Business Statistics Assignment: Sample Analysis and Conclusion

VerifiedAdded on 2020/03/28

|12

|2331

|39

Homework Assignment

AI Summary

This document presents a business statistics assignment completed by a student, covering various statistical concepts and techniques. The assignment includes analyzing datasets, creating scatterplots, and calculating regression equations to determine relationships between variables like income and annual contributions. It involves using pivot tables in Excel to find summary statistics for different investment types, calculating sample proportions and differences, and constructing graphs to compare proportions. Furthermore, the assignment covers hypothesis testing, calculating z-scores and p-values, and determining confidence intervals. The student also analyzes their own dataset to find sample statistics, generate graphs, and interpret relationships between variables. Finally, the assignment concludes with a summary of risk and return, including calculations and interpretations based on a provided case study and dataset.

Business Statistics

Name

Institution

Instructor

22nd September 2017

Allocated sample number: 107

1

Name

Institution

Instructor

22nd September 2017

Allocated sample number: 107

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 1

Use the dataset given below you must use the sample allocated to you based on your student

number

https://app.box.com/s/56pb6hqu0ypcg0f3lhy6cl5szt1jgdla

Note that for section 1 the answers are provided so you can check your work, the answers will

not be provided for the other sections.

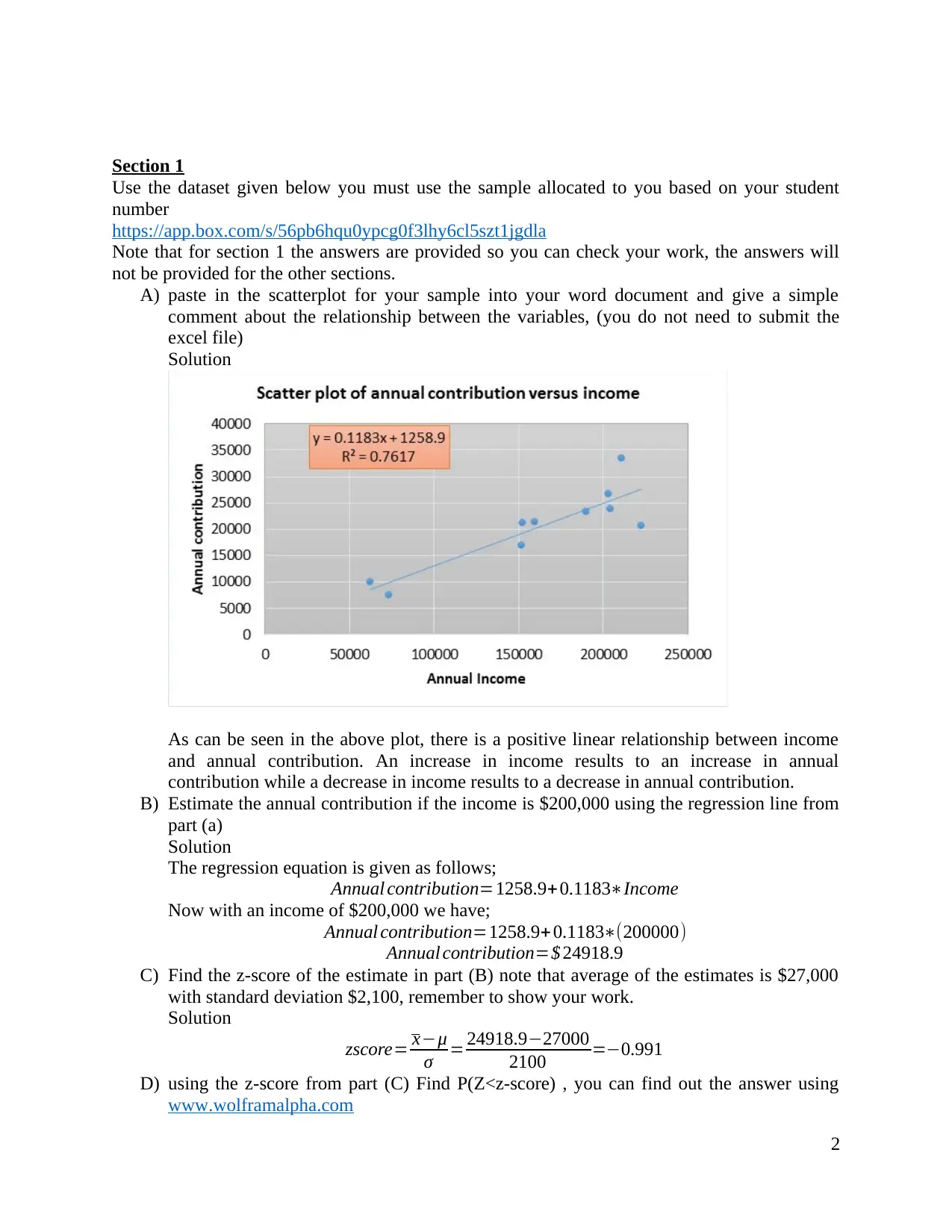

A) paste in the scatterplot for your sample into your word document and give a simple

comment about the relationship between the variables, (you do not need to submit the

excel file)

Solution

As can be seen in the above plot, there is a positive linear relationship between income

and annual contribution. An increase in income results to an increase in annual

contribution while a decrease in income results to a decrease in annual contribution.

B) Estimate the annual contribution if the income is $200,000 using the regression line from

part (a)

Solution

The regression equation is given as follows;

Annual contribution=1258.9+0.1183∗Income

Now with an income of $200,000 we have;

Annual contribution=1258.9+ 0.1183∗(200000)

Annual contribution=$ 24918.9

C) Find the z-score of the estimate in part (B) note that average of the estimates is $27,000

with standard deviation $2,100, remember to show your work.

Solution

zscore= x−μ

σ = 24918.9−27000

2100 =−0.991

D) using the z-score from part (C) Find P(Z<z-score) , you can find out the answer using

www.wolframalpha.com

2

Use the dataset given below you must use the sample allocated to you based on your student

number

https://app.box.com/s/56pb6hqu0ypcg0f3lhy6cl5szt1jgdla

Note that for section 1 the answers are provided so you can check your work, the answers will

not be provided for the other sections.

A) paste in the scatterplot for your sample into your word document and give a simple

comment about the relationship between the variables, (you do not need to submit the

excel file)

Solution

As can be seen in the above plot, there is a positive linear relationship between income

and annual contribution. An increase in income results to an increase in annual

contribution while a decrease in income results to a decrease in annual contribution.

B) Estimate the annual contribution if the income is $200,000 using the regression line from

part (a)

Solution

The regression equation is given as follows;

Annual contribution=1258.9+0.1183∗Income

Now with an income of $200,000 we have;

Annual contribution=1258.9+ 0.1183∗(200000)

Annual contribution=$ 24918.9

C) Find the z-score of the estimate in part (B) note that average of the estimates is $27,000

with standard deviation $2,100, remember to show your work.

Solution

zscore= x−μ

σ = 24918.9−27000

2100 =−0.991

D) using the z-score from part (C) Find P(Z<z-score) , you can find out the answer using

www.wolframalpha.com

2

for example found the z-score was 1.5 if the z-score is 1.5 type in

P(Z<1.5)

into wolfram alpha.com

Solution

P( Z< zscore)=P( Z ←0.991)=0.16 08

E) If there was a list of 10,000 estimates ranked from lowest to highest, what rank do you

think your estimate would be close to?

Hint: just use the formula

expected rank = P(Z<z-score)*10000, remember to show your work.

