Oil & Gas Industry Analysis and Strategy

VerifiedAdded on 2020/06/06

|12

|3395

|142

AI Summary

This assignment delves into the complexities of the oil and gas industry, analyzing key factors influencing its success. It emphasizes supply chain management strategies, highlighting the benefits of integrated operations with manufacturing firms in the target country. The analysis also underscores the importance of flexible pricing strategies to mitigate price volatility risks. Furthermore, it draws upon industry trends, case studies, and academic research to provide a comprehensive understanding of the sector's challenges and opportunities.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

BUSINESS

ORGANISATION

ORGANISATION

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

BACKGROUND INFORMATION OF THE ORGANISATION..................................................1

Market entry strategy..................................................................................................................1

Market share of the company......................................................................................................2

Relevant information of the business such as competitors and turnover....................................3

BACKGROUND INFORMATION ON BUSINESS ENVIRONMENT IN THE SELECTED

COUNTRY......................................................................................................................................4

PESTLE analysis.........................................................................................................................4

ANALYSIS SCENARIO OF THE ENTERPRISE.........................................................................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................1

BACKGROUND INFORMATION OF THE ORGANISATION..................................................1

Market entry strategy..................................................................................................................1

Market share of the company......................................................................................................2

Relevant information of the business such as competitors and turnover....................................3

BACKGROUND INFORMATION ON BUSINESS ENVIRONMENT IN THE SELECTED

COUNTRY......................................................................................................................................4

PESTLE analysis.........................................................................................................................4

ANALYSIS SCENARIO OF THE ENTERPRISE.........................................................................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

Business organisation consists with group of members and individual who collaborate to

accomplish goals of the enterprise. It includes commercial activities that are used for some

specific purposes that need to be accomplished to create culture within the enterprise (Gilje and

Taillard, 2016). Different enterprises follow distinctive policies, work flows and objectives to

accomplish effective results. In this context, report is based on Lukoil which is public sector

organisation and deals in oil and gas industry. It provides several types of products such as

petroleum natural gas in the market to develop effective results in business unit. For gaining

insight knowledge of the enterprise, report covers background information of the business and

country where it wants to expand operations. Furthermore, it discusses about SWOT analysis to

assess company position in market.

In the present report, Lukoil enterprise have been taken which is the largest oil company

of Russia and deals in petroleum, natural gas and petrochemical products. Project aim is to

establish operations of the present company in Belgium through using exporting method. In this

context, report covers internal and external analysis to produce effective results in the chosen

country.

BACKGROUND INFORMATION OF THE ORGANISATION

Lukoil is one of the Russia's largest oil company. They are producing the highest oil in

the market. In the 2012, the enterprise produced 89.856 million tons oil per day. The company

operate functions and operations in more than 40 nations. Now they want to expanding

operations in Belgium to develop more profits and revenue at workplace (Popli, Rodgers and

Eveloy, 2013). In respect to ascertain effective results following elements need to be included for

increasing their functions:

Market entry strategy

Market entry strategy defines as the planned method which used to deliver goods and

services for target market and distributing it at new place. In respect to make effective decisions,

Lukoil need to enter an overseas market. They have variety of options to cater their functions and

operations (Kilian, 2016). There are several types of strategies exist in front of the selected

business to enter in Belgium such as exporting, licensing, franchising, joint venture, contract

manufacturing, merger and acquisition, etc. From the above methods, the enterprise can use

1

Business organisation consists with group of members and individual who collaborate to

accomplish goals of the enterprise. It includes commercial activities that are used for some

specific purposes that need to be accomplished to create culture within the enterprise (Gilje and

Taillard, 2016). Different enterprises follow distinctive policies, work flows and objectives to

accomplish effective results. In this context, report is based on Lukoil which is public sector

organisation and deals in oil and gas industry. It provides several types of products such as

petroleum natural gas in the market to develop effective results in business unit. For gaining

insight knowledge of the enterprise, report covers background information of the business and

country where it wants to expand operations. Furthermore, it discusses about SWOT analysis to

assess company position in market.

In the present report, Lukoil enterprise have been taken which is the largest oil company

of Russia and deals in petroleum, natural gas and petrochemical products. Project aim is to

establish operations of the present company in Belgium through using exporting method. In this

context, report covers internal and external analysis to produce effective results in the chosen

country.

BACKGROUND INFORMATION OF THE ORGANISATION

Lukoil is one of the Russia's largest oil company. They are producing the highest oil in

the market. In the 2012, the enterprise produced 89.856 million tons oil per day. The company

operate functions and operations in more than 40 nations. Now they want to expanding

operations in Belgium to develop more profits and revenue at workplace (Popli, Rodgers and

Eveloy, 2013). In respect to ascertain effective results following elements need to be included for

increasing their functions:

Market entry strategy

Market entry strategy defines as the planned method which used to deliver goods and

services for target market and distributing it at new place. In respect to make effective decisions,

Lukoil need to enter an overseas market. They have variety of options to cater their functions and

operations (Kilian, 2016). There are several types of strategies exist in front of the selected

business to enter in Belgium such as exporting, licensing, franchising, joint venture, contract

manufacturing, merger and acquisition, etc. From the above methods, the enterprise can use

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

exporting which is the traditional and well-established form to operate functions in foreign place.

