Financial Performance Analysis of Tusker Plc: Accounting Report

VerifiedAdded on 2020/01/07

|17

|4620

|176

Report

AI Summary

This report provides a detailed financial analysis of Tusker Plc, a building and home improvement merchant firm. The report begins with an interpretation of the statement of profit or loss, including revenue growth, gross profit margin, net profit margin, and return on capital employed. It then analyzes the statement of cash flows, examining liquidity, solvency, and efficiency ratios. The report calculates and interprets ratios such as current ratio, quick ratio, interest cover ratio, gearing ratio, inventory days, receivable days, and payable days. The report also evaluates investment appraisal techniques, focusing on a Western Europe expansion plan, and discusses non-financial factors and internal sources of finance. The analysis highlights the company's financial performance over the years 2014 and 2015, providing insights into its profitability, liquidity, and efficiency. The report concludes with an overall assessment of the firm's financial health and strategic recommendations.

Accounting and Decision

Making

Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

PART 1: BUSINESS PERFORMANCE ANALYSIS....................................................................1

Interpreting the statement of Profit or Loss............................................................................1

Analysing the statement of cash flows...................................................................................3

Stating the advantages and limitations of ratio analysis.........................................................6

PART 2: INVESTMENT APPRAISAL..........................................................................................7

Evaluating investment appraisal techniques Western Europe expansion plan.......................7

NON-FINANCIAL FACTORS.....................................................................................................10

Advising board of director in relation to non-financial factors in decision making............10

SOURCES OF INTERNAL FINANCE........................................................................................10

Evaluating three internal sources of finance........................................................................10

PART 3..........................................................................................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

PART 1: BUSINESS PERFORMANCE ANALYSIS....................................................................1

Interpreting the statement of Profit or Loss............................................................................1

Analysing the statement of cash flows...................................................................................3

Stating the advantages and limitations of ratio analysis.........................................................6

PART 2: INVESTMENT APPRAISAL..........................................................................................7

Evaluating investment appraisal techniques Western Europe expansion plan.......................7

NON-FINANCIAL FACTORS.....................................................................................................10

Advising board of director in relation to non-financial factors in decision making............10

SOURCES OF INTERNAL FINANCE........................................................................................10

Evaluating three internal sources of finance........................................................................10

PART 3..........................................................................................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

TABLE OF FIGURES

Figure 1: Investment Appraisal Techniques....................................................................................7

Figure 1: Investment Appraisal Techniques....................................................................................7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INDEX OF TABLES

Table 1: Ratios calculation for Tusker Plc for the year 2014 and 2015..........................................1

Table 2: Calculation of more Ratios for Tusker plc........................................................................3

Table 3: Calculation of Payback period...........................................................................................7

Table 4: Calculation of Net present value.......................................................................................9

Table 1: Ratios calculation for Tusker Plc for the year 2014 and 2015..........................................1

Table 2: Calculation of more Ratios for Tusker plc........................................................................3

Table 3: Calculation of Payback period...........................................................................................7

Table 4: Calculation of Net present value.......................................................................................9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Accounting is the most important field of finance that provides deeper insight into the

financial transactions of the company. Each and every organization prepares Income &

Expenditure, cash flow and balance sheet statements to assess their financial health and

performance. These statements help business units in assessing their financial position with the

help of ratio analysis (Di Lorenzo and et.al., 2012). Through this, corporation is able to make

effectual decisions which make contribution in the attainment of organizational goals. Besides

this, investment appraisal techniques also provide assistance to the finance manager in making

suitable investment decisions. The present report is based on Tusker Plc which is the building

and home improvement merchant firm. According to as mentioned in given study, the cited firm

supplies range of materials to trade professionals through retail stores. This report will shed light

on financial performance of Tusker plc with the help of ratio analysis. Further, it will also

provide information about the project which offers high benefit to the firm.

