Detailed Regression Model Analysis for Business Statistics Assignment

VerifiedAdded on 2021/02/19

|19

|2073

|110

Homework Assignment

AI Summary

This assignment delves into the application of regression models within the context of business statistics, specifically focusing on the Japanese electronic industry. The analysis begins with an introduction to the regression model, explaining its use in investigating relationships between variables, such as operating revenue, shareholders' funds, debtors, intangible assets, and other fixed assets. The assignment utilizes SPSS for data analysis, including the creation of scatter plots to visualize relationships between variables. It then proceeds to evaluate the significance of the initial model through ANOVA analysis, rejecting or accepting null hypotheses based on p-values. The document also includes a re-estimated model, comparing the initial and re-estimated models and interpreting the estimated coefficients. The study concludes by emphasizing the importance of business statistics in decision-making, highlighting the effective use of statistical tools and techniques in areas like finance and research.

Business statistics

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK...............................................................................................................................................1

1. Regression Model:...................................................................................................................1

2. Considered variables................................................................................................................1

3. Plot the dependent variable against each independent variable using scatter plot/dot function

in SPSS. Describe any visible relationship from the plots..........................................................2

4. Evaluation of significance with initial model..........................................................................9

5. Re - estimated model.............................................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK...............................................................................................................................................1

1. Regression Model:...................................................................................................................1

2. Considered variables................................................................................................................1

3. Plot the dependent variable against each independent variable using scatter plot/dot function

in SPSS. Describe any visible relationship from the plots..........................................................2

4. Evaluation of significance with initial model..........................................................................9

5. Re - estimated model.............................................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION

Business statistics implies to organised use of statistical measures and methods in respect

of management and trade problems with aim to improve decision making (Wang and et. al.,

2013). Statistics is areas of research and study which covers detailed analysis of numeric facts,

data, information, relevant figures and other key measurements. The study involves practical

application of statistical tools like regression model, Hypothesis tests, coefficients of the re-

estimated model etc. in context of Japan's electronic industry. It also provides comparison of

initial model and re-estimated model along with evaluation of characteristics of fit between them.

TASK

1. Regression Model:

For investigating the connection among two or maybe more elements and to predict one

element based on another, a regression model is often used. This model mainly includes

regression analysis in which variables selected may be independent those which are applied as

forecaster or normal input sources and dependent, those which are applied as response or output

variables (Berrett and Calder, 2012). Generally independent Variable-X is considered as factor

which could be easily controlled while variable-Y is factor which indicates variations in

independent variable-X. The causal link among factors X and Y under regression model enables

an researcher to anticipate Y's value in respect of each X's value appropriately.

2. Considered variables

Variables Particulars

Y = Operating Revenue

(Turnover)

It is gross receipts generated through corporation's primary and

core business or trade activities.

X1 = Shareholders’ funds Amount of shareholder's equity or fund is to assess how much

of corporation's net assets belong to company's shareholders. It

is sum of equity or capital in a corporation owned by the

stakeholders or investors.

X2 = Debtors Debtors or trade receivables in company's financial statement

shows that money or sum is to be received from vendors or

1

Business statistics implies to organised use of statistical measures and methods in respect

of management and trade problems with aim to improve decision making (Wang and et. al.,

2013). Statistics is areas of research and study which covers detailed analysis of numeric facts,

data, information, relevant figures and other key measurements. The study involves practical

application of statistical tools like regression model, Hypothesis tests, coefficients of the re-

estimated model etc. in context of Japan's electronic industry. It also provides comparison of

initial model and re-estimated model along with evaluation of characteristics of fit between them.

TASK

1. Regression Model:

For investigating the connection among two or maybe more elements and to predict one

element based on another, a regression model is often used. This model mainly includes

regression analysis in which variables selected may be independent those which are applied as

forecaster or normal input sources and dependent, those which are applied as response or output

variables (Berrett and Calder, 2012). Generally independent Variable-X is considered as factor

which could be easily controlled while variable-Y is factor which indicates variations in

independent variable-X. The causal link among factors X and Y under regression model enables

an researcher to anticipate Y's value in respect of each X's value appropriately.

2. Considered variables

Variables Particulars

Y = Operating Revenue

(Turnover)

It is gross receipts generated through corporation's primary and

core business or trade activities.

X1 = Shareholders’ funds Amount of shareholder's equity or fund is to assess how much

of corporation's net assets belong to company's shareholders. It

is sum of equity or capital in a corporation owned by the

stakeholders or investors.

X2 = Debtors Debtors or trade receivables in company's financial statement

shows that money or sum is to be received from vendors or

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

customers who purchased goods or owes money.

X3 = Intangible Assets An intangible asset is a non-physical asset in essence.

Goodwill, copyrights, patents, brand recognition and other

intellectual properties are key intangible assets.

