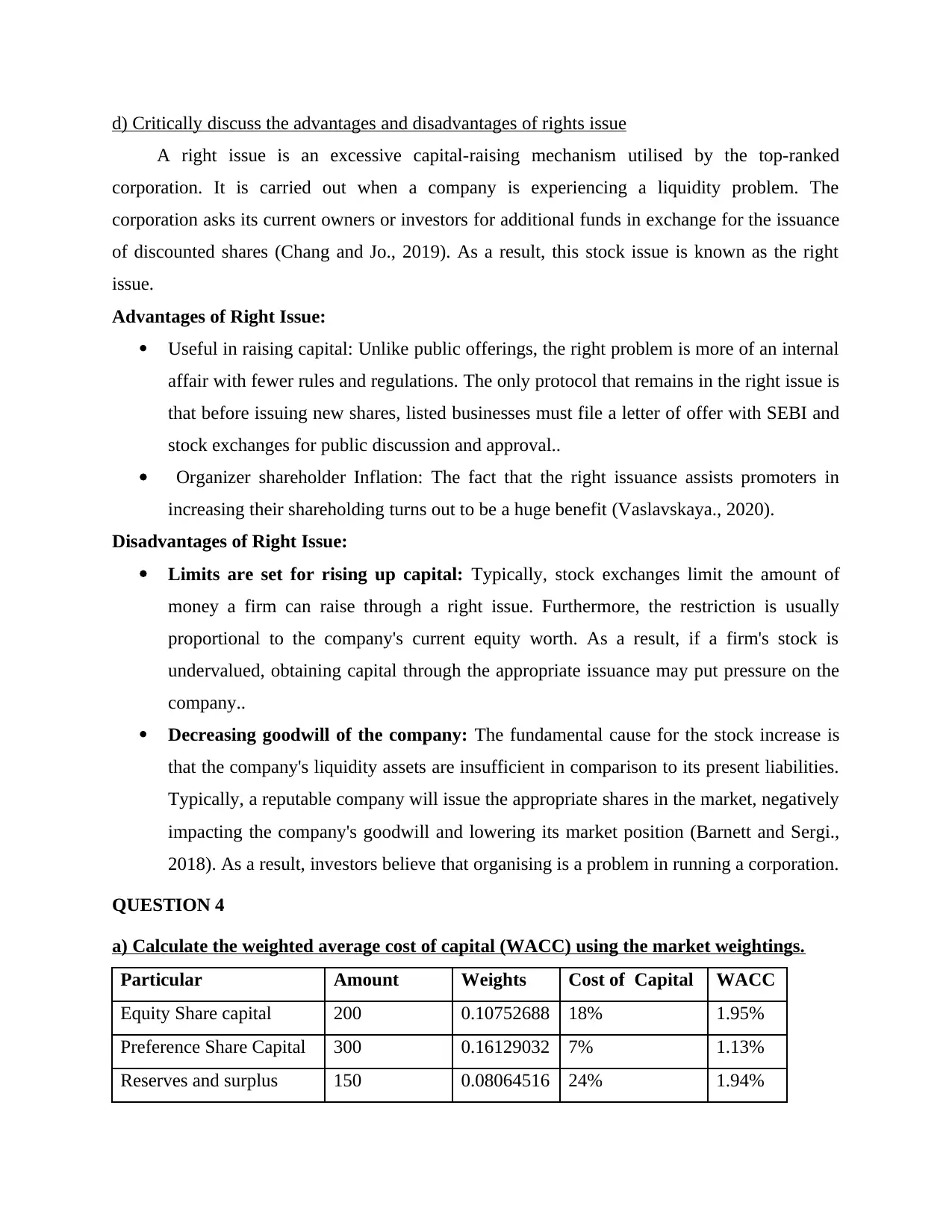

QUESTION 4

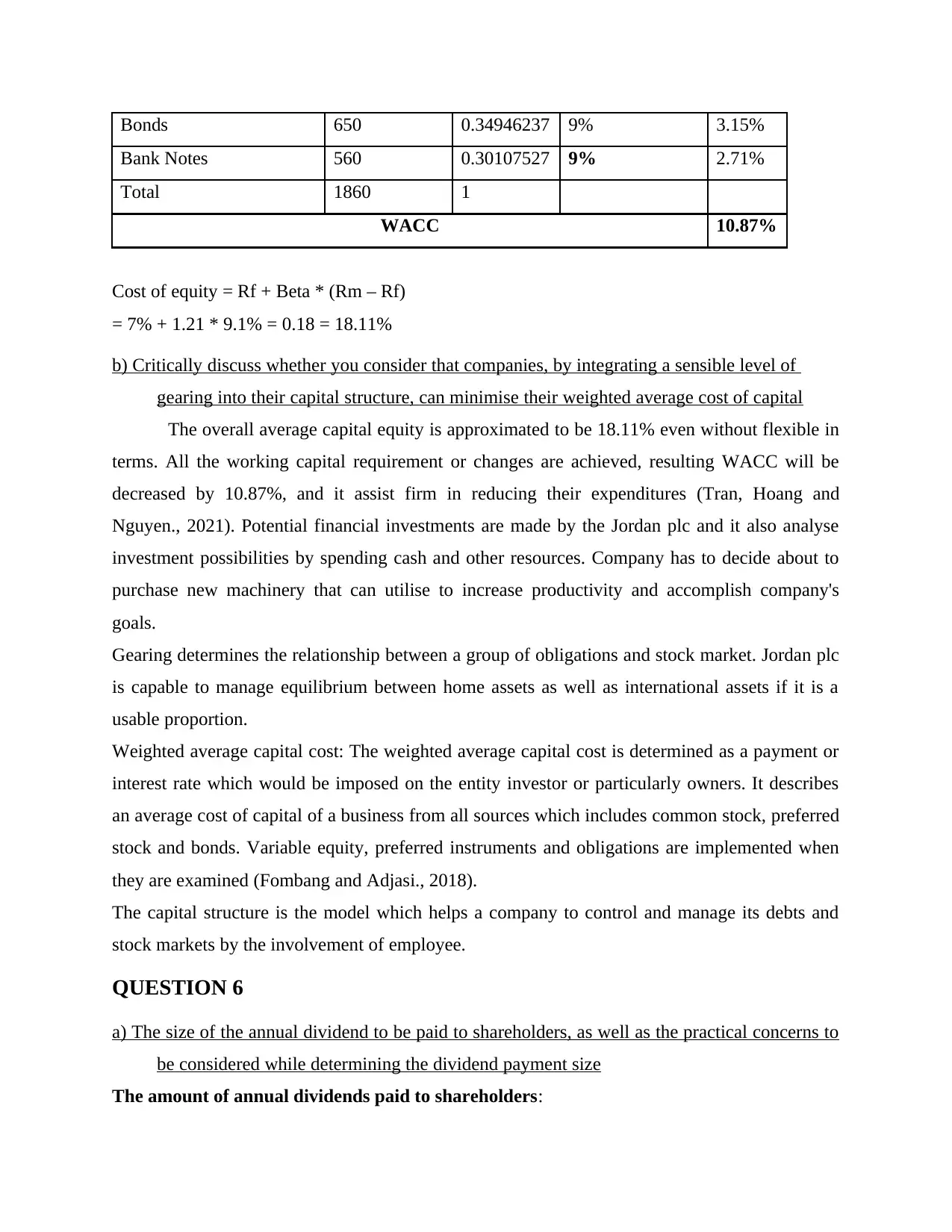

a) Calculate the weighted average cost of capital (WACC) using the market weightings.