PART 1: BUSINESS PERFORMANCE ANALYSIS

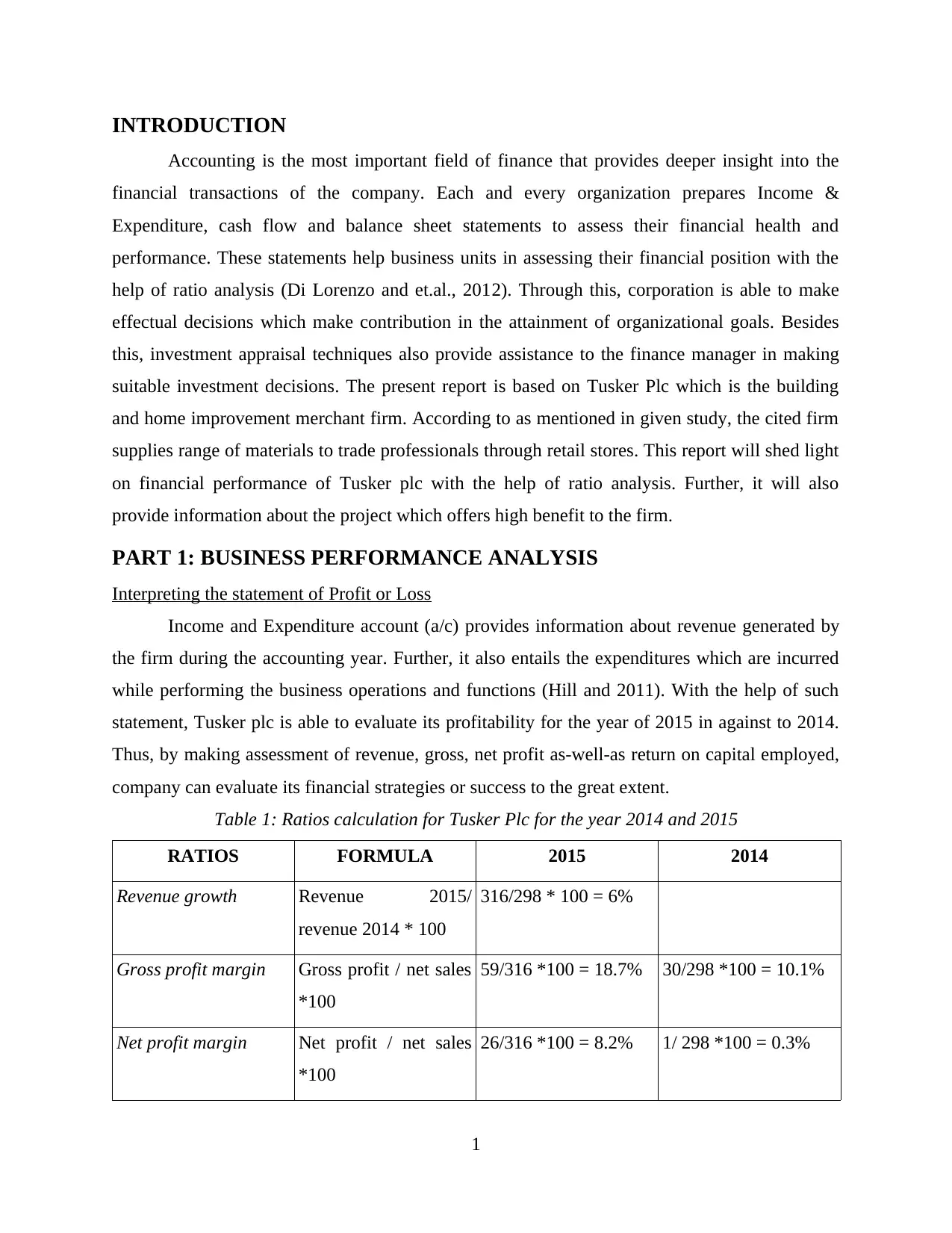

Interpreting the statement of Profit or Loss

Income and Expenditure account (a/c) provides information about revenue generated by

the firm during the accounting year. Further, it also entails the expenditures which are incurred

while performing the business operations and functions (Hill and 2011). With the help of such

statement, Tusker plc is able to evaluate its profitability for the year of 2015 in against to 2014.

Thus, by making assessment of revenue, gross, net profit as-well-as return on capital employed,

company can evaluate its financial strategies or success to the great extent.

Table 1: Ratios calculation for Tusker Plc for the year 2014 and 2015

RATIOS FORMULA 2015 2014

Revenue growth Revenue 2015/

revenue 2014 * 100

316/298 * 100 = 6%

Gross profit margin Gross profit / net sales

*100

59/316 *100 = 18.7% 30/298 *100 = 10.1%

Net profit margin Net profit / net sales

*100

26/316 *100 = 8.2% 1/ 298 *100 = 0.3%

1

Accounting is the most important field of finance that provides deeper insight into the

financial transactions of the company. Each and every organization prepares Income &

Expenditure, cash flow and balance sheet statements to assess their financial health and

performance. These statements help business units in assessing their financial position with the

help of ratio analysis (Di Lorenzo and et.al., 2012). Through this, corporation is able to make

effectual decisions which make contribution in the attainment of organizational goals. Besides

this, investment appraisal techniques also provide assistance to the finance manager in making

suitable investment decisions. The present report is based on Tusker Plc which is the building

and home improvement merchant firm. According to as mentioned in given study, the cited firm

supplies range of materials to trade professionals through retail stores. This report will shed light

on financial performance of Tusker plc with the help of ratio analysis. Further, it will also

provide information about the project which offers high benefit to the firm.

PART 1: BUSINESS PERFORMANCE ANALYSIS

Interpreting the statement of Profit or Loss

Income and Expenditure account (a/c) provides information about revenue generated by

the firm during the accounting year. Further, it also entails the expenditures which are incurred

while performing the business operations and functions (Hill and 2011). With the help of such

statement, Tusker plc is able to evaluate its profitability for the year of 2015 in against to 2014.

Thus, by making assessment of revenue, gross, net profit as-well-as return on capital employed,

company can evaluate its financial strategies or success to the great extent.

