BHP Billiton Financial Analysis: Ratio Analysis and Capital Structure

VerifiedAdded on 2020/10/23

|16

|3997

|171

Report

AI Summary

This report provides a comprehensive financial analysis of BHP Billiton, a major mining company. It begins with an overview of the company's operations and market position. The main body of the report focuses on a detailed ratio analysis, covering liquidity, profitability, and market value ratios for the years 2017-18 and 2016-17. The analysis includes interpretations of each ratio and their implications for the company's financial health. Additionally, the report examines share price movements over a two-year period, comparing them to the All Ordinaries Index and discussing the factors that influence share prices, such as political decisions, natural disasters, interest rates, and inflation. Furthermore, the report delves into the calculation of the cost of equity and analyzes the company's capital structure, including debt and equity weights. The report concludes with recommendations based on the analysis and provides a list of references.

Business Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

1. Overview of Company.............................................................................................................3

2. Ratio Analysis of BHP Billiton................................................................................................4

3. Graphs and comparison of share price movement:..................................................................7

5. Calculation of Cost of Equity:.................................................................................................9

6. Capital Structure of Company:..............................................................................................10

CONCLUSION..............................................................................................................................12

RECOMMENDATION.................................................................................................................12

REFERENCES..............................................................................................................................13

APPENDIX....................................................................................................................................14

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

1. Overview of Company.............................................................................................................3

2. Ratio Analysis of BHP Billiton................................................................................................4

3. Graphs and comparison of share price movement:..................................................................7

5. Calculation of Cost of Equity:.................................................................................................9

6. Capital Structure of Company:..............................................................................................10

CONCLUSION..............................................................................................................................12

RECOMMENDATION.................................................................................................................12

REFERENCES..............................................................................................................................13

APPENDIX....................................................................................................................................14

INTRODUCTION

Money invested or money engaged in business refers to business finance. All activities of

business is purely depends upon finance. Business finance includes acquisition and application

of money or funds that assists business organisation to operate productively and efficiently.

Business finance also includes forecasting and budgeting of funds (Bojadziev, 2007). It is related

with raising funds from various means along with investment of funds for various activities. This

report describes, in the context of BHP Billiton Company, a systematic analysis of performance

through ratio analysis and an analysis to compare the movements in the companies’ share prices

along with a deep discussion on capital structure of the company by calculating capital structure

ratios and weights of debts and equity structure capital. This report also provides

recommendation based on analysis.

MAIN BODY

1. Overview of Company

BHP Billiton Limited is world's largest mining company with respect to the market-cap.

Company is producer of various commodities, including iron ore, metallurgical coal, copper and

uranium. Company has four major segments: Coal, Iron ore, Petroleum and Copper. Company

through Petroleum segment is pinned in production and exploration of oil and gas, under Copper

and iron segment company conducting activities of mining of copper, silver, lead, zinc,

molybdenum, uranium, iron ore and gold (Burns and Dewhurst, 2016). In Coal segment mining

of coal is main activity and coal is mined in form of metallurgical coal and thermal coal.

Company's major activities of extraction and mining are operating in Australia and the Americas

and product distribution activities by its global logistics chain. So the core activities of company

includes extraction, mining, development and production. Company is selling its produced

products through direct supply agreements with its customers by using global commodity

exchanges. Company's major businesses are Minerals Australia, Minerals Americas, Petroleum

and Marketing. BHP Billiton is largest mining company and having limited but small

competitors so company is enjoying competitive advantages. BHP with wide resources and

greater capabilities has strong interference in economy and therefore it get advantages from other

competing organisation due to wide range of resources. Due to operations on large scale BHP is

able to attract financial big customers by providing delivery of produced product within

Money invested or money engaged in business refers to business finance. All activities of

business is purely depends upon finance. Business finance includes acquisition and application

of money or funds that assists business organisation to operate productively and efficiently.

Business finance also includes forecasting and budgeting of funds (Bojadziev, 2007). It is related

with raising funds from various means along with investment of funds for various activities. This

report describes, in the context of BHP Billiton Company, a systematic analysis of performance

through ratio analysis and an analysis to compare the movements in the companies’ share prices

along with a deep discussion on capital structure of the company by calculating capital structure

ratios and weights of debts and equity structure capital. This report also provides

recommendation based on analysis.

MAIN BODY

1. Overview of Company

BHP Billiton Limited is world's largest mining company with respect to the market-cap.

Company is producer of various commodities, including iron ore, metallurgical coal, copper and

uranium. Company has four major segments: Coal, Iron ore, Petroleum and Copper. Company

through Petroleum segment is pinned in production and exploration of oil and gas, under Copper

and iron segment company conducting activities of mining of copper, silver, lead, zinc,

molybdenum, uranium, iron ore and gold (Burns and Dewhurst, 2016). In Coal segment mining

of coal is main activity and coal is mined in form of metallurgical coal and thermal coal.

Company's major activities of extraction and mining are operating in Australia and the Americas

and product distribution activities by its global logistics chain. So the core activities of company

includes extraction, mining, development and production. Company is selling its produced

products through direct supply agreements with its customers by using global commodity

exchanges. Company's major businesses are Minerals Australia, Minerals Americas, Petroleum

and Marketing. BHP Billiton is largest mining company and having limited but small

competitors so company is enjoying competitive advantages. BHP with wide resources and

greater capabilities has strong interference in economy and therefore it get advantages from other

competing organisation due to wide range of resources. Due to operations on large scale BHP is

able to attract financial big customers by providing delivery of produced product within

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

scheduled delivery time, more efficiently which is one of the major competitive advantages.

There are some factors related with BHP's achievements, which are responsible for success of

company in global market. In BHP profits earned after deductions of tax are directly distributed

among its members which is key factor that build trust in shareholders and investors. Total return

to shareholders in a financial year indicates mix of dividends and share prices which has helped

BHP Billiton in enhancement in wealth.

2. Ratio Analysis of BHP Billiton

Ratio analysis is systematic tool used by business organisation to evaluate company's

efficiency, effectiveness of operations, profitability and liquidity position. Ratio analysis for

more than one year provides a significant comparison of company's performance which helps in

decision making activities of company (Drake and Fabozzi, 2010).

Liquidity Ratio: - It is an financial ratio which indicate that current assets of the organisations

are sufficient or not to meet their obligations. Liquidity ratio also classified between two ratios

such as current and quick ratio.