It can be determining as the marketing of goods produced in one nation to other country (Revie,

2015). In this strategy, the cited firm has following advantages and disadvantages to operate

functions and operations in Belgium:

With using exporting method, Lukoil has advantages to produce home based products

which is less risky to enhance outcomes in market. Furthermore, it diminishes potential risk to

operate overseas and determines the best opportunity to invest bricks and mortar. However,

exporting also create negative impact which has lack of control in market. High cost also needed

to operate effective functions and operations. For example, Lukoil can started their operations

and functions to cater their functions with exporting in different country.

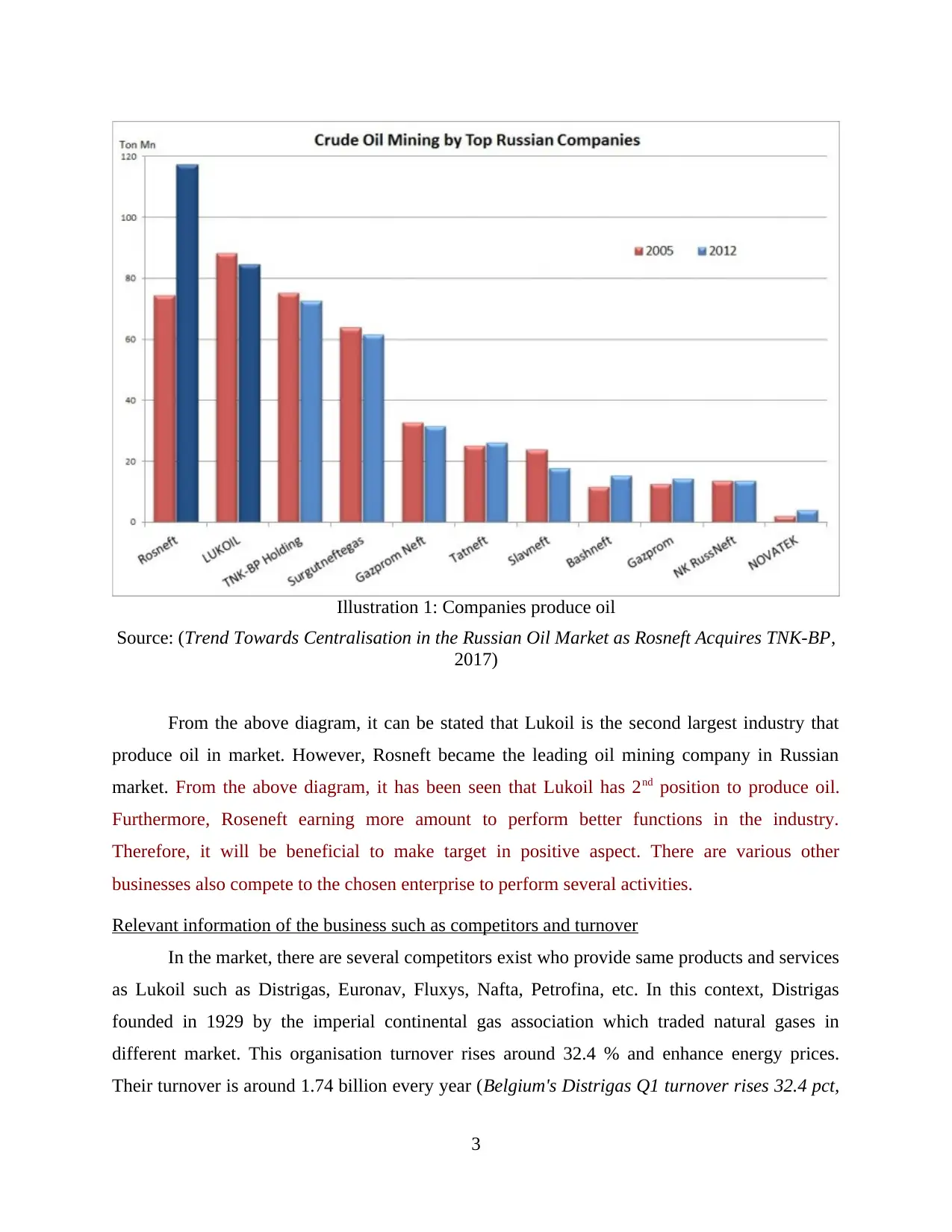

Market share of the company

Oil and gas are important primary assets in Russia to gain revenue by the governments

and generates stable economic growth for social development. Foreign trade, capital inflow from

international market, budget execute, etc. (Perrons and Hems, 2013). Beside this, there is high

investment required to revolve production and revenue. Oil market of Russia has been relatively

decentralised with ownership structure evolve dramatically over the past twenty years. In Russia,

mainly four companies produce oil such as Lukoil, TNK-BP, Rosneft and Surgutneftegas.

