Corporate Social Responsibility and Environmental Management

VerifiedAdded on 2020/10/22

|19

|6654

|285

AI Summary

This assignment delves into the realm of corporate social responsibility (CSR) and environmental management, examining the role of businesses in addressing societal and environmental challenges. The provided references and readings cover a range of topics, from university-industry linkages to sustainable branding and energy security. The assignment is likely geared towards students in business, management, or related fields, aiming to equip them with a deeper understanding of CSR and environmental management principles and practices.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

BUSINESS STRATEGY

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

Impact and Influence of macro environment on the business.....................................................3

TASK 2............................................................................................................................................7

Internal Environment and Capabilities of BP Oil Company.......................................................7

TASK 3............................................................................................................................................9

Evaluating the competitive forces that influences the BP Oil Company....................................9

TASK 4..........................................................................................................................................11

Strategic direction available for the company. .........................................................................11

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

Impact and Influence of macro environment on the business.....................................................3

TASK 2............................................................................................................................................7

Internal Environment and Capabilities of BP Oil Company.......................................................7

TASK 3............................................................................................................................................9

Evaluating the competitive forces that influences the BP Oil Company....................................9

TASK 4..........................................................................................................................................11

Strategic direction available for the company. .........................................................................11

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Business Strategy is the core management function. It is a set priorities for the company

and management team as well as help to attract and retain talented workers that a firm needs. The

combination of all the decisions taken and actions performed by the business to execute the

business goals and to secure a competitive position in the market (Begg, Van der Woerd and

Levy, 2018). It is fact that achieving the business objectives without business strategy is like a

dream that never comes true. In today's business environment, business strategy is becoming

apparent with the continuous rising competition.

This present report is context to the BP Oil company. It is a public limited company

operating in Oil and Gas industry founded in 1909 by William Knows D'Arcy. The British

Petroleum company plc is a British multinational oil and gas company (BP Oil Company, 2019).

London is the headquarter of BP oil company. It is one of the world seven largest oil and gas

company whose performance in 2012 made it sixth largest energy company in the world.

This present report will analyse the impact and influence which external environment has

on BP oil company and its business strategies as well as assesses the internal environment and

capabilities of the company. Further, report will also cover the competitive forces company is

facing in the business environment. Thus, by conducting the business environmental analysis,

organisation will find and solve the reason for not meeting the demands of stakeholders by

formulating effective business strategies.

TASK 1

Impact and Influence of macro environment on the business.

Strategy:

Strategy is defined as the plan of action of designing a long term or overall aim of the

organisation. Business strategy is defined as the master plan that management of the company

used to secure the competitive position in the market to carry its operations (Ubini, 2019).

On the other hand, Thompson, Strickland and Gamble, (2015) said that, business strategy can be

referred to as the master plan that the management use to sure a competitive position in the

market carry on its operations, please customers and execute the desired goals of the business.

Role of Business Strategy to achieve the business objectives

Business Strategy is the very important for the success as well as to retain employees in

the business environment. Strategy helps organisation to achieve the desire goals and objectives

3

Business Strategy is the core management function. It is a set priorities for the company

and management team as well as help to attract and retain talented workers that a firm needs. The

combination of all the decisions taken and actions performed by the business to execute the

business goals and to secure a competitive position in the market (Begg, Van der Woerd and

Levy, 2018). It is fact that achieving the business objectives without business strategy is like a

dream that never comes true. In today's business environment, business strategy is becoming

apparent with the continuous rising competition.

This present report is context to the BP Oil company. It is a public limited company

operating in Oil and Gas industry founded in 1909 by William Knows D'Arcy. The British

Petroleum company plc is a British multinational oil and gas company (BP Oil Company, 2019).

London is the headquarter of BP oil company. It is one of the world seven largest oil and gas

company whose performance in 2012 made it sixth largest energy company in the world.

This present report will analyse the impact and influence which external environment has

on BP oil company and its business strategies as well as assesses the internal environment and

capabilities of the company. Further, report will also cover the competitive forces company is

facing in the business environment. Thus, by conducting the business environmental analysis,

organisation will find and solve the reason for not meeting the demands of stakeholders by

formulating effective business strategies.

TASK 1

Impact and Influence of macro environment on the business.

Strategy:

Strategy is defined as the plan of action of designing a long term or overall aim of the

organisation. Business strategy is defined as the master plan that management of the company

used to secure the competitive position in the market to carry its operations (Ubini, 2019).

On the other hand, Thompson, Strickland and Gamble, (2015) said that, business strategy can be

referred to as the master plan that the management use to sure a competitive position in the

market carry on its operations, please customers and execute the desired goals of the business.

Role of Business Strategy to achieve the business objectives

Business Strategy is the very important for the success as well as to retain employees in

the business environment. Strategy helps organisation to achieve the desire goals and objectives

3

of the organisation. BP oil company is facing serious challenges operating the business like not

meeting the demands of stakeholders, losing the key employees and some other issues a well. So

company is to establish their business strategies as it helps in following way:

Planning: Business strategies is the core and fundamental part of business plan. All the goals

and objectives are set in the business plan to achieve. Strategies provides the path to fulfils the

business goals.

Competitive Advantage: Business strategies also helps in capitalising on the capabilities of the

business as well as utilize it as competitive advantage to position the brand in a strategic manner.

It also provides a unique image in the eye of customers that will give strategic direction to the

company.

Pestle Analysis of BP Oil Company

Pestle Analysis is one of the best tool to track the forces in business environment. Pestle

analysis is also used as the different strategic planning tool used by the company. BP oil is also

going to use Pestle analysis in order to track the factors influencing the operations and function

of the company (Feng, Morgan and Rego, 2017). There are six major factors which are included

in Pestle analysis which are as follows-

Political Factors: This factors includes government policies, foreign trade policies,

taxation laws, environment and labour laws, political stability and instability and many others.

These elements of the political factors influences the way business operates in the business. UK

has stable political situation of the nation which is one of the biggest advantage of expanding the

business and gaining profitability as organisation do not have to bring changes accordingly. On

the other hand, due to changing demands of oil and geopolitical variability energy market in the

world are getting quite unstable that is creating threat for BP Oil company. Governments of

different counties are choosing more sustainable forms of energy due to climate destabilisation

from emission of carbon dioxide. However, BP oil company can also conduct ethical practices

and can save the reputation of the business and meet the needs of stakeholders.

Economic Factors: This factor includes economic growth, interest rates, exchange rates,

inflation and so on. These factors also influences the operation and functions of BP oil company.

The positive advantage of this factor is that the economy of the many nations is depends of BP

oil company as it largely support the economy and this creates an opportunity for BP Oil

company to meet the needs of stakeholders of various nations.

4

meeting the demands of stakeholders, losing the key employees and some other issues a well. So

company is to establish their business strategies as it helps in following way:

Planning: Business strategies is the core and fundamental part of business plan. All the goals

and objectives are set in the business plan to achieve. Strategies provides the path to fulfils the

business goals.

Competitive Advantage: Business strategies also helps in capitalising on the capabilities of the

business as well as utilize it as competitive advantage to position the brand in a strategic manner.

It also provides a unique image in the eye of customers that will give strategic direction to the

company.

Pestle Analysis of BP Oil Company

Pestle Analysis is one of the best tool to track the forces in business environment. Pestle

analysis is also used as the different strategic planning tool used by the company. BP oil is also

going to use Pestle analysis in order to track the factors influencing the operations and function

of the company (Feng, Morgan and Rego, 2017). There are six major factors which are included

in Pestle analysis which are as follows-

Political Factors: This factors includes government policies, foreign trade policies,

taxation laws, environment and labour laws, political stability and instability and many others.

These elements of the political factors influences the way business operates in the business. UK

has stable political situation of the nation which is one of the biggest advantage of expanding the

business and gaining profitability as organisation do not have to bring changes accordingly. On

the other hand, due to changing demands of oil and geopolitical variability energy market in the

world are getting quite unstable that is creating threat for BP Oil company. Governments of

different counties are choosing more sustainable forms of energy due to climate destabilisation

from emission of carbon dioxide. However, BP oil company can also conduct ethical practices

and can save the reputation of the business and meet the needs of stakeholders.

Economic Factors: This factor includes economic growth, interest rates, exchange rates,

inflation and so on. These factors also influences the operation and functions of BP oil company.

The positive advantage of this factor is that the economy of the many nations is depends of BP

oil company as it largely support the economy and this creates an opportunity for BP Oil

company to meet the needs of stakeholders of various nations.

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Social Factors: This factor includes socio-cultural factors like population growth, age

distribution, career attitudes, health consciousness and so on. It is very important for BP oil

company to understand the social factors as it leads to direct impact on the organisation

profitability and market share. The challenges of not meeting the demands of stakeholder is

because of the impact of social factors also, so it is important that include social factors while

making business strategies. The demand of CNG gas is increasing in the society, BP oil company

can take this as an opportunity as society is highly health conscious so they will prefer to

purchase the CNG products. By providing CNG products to BP oil company they will meet the

needs of stakeholders like society, employees, government etc.

Technological Factors: This factors included automation and innovation in the industry

and it influences the market and industry. The demand of alternative energy is rising and

integration with market needs is to be done only through advance technology. Technology is one

of the key factor in raising the competition in the market (Alrazi, De Villiers and Van Staden,

2016). BP oil has put their great contribution in reducing the green house gas emission by using

advance technologies in UK. The negative report of BP oil company ranging from the explosion

of the organisation’s deep-water drilling horizon, uncontrolled oil gushing from the BP oil

drilling reek into the ocean putting aquatic life at a high risk and these issues can only be save by

sing advance technologies within operations. On the other hand, rapid changing of technology

sometimes leads to negative impact on the BP oil company as it raises the cost of operations

which has become threat for the organisation.

Environmental Factors: The most important factor for oil and gas company is

environmental factors and the reason for its significance is scarcity or depleting of natural

resources like raw materials, ethical practices for businesses, pollution tagetes, carbon foot print

targets which is formulated by government as depletion of natural resources affects the operation

of the company. Government of UK has formulated the Environment Protection act 1990, Wilde-

life and Country side Act 1981. Furthermore, explosion of the organisation’s deep-water drilling

horizon, uncontrolled oil gushing from the BP oil is also creating high threat for environment and

it becomes s a challenge for the company to manage the pollution so that thye can meet the needs

of stakeholders. BP oil company can add these elements in the business strategies so that they

can meet the stakeholders demand. However, BP Oil has cut 40 percent of green house emission

by using the nuclear power.

5

distribution, career attitudes, health consciousness and so on. It is very important for BP oil

company to understand the social factors as it leads to direct impact on the organisation

profitability and market share. The challenges of not meeting the demands of stakeholder is

because of the impact of social factors also, so it is important that include social factors while

making business strategies. The demand of CNG gas is increasing in the society, BP oil company

can take this as an opportunity as society is highly health conscious so they will prefer to

purchase the CNG products. By providing CNG products to BP oil company they will meet the

needs of stakeholders like society, employees, government etc.

Technological Factors: This factors included automation and innovation in the industry

and it influences the market and industry. The demand of alternative energy is rising and

integration with market needs is to be done only through advance technology. Technology is one

of the key factor in raising the competition in the market (Alrazi, De Villiers and Van Staden,

2016). BP oil has put their great contribution in reducing the green house gas emission by using

advance technologies in UK. The negative report of BP oil company ranging from the explosion

of the organisation’s deep-water drilling horizon, uncontrolled oil gushing from the BP oil

drilling reek into the ocean putting aquatic life at a high risk and these issues can only be save by

sing advance technologies within operations. On the other hand, rapid changing of technology

sometimes leads to negative impact on the BP oil company as it raises the cost of operations

which has become threat for the organisation.

