Business Finance Case Study: Costing, Variance, and Financial Analysis

VerifiedAdded on 2023/06/11

|23

|5468

|265

Case Study

AI Summary

This case study delves into the financial analysis of Lobelia Ltd., focusing on costing methods, variance analysis, and financial decision-making. Part A computes the contribution per unit, break-even point, margin of safety, and required sales units for a target profit. It also clarifies the importance of contribution margin and reconciles profit calculations using marginal and absorption costing. Part B examines the significance of standard costing and variance analysis, formulates material and labor variances, and creates a budget for controlling activities. Case Study 2 assesses project quality and evaluates Omega Limited's risk using accounting ratios, along with the effect of pricing policy on business performance. The study emphasizes the importance of standard pricing and variance assessment in evaluating management efficiency and ensuring smooth operations. Desklib provides a platform for students to access this and similar solved assignments.

Business Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................................3

MAIN BODY.................................................................................................................................................3

Part A......................................................................................................................................................3

1. Compute the Contribution per unit.....................................................................................................3

2. Concept of Break-even point per unit and Break-even Sales...............................................................3

3. Calculate Margin of Safety as a percentage of Sales budget emerges.................................................4

Key areas of Margin of safety:.................................................................................................................4

4. Determine the number of units to be sold for earning a profit of £700,000 during the financial year 5

5. Preparing a memo of Lobelia Ltd. Financial Manager clarifying the importance of Contribution.......5

6. Calculation of profit using marginal and absorption costing and reconciliation between them:.........6

Part B.......................................................................................................................................................8

1. Significance of Standard Costing and Variance Analysis:.....................................................................8

2. Formulation of material and labour variance with comment on them:...............................................9

3. Creation of budget for controlling the activity:.................................................................................11

CONCLUSION.............................................................................................................................................11

CASE STUDY 2............................................................................................................................................12

INTRODUCTION.........................................................................................................................................12

MAIN BODY...............................................................................................................................................12

Part A.....................................................................................................................................................12

4. Suggestion regarding quality of the project:......................................................................................16

PART B.......................................................................................................................................................16

1. Risk assessment of Omega limited using accounting ratios:..............................................................16

3. Effect on pricing policy on the performance of the business:............................................................19

CONCLUSION.............................................................................................................................................19

REFERENCES..............................................................................................................................................20

INTRODUCTION...........................................................................................................................................3

MAIN BODY.................................................................................................................................................3

Part A......................................................................................................................................................3

1. Compute the Contribution per unit.....................................................................................................3

2. Concept of Break-even point per unit and Break-even Sales...............................................................3

3. Calculate Margin of Safety as a percentage of Sales budget emerges.................................................4

Key areas of Margin of safety:.................................................................................................................4

4. Determine the number of units to be sold for earning a profit of £700,000 during the financial year 5

5. Preparing a memo of Lobelia Ltd. Financial Manager clarifying the importance of Contribution.......5

6. Calculation of profit using marginal and absorption costing and reconciliation between them:.........6

Part B.......................................................................................................................................................8

1. Significance of Standard Costing and Variance Analysis:.....................................................................8

2. Formulation of material and labour variance with comment on them:...............................................9

3. Creation of budget for controlling the activity:.................................................................................11

CONCLUSION.............................................................................................................................................11

CASE STUDY 2............................................................................................................................................12

INTRODUCTION.........................................................................................................................................12

MAIN BODY...............................................................................................................................................12

Part A.....................................................................................................................................................12

4. Suggestion regarding quality of the project:......................................................................................16

PART B.......................................................................................................................................................16

1. Risk assessment of Omega limited using accounting ratios:..............................................................16

3. Effect on pricing policy on the performance of the business:............................................................19

CONCLUSION.............................................................................................................................................19

REFERENCES..............................................................................................................................................20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

The necessity of standard pricing and several types of variance assessment are discussed in

this research study. Essentially, this study aids in comprehending the critical function of standard

price, which is a sort of cost that aids in assessing the management dept's efficiency (Chen, Tang

and Wang, 2021). However, it also discusses numerous forms of variation, such as prices of

materials and utilization variance, workforce rates and effectiveness variability, and fixed

expense productivity variability. After that, create a budget to guide the employee's work

performance and ensure that it runs smoothly in the lengthy period.

MAIN BODY

Part A

1. Compute the Contribution per unit

After deducting all contribution margins from the selling per unit price, it's useful to calculate the

residual income. Material, labor and overhead costs are subtracted from linked income to

evaluate the distribution. It also displays the expenses incurred for selling a product.

Contribution per unit = sales per unit – variable cost per unit

= £120 – £50

= £70 per unit

When reducing unit variable £50 from selling per unit £120, the contribution margin of firm

Lobelia Ltd is £70 per unit, according to the above estimate.

2. Concept of Break-even point per unit and Break-even Sales

This approach is critical for calculating the point at which a beginning firm's costs, products, or

services are weighed against with a single entity of sale value to determine the break-even point.

The break even point is the moment at which the quantity of output equals the amount of price

income (Egginton and McCumber, 2019).

From the other extreme, it is defined as a point at which the whole fixed and variable

expenditures are covered by the cost of production. It is typically dependent on sales; if the firm's

The necessity of standard pricing and several types of variance assessment are discussed in

this research study. Essentially, this study aids in comprehending the critical function of standard

price, which is a sort of cost that aids in assessing the management dept's efficiency (Chen, Tang

and Wang, 2021). However, it also discusses numerous forms of variation, such as prices of

materials and utilization variance, workforce rates and effectiveness variability, and fixed

expense productivity variability. After that, create a budget to guide the employee's work

performance and ensure that it runs smoothly in the lengthy period.

MAIN BODY

Part A

1. Compute the Contribution per unit

After deducting all contribution margins from the selling per unit price, it's useful to calculate the

residual income. Material, labor and overhead costs are subtracted from linked income to

evaluate the distribution. It also displays the expenses incurred for selling a product.

Contribution per unit = sales per unit – variable cost per unit

= £120 – £50

= £70 per unit

When reducing unit variable £50 from selling per unit £120, the contribution margin of firm

Lobelia Ltd is £70 per unit, according to the above estimate.

