Detailed Business Report: Financial Analysis of Restaurant Investment

VerifiedAdded on 2020/07/22

|11

|2374

|33

Report

AI Summary

This business report provides a financial analysis of a restaurant investment for Mark and Paul. It begins with an introduction that outlines the report's purpose, scope, and limitations. The report then explores investment strategies, including explanations of investment nature and scope, and the creation of sales, labor, and cash budgets for June to September. It critically analyzes these budgets and considers practical investment issues. The second section focuses on investment calculations, including Net Present Value (NPV), Accounting Rate of Return (ARR), and payback period. It compares and contrasts two investment options suitable for the partners. The report concludes with a summary of findings and provides references and an appendix with working notes. The analysis suggests a positive investment opportunity based on the financial metrics and budget projections.

BUSINESS REPORT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

INVESTMENT 1.............................................................................................................................1

A. Explaining nature and scope of investments to Mark and Paul.........................................1

B. Budgets for June - September............................................................................................1

C. Analysing critically these three budgets and forecasted information................................3

D. Considering the practical issue to invest in restaurant by Mark and Paul.........................4

INVESTMENT 2.............................................................................................................................4

A. Calculations for NPV, accounting rate of return and payback period...............................4

B. Comparing and contrasting two investments suitable for Mark and Paul.........................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

APPENDIX......................................................................................................................................9

INTRODUCTION...........................................................................................................................1

INVESTMENT 1.............................................................................................................................1

A. Explaining nature and scope of investments to Mark and Paul.........................................1

B. Budgets for June - September............................................................................................1

C. Analysing critically these three budgets and forecasted information................................3

D. Considering the practical issue to invest in restaurant by Mark and Paul.........................4

INVESTMENT 2.............................................................................................................................4

A. Calculations for NPV, accounting rate of return and payback period...............................4

B. Comparing and contrasting two investments suitable for Mark and Paul.........................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

APPENDIX......................................................................................................................................9

INTRODUCTION

Business reports are prepared to provide necessary information to managers as well as

other stakeholders of the entity. It consists of various financial, statistical data that helps the

professionals of firm in making fruitful decisions as well as forecasting the costs for future

investments. In the present report, there has been use of several financial tools that will be

beneficial in providing necessary solutions or investment suggestions to Mark and Paul. It

consists of various budgets that will explain forecasting of costs or expenses for the future in

particular statements.

Purpose: Present report will describe the use of financial tools that will be helpful in making

estimation for the future growth.

Scope: The budgetary tool will be beneficial in making estimation and corrective decisions that

will help in providing necessary solution to any monetary problems.

Limitations: For preparing this report, the budgets were made on the basis of 4 month’s data. In

the case of availability of more data firm would become able to conduct in-depth investigation so

it is recognized as limitation.

INVESTMENT 1

A. Explaining nature and scope of investments to Mark and Paul

Investments are made by stakeholders in an organisation as an initial cost that will

generate more revenue and reserves for the organisational heads (Bennouna and et.al., 2010).

Mark and Paul will be benefited as they will get better knowledge about the nature and scope of

investments.

Making an investment will help in proper decision making by both the partners. It will

help them in knowing the loopholes and better managerial functioning in restaurant.

With the help of investments, they will be able to generate funds for fruitful operations of

business (Chen and et.al., 2012).

Helps in analysing the requirements of costs to be needed for future tasks. These will be

measured by accounting professionals of the organisation in making statements or

planning budgets for investments.

