Business Finance Project Report: Yield Curve, Expectation Theory, and Spread Analysis

VerifiedAdded on 2023/06/04

|15

|2942

|309

AI Summary

This project report analyzes the yield curve, expectation theory, and spread analysis of the Australian market. It includes graphs, tables, and explanations of the economical position of the Australian market and the NSW economy.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: Business Finance

1

Project Report: Business Finance

1

Project Report: Business Finance

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Business Finance

2

Contents

Question 1:........................................................................................................................3

Part a:............................................................................................................................3

Part b:............................................................................................................................3

Part c:............................................................................................................................3

Part d:............................................................................................................................4

Part e:............................................................................................................................5

Part f:............................................................................................................................6

Part g:............................................................................................................................7

Question 2:........................................................................................................................9

Part a:............................................................................................................................9

Part b:............................................................................................................................9

Part c:..........................................................................................................................11

Part d:..........................................................................................................................11

Part e:..........................................................................................................................11

Part f:..........................................................................................................................12

References.......................................................................................................................14

2

Contents

Question 1:........................................................................................................................3

Part a:............................................................................................................................3

Part b:............................................................................................................................3

Part c:............................................................................................................................3

Part d:............................................................................................................................4

Part e:............................................................................................................................5

Part f:............................................................................................................................6

Part g:............................................................................................................................7

Question 2:........................................................................................................................9

Part a:............................................................................................................................9

Part b:............................................................................................................................9

Part c:..........................................................................................................................11

Part d:..........................................................................................................................11

Part e:..........................................................................................................................11

Part f:..........................................................................................................................12

References.......................................................................................................................14

Business Finance

3

Question 1:

Part a:

0 1 2 3 4 5 6 7 8 9 10

2.00

3.00

4.00

5.00

6.00

7.00

8.00

Yield Curve

Apr-2008 Oct-2008 Apr-2009

Figure 1: Yield Curve

Part b:

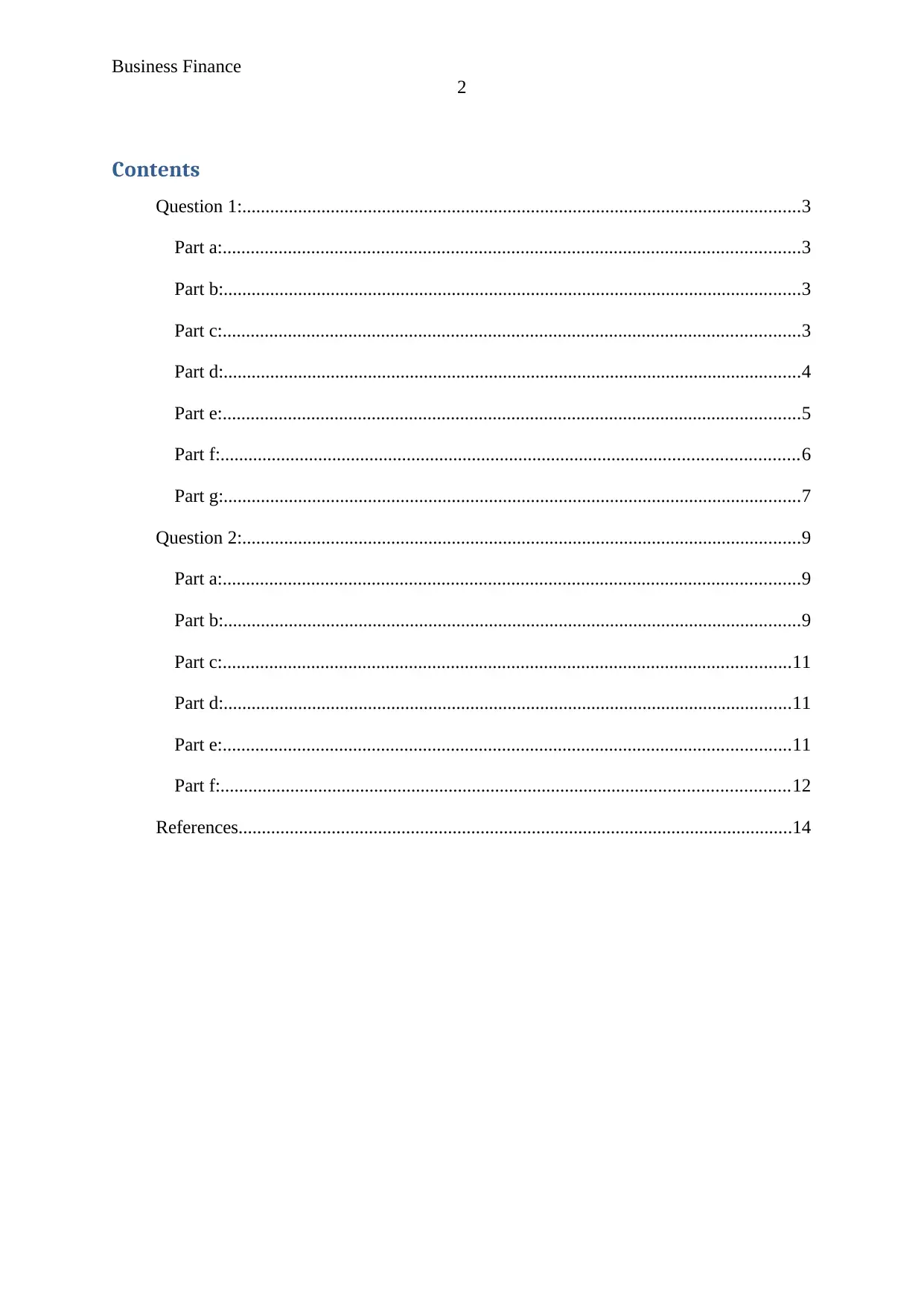

Under the normal circumstance, a yield curve always shows the upward graph and it

briefs the long term investment always offers more return to the investors than the short term

investment (Horngren, 2009).

Part c:

On the basis of the given graph, it has been found that the slopes are showing the

increased position at initial stage but along with the time, the slopes are offering the upwards

position. It expresses that the long term investment into the Australian market would offer

improved return (Jiashu, 2009). It also explains that the economical position of the Australian

market has been improved.

3

Question 1:

Part a:

0 1 2 3 4 5 6 7 8 9 10

2.00

3.00

4.00

5.00

6.00

7.00

8.00

Yield Curve

Apr-2008 Oct-2008 Apr-2009

Figure 1: Yield Curve

Part b:

Under the normal circumstance, a yield curve always shows the upward graph and it

briefs the long term investment always offers more return to the investors than the short term

investment (Horngren, 2009).

Part c:

On the basis of the given graph, it has been found that the slopes are showing the

increased position at initial stage but along with the time, the slopes are offering the upwards

position. It expresses that the long term investment into the Australian market would offer

improved return (Jiashu, 2009). It also explains that the economical position of the Australian

market has been improved.

Business Finance

4

0 1 2 3 4 5 6 7 8 9 10

2.00

3.00

4.00

5.00

6.00

7.00

8.00

Yield Curve

Apr-2008 Oct-2008 Apr-2009

Figure 2 Yield Curve

Part d:

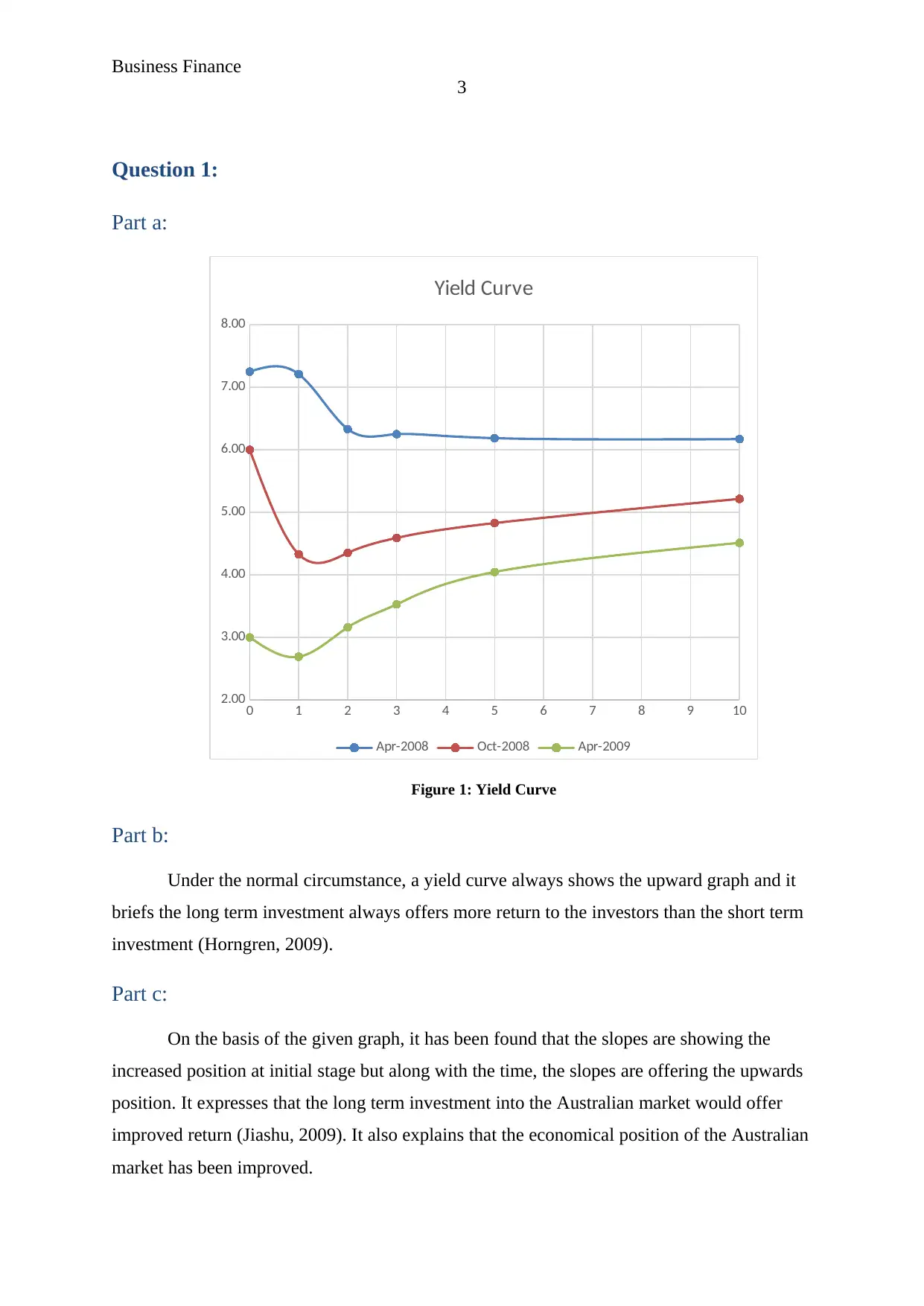

The 2 years bond yield rate of Australia market in the year of 2008 has been described