1. Current ratio: - This ratio is calculate to know about what are the position of current

assets in comparison to current liability. Because it represent that whether assets are

enough to pay companies liabilities or not. Ideal ratio is 2:1 which means any

organisation required double of assets in comparison to liabilities meet their obligations.

2. Quick ratio: - It is also know by acid test ratio and it consider those assets which one is

quickly converted into cash. Stocks are excluded from this ratio because it will take time

to convert stock into finished goods and generate money from it.

Profitability ratio: - It is generally used to check organisational ability to generate profit in

relation to expenses and cost of the production. It is include other ratio like gross profit and net

profit ratio.

Gross profit ratio: - This ratio shows the relationship between net sales and gross profit

and this profit is generated by the operational activity. It is an important tool which

identify the accurate profit from operational activities.

Net profit ratio: - This ratio is calculated by after deducting tax, it means this is the

final profit earned by the organisation. It represent the relationship between net profit or

net sales.

There are some factors related with BHP's achievements, which are responsible for success of

company in global market. In BHP profits earned after deductions of tax are directly distributed

among its members which is key factor that build trust in shareholders and investors. Total return

to shareholders in a financial year indicates mix of dividends and share prices which has helped

BHP Billiton in enhancement in wealth.

2. Ratio Analysis of BHP Billiton

Ratio analysis is systematic tool used by business organisation to evaluate company's

efficiency, effectiveness of operations, profitability and liquidity position. Ratio analysis for

more than one year provides a significant comparison of company's performance which helps in

decision making activities of company (Drake and Fabozzi, 2010).

Liquidity Ratio: - It is an financial ratio which indicate that current assets of the organisations

are sufficient or not to meet their obligations. Liquidity ratio also classified between two ratios

such as current and quick ratio.

1. Current ratio: - This ratio is calculate to know about what are the position of current

assets in comparison to current liability. Because it represent that whether assets are

enough to pay companies liabilities or not. Ideal ratio is 2:1 which means any

organisation required double of assets in comparison to liabilities meet their obligations.

2. Quick ratio: - It is also know by acid test ratio and it consider those assets which one is

quickly converted into cash. Stocks are excluded from this ratio because it will take time

to convert stock into finished goods and generate money from it.

Profitability ratio: - It is generally used to check organisational ability to generate profit in

relation to expenses and cost of the production. It is include other ratio like gross profit and net

profit ratio.

Gross profit ratio: - This ratio shows the relationship between net sales and gross profit

and this profit is generated by the operational activity. It is an important tool which

identify the accurate profit from operational activities.

Net profit ratio: - This ratio is calculated by after deducting tax, it means this is the

final profit earned by the organisation. It represent the relationship between net profit or

net sales.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

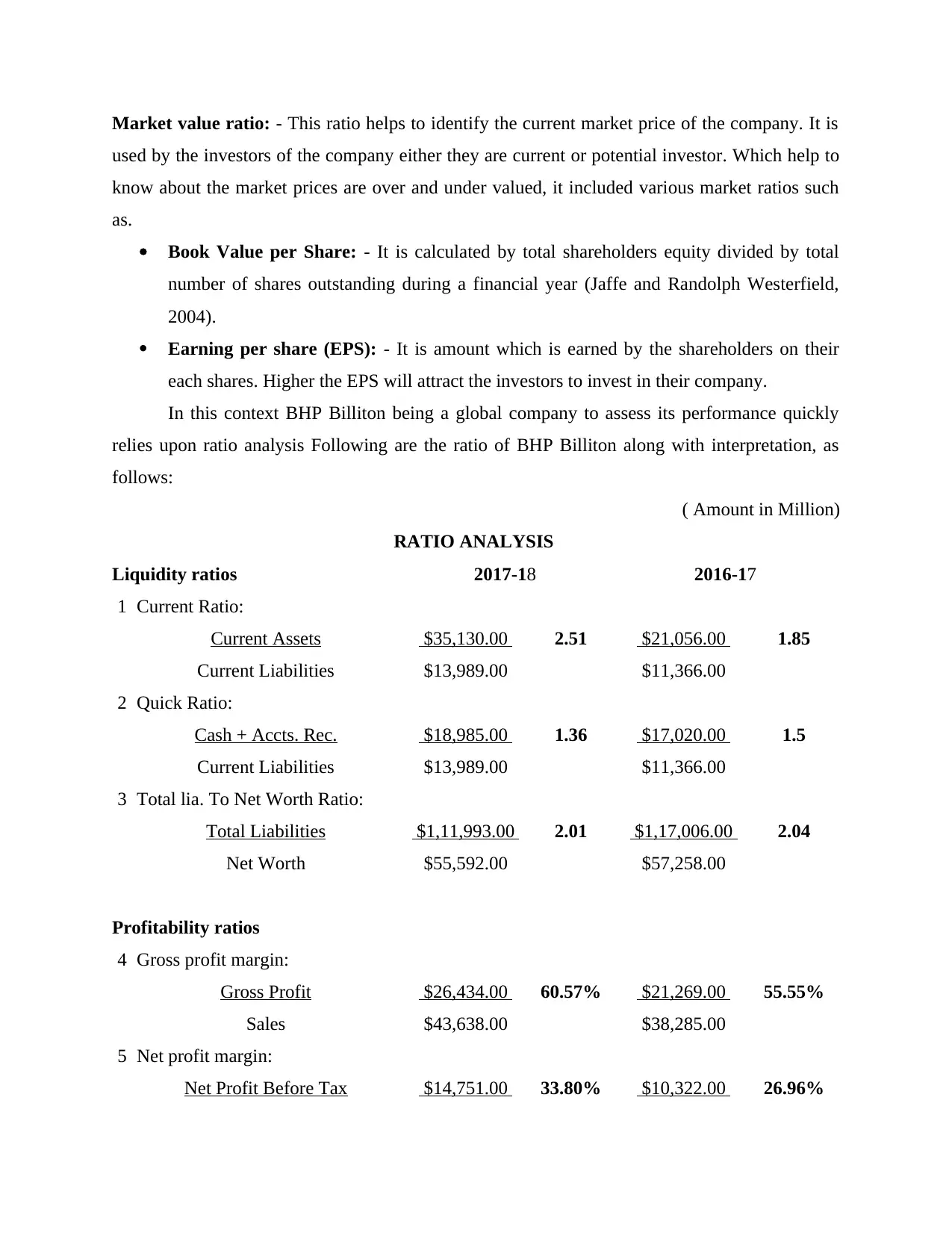

Market value ratio: - This ratio helps to identify the current market price of the company. It is

used by the investors of the company either they are current or potential investor. Which help to

know about the market prices are over and under valued, it included various market ratios such

as.

