Business Finance Report: Risk Analysis, Return, and CAPM Modeling

VerifiedAdded on 2023/06/06

|10

|2485

|80

Report

AI Summary

This report provides a comprehensive analysis of business finance principles, focusing on risk and return assessment and capital budgeting techniques. Part A delves into risk and return calculations, including continuously compounded monthly returns for stocks and market indices, correlation coeffici...

Running head: BUSINESS FINANCE

Business Finance

Name of the Student:

Name of the University:

Authors Note:

Business Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

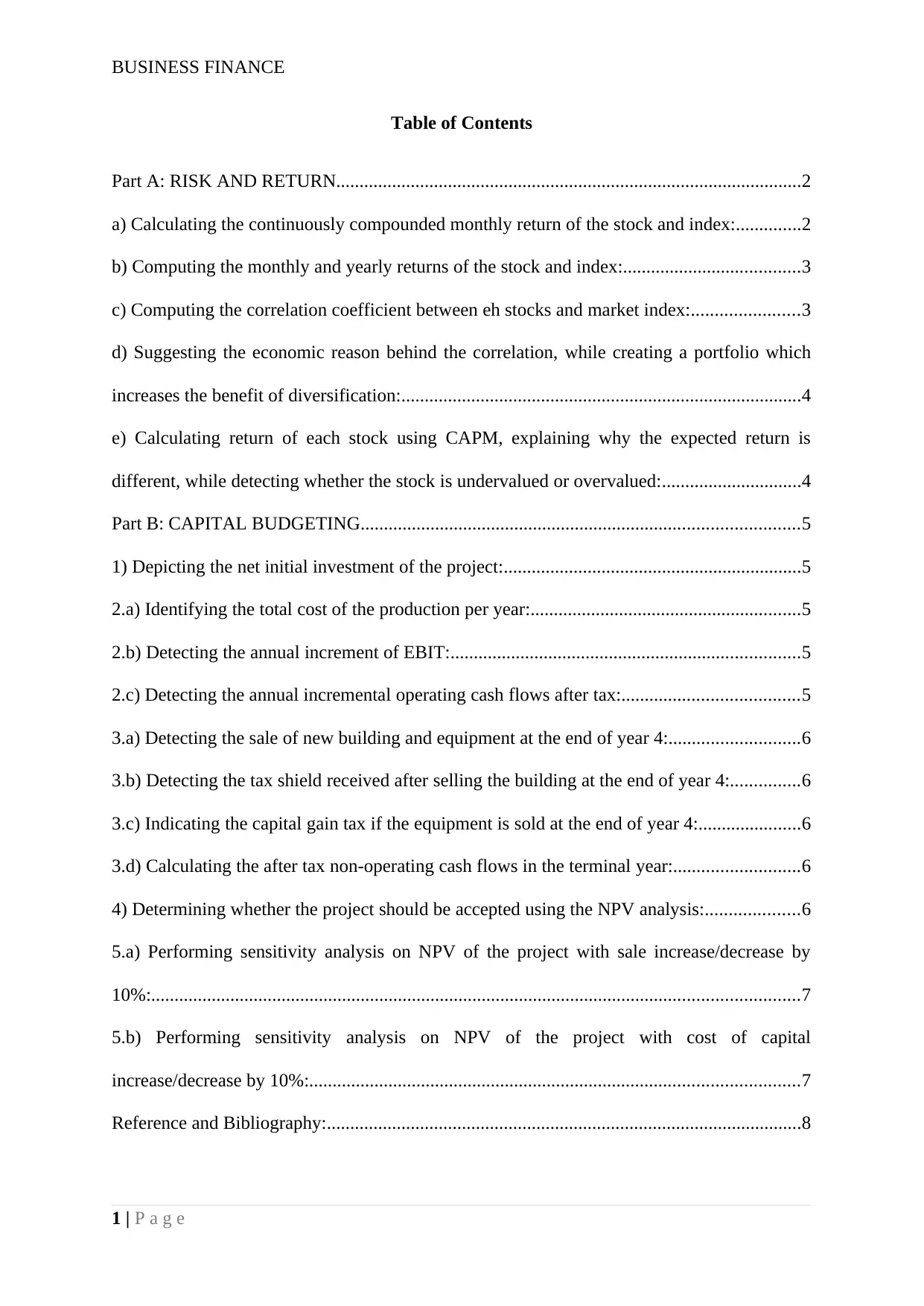

Table of Contents

Part A: RISK AND RETURN....................................................................................................2

a) Calculating the continuously compounded monthly return of the stock and index:..............2

b) Computing the monthly and yearly returns of the stock and index:......................................3

c) Computing the correlation coefficient between eh stocks and market index:.......................3

d) Suggesting the economic reason behind the correlation, while creating a portfolio which

increases the benefit of diversification:......................................................................................4

e) Calculating return of each stock using CAPM, explaining why the expected return is

different, while detecting whether the stock is undervalued or overvalued:..............................4

Part B: CAPITAL BUDGETING..............................................................................................5

1) Depicting the net initial investment of the project:................................................................5

2.a) Identifying the total cost of the production per year:..........................................................5

2.b) Detecting the annual increment of EBIT:...........................................................................5

2.c) Detecting the annual incremental operating cash flows after tax:......................................5

3.a) Detecting the sale of new building and equipment at the end of year 4:............................6

3.b) Detecting the tax shield received after selling the building at the end of year 4:...............6

3.c) Indicating the capital gain tax if the equipment is sold at the end of year 4:......................6

3.d) Calculating the after tax non-operating cash flows in the terminal year:...........................6

4) Determining whether the project should be accepted using the NPV analysis:....................6

5.a) Performing sensitivity analysis on NPV of the project with sale increase/decrease by

10%:...........................................................................................................................................7

5.b) Performing sensitivity analysis on NPV of the project with cost of capital

increase/decrease by 10%:.........................................................................................................7

Reference and Bibliography:......................................................................................................8

1 | P a g e

Table of Contents

Part A: RISK AND RETURN....................................................................................................2

a) Calculating the continuously compounded monthly return of the stock and index:..............2

b) Computing the monthly and yearly returns of the stock and index:......................................3

c) Computing the correlation coefficient between eh stocks and market index:.......................3

d) Suggesting the economic reason behind the correlation, while creating a portfolio which

increases the benefit of diversification:......................................................................................4

e) Calculating return of each stock using CAPM, explaining why the expected return is

different, while detecting whether the stock is undervalued or overvalued:..............................4

Part B: CAPITAL BUDGETING..............................................................................................5

1) Depicting the net initial investment of the project:................................................................5

2.a) Identifying the total cost of the production per year:..........................................................5

2.b) Detecting the annual increment of EBIT:...........................................................................5

2.c) Detecting the annual incremental operating cash flows after tax:......................................5

3.a) Detecting the sale of new building and equipment at the end of year 4:............................6

3.b) Detecting the tax shield received after selling the building at the end of year 4:...............6

3.c) Indicating the capital gain tax if the equipment is sold at the end of year 4:......................6