2. Concept of Break-even point per unit and Break-even Sales

This approach is critical for calculating the point at which a beginning firm's costs, products, or

services are weighed against with a single entity of sale value to determine the break-even point.

The break even point is the moment at which the quantity of output equals the amount of price

income (Egginton and McCumber, 2019).

From the other extreme, it is defined as a point at which the whole fixed and variable

expenditures are covered by the cost of production. It is typically dependent on sales; if the firm's

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

sales decline, so does its success; however, whereas if sales earnings exceed the break-even

threshold, the business creates a return even after expenditures is paid.

Essential of break even point

• The moment at which a corporation generates neither revenue nor a loss is known as break

even.

• It is beneficial in determining the company's selling price and designing a business plan.

As a result, the break-even point and break-even revenues are calculated as follows:

Break-even point = Fixed cost / ( sales per unit – variable cost per unit )

Break-even point = £700000 / (£120 - £50)

= £700000 / £70

= £10000 units

In the example given, the break even threshold is calculated by removing contribution per unit

price from the firm's fixed cost, resulting in a result of £10000 units in which the fixed financial

cost is £700000 and marginal revenue is £70.

Break- even sales in % = Fixed cost / Contribution margin

Break- even sales = £700000 / £2800000 *100

= 25 %

The break even sales % in the aforementioned computation is equivalent to 25%, in which the

fixed expenses is £700000 and the marginal revenue is £2800000.

3. Calculate Margin of Safety as a percentage of Sales budget emerges

The differential between sales numbers and break-even sales is defined using the margin of

safety approach. It determines the amount of security that the company values prior taking on

any chance or loss, lowering the break-even point (Hamid and Loke, 2021).

Key areas of Margin of safety:

• It is beneficial to hedge the firm's danger.

threshold, the business creates a return even after expenditures is paid.

Essential of break even point

• The moment at which a corporation generates neither revenue nor a loss is known as break

even.

• It is beneficial in determining the company's selling price and designing a business plan.

As a result, the break-even point and break-even revenues are calculated as follows:

Break-even point = Fixed cost / ( sales per unit – variable cost per unit )

Break-even point = £700000 / (£120 - £50)

= £700000 / £70

= £10000 units

In the example given, the break even threshold is calculated by removing contribution per unit

price from the firm's fixed cost, resulting in a result of £10000 units in which the fixed financial

cost is £700000 and marginal revenue is £70.

Break- even sales in % = Fixed cost / Contribution margin

Break- even sales = £700000 / £2800000 *100

= 25 %

The break even sales % in the aforementioned computation is equivalent to 25%, in which the

fixed expenses is £700000 and the marginal revenue is £2800000.

3. Calculate Margin of Safety as a percentage of Sales budget emerges

The differential between sales numbers and break-even sales is defined using the margin of

safety approach. It determines the amount of security that the company values prior taking on

any chance or loss, lowering the break-even point (Hamid and Loke, 2021).

Key areas of Margin of safety:

• It is beneficial to hedge the firm's danger.

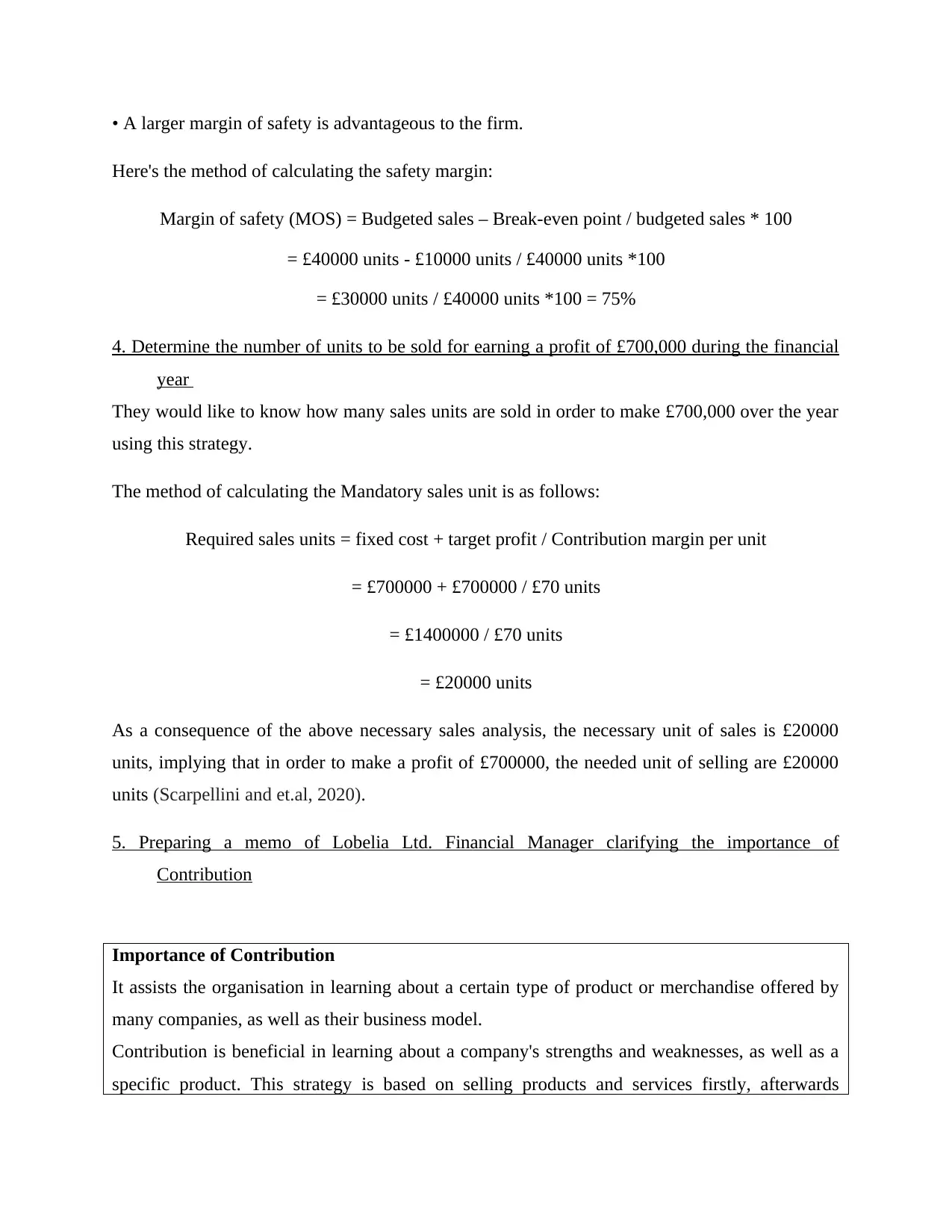

• A larger margin of safety is advantageous to the firm.