Particular Amount Weights Cost of Capital WACC

Equity Share capital 200 0.10752688 18% 1.95%

Preference Share Capital 300 0.16129032 7% 1.13%

Reserves and surplus 150 0.08064516 24% 1.94%

A right issue is an excessive capital-raising mechanism utilised by the top-ranked

corporation. It is carried out when a company is experiencing a liquidity problem. The

corporation asks its current owners or investors for additional funds in exchange for the issuance

of discounted shares (Chang and Jo., 2019). As a result, this stock issue is known as the right

issue.

Advantages of Right Issue:

Useful in raising capital: Unlike public offerings, the right problem is more of an internal

affair with fewer rules and regulations. The only protocol that remains in the right issue is

that before issuing new shares, listed businesses must file a letter of offer with SEBI and

stock exchanges for public discussion and approval..

Organizer shareholder Inflation: The fact that the right issuance assists promoters in

increasing their shareholding turns out to be a huge benefit (Vaslavskaya., 2020).

Disadvantages of Right Issue:

Limits are set for rising up capital: Typically, stock exchanges limit the amount of

money a firm can raise through a right issue. Furthermore, the restriction is usually

proportional to the company's current equity worth. As a result, if a firm's stock is

undervalued, obtaining capital through the appropriate issuance may put pressure on the

company..

Decreasing goodwill of the company: The fundamental cause for the stock increase is

that the company's liquidity assets are insufficient in comparison to its present liabilities.

Typically, a reputable company will issue the appropriate shares in the market, negatively

impacting the company's goodwill and lowering its market position (Barnett and Sergi.,

2018). As a result, investors believe that organising is a problem in running a corporation.

QUESTION 4

a) Calculate the weighted average cost of capital (WACC) using the market weightings.

Particular Amount Weights Cost of Capital WACC

Equity Share capital 200 0.10752688 18% 1.95%

Preference Share Capital 300 0.16129032 7% 1.13%

Reserves and surplus 150 0.08064516 24% 1.94%

Bonds 650 0.34946237 9% 3.15%

Bank Notes 560 0.30107527 9% 2.71%

Total 1860 1

WACC 10.87%

Cost of equity = Rf + Beta * (Rm – Rf)

= 7% + 1.21 * 9.1% = 0.18 = 18.11%

b) Critically discuss whether you consider that companies, by integrating a sensible level of

gearing into their capital structure, can minimise their weighted average cost of capital

The overall average capital equity is approximated to be 18.11% even without flexible in

terms. All the working capital requirement or changes are achieved, resulting WACC will be

decreased by 10.87%, and it assist firm in reducing their expenditures (Tran, Hoang and

Nguyen., 2021). Potential financial investments are made by the Jordan plc and it also analyse

investment possibilities by spending cash and other resources. Company has to decide about to

purchase new machinery that can utilise to increase productivity and accomplish company's

goals.

Gearing determines the relationship between a group of obligations and stock market. Jordan plc

is capable to manage equilibrium between home assets as well as international assets if it is a

usable proportion.

Weighted average capital cost: The weighted average capital cost is determined as a payment or

interest rate which would be imposed on the entity investor or particularly owners. It describes

an average cost of capital of a business from all sources which includes common stock, preferred

stock and bonds. Variable equity, preferred instruments and obligations are implemented when

they are examined (Fombang and Adjasi., 2018).

The capital structure is the model which helps a company to control and manage its debts and

stock markets by the involvement of employee.

QUESTION 6

a) The size of the annual dividend to be paid to shareholders, as well as the practical concerns to

be considered while determining the dividend payment size

The amount of annual dividends paid to shareholders:

Bank Notes 560 0.30107527 9% 2.71%

Total 1860 1

WACC 10.87%

Cost of equity = Rf + Beta * (Rm – Rf)

= 7% + 1.21 * 9.1% = 0.18 = 18.11%

b) Critically discuss whether you consider that companies, by integrating a sensible level of

gearing into their capital structure, can minimise their weighted average cost of capital

The overall average capital equity is approximated to be 18.11% even without flexible in

terms. All the working capital requirement or changes are achieved, resulting WACC will be

decreased by 10.87%, and it assist firm in reducing their expenditures (Tran, Hoang and

Nguyen., 2021). Potential financial investments are made by the Jordan plc and it also analyse

investment possibilities by spending cash and other resources. Company has to decide about to

purchase new machinery that can utilise to increase productivity and accomplish company's

goals.