in the below table. The expectation theory explains that along with the time, the worth of the

money get reduced and thus for the compensation and for the long term investment, the return

of the investment is always higher. On the basis of the expectation theory, an improved rate

of return is expected in the year of 2009. The expectation has been shown in the below graph

in part e. The expectation hypothesis sometime not holds because of the fluctuations in the

economical factors and the international market changes (Higgins, 2012).

two year's bond yield (2008)

Year-

1

Year-

2

Actual

interest rate

Year 2

Actual interest

rate Year -1

Expected

Interest rate

Jan-2008 6.83% 6.61% 1.1365 1.0683 1.0638

Feb-2008 7.12% 6.82% 1.1411 1.0712 1.0652

Mar-2008 7.03% 6.30% 1.13 1.0703 1.0558

Apr-2008 7.21% 6.33% 1.1306 1.0721 1.0546

May-2008 7.35% 6.60% 1.1364 1.0735 1.0585

4

0 1 2 3 4 5 6 7 8 9 10

2.00

3.00

4.00

5.00

6.00

7.00

8.00

Yield Curve

Apr-2008 Oct-2008 Apr-2009

Figure 2 Yield Curve

Part d:

The 2 years bond yield rate of Australia market in the year of 2008 has been described

in the below table. The expectation theory explains that along with the time, the worth of the

money get reduced and thus for the compensation and for the long term investment, the return

of the investment is always higher. On the basis of the expectation theory, an improved rate

of return is expected in the year of 2009. The expectation has been shown in the below graph

in part e. The expectation hypothesis sometime not holds because of the fluctuations in the

economical factors and the international market changes (Higgins, 2012).

two year's bond yield (2008)

Year-

1

Year-

2

Actual

interest rate

Year 2

Actual interest

rate Year -1

Expected

Interest rate

Jan-2008 6.83% 6.61% 1.1365 1.0683 1.0638

Feb-2008 7.12% 6.82% 1.1411 1.0712 1.0652

Mar-2008 7.03% 6.30% 1.13 1.0703 1.0558

Apr-2008 7.21% 6.33% 1.1306 1.0721 1.0546

May-2008 7.35% 6.60% 1.1364 1.0735 1.0585

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Business Finance

5

Jun-2008 7.26% 6.97% 1.1442 1.0726 1.0668

Jul-2008 6.87% 6.64% 1.1372 1.0687 1.0641

Aug-2008 6.34% 5.83% 1.12 1.0634 1.0532

Sep-2008 5.63% 5.51% 1.1133 1.0563 1.0539

Oct-2008 4.33% 4.35% 1.0889 1.0433 1.0437

Nov-2008 3.09% 3.64% 1.074 1.0309 1.0419

Dec-2008 2.67% 3.07% 1.0624 1.0267 1.0347

Yield on two year's bond

Year-

1

Year-

2

Actual interest

rate Year 2

Actual interest

rate Year -1

Expected

Interest rate

Jan-2009 2.69% 2.83

%

1.05741 1.0269 1.02971

Feb-2009 2.59% 2.80

%

1.05685 1.0259 1.03017

Mar-2009 2.74% 2.87

%

1.05826 1.0274 1.03004

Apr-2009 2.69% 3.16

%

1.06419 1.0269 1.03631

May-2009 2.87% 3.46

%

1.07039 1.0287 1.04053

Jun-2009 2.95% 3.90

%

1.07961 1.0295 1.04867

Jul-2009 3.00% 4.04

%

1.08242 1.03 1.0509

Aug-2009 3.19% 4.57

%

1.09349 1.0319 1.05968

Sep-2009 3.23% 4.42

%

1.0904 1.0323 1.05628

Oct-2009 3.66% 4.82

%

1.09877 1.0366 1.05998

Nov-2009 3.73% 4.71

%

1.09645 1.0373 1.05702

Dec-2009 3.83% 4.54

%

1.09282 1.0383 1.05251

Part e:

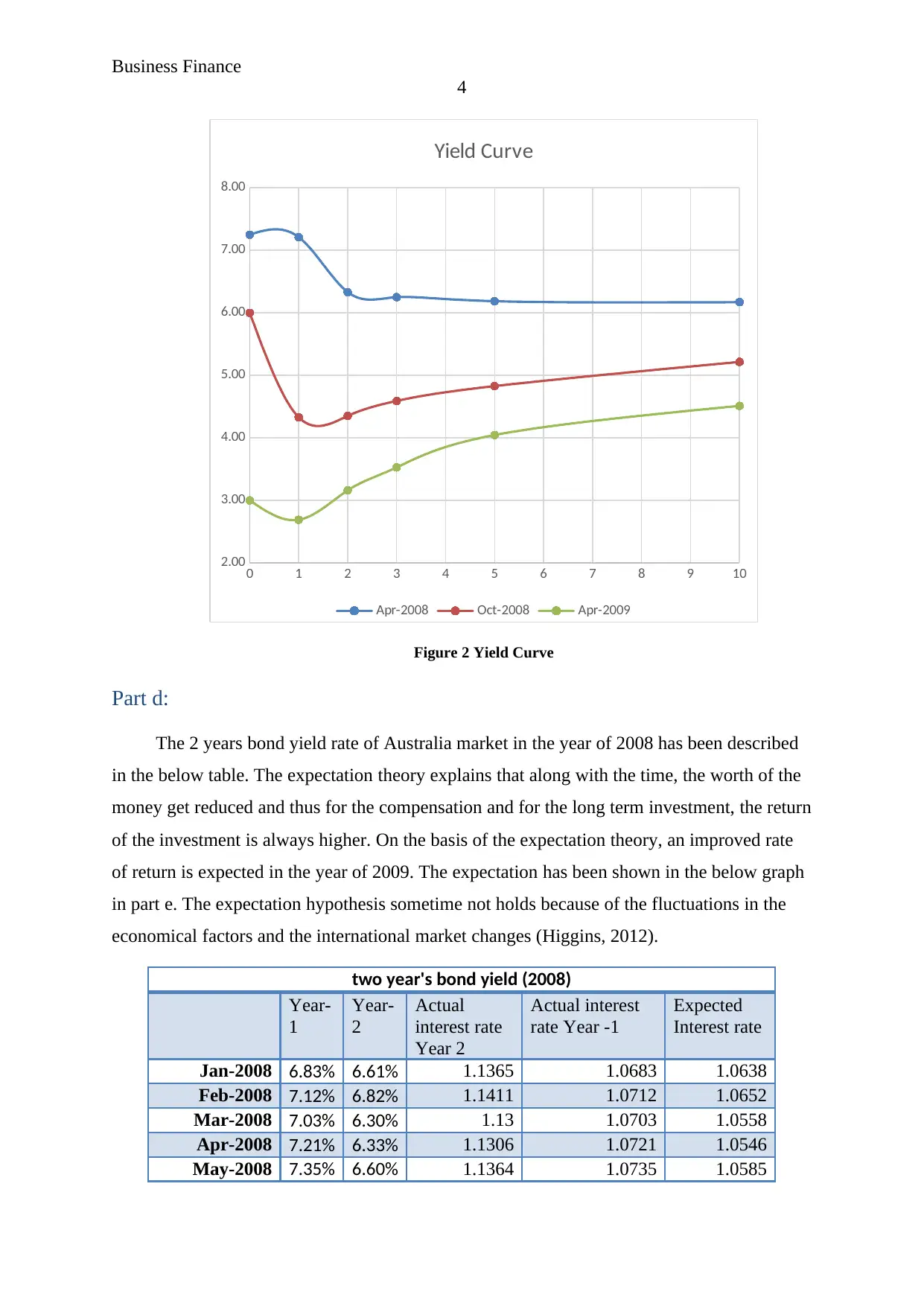

The expected rate of 2008 has been compared with the rate of 2009 to measure that

whether the expectation in the next year is getting higher. And as described in the expectation

theory that along with the time, the worth of the money get reduced and thus for the

compensation and for the long term investment, the return of the investment is always higher;

