Frank's All-American BarBeQue: Financial and Strategic Analysis

VerifiedAdded on 2023/01/18

|9

|1850

|64

Report

AI Summary

This report provides a detailed analysis of the business and strategic management of Frank’s All-American BarBeQue, focusing on its financial performance and future prospects. The analysis includes a comprehensive examination of the company's financial ratios, such as profitability, liquidity, asset turnover, and debt-equity ratios, from 2008 to 2010. The report assesses the company's current financial position, including its cash flow, and projects its future financial estimates, considering the planned expansion and sauce production. Furthermore, it explores the costs associated with venture capital, its sources, and various options for capitalizing the business, emphasizing the potential of equity financing for future growth. The conclusion highlights the company's strong financial base and recommends strategic decisions regarding venture capital and equity financing to enhance profitability and shareholder value in the competitive restaurant industry.

Running Head: BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Name of the Student

Name of the University

Author Note

BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Table of Contents

Introduction................................................................................................................................2

Financial Analysis of the business.............................................................................................2

Analysis of cost of Venture capital and its sources....................................................................4

Business Current Financial position and Project’s future estimates..........................................5

Options for capitalizing the business.........................................................................................5

Conclusion..................................................................................................................................5

References..................................................................................................................................7

Table of Contents

Introduction................................................................................................................................2

Financial Analysis of the business.............................................................................................2

Analysis of cost of Venture capital and its sources....................................................................4

Business Current Financial position and Project’s future estimates..........................................5

Options for capitalizing the business.........................................................................................5

Conclusion..................................................................................................................................5

References..................................................................................................................................7

2BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Introduction

The aim of this assignment is the analysis of the business and strategic management

of the entrepreneurial business of the Frank’s All-American BarBeQue. It has operated for

the years in the region of the Southern Connecticut with the tradition of providing traditional

food at the reasonable and fair prices in the atmosphere of friendly family. The company

plans for opening second restaurant in Darien, Connecticut and revamping the production of

sauces and increases the sales in future (Frank 2017). Hence, for this, analysis will be to

understand the costs of maintaining business from the star-up expenses to operating capital

with the analysis of the ways of determining costs of venture capital and its sources. In

addition, current and future financial projection will be done. Moreover, the options for

investors and partners for capitalizing the business will be discussed.