Book Value per Share: - It is calculated by total shareholders equity divided by total

number of shares outstanding during a financial year (Jaffe and Randolph Westerfield,

2004).

Earning per share (EPS): - It is amount which is earned by the shareholders on their

each shares. Higher the EPS will attract the investors to invest in their company.

In this context BHP Billiton being a global company to assess its performance quickly

relies upon ratio analysis Following are the ratio of BHP Billiton along with interpretation, as

follows:

( Amount in Million)

RATIO ANALYSIS

Liquidity ratios 2017-18 2016-17

1 Current Ratio:

Current Assets $35,130.00 2.51 $21,056.00 1.85

Current Liabilities $13,989.00 $11,366.00

2 Quick Ratio:

Cash + Accts. Rec. $18,985.00 1.36 $17,020.00 1.5

Current Liabilities $13,989.00 $11,366.00

3 Total lia. To Net Worth Ratio:

Total Liabilities $1,11,993.00 2.01 $1,17,006.00 2.04

Net Worth $55,592.00 $57,258.00

Profitability ratios

4 Gross profit margin:

Gross Profit $26,434.00 60.57% $21,269.00 55.55%

Sales $43,638.00 $38,285.00

5 Net profit margin:

Net Profit Before Tax $14,751.00 33.80% $10,322.00 26.96%

used by the investors of the company either they are current or potential investor. Which help to

know about the market prices are over and under valued, it included various market ratios such

as.

Book Value per Share: - It is calculated by total shareholders equity divided by total

number of shares outstanding during a financial year (Jaffe and Randolph Westerfield,

2004).

Earning per share (EPS): - It is amount which is earned by the shareholders on their

each shares. Higher the EPS will attract the investors to invest in their company.

In this context BHP Billiton being a global company to assess its performance quickly

relies upon ratio analysis Following are the ratio of BHP Billiton along with interpretation, as

follows:

( Amount in Million)

RATIO ANALYSIS

Liquidity ratios 2017-18 2016-17

1 Current Ratio:

Current Assets $35,130.00 2.51 $21,056.00 1.85

Current Liabilities $13,989.00 $11,366.00

2 Quick Ratio:

Cash + Accts. Rec. $18,985.00 1.36 $17,020.00 1.5

Current Liabilities $13,989.00 $11,366.00

3 Total lia. To Net Worth Ratio:

Total Liabilities $1,11,993.00 2.01 $1,17,006.00 2.04

Net Worth $55,592.00 $57,258.00

Profitability ratios

4 Gross profit margin:

Gross Profit $26,434.00 60.57% $21,269.00 55.55%

Sales $43,638.00 $38,285.00

5 Net profit margin:

Net Profit Before Tax $14,751.00 33.80% $10,322.00 26.96%

Sales $43,638.00 $38,285.00

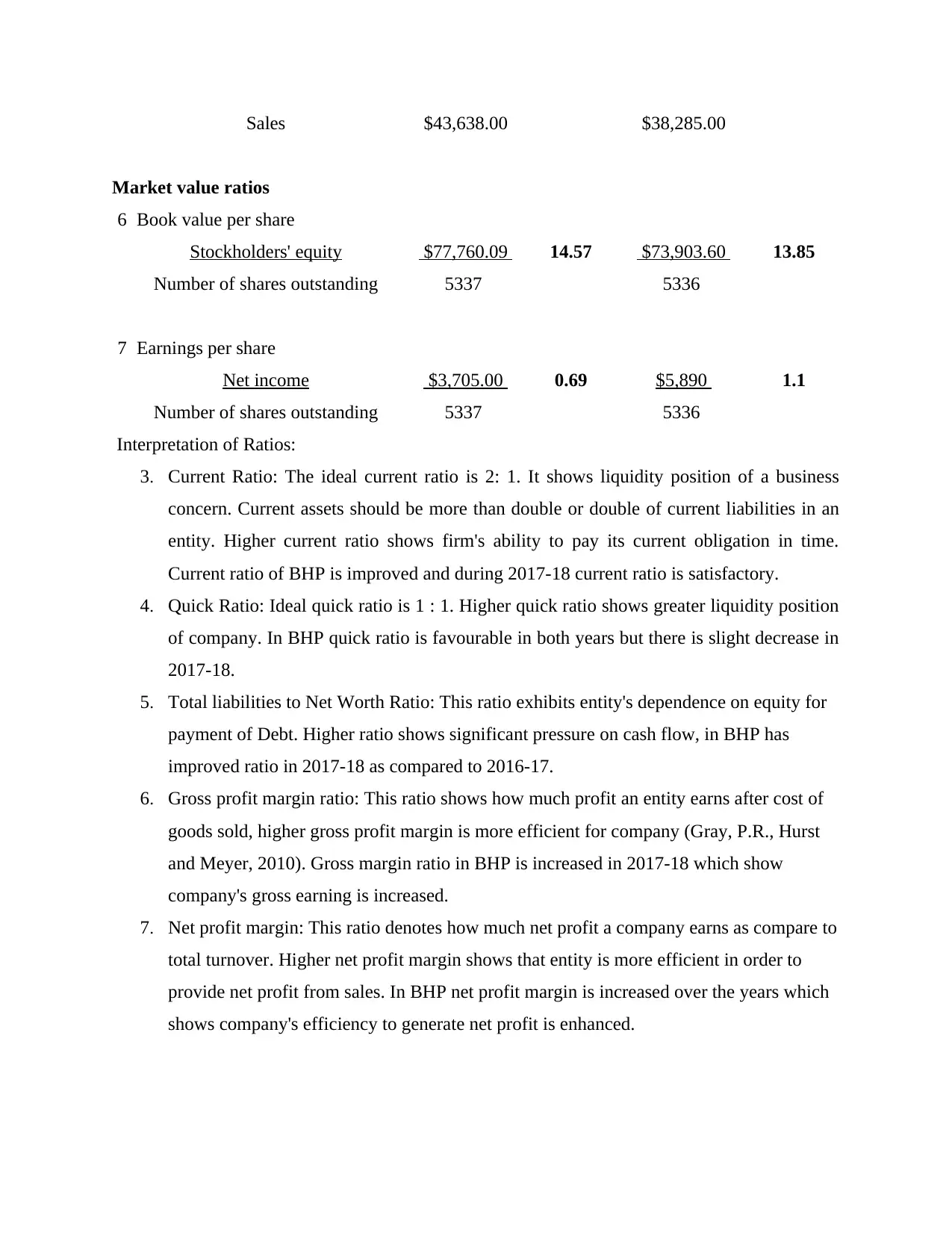

Market value ratios

6 Book value per share

Stockholders' equity $77,760.09 14.57 $73,903.60 13.85

Number of shares outstanding 5337 5336

7 Earnings per share

Net income $3,705.00 0.69 $5,890 1.1

Number of shares outstanding 5337 5336

Interpretation of Ratios:

3. Current Ratio: The ideal current ratio is 2: 1. It shows liquidity position of a business

concern. Current assets should be more than double or double of current liabilities in an

entity. Higher current ratio shows firm's ability to pay its current obligation in time.