Table 1: Ratios calculation for Tusker Plc for the year 2014 and 2015

RATIOS FORMULA 2015 2014

Revenue growth Revenue 2015/

revenue 2014 * 100

316/298 * 100 = 6%

Gross profit margin Gross profit / net sales

*100

59/316 *100 = 18.7% 30/298 *100 = 10.1%

Net profit margin Net profit / net sales

*100

26/316 *100 = 8.2% 1/ 298 *100 = 0.3%

1

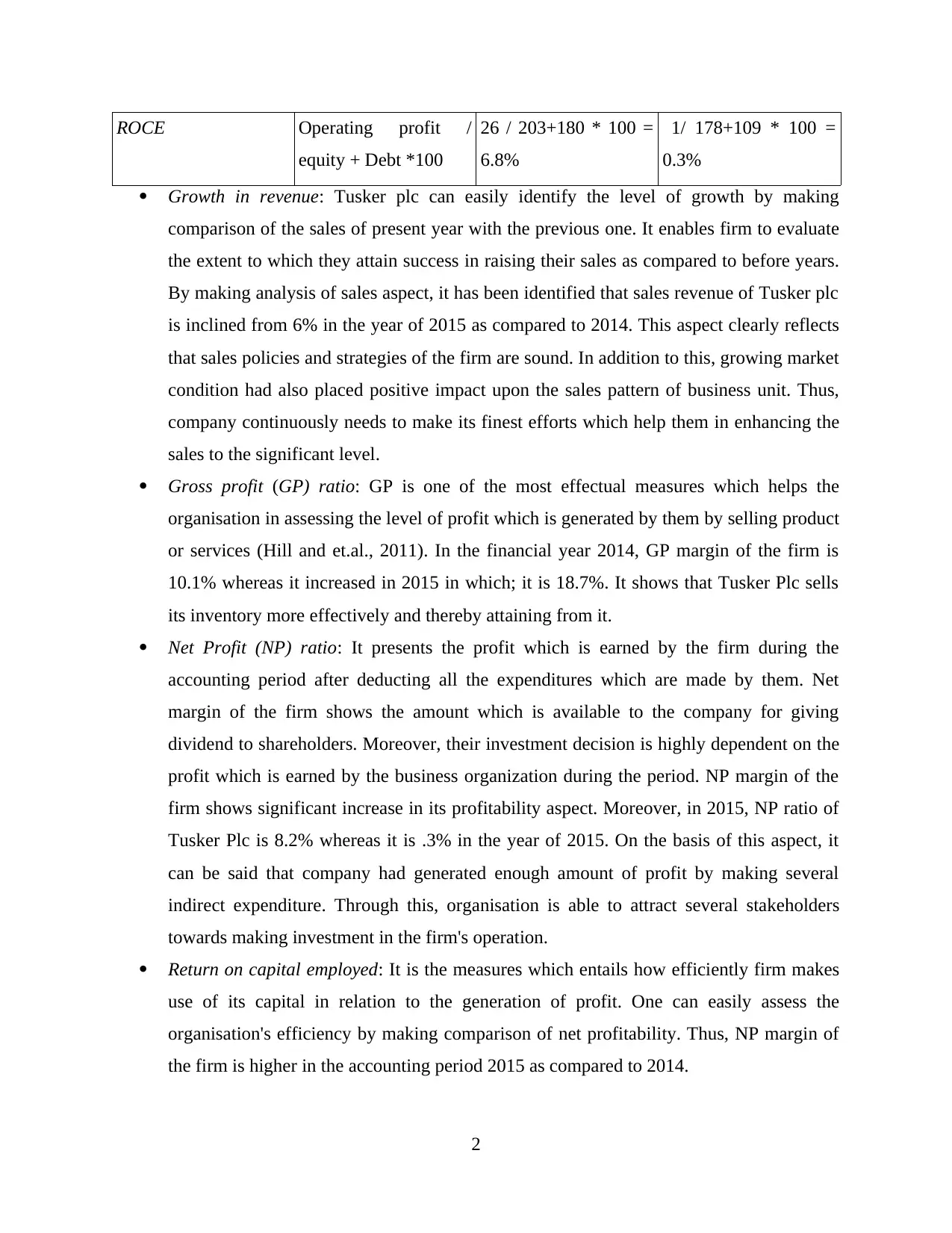

ROCE Operating profit /

equity + Debt *100

26 / 203+180 * 100 =

6.8%

1/ 178+109 * 100 =

0.3%

Growth in revenue: Tusker plc can easily identify the level of growth by making

comparison of the sales of present year with the previous one. It enables firm to evaluate

the extent to which they attain success in raising their sales as compared to before years.

By making analysis of sales aspect, it has been identified that sales revenue of Tusker plc

is inclined from 6% in the year of 2015 as compared to 2014. This aspect clearly reflects

that sales policies and strategies of the firm are sound. In addition to this, growing market

condition had also placed positive impact upon the sales pattern of business unit. Thus,

company continuously needs to make its finest efforts which help them in enhancing the

sales to the significant level.

Gross profit (GP) ratio: GP is one of the most effectual measures which helps the

organisation in assessing the level of profit which is generated by them by selling product

or services (Hill and et.al., 2011). In the financial year 2014, GP margin of the firm is

10.1% whereas it increased in 2015 in which; it is 18.7%. It shows that Tusker Plc sells

its inventory more effectively and thereby attaining from it.

Net Profit (NP) ratio: It presents the profit which is earned by the firm during the

accounting period after deducting all the expenditures which are made by them. Net

margin of the firm shows the amount which is available to the company for giving

dividend to shareholders. Moreover, their investment decision is highly dependent on the

profit which is earned by the business organization during the period. NP margin of the

firm shows significant increase in its profitability aspect. Moreover, in 2015, NP ratio of

Tusker Plc is 8.2% whereas it is .3% in the year of 2015. On the basis of this aspect, it

can be said that company had generated enough amount of profit by making several

indirect expenditure. Through this, organisation is able to attract several stakeholders

towards making investment in the firm's operation.

Return on capital employed: It is the measures which entails how efficiently firm makes

use of its capital in relation to the generation of profit. One can easily assess the

organisation's efficiency by making comparison of net profitability. Thus, NP margin of

the firm is higher in the accounting period 2015 as compared to 2014.

2

equity + Debt *100

26 / 203+180 * 100 =

6.8%

1/ 178+109 * 100 =

0.3%

Growth in revenue: Tusker plc can easily identify the level of growth by making

comparison of the sales of present year with the previous one. It enables firm to evaluate

the extent to which they attain success in raising their sales as compared to before years.

By making analysis of sales aspect, it has been identified that sales revenue of Tusker plc

is inclined from 6% in the year of 2015 as compared to 2014. This aspect clearly reflects

that sales policies and strategies of the firm are sound. In addition to this, growing market

condition had also placed positive impact upon the sales pattern of business unit. Thus,

company continuously needs to make its finest efforts which help them in enhancing the

sales to the significant level.

Gross profit (GP) ratio: GP is one of the most effectual measures which helps the

organisation in assessing the level of profit which is generated by them by selling product

or services (Hill and et.al., 2011). In the financial year 2014, GP margin of the firm is

10.1% whereas it increased in 2015 in which; it is 18.7%. It shows that Tusker Plc sells

its inventory more effectively and thereby attaining from it.

Net Profit (NP) ratio: It presents the profit which is earned by the firm during the

accounting period after deducting all the expenditures which are made by them. Net

margin of the firm shows the amount which is available to the company for giving

dividend to shareholders. Moreover, their investment decision is highly dependent on the

profit which is earned by the business organization during the period. NP margin of the

firm shows significant increase in its profitability aspect. Moreover, in 2015, NP ratio of

Tusker Plc is 8.2% whereas it is .3% in the year of 2015. On the basis of this aspect, it

can be said that company had generated enough amount of profit by making several

indirect expenditure. Through this, organisation is able to attract several stakeholders

towards making investment in the firm's operation.

Return on capital employed: It is the measures which entails how efficiently firm makes

use of its capital in relation to the generation of profit. One can easily assess the

organisation's efficiency by making comparison of net profitability. Thus, NP margin of

the firm is higher in the accounting period 2015 as compared to 2014.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Therefore, by making assessment of profit or loss a/c, it has found that profitability aspect

of Tusker plc is sound as compared to previous year. Thus, company needs to enhance its

profitability by making further investment in the other profitable projects. As per the cited case

scenario, building and construction market is continuously growing. In this, Tusker plc can

maximize its profitability by entering or serving more number of customers in the UK market.

