Business Investment Analysis 2022

VerifiedAdded on 2022/09/27

|5

|889

|18

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: BUSINESS INVESTMENT

Business Investment

Name of the Student:

Name of the University:

Author’s Note:

Business Investment

Name of the Student:

Name of the University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1BUSINESS INVESTMENT

Business Investment

The financial analysis has been well carried out for the Vinyl Fencing Company in which

the financial aspects of the company has been well covered. As an owner of the company the

company is well aiming to make plans for large plans of purchases that would be done in the

next three to five years of time period for well achieving the goals of the business.

Future Value of Annuity

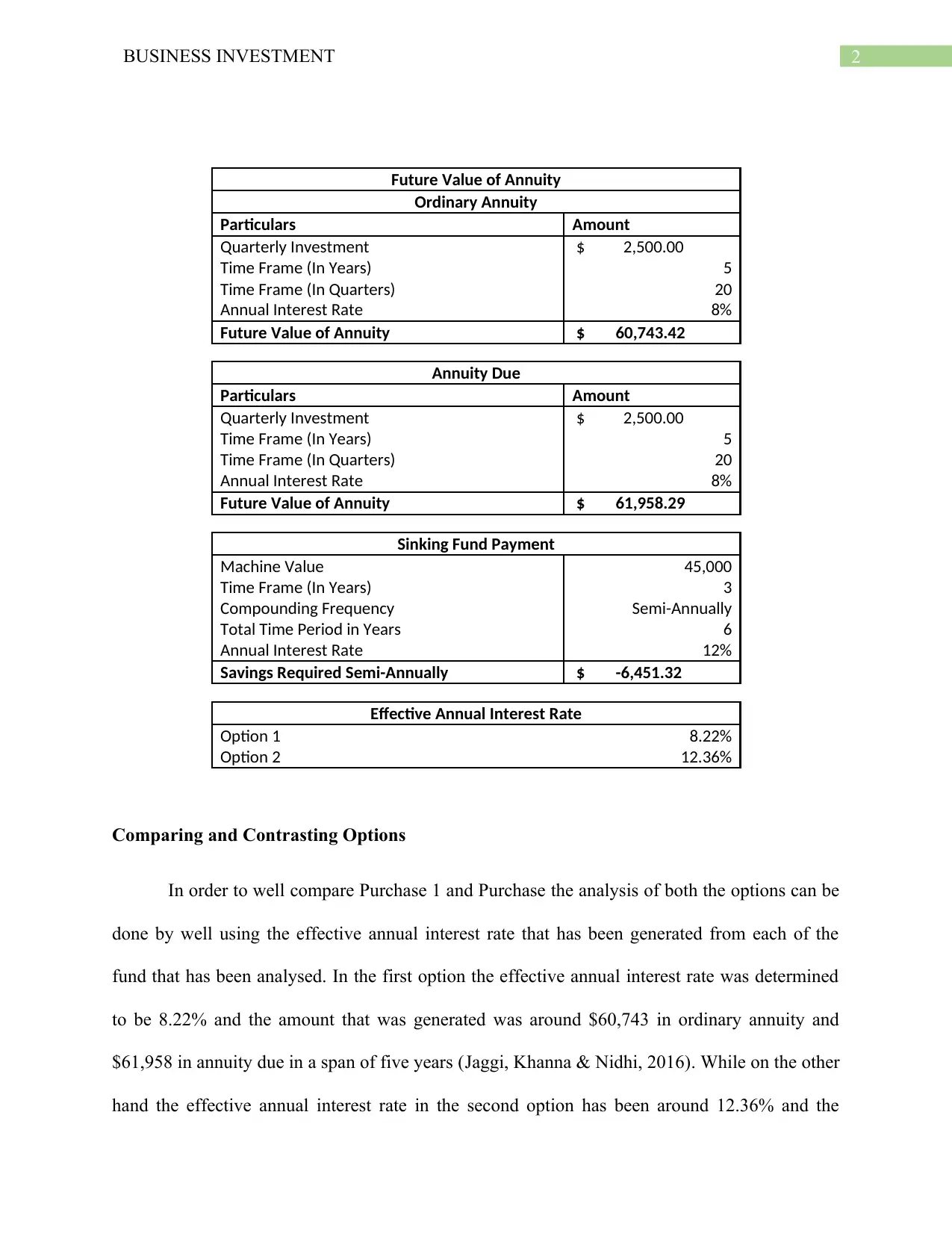

Ordinary Annuity: The future value of the annuity has been well calculated for each of the