Current ratio of BHP is improved and during 2017-18 current ratio is satisfactory.

4. Quick Ratio: Ideal quick ratio is 1 : 1. Higher quick ratio shows greater liquidity position

of company. In BHP quick ratio is favourable in both years but there is slight decrease in

2017-18.

5. Total liabilities to Net Worth Ratio: This ratio exhibits entity's dependence on equity for

payment of Debt. Higher ratio shows significant pressure on cash flow, in BHP has

improved ratio in 2017-18 as compared to 2016-17.

6. Gross profit margin ratio: This ratio shows how much profit an entity earns after cost of

goods sold, higher gross profit margin is more efficient for company (Gray, P.R., Hurst

and Meyer, 2010). Gross margin ratio in BHP is increased in 2017-18 which show

company's gross earning is increased.

7. Net profit margin: This ratio denotes how much net profit a company earns as compare to

total turnover. Higher net profit margin shows that entity is more efficient in order to

provide net profit from sales. In BHP net profit margin is increased over the years which

shows company's efficiency to generate net profit is enhanced.

Market value ratios

6 Book value per share

Stockholders' equity $77,760.09 14.57 $73,903.60 13.85

Number of shares outstanding 5337 5336

7 Earnings per share

Net income $3,705.00 0.69 $5,890 1.1

Number of shares outstanding 5337 5336

Interpretation of Ratios:

3. Current Ratio: The ideal current ratio is 2: 1. It shows liquidity position of a business

concern. Current assets should be more than double or double of current liabilities in an

entity. Higher current ratio shows firm's ability to pay its current obligation in time.

Current ratio of BHP is improved and during 2017-18 current ratio is satisfactory.

4. Quick Ratio: Ideal quick ratio is 1 : 1. Higher quick ratio shows greater liquidity position

of company. In BHP quick ratio is favourable in both years but there is slight decrease in

2017-18.

5. Total liabilities to Net Worth Ratio: This ratio exhibits entity's dependence on equity for

payment of Debt. Higher ratio shows significant pressure on cash flow, in BHP has

improved ratio in 2017-18 as compared to 2016-17.

6. Gross profit margin ratio: This ratio shows how much profit an entity earns after cost of

goods sold, higher gross profit margin is more efficient for company (Gray, P.R., Hurst

and Meyer, 2010). Gross margin ratio in BHP is increased in 2017-18 which show

company's gross earning is increased.

7. Net profit margin: This ratio denotes how much net profit a company earns as compare to

total turnover. Higher net profit margin shows that entity is more efficient in order to

provide net profit from sales. In BHP net profit margin is increased over the years which

shows company's efficiency to generate net profit is enhanced.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

8. Book value per share: Book value per share shows book value of each share of stock

which indicates entity's net asset value. In BHP book value per share has increased in

2017-18, high book value per share in relation to stock price shows stock is undervalued.

9. Earning per share: It shows amount of net income earned per share in an company. In

simple words it shows net profit attributable to each share held by shareholders. EPS of

BHP has decreased in 2017-18, higher EPS builds trust of shareholders in company.

which indicates entity's net asset value. In BHP book value per share has increased in

2017-18, high book value per share in relation to stock price shows stock is undervalued.

9. Earning per share: It shows amount of net income earned per share in an company. In

simple words it shows net profit attributable to each share held by shareholders. EPS of

BHP has decreased in 2017-18, higher EPS builds trust of shareholders in company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