3.d) Calculating the after tax non-operating cash flows in the terminal year:...........................6

4) Determining whether the project should be accepted using the NPV analysis:....................6

5.a) Performing sensitivity analysis on NPV of the project with sale increase/decrease by

10%:...........................................................................................................................................7

5.b) Performing sensitivity analysis on NPV of the project with cost of capital

increase/decrease by 10%:.........................................................................................................7

Reference and Bibliography:......................................................................................................8

1 | P a g e

BUSINESS FINANCE

Part A: RISK AND RETURN

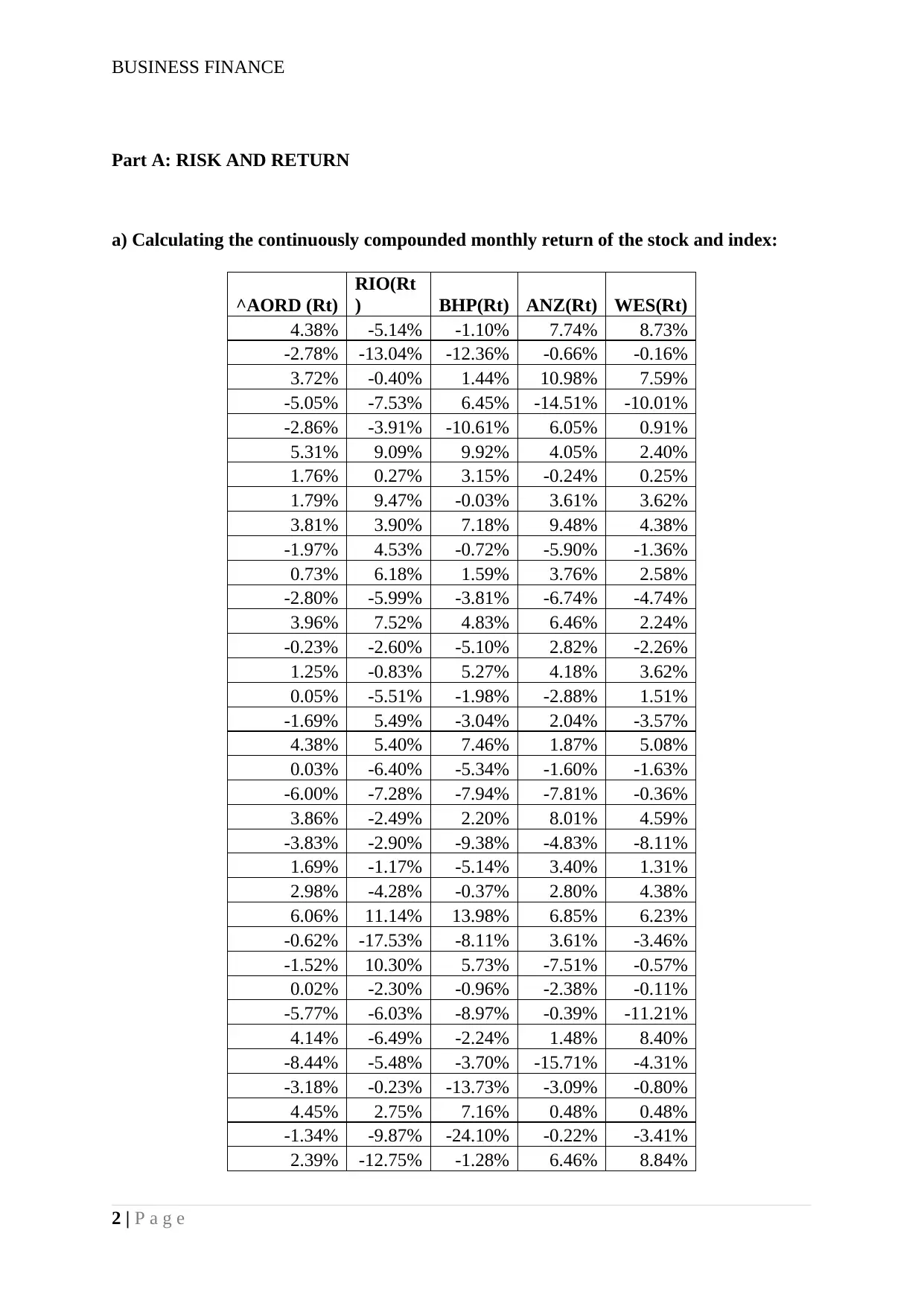

a) Calculating the continuously compounded monthly return of the stock and index:

^AORD (Rt)

RIO(Rt

) BHP(Rt) ANZ(Rt) WES(Rt)

4.38% -5.14% -1.10% 7.74% 8.73%

-2.78% -13.04% -12.36% -0.66% -0.16%

3.72% -0.40% 1.44% 10.98% 7.59%

-5.05% -7.53% 6.45% -14.51% -10.01%

-2.86% -3.91% -10.61% 6.05% 0.91%

5.31% 9.09% 9.92% 4.05% 2.40%

1.76% 0.27% 3.15% -0.24% 0.25%

1.79% 9.47% -0.03% 3.61% 3.62%

3.81% 3.90% 7.18% 9.48% 4.38%

-1.97% 4.53% -0.72% -5.90% -1.36%

0.73% 6.18% 1.59% 3.76% 2.58%

-2.80% -5.99% -3.81% -6.74% -4.74%

3.96% 7.52% 4.83% 6.46% 2.24%

-0.23% -2.60% -5.10% 2.82% -2.26%

1.25% -0.83% 5.27% 4.18% 3.62%

0.05% -5.51% -1.98% -2.88% 1.51%

-1.69% 5.49% -3.04% 2.04% -3.57%

4.38% 5.40% 7.46% 1.87% 5.08%

0.03% -6.40% -5.34% -1.60% -1.63%

-6.00% -7.28% -7.94% -7.81% -0.36%

3.86% -2.49% 2.20% 8.01% 4.59%

-3.83% -2.90% -9.38% -4.83% -8.11%

1.69% -1.17% -5.14% 3.40% 1.31%

2.98% -4.28% -0.37% 2.80% 4.38%

6.06% 11.14% 13.98% 6.85% 6.23%

-0.62% -17.53% -8.11% 3.61% -3.46%

-1.52% 10.30% 5.73% -7.51% -0.57%

0.02% -2.30% -0.96% -2.38% -0.11%

-5.77% -6.03% -8.97% -0.39% -11.21%

4.14% -6.49% -2.24% 1.48% 8.40%

-8.44% -5.48% -3.70% -15.71% -4.31%

-3.18% -0.23% -13.73% -3.09% -0.80%

4.45% 2.75% 7.16% 0.48% 0.48%

-1.34% -9.87% -24.10% -0.22% -3.41%

2.39% -12.75% -1.28% 6.46% 8.84%

2 | P a g e

Part A: RISK AND RETURN

a) Calculating the continuously compounded monthly return of the stock and index:

^AORD (Rt)

RIO(Rt

) BHP(Rt) ANZ(Rt) WES(Rt)