X4 = BvD Indep. Indic. Regarded as ‘Corporation independence indicator’. It

categorises the grade of independence of a corporation.

Following are indicator marks, as follows:

A: No reported shareholder with direct or complete equity in

excess of 25 shares.

B: No reported shareholder with immediate or complete equity

in excess of 50 percent. And with more than 25 percent direct

or complete property, one or more shareholders are reported.

C: One reported shareholder with direct or full of more than 50

percent. Also provided to a business when a reference shows

the real proprietor of the business.

D: One reported shareholder with direct ownership of over

50%.

U: Unknown status of independence.

Note: Cases with ‘U’ must be excluded from the data sample.

Please recode this categorical variable into a dummy variable

as follows: 1 = BvD Indep. Indic. ‘A’ 0 = BvD Indep. Indic.

‘B’, ‘C’ or ‘D’.

X5 = Other fixed assets These are assets that are acquired by company for long run use

and not easily convertible in into cash like land, equipment,

buildings etc.

2

X3 = Intangible Assets An intangible asset is a non-physical asset in essence.

Goodwill, copyrights, patents, brand recognition and other

intellectual properties are key intangible assets.

X4 = BvD Indep. Indic. Regarded as ‘Corporation independence indicator’. It

categorises the grade of independence of a corporation.

Following are indicator marks, as follows:

A: No reported shareholder with direct or complete equity in

excess of 25 shares.

B: No reported shareholder with immediate or complete equity

in excess of 50 percent. And with more than 25 percent direct

or complete property, one or more shareholders are reported.

C: One reported shareholder with direct or full of more than 50

percent. Also provided to a business when a reference shows

the real proprietor of the business.

D: One reported shareholder with direct ownership of over

50%.

U: Unknown status of independence.

Note: Cases with ‘U’ must be excluded from the data sample.

Please recode this categorical variable into a dummy variable

as follows: 1 = BvD Indep. Indic. ‘A’ 0 = BvD Indep. Indic.

‘B’, ‘C’ or ‘D’.

X5 = Other fixed assets These are assets that are acquired by company for long run use