Gearing determines the relationship between a group of obligations and stock market. Jordan plc

is capable to manage equilibrium between home assets as well as international assets if it is a

usable proportion.

Weighted average capital cost: The weighted average capital cost is determined as a payment or

interest rate which would be imposed on the entity investor or particularly owners. It describes

an average cost of capital of a business from all sources which includes common stock, preferred

stock and bonds. Variable equity, preferred instruments and obligations are implemented when

they are examined (Fombang and Adjasi., 2018).

The capital structure is the model which helps a company to control and manage its debts and

stock markets by the involvement of employee.

QUESTION 6

a) The size of the annual dividend to be paid to shareholders, as well as the practical concerns to

be considered while determining the dividend payment size

The amount of annual dividends paid to shareholders:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

A dividend is a one-time payment provided to shareholders in exchange for their

investment in a profit-generating stock, which is subtracted from the income statement. While

the majority of earnings are kept as capital appreciation, money that can be used for current and

future operations and has a specific purpose can be distributed to investors as profits. Industries

will occasionally experience capital growth even if they do not earn enough money. Companies

can do so to maintain their long-standing dividend-paying legacy (Tongpoon-Patanasorn., 2018).

Even if they admit to the accounting goal, advisers have the authority to pursue that amount of

money. When a corporation needs money, it can either keep the entire proportion of incentives or

avoid engaging in the financial markets entirely. Furthermore, no allocation is recorded if the full

income is expected to be in the form of all or reserved. Buyers should consider the following two

factors when calculating the dividend distribution.

The practical considerations that must be made while determining the size of the dividend

pay-out:

Various challenges that the corporation has while deciding on the size of the dividend

pay-out have been identified, including:

Owners' tax plan: The tax treatment of stockholders is one factor that influences financial

decisions. Those who would not be prevalent in decent distribution functions for a corporation

with a significant share capital that has had high profitability from several sources and are

clustered for a modest income scheme, because a significant portion of the financial gain either

from compensation or through taxpayers would still go away (Ejiogu., 2018). They also prefer

investment returns to cash earnings, which they do by distributing retained earnings from share

capital or profits at cost.

Legal requirements: Senior management should be aware of the current limits whenever a

dividend is declared. The United Kingdom has approved several dividend pay-out and delivery

rules, which corporations must adhere to when paying dividends.

Investor's choice: Because they all have different perspectives and sentiments, the most

important factor is the customer's choice. Furthermore, income is unimportant to investors; all

they need to do is assess the firm from which funds were raised to support new initiatives or

expand local industries.

Company growth requirements: Another aspect that determines the cash dividend is the firm's

economic requirements. If a business has grown sufficiently, it should not need additional funds

investment in a profit-generating stock, which is subtracted from the income statement. While

the majority of earnings are kept as capital appreciation, money that can be used for current and

future operations and has a specific purpose can be distributed to investors as profits. Industries

will occasionally experience capital growth even if they do not earn enough money. Companies

can do so to maintain their long-standing dividend-paying legacy (Tongpoon-Patanasorn., 2018).

Even if they admit to the accounting goal, advisers have the authority to pursue that amount of

money. When a corporation needs money, it can either keep the entire proportion of incentives or

avoid engaging in the financial markets entirely. Furthermore, no allocation is recorded if the full

income is expected to be in the form of all or reserved. Buyers should consider the following two

factors when calculating the dividend distribution.

The practical considerations that must be made while determining the size of the dividend

pay-out:

Various challenges that the corporation has while deciding on the size of the dividend

pay-out have been identified, including:

Owners' tax plan: The tax treatment of stockholders is one factor that influences financial

decisions. Those who would not be prevalent in decent distribution functions for a corporation

with a significant share capital that has had high profitability from several sources and are

clustered for a modest income scheme, because a significant portion of the financial gain either

from compensation or through taxpayers would still go away (Ejiogu., 2018). They also prefer

investment returns to cash earnings, which they do by distributing retained earnings from share

capital or profits at cost.