Financial Analysis of the business

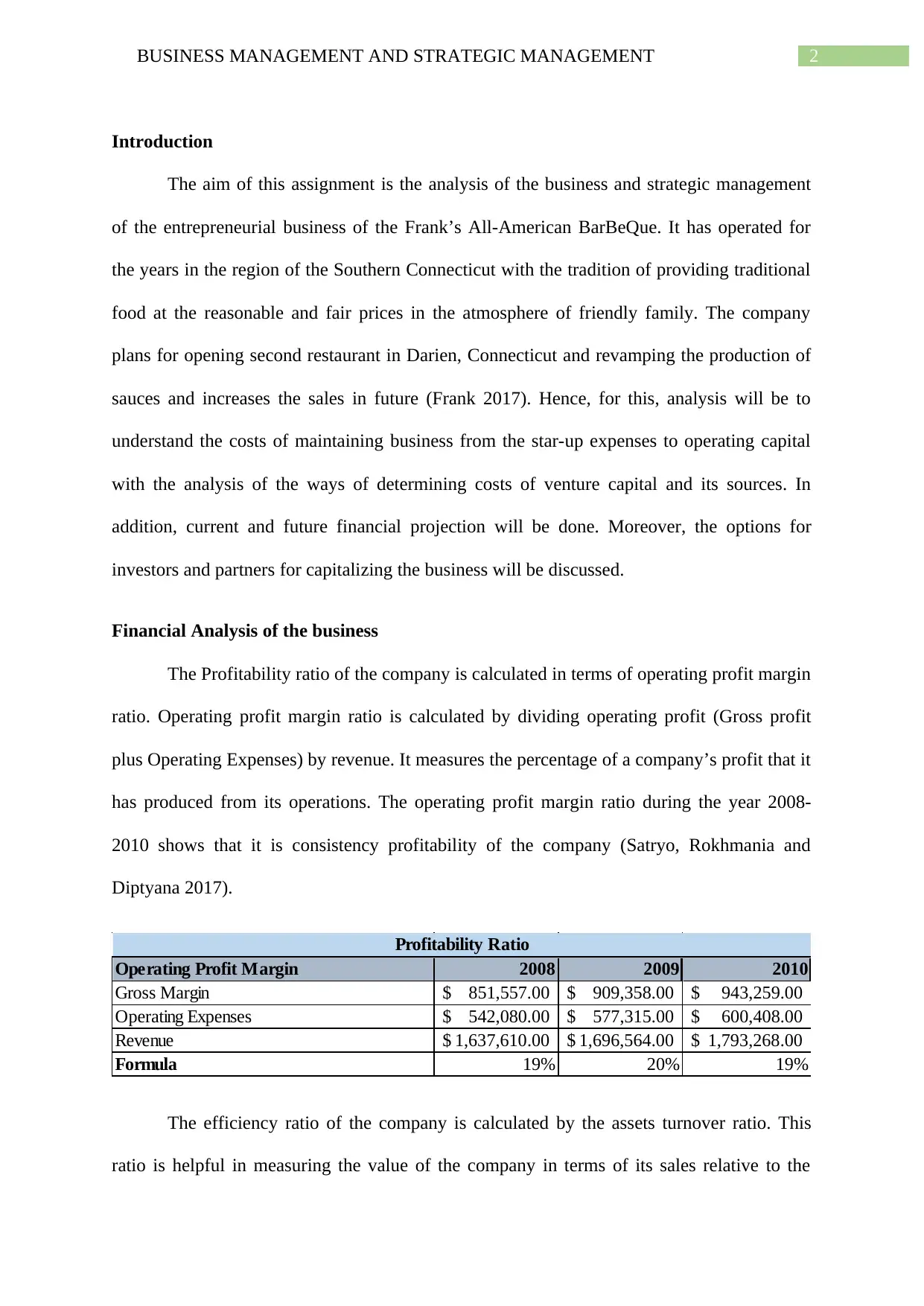

The Profitability ratio of the company is calculated in terms of operating profit margin

ratio. Operating profit margin ratio is calculated by dividing operating profit (Gross profit

plus Operating Expenses) by revenue. It measures the percentage of a company’s profit that it

has produced from its operations. The operating profit margin ratio during the year 2008-

2010 shows that it is consistency profitability of the company (Satryo, Rokhmania and

Diptyana 2017).

Operating Profit Margin 2008 2009 2010

Gross Margin 851,557.00$ 909,358.00$ 943,259.00$

Operating Expenses 542,080.00$ 577,315.00$ 600,408.00$

Revenue 1,637,610.00$ 1,696,564.00$ 1,793,268.00$

Formula 19% 20% 19%

Profitability Ratio

The efficiency ratio of the company is calculated by the assets turnover ratio. This

ratio is helpful in measuring the value of the company in terms of its sales relative to the

Introduction

The aim of this assignment is the analysis of the business and strategic management

of the entrepreneurial business of the Frank’s All-American BarBeQue. It has operated for

the years in the region of the Southern Connecticut with the tradition of providing traditional

food at the reasonable and fair prices in the atmosphere of friendly family. The company

plans for opening second restaurant in Darien, Connecticut and revamping the production of

sauces and increases the sales in future (Frank 2017). Hence, for this, analysis will be to

understand the costs of maintaining business from the star-up expenses to operating capital

with the analysis of the ways of determining costs of venture capital and its sources. In

addition, current and future financial projection will be done. Moreover, the options for

investors and partners for capitalizing the business will be discussed.

Financial Analysis of the business

The Profitability ratio of the company is calculated in terms of operating profit margin

ratio. Operating profit margin ratio is calculated by dividing operating profit (Gross profit

plus Operating Expenses) by revenue. It measures the percentage of a company’s profit that it

has produced from its operations. The operating profit margin ratio during the year 2008-

2010 shows that it is consistency profitability of the company (Satryo, Rokhmania and

Diptyana 2017).