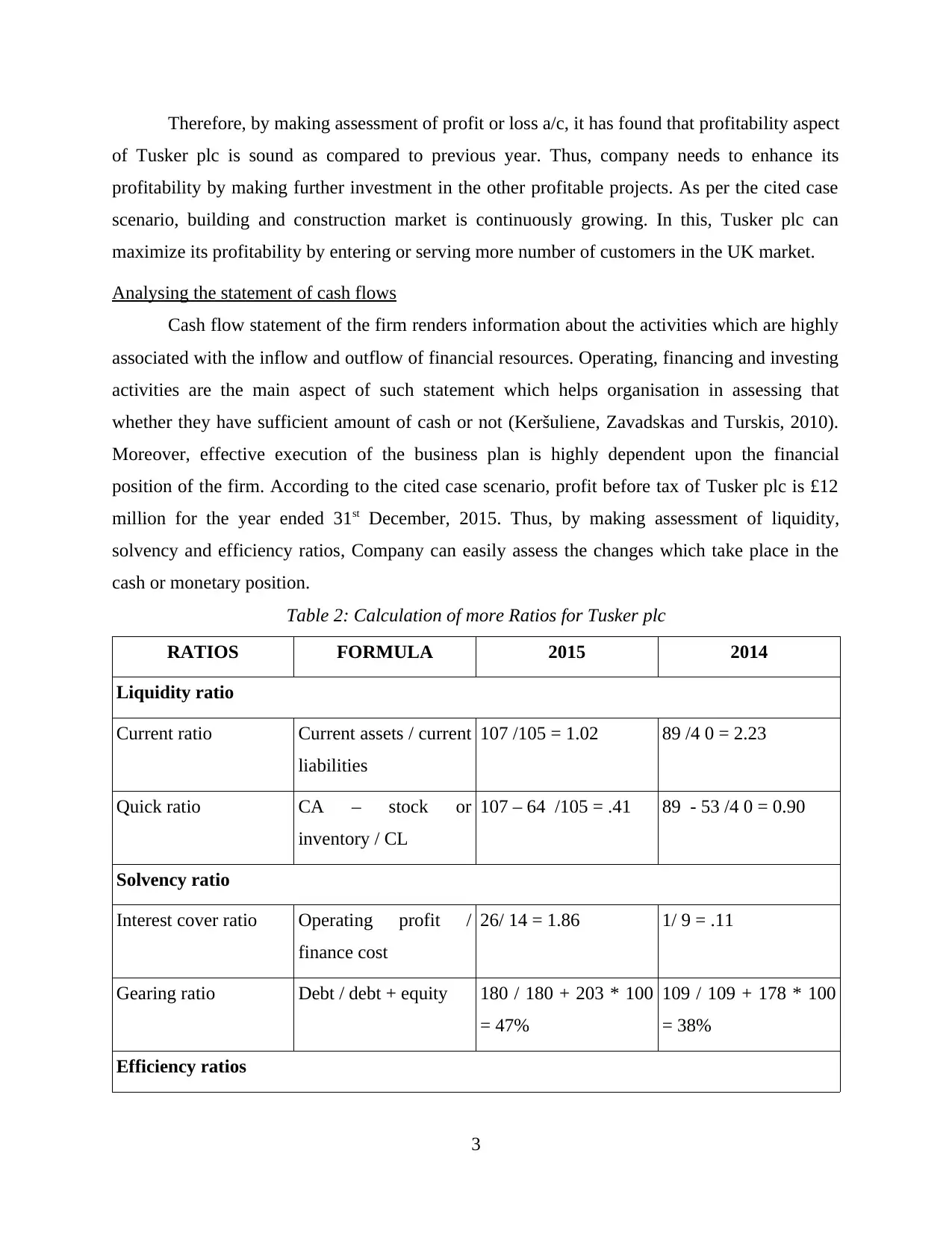

Analysing the statement of cash flows

Cash flow statement of the firm renders information about the activities which are highly

associated with the inflow and outflow of financial resources. Operating, financing and investing

activities are the main aspect of such statement which helps organisation in assessing that

whether they have sufficient amount of cash or not (Keršuliene, Zavadskas and Turskis, 2010).

Moreover, effective execution of the business plan is highly dependent upon the financial

position of the firm. According to the cited case scenario, profit before tax of Tusker plc is £12

million for the year ended 31st December, 2015. Thus, by making assessment of liquidity,

solvency and efficiency ratios, Company can easily assess the changes which take place in the

cash or monetary position.

Table 2: Calculation of more Ratios for Tusker plc

RATIOS FORMULA 2015 2014

Liquidity ratio

Current ratio Current assets / current

liabilities

107 /105 = 1.02 89 /4 0 = 2.23

Quick ratio CA – stock or

inventory / CL

107 – 64 /105 = .41 89 - 53 /4 0 = 0.90

Solvency ratio

Interest cover ratio Operating profit /

finance cost

26/ 14 = 1.86 1/ 9 = .11

Gearing ratio Debt / debt + equity 180 / 180 + 203 * 100

= 47%

109 / 109 + 178 * 100

= 38%

Efficiency ratios

3

of Tusker plc is sound as compared to previous year. Thus, company needs to enhance its

profitability by making further investment in the other profitable projects. As per the cited case

scenario, building and construction market is continuously growing. In this, Tusker plc can

maximize its profitability by entering or serving more number of customers in the UK market.

Analysing the statement of cash flows

Cash flow statement of the firm renders information about the activities which are highly

associated with the inflow and outflow of financial resources. Operating, financing and investing

activities are the main aspect of such statement which helps organisation in assessing that

whether they have sufficient amount of cash or not (Keršuliene, Zavadskas and Turskis, 2010).

Moreover, effective execution of the business plan is highly dependent upon the financial

position of the firm. According to the cited case scenario, profit before tax of Tusker plc is £12

million for the year ended 31st December, 2015. Thus, by making assessment of liquidity,

solvency and efficiency ratios, Company can easily assess the changes which take place in the

cash or monetary position.