Legal requirements: Senior management should be aware of the current limits whenever a

dividend is declared. The United Kingdom has approved several dividend pay-out and delivery

rules, which corporations must adhere to when paying dividends.

Investor's choice: Because they all have different perspectives and sentiments, the most

important factor is the customer's choice. Furthermore, income is unimportant to investors; all

they need to do is assess the firm from which funds were raised to support new initiatives or

expand local industries.

Company growth requirements: Another aspect that determines the cash dividend is the firm's

economic requirements. If a business has grown sufficiently, it should not need additional funds

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

for acquisitions (Gan, Lv and Chen., 2021). However, if a company seeks to expand, more funds

are required for survival and growth.

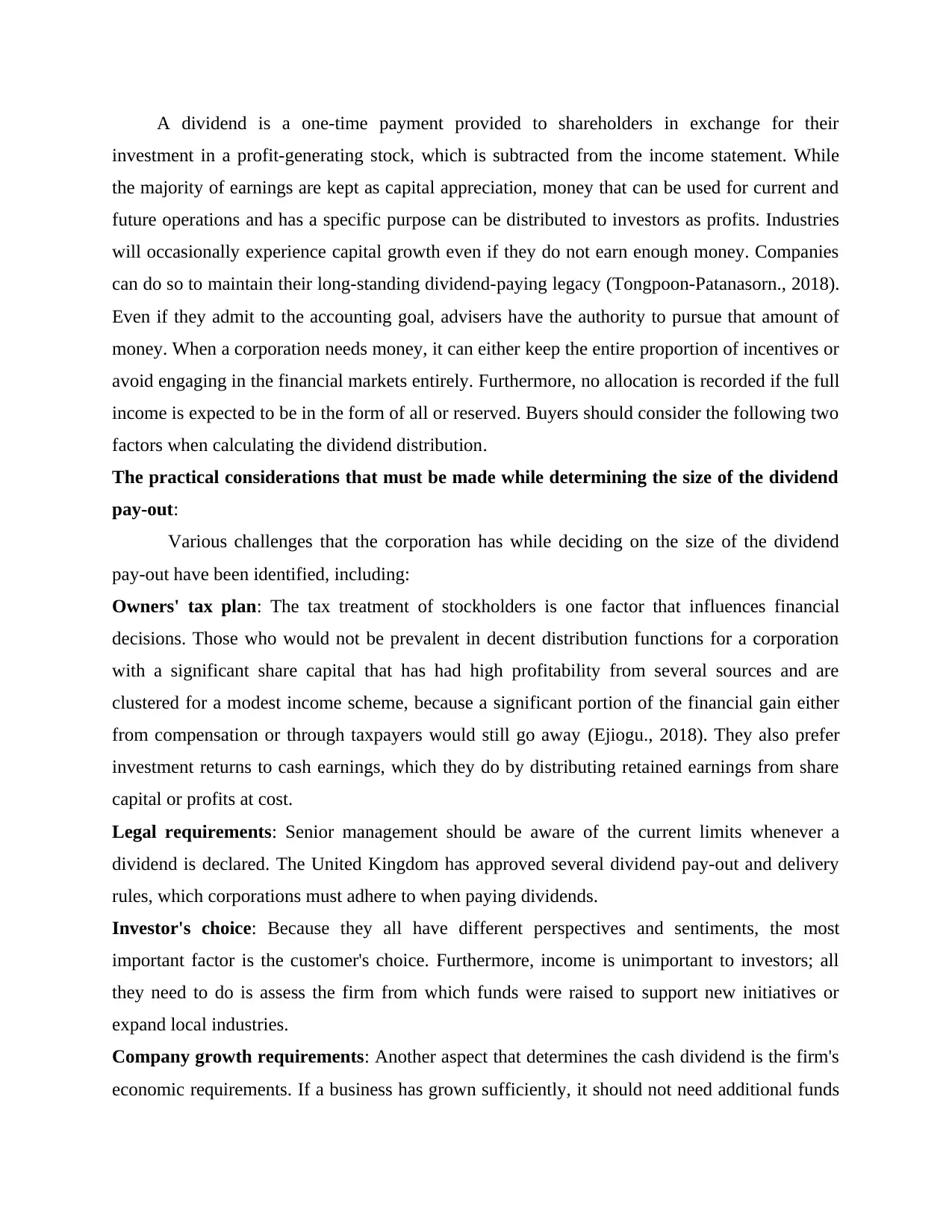

b) Calculate the three options

Cash dividend:

Interpretation: The total cash dividend is computed using the company's current value of 1250

and the dividend payout of 15p, as shown in the above calculation. As a result, add both values

to get the total money dividend, which is 187.5.