Here's the method of calculating the safety margin:

Margin of safety (MOS) = Budgeted sales – Break-even point / budgeted sales * 100

= £40000 units - £10000 units / £40000 units *100

= £30000 units / £40000 units *100 = 75%

4. Determine the number of units to be sold for earning a profit of £700,000 during the financial

year

They would like to know how many sales units are sold in order to make £700,000 over the year

using this strategy.

The method of calculating the Mandatory sales unit is as follows:

Required sales units = fixed cost + target profit / Contribution margin per unit

= £700000 + £700000 / £70 units

= £1400000 / £70 units

= £20000 units

As a consequence of the above necessary sales analysis, the necessary unit of sales is £20000

units, implying that in order to make a profit of £700000, the needed unit of selling are £20000

units (Scarpellini and et.al, 2020).

5. Preparing a memo of Lobelia Ltd. Financial Manager clarifying the importance of

Contribution

Importance of Contribution

It assists the organisation in learning about a certain type of product or merchandise offered by

many companies, as well as their business model.

Contribution is beneficial in learning about a company's strengths and weaknesses, as well as a

specific product. This strategy is based on selling products and services firstly, afterwards

Here's the method of calculating the safety margin:

Margin of safety (MOS) = Budgeted sales – Break-even point / budgeted sales * 100

= £40000 units - £10000 units / £40000 units *100

= £30000 units / £40000 units *100 = 75%

4. Determine the number of units to be sold for earning a profit of £700,000 during the financial

year

They would like to know how many sales units are sold in order to make £700,000 over the year

using this strategy.

The method of calculating the Mandatory sales unit is as follows:

Required sales units = fixed cost + target profit / Contribution margin per unit

= £700000 + £700000 / £70 units

= £1400000 / £70 units

= £20000 units

As a consequence of the above necessary sales analysis, the necessary unit of sales is £20000

units, implying that in order to make a profit of £700000, the needed unit of selling are £20000

units (Scarpellini and et.al, 2020).

5. Preparing a memo of Lobelia Ltd. Financial Manager clarifying the importance of

Contribution

Importance of Contribution

It assists the organisation in learning about a certain type of product or merchandise offered by

many companies, as well as their business model.

Contribution is beneficial in learning about a company's strengths and weaknesses, as well as a

specific product. This strategy is based on selling products and services firstly, afterwards

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

calculating the net value.

Suggestions that are useful for how contribution margin helps to take business decisions:

It is the most crucial tool for managers to use when making decisions, responding appropriately,

and setting budgets, including whether to add or remove a certain commodity from a line of

products. It is typically used this to distinguish between items and determine which should be

kept and which should be eliminated. In just this case, financial decision is also employed to

establish the appropriate price. It is easier to promote the marketing costs because it will cover

both fixed costs and variable costs. It is permissible to create a chart in order to determine

whether or not the company is profitable (Lulaj, 2021).

How margin of safety affected from contribution

The amount of the break-even threshold is dependent on marginal costing volatility, as

mentioned in the preceding computation. When deducting the break-even level from sale prices,

the margin of safety is computed.