5

Jun-2008 7.26% 6.97% 1.1442 1.0726 1.0668

Jul-2008 6.87% 6.64% 1.1372 1.0687 1.0641

Aug-2008 6.34% 5.83% 1.12 1.0634 1.0532

Sep-2008 5.63% 5.51% 1.1133 1.0563 1.0539

Oct-2008 4.33% 4.35% 1.0889 1.0433 1.0437

Nov-2008 3.09% 3.64% 1.074 1.0309 1.0419

Dec-2008 2.67% 3.07% 1.0624 1.0267 1.0347

Yield on two year's bond

Year-

1

Year-

2

Actual interest

rate Year 2

Actual interest

rate Year -1

Expected

Interest rate

Jan-2009 2.69% 2.83

%

1.05741 1.0269 1.02971

Feb-2009 2.59% 2.80

%

1.05685 1.0259 1.03017

Mar-2009 2.74% 2.87

%

1.05826 1.0274 1.03004

Apr-2009 2.69% 3.16

%

1.06419 1.0269 1.03631

May-2009 2.87% 3.46

%

1.07039 1.0287 1.04053

Jun-2009 2.95% 3.90

%

1.07961 1.0295 1.04867

Jul-2009 3.00% 4.04

%

1.08242 1.03 1.0509

Aug-2009 3.19% 4.57

%

1.09349 1.0319 1.05968

Sep-2009 3.23% 4.42

%

1.0904 1.0323 1.05628

Oct-2009 3.66% 4.82

%

1.09877 1.0366 1.05998

Nov-2009 3.73% 4.71

%

1.09645 1.0373 1.05702

Dec-2009 3.83% 4.54

%

1.09282 1.0383 1.05251

Part e:

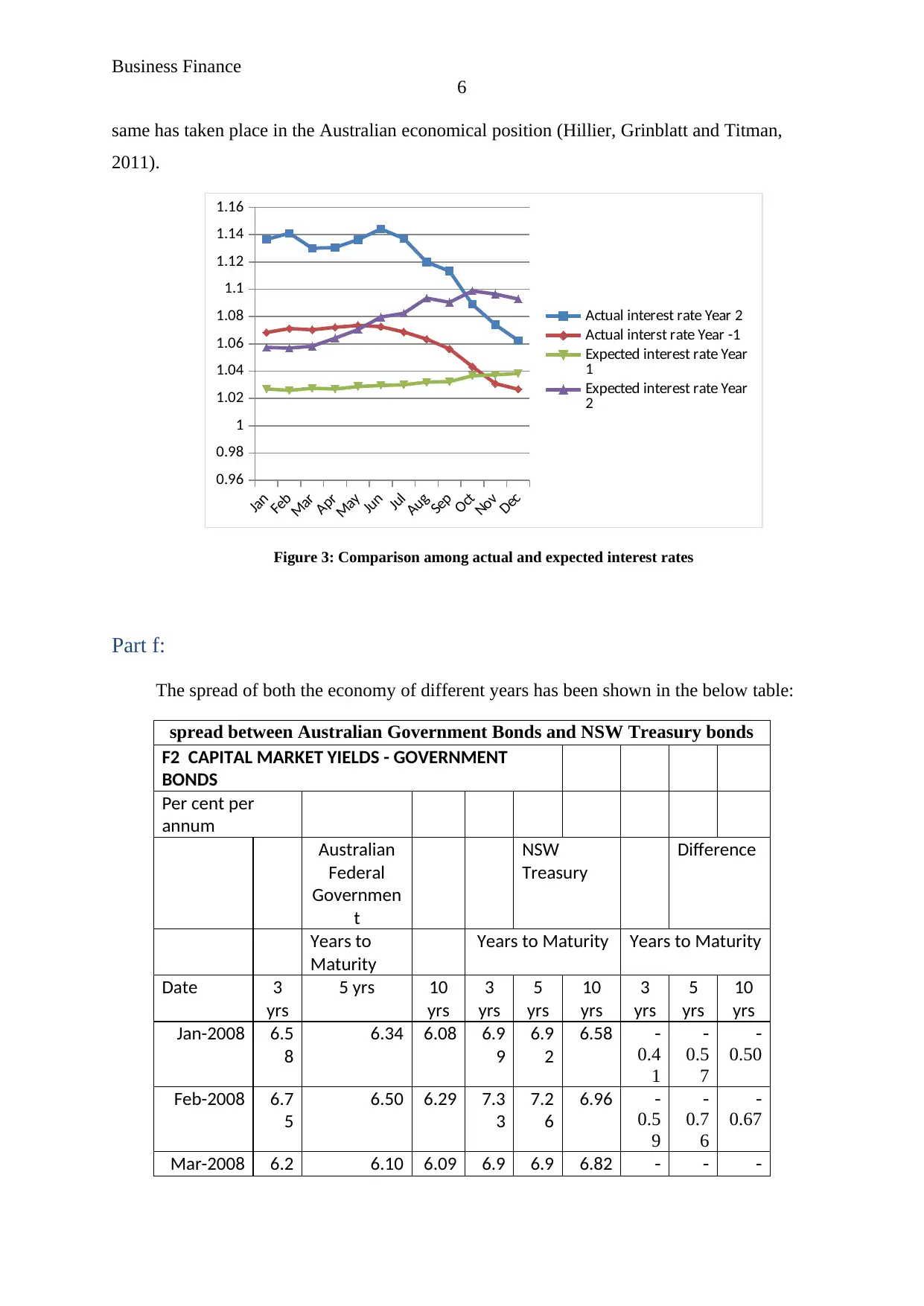

The expected rate of 2008 has been compared with the rate of 2009 to measure that

whether the expectation in the next year is getting higher. And as described in the expectation

theory that along with the time, the worth of the money get reduced and thus for the

compensation and for the long term investment, the return of the investment is always higher;

Business Finance

6

same has taken place in the Australian economical position (Hillier, Grinblatt and Titman,

2011).

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

0.96

0.98

1

1.02

1.04

1.06

1.08

1.1

1.12

1.14

1.16

Actual interest rate Year 2

Actual interst rate Year -1

Expected interest rate Year

1

Expected interest rate Year

2

Figure 3: Comparison among actual and expected interest rates

Part f:

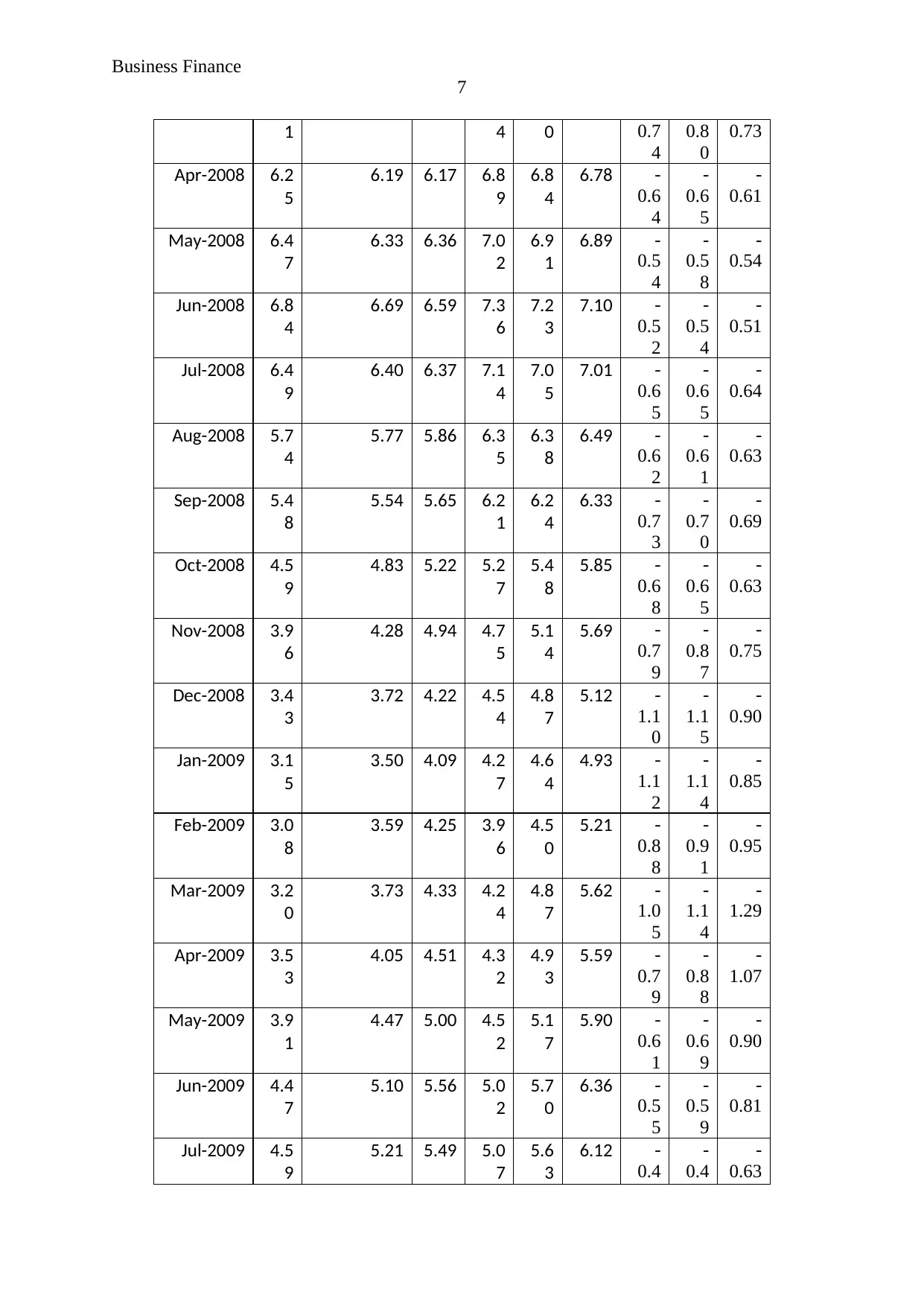

The spread of both the economy of different years has been shown in the below table:

spread between Australian Government Bonds and NSW Treasury bonds

F2 CAPITAL MARKET YIELDS - GOVERNMENT

BONDS

Per cent per

annum

Australian

Federal

Governmen

t

NSW

Treasury

Difference

Years to

Maturity

Years to Maturity Years to Maturity

Date 3

yrs

5 yrs 10

yrs

3

yrs

5

yrs

10

yrs

3

yrs

5

yrs

10

yrs

Jan-2008 6.5

8

6.34 6.08 6.9

9

6.9

2

6.58 -

0.4

1

-

0.5

7

-

0.50

Feb-2008 6.7

5

6.50 6.29 7.3

3

7.2

6

6.96 -

0.5

9

-

0.7

6

-

0.67

Mar-2008 6.2 6.10 6.09 6.9 6.9 6.82 - - -

6

same has taken place in the Australian economical position (Hillier, Grinblatt and Titman,

2011).