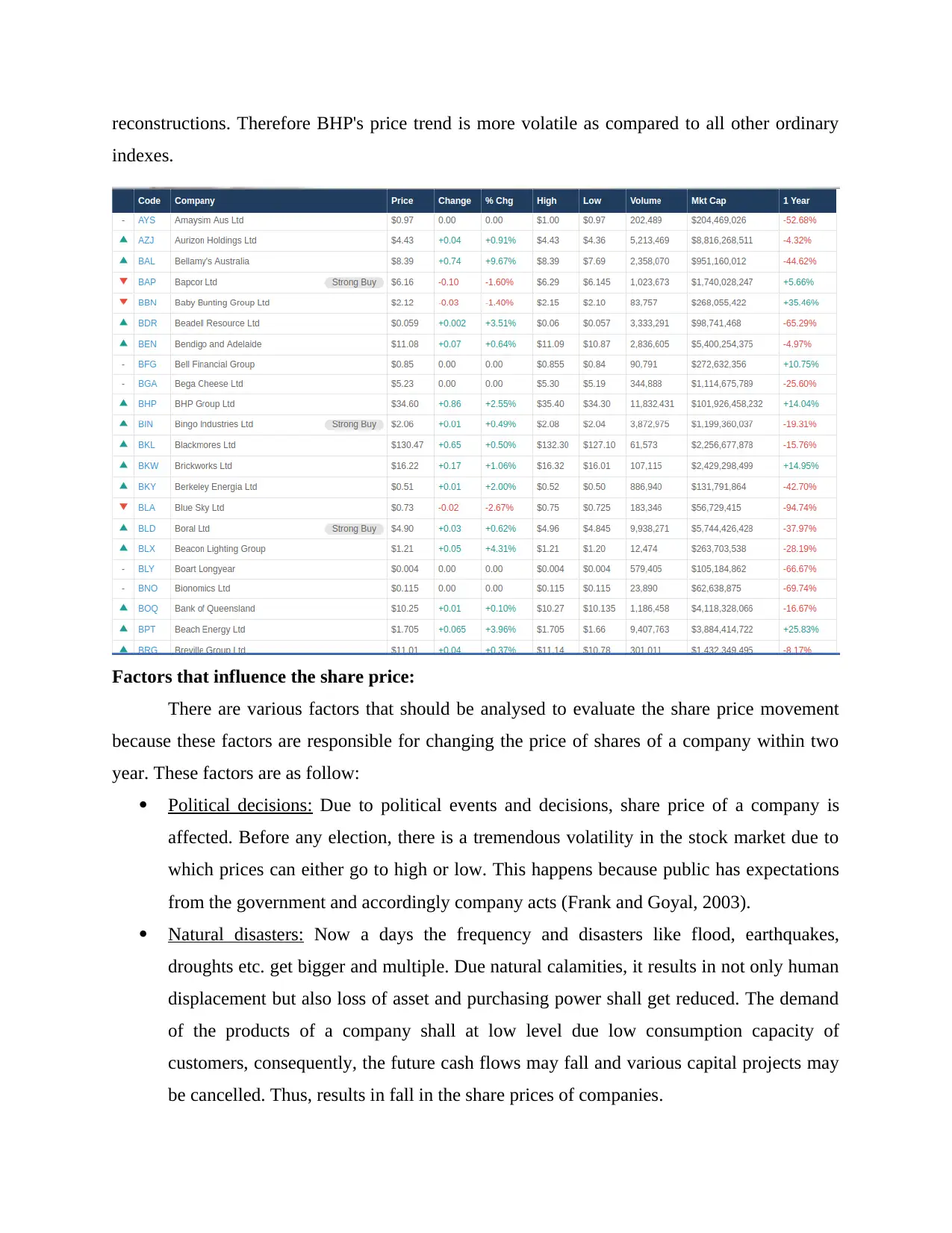

3. Graphs and comparison of share price movement:

Graph displaying movement in monthly share price over the last 2 years:

Analysis to compare the movements in companies’ share prices to the All Ordinaries

Index:

In order to be included in the All-Ordinaries index, a listed company required to have

market value of at least 0.2 percent of total domestic equities quoted on the ASX and must

maintain an average turnover on the ASX of at least 0.5 percent of its quoted shares per month

(Baker and Wurgler, 2002). There are wide range of companies that met this criteria and market

values are favourable. In this context, in BHP price movements in securities with great

capitalizations have a great effect on the All Ordinaries Index as compare to other small

companies. All Ordinaries Index portfolio is revised at the end of every month to analyse

whether companies included continue to met the criteria. It is also revised within one month

when there are changes in the portfolio companies, including de listings, additions and capital

Graph displaying movement in monthly share price over the last 2 years:

Analysis to compare the movements in companies’ share prices to the All Ordinaries

Index:

In order to be included in the All-Ordinaries index, a listed company required to have

market value of at least 0.2 percent of total domestic equities quoted on the ASX and must

maintain an average turnover on the ASX of at least 0.5 percent of its quoted shares per month

(Baker and Wurgler, 2002). There are wide range of companies that met this criteria and market

values are favourable. In this context, in BHP price movements in securities with great

capitalizations have a great effect on the All Ordinaries Index as compare to other small

companies. All Ordinaries Index portfolio is revised at the end of every month to analyse

whether companies included continue to met the criteria. It is also revised within one month

when there are changes in the portfolio companies, including de listings, additions and capital

reconstructions. Therefore BHP's price trend is more volatile as compared to all other ordinary

indexes.

Factors that influence the share price:

There are various factors that should be analysed to evaluate the share price movement

because these factors are responsible for changing the price of shares of a company within two

year. These factors are as follow:

Political decisions: Due to political events and decisions, share price of a company is

affected. Before any election, there is a tremendous volatility in the stock market due to

which prices can either go to high or low. This happens because public has expectations

from the government and accordingly company acts (Frank and Goyal, 2003).

Natural disasters: Now a days the frequency and disasters like flood, earthquakes,

droughts etc. get bigger and multiple. Due natural calamities, it results in not only human

displacement but also loss of asset and purchasing power shall get reduced. The demand

of the products of a company shall at low level due low consumption capacity of

customers, consequently, the future cash flows may fall and various capital projects may

be cancelled. Thus, results in fall in the share prices of companies.

indexes.

Factors that influence the share price:

There are various factors that should be analysed to evaluate the share price movement

because these factors are responsible for changing the price of shares of a company within two

year. These factors are as follow:

Political decisions: Due to political events and decisions, share price of a company is

affected. Before any election, there is a tremendous volatility in the stock market due to

which prices can either go to high or low. This happens because public has expectations

from the government and accordingly company acts (Frank and Goyal, 2003).

Natural disasters: Now a days the frequency and disasters like flood, earthquakes,

droughts etc. get bigger and multiple. Due natural calamities, it results in not only human

displacement but also loss of asset and purchasing power shall get reduced. The demand

of the products of a company shall at low level due low consumption capacity of

customers, consequently, the future cash flows may fall and various capital projects may

be cancelled. Thus, results in fall in the share prices of companies.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