Operating Profit Margin 2008 2009 2010

Gross Margin 851,557.00$ 909,358.00$ 943,259.00$

Operating Expenses 542,080.00$ 577,315.00$ 600,408.00$

Revenue 1,637,610.00$ 1,696,564.00$ 1,793,268.00$

Formula 19% 20% 19%

Profitability Ratio

The efficiency ratio of the company is calculated by the assets turnover ratio. This

ratio is helpful in measuring the value of the company in terms of its sales relative to the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

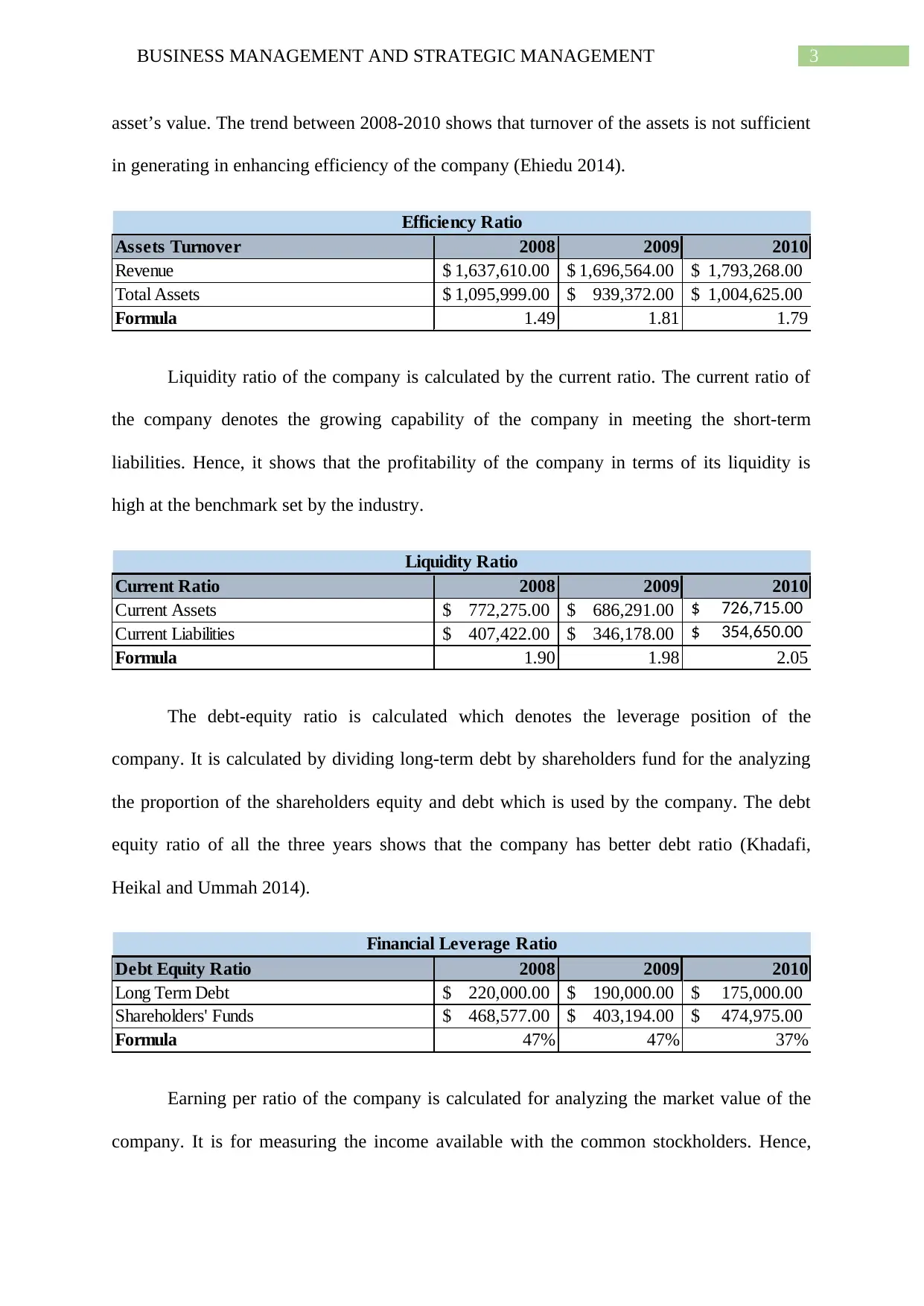

asset’s value. The trend between 2008-2010 shows that turnover of the assets is not sufficient

in generating in enhancing efficiency of the company (Ehiedu 2014).