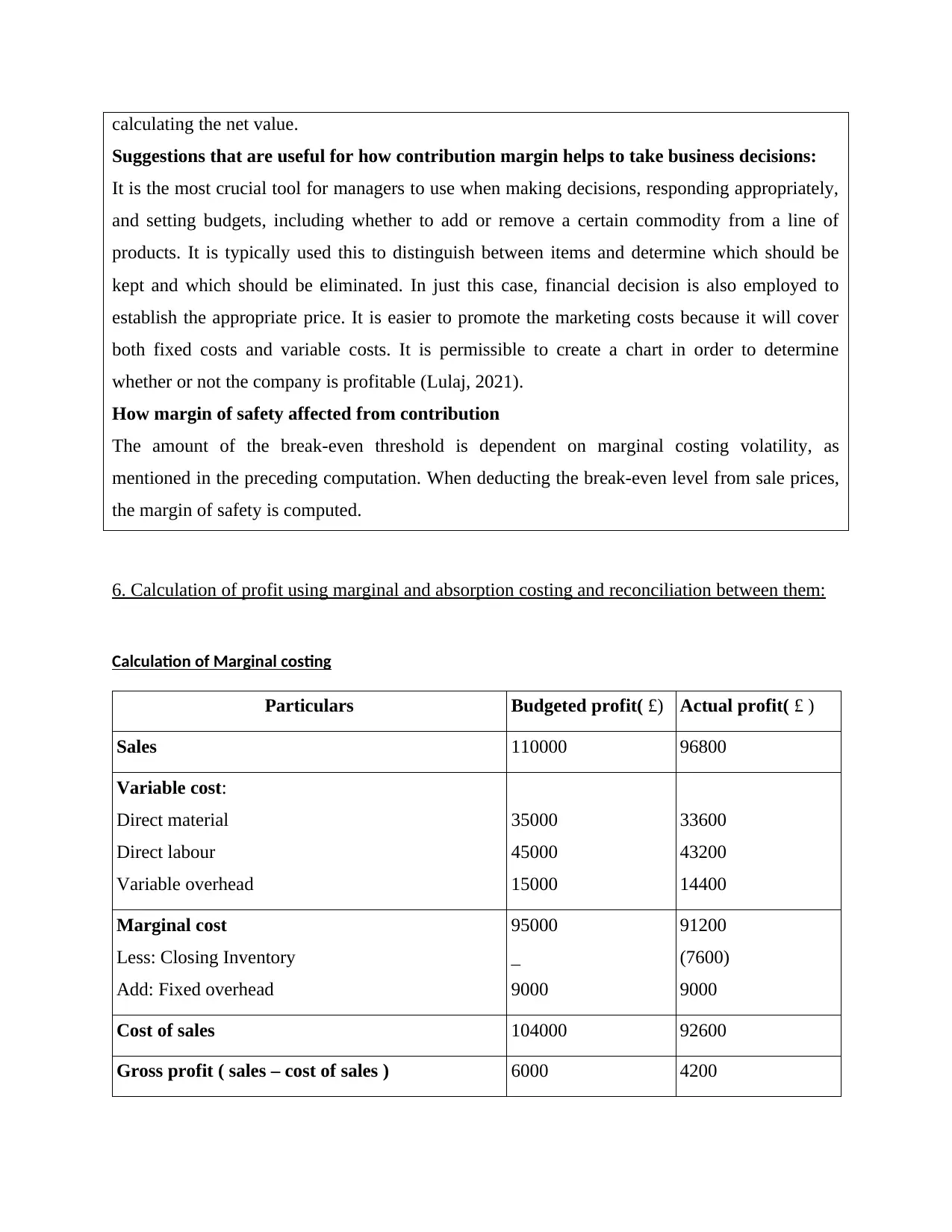

6. Calculation of profit using marginal and absorption costing and reconciliation between them:

Calculation of Marginal costing

Particulars Budgeted profit( £) Actual profit( £ )

Sales 110000 96800

Variable cost:

Direct material

Direct labour

Variable overhead

35000

45000

15000

33600

43200

14400

Marginal cost

Less: Closing Inventory

Add: Fixed overhead

95000

_

9000

91200

(7600)

9000

Cost of sales 104000 92600

Gross profit ( sales – cost of sales ) 6000 4200

Suggestions that are useful for how contribution margin helps to take business decisions:

It is the most crucial tool for managers to use when making decisions, responding appropriately,

and setting budgets, including whether to add or remove a certain commodity from a line of

products. It is typically used this to distinguish between items and determine which should be

kept and which should be eliminated. In just this case, financial decision is also employed to

establish the appropriate price. It is easier to promote the marketing costs because it will cover

both fixed costs and variable costs. It is permissible to create a chart in order to determine

whether or not the company is profitable (Lulaj, 2021).

How margin of safety affected from contribution

The amount of the break-even threshold is dependent on marginal costing volatility, as

mentioned in the preceding computation. When deducting the break-even level from sale prices,

the margin of safety is computed.

6. Calculation of profit using marginal and absorption costing and reconciliation between them:

Calculation of Marginal costing

Particulars Budgeted profit( £) Actual profit( £ )

Sales 110000 96800

Variable cost:

Direct material

Direct labour

Variable overhead

35000

45000

15000

33600

43200

14400

Marginal cost

Less: Closing Inventory

Add: Fixed overhead

95000

_

9000

91200

(7600)

9000

Cost of sales 104000 92600

Gross profit ( sales – cost of sales ) 6000 4200

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Less: Administration, selling and distribution cost _ _

Net profit 6000 4200

Working on closing stock:

• The firm's planned revenues and output are comparable to £5000 and equivalent to sales

revenue, thus the closing inventory is zero, however the company's absorption rate is:

Absorption rate = marginal cost / budgeted production

= £95000 / £5000

= £19 per unit

• The business Actual sales and production units are 4800 and 4400, correspondingly, resulting

in an ending inventory of £400 units. The firm's absorption rate is:

Absorption rate = marginal cost / budgeted production

= 91200 / 4800

= 19 per unit

Therefore, the company actual closing inventory is 7600 (400*19).

