Impact of International Accounting Standards on Small Business Development

VerifiedAdded on 2023/01/20

|26

|9172

|52

AI Summary

This research study focuses on the impact of International Accounting Standards on small business development, with a case study on RH Amar. It analyzes the concept of international accounting standards, evaluates the current business environment of small businesses, and assesses the positive and negative impact of international accounting standards on small business development.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Business Project

Contents

TITLE..............................................................................................................................................2

Chapter 1: INTRODUCTION..........................................................................................................2

CHAPTER 2: LITERATURE REVIEW.........................................................................................4

CHAPTER 3: RESEARCH METHODOLOGY.............................................................................9

CHAPTER 4: DATA ANALYSIS................................................................................................11

Discussion......................................................................................................................................18

Conclusion.....................................................................................................................................19

REFERENCES..............................................................................................................................21

Contents

TITLE..............................................................................................................................................2

Chapter 1: INTRODUCTION..........................................................................................................2

CHAPTER 2: LITERATURE REVIEW.........................................................................................4

CHAPTER 3: RESEARCH METHODOLOGY.............................................................................9

CHAPTER 4: DATA ANALYSIS................................................................................................11

Discussion......................................................................................................................................18

Conclusion.....................................................................................................................................19

REFERENCES..............................................................................................................................21

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TITLE

“Impact of International Accounting Standards on Small Business Development”.

Chapter 1: INTRODUCTION

Overview of research

In accounting world, companies have to apply specific guidelines and principle in order to prepare

essential statements and authentic reports that are known as International Accounting Standards. These

are further replaced by international accounting standard board (IASB) into IFRS international financial

reporting standard (Beaumont, 2015). The concept of IAS was first developed in 1973 by IASC with the

main purpose to compare companies in different part of world, raise transparency and believe in reports

and improve foster international trade and investment. In recent time as economy is becoming more

international and global thus business activities of companies are also expanding. Therefore, they need

for globally accepted framework is greater which help in proper preparation of financial report and

records. These reports must be consistency, comparable, reliable and transparent at global and domestic

level so that meaningful decision are made for improvement. Each kind of organisation either small,

medium or big require accounting standard so that companies would be able to present financial

statements and promote business al global market.

Background of research

RH Amar is one of the best and growing food and grocery distributor and importer in UK. There

are around 68 employees selling around 1200 products and dealing with 40 brands. Company

have effective marketing and distribution channels that use to provide desired food to respective

customer across different part of UK (About RH Amar, 2019). The company is a full-service

distributor and importer, substance skills and expertise in marketing, brand management, sales,

logistics, category management, IT support, food technology and much more. Company use to

represent some most popular UK brands that basically includes Del Monte, Starbucks, Nando’s,

Schwartz, Kikkoman, Crespo, Mutti as well as Kuhne. In the Original Waffle Company brands

which is Cooks & Co, Mary Berry’s.

Rationale of Research

It is observed that work of researcher is reliant on the impact of International accounting standard on

small businesses, thus it is necessary to reduce any error or gap in literature review which enable in

making of proper and described plans to conduct research. This particular work deal with defining the

actual and entire influence of International Accounting Standard on the business of small-medium size

companies. (Brooks and Oikonomou, 2018)

Research Aim

“Impact of International Accounting Standards on Small Business Development”.

Chapter 1: INTRODUCTION

Overview of research

In accounting world, companies have to apply specific guidelines and principle in order to prepare

essential statements and authentic reports that are known as International Accounting Standards. These

are further replaced by international accounting standard board (IASB) into IFRS international financial

reporting standard (Beaumont, 2015). The concept of IAS was first developed in 1973 by IASC with the

main purpose to compare companies in different part of world, raise transparency and believe in reports

and improve foster international trade and investment. In recent time as economy is becoming more

international and global thus business activities of companies are also expanding. Therefore, they need

for globally accepted framework is greater which help in proper preparation of financial report and

records. These reports must be consistency, comparable, reliable and transparent at global and domestic

level so that meaningful decision are made for improvement. Each kind of organisation either small,

medium or big require accounting standard so that companies would be able to present financial

statements and promote business al global market.

Background of research

RH Amar is one of the best and growing food and grocery distributor and importer in UK. There

are around 68 employees selling around 1200 products and dealing with 40 brands. Company

have effective marketing and distribution channels that use to provide desired food to respective

customer across different part of UK (About RH Amar, 2019). The company is a full-service

distributor and importer, substance skills and expertise in marketing, brand management, sales,

logistics, category management, IT support, food technology and much more. Company use to

represent some most popular UK brands that basically includes Del Monte, Starbucks, Nando’s,

Schwartz, Kikkoman, Crespo, Mutti as well as Kuhne. In the Original Waffle Company brands

which is Cooks & Co, Mary Berry’s.

Rationale of Research

It is observed that work of researcher is reliant on the impact of International accounting standard on

small businesses, thus it is necessary to reduce any error or gap in literature review which enable in

making of proper and described plans to conduct research. This particular work deal with defining the

actual and entire influence of International Accounting Standard on the business of small-medium size

companies. (Brooks and Oikonomou, 2018)

Research Aim

Business project primary aim must be authentic, clear, meaningful and appropriate and which help in

disclosing the suitable results to the topic. The main aim of this research is Impact of international

accounting standards on small business development, a case study on RH Amar

Objective

It is understood that the objective of investigation must be reliable, clear, related and specific to topic so

that meaningful outcome can be ascertained. The certain objective related to the basic aim of business

project is as follows:

Analyse the concept of international accounting standards.

To assess and understand the current business environment of small businesses.

Evaluate the negative as well positive impact of international accounting standards on small

business development.

Research Questions

The main role of researcher is to define the question related to the particular topic selected for

research (Brusca and Martínez, 2016). These question might be abbreviated, clear, related to topic so

that answer can be made as per the requirement. In research study all the specific question is related with

existent aims and objective. The crucial questions are stated below:

1. What is the main concept of international accounting standards?

2. Evaluate the actual and current situation of small businesses in present time?

3. Critically elaborate the negative and positive impact of IAS on functioning small business

development and growth?

disclosing the suitable results to the topic. The main aim of this research is Impact of international

accounting standards on small business development, a case study on RH Amar

Objective

It is understood that the objective of investigation must be reliable, clear, related and specific to topic so

that meaningful outcome can be ascertained. The certain objective related to the basic aim of business

project is as follows:

Analyse the concept of international accounting standards.

To assess and understand the current business environment of small businesses.

Evaluate the negative as well positive impact of international accounting standards on small

business development.

Research Questions

The main role of researcher is to define the question related to the particular topic selected for

research (Brusca and Martínez, 2016). These question might be abbreviated, clear, related to topic so

that answer can be made as per the requirement. In research study all the specific question is related with

existent aims and objective. The crucial questions are stated below:

1. What is the main concept of international accounting standards?

2. Evaluate the actual and current situation of small businesses in present time?

3. Critically elaborate the negative and positive impact of IAS on functioning small business

development and growth?

CHAPTER 2: LITERATURE REVIEW

The process associated with rational analysis and appropriate evaluation of sensitive data,

supported by credible sources that help decide any lack of basic knowledge and infrastructure. It helps to

evaluate the appropriate knowledge which also helps to increase the study topic's best appropriate output

(Cleary and Quinn, 2016). The analysis of literature also helps to generate a more in-depth knowledge of

the particular subject through appropriate papers, published journals, academic paper, etc. This segment

is considered to be the most important part of the study and is linked to the development of the greatest

thoughts and ideas that could give a quick knowledge of the corresponding research. A literature review is

also described in a specific topic region as information published and in a defined vulnerable region within

a defined period of time. Data was collected through sources such as books, magazines, articles,

scholarly papers, papers in this chapter. In general term, it is defined as the detailed, analyses summary

of the active evidence in context to specific topic area of research.

Analyse the concept of international accounting standards.

According to Robin Jarvis, 2017, regulations for preparing and presenting the financial

statements that were first developed by International Accounting Standards Committee (IASC) in 1973. In

the recent time, the international accounting standard board create accounting standard that were

accepted all over the world which are known as IFRS (IFRS’ Impact on SMEs, 2017). There are

different types of IAS standard that were issued for the purpose of making reports more authentic and

accurate so that they can easily describe the overall image of business. Some common International

accounting standard are IAS1 that are related with presenting of financial statements that was issued in

2007, IAS 2 which was relevant to recording of inventories which was published in 2005, IAS 3 that

relates to consolidation of financial statements, IAS 4 which shows depreciation accounting and many

more. Every Standard have its own importance in context to any business either small or big as it helps

internal managers to sort information in meaningful manner and present to external stakeholder which

makes easy for them to take respective investment decision.

In recent times, around 2001, the board IASB developed the independent standard IRFS having

the main objective:

To establish single high quality, reliable, high quality, understandable and globally accepted IFRS

standard that are depended upon clear articulated framework. These norms should involve

strong-quality, consistent and similar data in annual reports and other accounting to assist

shareholders, other stakeholders in investment markets as well as other business information

participants in making economic choices.

Promoting the implementation and strict implementation of these norms.

To meet the strategies of (1) and (2), take into account the requirements of a variety of sizes and

kinds of organisations in a variety of economic configurations, as applicable.

Promoting and facilitating the implementation by the Board of IFRS standards and interpretations,

through the happening of international accounting standard and IFRS regulation.

The process associated with rational analysis and appropriate evaluation of sensitive data,

supported by credible sources that help decide any lack of basic knowledge and infrastructure. It helps to

evaluate the appropriate knowledge which also helps to increase the study topic's best appropriate output

(Cleary and Quinn, 2016). The analysis of literature also helps to generate a more in-depth knowledge of

the particular subject through appropriate papers, published journals, academic paper, etc. This segment

is considered to be the most important part of the study and is linked to the development of the greatest

thoughts and ideas that could give a quick knowledge of the corresponding research. A literature review is

also described in a specific topic region as information published and in a defined vulnerable region within

a defined period of time. Data was collected through sources such as books, magazines, articles,

scholarly papers, papers in this chapter. In general term, it is defined as the detailed, analyses summary

of the active evidence in context to specific topic area of research.

Analyse the concept of international accounting standards.

According to Robin Jarvis, 2017, regulations for preparing and presenting the financial

statements that were first developed by International Accounting Standards Committee (IASC) in 1973. In

the recent time, the international accounting standard board create accounting standard that were

accepted all over the world which are known as IFRS (IFRS’ Impact on SMEs, 2017). There are

different types of IAS standard that were issued for the purpose of making reports more authentic and

accurate so that they can easily describe the overall image of business. Some common International

accounting standard are IAS1 that are related with presenting of financial statements that was issued in

2007, IAS 2 which was relevant to recording of inventories which was published in 2005, IAS 3 that

relates to consolidation of financial statements, IAS 4 which shows depreciation accounting and many

more. Every Standard have its own importance in context to any business either small or big as it helps

internal managers to sort information in meaningful manner and present to external stakeholder which

makes easy for them to take respective investment decision.

In recent times, around 2001, the board IASB developed the independent standard IRFS having

the main objective:

To establish single high quality, reliable, high quality, understandable and globally accepted IFRS

standard that are depended upon clear articulated framework. These norms should involve

strong-quality, consistent and similar data in annual reports and other accounting to assist

shareholders, other stakeholders in investment markets as well as other business information

participants in making economic choices.

Promoting the implementation and strict implementation of these norms.

To meet the strategies of (1) and (2), take into account the requirements of a variety of sizes and

kinds of organisations in a variety of economic configurations, as applicable.

Promoting and facilitating the implementation by the Board of IFRS standards and interpretations,

through the happening of international accounting standard and IFRS regulation.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

In accounting terms, the IFRS is accounting standard that help to organise and report financial data and

recently it is one of the most necessary accounting standard that is being followed in approx 120 nations.

It generally allows companies to post annual results and define the financial status and strength by

applying the basic concept and rules in order to reduce any fraudulent of manipulation so it makes easy

for external stakeholder to compare and contrast financial outcome for that specific year (Fang, 2015).

Companies mainly implement IFRS for reporting their financial outcome anywhere in the world except few

countries such as the United states as GAAP is the only accounting framework that is used in US. IFRS

primarily cover huge array such as:

Presentation of financial statements.

Employee benefits.

