Business Law Report: UK Business Law, Company Structure and ADR

VerifiedAdded on 2020/10/22

|11

|3075

|454

Report

AI Summary

This report provides an overview of UK business law, focusing on key aspects relevant to a courier company, 'K Company'. It begins by outlining the nature of the English legal system, including criminal and civil laws, sources of law such as European and Common law, and the role of Parliament in enacting legislation. The report then delves into employment law, discussing employment status, the gig economy, and the implications of employment contracts. The report uses the case of Pimlico Plumbers vs Smith to illustrate the distinction between employees and independent contractors. Furthermore, the report examines various types of business registrations, including sole trader, partnership, and limited liability, along with the steps required to form a company. It also discusses the roles of directors in managing a company. Finally, the report explores alternate dispute resolution (ADR) methods, such as negotiation, arbitration, and mediation, as effective means of resolving legal disputes. The report refers to the case of Salomon vs Salomon & Co Ltd to illustrate the concept of limited liability.

BUSINESS LAW

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

The nature of legal system...........................................................................................................1

TASK 2............................................................................................................................................3

Employment status.......................................................................................................................3

TASK 3............................................................................................................................................5

Registration of companies............................................................................................................5

Explanation of how business are managed and funded...............................................................6

TASK 4 ...........................................................................................................................................7

Alternate Dispute Resolution.......................................................................................................7

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

BIBLIOGRAPHY ...........................................................................................................................9

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

The nature of legal system...........................................................................................................1

TASK 2............................................................................................................................................3

Employment status.......................................................................................................................3

TASK 3............................................................................................................................................5

Registration of companies............................................................................................................5

Explanation of how business are managed and funded...............................................................6

TASK 4 ...........................................................................................................................................7

Alternate Dispute Resolution.......................................................................................................7

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

BIBLIOGRAPHY ...........................................................................................................................9

INTRODUCTION

Business Law means rules and regulation that a business or company has to follow while it

is carrying a business, even a company exist because of law . There are several acts and

regulation passed by government. The present study is on K company that is a courier company .

A brief discussion is done on criminal and civil law of UK regarding a business .Apart from that

explanation is given on potential impact of law on business that contain various factors like

equipment’s , services, employment benefits etc. In addition to this a briefing is done on types of

organisation and disputes among members , shareholders and all the stakeholders. The present

study also includes resolving method of disputes.

TASK 1

The nature of legal system

English legal system comprise of the rules and regulations followed by the organizations

in the formation and also in the normal functioning of the business. The English legal system

mainly comprise of the criminal and civil laws and there courts and procedures. Mainly the acts

are passed by the parliament and the Queen or the king are the head of the state and bills are

signed by them (Hsieh, Enderle and Murphy, 2015). The European legal system mainly includes-

Criminal law- This law relates to the serious cases like murder or any sexual harassment.

Civil law- these laws are designed to regulate the cases like theft, frauds and misconduct.

Sources of law

European law- European law is the major source of the law for dissolving the cases in

UK. This law is the English law which is regulated by the UK law which was formed in

1973. In this court cases relating to the social, economic and political justice are

governed. This comprises of the European union and the European community.

Common law- common law refers to the law governed by the bench set up by the head of

the state that is the queen (Ricks, 2017). The bench includes the judges who give

decisions on the cases of common nature. The subordinate court are bound by the

superior court. The decision passed by the superior court are binding upon the

subordinate courts.

Act of Parliament- This is the regulatory body which makes and amends the laws in the

order to make the functioning of the law efficient.

1

Business Law means rules and regulation that a business or company has to follow while it

is carrying a business, even a company exist because of law . There are several acts and

regulation passed by government. The present study is on K company that is a courier company .

A brief discussion is done on criminal and civil law of UK regarding a business .Apart from that

explanation is given on potential impact of law on business that contain various factors like

equipment’s , services, employment benefits etc. In addition to this a briefing is done on types of

organisation and disputes among members , shareholders and all the stakeholders. The present

study also includes resolving method of disputes.

TASK 1

The nature of legal system

English legal system comprise of the rules and regulations followed by the organizations

in the formation and also in the normal functioning of the business. The English legal system

mainly comprise of the criminal and civil laws and there courts and procedures. Mainly the acts

are passed by the parliament and the Queen or the king are the head of the state and bills are

signed by them (Hsieh, Enderle and Murphy, 2015). The European legal system mainly includes-

Criminal law- This law relates to the serious cases like murder or any sexual harassment.

Civil law- these laws are designed to regulate the cases like theft, frauds and misconduct.

Sources of law

European law- European law is the major source of the law for dissolving the cases in

UK. This law is the English law which is regulated by the UK law which was formed in

1973. In this court cases relating to the social, economic and political justice are

governed. This comprises of the European union and the European community.

Common law- common law refers to the law governed by the bench set up by the head of

the state that is the queen (Ricks, 2017). The bench includes the judges who give

decisions on the cases of common nature. The subordinate court are bound by the

superior court. The decision passed by the superior court are binding upon the

subordinate courts.