2

It can be determining as the marketing of goods produced in one nation to other country (Revie,

2015). In this strategy, the cited firm has following advantages and disadvantages to operate

functions and operations in Belgium:

With using exporting method, Lukoil has advantages to produce home based products

which is less risky to enhance outcomes in market. Furthermore, it diminishes potential risk to

operate overseas and determines the best opportunity to invest bricks and mortar. However,

exporting also create negative impact which has lack of control in market. High cost also needed

to operate effective functions and operations. For example, Lukoil can started their operations

and functions to cater their functions with exporting in different country.

Market share of the company

Oil and gas are important primary assets in Russia to gain revenue by the governments

and generates stable economic growth for social development. Foreign trade, capital inflow from

international market, budget execute, etc. (Perrons and Hems, 2013). Beside this, there is high

investment required to revolve production and revenue. Oil market of Russia has been relatively

decentralised with ownership structure evolve dramatically over the past twenty years. In Russia,

mainly four companies produce oil such as Lukoil, TNK-BP, Rosneft and Surgutneftegas.

2

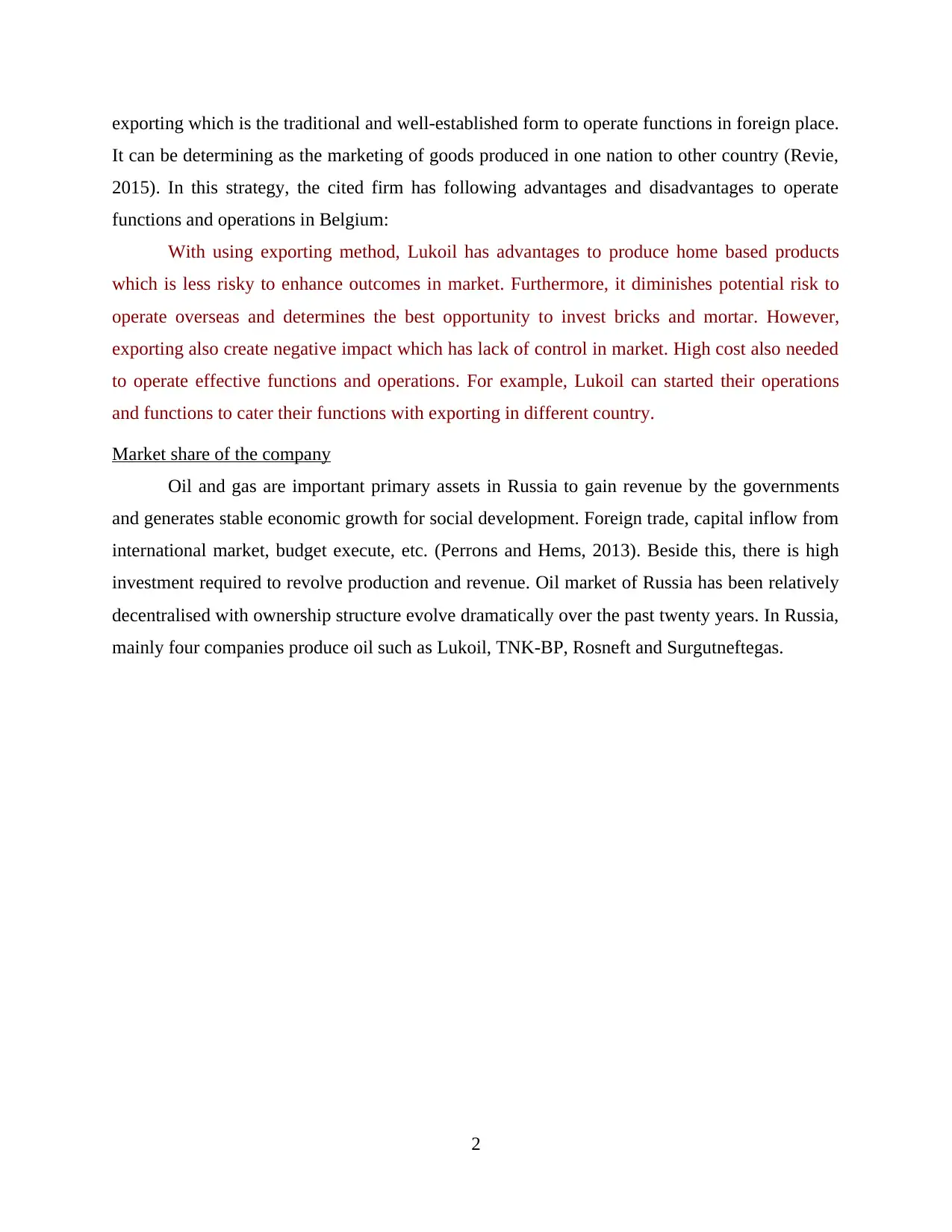

From the above diagram, it can be stated that Lukoil is the second largest industry that

produce oil in market. However, Rosneft became the leading oil mining company in Russian

market. From the above diagram, it has been seen that Lukoil has 2nd position to produce oil.