Revenue recognition.

Borrowing costs.

Income taxes.

Investment in subordinate companies.

Inventories.

Fixed assets.

Intangible assets.

Leases.

Retirement benefit plans.

Business combinations.

Foreign exchange rates.

Operating segments.

Recording to consequent events.

Industry-specific accounting, like mineral and agriculture resources.

The entire concept of IFRS is mainly developed by International accounting standard Board that

use to work closely with expertise from finance department all around the globe which includes analysts,

investor, functionary controller, business leader and responsible accountant that put valuable inputs

(Fields, 2016). There are basically 6 steps of IFRS development these are as follows:

Fixing the agenda and accounting criteria.

Effective planning for project.

Establishing and familiarising exact discussion documents with the aim to define public

consultation.

Creating and publishing the disclosure draft involving public consequent.

Publishing and development standard that ease to produce statements.

Defining a procedure after publishing an IFRS.

To understand the current conditions of small businesses.

recently it is one of the most necessary accounting standard that is being followed in approx 120 nations.

It generally allows companies to post annual results and define the financial status and strength by

applying the basic concept and rules in order to reduce any fraudulent of manipulation so it makes easy

for external stakeholder to compare and contrast financial outcome for that specific year (Fang, 2015).

Companies mainly implement IFRS for reporting their financial outcome anywhere in the world except few

countries such as the United states as GAAP is the only accounting framework that is used in US. IFRS

primarily cover huge array such as:

Presentation of financial statements.

Employee benefits.

Revenue recognition.

Borrowing costs.

Income taxes.

Investment in subordinate companies.

Inventories.

Fixed assets.

Intangible assets.

Leases.

Retirement benefit plans.

Business combinations.

Foreign exchange rates.

Operating segments.

Recording to consequent events.

Industry-specific accounting, like mineral and agriculture resources.

The entire concept of IFRS is mainly developed by International accounting standard Board that

use to work closely with expertise from finance department all around the globe which includes analysts,

investor, functionary controller, business leader and responsible accountant that put valuable inputs

(Fields, 2016). There are basically 6 steps of IFRS development these are as follows:

Fixing the agenda and accounting criteria.

Effective planning for project.

Establishing and familiarising exact discussion documents with the aim to define public

consultation.

Creating and publishing the disclosure draft involving public consequent.

Publishing and development standard that ease to produce statements.

Defining a procedure after publishing an IFRS.

To understand the current conditions of small businesses.

In the opinion of Hillary, 2017, small business is defined as the small scale independent business

entity that are mainly controlled, managed and funded by its proprietor. These kind of companies mainly

have small or limited staff, assets and resources as compare with other companies. In this type of

business company owner have to bear or contribute maximum contribution, efforts or capital as they do

not have large number of employee and as a result they have to bear all risk and are entitled to profit.

Company is small in size and willing to expand business in different part of world, thus it is crucial for

internal manager to implement best accounting standard that are accepted at international level (Fischer-

Pauzenberger and Schwaiger, 2017). This would help interested parties to gain the actual position and

financial strength of company during an accounting year and allows them to make investment to attain the

desired profit.

Small business generally has both qualitative and quantitative aspect or criteria such as qualitative criteria

says that proprietor makes important decision own their own as they are not accountable to anyone and

these business have smaller market share at domestic level. On the other side, quantitative variables are

used to define the actual strength of employee, salaries and wages, legal framework, valuation of fixed

assets, share of ownership which is held by management. Small companies are organizations operated

separately that necessitate very little equity, less labour force less or no equipment. These companies are

perfectly suited for small-scale operations to represent a local people and provide earnings to the

shareholders of the company. There are some of the crucial effective characteristic of small companies

that are listed below:

Limited investment: Capital is provided by a person or a tiny set of people in a tiny company. According

to a survey related to low-scale units it is ascertained the majority of tiny businesses are run as sole

ownership and relationship.

Owner management:

These kinds of companies are identified with its owner those are the manager and risk taker. They have

the main work to motivate the employees and make them comfortable to put maximum efforts so that

desired goals can be accomplished (Gitman, Juchau and Flanagan, 2015).

Labour Intensive:

For the most part, small companies are manpower-intensive. Different kinds of small business depend

mainly for their operating on labour. Small businesses' main nature will be more physical job participation

than academic job. The absence of equipment helps handle the activities of the staff manually.

Community Based:

Mainly small company have the main purpose of satisfying the demands and requirement of customer

living in local community. The management use strategies and target smaller demographic areas so that

they can easily make out the actual demand and requirement of clients and produced goods and services

accordantly. As respective company is currently target demographically little area

entity that are mainly controlled, managed and funded by its proprietor. These kind of companies mainly

have small or limited staff, assets and resources as compare with other companies. In this type of

business company owner have to bear or contribute maximum contribution, efforts or capital as they do

not have large number of employee and as a result they have to bear all risk and are entitled to profit.

Company is small in size and willing to expand business in different part of world, thus it is crucial for

internal manager to implement best accounting standard that are accepted at international level (Fischer-

Pauzenberger and Schwaiger, 2017). This would help interested parties to gain the actual position and

financial strength of company during an accounting year and allows them to make investment to attain the

desired profit.

Small business generally has both qualitative and quantitative aspect or criteria such as qualitative criteria

says that proprietor makes important decision own their own as they are not accountable to anyone and

these business have smaller market share at domestic level. On the other side, quantitative variables are

used to define the actual strength of employee, salaries and wages, legal framework, valuation of fixed

assets, share of ownership which is held by management. Small companies are organizations operated

separately that necessitate very little equity, less labour force less or no equipment. These companies are

perfectly suited for small-scale operations to represent a local people and provide earnings to the

shareholders of the company. There are some of the crucial effective characteristic of small companies

that are listed below:

Limited investment: Capital is provided by a person or a tiny set of people in a tiny company. According

to a survey related to low-scale units it is ascertained the majority of tiny businesses are run as sole

ownership and relationship.

Owner management:

These kinds of companies are identified with its owner those are the manager and risk taker. They have

the main work to motivate the employees and make them comfortable to put maximum efforts so that

desired goals can be accomplished (Gitman, Juchau and Flanagan, 2015).

Labour Intensive:

For the most part, small companies are manpower-intensive. Different kinds of small business depend

mainly for their operating on labour. Small businesses' main nature will be more physical job participation

than academic job. The absence of equipment helps handle the activities of the staff manually.

Community Based:

Mainly small company have the main purpose of satisfying the demands and requirement of customer

living in local community. The management use strategies and target smaller demographic areas so that

they can easily make out the actual demand and requirement of clients and produced goods and services

accordantly. As respective company is currently target demographically little area

Shoestring Budget:

Small business is run by a single owner or a tiny group of individuals. These firms sometimes conduct

business on 'short string budget, which means that tiny firms conduct business on a very limited budget

(Hillary, 2017). It is noticeable that small companies faced number of problem in within in functioning that

has a major impact on growth and development. These can be either financial or other problem related

with business term. Financial problems can be major problem to business as if company do not have

enough funds than they would not be able to meet its working and fixed capital. In addition, in case of

insufficient funds small company is not able to implement latest technology, there might by problem within

management and workforce, problem of promotion and advertising that can impact the entire business

operation (Hoyle, Schaefer and Doupnik, 2015). Other problem might be related with ineffective

planning, shortage of raw material and lack of other infrastructural facilities, improper marketing

techniques and lack of special and professional staff member.

Negative and positive impact of international accounting standards on small business development

According to Cordazzo, 2008, small and medium-sized enterprises (SMEs) are being seen as main

players in every country for financial growth, job creation, export advancement and entrepreneurial

development. As market is growing and increased market globalization, the difficulty of trade and

company participation in international competition also resulted to an even bigger in need of international

standardisation. Highly competitive climate needs businesses to develop a viable business approach, and

reporting must be part from this approach as it enables private businesses attain their goals and

objectives. International accounting standards are worldwide forms of developing integrated company

information structures and are capable of harmonizing economic systems globally. There are number of

positive impact or benefit of implementing IAS on small companies like that is discussed below:

Facilitates Ethics Compliance: The advantages of worldwide accounting standards is that they

contribute to ethics are that they sometimes involve recommendations from accounting experts worldwide

(Ji, 2017). It enables company owners in distinct areas of the globe to conform to those same rules by

having a standardized code of accounting principles.

Improves International Investment: It is more suitable for investors as well as other participants

to measure their performance of the company with other global businesses so that they can make

investment. IAS enables them to review overseas company financial records that they might want

to engage in or at least build relationships with as both are operating on the very same range of

accounting rules. This prevents a lot of controversy when it comes to producing a final choice

about whether or not the economic position of that firm is sufficiently strong to merit their

consideration.

As implementations of IAS have number of advantages or positive influence on business of SMEs, at the

same it also creates some issues or might have negative influence on business performance. Such as:

They have very little chance of influencing the international accounting standard procedure (Kallamu and

Saat, 2015).

Small business is run by a single owner or a tiny group of individuals. These firms sometimes conduct

business on 'short string budget, which means that tiny firms conduct business on a very limited budget

(Hillary, 2017). It is noticeable that small companies faced number of problem in within in functioning that

has a major impact on growth and development. These can be either financial or other problem related

with business term. Financial problems can be major problem to business as if company do not have

enough funds than they would not be able to meet its working and fixed capital. In addition, in case of

insufficient funds small company is not able to implement latest technology, there might by problem within

management and workforce, problem of promotion and advertising that can impact the entire business

operation (Hoyle, Schaefer and Doupnik, 2015). Other problem might be related with ineffective

planning, shortage of raw material and lack of other infrastructural facilities, improper marketing

techniques and lack of special and professional staff member.

Negative and positive impact of international accounting standards on small business development

According to Cordazzo, 2008, small and medium-sized enterprises (SMEs) are being seen as main

players in every country for financial growth, job creation, export advancement and entrepreneurial

development. As market is growing and increased market globalization, the difficulty of trade and

company participation in international competition also resulted to an even bigger in need of international

standardisation. Highly competitive climate needs businesses to develop a viable business approach, and

reporting must be part from this approach as it enables private businesses attain their goals and

objectives. International accounting standards are worldwide forms of developing integrated company

information structures and are capable of harmonizing economic systems globally. There are number of

positive impact or benefit of implementing IAS on small companies like that is discussed below:

Facilitates Ethics Compliance: The advantages of worldwide accounting standards is that they

contribute to ethics are that they sometimes involve recommendations from accounting experts worldwide

(Ji, 2017). It enables company owners in distinct areas of the globe to conform to those same rules by

having a standardized code of accounting principles.

Improves International Investment: It is more suitable for investors as well as other participants

to measure their performance of the company with other global businesses so that they can make

investment. IAS enables them to review overseas company financial records that they might want

to engage in or at least build relationships with as both are operating on the very same range of

accounting rules. This prevents a lot of controversy when it comes to producing a final choice

about whether or not the economic position of that firm is sufficiently strong to merit their

consideration.

As implementations of IAS have number of advantages or positive influence on business of SMEs, at the

same it also creates some issues or might have negative influence on business performance. Such as:

They have very little chance of influencing the international accounting standard procedure (Kallamu and

Saat, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Their economic and business conditions cannot be conscientiously depicted by the worldwide

standard's recommended accounting processes

They may experience elevated expenses of altering from one set of practices without any

corresponding advantages.

In the modern time, it is determined from the above market growth and increasing market integration have

developed in an even stronger need for international standardization due to the difficulty of trading and

client involvement in international competition. Global accounting rules are specific ways of the creation of

unified business information frameworks and are supportive of mutual harmonization of market

economies. IAS allows them to examine financial records from foreign companies that they may regularly

engage in or at least create interactions with, as both operate within the same range of accounting

standards.

standard's recommended accounting processes

They may experience elevated expenses of altering from one set of practices without any

corresponding advantages.

In the modern time, it is determined from the above market growth and increasing market integration have

developed in an even stronger need for international standardization due to the difficulty of trading and

client involvement in international competition. Global accounting rules are specific ways of the creation of

unified business information frameworks and are supportive of mutual harmonization of market

economies. IAS allows them to examine financial records from foreign companies that they may regularly

engage in or at least create interactions with, as both operate within the same range of accounting

standards.