Solution

Expected rank =P(Z < zscore )∗10000

Expected rank =0.1608∗10000=16 08

Section 2

Use the dataset given below you must use the sample allocated to you based on your student

number

https://app.box.com/s/yvhk3e3oymbs3toy6j5xetid82dsjyz4

A) Use the PivotTable feature in excel to find appropriate summary statistics for your

sample, This will probably require two PivotTables. You should paste both into word,

you do not need the excel file.

Make sure the pivot table (or pivot tables) include the following statistics

*Just considering the high risk (riskier type) investments what is the sample size n1 and

the proportion of high risk investments that made a loss ^p1

*Just considering the low risk (safer type) investments what is the sample size =n2 and

What is the proportion of low risk investments that made a loss ^p2

Solution

Count of made a loss (L or P)? Column Labels

Row Labels L P Grand Total

r 19 56 75

s 1 24 25

Grand Total 20 80 100

High risk investment

Sample size n1 is 75

Proportion that made a loss ^p1 is 19

75 =0.2533

Low risk investments,

Sample size n2 is 25

Proportion that made a loss ^p2 is 1

25 =0.0 4

3

P(Z<1.5)

into wolfram alpha.com

Solution

P( Z< zscore)=P( Z ←0.991)=0.16 08

E) If there was a list of 10,000 estimates ranked from lowest to highest, what rank do you

think your estimate would be close to?

Hint: just use the formula

expected rank = P(Z<z-score)*10000, remember to show your work.

Solution

Expected rank =P(Z < zscore )∗10000

Expected rank =0.1608∗10000=16 08

Section 2

Use the dataset given below you must use the sample allocated to you based on your student

number

https://app.box.com/s/yvhk3e3oymbs3toy6j5xetid82dsjyz4

A) Use the PivotTable feature in excel to find appropriate summary statistics for your

sample, This will probably require two PivotTables. You should paste both into word,

you do not need the excel file.

Make sure the pivot table (or pivot tables) include the following statistics

*Just considering the high risk (riskier type) investments what is the sample size n1 and

the proportion of high risk investments that made a loss ^p1

*Just considering the low risk (safer type) investments what is the sample size =n2 and

What is the proportion of low risk investments that made a loss ^p2

Solution

Count of made a loss (L or P)? Column Labels

Row Labels L P Grand Total

r 19 56 75

s 1 24 25

Grand Total 20 80 100

High risk investment

Sample size n1 is 75

Proportion that made a loss ^p1 is 19

75 =0.2533

Low risk investments,

Sample size n2 is 25

Proportion that made a loss ^p2 is 1

25 =0.0 4

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

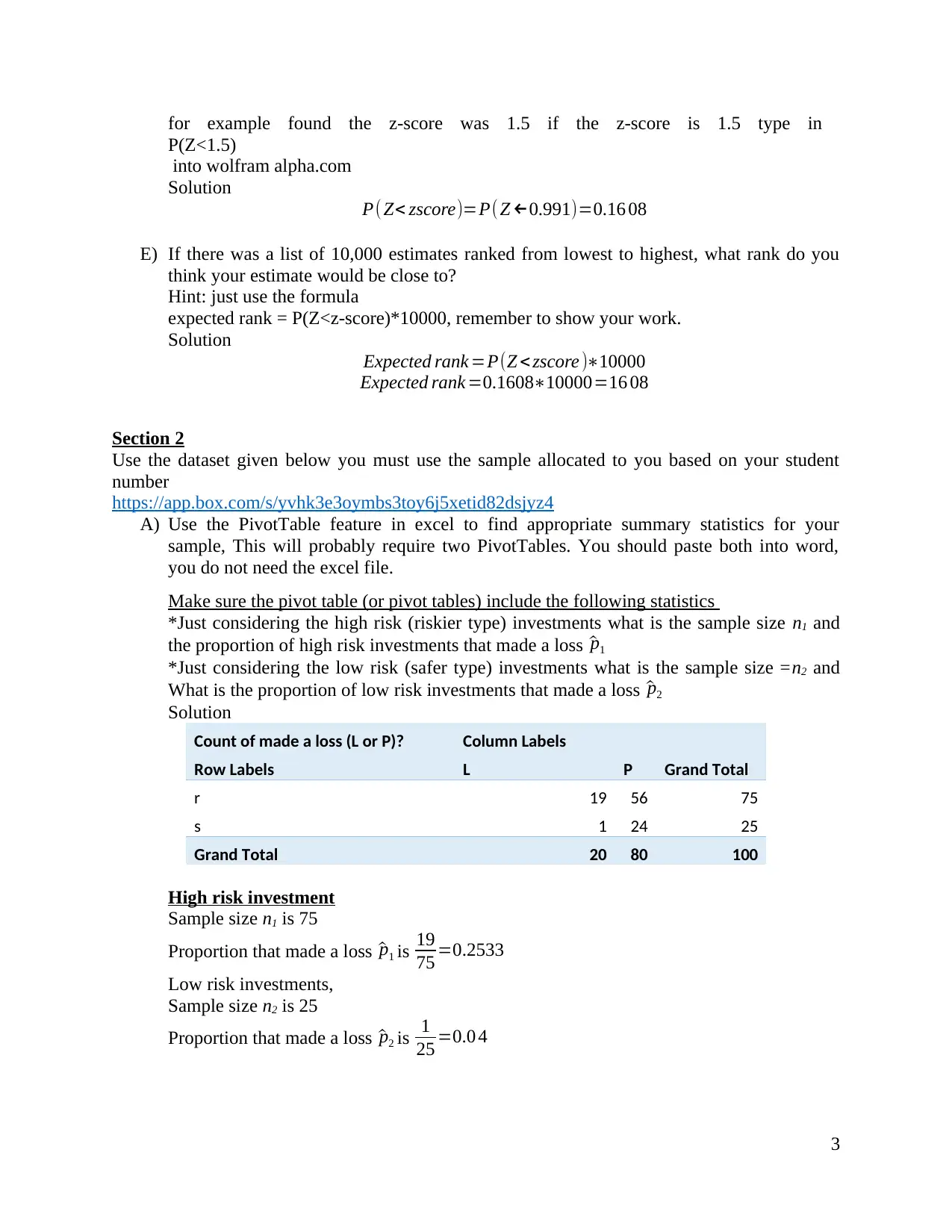

B) Use excel to make an appropriate graph that lets you compare the proportions found in

parts A and paste this into your word document

Solution

C) Looking at your answers to parts (A) and (B) Make a simple comment about the

relationship between the variables investment type (risk or safe) and Made a profit (made

a profit/made a loss)

Solution

Clearly a huge proportion (96%) of safer investments made profits as compared to riskier

investments (74.7%)

D) Questions

i) Using your sample what is the estimate for p1- p2? In other words what is the

difference between the sample proportions ^p1 - ^p2

Solution

^p1− ^p2

¿ 0.2533−0.04=0.2133

ii) Find the z-score of the estimate in part (i) note that average of the estimates is 0.1

with standard deviation 0.0743

Solution

0.2133

√ 0.1 ( 1−0.1 ) ( 1

75 + 1

25 ) =3.0787

iii) Using part (ii) find P(Z<z-score) using www.wolframalpha.com for example if

the z-score is 0.5 type in P(Z<0.5)” into wolframalpha.com

Solution

P(Z< 3.0787)=0.9990

4

parts A and paste this into your word document

Solution

C) Looking at your answers to parts (A) and (B) Make a simple comment about the

relationship between the variables investment type (risk or safe) and Made a profit (made

a profit/made a loss)

Solution

Clearly a huge proportion (96%) of safer investments made profits as compared to riskier

investments (74.7%)

