Preventing Decline in Sales Below Break-Even Point

VerifiedAdded on 2019/12/04

|10

|3404

|130

Essay

AI Summary

The assignment discusses the limitation and merits of payback period and net present value (NPV) methods in project evaluation. Valco plc chooses site A over site B based on NPV calculations, despite similar payback periods. The article highlights the importance of considering current business environment changes and accurate discount rates to avoid selecting non-viable projects. It concludes that firms must control expenses, use break-even analysis to identify profitable sales levels, and employ project evaluation methods like NPV to choose viable projects.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MARKETING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

(1) Business performance analysis...................................................................................................3

(b).....................................................................................................................................................5

Interpretation of statement of P&L.........................................................................................5

Statement of cash flow...........................................................................................................6

Liquidity, working capital and solvency................................................................................6

Sources of internal finance.....................................................................................................7

(2) Electronic flexed budget data.....................................................................................................7

(3) Appraisal of electronic site.........................................................................................................8

Conclusion.......................................................................................................................................9

REFERENCES..............................................................................................................................10

INDEX OF TABLES

Table 1: Ratio analysis of Valco plc................................................................................................3

Table 2: Break even analysis of firm...............................................................................................7

Table 3: Calculation of payback period...........................................................................................8

Table 4: Calculation of NPV............................................................................................................8

INTRODUCTION...........................................................................................................................3

(1) Business performance analysis...................................................................................................3

(b).....................................................................................................................................................5

Interpretation of statement of P&L.........................................................................................5

Statement of cash flow...........................................................................................................6

Liquidity, working capital and solvency................................................................................6

Sources of internal finance.....................................................................................................7

(2) Electronic flexed budget data.....................................................................................................7

(3) Appraisal of electronic site.........................................................................................................8

Conclusion.......................................................................................................................................9

REFERENCES..............................................................................................................................10

INDEX OF TABLES

Table 1: Ratio analysis of Valco plc................................................................................................3

Table 2: Break even analysis of firm...............................................................................................7

Table 3: Calculation of payback period...........................................................................................8

Table 4: Calculation of NPV............................................................................................................8

INTRODUCTION

In order to evaluate business, ratio analysis technique is used. In this report ratio analysis

of firm is done and its results are interpreted. On each ratio performance comments are done in

the report. Firm financial statements are evaluated and comments are done on the rends. At end

of the report, conclusion is done on the basis of results of ratio analysis. In this report break even

analysis is done and its results are interpreted. Along with this, its components are also discussed

in the report. Apart from this in report, project evaluation methods are applied and best project is

selected for the firm.