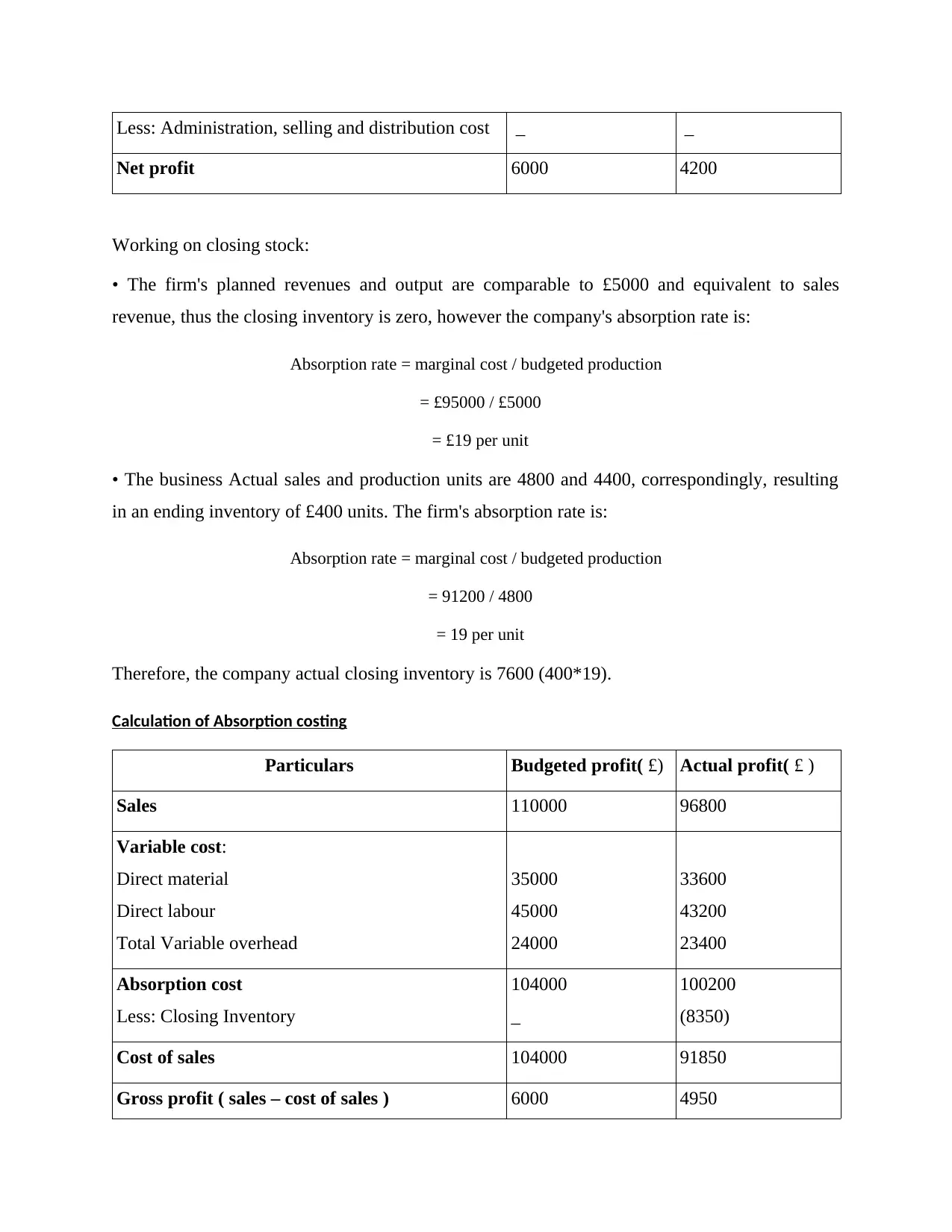

Calculation of Absorption costing

Particulars Budgeted profit( £) Actual profit( £ )

Sales 110000 96800

Variable cost:

Direct material

Direct labour

Total Variable overhead

35000

45000

24000

33600

43200

23400

Absorption cost

Less: Closing Inventory

104000

_

100200

(8350)

Cost of sales 104000 91850

Gross profit ( sales – cost of sales ) 6000 4950

Net profit 6000 4200

Working on closing stock:

• The firm's planned revenues and output are comparable to £5000 and equivalent to sales

revenue, thus the closing inventory is zero, however the company's absorption rate is:

Absorption rate = marginal cost / budgeted production

= £95000 / £5000

= £19 per unit

• The business Actual sales and production units are 4800 and 4400, correspondingly, resulting

in an ending inventory of £400 units. The firm's absorption rate is:

Absorption rate = marginal cost / budgeted production

= 91200 / 4800

= 19 per unit

Therefore, the company actual closing inventory is 7600 (400*19).

Calculation of Absorption costing

Particulars Budgeted profit( £) Actual profit( £ )

Sales 110000 96800

Variable cost:

Direct material

Direct labour

Total Variable overhead

35000

45000

24000

33600

43200

23400

Absorption cost

Less: Closing Inventory

104000

_

100200

(8350)

Cost of sales 104000 91850

Gross profit ( sales – cost of sales ) 6000 4950

Less: Administration, selling and distribution cost _

_

Net profit 6000 4950

Working of closing stock and total variable overhead:

• The firm's selling and production budgets are equivalent to £5000 and equivalent to asset value,

implying that the firm's closing inventory is zero but its rate of absorption is.

Absorption rate = Absorption cost / budgeted production

= £104000 / £5000

= £20.8per unit

• The ending inventory is £400 units, based on the firm's future sales and production units of

£4800 and £4400, accordingly. The pace at which a firm absorbs new information is:

Absorption rate = Absorption cost / budgeted production

= £100200 / £4800

= £20.875 per unit

Hence, the company actual closing stock is £8350 (£400*£20.875)

Total variable overhead = Variable overhead + fixed overhead

= £14400 + £9000

= £23400

Part B

1. Significance of Standard Costing and Variance Analysis:

Standard costs are established to assess a managerial department's performance. Standard

costs are also used to evaluate the inventory where real numbers are not accountable to show and

to determine retail prices, notably when making quotes, in the results estimate and cost

management. The standard pricing method caters to a wide range of business demands. For the

following situations, conventional pricing is used:

_

Net profit 6000 4950

Working of closing stock and total variable overhead:

• The firm's selling and production budgets are equivalent to £5000 and equivalent to asset value,

implying that the firm's closing inventory is zero but its rate of absorption is.

Absorption rate = Absorption cost / budgeted production

= £104000 / £5000

= £20.8per unit

• The ending inventory is £400 units, based on the firm's future sales and production units of

£4800 and £4400, accordingly. The pace at which a firm absorbs new information is:

Absorption rate = Absorption cost / budgeted production

= £100200 / £4800

= £20.875 per unit

Hence, the company actual closing stock is £8350 (£400*£20.875)

Total variable overhead = Variable overhead + fixed overhead

= £14400 + £9000

= £23400

Part B

1. Significance of Standard Costing and Variance Analysis:

Standard costs are established to assess a managerial department's performance. Standard

costs are also used to evaluate the inventory where real numbers are not accountable to show and

to determine retail prices, notably when making quotes, in the results estimate and cost

management. The standard pricing method caters to a wide range of business demands. For the

following situations, conventional pricing is used:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