Assets Turnover 2008 2009 2010

Revenue 1,637,610.00$ 1,696,564.00$ 1,793,268.00$

Total Assets 1,095,999.00$ 939,372.00$ 1,004,625.00$

Formula 1.49 1.81 1.79

Efficiency Ratio

Liquidity ratio of the company is calculated by the current ratio. The current ratio of

the company denotes the growing capability of the company in meeting the short-term

liabilities. Hence, it shows that the profitability of the company in terms of its liquidity is

high at the benchmark set by the industry.

Current Ratio 2008 2009 2010

Current Assets 772,275.00$ 686,291.00$ 726,715.00$

Current Liabilities 407,422.00$ 346,178.00$ 354,650.00$

Formula 1.90 1.98 2.05

Liquidity Ratio

The debt-equity ratio is calculated which denotes the leverage position of the

company. It is calculated by dividing long-term debt by shareholders fund for the analyzing

the proportion of the shareholders equity and debt which is used by the company. The debt

equity ratio of all the three years shows that the company has better debt ratio (Khadafi,

Heikal and Ummah 2014).

Debt Equity Ratio 2008 2009 2010

Long Term Debt 220,000.00$ 190,000.00$ 175,000.00$

Shareholders' Funds 468,577.00$ 403,194.00$ 474,975.00$

Formula 47% 47% 37%

Financial Leverage Ratio

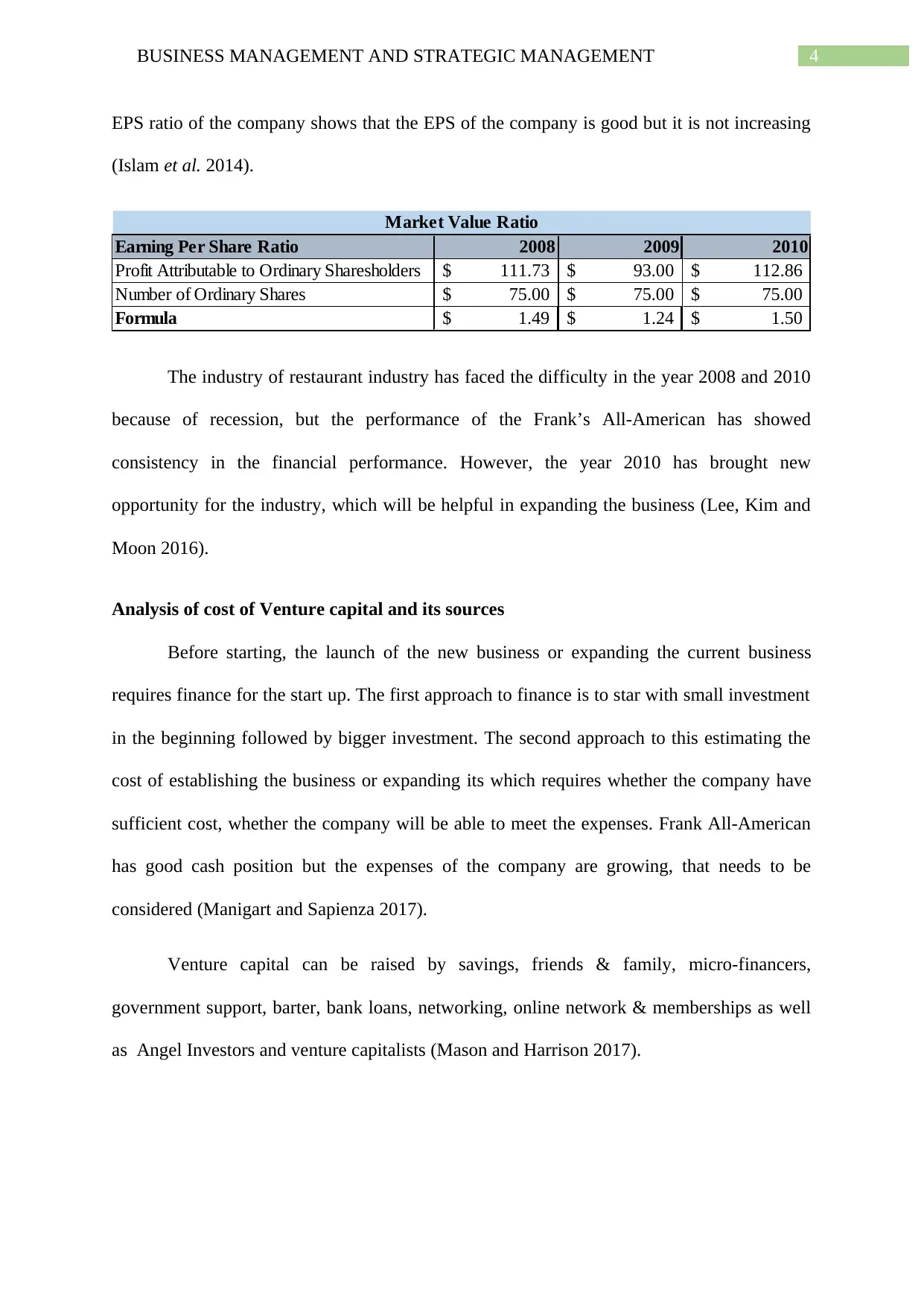

Earning per ratio of the company is calculated for analyzing the market value of the

company. It is for measuring the income available with the common stockholders. Hence,

asset’s value. The trend between 2008-2010 shows that turnover of the assets is not sufficient

in generating in enhancing efficiency of the company (Ehiedu 2014).

Assets Turnover 2008 2009 2010

Revenue 1,637,610.00$ 1,696,564.00$ 1,793,268.00$

Total Assets 1,095,999.00$ 939,372.00$ 1,004,625.00$

Formula 1.49 1.81 1.79

Efficiency Ratio

Liquidity ratio of the company is calculated by the current ratio. The current ratio of

the company denotes the growing capability of the company in meeting the short-term

liabilities. Hence, it shows that the profitability of the company in terms of its liquidity is

high at the benchmark set by the industry.

Current Ratio 2008 2009 2010

Current Assets 772,275.00$ 686,291.00$ 726,715.00$

Current Liabilities 407,422.00$ 346,178.00$ 354,650.00$

Formula 1.90 1.98 2.05

Liquidity Ratio

The debt-equity ratio is calculated which denotes the leverage position of the

company. It is calculated by dividing long-term debt by shareholders fund for the analyzing

the proportion of the shareholders equity and debt which is used by the company. The debt

equity ratio of all the three years shows that the company has better debt ratio (Khadafi,