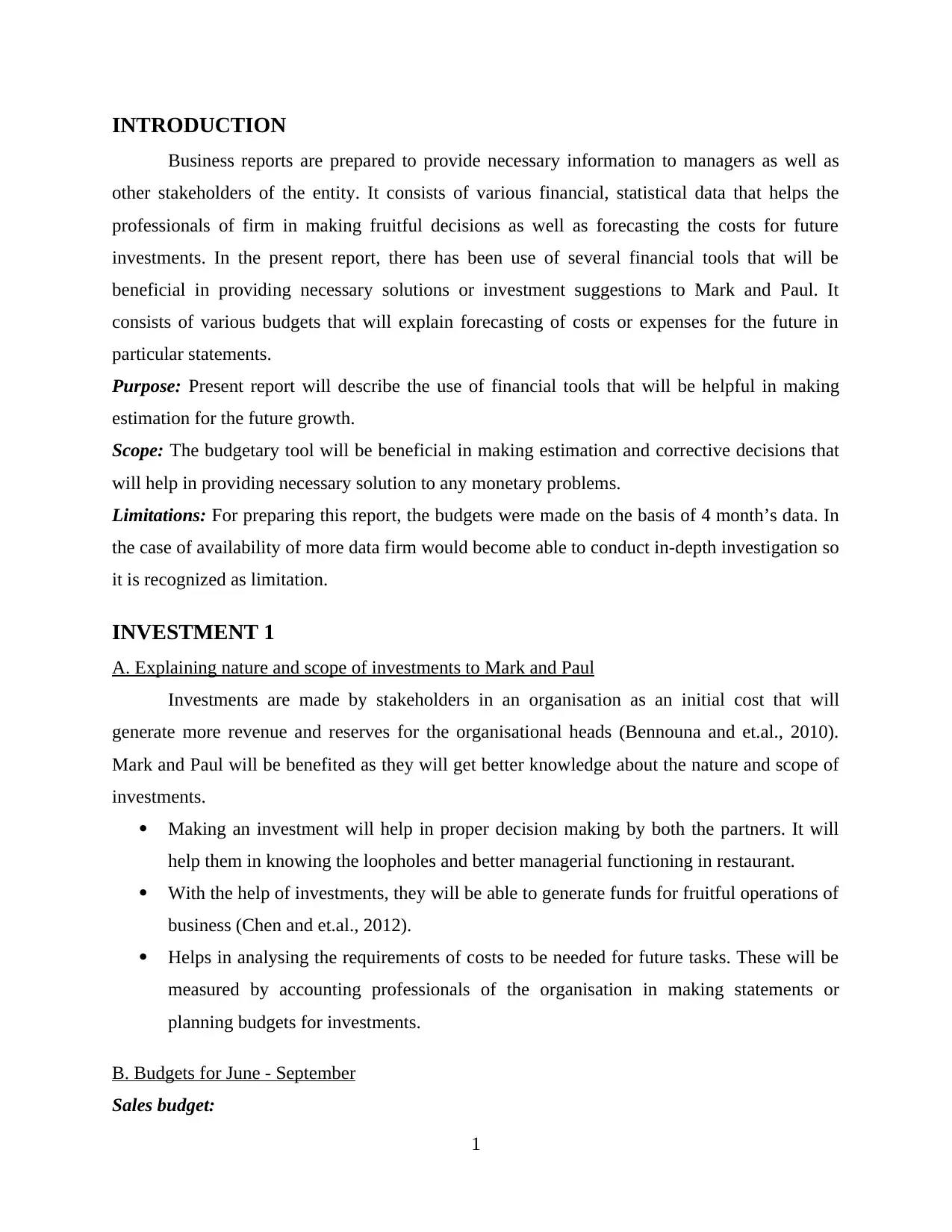

B. Budgets for June - September

Sales budget:

1

Business reports are prepared to provide necessary information to managers as well as

other stakeholders of the entity. It consists of various financial, statistical data that helps the

professionals of firm in making fruitful decisions as well as forecasting the costs for future

investments. In the present report, there has been use of several financial tools that will be

beneficial in providing necessary solutions or investment suggestions to Mark and Paul. It

consists of various budgets that will explain forecasting of costs or expenses for the future in

particular statements.

Purpose: Present report will describe the use of financial tools that will be helpful in making

estimation for the future growth.

Scope: The budgetary tool will be beneficial in making estimation and corrective decisions that

will help in providing necessary solution to any monetary problems.

Limitations: For preparing this report, the budgets were made on the basis of 4 month’s data. In

the case of availability of more data firm would become able to conduct in-depth investigation so

it is recognized as limitation.

INVESTMENT 1

A. Explaining nature and scope of investments to Mark and Paul

Investments are made by stakeholders in an organisation as an initial cost that will

generate more revenue and reserves for the organisational heads (Bennouna and et.al., 2010).

Mark and Paul will be benefited as they will get better knowledge about the nature and scope of

investments.

Making an investment will help in proper decision making by both the partners. It will

help them in knowing the loopholes and better managerial functioning in restaurant.

With the help of investments, they will be able to generate funds for fruitful operations of

business (Chen and et.al., 2012).

Helps in analysing the requirements of costs to be needed for future tasks. These will be

measured by accounting professionals of the organisation in making statements or

planning budgets for investments.

B. Budgets for June - September

Sales budget:

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

SALES BUDGET

PARTICULARS June July August September

Sales unit (meals) 20000 18000 18000 22000

prices 45 45 45 45

Total sales (meals) 900000 810000 810000 990000

Sales unit (Drink) 450000 405000 405000 495000

prices 6 6 6 6

Total Sales (Drink) 2700000 2430000 2430000 2970000

TOTAL SALES 3600000 3240000 3240000 3960000

Labour budget:

LABOUR BUDGET

PARTICULARS June July August September

Production per unit (meals) 20000 18000 18000 22000

labour per hour 6 6 6 6

Budgeted labour hours 120000 108000 108000 132000

cost of labour per hour 23 23 23 23

budgeted labour cost 2760000 2484000 2484000 3036000

Production per unit (drinks) 450000 405000 405000 495000

labour per hour 6 6 6 6

Budgeted labour hours 2700000 2430000 2430000 2970000

cost of labour per hour 23 23 23 23

budgeted labour cost 62100000 55890000 55890000 68310000

2

PARTICULARS June July August September

Sales unit (meals) 20000 18000 18000 22000

prices 45 45 45 45

Total sales (meals) 900000 810000 810000 990000

Sales unit (Drink) 450000 405000 405000 495000

prices 6 6 6 6

Total Sales (Drink) 2700000 2430000 2430000 2970000

TOTAL SALES 3600000 3240000 3240000 3960000

Labour budget:

LABOUR BUDGET

PARTICULARS June July August September

Production per unit (meals) 20000 18000 18000 22000

labour per hour 6 6 6 6

Budgeted labour hours 120000 108000 108000 132000

cost of labour per hour 23 23 23 23

budgeted labour cost 2760000 2484000 2484000 3036000

Production per unit (drinks) 450000 405000 405000 495000

labour per hour 6 6 6 6

Budgeted labour hours 2700000 2430000 2430000 2970000

cost of labour per hour 23 23 23 23

budgeted labour cost 62100000 55890000 55890000 68310000

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

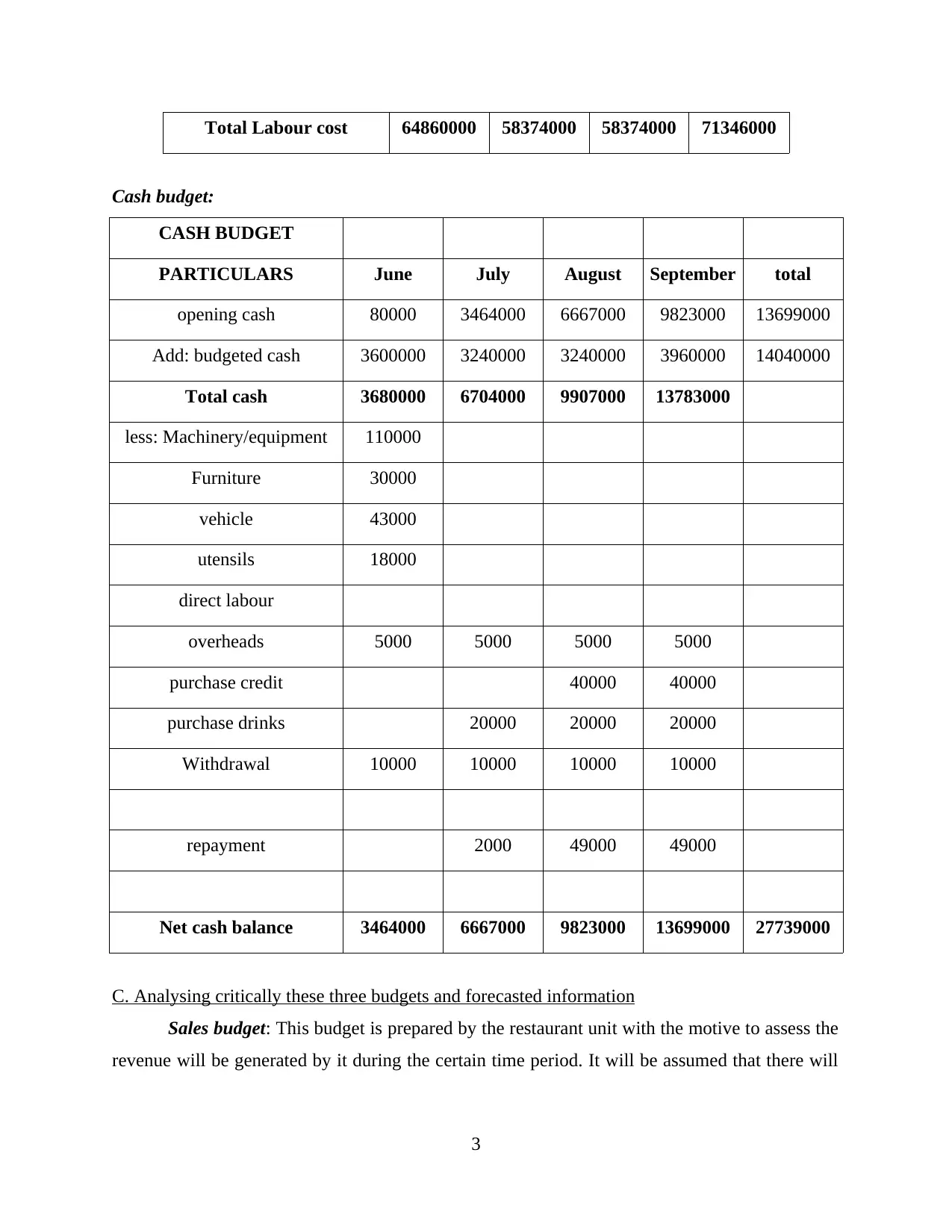

Total Labour cost 64860000 58374000 58374000 71346000

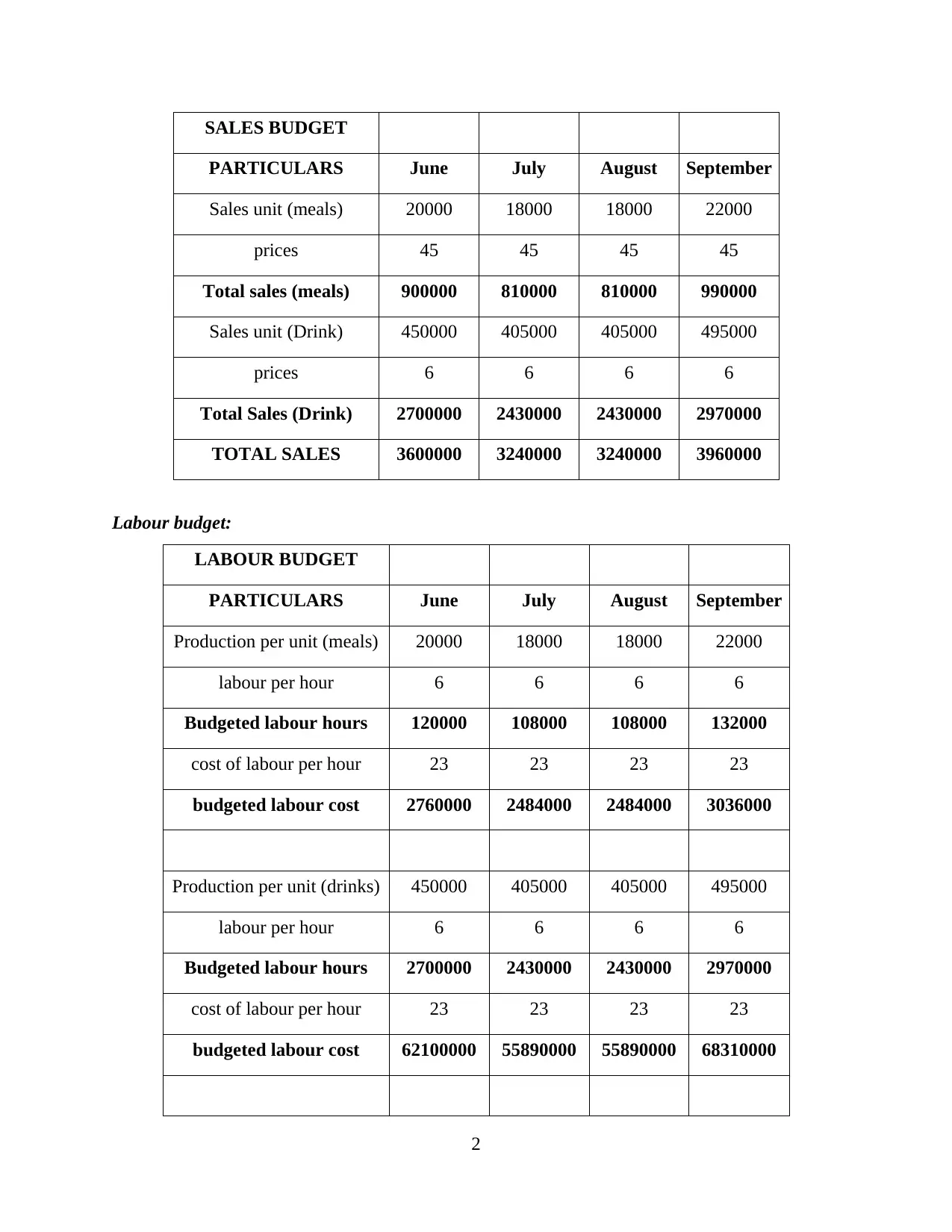

Cash budget:

CASH BUDGET

PARTICULARS June July August September total

opening cash 80000 3464000 6667000 9823000 13699000

Add: budgeted cash 3600000 3240000 3240000 3960000 14040000

Total cash 3680000 6704000 9907000 13783000

less: Machinery/equipment 110000

Furniture 30000

vehicle 43000

utensils 18000

direct labour

overheads 5000 5000 5000 5000

purchase credit 40000 40000

purchase drinks 20000 20000 20000

Withdrawal 10000 10000 10000 10000

repayment 2000 49000 49000

Net cash balance 3464000 6667000 9823000 13699000 27739000

C. Analysing critically these three budgets and forecasted information

Sales budget: This budget is prepared by the restaurant unit with the motive to assess the

revenue will be generated by it during the certain time period. It will be assumed that there will

3

Cash budget:

CASH BUDGET

PARTICULARS June July August September total

opening cash 80000 3464000 6667000 9823000 13699000

Add: budgeted cash 3600000 3240000 3240000 3960000 14040000

Total cash 3680000 6704000 9907000 13783000

less: Machinery/equipment 110000

Furniture 30000

vehicle 43000

utensils 18000

direct labour

overheads 5000 5000 5000 5000

purchase credit 40000 40000

purchase drinks 20000 20000 20000

Withdrawal 10000 10000 10000 10000

repayment 2000 49000 49000

Net cash balance 3464000 6667000 9823000 13699000 27739000

C. Analysing critically these three budgets and forecasted information

Sales budget: This budget is prepared by the restaurant unit with the motive to assess the

revenue will be generated by it during the certain time period. It will be assumed that there will

3

be generation of sales such as 3600000 for the month of June, 3240000 for the month of July,

3240000 for August and 3960000 for September.

Cash budget: On the basis of several purchases and sales, there has been various inflow

as well as outflow of the cash in months of June, July, August and September is 3464000,

6667000, 9823000 and 13699000 respectively. These balances indicate that the business will

earn favourable amount of profit in upcoming time as the cash is continuously showing surplus

balance.

Labour budget: The total labour cost will be budgeted as per month sales and unit

production such as 64860000, 58374000, 58374000 as well as 71346000 for the month of June,

July, August and September respectively. It indicates that as per the incline in units of

production labour cost is also growing up to the significant level.

D. Considering the practical issue to invest in restaurant by Mark and Paul

Mark and Paul must consider the cash budget before investing in the restaurant as the

cash inflow and outflow will not affect it’s per month earning (Mbabazize and Daniel, 2014). As

it is \advised that restaurant unit should invest money in the concerned project because it shows

positive balance. They may be increasing the cost of labour in entity but as compared to the sales

generated by business ratio of such expenditure is not very high.They must considered the

purchase and selling of meals and drinks per unit.