and not easily convertible in into cash like land, equipment,

buildings etc.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

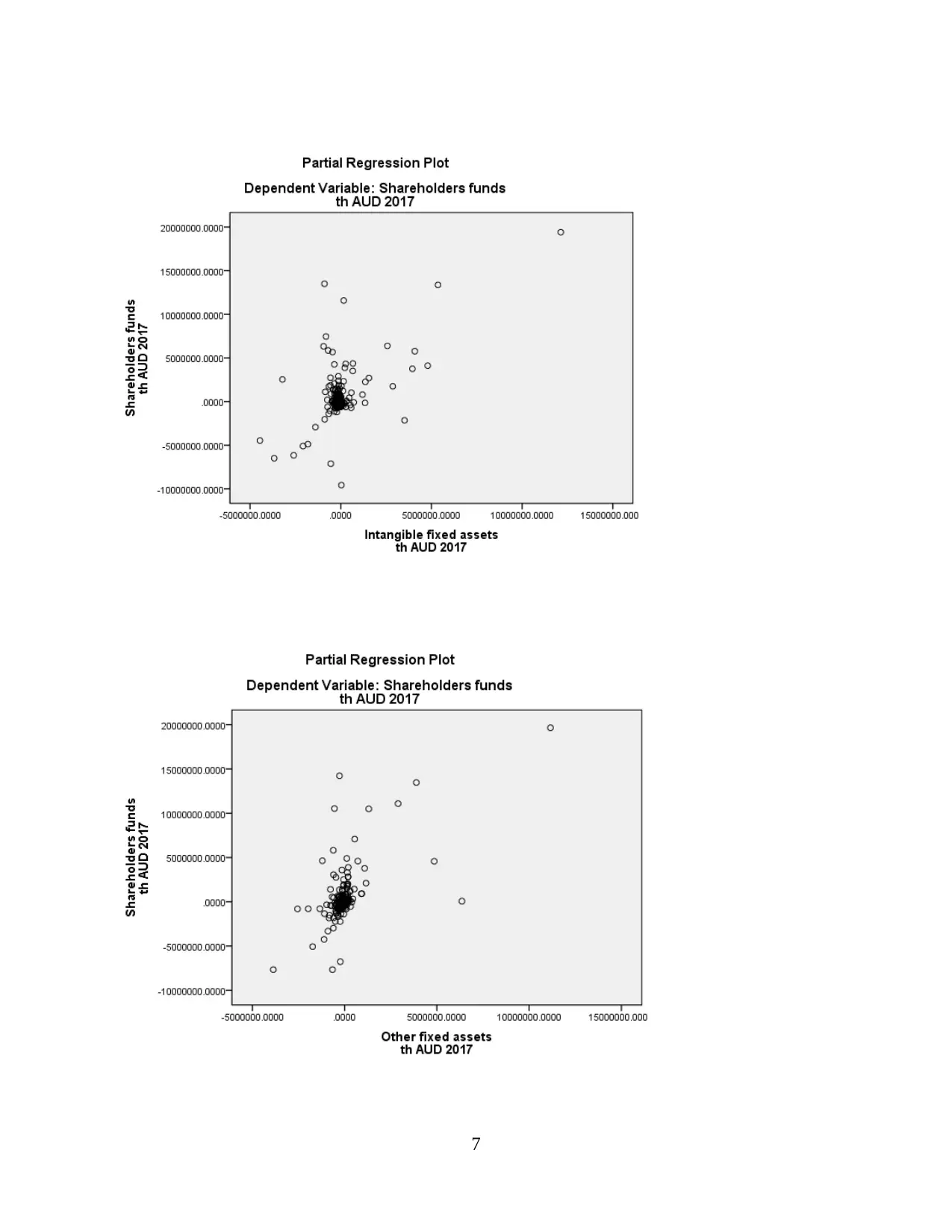

3. Plot the dependent variable against each independent variable using scatter plot/dot function in

SPSS. Describe any visible relationship from the plots