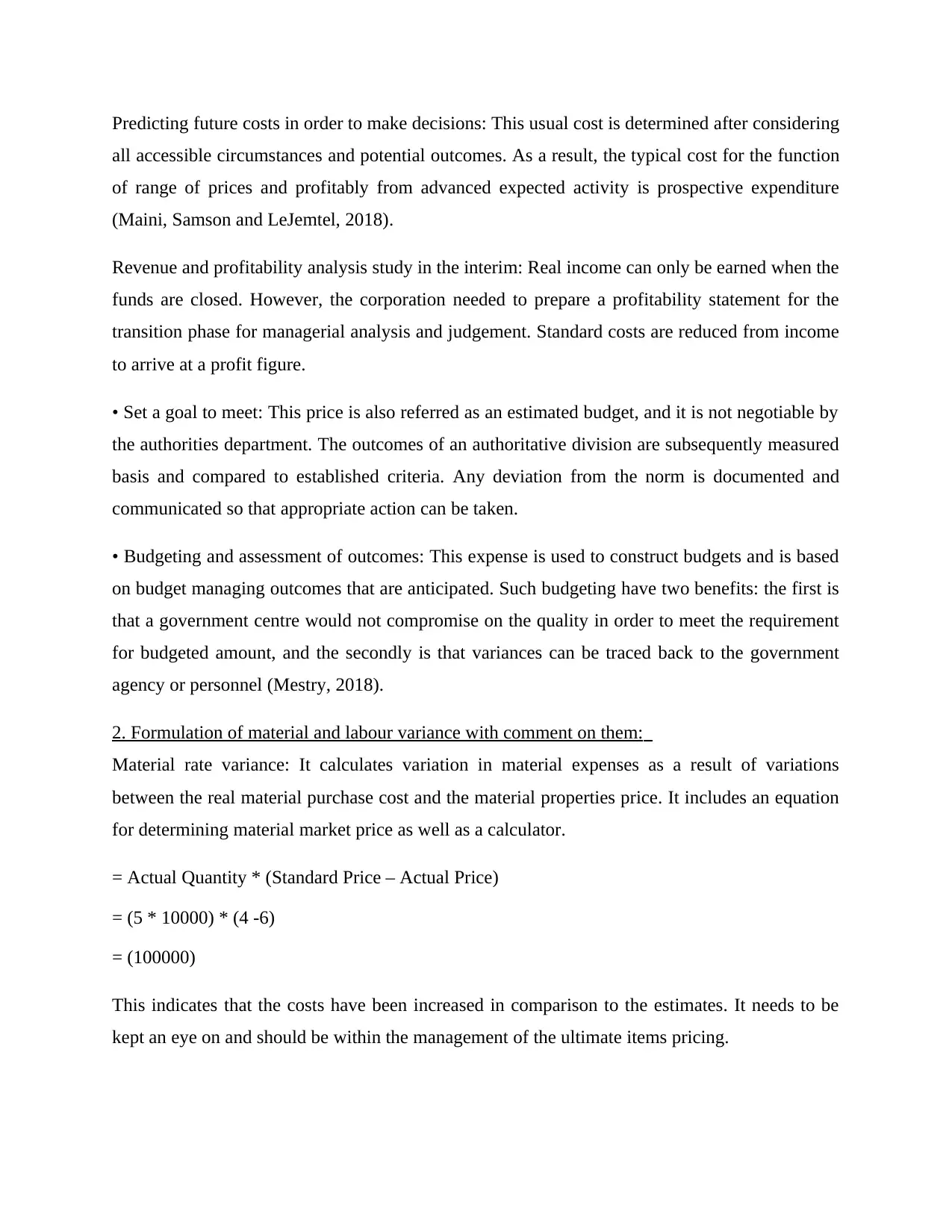

Predicting future costs in order to make decisions: This usual cost is determined after considering

all accessible circumstances and potential outcomes. As a result, the typical cost for the function

of range of prices and profitably from advanced expected activity is prospective expenditure

(Maini, Samson and LeJemtel, 2018).

Revenue and profitability analysis study in the interim: Real income can only be earned when the

funds are closed. However, the corporation needed to prepare a profitability statement for the

transition phase for managerial analysis and judgement. Standard costs are reduced from income

to arrive at a profit figure.

• Set a goal to meet: This price is also referred as an estimated budget, and it is not negotiable by

the authorities department. The outcomes of an authoritative division are subsequently measured

basis and compared to established criteria. Any deviation from the norm is documented and

communicated so that appropriate action can be taken.

• Budgeting and assessment of outcomes: This expense is used to construct budgets and is based

on budget managing outcomes that are anticipated. Such budgeting have two benefits: the first is

that a government centre would not compromise on the quality in order to meet the requirement

for budgeted amount, and the secondly is that variances can be traced back to the government

agency or personnel (Mestry, 2018).

2. Formulation of material and labour variance with comment on them:

Material rate variance: It calculates variation in material expenses as a result of variations

between the real material purchase cost and the material properties price. It includes an equation

for determining material market price as well as a calculator.

= Actual Quantity * (Standard Price – Actual Price)

= (5 * 10000) * (4 -6)

= (100000)

This indicates that the costs have been increased in comparison to the estimates. It needs to be

kept an eye on and should be within the management of the ultimate items pricing.

all accessible circumstances and potential outcomes. As a result, the typical cost for the function

of range of prices and profitably from advanced expected activity is prospective expenditure

(Maini, Samson and LeJemtel, 2018).

Revenue and profitability analysis study in the interim: Real income can only be earned when the

funds are closed. However, the corporation needed to prepare a profitability statement for the

transition phase for managerial analysis and judgement. Standard costs are reduced from income

to arrive at a profit figure.

• Set a goal to meet: This price is also referred as an estimated budget, and it is not negotiable by

the authorities department. The outcomes of an authoritative division are subsequently measured

basis and compared to established criteria. Any deviation from the norm is documented and

communicated so that appropriate action can be taken.

• Budgeting and assessment of outcomes: This expense is used to construct budgets and is based

on budget managing outcomes that are anticipated. Such budgeting have two benefits: the first is

that a government centre would not compromise on the quality in order to meet the requirement

for budgeted amount, and the secondly is that variances can be traced back to the government

agency or personnel (Mestry, 2018).

2. Formulation of material and labour variance with comment on them:

Material rate variance: It calculates variation in material expenses as a result of variations

between the real material purchase cost and the material properties price. It includes an equation

for determining material market price as well as a calculator.