Table 2: Calculation of more Ratios for Tusker plc

RATIOS FORMULA 2015 2014

Liquidity ratio

Current ratio Current assets / current

liabilities

107 /105 = 1.02 89 /4 0 = 2.23

Quick ratio CA – stock or

inventory / CL

107 – 64 /105 = .41 89 - 53 /4 0 = 0.90

Solvency ratio

Interest cover ratio Operating profit /

finance cost

26/ 14 = 1.86 1/ 9 = .11

Gearing ratio Debt / debt + equity 180 / 180 + 203 * 100

= 47%

109 / 109 + 178 * 100

= 38%

Efficiency ratios

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

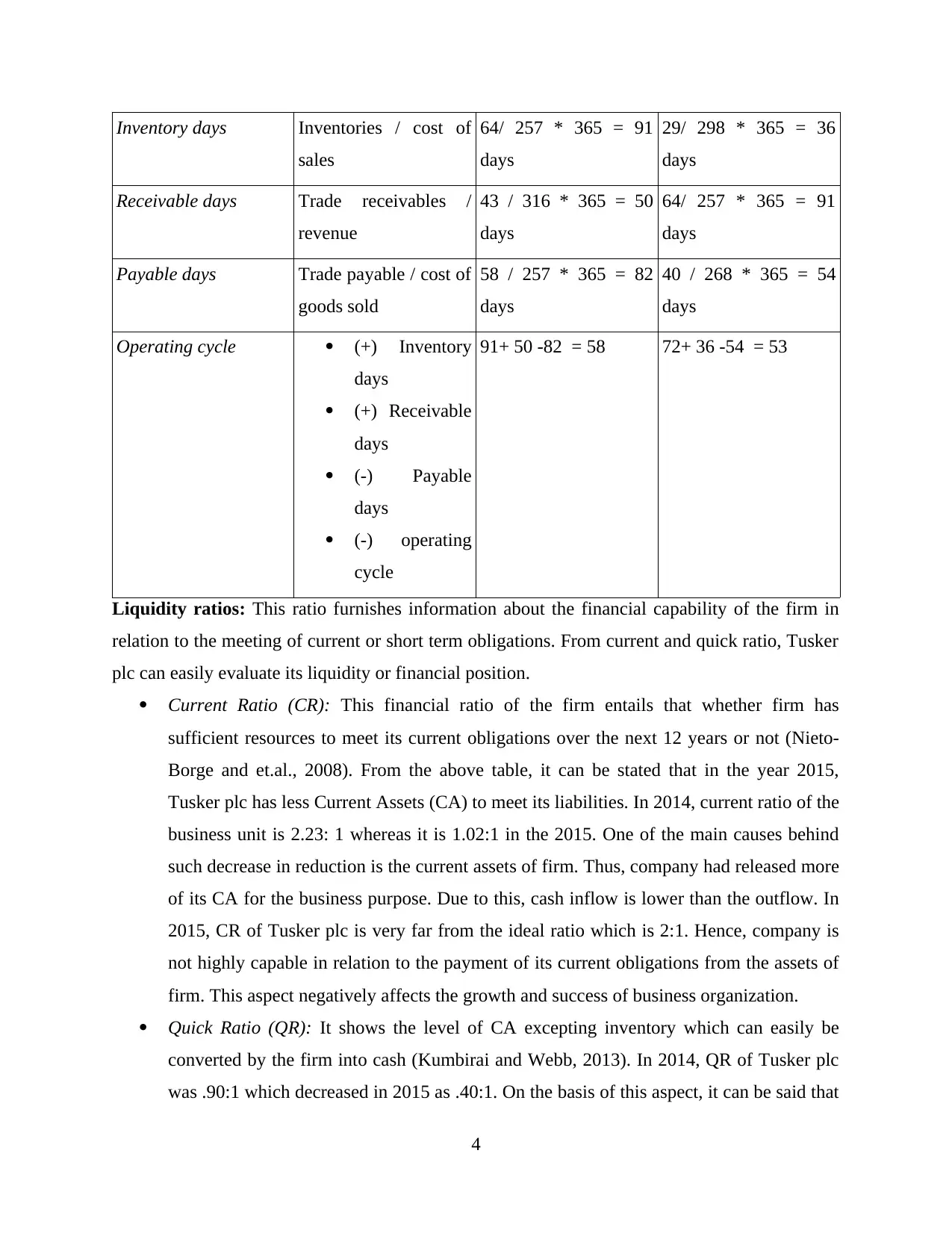

Inventory days Inventories / cost of

sales

64/ 257 * 365 = 91

days

29/ 298 * 365 = 36

days

Receivable days Trade receivables /

revenue

43 / 316 * 365 = 50

days

64/ 257 * 365 = 91

days

Payable days Trade payable / cost of

goods sold

58 / 257 * 365 = 82

days

40 / 268 * 365 = 54

days

Operating cycle (+) Inventory

days

(+) Receivable

days

(-) Payable

days

(-) operating

cycle

91+ 50 -82 = 58 72+ 36 -54 = 53

Liquidity ratios: This ratio furnishes information about the financial capability of the firm in

relation to the meeting of current or short term obligations. From current and quick ratio, Tusker

plc can easily evaluate its liquidity or financial position.

Current Ratio (CR): This financial ratio of the firm entails that whether firm has

sufficient resources to meet its current obligations over the next 12 years or not (Nieto-

Borge and et.al., 2008). From the above table, it can be stated that in the year 2015,

Tusker plc has less Current Assets (CA) to meet its liabilities. In 2014, current ratio of the

business unit is 2.23: 1 whereas it is 1.02:1 in the 2015. One of the main causes behind

such decrease in reduction is the current assets of firm. Thus, company had released more

of its CA for the business purpose. Due to this, cash inflow is lower than the outflow. In

2015, CR of Tusker plc is very far from the ideal ratio which is 2:1. Hence, company is

not highly capable in relation to the payment of its current obligations from the assets of

firm. This aspect negatively affects the growth and success of business organization.

Quick Ratio (QR): It shows the level of CA excepting inventory which can easily be

converted by the firm into cash (Kumbirai and Webb, 2013). In 2014, QR of Tusker plc

was .90:1 which decreased in 2015 as .40:1. On the basis of this aspect, it can be said that

4

sales

64/ 257 * 365 = 91

days

29/ 298 * 365 = 36

days

Receivable days Trade receivables /

revenue

43 / 316 * 365 = 50

days

64/ 257 * 365 = 91

days

Payable days Trade payable / cost of

goods sold

58 / 257 * 365 = 82

days

40 / 268 * 365 = 54

days

Operating cycle (+) Inventory

days

(+) Receivable

days

(-) Payable

days

(-) operating

cycle

91+ 50 -82 = 58 72+ 36 -54 = 53

Liquidity ratios: This ratio furnishes information about the financial capability of the firm in

relation to the meeting of current or short term obligations. From current and quick ratio, Tusker

plc can easily evaluate its liquidity or financial position.

Current Ratio (CR): This financial ratio of the firm entails that whether firm has

sufficient resources to meet its current obligations over the next 12 years or not (Nieto-

Borge and et.al., 2008). From the above table, it can be stated that in the year 2015,

Tusker plc has less Current Assets (CA) to meet its liabilities. In 2014, current ratio of the

business unit is 2.23: 1 whereas it is 1.02:1 in the 2015. One of the main causes behind

such decrease in reduction is the current assets of firm. Thus, company had released more

of its CA for the business purpose. Due to this, cash inflow is lower than the outflow. In

2015, CR of Tusker plc is very far from the ideal ratio which is 2:1. Hence, company is

not highly capable in relation to the payment of its current obligations from the assets of

firm. This aspect negatively affects the growth and success of business organization.

Quick Ratio (QR): It shows the level of CA excepting inventory which can easily be

converted by the firm into cash (Kumbirai and Webb, 2013). In 2014, QR of Tusker plc

was .90:1 which decreased in 2015 as .40:1. On the basis of this aspect, it can be said that

4

business unit made more use of cash, bank, debtors and other current assets except

inventory. It is also one of the main reasons due to which outflow of the firm is more

rather than inflow. In 2015, QR of the firm is very near to the ideal ratio which is .5:1. It

shows positive sign for the firm.

Solvency ratio: This ratio helps business organisations in assessing their financial capability in

relation to the meeting of long term obligations. Debt-equity, interest coverage ratio etc. are the

main elements which provide information about the financial capacity of the firm.

Interest cover ratio: From the above mentioned calculation, it has been assessed that

Tusker plc is able to pay interest and other outstanding debt on time. Moreover, in the

accounting year 2015, interest coverage ratio of the firm is higher as compared to 2014 in

which it was .11:1.