4.38% -5.14% -1.10% 7.74% 8.73%

-2.78% -13.04% -12.36% -0.66% -0.16%

3.72% -0.40% 1.44% 10.98% 7.59%

-5.05% -7.53% 6.45% -14.51% -10.01%

-2.86% -3.91% -10.61% 6.05% 0.91%

5.31% 9.09% 9.92% 4.05% 2.40%

1.76% 0.27% 3.15% -0.24% 0.25%

1.79% 9.47% -0.03% 3.61% 3.62%

3.81% 3.90% 7.18% 9.48% 4.38%

-1.97% 4.53% -0.72% -5.90% -1.36%

0.73% 6.18% 1.59% 3.76% 2.58%

-2.80% -5.99% -3.81% -6.74% -4.74%

3.96% 7.52% 4.83% 6.46% 2.24%

-0.23% -2.60% -5.10% 2.82% -2.26%

1.25% -0.83% 5.27% 4.18% 3.62%

0.05% -5.51% -1.98% -2.88% 1.51%

-1.69% 5.49% -3.04% 2.04% -3.57%

4.38% 5.40% 7.46% 1.87% 5.08%

0.03% -6.40% -5.34% -1.60% -1.63%

-6.00% -7.28% -7.94% -7.81% -0.36%

3.86% -2.49% 2.20% 8.01% 4.59%

-3.83% -2.90% -9.38% -4.83% -8.11%

1.69% -1.17% -5.14% 3.40% 1.31%

2.98% -4.28% -0.37% 2.80% 4.38%

6.06% 11.14% 13.98% 6.85% 6.23%

-0.62% -17.53% -8.11% 3.61% -3.46%

-1.52% 10.30% 5.73% -7.51% -0.57%

0.02% -2.30% -0.96% -2.38% -0.11%

-5.77% -6.03% -8.97% -0.39% -11.21%

4.14% -6.49% -2.24% 1.48% 8.40%

-8.44% -5.48% -3.70% -15.71% -4.31%

-3.18% -0.23% -13.73% -3.09% -0.80%

4.45% 2.75% 7.16% 0.48% 0.48%

-1.34% -9.87% -24.10% -0.22% -3.41%

2.39% -12.75% -1.28% 6.46% 8.84%

2 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUSINESS FINANCE

-5.54% -16.66% -15.14% -14.42% 1.34%

-2.17% 5.72% 1.42% -7.65% -7.58%

4.04% 11.87% 7.96% 4.62% 8.14%

3.14% 17.45% 21.63% 3.39% 3.13%

2.45% -18.27% -8.05% 4.87% -5.13%

-2.55% 11.00% -2.28% -2.25% -1.31%

6.09% 4.74% 4.56% 6.89% 6.82%

-2.05% -8.42% 4.56% 4.02% -1.15%

-0.08% 11.54% 9.12% 2.68% 6.00%

-2.25% 4.25% 3.95% 0.79% -7.26%

1.83% 8.42% 5.65% 1.99% 1.86%

3.86% 1.44% 2.63% 9.70% 0.86%

-0.77% 15.24% 6.11% -3.79% -4.56%

1.50% -7.58% -6.35% 5.35% 5.93%

2.45% 0.72% -3.92% 2.93% 7.77%

0.74% -2.14% 0.79% 2.91% -4.70%

-3.18% 1.22% 0.76% -15.66% -0.70%

0.05% 4.84% -2.63% 5.15% -6.23%

0.17% 11.32% 10.47% 3.12% 1.51%

0.04% 3.53% 5.75% -0.78% 4.54%

-0.55% -1.57% -6.02% 0.68% -0.22%

3.95% 1.56% 4.83% 1.08% 1.13%

1.34% -0.06% 2.82% -5.00% 4.95%

1.80% 9.99% 7.99% 3.65% 1.13%

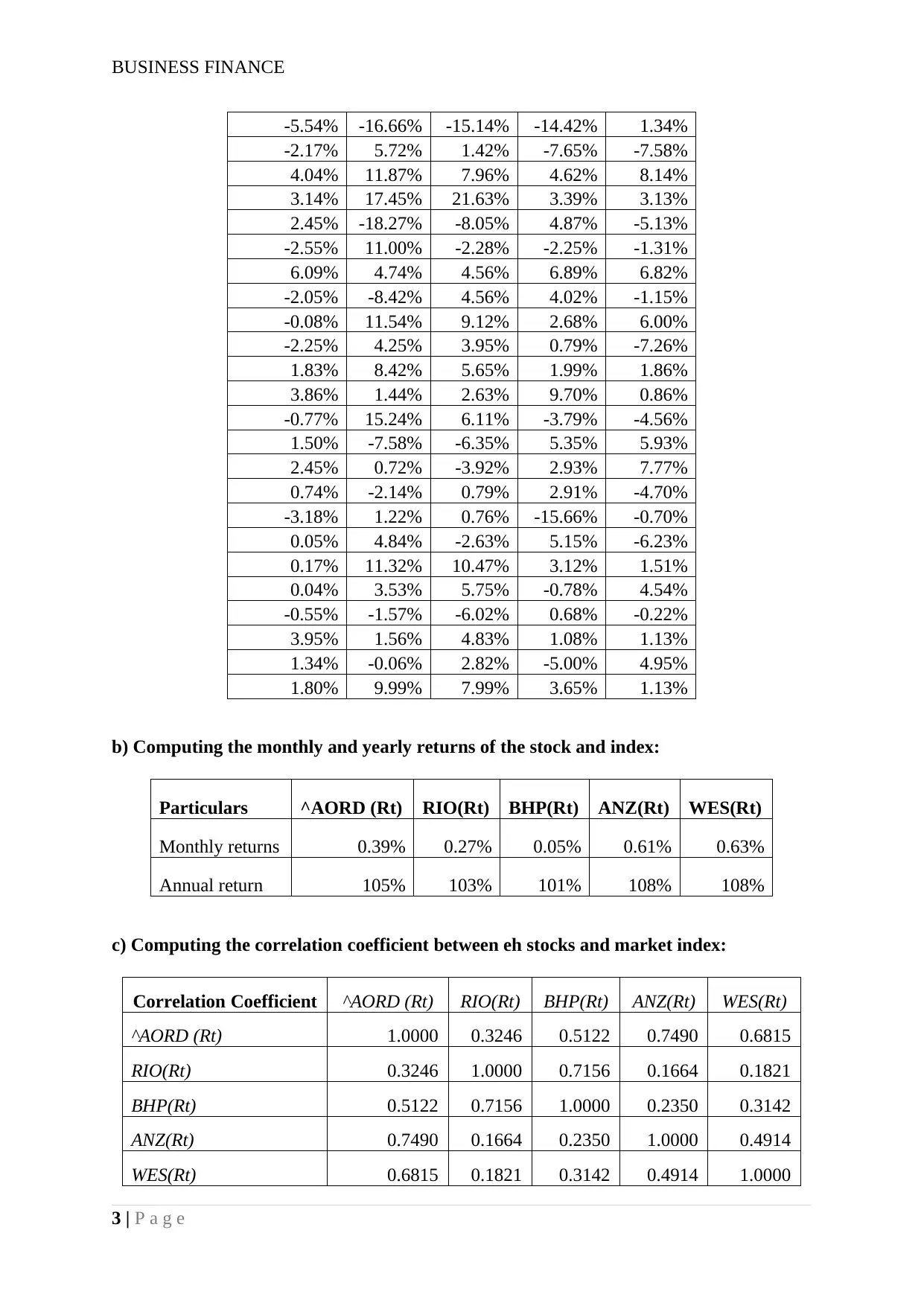

b) Computing the monthly and yearly returns of the stock and index:

Particulars ^AORD (Rt) RIO(Rt) BHP(Rt) ANZ(Rt) WES(Rt)

Monthly returns 0.39% 0.27% 0.05% 0.61% 0.63%

Annual return 105% 103% 101% 108% 108%

c) Computing the correlation coefficient between eh stocks and market index:

Correlation Coefficient ^AORD (Rt) RIO(Rt) BHP(Rt) ANZ(Rt) WES(Rt)

^AORD (Rt) 1.0000 0.3246 0.5122 0.7490 0.6815

RIO(Rt) 0.3246 1.0000 0.7156 0.1664 0.1821

BHP(Rt) 0.5122 0.7156 1.0000 0.2350 0.3142

ANZ(Rt) 0.7490 0.1664 0.2350 1.0000 0.4914

WES(Rt) 0.6815 0.1821 0.3142 0.4914 1.0000

3 | P a g e

-5.54% -16.66% -15.14% -14.42% 1.34%

-2.17% 5.72% 1.42% -7.65% -7.58%

4.04% 11.87% 7.96% 4.62% 8.14%

3.14% 17.45% 21.63% 3.39% 3.13%

2.45% -18.27% -8.05% 4.87% -5.13%

-2.55% 11.00% -2.28% -2.25% -1.31%

6.09% 4.74% 4.56% 6.89% 6.82%

-2.05% -8.42% 4.56% 4.02% -1.15%

-0.08% 11.54% 9.12% 2.68% 6.00%

-2.25% 4.25% 3.95% 0.79% -7.26%

1.83% 8.42% 5.65% 1.99% 1.86%

3.86% 1.44% 2.63% 9.70% 0.86%

-0.77% 15.24% 6.11% -3.79% -4.56%

1.50% -7.58% -6.35% 5.35% 5.93%

2.45% 0.72% -3.92% 2.93% 7.77%

0.74% -2.14% 0.79% 2.91% -4.70%

-3.18% 1.22% 0.76% -15.66% -0.70%

0.05% 4.84% -2.63% 5.15% -6.23%

0.17% 11.32% 10.47% 3.12% 1.51%

0.04% 3.53% 5.75% -0.78% 4.54%

-0.55% -1.57% -6.02% 0.68% -0.22%

3.95% 1.56% 4.83% 1.08% 1.13%

1.34% -0.06% 2.82% -5.00% 4.95%

1.80% 9.99% 7.99% 3.65% 1.13%

b) Computing the monthly and yearly returns of the stock and index:

Particulars ^AORD (Rt) RIO(Rt) BHP(Rt) ANZ(Rt) WES(Rt)

Monthly returns 0.39% 0.27% 0.05% 0.61% 0.63%

Annual return 105% 103% 101% 108% 108%

c) Computing the correlation coefficient between eh stocks and market index:

Correlation Coefficient ^AORD (Rt) RIO(Rt) BHP(Rt) ANZ(Rt) WES(Rt)

^AORD (Rt) 1.0000 0.3246 0.5122 0.7490 0.6815

RIO(Rt) 0.3246 1.0000 0.7156 0.1664 0.1821

BHP(Rt) 0.5122 0.7156 1.0000 0.2350 0.3142

ANZ(Rt) 0.7490 0.1664 0.2350 1.0000 0.4914

WES(Rt) 0.6815 0.1821 0.3142 0.4914 1.0000

3 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

From the evaluation of above table, it can be identified that the highest correlation is

between Rio Tinto and BHP Billiton, where the values are at the levels of 0.7156. In addition,

the least correlation is between ANZ Bank and Rio Tinto, where the values are at the levels

of 0.1664. Further evaluation of the correlation table indicates that ANZ Bank has the highest

correlation with the market, while Rio Tinto has the lowest correlation (Fang et al. 2018).

d) Suggesting the economic reason behind the correlation, while creating a portfolio

which increases the benefit of diversification:

There are certain economic reasons behind the correlation between the high and low

correlated organisations. The high correlation between Rio Tinto and BHP Billiton is because

of their underlying industry, where both the companies fall under mining industry of

Australia. Hence, the changes in values of mining industry directly affect the share price

valuation of both Rio Tinto and BHP Billiton. The low correlation is between ANZ Bank and

Rio Tinto, as both the companies fall in different sectors. The changes in market conditions

of Rio Tinto alter the share price valuation of the organisation, where increment in one will

result in slow improvement of other. Therefore, using ANZ Bank and Rio Tinto for

diversification could eventually help the portfolio to minimise the risk from investment.

e) Calculating return of each stock using CAPM, explaining why the expected return is

different, while detecting whether the stock is undervalued or overvalued:

Particulars ^AORD (Rt) RIO(Rt) BHP(Rt) ANZ(Rt) WES(Rt)

Standard Deviation 0.032444732 0.08068 0.076442 0.060728 0.047715

Beta 1.24 2.07 3.80 4.40

CAPM 7.08% 10.79% 18.61% 21.31%

4 | P a g e

From the evaluation of above table, it can be identified that the highest correlation is

between Rio Tinto and BHP Billiton, where the values are at the levels of 0.7156. In addition,

the least correlation is between ANZ Bank and Rio Tinto, where the values are at the levels

of 0.1664. Further evaluation of the correlation table indicates that ANZ Bank has the highest

correlation with the market, while Rio Tinto has the lowest correlation (Fang et al. 2018).

d) Suggesting the economic reason behind the correlation, while creating a portfolio

which increases the benefit of diversification:

There are certain economic reasons behind the correlation between the high and low

correlated organisations. The high correlation between Rio Tinto and BHP Billiton is because

of their underlying industry, where both the companies fall under mining industry of

Australia. Hence, the changes in values of mining industry directly affect the share price

valuation of both Rio Tinto and BHP Billiton. The low correlation is between ANZ Bank and

Rio Tinto, as both the companies fall in different sectors. The changes in market conditions

of Rio Tinto alter the share price valuation of the organisation, where increment in one will

result in slow improvement of other. Therefore, using ANZ Bank and Rio Tinto for

diversification could eventually help the portfolio to minimise the risk from investment.

e) Calculating return of each stock using CAPM, explaining why the expected return is

different, while detecting whether the stock is undervalued or overvalued:

Particulars ^AORD (Rt) RIO(Rt) BHP(Rt) ANZ(Rt) WES(Rt)