Act of Parliament- This is the regulatory body which makes and amends the laws in the

order to make the functioning of the law efficient.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

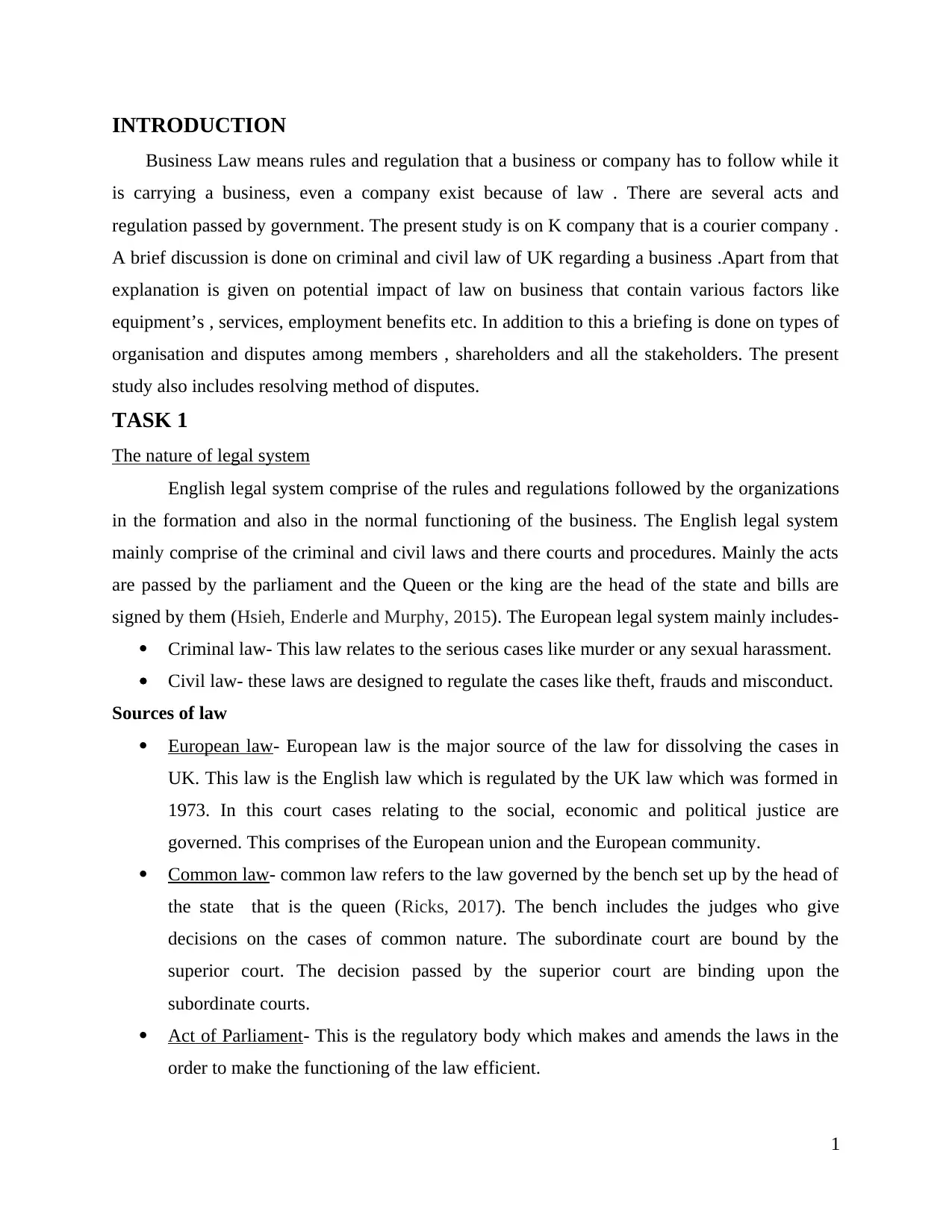

Custom- this law is concerned with the making of law using the peoples behaviour and

habits. This law was enacted by the kings in the interest of the common person.

Ill

ustration 1: Stages of passing the bill in parliament

(Source: How does a bill become a law, 2018)