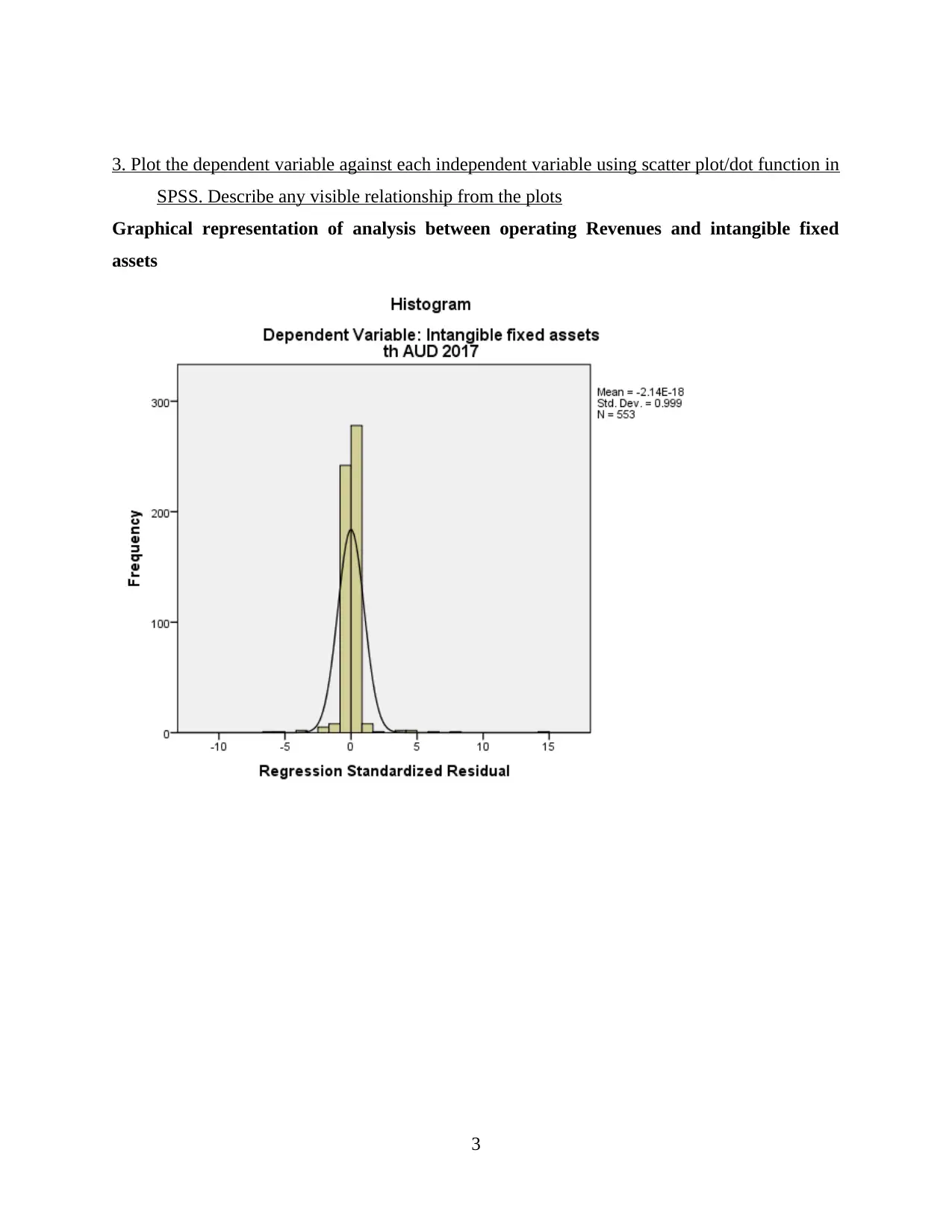

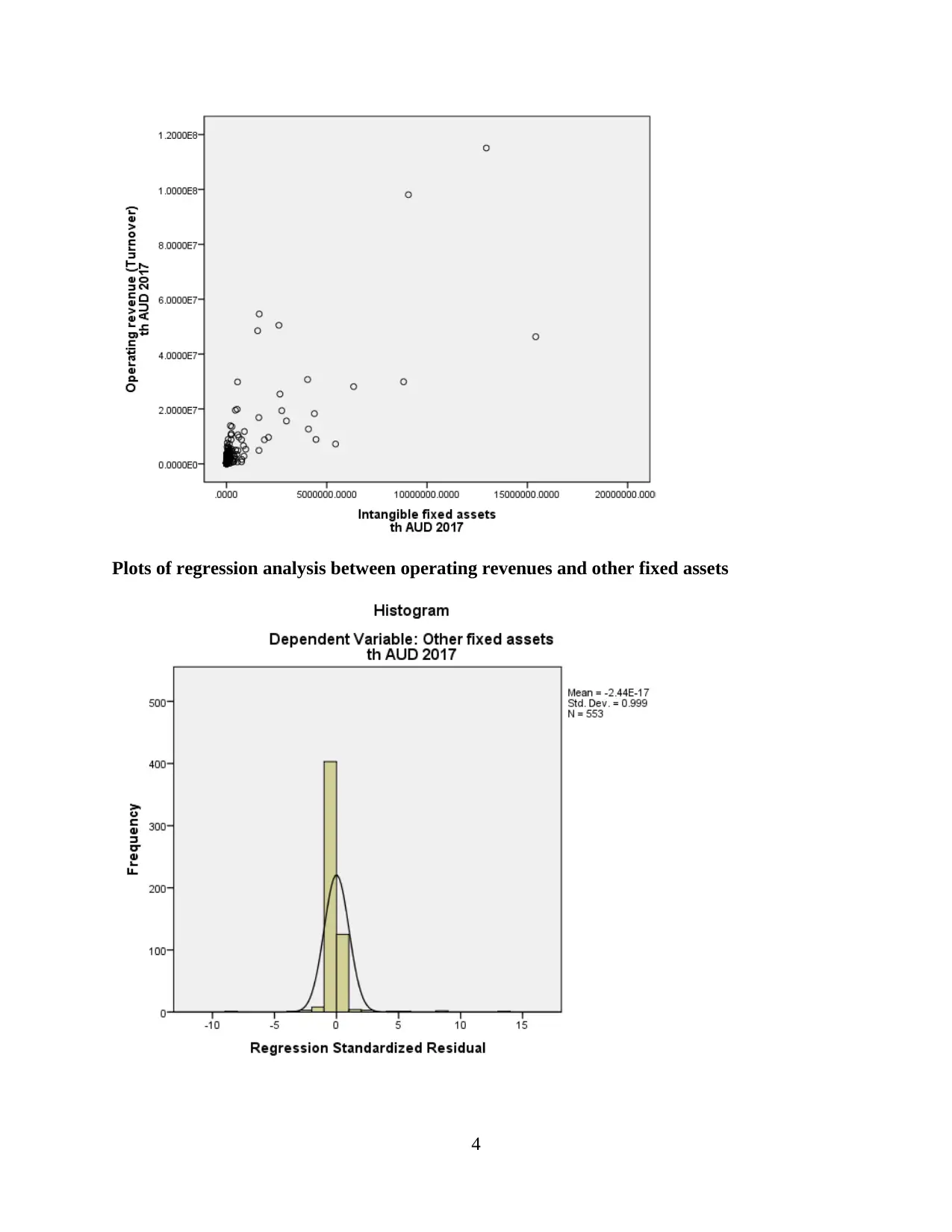

Graphical representation of analysis between operating Revenues and intangible fixed

assets

3

SPSS. Describe any visible relationship from the plots

Graphical representation of analysis between operating Revenues and intangible fixed