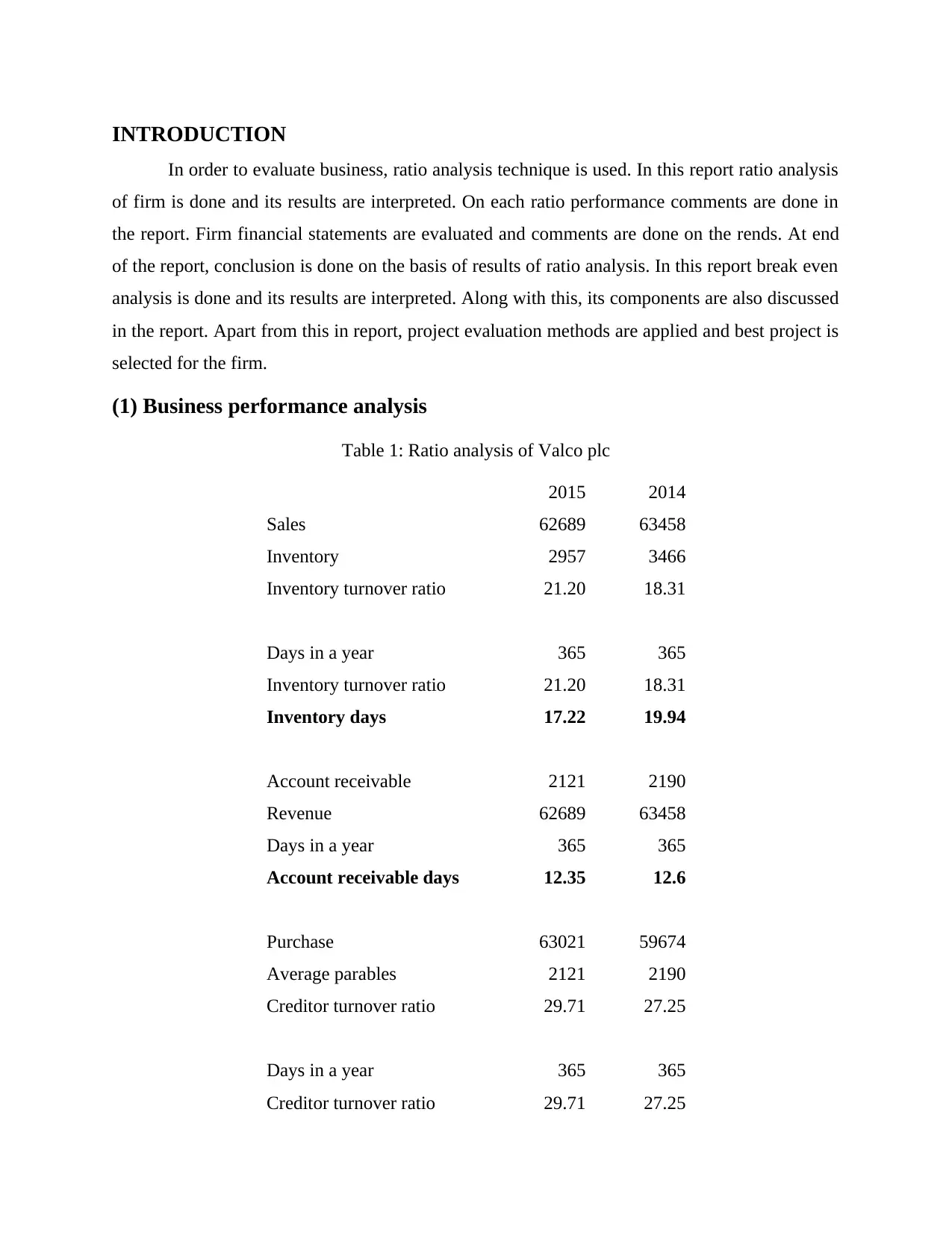

(1) Business performance analysis

Table 1: Ratio analysis of Valco plc

2015 2014

Sales 62689 63458

Inventory 2957 3466

Inventory turnover ratio 21.20 18.31

Days in a year 365 365

Inventory turnover ratio 21.20 18.31

Inventory days 17.22 19.94

Account receivable 2121 2190

Revenue 62689 63458

Days in a year 365 365

Account receivable days 12.35 12.6

Purchase 63021 59674

Average parables 2121 2190

Creditor turnover ratio 29.71 27.25

Days in a year 365 365

Creditor turnover ratio 29.71 27.25

In order to evaluate business, ratio analysis technique is used. In this report ratio analysis

of firm is done and its results are interpreted. On each ratio performance comments are done in

the report. Firm financial statements are evaluated and comments are done on the rends. At end

of the report, conclusion is done on the basis of results of ratio analysis. In this report break even

analysis is done and its results are interpreted. Along with this, its components are also discussed

in the report. Apart from this in report, project evaluation methods are applied and best project is

selected for the firm.