Environmental Factors: The most important factor for oil and gas company is

environmental factors and the reason for its significance is scarcity or depleting of natural

resources like raw materials, ethical practices for businesses, pollution tagetes, carbon foot print

targets which is formulated by government as depletion of natural resources affects the operation

of the company. Government of UK has formulated the Environment Protection act 1990, Wilde-

life and Country side Act 1981. Furthermore, explosion of the organisation’s deep-water drilling

horizon, uncontrolled oil gushing from the BP oil is also creating high threat for environment and

it becomes s a challenge for the company to manage the pollution so that thye can meet the needs

of stakeholders. BP oil company can add these elements in the business strategies so that they

can meet the stakeholders demand. However, BP Oil has cut 40 percent of green house emission

by using the nuclear power.

5

Legal Factors: This factor includes all the laws and regulations to conduct the

operations. UK government is highly concern about the policies regarding health and safety. At

the same time, government of UK is highly concerned for the employees of oil and gas

companies because they are working in highly dangerous department like drilling of oil and

petroleum, exploration and disposal. Employees are key stakeholders of BP oil company, so

company should add for employees sake to make them satisfied (Hamilton and Webster, 2018).

If BP oil company do not follow the laws and regulations than it will create threat for the

organisation as it directly impact in the image of the company and sometimes it leads to seas of

the businesses. But on the other hand, if BP oil follow the laws and regulation it will create

opportunity to raise the corporate image.

From the above external analysis, it has been understood that factors of macro

environment is rendering both positive and negative impact on the businesses that also infuces

the business decisions of BP oil company.

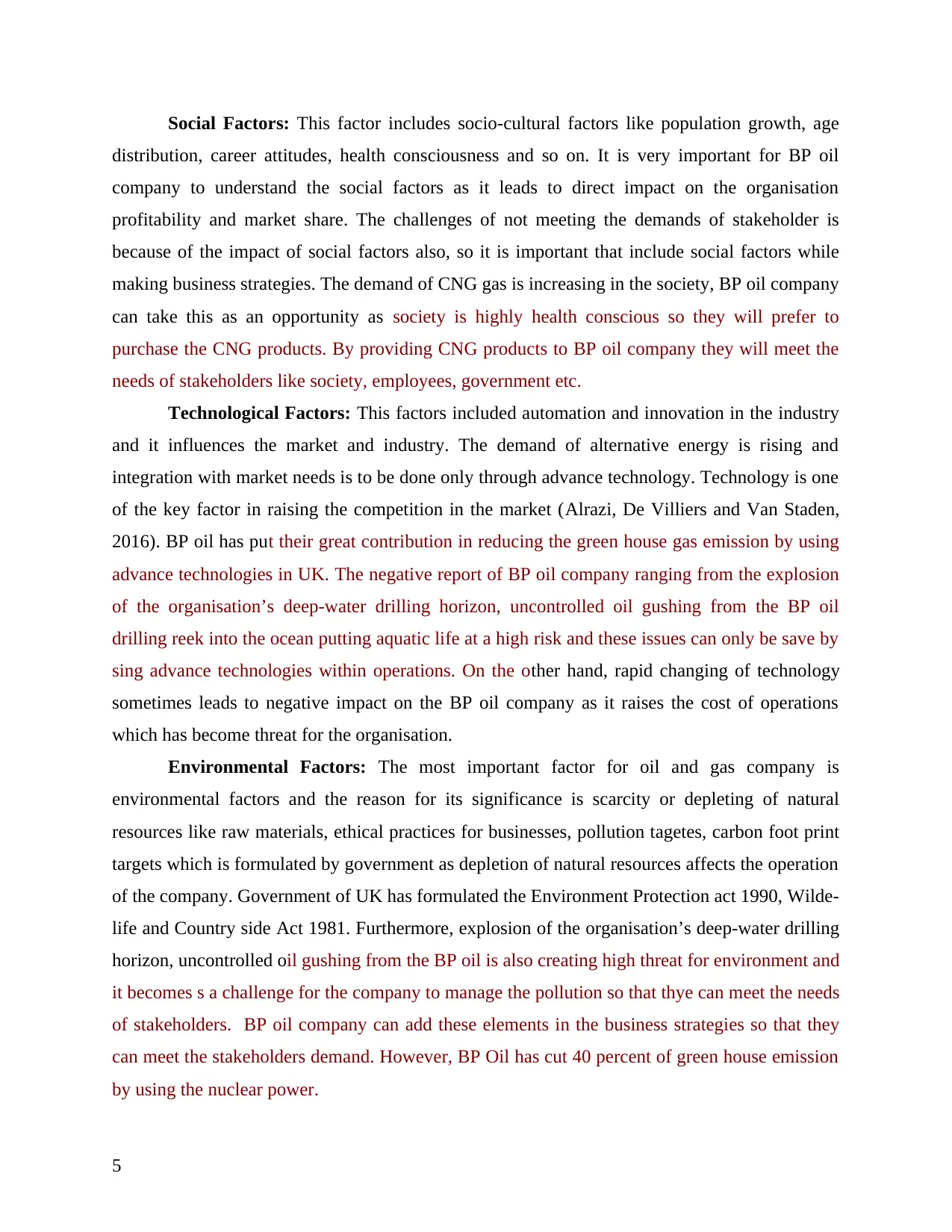

SWOT Analysis

STRENGTH

Strong International Presence

BP has number of retail brands and

subsidiaries like ARCO, BP Express,

BP Connect and any other that provides

diversified revenue.

Highly Skilled Workers (Crystal,

2016).

WEAKNESSES

Dissatisfied Stakeholders of BP oil

company as key workers are leaving

their jobs.

Employee Turnover is getting high

because of decreasing reputation.

Long term debt is increasing.

Petrol pricing are increasing in UK

(Wadud, 2016).

OPPORTUNITIES

Have Potential to become market

leaders through organic or alternative

energy and fuel market (Ottman, 2017).

Business expansion in new

geographical area.

Could launch easy prices to customers

THREAT

Environmental issues are very high.

Threat of global carbon foot print

emission.

Threat of high competition from

Chevron and Shell (Begum and Pereira,

6

operations. UK government is highly concern about the policies regarding health and safety. At

the same time, government of UK is highly concerned for the employees of oil and gas

companies because they are working in highly dangerous department like drilling of oil and

petroleum, exploration and disposal. Employees are key stakeholders of BP oil company, so

company should add for employees sake to make them satisfied (Hamilton and Webster, 2018).

If BP oil company do not follow the laws and regulations than it will create threat for the

organisation as it directly impact in the image of the company and sometimes it leads to seas of

the businesses. But on the other hand, if BP oil follow the laws and regulation it will create

opportunity to raise the corporate image.

From the above external analysis, it has been understood that factors of macro

environment is rendering both positive and negative impact on the businesses that also infuces

the business decisions of BP oil company.

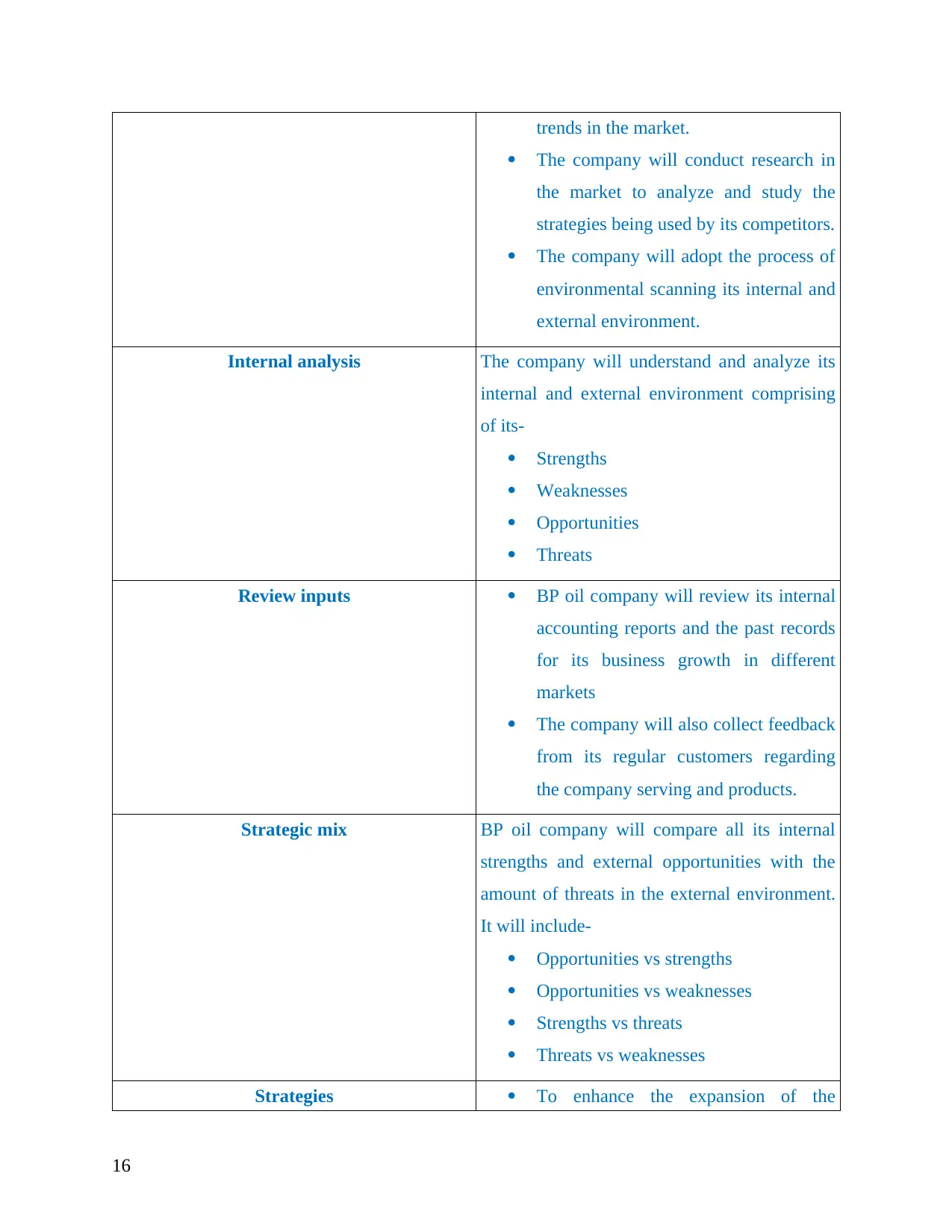

SWOT Analysis

STRENGTH

Strong International Presence

BP has number of retail brands and

subsidiaries like ARCO, BP Express,

BP Connect and any other that provides

diversified revenue.

Highly Skilled Workers (Crystal,

2016).

WEAKNESSES

Dissatisfied Stakeholders of BP oil

company as key workers are leaving

their jobs.

Employee Turnover is getting high

because of decreasing reputation.

Long term debt is increasing.

Petrol pricing are increasing in UK

(Wadud, 2016).

OPPORTUNITIES

Have Potential to become market

leaders through organic or alternative

energy and fuel market (Ottman, 2017).

Business expansion in new

geographical area.

Could launch easy prices to customers

THREAT

Environmental issues are very high.

Threat of global carbon foot print

emission.

Threat of high competition from

Chevron and Shell (Begum and Pereira,

6

to defeat rivals.

Highly demand of fuel and gases.

Could build corporate image by abiding

the laws and regulations.

2015).