assets

3

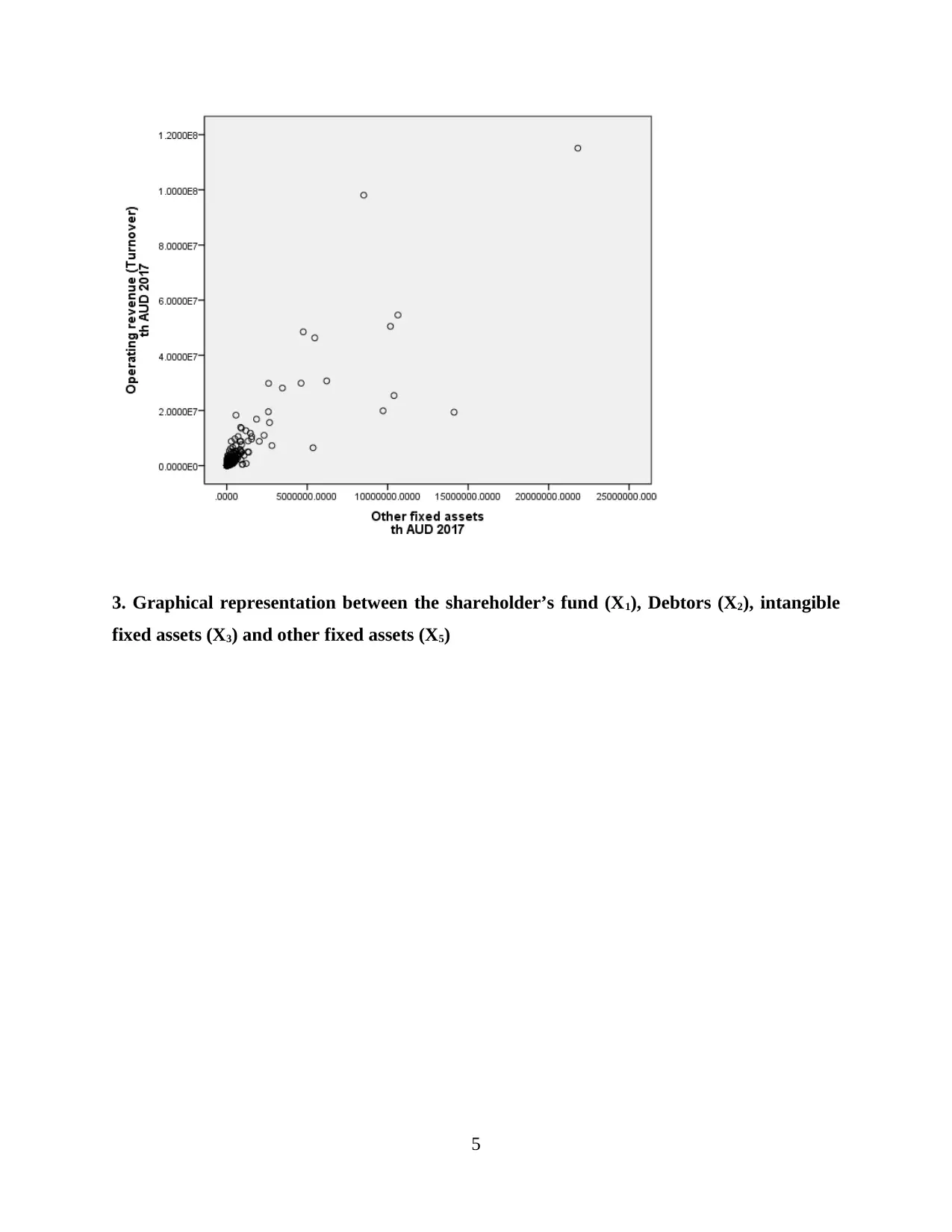

Plots of regression analysis between operating revenues and other fixed assets

4