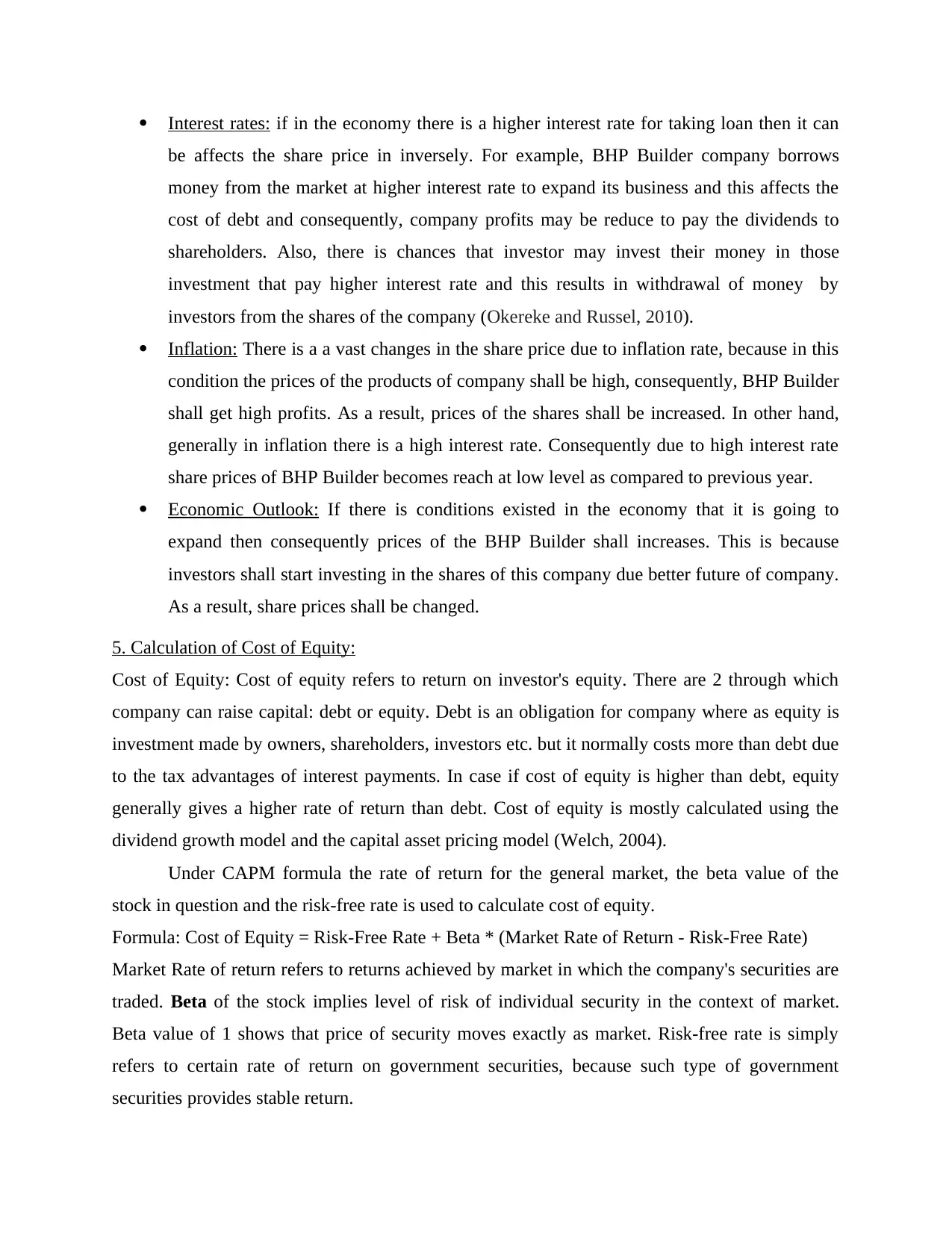

Interest rates: if in the economy there is a higher interest rate for taking loan then it can

be affects the share price in inversely. For example, BHP Builder company borrows

money from the market at higher interest rate to expand its business and this affects the

cost of debt and consequently, company profits may be reduce to pay the dividends to

shareholders. Also, there is chances that investor may invest their money in those

investment that pay higher interest rate and this results in withdrawal of money by

investors from the shares of the company (Okereke and Russel, 2010).

Inflation: There is a a vast changes in the share price due to inflation rate, because in this

condition the prices of the products of company shall be high, consequently, BHP Builder

shall get high profits. As a result, prices of the shares shall be increased. In other hand,

generally in inflation there is a high interest rate. Consequently due to high interest rate

share prices of BHP Builder becomes reach at low level as compared to previous year.

Economic Outlook: If there is conditions existed in the economy that it is going to

expand then consequently prices of the BHP Builder shall increases. This is because

investors shall start investing in the shares of this company due better future of company.

As a result, share prices shall be changed.

5. Calculation of Cost of Equity:

Cost of Equity: Cost of equity refers to return on investor's equity. There are 2 through which

company can raise capital: debt or equity. Debt is an obligation for company where as equity is

investment made by owners, shareholders, investors etc. but it normally costs more than debt due

to the tax advantages of interest payments. In case if cost of equity is higher than debt, equity

generally gives a higher rate of return than debt. Cost of equity is mostly calculated using the

dividend growth model and the capital asset pricing model (Welch, 2004).

Under CAPM formula the rate of return for the general market, the beta value of the

stock in question and the risk-free rate is used to calculate cost of equity.

Formula: Cost of Equity = Risk-Free Rate + Beta * (Market Rate of Return - Risk-Free Rate)

Market Rate of return refers to returns achieved by market in which the company's securities are

traded. Beta of the stock implies level of risk of individual security in the context of market.

Beta value of 1 shows that price of security moves exactly as market. Risk-free rate is simply

refers to certain rate of return on government securities, because such type of government

securities provides stable return.

be affects the share price in inversely. For example, BHP Builder company borrows

money from the market at higher interest rate to expand its business and this affects the

cost of debt and consequently, company profits may be reduce to pay the dividends to

shareholders. Also, there is chances that investor may invest their money in those

investment that pay higher interest rate and this results in withdrawal of money by

investors from the shares of the company (Okereke and Russel, 2010).

Inflation: There is a a vast changes in the share price due to inflation rate, because in this

condition the prices of the products of company shall be high, consequently, BHP Builder

shall get high profits. As a result, prices of the shares shall be increased. In other hand,

generally in inflation there is a high interest rate. Consequently due to high interest rate

share prices of BHP Builder becomes reach at low level as compared to previous year.

Economic Outlook: If there is conditions existed in the economy that it is going to

expand then consequently prices of the BHP Builder shall increases. This is because

investors shall start investing in the shares of this company due better future of company.

As a result, share prices shall be changed.

5. Calculation of Cost of Equity:

Cost of Equity: Cost of equity refers to return on investor's equity. There are 2 through which

company can raise capital: debt or equity. Debt is an obligation for company where as equity is

investment made by owners, shareholders, investors etc. but it normally costs more than debt due

to the tax advantages of interest payments. In case if cost of equity is higher than debt, equity

generally gives a higher rate of return than debt. Cost of equity is mostly calculated using the

dividend growth model and the capital asset pricing model (Welch, 2004).

Under CAPM formula the rate of return for the general market, the beta value of the

stock in question and the risk-free rate is used to calculate cost of equity.

Formula: Cost of Equity = Risk-Free Rate + Beta * (Market Rate of Return - Risk-Free Rate)

Market Rate of return refers to returns achieved by market in which the company's securities are

traded. Beta of the stock implies level of risk of individual security in the context of market.