Standard Deviation 0.032444732 0.08068 0.076442 0.060728 0.047715

Beta 1.24 2.07 3.80 4.40

CAPM 7.08% 10.79% 18.61% 21.31%

4 | P a g e

BUSINESS FINANCE

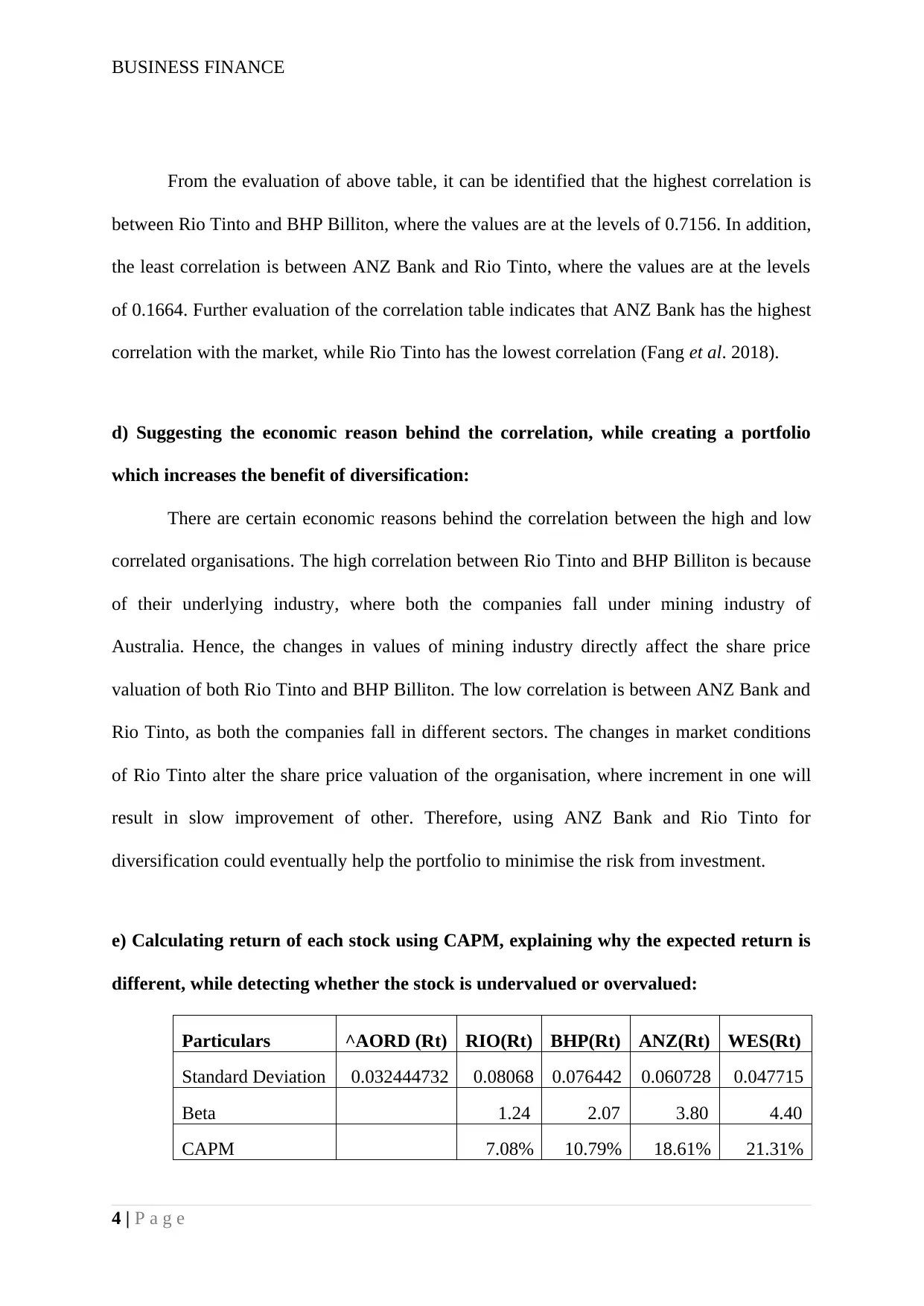

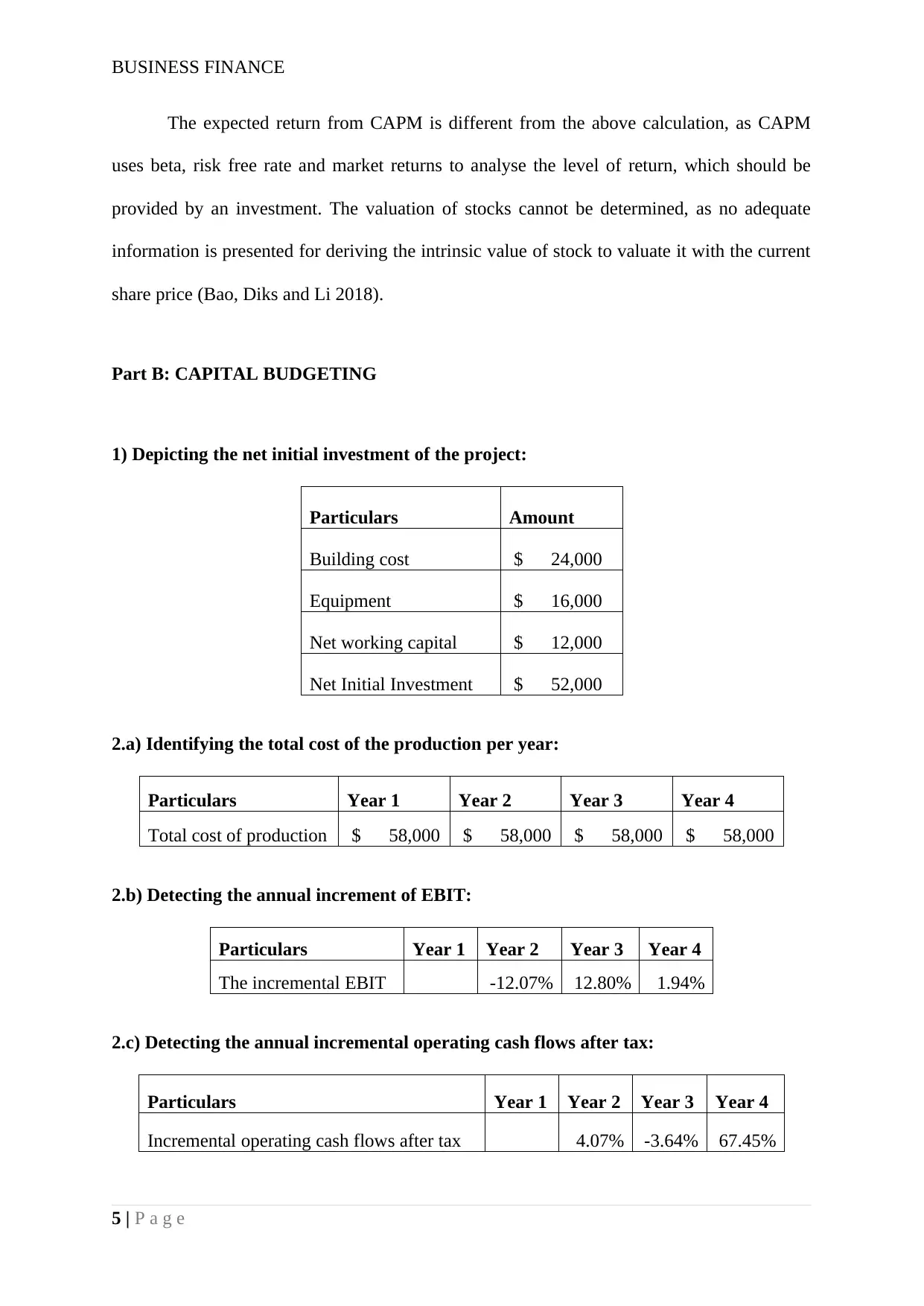

The expected return from CAPM is different from the above calculation, as CAPM

uses beta, risk free rate and market returns to analyse the level of return, which should be