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

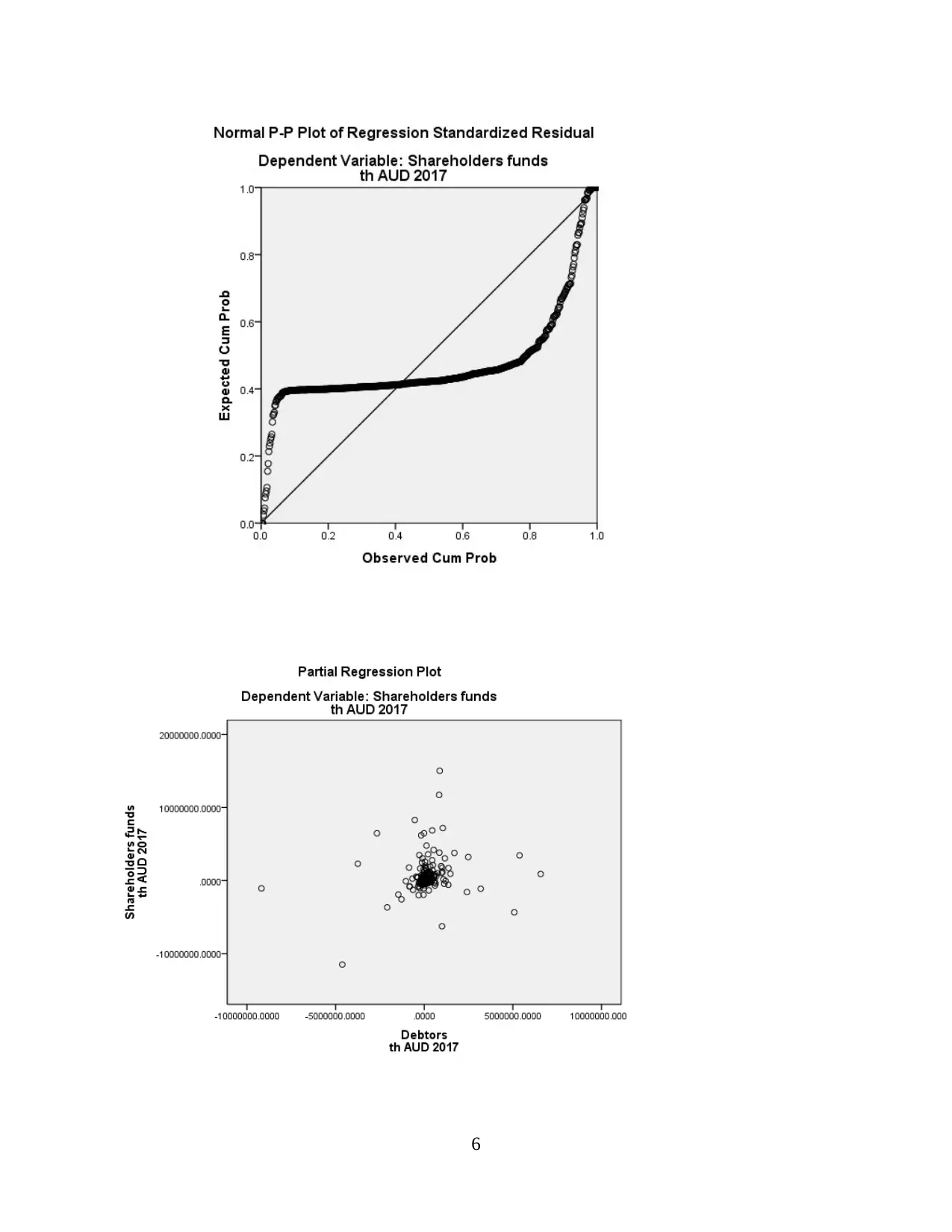

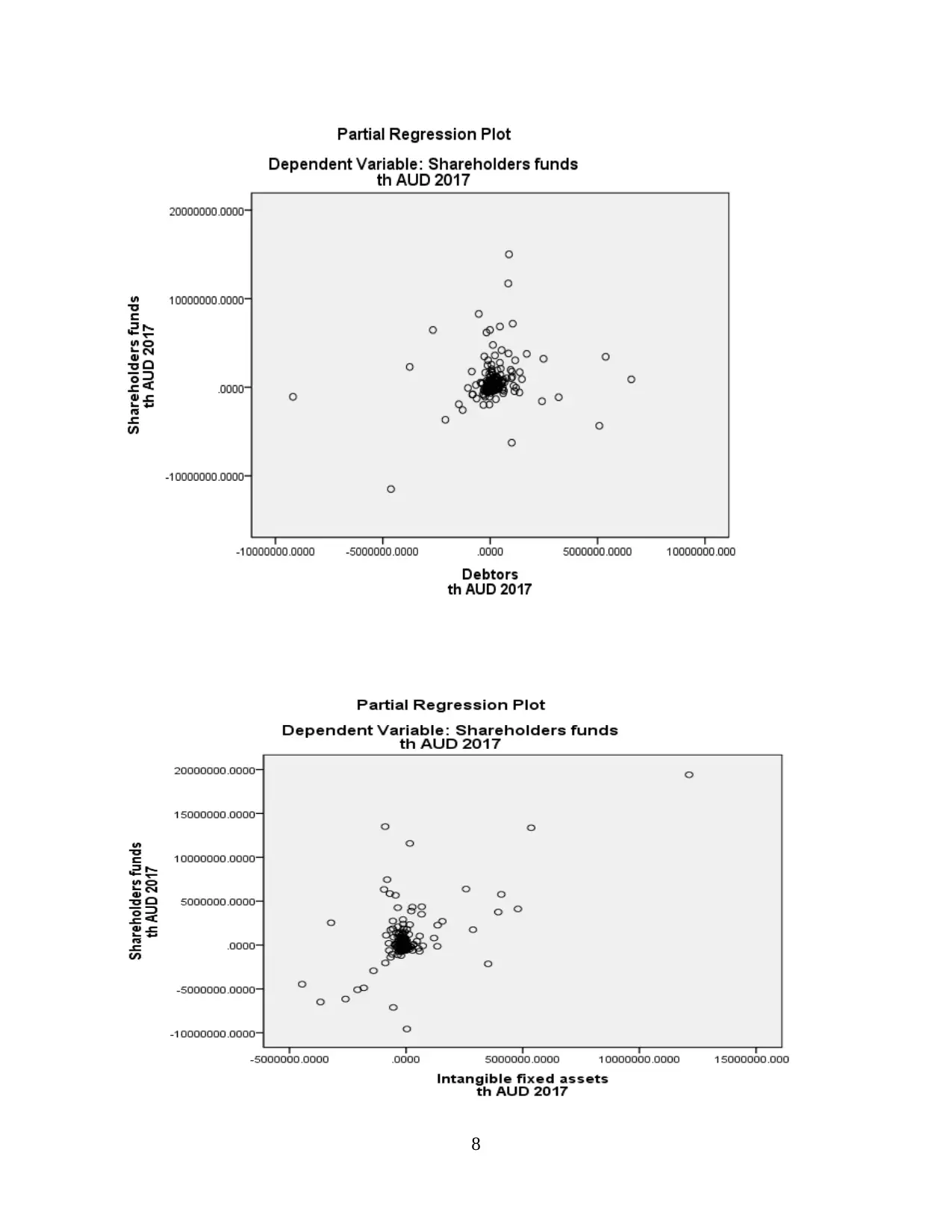

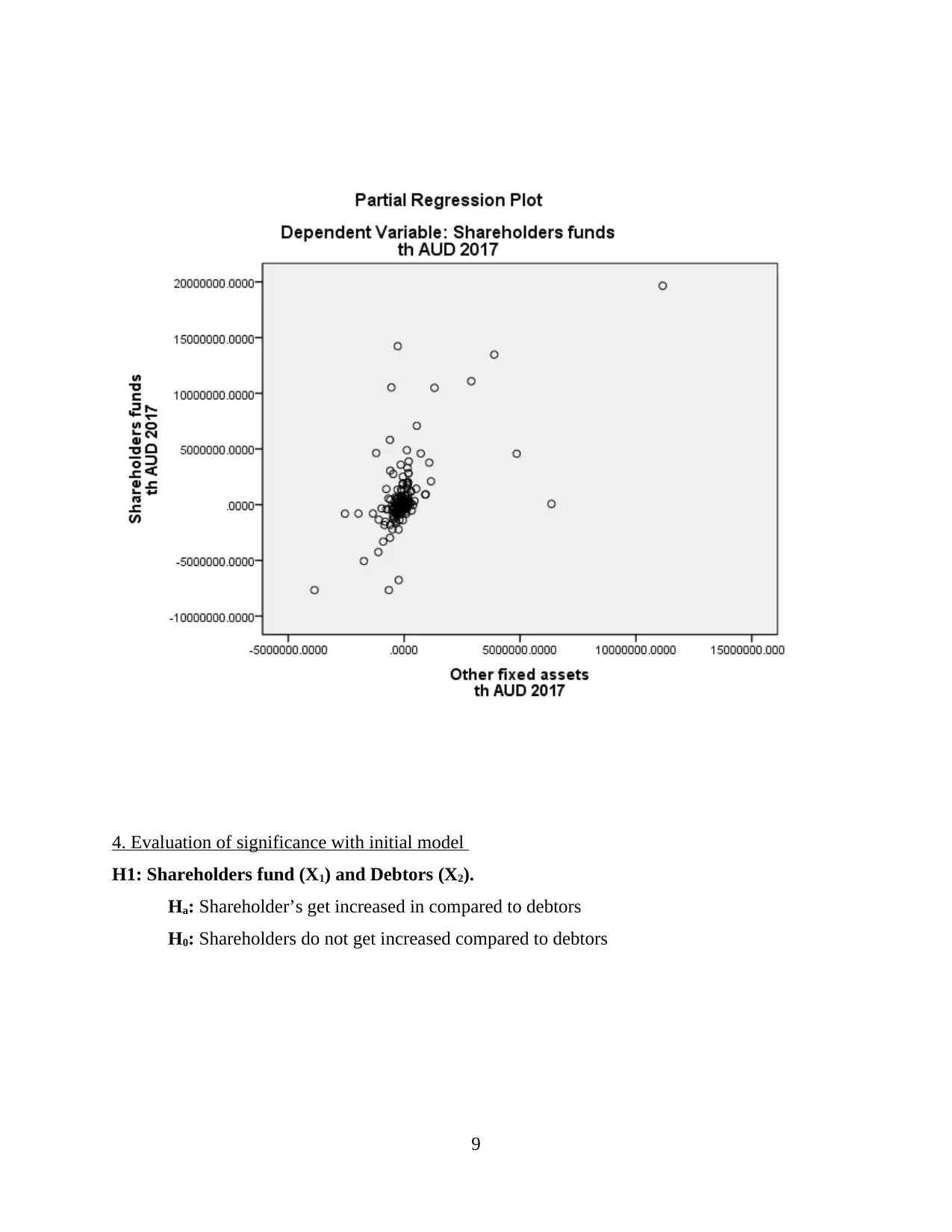

3. Graphical representation between the shareholder’s fund (X1), Debtors (X2), intangible

fixed assets (X3) and other fixed assets (X5)