CHAPTER 3: RESEARCH METHODOLOGY

According to the study context, this is regarded to be the main component of the feature of the inquiry as

it enables the Research to properly perform the activities of the inquiry (Lin,Yang. and Wang, 2018). For

most of the aspect, it includes the accumulation of multiple strategies and norms linked to a subdivision of

understanding and training as a preoccupied research.

Research types: A research work relies on two special types of research that are quantitative and

qualitative. These are discussed below:

Qualitative research: This technique is objective, non-numeric and implements reasoning and phrases to

obtain the detailed description of the subject of the study and to actually create genuine decisions for

better outcomes. This method of research is used in this particular research work so that results are

extracted appropriately and more meaningful decision are made for improvement and increasing

performance of respective firm.

Quantitative research: It primarily involves mathematical or geometry numbers, pre-descriptive numbers

and an algebraic method for evaluating helpful proof. It allows to reveal the preceding outcomes in table

format in order to be definitive and justifiable and to definitely make meaningful decisions in appropriate

topics.

Quantitative instrument has been used in the present Research piece of job, making it the best hotspot to

achieve appropriate results by guiding detailed assessment of important subject.

Approach for Research: This is an integral part of the research scheme that involves two types of

categorization, like inductive and deductive research strategy. The deductive approach relies on creating

fresh or advanced speculations that support the hypothesis on the other end inductive research help in

gathering data by executing an appropriate estimate of available data with truths or assumptions that go

beyond the particular subject. The inductive study strategy has been used by the researcher in this

present research project.

Philosophy of Research: The philosophy of research is described by two distinct parts of interpretation

and positivism. Researchers are more concentrated in the framework of present research job on

interpretation methodologies that promote qualitative report which further assist in analysing collective

information in different ways. To conduct this particular research interpretivism philosophy is selected that

is mainly concerned with the assessment of differences among different individual selected for the survey

and their social factors related with particular topic.

Data Collection Tools: There are two vital types of data gathering systems accessible for research, such

as primary and secondary data gathering applications (Loughran and McDonald, 2016). Both main and

secondary sources are used in the study in the present research study to explain real data and

information. In this way, the primary device is thrilling in guiding a survey with the help of the genuine

question set. Questionnaires, auxiliary tools such as books, diaries and papers, previous study

undertakings, articles etc. are all effective in carrying out literature reviews with the assistance of the

authors ' viewpoint.

According to the study context, this is regarded to be the main component of the feature of the inquiry as

it enables the Research to properly perform the activities of the inquiry (Lin,Yang. and Wang, 2018). For

most of the aspect, it includes the accumulation of multiple strategies and norms linked to a subdivision of

understanding and training as a preoccupied research.

Research types: A research work relies on two special types of research that are quantitative and

qualitative. These are discussed below:

Qualitative research: This technique is objective, non-numeric and implements reasoning and phrases to

obtain the detailed description of the subject of the study and to actually create genuine decisions for

better outcomes. This method of research is used in this particular research work so that results are

extracted appropriately and more meaningful decision are made for improvement and increasing

performance of respective firm.

Quantitative research: It primarily involves mathematical or geometry numbers, pre-descriptive numbers

and an algebraic method for evaluating helpful proof. It allows to reveal the preceding outcomes in table

format in order to be definitive and justifiable and to definitely make meaningful decisions in appropriate

topics.

Quantitative instrument has been used in the present Research piece of job, making it the best hotspot to

achieve appropriate results by guiding detailed assessment of important subject.

Approach for Research: This is an integral part of the research scheme that involves two types of

categorization, like inductive and deductive research strategy. The deductive approach relies on creating

fresh or advanced speculations that support the hypothesis on the other end inductive research help in

gathering data by executing an appropriate estimate of available data with truths or assumptions that go

beyond the particular subject. The inductive study strategy has been used by the researcher in this

present research project.

Philosophy of Research: The philosophy of research is described by two distinct parts of interpretation

and positivism. Researchers are more concentrated in the framework of present research job on

interpretation methodologies that promote qualitative report which further assist in analysing collective

information in different ways. To conduct this particular research interpretivism philosophy is selected that

is mainly concerned with the assessment of differences among different individual selected for the survey

and their social factors related with particular topic.

Data Collection Tools: There are two vital types of data gathering systems accessible for research, such

as primary and secondary data gathering applications (Loughran and McDonald, 2016). Both main and

secondary sources are used in the study in the present research study to explain real data and

information. In this way, the primary device is thrilling in guiding a survey with the help of the genuine

question set. Questionnaires, auxiliary tools such as books, diaries and papers, previous study

undertakings, articles etc. are all effective in carrying out literature reviews with the assistance of the

authors ' viewpoint.

Data sampling: Research will be carried out with the assistance of a purposeful inspection method, so it

is essential for them to decide on the appropriate population instance. 30 workers from RH Amar have

been selected as the example in order to gain the understanding of the implementation of reliable

accounting standard which bring authenticity in respective reports and statements.

Ethical Consideration: Problems and conflicts may arise under any circumstances, there can be some

research-related problems also within an organisation and for this reason it is essential that a Research

rearranges certain objectives with respect to their defeat. They are used to fabricate a research

framework where all workouts can be performed appropriately. Among the study, their participants will

also be guaranteed not to request any kind of individual information that would harm their sense of

making significant decisions (Maskell, Baggaley and Grasso, 2017).

Time Scale: It is linked to the real moment taken to complete an activity or study program in order to

obtain precise outcomes in line with the organizational position and conditions. In particular, measured in

relation to any wider amount of time, the amount of time in which decisions and actions occur or are

planned to happen.

is essential for them to decide on the appropriate population instance. 30 workers from RH Amar have

been selected as the example in order to gain the understanding of the implementation of reliable

accounting standard which bring authenticity in respective reports and statements.

Ethical Consideration: Problems and conflicts may arise under any circumstances, there can be some

research-related problems also within an organisation and for this reason it is essential that a Research

rearranges certain objectives with respect to their defeat. They are used to fabricate a research

framework where all workouts can be performed appropriately. Among the study, their participants will

also be guaranteed not to request any kind of individual information that would harm their sense of

making significant decisions (Maskell, Baggaley and Grasso, 2017).

Time Scale: It is linked to the real moment taken to complete an activity or study program in order to

obtain precise outcomes in line with the organizational position and conditions. In particular, measured in

relation to any wider amount of time, the amount of time in which decisions and actions occur or are

planned to happen.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CHAPTER 4: DATA ANALYSIS

In the company situation, the technique of measuring and assessing suitable information using various

logical and perceptive instruments and the explanation of why all elements of the obtained information are

better analysed is regarded as data analysis. It is noted that information is gathered, post-checked and

examined for a particular subject in order to arrive at a workable solution or judgment (O'Leary, 2017).

There are numerous helpful techniques including data mining, data visualization, text analysis and

database management to perform the data analysis mechanism that assist obtain the highest results

appropriate to a specific subject. This part of study is intended as being the most necessary element that

properly shows the project's purpose and consequences. For the current studies, the idea of data

analysis is essential as it comprises multiple stages that assist to draw meaningful results. These phases

are data cleaning, quality assessment, quality assessment and results stabilization, use of statistically

meaningful methods and adequate representations of information. There are some main components that

demonstrate the overall need and requirement of data analysis:

Gather Hidden Insights: Data hidden perspectives are collected and then evaluated for company

demands.

Generate Reports: Reports are produced from the information and are transmitted to the

corresponding groups and people to address further activities for strong company growth.

Perform Market Analysis: Market Forecasting can be done to know opponents' strengths and weaknesses

(Outa, Ozili and Eisenberg, 2017).

Improve Business Requirement: Data analysis enables business to be improved on client

demands and understanding.