Heikal and Ummah 2014).

Debt Equity Ratio 2008 2009 2010

Long Term Debt 220,000.00$ 190,000.00$ 175,000.00$

Shareholders' Funds 468,577.00$ 403,194.00$ 474,975.00$

Formula 47% 47% 37%

Financial Leverage Ratio

Earning per ratio of the company is calculated for analyzing the market value of the

company. It is for measuring the income available with the common stockholders. Hence,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

EPS ratio of the company shows that the EPS of the company is good but it is not increasing

(Islam et al. 2014).

Earning Per Share Ratio 2008 2009 2010

Profit Attributable to Ordinary Sharesholders 111.73$ 93.00$ 112.86$

Number of Ordinary Shares 75.00$ 75.00$ 75.00$

Formula 1.49$ 1.24$ 1.50$

Market Value Ratio

The industry of restaurant industry has faced the difficulty in the year 2008 and 2010

because of recession, but the performance of the Frank’s All-American has showed

consistency in the financial performance. However, the year 2010 has brought new

opportunity for the industry, which will be helpful in expanding the business (Lee, Kim and

Moon 2016).

Analysis of cost of Venture capital and its sources

Before starting, the launch of the new business or expanding the current business

requires finance for the start up. The first approach to finance is to star with small investment

in the beginning followed by bigger investment. The second approach to this estimating the

cost of establishing the business or expanding its which requires whether the company have

sufficient cost, whether the company will be able to meet the expenses. Frank All-American

has good cash position but the expenses of the company are growing, that needs to be

considered (Manigart and Sapienza 2017).

Venture capital can be raised by savings, friends & family, micro-financers,

government support, barter, bank loans, networking, online network & memberships as well

as Angel Investors and venture capitalists (Mason and Harrison 2017).

EPS ratio of the company shows that the EPS of the company is good but it is not increasing

(Islam et al. 2014).

Earning Per Share Ratio 2008 2009 2010

Profit Attributable to Ordinary Sharesholders 111.73$ 93.00$ 112.86$

Number of Ordinary Shares 75.00$ 75.00$ 75.00$

Formula 1.49$ 1.24$ 1.50$

Market Value Ratio

The industry of restaurant industry has faced the difficulty in the year 2008 and 2010

because of recession, but the performance of the Frank’s All-American has showed

consistency in the financial performance. However, the year 2010 has brought new

opportunity for the industry, which will be helpful in expanding the business (Lee, Kim and

Moon 2016).