(1) Business performance analysis

Table 1: Ratio analysis of Valco plc

2015 2014

Sales 62689 63458

Inventory 2957 3466

Inventory turnover ratio 21.20 18.31

Days in a year 365 365

Inventory turnover ratio 21.20 18.31

Inventory days 17.22 19.94

Account receivable 2121 2190

Revenue 62689 63458

Days in a year 365 365

Account receivable days 12.35 12.6

Purchase 63021 59674

Average parables 2121 2190

Creditor turnover ratio 29.71 27.25

Days in a year 365 365

Creditor turnover ratio 29.71 27.25

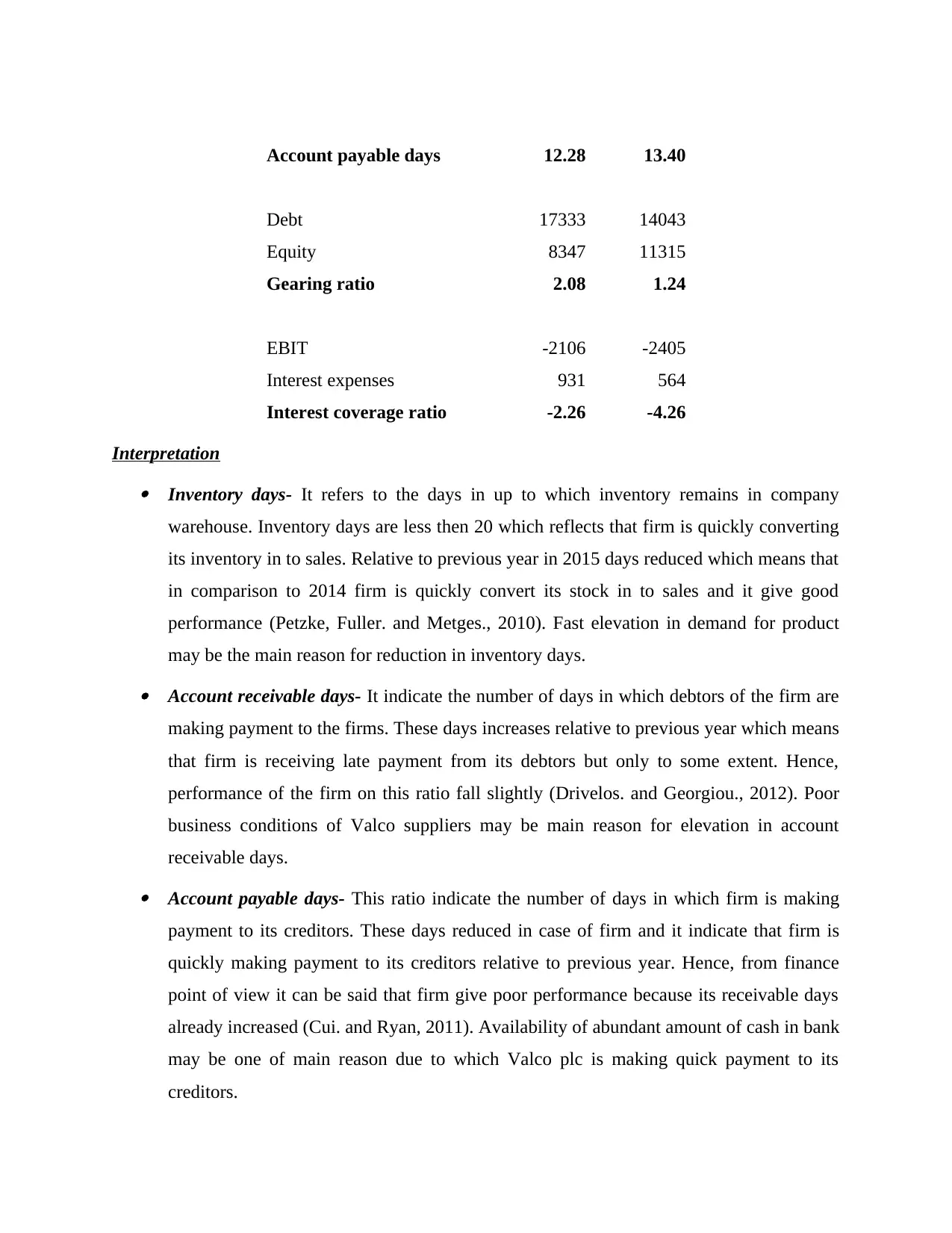

Account payable days 12.28 13.40

Debt 17333 14043

Equity 8347 11315

Gearing ratio 2.08 1.24

EBIT -2106 -2405

Interest expenses 931 564

Interest coverage ratio -2.26 -4.26

Interpretation Inventory days- It refers to the days in up to which inventory remains in company

warehouse. Inventory days are less then 20 which reflects that firm is quickly converting

its inventory in to sales. Relative to previous year in 2015 days reduced which means that

in comparison to 2014 firm is quickly convert its stock in to sales and it give good

performance (Petzke, Fuller. and Metges., 2010). Fast elevation in demand for product

may be the main reason for reduction in inventory days. Account receivable days- It indicate the number of days in which debtors of the firm are

making payment to the firms. These days increases relative to previous year which means

that firm is receiving late payment from its debtors but only to some extent. Hence,

performance of the firm on this ratio fall slightly (Drivelos. and Georgiou., 2012). Poor

business conditions of Valco suppliers may be main reason for elevation in account

receivable days. Account payable days- This ratio indicate the number of days in which firm is making

payment to its creditors. These days reduced in case of firm and it indicate that firm is

quickly making payment to its creditors relative to previous year. Hence, from finance

point of view it can be said that firm give poor performance because its receivable days

already increased (Cui. and Ryan, 2011). Availability of abundant amount of cash in bank

may be one of main reason due to which Valco plc is making quick payment to its

creditors.

Debt 17333 14043

Equity 8347 11315

Gearing ratio 2.08 1.24

EBIT -2106 -2405

Interest expenses 931 564

Interest coverage ratio -2.26 -4.26

Interpretation Inventory days- It refers to the days in up to which inventory remains in company

warehouse. Inventory days are less then 20 which reflects that firm is quickly converting

its inventory in to sales. Relative to previous year in 2015 days reduced which means that

in comparison to 2014 firm is quickly convert its stock in to sales and it give good

performance (Petzke, Fuller. and Metges., 2010). Fast elevation in demand for product

may be the main reason for reduction in inventory days. Account receivable days- It indicate the number of days in which debtors of the firm are

making payment to the firms. These days increases relative to previous year which means

that firm is receiving late payment from its debtors but only to some extent. Hence,

performance of the firm on this ratio fall slightly (Drivelos. and Georgiou., 2012). Poor

business conditions of Valco suppliers may be main reason for elevation in account

receivable days. Account payable days- This ratio indicate the number of days in which firm is making

payment to its creditors. These days reduced in case of firm and it indicate that firm is

quickly making payment to its creditors relative to previous year. Hence, from finance

point of view it can be said that firm give poor performance because its receivable days

already increased (Cui. and Ryan, 2011). Availability of abundant amount of cash in bank

may be one of main reason due to which Valco plc is making quick payment to its

creditors.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Gearing ratio- It indicate proportion of debt to equity and in case of Valco plc this ratio

increases which indicate that is performance on this ratio is not good. Proportion of debt

increases and same of equity decrease which will elevate firm finance cost in future

(Brand. and et.al., 2014). Sale of shareholding by the company directors may be one of

the main reason for decline in proportion of equity in capital structure.

Interest coverage ratio- This ratio indicate the extent to which firm can easily pay its

interest by using operating ratio. This ratio is negative for both years which means firm

can not pay its interest by using operating profit. Consistent fall in revenue may be one

one main reason for negative interest coverage ratio.