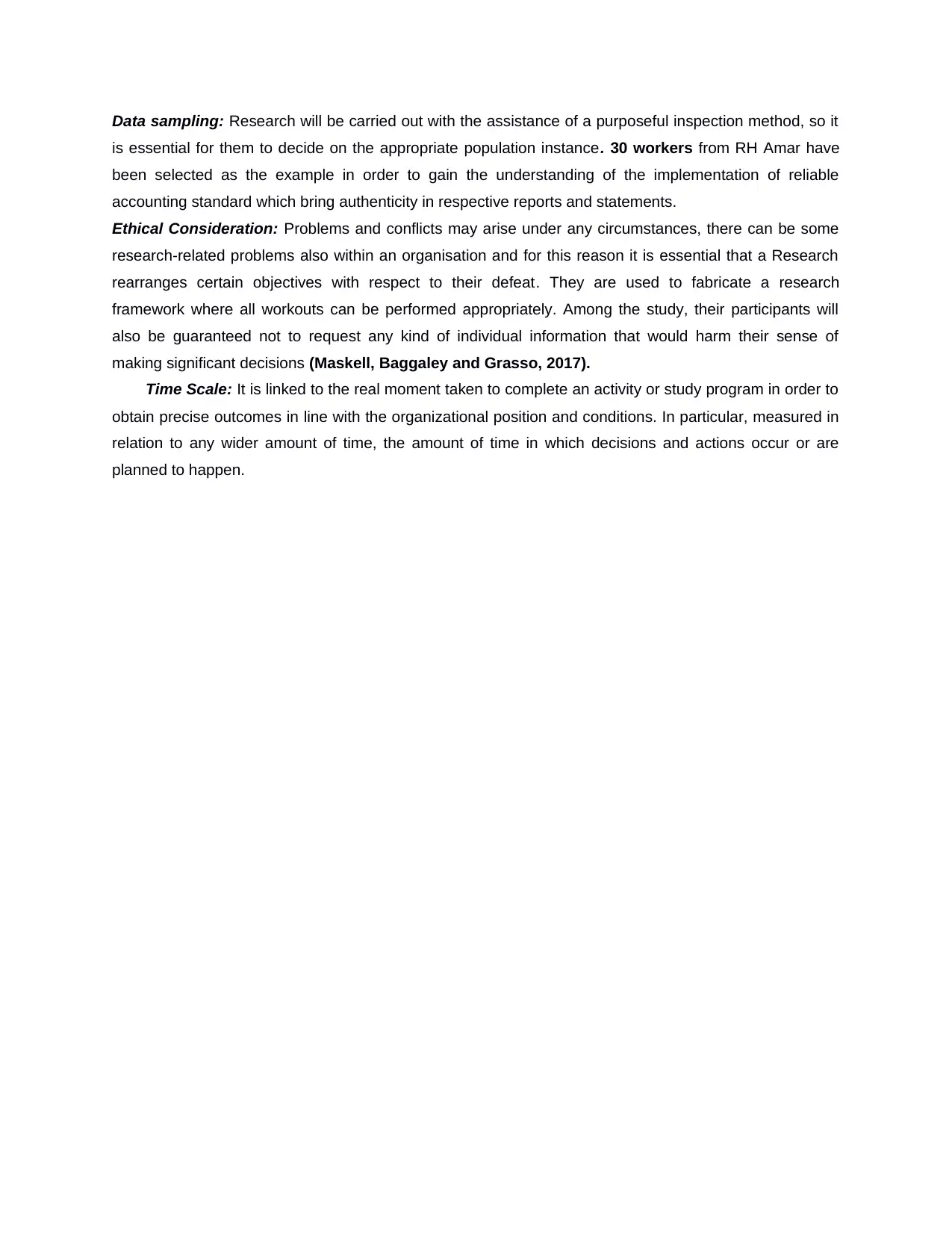

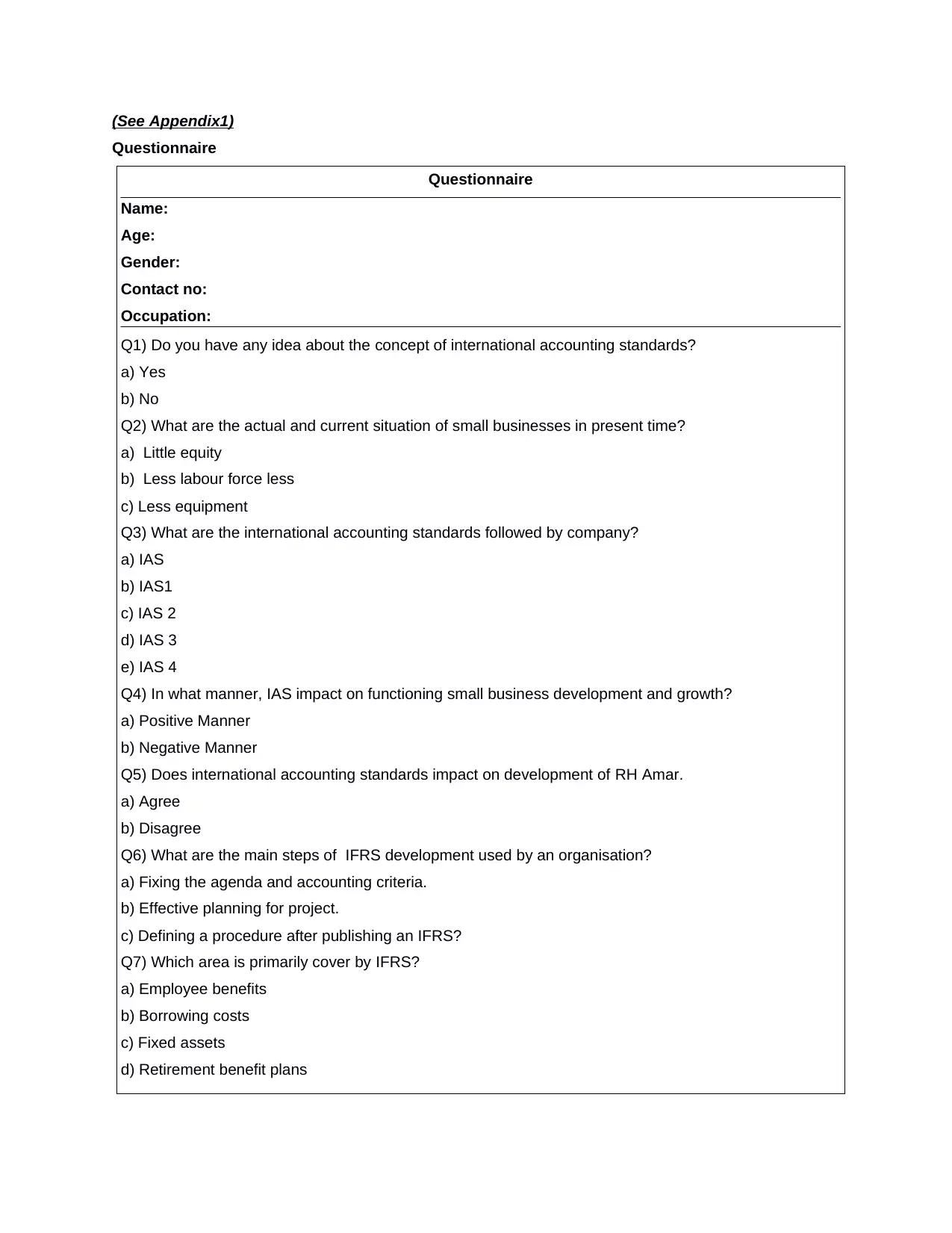

THEME 1: Concept of IAS

Q1) Do you have any idea about the concept of international accounting

standards?

Frequency

Yes 20

No 10

Interpretation: On the basis of above questionnaire, two columns that define the exact frequency

relevant to understanding of concept of IAS. It is clearly ascertained by the researcher that out of 30

candidates 20 are those which have proper and clear understanding about the actual concept of

International Accounting Standard. They know the idea behind implementing right and correct accounting

standard within company has it will enable number of advantages in approaching time. This will be

beneficial for company to reduce time, cost and efforts by making single financial statement which would

be acceptable at worldwide. From the selected data set, 10 members are not familiar with the idea of IAS

as they work only limited area within RH Amar and do not have proper accounting knowledge. It is very

crucial for each member of accounting team to have a subsequent knowledge about international

In the company situation, the technique of measuring and assessing suitable information using various

logical and perceptive instruments and the explanation of why all elements of the obtained information are

better analysed is regarded as data analysis. It is noted that information is gathered, post-checked and

examined for a particular subject in order to arrive at a workable solution or judgment (O'Leary, 2017).

There are numerous helpful techniques including data mining, data visualization, text analysis and

database management to perform the data analysis mechanism that assist obtain the highest results

appropriate to a specific subject. This part of study is intended as being the most necessary element that

properly shows the project's purpose and consequences. For the current studies, the idea of data

analysis is essential as it comprises multiple stages that assist to draw meaningful results. These phases

are data cleaning, quality assessment, quality assessment and results stabilization, use of statistically

meaningful methods and adequate representations of information. There are some main components that

demonstrate the overall need and requirement of data analysis:

Gather Hidden Insights: Data hidden perspectives are collected and then evaluated for company

demands.

Generate Reports: Reports are produced from the information and are transmitted to the

corresponding groups and people to address further activities for strong company growth.

Perform Market Analysis: Market Forecasting can be done to know opponents' strengths and weaknesses

(Outa, Ozili and Eisenberg, 2017).

Improve Business Requirement: Data analysis enables business to be improved on client

demands and understanding.

THEME 1: Concept of IAS

Q1) Do you have any idea about the concept of international accounting

standards?

Frequency

Yes 20

No 10

Interpretation: On the basis of above questionnaire, two columns that define the exact frequency

relevant to understanding of concept of IAS. It is clearly ascertained by the researcher that out of 30

candidates 20 are those which have proper and clear understanding about the actual concept of

International Accounting Standard. They know the idea behind implementing right and correct accounting

standard within company has it will enable number of advantages in approaching time. This will be

beneficial for company to reduce time, cost and efforts by making single financial statement which would

be acceptable at worldwide. From the selected data set, 10 members are not familiar with the idea of IAS

as they work only limited area within RH Amar and do not have proper accounting knowledge. It is very

crucial for each member of accounting team to have a subsequent knowledge about international

accounting standard which help in forming and preparing accounting statement according to standard that

are accepted all over the world so that they are able to formulate the statements which are accepted by

every interested parties across the world in order to make suitable decision of making investment of not.

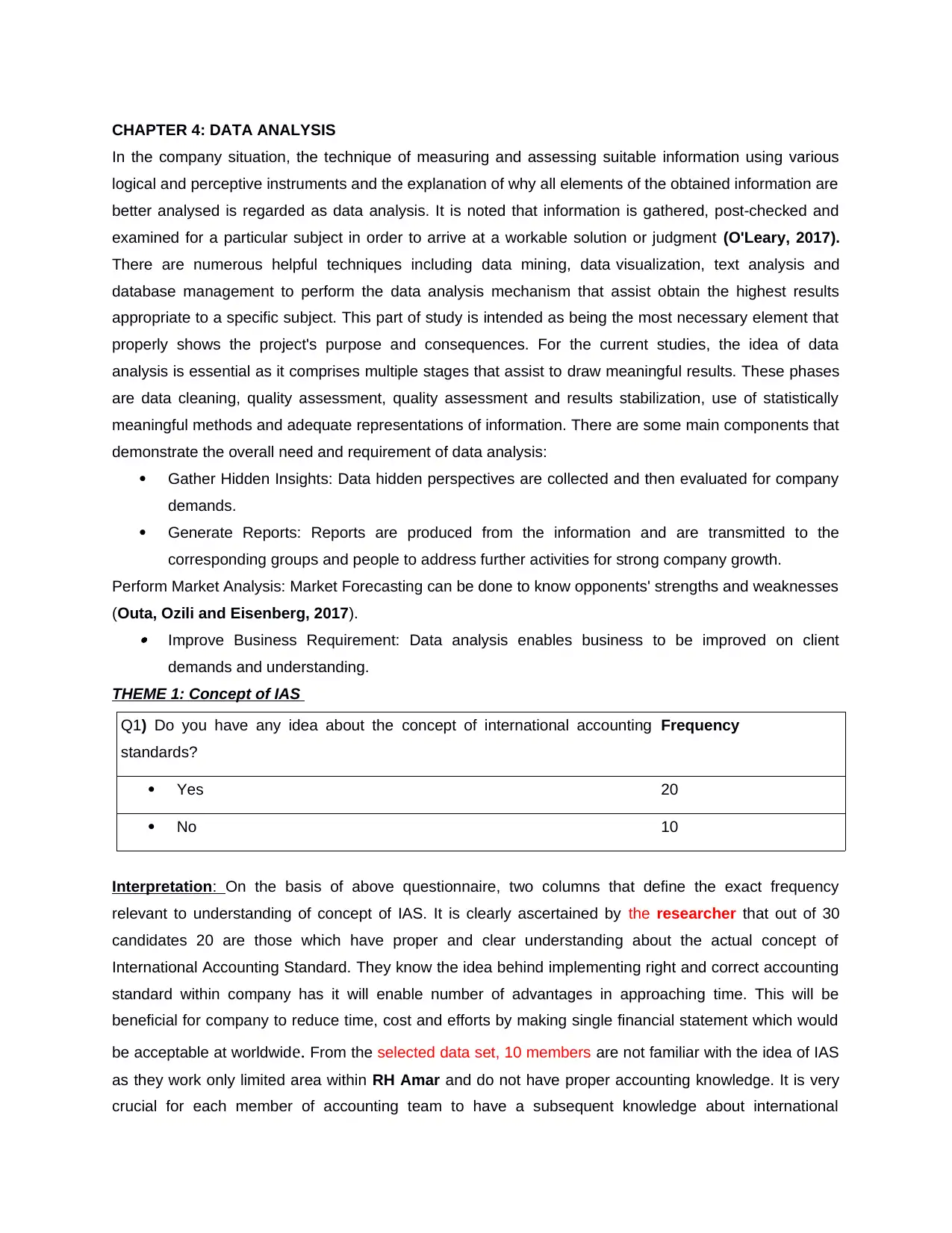

THEME 2: Circumstance of small businesses.

Q2)What are the actual and current situation of small businesses in present

time?

Frequency

Little equity 12

Less labour force 10

Less equipment 8

Interpretation: Based on the above question, the above table clearly defines the real and

present conditions of small companies in the current business situation. The Researcher identified that 12

individuals believe that small companies have few or little equity due to which they are unable to attract

the number of stakeholders. It is also determined that interested parties used to analyse the financial

statement about the equity position of a company and in the context of small companies, they get clear

information about the issue as compared to any large business entity. It is noticed that 10 respondents

assume that the main reason for slow success for a small firm is less about the number of workers they

have at a specific time. Labour is required in every part of a business as they are the standard pillar of

business with the shortage of skilled labour company fails to conduct different crucial function. From the 8

candidates sees those which have a gut feeling that due to lack of proper and effective equipment the firm

remains small in size.