= Actual Quantity * (Standard Price – Actual Price)

= (5 * 10000) * (4 -6)

= (100000)

This indicates that the costs have been increased in comparison to the estimates. It needs to be

kept an eye on and should be within the management of the ultimate items pricing.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

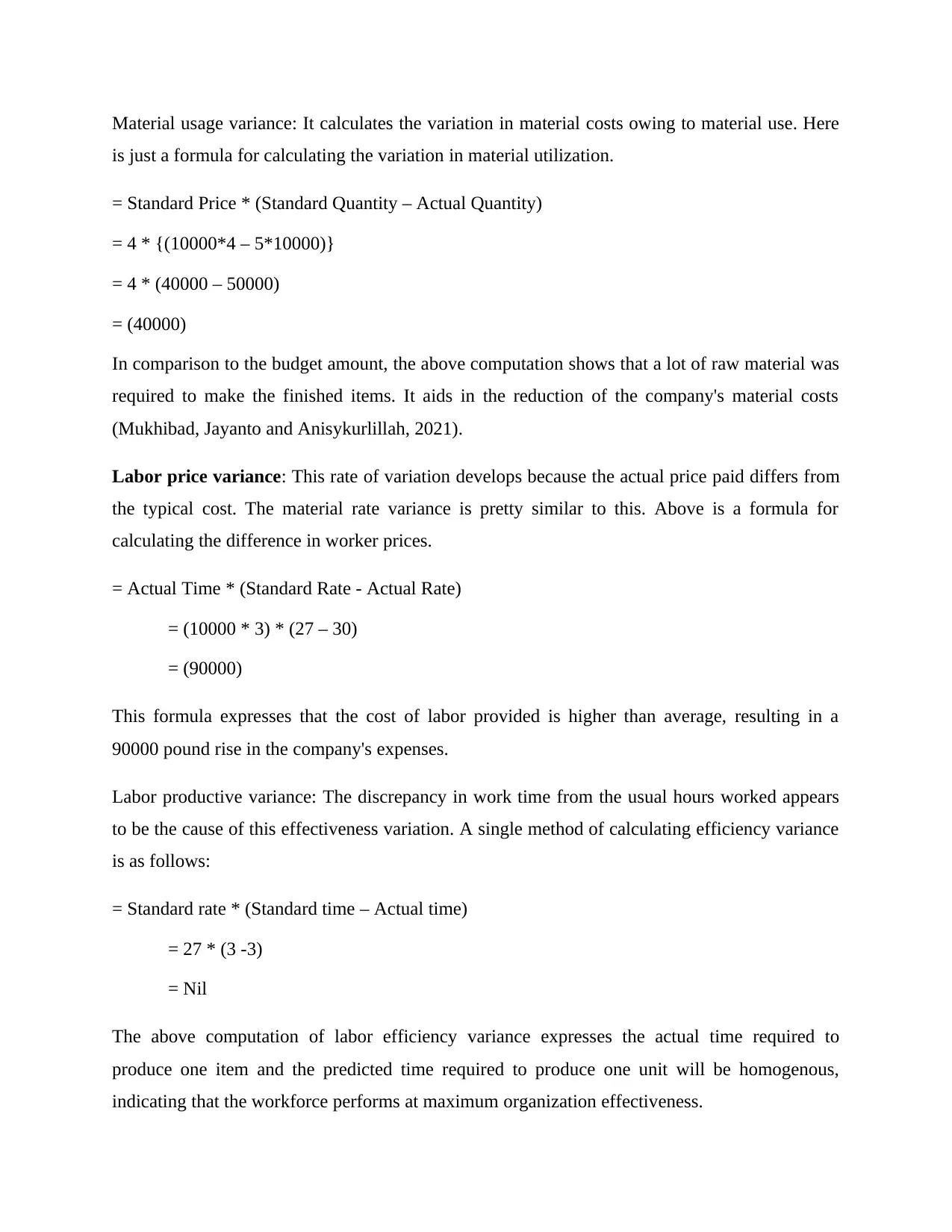

Material usage variance: It calculates the variation in material costs owing to material use. Here

is just a formula for calculating the variation in material utilization.

= Standard Price * (Standard Quantity – Actual Quantity)

= 4 * {(10000*4 – 5*10000)}

= 4 * (40000 – 50000)

= (40000)

In comparison to the budget amount, the above computation shows that a lot of raw material was

required to make the finished items. It aids in the reduction of the company's material costs

(Mukhibad, Jayanto and Anisykurlillah, 2021).

Labor price variance: This rate of variation develops because the actual price paid differs from

the typical cost. The material rate variance is pretty similar to this. Above is a formula for

calculating the difference in worker prices.

= Actual Time * (Standard Rate - Actual Rate)

= (10000 * 3) * (27 – 30)

= (90000)

This formula expresses that the cost of labor provided is higher than average, resulting in a

90000 pound rise in the company's expenses.

Labor productive variance: The discrepancy in work time from the usual hours worked appears

to be the cause of this effectiveness variation. A single method of calculating efficiency variance

is as follows:

= Standard rate * (Standard time – Actual time)

= 27 * (3 -3)

= Nil

The above computation of labor efficiency variance expresses the actual time required to

produce one item and the predicted time required to produce one unit will be homogenous,

indicating that the workforce performs at maximum organization effectiveness.

is just a formula for calculating the variation in material utilization.

= Standard Price * (Standard Quantity – Actual Quantity)

= 4 * {(10000*4 – 5*10000)}

= 4 * (40000 – 50000)

= (40000)

In comparison to the budget amount, the above computation shows that a lot of raw material was

required to make the finished items. It aids in the reduction of the company's material costs

(Mukhibad, Jayanto and Anisykurlillah, 2021).

Labor price variance: This rate of variation develops because the actual price paid differs from

the typical cost. The material rate variance is pretty similar to this. Above is a formula for

calculating the difference in worker prices.

= Actual Time * (Standard Rate - Actual Rate)

= (10000 * 3) * (27 – 30)

= (90000)

This formula expresses that the cost of labor provided is higher than average, resulting in a

90000 pound rise in the company's expenses.

Labor productive variance: The discrepancy in work time from the usual hours worked appears

to be the cause of this effectiveness variation. A single method of calculating efficiency variance

is as follows:

= Standard rate * (Standard time – Actual time)

= 27 * (3 -3)

= Nil

The above computation of labor efficiency variance expresses the actual time required to

produce one item and the predicted time required to produce one unit will be homogenous,

indicating that the workforce performs at maximum organization effectiveness.

Fixed overhead productive variance: The difference here between total cost occupied and the

normal achieve a stable is this (Pieper and et.al, 2020). The method of calculating the fixed

production performance variation is as follows:

= (Recovered overhead – Standard overhead)

= (15000- 20000)

= (5000)

The preceding estimate of fixed production effectiveness levels of analysis that overhead is an

additional cost that the business must minimize since it affects the company's business

performance (Ravidà, Barootchi and Amo, 2019).