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

0.96

0.98

1

1.02

1.04

1.06

1.08

1.1

1.12

1.14

1.16

Actual interest rate Year 2

Actual interst rate Year -1

Expected interest rate Year

1

Expected interest rate Year

2

Figure 3: Comparison among actual and expected interest rates

Part f:

The spread of both the economy of different years has been shown in the below table:

spread between Australian Government Bonds and NSW Treasury bonds

F2 CAPITAL MARKET YIELDS - GOVERNMENT

BONDS

Per cent per

annum

Australian

Federal

Governmen

t

NSW

Treasury

Difference

Years to

Maturity

Years to Maturity Years to Maturity

Date 3

yrs

5 yrs 10

yrs

3

yrs

5

yrs

10

yrs

3

yrs

5

yrs

10

yrs

Jan-2008 6.5

8

6.34 6.08 6.9

9

6.9

2

6.58 -

0.4

1

-

0.5

7

-

0.50

Feb-2008 6.7

5

6.50 6.29 7.3

3

7.2

6

6.96 -

0.5

9

-

0.7

6

-

0.67

Mar-2008 6.2 6.10 6.09 6.9 6.9 6.82 - - -

Business Finance

7

1 4 0 0.7

4

0.8

0

0.73

Apr-2008 6.2

5

6.19 6.17 6.8

9

6.8

4

6.78 -

0.6

4

-

0.6

5

-

0.61

May-2008 6.4

7

6.33 6.36 7.0

2

6.9

1

6.89 -

0.5

4

-

0.5

8

-

0.54

Jun-2008 6.8

4

6.69 6.59 7.3

6

7.2

3

7.10 -

0.5

2

-

0.5

4

-

0.51

Jul-2008 6.4

9

6.40 6.37 7.1

4

7.0

5

7.01 -

0.6

5

-

0.6

5

-

0.64

Aug-2008 5.7

4

5.77 5.86 6.3

5

6.3

8

6.49 -

0.6

2

-

0.6

1

-

0.63

Sep-2008 5.4

8

5.54 5.65 6.2

1

6.2

4

6.33 -

0.7

3

-

0.7

0

-

0.69

Oct-2008 4.5

9

4.83 5.22 5.2

7

5.4

8

5.85 -

0.6

8

-

0.6

5

-

0.63

Nov-2008 3.9

6

4.28 4.94 4.7

5

5.1

4

5.69 -

0.7

9

-

0.8

7

-

0.75

Dec-2008 3.4

3

3.72 4.22 4.5

4

4.8

7

5.12 -

1.1

0

-

1.1

5

-

0.90

Jan-2009 3.1

5

3.50 4.09 4.2

7

4.6

4

4.93 -

1.1

2

-

1.1

4

-

0.85

Feb-2009 3.0

8

3.59 4.25 3.9

6

4.5

0

5.21 -

0.8

8

-

0.9

1

-

0.95

Mar-2009 3.2

0

3.73 4.33 4.2

4

4.8

7

5.62 -

1.0

5

-

1.1

4

-

1.29

Apr-2009 3.5

3

4.05 4.51 4.3

2

4.9

3

5.59 -

0.7

9

-

0.8

8

-

1.07

May-2009 3.9

1

4.47 5.00 4.5

2

5.1

7

5.90 -

0.6

1

-

0.6

9

-

0.90

Jun-2009 4.4

7

5.10 5.56 5.0

2

5.7

0

6.36 -

0.5

5

-

0.5

9

-

0.81

Jul-2009 4.5

9

5.21 5.49 5.0

7

5.6

3

6.12 -

0.4

-

0.4

-

0.63

7

1 4 0 0.7

4

0.8

0

0.73

Apr-2008 6.2

5

6.19 6.17 6.8

9

6.8

4

6.78 -

0.6

4

-

0.6

5

-

0.61

May-2008 6.4

7

6.33 6.36 7.0

2

6.9

1

6.89 -

0.5

4

-

0.5

8

-

0.54

Jun-2008 6.8

4

6.69 6.59 7.3

6

7.2

3

7.10 -

0.5

2

-

0.5

4

-

0.51

Jul-2008 6.4

9

6.40 6.37 7.1

4

7.0

5

7.01 -

0.6

5

-

0.6

5

-

0.64

Aug-2008 5.7

4

5.77 5.86 6.3

5

6.3

8

6.49 -

0.6

2

-

0.6

1

-

0.63

Sep-2008 5.4

8

5.54 5.65 6.2

1

6.2

4

6.33 -

0.7

3

-

0.7

0

-

0.69

Oct-2008 4.5

9

4.83 5.22 5.2

7

5.4

8

5.85 -

0.6

8

-

0.6

5

-

0.63

Nov-2008 3.9

6

4.28 4.94 4.7

5

5.1

4

5.69 -

0.7

9

-

0.8

7

-

0.75

Dec-2008 3.4

3

3.72 4.22 4.5

4

4.8

7

5.12 -

1.1

0

-

1.1

5

-

0.90

Jan-2009 3.1

5

3.50 4.09 4.2

7

4.6

4

4.93 -

1.1

2

-

1.1

4

-

0.85