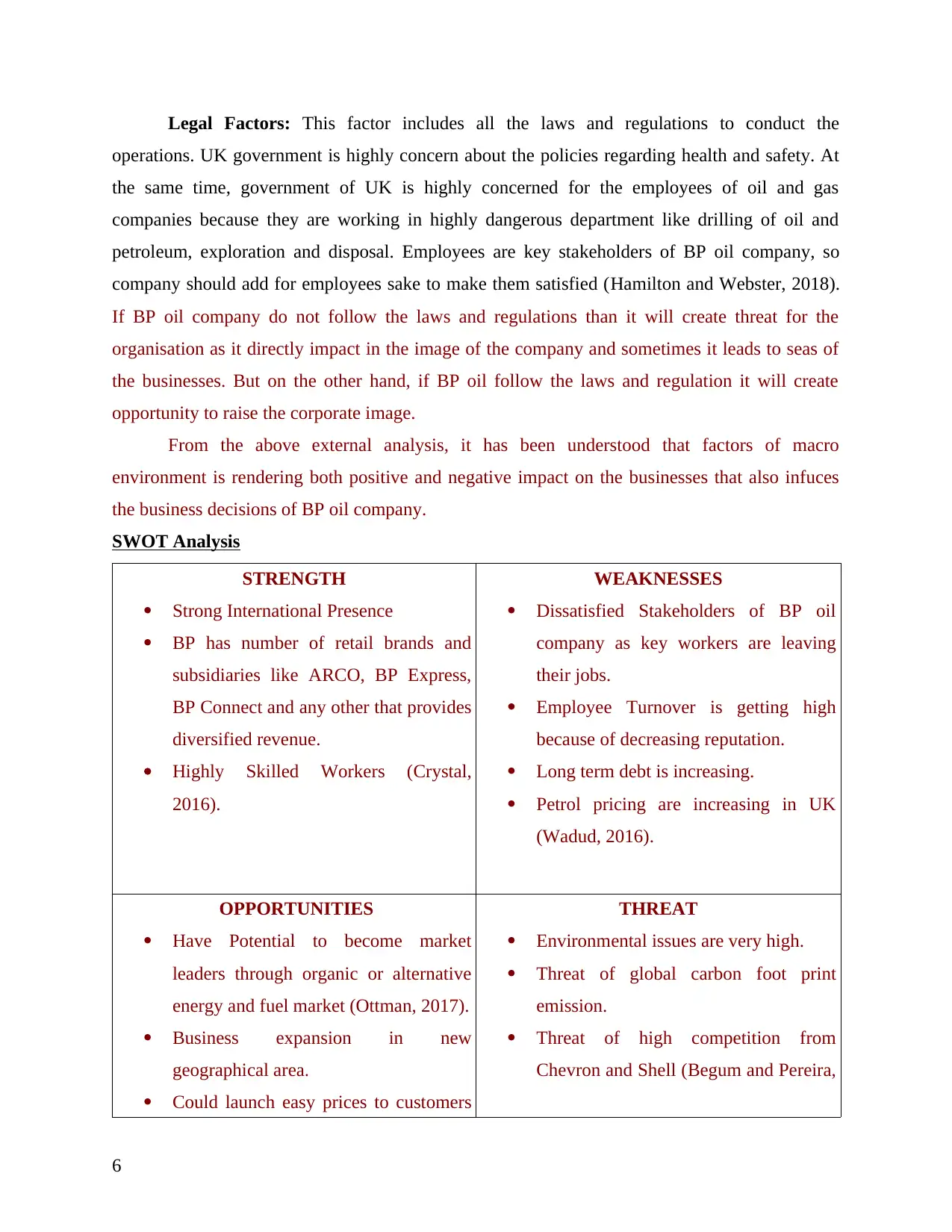

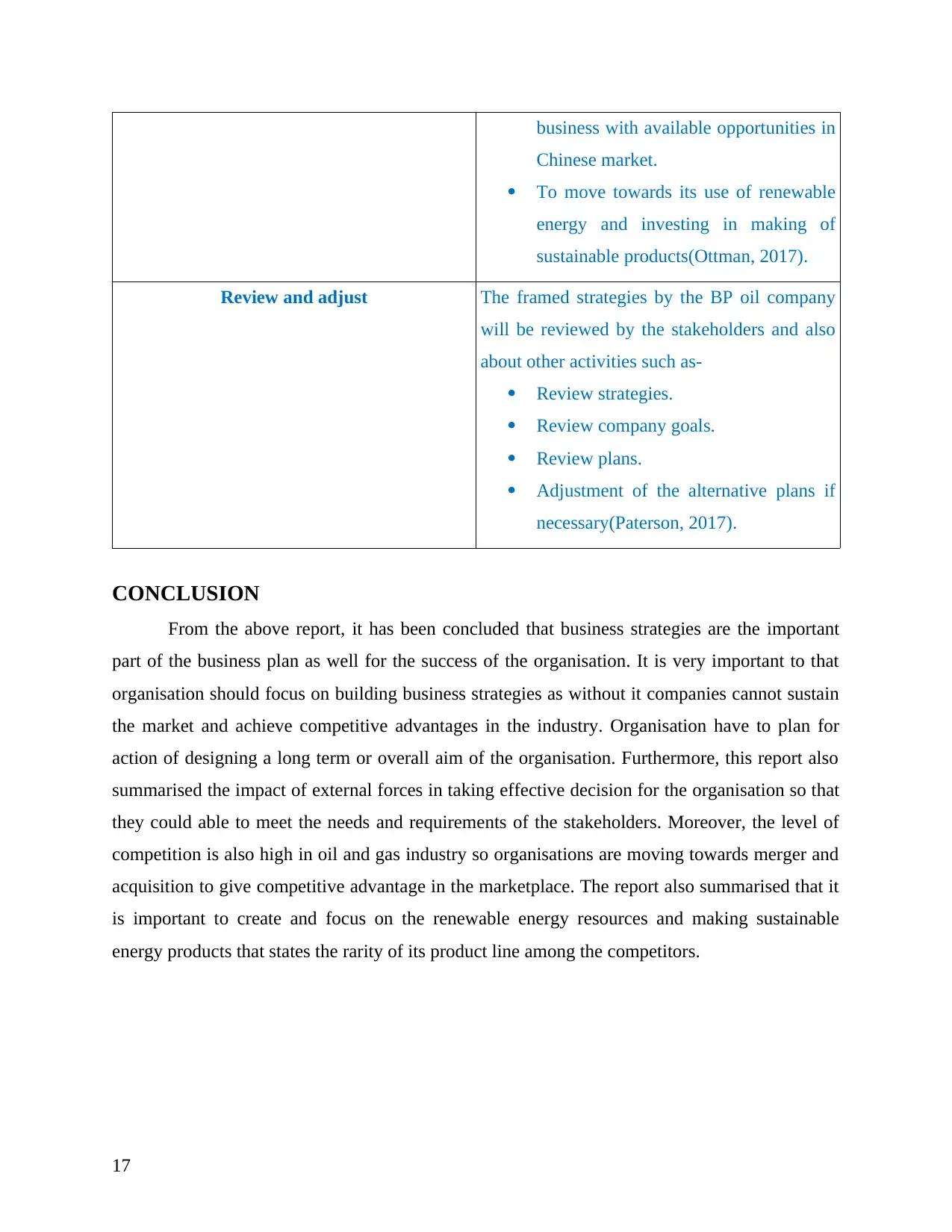

Stakeholders Mapping

Stakeholders mapping is very important for company to retain competitive in the business

environment. It is the process of assessing a system and potential changes as they relate to

relevant as well as interested parties.

Shareholder Mapping of BP Oil Company

Interest of

Stakehold

ers

KEEP COMPLETELY

INFORMED

Employees

Government

MANAGE MOST THOROUGHLY

Employees

Union

Shareholders

Directors

REGULAR MINIMAL CONTACT

Suppliers

Community & Society

Creditors

ANTICIPATE & MEET NEEDS

Customers

Employees

Shareholders

Influences of stakeholders -----------

From the above shareholders mapping, BP oil company can manage its stakeholder by

fulfilling there needs and demands.

Some important stakeholders of BP oil company.

Employees: Employees are the key stakeholders of the company and it is very important to keep

them completely informed, manage most thoroughly and anticipate and meet their needs.

Government: Government rely high pressure BP oil company as they have to take de scions as

per the policies and system of the government. On the other hand, it is also very important for BP

7

Highly demand of fuel and gases.

Could build corporate image by abiding

the laws and regulations.

2015).

Stakeholders Mapping

Stakeholders mapping is very important for company to retain competitive in the business

environment. It is the process of assessing a system and potential changes as they relate to

relevant as well as interested parties.

Shareholder Mapping of BP Oil Company

Interest of

Stakehold

ers

KEEP COMPLETELY

INFORMED

Employees

Government

MANAGE MOST THOROUGHLY

Employees

Union

Shareholders

Directors

REGULAR MINIMAL CONTACT

Suppliers

Community & Society

Creditors

ANTICIPATE & MEET NEEDS

Customers

Employees

Shareholders

Influences of stakeholders -----------

From the above shareholders mapping, BP oil company can manage its stakeholder by

fulfilling there needs and demands.

Some important stakeholders of BP oil company.

Employees: Employees are the key stakeholders of the company and it is very important to keep

them completely informed, manage most thoroughly and anticipate and meet their needs.

Government: Government rely high pressure BP oil company as they have to take de scions as

per the policies and system of the government. On the other hand, it is also very important for BP

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

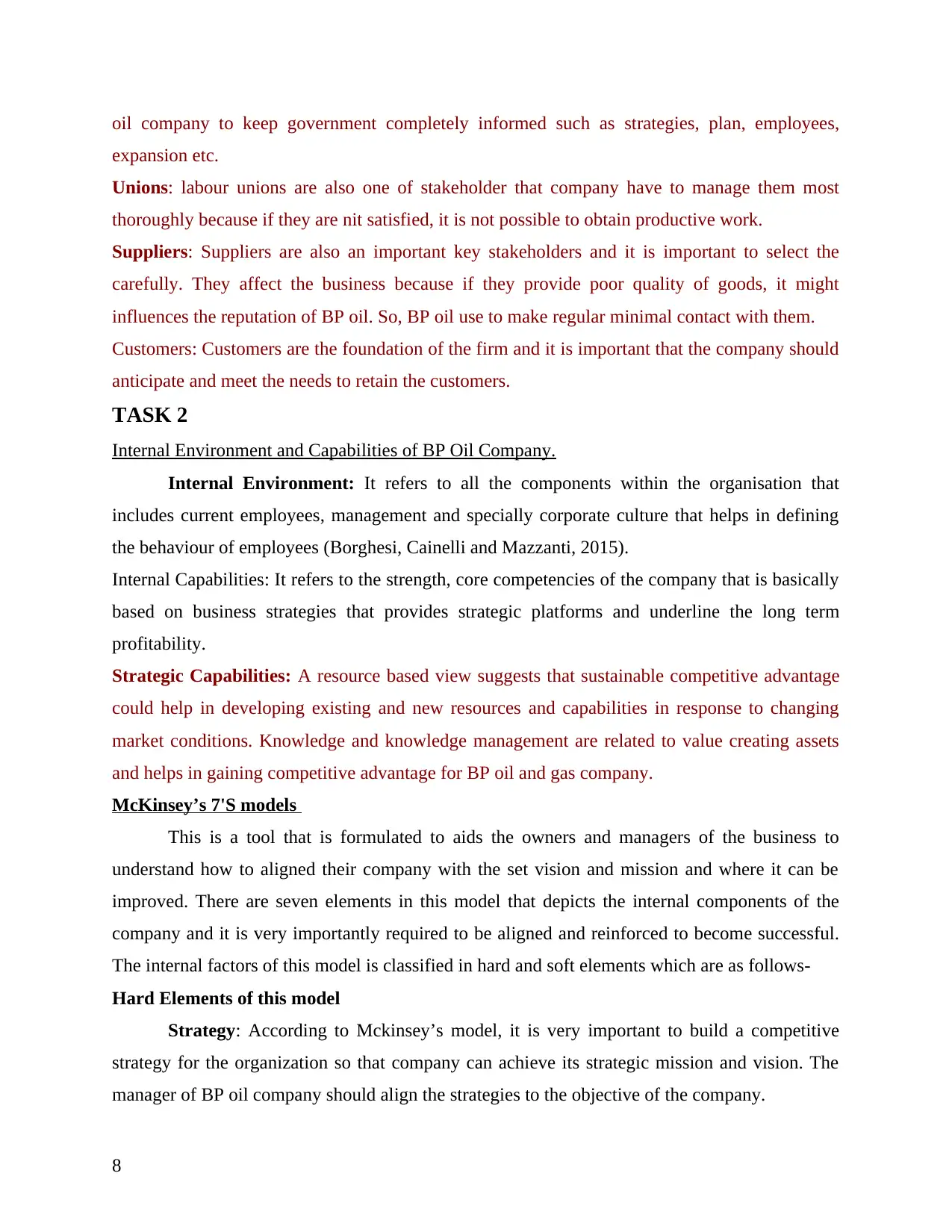

oil company to keep government completely informed such as strategies, plan, employees,

expansion etc.