Analysis of cost of Venture capital and its sources

Before starting, the launch of the new business or expanding the current business

requires finance for the start up. The first approach to finance is to star with small investment

in the beginning followed by bigger investment. The second approach to this estimating the

cost of establishing the business or expanding its which requires whether the company have

sufficient cost, whether the company will be able to meet the expenses. Frank All-American

has good cash position but the expenses of the company are growing, that needs to be

considered (Manigart and Sapienza 2017).

Venture capital can be raised by savings, friends & family, micro-financers,

government support, barter, bank loans, networking, online network & memberships as well

as Angel Investors and venture capitalists (Mason and Harrison 2017).

5BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Business Current Financial position and Project’s future estimates

The current financial position of the company in terms of profitability, liquidity and

solvency ratio is performing well and it will be good for expanding the business. In terms of

future estimation of the project, the assets of the company will increase over the years, with

the efficient performance of it will increase the sales of the company. It has been estimated

that the long-term liabilities of the company will also decrease over the years. Moreover, with

the year 2011-2015, the net worth of the company will also increase triple as compare to

current position, as it will be able to cover its expenses over revenue.

Options for capitalizing the business

This decision is very critical for the business. Most of the companies use both the

combination of equity financing and debt financing. However, there are certain advantages

for equity financing, which is based on the principle that there is no obligation of repayment

and it provides excess working capital, which can be used for growing the business. In

contrast with that debt financing have some restrictions on the activities of the company and

preventing it from the available opportunities (Coleman, Cotei and Farhat 2016).

Hence, the financial statement of Frank’s All-American BarBeQue shows that the

company’s position in terms of equity can be helpful for capitalizing the business. They can

use the equity of the company, which will be helpful in the expansion of the business as well

as scope for further growth in the industry of restaurant in America (De Rassenfosse and

Fischer 2016).

Conclusion

Hence, it is concluded that Frank’s All-American BarBeQue financial position in

terms of liquidity, profitability and solvency is good and it has strong base, which will be

helpful in expanding the business operations. It is analyzed that if the company will increase

Business Current Financial position and Project’s future estimates

The current financial position of the company in terms of profitability, liquidity and

solvency ratio is performing well and it will be good for expanding the business. In terms of

future estimation of the project, the assets of the company will increase over the years, with

the efficient performance of it will increase the sales of the company. It has been estimated

that the long-term liabilities of the company will also decrease over the years. Moreover, with

the year 2011-2015, the net worth of the company will also increase triple as compare to

current position, as it will be able to cover its expenses over revenue.

Options for capitalizing the business

This decision is very critical for the business. Most of the companies use both the

combination of equity financing and debt financing. However, there are certain advantages

for equity financing, which is based on the principle that there is no obligation of repayment

and it provides excess working capital, which can be used for growing the business. In

contrast with that debt financing have some restrictions on the activities of the company and

preventing it from the available opportunities (Coleman, Cotei and Farhat 2016).

Hence, the financial statement of Frank’s All-American BarBeQue shows that the

company’s position in terms of equity can be helpful for capitalizing the business. They can

use the equity of the company, which will be helpful in the expansion of the business as well

as scope for further growth in the industry of restaurant in America (De Rassenfosse and

Fischer 2016).

Conclusion

Hence, it is concluded that Frank’s All-American BarBeQue financial position in

terms of liquidity, profitability and solvency is good and it has strong base, which will be

helpful in expanding the business operations. It is analyzed that if the company will increase

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

the sales from the operations, it will be able to cover its expenses. The decisions regarding the

sources of venture capital will have to be carefully decided so that it will increase the revenue

and profits of the company. Further, it has been analyzed that equity financing will be good

for the company due to strong hold of it which in turn saves the excess profit of the company

that will be helpful in improving the productivity and shareholders value. Hence, the

expansion of the business will lead to success in financial aspect in the growth sector of

restaurants.

the sales from the operations, it will be able to cover its expenses. The decisions regarding the

sources of venture capital will have to be carefully decided so that it will increase the revenue

and profits of the company. Further, it has been analyzed that equity financing will be good

for the company due to strong hold of it which in turn saves the excess profit of the company

that will be helpful in improving the productivity and shareholders value. Hence, the

expansion of the business will lead to success in financial aspect in the growth sector of

restaurants.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

References

Coleman, S., Cotei, C. and Farhat, J., 2016. The debt-equity financing decisions of US startup

firms. Journal of Economics and Finance, 40(1), pp.105-126.