INVESTMENT 2

A. Calculations for NPV, accounting rate of return and payback period

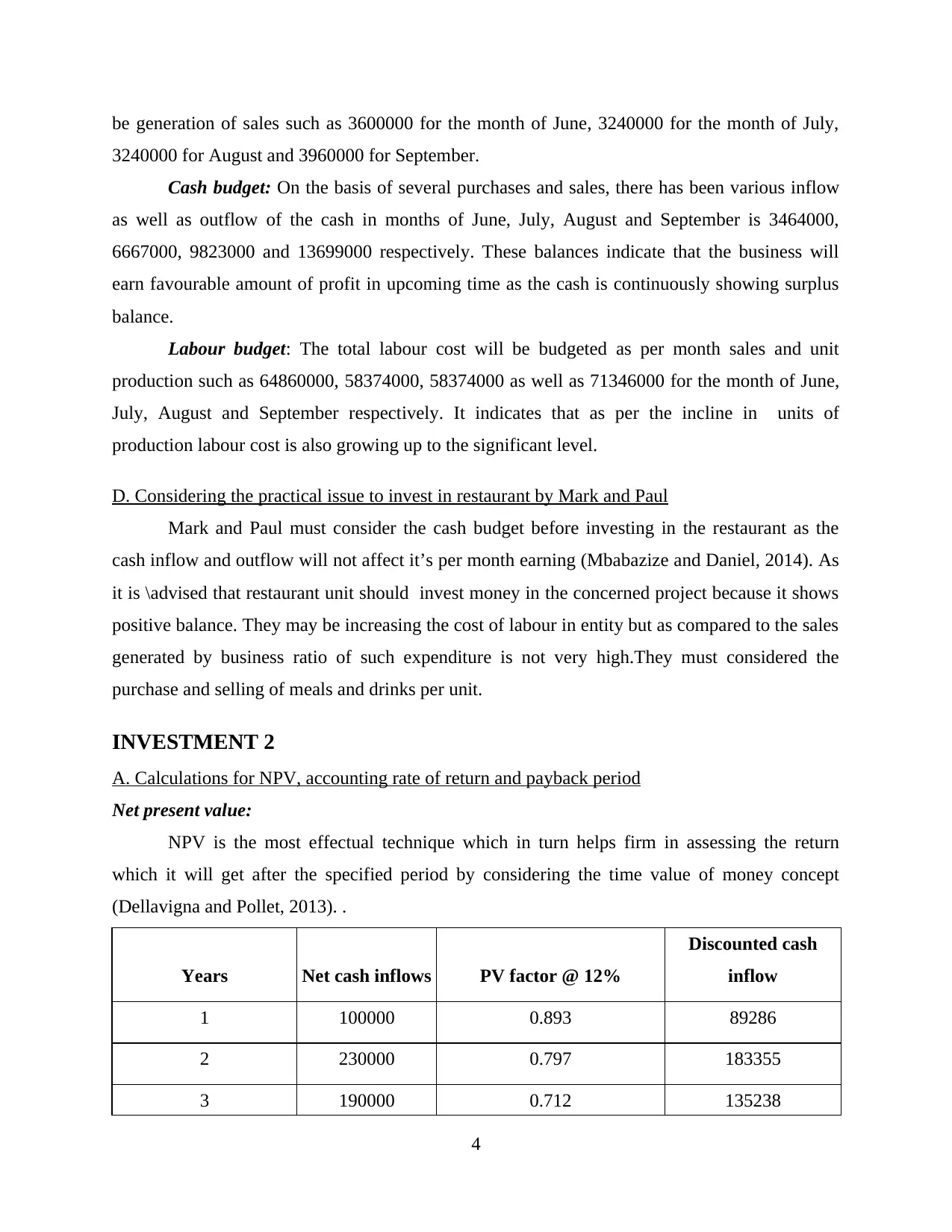

Net present value:

NPV is the most effectual technique which in turn helps firm in assessing the return

which it will get after the specified period by considering the time value of money concept

(Dellavigna and Pollet, 2013). .

Years Net cash inflows PV factor @ 12%

Discounted cash

inflow

1 100000 0.893 89286

2 230000 0.797 183355

3 190000 0.712 135238

4

3240000 for August and 3960000 for September.

Cash budget: On the basis of several purchases and sales, there has been various inflow

as well as outflow of the cash in months of June, July, August and September is 3464000,

6667000, 9823000 and 13699000 respectively. These balances indicate that the business will

earn favourable amount of profit in upcoming time as the cash is continuously showing surplus

balance.

Labour budget: The total labour cost will be budgeted as per month sales and unit

production such as 64860000, 58374000, 58374000 as well as 71346000 for the month of June,

July, August and September respectively. It indicates that as per the incline in units of

production labour cost is also growing up to the significant level.

D. Considering the practical issue to invest in restaurant by Mark and Paul

Mark and Paul must consider the cash budget before investing in the restaurant as the

cash inflow and outflow will not affect it’s per month earning (Mbabazize and Daniel, 2014). As

it is \advised that restaurant unit should invest money in the concerned project because it shows

positive balance. They may be increasing the cost of labour in entity but as compared to the sales

generated by business ratio of such expenditure is not very high.They must considered the

purchase and selling of meals and drinks per unit.

INVESTMENT 2

A. Calculations for NPV, accounting rate of return and payback period

Net present value:

NPV is the most effectual technique which in turn helps firm in assessing the return

which it will get after the specified period by considering the time value of money concept

(Dellavigna and Pollet, 2013). .

Years Net cash inflows PV factor @ 12%

Discounted cash

inflow

1 100000 0.893 89286

2 230000 0.797 183355

3 190000 0.712 135238

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4 140000 0.636 88973

Total discounted cash

inflow 496851

Less: initial investment 390000

NPV (TDCF – II) $106851

Interpretation: As per the above calculation, it can be interpreted that Mark and Paul will

be generating favourable net present value. For the first year, cash balance was amounted to

100000 at rate of 0.893 which facilitates discount of 89286. For the second year, 230000 at the

rate of 0.797 generate discount for 183355. Initial investments will be deductible at 390000

which brings the final value of NPV around 106851. By considering this, it can be stated that

NPV is positive and greater than the amount of initial investment. Thus, it is recommended to the

firm to invest money in such project and thereby attains financial benefits.

Average rate of return:

Ratios of ARR can be generated through profit earned by restaurant and the rate of return.

Mark and Paul will be able to earn the expected returns (Cheng and et.al., 2011).

Years Net cash inflows

Initial investment 390000

1 100000

2 230000

3 190000

4 140000

Total 660000

Average return 165000

Average investment 390000

5

Total discounted cash

inflow 496851

Less: initial investment 390000

NPV (TDCF – II) $106851

Interpretation: As per the above calculation, it can be interpreted that Mark and Paul will

be generating favourable net present value. For the first year, cash balance was amounted to

100000 at rate of 0.893 which facilitates discount of 89286. For the second year, 230000 at the

rate of 0.797 generate discount for 183355. Initial investments will be deductible at 390000

which brings the final value of NPV around 106851. By considering this, it can be stated that

NPV is positive and greater than the amount of initial investment. Thus, it is recommended to the

firm to invest money in such project and thereby attains financial benefits.

Average rate of return:

Ratios of ARR can be generated through profit earned by restaurant and the rate of return.

Mark and Paul will be able to earn the expected returns (Cheng and et.al., 2011).