Beta value of 1 shows that price of security moves exactly as market. Risk-free rate is simply

refers to certain rate of return on government securities, because such type of government

securities provides stable return.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Beta = 1.20

Risk Free Rate of Return(Rf) = 6.00%

Market Risk Premium ( Rm – Rf) = 7.00%

Required Rate of Return(Ke) using the Capital Asset Pricing Model (CAPM) (SML approach) :

Ke = Rf + (Rm - Rf)x Beta

= 6 + 7 x 1.2

= 14.40 %

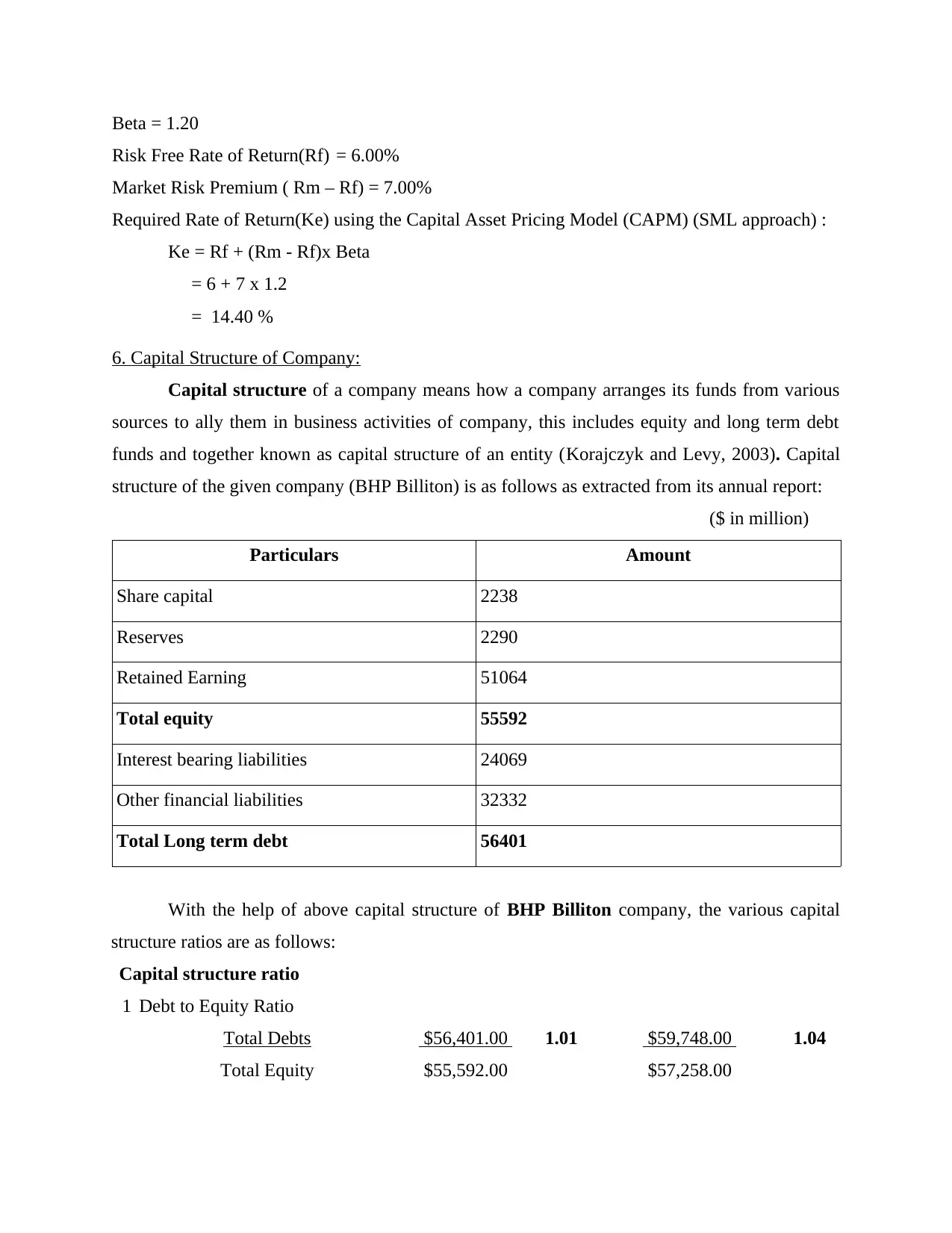

6. Capital Structure of Company:

Capital structure of a company means how a company arranges its funds from various

sources to ally them in business activities of company, this includes equity and long term debt

funds and together known as capital structure of an entity (Korajczyk and Levy, 2003). Capital

structure of the given company (BHP Billiton) is as follows as extracted from its annual report:

($ in million)

Particulars Amount

Share capital 2238

Reserves 2290

Retained Earning 51064

Total equity 55592

Interest bearing liabilities 24069

Other financial liabilities 32332

Total Long term debt 56401

With the help of above capital structure of BHP Billiton company, the various capital

structure ratios are as follows:

Capital structure ratio

1 Debt to Equity Ratio

Total Debts $56,401.00 1.01 $59,748.00 1.04

Total Equity $55,592.00 $57,258.00

Risk Free Rate of Return(Rf) = 6.00%

Market Risk Premium ( Rm – Rf) = 7.00%

Required Rate of Return(Ke) using the Capital Asset Pricing Model (CAPM) (SML approach) :

Ke = Rf + (Rm - Rf)x Beta

= 6 + 7 x 1.2

= 14.40 %

6. Capital Structure of Company:

Capital structure of a company means how a company arranges its funds from various

sources to ally them in business activities of company, this includes equity and long term debt

funds and together known as capital structure of an entity (Korajczyk and Levy, 2003). Capital

structure of the given company (BHP Billiton) is as follows as extracted from its annual report:

($ in million)

Particulars Amount

Share capital 2238

Reserves 2290

Retained Earning 51064

Total equity 55592

Interest bearing liabilities 24069

Other financial liabilities 32332

Total Long term debt 56401

With the help of above capital structure of BHP Billiton company, the various capital

structure ratios are as follows:

Capital structure ratio

1 Debt to Equity Ratio

Total Debts $56,401.00 1.01 $59,748.00 1.04

Total Equity $55,592.00 $57,258.00

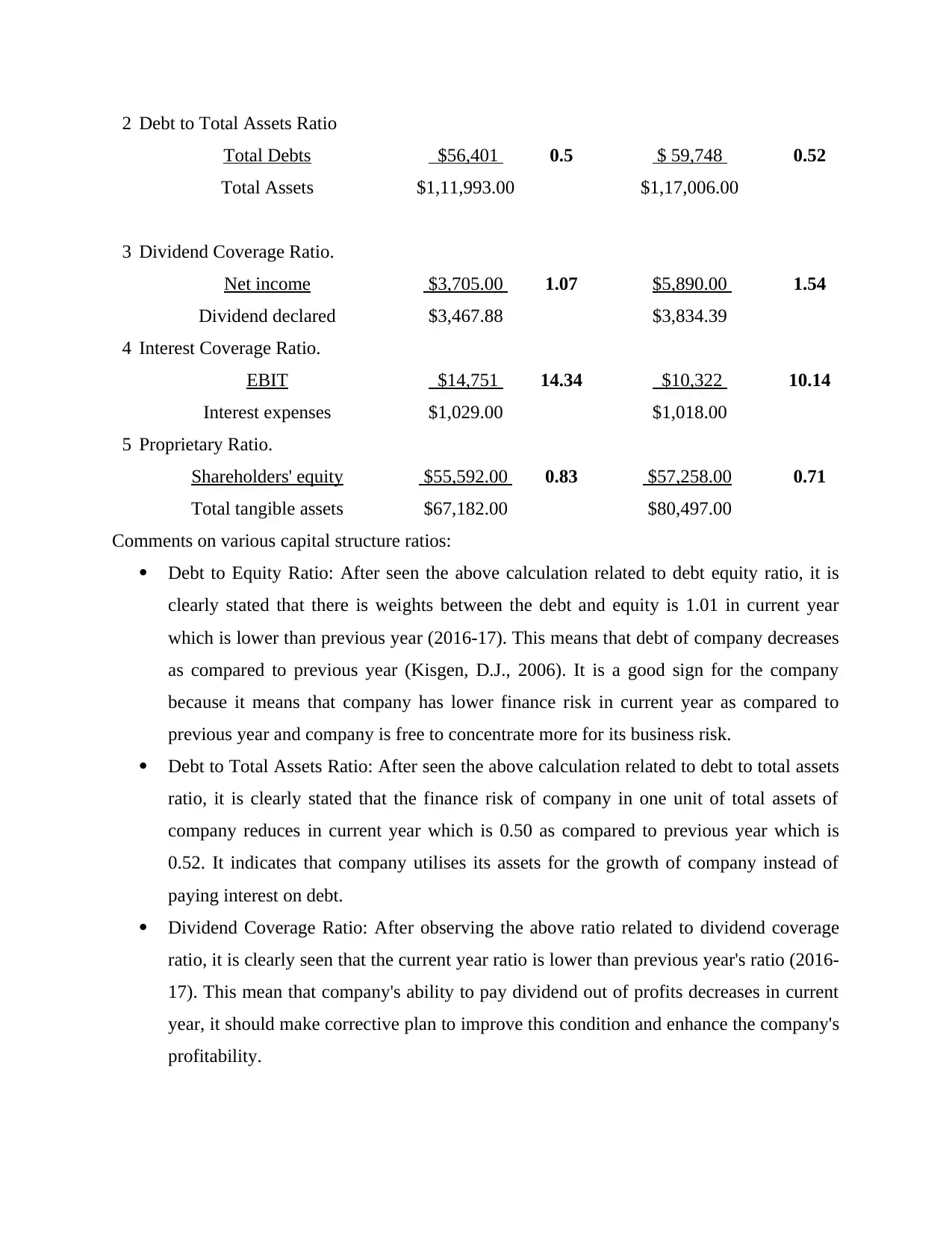

2 Debt to Total Assets Ratio

Total Debts $56,401 0.5 $ 59,748 0.52

Total Assets $1,11,993.00 $1,17,006.00

3 Dividend Coverage Ratio.

Net income $3,705.00 1.07 $5,890.00 1.54

Dividend declared $3,467.88 $3,834.39

4 Interest Coverage Ratio.

EBIT $14,751 14.34 $10,322 10.14

Interest expenses $1,029.00 $1,018.00

5 Proprietary Ratio.

Shareholders' equity $55,592.00 0.83 $57,258.00 0.71

Total tangible assets $67,182.00 $80,497.00

Comments on various capital structure ratios:

Debt to Equity Ratio: After seen the above calculation related to debt equity ratio, it is

clearly stated that there is weights between the debt and equity is 1.01 in current year

which is lower than previous year (2016-17). This means that debt of company decreases

as compared to previous year (Kisgen, D.J., 2006). It is a good sign for the company

because it means that company has lower finance risk in current year as compared to

previous year and company is free to concentrate more for its business risk.

Debt to Total Assets Ratio: After seen the above calculation related to debt to total assets

ratio, it is clearly stated that the finance risk of company in one unit of total assets of

company reduces in current year which is 0.50 as compared to previous year which is

0.52. It indicates that company utilises its assets for the growth of company instead of

paying interest on debt.

Dividend Coverage Ratio: After observing the above ratio related to dividend coverage

ratio, it is clearly seen that the current year ratio is lower than previous year's ratio (2016-

17). This mean that company's ability to pay dividend out of profits decreases in current

year, it should make corrective plan to improve this condition and enhance the company's

profitability.

Total Debts $56,401 0.5 $ 59,748 0.52

Total Assets $1,11,993.00 $1,17,006.00

3 Dividend Coverage Ratio.

Net income $3,705.00 1.07 $5,890.00 1.54

Dividend declared $3,467.88 $3,834.39

4 Interest Coverage Ratio.

EBIT $14,751 14.34 $10,322 10.14

Interest expenses $1,029.00 $1,018.00

5 Proprietary Ratio.

Shareholders' equity $55,592.00 0.83 $57,258.00 0.71

Total tangible assets $67,182.00 $80,497.00

Comments on various capital structure ratios:

Debt to Equity Ratio: After seen the above calculation related to debt equity ratio, it is

clearly stated that there is weights between the debt and equity is 1.01 in current year

which is lower than previous year (2016-17). This means that debt of company decreases

as compared to previous year (Kisgen, D.J., 2006). It is a good sign for the company

because it means that company has lower finance risk in current year as compared to

previous year and company is free to concentrate more for its business risk.

Debt to Total Assets Ratio: After seen the above calculation related to debt to total assets

ratio, it is clearly stated that the finance risk of company in one unit of total assets of

company reduces in current year which is 0.50 as compared to previous year which is

0.52. It indicates that company utilises its assets for the growth of company instead of

paying interest on debt.

Dividend Coverage Ratio: After observing the above ratio related to dividend coverage

ratio, it is clearly seen that the current year ratio is lower than previous year's ratio (2016-

17). This mean that company's ability to pay dividend out of profits decreases in current

year, it should make corrective plan to improve this condition and enhance the company's

profitability.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.