Furthermore, Roseneft earning more amount to perform better functions in the industry.

Therefore, it will be beneficial to make target in positive aspect. There are various other

businesses also compete to the chosen enterprise to perform several activities.

Relevant information of the business such as competitors and turnover

In the market, there are several competitors exist who provide same products and services

as Lukoil such as Distrigas, Euronav, Fluxys, Nafta, Petrofina, etc. In this context, Distrigas

founded in 1929 by the imperial continental gas association which traded natural gases in

different market. This organisation turnover rises around 32.4 % and enhance energy prices.

Their turnover is around 1.74 billion every year (Belgium's Distrigas Q1 turnover rises 32.4 pct,

3

Illustration 1: Companies produce oil

Source: (Trend Towards Centralisation in the Russian Oil Market as Rosneft Acquires TNK-BP,

2017)

produce oil in market. However, Rosneft became the leading oil mining company in Russian

market. From the above diagram, it has been seen that Lukoil has 2nd position to produce oil.

Furthermore, Roseneft earning more amount to perform better functions in the industry.

Therefore, it will be beneficial to make target in positive aspect. There are various other

businesses also compete to the chosen enterprise to perform several activities.

Relevant information of the business such as competitors and turnover

In the market, there are several competitors exist who provide same products and services

as Lukoil such as Distrigas, Euronav, Fluxys, Nafta, Petrofina, etc. In this context, Distrigas

founded in 1929 by the imperial continental gas association which traded natural gases in

different market. This organisation turnover rises around 32.4 % and enhance energy prices.

Their turnover is around 1.74 billion every year (Belgium's Distrigas Q1 turnover rises 32.4 pct,

3

Illustration 1: Companies produce oil

Source: (Trend Towards Centralisation in the Russian Oil Market as Rosneft Acquires TNK-BP,

2017)

2017). In addition to this, Euronav has low performances as compare to Lukoil in 2017. This is

because, there total inventories are around 0 in June 2017. Hence, the chosen enterprise has the

big opportunity to expand their operations in new market. Legal form of the organisation is very

creative so that it would be beneficial to enhance operations in different areas. Financial

performances of the company very strong so that it would be better to develop more effective

results in systematic way. For next three years 2018 to 2021, the chosen organisation has

opportunities to enhance their profits around 18 to 20%. It will be beneficial to arrange more

effective results.

BACKGROUND INFORMATION ON BUSINESS ENVIRONMENT IN

THE SELECTED COUNTRY

Belgium is the federal monarchy within the Western Europe. This is found in EU as their

member to operate functions and operations in successful aspect. This country covers around

11,787 square miles and its capital is the largest in term of oil and gas industry. In respect to

enter in this market, Lukoil need to analysis their functions and operations to implement in the

area (Allen and Kraakman, 2016). In this aspect, following analysis can be determines:

PESTLE analysis

To expand operations and functions in new market, firstly business has responsibility to

assess place in which they want to enter (Dhillon, 2016). In this way, PESTLE analysis is the

best way to establish operations in external environment:

Political factors: In Belgium, political institution are very complex and there is power of

political party is very high which is organised to represent main culture of communities.

From 1970, political parties also split with distinctive components that mainly present to

make linguistic interest in the communities (Rees and Smith, 2017). Due to changes in

economic policies, social policies and foreign policies, country has advantages to make

good momentum and place at global stages. It creates positive impact on the operations

and functions of the Lukoil to make their activities in this place. In addition to this,

country has high demand of oil and gas products due to enhancement of updated products

and services in the market (Popli, Rodgers and Eveloy, 2013). Further, rising in corporate

profitability and improvements in labour market perceive significant results to boost

4

because, there total inventories are around 0 in June 2017. Hence, the chosen enterprise has the

big opportunity to expand their operations in new market. Legal form of the organisation is very

creative so that it would be beneficial to enhance operations in different areas. Financial

performances of the company very strong so that it would be better to develop more effective

results in systematic way. For next three years 2018 to 2021, the chosen organisation has

opportunities to enhance their profits around 18 to 20%. It will be beneficial to arrange more

effective results.