(b)

Interpretation of statement of P&L

On analysis of figures of income statement it can be seen that revenue of the firm is

decline from 63,458 to 62689. This reflects that Valco plc earning is declined and it is big

challenge to control expenses in such kind of situation. The main matter of concern for the firm

is that in 2015 its sales declined but cost of goods sold increases. This elevate level of cost for

the firm and its gross profit become negative from positive figure in FY 2015. This is evident

from the figure in which it can be seen that gross profit ratio of the firm was 5.96% in FY 2014

but it become negative to in FY 2015 to -0.53%. Hence, Valco plc needs to work on this front. It

can be seen from the table that firm operating expenses decline in 2015 relative to 2014. This

fact indicate that to some extent firm is giving excellent control on its operating expenses. Scene

is that Valco plc does not have strong control on its direct expenses but it have stiff control on

its indirect expenses. There may be many other reason for elevation in direct cost. It is possible

that sudden change happened in demand for the product from people side (Oelze. and et.al.,

2011). Due to sudden and sharp decline in the demand firm may failed to convert its entire

inventory in to sales. In order to verify this estimation we can look at the inventory days and its

value is clearly indicating that Valco plc is converting its inventory in to sales quickly. Hence,

decline in demand may not be main reason for low sales and elevation in cost of goods sold.

If inventory days decline then we can assume that due to slow conversion of inventory in

to sales firm book low sales. But this is not main reason responsible for low sales. High

inventory ratio means firm is quickly selling its stock in the market and revenue is low which

increases which indicate that is performance on this ratio is not good. Proportion of debt

increases and same of equity decrease which will elevate firm finance cost in future

(Brand. and et.al., 2014). Sale of shareholding by the company directors may be one of

the main reason for decline in proportion of equity in capital structure.

Interest coverage ratio- This ratio indicate the extent to which firm can easily pay its

interest by using operating ratio. This ratio is negative for both years which means firm

can not pay its interest by using operating profit. Consistent fall in revenue may be one

one main reason for negative interest coverage ratio.

(b)

Interpretation of statement of P&L

On analysis of figures of income statement it can be seen that revenue of the firm is

decline from 63,458 to 62689. This reflects that Valco plc earning is declined and it is big

challenge to control expenses in such kind of situation. The main matter of concern for the firm

is that in 2015 its sales declined but cost of goods sold increases. This elevate level of cost for

the firm and its gross profit become negative from positive figure in FY 2015. This is evident

from the figure in which it can be seen that gross profit ratio of the firm was 5.96% in FY 2014

but it become negative to in FY 2015 to -0.53%. Hence, Valco plc needs to work on this front. It

can be seen from the table that firm operating expenses decline in 2015 relative to 2014. This

fact indicate that to some extent firm is giving excellent control on its operating expenses. Scene

is that Valco plc does not have strong control on its direct expenses but it have stiff control on

its indirect expenses. There may be many other reason for elevation in direct cost. It is possible

that sudden change happened in demand for the product from people side (Oelze. and et.al.,

2011). Due to sudden and sharp decline in the demand firm may failed to convert its entire

inventory in to sales. In order to verify this estimation we can look at the inventory days and its

value is clearly indicating that Valco plc is converting its inventory in to sales quickly. Hence,

decline in demand may not be main reason for low sales and elevation in cost of goods sold.

If inventory days decline then we can assume that due to slow conversion of inventory in

to sales firm book low sales. But this is not main reason responsible for low sales. High

inventory ratio means firm is quickly selling its stock in the market and revenue is low which

means that firm produce low quantity of goods (Healy. and Palepu., 2012). Due to low

production of goods cost of producing them must also decline in 2015 relative to 2014. But

inverse happens which means that Valco plc makes overuse of raw material and labor on its

production place. Due to this reason even firm produce less number of units relative to 2014 and

its cost of good sold increases. This proved that firm is not utilizing its resources in proper

manner and even though revenue decline relative to previous year, cost of goods sold increase in

comparison to previous year.

Analysis of indirect expenses are clearly indicating that firm is having a stiff control on

its indirect expenses. In the FY 2015 relative to 2014 marketing and advertising expenses decline

by -2.16% and distribution expenses fall by -18.65% which was huge decline in the cost of

distribution from the firm side. Not only distribution expenses employee expenses of the firm

also decline by -15.79%. This was an attempt to improve firm condition in comparison to small

competitors. In line to this trend directors remuneration also fall by -16.67%. Only depreciation

on assets increased by 7.33%. In a year total operating expenses declined by -1.51% and it can be

said that Valco ltd is having fast control on its operating cost. Hence, it can be said on this front

Valco plc really doing well. Elevation in finance cost and direct expenses acts as two main

factors that lead to decline in the firm net profit. This is proved from the fact that in a year net

profit of the firm declined by -123%. Hence, such a huge decline in a year in the business is the

matter of concern for the firm.

Statement of cash flow

Cash flow statement indicate the cash inflow and outflow that is taking place in the

operating, investing and financing activities of the firm. On analysis of figures it can be seen that

cash flow from operating activities decline and same from investing activity also declined. But in

case of cash flow from financing activity cash flow is increased. At end of this statement cash in

bank balance is negative only by 341. If we compare income statement with cash flow figures

then it can be observed that is former statement firm cash flow is negative by huge value but

even though cash flow is negative only by -341 in latter statement. This happens because Valco

plc takes heavy amount of loan from the banks and equity from public and institutional investors.