presented two options. The first option involves saving via the ordinary annuity in which if a

savings of $2500 is invested into a quarterly basis, using a 8% interest rate and the future value

for the sum would be around $60,743.42 for the annuity investment that would be done.

Annuity Due: If the quarterly savings of $2500 is invested into the investment fund with the

help of the annuity due approach then the fund on an approximately be generating around

$61,958.29 which is slightly higher than the ordinary annuity and in turn would be providing a

higher value of investment return for the owner.

Sinking Fund Payment:

In order to well purchase the machinery which is of worth $45,000 needs to save around $6,451

on a semi-annual basis and invest the same into the account that would be generating a return of

12% compounded on a semi-annual basis.

Business Investment

The financial analysis has been well carried out for the Vinyl Fencing Company in which

the financial aspects of the company has been well covered. As an owner of the company the

company is well aiming to make plans for large plans of purchases that would be done in the

next three to five years of time period for well achieving the goals of the business.

Future Value of Annuity

Ordinary Annuity: The future value of the annuity has been well calculated for each of the

presented two options. The first option involves saving via the ordinary annuity in which if a

savings of $2500 is invested into a quarterly basis, using a 8% interest rate and the future value

for the sum would be around $60,743.42 for the annuity investment that would be done.

Annuity Due: If the quarterly savings of $2500 is invested into the investment fund with the

help of the annuity due approach then the fund on an approximately be generating around

$61,958.29 which is slightly higher than the ordinary annuity and in turn would be providing a

higher value of investment return for the owner.

Sinking Fund Payment:

In order to well purchase the machinery which is of worth $45,000 needs to save around $6,451

on a semi-annual basis and invest the same into the account that would be generating a return of

12% compounded on a semi-annual basis.

2BUSINESS INVESTMENT

Future Value of Annuity

Ordinary Annuity

Particulars Amount

Quarterly Investment $ 2,500.00

Time Frame (In Years) 5

Time Frame (In Quarters) 20

Annual Interest Rate 8%

Future Value of Annuity $ 60,743.42

Annuity Due

Particulars Amount

Quarterly Investment $ 2,500.00

Time Frame (In Years) 5

Time Frame (In Quarters) 20

Annual Interest Rate 8%

Future Value of Annuity $ 61,958.29

Sinking Fund Payment

Machine Value 45,000

Time Frame (In Years) 3

Compounding Frequency Semi-Annually

Total Time Period in Years 6

Annual Interest Rate 12%

Savings Required Semi-Annually $ -6,451.32

Effective Annual Interest Rate

Option 1 8.22%

Option 2 12.36%

Comparing and Contrasting Options

In order to well compare Purchase 1 and Purchase the analysis of both the options can be

done by well using the effective annual interest rate that has been generated from each of the

fund that has been analysed. In the first option the effective annual interest rate was determined

to be 8.22% and the amount that was generated was around $60,743 in ordinary annuity and

$61,958 in annuity due in a span of five years (Jaggi, Khanna & Nidhi, 2016). While on the other

hand the effective annual interest rate in the second option has been around 12.36% and the