Feb-2009 3.0

8

3.59 4.25 3.9

6

4.5

0

5.21 -

0.8

8

-

0.9

1

-

0.95

Mar-2009 3.2

0

3.73 4.33 4.2

4

4.8

7

5.62 -

1.0

5

-

1.1

4

-

1.29

Apr-2009 3.5

3

4.05 4.51 4.3

2

4.9

3

5.59 -

0.7

9

-

0.8

8

-

1.07

May-2009 3.9

1

4.47 5.00 4.5

2

5.1

7

5.90 -

0.6

1

-

0.6

9

-

0.90

Jun-2009 4.4

7

5.10 5.56 5.0

2

5.7

0

6.36 -

0.5

5

-

0.5

9

-

0.81

Jul-2009 4.5

9

5.21 5.49 5.0

7

5.6

3

6.12 -

0.4

-

0.4

-

0.63

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance

8

8 2

Aug-2009 4.9

9

5.39 5.53 5.4

0

5.7

7

6.09 -

0.4

1

-

0.3

7

-

0.55

Sep-2009 4.8

2

5.14 5.32 5.1

2

5.5

4

5.86 -

0.3

1

-

0.4

0

-

0.54

Oct-2009 5.1

4

5.35 5.45 5.4

7

5.7

7

5.98 -

0.3

3

-

0.4

1

-

0.53

Nov-2009 4.9

9

5.24 5.47 5.3

4

5.6

7

6.05 -

0.3

5

-

0.4

3

-

0.58

Dec-2009 4.8

3

5.15 5.47 5.2

1

5.6

0

6.09 -

0.3

9

-

0.4

5

-

0.62

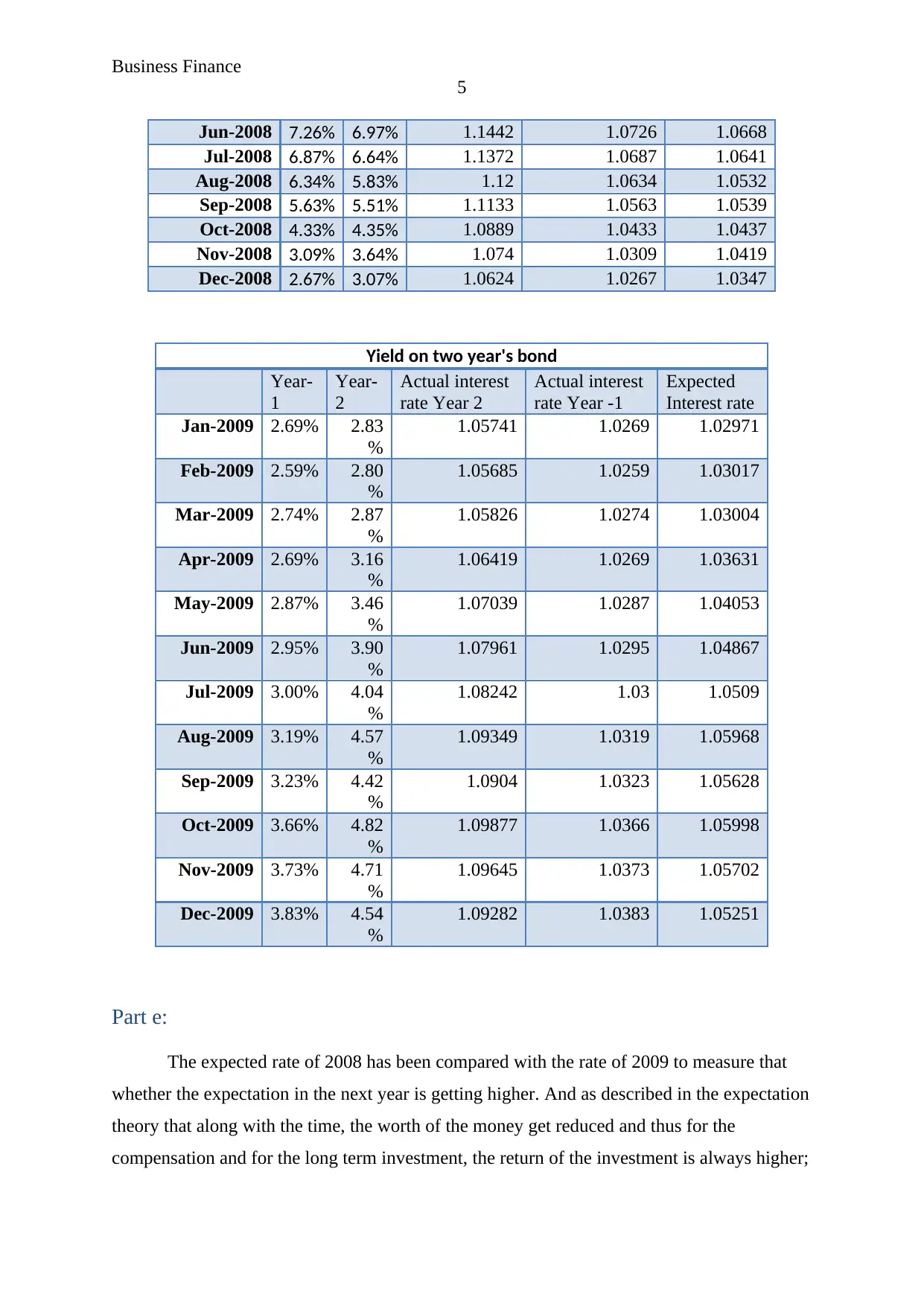

The average spread rate of Australian and NSW market is -0.64, -0.68 and -0.71 in the

year of 3, 5 and 10. It explains that the changes into the NSW economy is more improved

(Madura, 2014).

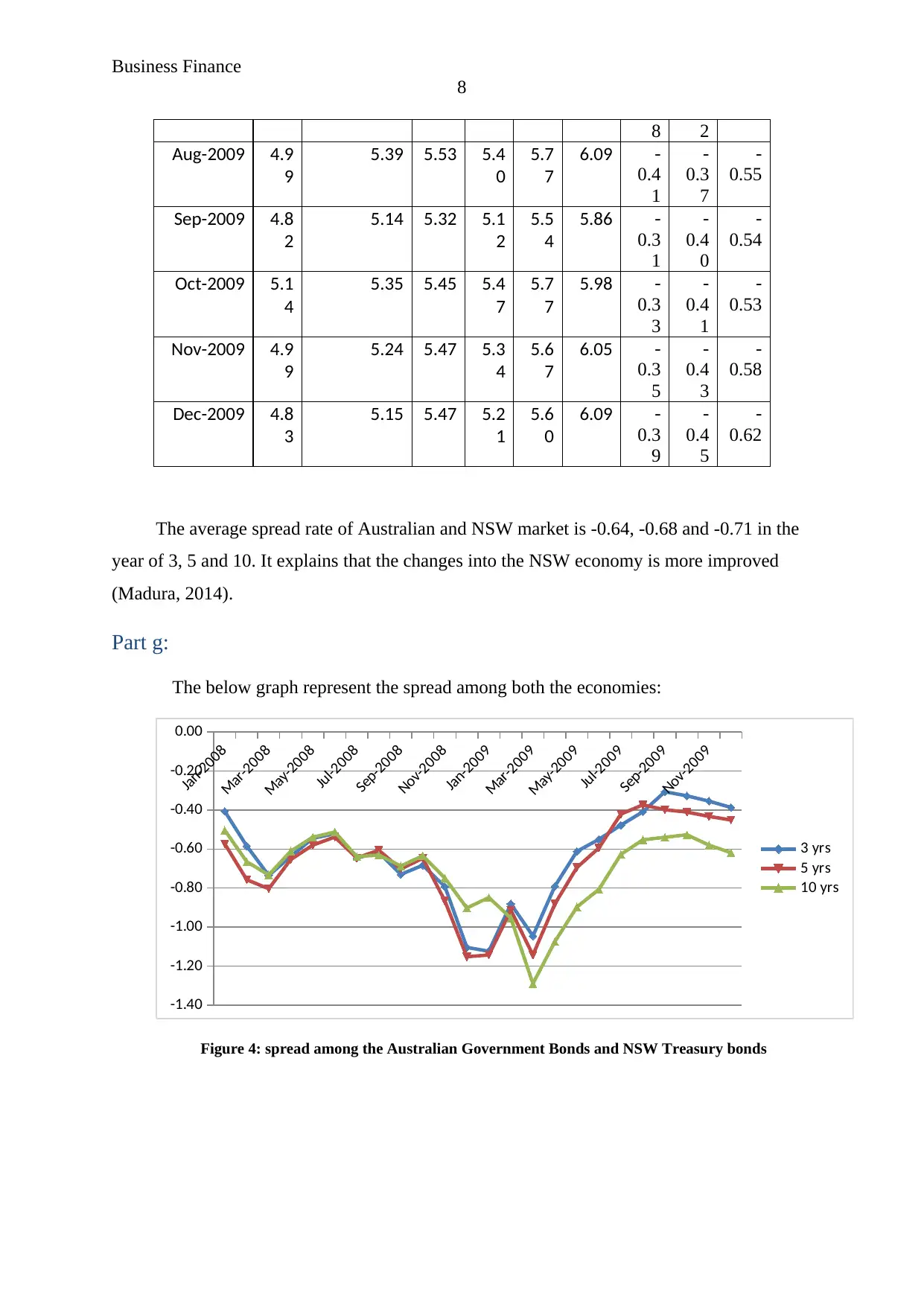

Part g:

The below graph represent the spread among both the economies:

Jan-2008

Mar-2008

May-2008

Jul-2008

Sep-2008

Nov-2008

Jan-2009

Mar-2009

May-2009

Jul-2009

Sep-2009

Nov-2009

-1.40

-1.20

-1.00

-0.80

-0.60

-0.40

-0.20

0.00

3 yrs

5 yrs

10 yrs

Figure 4: spread among the Australian Government Bonds and NSW Treasury bonds

8

8 2

Aug-2009 4.9

9

5.39 5.53 5.4

0

5.7

7

6.09 -

0.4

1

-

0.3

7

-

0.55

Sep-2009 4.8

2

5.14 5.32 5.1

2

5.5

4

5.86 -

0.3

1

-

0.4

0

-

0.54

Oct-2009 5.1

4

5.35 5.45 5.4

7

5.7

7

5.98 -

0.3

3

-

0.4

1

-

0.53

Nov-2009 4.9

9

5.24 5.47 5.3

4

5.6

7

6.05 -

0.3

5

-

0.4

3

-

0.58

Dec-2009 4.8

3

5.15 5.47 5.2

1

5.6

0

6.09 -

0.3

9

-

0.4

5

-

0.62

The average spread rate of Australian and NSW market is -0.64, -0.68 and -0.71 in the

year of 3, 5 and 10. It explains that the changes into the NSW economy is more improved

(Madura, 2014).

Part g:

The below graph represent the spread among both the economies:

Jan-2008

Mar-2008

May-2008

Jul-2008

Sep-2008

Nov-2008

Jan-2009

Mar-2009

May-2009

Jul-2009

Sep-2009

Nov-2009

-1.40

-1.20

-1.00

-0.80

-0.60

-0.40

-0.20

0.00

3 yrs

5 yrs

10 yrs

Figure 4: spread among the Australian Government Bonds and NSW Treasury bonds

Business Finance

9

On the basis of the above graph, it has been found that along with the time, the return

of the economies has also been changed. It expresses that the changes into the NSW economy

is more improved. The pattern explains better performance of NSW.

9

On the basis of the above graph, it has been found that along with the time, the return

of the economies has also been changed. It expresses that the changes into the NSW economy

is more improved. The pattern explains better performance of NSW.

Business Finance

10

Question 2:

Part a:

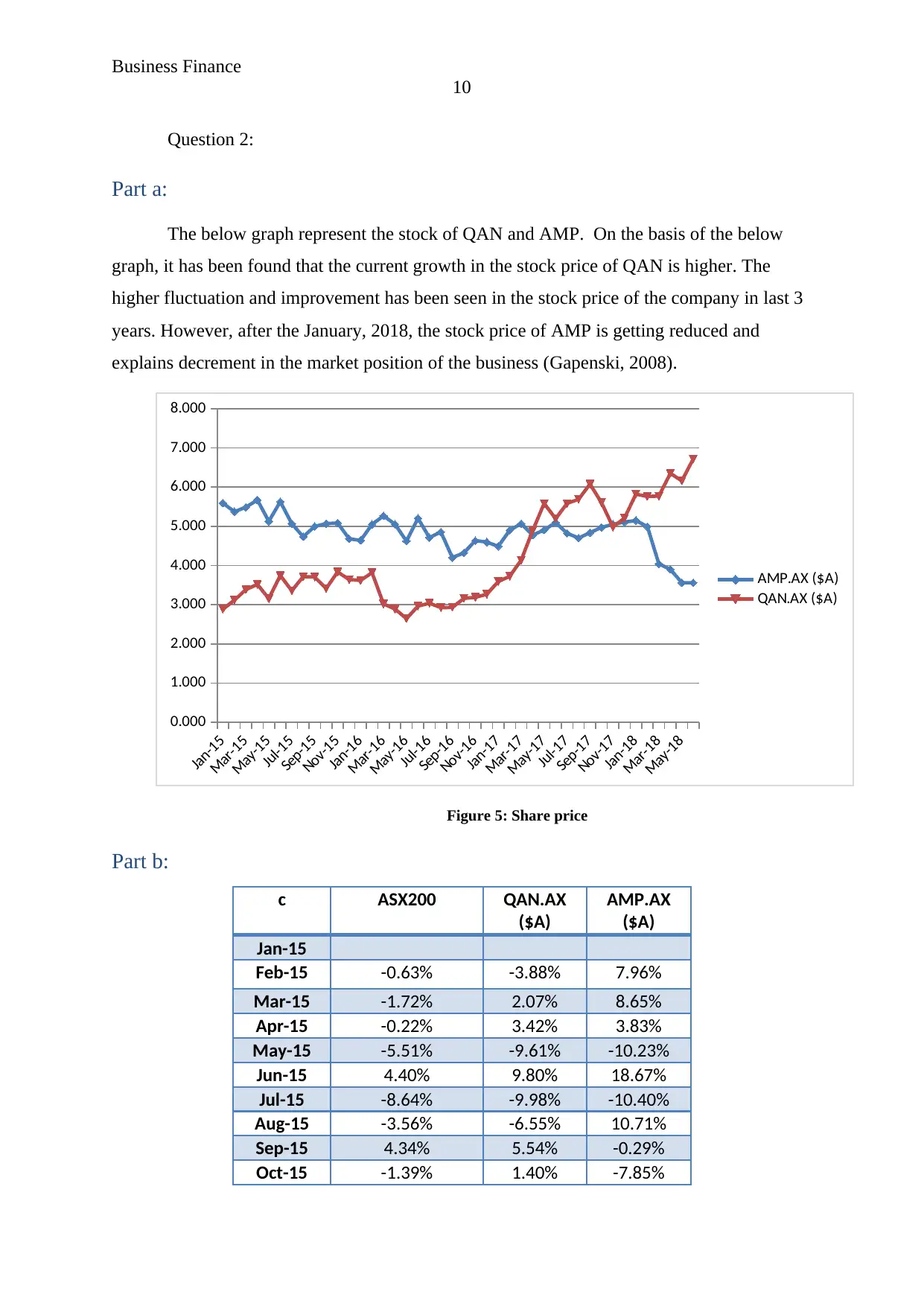

The below graph represent the stock of QAN and AMP. On the basis of the below

graph, it has been found that the current growth in the stock price of QAN is higher. The

higher fluctuation and improvement has been seen in the stock price of the company in last 3

years. However, after the January, 2018, the stock price of AMP is getting reduced and

explains decrement in the market position of the business (Gapenski, 2008).

Jan-15

Mar-15

May-15

Jul-15

Sep-15

Nov-15

Jan-16

Mar-16

May-16

Jul-16

Sep-16

Nov-16

Jan-17

Mar-17

May-17

Jul-17

Sep-17

Nov-17

Jan-18

Mar-18

May-18

0.000

1.000

2.000

3.000

4.000

5.000

6.000

7.000

8.000

AMP.AX ($A)

QAN.AX ($A)

Figure 5: Share price

Part b:

c ASX200 QAN.AX

($A)

AMP.AX

($A)

Jan-15

Feb-15 -0.63% -3.88% 7.96%

Mar-15 -1.72% 2.07% 8.65%

Apr-15 -0.22% 3.42% 3.83%

May-15 -5.51% -9.61% -10.23%

Jun-15 4.40% 9.80% 18.67%

Jul-15 -8.64% -9.98% -10.40%

Aug-15 -3.56% -6.55% 10.71%

Sep-15 4.34% 5.54% -0.29%

Oct-15 -1.39% 1.40% -7.85%

10

Question 2:

Part a:

The below graph represent the stock of QAN and AMP. On the basis of the below

graph, it has been found that the current growth in the stock price of QAN is higher. The

higher fluctuation and improvement has been seen in the stock price of the company in last 3

years. However, after the January, 2018, the stock price of AMP is getting reduced and

explains decrement in the market position of the business (Gapenski, 2008).

Jan-15

Mar-15

May-15

Jul-15

Sep-15

Nov-15

Jan-16

Mar-16

May-16

Jul-16

Sep-16

Nov-16

Jan-17

Mar-17

May-17

Jul-17

Sep-17

Nov-17

Jan-18

Mar-18

May-18

0.000

1.000

2.000

3.000

4.000

5.000

6.000

7.000

8.000

AMP.AX ($A)

QAN.AX ($A)

Figure 5: Share price

Part b:

c ASX200 QAN.AX

($A)

AMP.AX

($A)

Jan-15

Feb-15 -0.63% -3.88% 7.96%

Mar-15 -1.72% 2.07% 8.65%

Apr-15 -0.22% 3.42% 3.83%

May-15 -5.51% -9.61% -10.23%

Jun-15 4.40% 9.80% 18.67%

Jul-15 -8.64% -9.98% -10.40%

Aug-15 -3.56% -6.55% 10.71%

Sep-15 4.34% 5.54% -0.29%

Oct-15 -1.39% 1.40% -7.85%

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Business Finance

11

Nov-15 2.50% 0.34% 12.36%

Dec-15 -5.48% -7.89% -5.13%

Jan-16 -2.49% -0.93% -0.52%

Feb-16 4.14% 8.83% 5.44%

Mar-16 3.33% 4.30% -20.88%

Apr-16 2.41% -4.08% -4.35%

May-16 -2.70% -8.51% -8.44%

Jun-16 6.28% 12.60% 12.06%

Jul-16 -2.32% -9.47% 2.53%

Aug-16 0.05% 3.04% -3.70%

Sep-16 -2.17% -13.45% 0.14%

Oct-16 2.31% 2.84% 7.84%

Nov-16 4.14% 7.23% 0.91%

Dec-16 -0.79% -0.79% 2.40%

Jan-17 1.62% -2.40% 9.97%

Feb-17 2.67% 9.16% 3.73%

Mar-17 1.01% 3.47% 11.07%

Apr-17 -3.37% -5.78% 18.16%

May-17 -0.05% 2.77% 14.17%

Jun-17 -0.02% 3.85% -6.99%

Jul-17 -0.11% -5.38% 7.52%

Aug-17 -0.58% -2.53% 1.92%

Sep-17 4.00% 2.90% 6.81%

Oct-17 1.03% 2.82% -7.80%

Nov-17 1.59% 1.57% -11.11%

Dec-17 -0.45% 1.16% 4.56%

Jan-18 -0.36% 0.76% 11.76%

Feb-18 -4.27% -3.05% -1.02%

Mar-18 3.88% -19.04% 0.16%

Apr-18 0.49% -3.47% 10.05%

May-18 3.04% -8.72% -2.99%

Jun-18 0.53% 0.00% 9.09%

ASX200 QAN.AX ($A) AMP.AX

($A)

Mean 0.17% -0.87% 2.46%

Variance 0.10% 0.45% 0.77%

Standard

Deviation

0.032 0.067 0.088

Covariance 0.118% 0.061%

11

Nov-15 2.50% 0.34% 12.36%

Dec-15 -5.48% -7.89% -5.13%

Jan-16 -2.49% -0.93% -0.52%

Feb-16 4.14% 8.83% 5.44%

Mar-16 3.33% 4.30% -20.88%

Apr-16 2.41% -4.08% -4.35%

May-16 -2.70% -8.51% -8.44%

Jun-16 6.28% 12.60% 12.06%

Jul-16 -2.32% -9.47% 2.53%

Aug-16 0.05% 3.04% -3.70%

Sep-16 -2.17% -13.45% 0.14%

Oct-16 2.31% 2.84% 7.84%

Nov-16 4.14% 7.23% 0.91%

Dec-16 -0.79% -0.79% 2.40%

Jan-17 1.62% -2.40% 9.97%

Feb-17 2.67% 9.16% 3.73%

Mar-17 1.01% 3.47% 11.07%

Apr-17 -3.37% -5.78% 18.16%

May-17 -0.05% 2.77% 14.17%

Jun-17 -0.02% 3.85% -6.99%

Jul-17 -0.11% -5.38% 7.52%

Aug-17 -0.58% -2.53% 1.92%

Sep-17 4.00% 2.90% 6.81%

Oct-17 1.03% 2.82% -7.80%

Nov-17 1.59% 1.57% -11.11%

Dec-17 -0.45% 1.16% 4.56%

Jan-18 -0.36% 0.76% 11.76%

Feb-18 -4.27% -3.05% -1.02%

Mar-18 3.88% -19.04% 0.16%

Apr-18 0.49% -3.47% 10.05%

May-18 3.04% -8.72% -2.99%

Jun-18 0.53% 0.00% 9.09%

ASX200 QAN.AX ($A) AMP.AX

($A)