Gearing ratio: Debt-equity ratio of Tusker plc increased in the year 2015 as compared to

2014 (Guo and et.al., 2010). This ratio entails the extent to which fund is raised by the

firm through debt instrument rather than equity. Ideal debt-equity ratio is .5:1 which

states that business organisation requires to fulfil its financial need by issuing equity

rather than debt instruments. In the financial year 2014, debt-equity ratio of Tusker plc

is .61:1 which is near to the ideal ratio. On contrary to this, in 2015; debt-equity ratio of

the business organization is .88:1. It clearly reflects that company has fulfilled more of its

financial requirements from debt instruments as compared to equity. Therefore, company

needs to make periodical payment to the debt-holders. Moreover, in equity, company

requires to pay dividend only when they generate enough amount of profit. In this,

interest amount have high level of impact upon outflow or profitability aspect of the firm.

Efficiency ratios

Inventory turnover ratio: This ratio of the firm is getting inclined in 2015 as compared to

2014. Moreover, in 2015 inventory turnover period is 91 days which shows that Tusker

plc is efficiently able to covert its inventory into finished goods. Thus, it helps

organisation to supply the products in the suitable time frame.

Receivable days: This ratio of the firm shows that it is able to get payment earlier from its

debtor (Baum and Crosby, 2014). In 2015, receivable turnover ratio is 50 days whereas

Tusker plc had to wait for 91 days for the recovery of payment from debtors in 2014.

5

inventory. It is also one of the main reasons due to which outflow of the firm is more

rather than inflow. In 2015, QR of the firm is very near to the ideal ratio which is .5:1. It

shows positive sign for the firm.

Solvency ratio: This ratio helps business organisations in assessing their financial capability in

relation to the meeting of long term obligations. Debt-equity, interest coverage ratio etc. are the

main elements which provide information about the financial capacity of the firm.

Interest cover ratio: From the above mentioned calculation, it has been assessed that

Tusker plc is able to pay interest and other outstanding debt on time. Moreover, in the

accounting year 2015, interest coverage ratio of the firm is higher as compared to 2014 in

which it was .11:1.

Gearing ratio: Debt-equity ratio of Tusker plc increased in the year 2015 as compared to

2014 (Guo and et.al., 2010). This ratio entails the extent to which fund is raised by the

firm through debt instrument rather than equity. Ideal debt-equity ratio is .5:1 which

states that business organisation requires to fulfil its financial need by issuing equity

rather than debt instruments. In the financial year 2014, debt-equity ratio of Tusker plc

is .61:1 which is near to the ideal ratio. On contrary to this, in 2015; debt-equity ratio of

the business organization is .88:1. It clearly reflects that company has fulfilled more of its

financial requirements from debt instruments as compared to equity. Therefore, company

needs to make periodical payment to the debt-holders. Moreover, in equity, company

requires to pay dividend only when they generate enough amount of profit. In this,

interest amount have high level of impact upon outflow or profitability aspect of the firm.

Efficiency ratios

Inventory turnover ratio: This ratio of the firm is getting inclined in 2015 as compared to

2014. Moreover, in 2015 inventory turnover period is 91 days which shows that Tusker

plc is efficiently able to covert its inventory into finished goods. Thus, it helps

organisation to supply the products in the suitable time frame.

Receivable days: This ratio of the firm shows that it is able to get payment earlier from its

debtor (Baum and Crosby, 2014). In 2015, receivable turnover ratio is 50 days whereas

Tusker plc had to wait for 91 days for the recovery of payment from debtors in 2014.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

This is a positive sign for the firm because by receiving earlier payment, company is able

to make investment in the further productive activities.

Payable days: In 2014, Tusker plc took 54 days for making payment to creditors for the

material which is purchased on credit basis. On contrast to this, in the year 2015, payable

days of Tusker plc are increased to 82 days which is good for the company.

By making analysis of efficiency ratio, it can be said that Tusker plc has to make

payment to their creditors within 82 days whereas it received payment from debtors within 50

days. Thus, by taking into this fact consideration, it can be stated that Tusker plc had efficiently

managed its business operations.

Stating the advantages and limitations of ratio analysis

There are several drawbacks and benefits which are associated with the financial ratio

analysis and are as follows:

Advantages: By doing ratio analysis, Tusker plc can effectively evaluate its financial statements.

By this, company is able to assess its financial performance and health to the large extent. In

addition to this, it also provides opportunity to the business organization to make evaluation of

the strategies and policies which are employed by them (Di Lorenzo and et.al., 2012). Along

with this, with the assistance of ratios, company is able to formulate competent plan which helps

them in improving their financial position and performance. For instance; from the analysis of

cash flow statement, it has found by the company that they need to make balance in their

financial structure. In addition to this, they also required to make improvement in their current

ratio.

Limitations: In financial statement, prices of the asset are recorded at cost only. Thus, it does

not reflect the changes which actually took place in the price level. Beside this, lack of

standardized rules and regulations also has high level of influence upon the appropriateness of

the ratios. Further, financial statements are the subject of high level of manipulation (Calabrò and

Della Spina, 2013). Thus, company or other stakeholders are unable to derive valid conclusion

by making analysis of ratios. Along with it, different accounting policies which are employed by

the firm closely affect the reliability or validity of the outcomes of ratios (Ratio Analysis:

Meaning, Advantages and Limitations Accounting, 2015).

6

to make investment in the further productive activities.

Payable days: In 2014, Tusker plc took 54 days for making payment to creditors for the

material which is purchased on credit basis. On contrast to this, in the year 2015, payable

days of Tusker plc are increased to 82 days which is good for the company.

By making analysis of efficiency ratio, it can be said that Tusker plc has to make

payment to their creditors within 82 days whereas it received payment from debtors within 50

days. Thus, by taking into this fact consideration, it can be stated that Tusker plc had efficiently

managed its business operations.

Stating the advantages and limitations of ratio analysis

There are several drawbacks and benefits which are associated with the financial ratio

analysis and are as follows:

Advantages: By doing ratio analysis, Tusker plc can effectively evaluate its financial statements.

By this, company is able to assess its financial performance and health to the large extent. In

addition to this, it also provides opportunity to the business organization to make evaluation of

the strategies and policies which are employed by them (Di Lorenzo and et.al., 2012). Along

with this, with the assistance of ratios, company is able to formulate competent plan which helps

them in improving their financial position and performance. For instance; from the analysis of

cash flow statement, it has found by the company that they need to make balance in their

financial structure. In addition to this, they also required to make improvement in their current

ratio.

Limitations: In financial statement, prices of the asset are recorded at cost only. Thus, it does

not reflect the changes which actually took place in the price level. Beside this, lack of

standardized rules and regulations also has high level of influence upon the appropriateness of

the ratios. Further, financial statements are the subject of high level of manipulation (Calabrò and

Della Spina, 2013). Thus, company or other stakeholders are unable to derive valid conclusion

by making analysis of ratios. Along with it, different accounting policies which are employed by

the firm closely affect the reliability or validity of the outcomes of ratios (Ratio Analysis:

Meaning, Advantages and Limitations Accounting, 2015).