Future Value of Annuity

Ordinary Annuity

Particulars Amount

Quarterly Investment $ 2,500.00

Time Frame (In Years) 5

Time Frame (In Quarters) 20

Annual Interest Rate 8%

Future Value of Annuity $ 60,743.42

Annuity Due

Particulars Amount

Quarterly Investment $ 2,500.00

Time Frame (In Years) 5

Time Frame (In Quarters) 20

Annual Interest Rate 8%

Future Value of Annuity $ 61,958.29

Sinking Fund Payment

Machine Value 45,000

Time Frame (In Years) 3

Compounding Frequency Semi-Annually

Total Time Period in Years 6

Annual Interest Rate 12%

Savings Required Semi-Annually $ -6,451.32

Effective Annual Interest Rate

Option 1 8.22%

Option 2 12.36%

Comparing and Contrasting Options

In order to well compare Purchase 1 and Purchase the analysis of both the options can be

done by well using the effective annual interest rate that has been generated from each of the

fund that has been analysed. In the first option the effective annual interest rate was determined

to be 8.22% and the amount that was generated was around $60,743 in ordinary annuity and

$61,958 in annuity due in a span of five years (Jaggi, Khanna & Nidhi, 2016). While on the other

hand the effective annual interest rate in the second option has been around 12.36% and the

3BUSINESS INVESTMENT

amount that has been generated by the purchase option was around $45,000 in a span of three

years. From an interest rate perspective purchase 2 is most favourable as the rate is higher and on

the other hand side when comparing with higher cash flows or amount basis purchase 1 that is

annuity option will be considered (Khir & Fairooz, 2013).

Analysing Options

In order to well prioritize and select options one must well consider the investment and

borrowings options that is available to the owner to the company. As analysed it can be well

financed that the interest rate offered in the Sinking Fund Account is greater that is around 12%

which would allow him to earn a greater sum of money and at the time save money rather than

borrowing the fund. At the same time what he can do is borrow money after a sum of three years

when he well starts his business by taking a amortized loan or mortgage loan against the assets

that he would well purchase after a sum of three years with the savings done. Now considering

the fact that this will be a mortgage loan where the purchased asset would be kept as a mortgage

the company can not only use the asset but also take a loan against the same this would help the

owner serve the business asset requirement as well as the financial requirement.

amount that has been generated by the purchase option was around $45,000 in a span of three

years. From an interest rate perspective purchase 2 is most favourable as the rate is higher and on

the other hand side when comparing with higher cash flows or amount basis purchase 1 that is

annuity option will be considered (Khir & Fairooz, 2013).

Analysing Options

In order to well prioritize and select options one must well consider the investment and

borrowings options that is available to the owner to the company. As analysed it can be well

financed that the interest rate offered in the Sinking Fund Account is greater that is around 12%

which would allow him to earn a greater sum of money and at the time save money rather than

borrowing the fund. At the same time what he can do is borrow money after a sum of three years

when he well starts his business by taking a amortized loan or mortgage loan against the assets

that he would well purchase after a sum of three years with the savings done. Now considering

the fact that this will be a mortgage loan where the purchased asset would be kept as a mortgage

the company can not only use the asset but also take a loan against the same this would help the

owner serve the business asset requirement as well as the financial requirement.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4BUSINESS INVESTMENT

References

Jaggi, C., Khanna, A., & Nidhi, N. (2016). Effects of inflation and time value of money on an

inventory system with deteriorating items and partially backlogged

shortages. International Journal of Industrial Engineering Computations, 7(2), 267-282.

Khir, A., & Fairooz, M. (2013). The concept of the time value of money: A Shari ‘ah

viewpoint. International Journal of Excellence in Islamic Banking and

Finance, 182(882), 1-30.

Lucko, G. (2013). Supporting financial decision-making based on time value of money with

singularity functions in cash flow models. Construction Management and

Economics, 31(3), 238-253.

References

Jaggi, C., Khanna, A., & Nidhi, N. (2016). Effects of inflation and time value of money on an

inventory system with deteriorating items and partially backlogged

shortages. International Journal of Industrial Engineering Computations, 7(2), 267-282.

Khir, A., & Fairooz, M. (2013). The concept of the time value of money: A Shari ‘ah

viewpoint. International Journal of Excellence in Islamic Banking and

Finance, 182(882), 1-30.

Lucko, G. (2013). Supporting financial decision-making based on time value of money with

singularity functions in cash flow models. Construction Management and

Economics, 31(3), 238-253.

1 out of 5

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.