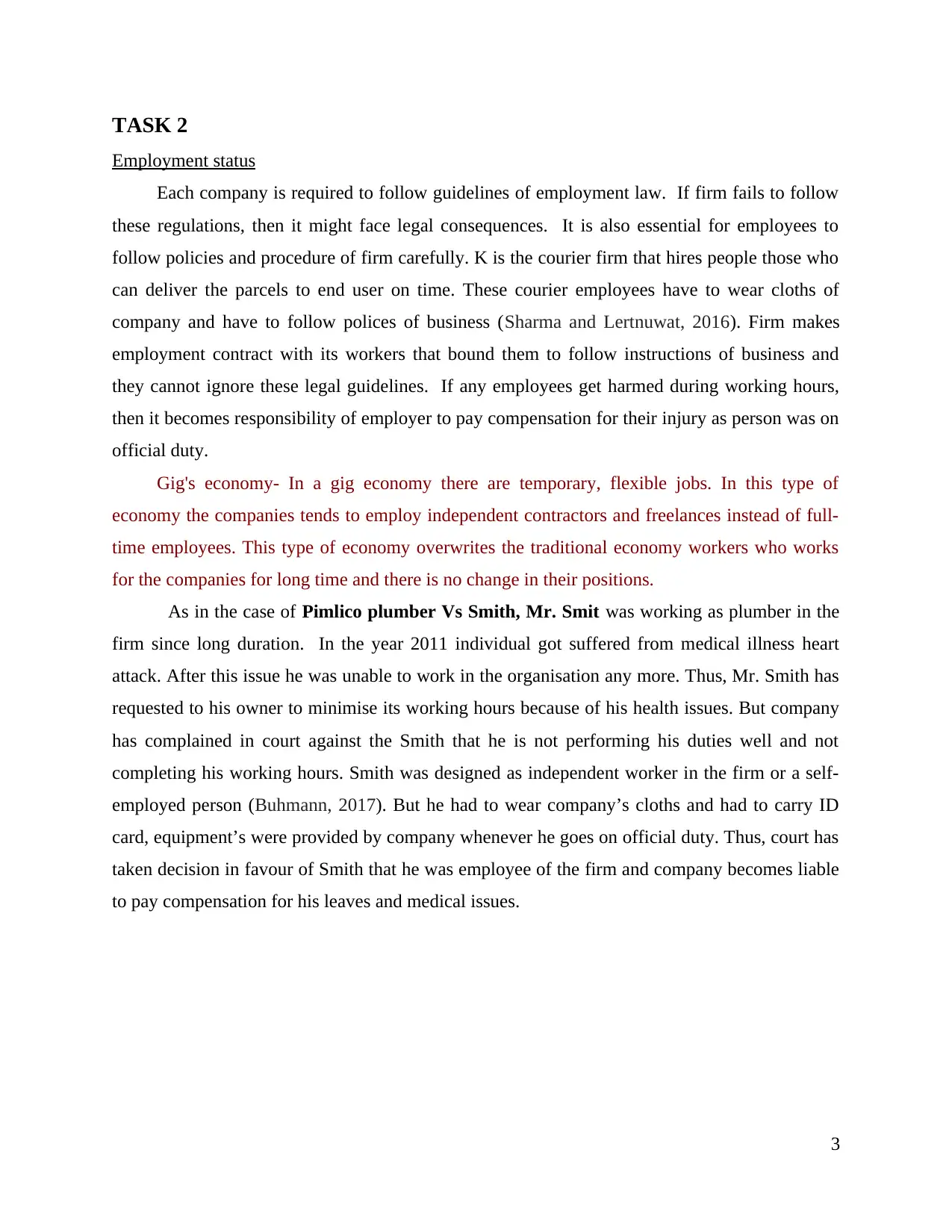

The Parliament is the regulating and the governing body in UK. Parliament consists of 785

members which are directly elected by the people with right to vote in each state. There is the

demographic supervision over the commission by the President. Both the council and the

parliament formulates and adopts the legislation of the country (Ball and Viswanathan, 2017).

Stages of passing of bill in parliament-

The law is made in the parliament by passing of the proposal initially which is commonly

known as the bill. Thus the bill is considered in the first reading where the bill is been read and

noticed. Thereafter in the second reading the bill is considered in the floor of the houses where

the relevancy of the bill is being checked and than the bill is considered in the third reading in

which the there is a debate in relating to the bill contents. After both the houses agrees on the bill

it is passed through the house of lords and receives the Royal Assent from the Queen and

denoted as the act of Parliament (Hopkins, 2019).

2

habits. This law was enacted by the kings in the interest of the common person.

Ill

ustration 1: Stages of passing the bill in parliament

(Source: How does a bill become a law, 2018)

The Parliament is the regulating and the governing body in UK. Parliament consists of 785

members which are directly elected by the people with right to vote in each state. There is the

demographic supervision over the commission by the President. Both the council and the

parliament formulates and adopts the legislation of the country (Ball and Viswanathan, 2017).

Stages of passing of bill in parliament-

The law is made in the parliament by passing of the proposal initially which is commonly

known as the bill. Thus the bill is considered in the first reading where the bill is been read and

noticed. Thereafter in the second reading the bill is considered in the floor of the houses where

the relevancy of the bill is being checked and than the bill is considered in the third reading in

which the there is a debate in relating to the bill contents. After both the houses agrees on the bill

it is passed through the house of lords and receives the Royal Assent from the Queen and

denoted as the act of Parliament (Hopkins, 2019).