Unions: labour unions are also one of stakeholder that company have to manage them most

thoroughly because if they are nit satisfied, it is not possible to obtain productive work.

Suppliers: Suppliers are also an important key stakeholders and it is important to select the

carefully. They affect the business because if they provide poor quality of goods, it might

influences the reputation of BP oil. So, BP oil use to make regular minimal contact with them.

Customers: Customers are the foundation of the firm and it is important that the company should

anticipate and meet the needs to retain the customers.

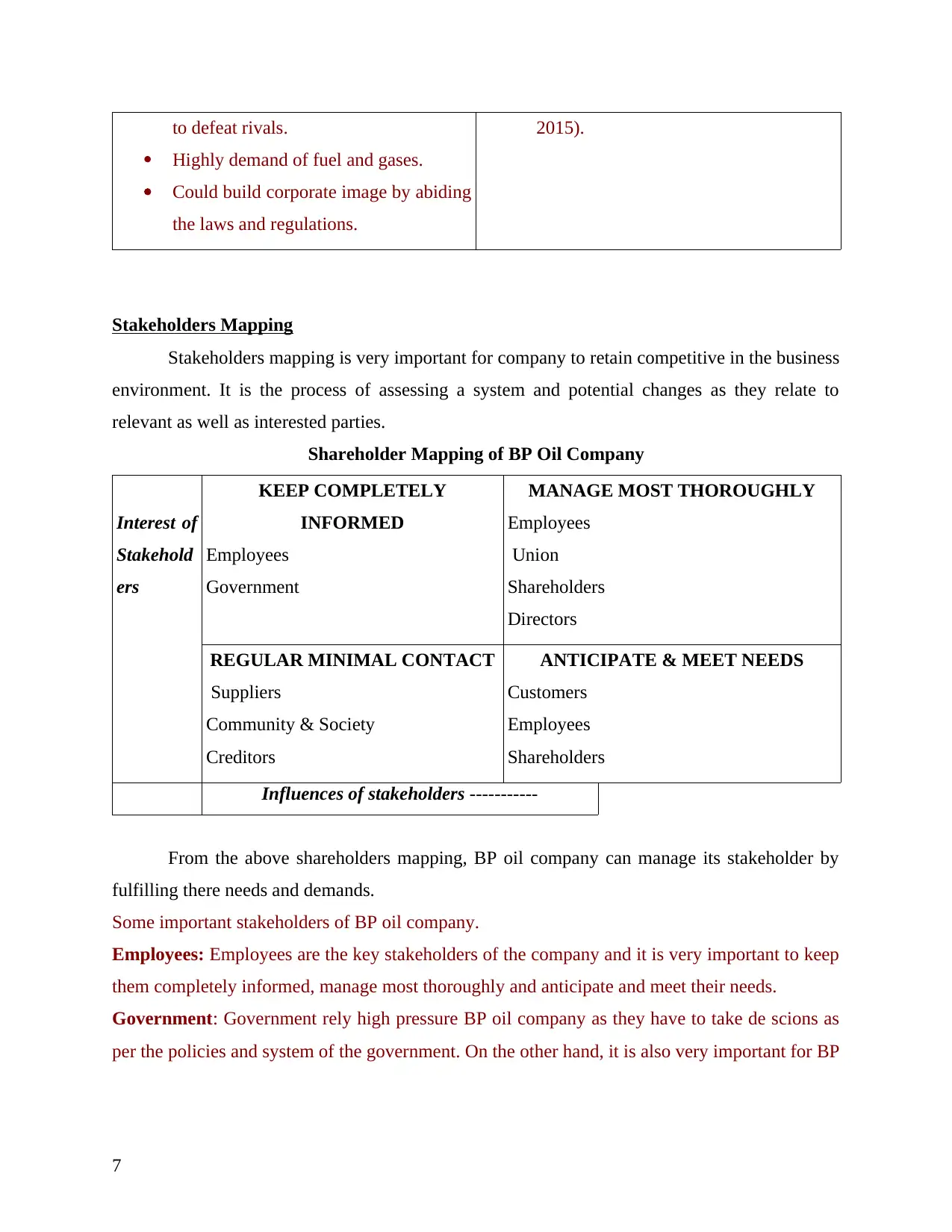

TASK 2

Internal Environment and Capabilities of BP Oil Company.

Internal Environment: It refers to all the components within the organisation that

includes current employees, management and specially corporate culture that helps in defining

the behaviour of employees (Borghesi, Cainelli and Mazzanti, 2015).

Internal Capabilities: It refers to the strength, core competencies of the company that is basically

based on business strategies that provides strategic platforms and underline the long term

profitability.

Strategic Capabilities: A resource based view suggests that sustainable competitive advantage

could help in developing existing and new resources and capabilities in response to changing

market conditions. Knowledge and knowledge management are related to value creating assets

and helps in gaining competitive advantage for BP oil and gas company.

McKinsey’s 7'S models

This is a tool that is formulated to aids the owners and managers of the business to

understand how to aligned their company with the set vision and mission and where it can be

improved. There are seven elements in this model that depicts the internal components of the

company and it is very importantly required to be aligned and reinforced to become successful.

The internal factors of this model is classified in hard and soft elements which are as follows-

Hard Elements of this model

Strategy: According to Mckinsey’s model, it is very important to build a competitive

strategy for the organization so that company can achieve its strategic mission and vision. The

manager of BP oil company should align the strategies to the objective of the company.

8

expansion etc.

Unions: labour unions are also one of stakeholder that company have to manage them most

thoroughly because if they are nit satisfied, it is not possible to obtain productive work.

Suppliers: Suppliers are also an important key stakeholders and it is important to select the

carefully. They affect the business because if they provide poor quality of goods, it might

influences the reputation of BP oil. So, BP oil use to make regular minimal contact with them.

Customers: Customers are the foundation of the firm and it is important that the company should

anticipate and meet the needs to retain the customers.

TASK 2

Internal Environment and Capabilities of BP Oil Company.

Internal Environment: It refers to all the components within the organisation that

includes current employees, management and specially corporate culture that helps in defining

the behaviour of employees (Borghesi, Cainelli and Mazzanti, 2015).

Internal Capabilities: It refers to the strength, core competencies of the company that is basically

based on business strategies that provides strategic platforms and underline the long term

profitability.

Strategic Capabilities: A resource based view suggests that sustainable competitive advantage

could help in developing existing and new resources and capabilities in response to changing

market conditions. Knowledge and knowledge management are related to value creating assets

and helps in gaining competitive advantage for BP oil and gas company.

McKinsey’s 7'S models

This is a tool that is formulated to aids the owners and managers of the business to

understand how to aligned their company with the set vision and mission and where it can be

improved. There are seven elements in this model that depicts the internal components of the

company and it is very importantly required to be aligned and reinforced to become successful.

The internal factors of this model is classified in hard and soft elements which are as follows-

Hard Elements of this model

Strategy: According to Mckinsey’s model, it is very important to build a competitive

strategy for the organization so that company can achieve its strategic mission and vision. The

manager of BP oil company should align the strategies to the objective of the company.

8

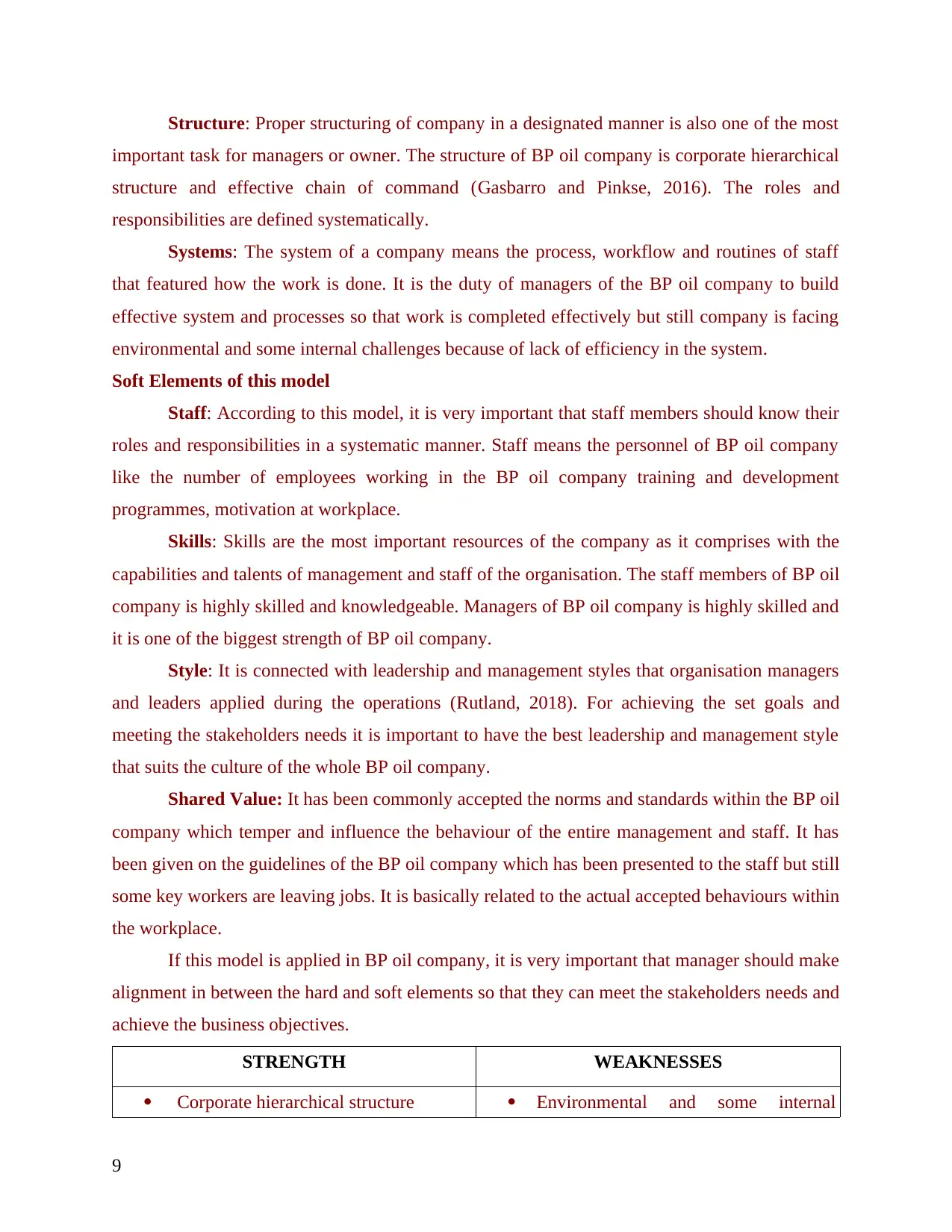

Structure: Proper structuring of company in a designated manner is also one of the most

important task for managers or owner. The structure of BP oil company is corporate hierarchical

structure and effective chain of command (Gasbarro and Pinkse, 2016). The roles and

responsibilities are defined systematically.