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PART 2: INVESTMENT APPRAISAL

Evaluating investment appraisal techniques Western Europe expansion plan

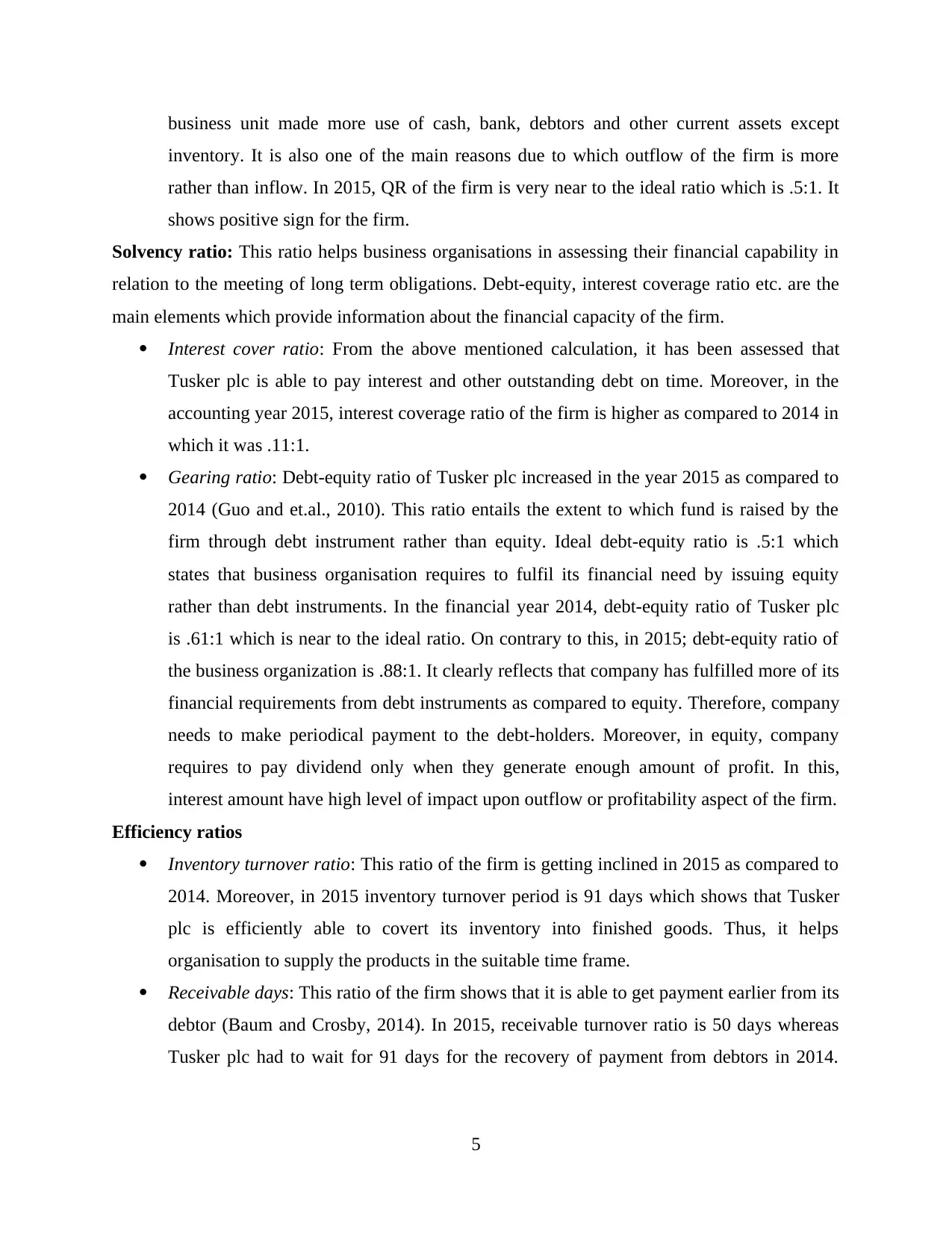

Capital budgeting is the most effectual financial tool or technique which helps finance

manager of the firm in making suitable investment decisions. Payback period, Net Present Value

(NPV) and ARR (Average Rate of Return) etc. helps business unit in assessing the financial

viability of the project.

Figure 1: Investment Appraisal Techniques

Payback period: This measure of capital budgeting refers to the time period in which

organisation is able to recover the money that are initially invested by the firm (Eliasson

and Börjesson, 2014). Thus, company is required to make assessment of the time within

which they are able to get break-even point.