BACKGROUND INFORMATION ON BUSINESS ENVIRONMENT IN

THE SELECTED COUNTRY

Belgium is the federal monarchy within the Western Europe. This is found in EU as their

member to operate functions and operations in successful aspect. This country covers around

11,787 square miles and its capital is the largest in term of oil and gas industry. In respect to

enter in this market, Lukoil need to analysis their functions and operations to implement in the

area (Allen and Kraakman, 2016). In this aspect, following analysis can be determines:

PESTLE analysis

To expand operations and functions in new market, firstly business has responsibility to

assess place in which they want to enter (Dhillon, 2016). In this way, PESTLE analysis is the

best way to establish operations in external environment:

Political factors: In Belgium, political institution are very complex and there is power of

political party is very high which is organised to represent main culture of communities.

From 1970, political parties also split with distinctive components that mainly present to

make linguistic interest in the communities (Rees and Smith, 2017). Due to changes in

economic policies, social policies and foreign policies, country has advantages to make

good momentum and place at global stages. It creates positive impact on the operations

and functions of the Lukoil to make their activities in this place. In addition to this,

country has high demand of oil and gas products due to enhancement of updated products

and services in the market (Popli, Rodgers and Eveloy, 2013). Further, rising in corporate

profitability and improvements in labour market perceive significant results to boost

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

domestic investment and consumption. On the other hand, economic growth of the nation

is moderate.

Economic factors: Belgium has the strongest globalization economy which has effective

transport infrastructure and it is integrated with different part of the nation. Location of

this country is highly effective so that it is the best opportunity towards Lukoil to enhance

their operations in this country. This country face high stagflation due to high inflation

rate and low economic and GDP growth (Perrons and Hems, 2013). Therefore, it creates

significant challenge in Belgian economy. Due to strong domestic demand, Belgium has

the effective economy to make effective results in market. From past year analysis, it has

been seen that GDP of the country is around 28.5% which increase continuously over the

year around 29.4%. Now company trying to show their profits almost 2% increasing

every year.

Social factors: Social factors includes changes in customer demand and perception

towards product and services in market. Due to demographic dividend, Belgium economy

affected through more than 50% population in age group of 20-60 years. In the country

population also increasing continuously. It assists to enhance operations and functions in

systematic way for business development and also cater for ascertain more effective

results. It can be demonstrated opportunity to foster the economic development and

create disadvantage which lead in social problems such as unemployment (Allen and

Kraakman, 2016). Therefore, it could be creating negative impact on the Lukoil

operations. Further, social factors also indicate sustain and boost to the current rate of

domestic consumption in the corporate sector. It also helps in providing employment

opportunity in the rural areas. It is concern with keen sense of community in backward

areas.

Technological factors: Belgium has the effective and proper national science and

technology in different aspects. There are several laboratories that assists to make

research and development for oil and gas manufacturing (Popli, Rodgers and Eveloy,

2013). Thus, Lukoil has effective advantages to coordinate and decide priorities to

implement societies concerned with agriculture and many other technological aspects.

The selected business has also opportunity to get high amount and effective technology to

conduct research in areas. This analysis also helps in to understand the organisation to

5

is moderate.

Economic factors: Belgium has the strongest globalization economy which has effective

transport infrastructure and it is integrated with different part of the nation. Location of

this country is highly effective so that it is the best opportunity towards Lukoil to enhance

their operations in this country. This country face high stagflation due to high inflation

rate and low economic and GDP growth (Perrons and Hems, 2013). Therefore, it creates

significant challenge in Belgian economy. Due to strong domestic demand, Belgium has

the effective economy to make effective results in market. From past year analysis, it has

been seen that GDP of the country is around 28.5% which increase continuously over the

year around 29.4%. Now company trying to show their profits almost 2% increasing

every year.

Social factors: Social factors includes changes in customer demand and perception

towards product and services in market. Due to demographic dividend, Belgium economy

affected through more than 50% population in age group of 20-60 years. In the country

population also increasing continuously. It assists to enhance operations and functions in

systematic way for business development and also cater for ascertain more effective

results. It can be demonstrated opportunity to foster the economic development and

create disadvantage which lead in social problems such as unemployment (Allen and

Kraakman, 2016). Therefore, it could be creating negative impact on the Lukoil

operations. Further, social factors also indicate sustain and boost to the current rate of

domestic consumption in the corporate sector. It also helps in providing employment

opportunity in the rural areas. It is concern with keen sense of community in backward

areas.

Technological factors: Belgium has the effective and proper national science and

technology in different aspects. There are several laboratories that assists to make

research and development for oil and gas manufacturing (Popli, Rodgers and Eveloy,

2013). Thus, Lukoil has effective advantages to coordinate and decide priorities to

implement societies concerned with agriculture and many other technological aspects.

The selected business has also opportunity to get high amount and effective technology to

conduct research in areas. This analysis also helps in to understand the organisation to

5

make effective functions and operations in market to grow potential (Rees and Smith,

2017).