Systems: The system of a company means the process, workflow and routines of staff

that featured how the work is done. It is the duty of managers of the BP oil company to build

effective system and processes so that work is completed effectively but still company is facing

environmental and some internal challenges because of lack of efficiency in the system.

Soft Elements of this model

Staff: According to this model, it is very important that staff members should know their

roles and responsibilities in a systematic manner. Staff means the personnel of BP oil company

like the number of employees working in the BP oil company training and development

programmes, motivation at workplace.

Skills: Skills are the most important resources of the company as it comprises with the

capabilities and talents of management and staff of the organisation. The staff members of BP oil

company is highly skilled and knowledgeable. Managers of BP oil company is highly skilled and

it is one of the biggest strength of BP oil company.

Style: It is connected with leadership and management styles that organisation managers

and leaders applied during the operations (Rutland, 2018). For achieving the set goals and

meeting the stakeholders needs it is important to have the best leadership and management style

that suits the culture of the whole BP oil company.

Shared Value: It has been commonly accepted the norms and standards within the BP oil

company which temper and influence the behaviour of the entire management and staff. It has

been given on the guidelines of the BP oil company which has been presented to the staff but still

some key workers are leaving jobs. It is basically related to the actual accepted behaviours within

the workplace.

If this model is applied in BP oil company, it is very important that manager should make

alignment in between the hard and soft elements so that they can meet the stakeholders needs and

achieve the business objectives.

STRENGTH WEAKNESSES

Corporate hierarchical structure Environmental and some internal

9

important task for managers or owner. The structure of BP oil company is corporate hierarchical

structure and effective chain of command (Gasbarro and Pinkse, 2016). The roles and

responsibilities are defined systematically.

Systems: The system of a company means the process, workflow and routines of staff

that featured how the work is done. It is the duty of managers of the BP oil company to build

effective system and processes so that work is completed effectively but still company is facing

environmental and some internal challenges because of lack of efficiency in the system.

Soft Elements of this model

Staff: According to this model, it is very important that staff members should know their

roles and responsibilities in a systematic manner. Staff means the personnel of BP oil company

like the number of employees working in the BP oil company training and development

programmes, motivation at workplace.

Skills: Skills are the most important resources of the company as it comprises with the

capabilities and talents of management and staff of the organisation. The staff members of BP oil

company is highly skilled and knowledgeable. Managers of BP oil company is highly skilled and

it is one of the biggest strength of BP oil company.

Style: It is connected with leadership and management styles that organisation managers

and leaders applied during the operations (Rutland, 2018). For achieving the set goals and

meeting the stakeholders needs it is important to have the best leadership and management style

that suits the culture of the whole BP oil company.

Shared Value: It has been commonly accepted the norms and standards within the BP oil

company which temper and influence the behaviour of the entire management and staff. It has

been given on the guidelines of the BP oil company which has been presented to the staff but still

some key workers are leaving jobs. It is basically related to the actual accepted behaviours within

the workplace.

If this model is applied in BP oil company, it is very important that manager should make

alignment in between the hard and soft elements so that they can meet the stakeholders needs and

achieve the business objectives.

STRENGTH WEAKNESSES

Corporate hierarchical structure Environmental and some internal

9

Effective Chain of Command

Highly skilled and knowledgeable

workforce

challenges due to lack of effeciency in

system.

Key workers are leaving jobs of

because shared values are not effective.

VRIO Framework

VRIO Framework will be based on the industrial operations and the sustainable products

that the company is making out of the renewable energy resources. These are the four

components of VRIO framework-

Value- It describes the value of the company in its respective market. BP oil company

have the total assets of US$ 282.18 billion and with the net income of US$ 9.58 billion. The

company has the huge market coverage as it is operating in 70 different countries worldwide and

has established 19,000 workstations all over the world. The company has many valuable

resources that can be utilized in the improvement of the efficiency and the current conditions of

the company (Warner and Sullivan, 2017). Thus, the value of BP oil company turns to be

competitive advantage for the company.

Rarity- BP oil company aims to create and focus on the renewable energy resources and

making sustainable energy products that states the rarity of its product line among the

competitors. Also the company has aimed in building up the strong logistics network to build its

better delivery channel to the customers which is an another rare component of the company.

This things help the company to gain the competitive advantage in the market.

Imitability- Most often the value and rarity of the resources help the company to

overcome with the competitive advantage and keep the company engage in the strategies that

other firms cannot pursue. But in case of long-term its no guarantee for this advantage as the

other companies try to imitate these resources in their business. BP oil company must make sure

that the cost of imitating these sustainable products made out of renewable sources of energy is

so high that the competitors may not be able to afford it which will in turn benefit BP oil

company.

Organization- This involves the structure and the system of the company to what extent

it is organized. As in case of BP oil company the main issue is with the workforce in the

10

Highly skilled and knowledgeable

workforce

challenges due to lack of effeciency in

system.

Key workers are leaving jobs of

because shared values are not effective.

VRIO Framework

VRIO Framework will be based on the industrial operations and the sustainable products

that the company is making out of the renewable energy resources. These are the four

components of VRIO framework-

Value- It describes the value of the company in its respective market. BP oil company

have the total assets of US$ 282.18 billion and with the net income of US$ 9.58 billion. The

company has the huge market coverage as it is operating in 70 different countries worldwide and

has established 19,000 workstations all over the world. The company has many valuable

resources that can be utilized in the improvement of the efficiency and the current conditions of

the company (Warner and Sullivan, 2017). Thus, the value of BP oil company turns to be

competitive advantage for the company.

Rarity- BP oil company aims to create and focus on the renewable energy resources and

making sustainable energy products that states the rarity of its product line among the

competitors. Also the company has aimed in building up the strong logistics network to build its

better delivery channel to the customers which is an another rare component of the company.

This things help the company to gain the competitive advantage in the market.

Imitability- Most often the value and rarity of the resources help the company to

overcome with the competitive advantage and keep the company engage in the strategies that

other firms cannot pursue. But in case of long-term its no guarantee for this advantage as the

other companies try to imitate these resources in their business. BP oil company must make sure

that the cost of imitating these sustainable products made out of renewable sources of energy is

so high that the competitors may not be able to afford it which will in turn benefit BP oil

company.

Organization- This involves the structure and the system of the company to what extent

it is organized. As in case of BP oil company the main issue is with the workforce in the

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

company as the key workers of the company are being shifted in its competitors firms. This has

cause the decline in the production efficiency as well as increased the chances of risk and loss

over the time (Post, Rahman and McQuillen, 2015). BP oil company has to find out the cause for

this issue and also find out the immediate solution for it. The company has to frame different

strategies to achieve the primary objective of the firm and survive in the market through beating

up its competitors.

TASK 3

Evaluating the competitive forces that influences the BP Oil Company.

Firm deals in various petrochemical products along with regular reforms are being

undertaken by the professionals in accordance with analysing the profitability of the product line

which would be beneficial in attracting the large number of buyers. The fuel efficiency and

mileage would result in generating consumers.

Porter's Five Force's to evaluate the competitive forces.

Porter's five forces is one of the best model that helps in determining the level of

competition in the market as well as other external forces that impact ion the entire functions and

operations of the organizations. There are mainly five elements in this model which are as

follows-

Threat of Competition: The threat of competition is very high in oil and gas company.

There are major players operating in the market that includes Total, Shell, Texaco, Gilf Coast,

Petro China, OMP and many more players operating in the industry. There are many factors on

which all the players compete from each other such as product differentiation, economies of

scale and variable and fixed cost (Buckley and et.al., 2016). Thus, in order to over the threat of

competition, BP oil company have started moving towards merger will small firms to have

competitive edge over its rivalries.

Thereat of New Entrants:The threat of new entrants is relatively low in oil and gas

company, it is because of high infrastructure, high cost of operations and extreme challenges in

operating the company. Moreover, it is not easy for any organisations or a person to set up the

entire organisation.

Threat of Substitutes: The threat of substitutes is moderate in the oil and gas industry

and the forces influences the BP oil company as well. There are some products like biofuels and

11

cause the decline in the production efficiency as well as increased the chances of risk and loss

over the time (Post, Rahman and McQuillen, 2015). BP oil company has to find out the cause for

this issue and also find out the immediate solution for it. The company has to frame different

strategies to achieve the primary objective of the firm and survive in the market through beating

up its competitors.

TASK 3

Evaluating the competitive forces that influences the BP Oil Company.

Firm deals in various petrochemical products along with regular reforms are being

undertaken by the professionals in accordance with analysing the profitability of the product line

which would be beneficial in attracting the large number of buyers. The fuel efficiency and

mileage would result in generating consumers.

Porter's Five Force's to evaluate the competitive forces.

Porter's five forces is one of the best model that helps in determining the level of

competition in the market as well as other external forces that impact ion the entire functions and

operations of the organizations. There are mainly five elements in this model which are as

follows-

Threat of Competition: The threat of competition is very high in oil and gas company.

There are major players operating in the market that includes Total, Shell, Texaco, Gilf Coast,

Petro China, OMP and many more players operating in the industry. There are many factors on

which all the players compete from each other such as product differentiation, economies of

scale and variable and fixed cost (Buckley and et.al., 2016). Thus, in order to over the threat of

competition, BP oil company have started moving towards merger will small firms to have

competitive edge over its rivalries.

Thereat of New Entrants:The threat of new entrants is relatively low in oil and gas

company, it is because of high infrastructure, high cost of operations and extreme challenges in

operating the company. Moreover, it is not easy for any organisations or a person to set up the

entire organisation.

Threat of Substitutes: The threat of substitutes is moderate in the oil and gas industry

and the forces influences the BP oil company as well. There are some products like biofuels and

11

other renewable resources which ca be substitutes in the oil and gas industry (Paterson, 2017).

But still the substitution is moderate because BP oil company is still working for their

development as well as it consumes lots of time to replace the oil resources.

Bargaining Power of Customers: In Oil and gas industry, the price of oil products

depends on the global demands. The nations that have high power and are developed also have

bargaining power over their suppliers. There are many countries such as USA, Japan or China

that increases their power to bargain with the suppliers.

Bargaining Power of Suppliers: Suppliers includes technicians, engineers and suppliers

from other field of oil. British Oil company used to make relationship with large number of

suppliers, so that if any suppliers raises the cost of operations, BP oil company can switch to

another suppliers. So, the power of suppliers of BP oil company is moderate.