Years Net cash inflows

Initial investment 390000

1 100000

2 230000

3 190000

4 140000

Total 660000

Average return 165000

Average investment 390000

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

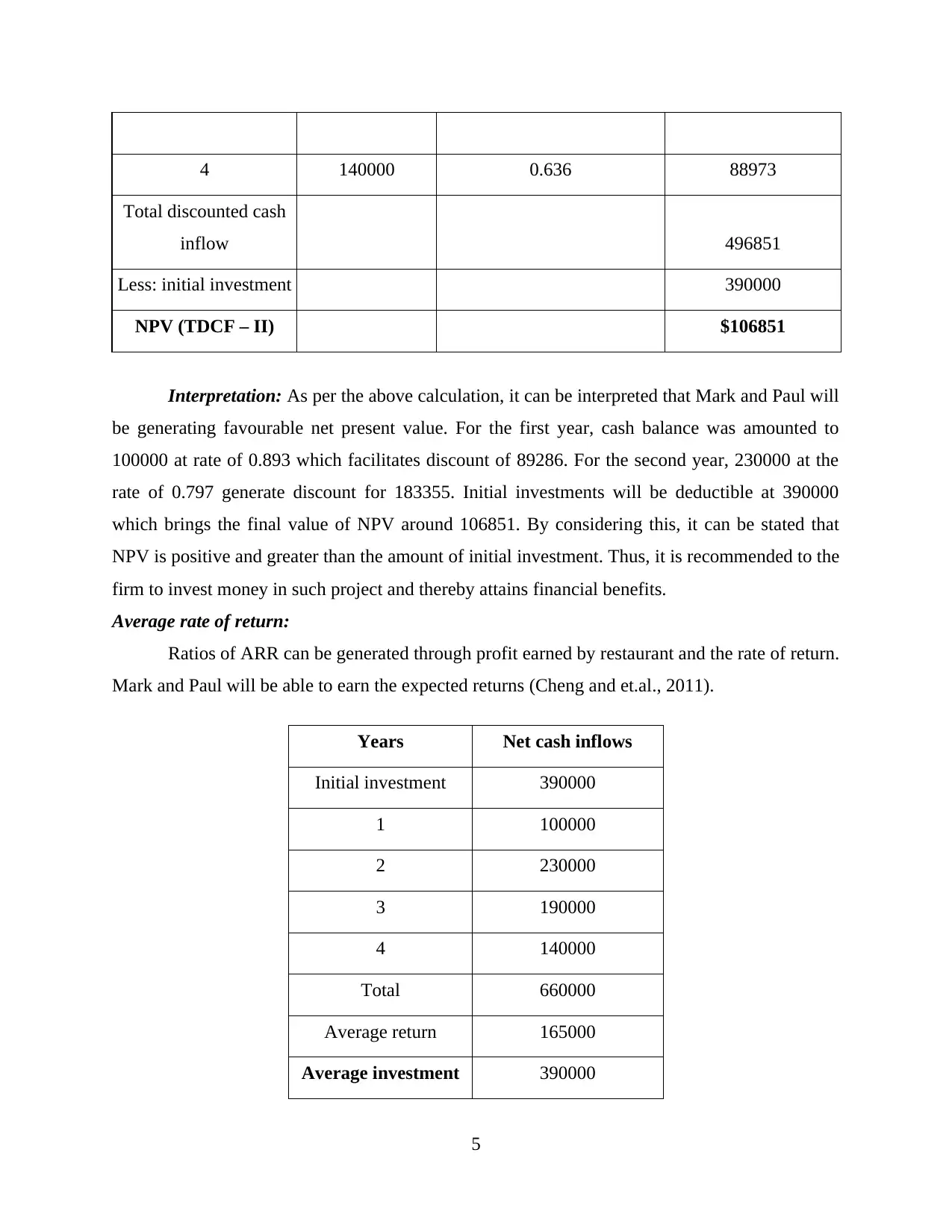

ARR

165000 / 39000 * 100 =

42%

Interpretation: As per the above calculation, it can be said that restaurant has made the

initial investment for 390000 and for the 4 years, restaurant has generated profit for 100000,

230000, 190000 as well as 140000 which brings the total of 660000. The average investment of

390000 brings ARR for 42%.

Payback period:

Payback period is denoted as investment make in the present period when it will be

recovered in the upcoming time (Bennouna and et.al., 2010).

Years Net cash inflows Cumulative net cash inflows

1 100000 100000

2 230000 330000

3 190000 520000

4 140000 660000

Payback period

1 + (390000 – 330000) /

190000 = 2.3 years

Interpretation: As per the above calculation, it can be interpreted that there has been

recovery of investment after completion of 2.3 years. It will be fruitful for the partners to make

investment in this business as it will require less time to recover the amount.