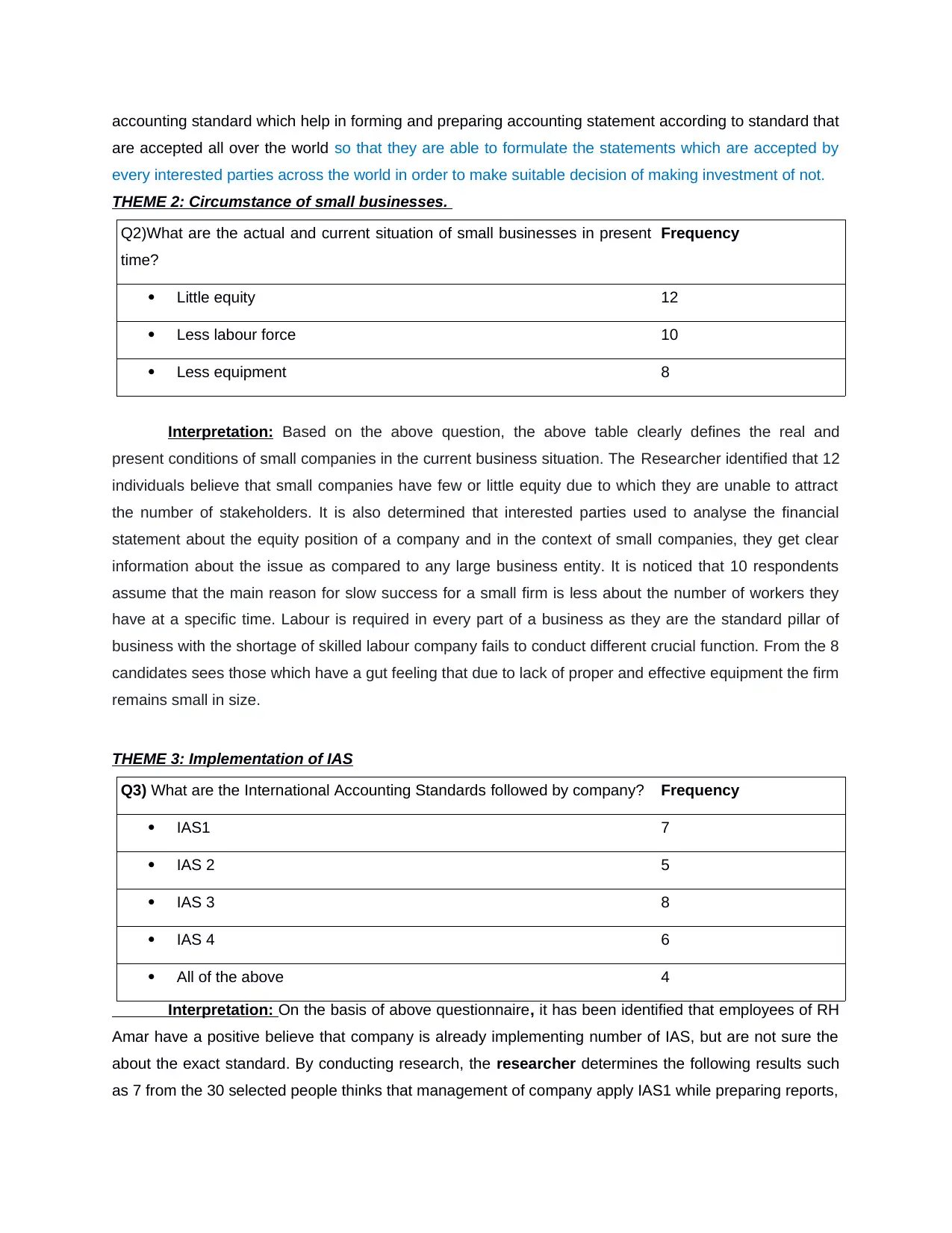

THEME 3: Implementation of IAS

Q3) What are the International Accounting Standards followed by company? Frequency

IAS1 7

IAS 2 5

IAS 3 8

IAS 4 6

All of the above 4

Interpretation: On the basis of above questionnaire, it has been identified that employees of RH

Amar have a positive believe that company is already implementing number of IAS, but are not sure the

about the exact standard. By conducting research, the researcher determines the following results such

as 7 from the 30 selected people thinks that management of company apply IAS1 while preparing reports,

are accepted all over the world so that they are able to formulate the statements which are accepted by

every interested parties across the world in order to make suitable decision of making investment of not.

THEME 2: Circumstance of small businesses.

Q2)What are the actual and current situation of small businesses in present

time?

Frequency

Little equity 12

Less labour force 10

Less equipment 8

Interpretation: Based on the above question, the above table clearly defines the real and

present conditions of small companies in the current business situation. The Researcher identified that 12

individuals believe that small companies have few or little equity due to which they are unable to attract

the number of stakeholders. It is also determined that interested parties used to analyse the financial

statement about the equity position of a company and in the context of small companies, they get clear

information about the issue as compared to any large business entity. It is noticed that 10 respondents

assume that the main reason for slow success for a small firm is less about the number of workers they

have at a specific time. Labour is required in every part of a business as they are the standard pillar of

business with the shortage of skilled labour company fails to conduct different crucial function. From the 8

candidates sees those which have a gut feeling that due to lack of proper and effective equipment the firm

remains small in size.

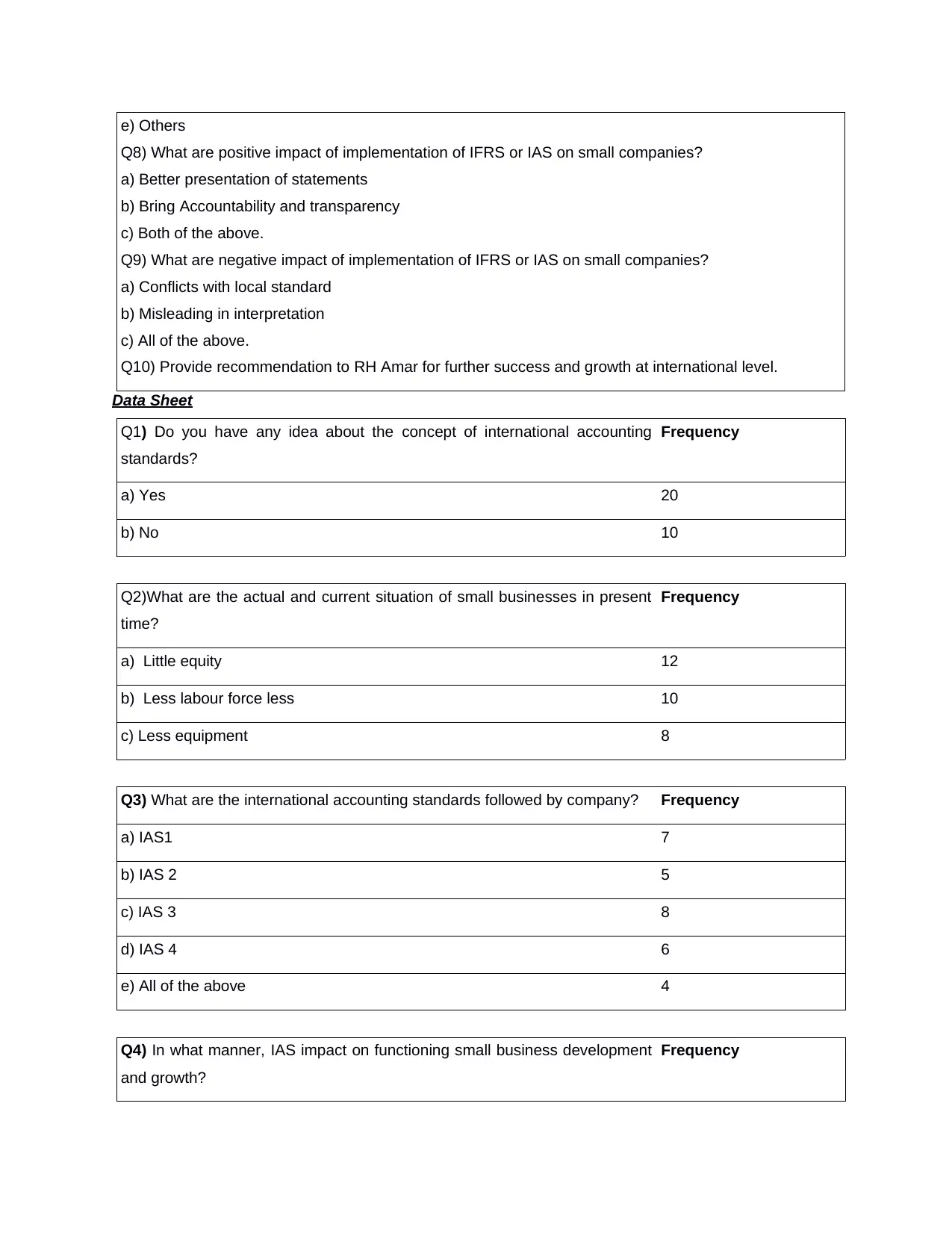

THEME 3: Implementation of IAS

Q3) What are the International Accounting Standards followed by company? Frequency

IAS1 7

IAS 2 5

IAS 3 8

IAS 4 6

All of the above 4

Interpretation: On the basis of above questionnaire, it has been identified that employees of RH

Amar have a positive believe that company is already implementing number of IAS, but are not sure the

about the exact standard. By conducting research, the researcher determines the following results such

as 7 from the 30 selected people thinks that management of company apply IAS1 while preparing reports,

5 thinks that they are more focused on IAS 2. Out of 30 the maximum number of employee i.e. 8 assume

that company is implementing IAS 3 in order to prepare financial reports on the other side 6 individual

have a feeling that IAS 4 are more applied to the business section of RH Amar. The respective graph

also displays that few individual have a strong understanding about IAS and they believe that company is

adopting number of international accounting standard when preparing reports. Researcher believe that

each accounting principle have its own importance in respect of making authentic financial reports as it

makes it easier for RH Amar to present these statement to number of stakeholder at international level.

Likewise, IAS1 in relation to the presentation of annual reports which was issued in 2007, IAS 2 in relation

to the processing of inventory levels released in 2005, IAS 3 in relation to the reorganization of income

statement, IAS 4 in relation to depreciation reporting (Raiborn and Sivitanides, 2015).

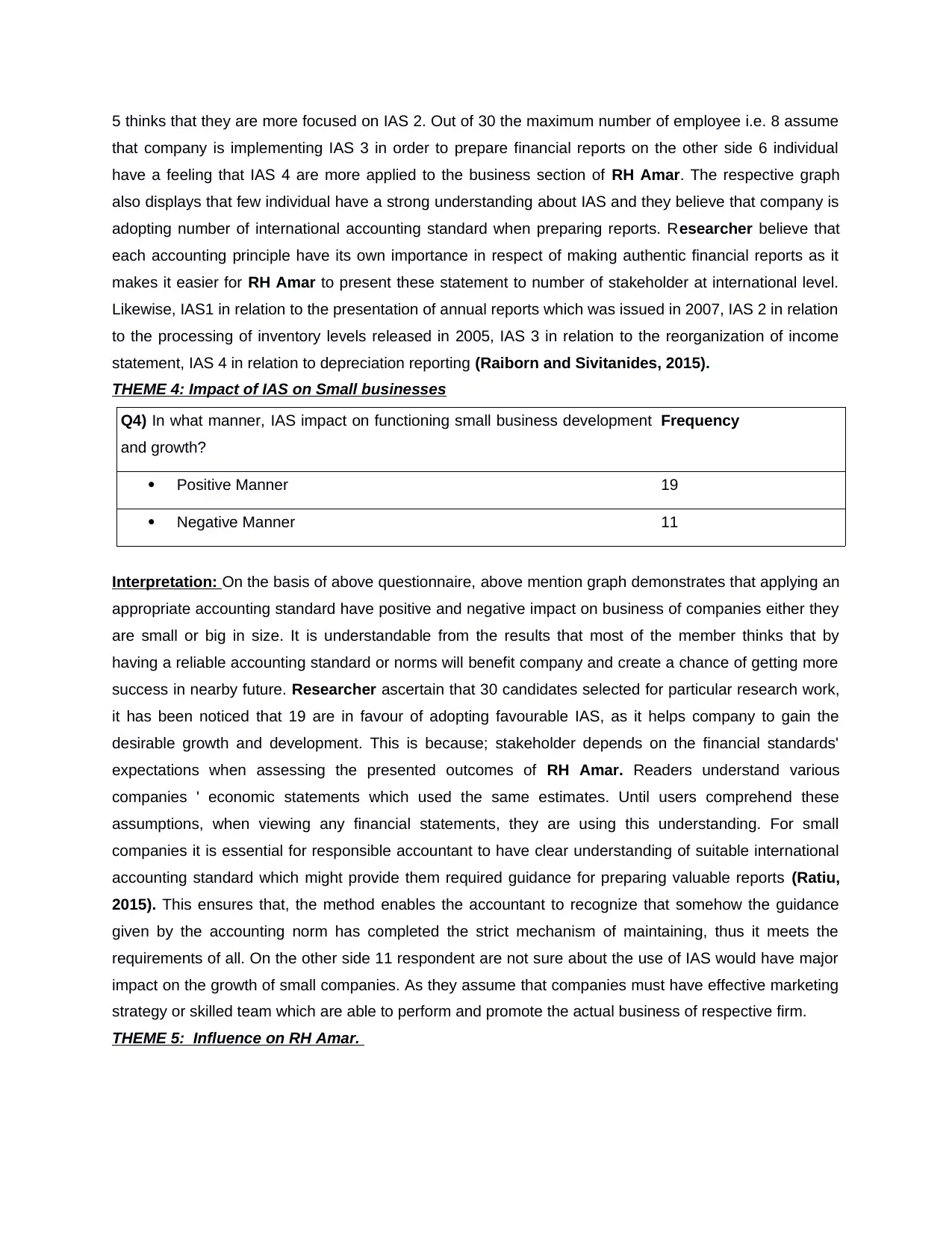

THEME 4: Impact of IAS on Small businesses

Q4) In what manner, IAS impact on functioning small business development

and growth?