D) Questions

i) Using your sample what is the estimate for p1- p2? In other words what is the

difference between the sample proportions ^p1 - ^p2

Solution

^p1− ^p2

¿ 0.2533−0.04=0.2133

ii) Find the z-score of the estimate in part (i) note that average of the estimates is 0.1

with standard deviation 0.0743

Solution

0.2133

√ 0.1 ( 1−0.1 ) ( 1

75 + 1

25 ) =3.0787

iii) Using part (ii) find P(Z<z-score) using www.wolframalpha.com for example if

the z-score is 0.5 type in P(Z<0.5)” into wolframalpha.com

Solution

P(Z< 3.0787)=0.9990

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

iv) IF there was a list of 4000 estimates ranked from lowest to highest, roughly what

rank do you expect your estimate to have? Hint: just use the formula expected

rank = P(Z<z-score)*4000

Solution

Expected rank =P(Z <zscore )∗4000

Expected rank =0.9990∗4000=3996

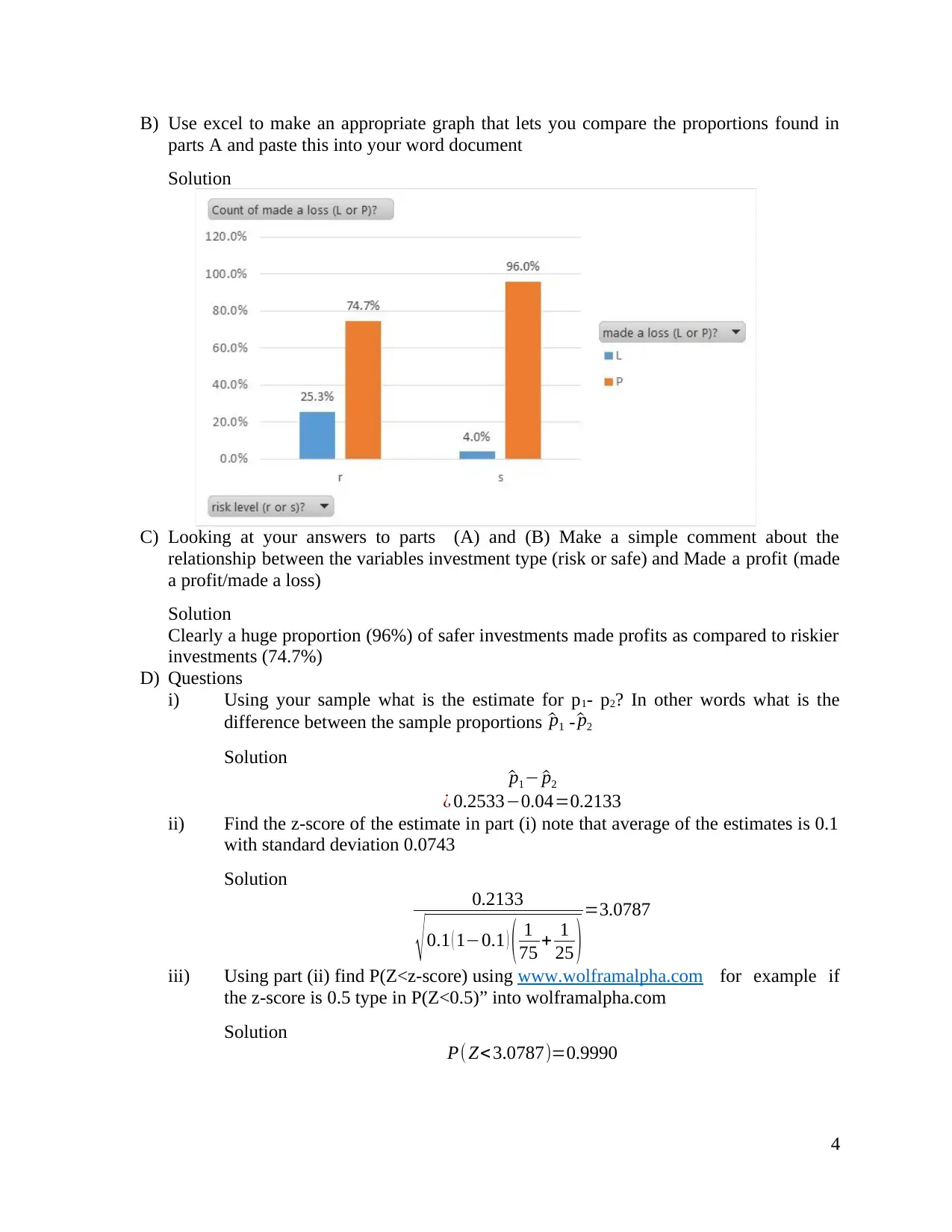

E) Test the claim there is a difference in the proportions use a 5% level of significance

i) State an appropriate H0 and H1

Solution

H0 : ^p1= ^p2

H1 : ^p1 ≠ ^p2

ii) Find the p-value Only using the answers to part (A) and the webpage

http://epitools.ausvet.com.au/content.php?page=z-test-2 Do NOT use any other

method to find the p-value. Do NOT use any other software package such as

SPSS or Analysis tookpak

Solution

Results

Sample 1 Sample 2 Difference

Sample proportion 0.2533 0.04 0.2133

95% CI (asymptotic) 0.1549 - 0.3517 -0.0368 - 0.1168 0.0323 - 0.3943

z-value 2.3

P-value 0.0209

Interpretation

Statistically significant,

reject null hypothesis that

sample proportions are equal

n by pi n * pi <=5, test inappropriate

5

rank do you expect your estimate to have? Hint: just use the formula expected

rank = P(Z<z-score)*4000

Solution

Expected rank =P(Z <zscore )∗4000

Expected rank =0.9990∗4000=3996

E) Test the claim there is a difference in the proportions use a 5% level of significance