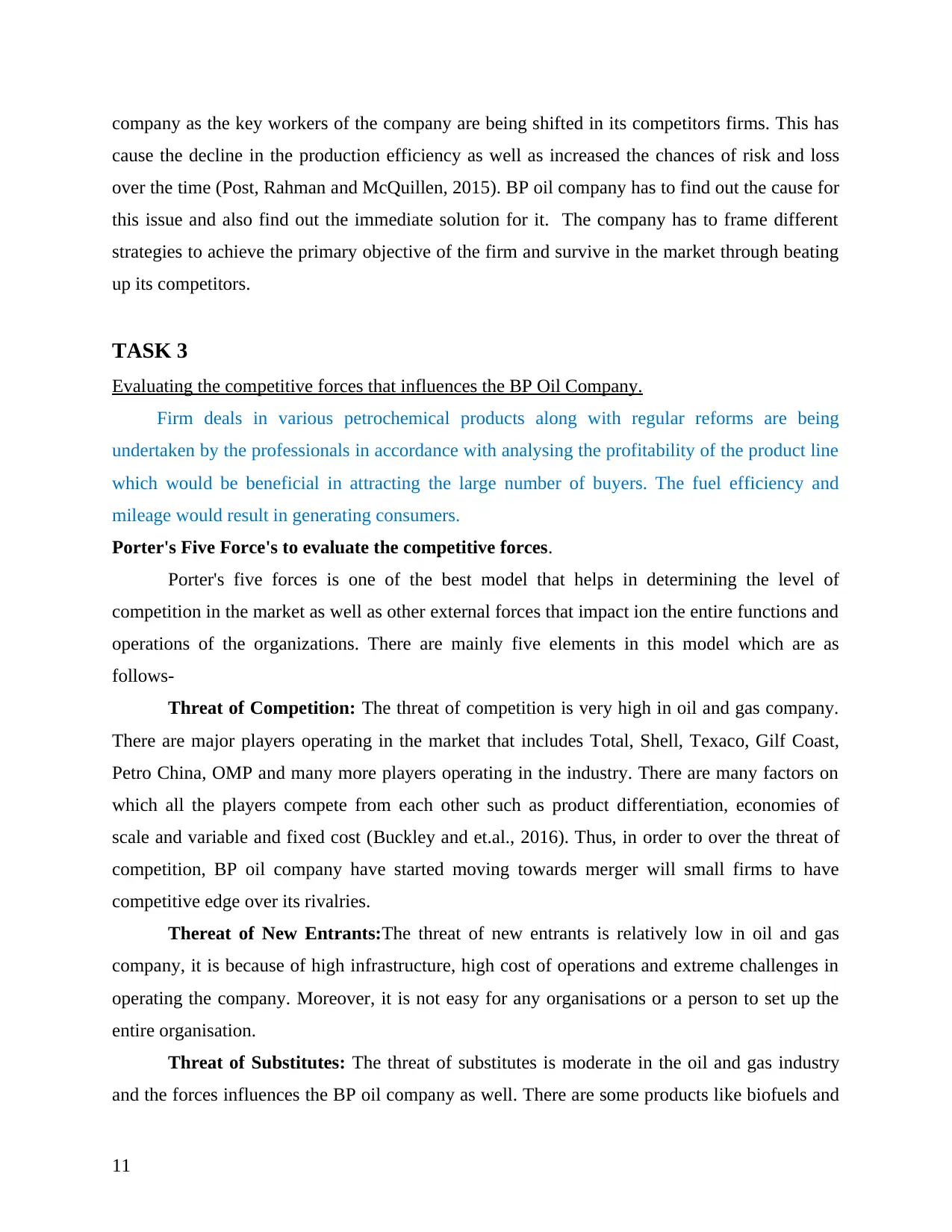

Ansoff Matrix:

It is the strategic tool for planning that help the organisational to chalk our the strategy

for the growth of market and product. This model is best for BP oil company as it helps in

identifying the growth opportunities. The best growth strategy of BP oil company is market

development because of its corporate mage in the market, they can win the new market as well.

Existing products New Products

Existing Market Market Penetration

BP Oil company could adopt

this strategy as this is one the

best growth strategy when

market is kn won and company

have its existing products

(Ishengoma and Vaaland,

2016).

Product Development

This is also one of the growth

strategy where BP oil company

can focus on offering new

product in the market.

New Market Market Development

This is one of the complex

quadrant of this model as it

includes the offering of new

product to the customers in

Diversification

This is also called as

innovative quadrant as in this

strategy, the product is

completely new which is not

12

But still the substitution is moderate because BP oil company is still working for their

development as well as it consumes lots of time to replace the oil resources.

Bargaining Power of Customers: In Oil and gas industry, the price of oil products

depends on the global demands. The nations that have high power and are developed also have

bargaining power over their suppliers. There are many countries such as USA, Japan or China

that increases their power to bargain with the suppliers.

Bargaining Power of Suppliers: Suppliers includes technicians, engineers and suppliers

from other field of oil. British Oil company used to make relationship with large number of

suppliers, so that if any suppliers raises the cost of operations, BP oil company can switch to

another suppliers. So, the power of suppliers of BP oil company is moderate.

Ansoff Matrix:

It is the strategic tool for planning that help the organisational to chalk our the strategy

for the growth of market and product. This model is best for BP oil company as it helps in

identifying the growth opportunities. The best growth strategy of BP oil company is market

development because of its corporate mage in the market, they can win the new market as well.

Existing products New Products

Existing Market Market Penetration

BP Oil company could adopt

this strategy as this is one the

best growth strategy when

market is kn won and company

have its existing products

(Ishengoma and Vaaland,

2016).

Product Development

This is also one of the growth

strategy where BP oil company

can focus on offering new

product in the market.

New Market Market Development

This is one of the complex

quadrant of this model as it

includes the offering of new

product to the customers in

Diversification

This is also called as

innovative quadrant as in this

strategy, the product is

completely new which is not

12

completely new market. But

for BP oil company, this

segment is not so complex

because of high brand

positioning in the market

yet manufactured by any other

firm.

TASK 4

Strategic direction available for the company.

Porters Generic Model

Porters generic model states that how the company acquires competitive advantage over

its existing market scope. This model includes three generic strategies as given below-

Cost Leadership strategy- This generic strategy aims at being the low cost producer in an

industry by the company. BP oil company has to sell the products at average prices in order to

beat the competition. If the selling price of BP products equals or near the average of the market

then it will enjoy greater profits at lower cost of production (Proedrou, 2016). BP oil company

can use the following ways to reduce its cost-

BP oil company has to eliminate or postpone the fields that aren't bringing profits to the

company as in order to sell as well as produce at the lower cost it will be difficult to spent on low

profit making fields in order to avoid wastage of the financial resources and cost reduction.

The company has to focus more on the use of new technology and techniques of

production in order to get more crude oil from the wells. It can be done by injecting water and

gas in the wells to create more pressure and flow of the oil out of each well. Also, the use of new

software or application that states the exact amount of sands, chemicals and water in order to

maximize production from every single well and in turn reduce the wastage and reduce the

pumping costs as well.

BP oil company has to use the automation techniques for measurement of data as well as

analyze the production process to understand the exact production turn over and its improvement

(Liang and Renneboog, 2017).

Demand Lower prices from service providers and supply chains to reduce the direct and

indirect costs for the products.

13

for BP oil company, this

segment is not so complex

because of high brand

positioning in the market

yet manufactured by any other

firm.

TASK 4

Strategic direction available for the company.

Porters Generic Model

Porters generic model states that how the company acquires competitive advantage over

its existing market scope. This model includes three generic strategies as given below-

Cost Leadership strategy- This generic strategy aims at being the low cost producer in an

industry by the company. BP oil company has to sell the products at average prices in order to

beat the competition. If the selling price of BP products equals or near the average of the market

then it will enjoy greater profits at lower cost of production (Proedrou, 2016). BP oil company

can use the following ways to reduce its cost-

BP oil company has to eliminate or postpone the fields that aren't bringing profits to the

company as in order to sell as well as produce at the lower cost it will be difficult to spent on low

profit making fields in order to avoid wastage of the financial resources and cost reduction.

The company has to focus more on the use of new technology and techniques of

production in order to get more crude oil from the wells. It can be done by injecting water and

gas in the wells to create more pressure and flow of the oil out of each well. Also, the use of new

software or application that states the exact amount of sands, chemicals and water in order to

maximize production from every single well and in turn reduce the wastage and reduce the

pumping costs as well.

BP oil company has to use the automation techniques for measurement of data as well as

analyze the production process to understand the exact production turn over and its improvement

(Liang and Renneboog, 2017).

Demand Lower prices from service providers and supply chains to reduce the direct and

indirect costs for the products.

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

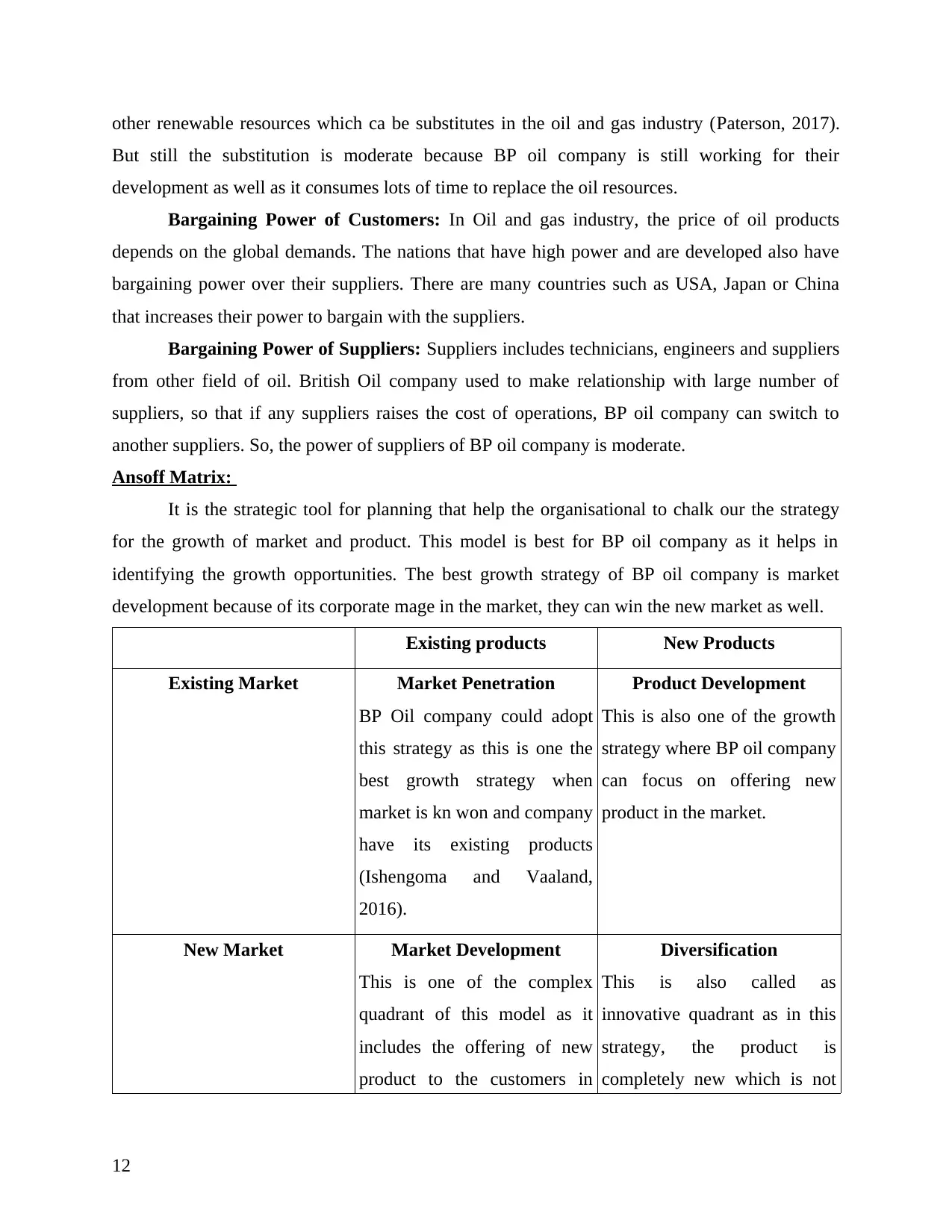

Differentiation Strategy- This strategy includes the development of the product or

services so that it offers unique quality to the customers and also increase the product value by

customers and establish the product different from other ones in market. BP oil company will

have to build a strong logistics network to enhance its delivery channels for its products so that it

can improve better service for its customers. Another thing is that the company will work and

invest in the renewable energy which will further lead to build up sustainable energy products

which will be different from its competitors and add gear up the value by customers.

Focus Strategy- Focus strategy is concerned with the company's prime focus on any

particular component which may be either cost or differentiation. BP oil company will focus

mainly on the cost reduction component as in the scenario due to its lack of profitability and the

threat of loosing the investors trust (Gasbarro, Rizzi and Frey, 2016). As discussed above the

reduction in the operational costs and using the better techniques for more production will boost

the profitability of the company through its selling products at lower prices in market. This focus

will also gain back the confidence of the stakeholders of the company as well as improve the

current condition of the company.