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

Employment status

Each company is required to follow guidelines of employment law. If firm fails to follow

these regulations, then it might face legal consequences. It is also essential for employees to

follow policies and procedure of firm carefully. K is the courier firm that hires people those who

can deliver the parcels to end user on time. These courier employees have to wear cloths of

company and have to follow polices of business (Sharma and Lertnuwat, 2016). Firm makes

employment contract with its workers that bound them to follow instructions of business and

they cannot ignore these legal guidelines. If any employees get harmed during working hours,

then it becomes responsibility of employer to pay compensation for their injury as person was on

official duty.

Gig's economy- In a gig economy there are temporary, flexible jobs. In this type of

economy the companies tends to employ independent contractors and freelances instead of full-

time employees. This type of economy overwrites the traditional economy workers who works

for the companies for long time and there is no change in their positions.

As in the case of Pimlico plumber Vs Smith, Mr. Smit was working as plumber in the

firm since long duration. In the year 2011 individual got suffered from medical illness heart

attack. After this issue he was unable to work in the organisation any more. Thus, Mr. Smith has

requested to his owner to minimise its working hours because of his health issues. But company

has complained in court against the Smith that he is not performing his duties well and not

completing his working hours. Smith was designed as independent worker in the firm or a self-

employed person (Buhmann, 2017). But he had to wear company’s cloths and had to carry ID

card, equipment’s were provided by company whenever he goes on official duty. Thus, court has

taken decision in favour of Smith that he was employee of the firm and company becomes liable

to pay compensation for his leaves and medical issues.

3

Employment status

Each company is required to follow guidelines of employment law. If firm fails to follow

these regulations, then it might face legal consequences. It is also essential for employees to

follow policies and procedure of firm carefully. K is the courier firm that hires people those who

can deliver the parcels to end user on time. These courier employees have to wear cloths of

company and have to follow polices of business (Sharma and Lertnuwat, 2016). Firm makes

employment contract with its workers that bound them to follow instructions of business and

they cannot ignore these legal guidelines. If any employees get harmed during working hours,

then it becomes responsibility of employer to pay compensation for their injury as person was on

official duty.

Gig's economy- In a gig economy there are temporary, flexible jobs. In this type of

economy the companies tends to employ independent contractors and freelances instead of full-

time employees. This type of economy overwrites the traditional economy workers who works

for the companies for long time and there is no change in their positions.

As in the case of Pimlico plumber Vs Smith, Mr. Smit was working as plumber in the

firm since long duration. In the year 2011 individual got suffered from medical illness heart

attack. After this issue he was unable to work in the organisation any more. Thus, Mr. Smith has

requested to his owner to minimise its working hours because of his health issues. But company

has complained in court against the Smith that he is not performing his duties well and not

completing his working hours. Smith was designed as independent worker in the firm or a self-

employed person (Buhmann, 2017). But he had to wear company’s cloths and had to carry ID

card, equipment’s were provided by company whenever he goes on official duty. Thus, court has

taken decision in favour of Smith that he was employee of the firm and company becomes liable

to pay compensation for his leaves and medical issues.