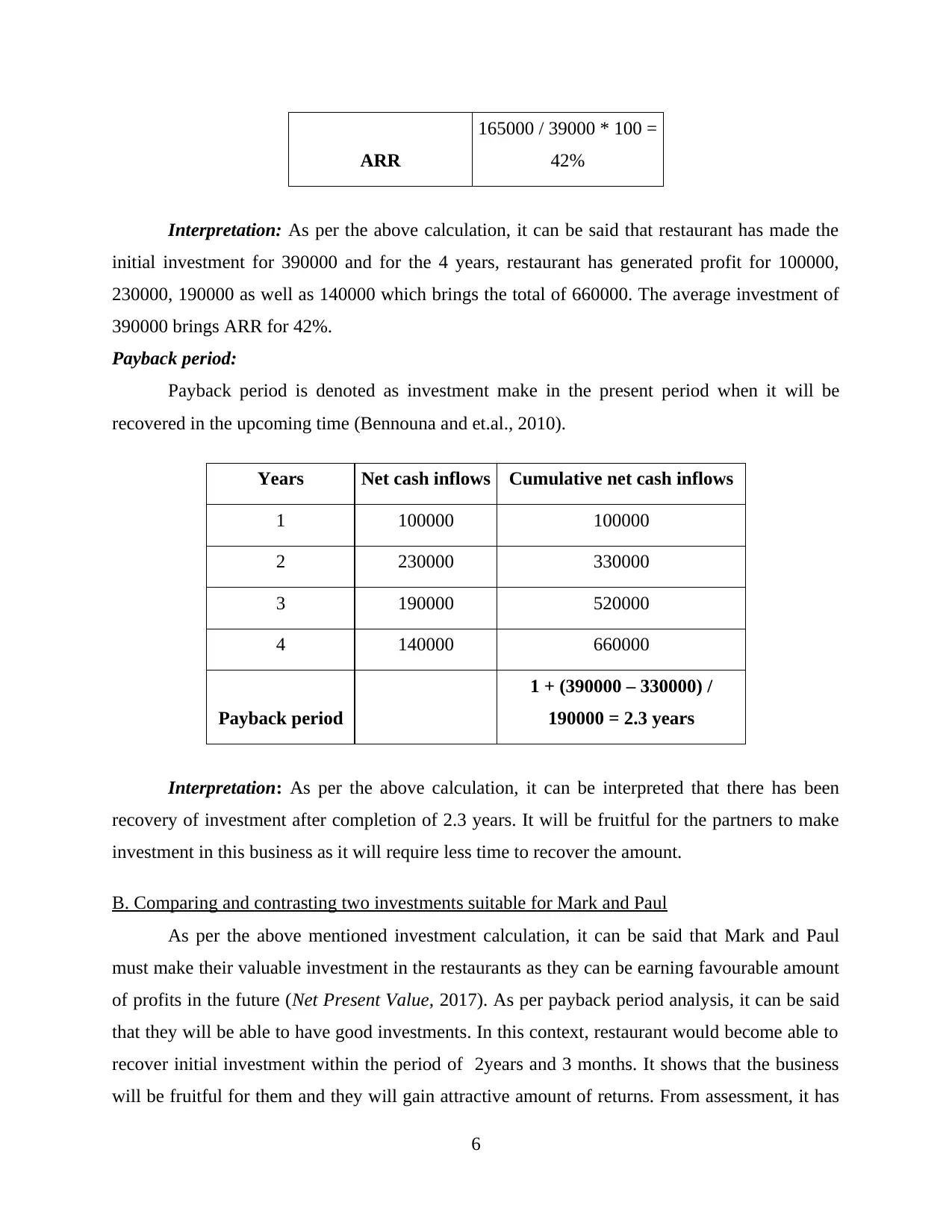

B. Comparing and contrasting two investments suitable for Mark and Paul

As per the above mentioned investment calculation, it can be said that Mark and Paul

must make their valuable investment in the restaurants as they can be earning favourable amount

of profits in the future (Net Present Value, 2017). As per payback period analysis, it can be said

that they will be able to have good investments. In this context, restaurant would become able to

recover initial investment within the period of 2years and 3 months. It shows that the business

will be fruitful for them and they will gain attractive amount of returns. From assessment, it has

6

165000 / 39000 * 100 =

42%

Interpretation: As per the above calculation, it can be said that restaurant has made the

initial investment for 390000 and for the 4 years, restaurant has generated profit for 100000,

230000, 190000 as well as 140000 which brings the total of 660000. The average investment of

390000 brings ARR for 42%.

Payback period:

Payback period is denoted as investment make in the present period when it will be

recovered in the upcoming time (Bennouna and et.al., 2010).

Years Net cash inflows Cumulative net cash inflows

1 100000 100000

2 230000 330000

3 190000 520000

4 140000 660000

Payback period

1 + (390000 – 330000) /

190000 = 2.3 years

Interpretation: As per the above calculation, it can be interpreted that there has been

recovery of investment after completion of 2.3 years. It will be fruitful for the partners to make

investment in this business as it will require less time to recover the amount.

B. Comparing and contrasting two investments suitable for Mark and Paul

As per the above mentioned investment calculation, it can be said that Mark and Paul

must make their valuable investment in the restaurants as they can be earning favourable amount

of profits in the future (Net Present Value, 2017). As per payback period analysis, it can be said

that they will be able to have good investments. In this context, restaurant would become able to

recover initial investment within the period of 2years and 3 months. It shows that the business

will be fruitful for them and they will gain attractive amount of returns. From assessment, it has

6

been identified that ARR of the restaurant accounts for 42% as per the cash inflows of 4 years.

The suitable investments will be the payback period for the restaurant. Mark and Paul must

consider the payback period it will help them in making the earnings in 2.3 years.

CONCLUSION

Conclusion can be made as per the above report that Mark and Paul will be beneficial if

they make the investment for Restaurant. It has shown the positive value to them as per the Cash,

sale and labour budgets. The balances in such statements will show the favourable results and

shows the continues growth for the rest of the period. Further conclusion can be made as per

NPV, ARR and the payback period earned by them. They can be able to make the favourable

investments in as the returns will be covered within 2.3 years of duration.

7

The suitable investments will be the payback period for the restaurant. Mark and Paul must

consider the payback period it will help them in making the earnings in 2.3 years.

CONCLUSION

Conclusion can be made as per the above report that Mark and Paul will be beneficial if

they make the investment for Restaurant. It has shown the positive value to them as per the Cash,

sale and labour budgets. The balances in such statements will show the favourable results and

shows the continues growth for the rest of the period. Further conclusion can be made as per

NPV, ARR and the payback period earned by them. They can be able to make the favourable

investments in as the returns will be covered within 2.3 years of duration.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Bennouna, K. and et.al., 2010. Improved capital budgeting decision making: evidence from

Canada. Management decision. 48(2). pp.225-247.

Chen, C. and et.al., 2012. Robust constrained optimization of short-and long-term net present

value for closed-loop reservoir management. SPE Journal. 17(03). pp.849-864.

Cheng, M.Y. and et.al., 2011. Evolutionary fuzzy decision model for cash flow prediction using

time-dependent support vector machines. International Journal of Project Management.

29(1). pp.56-65.

Dellavigna, S. and Pollet, J. M., 2013. Capital budgeting versus market timing: An evaluation

using demographics. The Journal of Finance. 68(1). pp.237-270.

Mbabazize, P. M. and Daniel, T., 2014. Capital Budgeting Practices In Developing Countries: A

Case Of Rwanda. Research journali’s Journal of Finance. pp.34-38.

Online

Net Present Value. 2017. [Online]. Available through:

<http://financeformulas.net/Net_Present_Value.html>. [Accessed on 27th September.

2017].

8

Books and Journals

Bennouna, K. and et.al., 2010. Improved capital budgeting decision making: evidence from

Canada. Management decision. 48(2). pp.225-247.

Chen, C. and et.al., 2012. Robust constrained optimization of short-and long-term net present

value for closed-loop reservoir management. SPE Journal. 17(03). pp.849-864.

Cheng, M.Y. and et.al., 2011. Evolutionary fuzzy decision model for cash flow prediction using

time-dependent support vector machines. International Journal of Project Management.

29(1). pp.56-65.

Dellavigna, S. and Pollet, J. M., 2013. Capital budgeting versus market timing: An evaluation

using demographics. The Journal of Finance. 68(1). pp.237-270.