Bowman's Strategic Clock Model

Bowman's Strategic Clock is a model that illustrate the different options for strategic

positioning of the company products in the market which may be either on the basis of the price

or value. The model will be applied to the Petroleum product of the BP oil company through a

particular position suitable for the product. The following are the stages of this model-

Position 1 (Low price and low value)- This is the position where the company sells

inferior quality products along with the low price. The main objective is to attract the new

customers through the price. However, this position cannot be used by BP oil company, as this

position lacks profitability in the business (Kheiravar and et.al., 2017).

Position 2 (Low Price)- In this position the prices as well as the profit margin will be

lowered in order to promote higher sales. The success of this position is being achieved by

selling more volume of products and low production cost to earn more profits. This position will

be initiated by BP oil company by reducing production costs through the use of better technology

to produce goods and services.

Position 3 (Hybrid)- It includes offering goods and services to customers at lower price

but at high value from its competitors. This in turn out more customer attraction and give rise in

14

services so that it offers unique quality to the customers and also increase the product value by

customers and establish the product different from other ones in market. BP oil company will

have to build a strong logistics network to enhance its delivery channels for its products so that it

can improve better service for its customers. Another thing is that the company will work and

invest in the renewable energy which will further lead to build up sustainable energy products

which will be different from its competitors and add gear up the value by customers.

Focus Strategy- Focus strategy is concerned with the company's prime focus on any

particular component which may be either cost or differentiation. BP oil company will focus

mainly on the cost reduction component as in the scenario due to its lack of profitability and the

threat of loosing the investors trust (Gasbarro, Rizzi and Frey, 2016). As discussed above the

reduction in the operational costs and using the better techniques for more production will boost

the profitability of the company through its selling products at lower prices in market. This focus

will also gain back the confidence of the stakeholders of the company as well as improve the

current condition of the company.

Bowman's Strategic Clock Model

Bowman's Strategic Clock is a model that illustrate the different options for strategic

positioning of the company products in the market which may be either on the basis of the price

or value. The model will be applied to the Petroleum product of the BP oil company through a

particular position suitable for the product. The following are the stages of this model-

Position 1 (Low price and low value)- This is the position where the company sells

inferior quality products along with the low price. The main objective is to attract the new

customers through the price. However, this position cannot be used by BP oil company, as this

position lacks profitability in the business (Kheiravar and et.al., 2017).

Position 2 (Low Price)- In this position the prices as well as the profit margin will be

lowered in order to promote higher sales. The success of this position is being achieved by

selling more volume of products and low production cost to earn more profits. This position will

be initiated by BP oil company by reducing production costs through the use of better technology

to produce goods and services.

Position 3 (Hybrid)- It includes offering goods and services to customers at lower price

but at high value from its competitors. This in turn out more customer attraction and give rise in

14

the profitability of the business. This position will be the prime focus of BP oil company as it

includes rendering better value to customers and earning higher profits to improve the company's

position.

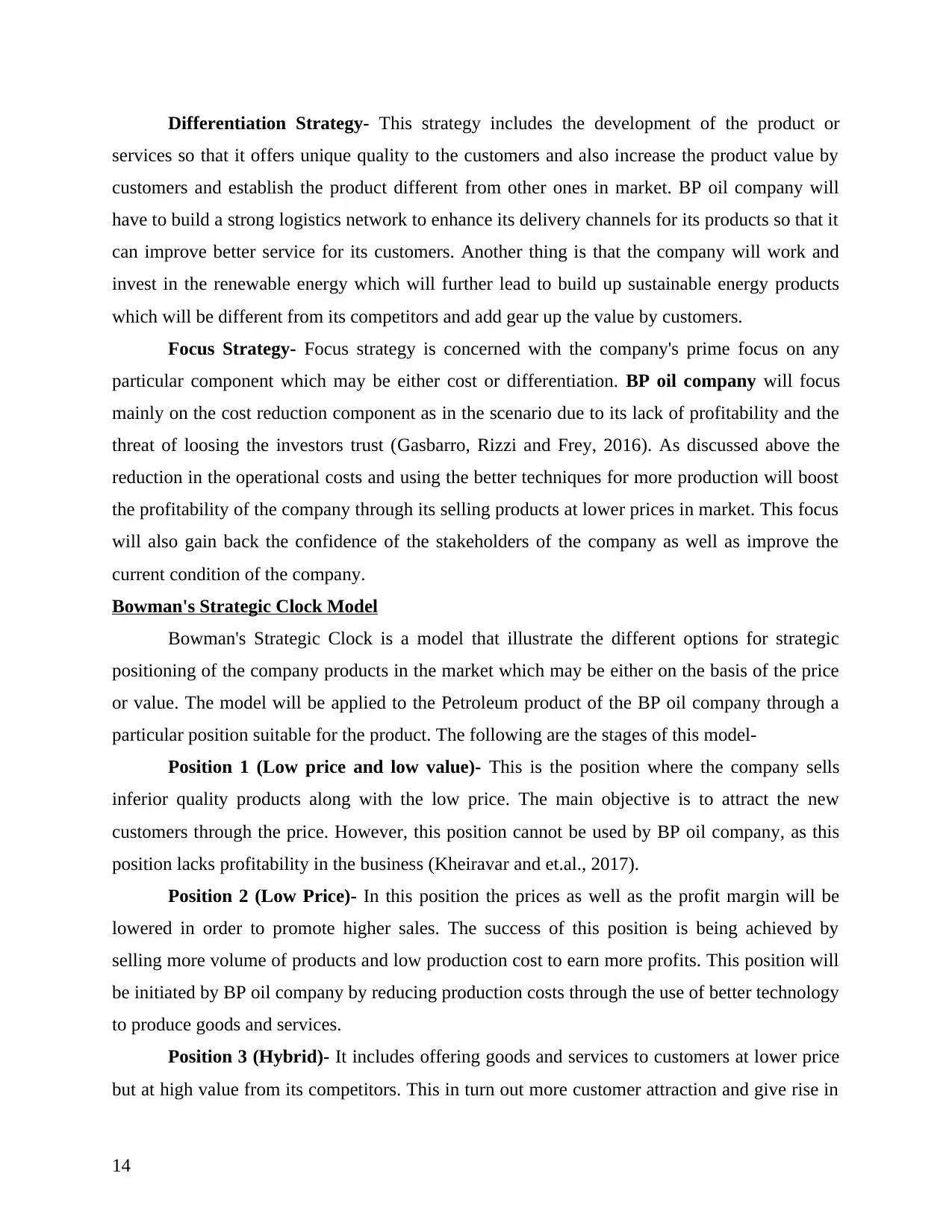

Position 4 (Differentiation)- In this position the company gains competitive advantage

by offering unique attributes which are valued by the customers. BP oil company's secondary

focus will be on this position as it will include building up of sustainable and environmental

friendly techniques to build up its products (Vivoda, 2016).

Position 5 (Focused Differentiation)- Here the company offers high value against the

high prices of the products. It is mainly done by the company whose customers turn up to the

perceived value rather than real value. It is not possible in case of BP oil company as its

competitors are offering the products at average competitive prices.

Position 6 (Increased price and standard product)- Here the company increases the

prices of the products without any increase in the value of the product as in the view that if the

customers accept the high price it will turn out more profits for the company. BP oil company

cannot of this strategy as its prime focus is to lower the costs of products to beat its competitors.

Position 7 (Monopoly Pricing)- The name itself suggests the nature of the strategy as it

includes charging any price for the products in the market. It is possible when there is only one

company in a market or has its monopoly in the industry which is totally not possible as BP oil

company has many competitor's rivalry in the market.

Position 8 (Loss of market share)- This position is a road for winding up of products

from the market for any company as it includes selling low value at standard prices (Aguilera

and et.al., 2017). This position is not at all relevant to BP oil or any company as the market is full

of competitors and options for the customers.

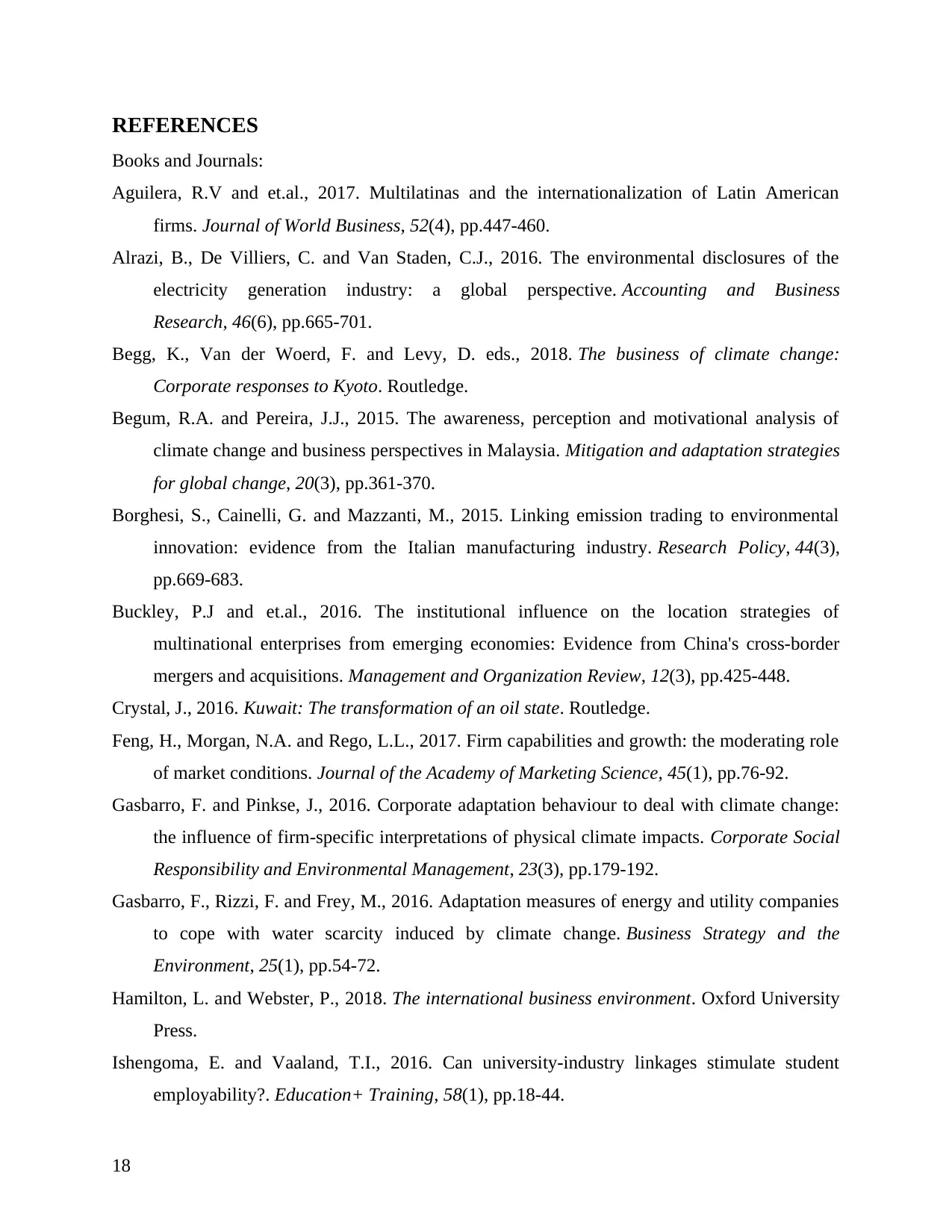

Strategic management plan to achieve the objectives of BP oil company-

Basis Description

Gathering Facts BP oil company will gather all te

information and statistics from its

stakeholders regarding the current

15

includes rendering better value to customers and earning higher profits to improve the company's

position.