i) State an appropriate H0 and H1

Solution

H0 : ^p1= ^p2

H1 : ^p1 ≠ ^p2

ii) Find the p-value Only using the answers to part (A) and the webpage

http://epitools.ausvet.com.au/content.php?page=z-test-2 Do NOT use any other

method to find the p-value. Do NOT use any other software package such as

SPSS or Analysis tookpak

Solution

Results

Sample 1 Sample 2 Difference

Sample proportion 0.2533 0.04 0.2133

95% CI (asymptotic) 0.1549 - 0.3517 -0.0368 - 0.1168 0.0323 - 0.3943

z-value 2.3

P-value 0.0209

Interpretation

Statistically significant,

reject null hypothesis that

sample proportions are equal

n by pi n * pi <=5, test inappropriate

5

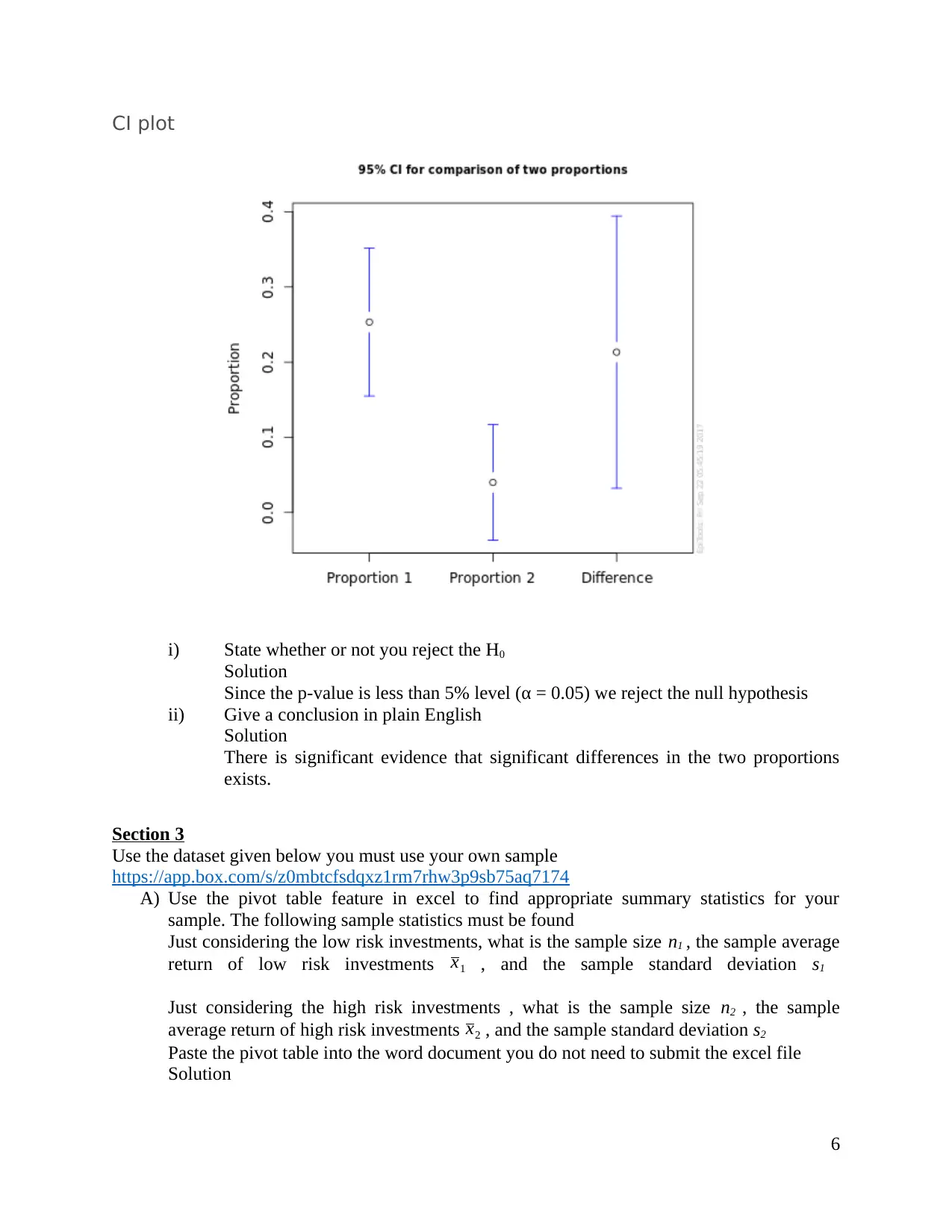

CI plot

i) State whether or not you reject the H0

Solution

Since the p-value is less than 5% level (α = 0.05) we reject the null hypothesis

ii) Give a conclusion in plain English

Solution

There is significant evidence that significant differences in the two proportions

exists.

Section 3

Use the dataset given below you must use your own sample

https://app.box.com/s/z0mbtcfsdqxz1rm7rhw3p9sb75aq7174

A) Use the pivot table feature in excel to find appropriate summary statistics for your

sample. The following sample statistics must be found

Just considering the low risk investments, what is the sample size n1 , the sample average

return of low risk investments x1 , and the sample standard deviation s1

Just considering the high risk investments , what is the sample size n2 , the sample

average return of high risk investments x2 , and the sample standard deviation s2

Paste the pivot table into the word document you do not need to submit the excel file

Solution

6

i) State whether or not you reject the H0

Solution

Since the p-value is less than 5% level (α = 0.05) we reject the null hypothesis

ii) Give a conclusion in plain English

Solution

There is significant evidence that significant differences in the two proportions

exists.

Section 3

Use the dataset given below you must use your own sample

https://app.box.com/s/z0mbtcfsdqxz1rm7rhw3p9sb75aq7174

A) Use the pivot table feature in excel to find appropriate summary statistics for your

sample. The following sample statistics must be found

Just considering the low risk investments, what is the sample size n1 , the sample average

return of low risk investments x1 , and the sample standard deviation s1

Just considering the high risk investments , what is the sample size n2 , the sample

average return of high risk investments x2 , and the sample standard deviation s2

Paste the pivot table into the word document you do not need to submit the excel file

Solution

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

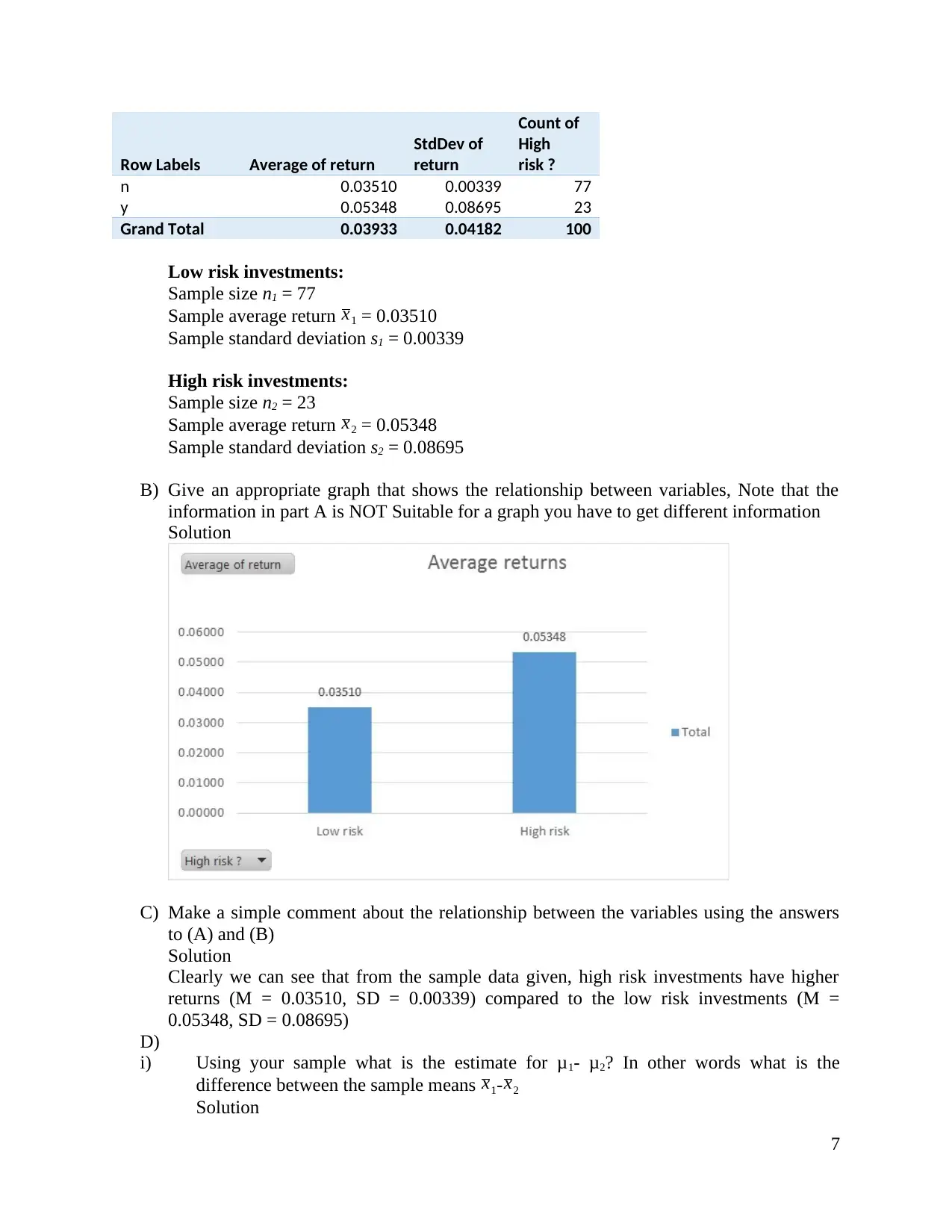

Row Labels Average of return

StdDev of

return

Count of

High

risk ?