provided by an investment. The valuation of stocks cannot be determined, as no adequate

information is presented for deriving the intrinsic value of stock to valuate it with the current

share price (Bao, Diks and Li 2018).

Part B: CAPITAL BUDGETING

1) Depicting the net initial investment of the project:

Particulars Amount

Building cost $ 24,000

Equipment $ 16,000

Net working capital $ 12,000

Net Initial Investment $ 52,000

2.a) Identifying the total cost of the production per year:

Particulars Year 1 Year 2 Year 3 Year 4

Total cost of production $ 58,000 $ 58,000 $ 58,000 $ 58,000

2.b) Detecting the annual increment of EBIT:

Particulars Year 1 Year 2 Year 3 Year 4

The incremental EBIT -12.07% 12.80% 1.94%

2.c) Detecting the annual incremental operating cash flows after tax:

Particulars Year 1 Year 2 Year 3 Year 4

Incremental operating cash flows after tax 4.07% -3.64% 67.45%

5 | P a g e

The expected return from CAPM is different from the above calculation, as CAPM

uses beta, risk free rate and market returns to analyse the level of return, which should be

provided by an investment. The valuation of stocks cannot be determined, as no adequate

information is presented for deriving the intrinsic value of stock to valuate it with the current

share price (Bao, Diks and Li 2018).

Part B: CAPITAL BUDGETING

1) Depicting the net initial investment of the project:

Particulars Amount

Building cost $ 24,000

Equipment $ 16,000

Net working capital $ 12,000

Net Initial Investment $ 52,000

2.a) Identifying the total cost of the production per year:

Particulars Year 1 Year 2 Year 3 Year 4

Total cost of production $ 58,000 $ 58,000 $ 58,000 $ 58,000

2.b) Detecting the annual increment of EBIT:

Particulars Year 1 Year 2 Year 3 Year 4

The incremental EBIT -12.07% 12.80% 1.94%

2.c) Detecting the annual incremental operating cash flows after tax:

Particulars Year 1 Year 2 Year 3 Year 4

Incremental operating cash flows after tax 4.07% -3.64% 67.45%

5 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUSINESS FINANCE

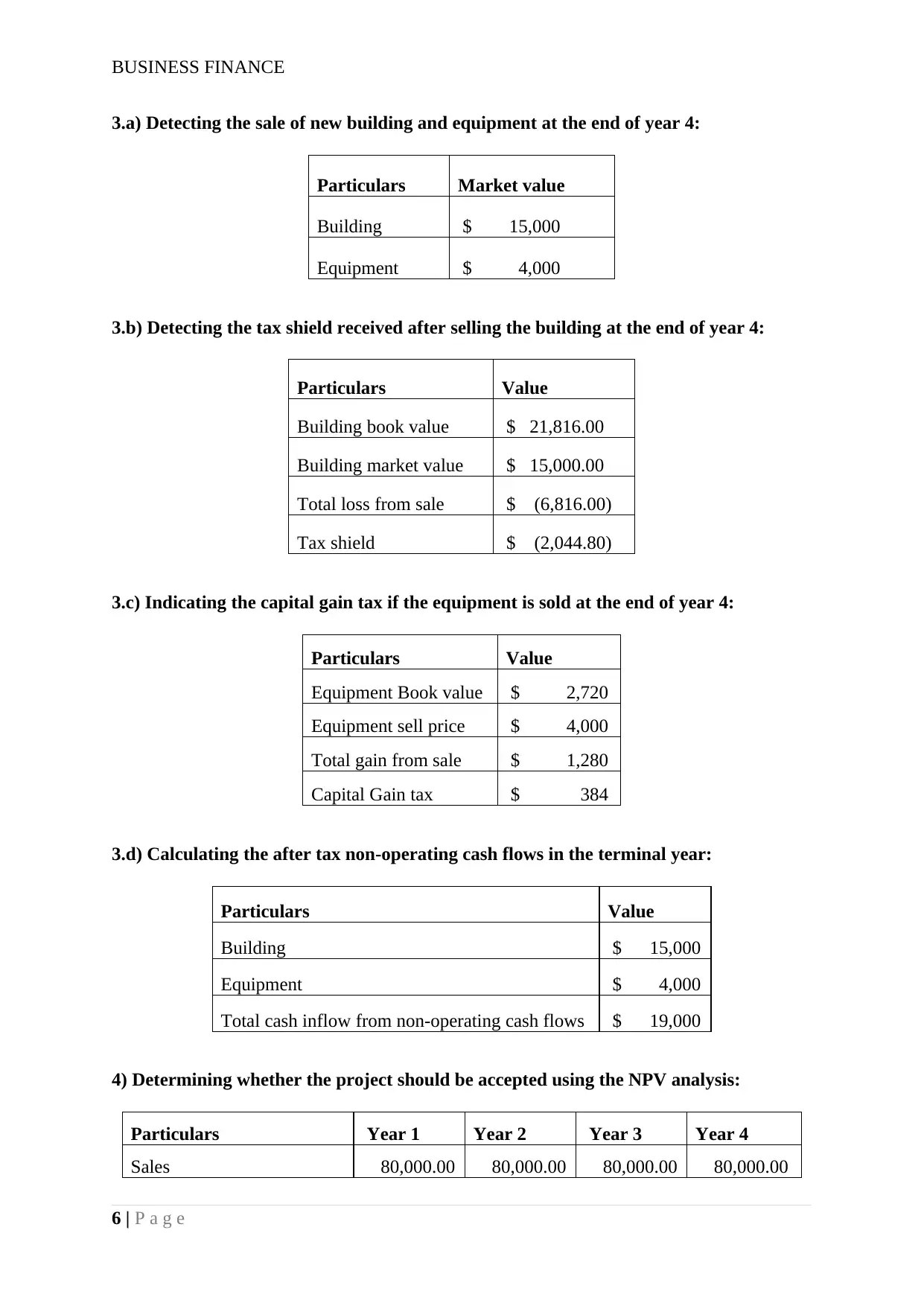

3.a) Detecting the sale of new building and equipment at the end of year 4:

Particulars Market value

Building $ 15,000

Equipment $ 4,000

3.b) Detecting the tax shield received after selling the building at the end of year 4:

Particulars Value

Building book value $ 21,816.00

Building market value $ 15,000.00

Total loss from sale $ (6,816.00)

Tax shield $ (2,044.80)

3.c) Indicating the capital gain tax if the equipment is sold at the end of year 4:

Particulars Value

Equipment Book value $ 2,720

Equipment sell price $ 4,000

Total gain from sale $ 1,280

Capital Gain tax $ 384

3.d) Calculating the after tax non-operating cash flows in the terminal year:

Particulars Value

Building $ 15,000

Equipment $ 4,000

Total cash inflow from non-operating cash flows $ 19,000

4) Determining whether the project should be accepted using the NPV analysis:

Particulars Year 1 Year 2 Year 3 Year 4

Sales 80,000.00 80,000.00 80,000.00 80,000.00

6 | P a g e

3.a) Detecting the sale of new building and equipment at the end of year 4:

Particulars Market value

Building $ 15,000

Equipment $ 4,000

3.b) Detecting the tax shield received after selling the building at the end of year 4:

Particulars Value

Building book value $ 21,816.00

Building market value $ 15,000.00

Total loss from sale $ (6,816.00)

Tax shield $ (2,044.80)

3.c) Indicating the capital gain tax if the equipment is sold at the end of year 4:

Particulars Value

Equipment Book value $ 2,720

Equipment sell price $ 4,000

Total gain from sale $ 1,280

Capital Gain tax $ 384

3.d) Calculating the after tax non-operating cash flows in the terminal year:

Particulars Value

Building $ 15,000

Equipment $ 4,000

Total cash inflow from non-operating cash flows $ 19,000

4) Determining whether the project should be accepted using the NPV analysis:

Particulars Year 1 Year 2 Year 3 Year 4

Sales 80,000.00 80,000.00 80,000.00 80,000.00

6 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUSINESS FINANCE

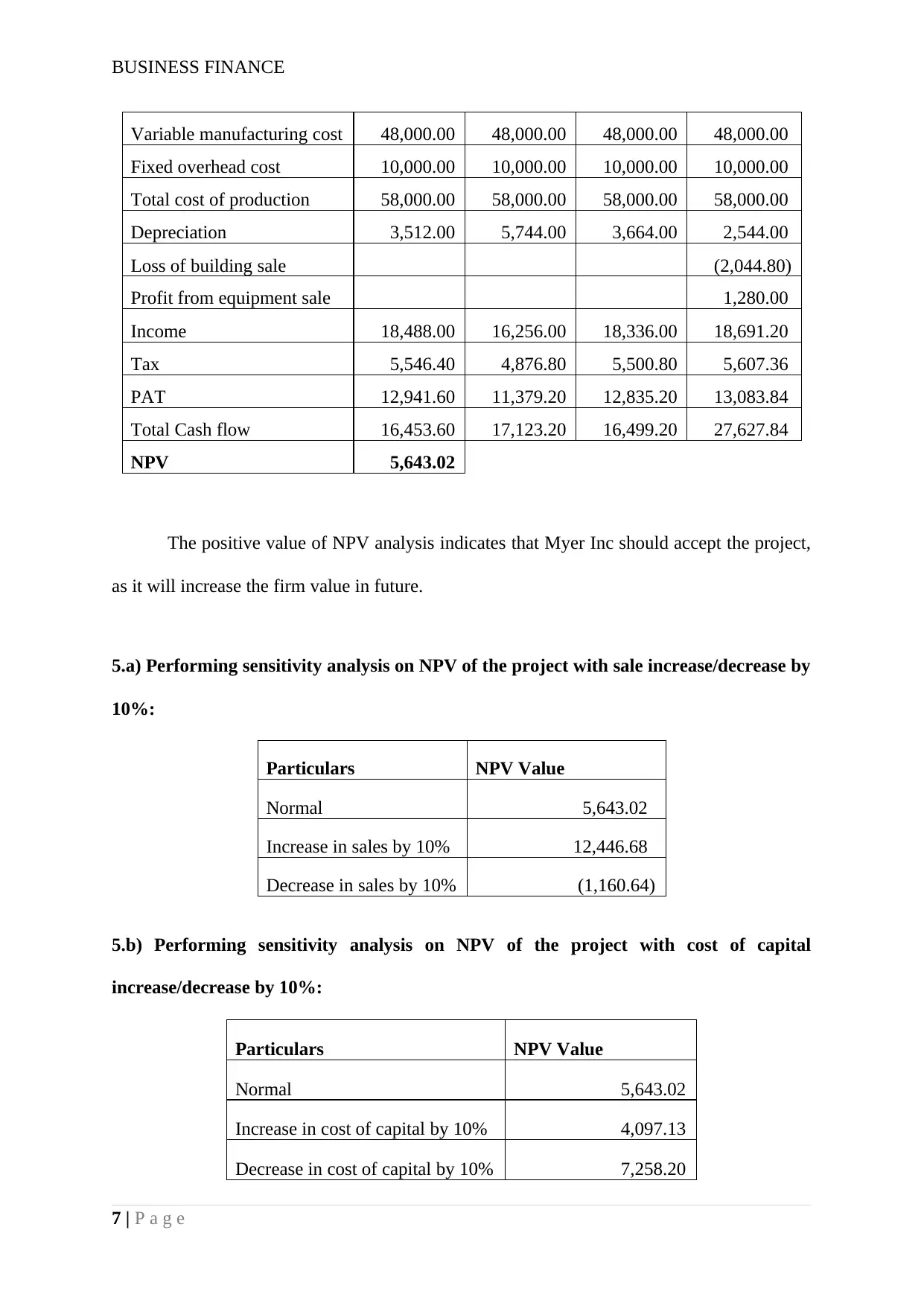

Variable manufacturing cost 48,000.00 48,000.00 48,000.00 48,000.00

Fixed overhead cost 10,000.00 10,000.00 10,000.00 10,000.00

Total cost of production 58,000.00 58,000.00 58,000.00 58,000.00

Depreciation 3,512.00 5,744.00 3,664.00 2,544.00

Loss of building sale (2,044.80)

Profit from equipment sale 1,280.00

Income 18,488.00 16,256.00 18,336.00 18,691.20

Tax 5,546.40 4,876.80 5,500.80 5,607.36

PAT 12,941.60 11,379.20 12,835.20 13,083.84

Total Cash flow 16,453.60 17,123.20 16,499.20 27,627.84

NPV 5,643.02

The positive value of NPV analysis indicates that Myer Inc should accept the project,

as it will increase the firm value in future.