Frequency

Positive Manner 19

Negative Manner 11

Interpretation: On the basis of above questionnaire, above mention graph demonstrates that applying an

appropriate accounting standard have positive and negative impact on business of companies either they

are small or big in size. It is understandable from the results that most of the member thinks that by

having a reliable accounting standard or norms will benefit company and create a chance of getting more

success in nearby future. Researcher ascertain that 30 candidates selected for particular research work,

it has been noticed that 19 are in favour of adopting favourable IAS, as it helps company to gain the

desirable growth and development. This is because; stakeholder depends on the financial standards'

expectations when assessing the presented outcomes of RH Amar. Readers understand various

companies ' economic statements which used the same estimates. Until users comprehend these

assumptions, when viewing any financial statements, they are using this understanding. For small

companies it is essential for responsible accountant to have clear understanding of suitable international

accounting standard which might provide them required guidance for preparing valuable reports (Ratiu,

2015). This ensures that, the method enables the accountant to recognize that somehow the guidance

given by the accounting norm has completed the strict mechanism of maintaining, thus it meets the

requirements of all. On the other side 11 respondent are not sure about the use of IAS would have major

impact on the growth of small companies. As they assume that companies must have effective marketing

strategy or skilled team which are able to perform and promote the actual business of respective firm.

THEME 5: Influence on RH Amar.

that company is implementing IAS 3 in order to prepare financial reports on the other side 6 individual

have a feeling that IAS 4 are more applied to the business section of RH Amar. The respective graph

also displays that few individual have a strong understanding about IAS and they believe that company is

adopting number of international accounting standard when preparing reports. Researcher believe that

each accounting principle have its own importance in respect of making authentic financial reports as it

makes it easier for RH Amar to present these statement to number of stakeholder at international level.

Likewise, IAS1 in relation to the presentation of annual reports which was issued in 2007, IAS 2 in relation

to the processing of inventory levels released in 2005, IAS 3 in relation to the reorganization of income

statement, IAS 4 in relation to depreciation reporting (Raiborn and Sivitanides, 2015).

THEME 4: Impact of IAS on Small businesses

Q4) In what manner, IAS impact on functioning small business development

and growth?

Frequency

Positive Manner 19

Negative Manner 11

Interpretation: On the basis of above questionnaire, above mention graph demonstrates that applying an

appropriate accounting standard have positive and negative impact on business of companies either they

are small or big in size. It is understandable from the results that most of the member thinks that by

having a reliable accounting standard or norms will benefit company and create a chance of getting more

success in nearby future. Researcher ascertain that 30 candidates selected for particular research work,

it has been noticed that 19 are in favour of adopting favourable IAS, as it helps company to gain the

desirable growth and development. This is because; stakeholder depends on the financial standards'

expectations when assessing the presented outcomes of RH Amar. Readers understand various

companies ' economic statements which used the same estimates. Until users comprehend these

assumptions, when viewing any financial statements, they are using this understanding. For small

companies it is essential for responsible accountant to have clear understanding of suitable international

accounting standard which might provide them required guidance for preparing valuable reports (Ratiu,

2015). This ensures that, the method enables the accountant to recognize that somehow the guidance

given by the accounting norm has completed the strict mechanism of maintaining, thus it meets the

requirements of all. On the other side 11 respondent are not sure about the use of IAS would have major

impact on the growth of small companies. As they assume that companies must have effective marketing

strategy or skilled team which are able to perform and promote the actual business of respective firm.

THEME 5: Influence on RH Amar.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

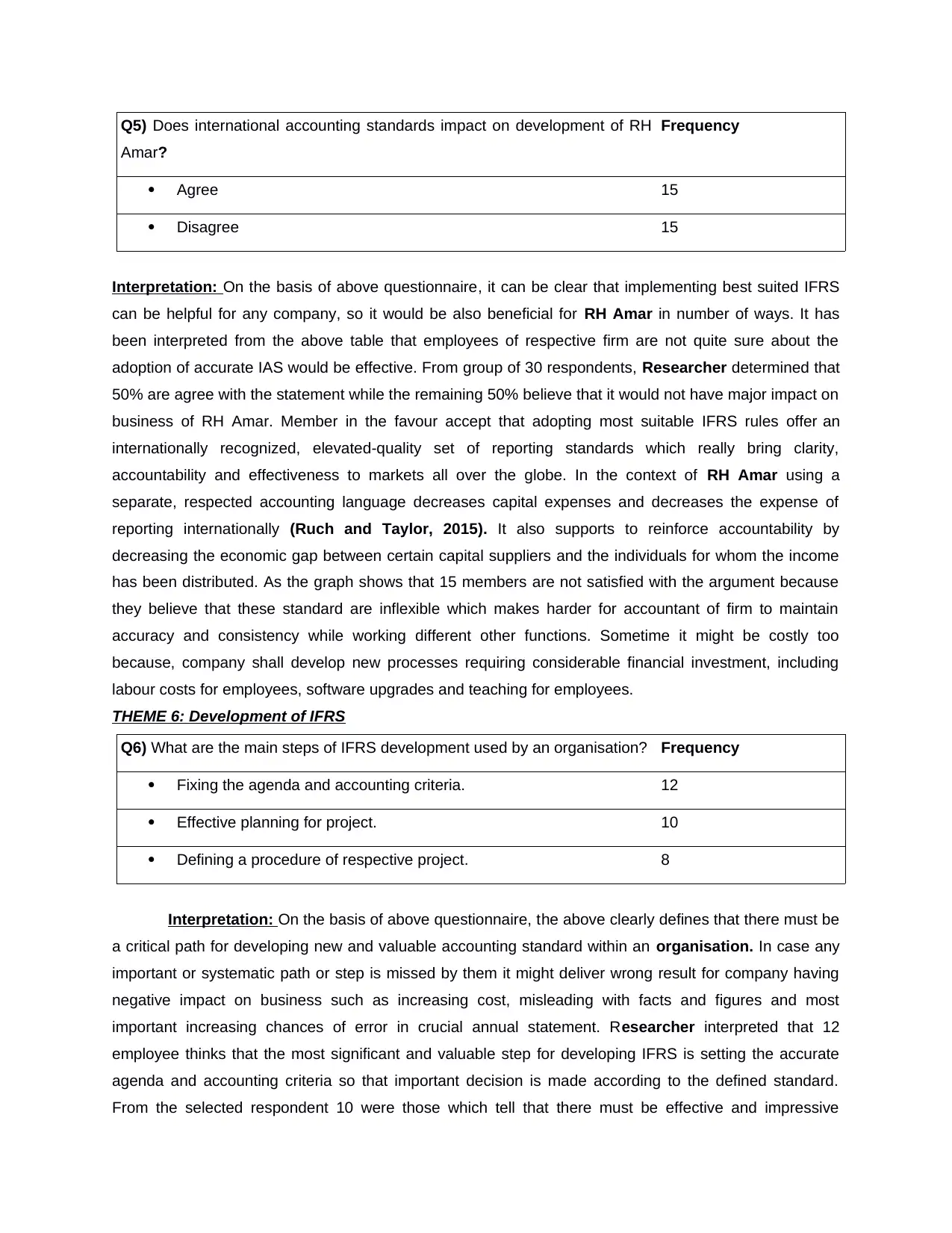

Q5) Does international accounting standards impact on development of RH

Amar?

Frequency

Agree 15

Disagree 15

Interpretation: On the basis of above questionnaire, it can be clear that implementing best suited IFRS

can be helpful for any company, so it would be also beneficial for RH Amar in number of ways. It has

been interpreted from the above table that employees of respective firm are not quite sure about the

adoption of accurate IAS would be effective. From group of 30 respondents, Researcher determined that

50% are agree with the statement while the remaining 50% believe that it would not have major impact on

business of RH Amar. Member in the favour accept that adopting most suitable IFRS rules offer an

internationally recognized, elevated-quality set of reporting standards which really bring clarity,

accountability and effectiveness to markets all over the globe. In the context of RH Amar using a

separate, respected accounting language decreases capital expenses and decreases the expense of

reporting internationally (Ruch and Taylor, 2015). It also supports to reinforce accountability by

decreasing the economic gap between certain capital suppliers and the individuals for whom the income

has been distributed. As the graph shows that 15 members are not satisfied with the argument because

they believe that these standard are inflexible which makes harder for accountant of firm to maintain

accuracy and consistency while working different other functions. Sometime it might be costly too

because, company shall develop new processes requiring considerable financial investment, including

labour costs for employees, software upgrades and teaching for employees.

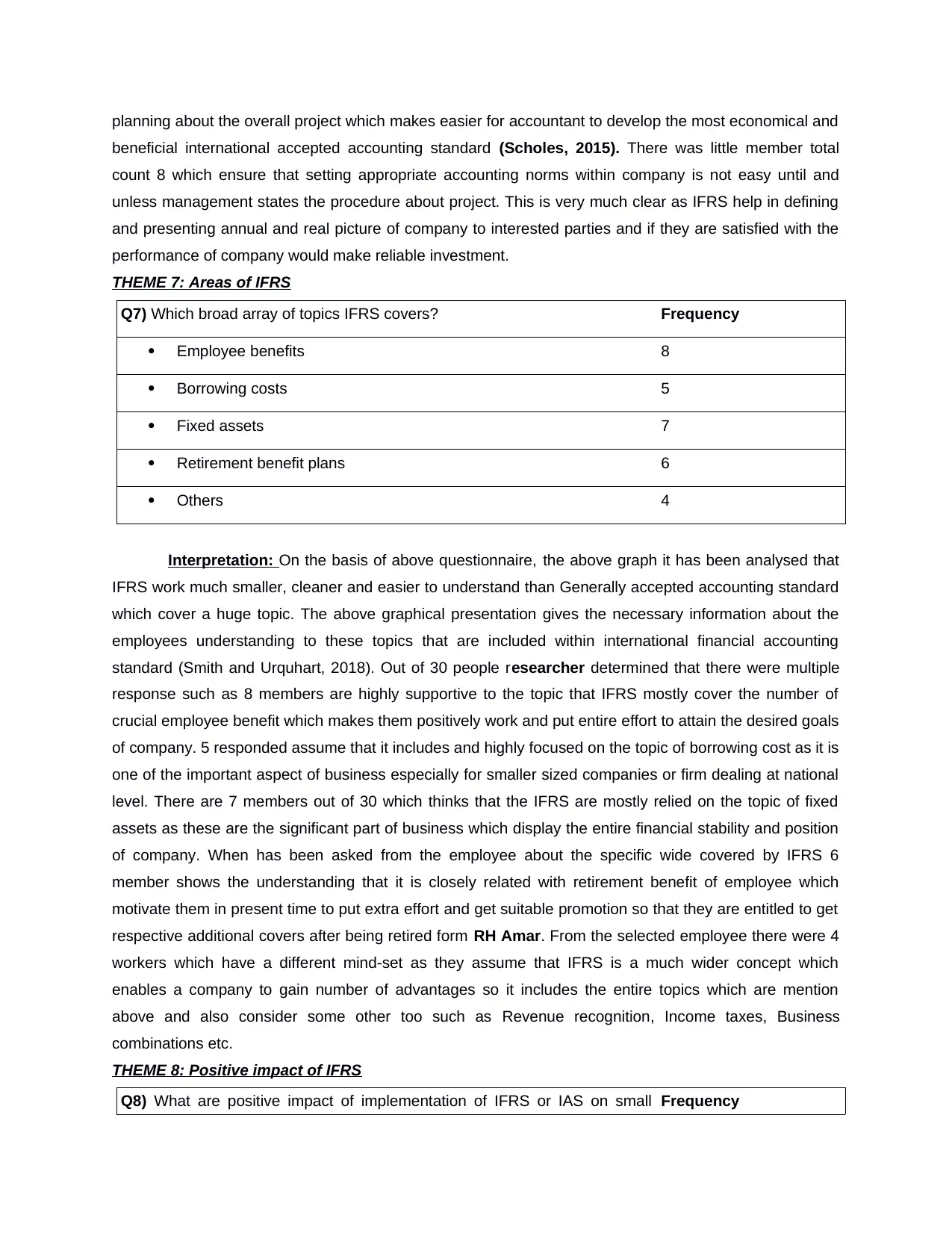

THEME 6: Development of IFRS

Q6) What are the main steps of IFRS development used by an organisation? Frequency

Fixing the agenda and accounting criteria. 12

Effective planning for project. 10

Defining a procedure of respective project. 8

Interpretation: On the basis of above questionnaire, the above clearly defines that there must be

a critical path for developing new and valuable accounting standard within an organisation. In case any

important or systematic path or step is missed by them it might deliver wrong result for company having

negative impact on business such as increasing cost, misleading with facts and figures and most

important increasing chances of error in crucial annual statement. Researcher interpreted that 12

employee thinks that the most significant and valuable step for developing IFRS is setting the accurate

agenda and accounting criteria so that important decision is made according to the defined standard.