3

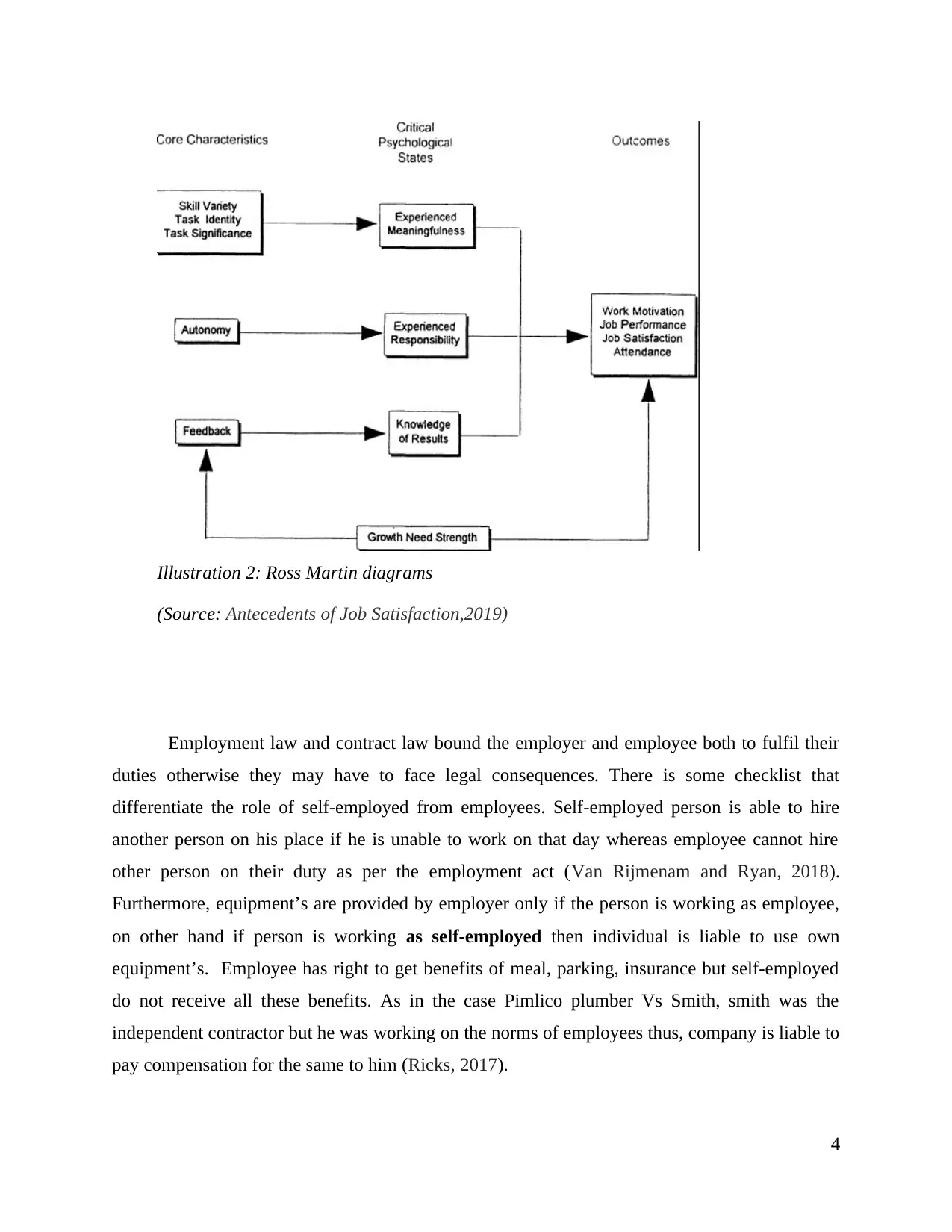

Illustration 2: Ross Martin diagrams

(Source: Antecedents of Job Satisfaction,2019)

Employment law and contract law bound the employer and employee both to fulfil their

duties otherwise they may have to face legal consequences. There is some checklist that

differentiate the role of self-employed from employees. Self-employed person is able to hire

another person on his place if he is unable to work on that day whereas employee cannot hire

other person on their duty as per the employment act (Van Rijmenam and Ryan, 2018).

Furthermore, equipment’s are provided by employer only if the person is working as employee,

on other hand if person is working as self-employed then individual is liable to use own

equipment’s. Employee has right to get benefits of meal, parking, insurance but self-employed

do not receive all these benefits. As in the case Pimlico plumber Vs Smith, smith was the

independent contractor but he was working on the norms of employees thus, company is liable to

pay compensation for the same to him (Ricks, 2017).

4

(Source: Antecedents of Job Satisfaction,2019)

Employment law and contract law bound the employer and employee both to fulfil their

duties otherwise they may have to face legal consequences. There is some checklist that

differentiate the role of self-employed from employees. Self-employed person is able to hire

another person on his place if he is unable to work on that day whereas employee cannot hire

other person on their duty as per the employment act (Van Rijmenam and Ryan, 2018).

Furthermore, equipment’s are provided by employer only if the person is working as employee,

on other hand if person is working as self-employed then individual is liable to use own

equipment’s. Employee has right to get benefits of meal, parking, insurance but self-employed

do not receive all these benefits. As in the case Pimlico plumber Vs Smith, smith was the

independent contractor but he was working on the norms of employees thus, company is liable to

pay compensation for the same to him (Ricks, 2017).

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 3

Registration of companies

There are so many ways that can be adopted by K company in order to sustain in the

market for longer duration. There are so many different types of business in which firm may get

engaged.

Sole trader: It is considered as one of the simplest type of business in which owner itself

takes all the decision for the business and run the firm accordingly. Owner is required to invest

own amount to run business successfully (Dahan, Doh and Raelin, 2015). There is no need to

pay tax of company, individual has to pay individual tax only. In order to run business as sole

trader K company will have to invest own amount and if firm fails to generate revenues then it

may affect financial position of owner to great extent.

Partnership firm: This is another type of business in which two or more partners operate

the business. Both these partners are liable for risk and they share their profit equally. Both they

come into partnership contract and invest their own amount. On the bases of their legal rights in

business profit is shared among them. If firm faces any risk then both owners can bear that loss,

if K company gets engaged in this type of business then it would be beneficial for the

organisation to manage its risk and run its business successfully for longer duration (Molina-

Azorín and Cameron, 2015).

Limited liability: It is another kind of business, company act 2006 explains that any firm

can come under private or public limited firm but it has to follow guidelines and requirements of

this act. If K company gets engaged in this type of business, then it would be essential for

business to pay tax of company. Furthermore, it will have to sell its shares in stock exchange.

Firm might issue its own memorandum. Owner is responsible to bear risk of business in limited

firm (O'Kelley and Thompson, 2017).