Due to this reason heavy amount of cash inflow happened in the business and cash and cash

equivalent value become negative only to -341.

production of goods cost of producing them must also decline in 2015 relative to 2014. But

inverse happens which means that Valco plc makes overuse of raw material and labor on its

production place. Due to this reason even firm produce less number of units relative to 2014 and

its cost of good sold increases. This proved that firm is not utilizing its resources in proper

manner and even though revenue decline relative to previous year, cost of goods sold increase in

comparison to previous year.

Analysis of indirect expenses are clearly indicating that firm is having a stiff control on

its indirect expenses. In the FY 2015 relative to 2014 marketing and advertising expenses decline

by -2.16% and distribution expenses fall by -18.65% which was huge decline in the cost of

distribution from the firm side. Not only distribution expenses employee expenses of the firm

also decline by -15.79%. This was an attempt to improve firm condition in comparison to small

competitors. In line to this trend directors remuneration also fall by -16.67%. Only depreciation

on assets increased by 7.33%. In a year total operating expenses declined by -1.51% and it can be

said that Valco ltd is having fast control on its operating cost. Hence, it can be said on this front

Valco plc really doing well. Elevation in finance cost and direct expenses acts as two main

factors that lead to decline in the firm net profit. This is proved from the fact that in a year net

profit of the firm declined by -123%. Hence, such a huge decline in a year in the business is the

matter of concern for the firm.

Statement of cash flow

Cash flow statement indicate the cash inflow and outflow that is taking place in the

operating, investing and financing activities of the firm. On analysis of figures it can be seen that

cash flow from operating activities decline and same from investing activity also declined. But in

case of cash flow from financing activity cash flow is increased. At end of this statement cash in

bank balance is negative only by 341. If we compare income statement with cash flow figures

then it can be observed that is former statement firm cash flow is negative by huge value but

even though cash flow is negative only by -341 in latter statement. This happens because Valco

plc takes heavy amount of loan from the banks and equity from public and institutional investors.

Due to this reason heavy amount of cash inflow happened in the business and cash and cash

equivalent value become negative only to -341.

Liquidity, working capital and solvency

In order to measure liquidity position of the firm current and quick ratio are used for

analysis. Current ratio indicate the proportion of current assets in comparison to current liability.

It also indicate firm ability to make payment of current liability of time (Krolzig, 2013). The

value of this ratio is 0.72 and less then previous year figure. It can be said that current liability

increased in the firm balance sheet relative to previous year. Industry standard for current ratio is

1:1 and firm performance is below industry standard. This reflects that condition of Vaclo plc is

not good relative to its peer firms. Inventory days of retail firms in UK is 16 and firm inventory

days value is 17. It can be said that firm is giving performance nearby to industry standards. Like

other peer firms Valco plc is also converting its stock in to sales quickly. Due to this reason its

inventory holding cost is in control. Account receivable days is low in case of Valco relative to

industry standards. Industry average receivable days is 11 and same of firm is 12 and it can be

said that firm is taking more time in receiving payment from its debtors. Hence, here Valco plc

needs to make improvement in its performance and it must give debt only to those business firms

who can pay debt amount on time. Average payment days in the industry is 14 but firm is

making payment to its creditors in 12 days. This reflects that firm in comparison to industry is

making quick payment. If we analyze this situation from creditors point of view then it can be

said that firm is giving good performance. Condition of Valco ltd is not good and even though it

is making quick payment to its creditors. Such kind of act may negatively affect firm business. In

case of gearing ratio standard of industry and firm ratio value is same and it can be said that there

is similarity in the capital structure of the firm and peer firms of industry . Interest coverage ratio

of the industry is 1 and same of firm is negative and it can be said that company performance is

below industry standards.

Sources of internal finance

In order to do short term finance Valco plc can reduce its inventory days and for this it

can produce less units. By doing this it can reduce inventory storage time in the warehouse. This

will reduce storage cost of the firm and saved amount will be used to finance internal operations

(Gertler. and Kiyotaki, 2010). Thus, it is a viable option for the Valco plc. Firm can also increase

payment terms for the supplier in order to reduce receivable time. By doing so firm can boost

cash inflow from debtors side and received amount will be used to finance internal operations.

Thus, it is also viable option for the firm.

In order to measure liquidity position of the firm current and quick ratio are used for

analysis. Current ratio indicate the proportion of current assets in comparison to current liability.

It also indicate firm ability to make payment of current liability of time (Krolzig, 2013). The

value of this ratio is 0.72 and less then previous year figure. It can be said that current liability

increased in the firm balance sheet relative to previous year. Industry standard for current ratio is

1:1 and firm performance is below industry standard. This reflects that condition of Vaclo plc is

not good relative to its peer firms. Inventory days of retail firms in UK is 16 and firm inventory

days value is 17. It can be said that firm is giving performance nearby to industry standards. Like

other peer firms Valco plc is also converting its stock in to sales quickly. Due to this reason its

inventory holding cost is in control. Account receivable days is low in case of Valco relative to

industry standards. Industry average receivable days is 11 and same of firm is 12 and it can be

said that firm is taking more time in receiving payment from its debtors. Hence, here Valco plc

needs to make improvement in its performance and it must give debt only to those business firms

who can pay debt amount on time. Average payment days in the industry is 14 but firm is

making payment to its creditors in 12 days. This reflects that firm in comparison to industry is

making quick payment. If we analyze this situation from creditors point of view then it can be

said that firm is giving good performance. Condition of Valco ltd is not good and even though it

is making quick payment to its creditors. Such kind of act may negatively affect firm business. In

case of gearing ratio standard of industry and firm ratio value is same and it can be said that there

is similarity in the capital structure of the firm and peer firms of industry . Interest coverage ratio

of the industry is 1 and same of firm is negative and it can be said that company performance is

below industry standards.