From the selected respondent 10 were those which tell that there must be effective and impressive

Amar?

Frequency

Agree 15

Disagree 15

Interpretation: On the basis of above questionnaire, it can be clear that implementing best suited IFRS

can be helpful for any company, so it would be also beneficial for RH Amar in number of ways. It has

been interpreted from the above table that employees of respective firm are not quite sure about the

adoption of accurate IAS would be effective. From group of 30 respondents, Researcher determined that

50% are agree with the statement while the remaining 50% believe that it would not have major impact on

business of RH Amar. Member in the favour accept that adopting most suitable IFRS rules offer an

internationally recognized, elevated-quality set of reporting standards which really bring clarity,

accountability and effectiveness to markets all over the globe. In the context of RH Amar using a

separate, respected accounting language decreases capital expenses and decreases the expense of

reporting internationally (Ruch and Taylor, 2015). It also supports to reinforce accountability by

decreasing the economic gap between certain capital suppliers and the individuals for whom the income

has been distributed. As the graph shows that 15 members are not satisfied with the argument because

they believe that these standard are inflexible which makes harder for accountant of firm to maintain

accuracy and consistency while working different other functions. Sometime it might be costly too

because, company shall develop new processes requiring considerable financial investment, including

labour costs for employees, software upgrades and teaching for employees.

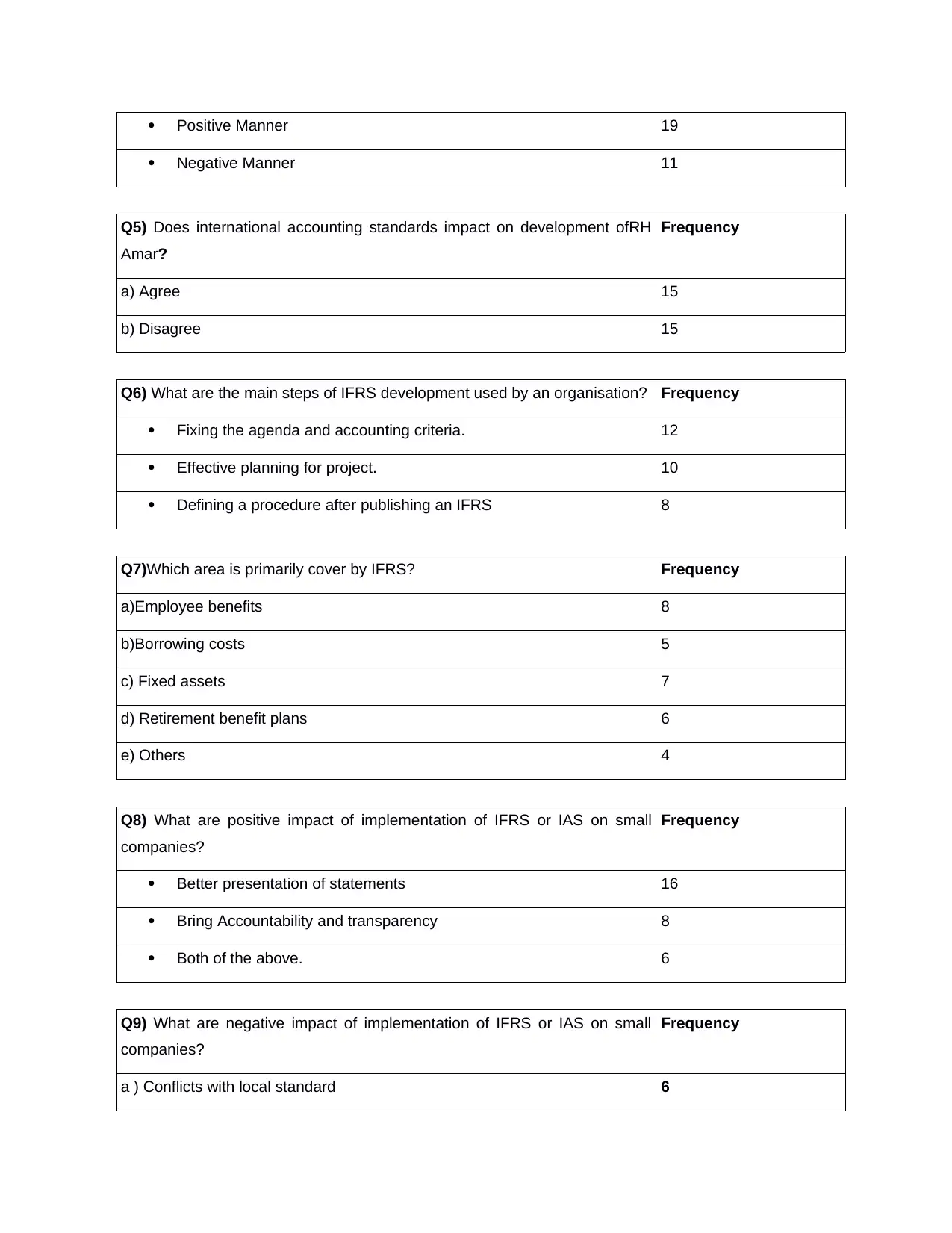

THEME 6: Development of IFRS

Q6) What are the main steps of IFRS development used by an organisation? Frequency

Fixing the agenda and accounting criteria. 12

Effective planning for project. 10

Defining a procedure of respective project. 8

Interpretation: On the basis of above questionnaire, the above clearly defines that there must be

a critical path for developing new and valuable accounting standard within an organisation. In case any

important or systematic path or step is missed by them it might deliver wrong result for company having

negative impact on business such as increasing cost, misleading with facts and figures and most

important increasing chances of error in crucial annual statement. Researcher interpreted that 12

employee thinks that the most significant and valuable step for developing IFRS is setting the accurate

agenda and accounting criteria so that important decision is made according to the defined standard.

From the selected respondent 10 were those which tell that there must be effective and impressive

planning about the overall project which makes easier for accountant to develop the most economical and

beneficial international accepted accounting standard (Scholes, 2015). There was little member total

count 8 which ensure that setting appropriate accounting norms within company is not easy until and

unless management states the procedure about project. This is very much clear as IFRS help in defining

and presenting annual and real picture of company to interested parties and if they are satisfied with the

performance of company would make reliable investment.

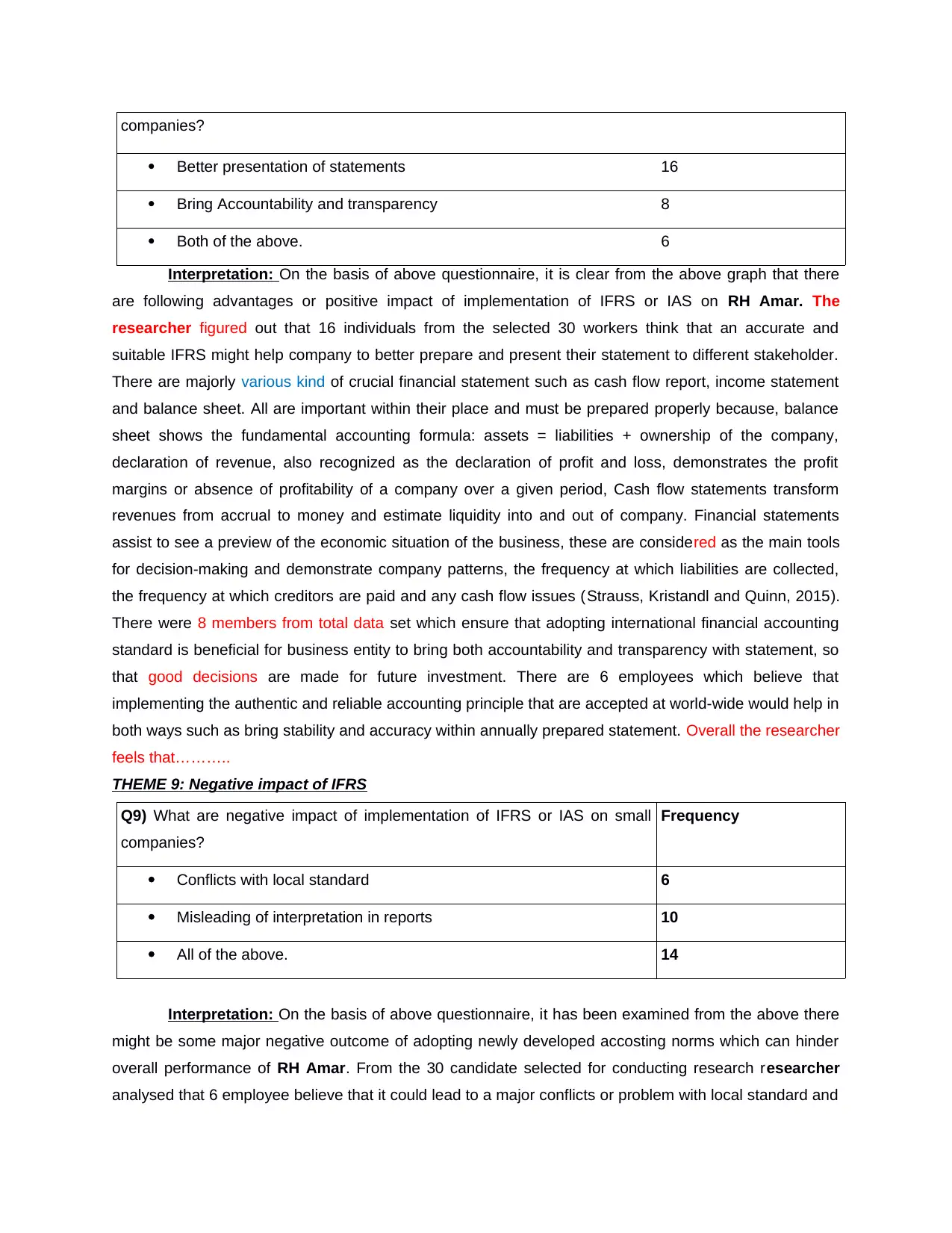

THEME 7: Areas of IFRS

Q7) Which broad array of topics IFRS covers? Frequency

Employee benefits 8

Borrowing costs 5

Fixed assets 7

Retirement benefit plans 6

Others 4

Interpretation: On the basis of above questionnaire, the above graph it has been analysed that

IFRS work much smaller, cleaner and easier to understand than Generally accepted accounting standard

which cover a huge topic. The above graphical presentation gives the necessary information about the

employees understanding to these topics that are included within international financial accounting

standard (Smith and Urquhart, 2018). Out of 30 people researcher determined that there were multiple

response such as 8 members are highly supportive to the topic that IFRS mostly cover the number of

crucial employee benefit which makes them positively work and put entire effort to attain the desired goals

of company. 5 responded assume that it includes and highly focused on the topic of borrowing cost as it is

one of the important aspect of business especially for smaller sized companies or firm dealing at national

level. There are 7 members out of 30 which thinks that the IFRS are mostly relied on the topic of fixed

assets as these are the significant part of business which display the entire financial stability and position

of company. When has been asked from the employee about the specific wide covered by IFRS 6

member shows the understanding that it is closely related with retirement benefit of employee which

motivate them in present time to put extra effort and get suitable promotion so that they are entitled to get

respective additional covers after being retired form RH Amar. From the selected employee there were 4

workers which have a different mind-set as they assume that IFRS is a much wider concept which

enables a company to gain number of advantages so it includes the entire topics which are mention

above and also consider some other too such as Revenue recognition, Income taxes, Business

combinations etc.