Mean 0.17% -0.87% 2.46%

Variance 0.10% 0.45% 0.77%

Standard

Deviation

0.032 0.067 0.088

Covariance 0.118% 0.061%

Business Finance

12

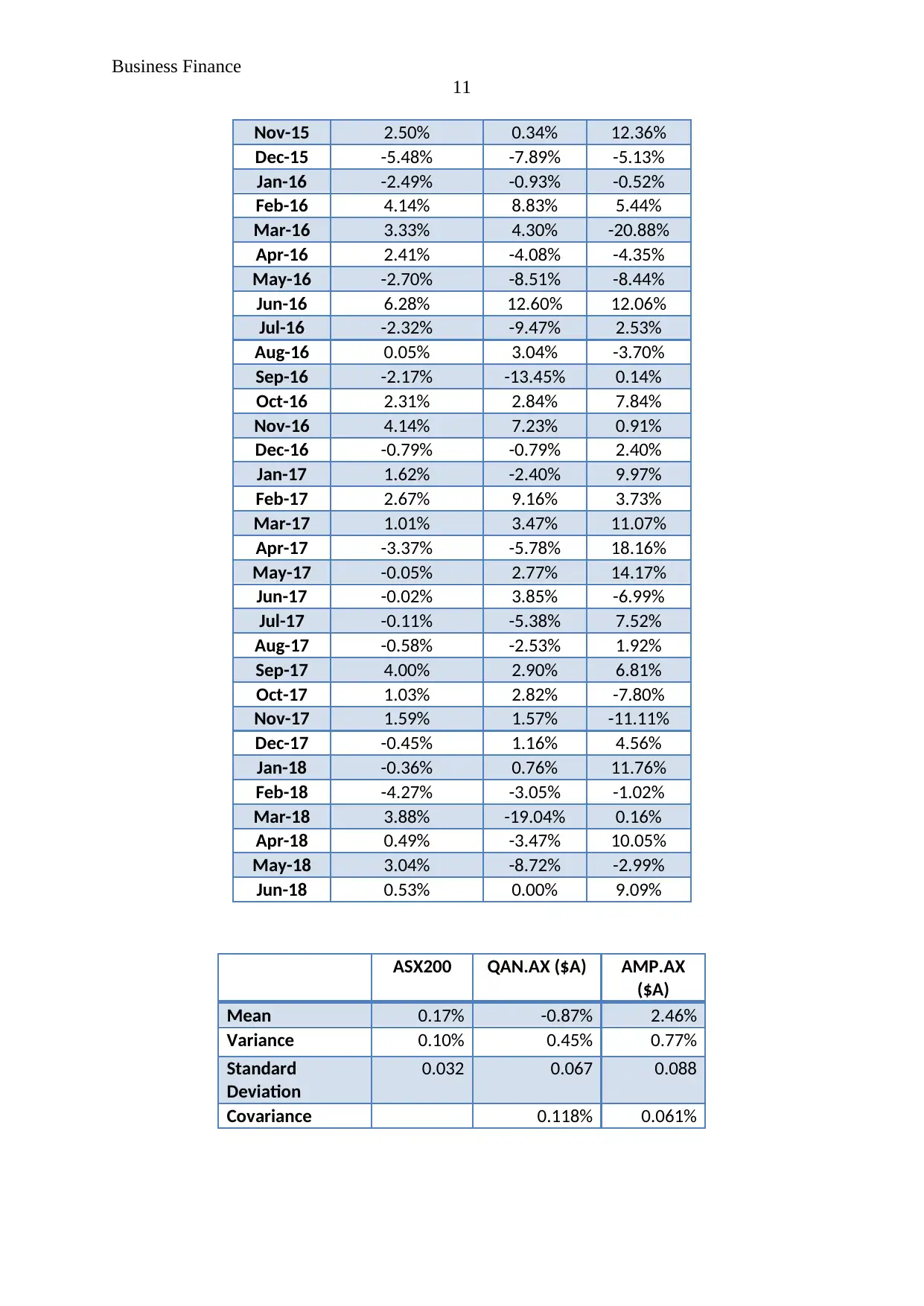

The above tables represent the return, mean, covariance, standard deviation, variance

etc. the table brief that the mean, variance, standard deviation and covariance of QAN and

AMP are -0.87% and 2.46%, 0.45% and 0.77%, 0.067 and 0.088 & 0.118% and 0.061%.

However, the mean, variance and standard deviation of ASX 200 is 0.17%, 0.10% and

0.032. It explains that the return of Amp is higher in the industry. Though, the associated risk

of AMP is also higher. The standard deviation also explains that the risk position associated

with AMP is highest in the industry. Further the covariance level of QAN is better (Lord,

2007). It leads to the conclusion that the performance of QAN is better in terms of overall

management.

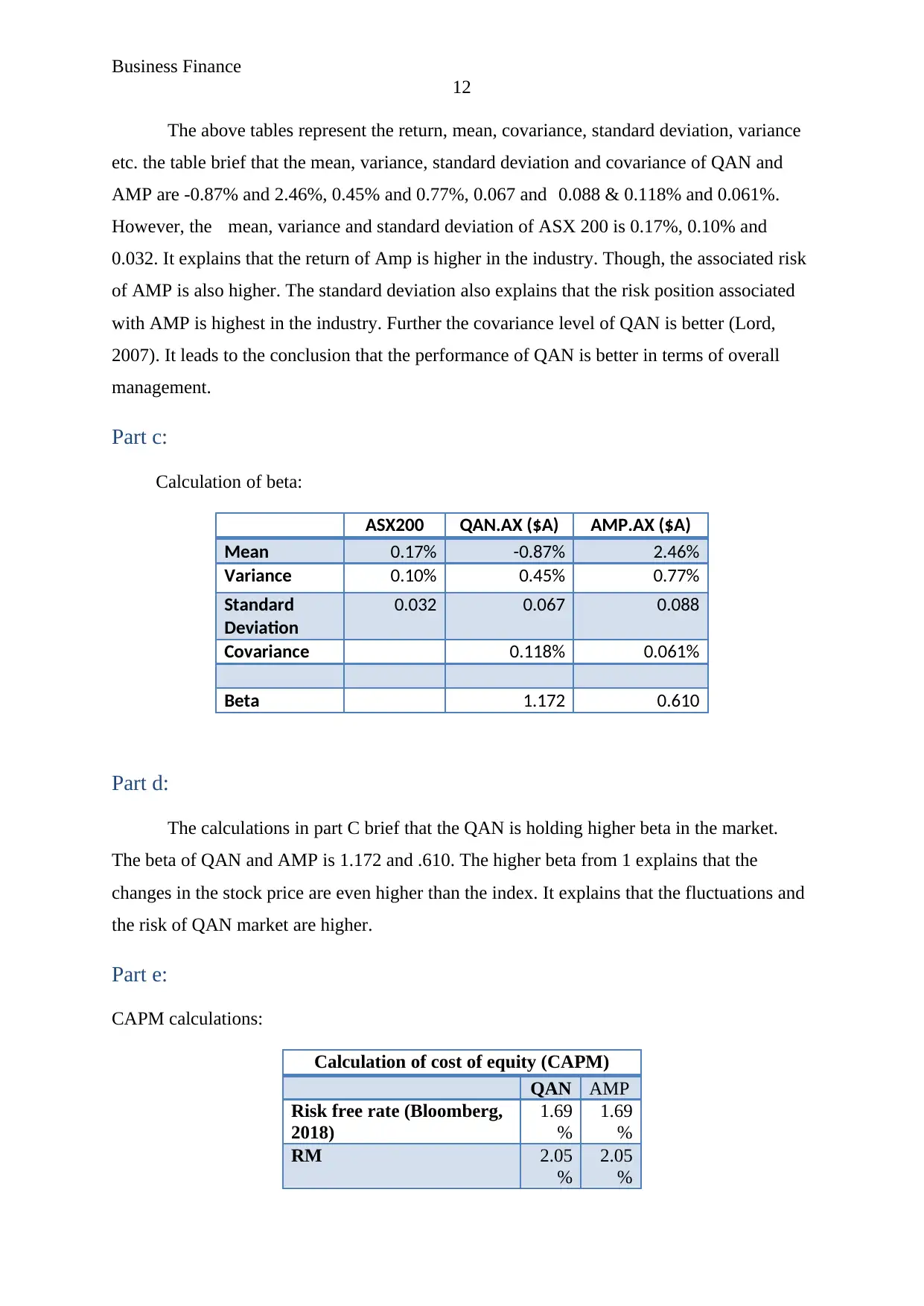

Part c:

Calculation of beta:

ASX200 QAN.AX ($A) AMP.AX ($A)

Mean 0.17% -0.87% 2.46%

Variance 0.10% 0.45% 0.77%

Standard

Deviation

0.032 0.067 0.088

Covariance 0.118% 0.061%

Beta 1.172 0.610

Part d:

The calculations in part C brief that the QAN is holding higher beta in the market.

The beta of QAN and AMP is 1.172 and .610. The higher beta from 1 explains that the

changes in the stock price are even higher than the index. It explains that the fluctuations and

the risk of QAN market are higher.