Sources of internal finance

In order to do short term finance Valco plc can reduce its inventory days and for this it

can produce less units. By doing this it can reduce inventory storage time in the warehouse. This

will reduce storage cost of the firm and saved amount will be used to finance internal operations

(Gertler. and Kiyotaki, 2010). Thus, it is a viable option for the Valco plc. Firm can also increase

payment terms for the supplier in order to reduce receivable time. By doing so firm can boost

cash inflow from debtors side and received amount will be used to finance internal operations.

Thus, it is also viable option for the firm.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(2) Electronic flexed budget data

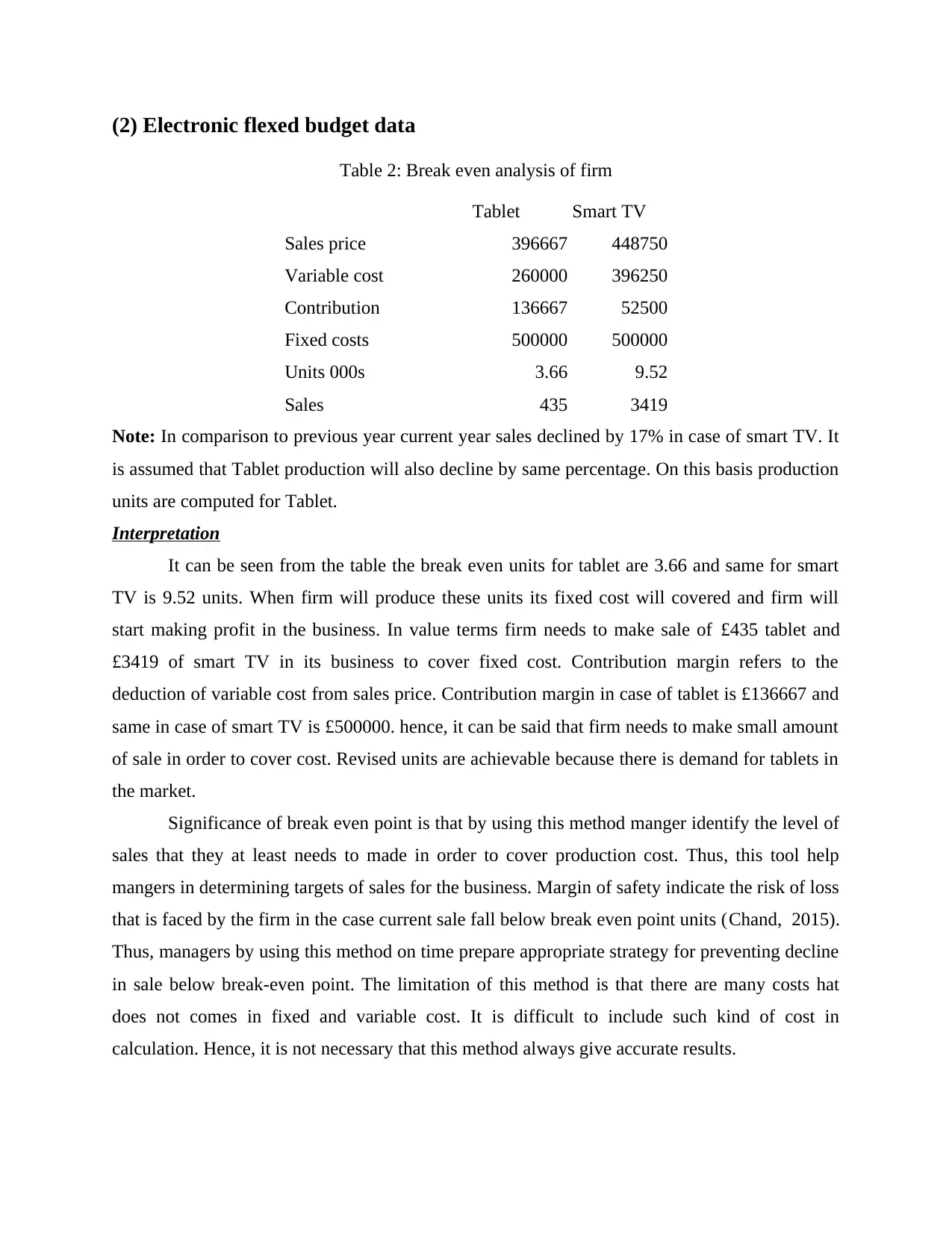

Table 2: Break even analysis of firm

Tablet Smart TV

Sales price 396667 448750

Variable cost 260000 396250

Contribution 136667 52500

Fixed costs 500000 500000

Units 000s 3.66 9.52

Sales 435 3419

Note: In comparison to previous year current year sales declined by 17% in case of smart TV. It

is assumed that Tablet production will also decline by same percentage. On this basis production

units are computed for Tablet.