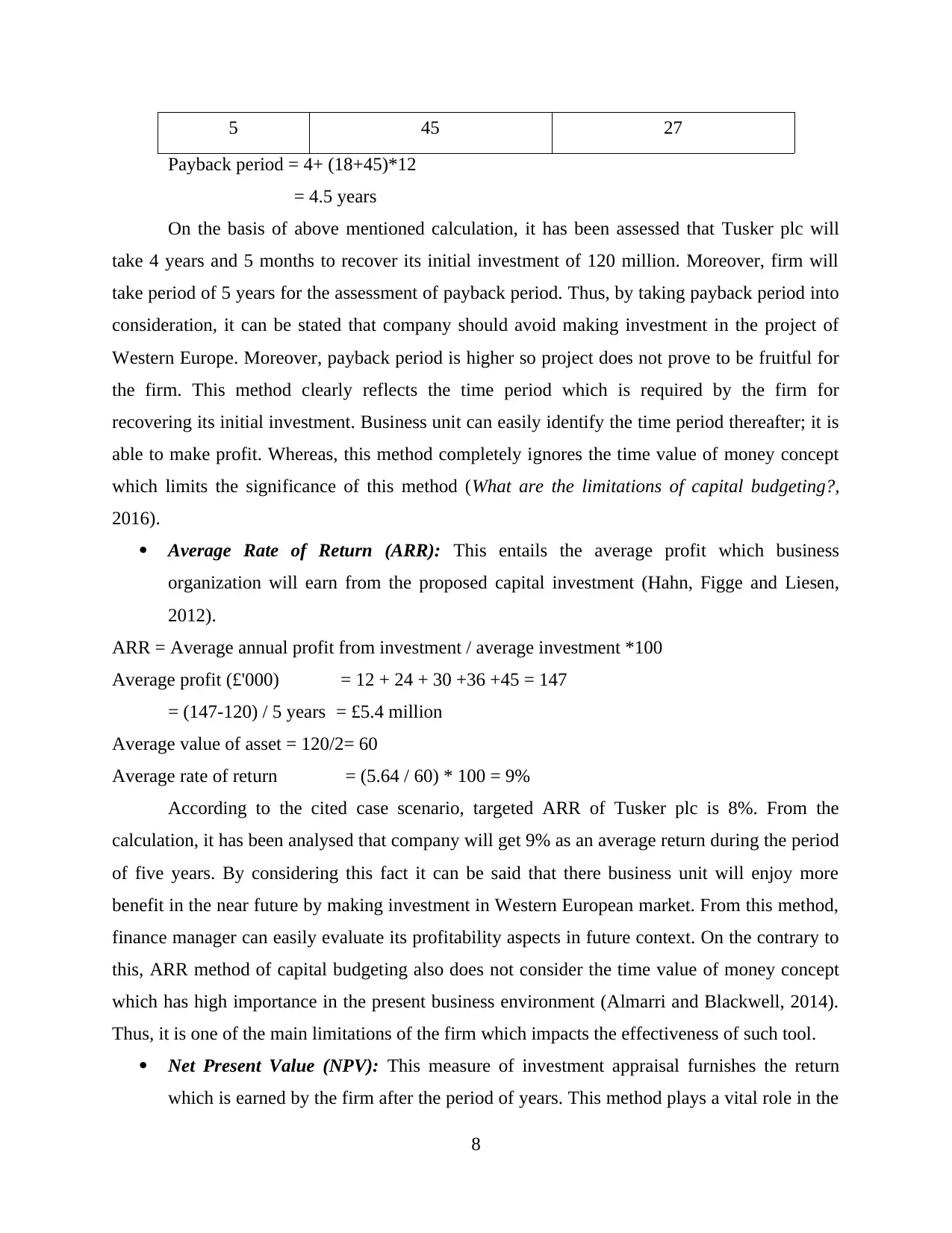

Table 3: Calculation of back Payback period

YEAR CASH INFLOW (£'000) CUMULATIVE CASH

INFLOW (£'000)

0 -120 -120

1 12 -108

2 24 -84

3 30 -54

4 36 -18

7

InvestmentappraisaltechniquesPaybackperiodAverageRateofReturn(ARR)NetPresentValue(NPV)

Evaluating investment appraisal techniques Western Europe expansion plan

Capital budgeting is the most effectual financial tool or technique which helps finance

manager of the firm in making suitable investment decisions. Payback period, Net Present Value

(NPV) and ARR (Average Rate of Return) etc. helps business unit in assessing the financial

viability of the project.

Figure 1: Investment Appraisal Techniques

Payback period: This measure of capital budgeting refers to the time period in which

organisation is able to recover the money that are initially invested by the firm (Eliasson

and Börjesson, 2014). Thus, company is required to make assessment of the time within

which they are able to get break-even point.

Table 3: Calculation of back Payback period

YEAR CASH INFLOW (£'000) CUMULATIVE CASH

INFLOW (£'000)

0 -120 -120

1 12 -108

2 24 -84

3 30 -54

4 36 -18

7

InvestmentappraisaltechniquesPaybackperiodAverageRateofReturn(ARR)NetPresentValue(NPV)

5 45 27

Payback period = 4+ (18+45)*12

= 4.5 years

On the basis of above mentioned calculation, it has been assessed that Tusker plc will

take 4 years and 5 months to recover its initial investment of 120 million. Moreover, firm will

take period of 5 years for the assessment of payback period. Thus, by taking payback period into

consideration, it can be stated that company should avoid making investment in the project of

Western Europe. Moreover, payback period is higher so project does not prove to be fruitful for

the firm. This method clearly reflects the time period which is required by the firm for

recovering its initial investment. Business unit can easily identify the time period thereafter; it is

able to make profit. Whereas, this method completely ignores the time value of money concept

which limits the significance of this method (What are the limitations of capital budgeting?,

2016).

Average Rate of Return (ARR): This entails the average profit which business

organization will earn from the proposed capital investment (Hahn, Figge and Liesen,

2012).

ARR = Average annual profit from investment / average investment *100

Average profit (£'000) = 12 + 24 + 30 +36 +45 = 147

= (147-120) / 5 years = £5.4 million

Average value of asset = 120/2= 60

Average rate of return = (5.64 / 60) * 100 = 9%

According to the cited case scenario, targeted ARR of Tusker plc is 8%. From the

calculation, it has been analysed that company will get 9% as an average return during the period

of five years. By considering this fact it can be said that there business unit will enjoy more

benefit in the near future by making investment in Western European market. From this method,

finance manager can easily evaluate its profitability aspects in future context. On the contrary to

this, ARR method of capital budgeting also does not consider the time value of money concept

which has high importance in the present business environment (Almarri and Blackwell, 2014).

Thus, it is one of the main limitations of the firm which impacts the effectiveness of such tool.

Net Present Value (NPV): This measure of investment appraisal furnishes the return

which is earned by the firm after the period of years. This method plays a vital role in the

8

Payback period = 4+ (18+45)*12

= 4.5 years

On the basis of above mentioned calculation, it has been assessed that Tusker plc will

take 4 years and 5 months to recover its initial investment of 120 million. Moreover, firm will

take period of 5 years for the assessment of payback period. Thus, by taking payback period into

consideration, it can be stated that company should avoid making investment in the project of

Western Europe. Moreover, payback period is higher so project does not prove to be fruitful for

the firm. This method clearly reflects the time period which is required by the firm for

recovering its initial investment. Business unit can easily identify the time period thereafter; it is

able to make profit. Whereas, this method completely ignores the time value of money concept

which limits the significance of this method (What are the limitations of capital budgeting?,

2016).

Average Rate of Return (ARR): This entails the average profit which business

organization will earn from the proposed capital investment (Hahn, Figge and Liesen,

2012).

ARR = Average annual profit from investment / average investment *100

Average profit (£'000) = 12 + 24 + 30 +36 +45 = 147

= (147-120) / 5 years = £5.4 million

Average value of asset = 120/2= 60

Average rate of return = (5.64 / 60) * 100 = 9%

According to the cited case scenario, targeted ARR of Tusker plc is 8%. From the

calculation, it has been analysed that company will get 9% as an average return during the period

of five years. By considering this fact it can be said that there business unit will enjoy more

benefit in the near future by making investment in Western European market. From this method,

finance manager can easily evaluate its profitability aspects in future context. On the contrary to

this, ARR method of capital budgeting also does not consider the time value of money concept

which has high importance in the present business environment (Almarri and Blackwell, 2014).

Thus, it is one of the main limitations of the firm which impacts the effectiveness of such tool.

Net Present Value (NPV): This measure of investment appraisal furnishes the return

which is earned by the firm after the period of years. This method plays a vital role in the

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.