De Rassenfosse, G. and Fischer, T., 2016. Venture debt financing: Determinants of the

lending decision. Strategic Entrepreneurship Journal, 10(3), pp.235-256.

Ehiedu, V.C., 2014. The impact of liquidity on profitability of some selected companies: the

financial statement analysis (FSA) approach. Research Journal of Finance and

Accounting, 5(5), pp.81-90.

Frank, E.J., 2017. Teaching International Business as an Opportunity to Develop Cultural

Sensitivity. Journal of Teaching in International Business, 28(3-4), pp.197-211.

Islam, M., Khan, T.R., Choudhury, T.T. and Adnan, A.M., 2014. How earning per share

(EPS) affects on share price and firm value. European Journal of Business and

Management, 6(17), pp.97-108.

Khadafi, M., Heikal, M. and Ummah, A., 2014. Influence analysis of return on assets (ROA),

return on equity (ROE), net profit margin (NPM), debt to equity ratio (DER), and current

ratio (CR), against corporate profit growth in automotive in Indonesia Stock

Exchange. International Journal of Academic Research in Business and Social

Sciences, 4(12).

Lee, W.S., Kim, I. and Moon, J., 2016. Determinants of restaurant internationalization: an

upper echelons theory perspective. International Journal of Contemporary Hospitality

Management, 28(12), pp.2864-2887.

Manigart, S. and Sapienza, H., 2017. Venture capital and growth. The Blackwell handbook of

entrepreneurship, pp.240-258.

References

Coleman, S., Cotei, C. and Farhat, J., 2016. The debt-equity financing decisions of US startup

firms. Journal of Economics and Finance, 40(1), pp.105-126.

De Rassenfosse, G. and Fischer, T., 2016. Venture debt financing: Determinants of the

lending decision. Strategic Entrepreneurship Journal, 10(3), pp.235-256.

Ehiedu, V.C., 2014. The impact of liquidity on profitability of some selected companies: the

financial statement analysis (FSA) approach. Research Journal of Finance and

Accounting, 5(5), pp.81-90.

Frank, E.J., 2017. Teaching International Business as an Opportunity to Develop Cultural

Sensitivity. Journal of Teaching in International Business, 28(3-4), pp.197-211.

Islam, M., Khan, T.R., Choudhury, T.T. and Adnan, A.M., 2014. How earning per share

(EPS) affects on share price and firm value. European Journal of Business and

Management, 6(17), pp.97-108.

Khadafi, M., Heikal, M. and Ummah, A., 2014. Influence analysis of return on assets (ROA),

return on equity (ROE), net profit margin (NPM), debt to equity ratio (DER), and current

ratio (CR), against corporate profit growth in automotive in Indonesia Stock

Exchange. International Journal of Academic Research in Business and Social

Sciences, 4(12).

Lee, W.S., Kim, I. and Moon, J., 2016. Determinants of restaurant internationalization: an

upper echelons theory perspective. International Journal of Contemporary Hospitality

Management, 28(12), pp.2864-2887.

Manigart, S. and Sapienza, H., 2017. Venture capital and growth. The Blackwell handbook of

entrepreneurship, pp.240-258.

8BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Mason, C. and Harrison, R., 2017. Informal venture capital and the financing of emerging

growth businesses. The Blackwell handbook of entrepreneurship, pp.221-239.

Satryo, A.G., Rokhmania, N.A. and Diptyana, P., 2017. The influence of profitability ratio,

market ratio, and solvency ratio on the share prices of companies listed on LQ 45 Index. The

Indonesian Accounting Review, 6(1), pp.55-66.

Mason, C. and Harrison, R., 2017. Informal venture capital and the financing of emerging

growth businesses. The Blackwell handbook of entrepreneurship, pp.221-239.

Satryo, A.G., Rokhmania, N.A. and Diptyana, P., 2017. The influence of profitability ratio,

market ratio, and solvency ratio on the share prices of companies listed on LQ 45 Index. The

Indonesian Accounting Review, 6(1), pp.55-66.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.