Interpretation

It can be seen from the table the break even units for tablet are 3.66 and same for smart

TV is 9.52 units. When firm will produce these units its fixed cost will covered and firm will

start making profit in the business. In value terms firm needs to make sale of £435 tablet and

£3419 of smart TV in its business to cover fixed cost. Contribution margin refers to the

deduction of variable cost from sales price. Contribution margin in case of tablet is £136667 and

same in case of smart TV is £500000. hence, it can be said that firm needs to make small amount

of sale in order to cover cost. Revised units are achievable because there is demand for tablets in

the market.

Significance of break even point is that by using this method manger identify the level of

sales that they at least needs to made in order to cover production cost. Thus, this tool help

mangers in determining targets of sales for the business. Margin of safety indicate the risk of loss

that is faced by the firm in the case current sale fall below break even point units (Chand, 2015).

Thus, managers by using this method on time prepare appropriate strategy for preventing decline

in sale below break-even point. The limitation of this method is that there are many costs hat

does not comes in fixed and variable cost. It is difficult to include such kind of cost in

calculation. Hence, it is not necessary that this method always give accurate results.

Table 2: Break even analysis of firm

Tablet Smart TV

Sales price 396667 448750

Variable cost 260000 396250

Contribution 136667 52500

Fixed costs 500000 500000

Units 000s 3.66 9.52

Sales 435 3419

Note: In comparison to previous year current year sales declined by 17% in case of smart TV. It

is assumed that Tablet production will also decline by same percentage. On this basis production

units are computed for Tablet.

Interpretation

It can be seen from the table the break even units for tablet are 3.66 and same for smart

TV is 9.52 units. When firm will produce these units its fixed cost will covered and firm will

start making profit in the business. In value terms firm needs to make sale of £435 tablet and

£3419 of smart TV in its business to cover fixed cost. Contribution margin refers to the

deduction of variable cost from sales price. Contribution margin in case of tablet is £136667 and

same in case of smart TV is £500000. hence, it can be said that firm needs to make small amount

of sale in order to cover cost. Revised units are achievable because there is demand for tablets in

the market.

Significance of break even point is that by using this method manger identify the level of

sales that they at least needs to made in order to cover production cost. Thus, this tool help

mangers in determining targets of sales for the business. Margin of safety indicate the risk of loss

that is faced by the firm in the case current sale fall below break even point units (Chand, 2015).

Thus, managers by using this method on time prepare appropriate strategy for preventing decline

in sale below break-even point. The limitation of this method is that there are many costs hat

does not comes in fixed and variable cost. It is difficult to include such kind of cost in

calculation. Hence, it is not necessary that this method always give accurate results.