5.a) Performing sensitivity analysis on NPV of the project with sale increase/decrease by

10%:

Particulars NPV Value

Normal 5,643.02

Increase in sales by 10% 12,446.68

Decrease in sales by 10% (1,160.64)

5.b) Performing sensitivity analysis on NPV of the project with cost of capital

increase/decrease by 10%:

Particulars NPV Value

Normal 5,643.02

Increase in cost of capital by 10% 4,097.13

Decrease in cost of capital by 10% 7,258.20

7 | P a g e

Variable manufacturing cost 48,000.00 48,000.00 48,000.00 48,000.00

Fixed overhead cost 10,000.00 10,000.00 10,000.00 10,000.00

Total cost of production 58,000.00 58,000.00 58,000.00 58,000.00

Depreciation 3,512.00 5,744.00 3,664.00 2,544.00

Loss of building sale (2,044.80)

Profit from equipment sale 1,280.00

Income 18,488.00 16,256.00 18,336.00 18,691.20

Tax 5,546.40 4,876.80 5,500.80 5,607.36

PAT 12,941.60 11,379.20 12,835.20 13,083.84

Total Cash flow 16,453.60 17,123.20 16,499.20 27,627.84

NPV 5,643.02

The positive value of NPV analysis indicates that Myer Inc should accept the project,

as it will increase the firm value in future.

5.a) Performing sensitivity analysis on NPV of the project with sale increase/decrease by

10%:

Particulars NPV Value

Normal 5,643.02

Increase in sales by 10% 12,446.68

Decrease in sales by 10% (1,160.64)

5.b) Performing sensitivity analysis on NPV of the project with cost of capital

increase/decrease by 10%:

Particulars NPV Value

Normal 5,643.02

Increase in cost of capital by 10% 4,097.13

Decrease in cost of capital by 10% 7,258.20

7 | P a g e

BUSINESS FINANCE

Reference and Bibliography:

Bao, T., Diks, C. and Li, H., 2018. A generalized CAPM model with asymmetric power

distributed errors with an application to portfolio construction. Economic Modelling, 68,

pp.611-621.

Baum, A.E. and Crosby, N., 2014. Property investment appraisal. John Wiley & Sons.

Fang, L., Chen, B., Yu, H. and Xiong, C., 2018. The effect of economic policy uncertainty on

the long-run correlation between crude oil and the US stock markets. Finance Research

Letters, 24, pp.56-63.

Fard, H.V. and Falah, A.B., 2015. A New Modified CAPM Model: The Two Beta

CAPM. Jurnal UMP Social Sciences and Technology Management Vol, 3(1).

Li, F.G. and Trutnevyte, E., 2017. Investment appraisal of cost-optimal and near-optimal

pathways for the UK electricity sector transition to 2050. Applied energy, 189, pp.89-109.

Lokman, S., Volker, D., Zijlstra-Vlasveld, M.C., Brouwers, E.P., Boon, B., Beekman, A.T.,

Smit, F. and Van der Feltz-Cornelis, C.M., 2017. Return-to-work intervention versus usual

care for sick-listed employees: health-economic investment appraisal alongside a cluster

randomised trial. BMJ open, 7(10), p.e016348.

Nasiri, M., Alishah, A.Y., Sayyahmelli, S.A.S. and Karimi, A., 2017. Estimating Expected

Return based on Capital Asset Pricing Model compared with Stock Interest Rate at Tehran

Stock Exchange. HELIX, 7(2), pp.1406-1415.

Nghiem, L., 2015. Risk-return relationship: An empirical study of different statistical

methods for estimating the Capital Asset Pricing Models (CAPM) and the Fama-French

model for large cap stocks. arXiv preprint arXiv:1511.07101.

8 | P a g e

Reference and Bibliography:

Bao, T., Diks, C. and Li, H., 2018. A generalized CAPM model with asymmetric power

distributed errors with an application to portfolio construction. Economic Modelling, 68,

pp.611-621.

Baum, A.E. and Crosby, N., 2014. Property investment appraisal. John Wiley & Sons.

Fang, L., Chen, B., Yu, H. and Xiong, C., 2018. The effect of economic policy uncertainty on

the long-run correlation between crude oil and the US stock markets. Finance Research

Letters, 24, pp.56-63.

Fard, H.V. and Falah, A.B., 2015. A New Modified CAPM Model: The Two Beta

CAPM. Jurnal UMP Social Sciences and Technology Management Vol, 3(1).

Li, F.G. and Trutnevyte, E., 2017. Investment appraisal of cost-optimal and near-optimal

pathways for the UK electricity sector transition to 2050. Applied energy, 189, pp.89-109.

Lokman, S., Volker, D., Zijlstra-Vlasveld, M.C., Brouwers, E.P., Boon, B., Beekman, A.T.,

Smit, F. and Van der Feltz-Cornelis, C.M., 2017. Return-to-work intervention versus usual

care for sick-listed employees: health-economic investment appraisal alongside a cluster

randomised trial. BMJ open, 7(10), p.e016348.

Nasiri, M., Alishah, A.Y., Sayyahmelli, S.A.S. and Karimi, A., 2017. Estimating Expected

Return based on Capital Asset Pricing Model compared with Stock Interest Rate at Tehran

Stock Exchange. HELIX, 7(2), pp.1406-1415.

Nghiem, L., 2015. Risk-return relationship: An empirical study of different statistical

methods for estimating the Capital Asset Pricing Models (CAPM) and the Fama-French

model for large cap stocks. arXiv preprint arXiv:1511.07101.

8 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUSINESS FINANCE

Sattar, M., 2017. CAPM Vs Fama-French three-factor model: an evaluation of effectiveness

in explaining excess return in Dhaka stock exchange. International Journal of Business and

Management, 12(5), p.119.

Shortall, J., Shalloo, L., Foley, C., Sleator, R.D. and O’Brien, B., 2016. Investment appraisal

of automatic milking and conventional milking technologies in a pasture-based dairy

system. Journal of dairy science, 99(9), pp.7700-7713.

Upton, J., Murphy, M., De Boer, I.J.M., Koerkamp, P.G., Berentsen, P.B.M. and Shalloo, L.,

2015. Investment appraisal of technology innovations on dairy farm electricity

consumption. Journal of dairy science, 98(2), pp.898-909.

Warren, L. and Seal, W., 2018. Using investment appraisal models in strategic negotiation:

the cultural political economy of electricity generation. Accounting, Organizations and

Society.

9 | P a g e

Sattar, M., 2017. CAPM Vs Fama-French three-factor model: an evaluation of effectiveness

in explaining excess return in Dhaka stock exchange. International Journal of Business and

Management, 12(5), p.119.

Shortall, J., Shalloo, L., Foley, C., Sleator, R.D. and O’Brien, B., 2016. Investment appraisal

of automatic milking and conventional milking technologies in a pasture-based dairy

system. Journal of dairy science, 99(9), pp.7700-7713.

Upton, J., Murphy, M., De Boer, I.J.M., Koerkamp, P.G., Berentsen, P.B.M. and Shalloo, L.,

2015. Investment appraisal of technology innovations on dairy farm electricity

consumption. Journal of dairy science, 98(2), pp.898-909.

Warren, L. and Seal, W., 2018. Using investment appraisal models in strategic negotiation:

the cultural political economy of electricity generation. Accounting, Organizations and

Society.

9 | P a g e

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.