K company can get registered itself as partnership firm, in this firm will be able to

manage its risk well and it will be able to get ideas from partners that would help in getting more

profit. Furthermore, less investment will be required by the owner of K company thus, it should

get registered itself as partnership firm.

As per the case, of Salomon vs Salomon & co Ltd: owner of the firm has opened his

business as sole trader but his children have forced him to take the title of limited company. All

the requirements of being limited firm was fulfilled by Salomon. But he was unable to manage

5

Registration of companies

There are so many ways that can be adopted by K company in order to sustain in the

market for longer duration. There are so many different types of business in which firm may get

engaged.

Sole trader: It is considered as one of the simplest type of business in which owner itself

takes all the decision for the business and run the firm accordingly. Owner is required to invest

own amount to run business successfully (Dahan, Doh and Raelin, 2015). There is no need to

pay tax of company, individual has to pay individual tax only. In order to run business as sole

trader K company will have to invest own amount and if firm fails to generate revenues then it

may affect financial position of owner to great extent.

Partnership firm: This is another type of business in which two or more partners operate

the business. Both these partners are liable for risk and they share their profit equally. Both they

come into partnership contract and invest their own amount. On the bases of their legal rights in

business profit is shared among them. If firm faces any risk then both owners can bear that loss,

if K company gets engaged in this type of business then it would be beneficial for the

organisation to manage its risk and run its business successfully for longer duration (Molina-

Azorín and Cameron, 2015).

Limited liability: It is another kind of business, company act 2006 explains that any firm

can come under private or public limited firm but it has to follow guidelines and requirements of

this act. If K company gets engaged in this type of business, then it would be essential for

business to pay tax of company. Furthermore, it will have to sell its shares in stock exchange.

Firm might issue its own memorandum. Owner is responsible to bear risk of business in limited

firm (O'Kelley and Thompson, 2017).

K company can get registered itself as partnership firm, in this firm will be able to

manage its risk well and it will be able to get ideas from partners that would help in getting more

profit. Furthermore, less investment will be required by the owner of K company thus, it should

get registered itself as partnership firm.

As per the case, of Salomon vs Salomon & co Ltd: owner of the firm has opened his

business as sole trader but his children have forced him to take the title of limited company. All

the requirements of being limited firm was fulfilled by Salomon. But he was unable to manage

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

debts thus, liquidity position of firm gets affected badly (The Law Journal Reports, Volume 57,

Part 1, 2017). It was not having adequate assets. High court has taken decision that he is liable to

pay all the debt amount to its creditors because company is separated from members and it has to

repay all the debt amount from personal funds.

Steps needed to form a company-

These are the various steps included in the formation of the companies in United Kingdom-

1. Choose business name

2. Identify location of company

3. Select the type of corporations

4. Name the company directors

5. Determine the type of shares

6. Obtain a certificate of incorporation

7. Process and file the paperwork of the company.

Role of directors-

The role of directors in a company are in-charge of the management of the company. The

company operates through the two bodies of people- its shareholders and its board of directors.

The directors are agents of company, directors are appointed by the shareholders of the

companies who manges the day to day affairs of the company. The directors of the companies

act collectively with the board but in some cases the board may delegate its power to individual

director or to a committee. The directors of the company promote and assist the success of the

company and achieve organization goals.

Explanation of how business are managed and funded

As in the case of Salomon vs Solomon it is found that company is liable to pay debt

amount to its creditors. Directors are not liable for any action until firm is pierced. In order to

manage the firm well it is essential to fulfil requirements of section 9 (5) (Ball and Viswanathan,

2017). This section states that it is essential to form article of association in order to run a

business successfully. Furthermore, section 9(4) needs to be followed that states that each private

firm must maintain minimum capital requirements so that if it fails to generate revenues then it

can repay its debts timely (Hopkins, 2019). Section 9 (2) explains that registered needs to be

done properly there should be name, address of firm (Adams, 2018).

6

Part 1, 2017). It was not having adequate assets. High court has taken decision that he is liable to

pay all the debt amount to its creditors because company is separated from members and it has to

repay all the debt amount from personal funds.

Steps needed to form a company-

These are the various steps included in the formation of the companies in United Kingdom-

1. Choose business name

2. Identify location of company

3. Select the type of corporations

4. Name the company directors

5. Determine the type of shares

6. Obtain a certificate of incorporation

7. Process and file the paperwork of the company.

Role of directors-

The role of directors in a company are in-charge of the management of the company. The

company operates through the two bodies of people- its shareholders and its board of directors.

The directors are agents of company, directors are appointed by the shareholders of the

companies who manges the day to day affairs of the company. The directors of the companies

act collectively with the board but in some cases the board may delegate its power to individual

director or to a committee. The directors of the company promote and assist the success of the

company and achieve organization goals.