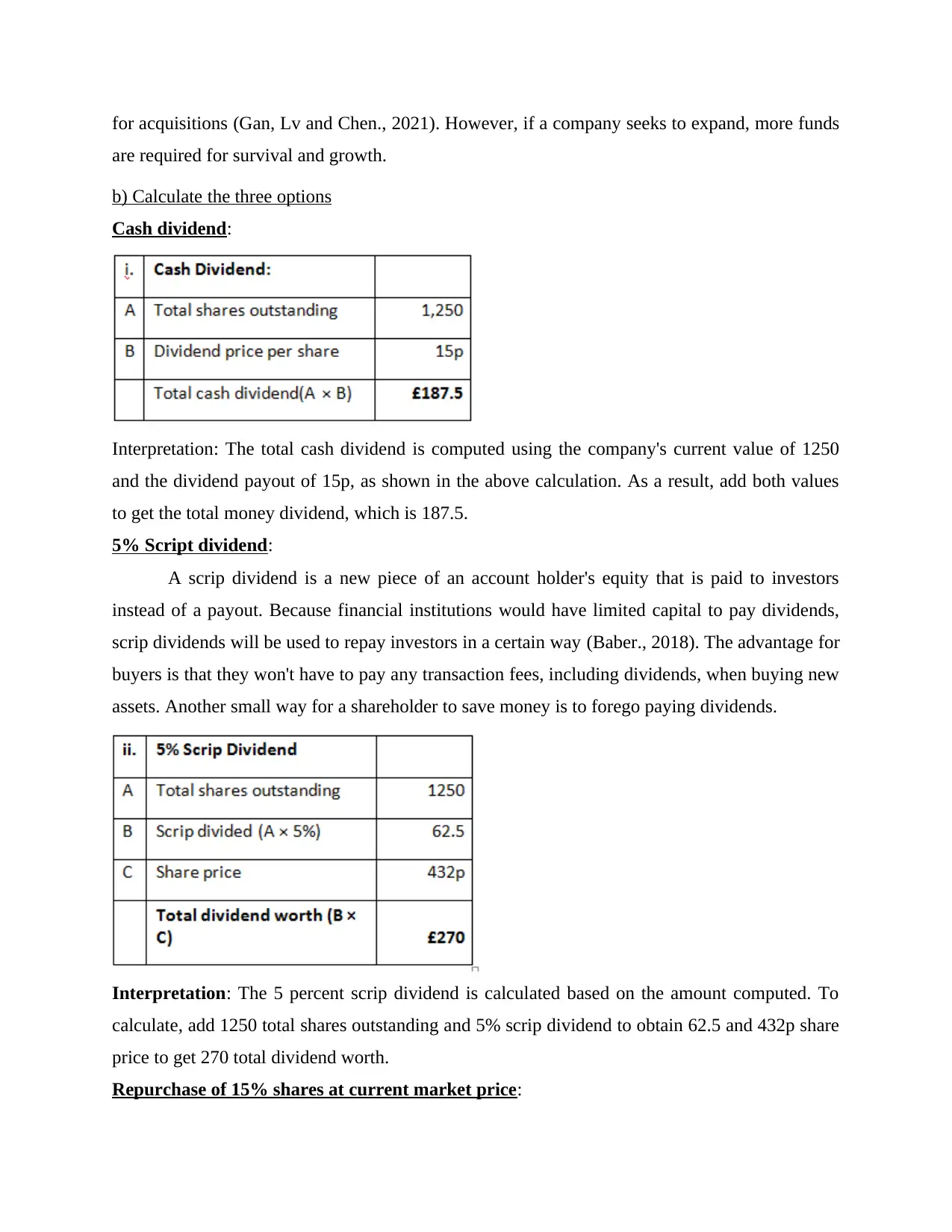

5% Script dividend:

A scrip dividend is a new piece of an account holder's equity that is paid to investors

instead of a payout. Because financial institutions would have limited capital to pay dividends,

scrip dividends will be used to repay investors in a certain way (Baber., 2018). The advantage for

buyers is that they won't have to pay any transaction fees, including dividends, when buying new

assets. Another small way for a shareholder to save money is to forego paying dividends.

Interpretation: The 5 percent scrip dividend is calculated based on the amount computed. To

calculate, add 1250 total shares outstanding and 5% scrip dividend to obtain 62.5 and 432p share

price to get 270 total dividend worth.