Legal factors: This factor create impact on both aspect such as internal and external

environment. This is because, Belgium consists several laws and policies that assists to

maintain operations and functions in successful aspects. With the help of legal analysis,

Lukoil can easily make strategies to operate functions and operations in the country.

Further, the chosen business has also responsibility to follow rules and regulations to

maintain effective results in business unit. For example, consumer laws, labour laws,

safety standards and many other laws which need to be followed by the business unit

(Perrons and Hems, 2013).

Environment factors: These factors include all those aspects that are determined

through surrounding the business unit. In other words, it can be stated that environment

factors create crucial impact on the operations and functions of oil and gas industry such

as climate, weather, global changes, etc. To operate functions and operations in Belgium,

Lukoil has responsibility to make sure their operations never harm to surrounding

environment where they operate. With the help of following all rules regulations, the

chosen organisation has opportunity to increase their operations in new market to develop

their outcomes in successful manner (Urciuoli, Mohanty and Gerine Boekesteijn, 2014).

From the above PESTLE analysis, it has been shown that it widely create impact on the

performances of Lukoil to operate functions in marketing and distribution system. With the help

of economic factors, it has been analysis that technological factors are more effective to operate

effective results at workplace. In this way, legal factors includes several laws that need to be

followed by the selected business for developing results in business.

ANALYSIS SCENARIO OF THE ENTERPRISE

In respect to analysis the scenario of the organisation, Lukoil need to use strategic tool

that assists to evaluate potential opportunities and assess risk exists in market in oil and gas

industry of Belgium (Popli, Rodgers and Eveloy, 2013). In this aspect, Porter five forces analysis

can be used which includes following elements to assess the market environment:

6

2017).

Legal factors: This factor create impact on both aspect such as internal and external

environment. This is because, Belgium consists several laws and policies that assists to

maintain operations and functions in successful aspects. With the help of legal analysis,

Lukoil can easily make strategies to operate functions and operations in the country.

Further, the chosen business has also responsibility to follow rules and regulations to

maintain effective results in business unit. For example, consumer laws, labour laws,

safety standards and many other laws which need to be followed by the business unit

(Perrons and Hems, 2013).

Environment factors: These factors include all those aspects that are determined

through surrounding the business unit. In other words, it can be stated that environment

factors create crucial impact on the operations and functions of oil and gas industry such

as climate, weather, global changes, etc. To operate functions and operations in Belgium,

Lukoil has responsibility to make sure their operations never harm to surrounding

environment where they operate. With the help of following all rules regulations, the

chosen organisation has opportunity to increase their operations in new market to develop

their outcomes in successful manner (Urciuoli, Mohanty and Gerine Boekesteijn, 2014).

From the above PESTLE analysis, it has been shown that it widely create impact on the

performances of Lukoil to operate functions in marketing and distribution system. With the help

of economic factors, it has been analysis that technological factors are more effective to operate

effective results at workplace. In this way, legal factors includes several laws that need to be

followed by the selected business for developing results in business.

ANALYSIS SCENARIO OF THE ENTERPRISE

In respect to analysis the scenario of the organisation, Lukoil need to use strategic tool

that assists to evaluate potential opportunities and assess risk exists in market in oil and gas

industry of Belgium (Popli, Rodgers and Eveloy, 2013). In this aspect, Porter five forces analysis

can be used which includes following elements to assess the market environment:

6

Competitive rivalry (HIGH): In the Belgium, there is high competitive rivalry because

there are more businesses exist who operate in same sector of operations and functions in the

market. Therefore, it can be creating high impact on the operations and functions of Lukoil.

Large size of the company and its market capitalization has the biggest impact to the firm

operations and functions of oil and gas industry. Large group of company has control more than

90% so that it can also create major threat to the business unit. In the Belgium, there is Rosneft is

the biggest competitive rivalry in market (Popli, Rodgers and Eveloy, 2013).

Threat of new entrants (MODERATE): Further, in Belgium there are several sources

of energy can replace high amount of oil and gas in industry. This strategy required as the big

amount of investment in research and development to produce effective results. In the country,

Lukoil has the major threat from nuclear energy, hydrogen, coal, etc. (Rees and Smith, 2017).

Threat of substitute (HIGH): In the Belgium market, there are many alternative

resources can be used to produce energy such as biofuel, renewable resources, heating,

transportation, etc. These alternative elements can be replacing high amount of hydrocarbon that

used by business to compete with Lukoils. However, this strategy required high investment in

research and development to produce procedure in systematic way so that it is possible to make

substitute products and services (Perrons and Hems, 2013).