Explanation of how business are managed and funded

As in the case of Salomon vs Solomon it is found that company is liable to pay debt

amount to its creditors. Directors are not liable for any action until firm is pierced. In order to

manage the firm well it is essential to fulfil requirements of section 9 (5) (Ball and Viswanathan,

2017). This section states that it is essential to form article of association in order to run a

business successfully. Furthermore, section 9(4) needs to be followed that states that each private

firm must maintain minimum capital requirements so that if it fails to generate revenues then it

can repay its debts timely (Hopkins, 2019). Section 9 (2) explains that registered needs to be

done properly there should be name, address of firm (Adams, 2018).

6

TASK 4

Alternate Dispute Resolution

To resolve legal disputes between two or more parties there are different methods like

like negotiation, arbitration and mediation. These method of negotiation is very helpful because

it saves times of the affected parties in fulfilling various formalities in court (Catan and Kahan,

2016). Here the final decision is taken by arbitrator or the negotiating authority but if the case is

not handled by these authorities then it has to be taken to higher authorities like high courts or

supreme courts.

Mediation:Mediator are the persons who does not take any decision but it only give

guidance for proper decision thus mediator is the person mutually appointed by the affected

parties by an agreement and who does not have any right to pass judgement regarding the

disputes. If mediator is unable to reach at any decision then parties have right to take their case to

the court or higher authority.

Arbitration:An arbitrator is appointed when parties are unable to reach at mutual point

so it is appointed by the own choice of parties where both the parties has to follow rules made by

the arbitrator, here the decision of arbitrator is final that both the parties have to follow.this

decision of the arbitrator may or may not be in the favour of parties (McBarnet, 2019) . The

benefit of arbitration is that both the parties can rely on the arbitrator as it is the third party and

any decision that will be taken by arbitrator will be fair.

Negotiation: Here negotiator is appointed by both the parties by their mutual decision

who settles the dispute among the parties .Apart from that both the parties has to follow the

guidelines made by the negotiator and its decision is final. Parties here cannot move to higher

authorities for further prosecution. (Molina-Azorín and Cameron, 2015). move to higher

authorities for further prosecution.

CONCLUSION

From the above study it can be concluded that every business has its own legal rules for its

internal matter. These legal regulation helps company from commencing its business to its

dissolution.

7

Alternate Dispute Resolution

To resolve legal disputes between two or more parties there are different methods like

like negotiation, arbitration and mediation. These method of negotiation is very helpful because

it saves times of the affected parties in fulfilling various formalities in court (Catan and Kahan,

2016). Here the final decision is taken by arbitrator or the negotiating authority but if the case is

not handled by these authorities then it has to be taken to higher authorities like high courts or

supreme courts.

Mediation:Mediator are the persons who does not take any decision but it only give

guidance for proper decision thus mediator is the person mutually appointed by the affected

parties by an agreement and who does not have any right to pass judgement regarding the

disputes. If mediator is unable to reach at any decision then parties have right to take their case to

the court or higher authority.

Arbitration:An arbitrator is appointed when parties are unable to reach at mutual point

so it is appointed by the own choice of parties where both the parties has to follow rules made by

the arbitrator, here the decision of arbitrator is final that both the parties have to follow.this

decision of the arbitrator may or may not be in the favour of parties (McBarnet, 2019) . The

benefit of arbitration is that both the parties can rely on the arbitrator as it is the third party and

any decision that will be taken by arbitrator will be fair.

Negotiation: Here negotiator is appointed by both the parties by their mutual decision

who settles the dispute among the parties .Apart from that both the parties has to follow the

guidelines made by the negotiator and its decision is final. Parties here cannot move to higher

authorities for further prosecution. (Molina-Azorín and Cameron, 2015). move to higher

authorities for further prosecution.

CONCLUSION

From the above study it can be concluded that every business has its own legal rules for its

internal matter. These legal regulation helps company from commencing its business to its

dissolution.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Ball, A. and Viswanathan, M., 2017. From Business Tax Theory to Practice. Clinical L. Rev. 24.

p.27.

Buhmann, K., 2017. Changing sustainability norms through communication processes: the

emergence of the business and human rights regime as transnational law. Edward Elgar

Publishing.

Catan, E. M. and Kahan, M., 2016. The law and finance of antitakeover statutes. Stan. L.

Rev. 68. pp.629.

Dahan, N. M., Doh, J. P. and Raelin, J. D., 2015. Pivoting the role of government in the business

and society interface: A stakeholder perspective. Journal of Business ethics. 131(3).

pp.665-680.

Hopkins, B. R., 2019. The law of tax-exempt organizations. Wiley.

Hsieh, N. H., Enderle, G. and Murphy, P. E., 2015. Managerial Responsibility and the Purpose of

Business: Doing One’s Job Well. Ethical Innovation in Business and the Economy:

Studies in Transatlantic Business Ethics. pp.95-118.

McBarnet, D., 2019. When compliance is not the solution but the problem: From changes in law

to changes in attitude. Centre for Tax System Integrity (CTSI), Research School of

Social Sciences, The Australian National University.