5

fixed assets (X3) and other fixed assets (X5)

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

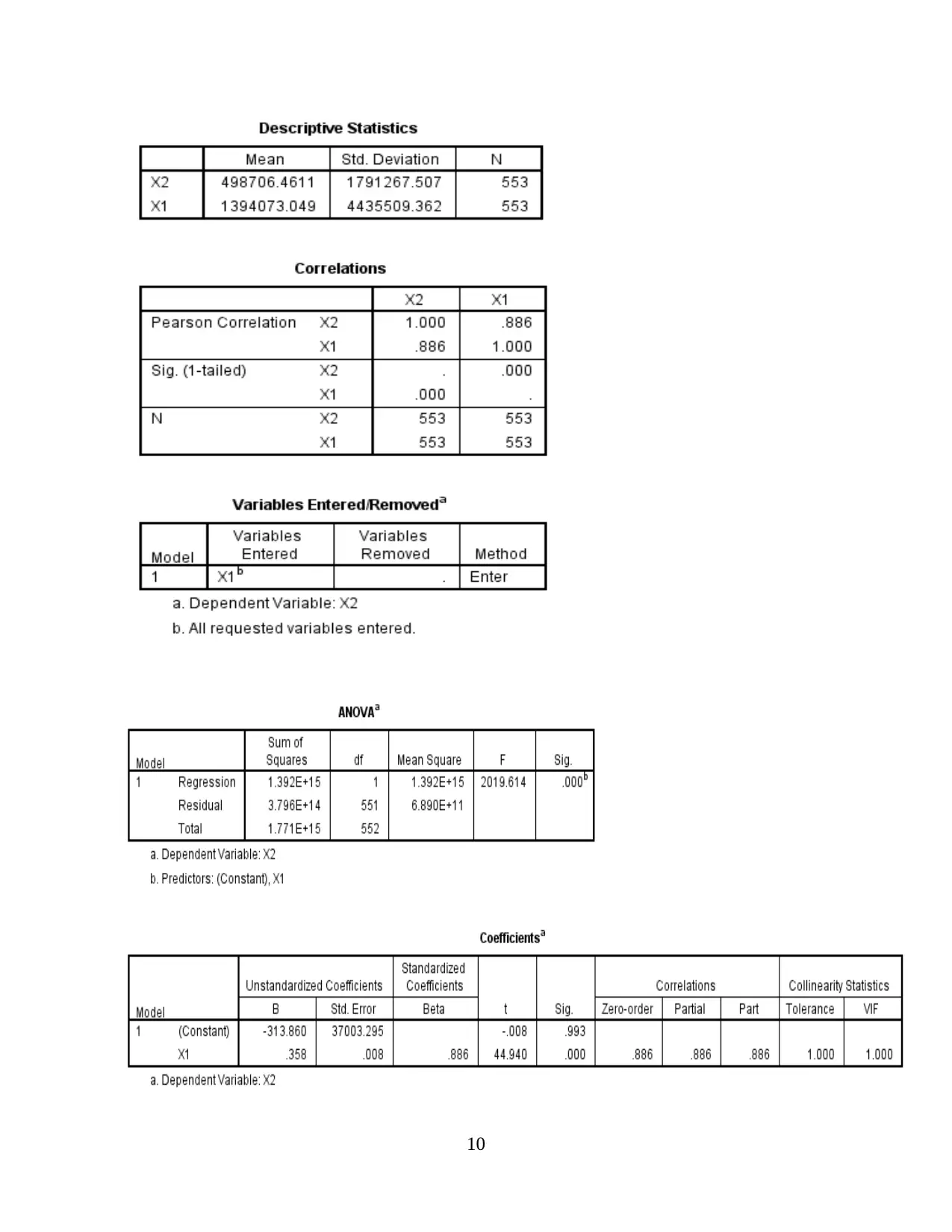

4. Evaluation of significance with initial model

H1: Shareholders fund (X1) and Debtors (X2).

Ha: Shareholder’s get increased in compared to debtors

H0: Shareholders do not get increased compared to debtors

9

H1: Shareholders fund (X1) and Debtors (X2).

Ha: Shareholder’s get increased in compared to debtors

H0: Shareholders do not get increased compared to debtors

9

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.