THEME 8: Positive impact of IFRS

Q8) What are positive impact of implementation of IFRS or IAS on small Frequency

beneficial international accepted accounting standard (Scholes, 2015). There was little member total

count 8 which ensure that setting appropriate accounting norms within company is not easy until and

unless management states the procedure about project. This is very much clear as IFRS help in defining

and presenting annual and real picture of company to interested parties and if they are satisfied with the

performance of company would make reliable investment.

THEME 7: Areas of IFRS

Q7) Which broad array of topics IFRS covers? Frequency

Employee benefits 8

Borrowing costs 5

Fixed assets 7

Retirement benefit plans 6

Others 4

Interpretation: On the basis of above questionnaire, the above graph it has been analysed that

IFRS work much smaller, cleaner and easier to understand than Generally accepted accounting standard

which cover a huge topic. The above graphical presentation gives the necessary information about the

employees understanding to these topics that are included within international financial accounting

standard (Smith and Urquhart, 2018). Out of 30 people researcher determined that there were multiple

response such as 8 members are highly supportive to the topic that IFRS mostly cover the number of

crucial employee benefit which makes them positively work and put entire effort to attain the desired goals

of company. 5 responded assume that it includes and highly focused on the topic of borrowing cost as it is

one of the important aspect of business especially for smaller sized companies or firm dealing at national

level. There are 7 members out of 30 which thinks that the IFRS are mostly relied on the topic of fixed

assets as these are the significant part of business which display the entire financial stability and position

of company. When has been asked from the employee about the specific wide covered by IFRS 6

member shows the understanding that it is closely related with retirement benefit of employee which

motivate them in present time to put extra effort and get suitable promotion so that they are entitled to get

respective additional covers after being retired form RH Amar. From the selected employee there were 4

workers which have a different mind-set as they assume that IFRS is a much wider concept which

enables a company to gain number of advantages so it includes the entire topics which are mention

above and also consider some other too such as Revenue recognition, Income taxes, Business

combinations etc.

THEME 8: Positive impact of IFRS

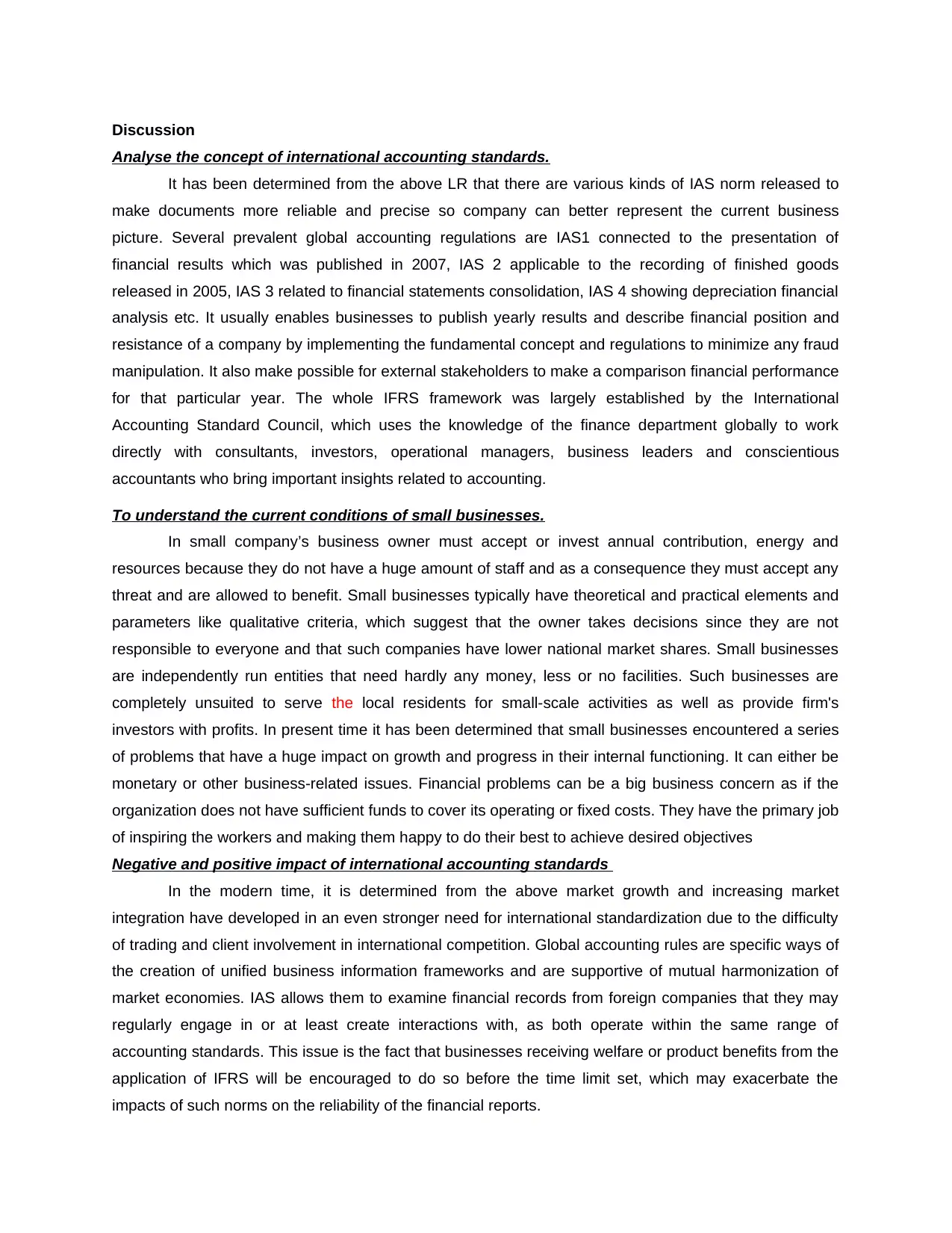

Q8) What are positive impact of implementation of IFRS or IAS on small Frequency

companies?

Better presentation of statements 16

Bring Accountability and transparency 8

Both of the above. 6

Interpretation: On the basis of above questionnaire, it is clear from the above graph that there

are following advantages or positive impact of implementation of IFRS or IAS on RH Amar. The

researcher figured out that 16 individuals from the selected 30 workers think that an accurate and

suitable IFRS might help company to better prepare and present their statement to different stakeholder.

There are majorly various kind of crucial financial statement such as cash flow report, income statement

and balance sheet. All are important within their place and must be prepared properly because, balance

sheet shows the fundamental accounting formula: assets = liabilities + ownership of the company,

declaration of revenue, also recognized as the declaration of profit and loss, demonstrates the profit

margins or absence of profitability of a company over a given period, Cash flow statements transform

revenues from accrual to money and estimate liquidity into and out of company. Financial statements

assist to see a preview of the economic situation of the business, these are considered as the main tools

for decision-making and demonstrate company patterns, the frequency at which liabilities are collected,

the frequency at which creditors are paid and any cash flow issues (Strauss, Kristandl and Quinn, 2015).

There were 8 members from total data set which ensure that adopting international financial accounting

standard is beneficial for business entity to bring both accountability and transparency with statement, so

that good decisions are made for future investment. There are 6 employees which believe that

implementing the authentic and reliable accounting principle that are accepted at world-wide would help in

both ways such as bring stability and accuracy within annually prepared statement. Overall the researcher

feels that………..

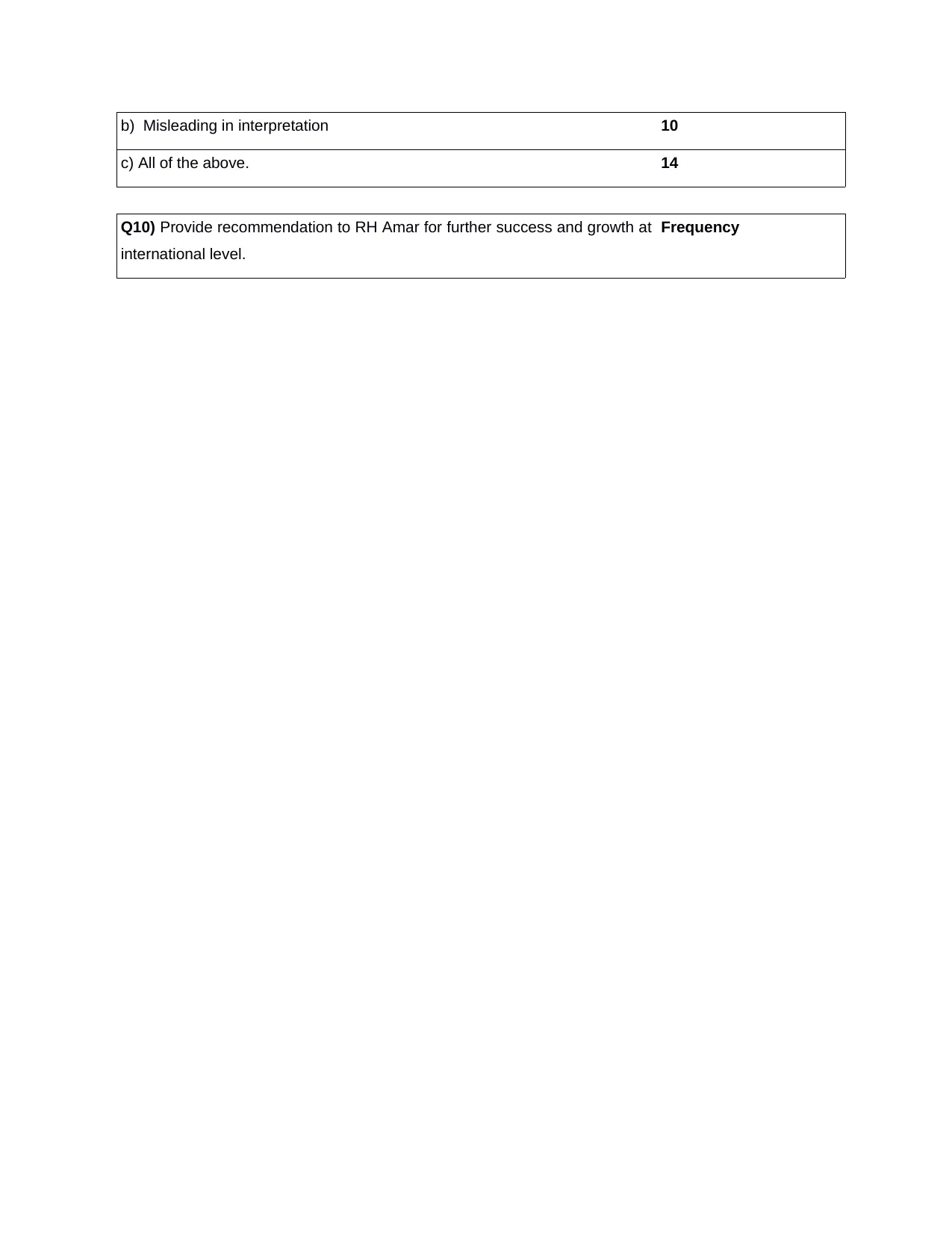

THEME 9: Negative impact of IFRS

Q9) What are negative impact of implementation of IFRS or IAS on small

companies?

Frequency

Conflicts with local standard 6

Misleading of interpretation in reports 10

All of the above. 14

Interpretation: On the basis of above questionnaire, it has been examined from the above there

might be some major negative outcome of adopting newly developed accosting norms which can hinder

overall performance of RH Amar. From the 30 candidate selected for conducting research researcher

analysed that 6 employee believe that it could lead to a major conflicts or problem with local standard and

Better presentation of statements 16

Bring Accountability and transparency 8

Both of the above. 6

Interpretation: On the basis of above questionnaire, it is clear from the above graph that there

are following advantages or positive impact of implementation of IFRS or IAS on RH Amar. The

researcher figured out that 16 individuals from the selected 30 workers think that an accurate and

suitable IFRS might help company to better prepare and present their statement to different stakeholder.

There are majorly various kind of crucial financial statement such as cash flow report, income statement

and balance sheet. All are important within their place and must be prepared properly because, balance

sheet shows the fundamental accounting formula: assets = liabilities + ownership of the company,