n 0.03510 0.00339 77

y 0.05348 0.08695 23

Grand Total 0.03933 0.04182 100

Low risk investments:

Sample size n1 = 77

Sample average return x1 = 0.03510

Sample standard deviation s1 = 0.00339

High risk investments:

Sample size n2 = 23

Sample average return x2 = 0.05348

Sample standard deviation s2 = 0.08695

B) Give an appropriate graph that shows the relationship between variables, Note that the

information in part A is NOT Suitable for a graph you have to get different information

Solution

C) Make a simple comment about the relationship between the variables using the answers

to (A) and (B)

Solution

Clearly we can see that from the sample data given, high risk investments have higher

returns (M = 0.03510, SD = 0.00339) compared to the low risk investments (M =

0.05348, SD = 0.08695)

D)

i) Using your sample what is the estimate for μ1- μ2? In other words what is the

difference between the sample means x1- x2

Solution

7

StdDev of

return

Count of

High

risk ?

n 0.03510 0.00339 77

y 0.05348 0.08695 23

Grand Total 0.03933 0.04182 100

Low risk investments:

Sample size n1 = 77

Sample average return x1 = 0.03510

Sample standard deviation s1 = 0.00339

High risk investments:

Sample size n2 = 23

Sample average return x2 = 0.05348

Sample standard deviation s2 = 0.08695

B) Give an appropriate graph that shows the relationship between variables, Note that the

information in part A is NOT Suitable for a graph you have to get different information

Solution

C) Make a simple comment about the relationship between the variables using the answers

to (A) and (B)

Solution

Clearly we can see that from the sample data given, high risk investments have higher

returns (M = 0.03510, SD = 0.00339) compared to the low risk investments (M =

0.05348, SD = 0.08695)

D)

i) Using your sample what is the estimate for μ1- μ2? In other words what is the

difference between the sample means x1- x2

Solution

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

x1- x2=¿0.03510-0.05348 = -0.01838

ii) Find the z-score of the estimate in part (i) note that average of the estimates -0.0256

with standard deviation 0.0173

Solution

Z=−0.01838−(−0.0256)

0.0173 =0.4173

iii) Using part (ii) What is P(Z<z-score), you can find out the answer using

www.wolframalpha.com

for example if the z-score =-1 type in

P(Z<-1) into wolfram alpha

Solution

P(Z<z-score)= P(Z<0.4173) = 0.6618

iv) If there was a list of 2000 estimates ranked from lowest to highest, what rank do you

think your would be close to, hint just use the formula

expected rank = P(Z<z-score)*2000

Solution

Expected rank = P(Z<z-score)*2000 = 0.6618*2000 = 1324

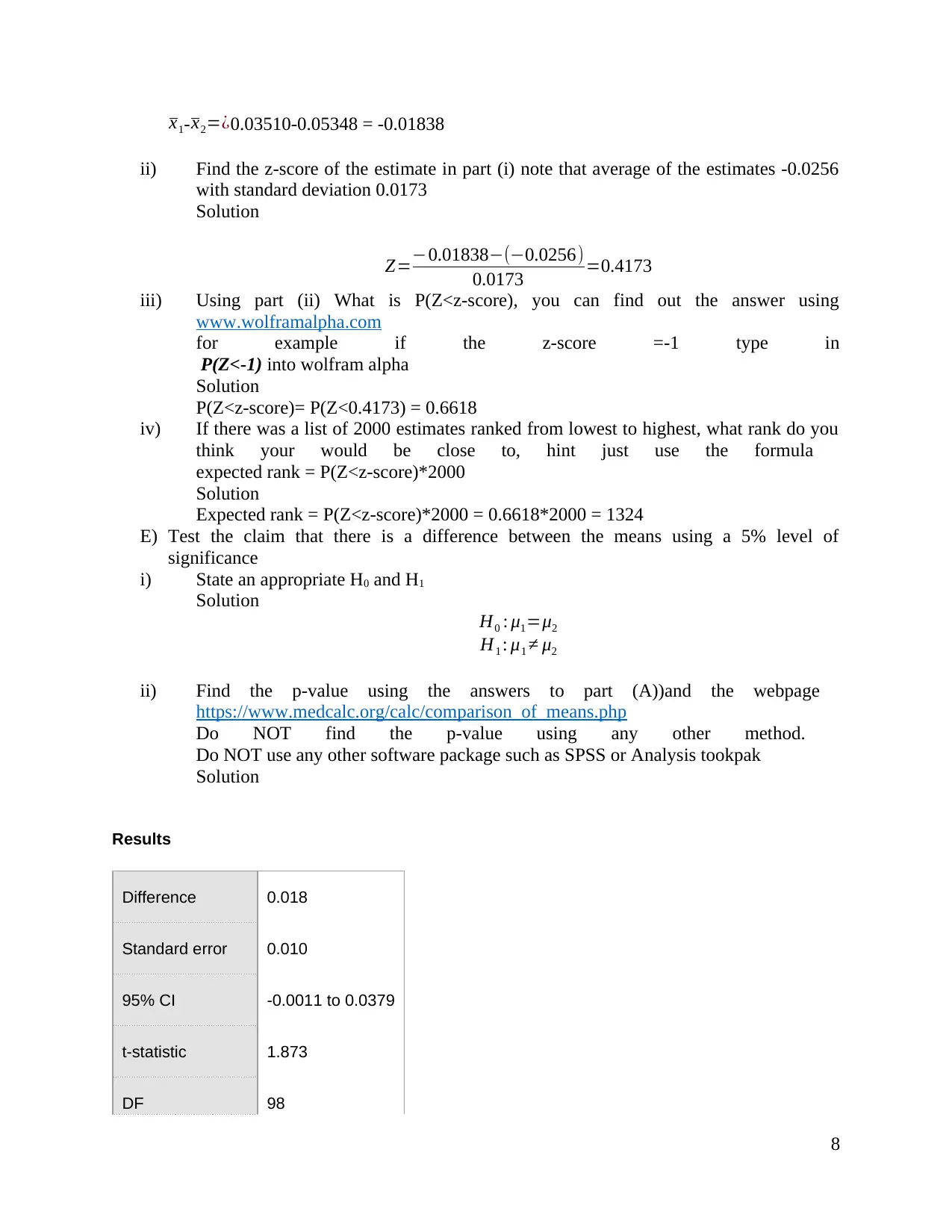

E) Test the claim that there is a difference between the means using a 5% level of

significance

i) State an appropriate H0 and H1

Solution

H0 : μ1=μ2

H1 : μ1 ≠ μ2

ii) Find the p-value using the answers to part (A))and the webpage

https://www.medcalc.org/calc/comparison_of_means.php

Do NOT find the p-value using any other method.

Do NOT use any other software package such as SPSS or Analysis tookpak

Solution

Results

Difference 0.018

Standard error 0.010

95% CI -0.0011 to 0.0379

t-statistic 1.873

DF 98

8

ii) Find the z-score of the estimate in part (i) note that average of the estimates -0.0256

with standard deviation 0.0173

Solution

Z=−0.01838−(−0.0256)

0.0173 =0.4173

iii) Using part (ii) What is P(Z<z-score), you can find out the answer using

www.wolframalpha.com

for example if the z-score =-1 type in

P(Z<-1) into wolfram alpha

Solution

P(Z<z-score)= P(Z<0.4173) = 0.6618

iv) If there was a list of 2000 estimates ranked from lowest to highest, what rank do you

think your would be close to, hint just use the formula

expected rank = P(Z<z-score)*2000

Solution

Expected rank = P(Z<z-score)*2000 = 0.6618*2000 = 1324

E) Test the claim that there is a difference between the means using a 5% level of

significance

i) State an appropriate H0 and H1

Solution

H0 : μ1=μ2

H1 : μ1 ≠ μ2

ii) Find the p-value using the answers to part (A))and the webpage

https://www.medcalc.org/calc/comparison_of_means.php

Do NOT find the p-value using any other method.