Mbabazize, P. M. and Daniel, T., 2014. Capital Budgeting Practices In Developing Countries: A

Case Of Rwanda. Research journali’s Journal of Finance. pp.34-38.

Online

Net Present Value. 2017. [Online]. Available through:

<http://financeformulas.net/Net_Present_Value.html>. [Accessed on 27th September.

2017].

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

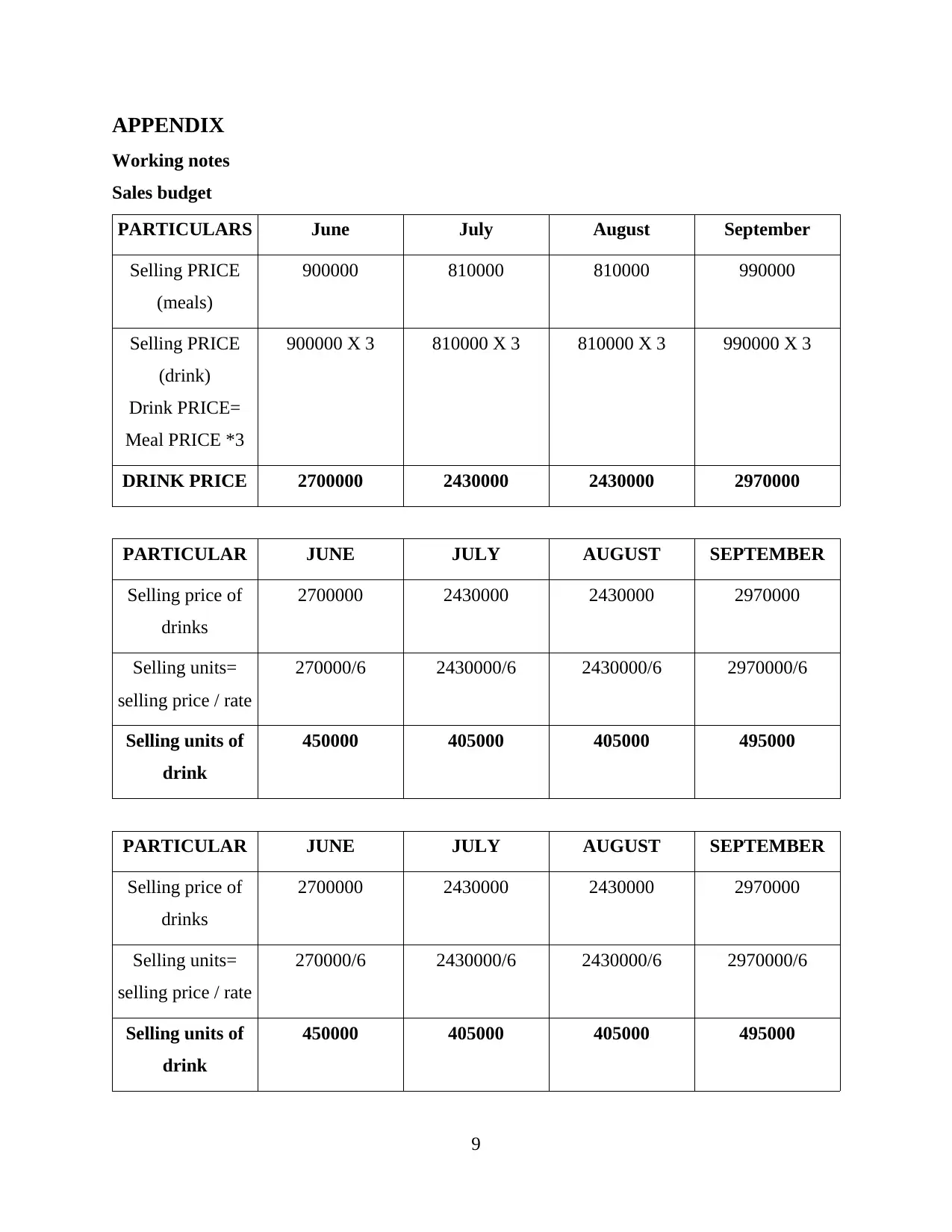

APPENDIX

Working notes

Sales budget

PARTICULARS June July August September

Selling PRICE

(meals)

900000 810000 810000 990000

Selling PRICE

(drink)

Drink PRICE=

Meal PRICE *3

900000 X 3 810000 X 3 810000 X 3 990000 X 3

DRINK PRICE 2700000 2430000 2430000 2970000

PARTICULAR JUNE JULY AUGUST SEPTEMBER

Selling price of

drinks

2700000 2430000 2430000 2970000

Selling units=

selling price / rate

270000/6 2430000/6 2430000/6 2970000/6

Selling units of

drink

450000 405000 405000 495000

PARTICULAR JUNE JULY AUGUST SEPTEMBER

Selling price of

drinks

2700000 2430000 2430000 2970000

Selling units=

selling price / rate

270000/6 2430000/6 2430000/6 2970000/6

Selling units of

drink

450000 405000 405000 495000

9

Working notes

Sales budget

PARTICULARS June July August September

Selling PRICE

(meals)

900000 810000 810000 990000

Selling PRICE

(drink)

Drink PRICE=

Meal PRICE *3

900000 X 3 810000 X 3 810000 X 3 990000 X 3

DRINK PRICE 2700000 2430000 2430000 2970000

PARTICULAR JUNE JULY AUGUST SEPTEMBER

Selling price of

drinks

2700000 2430000 2430000 2970000

Selling units=

selling price / rate

270000/6 2430000/6 2430000/6 2970000/6

Selling units of

drink

450000 405000 405000 495000

PARTICULAR JUNE JULY AUGUST SEPTEMBER

Selling price of

drinks

2700000 2430000 2430000 2970000

Selling units=

selling price / rate

270000/6 2430000/6 2430000/6 2970000/6

Selling units of

drink

450000 405000 405000 495000

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.