Position 4 (Differentiation)- In this position the company gains competitive advantage

by offering unique attributes which are valued by the customers. BP oil company's secondary

focus will be on this position as it will include building up of sustainable and environmental

friendly techniques to build up its products (Vivoda, 2016).

Position 5 (Focused Differentiation)- Here the company offers high value against the

high prices of the products. It is mainly done by the company whose customers turn up to the

perceived value rather than real value. It is not possible in case of BP oil company as its

competitors are offering the products at average competitive prices.

Position 6 (Increased price and standard product)- Here the company increases the

prices of the products without any increase in the value of the product as in the view that if the

customers accept the high price it will turn out more profits for the company. BP oil company

cannot of this strategy as its prime focus is to lower the costs of products to beat its competitors.

Position 7 (Monopoly Pricing)- The name itself suggests the nature of the strategy as it

includes charging any price for the products in the market. It is possible when there is only one

company in a market or has its monopoly in the industry which is totally not possible as BP oil

company has many competitor's rivalry in the market.

Position 8 (Loss of market share)- This position is a road for winding up of products

from the market for any company as it includes selling low value at standard prices (Aguilera

and et.al., 2017). This position is not at all relevant to BP oil or any company as the market is full

of competitors and options for the customers.

Strategic management plan to achieve the objectives of BP oil company-

Basis Description

Gathering Facts BP oil company will gather all te

information and statistics from its

stakeholders regarding the current

15

trends in the market.

The company will conduct research in

the market to analyze and study the

strategies being used by its competitors.

The company will adopt the process of

environmental scanning its internal and

external environment.

Internal analysis The company will understand and analyze its

internal and external environment comprising

of its-

Strengths

Weaknesses

Opportunities

Threats

Review inputs BP oil company will review its internal

accounting reports and the past records

for its business growth in different

markets

The company will also collect feedback

from its regular customers regarding

the company serving and products.

Strategic mix BP oil company will compare all its internal

strengths and external opportunities with the

amount of threats in the external environment.

It will include-

Opportunities vs strengths

Opportunities vs weaknesses

Strengths vs threats

Threats vs weaknesses

Strategies To enhance the expansion of the

16

The company will conduct research in

the market to analyze and study the

strategies being used by its competitors.

The company will adopt the process of

environmental scanning its internal and

external environment.

Internal analysis The company will understand and analyze its

internal and external environment comprising

of its-

Strengths

Weaknesses

Opportunities

Threats

Review inputs BP oil company will review its internal

accounting reports and the past records

for its business growth in different

markets

The company will also collect feedback

from its regular customers regarding

the company serving and products.

Strategic mix BP oil company will compare all its internal

strengths and external opportunities with the

amount of threats in the external environment.

It will include-

Opportunities vs strengths

Opportunities vs weaknesses

Strengths vs threats

Threats vs weaknesses

Strategies To enhance the expansion of the

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

business with available opportunities in

Chinese market.

To move towards its use of renewable

energy and investing in making of

sustainable products(Ottman, 2017).

Review and adjust The framed strategies by the BP oil company

will be reviewed by the stakeholders and also

about other activities such as-

Review strategies.

Review company goals.

Review plans.

Adjustment of the alternative plans if

necessary(Paterson, 2017).

CONCLUSION

From the above report, it has been concluded that business strategies are the important

part of the business plan as well for the success of the organisation. It is very important to that

organisation should focus on building business strategies as without it companies cannot sustain

the market and achieve competitive advantages in the industry. Organisation have to plan for

action of designing a long term or overall aim of the organisation. Furthermore, this report also

summarised the impact of external forces in taking effective decision for the organisation so that

they could able to meet the needs and requirements of the stakeholders. Moreover, the level of

competition is also high in oil and gas industry so organisations are moving towards merger and

acquisition to give competitive advantage in the marketplace. The report also summarised that it

is important to create and focus on the renewable energy resources and making sustainable

energy products that states the rarity of its product line among the competitors.

17

Chinese market.

To move towards its use of renewable

energy and investing in making of

sustainable products(Ottman, 2017).

Review and adjust The framed strategies by the BP oil company

will be reviewed by the stakeholders and also

about other activities such as-

Review strategies.

Review company goals.

Review plans.

Adjustment of the alternative plans if

necessary(Paterson, 2017).

CONCLUSION

From the above report, it has been concluded that business strategies are the important

part of the business plan as well for the success of the organisation. It is very important to that

organisation should focus on building business strategies as without it companies cannot sustain

the market and achieve competitive advantages in the industry. Organisation have to plan for

action of designing a long term or overall aim of the organisation. Furthermore, this report also

summarised the impact of external forces in taking effective decision for the organisation so that

they could able to meet the needs and requirements of the stakeholders. Moreover, the level of

competition is also high in oil and gas industry so organisations are moving towards merger and

acquisition to give competitive advantage in the marketplace. The report also summarised that it

is important to create and focus on the renewable energy resources and making sustainable

energy products that states the rarity of its product line among the competitors.

17

REFERENCES

Books and Journals:

Aguilera, R.V and et.al., 2017. Multilatinas and the internationalization of Latin American

firms. Journal of World Business, 52(4), pp.447-460.

Alrazi, B., De Villiers, C. and Van Staden, C.J., 2016. The environmental disclosures of the

electricity generation industry: a global perspective. Accounting and Business

Research, 46(6), pp.665-701.

Begg, K., Van der Woerd, F. and Levy, D. eds., 2018. The business of climate change:

Corporate responses to Kyoto. Routledge.

Begum, R.A. and Pereira, J.J., 2015. The awareness, perception and motivational analysis of

climate change and business perspectives in Malaysia. Mitigation and adaptation strategies

for global change, 20(3), pp.361-370.

Borghesi, S., Cainelli, G. and Mazzanti, M., 2015. Linking emission trading to environmental

innovation: evidence from the Italian manufacturing industry. Research Policy, 44(3),

pp.669-683.

Buckley, P.J and et.al., 2016. The institutional influence on the location strategies of

multinational enterprises from emerging economies: Evidence from China's cross-border

mergers and acquisitions. Management and Organization Review, 12(3), pp.425-448.

Crystal, J., 2016. Kuwait: The transformation of an oil state. Routledge.

Feng, H., Morgan, N.A. and Rego, L.L., 2017. Firm capabilities and growth: the moderating role

of market conditions. Journal of the Academy of Marketing Science, 45(1), pp.76-92.

Gasbarro, F. and Pinkse, J., 2016. Corporate adaptation behaviour to deal with climate change:

the influence of firm‐specific interpretations of physical climate impacts. Corporate Social

Responsibility and Environmental Management, 23(3), pp.179-192.

Gasbarro, F., Rizzi, F. and Frey, M., 2016. Adaptation measures of energy and utility companies

to cope with water scarcity induced by climate change. Business Strategy and the

Environment, 25(1), pp.54-72.

Hamilton, L. and Webster, P., 2018. The international business environment. Oxford University

Press.

Ishengoma, E. and Vaaland, T.I., 2016. Can university-industry linkages stimulate student

employability?. Education+ Training, 58(1), pp.18-44.

18

Books and Journals:

Aguilera, R.V and et.al., 2017. Multilatinas and the internationalization of Latin American

firms. Journal of World Business, 52(4), pp.447-460.

Alrazi, B., De Villiers, C. and Van Staden, C.J., 2016. The environmental disclosures of the

electricity generation industry: a global perspective. Accounting and Business

Research, 46(6), pp.665-701.

Begg, K., Van der Woerd, F. and Levy, D. eds., 2018. The business of climate change:

Corporate responses to Kyoto. Routledge.

Begum, R.A. and Pereira, J.J., 2015. The awareness, perception and motivational analysis of

climate change and business perspectives in Malaysia. Mitigation and adaptation strategies

for global change, 20(3), pp.361-370.

Borghesi, S., Cainelli, G. and Mazzanti, M., 2015. Linking emission trading to environmental

innovation: evidence from the Italian manufacturing industry. Research Policy, 44(3),

pp.669-683.

Buckley, P.J and et.al., 2016. The institutional influence on the location strategies of

multinational enterprises from emerging economies: Evidence from China's cross-border

mergers and acquisitions. Management and Organization Review, 12(3), pp.425-448.

Crystal, J., 2016. Kuwait: The transformation of an oil state. Routledge.

Feng, H., Morgan, N.A. and Rego, L.L., 2017. Firm capabilities and growth: the moderating role

of market conditions. Journal of the Academy of Marketing Science, 45(1), pp.76-92.

Gasbarro, F. and Pinkse, J., 2016. Corporate adaptation behaviour to deal with climate change:

the influence of firm‐specific interpretations of physical climate impacts. Corporate Social

Responsibility and Environmental Management, 23(3), pp.179-192.

Gasbarro, F., Rizzi, F. and Frey, M., 2016. Adaptation measures of energy and utility companies

to cope with water scarcity induced by climate change. Business Strategy and the

Environment, 25(1), pp.54-72.

Hamilton, L. and Webster, P., 2018. The international business environment. Oxford University

Press.

Ishengoma, E. and Vaaland, T.I., 2016. Can university-industry linkages stimulate student

employability?. Education+ Training, 58(1), pp.18-44.

18

Kheiravar, K.H., Lawell, C.Y.L., Bushnell, J.B., Jaffe, A.M. and Muehlegger, E.J., 2017. A

structural econometric model of the dynamic game between petroleum producers in the

world petroleum market. Working paper, Cornell University.

Liang, H. and Renneboog, L., 2017. On the foundations of corporate social responsibility. The

Journal of Finance, 72(2), pp.853-910.

Lu, J. and Zhao, S., 2015. China's natural gas exploration and development strategies under the

new normal. Natural Gas Industry B, 2(6), pp.473-480.

Ottman, J., 2017. The new rules of green marketing: Strategies, tools, and inspiration for

sustainable branding. Routledge.

Paterson, J., 2017. Behind the Mask: Regulating health and safety in Britain's offshore oil and

gas industry. Routledge.

Post, C., Rahman, N. and McQuillen, C., 2015. From board composition to corporate

environmental performance through sustainability-themed alliances. Journal of Business

Ethics, 130(2), pp.423-435.

Proedrou, F., 2016. EU energy security in the gas sector: Evolving dynamics, policy dilemmas

and prospects. Routledge.

Rutland, P., 2018. Introduction: Business and the state in Russia. In Business and state in

contemporary Russia (pp. 1-32). Routledge.

Thompson, A., Strickland, A.J. and Gamble, J., 2015. Crafting and executing strategy: Concepts

and readings. McGraw-Hill Education.

Ubini, I.L., 2019. Efficient Financing, Banking, and Foreign Exchange Operations in Mitigating

Refined Petroleum Shortages in Nigerian Downstream Petroleum Supply Industry. Global

Journal of Management And Business Research.

Vivoda, V., 2016. Energy security in Japan: challenges after Fukushima. Routledge.

Wadud, Z., 2016. Diesel demand in the road freight sector in the UK: Estimates for different

vehicle types. Applied energy, 165, pp.849-857.

Warner, M. and Sullivan, R. eds., 2017. Putting partnerships to work: Strategic alliances for

development between government, the private sector and civil society. Routledge.

Online

BP Oil Company. 2019. [Online]. Available through :< https://www.bp.com/ >.

19

structural econometric model of the dynamic game between petroleum producers in the

world petroleum market. Working paper, Cornell University.

Liang, H. and Renneboog, L., 2017. On the foundations of corporate social responsibility. The

Journal of Finance, 72(2), pp.853-910.

Lu, J. and Zhao, S., 2015. China's natural gas exploration and development strategies under the

new normal. Natural Gas Industry B, 2(6), pp.473-480.

Ottman, J., 2017. The new rules of green marketing: Strategies, tools, and inspiration for

sustainable branding. Routledge.

Paterson, J., 2017. Behind the Mask: Regulating health and safety in Britain's offshore oil and

gas industry. Routledge.