Do NOT use any other software package such as SPSS or Analysis tookpak

Solution

Results

Difference 0.018

Standard error 0.010

95% CI -0.0011 to 0.0379

t-statistic 1.873

DF 98

8

Significance level P = 0.0641

iii) State whether or not you reject H0

Solution

The p-value is greater than the 5% level of significance (α = 0.05), we thus fail to

reject the null hypothesis

iv) Give a conclusion in plain English

Solution

We conclude that there is no significant evidence to make a claim that the differences

in the mean returns for the two investment types (low and high investments) is

statistically significant.

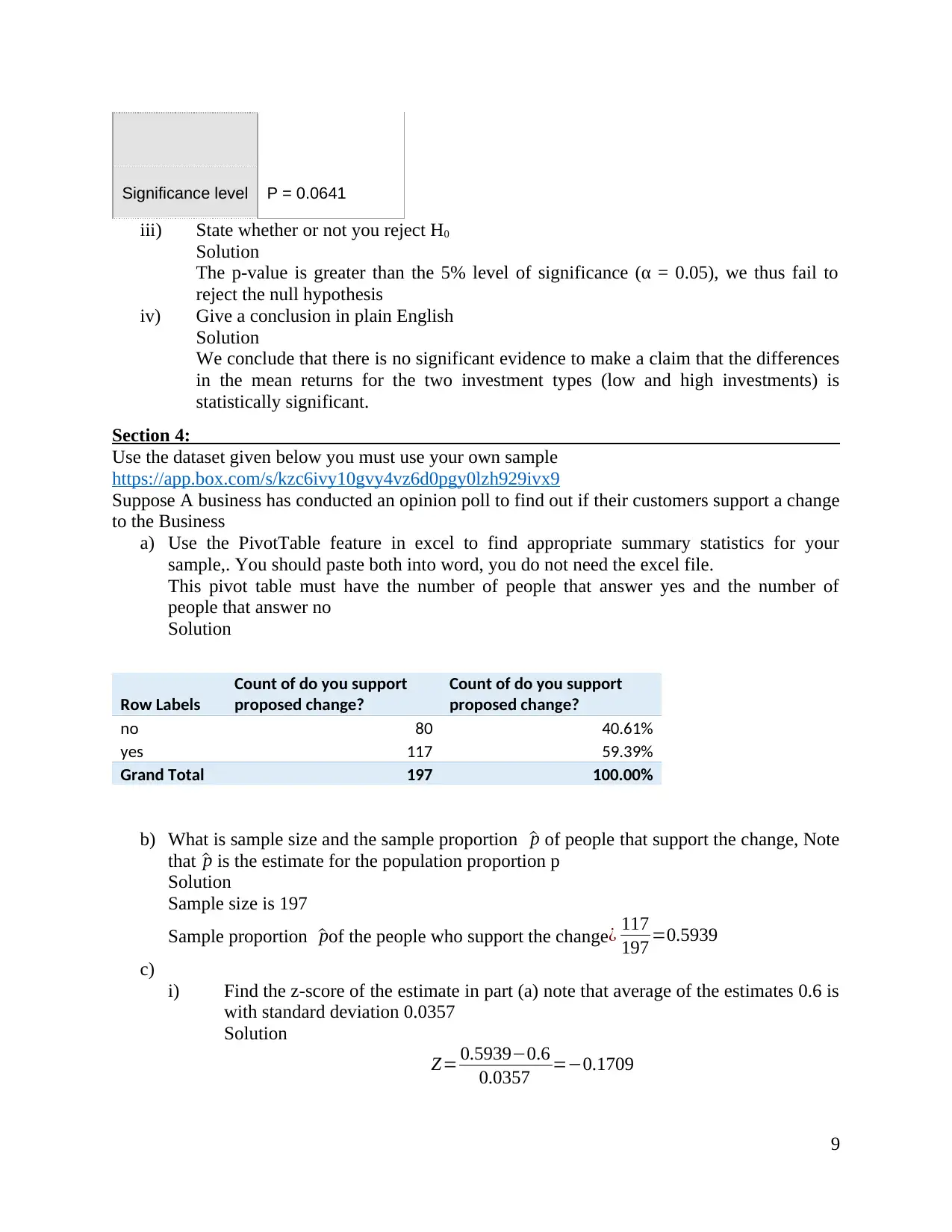

Section 4:

Use the dataset given below you must use your own sample

https://app.box.com/s/kzc6ivy10gvy4vz6d0pgy0lzh929ivx9

Suppose A business has conducted an opinion poll to find out if their customers support a change

to the Business

a) Use the PivotTable feature in excel to find appropriate summary statistics for your

sample,. You should paste both into word, you do not need the excel file.

This pivot table must have the number of people that answer yes and the number of

people that answer no

Solution

Row Labels

Count of do you support

proposed change?

Count of do you support

proposed change?

no 80 40.61%

yes 117 59.39%

Grand Total 197 100.00%

b) What is sample size and the sample proportion ^p of people that support the change, Note

that ^p is the estimate for the population proportion p

Solution

Sample size is 197

Sample proportion ^pof the people who support the change ¿ 117

197 =0.5939

c)

i) Find the z-score of the estimate in part (a) note that average of the estimates 0.6 is

with standard deviation 0.0357

Solution

Z= 0.5939−0.6

0.0357 =−0.1709

9

iii) State whether or not you reject H0

Solution

The p-value is greater than the 5% level of significance (α = 0.05), we thus fail to

reject the null hypothesis

iv) Give a conclusion in plain English

Solution

We conclude that there is no significant evidence to make a claim that the differences

in the mean returns for the two investment types (low and high investments) is

statistically significant.

Section 4:

Use the dataset given below you must use your own sample

https://app.box.com/s/kzc6ivy10gvy4vz6d0pgy0lzh929ivx9

Suppose A business has conducted an opinion poll to find out if their customers support a change

to the Business

a) Use the PivotTable feature in excel to find appropriate summary statistics for your

sample,. You should paste both into word, you do not need the excel file.

This pivot table must have the number of people that answer yes and the number of

people that answer no

Solution

Row Labels

Count of do you support

proposed change?