Molina-Azorín, J. F. and Cameron, R. A., 2015. History and emergent practices of multimethod

and mixed methods in business research. In The Oxford handbook of multimethod and

mixed methods research inquiry.

O'Kelley, C. R. and Thompson, R. B., 2017. Corporations and other business associations:

cases and materials. Wolters Kluwer Law & Business.

Ricks, M., 2017. Organizational law as commitment device. Vand. L. Rev. 70.pp.1303.

Sharma, S. and Lertnuwat, N., 2016. The financial crowdfunding with diverse business

models. Journal of Asian and African Social Science and Humanities (ISSN 2413-

2748). 2(2). pp.74-89.

Van Rijmenam, M. and Ryan, P., 2018. Blockchain: Transforming Your Business and Our

World. Routledge.

Adams. A., 2018. Law for Business Students Sixth edition. Pearson Education Limited.

8

Books and Journals

Ball, A. and Viswanathan, M., 2017. From Business Tax Theory to Practice. Clinical L. Rev. 24.

p.27.

Buhmann, K., 2017. Changing sustainability norms through communication processes: the

emergence of the business and human rights regime as transnational law. Edward Elgar

Publishing.

Catan, E. M. and Kahan, M., 2016. The law and finance of antitakeover statutes. Stan. L.

Rev. 68. pp.629.

Dahan, N. M., Doh, J. P. and Raelin, J. D., 2015. Pivoting the role of government in the business

and society interface: A stakeholder perspective. Journal of Business ethics. 131(3).

pp.665-680.

Hopkins, B. R., 2019. The law of tax-exempt organizations. Wiley.

Hsieh, N. H., Enderle, G. and Murphy, P. E., 2015. Managerial Responsibility and the Purpose of

Business: Doing One’s Job Well. Ethical Innovation in Business and the Economy:

Studies in Transatlantic Business Ethics. pp.95-118.

McBarnet, D., 2019. When compliance is not the solution but the problem: From changes in law

to changes in attitude. Centre for Tax System Integrity (CTSI), Research School of

Social Sciences, The Australian National University.

Molina-Azorín, J. F. and Cameron, R. A., 2015. History and emergent practices of multimethod

and mixed methods in business research. In The Oxford handbook of multimethod and

mixed methods research inquiry.

O'Kelley, C. R. and Thompson, R. B., 2017. Corporations and other business associations:

cases and materials. Wolters Kluwer Law & Business.

Ricks, M., 2017. Organizational law as commitment device. Vand. L. Rev. 70.pp.1303.

Sharma, S. and Lertnuwat, N., 2016. The financial crowdfunding with diverse business

models. Journal of Asian and African Social Science and Humanities (ISSN 2413-

2748). 2(2). pp.74-89.

Van Rijmenam, M. and Ryan, P., 2018. Blockchain: Transforming Your Business and Our

World. Routledge.

Adams. A., 2018. Law for Business Students Sixth edition. Pearson Education Limited.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Online

How does a bill become a law. 2018. [Online]. Available

through:<https://www.parliament.uk/about/how/laws/passage-bill/>.

The Law Journal Reports, Volume 57, Part 1. 2017. [Online]. Available through :<

https://books.google.co.in/books?

id=0tEfAQAAMAAJ&pg=PA1070&dq=alex+adam+law+for+business+students&hl=en&s

a=X&ved=0ahUKEwiomvPZooniAhWC73MBHawiB3UQ6AEIKDAA#v=onepage&q=al

ex%20adam%20law%20for%20business%20students&f=false>.

Antecedents of Job Satisfaction.2019. [online]. Available through.

<http://sk.sagepub.com/books/job-satisfaction/n4.xml>

BIBLIOGRAPHY

https://www.oxfordscholarship.com/view/10.1093/acprof:oso/9780198253631.001.0001/acprof-

9780198253631

www.gov.uk/limited-company-formation/register-your-company

https://www.law.cornell.edu/wex/alternative_dispute_resolution

9

How does a bill become a law. 2018. [Online]. Available

through:<https://www.parliament.uk/about/how/laws/passage-bill/>.

The Law Journal Reports, Volume 57, Part 1. 2017. [Online]. Available through :<

https://books.google.co.in/books?

id=0tEfAQAAMAAJ&pg=PA1070&dq=alex+adam+law+for+business+students&hl=en&s

a=X&ved=0ahUKEwiomvPZooniAhWC73MBHawiB3UQ6AEIKDAA#v=onepage&q=al

ex%20adam%20law%20for%20business%20students&f=false>.

Antecedents of Job Satisfaction.2019. [online]. Available through.

<http://sk.sagepub.com/books/job-satisfaction/n4.xml>

BIBLIOGRAPHY

https://www.oxfordscholarship.com/view/10.1093/acprof:oso/9780198253631.001.0001/acprof-

9780198253631

www.gov.uk/limited-company-formation/register-your-company

https://www.law.cornell.edu/wex/alternative_dispute_resolution

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.