Bargaining power of buyers (LOW): Bargaining power of buyers in oil and gas

industry comparative low because qualitative products and services demanded. Buyers interested

to purchase products and services at any price with effective quality. Thus, in Belgium, Lukoil

has opportunity to make global oil benchmark to develop their functions and operations. There

are diverse types of oil and gas products can be produces in term of refineries, national oil

companies, international oil and gas enterprises, etc. Thus, it can be stated that buyers power

never affects to the oil price (Urciuoli, Mohanty and Gerine Boekesteijn, 2014). Customers have

low bargaining power because they have no choice to purchase products instead of the chosen

enterprise.

Bargaining power of suppliers (MODERATE): In Belgium, there are several suppliers

exists in oil and gas industry which is fully integrated to make active whole chain to produce

effective results. Therefore, the oil and gas companies of the market have chances to produce

effective results and attract many customers towards them. Ability of the company also make

involvement to ascertain effective segmentation of oil and gas industry. Further, Lukoil has also

7

there are more businesses exist who operate in same sector of operations and functions in the

market. Therefore, it can be creating high impact on the operations and functions of Lukoil.

Large size of the company and its market capitalization has the biggest impact to the firm

operations and functions of oil and gas industry. Large group of company has control more than

90% so that it can also create major threat to the business unit. In the Belgium, there is Rosneft is

the biggest competitive rivalry in market (Popli, Rodgers and Eveloy, 2013).

Threat of new entrants (MODERATE): Further, in Belgium there are several sources

of energy can replace high amount of oil and gas in industry. This strategy required as the big

amount of investment in research and development to produce effective results. In the country,

Lukoil has the major threat from nuclear energy, hydrogen, coal, etc. (Rees and Smith, 2017).

Threat of substitute (HIGH): In the Belgium market, there are many alternative

resources can be used to produce energy such as biofuel, renewable resources, heating,

transportation, etc. These alternative elements can be replacing high amount of hydrocarbon that

used by business to compete with Lukoils. However, this strategy required high investment in

research and development to produce procedure in systematic way so that it is possible to make

substitute products and services (Perrons and Hems, 2013).

Bargaining power of buyers (LOW): Bargaining power of buyers in oil and gas

industry comparative low because qualitative products and services demanded. Buyers interested

to purchase products and services at any price with effective quality. Thus, in Belgium, Lukoil

has opportunity to make global oil benchmark to develop their functions and operations. There

are diverse types of oil and gas products can be produces in term of refineries, national oil

companies, international oil and gas enterprises, etc. Thus, it can be stated that buyers power

never affects to the oil price (Urciuoli, Mohanty and Gerine Boekesteijn, 2014). Customers have

low bargaining power because they have no choice to purchase products instead of the chosen

enterprise.

Bargaining power of suppliers (MODERATE): In Belgium, there are several suppliers

exists in oil and gas industry which is fully integrated to make active whole chain to produce

effective results. Therefore, the oil and gas companies of the market have chances to produce

effective results and attract many customers towards them. Ability of the company also make

involvement to ascertain effective segmentation of oil and gas industry. Further, Lukoil has also

7

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

chanced to produce more and effective results in business unit to grow outcomes in sustainable

operations (Popli, Rodgers and Eveloy, 2013).

From the above porter five forces analysis, it has been seen that competitive rivalry is

very high so that Lukoil need to add unique features in it. Therefore, it will assist to make

competitive results in the business. Furthermore, threat of substitute products has moderate

because in Belgium there is no option in respect to alternative source for oil and gas. Bargaining

power of customer is low because so many customer demanding for high quality and effective

results in it.

CONCLUSION

By conducting various analysis such as PESTLE analysis we can conclude that the

company must make its strategic plan work more effective on changing environment. Through

PESTLE analysis it has been evaluated that the company can expand its business by entry into

international market and increase its profitability by exporting its oil and gas produces by them.

These studies also conclude that the firm can conduct smooth operation and can extend its

growth by using technology for research and development purpose as well as for innovation

purpose. The company can survive long by framing operations policies according to the legal

environment of country.

The study of scenario analysis has concluded that the company must face stiff competition

in international market. The entry of new entrant may cause of threat for LUKOIL company.

Through this study it has been also evaluated that the firm can make use of its opportunity to

build oil benchmark globally. This can be concluded that the company has potential to increase

its production, quality as well as can increase its efficiency by integrated their business with the

firm manufacturing oil and gas in that country, the company can use this for expanding its supply

chain. This is concluded by swot analysis that the firm must make flexible pricing strategy or can

avoid threat of wave in prices by timely reviewing and rectifying the pricing strategy according

to the need.

8

operations (Popli, Rodgers and Eveloy, 2013).

From the above porter five forces analysis, it has been seen that competitive rivalry is

very high so that Lukoil need to add unique features in it. Therefore, it will assist to make

competitive results in the business. Furthermore, threat of substitute products has moderate

because in Belgium there is no option in respect to alternative source for oil and gas. Bargaining

power of customer is low because so many customer demanding for high quality and effective

results in it.