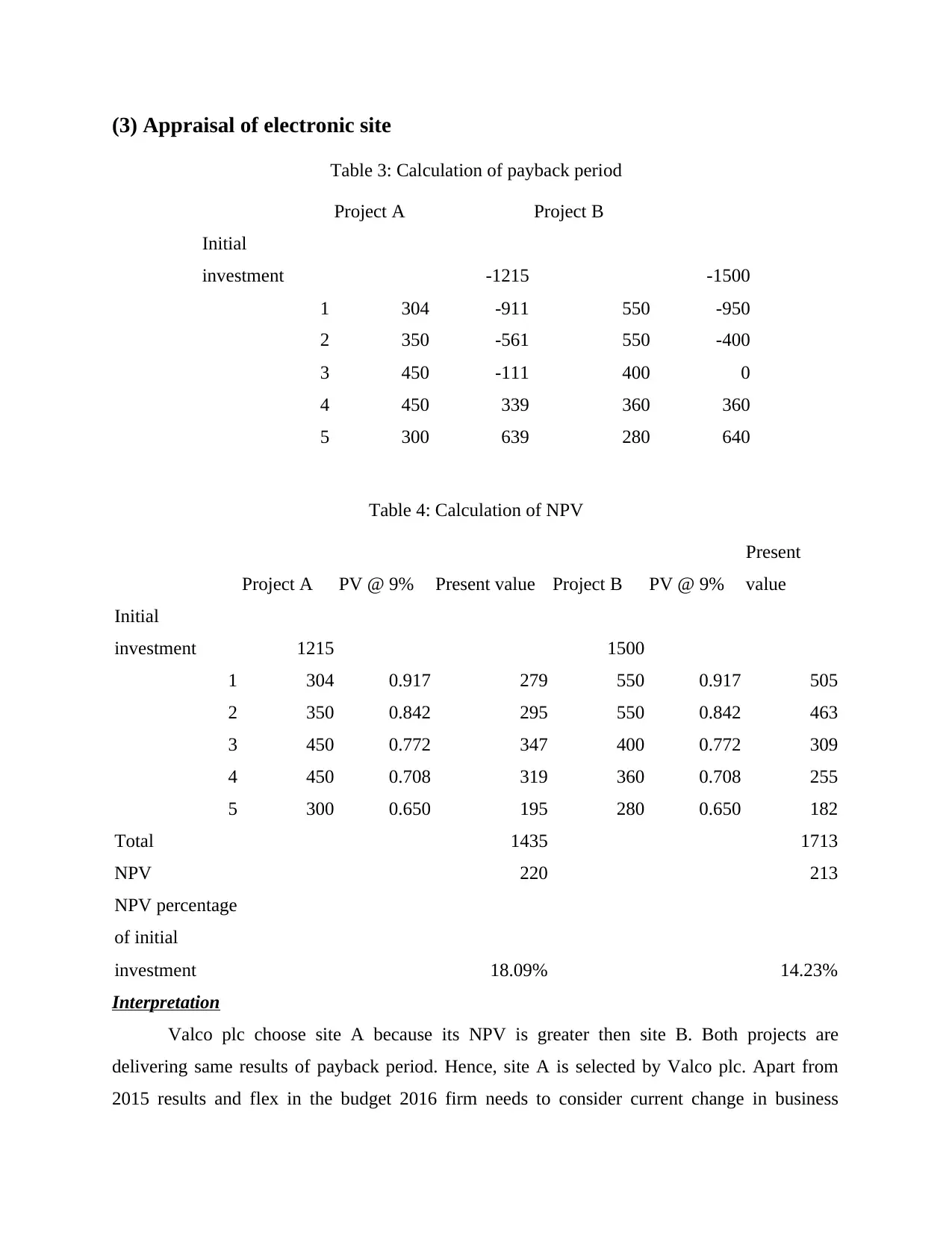

(3) Appraisal of electronic site

Table 3: Calculation of payback period

Project A Project B

Initial

investment -1215 -1500

1 304 -911 550 -950

2 350 -561 550 -400

3 450 -111 400 0

4 450 339 360 360

5 300 639 280 640

Table 4: Calculation of NPV

Project A PV @ 9% Present value Project B PV @ 9%

Present

value

Initial

investment 1215 1500

1 304 0.917 279 550 0.917 505

2 350 0.842 295 550 0.842 463

3 450 0.772 347 400 0.772 309

4 450 0.708 319 360 0.708 255

5 300 0.650 195 280 0.650 182

Total 1435 1713

NPV 220 213

NPV percentage

of initial

investment 18.09% 14.23%

Interpretation

Valco plc choose site A because its NPV is greater then site B. Both projects are

delivering same results of payback period. Hence, site A is selected by Valco plc. Apart from

2015 results and flex in the budget 2016 firm needs to consider current change in business

Table 3: Calculation of payback period

Project A Project B

Initial

investment -1215 -1500

1 304 -911 550 -950

2 350 -561 550 -400

3 450 -111 400 0

4 450 339 360 360

5 300 639 280 640

Table 4: Calculation of NPV

Project A PV @ 9% Present value Project B PV @ 9%

Present

value

Initial

investment 1215 1500

1 304 0.917 279 550 0.917 505

2 350 0.842 295 550 0.842 463

3 450 0.772 347 400 0.772 309

4 450 0.708 319 360 0.708 255

5 300 0.650 195 280 0.650 182

Total 1435 1713

NPV 220 213

NPV percentage

of initial

investment 18.09% 14.23%

Interpretation

Valco plc choose site A because its NPV is greater then site B. Both projects are

delivering same results of payback period. Hence, site A is selected by Valco plc. Apart from

2015 results and flex in the budget 2016 firm needs to consider current change in business

environment. Because it is a factor that is primarily responsible for increase or decrease in firm

sales.

Principles of payback-period and net present value method

Main merit of pay back period is that anyone can apply this method even managers does not

have finance background. Limitation of this method is that concept of present value is not used

in calculation (Capital investment appraisal, 2016). In case of NPV positive point is that present

value concept is used and it evaluate viability of project for present day. Main limitation of this

method is that it is very difficult to find out accurate discount rate. If wrong rate will be taken

then nonviable project can be selected by the managers for the firm.

CONCLUSION

It is concluded that firm maintain good control on its expenses but due to overuse of

materiel and labor at the workplace its COGS increased. Thus, firm must prepare suitable

strategy in order to keep direct expenses in control. It is concluded that managers must use break

even analysis method in order to identify the level up to which they needs to make sale in order

to cover cost. Managers must instead of randomly selecting a project should use project

evaluation method in order to choose most viable project for the firm.

sales.

Principles of payback-period and net present value method

Main merit of pay back period is that anyone can apply this method even managers does not

have finance background. Limitation of this method is that concept of present value is not used

in calculation (Capital investment appraisal, 2016). In case of NPV positive point is that present

value concept is used and it evaluate viability of project for present day. Main limitation of this

method is that it is very difficult to find out accurate discount rate. If wrong rate will be taken

then nonviable project can be selected by the managers for the firm.

CONCLUSION

It is concluded that firm maintain good control on its expenses but due to overuse of

materiel and labor at the workplace its COGS increased. Thus, firm must prepare suitable

strategy in order to keep direct expenses in control. It is concluded that managers must use break

even analysis method in order to identify the level up to which they needs to make sale in order

to cover cost. Managers must instead of randomly selecting a project should use project

evaluation method in order to choose most viable project for the firm.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.