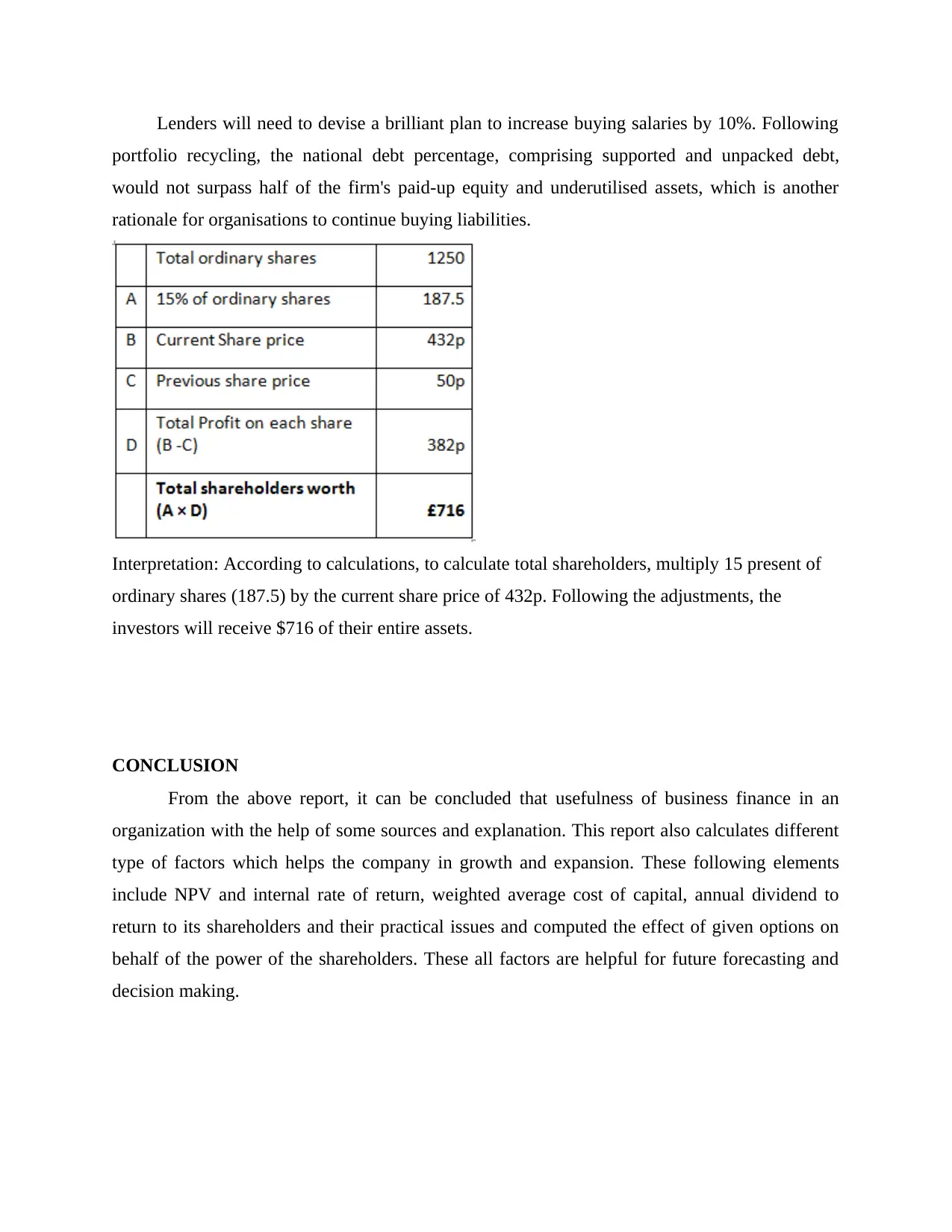

Repurchase of 15% shares at current market price:

are required for survival and growth.

b) Calculate the three options

Cash dividend:

Interpretation: The total cash dividend is computed using the company's current value of 1250

and the dividend payout of 15p, as shown in the above calculation. As a result, add both values

to get the total money dividend, which is 187.5.

5% Script dividend:

A scrip dividend is a new piece of an account holder's equity that is paid to investors

instead of a payout. Because financial institutions would have limited capital to pay dividends,

scrip dividends will be used to repay investors in a certain way (Baber., 2018). The advantage for

buyers is that they won't have to pay any transaction fees, including dividends, when buying new

assets. Another small way for a shareholder to save money is to forego paying dividends.

Interpretation: The 5 percent scrip dividend is calculated based on the amount computed. To

calculate, add 1250 total shares outstanding and 5% scrip dividend to obtain 62.5 and 432p share

price to get 270 total dividend worth.

Repurchase of 15% shares at current market price:

Lenders will need to devise a brilliant plan to increase buying salaries by 10%. Following

portfolio recycling, the national debt percentage, comprising supported and unpacked debt,

would not surpass half of the firm's paid-up equity and underutilised assets, which is another

rationale for organisations to continue buying liabilities.

Interpretation: According to calculations, to calculate total shareholders, multiply 15 present of

ordinary shares (187.5) by the current share price of 432p. Following the adjustments, the

investors will receive $716 of their entire assets.

CONCLUSION

From the above report, it can be concluded that usefulness of business finance in an

organization with the help of some sources and explanation. This report also calculates different

type of factors which helps the company in growth and expansion. These following elements

include NPV and internal rate of return, weighted average cost of capital, annual dividend to

return to its shareholders and their practical issues and computed the effect of given options on

behalf of the power of the shareholders. These all factors are helpful for future forecasting and

decision making.

portfolio recycling, the national debt percentage, comprising supported and unpacked debt,

would not surpass half of the firm's paid-up equity and underutilised assets, which is another

rationale for organisations to continue buying liabilities.

Interpretation: According to calculations, to calculate total shareholders, multiply 15 present of

ordinary shares (187.5) by the current share price of 432p. Following the adjustments, the

investors will receive $716 of their entire assets.

CONCLUSION

From the above report, it can be concluded that usefulness of business finance in an

organization with the help of some sources and explanation. This report also calculates different

type of factors which helps the company in growth and expansion. These following elements

include NPV and internal rate of return, weighted average cost of capital, annual dividend to

return to its shareholders and their practical issues and computed the effect of given options on

behalf of the power of the shareholders. These all factors are helpful for future forecasting and

decision making.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.