Count of do you support

proposed change?

no 80 40.61%

yes 117 59.39%

Grand Total 197 100.00%

b) What is sample size and the sample proportion ^p of people that support the change, Note

that ^p is the estimate for the population proportion p

Solution

Sample size is 197

Sample proportion ^pof the people who support the change ¿ 117

197 =0.5939

c)

i) Find the z-score of the estimate in part (a) note that average of the estimates 0.6 is

with standard deviation 0.0357

Solution

Z= 0.5939−0.6

0.0357 =−0.1709

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ii) Using part (i) what is P(Z<z-score) you can find out the answer using

www.wolframalpha.com

For example if the z-score is 2 then enter P(Z<2) into www.wolframalpha.com

Solution

P(Z<z-score) = P(Z< -0.1709) = 0.4322

iii) If there was a list of 1000 estimates ranked from lowest to highest, what rank do

you think your would be close to, hint just use the formula

expected rank = P(Z<z-score)*1000

Solution

Expected rank = P(Z<z-score)*1000 = 0.4322*1000 = 433

d) Find a 95% confidence interval for the proportion of people that support the change

Solution

𝑆.𝐸ሺ𝑝Ƹሻ= ඨ𝑝Ƹ(1 − 𝑝Ƹ)

𝑛 = ඨ0.5939ሺ1 − 0.5939ሻ

219 = ξ0.001101 = 0.033186

95% confidence interval

0.5939 ± 1.96 ∗0.033186

0.5939 ± 0.065045

Lower bound = 0.528855

Upper bound = 0.658945

Section 5

a) You have to obtain your own dataset,

Solution

Data is in excel

b) Paste the dataset and your summary into the word file, you do not need to submit the

excel file

add a very brief comment

Solution

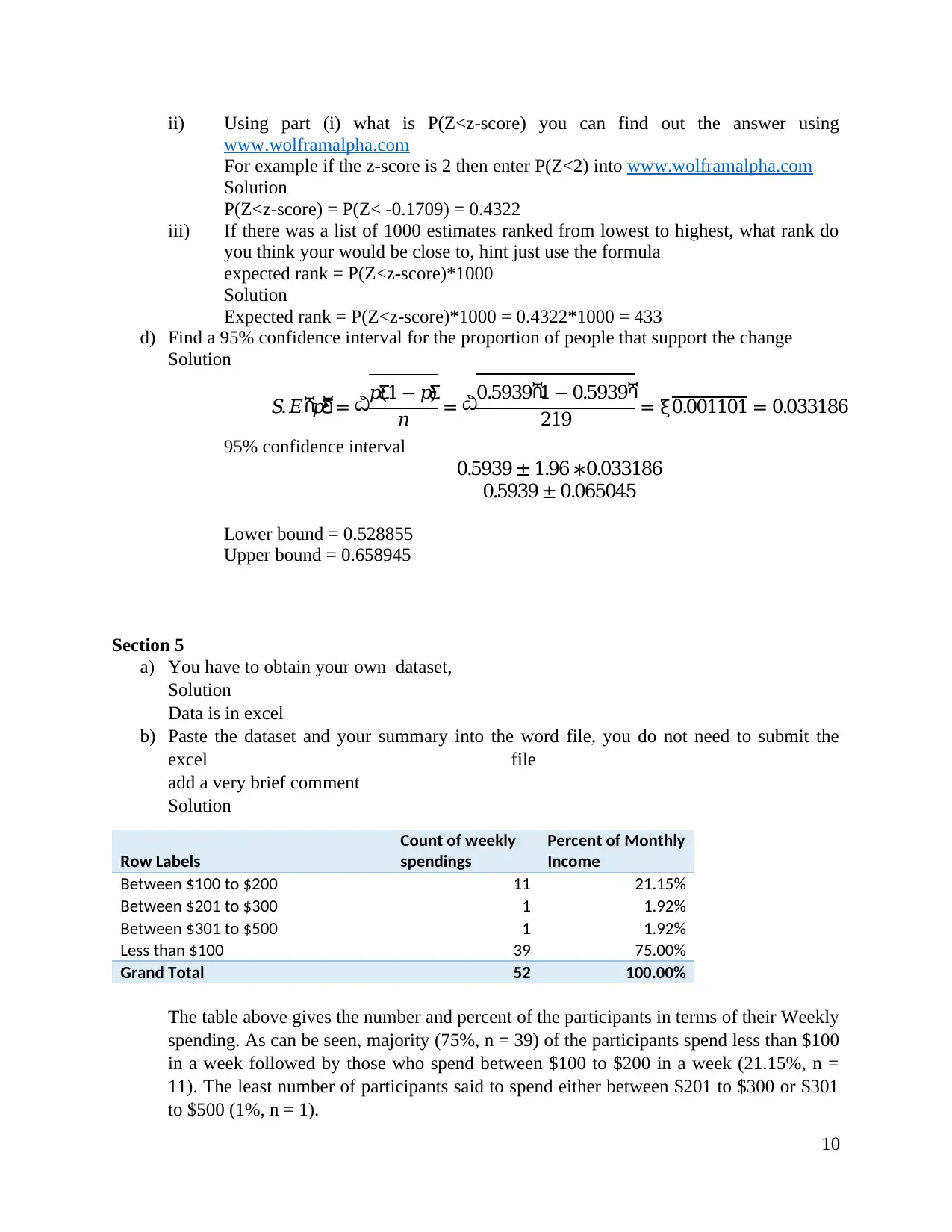

Row Labels

Count of weekly

spendings

Percent of Monthly

Income

Between $100 to $200 11 21.15%

Between $201 to $300 1 1.92%

Between $301 to $500 1 1.92%

Less than $100 39 75.00%

Grand Total 52 100.00%

The table above gives the number and percent of the participants in terms of their Weekly

spending. As can be seen, majority (75%, n = 39) of the participants spend less than $100

in a week followed by those who spend between $100 to $200 in a week (21.15%, n =

11). The least number of participants said to spend either between $201 to $300 or $301

to $500 (1%, n = 1).

10

www.wolframalpha.com

For example if the z-score is 2 then enter P(Z<2) into www.wolframalpha.com

Solution

P(Z<z-score) = P(Z< -0.1709) = 0.4322

iii) If there was a list of 1000 estimates ranked from lowest to highest, what rank do

you think your would be close to, hint just use the formula

expected rank = P(Z<z-score)*1000

Solution

Expected rank = P(Z<z-score)*1000 = 0.4322*1000 = 433

d) Find a 95% confidence interval for the proportion of people that support the change

Solution

𝑆.𝐸ሺ𝑝Ƹሻ= ඨ𝑝Ƹ(1 − 𝑝Ƹ)

𝑛 = ඨ0.5939ሺ1 − 0.5939ሻ

219 = ξ0.001101 = 0.033186

95% confidence interval

0.5939 ± 1.96 ∗0.033186

0.5939 ± 0.065045

Lower bound = 0.528855

Upper bound = 0.658945

Section 5

a) You have to obtain your own dataset,

Solution

Data is in excel

b) Paste the dataset and your summary into the word file, you do not need to submit the

excel file

add a very brief comment

Solution

Row Labels

Count of weekly

spendings

Percent of Monthly

Income

Between $100 to $200 11 21.15%

Between $201 to $300 1 1.92%

Between $301 to $500 1 1.92%

Less than $100 39 75.00%

Grand Total 52 100.00%

The table above gives the number and percent of the participants in terms of their Weekly

spending. As can be seen, majority (75%, n = 39) of the participants spend less than $100

in a week followed by those who spend between $100 to $200 in a week (21.15%, n =

11). The least number of participants said to spend either between $201 to $300 or $301

to $500 (1%, n = 1).