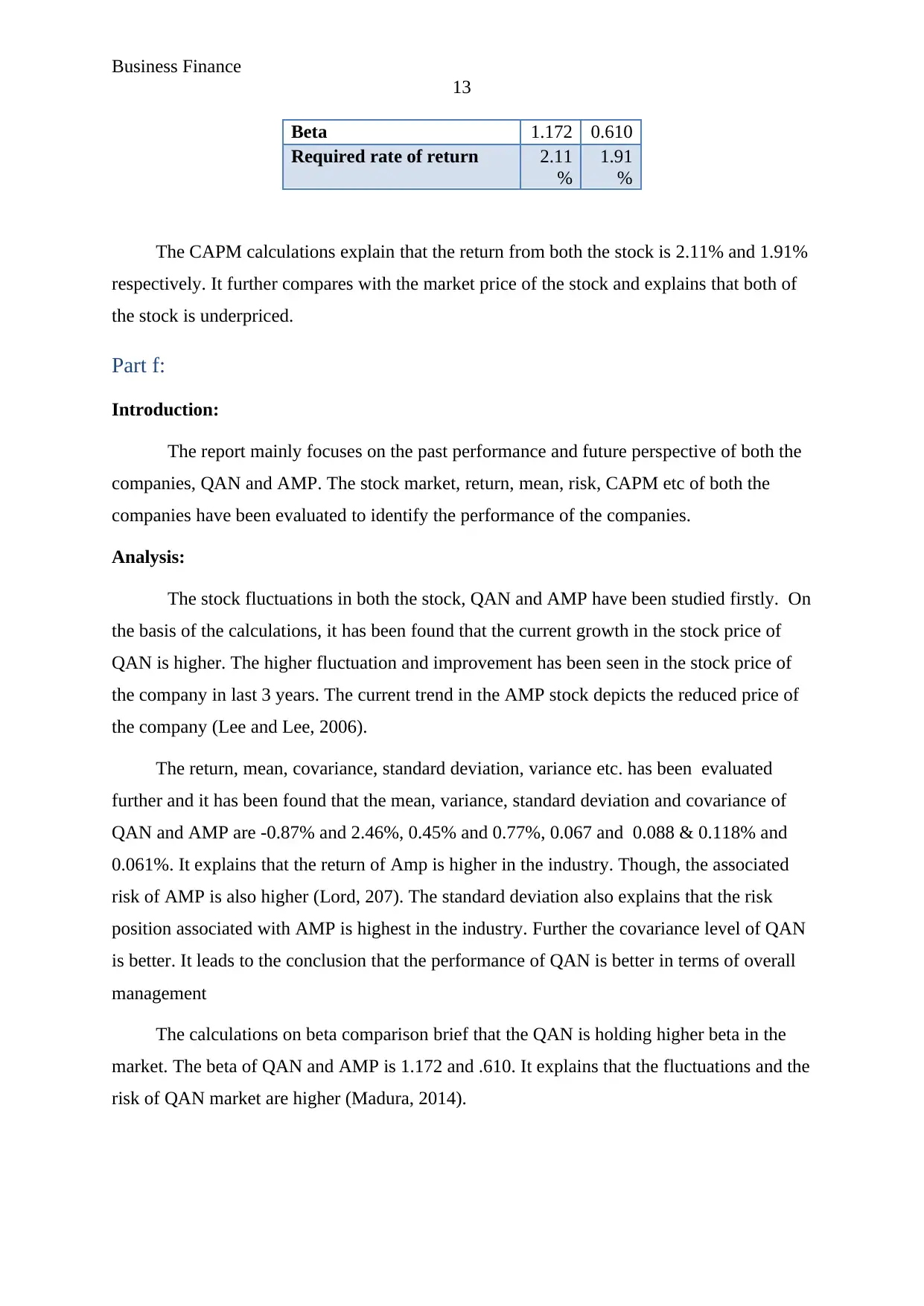

Part e:

CAPM calculations:

Calculation of cost of equity (CAPM)

QAN AMP

Risk free rate (Bloomberg,

2018)

1.69

%

1.69

%

RM 2.05

%

2.05

%

12

The above tables represent the return, mean, covariance, standard deviation, variance

etc. the table brief that the mean, variance, standard deviation and covariance of QAN and

AMP are -0.87% and 2.46%, 0.45% and 0.77%, 0.067 and 0.088 & 0.118% and 0.061%.

However, the mean, variance and standard deviation of ASX 200 is 0.17%, 0.10% and

0.032. It explains that the return of Amp is higher in the industry. Though, the associated risk

of AMP is also higher. The standard deviation also explains that the risk position associated

with AMP is highest in the industry. Further the covariance level of QAN is better (Lord,

2007). It leads to the conclusion that the performance of QAN is better in terms of overall

management.

Part c:

Calculation of beta:

ASX200 QAN.AX ($A) AMP.AX ($A)

Mean 0.17% -0.87% 2.46%

Variance 0.10% 0.45% 0.77%

Standard

Deviation

0.032 0.067 0.088

Covariance 0.118% 0.061%

Beta 1.172 0.610

Part d:

The calculations in part C brief that the QAN is holding higher beta in the market.

The beta of QAN and AMP is 1.172 and .610. The higher beta from 1 explains that the

changes in the stock price are even higher than the index. It explains that the fluctuations and

the risk of QAN market are higher.

Part e:

CAPM calculations:

Calculation of cost of equity (CAPM)

QAN AMP

Risk free rate (Bloomberg,

2018)

1.69

%

1.69

%

RM 2.05

%

2.05

%

Business Finance

13

Beta 1.172 0.610

Required rate of return 2.11

%

1.91

%

The CAPM calculations explain that the return from both the stock is 2.11% and 1.91%

respectively. It further compares with the market price of the stock and explains that both of

the stock is underpriced.

Part f:

Introduction:

The report mainly focuses on the past performance and future perspective of both the

companies, QAN and AMP. The stock market, return, mean, risk, CAPM etc of both the

companies have been evaluated to identify the performance of the companies.

Analysis:

The stock fluctuations in both the stock, QAN and AMP have been studied firstly. On

the basis of the calculations, it has been found that the current growth in the stock price of

QAN is higher. The higher fluctuation and improvement has been seen in the stock price of

the company in last 3 years. The current trend in the AMP stock depicts the reduced price of

the company (Lee and Lee, 2006).

The return, mean, covariance, standard deviation, variance etc. has been evaluated

further and it has been found that the mean, variance, standard deviation and covariance of

QAN and AMP are -0.87% and 2.46%, 0.45% and 0.77%, 0.067 and 0.088 & 0.118% and

0.061%. It explains that the return of Amp is higher in the industry. Though, the associated

risk of AMP is also higher (Lord, 207). The standard deviation also explains that the risk

position associated with AMP is highest in the industry. Further the covariance level of QAN

is better. It leads to the conclusion that the performance of QAN is better in terms of overall

management

The calculations on beta comparison brief that the QAN is holding higher beta in the

market. The beta of QAN and AMP is 1.172 and .610. It explains that the fluctuations and the

risk of QAN market are higher (Madura, 2014).

13

Beta 1.172 0.610

Required rate of return 2.11

%

1.91

%

The CAPM calculations explain that the return from both the stock is 2.11% and 1.91%

respectively. It further compares with the market price of the stock and explains that both of

the stock is underpriced.

Part f:

Introduction:

The report mainly focuses on the past performance and future perspective of both the

companies, QAN and AMP. The stock market, return, mean, risk, CAPM etc of both the

companies have been evaluated to identify the performance of the companies.

Analysis:

The stock fluctuations in both the stock, QAN and AMP have been studied firstly. On

the basis of the calculations, it has been found that the current growth in the stock price of

QAN is higher. The higher fluctuation and improvement has been seen in the stock price of

the company in last 3 years. The current trend in the AMP stock depicts the reduced price of

the company (Lee and Lee, 2006).

The return, mean, covariance, standard deviation, variance etc. has been evaluated

further and it has been found that the mean, variance, standard deviation and covariance of

QAN and AMP are -0.87% and 2.46%, 0.45% and 0.77%, 0.067 and 0.088 & 0.118% and

0.061%. It explains that the return of Amp is higher in the industry. Though, the associated

risk of AMP is also higher (Lord, 207). The standard deviation also explains that the risk

position associated with AMP is highest in the industry. Further the covariance level of QAN

is better. It leads to the conclusion that the performance of QAN is better in terms of overall

management

The calculations on beta comparison brief that the QAN is holding higher beta in the

market. The beta of QAN and AMP is 1.172 and .610. It explains that the fluctuations and the

risk of QAN market are higher (Madura, 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance

14

The CAPM calculations further explain that the return from both the stock is 2.11% and

1.91% respectively. It further compares with the market price of the stock and explains that

both of the stock is underpriced.

Conclusion:

On the basis of the overall analysis on both the stocks, it has been found that QAN

past performance has been improved a lot and it further explains that in near future, the

performance and the stock position of the business would improve much. Further, in case of

Amp, it could be concluded that from last few months, the position of the company has been

reduced but the strategies and management plan would help the business to cover up soon

and the performance of the company would be stable again.

14

The CAPM calculations further explain that the return from both the stock is 2.11% and

1.91% respectively. It further compares with the market price of the stock and explains that

both of the stock is underpriced.

Conclusion:

On the basis of the overall analysis on both the stocks, it has been found that QAN

past performance has been improved a lot and it further explains that in near future, the

performance and the stock position of the business would improve much. Further, in case of

Amp, it could be concluded that from last few months, the position of the company has been

reduced but the strategies and management plan would help the business to cover up soon

and the performance of the company would be stable again.

Business Finance

15

References:

Gapenski, L.C., 2008. Healthcare finance: an introduction to accounting and financial

management. Health Administration Press.

Higgins, R. C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Hillier, D., Grinblatt, M. and Titman, S., 2011. Financial markets and corporate strategy.

McGraw Hill.

Horngren, C.T., 2009. Cost accounting: A managerial emphasis, 13/e. Pearson Education

India.

Jiashu, G., 2009. Study on Fair Value Accounting——on the essential characteristics of

financial accounting [J]. Accounting Research, 5, p.003.

Lee.C.F and Lee, A, C,.2006. Encyclopedia of finance, Springer science, new York

Lord, B.R., 2007. Strategic management accounting. Issues in Management Accounting, 3 (2)

p. 6.

Lumby,S and Jones,C,.2007. Corporate finance theory & practice, 7th edition, Thomson,

London

Madura, J. 2014. Financial Markets and Institutions. Cengage Learning.

15

References:

Gapenski, L.C., 2008. Healthcare finance: an introduction to accounting and financial

management. Health Administration Press.

Higgins, R. C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Hillier, D., Grinblatt, M. and Titman, S., 2011. Financial markets and corporate strategy.

McGraw Hill.

Horngren, C.T., 2009. Cost accounting: A managerial emphasis, 13/e. Pearson Education

India.

Jiashu, G., 2009. Study on Fair Value Accounting——on the essential characteristics of

financial accounting [J]. Accounting Research, 5, p.003.

Lee.C.F and Lee, A, C,.2006. Encyclopedia of finance, Springer science, new York

Lord, B.R., 2007. Strategic management accounting. Issues in Management Accounting, 3 (2)

p. 6.

Lumby,S and Jones,C,.2007. Corporate finance theory & practice, 7th edition, Thomson,

London

Madura, J. 2014. Financial Markets and Institutions. Cengage Learning.

1 out of 15

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.