CONCLUSION

By conducting various analysis such as PESTLE analysis we can conclude that the

company must make its strategic plan work more effective on changing environment. Through

PESTLE analysis it has been evaluated that the company can expand its business by entry into

international market and increase its profitability by exporting its oil and gas produces by them.

These studies also conclude that the firm can conduct smooth operation and can extend its

growth by using technology for research and development purpose as well as for innovation

purpose. The company can survive long by framing operations policies according to the legal

environment of country.

The study of scenario analysis has concluded that the company must face stiff competition

in international market. The entry of new entrant may cause of threat for LUKOIL company.

Through this study it has been also evaluated that the firm can make use of its opportunity to

build oil benchmark globally. This can be concluded that the company has potential to increase

its production, quality as well as can increase its efficiency by integrated their business with the

firm manufacturing oil and gas in that country, the company can use this for expanding its supply

chain. This is concluded by swot analysis that the firm must make flexible pricing strategy or can

avoid threat of wave in prices by timely reviewing and rectifying the pricing strategy according

to the need.

8

REFERENCES

Books and Journals

Allen, W.T. and Kraakman, R., 2016. Commentaries and cases on the law of business

organization. Wolters Kluwer law & business.

Dhillon, B.S., 2016. Safety and Reliability in the Oil and Gas Industry: A Practical Approach.

CRC Press.

Gilje, E. P. and Taillard, J. P., 2016. Do private firms invest differently than public firms? taking

cues from the natural gas industry. The Journal of Finance. 71(4). pp.1733-1778.

Kilian, L., 2016. The impact of the shale oil revolution on US oil and gasoline prices. Review of

Environmental Economics and Policy. 10(2). pp.185-205.

Perrons, R.K. and Hems, A., 2013. Cloud computing in the upstream oil & gas industry: A

proposed way forward. Energy Policy. 56. pp.732-737.

Popli, S., Rodgers, P. and Eveloy, V., 2013. Gas turbine efficiency enhancement using waste

heat powered absorption chillers in the oil and gas industry. Applied Thermal

Engineering. 50(1). pp.918-931.

Rees, G. and Smith, P. eds., 2017. Strategic human resource management: An international

perspective. Sage.

Revie, R.W., 2015. Oil and Gas Pipelines: Integrity and Safety Handbook. John Wiley & Sons.

Urciuoli, L., Mohanty, S. and Gerine Boekesteijn, E., 2014. The resilience of energy supply

chains: a multiple case study approach on oil and gas supply chains to Europe. Supply

Chain Management: An International Journal. 19(1). pp.46-63.

Online

Belgium's Distrigas Q1 turnover rises 32.4 pct, 2017. [Online] Available through:

<http://in.reuters.com/article/distrigas-idINL1342434320080513>. [Accessed on 16th

August 2017].

Trend Towards Centralisation in the Russian Oil Market as Rosneft Acquires TNK-BP, 2017.

[Online] Available through: <https://www.ceicdata.com/en/blog/trend-towards-

9

Books and Journals

Allen, W.T. and Kraakman, R., 2016. Commentaries and cases on the law of business

organization. Wolters Kluwer law & business.

Dhillon, B.S., 2016. Safety and Reliability in the Oil and Gas Industry: A Practical Approach.

CRC Press.

Gilje, E. P. and Taillard, J. P., 2016. Do private firms invest differently than public firms? taking

cues from the natural gas industry. The Journal of Finance. 71(4). pp.1733-1778.

Kilian, L., 2016. The impact of the shale oil revolution on US oil and gasoline prices. Review of

Environmental Economics and Policy. 10(2). pp.185-205.

Perrons, R.K. and Hems, A., 2013. Cloud computing in the upstream oil & gas industry: A

proposed way forward. Energy Policy. 56. pp.732-737.

Popli, S., Rodgers, P. and Eveloy, V., 2013. Gas turbine efficiency enhancement using waste

heat powered absorption chillers in the oil and gas industry. Applied Thermal

Engineering. 50(1). pp.918-931.

Rees, G. and Smith, P. eds., 2017. Strategic human resource management: An international

perspective. Sage.

Revie, R.W., 2015. Oil and Gas Pipelines: Integrity and Safety Handbook. John Wiley & Sons.

Urciuoli, L., Mohanty, S. and Gerine Boekesteijn, E., 2014. The resilience of energy supply

chains: a multiple case study approach on oil and gas supply chains to Europe. Supply

Chain Management: An International Journal. 19(1). pp.46-63.

Online

Belgium's Distrigas Q1 turnover rises 32.4 pct, 2017. [Online] Available through:

<http://in.reuters.com/article/distrigas-idINL1342434320080513>. [Accessed on 16th

August 2017].

Trend Towards Centralisation in the Russian Oil Market as Rosneft Acquires TNK-BP, 2017.

[Online] Available through: <https://www.ceicdata.com/en/blog/trend-towards-

9

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.