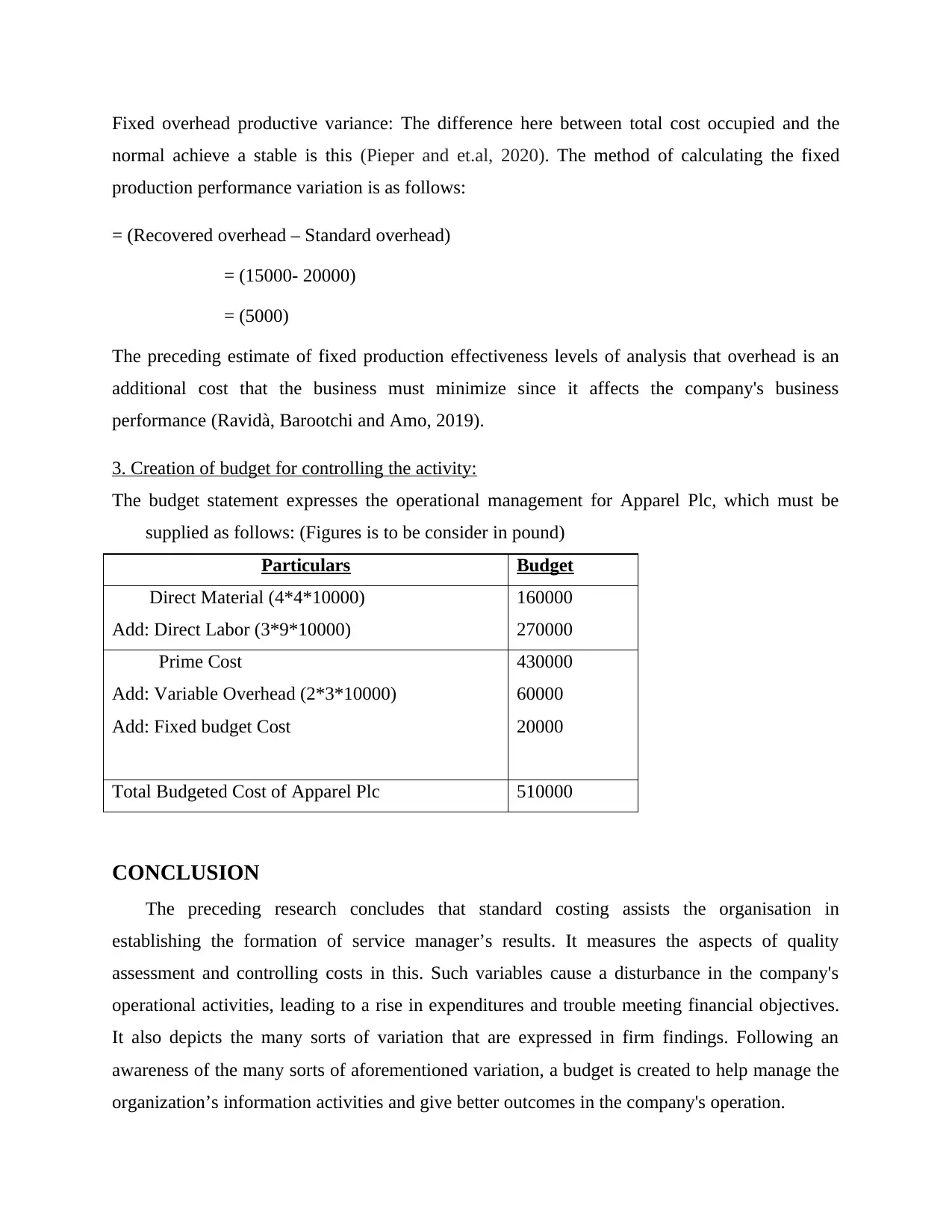

3. Creation of budget for controlling the activity:

The budget statement expresses the operational management for Apparel Plc, which must be

supplied as follows: (Figures is to be consider in pound)

Particulars Budget

Direct Material (4*4*10000)

Add: Direct Labor (3*9*10000)

160000

270000

Prime Cost

Add: Variable Overhead (2*3*10000)

Add: Fixed budget Cost

430000

60000

20000

Total Budgeted Cost of Apparel Plc 510000

CONCLUSION

The preceding research concludes that standard costing assists the organisation in

establishing the formation of service manager’s results. It measures the aspects of quality

assessment and controlling costs in this. Such variables cause a disturbance in the company's

operational activities, leading to a rise in expenditures and trouble meeting financial objectives.

It also depicts the many sorts of variation that are expressed in firm findings. Following an

awareness of the many sorts of aforementioned variation, a budget is created to help manage the

organization’s information activities and give better outcomes in the company's operation.

normal achieve a stable is this (Pieper and et.al, 2020). The method of calculating the fixed

production performance variation is as follows:

= (Recovered overhead – Standard overhead)

= (15000- 20000)

= (5000)

The preceding estimate of fixed production effectiveness levels of analysis that overhead is an

additional cost that the business must minimize since it affects the company's business

performance (Ravidà, Barootchi and Amo, 2019).

3. Creation of budget for controlling the activity:

The budget statement expresses the operational management for Apparel Plc, which must be

supplied as follows: (Figures is to be consider in pound)

Particulars Budget

Direct Material (4*4*10000)

Add: Direct Labor (3*9*10000)

160000

270000

Prime Cost

Add: Variable Overhead (2*3*10000)

Add: Fixed budget Cost

430000

60000

20000

Total Budgeted Cost of Apparel Plc 510000

CONCLUSION

The preceding research concludes that standard costing assists the organisation in

establishing the formation of service manager’s results. It measures the aspects of quality

assessment and controlling costs in this. Such variables cause a disturbance in the company's

operational activities, leading to a rise in expenditures and trouble meeting financial objectives.

It also depicts the many sorts of variation that are expressed in firm findings. Following an

awareness of the many sorts of aforementioned variation, a budget is created to help manage the

organization’s information activities and give better outcomes in the company's operation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.