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

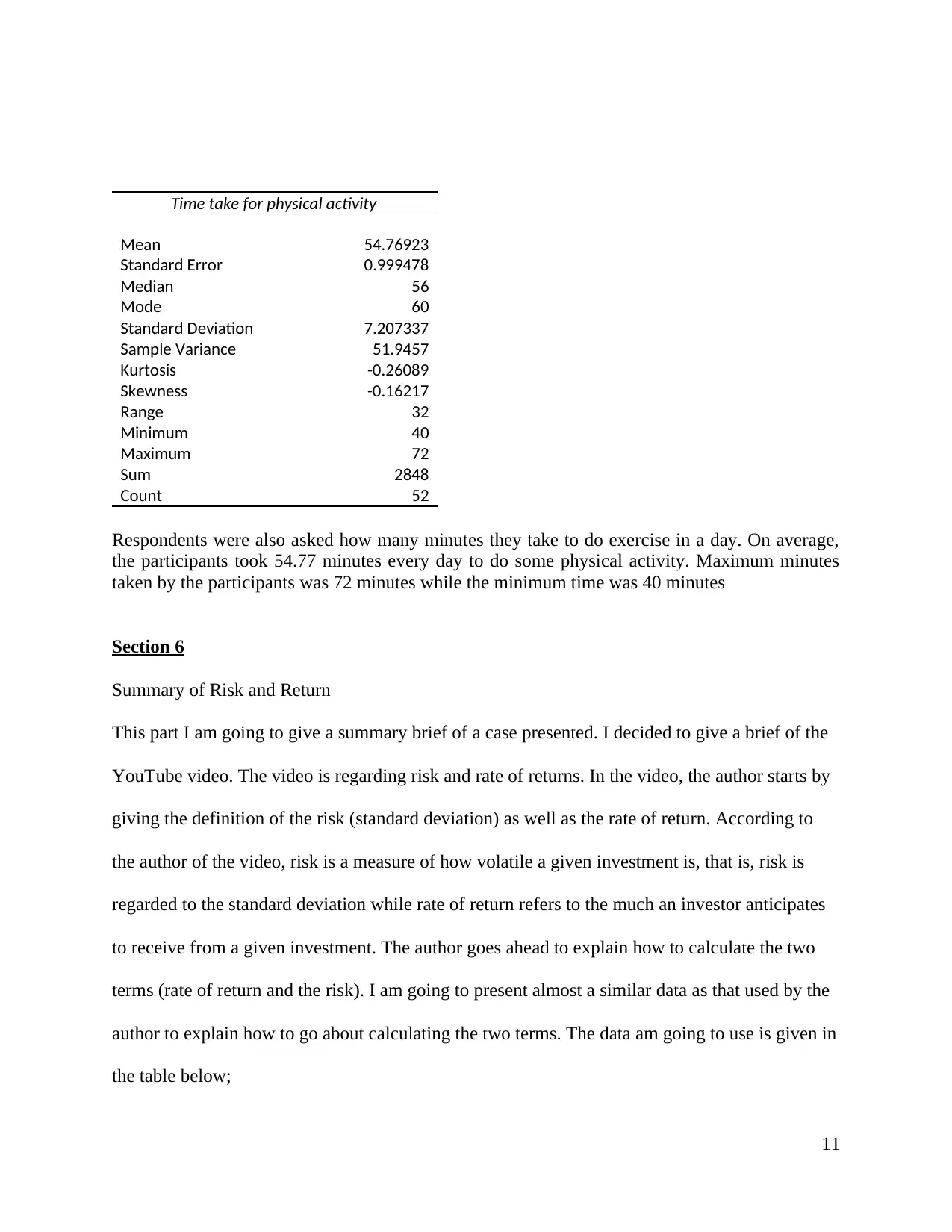

Time take for physical activity

Mean 54.76923

Standard Error 0.999478

Median 56

Mode 60

Standard Deviation 7.207337

Sample Variance 51.9457

Kurtosis -0.26089

Skewness -0.16217

Range 32

Minimum 40

Maximum 72

Sum 2848

Count 52

Respondents were also asked how many minutes they take to do exercise in a day. On average,

the participants took 54.77 minutes every day to do some physical activity. Maximum minutes

taken by the participants was 72 minutes while the minimum time was 40 minutes

Section 6

Summary of Risk and Return

This part I am going to give a summary brief of a case presented. I decided to give a brief of the

YouTube video. The video is regarding risk and rate of returns. In the video, the author starts by

giving the definition of the risk (standard deviation) as well as the rate of return. According to

the author of the video, risk is a measure of how volatile a given investment is, that is, risk is

regarded to the standard deviation while rate of return refers to the much an investor anticipates

to receive from a given investment. The author goes ahead to explain how to calculate the two

terms (rate of return and the risk). I am going to present almost a similar data as that used by the

author to explain how to go about calculating the two terms. The data am going to use is given in

the table below;

11

Mean 54.76923

Standard Error 0.999478

Median 56

Mode 60

Standard Deviation 7.207337

Sample Variance 51.9457

Kurtosis -0.26089

Skewness -0.16217

Range 32

Minimum 40

Maximum 72

Sum 2848

Count 52

Respondents were also asked how many minutes they take to do exercise in a day. On average,

the participants took 54.77 minutes every day to do some physical activity. Maximum minutes

taken by the participants was 72 minutes while the minimum time was 40 minutes

Section 6

Summary of Risk and Return

This part I am going to give a summary brief of a case presented. I decided to give a brief of the

YouTube video. The video is regarding risk and rate of returns. In the video, the author starts by

giving the definition of the risk (standard deviation) as well as the rate of return. According to

the author of the video, risk is a measure of how volatile a given investment is, that is, risk is

regarded to the standard deviation while rate of return refers to the much an investor anticipates

to receive from a given investment. The author goes ahead to explain how to calculate the two

terms (rate of return and the risk). I am going to present almost a similar data as that used by the

author to explain how to go about calculating the two terms. The data am going to use is given in

the table below;

11

Demand for

company’s product

(1)

Probability of

demand occurring

(2)

Rate of Return on

Stock (3)

Weak 0.2 40%

Normal 0.3 30%

Strong 0.5 20%

Expected rate of return=∑

i=1

n

Pi Ri

Expected rate of return= ( 0.2∗0.4 ) + ( 0.3∗0.3 ) + ( 0.5∗0.2 )=0.08+0.09+0.10=0.27=27 %

The author computes the risk (standard deviation) as follows;

Standard Deviation=σ= √∑

i=1

n

( ri− ^r )2 pi

√ ∑

i=1

n

( ri − ^r )

2 pi = √ ( 0.4−0.27 ) 2 0.3+ ( 0.1−0.27 ) 2 0.4 + ( 0.2−0.27 ) 2 0.3= √ 0.0181=0.1345=13.45 %

A case where the probability values are not provided, the author explain on how to go about such

a situation;

Standard Deviation=σ= √∑

i=1

n

( ri− ^ravg )2

n−1

He gave an example of where we have 25%, 10% , 15% and 25% with ^ravg =2 0 %

Standard Deviation=σ= √ (0.25−0.2)2+(0.1−0.2)2 +( 0.15−0.2)2+(0.25−0.2)2

4−1 = √ 0.005833=0.0764=7.64 %

12

company’s product

(1)

Probability of

demand occurring

(2)

Rate of Return on

Stock (3)

Weak 0.2 40%

Normal 0.3 30%

Strong 0.5 20%

Expected rate of return=∑

i=1

n

Pi Ri

Expected rate of return= ( 0.2∗0.4 ) + ( 0.3∗0.3 ) + ( 0.5∗0.2 )=0.08+0.09+0.10=0.27=27 %

The author computes the risk (standard deviation) as follows;

Standard Deviation=σ= √∑

i=1

n

( ri− ^r )2 pi

√ ∑

i=1

n

( ri − ^r )

2 pi = √ ( 0.4−0.27 ) 2 0.3+ ( 0.1−0.27 ) 2 0.4 + ( 0.2−0.27 ) 2 0.3= √ 0.0181=0.1345=13.45 %

A case where the probability values are not provided, the author explain on how to go about such

a situation;

Standard Deviation=σ= √∑

i=1

n

( ri− ^ravg )2

n−1

He gave an example of where we have 25%, 10% , 15% and 25% with ^ravg =2 0 %

Standard Deviation=σ= √ (0.25−0.2)2+(0.1−0.2)2 +( 0.15−0.2)2+(0.25−0.2)2

4−1 = √ 0.005833=0.0764=7.64 %

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.